FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v National Australia Bank [2025] FCA 947

File number(s): | VID 1253 of 2024 |

Judgment of: | NESKOVCIN J |

Date of judgment: | 13 August 2025 |

Catchwords: | BANKING AND FINANCIAL INSTITUTIONS – alleged contraventions of s 72(4) of the National Credit Code, being Schedule 1 to the National Consumer Credit Protection Act 2009 (Cth) – failure to provide a written response to hardship notices given by customers within the statutory timeframe under s 72(5) of the Code – admitted contraventions – where parties jointly proposed agreed declarations of contravention, a pecuniary penalty and adverse publicity notice – whether penalty appropriate – respondents ordered to pay a pecuniary penalty of $15.5 million |

Legislation: | Australian Securities and Investments Commission Act 2001 (Cth) ss 12GBCM, 12GLB(1)(a) Competition and Consumer Act 2010 (Cth) s 76 Competition and Consumer Act 2010 (Cth), Sch 2, Australian Consumer Law s 224 Corporations Act 2001 (Cth) ss 1101B(1), 1317QA Evidence Act 1995 (Cth) s 191 Federal Court of Australia Act 1976 (Cth) s 21, 43 Insurance Contracts Act 1984 (Cth) s 75R National Consumer Credit Protection Act 2009 (Cth) ss 3, 166, 167, 175A, 182 National Consumer Credit Protection Act 2009 (Cth), Sch 1, National Credit Code ss 72(4), 72(5) National Consumer Credit Protection (Transitional and Consequential Provisions) Act 2009 (Cth) Sch 8, Pt 2, s 3 Treasury Law Amendment (Strengthening Corporate and Financial Sector Penalties) Act 2019 (Cth) National Credit Protection Bill 2009 (Cth) (Pt 4) [8.2], [8.159]–[8.162] |

Cases cited: | Australian Building and Construction Commissioner v Pattinson (2022) 274 CLR 450; [2022] HCA 13 Australian Competition & Consumer Commission v Australian Safeway Stores Pty Ltd (1997) 145 ALR 36 Australian Competition and Consumer Commission v Cement Australia Pty Ltd (2017) 258 FCR 312; [2017] FCAFC 159 Australian Competition and Consumer Commission v Cryosite (2019) 135 ACSR 231; [2019] FCA 116 Australian Competition and Consumer Commission v Get Qualified Australia Pty Ltd (in liq) (No 3) [2017] FCA 1018 Australian Competition and Consumer Commission v Hillside (Australia New Media) Pty Ltd trading as Bet365 (No 2) [2016] FCA 698 Australian Competition and Consumer Commission v Reckitt Benckiser (Australia) Pty Ltd (2016) 340 ALR 25; [2016] FCAFC 181 Australian Competition and Consumer Commission v TPG Internet Pty Ltd (2013) 250 CLR 640; [2013] HCA 54 Australian Competition and Consumer Commission v Yazaki Corporation (2018) 262 FCR 243; [2018] FCAFC 73 Australian Securities and Investments Commission v AGM Markets Pty Ltd (In Liq) (No 4) (2020) 148 ACSR 511; [2020] FCA 1499 Australian Securities and Investments Commission v Allianz Australia Insurance Limited [2021] FCA 1062 Australian Securities and Investments Commission v AMP Financial Planning [2022] FCA 1115; (2022) 164 ACSR 64 Australian Securities and Investments Commission v AustralianSuper Pty Ltd [2025] FCA 102 Australian Securities and Investments Commission v Aware Financial Services Australia Ltd [2022] FCA 146 Australian Securities and Investments Commission v Colonial First State Investments Limited [2021] FCA 1268 Australian Securities and Investments Commission v Commonwealth Bank of Australia [2020] FCA 790 Australian Securities and Investments Commission v Commonwealth Bank of Australia (No 2) [2021] FCA 966 Australian Securities and Investments Commission v Membo Finance Pty Ltd (No 2) [2023] FCA 126 Australian Securities and Investments Commission v National Australia Bank Limited [2020] FCA 1494 Australian Securities and Investments Commission v National Australia Bank Limited [2021] FCA 1013 Australian Securities and Investments Commission v National Australia Bank Limited (2022) 164 ACSR 358; [2022] FCA 1324 Australian Securities and Investments Commission v National Australia Bank Limited (No 2) [2023] FCA 1118 Australian Securities and Investments Commission v Noumi Ltd (No 3) [2024] FCA 862 Australian Securities and Investments Commission v Statewide Superannuation Pty Ltd [2021] FCA 1650 Australian Securities and Investments Commission v Vanguard Investments Australia Ltd (No 2) [2024] FCA 1086 Commonwealth v Director, Fair Work Building Industry Inspectorate (2015) 258 CLR 482; [2015] HCA 46 Construction, Forestry, Mining and Energy Union v Cahill (2010) 269 ALR 1; [2010] FCAFC 39 Forster v Jododex Australia Pty Ltd (1972) 127 CLR 421; [1972] HCA 61 Singtel Optus Pty Ltd v Australian Competition and Consumer Commission (2012) 287 ALR 249; [2012] FCAFC 20 SunshineLoans Pty Ltd v Australian Securities and Investments Commission (2025) 308 FCR 474; [2025] FCAFC 34 Trade Practices Commission v TNT Australia Pty Ltd (1995) ATPR 41-375 Volkswagen Aktiengesellschaft v Australian Competition and Consumer Commission (2021) 284 FCR 24; [2021] FCAFC 49 |

Division: | General Division |

Registry: | Victoria |

National Practice Area: | Commercial and Corporations |

Sub-area: | Regulator and Consumer Protection |

Number of paragraphs: | 94 |

Date of hearing: | 13 June 2025 |

Counsel for the Applicant: | J S Graham and F S Shand |

Solicitor for the Applicant: | Maddocks |

Counsel for the Respondents: | D F C Thomas and J Findlay |

Solicitor for the Respondents: | King & Wood Mallesons |

ORDERS

VID 1253 of 2024 | ||

| ||

BETWEEN: | AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Applicant | |

AND: | NATIONAL AUSTRALIA BANK LIMITED (ACN 004 044 937) First Respondent AFSH NOMINEES PTY LTD ACN 143 937 437 Second Respondent | |

order made by: | NESKOVCIN J |

DATE OF ORDER: | 13 August 2025 |

In these Orders, the following definitions apply:

(a) AFSH means the Second Respondent, AFSH Nominees Pty Ltd (ACN 143 937 437).

(b) AFSH hardship notice means a hardship notice within the meaning of s 72(1) of the Code received by AFSH, and AFSH hardship notices means the AFSH hardship notices identified in Schedule B of these Orders.

(c) ASIC means the Applicant, the Australian Securities and Investments Commission.

(d) Code means the National Credit Code, being Schedule 1 to the Credit Act.

(e) Credit Act means the National Consumer Credit Protection Act 2009 (Cth).

(f) NAB means the First Respondent, National Australia Bank Limited (ACN 004 044 937).

(g) NAB hardship notice means a hardship notice within the meaning of s 72(1) of the Code received by NAB, and NAB hardship notices means the NAB hardship notices identified in Schedule A of these Orders.

(h) Response notice means a notice within the meaning of s 72(4)(a) or (b) of the Code.

THE COURT DECLARES THAT:

1. Pursuant to s 166(2) of the Credit Act:

(a) between 16 November 2018 and 14 October 2023, NAB contravened s 72(4) of the Code on 282 occasions by failing to give the debtor a Response notice in respect of the NAB hardship notices, within the time required by s 72(5) of the Code;

(b) further, in respect of 262 NAB hardship notices received by NAB on or after 13 March 2019 (as identified in Schedule A of these Orders), by operation of s 175A of the Credit Act, NAB contravened s 72(4) of the Code on the day after it contravened s 72(4) and on each day thereafter until the date in column (f) of Schedule A of these Orders, by failing to give the debtor a Response notice before the end of the period required by s 72(5) of the Code;

(c) between 9 January 2019 and 20 September 2023, AFSH contravened s 72(4) of the Code on 63 occasions by failing to give the debtor a Response notice in respect of the AFSH hardship notices, within the time required by s 72(5) of the Code; and

(d) further, in respect of 58 AFSH hardship notices received by AFSH on or after 13 March 2019 (as identified in Schedule B of these Orders), by operation of s 175A of the Credit Act, AFSH contravened s 72(4) of the Code on the day after AFSH contravened s 72(4) and on each day thereafter until the date in column (f) of Schedule B of these Orders, by failing to give the debtor a Response notice before the end of the period required by s 72(5) of the Code.

AND THE COURT ORDERS THAT:

2. Pursuant to s 167(2) of the Credit Act:

(a) within 28 days of the date of this order, NAB pay to the Commonwealth of Australia a pecuniary penalty in the amount of $13 million in respect of the contraventions of s 72(4) of the Code referred to in paragraphs 1(a) and 1(b); and

(b) within 28 days of the date of this order, AFSH pay to the Commonwealth of Australia a pecuniary penalty in the amount of $2.5 million in respect of the contraventions of s 72(4) of the Code referred to in paragraphs 1(c) and 1(d).

3. Pursuant to s 182(1) of the Credit Act, within 30 days of this order, NAB and AFSH publish, at their own expense, a written adverse publicity notice in the terms set out in the Annexure to these Orders (Written Notice), according to the following procedure:

(a) NAB and AFSH will cause the Written Notice to be published on the following webpages maintained by each of them respectively:

(ii) https://www.news.nab.com.au/

(iii) https://www.advantedge.com.au/

(the websites);

(b) NAB and AFSH will ensure that each notice:

(i) appears on the landing page of the websites as a tile on the websites under the heading, “Adverse publicity order”; and

(ii) is maintained on the websites for a period of no less than 90 days from the date of these orders;

(c) NAB will send a copy of the Written Notice to the last known email or postal address of each person who gave a NAB hardship notice as set out in Schedule A of these Orders; and

(d) AFSH will send a copy of the Written Notice to the last known email or postal address of each person who gave an AFSH hardship notice as set out in Schedule B of these Orders.

