Federal Court of Australia

Fraser, in the matter of AQC Dartbrook Pty Ltd (administrators appointed) (receivers and managers appointed) [2025] FCA 889

File number(s): | NSD 1258 of 2025 NSD 1259 of 2025 |

Judgment of: | CHEESEMAN J |

Date of judgment: | 30 July 2025 |

Date of publication of reasons: | 6 August 2025 |

Catchwords: | CORPORATIONS – applications by administrators under s 439A(6) of the Corporations Act 2001 (Cth) for an extension of the convening period for the second meeting of creditors of companies and ancillary orders – where companies are engaged in an unincorporated joint venture to operate a mine – where more time needed to effect a sale or recapitalisation of joint venture as a going concern – where the administrators of all the companies and also the receivers appointed by the secured creditor are of the view that allowing additional time likely to enhance return to creditors and to make recommendations for the consideration of creditors at the second meetings – whether the convening period ought be extended for a period of six months – whether to make a Daisytek order under s 447A(1) of the Corporations Act and s 90-15 of the Insolvency Practice Schedule (Corporations) 2016 – Held: applications granted |

Legislation: | Corporations Act 2001 (Cth) ss 435A, 439A and 447A(1) Insolvency Practice Schedule (Corporations) 2016 s 90-15 |

Cases cited: | Chamberlain, in the matter of South Wagga Sports and Bowling Club Ltd (administrators appointed) [2009] FCA 25 Clubb, in the matter of DS Opco Pty Ltd (administrators appointed) (receivers and managers appointed) [2019] FCA 2206; 141 ACSR 497 In the matter of Daisytek Australia Pty Ltd (administrators appointed) [2003] FCA 575; 45ACSR 446 Mighty River International Ltdv Hughes; Mighty River International Ltd v Mineral Resources Ltd (2018) 265 CLR 480; [2018] HCA 38 Re Diamond Press Australia Pty Ltd [2001] NSWSC 313 Re Riviera Group Pty Ltd (admins appointed) (receivers and managers appointed) [2009] NSWSC 585; 72 ACSR 352 Strawbridge, in the matter of Virgin Australia Holdings Pty Ltd (administrators appointed) (No 2) [2020] FCA 717; 144 ACSR 347 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 81 |

Date of hearing: | 30 July 2025 |

Counsel for the Plaintiffs in NSD 1258 of 2025 and NSD 1259 of 2025: | Ms Z Hillman |

Solicitor for the Plaintiffs in NSD 1258 of 2025: | Norton Rose Fulbright Australia |

Solicitor for the Plaintiffs in NSD 1259 of 2025 | GRT Lawyers |

Solicitor for the receivers and managers in NSD 1258 of 2025 and NSD 1259 of 2025: | Gilbert + Tobin |

ORDERS

NSD 1258 of 2025 | ||

IN THE MATTER OF AQC DARTBROOK PTY LTD (ADMINISTRATORS APPOINTED) (RECEIVERS AND MANAGERS APPOINTED) & ANOR | ||

BETWEEN: | SHAUN ROBERT FRASER AND JONATHAN PHILIP HENRY IN THEIR CAPACITY AS JOINT AND SEVERAL ADMINISTRATORS OF THE SECOND PLAINTIFF AND THIRD PLAINTIFF First Plaintiff AQC DARTBROOK PTY LTD ACN 000 012 813 (RECEIVERS AND MANAGERS APPOINTED) (ADMINISTRATORS APPOINTED) Second Plaintiff AQC DARTBROOK MANAGEMENT PTY LTD ACN 007 377 577 (RECEIVERS AND MANAGERS APPOINTED) (ADMINISTRATORS APPOINTED) Third Plaintiff | |

order made by: | CHEESEMAN J |

DATE OF ORDER: | 30 JULY 2025 |

THE COURT ORDERS THAT:

Extension to the period in which to convene second creditors’ meetings

1. Pursuant to s 439A(6) and s 447A(1) of the Corporations Act 2001 (Cth), the period within which the first plaintiffs (McGrathNicol Administrators) must convene the second meeting of creditors of each of the second and third plaintiffs (AQC Companies) under s 439A of the Act (Second Meetings) be extended to 11:59 pm on 2 February 2026.

2. Pursuant to s 447A(1) of the Act and or s 90-15 of the Insolvency Practice Schedule (Corporations), Part 5.3A of the Act is to operate in relation to the AQC Companies such that, notwithstanding s 439A(2) of the Act, the Second Meetings may be held together or separately at any time during the period up to, or within 5 business days after the end of, the convening period as extended by order 1.

3. Within two business days of these orders being made, the McGrathNicol Administrators are to give notice of these orders to creditors of each of the AQC Companies (including persons claiming to be creditors) by means of a circular:

(a) to be published on the website maintained by the McGrathNicol Administrators in respect of the administration of the AQC Companies; and

