Federal Court of Australia

Albarran in his capacity as administrator of State Road Constructions (Administrators Appointed) v Ferrazzano (No 2) [2025] FCA 837

File number: | NSD 502 of 2025 |

Judgment of: | DERRINGTON J |

Date of judgment: | 23 May 2025 |

Date of publication of reasons: | 1 August 2025 |

Catchwords: | CORPORATIONS – alleged misappropriation of property – urgent ex parte application for freezing and ancillary orders and warrants for the search and seizure of property – whether proof of “good arguable case” on accrued or prospective cause of action – whether danger of unsatisfied prospective judgment – whether proof of concealment or removal of property – application made under rr 7.32 and 7.35 of the Federal Court Rules 2011 (Cth) and s 530C of the Corporations Act 2001 (Cth) – application granted |

Legislation: | Corporations Act 2001 (Cth) Federal Court Rules 2011 (Cth) Conveyancing Act 1919 (NSW) |

Cases cited: | Albarran in his capacity as liquidator of State Road Constructions (in liquidation) v Ferrazzano [2025] FCA 730 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 30 |

Date of hearing: | 23 May 2025 |

Counsel for the Plaintiffs: | Mr N Carey |

Solicitor for the Plaintiffs: | Gadens |

Counsel for the Defendants: | The Defendants did not appear |

ORDERS

NSD 502 of 2025 | ||

| ||

BETWEEN: | RICHARD ALBARRAN, CAMERON SHAW AND KATHLEEN VOURIS, EACH IN THEIR CAPACITY AS JOINT AND SEVERAL ADMINISTRATORS OF STATE ROAD CONSTRUCTIONS (ADMINISTRATORS APPOINTED) ACN 156 503 883 First Plaintiff STATE ROAD CONSTRUCTIONS PTY LTD (IN LIQUIDATION) ACN 156 503 883 Second Plaintiff STATE ROAD QUEENSLAND PTY LTD (IN LIQUIDATION) ACN 632 746 386 (and others named in the Schedule) Third Plaintiff | |

AND: | VINCENZO FERRAZZANO First Defendant HAJAR TIPPERS PTY LTD ACN 610 800 845 Second Defendant RAIDA MATAR (and another named in the Schedule) Third Defendant | |

order made by: | DERRINGTON J |

DATE OF ORDER: | 23 MAY 2025 |

THE COURT ORDERS THAT:

1. An order that, in the first instance, the urgent application before start of a proceeding filed 23 May 2025 (the Application) be returnable instanter.

2. An order that, in the first instance, the Application be heard ex parte.

3. Pursuant to r 1.34 of the Federal Court Rules 2011 (Cth) (Federal Court Rules), an order dispensing with the requirement that the Plaintiffs give the undertaking referred to in r 7.01(3) of the Federal Court Rules.

4. An order that by 4:00 pm AEST on 12 June 2025, the Plaintiffs file and serve an affidavit deposing as to:

(a) the status of the Plaintiffs’ investigations pursuant to prayer 9; and

(b) the status of proceeding NSD503/2025.

Third Defendant and Prospective Fifth Defendant

5. Pursuant to s 23 of the Federal Court of Australia Act 1976 (Cth) (FCA Act) and rr 7.01, 7.32 and 7.35 of the Federal Court Rules, orders in terms of the Penal Order which forms Annexure A to the Application in respect of Raida Matar (Third Defendant) and Mohamad Abdul Hamid Matar (Prospective Fifth Defendant).

6. An order that the Plaintiffs serve on the Third Defendant by 6:00 pm AEST on 30 May 2025, the following documents:

(a) the Application;

(b) the affidavit of Deucalion Wolfgramm sworn 23 May 2025;

(c) the orders of Justice Lee of 16 May 2025 in Federal Court Proceedings NSD502/2025 (16 May 2025 Orders);

(d) any outline of submissions and list of authorities in respect of the Application;

(e) a copy of the transcript of any hearing of the Application; and

(f) a copy of any orders made consequent upon the hearing of the Application,

(together, the Documents).

7. An order that the Plaintiffs serve on the Prospective Fifth Defendant, by 6:00pm AEST on 30 May 2025, the following documents:

(a) the Documents;

(b) the transcript of the hearing before Justice Lee on 16 May 2025; and

(c) the documents referred to at Orders 6(b) to 6(l) of the 16 May 2025 Orders,

(together, the Prospective Fifth Defendant Documents).

8. An order that, in lieu of personal service, the Documents and the Prospective Fifth Defendant Documents may be served on the Third Defendant and the Prospective Fifth Defendant by:

(a) emailing copies of the Documents to nabil.ajaje@anblawyers.com.au; and

(b) posting copies of the Documents by ordinary pre-paid post addressed to Third Defendant and the Prospective Fifth Defendant at 15 Lowana Street, Villawood NSW 2163.

9. Pursuant to r 7.33 of the Federal Court Rules, within 14 days of service of the Documents and the Prospective Fifth Defendant Documents, the Third Defendant and the Prospective Fifth Defendant each file and serve an affidavit specifying:

