Federal Court of Australia

Insurance Australia Limited, in the matter of Insurance Australia Limited (No 2) [2025] FCA 1198

File number: | NSD 940 of 2025 |

Judgment of: | DERRINGTON J |

Date of judgment: | 2 October 2025 |

Catchwords: | INSURANCE – application for confirmation of scheme for the intra-group transfer of insurance business under s 17F(1) of the Insurance Act 1973 (Cth) – where minor instance of non-compliance with previous publication orders – where transfer will not detriment policyholders in material way – scheme confirmed without modification |

Legislation: | Corporations Act 2001 (Cth) Insurance Act 1973 (Cth) Workers Compensation and Injury Management Act 2023 (WA) Insurance (Prudential Supervision) Act 2010 (NZ) |

Cases cited: | Aioi Nissay Dowa Insurance Company Limited, in the matter of Aioi Nissay Dowa Insurance Company Limited [2023] FCA 697 Allianz Australia General Insurance Limited, in the matter of Allianz Australia General Insurance Limited [2023] FCA 994 FM Insurance Company Limited, in the matter of FM Insurance Company Limited [2021] FCA 1442 General Insurance Pty Limited, in the matter of OnePath General Insurance Pty Ltd [2023] FCA 1424 Insurance Australia Limited, in the application of Insurance Australia Limited [2025] FCA 809 Insurance Australia Limited, in the application of Insurance Australia Limited (No 2) [2017] FCA 980 Insurance Australia Limited, in the matter of Insurance Australia Limited [2025] FCA 1044 Integrity Life Australia Limited, in the matter of Integrity Life Australia Limited [2025] FCA 92 QBE Insurance (Australia) Ltd, in the matter of Division 3A of Part IIIA of the Insurance Act 1973 (Cth) and QBE Insurance (Australia) Ltd [2015] FCA 1223 Re London Life Association Limited (unreported, Ch D, Hoffman J, 21 February 1989) Re Prudential Assurance Company Limited and Rothesay Life plc [2020] EWCA Civ 1626 St Andrew’s Insurance (Australia) Pty Ltd, in the matter of St Andrew’s Insurance (Australia) Pty Ltd [2024] FCA 881 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Commercial Contracts, Banking, Finance and Insurance |

Number of paragraphs: | 51 |

Date of hearing: | 1 September 2025 |

Counsel for the Applicants: | Mr D Thomas SC |

Solicitor for the Applicants: | King & Wood Mallesons |

Counsel for the Interested Party: | Ms A Lyons |

Solicitor for the Interested Party: | Australian Prudential Regulation Authority |

ORDERS

NSD 940 of 2025 | ||

IN THE MATTER OF INSURANCE AUSTRALIA LIMITED ABN 11 000 016 722, AFSL 227681 | ||

INSURANCE AUSTRALIA LIMITED ABN 11 000 016 722, AFSL 227681 First Applicant CGU AUSTRALIA PTY LTD ABN 62 004 478 960 Second Applicant | ||

order made by: | DERRINGTON J |

DATE OF ORDER: | 1 SEPTEMBER 2025 |

THE COURT ORDERS THAT:

1. Pursuant to s 17F(1) of the Insurance Act 1973 (Cth) (the Act), the scheme proposed by the Applicants in the form, or substantially in the form, of the document annexed to this application and marked “A”, in relation to the transfer of part of the insurance business of the First Applicant to the Second Applicant (the Scheme), be confirmed effective on and from 12:01 am AEST on 1 October 2025.

2. Pursuant to s 17F(2) of the Act, to the extent that any reinsurance treaties and agreements (other than Transferring Facultative Reinsurance Agreements to which Order 3(a) below applies) entered into by the First Applicant as reinsured provide indemnity and/or benefits in respect of any Transferring Policies, the Second Applicant be able to rely on and enforce any right against the reinsurer of such reinsurance treaties and agreements that the First Applicant had with respect to the Transferring Policies immediately prior to the commencement date of the Scheme.

3. Pursuant to s 17F(2) of the Act:

(a) all “Transferring Facultative Reinsurance Agreements” entered into prior to the Transfer Time (of the character as included at Annexure B to the Implementation Deed) are transferred to the Second Applicant as valid, effective and continuing agreements between the Second Applicant and the parties (other than the First Applicant) to the facultative reinsurance agreements; and

(b) the Second Applicant be bound by, perform the obligations under, be entitled to the benefits of and to take action under, and assume any obligations and liabilities in respect of and relating to any matter arising out of the Transferring Facultative Reinsurance Agreements as if it were a party, and at all times had been a party, to the Transferring Facultative Reinsurance Agreements in the place of the First Applicant.

4. The Applicants pay the costs of the Australian Prudential Regulation Authority of this proceeding as agreed or, if agreement cannot be reached, as assessed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

Annexure A

REASONS FOR JUDGMENT

DERRINGTON J:

Introduction

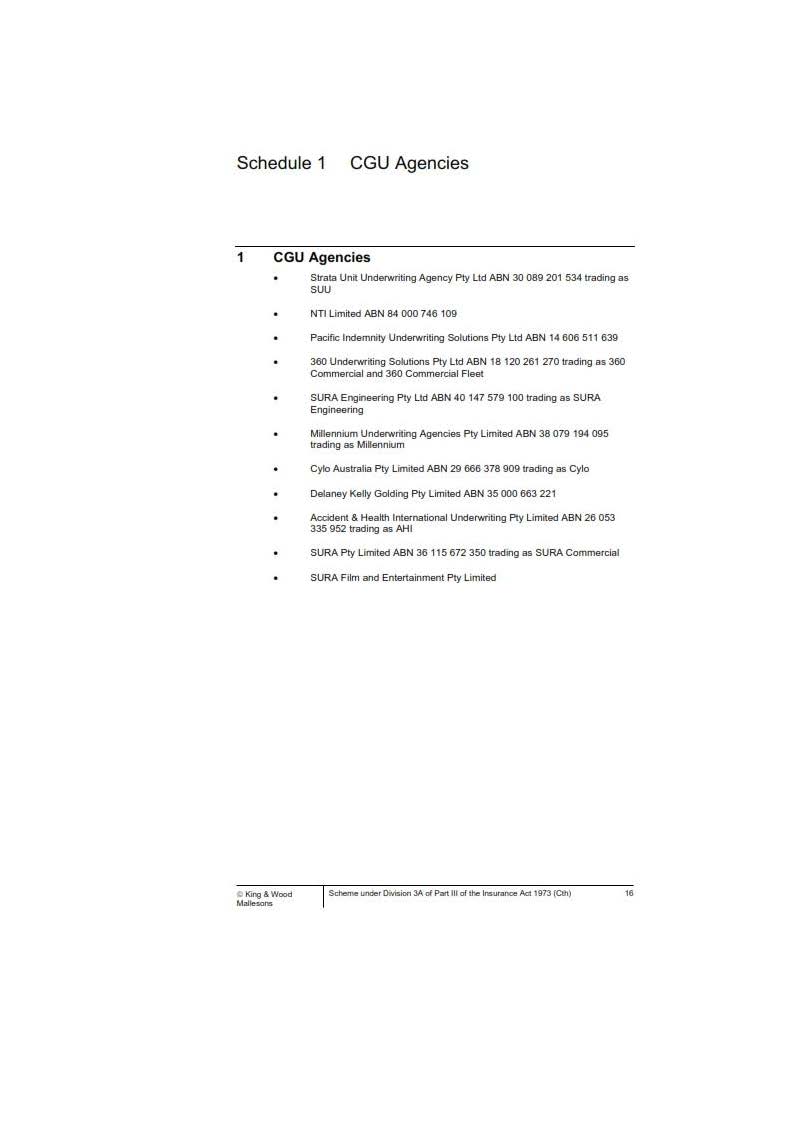

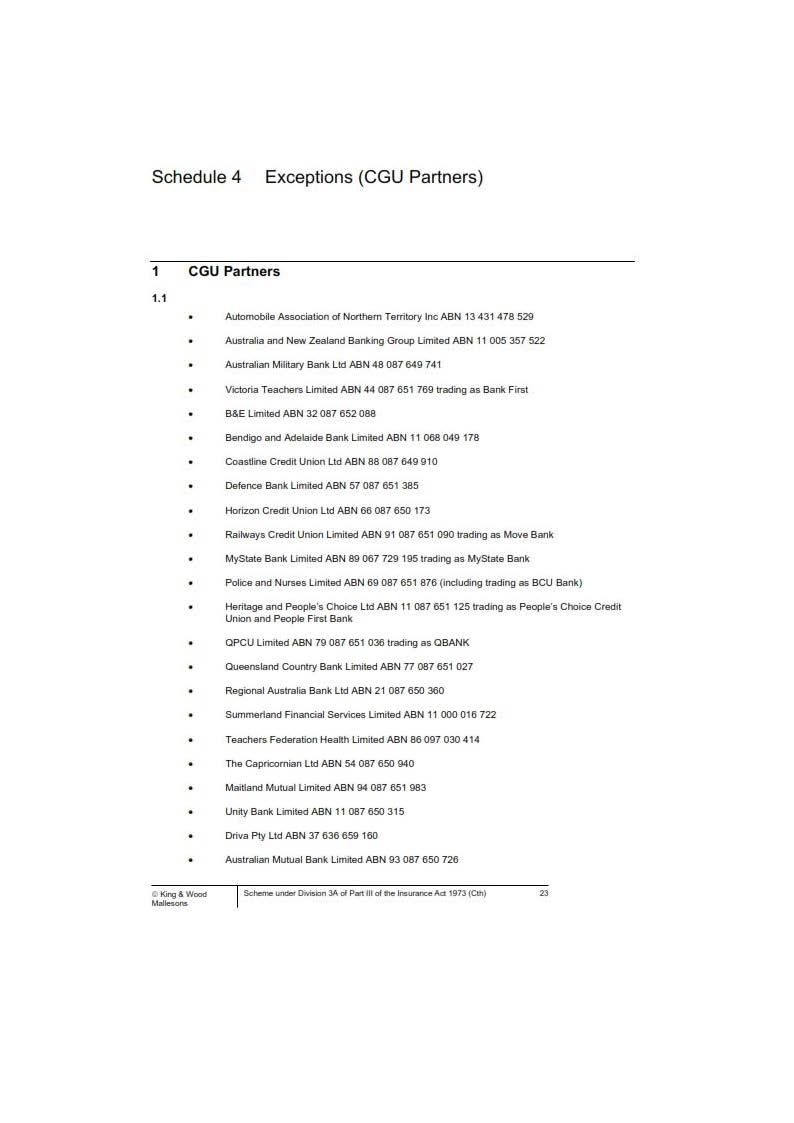

1 The applicants, Insurance Australia Limited (IAL) and CGU Australia Pty Ltd (CGUA), are wholly owned subsidiaries of Insurance Australia Group Limited (IAG). By an Originating Application filed 12 June 2025, they seek confirmation of a scheme for the transfer of part of IAL’s insurance business to CGUA (the Scheme) under the Insurance Act 1973 (Cth) (the Act).