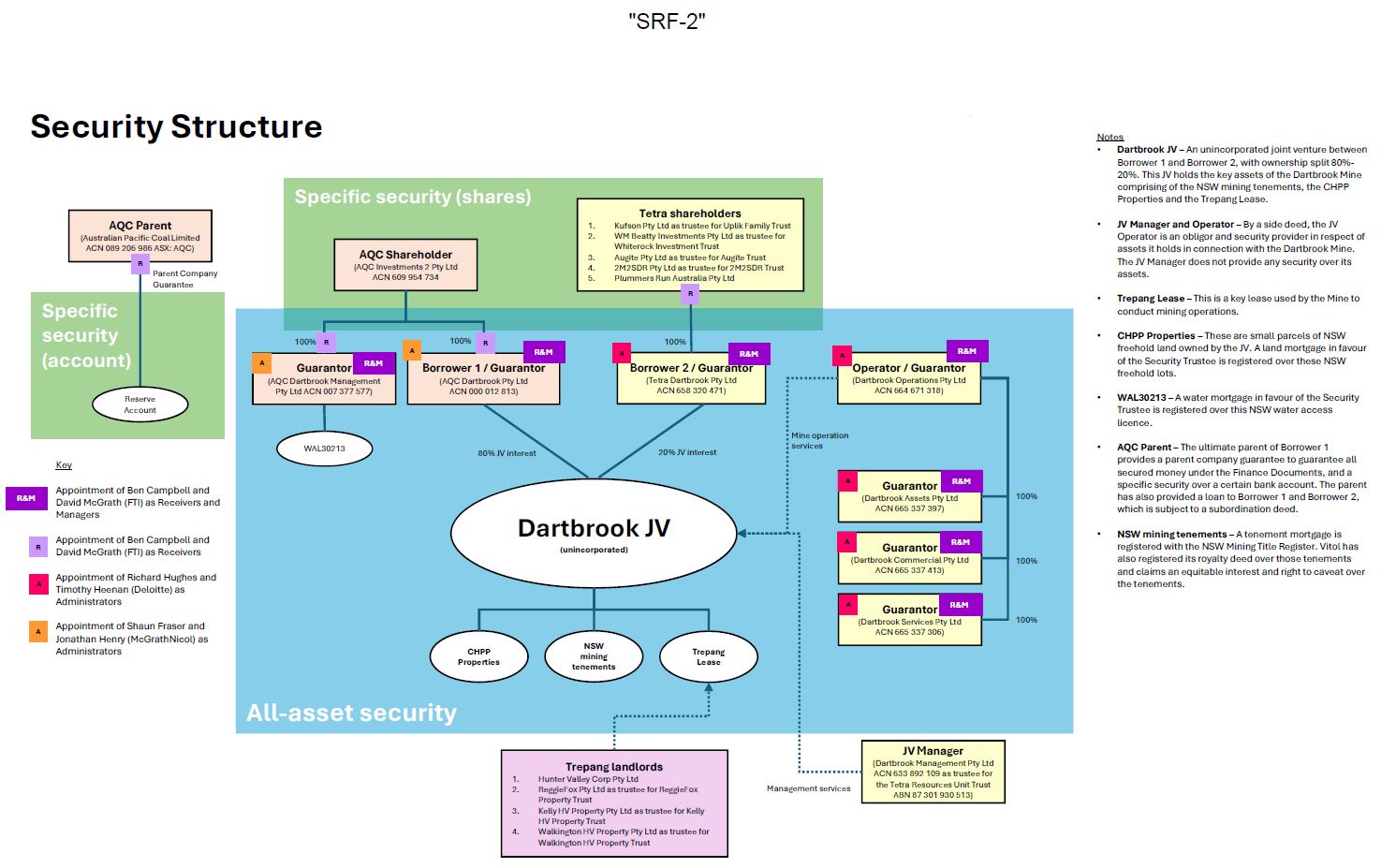

(b) to be sent by email or by post to all known creditors.

General

4. Liberty is granted to any person who can demonstrate sufficient interest to discharge or modify these orders on the giving of three business days' written notice to the plaintiffs and the Court.

5. The McGrathNicol Administrators’ costs of, and incidental to, this application be costs in the administrations of the AQC Companies.

6. The plaintiffs be granted leave to uplift from the court file the affidavit of Shaun Robert Fraser affirmed on 27 July 2025 including the annexures to that affidavit and to file in its place a version of that affidavit and Tab 11 of annexure SRF-1 that are redacted to mask those parts of the affidavit that were not read or tendered on this application.

The court notes that:

A. This application was heard concurrently with the application in proceeding NSD1259/2025 on 30 July 2025 with evidence in one proceeding being evidence in the other.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

NSD 1259 of 2025 | ||

IN THE MATTER OF DARTBROOK OPERATIONS PTY LTD ACN 664 671 318 (RECEIVERS AND MANAGERS APPOINTED) (ADMINISTRATORS APPOINTED) & ORS | ||

BETWEEN: | RICHARD JOHN HUGHES AND TIMOTHY JOSEPH HEENAN IN THEIR CAPACITY AS JOINT AND SEVERAL ADMINISTRATORS OF THE SECOND, THIRD, FOURTH, FIFTH, AND SIXTH PLAINTIFFS First Plaintiff DARTBROOK OPERATIONS PTY LTD ACN 664 671 318 (RECEIVERS AND MANAGERS APPOINTED) (ADMINISTRATORS APPOINTED) Second Plaintiff DARTBROOK ASSETS PTY LTD ACN 665 337 397 (RECEIVERS AND MANAGERS APPOINTED) (ADMINISTRATORS APPOINTED) (and others named in the Schedule) Third Plaintiff | |

order made by: | CHEESEMAN J |

DATE OF ORDER: | 30 JULY 2025 |

THE COURT ORDERS THAT:

Extension to the period in which to convene second creditors' meetings

1. Pursuant to s 439A(6) and s447A(1) of the Corporations Act 2001 (Cth), the period within which the first plaintiffs (Deloitte Administrators) must convene the second meeting of creditors of each of the second, third, fourth, fifth and sixth plaintiffs (Dartbrook Companies) under s 439A of the Act (Second Meetings) be extended to 11:59pm on 2 February 2026.

2. Pursuant to s 447A(1) of the Act and, or, s 90-15 of the Insolvency Practice Schedule (Corporations), Part 5.3A of the Act is to operate in relation to the Dartbrook Companies such that, notwithstanding s 439A(2) of the Act, the Second Meetings may be held together or separately at any time during the period up to, or within 5 business days after the end of the convening period as extended by order 1.

3. Within two business days of these orders being made, the Deloitte Administrators are to give notice of these orders to creditors of each of the companies (including persons claiming to be creditors) by means of a circular:

(a) to be published on the website maintained by the Deloitte Administrators in respect of the administration of the Dartbrook Companies; and

(b) to be sent by email or by post to all known creditors.

General

4. Liberty is granted to any person who can demonstrate sufficient interest to discharge or vary these orders to apply upon three (3) business days’ written notice to the plaintiffs and to the Court.

5. The Deloitte Administrators’ costs of, and incidental to, this application be costs in the administrations of the Dartbrook Companies.

6. The plaintiffs be granted leave to uplift from the court file the affidavit of Shaun Robert Fraser affirmed on 27 July 2025 including the annexures to that affidavit and to file in its place a version of that affidavit and Tab 11 of annexure SRF-1 that are redacted to mask those parts of the affidavit that were not read or tendered on this application.

The court notes that:

A. This application was heard concurrently with the application in proceeding NSD1258/2025 on 30 July 2025 with evidence in one proceeding being evidence in the other.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

CHEESEMAN J:

INTRODUCTION

1 These reasons concern two interlocutory applications that came before me as Commercial and Corporations duty Judge on 30 July 2025. By these applications, two groups of companies, the AQC Companies and Dartbrook Companies respectively, sought to extend the time in which to convene the second meetings of creditors of their constituent companies, who are each in voluntary administration.

2 The urgency attendant on these applications was that in the absence of an order extending the convening period, the time to convene the second meetings was due to expire imminently. In the case of some of the companies, unless the convening period was extended, the meetings must have been convened by 31 July 2025 and held by 7 August 2025.

3 The Applications, being the AQC Application and the Dartbrook Application, were supported by, and indeed funded by, the Receivers and managers who have been appointed to all the plaintiff companies in the two proceedings. The Receivers were appointed by a secured creditor, Vitol Asia Pte Ltd, a company registered in Singapore.