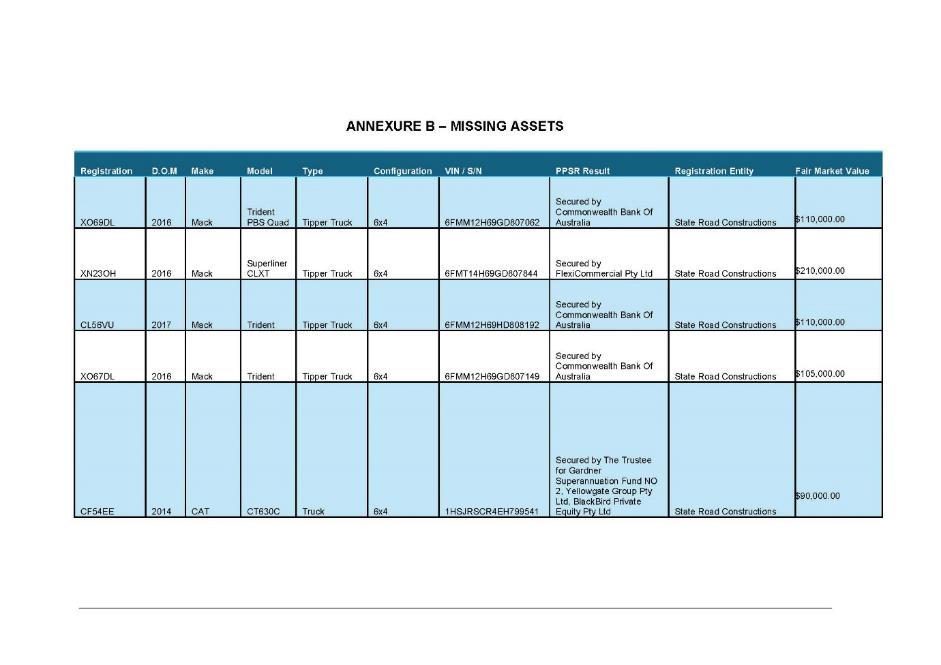

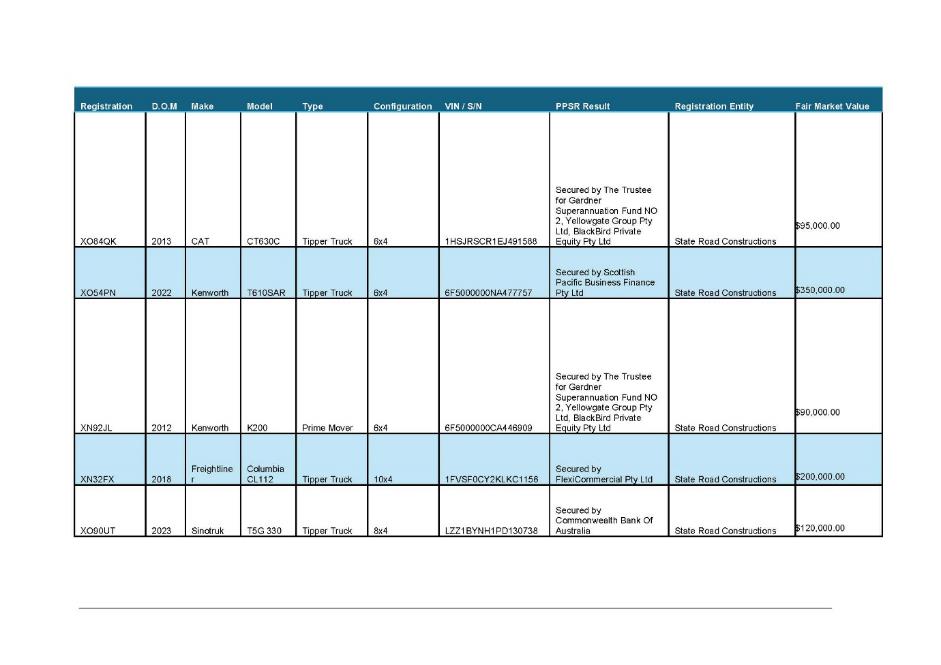

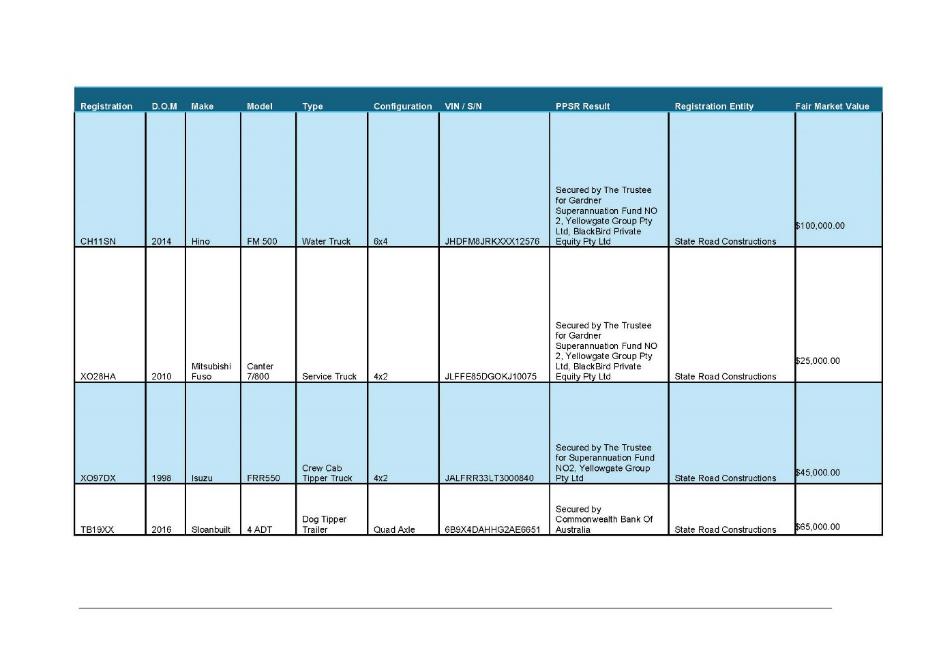

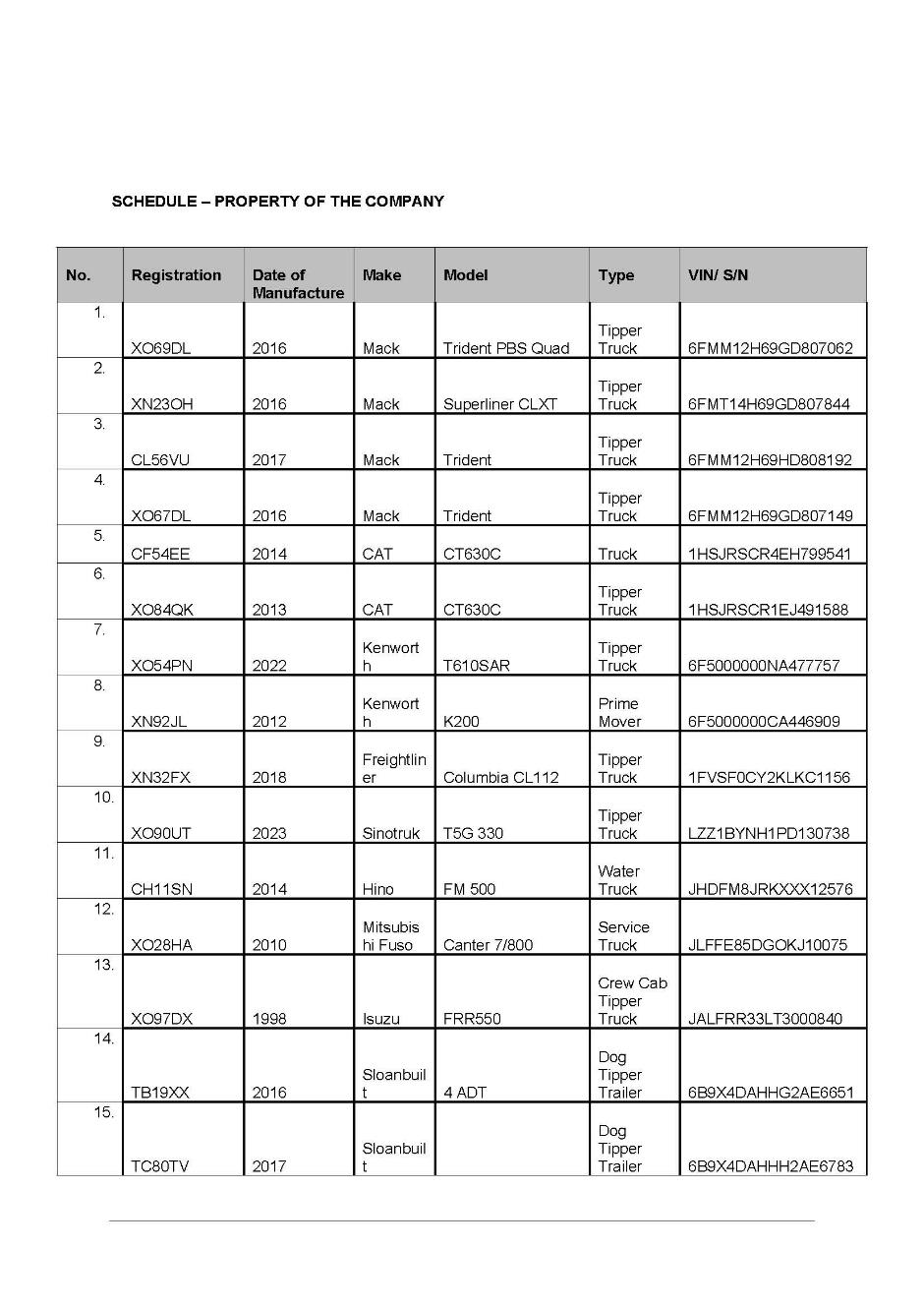

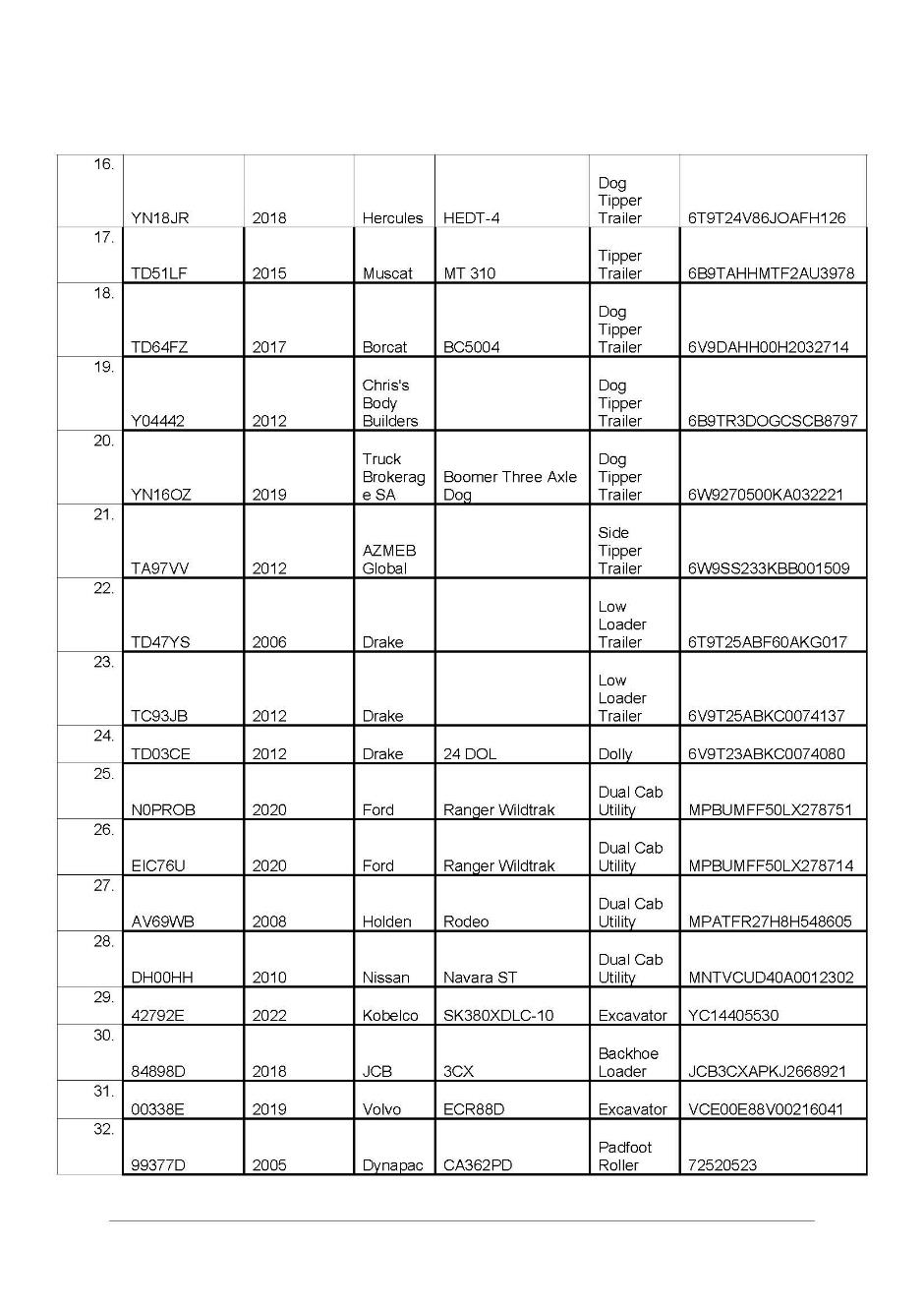

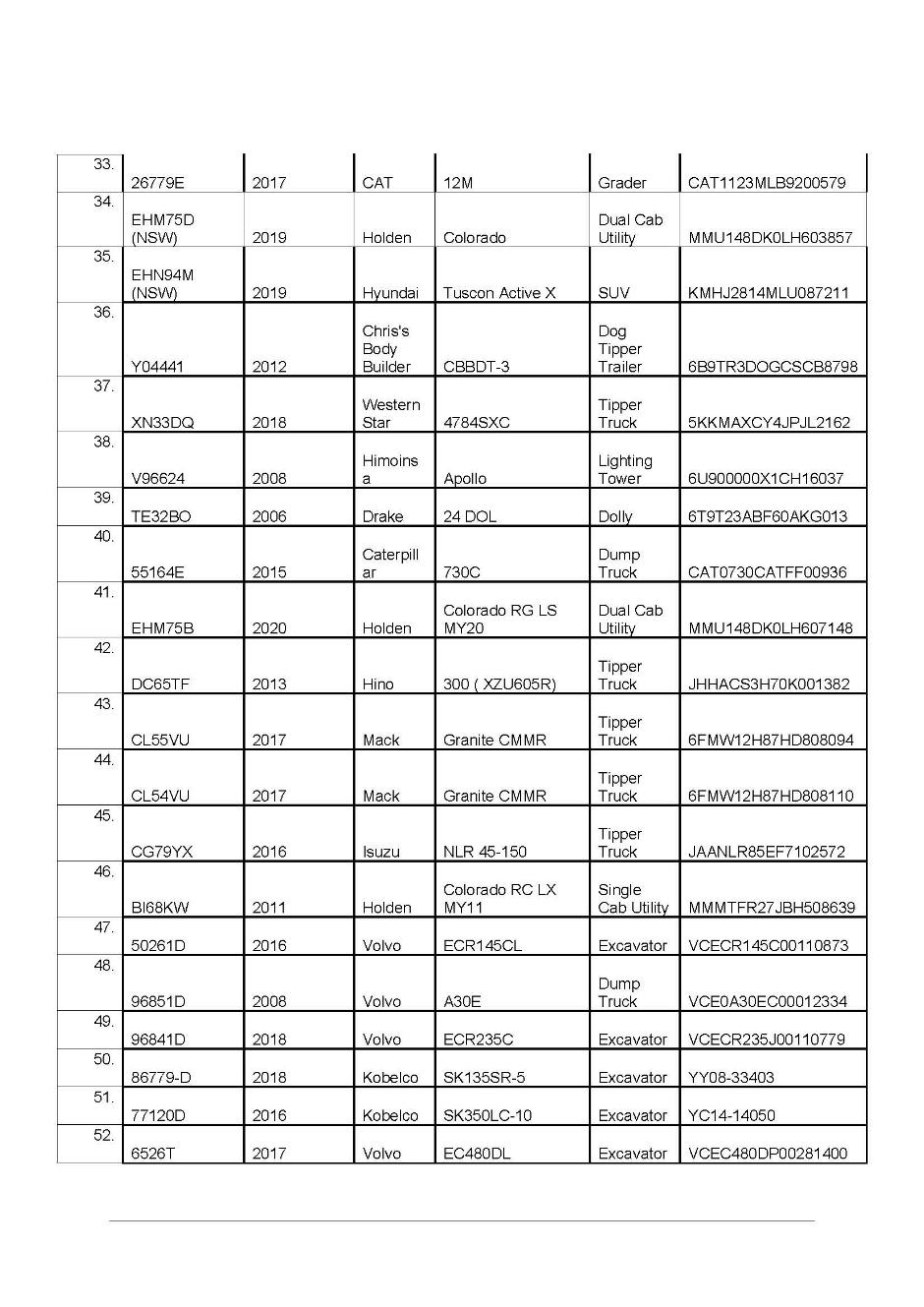

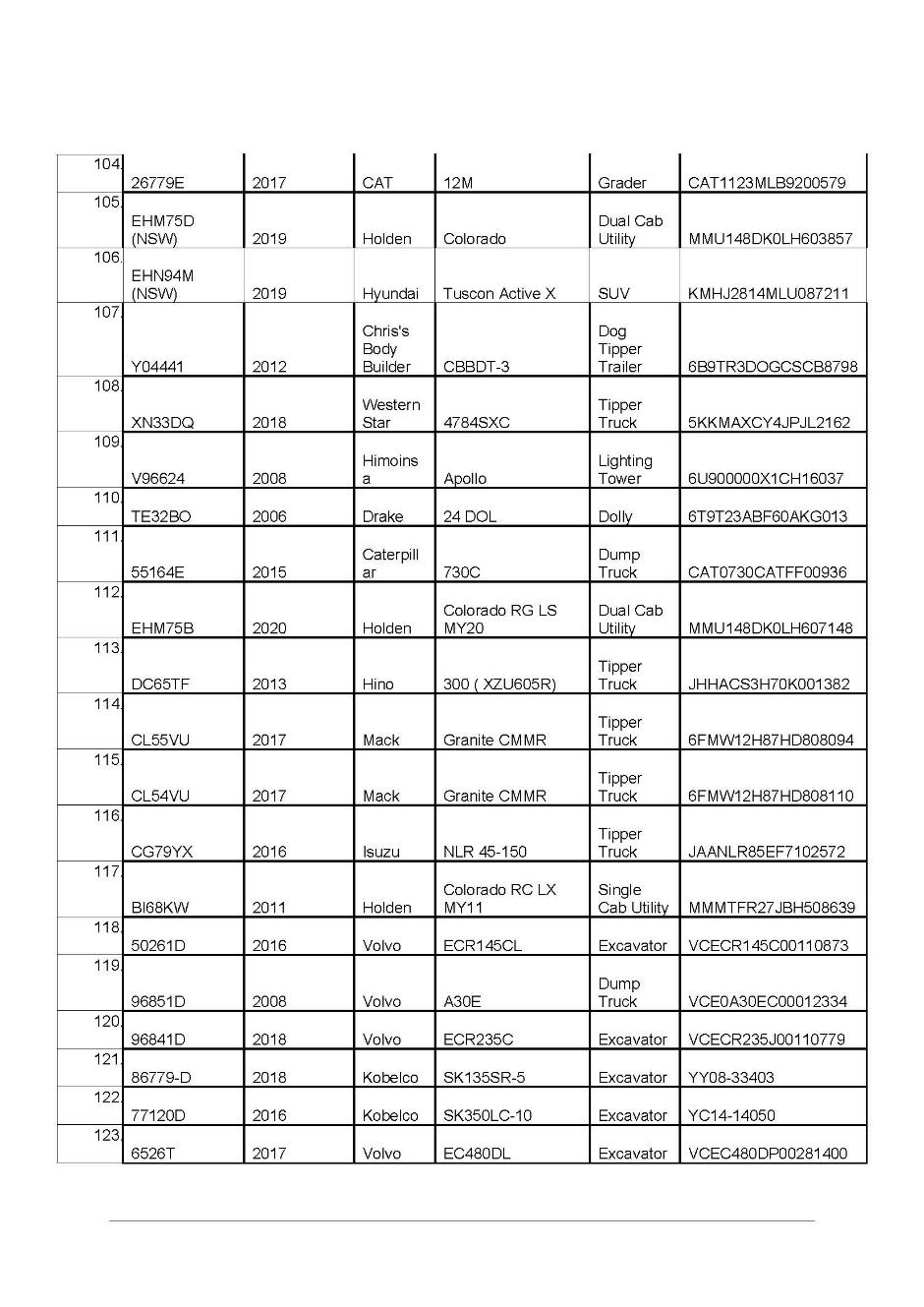

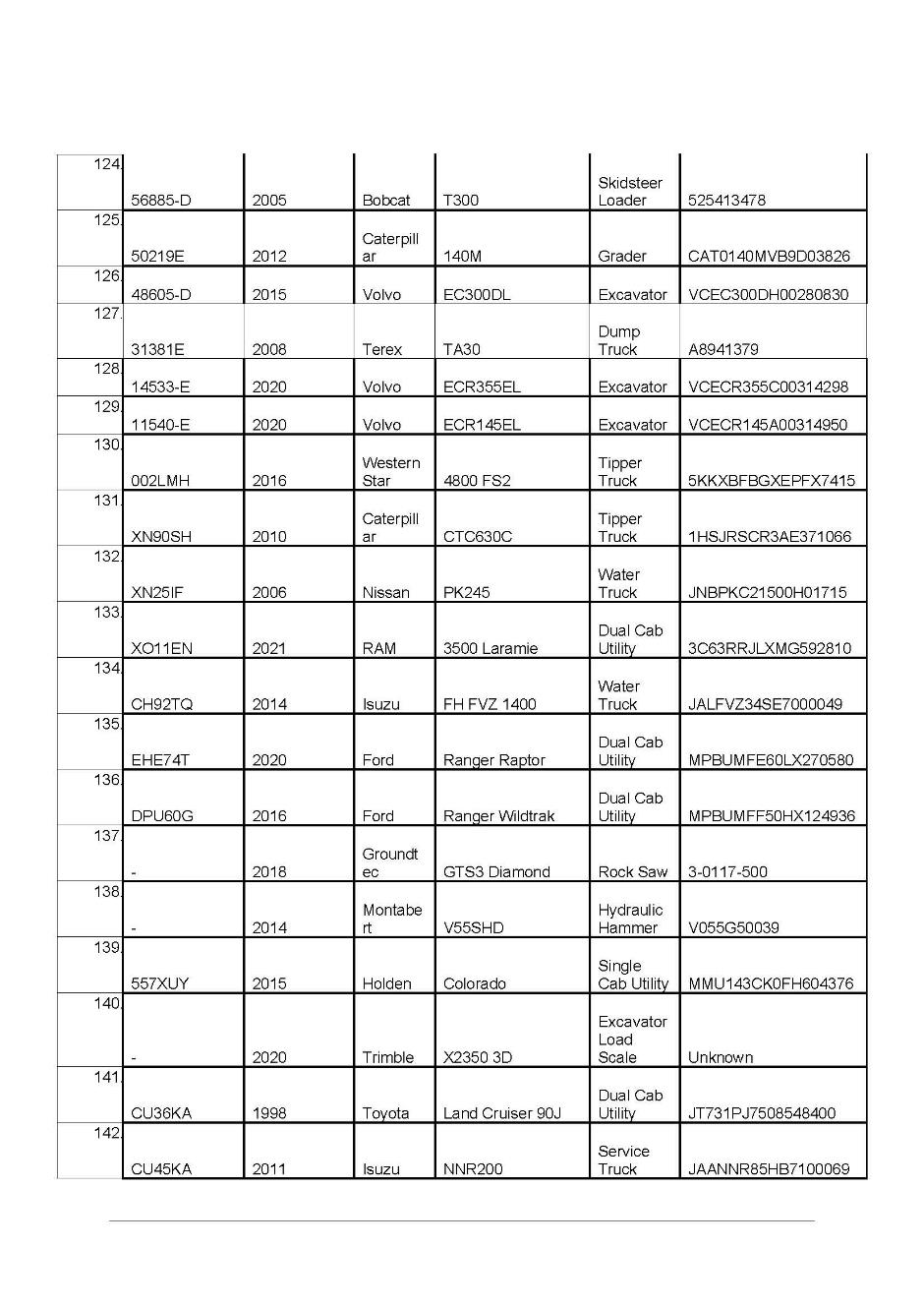

(a) the current whereabouts of the vehicles, and any keys for those vehicles, listed in Annexure B that have not been seized by the Plaintiffs (Outstanding Vehicles), including any specific address or addresses where the Outstanding Vehicles are located;

(b) if the current whereabouts of the Outstanding Vehicles, and any keys for the Outstanding Vehicles, are unknown, the address or addresses of the last known location or locations of the Outstanding Vehicles and keys for the Outstanding Vehicles;

(c) to the extent that the each of the Third Defendant or the Prospective Fifth Defendant is aware of any person or persons who may have possession, control or custody of the Outstanding Vehicles, the name and contact details of that person or those persons; and

(d) to the extent that each of the Third Defendant or the Prospective Fifth Defendant is aware of the circumstances in which the Outstanding Vehicles have been used since 4 February 2025 (being the date of the appointment of the Plaintiffs as voluntary administrators), the details of the person(s) (whether a company, partnership or otherwise) that has or have been using the Outstanding Vehicles and the facts, matters and circumstances concerning the use of the Outstanding Vehicles.

