Federal Court of Australia

Bad Wolf Purchasing Pty Ltd (as trustee for the Du Bray Property Trust) v Du Bray and Associates Pty Ltd [2025] FCA 814

File number(s): | VID 1066 of 2023 |

Judgment of: | MCELWAINE J |

Date of judgment: | 18 July 2025 |

Catchwords: | CORPORATIONS-insolvency-trusts and trustees-claim by successor trustee to vest trust property in possession of former insolvent trustee in particular funds held in trust bank account-right of indemnity-right of exoneration-where Court is not satisfied that the funds are trust property. INSOLVENCY PRACTICE SCHEDULE-application by liquidators for determination as to which assets of the trust are held by the former trustee as bare trustee-whether liquidators should be appointed as receivers of the assets of the trust |

Legislation: | Bankruptcy Act 1966 (Cth) Corporations Act 2001 (Cth) ss 206B(3), 471B, 1306 Evidence Act 1995 (Cth) s 69(3)(a) Federal Court of Australia Act 1976 (Cth) s 57(1) Insolvency Practice Schedule (Corporations), Schedule 2 to the Corporations Act 2001 (Cth) s 90-15 Trans-Tasman Proceedings Act 2010 (Cth) s 65 Federal Court Rules 2011 rr 14.21, 14.22 |

Cases cited: | Australian Securities and Investments Commission v Carey (No 6) [2006] FCA 814; (2006) 153 FCR 509 Black v S Freedman & Co [1910] HCA 58; (1910) 12 CLR 105 Byrnes v Kendle [2011] HCA 26; (2011) 243 CLR 253 Charles Marshall Pty Ltd v Grimsley [1956] HCA 28; (1956) 95 CLR 353 Commissioner of Stamp Duties v Jolliffe [1920] HCA 45; (1920) 28 CLR 178 Cook v Benson [2003] HCA 36; (2003) 214 CLR 370 Cremin, in the Matter of Brimson Pty Ltd (in liq) [2019] FCA 1023 Croton v R [1967] HCA 48; (1967) 117 CLR 326 Deputy Commissioner of Taxation v Huang [2021] HCA 43; (2021) 273 CLR 429 Fischer v Nemeske Pty Ltd [2016] HCA 11; (2016) 257 CLR 615 Fowkes v Pascoe (1875) 10 Ch App 343 His Eminence Petar Diocesan Bishop of Macedonian Orthodox Diocese of Australia and New Zealand v Macedonian Orthodox Community Church [2008] HCA 42; (2008) 237 CLR 66 Jennings v Mather [1902] 1 KB 1 Jones v Dunkel [1959] HCA 8; (1959) 101 CLR 298 Jones v Matrix Partners Pty Ltd; re Killarnee Civil & Concrete Contractors Pty Ltd (in liq) [2018] FCAFC 40; (2018) 260 FCR 310 Kauter v Hilton [1953] HCA 95; (1953) 90 CLR 86 Krejic (Liquidator) v Panella, in the matter of Richmond Lifts Pty Ltd (in liq) (No 2) [2025] FCA 248 Lemery Holdings Pty Ltd v Reliance Financial Services Pty Ltd [2008] NSWSC 1344; (2008) 74 NSWLR 550 LFDB v SM [2015] FCA 725; (2015) 239 FCR 262 LFDB v SM [2017] FCAFC 178; (2017) 256 FCR 218 Marley v Mutual Security Merchant Bank and Trust Co Ltd [1991] 3 All ER 198 Naaman v Jaken Properties Australia Pty Ltd [2025] HCA 1; (2025) 99 ALJR 295 Pirina, in the matter of Ceylan Irmak Pty Ltd (in liq) [2024] FCA 1280 Pitard Consortium Pty Ltd v Les Denny Pty Ltd [2019] VSC 614; (2019) 58 VR 524 Re Gembrook Investments Pty Ltd [2019] FCA 1143 Re Suco Gold Pty Ltd (in liq) (1983) 33 SASR 99 Re Universal Distributing Co (in liq) [1933] HCA 2; (1933) 48 CLR 171 Youyang Pty Ltd v Minter Ellison Morris Fletcher [2003] HCA 15; (2003) 212 CLR 484 |

Division: | General Division |

Registry: | Victoria |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 91 |

Date of hearing: | 10-11 June 2025 |

Counsel for the Plaintiff: | Mr D F McAloon |

Solicitor for the Plaintiff: | Strongman & Crouch |

Counsel for the First and Second Defendants: | Dr A J Greinke |

Solicitor for the First and Second Defendants: | Auyeung Hencent & Day Lawyers |

Counsel for the Fourth Defendant: | Mr N Kirby |

Solicitor for the Fourth Defendant: | Taylor David Lawyers |

ORDERS

VID 1066 of 2023 | ||

| ||

BETWEEN: | BAD WOLF PURCHASING PTY LTD (AS TRUSTEE OF THE DU BRAY PROPERTY TRUST) Plaintiff | |

AND: | DU BRAY AND ASSOCIATES PTY LTD First Defendant RICHARD STONE AND GREGORY BRUCE DUDLEY IN THEIR CAPACITY AS JOINT AND SEVERAL LIQUIDATORS OF DU BRAY AND ASSOCIATES PTY LTD (ACN 095 326 935) (IN LIQUIDATION) Second Defendant WESTPAC BANKING CORPORATION (and another named in the Schedule) Third Defendant | |

order made by: | MCELWAINE J |

DATE OF ORDER: | 18 July 2025 |

THE COURT ORDERS THAT:

1. Leave is granted to the plaintiff nunc pro tunc to commence this proceeding pursuant to s 471B of the Corporations Act 2001 (Cth) against the first defendant.