4 The connection between the AQC Companies and Dartbrook Companies is that they have been engaged in an unincorporated joint venture to operate the Dartbrook Mine — an underground thermal coal mine located approximately 10km north-west of Muswellbrook and 4.5km south-west of Aberdeen in the Upper Hunter region of New South Wales. I will refer to the joint venture as the Dartbrook JV. The Dartbrook JV is between AQC Dartbrook Pty Ltd ACN 000012 813 (administrators appointed) (receivers and managers appointed) (holding an 80% interest in the Dartbrook JV) and Tetra Dartbrook Pty Ltd ACN 658 320 471 (administrators appointed) (receivers and managers appointed) (holding a 20% interest in the Dartbrook JV) (AQC Dartbrook and Tetra, together, the JV Entities). The Dartbrook JV holds the key assets of the Dartbrook Mine.

5 The Applications were heard concurrently on 30 July 2025 with the plaintiffs in each proceeding being represented by Ms Hillman of counsel, instructed by the respective solicitors for each of the two groups of companies. The approach to the Applications and the administration of the two groups of companies has involved a high degree of co-ordination and consultation between the two sets of administrators and the Receivers. The plaintiffs in both applications relied on joint written and oral submissions in support of the relief sought. Evidence in one application was also evidence in the other.

6 For all but one of the plaintiff companies, a first meeting of creditors has taken place. The first meetings of the Dartbrook Companies were held concurrently on 15 July 2025. The first meetings of the AQC Companies were held concurrently on 16 July 2025. At those meetings the present applications to extend the convening period for the second meetings of creditors of each of the relevant companies were foreshadowed. The first meeting of creditors of the sixth plaintiff in the Dartbrook Proceeding, Tetra, is scheduled to take place on 6 August 2025. The evidence led on this application is that Tetra was only placed in administration on 25 July 2025.

7 The parties to the AQC Application are as follows:

(1) The first plaintiffs are Shaun Robert Fraser and Jonathan Philip Henry in their capacity as joint and several administrators of the second and third plaintiffs (the McGrathNicol Administrators);

(2) The second plaintiff, AQC Dartbrook, holds an 80% interest in the Dartbrook JV which owns the Dartbrook Mine; and

(3) The third plaintiff, AQC Dartbrook Management Pty Ltd ACN 007 377 577 (administrators appointed) (receivers and managers appointed), is the holder of Development Consent Approval 231-07-2000 and Water Access Licence WAL30213, which grants the water rights used for the operation of the Dartbrook Mine.

8 The parties to the Dartbrook Application are as follows:

(1) The first plaintiffs are Shaun Robert Fraser and Jonathan Philip Henry in their capacity as joint and several administrators of the second to sixth plaintiffs (the Deloitte Administrators);

(2) The second plaintiff, Dartbrook Operations Pty Ltd ACN 664 671 318 (administrators appointed) (receivers and managers appointed), is the mine operator and records trading income from thermal coal sales on its profit and loss;

(3) The third plaintiff, Dartbrook Assets Pty Ltd ACN665 337 397 (administrators appointed) (receivers and managers appointed), is largely dormant operationally but holds Coal Handling and Preparation Plant (CHPP) assets and underground infrastructure;

(4) The fourth plaintiff, Dartbrook Services Pty Ltd ACN 665 337 306 (administrators appointed) (receivers and managers appointed), is the only employing entity;

(5) The fifth plaintiff, Dartbrook Commercial Pty Ltd ACN 665 337 413 (administrators appointed) (receivers and managers appointed), is the entity through which third-party contractors and labour hire are engaged and most creditors are paid; and

(6) The sixth plaintiff, Tetra, holds the remaining 20% interest in the Dartbrook JV.

9 As mentioned, the Receivers have been appointed to the assets and undertaking of all of the corporate plaintiffs, which I will refer to collectively as the Group.

10 On 29 July 2025, the plaintiffs notified the Australian Securities and Investments Commission (ASIC) of the proceedings. No response has been received from ASIC. ASIC being on notice of the hearing on 30 July 2025 did not seek to appear at the hearing.

THE APPLICATIONS

11 The applications were heard concurrently, with evidence in one being evidence in the other.

12 In proceeding NSD1258 of 2025 (the AQC Proceeding), the McGrathNicol Administrators, sought an order pursuant to section 439A(6) of the Corporations Act 2001 (Cth), section 447A(1) of the Act and, or, section 90-15 of the Insolvency Practice Schedule (Corporations) (IPS), extending the period within which the McGrathNicol Administrators must convene the meeting required by section 439A of the Act (the second creditors’ meeting) in respect of the second plaintiff, AQC Dartbrook and the third plaintiff, AQC Dartbrook Management. Ancillary orders are also sought, including a “Daisytek order” to the effect that Part 5.3A operate in relation to the AQC Companies such that the second creditors’ meeting be convened at anytime before, or within, five business days after the end of the convening period as extended by the Court.

13 In proceeding NSD1259 of 2025 (the Dartbrook Proceeding), the Deloitte Administrators sought equivalent orders in respect of Dartbrook Operations, Dartbrook Assets, Dartbrook Services, Dartbrook Commercial and Tetra.

14 There is evidence before the Court that:

(1) the McGrathNicol Administrators are of the opinion that to extend the time in which to convene the second creditors meetings for each of the AQC Companies is in the best interests of creditors of those companies;

(2) the Deloitte Administrators are of the opinion that to extend the time in which to convene the second creditors meetings for each of the Dartbrook Companies is in the best interests of creditors of those companies; and

(3) the Receivers are of the opinion that to extend the time in which to convene the second creditors meetings for each of the companies in the Group is in the best interests of creditors of those companies.

15 The Deloitte and McGrathNicol Administrators have formed the view that an extension of the time in which to convene the second creditors’ meeting of the companies will enable the Receivers to pursue the sale or recapitalisation of the Dartbrook Mine, which in turn is likely to maximise the chance of the companies continuing in existence or, if that is not possible, obtain a better return for the companies’ creditors and members than would result from an immediate winding up.

16 The length of the requested extension of the convening period is six months, such that the Administrators would be required to convene the second meetings of creditors of the Group by 11.59pm on 2 February 2026.

17 The length of the proposed extension was justified on the basis of the proposed timeline for future progression of the sale process of the Group that is deposed to by the Receivers (see paragraph [59] below).