First Defendant

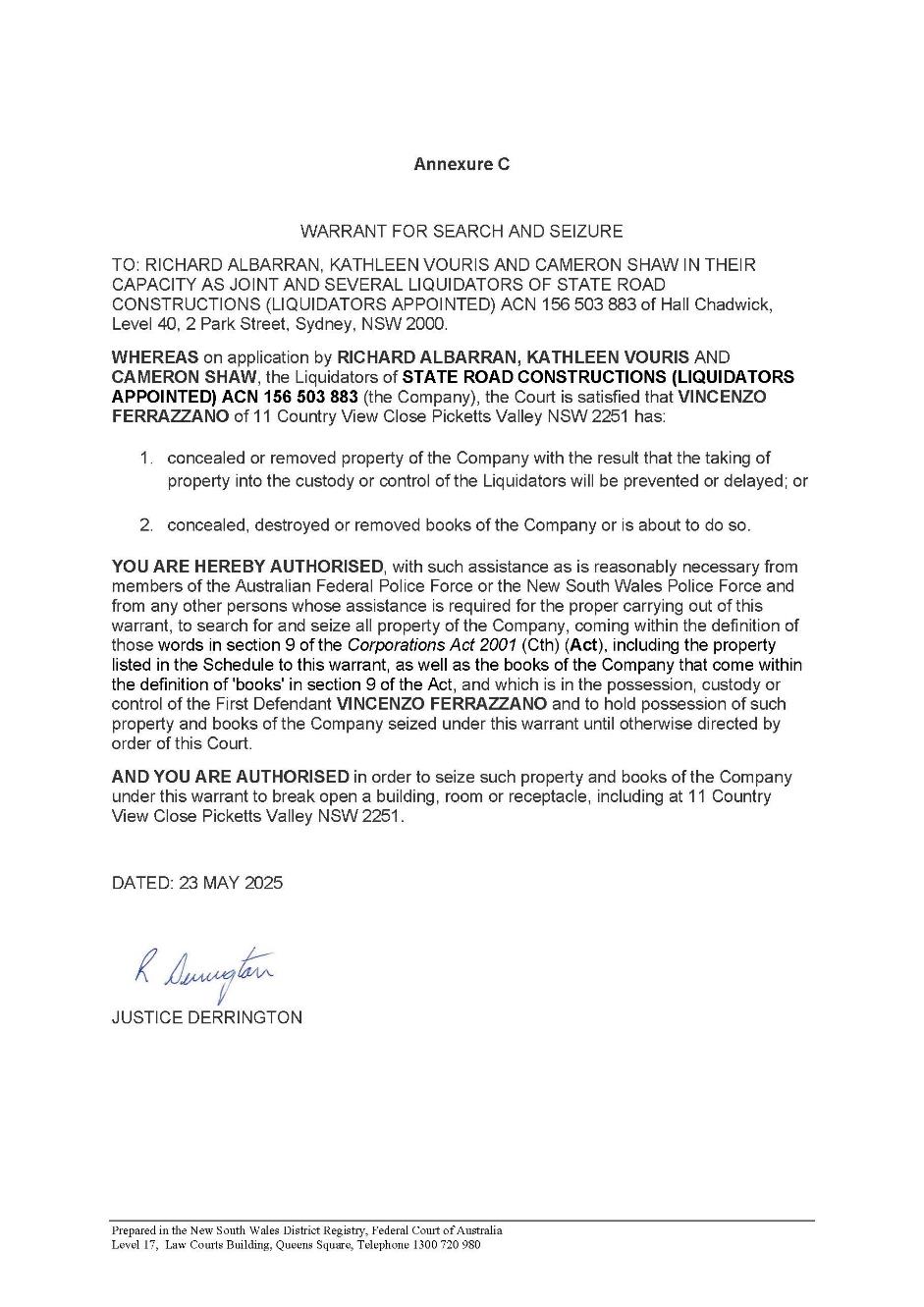

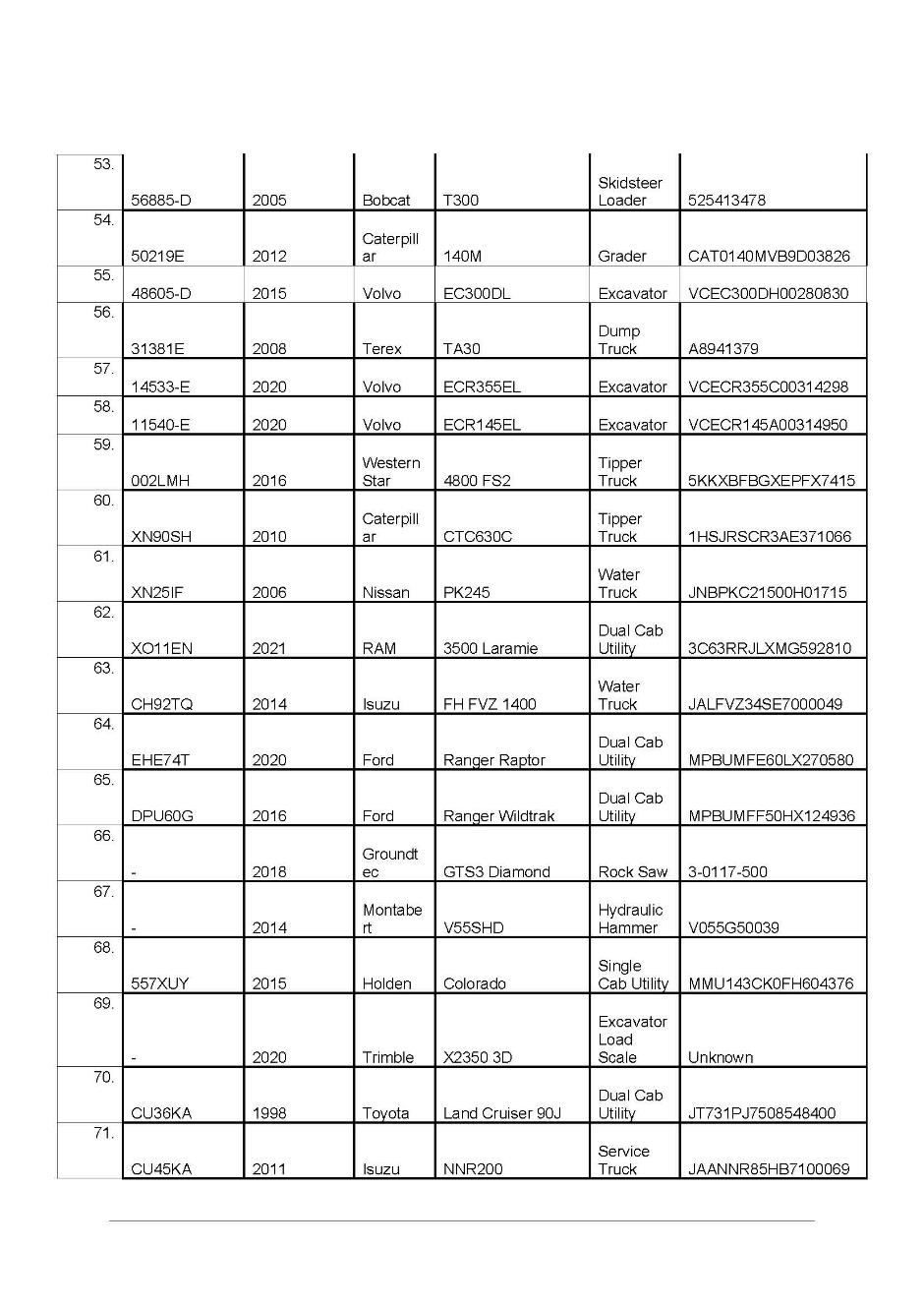

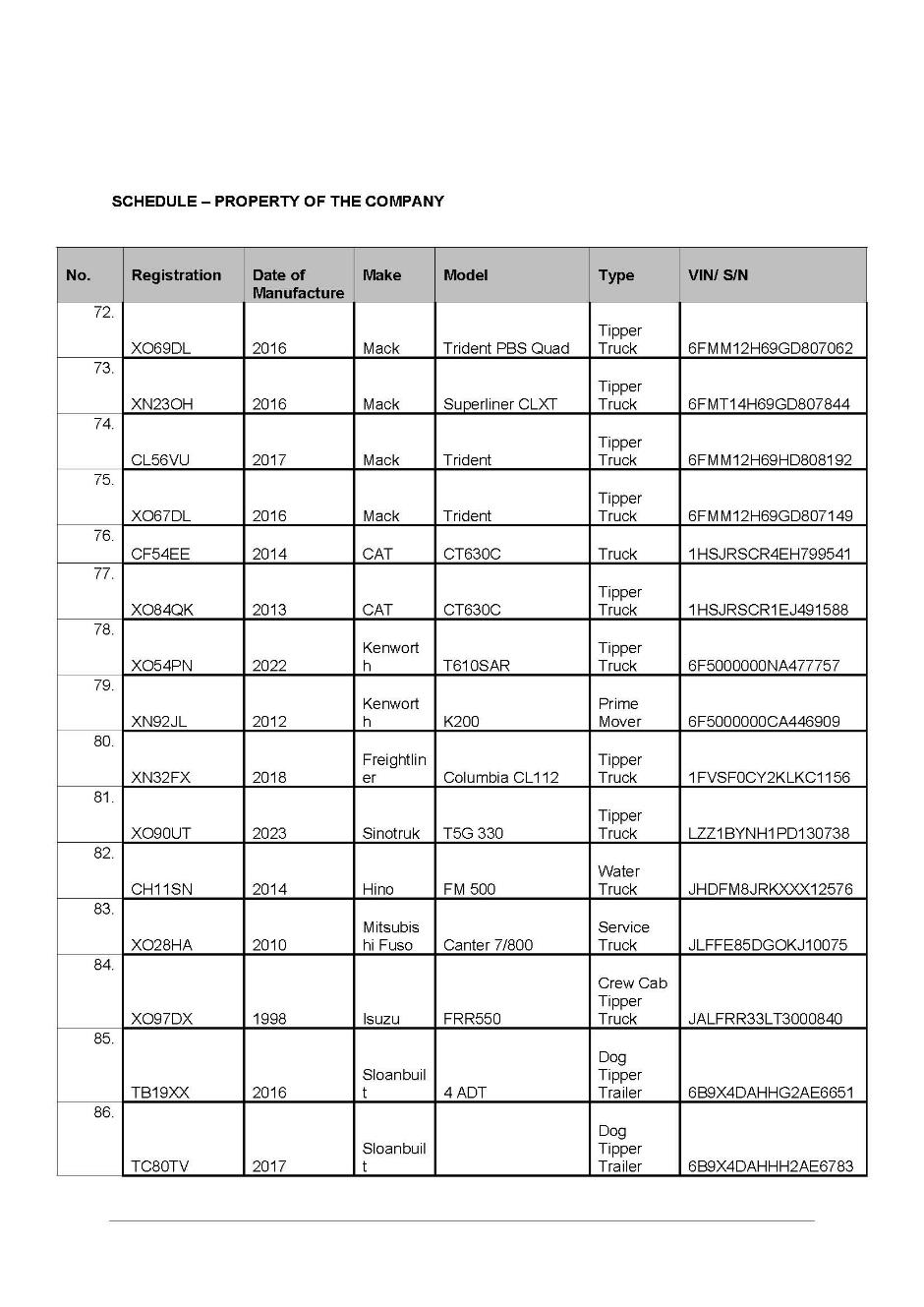

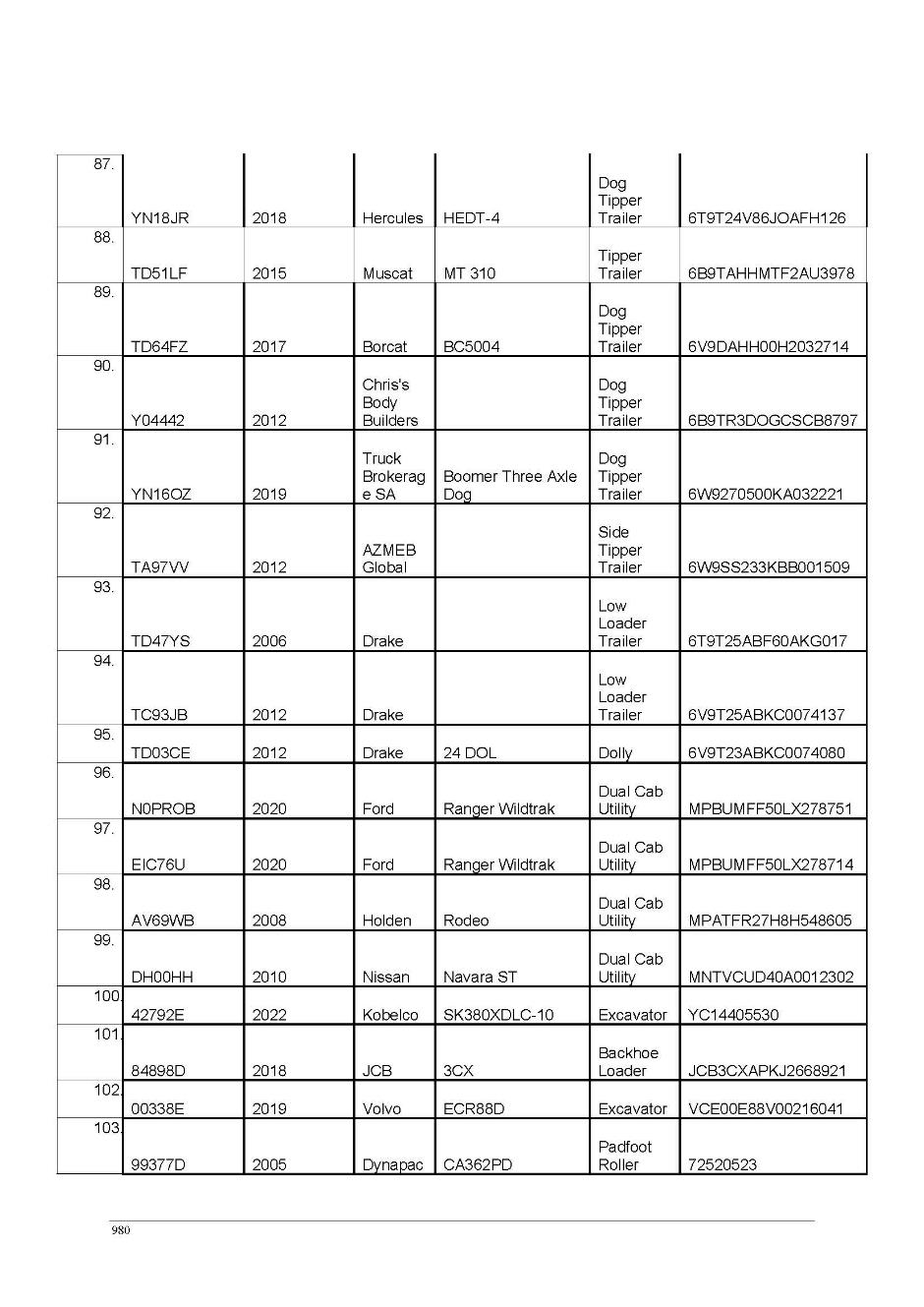

10. An order that, on the Plaintiffs giving the usual undertaking as to damages, the District Registrar issue, pursuant to s 530C of the Corporations Act 2001 (Cth) (Corporations Act), a warrant substantially in the form of the warrant appearing at Annexure C to these orders in respect of the First Defendant.

11. An order that, the warrant issued pursuant to order 10 be discharged if not executed prior to 6:00 pm AEST on 30 May 2025.

12. An order that, within 14 days of the last date on which the warrant issued pursuant to Order 11 has been executed, the Plaintiffs file and serve an affidavit reporting on the execution of the warrant and annexing a list of property seized.

13. An order that, forthwith upon execution of the warrant set out in Annexure C, the Plaintiffs serve on the First Defendant the Documents.

14. An order that, in lieu of personal service, the Documents may be served on the First Defendant by:

(a) emailing copies of the Documents to enzo@stateroadconstructions.com.au; and

(b) posting copies of the Documents by ordinary pre-paid post addressed to the First Defendant at 11 Country View Close, Picketts Valley NSW 2251.

Fourth Defendant

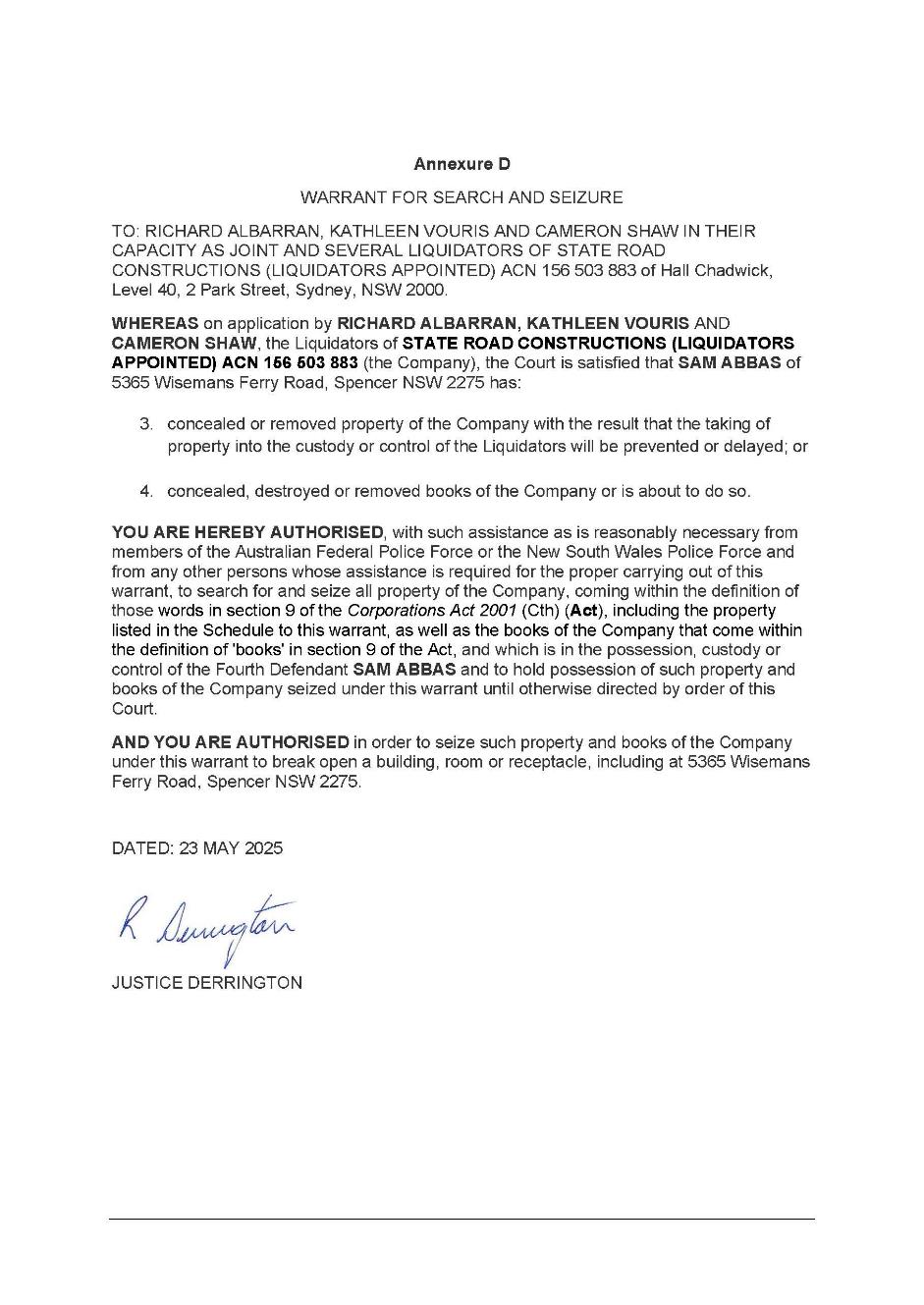

15. An order that, on the Plaintiffs giving the usual undertaking as to damages, the District Registrar issue, pursuant to s 530C of the Corporations Act, a warrant substantially in the form of the warrant appearing at Annexure D to these orders in respect of the Fourth Defendant.

