Federal Court of Australia

Krejci (liquidator), Neway Holdings Pty Limited, in the matter of Neway Holdings Pty Limited [2025] FCA 1233

File number: | NSD 998 of 2025 |

Judgment of: | MARKOVIC J |

Date of judgment: | 9 October 2025 |

Catchwords: | CORPORATIONS – application for a pooling order pursuant to s 579E of the Corporations Act 2001 (Cth) – whether just and equitable to make an order – whether satisfied a pooling order would not materially disadvantage an eligible unsecured creditor – satisfied disadvantage not materials and/or not sufficient to weigh against the potential advantages of making pooling order – where eligible unsecured creditors on notice of application for a pooling order – where no objection received in relation to making of pooling order – pooling order made CORPORATIONS – ancillary relief – application under s 579G(1) of the Act regarding filing of annual administration return and end of administration return in respect of all entities in pooled group – satisfied order will reduce expenditure across and facilitate the efficient completion of the administration of the companies in the pooled group – order made |

Legislation: | Corporations Act 2001 (Cth) ss 9, 46, 50, 579E, 579G, 579N, 579Q Insolvency Practice Schedule (Corporations), being Sch 2 to the Corporations Act 2001 (Cth) ss 70-5, 70-6 Corporations Regulations 2001 (Cth) r 5.6.73 |

Cases cited: | Hathway v Stacey Apartments Pty Ltd (In Liquidation), in the matter of Stacey Apartments Pty Ltd (In Liquidation) [2023] FCA 776 Hutson (liquidator), in the matter of WDS Limited (in liq) (Receivers and Managers Appointed) [2020] FCA 299 IMO Atlas Gaming Holdings Pty Ltd [2023] VSC 91; 70 VR 540 In the matter of Kirby Street (Holding) Pty Limited [2011] NSWSC 1536; (2011) 87 ACSR 84 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 61 |

Date of last submission: | 18 September 2025 |

Date of hearing: | 16 September 2025 |

Counsel for the Plaintiffs: | R Notley |

Solicitor for the Plaintiffs: | Addisons |

ORDERS

NSD 998 of 2025 | ||

IN THE MATTER OF NEWAY HOLDINGS PTY LIMITED (IN LIQUIDATION) | ||

BETWEEN: | PETER PAUL KREJCI IN HIS CAPACITY AS LIQUIDATOR OF NEWAY HOLDINGS PTY LIMITED (IN LIQUIDATION) ACN 003 972 076 & ORS First Plaintiff ANDREW JOHN CUMMINS IN HIS CAPACITY AS LIQUIDATOR OF NEWAY HOLDINGS PTY LIMITED (IN LIQUIDATION) ACN 003 972 076 & ORS Second Plaintiff | |

AND: | NEWAY HOLDINGS PTY LIMITED (IN LIQUIDATION) ACN 003 972 076 First Defendant NT QUEENSLAND PTY LTD (IN LIQUIDATION) ACN 128 810 622 Second Defendant N.T. SOUTHAUS PTY LTD (IN LIQUIDATION) ACN 117 283 093 (and others named in the Schedule) Third Defendant | |

order made by: | MARKOVIC J |

DATE OF ORDER: | 9 October 2025 |

THE COURT ORDERS THAT:

1. Pursuant to s 579E(1) of the Corporations Act 2001 (Cth) the defendants are a pooled group for the purposes of s 579E of the Corporations Act (Group).

2. Pursuant to s 579G(1) of the Corporations Act the plaintiffs are only required to lodge:

(a) one annual administration return, within the meaning of s 70-5 of the Insolvency Practice Schedule (Corporations) (IPSC) being Sch 2 to the Corporations Act, for the Group and not an annual administration return for each of the defendants; and

(b) one end of administration return, within the meaning of s 70-6 of the IPSC, for the Group and not an end of administration return for each of the defendants.

3. The costs of this proceeding be costs in the pooled winding up of the Group.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

MARKOVIC J:

1 Peter Paul Krejci and Andrew John Cummins are the joint and several liquidators of Neway Holdings Pty Limited (in liquidation), NT Queensland Pty Ltd (in liquidation) (NT QLD), N.T. Southaus Pty Ltd (in liquidation) (NT SA), NT Westaus Pty Ltd (in liquidation) (NT WA) and NT VIC Pty Limited (in liquidation) (NT VIC) (together the Companies). The liquidators as plaintiffs bring this application seeking an order that Holdings, NT QLD, NT SA, NT WA and NT VIC, who are respectively the first to fifth defendants, are a pooled group for the purposes of s 579E of the Corporations Act 2001 (Cth) or, in the alternative, that Holdings, NT QLD, NT SA and NT WA are a pooled group for the purposes of s 579E of the Act.

background

2 On 27 February 2023 the liquidators were appointed as joint and several voluntary administrators of each of the Companies and NT ACT Pty Ltd (deregistered). On 4 May 2023 the liquidators were appointed as joint and several liquidators of the Companies and NT ACT.

3 On 28 February 2024 NT ACT was deregistered. Accordingly, it is not a party to this proceeding.

The Companies

4 Insofar as the Companies are concerned:

(1) Holdings is the sole shareholder of each of NT ACT, NT QLD, NT SA, NT WA and NT VIC;

(2) Bruce Raymond Newey is the sole director of each of the Companies, save for Holdings; and

(3) Mr Newey and his wife, Lynne Louise Newey, are directors of Holdings and BRN Holdings Pty Ltd is its sole shareholder.