EVIDENCE

18 Read in support of the Applications are the following affidavits:

(1) David Peter McGrath, of FTI Consulting, in his capacity as one of the joint and several Receivers, affirmed 27 July 2025 (the McGrath Affidavit). Mr McGrath deposed that he is authorised to make his affidavit on behalf of the Receivers. Mr McGrath also deposed to his relevant experience of over 20 years in restructuring, insolvency and financial analysis in Australia. He is a registered liquidator, a fellow member of the Australian Restructuring, Insolvency and Turnaround Association, a graduate member of the Australian Institute of Company Directors and a Chartered Accountant. He has extensive experience in the mining and technology sectors, including recent appointments on Sun Cable Pty Ltd, Heron Resources Limited, Cromarty Resources Pty Ltd and Buddy Technologies Limited;

(2) Shaun Robert Fraser, of McGrathNicol, in his capacity as one of the McGrathNicol Administrators, affirmed 27 July 2025 (the Fraser Affidavit). Mr Fraser deposed that he is authorised to make his affidavit on behalf of the McGrathNicol Administrators. Mr Fraser also deposed to his relevant experience of over 35 years in restructuring and insolvency. He is a chartered accountant, registered liquidator, member of the Australian Restructuring, Insolvency and Turnaround Association and a member of the Turnaround Management Association. He has extensive experience in the mining sector, including recent appointments on Navarre Minerals Limited, Malle Resources Limited, Allegiance Coal Limited and AGL Energy Ltd;

(3) Timothy Joseph Heenan, of Deloitte, in his capacity as one of the Deloitte Administrators, sworn on 28 July 2025 (the Heenan Affidavit). Mr Heenan deposed that he is authorised to make his affidavit on behalf of the Deloitte Administrators. Mr Heenan also deposed to his relevant experience of approximately 19 years in corporate insolvency and restructuring. He is a chartered accountant, a registered liquidator, a member of the Australian Restructuring, Insolvency and Turnaround Association and a member of the Turnaround Management Association;

(4) second affidavit of David Peter McGrath, affirmed 29 July 2025 with annexure DPM-2. Mr McGrath deposed to the termination of employees of Dartbrook Services and contractors of Dartbrook Commercial. He also deposed to the Fair Work Commission applications;

(5) second affidavit of Shaun Robert Fraser, affirmed 30 July 2025 with annexure SRF-2. Mr Fraser deposed to the inadvertent inclusion of material subject to a claim of legal professional privilege in Tab 11 of annexure SRF-1. The privileged material that was inadvertently included was not read or adduced in evidence on this application. Instead, an alternative version of the relevant document which excluded the material over which privilege is claimed was adduced in evidence, the revised version being annexure SRF-2;

(6) Filip Markoski, of Norton Rose Fulbright Australia, solicitor for the plaintiffs in the AQC Proceeding, affirmed 30 July 2025 with annexure FM-1. Mr Markoski deposed to the service of documents notifying ASIC of the AQC Proceeding; and

(7) Rachel Camille Hendrie, of GRT Lawyers, solicitor for the plaintiffs in the Dartbrook Proceeding, affirmed 30 July 2025 with annexures RCH-1 to RCH-5. Ms Hendrie deposed to addressing enquiries from creditors of the Dartbrook Companies.

APPLICABLE PRINCIPLES

19 An application to extend the time in which to convene a second meeting of creditors falls to be considered in the context of Part 5.3A of the Act. The overarching objective of Part 5.3A is to administer a financially distressed company in such a way as to maximise the chances of the company continuing in existence or, if that is not possible obtain a better return for the company’s creditors and members than would result from an immediate winding up: s 435A.

20 The principles which apply to an application to extend the period in which to convene a second meeting of creditors of a company under administration are well established.

21 The Court must balance the expectation that an administration will be undertaken in a relatively speedy and summary manner with the need to ensure that the administration is not concluded without consideration of sensible and constructive options that may provide better returns for creditors and any return to shareholders, or to enable the company to return to trading in the interests of creditors and shareholders: Re Diamond Press Australia Pty Ltd [2001] NSWSC 313 at [10] (Barrett J); Strawbridge, in the matter of Virgin Australia Holdings Pty Ltd (administrators appointed) (No 2) [2020] FCA 717; 144 ACSR 347 at [64]–[68] (Middleton J).

22 Categories of case in which an extension of time has been granted include cases that involved, relevantly:

(a) businesses of a significant size and scope;

(b) complex corporate group structures and intercompany loans;

(c) the time needed to execute an orderly process of disposal of assets;

(d) circumstances whereby the extension would allow sale of the business as a going concern; and

(e) more generally, cases in which additional time is likely to enhance the return for unsecured creditors,

(see Re Riviera Group Pty Ltd (admins appointed) (receivers and managers appointed) [2009] NSWSC 585; 72 ACSR 352 at [13] (Austin J)).

23 As stated by Nettle and Gordon JJ in Mighty River International Ltdv Hughes; Mighty River International Ltd v Mineral Resources Ltd [2018] HCA 38; 265 CLR 480 at [73], in a passage regularly cited in the authorities:

Generally speaking, courts have been disposed to grant substantial extensions in cases where the administration has been complicated by, for example, the size and scope of the business, substantial offshore activities, large numbers of employees with complex entitlements, complex corporate structures and intercompany loans, and complex recovery proceedings, and, more generally, where the additional time is likely to enhance the return to unsecured creditors. Provided the evidentiary case for extension has been properly prepared, there has been no evidence of material prejudice to those affected by the moratorium imposed by the administration, and the administrator’s estimate of time has had a reasonable basis, the courts have tended to grant extensions for the periods sought by administrators …

24 The opinion of the administrators as to the need for an extension will be given weight in an application of this kind: Strawbridge at [68].

25 A particular consideration which may tell against the too ready grant of an extension is the fact that while the voluntary administration continues there is a moratorium on the enforcement of remedies by secured creditors, lessors and others: Chamberlain, in the matter of South Wagga Sports and Bowling Club Ltd (administrators appointed) [2009] FCA 25 at [9] (Jacobson J).

26 As mentioned, Tetra was only placed into administration very recently. The extension of time to convene the second meeting of its creditors was sought before the first creditors meeting has been held. In this context, the plaintiffs drew the Court’s attention to Clubb, in the matter of DS Opco Pty Ltd (administrators appointed) (receivers and managers appointed) [2019] FCA 2206; 141 ACSR 497 (Farrell J). In Clubb at [40], Farrell J observed:

The Court accepts the submission made by Scentre Management that this application for an extension of the convening period was made prematurely. It is difficult to envisage what circumstances might justify the Court making orders extending a convening period for the second creditors’ meeting before the first creditors’ meeting has been held and in circumstances where creditors have been given only a very short period of notice of the Administrators’ intention to seek the extension. Certainly, the fact that an application for extension of the convening period might have to be made before a duty judge in January is not a justification. Nor is the convenience of counsel.