16. An order that, the warrant issued pursuant to Order 15 be discharged if not executed prior to 6:00 pm AEST on 30 May 2025.

17. An order that, within 14 days of the last date on which the warrant issued pursuant to Order 15 has been executed, the Plaintiffs file and serve an affidavit reporting on the execution of the warrant and annexing a list of property seized.

18. An order that, forthwith upon execution of the warrant set out in Annexure D, the Plaintiffs serve on the Fourth Defendant the Documents.

19. An order that, in lieu of personal service, the Documents, may be served on the Fourth Defendant by:

(a) emailing copies of the Documents to accounts@lastminutehaulage.com.au or accounts@smileycivil.com.au; and

(b) posting copies of the Documents by ordinary pre-paid post addressed to the Fourth Defendant at 5365 Wisemans Ferry Road Spencer NSW 2775.

Further Orders

20. The costs of the Application to be paid out of the liquidation of the Second Plaintiff.

21. Leave be granted to the First Defendant, Third Defendant, Fourth Defendant and the Prospective Fifth Defendant to re-list the Application at short notice before the Commercial & Corporations Duty Judge.

22. Liberty to apply on short notice, such notice to specify the relief claimed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

DERRINGTON J:

Introduction

1 By an urgent interlocutory process filed 23 May 2025, the plaintiffs seek, amongst other things, the ex parte grant of freezing orders and search and seizure warrants against persons allegedly involved in the theft of approximately $6.6m worth of heavy vehicles in or about March 2025 (the Application). For the reasons below, it is appropriate the orders sought should be made.

Background

The parties

2 On 1 February 2025, Mr Richard Albarran, Mr Cameron Shaw and Ms Kathleen Vouris (the Liquidators) were appointed as joint and several administrators of State Road Quarry Products Pty Ltd (in liquidation) (State Road Quarry), State Road Constructions Pty Ltd (in liquidation) (State Road Constructions), State Road Queensland Pty Ltd (in liquidation) (State Road QLD) and Thorley Sand & Gravel Pty Ltd (administrators appointed) (the State Road Entities). Some two months later, being on 8 April 2025, the Liquidators were appointed as the joint and several liquidators of State Road Quarry, State Road Constructions and State Road QLD.

3 Prior to entering into external administration, the State Road Entities operated a civil contractor business that provided heavy vehicles, earthmoving equipment and machinery throughout New South Wales and Queensland. Those entities regularly stored high value assets – such as trucks, movers, trailers, utility vehicles, excavators and other heavy machinery – at a leased depot in Smithfield, New South Wales (the Depot): Albarran in his capacity as liquidator of State Road Constructions (in liquidation) v Ferrazzano [2025] FCA 730 [12] – [13] (Ferrazzano).

4 Mr Vincenzo Ferrazzano, the first defendant, is the sole director of the State Road Entities. Mr Sam Abbas, the fourth defendant, is a former employee of State Road Constructions (although his involvement in that enterprise may, at least on one view, have been somewhat greater). The third defendant, Mrs Raida Matar, is (a) the sole director and shareholder of Hajar Tippers Pty Ltd (Hajar Tippers), the second defendant; and (b) the wife of the fifth defendant, Mr Mohamad Matar (together, the Matars). Relevantly, it appears that Hajar Tippers (a) was a subcontractor of the State Road Entities; (b) is a creditor of State Road Constructions; and (c) lodged a proof of debt in the liquidation of that company in the amount of $759,831.84 on 12 February 2025 (the latter two observations being made with the benefit of hindsight: see Ferrazzano [23]).

