FEDERAL COURT OF AUSTRALIA

Silvia, in the matter of the Hewit Family Trust (Receivers and Managers Appointed) [2025] FCA 1196

File number(s): | NSD 1499 of 2025 NSD 1500 of 2025 |

Judgment of: | JACKMAN J |

Date of judgment: | 26 September 2025 |

Catchwords: | CORPORATIONS – application for approval of distribution of trust funds and property, receivers’ remuneration and termination of receivership – application for approval of distribution of company funds and property and release from administration – where distributions each in accordance with beneficiaries’ and shareholders’ wishes – where distributions each subject of executed deed of release and indemnity – where remuneration appropriate – applications granted |

Legislation: | Corporations Act 2001 (Cth) Federal Court (Corporations) Rules 2000 (Cth) Corporations Regulations 2001 (Cth) |

Cases cited: | Chou, in the matter of APR Detailed Joinery Pty Ltd (in Liq) [2024] FCA 798 Xu, in the matter of Sydney Carlingford Pty Ltd (Administrators Appointed) [2024] FCA 799 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 22 |

Date of hearing: | 26 September 2025 |

Solicitor for the Plaintiffs: | Mr N Fasullo of Somerset Ryckmans |

ORDERS

NSD 1499 of 2025 | ||

IN THE MATTER OF THE HEWIT FAMILY TRUST (RECEIVERS AND MANAGERS APPOINTED) | ||

BRIAN SILVIA AND GEOFFREY GRANGER IN THEIR CAPACITY AS THE JOINT AND SEVERAL RECEIVERS OF THE ASSETS OF THE HEWIT FAMILY TRUST (RECEIVERS & MANAGERS APPOINTED) Plaintiffs | ||

order made by: | JACKMAN J |

DATE OF ORDER: | 26 SEPTEMBER 2025 |

THE COURT ORDERS THAT:

1. The distribution of the funds and property of the Hewit Family Trust (Trust) by the plaintiffs, as joint and several receivers of the assets of Trust, in accordance with Schedule A to these orders, is approved.

2. The plaintiffs’ remuneration be fixed in the sum of $37,696.00 (excluding GST) for the period 1 November 2024 to 30 June 2025, to be paid from the assets of the Trust.

3. The plaintiffs’ future remuneration, as joint and several receivers of the assets of Trust, be fixed in the sum of $35,000.00 (excluding GST) for the period from 1 July 2025 to the conclusion of the receivership, to be paid from the assets of the Trust.

4. Upon the completion of the distribution referred to in Order 1, the plaintiffs be released from the administration of the affairs of the Trust.

5. Upon the completion of the distribution referred to in Order 1, the plaintiffs be released from any liability in respect of the receivership, save for any fraud, gross negligence, or breach of trust.

6. Upon the completion of the distribution referred to in Order 1, the receivership of the Trust be terminated.

7. The costs of the proceedings be costs in the receivership of the Trust.

8. There be liberty to apply on 2 days’ notice.

Schedule A

Distribution Schedule

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

NSD 1500 of 2025 | ||

IN THE MATTER OF ALON PTY LTD (IN LIQUIDATION) ACN 001 105 620 | ||

BRIAN SILVIA AND GEOFFREY GRANGER AS THE JOINT AND SEVERAL LIQUIDAORS OF ALON PTY LTD (IN LIQ) ACN 001 105 620 Plaintiffs | ||

order made by: | Jackman j |

DATE OF ORDER: | 26 september 2025 |

THE COURT ORDERS THAT:

1. Special leave be granted pursuant to s 488(2) of the Corporations Act 2001 (Cth) (the Act) for the distribution of the funds and property of Alon Pty Ltd (In Liq) ACN 001 105 620 (Company) by the plaintiffs in accordance with Schedule A to these orders.

2. Pursuant to s 480(d) of the Act, upon the completion of the distribution referred to in Order 1, the plaintiffs be released from the administration of the affairs of the Company and ASIC deregister the company.

3. The plaintiffs be released from any liability in respect of the liquidation, save for any fraud, gross negligence, or breach of trust.

4. Pursuant to r 1.3 of the Federal Court (Corporations) Rules 2000 (Cth), compliance with the requirements of r 7.9 of the Federal Court (Corporations) Rules 2000 (Cth) be dispensed with.

5. Pursuant to reg 5.6.71(1) of the Corporations Regulations 2001 (Cth), the requirements of reg 5.6.71 of the Corporations Regulations 2001 (Cth) be dispensed with.

6. The costs of the proceedings be costs in the liquidation of the Company.

7. There be liberty to apply on 2 days’ notice.

Schedule A

Distribution Schedule

[Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.]

