Federal Court of Australia

Liberty Primary Metals Australia Pty Ltd v Greensill Capital (UK) Limited [2025] FCA 1065

File number: | NSD 1442 of 2025 |

Judgment of: | DERRINGTON J |

Date of judgment: | 26 August 2025 |

Date of publication of reasons: | 4 September 2025 |

Catchwords: | CORPORATIONS – urgent application for orders to compel removal of financing statements/registrations from Personal Property Securities Register under s 182(4) of the Personal Property Securities Act 2009 (Cth) – where plaintiff granted security interests for defined purpose – where contemporaneous evidence shows security interests to now be obsolete – where continuing registration of security interests an impediment to access to urgent finance – where application unopposed – application granted |

Legislation: | Federal Court of Australia Act 1976 (Cth) Personal Property Securities Act 2009 (Cth) |

Cases cited: | Wickham Hill Investment Pty Ltd v Ding [2019] NSWSC 631 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 41 |

Date of hearing: | 26 August 2025 |

Counsel for the Plaintiff: | Dr C Ward SC with Mr N Mirzai |

Solicitor for the Plaintiff: | Pinsent Masons |

Counsel for the First Defendant: | The First Defendant filed a submitting notice |

Counsel for the Second Defendant: | The Second Defendant filed a submitting notice |

ORDERS

NSD 1442 of 2025 | ||

| ||

BETWEEN: | LIBERTY PRIMARY METALS AUSTRALIA PTY LTD (ACN 631 112 573) Plaintiff | |

AND: | GREENSILL CAPITAL (UK) LIMITED (COMPANY NUMBER 08126173) First Defendant REGISTRAR OF PERSONAL PROPERTY SECURITIES Second Defendant | |

order made by: | DERRINGTON J |

DATE OF ORDER: | 26 AUGUST 2025 |

THE COURT DECLARES THAT:

A. As at 14 August 2025, being the date of the Originating Process filed in these Proceedings, the First Defendant does not hold any security interest over any of the property of the Plaintiff.

THE COURT ORDERS THAT:

1. Pursuant to s 182(4)(a) of the Personal Property Securities Act 2009 (Cth) (PPSA), the Second Defendant is to register a financing change statement removing the following registrations from the Personal Property Securities Register (PPSR):

(a) PPSR registration 201907190008382; and

(b) PPSR registration 201907190013088,

(together, the GCUK Registrations).

2. The First Defendant is to, within 48 hours of the making of these Orders, deliver up any share certificate(s) in respect of any shares in Tahmoor Coal Pty Limited or OneSteel Manufacturing Pty Limited in its possession.

3. The First Defendant, its servants and agents, are restrained from registering or causing to be registered on the PPSR any further financing statement in respect of any security interest or purported security interest over any of the personal property of the Plaintiff prior to 14 August 2025, being the date of the Originating Process filed in these Proceedings.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

DERRINGTON J:

Introduction

1 By an Originating Process filed 18 August 2025, Liberty Primary Metals Australia Pty Ltd (Liberty), seeks orders relating to certain “dormant” security interests previously granted by it. In short, it seeks orders:

(1) compelling the Registrar of Personal Property Securities (the Registrar) to remove two financing statements/registrations (the GCUK Registrations) held by Greensill Capital (UK) Limited (Greensill) from the Personal Property Securities Register (the PPSR);

(2) requiring the delivery up of certain share certificates (to the extent that they are in the possession of Greensill) or, otherwise, confirmation, in writing, that Greensill does not have any such share certificates; and

(3) for declaratory relief that Greensill does not, as at the time of the application, hold any security interest over any of the property of Liberty.

2 Such orders are sought in circumstances where it is said the GCUK Registrations (a) no longer relate to any “Secured Money” (as that expression is defined in the relevant security agreements (see infra [7])); and (b) are an impediment to the ability of Liberty to arrange urgent financing.

3 The proceedings have been served upon Greensill and the Registrar, who have filed Submitting Notices (on 25 and 22 August 2025, respectively) and do not oppose the present application.

Background

4 The below recitation is but a summary of a series of complex arrangements and transactions. The detail of those matters is traversed in the affidavit of a Mr Theunis Victor filed 18 August 2025 (Victor Affidavit), who carefully describes the relevant events and annexes all supporting documentation. Whilst there is a risk the following might oversimplify matters, it is sufficient to show the general nature of the relevant transactions and fulfilment of the parties’ obligations.