2. The plaintiff’s proceeding is dismissed.

3. On the interlocutory application of Richard Stone and Gregory Bruce Dudley dated 31 January 2024, it is ordered as follows:

(a) Pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations), Schedule 2 to the Corporations Act 2001 (Cth) and s 57(1) of the Federal Court of Australia Act 1976 (Cth), the second defendants (Liquidators) be appointed joint and several receivers of the assets of the Du Bray Property Trust without security and the requirement to file a guarantee under r 14.21 and r 14.22 of the Federal Court Rules 2011 is dispensed with.

(b) It be declared that the Liquidators, as the Liquidators of Du Bray and Associates Pty Ltd (ACN 095 326 935) (in liquidation) and the receivers of the Du Bray Property Trust are entitled to collect and realise the property of Du Bray and Associates Pty Ltd and the Du Bray Property Trust, notwithstanding the freezing orders made by the High Court of New Zealand.

(c) Without limiting Order 3(b), the Liquidators are entitled to the monies in bank accounts in the name of Du Bray and Associates Pty Ltd referred to in the affidavits of Richard Stone affirmed on 5 September 2024 and 5 June 2025.

(d) The third defendant is to release to the Liquidators all monies in bank accounts in the name of Du Bray and Associates Pty Ltd, including the following accounts (partially redacted):

(i) XXXXXXXXX976 (as trustee for the Du Bray Property Trust);

(ii) XXXXXXXXX438;

(iii) XXXXXXXXX446;

(iv) XXXXXXXXX039;

(v) XXXXXXXXX618.

(e) Pursuant to section 90-15 of the Insolvency Practice Schedule:

(i) the Liquidators may call for proofs of debt in the winding up of Du Bray and Associates Pty Ltd together with the receivership of the Du Bray Property Trust, to be lodged by a particular date, after which any claims not so lodged, including claims by creditors of the Du Bray Property Trust, shall be deemed to be abandoned;

(ii) Du Bray and Associates Pty Ltd is entitled to be exonerated from the assets of the Du Bray Property Trust in respect of such liabilities incurred as trustee as are proved in the winding up;

(iii) the Liquidators are entitled to be exonerated from and hold a lien over assets of the Du Bray Property Trust for their remuneration, disbursements and costs, including legal costs, incurred in respect of investigating the affairs of the Du Bray Property Trust and as receivers of the Du Bray Property Trust, the amount of which to be determined by the Court, in respect of which the plaintiff, the fourth defendant and the Liquidators be granted liberty to apply.

(f) The Liquidators shall give notice of these orders by circular sent by email and by ordinary prepaid post within seven days of the making of these orders to each of the persons known to be potential creditors of Du Bray and Associates Pty Ltd and the Du Bray Property Trust and persons known to be beneficiaries of the Du Bray Property Trust.

(g) There be liberty to apply to any person not a party to these proceedings claiming to be prejudiced by the making of these orders (that is 3(a)-(f)) to apply to vacate or vary the orders within one month of the making of these orders.

4. Any application for costs, with written submissions and any affidavit evidence in support, is to be filed and served within 14 days. The submissions in support must not exceed 3 pages.

5. If an application for costs is made, it is to be responded to in writing filed and served within 14 days of the date of service pursuant to Order (4), limited to a submission not exceeding 3 pages plus any affidavit in support.

6. Subject to any further order, any costs application will be determined on the papers.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

MCELWAINE J:

Synopsis

1 The Du Bray Property Trust was settled by an accountant pursuant to an instrument described as: Hybrid Discretionary Trust Deed, dated 1 March 2007. Du Bray and Associates Pty Ltd accepted appointment as the Trustee. I refer to it as DBA. It must not be confused with Du Bray & Associates Ltd, a company incorporated in New Zealand which I refer to as DBNZ.

2 The Deed is in many respects a curious instrument. In part and in form it is a standard discretionary trust deed whereby the Trustee may make provision for one or more of the Beneficiaries. A Beneficiary means any of the General Beneficiaries, which is the subject of a somewhat convoluted definition which includes the Specified Beneficiaries, the Appointor, the Guardian and the Trustee. The Specified Beneficiaries means the Trustee “and if dead the estate of the Specified Beneficiary”. It was not explained in the course of the hearing how a corporation can have a deceased estate. Mr Lee Du Bray was the Appointor and the Guardian. He features prominently in the evidence, but did not appear as a witness. He was the subject of sequestration order made on 16 July 2020 pursuant to the Bankruptcy Act 1966 (Cth). He was discharged by operation of law on 17 November 2024.

3 Lee Du Bray was in a de facto relationship with an individual given the pseudonym of QRS in this proceeding. QRS and Lee Du Bray have been the subject of protracted litigation in New Zealand. QRS has the benefit of many orders that have been made in the High Court of New Zealand including asset freezing orders directed to Lee Du Bray and any associated company or trust. QRS also has the benefit of final orders made in the High Court of New Zealand on 26 November 2015 pursuant to which the property of the de facto relationship was identified, valued and divided. Amongst other things, Lee Du Bray was ordered to pay to QRS approximately $7 million plus various amounts for costs. Very little has been paid, despite garnishee orders, freezing orders and the sequestration of the estate of Lee Du Bray.