4. The respondents pay the applicant’s costs of and incidental to this proceeding, as agreed or assessed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

SCHEDULE A

NAB Credit Contracts

(a) Ref number | (b) Type of credit contract | (c) Date of credit contract | (d) Date NAB hardship notice received | (e) Date NAB response notice was due | (f) Date NAB response provided | (g) Number of days no NAB response notice provided (where s 175A applies) | |

N2 | Personal loan | 29 July 2013 | 5 April 2019 | 26 April 2019 | 13 December 2024 | 11 February 2025 | 2116 | |

N4 | Credit card | 14 October 2016 | 19 March 2020 | 9 April 2020 | 11 February 2025 | 1767 | |

N5 | Credit card | 29 June 2016 | 30 June 2020 | 21 July 2020 | 11 February 2025 | 1664 | |

N6 | Personal loan | 2 July 2015 | 11 December 2018 | 2 January 2019 | 11 February 2025 | Ongoing contravention not alleged | |

N7 | Home loan | 13 November 2015 | 11 September 2019 | 2 October 2019 | 13 December 2024 | 11 February 2025 | 1957 | |

N8 | Personal loan | 29 January 2018 | 31 May 2019 | 21 June 2019 | 11 February 2025 | 2060 | |

N9 | Home loan | 9 September 2014 | 15 August 2019 | 5 September 2019 | 13 December 2024 | 1924 | |

N10 | Personal loan | 17 October 2019 | 20 March 2020 | 14 April 2020 | 20 December 2024 | 1709 | |

N12 | Home loan | 3 October 2014 | 16 June 2020 | 7 July 2020 | 20 December 2024 | 1625 | |

N13 | Home loan | 21 May 2015 | 11 February 2020 | 3 March 2020 | 13 December 2024 | 1744 | |

N14 | Home loan | 12 November 2013 | 21 March 2023 | 11 April 2023 | 13 December 2024 | 610 | |

N15 | Home loan | 25 November 2014 | 1 April 2020 | 22 April 2020 | 13 December 2024 | 1694 | |

N16 | Home loan | 3 July 2015 | 24 March 2023 | 14 April 2023 | 20 December 2024 | 614 | |

N17 | Home loan | 6 November 2014 | 28 March 2021 | 19 April 2021 | 13 December 2024 | 1332 | |

N18 | Home loan | 21 October 2015 | 6 May 2019 | 27 May 2019 | 20 December 2024 | 2032 | |

N19 | Home loan | 4 December 2015 | 12 May 2021 | 2 June 2021 | 20 December 2024 | 1295 | |

N20 | Home loan | 2 June 2016 | 26 August 2021 | 16 September 2021 | 13 December 2024 | 1182 | |

N23 | Home loan | 12 February 2016 | 10 September 2021 | 1 October 2021 | 13 December 2024 | 1167 | |

N27 | Home loan | 23 April 2014 | 11 November 2021 | 2 December 2021 | 13 December 2024 | 1105 | |

N28 | Home loan | 6 December 2016 | 12 March 2020 | 2 April 2020 | 20 December 2024 | 1721 | |

N29 | Home loan | 1 May 2013 | 19 March 2021 | 9 April 2021 | 13 December 2024 | 1342 | |

N30 | Home loan | 11 February 2014 | 21 February 2019 | 14 March 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N33 | Home loan | 21 February 2017 | 25 July 2023 | 15 August 2023 | 13 December 2024 | 484 | |

N34 | Home loan | 1 May 2017 | 8 July 2019 | 29 July 2019 | 13 December 2024 | 1962 | |

N35 | Home loan | 1 May 2017 | 22 February 2019 | 15 March 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N37 | Home loan | 22 February 2017 | 2 August 2021 | 23 August 2021 | 20 December 2024 | 1213 | |

N38 | Home loan | 31 May 2017 | 11 November 2019 | 2 December 2019 | 13 December 2024 | 1836 | |

N39 | Home loan | 13 June 2017 | 27 May 2019 | 17 June 2019 | 13 December 2024 | 2004 | |

N40 | Home loan | 7 July 2017 | 1 July 2019 | 22 July 2019 | 13 December 2024 | 1969 | |

N41 | Home loan | 5 June 2017 | 8 October 2020 | 29 October 2020 | 13 December 2024 | 1504 | |

N42 | Home loan | 24 April 2015 | 21 February 2022 | 15 March 2022 | 13 December 2024 | 1002 | |

N43 | Home loan | 19 December 2013 | 19 August 2021 | 9 September 2021 | 13 December 2024 | 1189 | |

N44 | Home loan | 17 July 2017 | 27 September 2021 | 18 October 2021 | 20 December 2024 | 1157 | |

N45 | Home loan | 14 June 2017 | 20 March 2020 | 14 April 2020 | 13 December 2024 | 1702 | |

N46 | Home loan | 31 July 2017 | 3 April 2023 | 24 April 2023 | 13 December 2024 | 597 | |

N47 | Home loan | 8 August 2017 | 22 June 2023 | 13 July 2023 | 13 December 2024 | 517 | |

N48 | Home loan | 5 September 2017 | 29 January 2021 | 19 February 2021 | 20 December 2024 | 1398 | |

N50 | Home loan | 1 September 2017 | 13 October 2020 | 4 November 2020 | 13 December 2024 | 1498 | |

N51 | Home loan | 28 October 2013 | 28 February 2022 | 21 March 2022 | 13 December 2024 | 996 | |

N52 | Home loan | 16 May 2016 | 8 May 2023 | 29 May 2023 | 13 December 2024 | 562 | |

N53 | Home loan | 17 June 2015 | 10 December 2020 | 31 December 2020 | 13 December 2024 | 1441 | |

N54 | Personal loan | 23 December 2016 | 6 January 2020 | 28 January 2020 | 13 December 2024 | 1779 | |

N55 | Personal loan | 23 November 2015 | 18 December 2018 | 8 January 2019 | 20 December 2024 | Ongoing contravention not alleged | |

N56 | Personal loan | 13 December 2016 | 14 November 2018 | 5 December 2018 | 13 December 2024 | Ongoing contravention not alleged | |

N57 | Personal loan | 26 September 2017 | 13 June 2023 | 4 July 2023 | 20 December 2024 | 533 | |

N59 | Home loan | 21 August 2014 | 21 January 2019 | 11 February 2019 | 13 December 2024 | 11 February 2025 | Ongoing contravention not alleged | |

N61 | Personal loan | 28 June 2016 | 30 March 2020 | 20 April 2020 | 13 December 2024 | 1696 | |

N62 | Home loan | 9 October 2014 | 21 June 2022 | 12 July 2022 | 13 December 2024 | 883 | |

N64 | Home loan | 16 October 2017 | 1 September 2022 | 26 September 2022f | 13 December 2024 | 807 | |

N66 | Personal loan | 18 June 2015 | 23 March 2020 | 14 April 2020 | 13 December 2024 | 1702 | |

N67 | Credit card | 13 January 2014 | 14 December 2020 | 4 January 2021 | 20 December 2024 | 1444 | |

N69 | Personal loan | 8 January 2016 | 26 May 2021 | 16 June 2021 | 13 December 2024 | 1274 | |

N70 | Personal loan | 28 November 2017 | 27 February 2019 | 20 March 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N71 | Home loan | 30 September 2013 | 1 November 2021 | 22 November 2021 | 13 December 2024 | 1115 | |

N72 | Credit card | 7 December 2013 | 26 March 2020 | 16 April 2020 | 13 December 2024 | 1700 | |

N73 | Credit card | 9 December 2014 | 27 March 2020 | 17 April 2020 | 13 December 2024 | 1699 | |

N74 | Home loan | 19 December 2017 | 23 May 2023 | 13 June 2023 | 20 December 2024 | 554 | |

N75 | Credit card | 15 December 2014 | 9 February 2021 | 2 March 2021 | 13 December 2024 | 1380 | |

N76 | Credit card | 25 September 2017 | 1 April 2020 | 22 April 2020 | 13 December 2024 | 1694 | |

N77 | Credit card | 19 May 2014 | 25 October 2018 | 15 November 2018 | 20 December 2024 | Ongoing contravention not alleged | |

N78 | Credit card | 17 February 2014 | 3 January 2019 | 24 January 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N79 | Credit card | 25 March 2014 | 30 March 2020 | 20 April 2020 | 13 December 2024 | 1696 | |

N80 | Home loan | 4 January 2018 | 20 March 2020 | 14 April 2020 | 20 December 2024 | 1709 | |

N81 | Credit card | 30 June 2014 | 13 July 2020 | 3 August 2020 | 13 December 2024 | 1591 | |

N82 | Credit card | 26 November 2015 | 26 August 2019 | 16 September 2019 | 13 December 2024 | 1913 | |

N83 | Credit card | 29 January 2014 | 20 March 2020 | 14 April 2020 | 13 December 2024 | 1702 | |

N88 | Personal loan | 7 February 2018 | 25 February 2019 | 18 March 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N89 | Home loan | 15 December 2017 | 3 August 2021 | 24 August 2021 | 13 December 2024 | 1205 | |

N90 | Credit card | 12 September 2017 | 19 March 2020 | 9 April 2020 | 13 December 2024 | 1707 | |

N91 | Personal loan | 27 April 2015 | 19 November 2019 | 10 December 2019 | 13 December 2024 | 1828 | |

N92 | Home loan | 23 September 2014 | 17 March 2023 | 11 April 2023 | 13 December 2024 | 610 | |

N93 | Credit card | 5 March 2015 | 8 January 2020 | 29 January 2020 | 13 December 2024 | 1778 | |

N95 | Credit card | 9 April 2015 | 8 May 2019 | 29 May 2019 | 13 December 2024 | 2023 | |

N96 | Credit card | 9 February 2017 | 31 August 2020 | 21 September 2020 | 13 December 2024 | 1542 | |

N97 | Credit card | 1 August 2014 | 2 April 2020 | 23 April 2020 | 13 December 2024 | 1693 | |

N99 | Credit card | 30 November 2013 | 1 May 2019 | 22 May 2019 | 13 December 2024 | 2030 | |

N101 | Home loan | 29 August 2016 | 24 February 2022 | 17 March 2022 | 13 December 2024 | 1000 | |

N102 | Credit card | 27 November 2014 | 27 March 2020 | 17 April 2020 | 13 December 2024 | 1699 | |

N103 | Home loan | 4 December 2013 | 13 October 2022 | 3 November 2022 | 13 December 2024 | 769 | |

N104 | Home loan | 6 April 2018 | 13 July 2021 | 3 August 2021 | 13 December 2024 | 1226 | |

N105 | Credit card | 2 September 2016 | 14 March 2019 | 4 April 2019 | 13 December 2024 | 2078 | |