27 I accepted that in some cases, indeed perhaps most cases, it may be premature to grant an extension of the convening period for the second creditors’ meeting if the first creditors’ meeting is yet to occur and in circumstances where creditors have been given only a very short period of notice of the administrators’ intention to seek the extension. However, there is no principle of law that precludes the court from extending the convening period for the second creditors’ meeting prior to the first creditors’ meeting taking place. To extend the convening period requires the court to exercise its discretion informed by the overarching objective of Part 5.3A of the Act, which is to administer a financially distressed company in such a way as to maximise the chance of the company continuing in existence or, if that is not possible obtain a better return for the company’s creditors and members than would result from an immediate winding up, and having regard to the particular circumstances applying to the company in administration. For reasons I will come to in my consideration of the application so far as it pertains to Tetra, I was satisfied that the present circumstances are materially different from those that informed Farrell J’s observations in Clubb.

28 The Court has power pursuant to s 447A(1) of the Act to order that Part 5.3A operate in relation to a company under voluntary administration such that the second meeting of creditors required under s 439A may be convened at any time before, or within, five business days after the end of the convening period as extended by the Court: In the matter of Daisytek Australia Pty Ltd (administrators appointed) [2003] FCA 575; 45ACSR 446 at [10]-[14] (Lindgren J). I made that order. It will provide the McGrathNicol Administrators and the Deloitte Administrators flexibility, if they see fit, to convene the second creditors’ meetings earlier than the time allowed.

BACKGROUND

29 On 3 July 2025, David McGrath and Benjamin Campbell, of FTI Consulting, were appointed as the Receivers of the whole of the assets and undertaking of the AQC Companies and the Dartbrook Companies. The Receivers were jointly and severally appointed by Global Loan Agency Services Australia Specialist Activities Pty Limited as Security Trustee on behalf of Vitol, the senior secured lender. The Receivers were appointed on 3 July 2025, following the appointment of the Deloitte Administrators to Dartbrook Operations, Dartbrook Assets, Dartbrook Commercial and Dartbrook Services earlier that same day. On 4 July 2025, the McGrathNichol Administrators were appointed to the AQC Companies. As mentioned, on 25 July 2025, the Deloitte Administrators were appointed to Tetra.

30 Since their appointment, the Receivers have had the control of the business of the joint venture (the JV Business) and have assumed and met its liabilities accruing since 11 July 2025 in accordance with section 419A of the Act. Mr McGrath deposed that the Receivers are endeavouring to stabilise the JV Business and to effect a sale or recapitalisation of the Dartbrook Mine in an effort to maximise the returns available to the secured creditor, Vitol.

31 The McGrathNichol Administrators and the Deloitte Administrators have had limited access to the books and records of the companies and have relied on information which they believe to be true that has been supplied by the Receivers. Relevantly, the information supplied by the Receivers on which the Administrators have relied includes information as to security structure that is in place in relation to the Dartbrook JV. Included in the evidence led on this application is a copy of a diagram that depicts the security structure, which annexed as SRF-2 to the further affidavit of Mr Fraser affirmed on 30 July 2025. A copy of that diagram is annexed to these reasons.

The Trepang Lease

32 The Dartbrook Mine is located on land owned by Hunter Valley Corp Pty Ltd, Reggie Fox Pty Ltd, Kelly HV Property Pty Ltd and Walkington HV Pty Ltd (collectively, the Trepang Landowners).

33 A lease entered into by the Trepang Landowners and AQC Dartbrook and Tetra is a key asset of the Dartbrook JV. The agreement provides for the lease of land, NSW Water Access Licence WAL1021 and other access areas required for the operation of the Dartbrook Mine.

34 Maintenance of the Trepang Lease is fundamental to the ongoing operations of the Dartbrook Mine. Accordingly, since their appointment, the Receivers have caused the companies to remain in possession of the leased premises and have paid all rents and other amounts payable by the companies under the Trepang Lease accruing since 11 July 2025 (being the applicable commencement date for the Receivers’ liability pursuant to section 419A of the Act).

35 By exchange of correspondence between their respective solicitors, the Receivers have confirmed to the Trepang Landowners that they will continue to pay so much of the rent or other amounts payable by AQC Dartbrook and Tetra under the Trepang Lease as is attributable to the period commencing on 11 July and throughout which AQC Dartbrook and Tetra remain in possession of the Premises during the Receivership.

Dartbrook Mine’s staff and contractors

36 As at 27 July 2025, Dartbrook Services employed approximately 104 employees. Approximately 70 of those employees were employed under an enterprise agreement, and 34 employees were not employed under an enterprise agreement. Additionally, Dartbrook Commercial had entered into agreements with 49 independent contractors (sole traders), as well as agreements with approximately 15 labour hire providers for the supply of labour (totalling approximately 70 individual workers).

37 The Receivers have undertaken an extensive review of the Dartbrook Mine’s operating model, resulting in the development and now implementation of a Revised Operating Model, which will impact upon the number of employees and contractors engaged at the Dartbrook Mine.

38 Under the Revised Operating Model:

(1) there will be a decrease from three mining machines to one principal machine with a standby machine (known as the “1+1” model);

(2) there will be a reduction in the size of the workforce (employees and contractors) from approximately 223 to 106 people; and

(3) there will be a return of a number of items of hired equipment.

39 In that connection, the Administrators submitted that the Receivers have identified approximately 56 employees and approximately 58 contractor roles which they expect will be terminated (noting that two employees have resigned and one contractor has terminated their agreement in the period between the date of the Receivers’ appointment and 27 July 2025). The Second McGrath Affidavit broadly supported this submission, although there was a very slight variation in the precise number of employees identified.

40 The evidence led from the Receivers on this application is that they have been mindful of the impact of the reduction in staff at the Dartbrook Mine on both employees and contractors but that having regard to the Dartbrook Mine’s cash burn rate, absent implementation of the Revised Operating Model, the Receivers will not have sufficient funding to continue the operations of Dartbrook Mine.

41 On 28 July 2025, the Receivers sent termination letters to 46 employees and 8 staff advising that their employment with Dartbrook Services was terminated with immediate effect. The Receivers also sent letters to the remaining 21 employees and 25 staff advising them that their employment with Dartbrook Services was ongoing and had not changed.

42 On 28 July 2025, the Receivers similarly sent termination letters to 56 contractors and labour hire advising that their contracts with Dartbrook Commercial were terminated with immediate effect. The Receivers also sent letters to the remaining 62 contractors and labour hire personnel advising them that their contracts with Dartbrook Commercial were ongoing and had not changed.

43 The Receivers informed the relevant terminated employees, staff and contractors amongst other things that they would make payment of outstanding wages in the ordinary course up to and including 29 July 2025 and provided information about the Fair Entitlements Guarantee Scheme (FEG).