4 Lee Du Bray has been criticised in strident terms by a number of New Zealand judges for his conduct in the proceedings with QRS. Some of the history is summarised by the Full Court in an appeal concerning the registration of judgments by QRS pursuant to the Trans-Tasman Proceedings Act 2010 (Cth): LFDB v SM [2017] FCAFC 178; (2017) 256 FCR 218 at [10]-[26]. This proceeding does not require me to make adverse credit findings of Lee Du Bray. Rather, the issue concerns the legal and beneficial ownership of funds in a Westpac bank account or, as more correctly put by Mr McAloon as counsel for Bad Wolf Pty Ltd (the plaintiff), the ownership of the chose in action to require Westpac to honour the debtor/creditor relationship by paying over an equivalent sum on demand: Croton v R [1967] HCA 48; (1967) 117 CLR 326 at 330-331, Barwick CJ. It is technically correct to refer to the asset in dispute as the chose in action, but doing so adds an unnecessary layer of complexity to these reasons, leads to confusion because there are other bank accounts to which different choses in action apply and, in any event, counsel most frequently referenced the bank deposits, the bank account numbers and the “funds” in issue in submissions. Thus, in these reasons I simply refer to the funds or the balance funds in the accounts in issue as assets of the Trust or otherwise.

5 In this proceeding, Bad Wolf claims an order vesting in it the funds in one Westpac account as the property of the Trust on the basis that it is now the Trustee. There is no dispute that on 11 August 2022, when a winding up order was made in respect of DBA, it ceased to be the Trustee of the Trust, by operation of clause 18(4) of the Deed. Thereafter, Ms Danielle Woodhouse, the person then holding office as the Appointor, on 17 August 2022, pursuant to a Replacement and Appointment deed appointed Bad Wolf as the new Trustee. In consequence DBA is a bare trustee or trustee de son tort of the Trust property, with the obligation to protect the property: Jones v Matrix Partners Pty Ltd; re Killarnee Civil & Concrete Contractors Pty Ltd (in liq) [2018] FCAFC 40; (2018) 260 FCR 310 at [33], Allsop CJ.

6 The Liquidators of DBA are Richard Stone and Gregory Dudley (the second defendants). The Liquidators resist the application; as does QRS, who initially participated in the proceeding as an interested person but is now the fourth defendant. Westpac as the third defendant has filed a notice of submission. The Liquidators by interlocutory process under section 90 – 15 of the Insolvency Practice Schedule (Corporations), Schedule 2 to the Corporations Act 2001 (Cth), seek determination of a number of questions in the liquidation of DBA including, and presently importantly, which assets are held by DBA upon the terms of the Trust. As finally resolved, the Liquidators also seek orders that they be appointed joint and several receivers of the assets of the Trust.

7 During the course of the proceeding, the primary dispute narrowed to a single issue: are the funds of approximately $464,000 held in a Westpac account ending with the numerals 976 property of the Trust? If the answer to that question is in the affirmative, then the dispute between Bad Wolf and the Liquidators is whether the funds may be held by the Liquidators unless and until they have ascertained the extent of the creditors of DBA in its capacity as Trustee and have determined the extent, if any, of the right of recoupment or exoneration that DBA has over the assets of the Trust. For convenience I will refer to account 976 as the Westpac Trust Account.

8 For the reasons that follow, I am not satisfied that balance of funds in the Westpac Trust Account is the property of the Trust and for that reason the claim of Bad Wolf fails and the orders sought by the Liquidators will be made.

Suppression and non-publication orders

9 On 30 May 2024, I made suppression and non-publication orders to protect the identity of QRS, conformably with orders made by the High Court of New Zealand, which explains her pseudonym. On 10 June 2025, I varied those orders so that they do not apply to published judgments of this Court or to orders as registered in this Court concerning QRS and Lee Du Bray.

The framing of the issues

10 In an attempt to bring clarity to the position of each party, I made orders for the filing of concise statements, which was partially successful. More importantly, the parties attended a confidential conference before a registrar and managed to agree a chronology of material events, a statement of agreed facts and a list of issues for determination at trial. Drawing on the first and second of those documents, I set out the uncontroversial facts.

11 DBA was incorporated on 7 December 2000. Until 16 July 2020, Lee Du Bray was its director. Ms Lucinda Morgan was appointed as its director on 1 April 2022. She was described in the evidence as the girlfriend of Lee Du Bray. The lacuna in the office of director was not touched on in the evidence or submissions. There is one issued share held by Lee Du Bray. DBA was the former shareholder.

12 DBNZ was incorporated on 21 January 1997. It has two directors: Lucinda Morgan and Mr Michael Schwartz, a citizen and resident of the United States of America. There are 100 issued shares, held by Sofia Engcor Inc. One asset of the Trust is that it holds 1233 shares in Sofia. In evidence, Mr Andrew Chen, who for many years has been the accountant for Lee Du Bray and his related corporations, accepted that Sofia is wholly owned by the Trust. There is evidence of the shareholding in the Trust accounts he prepared to 30 June 2023.

13 Bad Wolf was incorporated on 11 November 2009. Lee Du Bray was appointed as its director that day and he remained until 16 July 2020. Lucinda Morgan held office as a director between 1 April 2022 and 9 September 2022. Andrew Chen was appointed as its director on 9 September 2022 and retains that office. There is one issued share, held by Lee Du Bray. DBA is noted as the former shareholder.

14 Sofia was the petitioning creditor which resulted in the Supreme Court of New South Wales making the order to wind up DBA and the appointment of the Liquidators on 11 August 2022, pursuant to s 459P of the Corporations Act.

15 On 26 November 2015, the High Court of New Zealand made a freezing order (First Freezing Order), final orders in a relationship property proceeding (Relationship Orders) and costs orders (Costs Orders) against Lee Du Bray in favour of QRS.