N106 | Home loan | 22 March 2018 | 26 February 2019 | 19 March 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N107 | Home loan | 17 February 2017 | 21 September 2021 | 12 October 2021 | 13 December 2024 | 1156 | |

N108 | Personal loan | 4 May 2017 | 31 July 2019 | 21 August 2019 | 13 December 2024 | 1939 | |

N109 | Home loan | 16 December 2014 | 13 March 2021 | 6 April 2021 | 13 December 2024 | 1345 | |

N110 | Credit card | 17 December 2014 | 21 March 2020 | 14 April 2020 | 20 December 2024 | 1709 | |

N111 | Credit card | 9 August 2016 | 19 March 2019 | 9 April 2019 | 20 December 2024 | 2080 | |

N112 | Credit card | 26 October 2016 | 26 July 2021 | 16 August 2021 | 13 December 2024 | 1213 | |

N113 | Credit card | 19 April 2016 | 30 March 2020 | 20 April 2020 | 13 December 2024 | 1696 | |

N114 | Home loan | 4 May 2018 | 17 May 2023 | 7 June 2023 | 13 December 2024 | 553 | |

N115 | Credit card | 3 December 2014 | 30 March 2021 | 20 April 2021 | 13 December 2024 | 1331 | |

N116 | Flexiplus mortgage | 24 December 2014 | 22 September 2021 | 13 October 2021 | 13 December 2024 | 1155 | |

N117 | Credit card | 6 January 2014 | 2 March 2020 | 23 March 2020 | 13 December 2024 | 1724 | |

N118 | Home loan | 9 May 2018 | 12 April 2023 | 3 May 2023 | 13 December 2024 | 588 | |

N119 | Home loan | 28 July 2016 | 23 February 2022 | 16 March 2022 | 13 December 2024 | 1001 | |

N120 | Credit card | 11 May 2016 | 3 September 2019 | 24 September 2019 | 13 December 2024 | 1905 | |

N121 | Credit card | 13 June 2017 | 26 March 2020 | 16 April 2020 | 13 December 2024 | 1700 | |

N122 | Personal loan | 7 July 2015 | 2 May 2019 | 23 May 2019 | 13 December 2024 | 2029 | |

N124 | Credit card | 13 May 2016 | 17 April 2020 | 8 May 2020 | 13 December 2024 | 1678 | |

N125 | Credit card | 3 March 2016 | 3 October 2019 | 24 October 2019 | 13 December 2024 | 1875 | |

N126 | Home loan | 4 May 2016 | 11 November 2021 | 2 December 2021 | 13 December 2024 | 1105 | |

N127 | Credit card | 1 September 2014 | 23 April 2019 | 14 May 2019 | 13 December 2024 | 2038 | |

N128 | Home loan | 21 June 2018 | 22 April 2022 | 13 May 2022 | 13 December 2024 | 943 | |

N129 | Home loan | 25 January 2016 | 3 April 2023 | 24 April 2023 | 13 December 2024 | 597 | |

N130 | Personal loan | 17 December 2014 | 21 September 2020 | 12 October 2020 | 13 December 2024 | 1521 | |

N131 | Credit card | 12 December 2013 | 4 January 2019 | 25 January 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N132 | Credit card | 9 August 2013 | 19 January 2021 | 9 February 2021 | 13 December 2024 | 1401 | |

N133 | Flexiplus mortgage | 12 February 2018 | 4 September 2019 | 25 September 2019 | 13 December 2024 | 1904 | |

N134 | Home loan | 13 September 2016 | 13 May 2023 | 5 June 2023 | 13 December 2024 | 555 | |

N135 | Credit card | 8 August 2016 | 17 February 2020 | 10 March 2020 | 13 December 2024 | 1737 | |

N136 | Home loan | 19 July 2017 | 23 February 2023 | 16 March 2023 | 13 December 2024 | 636 | |

N137 | Personal loan | 29 June 2018 | 17 July 2019 | 7 August 2019 | 13 December 2024 | 1953 | |

N138 | Home loan | 28 June 2018 | 19 March 2020 | 9 April 2020 | 13 December 2024 | 1707 | |

N139 | Personal loan | 20 July 2018 | 19 March 2020 | 9 April 2020 | 13 December 2024 | 1707 | |

N140 | Home loan | 20 July 2018 | 6 September 2021 | 27 September 2021 | 20 December 2024 | 1178 | |

N141 | Credit card | 21 July 2017 | 19 March 2019 | 9 April 2019 | 13 December 2024 | 2073 | |

N142 | Credit card | 31 May 2018 | 7 November 2019 | 28 November 2019 | 13 December 2024 | 1840 | |

N143 | Personal loan | 2 December 2016 | 19 September 2019 | 10 October 2019 | 16 December 2024 | 1892 | |

N144 | Credit card | 2 March 2018 | 31 July 2020 | 21 August 2020 | 13 December 2024 | 1573 | |

N145 | Personal loan | 12 December 2016 | 2 September 2020 | 23 September 2020 | 13 December 2024 | 1540 | |

N146 | Credit card | 21 July 2017 | 29 August 2020 | 21 September 2020 | 13 December 2024 | 1542 | |

N147 | Credit card | 15 June 2018 | 18 June 2019 | 9 July 2019 | 13 December 2024 | 1982 | |

N148 | Credit card | 15 August 2018 | 21 December 2020 | 11 January 2021 | 13 December 2024 | 1430 | |

N149 | Personal loan | 7 September 2018 | 2 September 2022 | 26 September 2022 | 13 December 2024 | 807 | |

N150 | Credit card | 29 June 2018 | 15 March 2021 | 6 April 2021 | 13 December 2024 | 1345 | |

N151 | Home loan | 31 August 2018 | 8 July 2019 | 29 July 2019 | 13 December 2024 | 1962 | |

N152 | Credit card | 22 March 2014 | 18 January 2021 | 8 February 2021 | 13 December 2024 | 1402 | |

N153 | Credit card | 3 December 2014 | 29 November 2022 | 20 December 2022 | 13 December 2024 | 722 | |

N154 | Credit card | 4 September 2017 | 6 April 2020 | 27 April 2020 | 13 December 2024 | 1689 | |

N155 | Personal loan | 24 July 2017 | 13 November 2018 | 4 December 2018 | 13 December 2024 | Ongoing contravention not alleged | |

N156 | Credit card | 7 March 2013 | 3 September 2021 | 27 September 2021 | 13 December 2024 | 1171 | |

N157 | Credit card | 9 October 2017 | 23 March 2020 | 14 April 2020 | 13 December 2024 | 1702 | |

N158 | Personal loan | 28 September 2018 | 15 September 2021 | 6 October 2021 | 13 December 2024 | 1162 | |

N161 | Credit card | 11 September 2013 | 17 April 2021 | 10 May 2021 | 13 December 2024 | 1311 | |

N162 | Credit card | 2 May 2016 | 8 May 2020 | 29 May 2020 | 13 December 2024 | 1657 | |

N163 | Home loan | 18 March 2014 | 29 March 2023 | 19 April 2023 | 13 December 2024 | 602 | |

N164 | Personal loan | 21 July 2016 | 28 December 2018 | 18 January 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N165 | Personal loan | 25 May 2017 | 8 July 2019 | 29 July 2019 | 13 December 2024 | 1962 | |

N166 | Credit card | 9 September 2014 | 9 June 2020 | 30 June 2020 | 13 December 2024 | 1625 | |

N167 | Credit card | 30 March 2015 | 16 September 2021 | 7 October 2021 | 13 December 2024 | 1161 | |

N168 | Home loan | 5 September 2018 | 28 February 2020 | 20 March 2020 | 13 December 2024 | 1727 | |

N169 | Credit card | 22 March 2016 | 18 July 2019 | 8 August 2019 | 13 December 2024 | 1952 | |

N170 | Credit card | 12 April 2018 | 15 September 2021 | 6 October 2021 | 13 December 2024 | 1162 | |

N171 | Credit card | 18 October 2018 | 3 November 2021 | 24 November 2021 | 13 December 2024 | 1113 | |

N172 | Personal loan | 4 January 2018 | 23 April 2019 | 14 May 2019 | 13 December 2024 | 2038 | |

N173 | Credit card | 15 July 2015 | 24 April 2019 | 15 May 2019 | 13 December 2024 | 2037 | |

N174 | Credit card | 29 October 2015 | 3 April 2019 | 24 April 2019 | 13 December 2024 | 2058 | |

N175 | Credit card | 8 September 2016 | 15 February 2019 | 8 March 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N176 | Home loan | 20 February 2018 | 11 February 2019 | 4 March 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N177 | Home loan | 23 October 2018 | 17 December 2019 | 7 January 2020 | 13 December 2024 | 20 December 2024 | 1807 | |

N178 | Home loan | 23 December 2014 | 10 January 2019 | 31 January 2019 | 13 December 2024 | 11 February 2025 | Ongoing contravention not alleged | |

N179 | Home loan | 14 February 2014 | 23 August 2021 | 13 September 2021 | 13 December 2024 | 1185 | |

N180 | Home loan | 22 August 2017 | 7 October 2019 | 28 October 2019 | 13 December 2024 | 1871 | |

N181 | Home loan | 2 January 2019 | 24 July 2019 | 14 August 2019 | 20 December 2024 | 1953 | |

N182 | Credit card | 14 July 2016 | 1 February 2019 | 22 February 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N183 | Personal loan | 25 July 2017 | 4 February 2019 | 25 February 2019 | 13 December 2024 | Ongoing contravention not alleged | |

N184 | Credit card | 4 July 2014 | 28 August 2020 | 18 September 2020 | 13 December 2024 | 1545 | |

N185 | Home loan | 1 November 2017 | 13 February 2019 | 6 March 2019 | 20 December 2024 | Ongoing contravention not alleged | |

N186 | Credit card | 25 January 2017 | 21 February 2023 | 14 March 2023 | 13 December 2024 | 638 | |

N187 | Home loan | 28 September 2018 | 23 February 2021 | 16 March 2021 | 13 December 2024 | 1366 | |

N188 | Credit card | 14 January 2019 | 29 January 2020 | 19 February 2020 | 13 December 2024 | 1757 | |

N189 | Home loan | 27 February 2017 | 25 March 2019 | 15 April 2019 | 13 December 2024 | 2067 | |