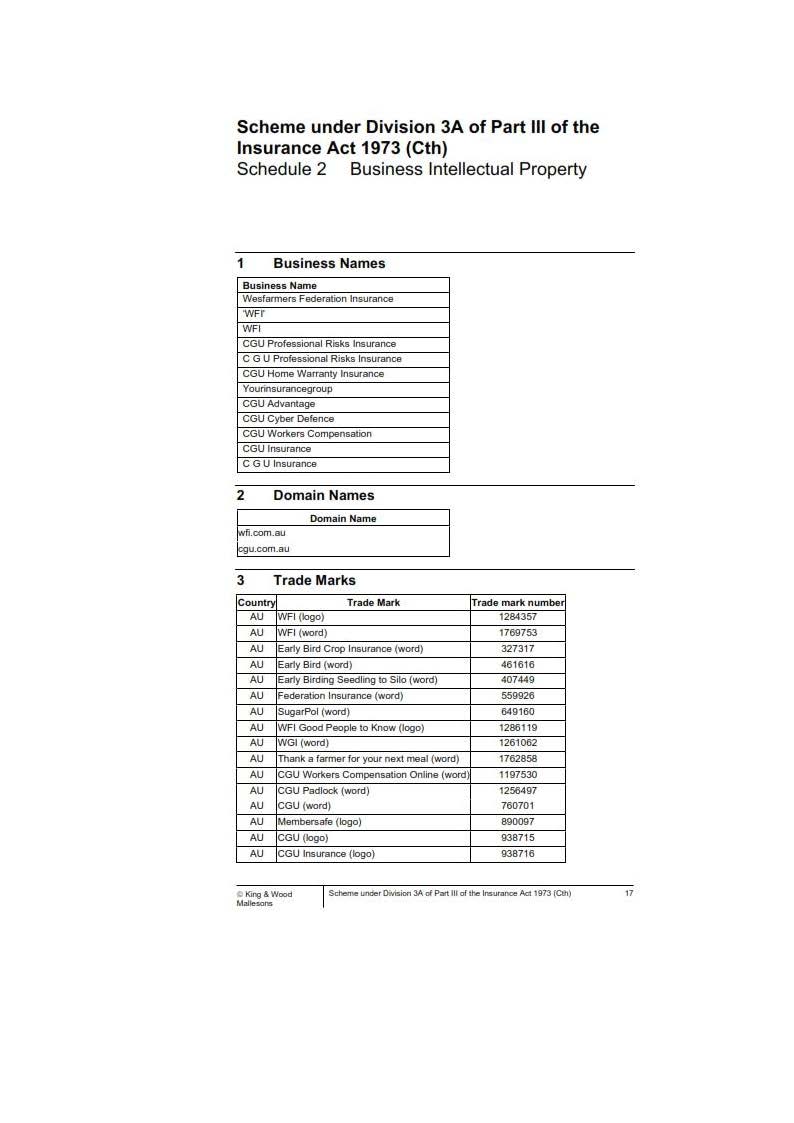

2 In short, the Scheme involves the intragroup transfer of the business of Intermediated Insurance Australia (IIA) – being one of the two operating divisions of IAL – in respect of policies issued under its active CGU Insurance (CGU) and WFI Insurance (WFI) brands, as well as (a) various IAL branded policies in “run-off”; and (b) certain defined business assets and agreements used for the purpose of conducting the IIA business (collectively, the Transferring Business).

3 In other words, the Scheme seeks to effect the transfer of the active intermediated business of IAL (under which policies issued by it are predominantly provided to policyholders via a large and established network of brokers, underwriting agencies and authorised representatives) and some of its “run-off” business to CGUA. In this respect, it is noted that CGUA is, as of 6 May 2025, an authorised general insurer within the wider IAG group of companies (the IAG Group).

4 On 20 June 2025, Orders were made that dispensed with the need for the applicants to comply with certain procedural requirements of the Act upon the happening of pre-defined events (the Dispensation Orders). In substance, the effect of such orders was to excuse the applicants from having to give a summary of the Scheme (as approved by the Australian Prudential Regulation Authority (APRA)) (a Scheme Summary) to holders of policies issued under the Transferring Business (the Transferring Policyholders and the Transferring Policies, respectively) where:

(1) the Transferring Policies were issued by IAL via a broker or underwriting agency.

(2) the Transferring Policies were not “active” (in the sense that the policy had expired and no open claim had been made upon it).

(3) IAL does not hold contact details for the holders of Transferring Policies issued directly by it or authorised representatives.

(4) there are certain underlying insureds or third-party beneficiaries (to the extent that they are “affected policyholders”) who may obtain a benefit under the Transferring Policies.

5 The applicants claim that they have “substantially complied” with s 17C of the Act, as modified by the Dispensation Orders. So much can be accepted (see infra [28] – [36]) and it is, therefore, appropriate to direct attention to whether the Scheme ought to be confirmed by way of s 17F(1).

Background

6 Much of the factual context that is relevant to the present application is canvassed in Insurance Australia Limited, in the matter of Insurance Australia Limited [2025] FCA 1044 [1] – [36] (In the matter of Insurance Australia). Nonetheless, some brief reiteration is appropriate.

The relevant entities

7 IAL is a registered corporation. It is authorised to carry on insurance business in Australia and is referred as a “Level 1” insurer for prudential purposes (see Prudential Standard CPS 001, Defined Terms (CPS 001)). CGUA is also a registered corporation. It has been a non-operating entity in the IAG Group since 2017 and, on 6 May 2025, it was authorised to carry on insurance business in Australia under s 12 of the Act (and is now a Level 1 insurer within the IAG Group).

8 IAL and CGUA are “related bodies corporate” (for the purposes of the Corporations Act 2001 (Cth)). As has been noted, they are wholly owned subsidiaries of IAG.