16 On 16 December 2015, this Court registered parts of the Relationship Orders and the Costs Orders pursuant to the Proceedings Act. The Freezing Orders were initially registered, but then set aside by Gleeson J on 20 July 2015: LFDB v SM [2015] FCA 725; (2015) 239 FCR 262. They are not registerable New Zealand judgments.

17 Further freezing orders were made by the High Court of New Zealand on 21 March 2016 (Second Freezing Order) and 24 April 2017 (Third Freezing Order). Neither is registered in Australia.

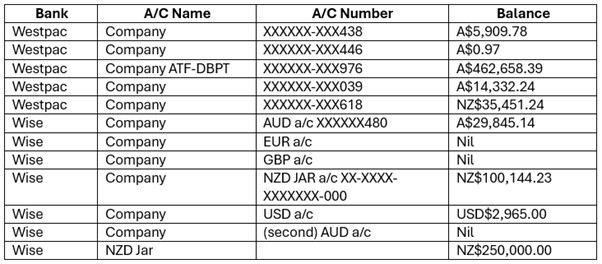

18 In the period prior to the appointment of the Liquidators, DBA held a number of bank accounts with Westpac and Wise Payments Ltd. According to a note on the Wise Payments statements it is an Authorised Electronic Money Institution, under a reference issued by the UK Financial Conduct Authority. It operates Wise Australia Pty Ltd as the local entity. Richard Stone’s unchallenged affidavit evidence is that he has identified the following accounts held by DBA with Westpac and Wise Payments, with balances determined as at 5 September 2024, save for the Wise NZD Jar account where the balance of NZ$250,000.00 is stated as at 5 June 2025 (the full BSB and account numbers are not reproduced):

19 Bad Wolf limits its claim to the Westpac Trust Account. More particularly, it concedes that that the balance funds in each other account are not Trust assets. Pausing there, it should be noted that DBA not only acted in its capacity as trustee of the Trust: it conducted a trading operation in its own right. That distinction is clear from the separate financial accounts for DBA and for the Trust for the financial years 30 June 2013-2016. It traded in its own right by using some, or some combination of, these accounts. One that features prominently in the evidence is account 618 with the description: NZD Currency Account.

20 Creditors and potential creditors of DBA and the Trust include Sofia, Andrew Chen in respect of unpaid accounting fees, the Police and Nurses Credit Society (as mortgagee of land purchased as an asset of the Trust) and the Commissioner of Taxation in relation to assessed income tax, GST and other taxation liabilities. During the course of the proceeding, other Trust assets were identified being various chattels (principally artworks) as set out in the depreciation schedule for the Trust accounts for the year ended 30 June 2023 that Andrew Chen caused to be prepared as at 8 October 2024. Andrew Chen’s evidence is that Lee Du Bray has possession of the chattels, which explains why Bad Wolf does not seek orders for delivery up against DBA.

The Westpac Trust Account

21 Bad Wolf as trustee of the Trust claims that DBA and/or the Liquidators must take steps to vest in it the funds in the Westpac Trust Account. Much of the focus of attention of the parties in argument, written and oral, concerned whether the Liquidators may resist doing so unless and until the extent of the right of indemnity (if any) and recoupment or exoneration of DBA has been ascertained. The Liquidators submit that they may retain possession of trust assets in aid of the equitable lien and the right of recoupment or exoneration of DBA, relying principally on the decision of the Full Court of the Supreme Court of South Australia in Re Suco Gold Pty Ltd (in liq) (1983) 33 SASR 99 and Jennings v Mather [1902] 1 KB 1 at 6.

22 Bad Wolf submits that the Liquidators have had more than sufficient time to determine the extent of any creditor claims, yet have not done so and, in any event, I should not follow Re Suco Gold to the extent that it is authority for the proposition that a former trustee may retain possession of trust assets for that purpose: Lemery Holdings Pty Ltd v Reliance Financial Services Pty Ltd [2008] NSWSC 1344; (2008) 74 NSWLR 550; Pitard Consortium Pty Ltd v Les Denny Pty Ltd [2019] VSC 614; (2019) 58 VR 524. That submission it is said finds strength in the recent decision of the High Court in Naaman v Jaken Properties Australia Pty Ltd [2025] HCA 1; (2025) 99 ALJR 295 where a majority determined that a replacement trustee does not owe a fiduciary duty to a former trustee to preserve trust assets to satisfy a right of indemnity. However, a former trustee may seek equitable relief to ensure that the successor does not “destroy, diminish or jeopardise” the right of indemnity: [28] – [30], Gageler CJ, Gleeson, Jagot and Beech-Jones J.

23 For completeness, it should be noted that Bad Wolf also submits that the Liquidators do not enjoy the benefit of a Universal Distributing Lien (Re Universal Distributing Co (in liq) [1933] HCA 2; (1933) 48 CLR 171) over the Westpac Trust Account because they have not cared for, preserved or realised the funds in that account: Re Gembrook Investments Pty Ltd [2019] FCA 1143 at [19], Colvin J.

24 QRS takes, or initially took, a different position. She submitted that the effect of the Freezing Orders and/or the Relationship Orders conferred in her favour an interest in the funds in the Westpac Trust Account by way of a constructive trust. How that was so was not made clear in her case in that a freezing order is an in personam remedy and confers no proprietary interest in assets subject to it: Deputy Commissioner of Taxation v Huang [2021] HCA 43; (2021) 273 CLR 429 at [25]. As to the Relationship Orders and the Costs Orders, neither confers a proprietary interest in the funds in the Westpac Trust Account.