5 Mr and Mrs Newey are the directors and shareholders of BRN Holdings, each holding 50% of the shares.

6 Mr and Mrs Newey are also directors of The Premier Group Pty Ltd and Holdings holds 99% and Mr Newey holds 1% of the shares in that company.

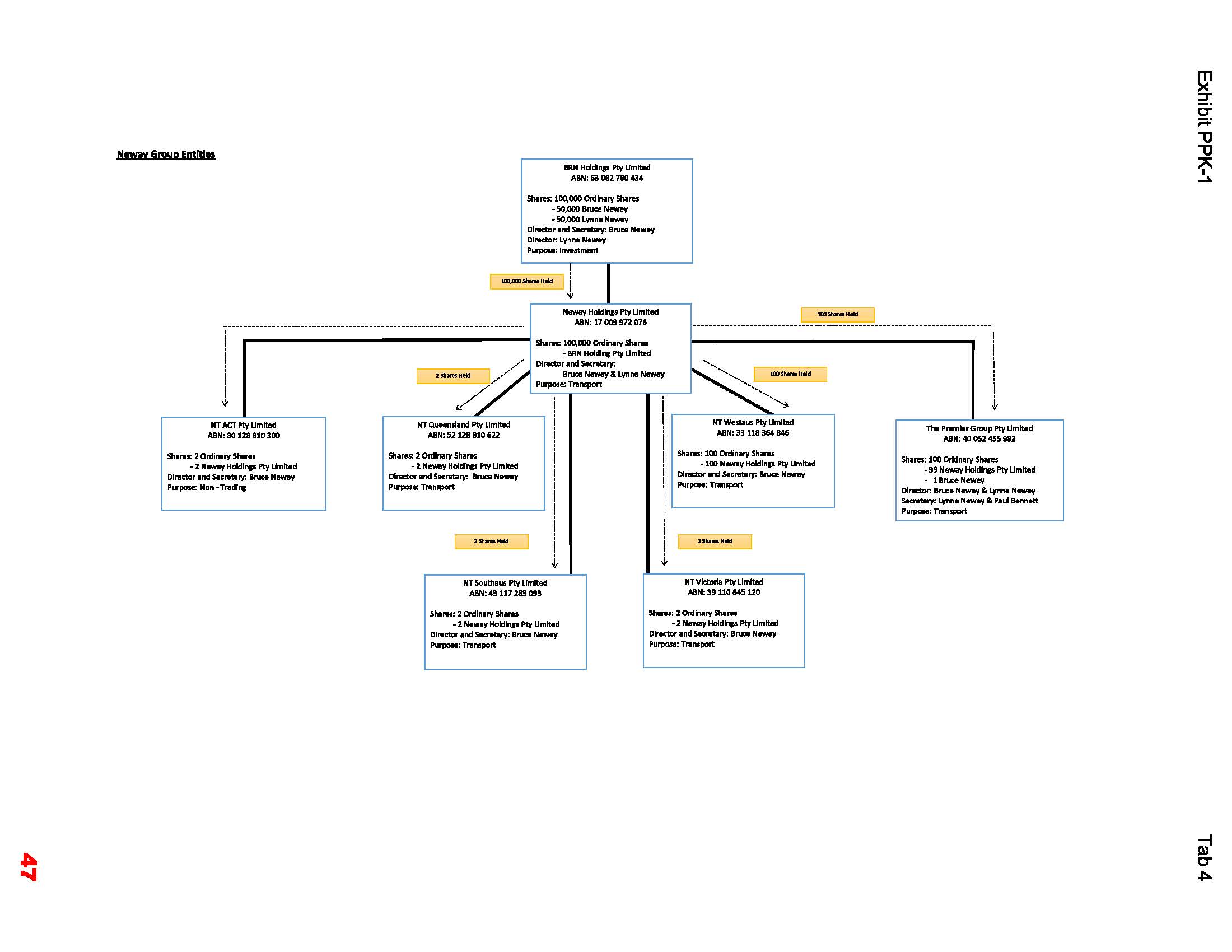

7 Appearing as Annexure A to these reasons is a copy of a corporate diagram showing the relationship between the Companies, BRN Holdings and Premier.

The nature and structure of the business operated by the Companies

8 The liquidators’ investigations into the affairs of the Companies and NT ACT have revealed the following:

(1) Holdings was incorporated in 1990 to operate a business specialising in sensitive freight services for telecommunications, information technology services, e-commerce furniture, print solutions, medical equipment, research related equipment, vending machines, artwork and photographic equipment (Business);

(2) the Business had been operating since 1985, prior to the incorporation of Holdings. The liquidators are not aware if it was operated through a corporate entity, a partnership or by Mr Newey as a sole trader;

(3) prior to the incorporation of NT VIC, NT SA, NT WA, NT QLD and NT ACT, the Business was operated under licence in New South Wales, Queensland, South Australia, Western Australia and Victoria;

(4) in 2004 NT VIC was incorporated and the Business was operated in Victoria through NT VIC;

(5) in 2005 NT SA was incorporated and the Business was operated in South Australia through NT SA;

(6) in 2006 NT WA was incorporated and the Business was operated in Western Australia through NT WA;

(7) in 2007 NT QLD was incorporated and the Business was operated in Queensland through NT QLD;