N190 | Credit card | 15 December 2015 | 19 March 2019 | 9 April 2019 | 13 December 2024 | 2073 | |

N191 | Credit card | 29 November 2014 | 26 September 2019 | 17 October 2019 | 13 December 2024 | 1882 | |

N192 | Interest only home loan | 11 May 2017 | 28 March 2019 | 18 April 2019 | 13 December 2024 | 2064 | |

N193 | Home loan | 8 September 2017 | 1 April 2019 | 23 April 2019 | 13 December 2024 | 2059 | |

N194 | Home loan | 23 July 2013 | 26 April 2019 | 17 May 2019 | 13 December 2024 | 2035 | |

N195 | Home loan | 6 March 2019 | 21 December 2022 | 11 January 2023 | 13 December 2024 | 700 | |

N196 | Personal loan | 14 February 2019 | 23 April 2019 | 14 May 2019 | 13 December 2024 | 2038 | |

N198 | Home loan | 24 December 2014 | 1 May 2019 | 22 May 2019 | 13 December 2024 | 2030 | |

N199 | Home loan | 11 April 2019 | 11 August 2022 | 1 September 2022 | 13 December 2024 | 832 | |

N200 | Home loan | 15 April 2019 | 21 March 2023 | 11 April 2023 | 13 December 2024 | 610 | |

N201 | Credit card | 10 September 2018 | 28 May 2019 | 18 June 2019 | 20 December 2024 | 2010 | |

N202 | Home loan | 18 March 2016 | 14 November 2019 | 5 December 2019 | 13 December 2024 | 1833 | |

N203 | Home loan | 19 October 2018 | 1 November 2019 | 22 November 2019 | 13 December 2024 | 1846 | |

N204 | Home loan | 30 July 2013 | 10 July 2019 | 31 July 2019 | 13 December 2024 | 1960 | |

N205 | Credit card | 27 March 2013 | 27 November 2019 | 18 December 2019 | 13 December 2024 | 1820 | |

N206 | Credit card | 30 December 2015 | 5 May 2020 | 26 May 2020 | 20 December 2024 | 1667 | |

N207 | Credit card | 3 May 2019 | 24 March 2020 | 14 April 2020 | 13 December 2024 | 1702 | |

N208 | Credit card | 28 June 2019 | 7 May 2020 | 28 May 2020 | 13 December 2024 | 1658 | |

N209 | Home loan | 16 August 2016 | 9 September 2022 | 30 September 2022 | 13 December 2024 | 803 | |

N210 | Personal loan | 31 July 2019 | 8 September 2021 | 29 September 2021 | 13 December 2024 | 1169 | |

N211 | Personal loan | 7 May 2015 | 23 June 2020 | 14 July 2020 | 13 December 2024 | 1611 | |

N212 | Home loan | 20 August 2019 | 12 April 2023 | 3 May 2023 | 13 December 2024 | 588 | |

N213 | Credit card | 29 September 2017 | 16 June 2020 | 7 July 2020 | 20 December 2024 | 1625 | |

N214 | Home loan | 14 November 2013 | 5 October 2021 | 26 October 2021 | 20 December 2024 | 1149 | |

N215 | Credit card | 28 June 2019 | 7 April 2020 | 28 April 2020 | 20 December 2024 | 1695 | |

N216 | Personal loan | 12 September 2019 | 13 November 2019 | 4 December 2019 | 13 December 2024 | 1834 | |

N217 | Home loan | 11 October 2016 | 16 October 2019 | 6 November 2019 | 13 December 2024 | 1862 | |

N218 | Home loan | 9 September 2014 | 30 December 2019 | 20 January 2020 | 13 December 2024 | 1787 | |

N219 | Home loan | 18 September 2018 | 29 October 2019 | 19 November 2019 | 13 December 2024 | 1849 | |

N220 | Credit card | 23 August 2017 | 3 November 2019 | 25 November 2019 | 13 December 2024 | 1843 | |

N221 | Home loan | 5 January 2018 | 7 November 2019 | 28 November 2019 | 13 December 2024 | 1840 | |

N222 | Credit card | 22 January 2016 | 30 April 2020 | 21 May 2020 | 13 December 2024 | 1665 | |

N223 | Home loan | 22 October 2018 | 5 November 2019 | 26 November 2019 | 13 December 2024 | 1842 | |

N224 | Personal loan | 27 September 2017 | 2 January 2020 | 23 January 2020 | 13 December 2024 | 1784 | |

N225 | Home loan | 25 June 2014 | 21 March 2020 | 14 April 2020 | 13 December 2024 | 1702 | |

N226 | Home loan | 2 September 2014 | 29 November 2019 | 20 December 2019 | 13 December 2024 | 1818 | |

N227 | Credit card | 30 October 2019 | 3 July 2020 | 24 July 2020 | 13 December 2024 | 1601 | |

N228 | Personal loan | 11 February 2019 | 2 December 2019 | 23 December 2019 | 13 December 2024 | 1815 | |

N229 | Home loan | 16 July 2019 | 17 January 2023 | 7 February 2023 | 13 December 2024 | 673 | |

N230 | Home loan | 3 July 2014 | 10 December 2019 | 31 December 2019 | 13 December 2024 | 1807 | |

N231 | Personal loan | 11 June 2019 | 25 March 2020 | 15 April 2020 | 13 December 2024 | 1701 | |

N232 | Credit card | 5 December 2016 | 13 December 2019 | 3 January 2020 | 13 December 2024 | 1804 | |

N233 | Home loan | 13 April 2016 | 14 December 2019 | 6 January 2020 | 13 December 2024 | 1801 | |

N234 | Interest only home loan | 19 April 2016 | 27 December 2019 | 17 January 2020 | 13 December 2024 | 1790 | |

N235 | Home loan | 30 May 2019 | 13 January 2020 | 3 February 2020 | 13 December 2024 | 1773 | |

N236 | Home loan | 23 October 2018 | 6 June 2022 | 27 June 2022 | 13 December 2024 | 898 | |

N237 | Credit card | 4 July 2016 | 1 August 2023 | 22 August 2023 | 13 December 2024 | 477 | |

N238 | Home loan | 30 January 2020 | 12 June 2023 | 3 July 2023 | 13 December 2024 | 527 | |

N239 | Home loan | 11 August 2015 | 19 March 2020 | 9 April 2020 | 13 December 2024 | 1707 | |

N240 | Home loan | 14 February 2020 | 12 August 2021 | 2 September 2021 | 13 December 2024 | 1196 | |

N241 | Home loan | 27 March 2015 | 16 March 2020 | 6 April 2020 | 13 December 2024 | 1710 | |

N242 | Home loan | 20 June 2017 | 19 March 2021 | 9 April 2021 | 13 December 2024 | 1342 | |

N243 | Flexiplus mortgage | 17 August 2018 | 30 March 2020 | 20 April 2020 | 13 December 2024 | 1696 | |

N244 | Home loan | 24 September 2019 | 20 March 2020 | 14 April 2020 | 13 December 2024 | 1702 | |

N245 | Personal loan | 10 August 2016 | 23 March 2020 | 14 April 2020 | 11 February 2025 | 1762 | |

N246 | Home loan | 16 March 2020 | 23 December 2021 | 13 January 2022 | 13 December 2024 | 1063 | |

N247 | Credit card | 13 February 2015 | 27 March 2020 | 17 April 2020 | 13 December 2024 | 1699 | |

N248 | Credit card | 1 April 2014 | 1 April 2020 | 22 April 2020 | 13 December 2024 | 1694 | |

N249 | Personal loan | 19 August 2015 | 30 March 2020 | 20 April 2020 | 13 December 2024 | 1696 | |

N250 | Flexiplus mortgage | 28 February 2019 | 21 April 2020 | 12 May 2020 | 13 December 2024 | 1674 | |

N251 | Home loan | 25 March 2013 | 23 July 2021 | 13 August 2021 | 13 December 2024 | 1216 | |

N252 | Home loan | 19 October 2015 | 1 August 2023 | 22 August 2023 | 13 December 2024 | 477 | |

N253 | Home loan | 23 September 2015 | 7 August 2021 | 30 August 2021 | 13 December 2024 | 1199 | |

N254 | Home loan | 29 July 2015 | 19 July 2021 | 9 August 2021 | 13 December 2024 | 1220 | |

N255 | Home loan | 11 February 2019 | 2 December 2020 | 23 December 2020 | 11 February 2025 | 1509 | |

N256 | Home loan | 1 April 2020 | 19 January 2021 | 9 February 2021 | 13 December 2024 | 1401 | |

N257 | Home loan | 22 August 2014 | 29 March 2021 | 19 April 2021 | 13 December 2024 | 1332 | |

N258 | Home loan | 7 July 2016 | 5 July 2021 | 26 July 2021 | 20 December 2024 | 1241 | |

N259 | Home loan | 26 March 2013 | 21 October 2022 | 11 November 2022 | 13 December 2024 | 761 | |

N260 | Home loan | 19 June 2020 | 4 August 2021 | 25 August 2021 | 13 December 2024 | 1204 | |

N261 | Home loan | 25 June 2015 | 6 September 2022 | 27 September 2022 | 13 December 2024 | 806 | |

N262 | Home loan | 10 June 2014 | 16 October 2020 | 6 November 2020 | 13 December 2024 | 1496 | |

N263 | Home loan | 28 September 2020 | 3 March 2023 | 24 March 2023 | 20 December 2024 | 635 | |

N264 | Home loan | 9 November 2020 | 18 August 2023 | 8 September 2023 | 13 December 2024 | 460 | |

N265 | Home loan | 4 December 2020 | 2 August 2021 | 23 August 2021 | 20 December 2024 | 1213 | |

N266 | Home loan | 8 December 2020 | 20 June 2023 | 11 July 2023 | 13 December 2024 | 519 | |

N267 | Home loan | 22 December 2020 | 2 November 2022 | 23 November 2022 | 13 December 2024 | 749 | |

N268 | Home loan | 24 June 2019 | 27 January 2022 | 17 February 2022 | 13 December 2024 | 1028 | |

N269 | Home loan | 16 December 2020 | 10 August 2023 | 31 August 2023 | 13 December 2024 | 468 | |

N270 | Home loan | 2 March 2020 | 20 June 2023 | 11 July 2023 | 13 December 2024 | 519 | |

N271 | Home loan | 2 December 2013 | 31 March 2021 | 21 April 2021 | 13 December 2024 | 1330 | |