25 The Relationship Orders declare a constructive trust in favour of QRS over one half of the shares in DBNZ, but do not do so over any of the assets of DBA whether held in its own right or pursuant to the Trust. Eventually, by the point of closing submissions, Mr Kirby for QRS abandoned the proprietary interest claim over the funds in the Westpac Trust Account. In its place he put a somewhat amorphous submission to the effect that Lee Du Bray engaged in a scheme to circumvent or subvert the effect of the Freezing Orders which then, as the submission went, conferred jurisdiction in this Court to order Westpac to pay the balance funds into a controlled monies account or into court, pending the resolution of competing claims. At another point, Mr Kirby appeared to embrace the position that I should find that Lee Du Bray engaged in fraudulent conduct in avoiding the effect of the Freezing Orders, and that this is a Black v S Freedman & Co [1910] HCA 58; (1910) 12 CLR 105 constructive trust. That claim was not developed.

26 During the hearing I raised with counsel whether there is an anterior issue that must first be resolved: Has it been established that the funds in the Westpac Trust Account are an asset of the Trust? Mr McAloon for Bad Wolf properly responded that as between Bad Wolf and the Liquidators that is not in issue on the pleadings. For that I was taken to paragraph [30] of the Liquidator’s concise statement. Mr McAloon submitted that remained the position of the Liquidators until the morning of the second day of the hearing, when they sought to resile from that position, which Dr Greinke for the Liquidators confirmed in unmistakably clear terms.

27 There are several answers to that submission. QRS has never accepted that the funds in the Westpac Trust Account are beneficially held upon the terms of the Deed. Her concise statement contends that she is the beneficial owner of the right to demand payment from Westpac ([9]) or alternatively that DBNZ is the beneficial owner: [16]. Thus, this was framed as an issue between her and Bad Wolf. Further, in formulating the list of issues for determination, the first identified by the parties requires a finding as to whether the Liquidators would be justified in treating some or all of the assets held by DBA as property of the Trust, and if so which assets? The fourth requires determination of who as between Bad Wolf, the Liquidators and QRS “is entitled to the money” held in all of the Westpac accounts and several Wise Payments accounts.

28 Bad Wolf brings this proceeding in part pursuant to s 90-15 of the Insolvency Practice Schedule. Similarly, the Liquidators seek the determination of a range of questions arising in the liquidation of DBA pursuant to that provision. Judicial advice is sought. The procedure is analogous to the well-understood Chancery procedure available to a trustee that was explained at length in His Eminence Petar Diocesan Bishop of Macedonian Orthodox Diocese of Australia and New Zealand v Macedonian Orthodox Community Church [2008] HCA 42; (2008) 237 CLR 66 at [34]-[45]. On such applications, as explained by the Court at [104], by reference to the Privy Council in Marley v Mutual Security Merchant Bank and Trust Co Ltd [1991] 3 All ER 198 at 201, in giving directions or advice to a trustee a court is “essentially engaged solely in determining what ought to be done in the best interests of the trust estate and not in determining the rights of adversarial parties”. That is the case on the Liquidators’ application for advice as to the assets of the Trust pursuant to s 90-15 of the Insolvency Practice Schedule.

29 Perhaps more importantly, once I raised whether I must first be satisfied that the funds in the Westpac Trust Account are trust assets, all counsel were content to proceed, no application was made for an adjournment to adduce further evidence, no party claimed prejudice and Mr McAloon, whose client is most affected, was content to proceed and deal with the issue (T 126).

Are the funds in the Westpac Trust Account a Trust asset?

Evidence

30 There is no direct evidence as to how or why the funds in the Westpac Trust Account came to be deposited. There is hearsay evidence which all parties reference. There is minimal by way of contemporaneous business records, limited to entries in bank statements, invoices and debtor payment advice. That evidence is as follows.

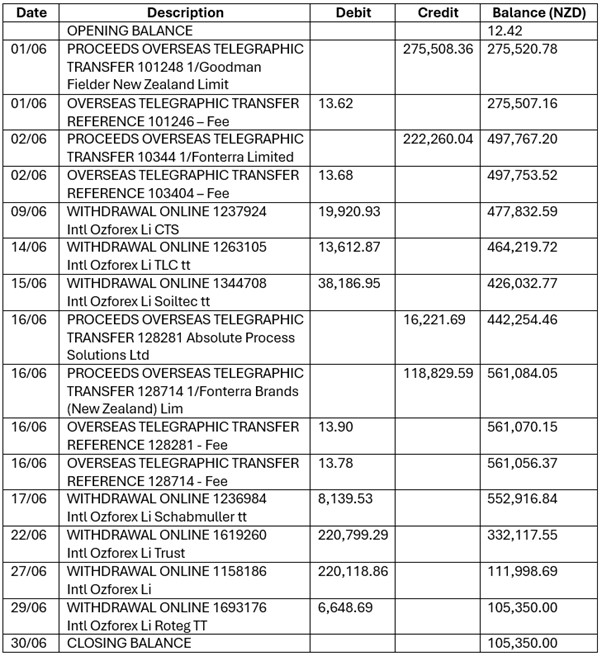

31 There has been produced some statements of account for the NZ Currency Account and the Westpac Trust Account. The NZD Currency Account is for the period 1 June 2022 to 30 June 2022. It commences with an opening credit balance of $12.42 and concludes with a closing balance of $105,350.00. Within that period, the total credits are $632,819.68 and the total debits $527,482.10. The transactions in that period were:

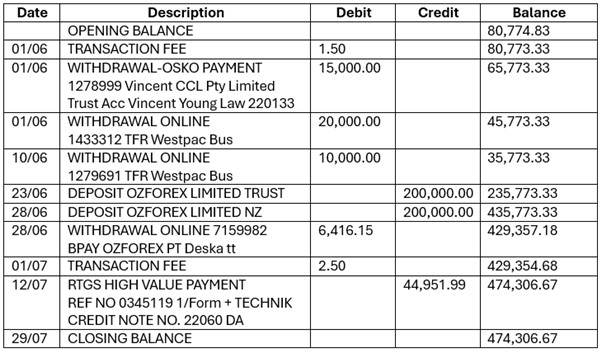

32 The statements for the Westpac Trust Account are for the period 17 March 2020 to 12 August 2022. For the relevant period, June to July 2022, the opening balance on 1 June 2022 was $80,774.83 in credit, the closing balance on 29 July 2022 was $474,306.67 and within that period total credits were $444,951.99 and total debits $51,420.15. The transactions in that period were:

33 The parties were initially in dispute as to the source of the credits in the Westpac Trust Account within the period of that statement. In consequence of some case management orders, that dispute was resolved upon the undertaking by Andrew Chen of a partial forensic accounting exercise that he verified pursuant to his affidavit of 13 December 2024. The amounts of $200,000.00 deposited respectively on 23 and 28 June 2022 were transfers from the NZD Currency Account. The deposit of $44,951.99 on 12 July 2022, was made directly by LinkExport and was not a transfer from the NZD Currency Account.

34 There are several explanations for the deposits to the Westpac Trust Account which I address in chronological order.

35 On 19 August 2022, Vincent Young Lawyers corresponded with the Liquidators and relevantly stated:

Du Bray & Associates Pty Ltd (sic) was the Trustee of the Du Bray Property Trust as reflected in the attached Hybrid Discretionary Trust Deed.

In accordance with clause 18(4) of the Trust Deed, Du Bray & Associates (sic) has ceased to act as the Trustee of the Du Bray Property Trust upon the making of the winding up order.

Daniel Woodhouse acts as the Appointor of the Du Bray Property Trust following Lee’s bankruptcy.

Ms Woodhouse has exercised her powers under clause 18(1) of the Trust Deed to appoint Bad Wolf Purchasing Pty Ltd to act as the Trustee of the Du Bray Property Trust going forward. As you will see from the attached document, Bad Wolf has accepted this appointment.

Bad Wolf will shortly provide you with a direction requiring you to pay the balance of [the Westpac Trust Account] into its nominated plant.

36 The foreshadowed payment direction was provided on 22 August 2022.

37 On 1 September 2022, Vincent Young further corresponded with the Liquidators. The letter commences with the statement that the firm acts for DBNZ. Relevantly for present purposes, the letter provides:

1. NZ Account

DB AU is the named holder of the NZ Account but the funds do not belong to DB AU. The NZ Account holds DB NZ’s funds and DB AU is trustee of those funds for DB NZ.

This situation arose out of freezing orders issued by the High Court of New Zealand against Mr Du Bray in matrimonial proceedings. As a result of those orders, the bank accounts held by DB NZ in New Zealand were frozen and the money held in those accounts was garnished by Mr Du Bray’s former partner. To avoid that situation being repeated, Mr Du Bray opened an account in New Zealand dollars in the name of DB AU first with Wise Bank and later with Westpac so that DB NZ could continue to trade and receive payments without those invoices being seized by Mr Du Bray’s former partner.

The Westpac bank account statements for the NZ Account support NZ DB’s contentions. The payments into the account are from transfers from people and entities based in New Zealand. They are customers of DB NZ, not DB AU.

To give you further comfort about this, DB NZ will shortly provide you with invoices and receipts that support its claims to the money held in the NZ Account.

In the interim, please do not deal with the funds in the NZ Account. Those funds do not form part of the winding up.

2. DBPT Account

The DBPT account is in the name of DB AU in its capacity as the former trustee of the Du Bray Property Trust.

You have been appointed liquidator over DB AU but not over the assets of the Du Bray Property Trust. As previously demonstrated, the trustee of the Du Bray Property Trust is now Bad Wolf Purchasing Pty Ltd. Accordingly, DB AU no longer has any ability to control or deal with the money in that account.

A review of the bank statement (sic) that were issued by Westpac shows that the current balance in the DBPT Account was substantially sourced from two transfer (sic) from the NZ Account and a payment into the DBPT Account. The two transfers can be found in bank statements for the NZ Account issued in the period 31 March 2022 to 30 June 2022.

[The tabular representation of those transactions is not reproduced].

The payment of $44,951.99 into the DBPT Account on 12 July 2022 was credit (sic) for RAT tests paid for by DB NZ. A Copy of the credit note from LinkExport is enclosed.

This indicates that these funds are either DBPT funds or funds held by DBPT for DB NZ. Either way, DBA is not entitled to the funds.

Going forward, we will liaise with you and Bad Wolf to assist with the orderly transfer of control of the DBPT Account to Bad Wolf once the document pertaining to the NZ account has been provided to you.

38 In that correspondence, to align the acronyms with those in these reasons: DBPT is the Trust, DB AU is DBA, the NZ Account is the NZD Currency Account and the DBPT Account is the Westpac Trust Account.

39 Vincent Young sent further correspondence to the Liquidators on 13 September 2022. The firm enclosed a bundle of invoices, remittance advices and bank account extracts said to demonstrate that “all the money deposited in the NZ account (which was subsequently transferred to the DBPT) was sourced from invoices that had been issued by DBNZ”. The correspondence continues:

DB NZ directed that this money be paid to DB AU for the reasons outlined in our previous letter. DB NZ directed payment to DB AU with the express intention that this money would be held on trust for DB NZ.