(8) in 2007 NT ACT was incorporated and the Business was operated in the Australian Capital Territory (ACT) through NT ACT. This arrangement continued until around 2012, when NT ACT ceased trading and Holdings resumed carrying on the Business in the ACT;

(9) the Business operated nationwide. Some of the major customers it serviced included Temple & Webster, Life Interiors, Telstra, Ericsson and CEVA Logistics. As a result, in carrying on the Business, the Companies adopted an approach by which:

(a) Holdings or NT VIC entered into contracts with the major customers of the Business and invoices were issued by Holdings and NT VIC to those customers;

(b) on receipt of funds from the major customers, Holdings and NT VIC periodically distributed revenue to each of the Companies in accordance with the work they had performed; and

(c) in making the distributions of revenue, Holdings and NT VIC would retain a percentage of the revenue they earned for the work they completed;

(4) funds were advanced by Holdings and NT VIC to other Companies to meet day-to-day expenses on an as needed basis, including for wages and employee entitlements, and these advances were subsequently reported in the management accounts as related party loans owed by those entities to Holdings and NT VIC; and

(5) trade debtors recorded in Holdings’ management accounts may have been misallocated and may relate to work performed by other Companies. The liquidators have only undertaken a preliminary analysis of the trade debtors outstanding as at the time of their appointment because they are of the opinion that the cost of a detailed analysis to determine the correct reconciliation of those amounts between the Companies, dating back to their incorporation, would not be an appropriate use of the funds available in the liquidation of the Companies, as it would not result in a proportionate return to creditors of the Companies.

The liquidators’ reports

9 On 1 March 2023 the liquidators, in their capacity as the administrators, issued their first report to creditors of the Companies and NT ACT, in which, among other things they reported that:

The Companies are a provider of nationwide logistics solutions with offices and depots in Sydney, Melbourne, Brisbane, Adelaide and Perth.

The Companies are part of a larger group ultimately owned by BRN Holdings Pty Ltd. We have been appointed to the entities which provide freight and transport services throughout Australia. Given the grouping and linked operations, we have determined it is appropriate to provide a single report to creditors regarding the affairs of the Companies. Attached as Annexure “9” is a group structure chart.

Similarly, it is appropriate for the first meetings of creditors to be held concurrently.

The group structure chart provided to creditors was the document reproduced at Annexure A of these reasons.

10 On 27 March 2023 the liquidators, again in their capacity as administrators, issued their second report to creditors of the Companies and NT ACT. That report included, by way of executive summary, that (noting that a reference to the liquidators in the following subparagraphs is a reference to the liquidators in their capacity as administrators of the Companies and NT ACT):

(1) on their appointment, the liquidators had been contacted by several parties who expressed interest in purchasing the Business on a going concern basis. In addition the liquidators advertised the business for sale by way of expressions of interest;

(2) the liquidators continued trading the Business during the voluntary administration period in order to retain the Companies’ customers and preserve goodwill;

(3) ultimately no offers were received from interested parties for the purchase of the Business and it was necessary to cease trading and terminate all staff; and

(4) the liquidators had prepared a likelihood of return to unsecured creditors on a group basis. It was prepared in this way because of the interrelationships between the Companies and the lending within the group. The liquidators anticipated that, should the Companies go into liquidation, they would pool the Companies thus treating them as a single company.

11 In the second report, the liquidators also reported under the heading “trading during the voluntary administration”, among other things, that:

As previously discussed, as at the date of our appointment, five (5) of the six (6) entities were actively trading, the exception being NT ACT which had ceased trading in 2012/13.

Whilst the five (5) entities operated as individual cost centres, most of the invoicing was done by Neway Holdings and NT VIC, which then periodically distributed the revenue to each entity in the group in accordance with the work they had performed. The nationwide reach of the Companies was essential in order to service the major customers being Temple & Webster, Life Interiors, Telstra, Ericsson and CEVA.

…

Since the date of our appointment, we had continued to trade the business operations of the Companies to preserve the value of the business with a view to selling the business as a going concern.

…

The total anticipated turnover of the five (5) Companies for trading during Administration was $847K with an estimated profit of $110K.

…

We provide the comments with respect to the trading position above as follows:

• During Administration, invoices were issued to sixty-seven (67) customers for a sum of $847K for the five (5) Companies. 72% of the total income were from five (5) major customers (“Major Customers”).

• The Major Customers required nationwide services, therefore, the trading and operation of all five (5) Companies was required to enable the achievement of a total revenue of $610K from the Major Customers.

• The Companies signed to the Contracts/Services Agreements with the Major Customers were either Neway Holdings or NT VIC. Sales were then reallocated to the five (5) Companies based on the data provided by accounts staff based on the work completed by each entity in the group. Given the time constraint in the Administration, there has been insufficient time to allow us to assess the appropriateness of such reallocation of revenue.

12 In part 6 of the second report the liquidators set out the reasons for failure of the Companies, summarising them as follows:

(1) slowdown in revenue from online household goods customers;

(2) deliveries for information technology communications dramatically reducing; and

(3) increased labour hire costs.

13 The liquidators continued:

Based on our experience in the trucking industry we have identified the following items as contributing to the failure of the business:

• The structure of the corporate group and the extra costs associated with this structure;

• Inability to determine the viability of a particular run, specifically whether the revenue was greater than the costs;

• Lingering ATO debt resulting from the major fall in revenue in 2019/20;

• Repairing the Group’s ageing fleet instead of renewing;

• Loss of Fuji Xerox contract in 2019; and

• The onset of the COVID-19 pandemic and global supply delays.