Allegations of theft

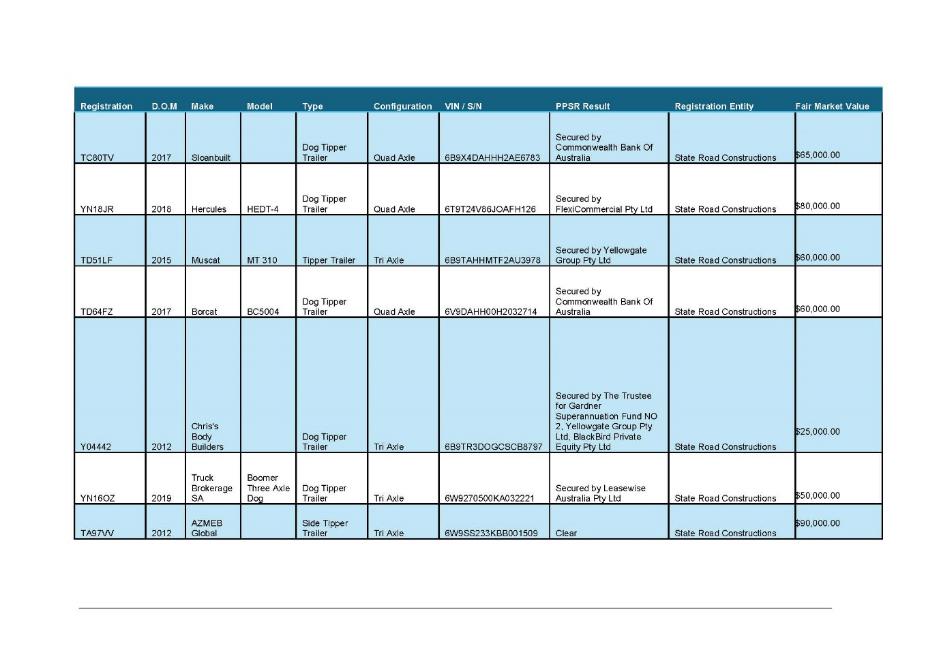

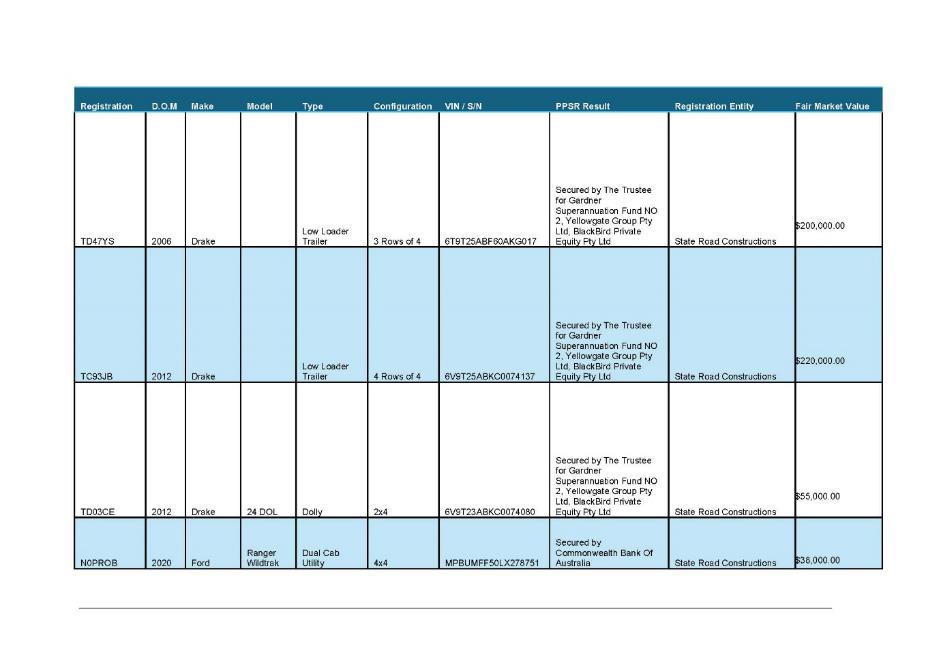

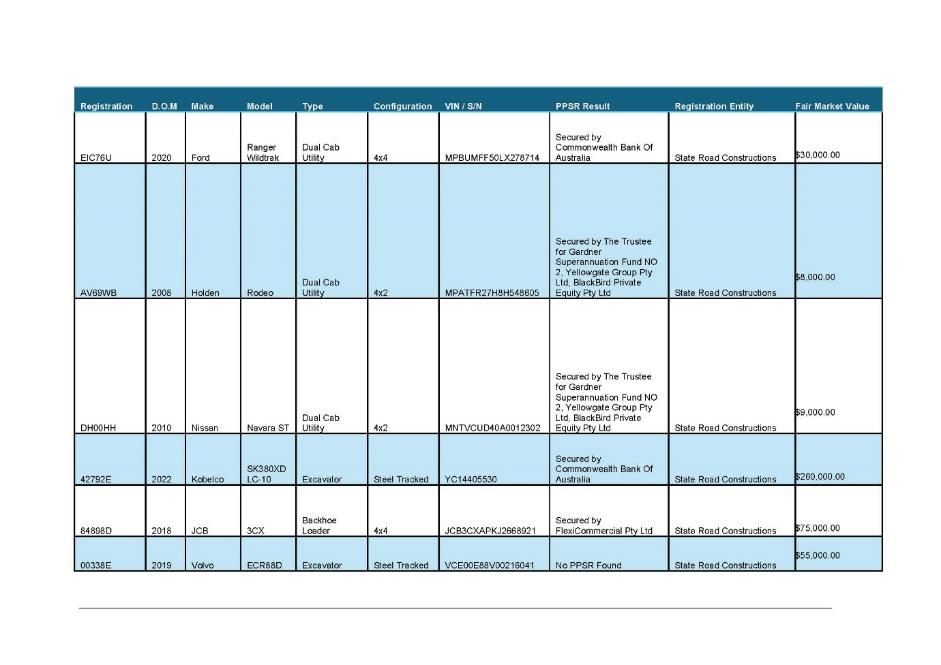

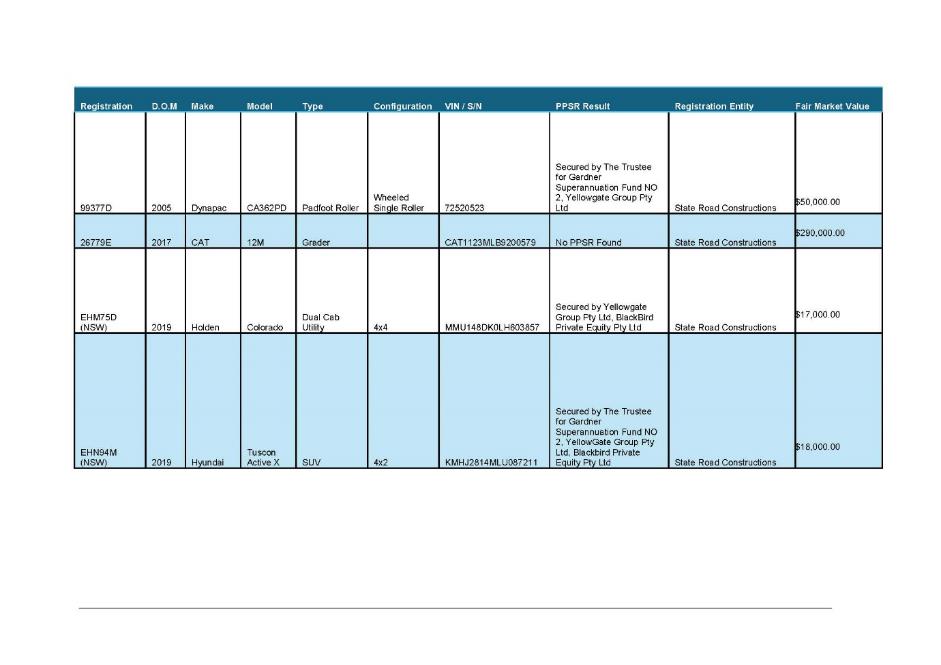

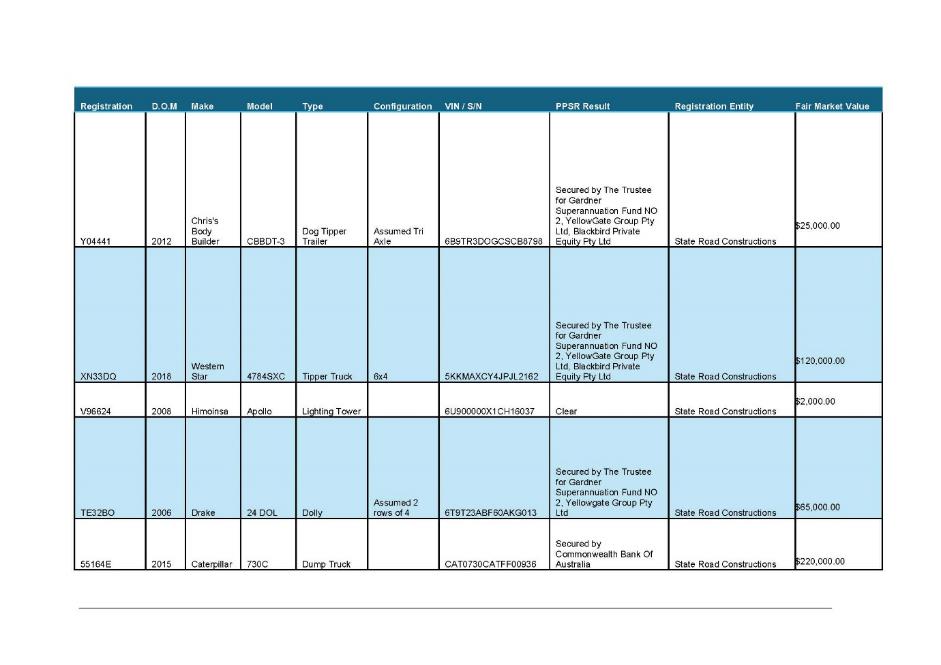

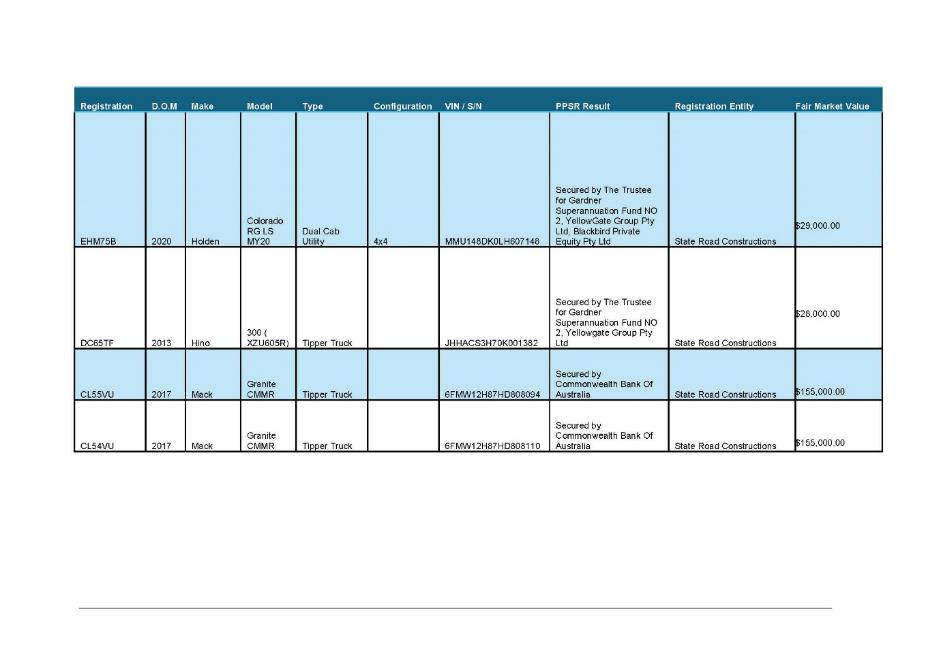

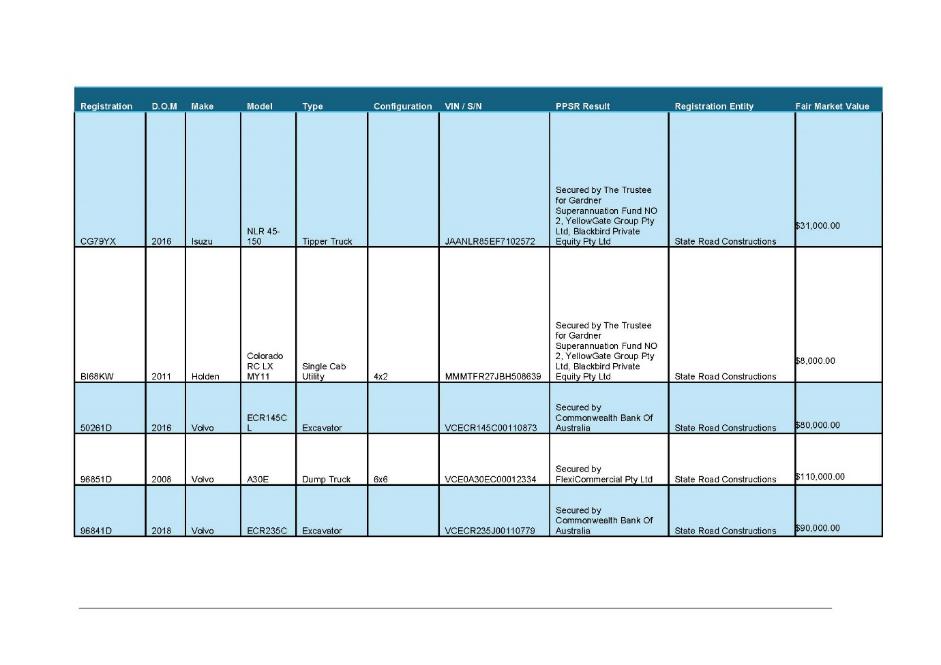

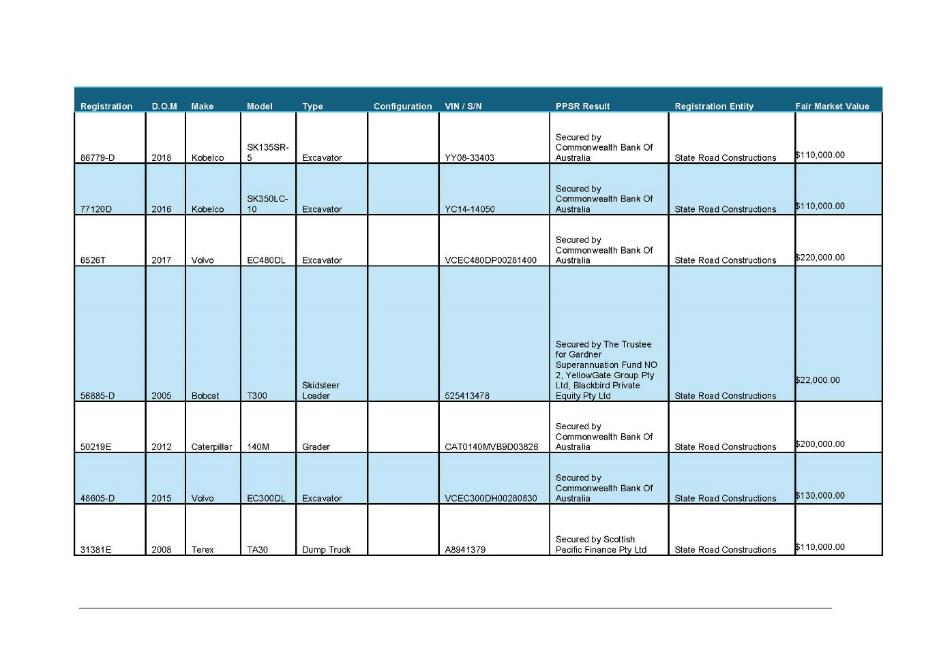

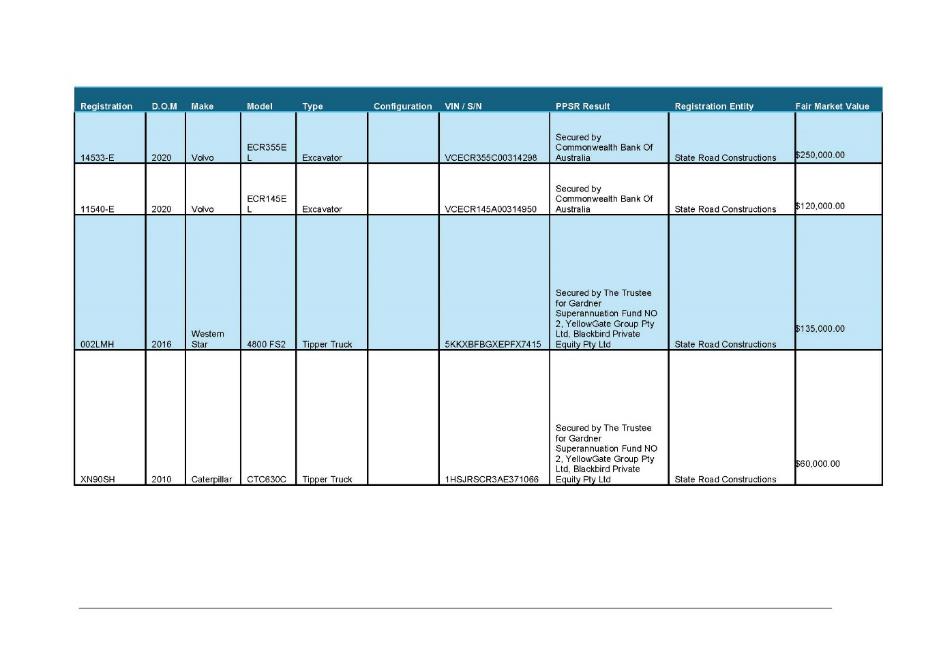

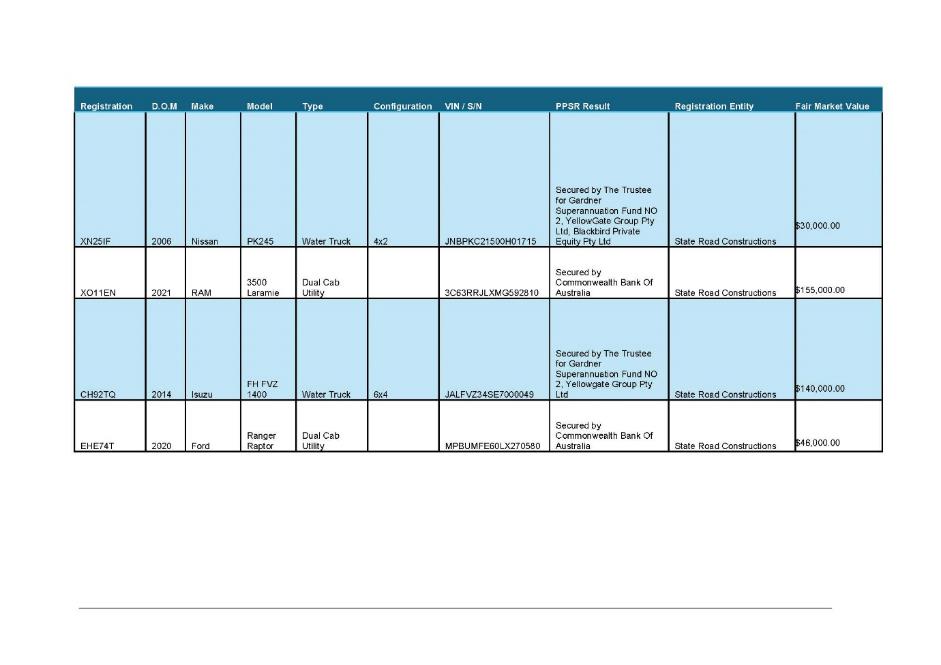

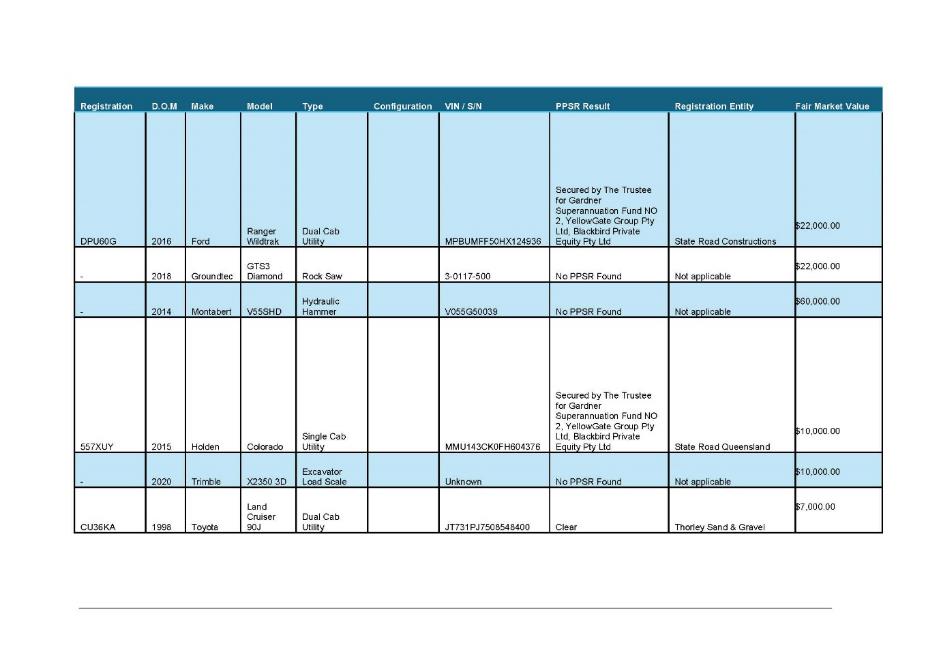

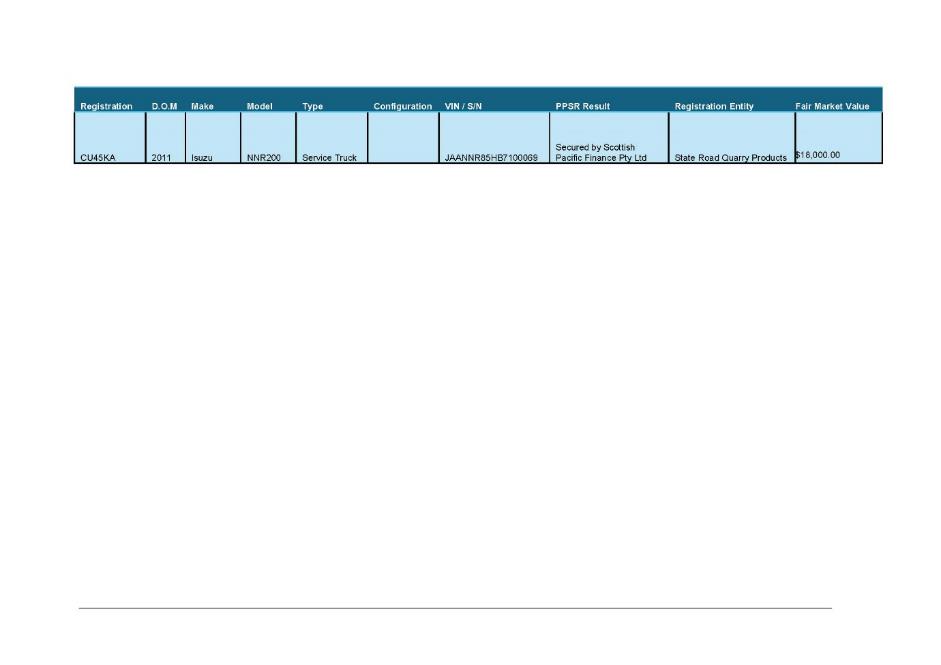

5 The plaintiffs allege a large number of vehicles and associated equipment were stolen from the Depot. That theft was allegedly discovered on 1 April 2025. Some 71 items of property remain missing, with a total market value of $6.6m (the Missing Vehicles). Specifically, it is said that:

… each of Mr Ferrazzano, Mr Abbas, Hajar Tippers and Raida Matar, and other unknown subcontractors, executed an organised and coordinated scheme to defraud the State Road Entities for the purpose of extracting monies to pay apparent debts owed by the State Road Entities.

6 On or about 29 March 2025, two days before the discovery of the Missing Vehicles, six vehicles registered to State Road Constructions were transferred to Hajar Tippers through Service NSW. Subsequently, on or about 10 April 2025, those vehicles were returned to the Liquidators.

The 16 May Orders

7 On 16 May 2025, Lee J, sitting as Commercial and Corporations Duty Judge, heard an urgent ex parte application that sought the making of orders (a) that froze the assets of Messrs Abbas and Ferrazzano (up to an unencumbered value of $6.6m), and obliged such persons to depose to certain information concerning the Missing Vehicles; and (b) for the issuance of search and seizure warrants against Hajar Tippers and Mrs Matar (together, the 16 May Orders). On that occasion, his Honour was satisfied the plaintiffs held a “good arguable case that [the Missing Vehicles] were removed [from the Depot] in an attempt to extort payment from the [State Road Entities] for alleged debt[s] owed to subcontractors”. As such, the 16 May Orders were made.

New evidence concerning the Matars

8 On 21 May 2025, representatives of Hall Chadwick, Bankstown Police and Lloyds Auctioneers and Valuers attended a property to execute search and seizure warrants pursuant to the orders of Lee J. The Missing Vehicles were not discovered at the property. However, according to the affidavit of a Mr Deucalion Wolfgramm (filed 23 May 2025) (the Wolfgramm Affidavit), Mr Matar was present. An interaction is said to have ensued between Messrs Wolfgramm and Matar, the effect of which was summarised in the plaintiffs’ outline of submissions as follows:

Mr Wolfgramm deposes that Mohamad Matar advised him that he:

“took the trucks and registered them in my name. Enzo [Ferrazzano] and Sam Abbas gave me signed registration papers to effect the transfer. The reason for the transfer of the registration of the trucks was because Hajar Tippers was owed around $800,000 by State Road Constructions.”

Mohamad Matar also stated that he currently held “about four trucks in [his] possession” at a holding yard nearby, and stated that he wanted “the debt owed to Hajar Tippers to be paid before the trucks are returned”. Mohamad Matar asserted that he was “the rightful owner of the trucks as Hajar Tippers is owed $800k by the Company”. Despite repeated requests, Mohamad Matar refused to disclose the location of the four trucks.

(Citations omitted).

9 Mr Matar’s comments seem to have caused the plaintiffs some consternation and lie at the heart of the Application. The Wolfgramm Affidavit proceeds to note that the representatives of Hall Chadwick seized six registration papers which corresponded to the registrations of the vehicles transferred from the ownership of State Road Constructions to Hajar Tippers in March 2025.

The relevant principles at a glance

10 The Application asks the Court to make certain freezing and ancillary orders against the Matars and Hajar Tippers pursuant to, relevantly, rules 7.01, 7.32, 7.33 and 7.35 of the Federal Court Rules 2011 (Cth) (the Rules). Rules 7.32 and 7.35 of the Rules provide:

7.32 Freezing order

(1) The Court may make an order (a freezing order), with or without notice to a respondent, for the purpose of preventing the frustration or inhibition of the Court’s process by seeking to meet a danger that a judgment or prospective judgment of the Court will be wholly or partly unsatisfied.

(2) A freezing order may be an order restraining a respondent from removing any assets located in or outside Australia or from disposing of, dealing with, or diminishing the value of, those assets.

…

7.35 Order against judgment debtor or prospective judgment debtor or third party

(1) This rule applies if:

(a) judgment has been given in favour of an applicant by:

(i) the Court; or

(ii) for a judgment to which subrule (2) applies—another court; or

(b) an applicant has a good arguable case on an accrued or prospective cause of action that is justiciable in:

(i) the Court; or

(ii) for a cause of action to which subrule (3) applies—another court.

(2) This subrule applies to a judgment if there is a sufficient prospect that the judgment will be registered in or enforced by the Court.

(3) This subrule applies to a cause of action if:

(a) there is a sufficient prospect that the other court will give judgment in favour of the applicant; and

(b) there is a sufficient prospect that the judgment will be registered in or enforced by the Court.