DB NZ then further directed that the money in the NZ Account be transferred to the DBPT Account.

Accordingly, it is irrefutable that the money in the DBPT Account is derived from funds sourced entirely from DB NZ and is therefore trust property belonging to either DBPT or DB NZ and over which DB AU has no claim.

For the avoidance of doubt, we are instructed that DB NZ now directs that the money held in the DBPT Account and the DB NZ Account be released no later than 4 pm, Thursday, 15 September 2022.

DB NZ urgently needs these funds to operate its business. It is losing customers and cannot pay its creditors without access to this money.

DB NZ demands that this money be paid as directed by no later than 15 September 2022. Failing receipt, DB NZ will commence proceedings to seek Court orders compelling the release of this money to DB NZ.

Can you please confirm that you will cooperate with DB NZ and Bad Wolf to facilitate an orderly and timely transfer of the funds held in the DBPT Account and the DB NZ Account.

40 On 15 September 2022, Andrew Chen emailed the Liquidators, attached a number of financial accounts for the Trust (and DBA in its own capacity) for the years 2013-2016 and relevantly stated:

We confirmed (sic) that the accounts and tax returns had (sic) not been finalised since 2016. We will endeavour to complete the Du Bray Property Trust financials and tax returns as soon as possible for your perusal.

…

Du Bray and Associates Pty Ltd derives the bulk of the income for the group trading as an overseas procurement specialist and on-lent to the rest of the entities. So as a general rule, Du Bray and Associates Pty Ltd is a debtor to the other entities.

The only exception might be transfers in relation to Du Bray & Associates Limited (domiciled NZ). Post 30 Jun 16, funds that belong to Du Bray & Associates Limited (domiciled NZ) were passed through accounts held by Du Bray and Associates Pty Ltd (domiciled in Australia) and also Du Bray Property Trust. As recent accounts have not been prepared for the entities, we do not know the actual current balance or characterisation of the transfers.

There is no formal written documentation of any trust relationship between the parties in relation to these transfers.

The trustee for the Du Bray Property Trust is now Bad Wolf purchasing Pty Ltd. It is our understanding that you have the supporting documents.

The most immediate concern at the moment is access to [the Westpac Trust Account] as suppliers have to be paid and assets held on trust for other entity (sic) should not form part of your liquidation process. Due to the liquidation of the trustee company, the fund in this account has been frozen by Westpac. It is our understanding that:

(a) Lee Du Bray is bankrupt and owes money to all his related entities. So it is highly unlikely that his bankruptcy trustee can put up any robust claim against Du Bray Property Trust’s assets.

(b) It is clear from the bank details that this bank account is held on trust for the Du Bray Property Trust.

(c) As evidenced by documents provided by Lee Du Bray and Vincent Young in other communications, the funds held in [the Westpac Trust Account] belongs to Du Bray & Associates Ltd (domiciled NZ).

41 When Andrew Chen authored that correspondence, he was not simply the accountant to DBA -he was also the sole director of Bad Wolf, having been appointed to that office on 9 September 2022.

42 On 9 November 2022, a new firm of solicitors corresponded with the Liquidators: Gavin Parsons and Associates. The firm stated that it acts for Bad Wolf and that Vincent Young Lawyers no longer act “in relation to this matter”. Under the heading ‘Withholding of Trust Assets’, the following was relevantly stated:

The Liquidators’ actions thus far, by unreasonably and unlawfully withholding the Trust Assets, despite our client’s provision of all relevant supporting material, has caused and continues to cause our client loss and damages, which our client is yet to fully quantify. We consider in the circumstances, the Liquidators’ actions are plainly unlawful, as they have access to sufficient material to satisfy themselves that the Company has no claim to the Trust Assets, however, refuse to release same to our client.

One such loss has been as a result of our client’s inability to access [the Westpac Trust Account] to, amongst other things, pay its liabilities which we note was brought to the attention of the Liquidators in Andrew Chen’s aforementioned correspondence of 15 September 2022. Additionally, we are instructed that our client is unable to meet its mortgage repayments with respect to [a property in Broome Western Australia], which may result is (sic) recovery action being taken by the mortgagee.

43 I return to the invoices and remittance advices provided by Vincent Young to the Liquidators. Recall that the letter of 1 September 2022, identifies and asserts two steps for the payment of debtor amounts due to DBNZ: (1) payment into an account of DBA held with Wise Bank; and (2) later payment into an account of DBA with Westpac. Recall also that the Vincent Young letter of 13 September 2022, asserts as the third step that DBNZ “further directed that the money in the NZ Account be transferred to the DBPT Account”.

44 There are no contemporaneous records evidencing any direction by DBNZ for the taking of those three steps.

45 What do the contemporaneous business records reveal? On 17 February 2022, DBNZ invoiced Fonterra for the supply of rapid antigen tests in the amount of $118,829.59. The payment slip requests that either a cheque be sent to DBNZ or that funds be electronically remitted to the Bank of New Zealand, to an account ending with the numbers 15 – 000. It will be immediately noticed that this account was not with the Bank of New Zealand; it was a Wise Payments account. On 24 March 2022, DBNZ invoiced Fonterra for the supply of rapid antigen tests in the amount of $222,260.04. That invoice also requested the remission of funds electronically to the Bank of New Zealand, with the Wise Payments Account number. There is a remittance advice from Fonterra dated 15 June 2022 for the amount of $118,829.59, but it does not disclose the account into which the funds were transferred. The Westpac statement for the NZD Currency Account records that this sum was deposited by Fonterra on 16 June 2022. That statement also records that the amount of $222,260.04 was deposited by Fonterra on 2 June 2022.