N272 | Credit card | 12 January 2021 | 27 May 2022 | 17 June 2022 | 13 December 2024 | 908 | |

N273 | Home loan | 13 May 2021 | 19 June 2023 | 10 July 2023 | 13 December 2024 | 520 | |

N274 | Personal loan | 26 July 2017 | 30 July 2021 | 20 August 2021 | 13 December 2024 | 1209 | |

N275 | Home loan | 10 May 2016 | 29 July 2021 | 19 August 2021 | 20 December 2024 | 1217 | |

N276 | Home loan | 9 July 2021 | 15 August 2023 | 5 September 2023 | 13 December 2024 | 463 | |

N277 | Home loan | 12 July 2021 | 25 March 2022 | 19 April 2022 | 13 December 2024 | 967 | |

N278 | Home loan | 19 November 2015 | 12 August 2021 | 2 September 2021 | 13 December 2024 | 1196 | |

N279 | Home loan | 20 November 2020 | 11 May 2023 | 1 June 2023 | 13 December 2024 | 559 | |

N280 | Home loan | 5 July 2021 | 3 November 2022 | 24 November 2022 | 13 December 2024 | 748 | |

N281 | Home loan | 1 September 2014 | 26 August 2021 | 16 September 2021 | 13 December 2024 | 1182 | |

N282 | Credit card | 17 February 2020 | 28 August 2021 | 20 September 2021 | 13 December 2024 | 1178 | |

N283 | Personal loan | 22 June 2021 | 14 June 2022 | 5 July 2022 | 13 December 2024 | 890 | |

N284 | Personal loan | 14 December 2020 | 4 October 2021 | 25 October 2021 | 13 December 2024 | 1143 | |

N285 | Home loan | 13 September 2021 | 10 August 2023 | 31 August 2023 | 13 December 2024 | 468 | |

N286 | Home loan | 15 October 2021 | 8 April 2022 | 29 April 2022 | 13 December 2024 | 957 | |

N287 | Home loan | 28 February 2020 | 21 March 2023 | 11 April 2023 | 13 December 2024 | 610 | |

N288 | Home loan | 9 November 2021 | 4 March 2022 | 25 March 2022 | 13 December 2024 | 992 | |

N290 | Credit card | 8 June 2021 | 11 April 2022 | 2 May 2022 | 13 December 2024 | 954 | |

N291 | Personal loan | 3 February 2022 | 9 June 2022 | 30 June 2022 | 13 December 2024 | 895 | |

N292 | Credit card | 11 January 2022 | 10 February 2023 | 3 March 2023 | 13 December 2024 | 649 | |

N293 | Home loan | 18 May 2021 | 4 March 2022 | 25 March 2022 | 20 December 2024 | 999 | |

N294 | Home loan | 4 March 2022 | 9 August 2023 | 30 August 2023 | 13 December 2024 | 469 | |

N295 | Home loan | 14 March 2022 | 23 May 2023 | 13 June 2023 | 13 December 2024 | 547 | |

N296 | Home loan | 11 May 2022 | 19 June 2023 | 10 July 2023 | 13 December 2024 | 520 | |

N297 | Personal loan | 22 September 2021 | 16 June 2022 | 7 July 2022 | 13 December 2024 | 888 | |

N298 | Personal loan | 4 May 2017 | 2 August 2022 | 23 August 2022 | 13 December 2024 | 841 | |

N299 | Credit card | 17 March 2022 | 9 August 2023 | 30 August 2023 | 13 December 2024 | 469 | |

N300 | Personal loan | 2 September 2022 | 29 September 2022 | 20 October 2022 | 13 December 2024 | 783 | |

N301 | Home loan | 8 September 2022 | 1 June 2023 | 22 June 2023 | 13 December 2024 | 538 | |

N302 | Home loan | 20 October 2022 | 22 September 2023 | 13 October 2023 | 13 December 2024 | 425 | |

N303 | Personal loan | 30 June 2022 | 21 November 2022 | 12 December 2022 | 13 December 2024 | 730 | |

N304 | Home loan | 22 March 2013 | 18 July 2023 | 8 August 2023 | 13 December 2024 | 491 | |

N305 | Home loan | 30 April 2019 | 28 June 2023 | 19 July 2023 | 13 December 2024 | 511 | |

N306 | Home loan | 24 May 2022 | 19 April 2023 | 10 May 2023 | 13 December 2024 | 581 | |

N307 | Home loan | 29 March 2022 | 28 April 2023 | 19 May 2023 | 13 December 2024 | 572 | |

N308 | Home loan | 12 May 2021 | 15 May 2023 | 5 June 2023 | 13 December 2024 | 555 | |

N309 | Home loan | 19 June 2013 | 19 November 2019 | 10 December 2019 | 13 December 2024 | 1828 | |

N311 | Home loan | 24 November 2021 | 26 July 2023 | 16 August 2023 | 13 December 2024 | 483 | |

N312 | Home loan | 24 November 2021 | 16 August 2023 | 6 September 2023 | 13 December 2024 | 462 | |

Total 282 | 353910 | ||||||

SCHEDULE B

AFSH Credit Contracts

(a) Ref number | (b) Type of credit contract | (c) Date of credit contract | (d) Date AFSH hardship notice received | (e) Date AFSH response notice was due | (f) Date AFSH response notice provided | (g) Number of days no AFSH response notice provided (where s 175A applies) | |

A1 | Advantedge home loan | 20 October 2015 | 8 December 2022 | 29 December 2022 | 13 December 2024 | 713 | |

A2 | Advantedge interest only home loan | 23 October 2014 | 18 December 2018 | 8 January 2019 | 12 December 2024 | Ongoing contravention not alleged | |

A3 | Advantedge interest only home loan | 9 September 2014 | 2 February 2022 | 23 February 2022 | 12 December 2024 | 1021 | |

A4 | Advantedge home loan | 2 March 2015 | 14 October 2019 | 4 November 2019 | 12 December 2024 | 1863 | |

A5 | Advantedge home loan | 20 April 2015 | 20 October 2021 | 10 November 2021 | 20 December 2024 | 1134 | |

A6 | Advantedge home loan | 5 June 2015 | 6 March 2023 | 27 March 2023 | 12 December 2024 | 624 | |

A7 | Advantedge home loan | 4 July 2013 | 4 May 2023 | 25 May 2023 | 20 December 2024 | 573 | |

A8 | Advantedge home loan | 6 June 2013 | 1 April 2020 | 22 April 2020 | 12 December 2024 | 16 December 2024 | 1697 | |

A9 | Advantedge home loan | 27 May 2015 | 14 October 2019 | 4 November 2019 | 12 December 2024 | 1863 | |

A10 | Advantedge home loan | 4 November 2016 | 1 December 2021 | 22 December 2021 | 12 December 2024 | 1084 | |

A11 | Advantedge home loan | 13 February 2017 | 13 May 2022 | 3 June 2022 | 12 December 2024 | 921 | |

A12 | Advantedge interest only home loan | 27 March 2017 | 27 November 2019 | 18 December 2019 | 12 December 2024 | 1819 | |

A13 | Advantedge home loan | 4 July 2017 | 20 May 2022 | 10 June 2022 | 12 December 2024 | 914 | |

A14 | Advantedge home loan | 16 October 2015 | 27 September 2022 | 18 October 2022 | 12 December 2024 | 784 | |

A15 | Advantedge home loan | 12 January 2017 | 6 February 2019 | 27 February 2019 | 12 December 2024 | Ongoing contravention not alleged | |

A16 | Advantedge home loan | 4 March 2015 | 17 February 2022 | 10 March 2022 | 12 December 2024 | 1006 | |

A17 | Advantedge home loan | 10 October 2016 | 29 August 2022 | 19 September 2022 | 12 December 2024 | 813 | |

A18 | Advantedge home loan | 21 October 2016 | 7 July 2022 | 28 July 2022 | 12 December 2024 | 866 | |

A19 | Advantedge home loan | 12 April 2018 | 24 February 2020 | 16 March 2020 | 13 December 2024 | 1731 | |

A20 | Advantedge home loan | 20 April 2017 | 31 January 2022 | 21 February 2022 | 11 February 2025 | 1084 | |

A21 | Advantedge home loan | 20 April 2017 | 8 April 2022 | 29 April 2022 | 11 February 2025 | 1017 | |

A22 | Advantedge home loan | 2 May 2018 | 16 August 2021 | 6 September 2021 | 12 December 2024 | 1191 | |

A23 | Advantedge home loan | 16 October 2017 | 7 October 2022 | 28 October 2022 | 12 December 2024 | 774 | |

A24 | Advantedge home loan | 14 December 2017 | 19 March 2020 | 9 April 2020 | 12 December 2024 | 1706 | |

A25 | Advantedge home loan | 22 May 2015 | 3 February 2022 | 24 February 2022 | 20 December 2024 | 1028 | |

A26 | Advantedge home loan | 7 February 2018 | 2 January 2019 | 23 January 2019 | 12 December 2024 | Ongoing contravention not alleged | |

A27 | Advantedge home loan | 6 December 2017 | 9 October 2019 | 30 October 2019 | 20 December 2024 | 1876 | |

A28 | Advantedge home loan | 4 October 2016 | 7 September 2021 | 28 September 2021 | 20 December 2024 | 1177 | |

A29 | Advantedge home loan | 28 October 2016 | 19 December 2019 | 9 January 2020 | 12 December 2024 | 1797 | |

A30 | Advantedge home loan | 16 June 2016 | 11 August 2021 | 1 September 2021 | 12 December 2024 | 1196 | |

A31 | Advantedge home loan | 20 September 2017 | 10 October 2019 | 31 October 2019 | 12 December 2024 | 1867 | |

A32 | Advantedge home loan | 4 May 2018 | 13 December 2022 | 3 January 2023 | 13 December 2024 | 708 | |

A33 | Advantedge home loan | 27 January 2017 | 22 February 2022 | 15 March 2022 | 12 December 2024 | 1001 | |

A34 | Advantedge home loan | 16 October 2017 | 4 October 2019 | 25 October 2019 | 12 December 2024 | 1873 | |

A35 | Advantedge home loan | 13 April 2017 | 10 January 2023 | 31 January 2023 | 20 December 2024 | 687 | |

A36 | Advantedge home loan | 2 June 2017 | 15 May 2019 | 5 June 2019 | 12 December 2024 | 2015 | |

