Federal Court of Australia

Alexiou v Australia and New Zealand Banking Group Limited (Subpoena) [2025] FCA 1238

File number(s): | NSD 719 of 2021 |

Judgment of: | PERRAM J |

Date of judgment: | 29 September 2025 |

Publication of reasons: | 9 October 2025 |

Catchwords: | PRACTICE AND PROCEDURE – application to set aside subpoena to give evidence – where prospective witness previously refused to assist respondent – where the circumstances of the prospective witness changed close to the trial start date – where preparation for cross-examination may be substantial – whether the subpoena should be set aside |

Legislation: | Fair Work Act 2009 (Cth), s 361 |

Cases cited: | Jones v Dunkel [1959] HCA 8; 101 CLR 298 Tamaya Resources Ltd (in liq) v Deloitte Touche Tohmatsu [2016] FCAFC 2; 332 ALR 199 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Commercial Contracts, Banking, Finance and Insurance |

Number of paragraphs: | 23 |

Date of hearing: | 29 September 2025 |

Counsel for the Applicant: | C H Withers SC with J S Burnett, C Mitchell and N Gollan |

Solicitor for the Applicant: | YPOL Lawyers |

Counsel for the Respondent: | K Morgan SC with R J Pietriche and B C Hord |

Solicitor for the Respondent: | Seyfarth Shaw Australia |

ORDERS

NSD 719 of 2021 | ||

| ||

BETWEEN: | ETIENNE ALEXIOU Applicant | |

AND: | AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED (ACN 005 357 522) Respondent | |

order made by: | PERRAM J |

DATE OF ORDER: | 29 SEPTEMBER 2025 |

THE COURT ORDERS THAT:

1. The subpoena to give evidence addressed to Mr Nigel Williams dated 22 September 2025 be set aside.

2. The respondent’s interlocutory application dated 28 September 2025 be dismissed.

3. The applicant’s interlocutory application dated 25 September 2025 be otherwise dismissed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

PERRAM J:

1 On 29 September 2025 I made orders whose effect was to prevent the respondent (‘ANZ’) from calling as a witness Mr Nigel Henry Murray Williams. These are my reasons for doing so.

The evidence that Mr Williams would be expected to give is relevant to the proceeding

2 Mr Williams was the Group Chief Risk Officer for ANZ between December 2011 and March 2018. He took part in the decision to claw back Mr Alexiou’s deferred but unvested equity awarded in 2012 and 2013. He also has knowledge of ANZ’s response to ASIC’s investigation into the Bank Bill Swap Rate (‘BBSW’) setting process, ANZ’s own investigation into the affair and the circumstances of the press release of 19 November 2014.

Mr Williams would not co-operate with ANZ

3 Mr Williams left ANZ in March 2018 and thereafter took up employment with Commonwealth Bank of Australia (‘CBA’) as its Group Chief Risk Officer in November 2018. From that time and until a date in February 2025, Mr Williams has maintained the position that he did not wish to assist ANZ in this litigation due to what he perceived to be a conflict of interest. It has thus not been possible for ANZ’s lawyers to meet with Mr Williams whilst he was employed by CBA.

4 ANZ filed and served its lay affidavit evidence on 17 November 2023, after a number of extensions were sought to the date by which lay evidence was to be filed. It did not serve any affidavit from Mr Williams which is unsurprising in the circumstances.

Mr Williams’ departure from CBA

5 Mr Williams’ employment at CBA concluded in February 2025. However, his impending departure was the subject of public comment. This included a press release by CBA (on 2 October 2024), an announcement to the Australian Stock Exchange (on 2 October 2024), articles in the Australian Financial Review (on 2 and 3 October 2024) and articles in the Australian (on 2 and 3 October 2024).

ANZ’s solicitors were not aware that Mr Williams had ceased employment with CBA until July 2025

6 The solicitor on the record for ANZ, Mr Tamvakologos, gives evidence that neither he nor his team of lawyers were aware that Mr Williams had ceased employment with CBA until sometime in July 2025. I accept this evidence. The litigation has been conducted on both sides with considerable gusto and much of the last 12 months has been spent by the parties in grinding trench warfare across the no-man’s land of discovery. It is inherently plausible that Mr Tamvakologos and his team would have been unaware of the information which became publicly available in October 2024 and hence that they would not have known that Mr Williams would be available from February 2025.

No evidence from ANZ about when it became aware that Mr Williams would be available from February 2025

7 There is no evidence from any relevant officer of ANZ about when the bank first became aware that Mr Williams had become available to speak with its solicitors. Mr Withers SC, senior counsel for Mr Alexiou, submitted that the situation was on all fours with Tamaya Resources Ltd (in liq) v Deloitte Touche Tohmatsu [2016] FCAFC 2; 332 ALR 199 (‘Tamaya’). Whilst the present debate is concerned with whether the late calling of a witness should be permitted, this is not a material distinction. I therefore accept that the Tamaya principle can be applied to the present situation.

8 However, I do not think that the failure of the bank to lead evidence from its own officers about when they knew that Mr Williams had left, or was to leave, CBA is relevant in this case. This is because the application to set aside the subpoena to Mr Williams came on very quickly. The subpoena to Mr Williams was issued on Monday, 22 September 2025. On Thursday, 25 September 2025 Mr Alexiou filed an interlocutory application to set the subpoena aside. This was not accompanied by an affidavit on that day.

9 At 1.51 pm on Sunday, 28 September 2025, ANZ lodged an interlocutory application seeking leave to rely upon the affidavit of Mr Williams dated 25 September 2025. This was accompanied by an affidavit of Mr Tamvakologos. Later that day, Mr Price, the solicitor on the record for Mr Alexiou, prepared an affidavit which was filed at 5.10 pm. It was in this affidavit that Mr Price explained that Mr Williams’ departure from CBA had become publicly known on 2 and 3 October 2024.