14 In part 12.1 of the second report in reporting on their “preliminary investigations” the liquidators reiterated that:

Throughout the investigation section of this report Creditors should keep at the forefront of their minds that we have conducted and reported on an entity by entity basis, though it is a group of Companies that should be treated as a single entity.

…

As we have mentioned, it is our view that the Companies be placed into Liquidation, the entities where we are appointed should be pooled and treated as one entity. Doing this will allow us to ignore all related party loans between entities. This would remove large debts from some of the subsidiaries and allow us to better understand what the Companies as one (1) entity creditor claims are. Pooling would also allow a better assessment as to whether the entity traded insolvently at what date did that occur.

15 On 4 August 2023 the liquidators issued a statutory report to creditors of the Companies and NT ACT in which among other things, in the executive summary, they reported:

The dealings between the Neway Entities historically were inter-related, and the projected outcome for creditors in these Liquidations were similarly inter-dependent, given the loans and potential claims against the same parties. Our current estimates indicate that any returns to Creditors are largely contingent on successfully realising the remaining assets recovering the outstanding debtors and successfully pursuing the above-mentioned claims against the DCoT, the Directors and related parties. …

(Underlining and emphasis removed.)

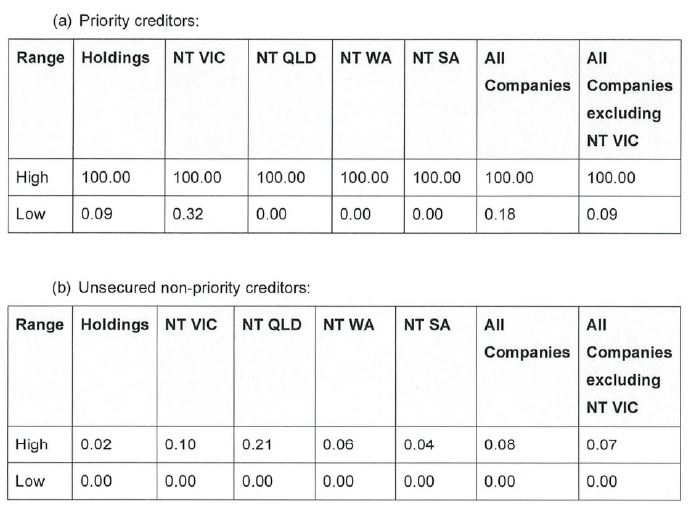

Estimated return to creditors if the group is pooled

16 The liquidators have carried out a detailed analysis of the expected outcome for priority and unsecured creditors of the Companies in:

(1) a non-pooled scenario;

(2) a pooled scenario including NT VIC; and

(3) a pooled scenario excluding NT VIC.

17 The analysis which is contained in a spreadsheet which was before the Court (estimated outcomes spreadsheet) is the subject of detailed evidence given by Mr Krejci.

18 The estimated outcomes spreadsheet refers to preference recoveries from the Australian Taxation Office and recovery from insolvent trading claims against Mr and Mrs Newey. Those claims are addressed by the liquidators in the statutory report. As to the latter, the liquidators note that Mr and Mrs Newey have a significant amount of equity, estimated at approximately $2 million, in real property located in New South Wales.

19 Mr Krejci explains that the estimated “high” and “low” outcomes in each of the columns of the estimated outcomes statement have been determined by applying percentages reflecting what the liquidators consider would reasonably represent a “high” outcome (or “best case scenario”) or “low” outcome (or “worst case scenario”). By way of example:

(1) in respect of the preference claims, the liquidators determined that the “high” percentage is 70%, and the “low” percentage is 0% in both a non-pooled scenario and a pooled scenario. They applied those percentages to each of the Companies individually and to the respective pooled scenarios; and

(2) in respect of the insolvent trading claims, the liquidators determined that:

(a) in a non-pooled scenario, the “high” percentage is 25% and the “low” percentage is 5%; and

(b) in a pooled scenario, the “high” percentage is 50%, and the “low” percentage is 10%.

20 Mr Krejci also notes that there are other potential claims that the liquidators have identified, and which will be subject of further investigations by way of public examinations under s 596A and s 596B of the Act and the issue of orders for production. Potential recoveries from these claims have not been included in the estimated outcomes spreadsheet.

21 The rows of the estimated outcomes spreadsheet under the heading “Return to Creditors (Cents in the Dollar)” record the estimated outcomes to creditors in each scenario as follows:

22 As the liquidators point out their analyses show:

(1) all priority creditors would receive 100 cents in the dollar in a “high” outcome, irrespective of whether a pooling order is made. However, the analysis assumes that each company could achieve the estimated recovery without a pooling order, which the liquidators say is unlikely for NT QLD, NT WA and NT SA, given the limited assets available in those windings up compared to Holdings;

(2) in a “low” outcome only priority creditors of NT VIC would be worse off, by 14 cents in the dollar, while priority creditors of Holdings, NT QLD, NT WA and NT SA would better off. Again, the analysis assumes that each company could achieve the estimated recoveries without a pooling order which is possible for NT VIC; and

(3) only unsecured non-priority creditors of NT VIC and NT QLD would be worse off in a “high” outcome by 2 cents and 14 cents in the dollar respectively for the unsecured non-priority creditors of NT VIC and NT QLD. The analysis once again assumes that NT VIC and NT QLD could achieve the estimated recoveries without a pooling order, which is possible for NT VIC but unlikely for NT QLD.