A37 | Advantedge home loan | 19 January 2017 | 15 January 2019 | 5 February 2019 | 13 December 2024 | Ongoing contravention not alleged | |

A38 | Advantedge home loan | 14 August 2018 | 27 August 2021 | 17 September 2021 | 12 December 2024 | 1180 | |

A39 | Advantedge home loan | 10 December 2018 | 19 March 2020 | 9 April 2020 | 12 December 2024 | 1706 | |

A40 | Advantedge interest only home loan | 16 January 2019 | 24 March 2020 | 14 April 2020 | 20 December 2024 | 1709 | |

A41 | Advantedge home loan | 8 April 2019 | 20 October 2021 | 10 November 2021 | 13 December 2024 | 1127 | |

A42 | Advantedge home loan | 1 May 2019 | 5 July 2023 | 26 July 2023 | 12 December 2024 | 503 | |

A43 | Advantedge home loan | 19 August 2019 | 15 August 2023 | 5 September 2023 | 12 December 2024 | 462 | |

A44 | Advantedge home loan | 31 October 2019 | 25 November 2022 | 16 December 2022 | 12 December 2024 | 725 | |

A45 | Advantedge home loan | 24 January 2020 | 3 April 2023 | 24 April 2023 | 12 December 2024 | 596 | |

A46 | Advantedge home loan | 19 February 2020 | 20 May 2021 | 10 June 2021 | 12 December 2024 | 1279 | |

A47 | Advantedge home loan | 14 April 2020 | 9 March 2022 | 30 March 2022 | 12 December 2024 | 986 | |

A48 | Advantedge home loan | 26 June 2020 | 6 October 2022 | 27 October 2022 | 12 December 2024 | 775 | |

A49 | Advantedge home loan | 20 October 2020 | 25 January 2022 | 15 February 2022 | 12 December 2024 | 1029 | |

A50 | Advantedge home loan | 5 May 2021 | 27 January 2022 | 17 February 2022 | 12 December 2024 | 1027 | |

A51 | Advantedge home loan | 16 August 2021 | 4 November 2022 | 25 November 2022 | 12 December 2024 | 746 | |

A52 | Advantedge home loan | 3 September 2021 | 14 April 2022 | 5 May 2022 | 12 December 2024 | 950 | |

A53 | Advantedge home loan | 8 November 2021 | 11 August 2022 | 1 September 2022 | 12 December 2024 | 831 | |

A54 | Advantedge home loan | 22 February 2022 | 1 February 2023 | 22 February 2023 | 12 December 2024 | 657 | |

A55 | Advantedge home loan | 7 March 2022 | 22 August 2023 | 12 September 2023 | 13 December 2024 | 456 | |

A56 | Advantedge home loan | 17 March 2022 | 6 December 2022 | 28 December 2022 | 12 December 2024 | 713 | |

A57 | Advantedge home loan | 19 April 2022 | 23 March 2023 | 13 April 2023 | 12 December 2024 | 607 | |

A58 | Advantedge home loan | 3 June 2022 | 14 June 2023 | 5 July 2023 | 12 December 2024 | 524 | |

A59 | Advantedge home loan | 22 June 2022 | 23 January 2023 | 13 February 2023 | 12 December 2024 | 666 | |

A60 | Advantedge home loan | 27 October 2022 | 29 August 2023 | 19 September 2023 | 12 December 2024 | 448 | |

A61 | Advantedge home loan | 16 October 2017 | 14 January 2019 | 4 February 2019 | 12 December 2024 | Ongoing contravention not alleged | |

A62 | Advantedge home loan | 5 April 2022 | 21 June 2023 | 12 July 2023 | 12 December 2024 | 517 | |

A63 | Advantedge home loan | 27 June 2022 | 3 February 2023 | 24 February 2023 | 12 December 2024 | 655 | |

Total 63 | 61,297 | ||||||

THE ANNEXURE: WRITTEN NOTICE

The Written Notice shall contain the following text:

ADVERSE PUBLICITY NOTICE

Ordered by the Federal Court of Australia

The Federal Court of Australia has ordered National Australia Bank Limited (NAB) and its wholly owned subsidiary AFSH Nominees Pty Ltd (AFSH) to publish this adverse publicity notice.

On 13 August 2025, Justice Neskovcin of the Federal Court ordered NAB and AFSH to pay penalties totalling $15.5 million to the Commonwealth for failing to provide written response notices to customers’ hardship notices within the required time frame between November 2018 and October 2023.

The failures by NAB and AFSH to provide written response notices concerned 282 hardship notices given by NAB customers and 63 hardship notices given by AFSH customers, being notices that those customers considered they were, or would be, unable to meet their obligations under a credit contract. The Court found that these failures by NAB and AFSH constituted breaches of section 72(4) of the National Credit Code, being Schedule 1 to the National Consumer Credit Protection Act 2009 (Cth). The Court ordered that NAB pay a penalty of $13 million, and AFSH pay a penalty of $2.5 million.

The failures resulted (with a few limited exceptions) from the incorrect use by NAB staff of a particular functionality in its internal system used to manage hardship notices. The causes have since been identified and NAB has taken steps to address those causes.

Since ASIC commenced court proceedings, NAB and ASFH have provided affected customers with a response to their hardship notice and conducted a remediation program which included remediation payments and the correction of repayment history information for some affected customers.

Further information

For further information about the conduct, see the following links:

Statement of facts agreed between the parties [hyperlink];

Supplementary statement of facts agreed between the parties (regarding penalty) [hyperlink];

Justice Neskovcin’s judgment [hyperlink]; and

ASIC media release [hyperlink].

REASONS FOR JUDGMENT

NESKOVCIN J:

1 National Australia Bank (NAB), the first respondent, is a major Australian bank. AFSH Nominees Pty Ltd (AFSH), the second respondent, is part of the NAB Group. NAB and AFSH each hold an Australian Credit Licence.

2 The applicant, the Australian Securities and Investments Commission (ASIC), commenced this proceeding pursuant to ss 166 and 167 of the National Consumer Credit Protection Act 2009 (Cth) (Credit Act) seeking declarations, payment of pecuniary penalties and other relief arising from contraventions by NAB and AFSH of s 72(4) of the National Credit Code (Code), being Schedule 1 to the Credit Act. ASIC alleged that NAB and AFSH contravened s 72(4) of the Code by failing to provide a written response to hardship notices given by customers within the statutory timeframe prescribed by s 72(5) of the Code.

3 NAB and AFSH admitted that:

(a) during the period 16 November 2018 to 14 October 2023, on 282 occasions, NAB contravened s 72(4) of the Code by failing to give a written response to hardship notices submitted by NAB customers within the statutory timeframe prescribed by s 72(5) of the Code;

(b) in respect of 262 hardship notices received by NAB on or after 13 March 2019, by operation of s 175A of the Credit Act, NAB contravened s 72(4) of the Code on each day after the contraventions referred to in paragraph (a) above by its continuing failure to give a written response to the hardship notices (resulting in a further 353,910 contraventions up until 10 February 2025);

(c) during the period 9 January 2019 to 20 September 2023, on 63 occasions, AFSH contravened s 72(4) of the Code by failing to give a written response to hardship notices submitted by AFSH customers within the statutory timeframe prescribed by s 72(5) of the Code; and

(d) in respect of 58 hardship notices received by AFSH on or after 13 March 2019, by operation of s 175A of the Credit Act, AFSH contravened s 72(4) of the Code on each day after the contraventions referred to in paragraph (c) above by its continuing failure to give a written response to the hardship notices (resulting in a further 61,297 contraventions up until 10 February 2025).

4 The parties filed and relied on:

(a) Statements of Agreed Facts and Admissions setting out the facts agreed between the parties pursuant to s 191 of the Evidence Act 1995 (Cth) and NAB and ASFH’s formal admissions of contravention; and

(b) Joint Submissions on liability and relief.

5 The parties agreed to orders by way of relief in the proceeding, including the imposition of pecuniary penalties. The parties jointly sought declarations of contravention, an order that NAB pay a pecuniary penalty of $13 million in respect of its contraventions of s 72(4) of the Code, an order that AFSH pay a pecuniary penalty of $2.5 million in respect of its contraventions of s 72(4) of the Code, an order in relation to a written adverse publicity notice and an order that NAB and AFSH pay ASIC’s costs of and incidental to the proceeding.

6 For the reasons that follow, I consider the proposed relief to be appropriate in all the circumstances, including the proposed pecuniary penalty, and I am satisfied that it is appropriate to make the orders proposed by the parties.

BACKGROUND

7 NAB and AFSH each hold an Australian Credit Licence which authorises them to engage in credit activities under s 6 of the Code and provide credit under credit contracts to which the Code applies. The proceeding concerns contracts for the provision of credit entered into on various dates after 1 March 2013 and before the commencement of the proceeding.

8 Under the Code, customers can advise their lender of their inability to meet their obligations under a credit contract, referred to as a ‘hardship notice’.

9 Relevantly, NAB entered into contracts for the provision of credit (the NAB credit contracts) with 345 customers whose claims are relevant to the proceeding (NAB customers). Further, the NAB customers gave NAB, and NAB received, a hardship notice within the meaning of s 72(1) of the Code (NAB hardship notice).

10 Furthermore, AFSH entered into contracts for the provision of credit (the AFSH credit contracts) with 63 customers whose claims are relevant to the proceeding (AFSH customers). The AFSH customers gave AFSH, and AFSH received, a hardship notice within the meaning of s 72(1) of the Code (AFSH hardship notice).

11 The NAB and AFSH credit contracts were contracts to which the Code applied.

12 NAB handled all aspects of the hardship process via its NAB Assist team (a team at NAB dedicated to managing collections, hardship and deceased estate functions for personal and business banking) on behalf of AFSH and NAB.

13 At all relevant times since about 2016, NAB Assist used the PowerCurve system for managing hardship notices received from customers. This included NAB Assist staff applying certain activities or functionalities within PowerCurve, for example, to approve or decline a hardship arrangement in response to a hardship notice from a customer.

14 The failure to provide responses to the NAB and AFSH hardship notices was as a result of NAB Assist staff using the “reject hardship request” activity (Activity) in PowerCurve in response to a hardship notice in circumstances where, with the exception of six NAB customers, the reasons for the use of the Activity did not fall within any of its intended uses. The Activity had the effect of removing the relevant NAB or AFSH customer’s account from the hardship workflow so that the NAB Assist team did not send a response notice, or any other written communication related to the hardship notice, to the relevant NAB or AFSH customers, with the exception of one NAB customer who was sent a letter confirming their hardship application had been withdrawn at their request.