10 Both applications were then argued at 9.30 am on Monday, 29 September 2025.

11 The consequence of this chronology is that at the time Mr Tamvakologos prepared his affidavit he did not know that Mr Williams’ departure from CBA had become public information on 1 and 2 October 2024. There was therefore no reason for him to canvas whether the relevant officers of ANZ were aware of this.

12 In that circumstance, it would be unfair on ANZ to criticise it along Tamaya lines because of its failure to adduce evidence from its officers on this issue.

The late calling of Mr Williams carries with it a significant risk of the trial to go part heard for 12 months

13 This case was originally listed for six weeks commencing on Monday, 15 September 2025. However, the size of ANZ’s discovery meant that the applicant could not be ready by then. The case was put back two weeks and was then due to commence on Monday, 29 September 2025 (some days from the previous week commencing Monday, 22 September 2025 were maintained for the hearing of various interlocutory debates). As it currently stands, the case is due to run from Monday, 29 September 2025 to Friday, 14 November 2025. The week commencing Monday, 27 October 2025 is not a sitting week since Mr Withers SC already had an obligation that week when the case was put back two weeks.

14 The trial timetable is tight. There are a large number of witnesses. ANZ accepts that if Mr Williams is called as a witness he would have to be called towards the end of the trial. This is because it will be necessary for his cross-examination to be prepared and for the voluminous discovery to be revisited for that purpose.

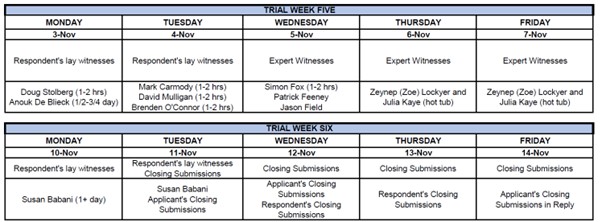

15 ANZ suggests that Mr Williams’ cross-examination might be fit in on Friday, 7 November 2025. The timetable for weeks five and six is presently this:

16 I do not think that it is realistic to think that the Court can finish hearing Mr Williams’ evidence, hear Ms Babani’s evidence and then for the parties to launch into closing submissions the next day. Nor do I accept that the fact that earlier in the trial days might become available means that this problem can be overcome. Because Mr Williams must come towards the end of the trial, free time at the start of the trial does not help.

17 As matters presently stand, there is a significant risk that if ANZ is permitted to call Mr Williams that it will cause the trial to go over part heard after Friday, 14 November 2025. I have Full Court and other obligations in the balance of November and am on leave in December 2025. I have put aside January 2026 to write the judgment in this case. Apart from that, my calendar for 2026 is full. The next available dates I would have to hear this matter if it were part-heard would be at the beginning of 2027. It would be very undesirable for any case, but particularly a case such as the present where credit is likely to be important, to be part-heard for over a year.

18 The risk that the calling of Mr Williams presents to the orderly hearing of this case is therefore significant.

ANZ is in the same position it would have been if Mr Williams had not left CBA

19 Until July 2025 when ANZ’s lawyers became aware that Mr Williams was now available, its position had been that it was unable to obtain an affidavit from Mr Williams (and for that reason did not serve one). Mr Pietriche for ANZ recognised that, had Mr Williams remained at CBA, ANZ would have had to make a forensic decision about whether or not to call Mr Williams without having an opportunity to meet with him first to find out what evidence he would give. I was informed by Mr Withers SC that ANZ had essentially made this decision and that, while Mr Williams remained CBA, ANZ did not want to take the risk of calling him in that way. This is entirely understandable. Nevertheless, it may be inferred that had Mr Williams remained at CBA then the position that ANZ would presently be in is that it would not be calling him as a witness.

20 I mention this because it has a tendency to suggest that the prejudice suffered by ANZ – if not permitted to call Mr Williams – is a species of prejudice with which it had already previously reconciled itself. This is not to say that the prejudice is not genuine but only that it is not one which ANZ regards as existential.

21 In saying that I am cognisant of the effect of s 361 of the Fair Work Act 2009 (Cth) and the impact this will have on ANZ’s ability to counter Mr Alexiou’s allegations concerning its decisions (a) to commence a disciplinary inquiry into Mr Alexiou; and (b) to clawback his performance bonuses. The evidence suggests that Mr Williams was involved in these decisions in a non-peripheral way. Whilst it would no doubt assist ANZ to have Mr Williams testify about his intentions, that is not the only way that Mr Williams’ intentions can be established. Nor will this be a case where the bank can be criticised for not calling him to give evidence since that course was successfully opposed by Mr Alexiou. No issues concerning Jones v Dunkel [1959] HCA 8; 101 CLR 298 will therefore arise.

22 Accepting that this is a species of real prejudice I do not think that it is sufficient to justify running the risk of this case becoming part heard for a year from mid-way through November 2025.

Conclusions

23 It will follow that ANZ is blameless in the circumstances which lead to it be attempting to call Mr Williams so late in the piece. However, accepting that to be so, I regard the risk of the trial becoming part heard as something which must be avoided if possible. As I have explained, ANZ has already had to confront the fact that Mr Williams would not be giving evidence and, until Mr Tamvakologos discovered this position had changed, had made its peace with that reality. The fact that recently this position fortuitously changed does not warrant running the risk of the case going over part heard for a year. It was for these reasons that I made orders setting aside the subpoena on 29 September 2025, dismissing the bank’s application for leave to rely upon the affidavit of Mr Williams and otherwise dismissing Mr Alexiou’s interlocutory application.

I certify that the preceding twenty-three (23) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Perram. |

Associate:

Dated: 9 October 2025