9 IAG is an authorised “non-operating holding company” and the “Level 2” parent company, for prudential purposes, of the “Level 2” IAG Group (see CPS 001). It owns two operating entities in Australia: IAL and Insurance Manufacturers of Australia Pty Limited. CGUA will become a third operating entity in Australia in the Level 2 insurance group if the Scheme is confirmed. IAG New Zealand Limited is also a controlled entity within the Level 2 insurance group and operates pursuant to the terms of the Insurance (Prudential Supervision) Act 2010 (NZ).

10 The IAG Group is a general insurance group with controlled entities in both New Zealand and Australia. It has approximately 13.2m current general insurance policies. IAL has some 8.5m active general insurance policies, of which 920,000 form part of the Transferring Business.

The insurance business of IAL (and its “intermediated” and “retail” limbs)

11 IAL is a significant insurer in the Australian general insurance market. At 30 June 2024, it had net assets of $3.9b (total assets: $17.7b; total liabilities: $13.8b). If the Scheme is confirmed, that figure is forecast to be $2.6b at 1 October 2025 (total assets: $11.1b; total liabilities: $8.5b).

12 IAL has two operating divisions: IIA and Retail Insurance Australia (RIA).

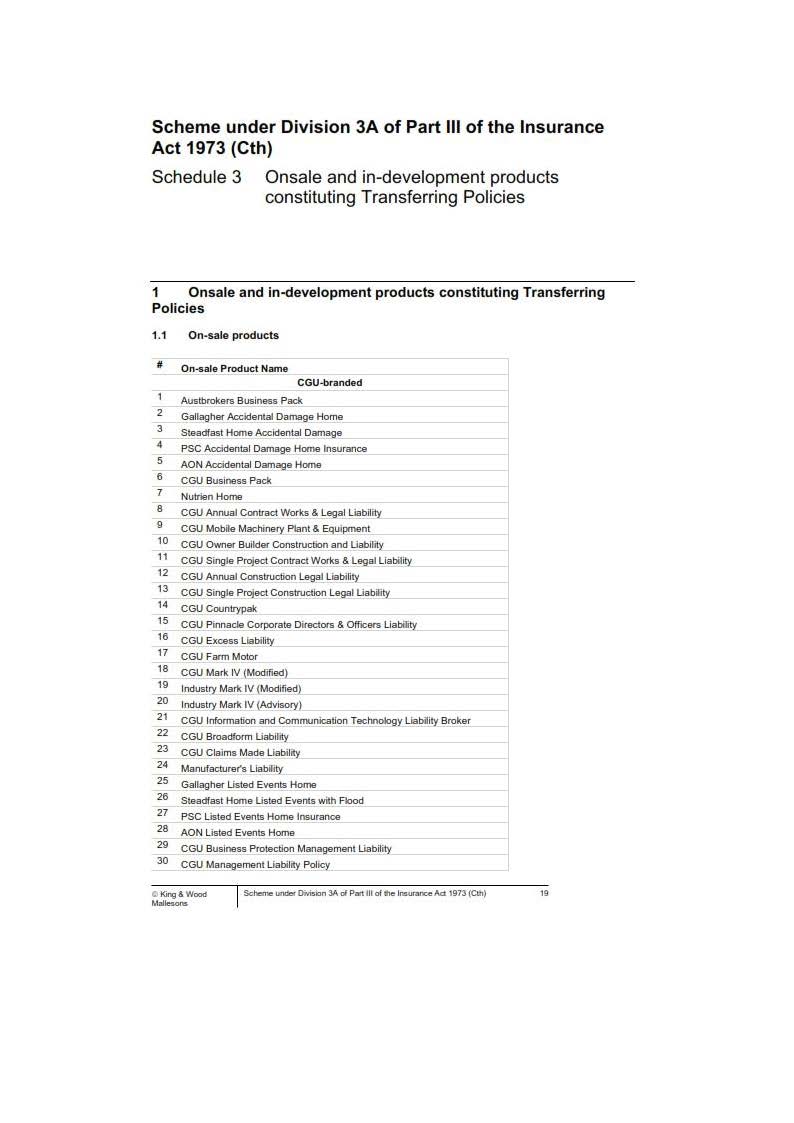

13 IIA deals predominantly in commercial lines general insurance products which are provided to customers typically via a network of intermediaries. The Transferring Business is part of IIA and involves general insurance products that are provided to businesses and individuals through intermediaries under the CGU and WFI brands. IIA commercial products include “short tail” (such as business packages, commercial property, farm and crop, construction and engineering, motorcycle, commercial motor and motor fleet) and “long tail” insurance (such as workers’ compensation, professional indemnity, directors & officers and public and products liability).

14 For the year ending 30 June 2024, the gross written premium of IIA was approximately $5.1b.

15 RIA deals predominantly in personal lines general insurance products that are sold directly to retail customers. The Scheme does not contemplate the transfer of the business of RIA.

The proposed business of CGUA

16 In an affidavit filed 12 June 2025 (the First Marjoribanks Affidavit), Ms Christa Marjoribanks, the Chief Financial Officer of IIA, states that “if the … Scheme is confirmed, the directors of CGUA intend to replicate the existing IIA business by utilising what is known as a “lift and shift” approach for the IIA business moving from IAL to CGUA”. That approach should be of no great concern to the Transferring Policyholders: (a) their rights, entitlements and liabilities will be substantively unaffected; (b) they will continue to be serviced by the same claims team and claims management systems; (c) the underwriting and pricing policies which are applicable to subsidiaries of the IAG Group will apply to CGUA; and (d) CGUA will adopt the existing risk management and reinsurance frameworks and strategies and operational and compliance policies which are established and embedded within the IAG Group. Further detail as to how the business of CGUA is intended to be operated, managed and governed is set out in the First Marjoribanks Affidavit and summarised in In the matter of Insurance Australia (at [25]).