15 From around April 2023, ASIC examined the policies, practices and procedures of credit providers, including NAB, in relation to financial hardship. In that context, in the course of responding to information requests and follow up questions from ASIC in relation to hardship and credit reporting data during 2023, NAB identified numerous instances where it had not responded to a hardship notice within the required timeframe.

16 On 11 October 2023, NAB notified ASIC of a reportable situation by way of a breach report. The breach report informed ASIC of the failures to provide responses to hardship notices due to the incorrect use of the Activity within PowerCurve.

17 On 29 October 2024, NAB produced data to ASIC during its investigation which indicated that there was a total of 746 instances where the Activity had been used incorrectly between October 2016 and October 2023. This incorrect use of the Activity represented a rate of about 6% of the approximately 12,600 rejected hardship notices reviewed by NAB. NAB has since taken various corrective measures to address the issue, which are mentioned below.

THE STATUTORY FRAMEWORK

18 The Code has effect as a law of the Commonwealth pursuant to s 3 of the Credit Act. It provides a consumer protection framework for consumer credit and related transactions, including setting out debtors’ rights to seek changes to credit contracts on the grounds of hardship: Explanatory Memorandum, National Credit Protection Bill 2009 (Cth) (part 4) [8.2], [8.159]–[8.162].

19 Section 72 of the Code governs aspects of the communications between a credit provider and a debtor where the debtor is facing hardship meeting their obligations under a credit contract entered into on or after 1 March 2013.

20 The relevant parts of the process under s 72 are as follows:

(a) If a debtor considers that he or she is, or will be, unable to meet their obligations under a credit contract to which the Code applies, the debtor may give the credit provider notice under s 72(1) of the Code, orally or in writing, of their inability to meet their obligations (namely, a hardship notice).

(b) Within 21 days after the day of receiving the debtor’s hardship notice, the credit provider may give the debtor notice under s 72(2) of the Code, orally or in writing, requiring the debtor to give the credit provider specified information within 21 days. If such notice is given, the debtor must comply with the requirement (s 72(3)).

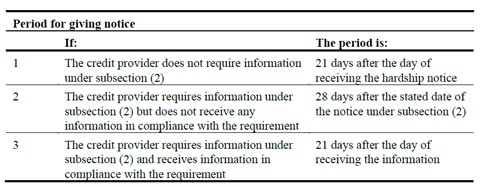

(c) The credit provider must give the debtor a written notice which complies with the requirements in s 72(4)(a) or (b) (as applicable) before the end of the period identified in the table set out at s 72(5) of the Code, which provides as follows:

As noted in the table above, if the credit provider does not require the debtor to provide information under s 72(2), the period specified is 21 days after the day of receiving the hardship notice.

21 Subsection 72(4) of the Code is a civil penalty provision, which enlivens the Court’s powers to make a declaration of contravention and order the payment of a pecuniary penalty for contravention of that section: ss 166 and 167 of the Credit Act

22 The current version of s 72(4) of the Code came into effect on 1 March 2013. Save for an increase in penalty units from 2,000 to 5,000 (from 13 March 2019), the amendments to s 72 of the Code during the contravening period were minor and/or of no present relevance.

23 Section 175A of the Credit Act is entitled “Continuing contraventions of civil penalty provisions” and it provides:

(1) If an act or thing is required under a civil penalty provision to be done:

(a) within a particular period; or

(b) before a particular time;

then the obligation to do that act or thing continues until the act or thing is done (even if the period has expired or the time has passed).

(2) A person who contravenes a civil penalty provision that requires an act or thing to be done:

(a) within a particular period; or

(b) before a particular time;

commits a separate contravention of that provision in respect of each day during which the contravention occurs (including the day the relevant pecuniary penalty order is made or any later day).

24 Section 175A of the Credit Act was introduced as part of the Treasury Law Amendment (Strengthening Corporate and Financial Sector Penalties) Act 2019 (Cth) (Strengthening Penalties Act) and commenced on 13 March 2019. That Act introduced near identical continuing contravention provisions in s 1317QA of the Corporations Act 2001 (Cth) (Corporations Act), s 12GBCM of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) and s 75R of the Insurance Contracts Act 1984 (Cth).

25 The Explanatory Memorandum to the Strengthening Penalties Act provides, at [1.113] (emphasis added):

Contravening a civil penalty provision does not relieve the person of their obligations under the provision. If an act or thing is required to be done, the obligations continue until the act or thing is done. This means that if the act or thing is not done, the civil penalty provision is initially contravened, and a separate contravention is then committed each day until the act or thing is done.

26 Thus, s 175A of the Credit Act provides that the credit provider’s obligation to give a written notice under s 72(4) of the Code continues until that act is done (s 175A(1)) and a credit provider who contravenes s 72(4) of the Code commits a separate contravention of that provision in respect of each day during which the contravention occurs (including the day the relevant pecuniary penalty order is made or any later day) (s 175A(2)). The transitional provisions of the Strengthening Penalties Act provide that s 175A applies in relation to a contravention of s 72(4) of the Code if the conduct constituting the contravention of the provision occurs wholly on or after the commencement date, being 13 March 2019: National Consumer Credit Protection (Transitional and Consequential Provisions) Act 2009 (Cth), Schedule 8, Part 2, s 3.

27 The parties did not refer to any authorities in relation to the transitional provisions of the Strengthening Penalties Act. They did, however, refer to Australian Securities and Investments Commission v AustralianSuper Pty Ltd [2025] FCA 102 (Hespe J), where AustralianSuper admitted that between 1 July 2013 to 19 June 2022 it failed to establish rules as required by s 108A of the Superannuation Industry (Supervision) Act 1993 (Cth). ASIC sought civil penalties under s 912A(1)(a) and (5A) of the Corporations Act for failures that occurred between 13 March 2019 to 30 June 2022. Section 912A(5A), which was introduced with effect from 13 March 2019, provides that a contravention of s 912A(1)(a) is a contravention of s 912A(5A), which is a civil penalty provision.

28 Justice Hespe said, at [164]:

It is only conduct occurring wholly on or after the commencement date which results in the contravention of s 912A(5A) and which attracts the civil penalty provision. However, the fact that contravening conduct commenced occurring prior to the commencement date and continued after the commencement date does not prevent a determination of a contravention in respect of the conduct that occurred after the commencement date. Such an outcome is consistent with the approach adopted in Australian Securities and Investments Commissioner v Westpac Banking Corporation [2022] FCA 515 at [409]–[412] (Beach J) and in Australian Securities and Investments Commission v Macquarie Bank Limited [2024] FCA 416 at [69] (Wigney J).

29 Finally, the analogous substantive provision, s 1317QA of the Corporations Act, was considered in Australian Securities and Investments Commission v Statewide Superannuation Pty Ltd [2021] FCA 1650 at [88]–[89] (Besanko J) and Australian Securities and Investments Commission v Noumi Ltd (No 3) [2024] FCA 862 at [49]–[50] (Jackman J). In Statewide Superannuation, the respondent had failed to lodge a written breach report with ASIC within the statutory timeframe in s 912D of the Corporations Act. Besanko J accepted that there was a separate contravention on each day that the defendant failed to lodge the written report. In Noumi, the respondent had failed to notify the ASX of relevant information and contravened the continuous disclosure obligations under s 674(2) of the Corporations Act. Jackman J accepted that, by operation of s 1317QA of the Corporations Act, the contraventions were continuing contraventions, with a separate contravention occurring on each trading day in the relevant periods.

NAB AND AFSH’S CONTRAVENTIONS OF SECTION 72(4)

30 NAB and AFSH admit that:

(a) each of the NAB customers and the AFSH customers gave NAB or AFSH respectively a hardship notice;

(b) NAB and AFSH each did not give their respective customers, within 21 days after receiving the hardship notice, any notice under s 72(2) of the Code requiring their customer to provide specified information;

(c) pursuant to s 72(4) and (5), NAB and AFSH were each required to give their respective customers a notice in accordance with s 72(4)(a) or (b) (response notice) before the end of the period comprising 21 days after the day it received the hardship notice;

(d) NAB and AFSH did not give their respective customers a response notice at any time before commencement of this proceeding; and

(e) since commencement of this proceeding, NAB and AFSH have each given their respective customers a response notice (with the exception of one NAB customer since deceased).

31 The parties having agreed the facts which establish each of the elements of a contravention of s 72(4) of the Code, I am satisfied that:

(a) during the period 16 November 2018 to 14 October 2023, NAB contravened s 72(4) on 282 occasions; and

(b) during the period 9 January 2019 to 20 September 2023, AFSH contravened s 72(4) on 63 occasions

(Initial Contraventions).

32 The parties submit that, in respect of NAB’s and AFSH’s admitted continuing failures to give a response notice to a hardship notice received after 13 March 2019, the Court can be satisfied that, in addition to the Initial Contraventions, after 13 March 2019:

(a) NAB contravened s 72(4) on 353,910 occasions up until 10 February 2025; and

(b) AFSH contravened s 72(4) on 61,297 occasions up until 10 February 2025,

(Continuing Contraventions).

33 I am satisfied that, in addition to the Initial Contraventions, the Continuing Contraventions arise on or after 13 March 2019 by operation of s 175A of the Credit Act. The parties submitted, and I accept, that:

(a) The transitional provisions of the Strengthening Penalties Act apply to s 175A of the Credit Act.

(b) The relevant enquiry is whether the continuing obligation and failure to give a response notice under s 72(4) by the timeframes prescribed by s 72(5) occurred wholly each day on or after 13 March 2019. That approach is consistent with AustralianSuper at [164] (Hespe J).

(c) By operation of s 175A, a separate contravention of s 72(4) of the Code occurred each day on or after 13 March 2019 that NAB or AFSH contravened s 72(4) of the Code until NAB or AFSH gave the relevant customer a response notice: s 175A(2) of the Credit Act; Statewide Superannuation at [88]–[89] (Besanko J); Noumi at [49]–[50] (Jackman J) .

DECLARATORY RELIEF

34 ASIC seeks declarations pursuant to s 21 of the Federal Court of Australia Act 1976 (Cth) (Federal Court Act) and s 166(2) of the Credit Act. The terms of the declaration were agreed between the parties.