23 Mr Krejci caused a number of other spreadsheets to be prepared.

24 The first shows an analysis of the expected return to each non-priority unsecured creditor of the Companies (estimated return spreadsheet) which Mr Krejci explains establishes that:

(1) in an all Companies pooled “high” scenario and a non-pooled “high” scenario, of the 109 unsecured non-priority creditors, 69 are estimated to be better off in an all Companies pooled “high” scenario as opposed to a non-pooled “high” scenario being approximately 63% of the unsecured non-priority creditor pool;

(2) in an all Companies pooled “low” scenario and a non-pooled “low” scenario, all 109 unsecured non-priority creditors are estimated to be in the same position;

(3) in an all Companies excluding NT VIC pooled “high” scenario and a non-pooled “high” scenario, of the 109 unsecured non-priority creditors, 87 are estimated to be better off in an all Companies excluding NT VIC pooled “high” scenario as opposed to a non-pooled “high” scenario being approximately 80% of the unsecured non-priority creditor pool; and

(4) in an all Companies excluding NT VIC pooled “low” scenario and a non-pooled “low” scenario, all 109 unsecured non-priority creditors are estimated to be in the same position.

25 The second spreadsheet provides an analysis of the expected outcome to priority and unsecured non-priority creditors of each of the Companies in a pooled scenario, pooled scenario excluding NT VIC and a non-pooled scenario, but it excludes the potential recoveries in pursuing the claims against Mr Newey and Mrs Newey for insolvent trading.

26 The third spreadsheet provides an analysis of the expected outcome to priority and unsecured non-priority creditors of each of the Companies in a pooled scenario, pooled scenario excluding NT VIC and a non-pooled scenario, but reflects a scenario where the liquidators would only have funds available to pursue a claim against Mr Newey and Mrs Newey for insolvent trading in relation to Holdings.

27 Finally, Mr Krejci explains that the pooling of the Companies will also likely result in significant savings across their respective administrations, and otherwise ensure the orderly and efficient completion of those administrations, including in relation to undertaking the liquidators’ necessary administrative, day-to-day duties, satisfying the statutory requirements of each of the Companies, including the filing of documents and calling and holding of meetings and allocating the liquidators’ costs for each of the Companies on a company-by-company basis.

statutory framework and legal principles

28 Division 8 of Pt 5.6 of the Act concerns pooling. Section 579E empowers the Court to make a pooling order. It relevantly provides:

(1) If it appears to the Court that the following conditions are satisfied in relation to a group of 2 or more companies:

(a) each company in the group is being wound up;

(b) any of the following subparagraphs applies:

(i) each company in the group is a related body corporate of each other company in the group;

(ii) apart from this section, the companies in the group are jointly liable for one or more debts or claims;

(iii) the companies in the group jointly own or operate particular property that is or was used, or for use, in connection with a business, a scheme, or an undertaking, carried on jointly by the companies in the group;

(iv) one or more companies in the group own particular property that is or was used, or for use, by any or all of the companies in the group in connection with a business, a scheme, or an undertaking, carried on jointly by the companies in the group;

the Court may, if the Court is satisfied that it is just and equitable to do so, by order, determine that the group is a pooled group for the purposes of this section.

Consequences of pooling order

(2) If a pooling order comes into force in relation to a group of 2 or more companies:

(a) each company in the group is taken to be jointly and severally liable for each debt payable by, and each claim against, each other company in the group; and

(b) each debt payable by a company or companies in the group to any other company or companies in the group is extinguished; and

(c) each claim that a company or companies in the group has against any other company or companies in the group is extinguished.

…

(10) The Court must not make a pooling order in relation to a group of 2 or more companies if:

(a) both:

(i) the Court is satisfied the order would materially disadvantage an eligible unsecured creditor of a company in the group; and

(ii) the eligible unsecured creditor has not consented to the making of the order; or

(b) all of the following conditions are satisfied:

(i) a company in the group is being wound up under a members’ voluntary winding up;

(ii) the Court is satisfied that the order would materially disadvantage a member of that company;

(iii) the member is not a company in the group;

(iv) the member has not consented to the making of the order.

Standing

(11) The Court may only make a pooling order on the application of the liquidator or liquidators of the companies in the group.

Just and equitable criteria

(12) In determining whether it is just and equitable to make a pooling order, the Court must have regard to all of the following matters:

(a) the extent to which:

(i) a company in the group; and

(ii) the officers or employees of a company in the group;

were involved in the management or operations of any of the other companies in the group;

(b) the conduct of:

(i) a company in the group; and

(ii) the officers or employees of a company in the group;

towards the creditors of any of the other companies in the group;

(c) the extent to which the circumstances that gave rise to the winding up of any of the companies in the group are directly or indirectly attributable to the acts or omissions of:

(i) any of the other companies in the group; or

(ii) the officers or employees of any of the other companies in the group;

(d) the extent to which the activities and business of the companies in the group have been intermingled;

(e) the extent to which creditors of any of the companies in the group may be advantaged or disadvantaged by the making of the order;

(f) any other relevant matters.

(Notes omitted.)