The arrangement as between Liberty and Greensill

5 Liberty is the sole shareholder of Tahmoor Coal Pty Limited (Tahmoor) – a mining and metals company that produces coking coal – and OneSteel Manufacturing Pty Limited (OneSteel) – a manufacturer and mining company that produces steel products and iron ore.

6 On or about 12 July 2019, Liberty granted Greensill a security interest over its:

(1) “present and after-acquired” personal property including, without limitation, its book debts and other receivables, and inventory; and

(2) shareholding in OneSteel and Tahmoor,

pursuant to a “General Security Deed” and “Subsidiary Share Security Deed”, respectively.

For the sake of brevity, such security interests shall forthwith be referred to as the “Receivables Purchase Agreement Security Interests”, and the property with which they are concerned shall be referred to, in accordance with the aforementioned deeds, as the “Secured Property”.

7 The Receivables Purchase Agreement Security Interests were granted so as “to secure payment of the Secured Money” (cl 2.1(a) of the General Security Deed and Subsidiary Share Security Deed). As will be seen, that purpose is important. “Secured Money” relevantly includes:

… all money which each Seller [OneSteel and Tahmoor] (whether alone or not) is or at any time may become actually or contingently liable to pay to or for the account of the Secured Party [Greensill] (whether alone or not) for any reason whatever under or in connection with a Secured Document (as amended, novated, supplemented, extended, replaced or restated) whether or not currently contemplated.

8 The phrase “Secured Document” in the aforementioned definition relevantly encompasses “the RPA” which, in turn, is defined by the Subsidiary Share Security Deed to mean:

… the receivables purchase agreement dated on or about the date of this deed between the Grantor as company, seller representative and servicer, the various sellers identified therein and the Secured Party as buyer.

A similar definition of that phrase is provided in the General Security Deed.

9 There is no need to delve into the minutia of the RPA for present purposes. It is sufficient to observe that, pursuant to its terms, Greensill agreed to purchase “Eligible Receivables” – being inclusive of the right to receive amounts due, or amounts expected to be due in the future, from customers of Tahmoor and OneSteel as payment for the supply of products which met certain criteria – from Tahmoor and OneSteel. The sale of such rights provided cash to Tahmoor and OneSteel; in return, Greensill would make a return or profit on each purchased receivable under the RPA equal to the so-called “Discount Margin”, assuming that the relevant customer paid at least the so-called “Net Invoice Amount” in respect of said receivable.

10 Importantly, no receivables could be purchased under the RPA after 21 February 2024.

PPSR Registrations

11 On 19 July 2019, Greensill lodged the GCUK Registrations on the PPSR. They comprised the following registration numbers: 201907190008382 and 201907190013088.

Assignment to Hoffman and issuance of Hoffman Seaview Notes

12 Greensill is a party to a “Master Assignment Agreement” dated 21 December 2017 (the MAA).

13 On 11 July 2019, Hoffman S.à r.l. (Hoffman) issued a “Series Supplement Number: 1” (SSN1) up to the value of USD$200m (as facilitated by the MAA). In effect, SSN1 provided for the assignment, by Greensill to Hoffman, of its right to the payment obligations that it had acquired under the RPA (as well as the Receivables Purchase Agreement Security Interests) for payment of an identified purchase price. Importantly, Hoffman funded such transaction by the issuance of one or more tranches of notes (the so-called Hoffman Seaview Notes) to a variety of holders.

Repayment arrangements

14 In or about March 2021, Greensill entered into administration.

15 On 8 October 2021, certain further agreements – a “Receivables Repayment Agreement” (the RRA), a “Note Purchase and Issuance Agreement” (the NPIA) and a “Loan Note Instrument” (the LNI) – were agreed. At its core, the operative effect of such agreements was to enable the “Obligors” – being a term that was defined to include OneSteel and Liberty – to repay the debt owing to Greensill (albeit a debt which, at that time, had been assigned to Hoffman).

16 On or about 11 October 2021, the holders of the Hoffman Seaview Notes agreed to sell their beneficial rights in such notes to OneSteel for some $146m. OneSteel was able to make such a payment by the issuance of “Loan Notes” to the holders of the Hoffman Seaview Notes.