REASONS FOR JUDGMENT

JACKMAN J:

1 The plaintiffs, Mr Brian Silvia and Mr Geoffrey Granger, are the joint and several receivers and managers of the assets of the Hewit Family Trust (Receivers & Managers Appointed) (Trust). In that capacity, they bring proceedings NSD1499/2025 and previous proceedings NSD1813/2024 (Hewit Proceedings). Mr Silvia and Mr Granger are also the joint and several liquidators of Alon Pty Ltd (in liquidation) (Company). In that capacity, they bring proceedings NSD1500/2025 and previous proceedings NSD1161/2022 (Alon Proceedings).

2 By Originating Processes filed on 27 August 2025 in each the Hewit Proceedings and Alon Proceedings, the plaintiffs seek the following orders.

3 In respect of the Hewit Proceedings, the plaintiffs seek orders that:

(a) the Court approve the distribution of the funds and property of the Trust in accordance with Schedule A to the Originating Process;

(b) the plaintiffs’ remuneration be fixed in the sum of $37,696.00 (excluding GST) for the period 1 November 2024 to 30 June 2025, to be paid from the assets of the Trust;

(c) the plaintiffs’ future remuneration be fixed in the sum of $35,000.00 (excluding GST) for the period from 1 July 2025 to the conclusion of the receivership;

(d) the plaintiffs be released from the administration of the affairs of the Trust and be released from any liability in respect of the receivership; and

(e) the receivership of the Trust be terminated.

4 In respect of the Alon Proceedings, the plaintiffs seek orders that:

(a) the Court approve the distribution of the funds and property of the Company, in accordance with Schedule A to the Originating Process; and

(b) the plaintiffs be released from the administration of the affairs of the Company and be released from any liability in respect of the liquidation.

5 The plaintiffs rely on the following affidavits filed in support of their applications:

(a) in respect of the Hewit Proceedings:

(i) the affidavit of Geoffrey Peter Granger sworn 22 November 2024 (filed in Proceedings NSD1813/2024) and accompanying exhibit GPG-1;

(ii) the affidavit of Geoffrey Peter Granger sworn 24 January 2025 (filed in Proceedings NSD1813/2024);

(iii) two Affidavits of Geoffrey Peter Granger sworn 31 July 2025 and exhibit GPG -2;

(iv) the affidavit of Nicholas Fasullo affirmed 25 August 2025; and

(v) the affidavit of Nicholas Fasullo affirmed 18 September 2025.

(b) in respect of the Alon Proceedings:

(i) the affidavit of Geoffrey Peter Granger sworn 22 November 2024 (filed in Proceedings NSD 1813/2024) together with Exhibit GPG-1;

(ii) the affidavit of Geoffrey Peter Granger sworn 31 July 2025 together with Exhibit GPG-3;

(iii) the affidavit of Nicholas Fasullo affirmed 25 August 2025; and

(iv) the affidavit of Nicholas Fasullo affirmed 18 September 2025.

6 Notice of this application together with a copy of the respective originating processes and the supporting affidavits was given to all beneficiaries and interested parties on 1 August 2025 and 12 September 2025. Further, notice of the applications and the hearing date was given on 12 September 2025. None of the interested parties has given notice or indicated that they oppose the application or wish to be heard.

7 The salient background facts are as follows:

(a) The prior trustee of the Trust was the Company, which had eleven shares issued to Ronald Hewit (one share), Alan Hewit (one share) and Richard Neal (nine shares, held by him as the Court-appointed administrator of the Estate of the late Paula Hewit).

(b) Following Paula Hewit’s death, there were disputes between shareholders, which resulted in orders being made on 7 February 2022 for the plaintiffs to be appointed as joint and several liquidators of the Company.

(c) As a result of a clause in the trust deed removing the Company as trustee and appointor immediately upon the Company’s winding up, the Company continued as a bare trustee only and the office of the trustee of the Trust became vacant on 7 February 2022.

(d) On 23 December 2022, in order to cure the vacancy of the trustee of the Trust, the plaintiffs filed an application with the Court to be appointed as the joint and several receivers and managers of the Trust.

(e) On 30 May 2023, the plaintiffs were appointed as the joint and several receivers and managers of the assets and undertakings of the Trust.

(f) As at the date of appointment of the plaintiffs as receivers and managers to the Trust, there were no known liabilities.

(g) Upon the transfer of the land in Marsden Park held by the Trust, it is expected that there will be council rates and possibly land tax payable. Otherwise, all known creditors of the Trust have been paid, and presently the Trust has no outstanding tax debts due to the Australian Taxation Office.