29 Section 9 of the Act defines the term “pooling order” as an order made under subs 579E(1).

30 Section 579N of the Act provides:

To avoid doubt, for the purposes of:

(a) this Division; or

(b) any other provision of this Act to the extent to which it relates to this Division;

a group of 2 or more companies need not be associated with each other in any way (other than a way described in paragraph 571(1)(b) or 579E(1)(b)).

31 Section 579Q defines the term “eligible unsecured creditor” as used in s 579E(1) as follows:

(1) Subject to subsection (2), for the purposes of the application of this Division to a group of 2 or more companies, a creditor of a company in the group is an eligible unsecured creditor of that company if:

(a) both:

(i) the creditor’s debt or claim is unsecured; and

(ii) the creditor is not a company in the group; or

(b) the creditor is specified in the regulations.

(2) The regulations may provide that, for the purposes of the application of this Division to a group of 2 or more companies, a specified creditor of a company in the group is not an eligible unsecured creditor of that company.

(Notes omitted.)

32 The relevant provision of the Corporations Regulations 2001 (Cth) for the purposes of s 579Q(2) is reg 5.6.73 which provides:

Eligible unsecured creditor

Creditors that are eligible unsecured creditors

(1) For paragraph 579Q(1)(b) of the Act, the following creditors are specified:

(a) a creditor to which either of the following applies as a result of a modification of the Act made under paragraph 571(1)(d) of the Act:

(i) a debt payable by a company or companies in a group to any other company or companies in the group is not extinguished;

(ii) a claim that a company or companies in a group has against any other company or companies in the group is not extinguished;

(b) a creditor that is determined by a Court to be an eligible unsecured creditor.

Creditors that are not eligible unsecured creditors

(2) For subsection 579Q(2) of the Act, a creditor that is determined by a Court not to be an eligible unsecured creditor is specified.

33 In In the matter of Kirby Street (Holding) Pty Limited [2011] NSWSC 1536; (2011) 87 ACSR 84 Barrett J described the effect of a pooling order at [3] as follows:

It can be said, at some risk of oversimplification, that, because of s 579E(2), the effect of a pooling order, once made, is to cause several distinct windings up, as they affect creditors only, to be administered as if they were a single winding up, with all available assets from all administrations applied towards the debts and claims of the creditors of all companies rateably according to the amounts of their debts and claims and as if they were the creditors of a single company.

34 His Honour noted the following questions which arise in determining an application for a pooling order, having regard to the statutory criteria, at [7]:

1. Is there “a group of 2 or more companies” (s 579E(1), introductory words)?

2. Is each company in the group being wound up (s 579E(1)(a))?

3. Is at least one of the conditions in sub-paragraphs (i) to (iv) of s 579E(1)(b) satisfied?

4. What does the evidence show with respect to the matters in s 579E(12) as they may affect the answer to the following Question 5?

5. Is it just and equitable that the order sought be made (s 579E(1)(b) concluding words)?

6. Does s 579E(10) preclude the making of a pooling order?

35 In Kirby Street Barrett J considered the meaning of a group of 2 or more companies observing at [8] that:

… the expression “group” in the opening words of s 579E(1) means no more than a collection or plurality; so that a “group” exists merely through identification of several companies, without any need to find any connection or shared characteristic.

36 His Honour also considered the meaning of the phrase “just and equitable” stating at [77]-[78]:

77 Numerous cases have considered the significance of the phrase “just and equitable”. It is sufficient, I think, to refer to what was said by Sheller JA In Stephenson v State Bank of New South Wales (1996) 39 NSWLR 101 at 113 when considering s 66M of the Conveyancing Act 1919:

“The determination of what is just and equitable in the circumstances is not a matter of unfettered individual opinion, nor does it involve a discretion of an arbitrary kind; see Cominos v Cominos [1972] HCA 54; (1972) 127 CLR 588 at 599; [1972-73] ALR 581 at 587-8. As Kitto J observed in R v Commonwealth Industrial Court; Ex parte the Amalgamated Engineering Union, Australian Section [1960] HCA 46; (1960) 103 CLR 368 at 383; [1961] ALR 104 at 112-13, the criteria are of a nature with which Courts are familiar. In Talga v MBC International Ltd [1976] HCA 22; (1976) 133 CLR 622 at 634; 9 ALR 359 at 366 Stephen, Mason and Jacobs JJ dealing with the issue raised for the Court by the Banking Act 1974 of whether it was just and equitable that a transaction should be treated as valid, said:

‘... The court will have before it an existing transaction replete with all its surrounding facts and circumstances and in their light will determine what is just and equitable. In doing so it will certainly be exercising a wide discretion that this is a commonplace of the curial process; the court will be bound to act judicially, exercising its discretion by reference only to such considerations affecting the transaction as, on an examination of the legislation, may be seen to be material to the decision which it is called on to make. Irrelevant matters, matters such as the plaintiffs instanced in the course of argument, which have no rational connection with the policy of the regulations but would be expressive only of the personal predilections of the Court cannot be allowed by it to play any part in its decision.’“

78 Section 579E(12) must therefore be seen as conferring a discretion that, while wide, can only be exercised judicially in the light of the whole of the circumstances surrounding the relevant subject matter.

consideration

37 Like Barrett J in Kirby Street (see [34] above), I will consider the liquidators’ application by reference to the six questions his Honour identified.

Is there a group of two or more companies?

38 There are five, or on the basis of the alternative relief sought by the liquidators, four companies in relation to which the liquidators seek an order under s 579E of the Act. This requirement is therefore met.

Is each company in the group being wound up?