(4) The Court may make a freezing order or an ancillary order or both against a judgment debtor or prospective judgment debtor if the Court is satisfied, having regard to all the circumstances, that there is a danger that a judgment or prospective judgment will be wholly or partly unsatisfied because any of the following might occur:

(a) the judgment debtor, prospective judgment debtor or another person absconds;

(b) the assets of the judgment debtor, prospective judgment debtor or another person are:

(i) removed from Australia or from a place inside or outside Australia; or

(ii) disposed of, dealt with or diminished in value.

(5) The Court may make a freezing order or an ancillary order or both against a person other than a judgment debtor or prospective judgment debtor (a third party) if the Court is satisfied, having regard to all the circumstances, that:

(a) there is a danger that a judgment or prospective judgment will be wholly or partly unsatisfied because:

(i) the third party holds or is using, or has exercised or is exercising, a power of disposition over assets (including claims and expectancies) of the judgment debtor or prospective judgment debtor; or

(ii) the third party is in possession of, or in a position of control or influence concerning, assets (including claims and expectancies) of the judgment debtor or prospective judgment debtor; or

(b) a process in the Court is or may ultimately be available to the applicant as a result of a judgment or prospective judgment, under which process the third party may be obliged to disgorge assets or contribute toward satisfying the judgment or prospective judgment.

(6) Nothing in this rule affects the power of the Court to make a freezing order or ancillary order if the Court considers it is in the interests of justice to do so.

11 The Application also asks the Court to make certain orders for the issuance of warrants for the search and seizure of property per s 530C of the Corporations Act 2001 (Cth) (the Corporations Act). That section provides as follows:

530C Warrant to search for, and seize, company’s property or books

(1) The Court may issue a warrant under subsection (2) if:

(a) a company is being wound up or a provisional liquidator of a company is acting; and

(b) on application by the liquidator or provisional liquidator, as the case may be, or by ASIC, the Court is satisfied that a person:

(i) has concealed or removed property of the company with the result that the taking of the property into the custody or control of the liquidator or provisional liquidator will be prevented or delayed; or

(ii) has concealed, destroyed or removed books of the company or is about to do so.

(2) The warrant may authorise a specified person, with such help as is reasonably necessary:

(a) to search for and seize property or books of the company in the possession of the person referred to in subsection (1); and

(b) to deliver, as specified in the warrant, property or books seized under it.

(3) In order to seize property or books under the warrant, the specified person may break open a building, room or receptacle where the property is or the books are, or where the person reasonably believes the property or books to be.

(4) A person who has custody of property or a book because of the execution of the warrant must retain it until the Court makes an order for its disposal.

12 The principles that guide the issuance of freezing orders and search and seizure warrants in the present context were set out in the careful written submissions that were prepared by Mr Carey for the plaintiffs before Lee J. Those submissions surveyed the relevant principles as follows:

E.1 Freezing Orders

E.1.1 Pursuant to FCR 7.32

The fundamental purpose of freezing orders is to prevent the abuse or frustration of a court’s process in relation to matters coming within its jurisdiction. The requirement of FCR 7.35(1)(b)(i) that an applicant have “a good arguable case on an accrued prospective cause of action” that is justiciable in the Court involves “something more than a serious question to be tried, but not necessarily rising so high as a prima facie case”. It has also been said that a good arguable case is one “which is more than barely capable of serious argument, and yet not necessarily one which the judge believes would have a better than 50 per cent chance of success”.

Pursuant to FCR 7.35(4), for an applicant to demonstrate there is “danger” that a prospective judgment will be wholly or partially unsatisfied because the subject of the order sought may abscond and/or the assets may be removed, disposed of, deal with or diminished in value, they must prove that, on the balance of probabilities, there is a “real risk” of that occurring, rather than that steps will be taken to frustrate the Court’s process.

…

E.2 Search and Seizure Warrants

The Liquidators seek, by proposed orders 10 and 15, that the District Registrar issue warrants to Hajar Tippers and Mr Matar, respectively. …

Under s 474 of the Corporations Act, liquidators have an obligation to take into their custody or control all property of the company. Section 530C, as with ss 530A and 530B, is designed to strengthen liquidators’ powers to enforce their obligations under s 474. The court’s power to issue a warrant under s 530C(2) is discretionary, yet that discretion is enlivened only if the court is satisfied that the applicant has established the elements of s 530C(1).