17 It is estimated that, should the Scheme be approved and its terms fulfilled, CGUA’s net assets will be some $1.6b as at 1 October 2025 (with total assets of $6.9b and total liabilities of $5.3b).

The general purpose and rationale of the Scheme

18 The separation of the businesses of IIA and RIA will, on the submission of Mr Thomas SC for the applicants, confer operational and managerial benefits upon the IAG Group. So much is said to follow from the fact that the operational limbs of IAL have different insurance focuses and technology requirements. There is substantial material before the Court to suggest, albeit in a generalised way, that such proposal will also enure to the benefit of policyholders. Though such benefits may be somewhat chimerical, it is a matter of common sense that a sensible and logically structured business will, in some way or the other, work to the benefit of its customers. Here, the proposed separation of the retail division of IAL’s business from its intermediated insurance division has much commend to it from both a business and managerial sense.

Nature and distribution of the Transferring Business

19 The Transferring Business consists predominantly of intermediated commercial lines policies. There is no need to set out, in detail, the breakdown of the Transferring Policies and the extent to which they are intermediated or of a “long” or “short” tail character (but see In the matter of Insurance Australia [27] – [33]), given the policies sought to be transferred will remain within the same group of companies, and the underwriting treaties and policies will remain the same.

Key elements of the Scheme

20 It can be accepted that the Scheme follows a form common amongst general insurance schemes that have been confirmed by the Court under Division 3A of Part III of the Act.

21 The Scheme gives effect to an Implementation Agreement executed by IAL and CGUA (dated 12 June 2025) which, inter alia, sets out the commercial arrangements between them in relation to the sale and transfer of the Transferring Business. The key elements of such are set out at in In the matter of Insurance Australia (at [35]). In short, although the Scheme envisages the internal reorganisation of the business of IAL, it does not involve a change to the terms binding, or the systems or processes for administering claims for, Transferring Policyholders.

22 The Scheme is subject to several conditions. It suffices to observe that little more need be done by the applicants, save for acquiring the Court’s imprimatur under s 17F of the Act.

The relevant legal framework

23 Division 3A of Part III of the Act governs the transfer and amalgamation of insurance business.

24 “No part” of the insurance business of a general insurer may be transferred to another general insurer – who may, relevantly, comprise a body corporate that is authorised under the Act, but has not yet begun, to carry on insurance business in Australia (e.g., CGUA; s 17B(2)) – “except under a scheme confirmed by the Federal Court” (s 17B(1)(a)). Any such scheme must set out the terms and particulars identified by s 17B(3); it was not in dispute that the Scheme did so.

25 Upon the application of any of the bodies corporate affected by the relevant scheme, the Court may confirm the scheme with or without modifications (as it thinks appropriate) or, otherwise, refuse to confirm the scheme (ss 17E – 17F). In so deciding, the Court is obliged to pay regard to the considerations stipulated in s 17F(1A) being, namely:

(1) the interests of the policyholders of a body corporate affected by the scheme;

(2) any report relevant to all or parts of the scheme that has been filed under s 62ZI; and,

(3) any other matter that the Court considers to be relevant.

26 The principles that bear upon the confirmation of the transfer of insurance businesses are not controversial: Insurance Australia Limited, in the application of Insurance Australia Limited [2025] FCA 809 [16] (In the application of Insurance Australia). They were summarised by Jackman J in Aioi Nissay Dowa Insurance Company Limited, in the matter of Aioi Nissay Dowa Insurance Company Limited [2023] FCA 697 (Aioi Nissay) at paragraph [7]:

A critical factor on an application of this kind is whether implementation of the scheme will materially detrimentally affect policyholders: Re Westport Insurance Corporation (No 2) [2009] FCA 1598; (2009) 181 FCR 530 at [32] (Lindgren J). Although an “affected policyholder” is defined in s 17C as the holder of a policy being transferred under the scheme, it is well accepted that the Court is to look to the interests of the relevant policyholders of both the transferor and transferee insurers and consider whether implementation of the scheme will detrimentally affect them in a material way: Re Australian Branch of Great Lakes Insurance SE (trading as Great Lakes Australia) (No 2) [2020] FCA 1266 at [13] (Allsop CJ). A prime consideration is the nature of the actual and potential claims to which the transferor insurer is subject and the financial viability of the transferee insurer: Great Lakes at [13]; Re Reward Insurance Ltd [2004] FCA 151 at [3] (Heerey J).

(see also St Andrew’s Insurance (Australia) Pty Ltd, in the matter of St Andrew’s Insurance (Australia) Pty Ltd [2024] FCA 881 [6] – [7]; Allianz Australia General Insurance Limited, in the matter of Allianz Australia General Insurance Limited [2023] FCA 994 [16] (Allianz); General Insurance Pty Limited, in the matter of OnePath General Insurance Pty Ltd [2023] FCA 1424 [6] – [7] (OnePath)).

27 The question of whether the interests of policyholders would be adversely affected by a scheme is to be resolved largely by recourse to actuarial evidence; a “very important” consideration in this inquiry involves a comparison of the policyholders’ “security and reasonable expectations without the scheme with what it would be if the scheme were implemented”: In the application of Insurance Australia [17], quoting Re London Life Association Limited (unreported, Ch D, Hoffman J, 21 February 1989) and citing both Re Prudential Assurance Company Limited and Rothesay Life plc [2020] EWCA Civ 1626 and Integrity Life Australia Limited, in the matter of Integrity Life Australia Limited [2025] FCA 92 [62] – [63], [142] – [143].

A preliminary consideration: compliance with the Act and Dispensation Orders

28 The applicants filed an application for confirmation of the Scheme on 12 June 2025. Pursuant to s 17C(2) of the Act, such an application “may not be made” unless:

(1) a copy of the scheme and any actuarial report on which the scheme is based have been given to APRA in accordance with the prudential standards; and

(2) notice of intention to make the application has been published by the applicant in accordance with the prudential standards; and

(3) an approved summary of the scheme has been given to every affected policyholder.