39 The evidence before me establishes that each of Holdings, NT QLD, NT SA, NT WA and NT VIC is being wound up.

Is at least one of the conditions in s 579E(1)(b) satisfied?

40 Section 579E(1)(b) is set out above. Among other things it is satisfied if each company in the group is a related body corporate of each other company in the group.

41 Section 9 of the Act defines the term “related body corporate” as a “body corporate that is related to the first-mentioned body, as determined in accordance with section 50”.

42 Section 50 of the Act, which is in Div 6 of Pt 1.2 of the Act titled “subsidiaries and related bodies corporate” provides:

Where a body corporate is:

(a) a holding company of another body corporate; or

(b) a subsidiary of another body corporate; or

(c) a subsidiary of a holding company of another body corporate;

the first‑mentioned body and the other body are related to each other.

43 Returning to s 9 of the Act, the term “holding company” is defined to mean “in relation to a body corporate, …a body corporate of which the first mentioned body corporate is a subsidiary” and the term “subsidiary” is defined to mean “in relation to a body corporate, … a body corporate that is a subsidiary of the first-mentioned body by virtue of Division 6”.

44 Division 6 of Pt 1.2 of the Act includes ss 46 to 50AA. I have already referred to s 50. Additionally, s 46 provides:

A body corporate (in this section called the first body) is a subsidiary of another body corporate if, and only if:

(a) the other body:

(i) controls the composition of the first body’s board; or

(ii) is in a position to cast, or control the casting of, more than one‑half of the maximum number of votes that might be cast at a general meeting of the first body; or

(iii) holds more than one‑half of the issued share capital of the first body (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital); or

(b) the first body is a subsidiary of a subsidiary of the other body.

45 As the evidence establishes, Holdings is the sole shareholder of each of NT QLD, NT SA, NT WA and NT VIC and BRN Holdings is the sole shareholder of Holdings. It follows that:

(1) BRN Holdings is the holding company of Holdings;

(2) Holdings is a subsidiary of BRN Holdings;

(3) Holdings is the holding company of each of NT QLD, NT SA, NT WA and NT VIC; and

(4) each of NT QLD, NT SA, NT WA and NT VIC are a subsidiary of both Holdings and BRN Holdings.

46 Thus, each of Holdings, NT QLD, NT SA, NT WA and NT VIC is a related body corporate to each other and the requirement in s 579E(1)(b)(i) of the Act is satisfied.

What does the evidence show with respect to the matters in s 579E(12) as they may affect the answer to the following question?

47 Section 579E(12) is set out above. In relation to the criteria set out in that section:

(1) in relation to s 579E(12)(a), the evidence establishes that each of Holdings, NT QLD, NT SA, NT WA and NT VIC was involved in the operations of other of those companies and the officers or employees of each of Holdings, NT QLD, NT SA, NT WA and NT VIC were involved in the operations of other of those companies;

(2) in relation to s 579E(12)(b), the evidence establishes that Holdings, NT QLD, NT SA, NT WA and NT VIC and their respective officers and employees held themselves out to creditors as a group of companies;

(3) in relation to s 579E(12)(c), the evidence establishes that the winding up of Holdings, NT QLD, NT SA, NT WA and NT VIC is attributable to the acts or omissions of other companies in the group or the officers or employees of the group because the group operated the Business collectively and the Business failed because of a number of issues that faced the group as a whole (see [12]-[13] above);

(4) in relation to s 579E(12)(d), the evidence establishes that the activities and business of Holdings, NT QLD, NT SA, NT WA and NT VIC were intermingled;

(5) in relation to s 579E(12)(e), the liquidators’ analysis shows that overall unsecured creditors will be advantaged by the making of the pooling order (see [24] above); and

(6) in relation to s 579E(12)(f), the making of a pooling order will likely result in significant savings across the administration of Holdings, NT QLD, NT SA, NT WA and NT VIC (see [27] above), the liquidators have notified creditors of each of the companies of this proceeding and no creditor has sought to appear to oppose the application and, in particular, the Department of Employment and Workplace Relations (DEWR), which is the largest creditor, has informed the liquidators that it does not oppose the orders sought and does not intend to appear in the proceeding.

Is it just and equitable that a pooling order be made?

48 Having regard to the whole of the evidence before me and for the reasons set out in the preceding paragraph I am satisfied, subject to a consideration of s 579E(10) of the Act, that it is just and equitable that a pooling order be made.

Does s 579E(10) preclude the making of a pooling order?

49 Section 579E(10) of the Act is set out at [28] above.

50 In Kirby Street (at [82]) Barrett J expressed the view that if “material disadvantage” is found the court could not be satisfied that it is just and equitable to make a pooling order.

51 In turning to consider s 579E(10), I note that as none of the windings up before me is a members voluntary winding up, s 579E(10) is to be approached by reference to s 579E(10)(a) only. To that end, s 579E(10)(a) provides that the Court must not make a pooling order if:

(1) the Court is satisfied that the order would materially disadvantage an eligible unsecured creditor of a company in the group; and

(2) the eligible unsecured creditor has not consented to the making of the order.