The Liquidators accept that the issue of a warrant under s 530C is an extreme step and ordinarily a remedy of last resort. However, that cautious approach will be tempered in circumstances where “it is necessary to take that extreme step in order to administer the company in circumstances that the liquidator has taken all reasonable steps to acquire the relevant property by other means”.

(Citations omitted).

Freezing orders ought to be issued

Proof of a “good arguable case” under r 7.35(1)(b) of the Rules

13 It is sufficiently clear the Liquidators have established the likelihood of a “good arguable case” on various accrued or prospective causes of action. In particular, they have established a “good arguable case” that a cause of action lies against the Matars under s 37A(1) of the Conveyancing Act 1919 (NSW) (the Conveyancing Act). By that provision, every alienation of property, made with intent to defraud creditors, is voidable at the instance of any person thereby prejudiced.

14 It is noted the plaintiffs cited the same cause of action, albeit vis-à-vis Messrs Ferrazzano and Abbas, before Lee J. There, Mr Carey elaborated on the prevailing understanding of s 37A(1):

The words of the provision are “of the widest possible application” (Hall v Poolman (2007) 65 ACSR 123, 235 – 236 [550]) and “should receive a liberal construction in effecting [its] purpose of suppressing fraud” (Marcolongo v Chen (2011) 242 CLR 546, 554 [20]). In particular, a broad approach is to be adopted as to what constitutes ‘alienation’ in the provision (Israel Discount Bank Ltd v ACN 078 272 867 Pty Ltd (In Liq) (formerly Advance Finances Pty Ltd) (2019) 367 ALR 71, 91 [75]): it “encompasses every conceivable means whereby property might be removed from the reach of a person’s creditors” (Hall v Poolman (2007) 65 ACSR 123, 235 – 236 [550]). As to intention to “defraud”, consistent with a broad construction which promotes the purpose of the provision, that term includes “hindering or delaying” of creditors (Marcolongo v Chen (2011) 242 CLR 546, 554 [19], 564 [56]).

15 In substance, the plaintiffs now submit there is a “good arguable case” that the Matars alienated the property of the State Road Entities with intent to defraud creditors. There is, on Mr Matar’s own observations, support for that proposition. He has indicated the “reason” for the transfer of certain vehicles in question was “because Hajar Tippers was owed $800,000 by State Road Constructions”; that is, the vehicles were to be held as some form of de facto security for the payment of the second plaintiff’s indebtedness to Hajar Tippers. That is, of course, inconsistent with the orderly resolution of the debts of an insolvent company and seeks to reserve, to Hajar Tippers, a benefit above and beyond that which might otherwise be accorded to other creditors.

16 The Wolfgramm Affidavit identifies that Mr Matar was informed that “[a]ll creditors will need to lodge a claim in the liquidation [of State Road Constructions]”. In response, Mr Matar is said to have indicated he would neither release the vehicles in his possession nor identify their whereabouts, instead asserting that Hajar Tippers had a right to be paid. In those circumstances, it may reasonably be thought that the Matars fell within the ambit of s 37A of the Conveyancing Act. Against that conclusion, and as was properly identified by Mr Carey, it might be said that:

… the transferral and movement of the vehicles to Raida Matar and Mohamad Matar amounted to an alienation to a purchaser in good faith not having, at the time of the alienation, notice of the intent to defraud creditors (cf Conveyancing Act, s 37A(3)). That is because of Mohamad Matar’s expressed view that he was the rightful owner of the trucks, given the asserted debt owed to Hajar Tippers. …

17 Prima facie, it is difficult to identify any force in such submission, noting (a) the information allegedly communicated to Mr Matar on 21 May 2025; and (b) the refusal of Mr Matar to return certain vehicles to the Liquidators which, on his admission, remain in his possession. As such, and in circumstances where s 37A(1) of the Conveyancing Act is to be read liberally, there is a good arguable case that a cause of action has accrued under that provision vis-à-vis the Matars.

18 In addition to the foregoing, it is also said there exists a “good arguable case” that the Matars are liable in conversion and detinue – that is, they allegedly dealt with the Missing Vehicles in a manner that was inconsistent with the rights of the State Road Entities, with an intent to deny those entities’ rights to possess them. Again, a similar submission was advanced before Lee J, and it is appropriate to recite the rather general summary that was then-provided by Mr Carey:

A claim in conversion is a claim as to “the wrongful act of dealing with goods in a manner inconsistent with the owner’s rights with the intention of denying the owner’s rights or asserting a right inconsistent with them. One of those rights is possession or the immediate claim to it” (Coleman v Harvey [1989] 1 NZLR 723, 730, quoted with approval in Hill v Reglon Pty Ltd [2007] NSWCA 295 [122]). The cause of action accrues at the time of the conversion (Volvo Finance Australia Pty Ltd v Waterfront Enterprises Pty Ltd (In Liq) (No 2) [2020] NSWSC 262 [44]).

As was said by Cavanagh J in Volvo Finance Australia Pty Ltd v Waterfront Enterprises Pty Ltd (In Liq) (No 2), in a claim also relating to missing vehicles, to establish a claim in conversion the plaintiff “must establish that the defendant dealt with the vehicles and that he had control, possession or dominion over them. … The fact that the vehicles were found on land owned by someone else does not preclude a finding that the defendant had sufficient control or possession of the vehicles at the relevant time” (Volvo Finance Australia Pty Ltd v Waterfront Enterprises Pty Ltd (In Liq) (No 2) [2020] NSWSC 262 [46]).

A claim in detinue is as to “the wrongful detention of a chattel after a demand has been made by a person with the immediate right to possession” (Volvo Finance Australia Pty Ltd v Waterfront Enterprises Pty Ltd (In Liq) (No 2) [2020] NSWSC 262 [39]). The essence of detinue is a refusal to deliver up goods to a person with such an immediate right (HEP Australia Ltd v Bunnings Group Ltd [2010] NSWSC 301 [183]).

19 Again, there is probably a good case to that effect. There is no doubt that the Matars have had control, possession or dominion over some of the Missing Vehicles. Whilst it may be said that they had a right to possess such vehicles, that submission is only good for a short period of time. The Liquidators have sought to recover the goods. That attempt has been denied. Such refusal to hand over the vehicles to the Liquidators is sufficient evidence to establish an absence of honest belief in their entitlement to possess the vehicles. In turn, that is sufficient to suggest that there is a wrongful conversion of the goods and, indeed, the wrongful detention of them.

Danger of unsatisfied prospective judgment under r 7.35(4) of the Rules

20 The Application questions whether there exists a “danger” that a prospective judgment will be wholly or partially unsatisfied because there is a “real risk” that the subject of the order sought may abscond and/or the assets may be removed, disposed of, dealt with or diminished in value. Here, so much is established by the evidence that has been adduced. Whatever may have been the original understanding of the Matars as to their rights or entitlements vis-à-vis the vehicles in question, in circumstances where (a) certain Missing Vehicles were removed from the depot with the apparent assistance of Mr Matar; (b) the Liquidators have identified their entitlement to certain goods; and (c) the Matars refuse to return the vehicles to the Liquidators, it appears sufficiently clear the Matars are persons willing to disregard the lawful entitlements of others in preference to their own. In those circumstances, there exists a tangible risk the Matars might dissipate any assets they hold to avoid the enforcement of any finding adverse to their interests.

21 Such a conclusion, it is stressed, arises from the material presently before the Court. It is not a final determination. That is particularly so in light of the fact that the Matars have neither been afforded the opportunity to appear today nor answer the material.

22 In sum, there are more than sufficient grounds to enliven the discretion of the Court to exercise the power to make the freezing orders sought by the Application. That discretion, it might be noted, is more readily exercised given the grant of substantively homogenous orders by Lee J. While I need not blindly follow his Honour’s reasoning, it is persuasive that there was sufficient evidence for another court to exercise a discretion to make analogous orders a mere week ago.

Discretionary considerations

23 The plaintiffs acknowledge the veracity of the Application may have been attacked on the basis that the carriage of the relevant liquidations have been plagued by delay. For example, whilst it may reasonably be said that the Liquidators have been aware since 4 April 2025 that certain vehicles were transferred to Hajar Tippers, the fact that (a) six vehicles were returned by that company some seven days later; and (b) the plaintiffs promptly sought the grant of the 16 May Orders on the basis of that conduct, sufficiently precludes the suggestion that the Liquidators have failed to act diligently and expeditiously (thus far). Indeed, the execution of those orders has, in large, proven a fruitless endeavour and, indeed, necessitated the return of the plaintiffs before the Court, such that any criticism levelled at them for delay is seemingly misplaced.

24 A further factor which supports the exercise of discretion in favour of granting the Application is the fact that the Liquidators are pursuing the matter in all appropriate ways, including seeking orders for the examination and production of documents by Mr Ferrazzano and the Matars, as well as other individuals whom they believe might hold information regarding the Missing Vehicles. In this sense, nothing sought by the orders today is in any way misdirected. In fact, on the contrary, it is but one part of a careful and thoughtful process by which the Liquidators seek to pursue their statutory duties. In those circumstances, the freezing orders sought by the plaintiffs vis-à-vis the Matars should be made pursuant to r 7.32 of the Rules.

Search and seizure warrants ought to be issued

25 Further orders are sought against Messrs Ferrazzano and Abbas pursuant to the operation of s 530C of the Corporations Act. The material presently before the Court establishes that those persons have engaged in the concealment or removal of property of the State Road Entities (those companies being, relevantly, in liquidation) (see ss 530C(1)(a) – (b)). In particular, the evidence of Mr Matar is important in that context. He has given evidence that he took certain vehicles and registered them in his name in circumstances where “Enzo [Ferrazzano] and Sam Abbas gave [him] signed registration papers to effect the transfer”. It is also noted that Mr Ferrazzano has been the subject of police investigation, who have confirmed to the Liquidators that he is a “suspect” and that they have received evidence that he authorised the “movement of gear” from a third-party property on the same evening that the removal of the Missing Vehicles was discovered. That assertion has been supported by the evidence of a third party.

26 As for Mr Abbas, on the morning the Missing Vehicles were discovered, it is alleged that he said, in a phone call to Mr Ferrazzano, that he had moved at least some of the Missing Vehicles to various locations, most of which he would not disclose. Furthermore, there is evidence that Mr Abbas acted as a go-between or mediator between the Liquidators and sub-subcontractors. That rather strongly suggests that he is aware of the Missing Vehicles and their whereabouts and, indeed, who might hold them. He has also indicated what those persons who hold such vehicles want in exchange for them. This all suggests that Ms Abbas is intimately involved in the scheme which was put in place to advance the interests of some creditors over others.

27 I acknowledge, as was properly drawn to my attention by Mr Carey, that some of the evidence adduced to the Court on this occasion is hearsay evidence; although that is not inappropriate in itself, it should be kept steadily in mind that such evidence may not have the weight that direct evidence would have. That being so, one must appreciate the context of this Application. That is, it is a circumstance where the Liquidators have discovered the misappropriation of property. Of course, they are unaware of the circumstances of the misappropriation, to whom the property was given and its present whereabouts. Necessarily, any information that they acquire in their investigations will be limited, and the court must necessarily act on inference from time to time.

28 In this case, it is rather plain that the Liquidators have taken a great deal of care and expended much energy in finding what information they can and it is, in my mind, sufficient to overcome the threshold that is required for the making of the orders sought.

29 Acknowledging that Mr Ferrazzano and Mr Abbas are not presently before the Court, sufficient evidence has been led to establish that they were involved in the concealment and removal of certain property of the State Road Entities, with the result that the Liquidators will be prevented or delayed from taking it into their custody or control. That satisfies the terms of s 530C(1) of the Corporations Act. In the circumstances, the Application should be made.

Note

30 These are the amended and revised reasons for judgment given on 23 May 2025. Whilst the reasons given above refine and develop those that were delivered ex tempore, the substance of what was said on 23 May has not been changed nor has any other material change been made.

I certify that the preceding thirty (30) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Derrington. |

Associate:

Dated: 1 August 2025

SCHEDULE OF PARTIES

NSD 502 of 2025 | |

Plaintiffs | |

Fourth Plaintiff: | STATE ROAD QUARRY PRODUCTS PTY LTD (IN LIQUIDATION) ACN 621 012 360 |

Fifth Plaintiff: | THORLEY SAND & GRAVEL PTY LTD (ADMINISTRATORS APPOINTED) ACN 154 850 898 IN ITS CORPORATE CAPACITY AND AS TRUSTEE FOR THORLEY SAND & GRAVEL TRUST ABN 60 951 101 517 |

Defendants | |

Fourth Defendant: | SAM ABBAS |

Fifth Defendant: | MOHAMAD ABDUL HAMID MATAR |