17 On 3 November 2021, the NPIA was amended by an “Amendment Agreement”. It, inter alia, inserted a new clause that, in effect, provided that once amounts received by the holders of the Loan Notes exceeded the amount equal to the debt owed to Hoffman – being some $400m – any amount received thereafter was to be paid to OneSteel. That is important to the extent that it signified, in the present circumstances, the finalisation of the indebtedness to Hoffman under the relevant arrangements. On the detailed and complex material which is presently before the Court, there is an indication that that indebtedness was satisfied on or about 30 June 2023.

18 It might also be observed that many of the later such transactions occurred in the context of several corporate insolvencies and substantial litigation. These factors might explain, in part, how the financial issues between the parties were resolved. In any event, the Victor Affidavit establishes the absence of any remaining liability under the securities.

19 On 6 July 2023, the NPIA was revised by a series of further amendments. One such amendment provided that all amounts required to be paid under the LNI (being, relevantly, the Loan Notes) had been paid or repaid to the holders as of 30 June 2023. Indeed, it expressly said that:

Each Original Holder confirms that all of the Loan Notes have been redeemed in full and all payments due under the Finance Documents have been satisfied in full on 30 June 2023.

20 As such, no monies that were secured by the Receivables Purchase Agreement Securities were owing to any party on and from 30 June 2023. Further, as the RPA terminated on 20 February 2024 (at the latest), no further amounts could be owing, or become owing, under that agreement on and from that date. That being so, there could be no contingent liability as of that date.

21 In that circumstance, Liberty, Tahmoor and OneSteel have sought to negotiate the collapse of the Hoffman Seaview Notes, including the Receivables Purchase Agreement Securities. Those negotiations have been ongoing since July 2023 and have continued to this day.

22 The impetus for the present application arises as a consequence of financial pressure on Liberty, Tahmoor and OneSteel. In particular, Tahmoor is engaged in considerable efforts to refinance. Whilst financing options have been pursued with urgency, the prospective incoming financiers have, naturally enough, insisted upon any such lending being guaranteed by Liberty and the provision, by Liberty, of first-ranking security interests.

23 The continuing GCUK Registrations are impediments to the provision of any such securities.

Demands for amendment of the Registrar

24 Sections 178 and 182 of the Personal Property Securities Act 2009 (Cth) (the Act) provide:

178 How amendment demands are given

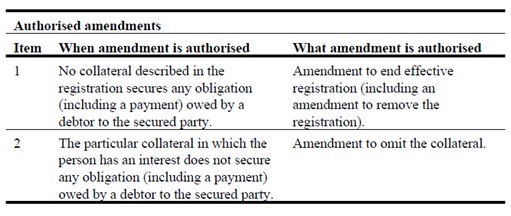

(1) A person with an interest (including a security interest) in collateral described in a registration with respect to a security interest may give a demand (an amendment demand), in writing, to the secured party for a financing change statement to be registered to amend the registration as authorised by the following table:

Note: If the secured party does not comply with the amendment demand, the demand may be enforced under Subdivision A (administrative process) or Subdivision B (judicial process) of Division 2.

…

182 Judicial process for considering amendment demand

(1) The following persons may apply to a court for an order in relation to an amendment demand:

(a) the secured party;

(b) the person who gave the amendment demand.

(2) The person who gave the amendment demand cannot make an application under this section before the end of 5 business days after the day the demand is given to the secured party.

Note: The period may be extended by a court under section 293.

…

(4) On an application under this section, a court may make the following orders:

(a) if the court considers the amendment demanded to be authorised under section 178—an order requiring the Registrar to register a financing change statement amending the registration (including an amendment to remove the registration);

(b) if the court does not consider the amendment demanded to be so authorised—one or more of the following orders:

(i) an order restraining the Registrar from registering a financing change statement amending the registration at the Registrar’s initiative (under section 181);

(ii) an order restraining the person who gave the amendment demand from making such further amendment demands as the court specifies;

(iii) an order restraining the Registrar from giving the secured party amendment notices under section 180 in relation to such further amendment demands as the court specifies;

(c) any other order that the court thinks fit.

(5) The Registrar must comply with a court order to register a financing change statement as soon as reasonably practicable after receiving the order.

Note: The Registrar must give a verification statement to each secured party after the registration of a financing change statement (see section 156).

…

25 On 20 June 2025, the legal representatives of Liberty issued an amendment demand to Greensill which requested that it “register financing change statements to remove the PPSR Registrations [GCUK Registrations] from the PPSR”. This was “because no collateral described in the PPSR Registrations secures any obligation (including a payment) owed by the Grantor [Liberty] or other person to the Secured Party [Greensill]”. Greensill responded five days later, on 25 June 2025. It declined to comply with the amendment demand. In doing so, it did not, as Dr Ward SC and Mr Mirzai for Liberty note, suggest there were any monies outstanding which supported the maintenance of the GCUK Registrations nor any other reason to support their continuance.