It is noted that the aforementioned references to “prudential standards” are to be understood as references to Prudential Standard GPS 410, Transfer and Amalgamation of Insurance Business for General Insurers (GPS 410) (see also s 32(1) of the Act). It is also noted that, as observed in Allianz at [18], the Court is entitled to assume that its orders (here, the Dispensation Orders) have been complied with, except to the extent that evidence is adduced as to non-compliance.

29 On the material before the Court, it is plain that the applicants have substantially complied with the procedural requirements of s 17C(2) (as modulated by Order 1 of the Dispensation Orders). First, and as set out in the First Marjoribanks Affidavit, draft copies of the Scheme, the Scheme Summary and relevant actuarial reports were provided to APRA by March 2025 (see also infra [46]). Second, and as per the affidavits of a Ms Mandy Todhunter (filed 25 August 2025) and a Mr Bernard Condon (filed 26 August 2025) (the Condon Affidavit), the applicants caused a notice of intention to be published in the Commonwealth Government Notices Gazette, as well as various newspapers approved by APRA, on 1 July 2025. Third, the applicants substantively complied with Orders 2 – 9 of the Dispensation Orders in the manner recorded in a letter that they sent to APRA on 21 August 2025 (as annexed to the Condon Affidavit; but see infra [31] – [35]) and, thereby, dispensed with the need to comply with s 17C(2)(c).

30 As an aside, it is noted that APRA considered the evidence pertaining to the nature and degree of publication undertaken by the applicants. It was satisfied that (a) “there has been substantive compliance with the Court’s dispensation orders”; and (b) “the notification process has resulted in sufficiently wide publicity of the scheme to ensure that any reasonable objections that policyholders might have to the Scheme would be made known”. It is a matter of much comfort that APRA has taken the time to consider and address such matters.

A minor instance of non-compliance

31 Notwithstanding the foregoing conclusion, the applicants, very properly, identified a so-called “minor instance of non-compliance with Order 6 of the Dispensation Orders”:

The Scheme Documents [as defined by Order 6 of the Dispensation Orders] were made available on the dedicated Scheme webpage, with links from the homepages of the IAG, CGU and WFI websites, from approximately 2 am on 1 July 2025 to 11 am on 3 July 2025, and from 10 am on 7 July 2025 to, it is planned, 1 September 2025. The actuarial reports of Kaise Stephan, Lisa Simpson and Brett Ward were removed from the dedicated Scheme webpage [on 3 July 2025] for approximately four days as a precautionary measure when potentially material changes to financial projections were identified, to limit the risk of ‘stale’ actuarial reports being viewed by policyholders. …

32 In other words, IAL did not make available, from the date the relevant notice of intention was published in The Age (1 July 2025) up to and including the date of the confirmation hearing (1 September 2025), the actuarial reports of Mr Kaise Stephan, Ms Lisa Simpson and Mr Brett Ward on the webpage https://www.iag.com.au/cgua-licence. Instead, it removed such reports between 3 and 7 July 2025 due to concerns vis-à-vis the currency of the data upon which they relied. By doing so, the applicants breached Orders 6(d) – (f) of the Dispensation Orders.

33 The applicants’ written outline of submissions proceeds to note that:

At approximately 5 pm on 8 August 2025, [the Further Supplementary Independent Actuarial Report of Kaise Stephan, the Further Supplementary Peer Review Actuarial Report of Lisa Simpson and Appointed Actuary Supplemental Note of Brett Ward] were published on the dedicated Scheme webpage. Additional newspaper advertisements on 8 August 2025 alerted policyholders to the publication of further actuarial reports on the dedicated Scheme webpage. …

34 There is no need to traverse, in detail, the nature and extent of the updated actuarial reports at this juncture (but see infra [37] – [44]). It suffices to note that the relevant actuaries concluded that there were no matters arising out of the updated financial forecasts which would, or were likely to, have any material adverse effect upon the interests of the Transferring Policyholders or the holders of IAL policies that were not proposed to be transferred under the Scheme (the Remaining Policyholders) (together, the Impacted Policyholders).

35 In that sense, it cannot be said that any discernible prejudice or disadvantage would flow to any person who was interested to understand the actuarial position of the Scheme, but was unable to do so by reason of the applicants’ instance of “minor non-compliance” with the Dispensation Orders. On the contrary, commendable efforts were made to identify and assess a variation in circumstances which necessitated the removal of some material, for a brief period, followed by the publication of additional information to ensure that policyholders and affected persons were fully and properly informed of the consequences of the Scheme.

36 Having regard to the available evidence and observations of APRA, it is not controversial that the procedural requirements of s 17C(2) of the Act have been substantively complied with.

Will the Scheme materially detrimentally affect Impacted Policyholders?

The actuarial evidence

37 The Scheme is the subject of several actuarial reports and opinions. In this respect:

(1) Mr Stephan, being a Partner of Deloitte Australia and fellow of the Institute of Actuaries Australia (the IAA), has prepared:

(a) an Independent actuarial opinion on the proposed scheme transfer of the IIA business from IAL to CGUA under Division 3A, Part III of the Act (dated 31 March 2025) (the Independent Actuarial Report);

(b) a Supplementary report to the Independent actuarial opinion dated 31 March 2025 on the proposed scheme transfer of the IIA business from IAL to CGUA under Division 3A, Part III of the Act (dated 26 May 2025) (the Supplementary Independent Actuarial Report); and

(c) a Further Supplementary Report to the Independent actuarial opinion dated 31 March 2025 on the proposed scheme transfer of the IIA business from IAL to CGUA under Division 3A, Part III of the Act (dated 29 July 2025) (the Further Supplementary Independent Actuarial Report),

(together, the Stephan Reports).