The Mod 8 Application

44 The Dartbrook Mine’s approval for mining of coal and coal works, which was granted by the NSW Department of Planning, Housing and Infrastructure (NSW DoPHI), is currently set to expire on 5 December 2027.

45 In an effort to extend the period of mining operations of the Dartbrook Mine, in July 2024, AQC Dartbrook and Tetra commenced a process with the NSW DoPHI, seeking a modification to the Development Consent Approval 231-07-2000 (Mod 8 or the Mod 8 Application). The purpose of the Mod 8 Application is to seek to extend the current operating period of mining at the Dartbrook Mine by 6 years (that is, until 5 December 2033). Other than the extension of the duration, all other aspects of mining operations are intended to remain consistent with the existing approval.

46 The Mod 8 Application is pending. It is at the assessment stage and has not progressed to the recommendation or determination stages.

47 A specialist mining industry adviser, Xenith, had been engaged by AQC Dartbrook and Tetra to assist them in their efforts to pursue approval of Mod 8 prior to their entry into external administration. The Receivers hold the view that undertaking a sale campaign with the Mod 8 approval (either unconditional or conditional) will likely yield a significantly higher return than without the Mod 8 approval. Furthermore, in circumstances where the current approval for mining of coal and coal works granted by the NSW DoPHI is set to expire on 5 December 2027, it is possible that, absent the Mod 8 approval, no party would be willing to acquire the Dartbrook Mine.

48 The Receivers are continuing to work with Xenith and the NSW DoPHI to progress the Mod 8 Application. This includes preparing a new Groundwater Model, which has been required by the NSW Department of Climate Change, Energy, the Environment and Water, and supplying further information as requested by the NSW Environmental Protection Authority in an effort to obtain approval of the Mod 8 Application. Further, one of the Receivers, Mr Campbell, has met with representatives of NSW DoPHI to discuss the status of the Mod 8 Application.

49 Based on their engagement with Xenith, the Receivers consider it is reasonably likely that the Mod 8 Application will be approved. The timing of any Mod 8 approval remains uncertain, but the Receivers consider it can be reasonably estimated that:

(1) achieving a non-conditional approval may take up to 20 weeks (while the new Groundwater Model is completed); and/or

(2) it is possible that a conditional approval be sought, and if sought, it is possible that such approval may be received by the end of August 2025.

The Coal Stockpile

50 The primary circulating asset of the Group is coal. As at the date of the Receivers’ appointment, the Group held approximately 120,000 tonnes of unwashed coal, as well as a further 8,000 tonnes of already washed coal (Coal Stockpile).

51 The Receivers are in the process of realising the Coal Stockpile, the proceeds of which may be available to pay priority employee entitlements (subject to adjudication and determination of each Company’s entitlement to the Coal Stockpile or the proceeds of sale thereof).

52 Sale of the Coal Stockpile involves processing and washing the unwashed coal at the Dartbrook Mine’s Coal Handling and Preparation Plant (CHPP) and loading the washed coal onto trains for distribution to domestic and export customers. That process is estimated by the Receivers to take approximately four months, based on the CHPP’s current capacity to process unwashed coal.

53 Realisation of the Coal Stockpile depends upon continued access to the Dartbrook Mine premises and key hired equipment, which is used for processing, washing and transporting the coal.

Fair Work Commission Applications

54 On 25 July 2025, the Receivers and Deloitte Administrators received an application made by the Northern Mining and Energy Union (MEU), in relation to the proposed workforce reduction that forms part of the Revised Operating Model (the First FWC Application). The MEU seeks orders which, it asserts, will have the effect of putting it and staff in the same position as they would have been in had the Receivers undertaken particular notification and consultation steps with Dartbrook Mine staff which the MEU alleges was required under the Fair Work Act 2009 (Cth). The Receivers maintain that they have taken all steps required of them under the Fair Work Act.

55 On 28 July 2025, the Receivers attended an urgent conciliation hearing in relation to the First FWC Application. The matter did not resolve.

56 Also on 28 July 2025, the Receivers, the Deloitte Administrators and Dartbrook Services received a separate application made by the MEU in relation to a failure to consult with and notify employees and their representatives of the impending redundancies under the relevant enterprise agreement (the Second FWC Application). The MEU seeks orders that the Receivers withdraw any notices of dismissal, issue no further notices of dismissal and engage in consultations with the MEU.

57 The First FWC Application and Second FWC Applications were listed to be heard together for an arbitration hearing on 31 July 2025 (being the day after the present application was heard).

58 On 29 July 2025, the Deloitte Administrators notified the Department of Employment and Workplace Relations (DEWR), the Commonwealth department administering the FEG, of the FWC Applications and the evidence filed in these proceedings. The DEWR confirmed to the Deloitte Administrators that it had no further comment on this present application at this stage.

Undertaking a transaction to sell or recapitalise the Dartbrook Mine

59 The Receivers anticipate that undertaking a sale or recapitalisation of the JV Business, based on their experience in undertaking transactions of similar complexity, will entail undertaking sufficient work to facilitate a two-stage process, initially to obtain non-binding indicative offers and then to obtain binding proposals from a smaller pool of selected bidders, to effect a transaction. They anticipate a transaction timeline with completion occurring in December of this year or January 2026 (including allowing for any necessary regulatory approvals). The evidence led on this application includes the anticipated transaction timeline. The steps in that timeline appear to be reasonably staged having regard to the nature of the task and are supported by Receivers and the Administrators, based on their collective expertise and relevant experience.

60 In terms of transaction structure, the Receivers consider it most likely that a transaction would entail entry into a deed of company arrangement, sale of shares or sale of operating assets. The Receivers note that a deed of company arrangement is the only mechanism that preserves the possibility of shareholders retaining an interest in the companies.

The external administrators’ opinions concerning extension of the time in which to convene a second meeting of the Group’s creditors

61 Each of the experienced external administrators with a role in respect of the JV Business have formed the common view that an extension of time in which to convene the second creditors meetings for a period of six months is likely to maximise the chance of the Group continuing in existence, or if that is not possible, to obtain a better return for the companies’ creditors and members than would result from an immediate winding up.