26 On 18 August 2025, Liberty filed an Originating Process that sought, inter alia, orders that the Registrar was to register a financing change statement that removed the GCUK Registrations pursuant to s 182(4)(a) of the Act. That which is required to be established under s 182 of the Act, as well as the question of onus, was surveyed by Parker J in Wickham Hill Investment Pty Ltd v Ding [2019] NSWSC 631 (at [162] and [164] – [165]) (Wickham Hill Investment):

… The statutory requirement for removal is negative in form. The consequence is, as Beach J said in National Australia Bank v Garrett, that the onus lies on a grantor seeking removal of the registration to demonstrate that no security interest exists.

… A party who bears the legal onus on an issue may present sufficient material to the Court for the evidentiary onus to shift to the opposing party. In a s 182 application, generally speaking it is the secured party who is best placed to lead evidence which would sustain the security interest claimed. In such circumstances, little evidence may be required from an owner of the collateral who is disputing the security for an evidentiary onus to shift to the secured party to prove that the claimed interest exists.

I also respectfully think that principle would be better served if the onus did lie on the security holder in an application under s 182. The lodgement of a finance statement on the Register, as we have seen, is purely an administrative process. It is not realistic to expect the Registrar to consider the bona fides of such statements when they are lodged. But a registration may have an important practical effect, making it harder for the owner of the collateral to raise finance. Registration also has a legal effect on the relative priorities between security holders. I think the balance will be better struck if the onus lay on the party claiming to have a security interest, once challenged, to justify that interest.

27 Liberty submits there is no outstanding “Secured Money” for the purposes of the Subsidiary Share Security Deed or the General Securities Deed, nor is there the potential for new “Secured Money” to arise. On that basis, it appears that any security interested conferred by those deeds no longer exists; that is to say, there is no extant primary obligation to which the Receivables Purchase Agreement Security Interests may attach (nor is there the potential for one to arise).

28 Liberty has advanced substantial evidence to that effect. It has provided sworn evidence of the repayment of any secured indebtedness and that the securities are now obsolete. In that context, the evidential onus falls on Greensill to justify the security interests which it ostensibly claims to hold. It has neither done so nor attempted to do; as noted, it was served with the proceedings on 18 August 2025 and has since only indicated it submits to “any order the Court may make”.

29 In that setting, it is appropriate to make the order sought under s 182(4)(a) of the Act.

30 As Messrs Ward SC and Mirzai note, s 182 of the Act also empowers the Court to make further orders which are, in effect, ancillary to, or derivative upon, any determination of the question of title. In Wickham Hill Investment, Parker J observed (at [231] – [232]):

In my view, the proper explanation of the decisions in Stocks & Holdings, Milne Feeds and Gangemi, is that where the court exercises its jurisdiction to determine a question of title, it may, in a proper case, grant an injunction in aid of that determination. It hardly needs to be said that the exercise of this power would be sparingly exercised. There would need to be a real basis for thinking that the unsuccessful party will not accept the Court’s conclusion. But in a proper case I think that the Court has power to ensure that its decision quelling the dispute is not frustrated by collateral means.

On this analysis, the power derives from the Court’s general law jurisdiction to determine title to property. It can therefore be exercised by this Court outside the framework of the PPSA. But, having regard to my analysis of s 182, I also think that a declaration of right, and, in a proper case, an injunction in aid of that declaration, can be granted under PPSA, s 182(4)(c).

31 Parker J identified the proper basis for granting an injunction as an aid to the declaratory relief granted. His Honour observed it to be appropriate to do so if there was a real basis for thinking that the unsuccessful party would not accept the Court’s conclusion. I fully accept his Honour’s observations.

32 Of course, sections 21 and 23 of the Federal Court of Australia Act 1976 (Cth) affords the Court a broad statutory power to grant binding declarations as of right and, it should be added, to grant interlocutory injunctive relief in any event. Similar to the learned observations of Parker J in Wickham Hill Investment, the power to grant declaratory relief necessarily carries with it the power to grant relief in aid of the declaration.