(h) Having received clearance from the Australian Tax Office on 22 May 2025, the plaintiffs, as liquidators of the Company, have paid dividends to all unsecured creditors of 100 cents in the dollar plus interest as prescribed in the Corporations Regulations 2001 (Cth).

(i) Following the distribution of the funds and property of the Trust, there are no further matters concerning the receivership of the Trust, and the Company can be deregistered.

8 All assets of the Trust have been realised, and all known creditors have been paid. The assets and the undertaking of the Trust consist of cash at bank of $683,289.61 and land at Marsden Park which is yet to be realised.

9 Following a deduction for the amount for remuneration and expenses such as accounting fees, disbursements and legal fees, the current estimate of the surplus funds, being the cash available for distribution, is $553,789.61.

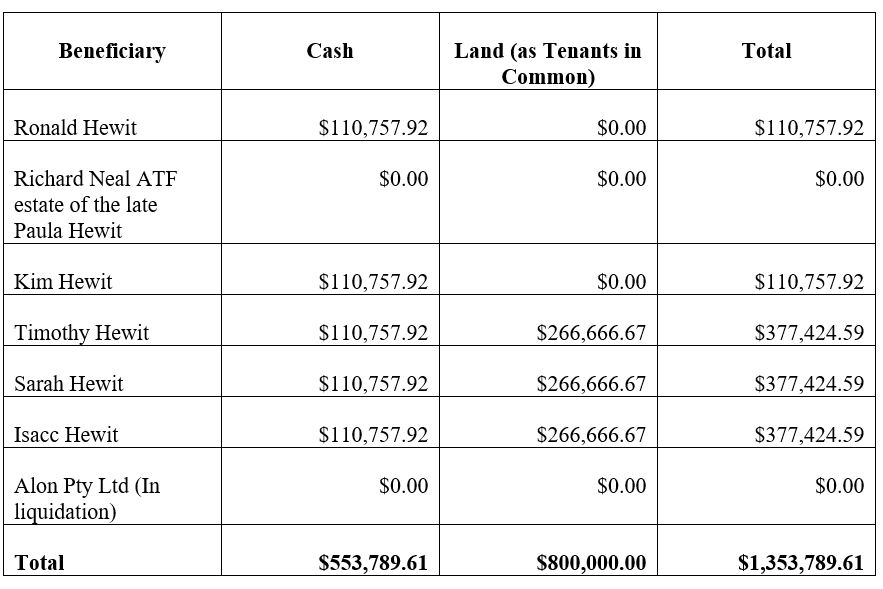

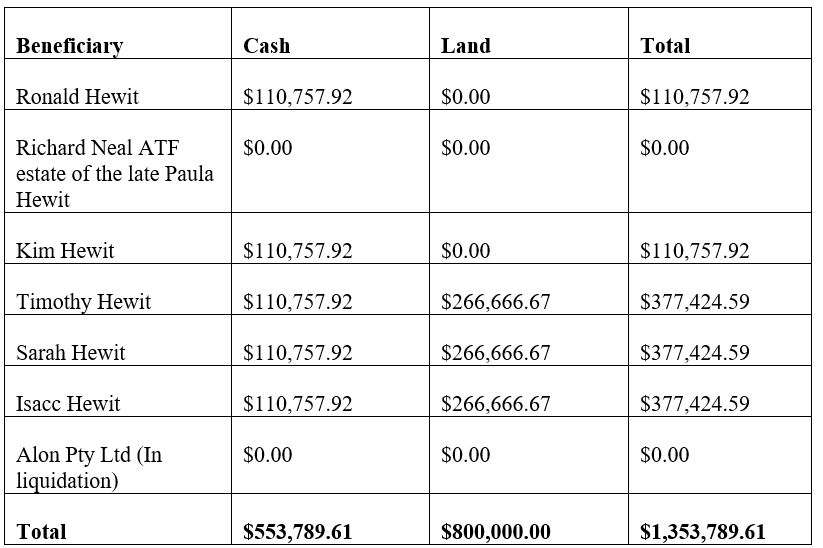

10 There are seven beneficiaries of the Trust. The proposed distribution is as follows:

11 The proposed distribution is:

(a) in accordance with the wishes of the beneficiaries of the Trust;

(b) sought where there is no objection to the orders sought by the plaintiffs; and

(c) is the subject of a Deed of Release and Indemnity which has now been executed.

12 The Originating Process is made under ss 480 and 488(2) of the Corporations Act 2001 (Cth) (the Act) and/or ss 90-15 and 90-20 of Sch 2 to the Act (Insolvency Practice Schedule (Corporations)) (the IPS).