(2) Ms Simpson, being an actuarial consultant and fellow of the IAA, has prepared:

(a) a Review of Intermediated Insurance Australia scheme transfer report (dated 5 June 2025);

(b) a Supplementary Report on the Review of Intermediated Insurance Australia scheme transfer report (dated 5 June 2025); and

(c) a Peer Review of Independent Actuary's Further Supplementary Report (dated 30 July 2025),

(together, the Simpson Reports).

(3) Mr Ward, being the Level 2 Appointed Actuary of IAG and the Appointed Actuary of IAL and CGUA, has prepared:

(a) an Appointed Actuary Advice and Opinion (dated 5 June 2025) (the Appointed Actuary Opinion); and

(b) an Appointed Actuary Supplemental Note (dated 29 July 2025) (the Appointed Actuary Supplemental Note).

The opinion of Mr Stephan

38 The Independent Actuarial Report offers “an independent opinion on the Scheme and whether the Scheme materially adversely affects the interests of impacted policyholders” (per Item 1.1). Mr Stephan’s “Summary opinion” of such matters is set out at Item 2.1:

Having reviewed the information noted in Appendix A, discussed the Scheme as outlined in Section 1.6, and considering that the transfer is from one Group entity to another which is subject to the same group-wide policies, processes and capital management frameworks, in my opinion:

* The Scheme will not materially reduce the financial protection provided to Impacted Policyholders [being defined to mean the Transferring Policyholders and Remaining Policyholders].

* There will be no change in the contractual rights of Impacted Policyholders other than in the case of the Transferring Policyholders the entity to whom they have recourse.

* There will be no material change in the provision of claims management, policy administration and other services provided to the Impacted Policyholders.

* I do not expect any adverse deterioration in the capital position or solvency of IAL and CGUA arising as a result of the Scheme.

In summary, I have concluded that the interests of the following policyholders are not materially adversely affected by the Scheme:

* Transferring Policyholders, and

* Remaining Policyholders.

39 Such conclusions were said to rest upon the matters identified in Items 2.2 – 2.5 of the report. Therein, Mr Stephan relevantly noted that:

(1) the “capital risk appetite” of IAL pre-Scheme was aligned with that of IAL and CGUA post-Scheme (with the corollary being that “[t]he Scheme will not materially affect the Impacted Policyholders in respect of capital adequacy”) (at Item 2.2.2);

(2) the proposed reinsurance protection for CGUA and its policyholders post-Scheme was consistent with that which protects the policyholders within IAL and IAG pre-Scheme. Furthermore, the reinsurance protections for Remaining Policyholders were unchanged when compared to the pre-Scheme position (at Item 2.2.5);

(3) IAG’s investment strategy is managed at a group level and applies to subsidiaries such as CGUA and IAL (with the corollary being that the appetite and approach of the IAG Group to managing investment risk would not be altered by the Scheme) (at Item 2.2.6);

(4) there would be no material change to the terms of the underlying insurance contracts that govern the Impacted Policyholders (at Item 2.3);

(5) IAG’s approach to claim management processes is governed by a group-wide policy applicable to all IAG subsidiaries (with the corollary being that the Scheme would not effect any alteration to those processes) (at Item 2.4.1); and

(6) the IIA business that was intended to be transferred to CGUA under the Scheme is not additive to, or subtracted from, the appetite and propensity to raise and inject funds into IAL if and when necessary (at Item 2.2.2).

40 The Supplementary Independent Actuarial Report was concerned with “the impact of IAG’s recent announcement of the proposed acquisition of 100% of the issued share capital in RAC Insurance Pty Limited (RACI) from RACI Pty Limited, a wholly owned subsidiary of the Royal Automobile Club of Western Australia Inc (RACWA) and its impact on the Scheme”. In short, Mr Stephan found that the acquisition of RACI would not adversely impact upon the financial stability of, or operations and services provided to, the Impacted Policyholders (at Item 2.2).

41 The Further Supplementary Independent Actuarial Report provides “an updated independent opinion on whether the Scheme adversely impacts the interests of the Impacted Policyholders, taking into account IAG’s updated financial forecasts” following the dispensation hearing on 20 June 2025 (at Item 1.1) (see supra [31] – [32]). Notwithstanding such updates, Mr Stephan considered that the Scheme would not (a) materially reduce the financial protection provided to Impacted Policyholders; or (b) cause adverse deterioration in the capital position or solvency of IAL or CGUA (at Item 1.3). In substance, he determined not to change the conclusions or opinions that had been reached and set out in either of his two earlier reports (at Item 4.6).

The opinion of Ms Simpson

42 The Simpson Reports undertake a peer review of the Stephan Reports. It is sufficient to observe that Ms Simpson is in agreeance with the conclusions reached in each of the Stephan Reports.

The opinion of Mr Ward

43 Mr Ward is the Appointed Actuary of IAG, IAL and CGUA. In his opinion (at Item 2):

… if the Scheme is implemented as proposed, then the policyholders transferring from IAL into CGUA and policyholders that remain within IAL are not expected to be materially adversely affected by the proposed Scheme.

The key reason I have formed this opinion is that I have evaluated and made recommendations in my role as appointed actuary to the Board of both IAL and CGUA, as detailed in the body of this report, concerning key sources of funds for both licensed entities such that the extent of policyholder protection afforded by these sources of funds remains materially similar pre and post implementation of the Scheme.

44 That opinion was the subject of reconsideration in the Appointed Actuary Supplemental Note having regard to “updated financial forecasts” for CGUA and IAL. There, Mr Ward said:

… My opinion remains unchanged in that if the Scheme is implemented as proposed, then the policyholders transferring from IAL into CGUA and policyholders that remain within IAL are not expected to be materially adversely affected by the proposed Scheme.