62 The McGrathNicol Administrators are of the opinion, based on their experience and commercial judgment, that it is in the best interests of the AQC Companies’ creditors, pursuant to the objectives of Part 5.3A of the Act, to further extend the convening period by the period sought and for the Receivers to conduct the sale or recapitalisation process(including by pursuing the Mod 8 Application) in respect of the JV Business. Their reasons for this conclusion included the following:

(1) an extension would allow the Receivers and Managers to best prepare the Dartbrook Mine for sale or otherwise to restructure the Dartbrook Mine via are capitalisation, thereby maximising the return to creditors of the AQC Companies. The McGrathNicol Administrators are of the view that obtaining approval of the Mod 8 Application, with the consequent extension to the operating period for the Dartbrook Mine, will significantly improve the prospects of the Receivers being able to sell the Dartbrook Mine as a going concern or otherwise recapitalise the business;

(2) the structure of the Dartbrook joint venture requires the convening periods for each of the AQC Companies and Dartbrook Companies to be extended to the same date to enable the Receivers to conduct one sale process for the Dartbrook joint venture and to preserve the option for pooled or interdependent deeds of company arrangement. It is the McGrathNicol Administrators’ view that the value of the assets held by the Dartbrook joint venture would be significantly diminished if not sold together, and that a sale as a going concern on a group basis, and potentially effected through a pooled or interdependent deed of company arrangement structure, is likely to maximise the value of any return to creditors; and

(3) the AQC Companies’ assets and business all relate to the Dartbrook Mine, they do not have other assets to realise. Maximising the opportunity to effect a sale or recapitalisation of the Dartbrook Mine represents the only opportunity for a return to the AQC Companies’ creditors.

63 The Deloitte Administrators have formed the view that it is in the best interests of the creditors of the Dartbrook Companies that there be an extension of the time in which to convene a second meeting of creditors because:

(1) based on Mr Heenan’s experience, he believes that obtaining approval of the Mod 8 Application will significantly improve the Receivers’ prospects of selling or recapitalising the Dartbrook Mine at the best value possible for the benefit of creditors. Mr Heenan considers that the Receivers’ view, that approval of the Mod 8 Application should be pursued by them, is reasonable in the present circumstances;

(2) they are likely to require further time beyond the current convening period in order to adequately investigate the affairs of the Dartbrook Companies and report to and make recommendations to the Dartbrook Companies’ creditors;

(3) further, and accepting that there may be a risk of prejudice to stakeholders such as employees, contractors and the Trepang Landowners, they are of the view that it is in the best interests of the creditors of the Dartbrook Companies as a whole, and the employees of Dartbrook Services as a whole, that an extension be granted because the alternative, being the winding up of the Dartbrook Companies, would likely result in:

(a) all of the employees of Dartbrook Services being made redundant and a diminution in the value that can be realised in respect of the Dartbrook Mine;

(b) a risk that leased equipment may be removed from the Dartbrook site, which would mean that the Coal Stockpile could not be realised; and

(c) a risk that enforcement action may be taken in respect of the Trepang Lease, the continuation of which is fundamental to any sale or recapitalisation of the Dartbrook Mine as a going concern.

64 As to Tetra, the Deloitte Administrators consider it is preferable, and consistent with the objectives of Part 5.3A of the Act, to extend the time in which a second meeting of creditors is to be convened in respect of Tetra. This is because:

(1) Tetra has no business outside of the joint venture;

(2) they consider that it would be prejudicial to creditors of Tetra for an application seeking an order for an extension of the convening period for the second creditors’ meeting for Tetra to be brought separately from the application which is to be heard in respect of the other Dartbrook Companies and the AQC Companies given the cost and expense that would be incurred and borne solely by Tetra in making a standalone application;

(3) it would be inefficient, given the intermingled structure and operations of the Group, to bring an application for an extension of time separately for Tetra; and

(4) the merits of an application for an extension of the time in which to convene a second creditors meeting for Tetra is best assessed holistically and in the context of considering the position of the Group as a whole.

65 The Receivers support the extension applications because they are of the opinion that:

(1) an extension of the convening periods is in the best interests of the secured creditors, employees and the general body of unsecured creditors of the Group;

(2) further time, as well as the moratorium on creditor enforcement action afforded during the administration period, are critical to the Receivers achieving their primary objectives of stabilising the JV Business, effect a sale of the Coal Stockpile and maximising the return to creditors through a sale or recapitalisation of the JV Business;

(3) in particular, maintaining the moratorium will best enable the Receivers to:

(a) better manage the working capital required to stabilise the JV Business;

(b) commence a sale process without disruption from litigation or enforcement activity;

(c) maintain supply of goods and services from suppliers that are critical to the Dartbrook Mine remaining as a going concern; and

(d) maintain the lease arrangements for:

(i) key equipment; and

(ii) the Dartbrook Mine premises.

First creditors’ meetings and notification of the AQC and Deloitte Administrators’ Applications

66 First creditors’ meetings have been held for all of the AQC Companies and all of the Dartbrook Companies other than Tetra. Prior to and at those meetings, the McGrathNicol and Deloitte Administrators respectively foreshadowed the likelihood that applications would be brought to extend the period within which they would be required to convene a second creditors’ meeting.

67 On 24 July 2025, the McGrathNicol and Deloitte Administrators gave notice to creditors of the Group in respect of these Applications, save that a specific notice was not directed to the creditors of Tetra.

68 On 28 July 2025, notice of the Deloitte Administrators’ application was issued specifically to known creditors, or potential creditors, of Tetra. Based on a review of the Tetra Balance Sheet and Profit and Loss Statements, the Deloitte Administrators consider that it is likely that most of Tetra’s creditors will be creditors of other entities in the Group such that it is reasonably likely they will have received the earlier notice of this application issued by the Deloitte Administrators and/or McGrathNicol Administrators. It is the Deloitte Administrators’ understanding that Tetra has no operations or business outside of the joint venture.

69 Limited responses have been received by the Deloitte and McGrathNicol Administrators in respect of the notice given that an extension to the convening period would likely be sought and in respect of this application. The Deloitte Administrators have received an email from a representative of a company which appears to have a contracting relationship with Dartbrook Mine, expressing disappointment at “the delay”. The McGrathNicol Administrators have received an email requesting a copy of the Originating Process in the McGrathNicol Proceeding, which has been provided.

CONSIDERATION

70 The evidence on this application demonstrates that each of the McGrathNicol Administrators, Deloitte Administrators and Receivers have carefully considered the position of the Group with respect to these applications. They advance cogent opinions as to why they have reached their respective views based on their significant expertise and experience. They exhibit an appreciation of the objectives of Part 5.3A of the Act, and have concluded that it is in the best interests of the creditors of the AQC Companies and Dartbrook Companies as a whole, that extensions of the time in which to convene a second meeting of creditors be granted. I have given significant weight to the opinions of the external administrators in my consideration of these applications. For the following reasons, I was satisfied that an extension of the convening periods was justified.