33 Here, Liberty seeks declaratory relief that Greensill no longer holds any security interest over its property. It has established, on the evidence presently before the Court, that it is entitled to that relief. It has also sought consequential relief vis-à-vis the Registrar. Not only did Greensill not oppose the application, it did not adduce any evidence to contradict the assertions and allegations made by Liberty. Nevertheless, it projected a position of defiance by refusing the amendment demand of June 2025. No explanation appears for such. Though it is apparent that Greensill is in administration, and that may explain some degree of reduced communication, it does not otherwise explain its position more generally. Further, that lack of responsiveness may reasonably give rise to some concern and, perhaps, suspicion and, for that reason, Liberty might be justifiably concerned as to what actions Greensill may take in the future. It is on that basis that it seeks to restrain Greensill from lodging further (or other) financing statements on the PPSR in respect of the security interests that are the subject of the present application.

34 In circumstances where there is a lacuna of evidence to establish that any “Secured Money” is owing under the relevant securities, and the lodging of further or other registration would stultify Liberty’s (and Tahmoor’s) ability to raise finance, there is sufficient justification for the injunctive relief sought. Whilst the granting of an injunction is to be approached cautiously, it is appropriate in the circumstances that are presently before the Court.

35 A correlative order sought by Liberty is for the delivery up of any share certificate(s) in respect of any shares in Tahmoor or OneSteel in Greensill’s possession. Given the existence of the Subsidiary Share Security Deed with respect to the shareholding in OneSteel and Tahmoor, there is a possibility that some share certificates may be held by Greensill in its capacity as the security holder. That concern is supported by the terms of cl 5.7 of that deed, which provides:

(a) If the Secured Property at any time includes any Marketable Securities, the Grantor must upon the occurrence of an Event of Termination which is continuing:

…

(iv) provide the Secured Party with Control over the Marketable Securities in the matter requested by the Secured Party, including by:

(A) providing a transfer of any certificated Market Securities, executed by the Grantor in blank and otherwise in a form satisfactory to the Secured Party; and

(B) entering into any tripartite agreement requested by the Secured Party with the Grantor’s sponsor or Intermediary.

(b) After the Security has become enforceable, the Grantor:

…

(iii) irrevocably and unconditionally authorises the Secured Party to procure itself or its nominee to be registered as the holder of the Marketable Securities and to:

(A) date and complete any transfers referred to in paragraph (a)(iv)(A) above and lodge those transfers for stamping (if required) and registration accompanied by any applicable Title Documents; and

(B) do all other things necessary to have the Marketable Securities registered in the name of the Secured Party or its nominee (including sending any necessary electronic communications) and, where the Marketable Securities are Intermediated Securities, to have the Securities Account maintained in the name of the Secured Party or its nominee.

36 The expression “Marketable Securities” is relevantly defined by cl 1.1 of that deed as being:

… marketable securities (as defined in section 9 of the Corporations Act 2001 (Cth)), an Investment Instrument, an Intermediated Security, a Negotiable Instrument, a unit or other interest in a trust or partnership, and any right or option in respect of or in connection with any of the foregoing, regardless of whether it has been issued.

37 The term “Control” is left undefined; however, it does link with the concept of “perfection by control” under s 21(2)(c) of the Act (noting that the definition of “investment instrument” in s 10 of the Act includes “a share in a body, or debenture of a body”).

38 It follows that, since the taking of the security interest that was conferred by the Subsidiary Share Security Deed, Greensill may have come into possession of share certificates in respect of Tahmoor or OneSteel, and if it has, it ought be required to deliver them up to Liberty (now that the relevant securities have effectively lapsed). Greensill would have no remaining right to them and has not suggested otherwise. While the order sought is in the nature of a mandatory injunction, an evidential basis for it has been established and, notably, it was not opposed.

39 In the circumstances, there is no need to consider the alternative relief by which Liberty sought written confirmation from Greensill that it does not have possession of any share certificates in respect of Tahmoor or OneSteel. In any event, the preferable relief is to make an order requiring the delivery up of the share certificates, if any. That order will continue and attach to any such certificates which the administrators of Greensill find or discover in the future.

40 In the result, I propose to make the orders that are sought by Liberty, subject to that which has been identified directly above.

Note

41 These are the amended and revised reasons for judgment given on 26 August 2025. Whilst the reasons given above refine and develop those delivered ex tempore, the substance of what was said on 26 August has not been changed nor has any other material change been made.

I certify that the preceding forty-one (41) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Derrington. |

Associate:

Dated: 4 September 2025