13 As to ss 424 and 425 of the Act and s 60-10(1)(c) of the IPS, the plaintiffs submit, and I accept, that:

(a) the Court has the powers to make orders concerning the remuneration of the plaintiffs as sought in the Originating Process; and

(b) they have satisfied the criteria to enable the Court to make the orders sought in respect of the plaintiffs’ remuneration.

14 As to ss 90-15 and 90-20 of the IPS, the Plaintiffs submit, and I accept, that:

(a) the Court has wide-ranging powers to make orders concerning external administrations; and

(b) the plaintiffs’ application falls within the scope of the matters which are the subject of the Court’s power under those provisions.

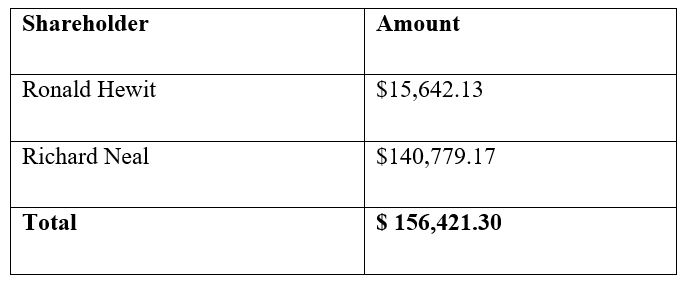

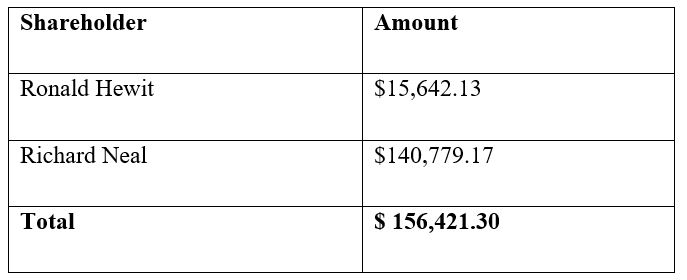

15 The current estimated return to shareholders of the Company is $156,421.30. There are two shareholders of the Company being Ronald Hewit (one share) and Richard Neal (nine shares). The proposed distribution to the shareholders is therefore:

16 As with the Hewit Proceedings, the proposed distribution for the Company is:

(a) in accordance with the wishes of the shareholders;

(b) sought where there is no objection to the orders sought by the plaintiffs; and

(c) is the subject of the Deed of Release and Indemnity which has now been executed.

17 As to ss 480(d) and 488(2) of the Act, the plaintiffs submit, and I accept, that:

(a) the Court has the powers to make orders concerning the distribution as sought by the plaintiffs in the Originating Process;

(b) they have satisfied the criteria to enable the Court to be satisfied that such orders ought to be made; and

(c) the circumstances justify the Court dispensing with the requirements in r 7.9 of the Federal Court (Corporations) Rules 2000 (Cth), and reg 5.6.71 of the Corporations Regulations 2001 (Cth).

18 As to ss 90-15 and 90-20 of the IPS, the plaintiffs repeat their submission, which I have accepted above, concerning the Court’s powers to make orders.

19 In respect of the Company, the plaintiffs’ remuneration has been approved by the creditors and paid, for the period from 7 February 2022 to the conclusion of the liquidation. The plaintiffs are not presently requesting any approval of any further remuneration in relation to the Company.

20 To date, in respect of their receivership of the assets of the Trust, the plaintiffs’ remuneration has been approved by the Court and paid, for the period from 30 May 2023 to 31 October 2024.

21 The plaintiffs submit, and I accept, that the approval of remuneration sought in the Hewit Proceedings is:

(a) in line with the matters which caused the Court to approve the remuneration sought by the plaintiffs in their application which was determined on 6 February 2025;

(b) reflective of the work undertaken since the last Court orders made on 6 February 2025;

(c) appropriate in accordance with the principles set out in the relevant authorities (such as Chou, in the matter of APR Detailed Joinery Pty Ltd (in Liq) [2024] FCA 798 and Xu, in the matter of Sydney Carlingford Pty Ltd (Administrators Appointed) [2024] FCA 799) and the matters set out in s 60–12 of the IPS;

(d) reflective of the nature of the future activities which will be undertaken to the conclusion of the receivership; and

(e) otherwise properly set out in the reports found at Annexures B and C to the second affidavit of Geoffrey Peter Granger sworn 31 July 2025.

22 Accordingly, I make orders substantially in the form propounded by the plaintiffs.

I certify that the preceding twenty-two (22) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Jackman. |

Associate:

Dated: 26 September 2025