71 It is clear that the joint venture that has been undertaken by the AQC Companies and Dartbrook Companies is a significant and complex undertaking which is underpinned by relatively complex security arrangements that are tailored to the specific property rights that are essential to the operation of the JV Business. The external administrators’ opinion is that given the cash burn rate, it is fundamental to maximising the returns available to creditors that attempts be made for the sale of the Dartbrook Mine as a going concern or for its recapitalisation and that in order toto advance these objectives changes in the way in which the JV Business is operated will be required. The external administrators have exposed the basis for reaching their respective conclusions to this effect. I am satisfied that their opinions are reasonably held.

72 The process of either preparing the Dartbrook Mine for sale or negotiating a recapitalisation is a process that should be undertaken in an orderly fashion and to a timetable that is commercially sensible and realistic. The considered opinion of highly experienced insolvency practitioners was to the effect that a six month extension to the time in which to convene a second meeting of creditors is a reasonable timeframe within which such a transaction maybe effected. Again, that opinion is explained and appears to be reasonable. The projected timeline prepared by the Receivers anticipates transaction completion by December 2025 or January 2026, allowing for any necessary regulatory approvals to be obtained. Both the Deloitte Administrators and McGrathNicol Administrators agree that this is a realistic and an appropriate timeline to undertake a transaction of this type, based on their experience.

73 There are key aspects of the running of the Dartbrook Mine which are best managed through the extension of the moratorium period which attends a voluntary administration. Specifically, maintenance of the Trepang Lease and leased equipment — essential to realisation of the Coal Stockpile and the ongoing operations of the Dartbrook Mine more generally — will be critical for any attempt to sell the JV Business as a going concern. I am conscious that an extension to the moratorium period is a matter to be approached with caution, but I am satisfied that in the present circumstances it is appropriate having regard to the objectives in s 435A of the Act to grant the extension. The Court has the benefit of the reasoned views of the Group’s external administrators that, on balance, an extension of the moratorium is likely to result in a net benefit to the affected stakeholders, being the Trepang Landowners and leased equipment owners. That is because the continuation of the Dartbrook Mine is most likely to result in a better financial outcome for each of those stakeholders than would be the case if the companies were to be wound up immediately. Moreover, the consistent and coherent view expressed by the external administrators — that a deed of company arrangement may provide the best possible structure by which to effect the sale of the JV Business or its recapitalisation — is an important counterweight to the concerns associated with an extension to the moratorium period.

74 The McGrathNicol Administrators, Deloitte Administrators and Receivers have given careful and measured consideration to the position of the employees and contract workers engaged to work at the Dartbrook Mine. The McGrathNicol Administrators are mindful of the difficulty faced by employees that are terminated including a longer waiting period to access FEG. In the circumstances set out above, the commercial reality is that without an extension of the convening period, the Dartbrook Mine is likely to move into liquidation and no employment will be preserved for any employee. The McGrathNicol Administrators have sought to balance the interests of the employees as a whole and concluded that it would be preferable that there be an extension of time in which the Dartbrook Mine continues to trade. That view is shared by the Deloitte Administrators, who are the administrators in control of Dartbrook Services, the entity that employs affected employees.

75 The Administrators acknowledge that the likely reduction in employees in consequence of the adoption of a Revised Operating Model is a difficult but commercially rational outcome having regard to the work performed to date by the Receivers. All of the external administrators have formed the view that, on balance, while the likely loss of some positions at the Dartbrook Mine if the extension is granted and the proposed process is effected is difficult, it is on balance preferable to the alternative of a winding up scenario, in which all workers would likely be terminated.

76 The FWC Applications are ongoing. The Receivers confirmed their intention to appear and participate in the arbitration hearing that was set to take place on 31 July 2025. The FWC proceedings will play out during the course of the extended convening period.

77 The present circumstances engage multiple of the categories identified in Re Riviera that would support the grant of an extension of the convening period: the business of the companies is complex; it is of significant size and scope; appropriate time is needed to effect an orderly sale of the business (and or recapitalisation); and ideally, if it is to be sold, the Dartbrook Mine should be sold as a going concern.

78 In considering this application, I have not overlooked that there has been an expression of concern by one person, likely a creditor of a Dartbrook Company, that the delay which attends an extension of the convening period is “disappointing”. I accept that it may be the case that some creditors may not withstand the nonpayment of the monies due to them for any length of time. However, taken in the context of the size and scale of the administrations of these companies, the expression of concern does not detract from my conclusion that the course of action proposed by the Administrators is more likely to result in a better return for creditors or the continuation of the JV Business than the alternative of an immediate winding up.

79 Additionally, the Deloitte Administrators properly drew to the Court’s attention the position of Tetra where an extension of time was sought in circumstances where a first meeting of its creditors was yet to be held and there is a decision in this Court which suggests that an application to extend the convening period for a second creditors’ meeting may be premature if made before the first creditors’ meeting has taken place. Applications to extend the convening period are, of course, especially fact specific. There is no statutory prohibition on granting an application in circumstances where the first meeting has not yet occurred. In this case, Tetra performs no role outside of the JV Business. Tetra’s creditors are likely within the broader creditor body of the Group and, as such, in a practical if not formal sense, will have received notice of the present applications. In any event any concern in relation to the issue of notice of this application being given to Tetra is allayed by the orders that I will make which will recognise leave to apply to any person who can demonstrate sufficient interest to discharge or vary these orders to apply upon notice. I am satisfied that the efficient course is for the Tetra administration to follow consistently with that of the other AQC Companies and Dartbrook Companies rather than Tetra bearing the burden of incurring the additional costs of bringing a separate application seeking similar relief at a later time. That is because each Dartbrook Company’s economic future is intertwined with that of the other companies involved in the JV Business.

80 There is no suggestion that the Administrators have acted other than diligently and in good faith in making this application. The Administrators’ costs of the interlocutory process will be costs in the administration.

CONCLUSION

81 For these reasons, I made orders extending the time in which to convene the second creditors’ meeting for each of the companies in the Group, together with ancillary orders.

I certify that the preceding eighty-one (81) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Cheeseman. |

Associate:

Dated: 6 August 2025

ANNEXURE

SCHEDULE OF PARTIES

NSD 1259 of 2025 | |

Plaintiffs | |

Fourth Plaintiff: | DARTBROOK SERVICES PTY LTD ACN 665 337 306 (RECEIVERS AND MANAGERS APPOINTED) (ADMINISTRATORS APPOINTED) |

Fifth Plaintiff: | DARTBROOK COMMERCIAL PTY LTD ACN 665 337 413 (RECIEVERS AND MANAGERS APPOINTED) (ADMINISTRATORS APPOINTED) |

Sixth Plaintiff: | TETRA DARTBROOK PTY LTD ACN 658 320 471 (ADMINISTRATORS APPOINTED) |