52 The term “eligible unsecured creditor” is defined in s 579Q (see [31] above).

53 Regulation 5.6.73 of the Regulations (see [32] above) is relevant for the purposes of s 579Q(2). However, as the liquidators point out, there has been no modification of s 571(1)(d) of the Act as envisaged by reg 5.6.73(1)(a) and the Court has not made any determination that any creditor is an eligible unsecured creditor for the purposes of reg 5.6.73(1)(b) or made any determination pursuant to reg 5.6.73(2). Thus the only creditors to consider are those referred to s 579Q(1)(a) of the Act. They are unsecured creditors of one of Holdings, NT QLD, NT SA, NT WA or NT VIC who are not one of those companies.

54 In Hutson (liquidator), in the matter of WDS Limited (in liq) (Receivers and Managers Appointed) [2020] FCA 299 I set out the following principles in relation to the term “material disadvantage” for the purposes of s 579E(10) of the Act at [62]:

The determination of whether an eligible unsecured creditor would be materially disadvantaged by the making of a pooling order is a question to be determined in all of the circumstances of the case: Re Walker at [42], [50]. Relevant matters to take into account in determining that issue include the dividend payable to creditors in a pooled scenario versus a non-pooled scenario and whether any creditor has appeared to object to the making of the proposed pooling order: Re Walker at [40]; Re Aboriginal Connections at [42].

55 In considering the application of s 579E(10) in WDS Limited a question arose as to whether the liquidator bears the onus of adducing evidence to establish whether the making of a pooling order would materially disadvantage an eligible unsecured creditor of a company in the relevant group or whether a pooling order can be made on the evidence before the Court provided that the Court is not satisfied that the order would materially disadvantage an eligible unsecured creditor: at [101]. While the question was the subject of submissions in WDS Limited (at [102]-[108]), I did not need to resolve it. At [112] I said:

In light of that it is not necessary for me to resolve the issue of onus as raised by the Liquidators, an issue which was not considered in any of the authorities to which I was taken and which, as noted at [101] above, I was invited by senior counsel for the plaintiffs ultimately not to resolve. However, in passing I observe that a court can of course only consider and form a view about the presence or otherwise of material disadvantage based on the evidence before it which will be led by a liquidator seeking such an order and, in the event of objection by an eligible unsecured creditor, evidence relied on by the objector. It may be that the issue of onus only arises in that scenario where, in the face of opposition, it would fall to the liquidator to satisfy the court that there is no material disadvantage.

See too Hathway v Stacey Apartments Pty Ltd (In Liquidation), in the matter of Stacey Apartments Pty Ltd (In Liquidation) [2023] FCA 776 at [43] (Halley J) and IMO Atlas Gaming Holdings Pty Ltd [2023] VSC 91; 70 VR 540 at [32]-[33] (M Osborne J).

56 The liquidators submit that:

(1) it is possible, having regard to the liquidators’ analyses, that there may be some disadvantage to some unsecured creditors of NT VIC and NT QLD. However, the extent of that possibility for disadvantage is not sufficient to weigh against the significant potential advantages of making the pooling order;

(2) the liquidators have given notice of this proceeding and the hearing date of their application to creditors of each the defendants under s 579J of the Act, meaning the Court can be satisfied that there has been an opportunity for creditors to make their views known; and

(3) the liquidators have not received any objection to a pooling order being made from any creditor of any of Holdings, NT QLD, NT SA, NT WA or NT VIC, nor did the liquidators expect that any creditor would appear at the hearing and oppose the making of the orders sought in the originating process. Rather, DEWR, which is the major priority creditor for Holdings, NT VIC, NT QLD and NT WA, has received and reviewed the originating process and Mr Krejci’s affidavit in support and has confirmed in writing that it does not oppose the orders sought in the originating process and does not intend to appear at the hearing.

57 Having regard to those matters I accept that the pooling order would not materially disadvantage any eligible unsecured creditor and therefore s 579E(10) does not preclude the making of a pooling order.

A pooling order should be made

58 I am satisfied that I should make an order determining that Holdings, NT QLD, NT SA, NT WA and NT VIC constitute a pooled group for the purposes of s 579E of the Corporations Act.

ancillary releif

59 The liquidators also seek ancillary relief pursuant to s 579G(1) of the Act which empowers the Court, where it makes a pooling order in relation to two or more companies and it is of the opinion that it is just and equitable to do so, among other things, to make such order and give such directions in relation to the winding up of the companies in the group as the Court thinks fit.

60 In particular the liquidators seeks orders that they are only required to lodge one annual administration return within the meaning of s 70-5 of the Insolvency Practice Schedule (Corporations), being Sch 2 to the Corporations Act (IPSC) and one end of administration return within the meaning of s 70-6 of the IPSC for the group and not one for each of Holdings, NT QLD, NT SA, NT WA and NT VIC in each case. I am satisfied that I should make such orders. They will assist in reducing expenditure across, and facilitate the efficient completion of, the administration of the Companies as a pooled group.

conclusion

61 For those reasons I will make the orders sought by the liquidators in relation to the pooling of the defendant companies and the ancillary relief. I will also make an order that the costs of this proceeding be costs in the pooled winding up of Holdings, NT QLD, NT SA, NT WA and NT VIC.

I certify that the preceding sixty-one (61) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Markovic. |

Associate:

Dated: 9 October 2025

ANNEXURE A

SCHEDULE OF PARTIES

NSD 998 of 2025 | |

Defendants | |

Fourth Defendant: | NT WESTAUS PTY LTD (IN LIQUIDATION) ACN 118 364 846 |

Fifth Defendant: | NT VIC PTY LIMITED (IN LIQUIDATION) ACN 110 845 120 |