The key reason I have formed this opinion is that I have evaluated the revised financial forecasts and while there have been changes to the forecasts including the presentation of the AASB [Australian Accounting Standards Board] basis for assets and liabilities, the net asset forecasts and capital forecasts have improved for both IAL and CGUA. The capital forecasts I have considered are set out in Section 4.3.3 of the Independent Actuary’s Further Supplementary Report and are reproduced in the Appendix. Further, actuarial modelling that supported my opinion was focused on the APRA basis for presenting assets and liabilities that have remained consistent since that modelling to the date of this report.

45 Having regard to the context of the Scheme, and its emphasis on continuity, the aforementioned opinions are unexceptional and unsurprising. It is appropriate that they be accepted. It will be recalled that the Scheme gives effect to an intragroup transfer. Though the insurance business of IAL will be disaggregated (by the transfer of the intermediated insurance business in its IIA division to CGUA), both it and CGUA are subsidiaries of IAG and Level 1 Insurers within the broader IAG Group. In that sense, policyholders are not faced with some “complete change of identity, in a group sense”: see FM Insurance Company Limited, in the matter of FM Insurance Company Limited [2021] FCA 1442 [19(g)] – [20]; QBE Insurance (Australia) Ltd, in the matter of Division 3A of Part IIIA of the Insurance Act 1973 (Cth) and QBE Insurance (Australia) Ltd [2015] FCA 1223 [26]. No terms and conditions are to be varied or replaced under the Scheme, and claims systems and processes, presently administered within the IAG Group and its officers and staff, will not be the subject of any changes under the Scheme.

The position of APRA

46 As alluded to in In the matter of Insurance Australia (at [102]), the applicants have engaged extensively with APRA. Between November 2024 and June 2025, they were provided with drafts of the Scheme transfer, the Scheme Summary, updates of the relevant actuarial reports and drafts of the lay evidence intended to be read. As noted above, it is not in doubt that APRA has been furnished with a copy of the Scheme and the actuarial reports prepared in connection with it (including all updates) for the purposes of s 17C(2)(a) and paragraph [4] of GPS 410.

47 On 13 June 2025, APRA formally approved (a) the Scheme Summary; (b) a notice of intention; (c) the newspapers in which such notice of intention was to be published; and (d) the locations for public inspection of the Scheme in each State and Territory.

48 Ms Lyons appeared on behalf of APRA at the hearing of the present application on 1 September 2025: s 17E(3) of the Act. There is much to commend in the manner in which APRA and its legal representatives have approached this application; as above, their independent assessment of the publication and merits of the Scheme has been of great assistance. Much solace can be taken from its view that implementation of the Scheme will not adversely impact policyholders of IAL or CGUA and the fact it, ultimately, supports the approval of the Scheme (see Insurance Australia Limited, in the application of Insurance Australia Limited (No 2) [2017] FCA 980 [109] – [116] (Insurance Australia (No 2)); OnePath [45] – [46]; Aioi Nissay [14]). To recite some of that which appears in Ms Lyons’ submissions, such conclusion was said to flow from:

(1) the applicants’ compliance with s 17C(2) of the Act and the Dispensation Orders;

(2) the content of the actuarial evidence (which “continues to be that the transfer will not impact the ability of IAL or [CGUA] to meet their policyholder obligations, APRA prudential capital requirements or internal target capital levels, or impact the financial security interests of IAL and CGUA policyholders”);

(3) the conclusions of the actuarial evidence (“the Scheme will not adversely affect the rights or interests or benefit security of the policyholders of CGUA and IAL”); and

(4) the updates to IAG’s financial results that were assessed by the supplementary actuarial evidence (“APRA is satisfied that this movement [in the balance sheet of IAL] will not adversely affect the interests of the policyholders”).

49 Ms Lyons also, very properly, noted that, as at 29 August 2025, CGUA had not yet been granted a licence under the relevant workers’ compensation legislation by either WorkCover WA or NT WorkSafe, or received an assurance from the relevant boards that such a licence would be granted upon judicial approval of the Scheme. That being said, the Court was taken to evidence that, on 22 August 2025, IAG had received a letter from WorkCover WA containing its in-principle agreement to grant CGUA a licence under the Workers Compensation and Injury Management Act 2023 (WA), subject to formal approval by the WorkCover WA Board. At the hearing of the matter, Mr Thomas SC adduced evidence that demonstrated a similar form of agreement had been reached vis-à-vis the Northern Territory regime. That being so, it can reasonably be assumed that these matters of licensing will be resolved with the passage of time.

Reinsurance

50 As an aside, it is noted that the Scheme provides for the transfer of all “Transferring Facultative Reinsurance Agreements” to CGUA “on and from” the date on which the Scheme is approved under the Act. Out of an alleged abundance of caution, the applicants also seek orders under the power conferred upon the Court by s 17F(2) (to “make such orders as it thinks fit in relation to reinsurance”) to, in effect, confirm the envisaged transfer of rights and obligations will occur. It is noted that orders of this kind have “frequently been made” to ensure affected policyholders are not deprived of reinsurance that existed pre-transfer in relation to their liabilities: see, eg, Insurance Australia (No 2) [119] – [121]. It is appropriate that such orders be made here.

Conclusion

51 The evidence presently before the Court supports the view that the Scheme will not materially detrimentally affect the interests of the Impacted Policyholders. No objection has been raised vis-à-vis the Scheme (by APRA or any policyholder). In those circumstances, it is appropriate that the Scheme be confirmed in the manner recorded by the orders proposed by the applicants.

I certify that the preceding fifty-one (51) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Derrington. |

Associate:

Dated: 2 October 2025