35 The language of s 166(2) of the Credit Act is mandatory. Once the Court finds that a person has contravened the Credit Act, the Court must give a declaration to that effect.

36 For the purpose of s 21 of the Federal Court Act, the parties directed the Court to the considerations which generally apply to the making of declarations, as outlined in Forster v Jododex Australia Pty Ltd (1972) 127 CLR 421; [1972] HCA 61 at 437–8 (Gibbs J). That is, that it is necessary for the Court to be satisfied before making a declaration that:

(a) the question is a real and not a hypothetical one;

(b) the applicant has a real interest in raising the question; and

(c) there is a proper contradictor, that is a person who has a true interest to oppose the declaration sought.

37 The proposed declarations relate to conduct that contravenes the Code and the Credit Act.

38 I am satisfied that ASIC has a real interest in seeking declarations of contravention in this proceeding. Declarations record the Court’s disapproval of the relevant conduct and vindicate the regulator’s claim that a party has contravened the law. Declarations sought by regulators serve an important deterrent effect, by warning others of the risk of engaging in conduct giving rise to similar contraventions: Australian Competition and Consumer Commission v Cryosite (2019) 135 ACSR 231; [2019] FCA 116 at [40] (Beach J); Australian Securities and Investments Commission v Allianz Australia Insurance Limited [2021] FCA 1062 at [121] (Allsop CJ).

39 NAB and AFSH are proper contradictors, even in circumstances where they have made admissions as to the contravening conduct and agreed to the proposed orders: Cryosite at [39]; Australian Securities and Investments Commission v Commonwealth Bank of Australia [2020] FCA 790 at [155] (Beach J).

40 I am satisfied that it is appropriate to make the declarations in the form of the declarations in the proposed orders.

PECUNIARY PENALTIES

The statutory power to impose a pecuniary penalty

41 The Court has power to order that NAB and AFSH pay a pecuniary penalty under s 167(1) and (2) of the Credit Act: SunshineLoans Pty Ltd v Australian Securities and Investments Commission (2025) 308 FCR 474; [2025] FCAFC 34 at [111] (Perram, Bromwich and Colvin JJ).

42 Section 167(2) of the Credit Act provides:

Court may order person to pay pecuniary penalty

(2) If a declaration has been made under section 166 that the person has contravened the provision, the court may order the person to pay to the Commonwealth a pecuniary penalty that the court considers is appropriate (but not more than the amount specified in section 167A).

43 Section 167(3) of the Credit Act provides that, in determining the pecuniary penalty, the Court must take into account all relevant matters, including:

(a) the nature and extent of the contravention; and

(b) the nature and extent of any loss or damage suffered because of the contravention; and

(c) the circumstances in which the contravention took place; and

(d) whether the person has previously been found by a court (including a court in a foreign country) to have engaged in similar conduct.

Approach where the parties have agreed a pecuniary penalty

44 The practice and approach to making orders proposed by agreement in a civil penalty proceeding was explained by the High Court in Commonwealth v Director, Fair Work Building Industry Inspectorate (2015) 258 CLR 482; [2015] HCA 46. The plurality (French CJ, Kiefel, Bell, Nettle and Gordon JJ) stated, at [58], that it is consistent with principle and highly desirable in practice for the Court to accept the parties’ proposal as to an agreed penalty, subject to the Court being sufficiently persuaded of the accuracy of the parties’ agreement as to facts and consequences, and that the penalty proposed is “an appropriate remedy in the circumstances”.

45 In considering whether the proposed agreed penalty is an appropriate penalty, the Court should generally recognise that the agreed penalty is most likely the result of compromise and pragmatism on the part of the regulator, and can be expected to reflect, amongst other things, the regulator’s considered estimation of the penalty necessary to achieve deterrence and the risks and expense of the litigation had it not been settled: Volkswagen Aktiengesellschaft v Australian Competition and Consumer Commission (2021) 284 FCR 24; [2021] FCAFC 49 at [129] (Wigney, Beach and O’Bryan JJ), referring to Fair Work at [109] (Keane J).

Applicable principles

46 The civil penalty regime in the Credit Act is similar in form to the civil penalty regimes in other Commonwealth statutes including the ASIC Act and the Competition and Consumer Act 2010 (Cth) (CCA) (s 76) and the Australian Consumer Law (being Schedule 2 to the CCA) (s 224). The principles relevant to the interpretation of those provisions were recently summarised by O’Bryan J in Australian Securities and Investments Commission v Vanguard Investments Australia Ltd (No 2) [2024] FCA 1086 at [33]–[37], which I gratefully adopt and repeat insofar as they are relevant to this proceeding.

47 First, the Court may impose a penalty in respect of each act or omission that constitutes a contravention, subject to the maximum penalty which is stated to apply to each act or omission.

48 Second, the penalty to be imposed is a penalty that the Court considers appropriate. In that regard, the principal object of imposing a pecuniary penalty is deterrence; both the need to deter repetition of the contravening conduct by the contravener (specific deterrence) and to deter others who might be tempted to engage in similar contraventions (general deterrence): Singtel Optus Pty Ltd v Australian Competition and Consumer Commission (2012) 287 ALR 249; [2012] FCAFC 20 at [62]–[63] (Keane CJ, Finn and Gilmour JJ); Australian Competition and Consumer Commission v TPG Internet Pty Ltd (2013) 250 CLR 640; [2013] HCA 54 at [65] (French CJ, Crennan, Bell and Keane JJ); Fair Work at [55] (French CJ, Kiefel, Bell, Nettle and Gordon JJ) and at [110] (Keane J); Australian Building and Construction Commissioner v Pattinson (2022) 274 CLR 450; [2022] HCA 13 at [15] (Kiefel CJ, Gageler, Keane, Gordon, Steward and Gleeson JJ).

49 Third, in determining the appropriate penalty, the Court must take into account all relevant matters, including the specific matters referred to in s 167(3) of the Credit Act. Other factors that are relevant to the assessment of the appropriate penalty, and which were the subject of agreed facts in this proceeding, are:

(a) the deliberateness of the contravention;

(b) whether the contravention arose out of the conduct of senior management or at a lower level;

(c) the size and financial position of the contravening company;

(d) corrective measures taken in response to an acknowledged contravention; and

(e) whether the company has shown a disposition to cooperate with the authorities responsible for the enforcement of the law in relation to the contravention.

50 Fourth, in considering the sufficiency of a proposed civil penalty, regard must ordinarily be had to the maximum penalty. The maximum penalty provides a “yardstick”, to be taken and balanced with all other relevant factors: Pattinson at [53]–[54]; Australian Competition and Consumer Commission v Reckitt Benckiser (Australia) Pty Ltd (2016) 340 ALR 25; [2016] FCAFC 181 at [155]–[156] (Jagot, Yates and Bromwich JJ).

51 Fifth, in determining the appropriate penalty for a multiplicity of civil penalty contraventions, the Court may have regard to two common law principles that originate in criminal sentencing, the “course of conduct” principle and the “totality” principle: Australian Competition and Consumer Commission v Yazaki Corporation (2018) 262 FCR 243; [2018] FCAFC 73 at [226] (Allsop CJ, Middleton and Robertson JJ) .

52 Under the “course of conduct” principle, the Court determines whether it is appropriate that a “concurrent” or single penalty should be imposed for the contraventions by considering whether the contravening acts or omissions arise out of the same course of conduct or the one transaction: Yazaki Corporation at [234]. Whether multiple contraventions should be treated as a single course of conduct is a question of fact and degree: Construction, Forestry, Mining and Energy Union v Cahill (2010) 269 ALR 1; [2010] FCAFC 39 at [39] (Middleton and Gordon JJ). The application of the principle requires an evaluative judgement in respect of the relevant circumstances: Australian Competition and Consumer Commission v Cement Australia Pty Ltd (2017) 258 FCR 312; [2017] FCAFC 159 at [425] (Middleton, Beach and Moshinsky JJ). The “course of conduct” principle guards against the risk that the respondent is punished twice in respect of multiple contravening acts or omissions that should be evaluated, for the purposes of assessing an appropriate penalty, as a lesser number of acts of wrongdoing: Cahill at [39].

53 The “totality” principle operates as a “final check” to ensure that the penalties to be imposed on a wrongdoer, considered as a whole, are just and appropriate and that the total penalty for related offences does not exceed what is proper for the entire contravening conduct in question: Trade Practices Commission v TNT Australia Pty Ltd (1995) ATPR 41–375 at 40,169 (Burchett J); Australian Competition & Consumer Commission v Australian Safeway Stores Pty Ltd (1997) 145 ALR 36 at 53 (Goldberg J).

Maximum penalty

54 Prior to 13 March 2019, the maximum penalty applying to a corporation under s 167(3)(b) of the Credit Act (from 1 March 2013) was 5 times the maximum number of penalty units referred to in the civil penalty provision (which was 2,000 penalty units).

55 The Strengthening Penalties Act introduced the following amendments relevant to determining the maximum penalty (from 13 March 2019):

(a) the maximum number of penalty units for a contravention of s 72(4) of the Code increased to 5,000 penalty units;

(b) s 175A of the Credit Act was introduced; and

(c) the maximum pecuniary penalty for a body corporate became the greatest of the penalty specified for the civil penalty provision, multiplied by 10, or the alternative calculations specified in s 167B(2) of the Credit Act.

56 From 13 March 2019, s 167B(2) has provided as follows:

The pecuniary penalty applicable to the contravention of a civil penalty provision by a body corporate is the greatest of:

(a) the penalty specified for the civil penalty provision, multiplied by 10; and

(b) if the court can determine the benefit derived and detriment avoided because of the contravention—that amount multiplied by 3; and

(c) either:

(i) 10% of the annual turnover of the body corporate for the 12-month period ending at the end of the month in which the body corporate contravened, or began to contravene, the civil penalty provision; or

(ii) if the amount worked out under subparagraph (i) is greater than an amount equal to 2.5 million penalty units—2.5 million penalty units.

57 The parties agreed that s 167B(2)(c) is applicable in determining the maximum pecuniary penalty in this proceeding. Further, s 167B(2)(c)(ii) is applicable, because 10% of the “annual turnover” (within the meaning of s 5 of the Credit Act) of the NAB Group (which includes AFSH) in each 12-month period since 13 March 2019 is greater than an amount equal to 2.5 million penalty units.