46 DBNZ invoiced Goodman Fielder on 19 April 2022 in the amount of $15,617. The payment slip section of the invoice requests the remission of electronic funds to the Bank of New Zealand, but with the Wise Payments Account number. The same procedure was adopted when DBNZ invoiced Goodman Fielder on 2 March 2022 in the amount of $259,516.87 and 20 April 2022 in the amount of $374.49. There is a remittance advice from Goodman Fielder dated 1 June 2022 for each of those invoices and which records that the total sum of $275,508.36 was transferred to the NZ Currency Account. That transfer is confirmed by the Westpac statement as having occurred on 1 June 2022.

47 No invoice has been produced relating to the LinkExport credit note dated 24 June 2022, in the amount of €31,200 which was deposited to the Westpac trust account on 12 July 2022 in the amount of $44,951.99. The notation on the bank statement refers to a credit note. That note includes this: payment will be offset against orders. There is no evidence as to why that was not done and instead a credit was allowed for and paid. The Vincent Young letter of 1 September 2022 simply notes the payment directly to the Westpac Trust Account. There is no evidence of why the funds were not paid first into the NZ Currency Account, consistently with Lee Du Bray’s asserted intention that debtor payments were to be redirected to the NZ Currency Account.

48 For each of those deposits, there is no documentary evidence as to why or when Goodman Fielder or Fonterra Ltd were instructed or advised not to remit the funds due to DBNZ to the nominated Wise Payments Account, but instead to transfer the funds to the NZD Currency Account. There is no documentary evidence that discloses when, how or by what mechanism DBNZ and DBA determined that invoiced amounts due to DBNZ would be paid into the Wise Payments Account, or further, how it came to be that amounts that DBNZ directed by each invoice be deposited to the Wise Payments Account were instead deposited to the NZ Currency Account. There is no documentary evidence as to how, when or by what mechanism DBNZ “directed” (to use the language of the Vincent Young letter of 13 September 2022) DBA to transfer some of the funds in the NZ Currency Account to the Westpac Trust Account.

49 The solicitors have no direct knowledge of these matters and nor does Andrew Chen. The individuals with knowledge of these transactions and steps have not given evidence. To the knowledge of Andrew Chen, there was no reason that prevented Lee Du Bray from attending at trial to give evidence. Similarly, Michael Schwartz, in his capacity as a director of DBNZ could have given evidence about these transactions but did not. Andrew Chen also said there was no reason why he could not have given evidence. Nothing has been said as to any inability of Lucinda Morgan to give evidence in her capacity as a director DBA and DBNZ at the time.

50 Instead, Andrew Chen is the person who made all of the affidavits in support of Bad Wolf’s claim. Andrew Chen was not a very satisfactory witness. There was an attempt to adduce hearsay evidence through him to the effect that DBNZ lent the monies deposited to the Westpac Trust Account which loans were later forgiven on 26 November 2024. Andrew Chen attached to one of his affidavits a document signed by Michael Schwartz addressed: ‘To Whom It May Concern’. It purports to be a “Loan Forgiveness Letter” for the amount of $444,951.99. I upheld the objections to the receipt of that self-serving hearsay evidence. The business records exception does not apply as it was clearly created for the purpose of this proceeding: s 69(3)(a) Evidence Act 1995 (Cth).

51 Andrew Chen managed to prepare a set of accounts for the Trust for the year ended 30 June 2023, that he attached to his affidavit made on 4 June 2025. The accounts are signed and dated 8 October 2024, by him in his capacity as the director of Bad Wolf. He prepared these accounts, despite not preparing any in the financial years 2017 – 2022. In the balance sheet, there is recorded as the primary current asset the balance of the Westpac Trust Account in the amount of $462,658, an increase from $429,357 in the previous financial year. In the liability section there is recorded a loan to DBNZ of $444,952. Of course, that liability is the total of the deposits to the Westpac Trust Account of $200,000, $200,000 and $44,951.99.

52 The accounts also record, under non-current liabilities, “beneficiaries accounts” in the amount of $59,093. There is no separate reconciliation of the amounts owed to the Trust beneficiaries or, indeed, no disclosure of who the beneficiaries are. I note, however, that in the accounts prepared as at 30 June 2014, Lee Du Bray is recorded in the beneficiary distribution statement as having an accumulated entitlement of $19,543 and in the Trust tax return for 2016, Lee Du Bray is recorded as having received the share of income of the Trust estate in that year of $19,685. The return is unsigned and there is no evidence that it was lodged in that form.

53 In cross-examination, Andrew Chen was questioned about recording the loan of $444,952 from DBNZ to the Trust. He was asked about the basis for that accounting entry. Initially he said “we are aware” that DBNZ “sends the money” to DBA. He clarified that by “we” he was referring to Lee Du Bray and Michael Schwartz. He then said that “as an accountant” he needed to characterise the money as “something”. It was not in his assessment “a payment for services or goods” and doing the best that he could, he recorded it as a loan. In answer to a question from me, he confirmed that he recorded it as a loan “just to balance the books”. Ordinarily an entry in the financial statements of a corporation is prima facie evidence of what is recorded: s 1306 Corporations Act. The presumption is rebutted in this case in that I am satisfied that having no knowledge of the underlying transaction, Andrew Chen created the loan entry to make the balance sheet balance. For the same reason, the fact that the accounts to 30 June 2023 record the balance of the Westpac Trust Account as a Trust asset is not prima facie evidence of that fact: this is a component of Andrew Chen’s book balancing and the allocation of a Trust asset about which he has no personal knowledge. The accounts are not reliable evidence of the entries therein concerning whether the funds in the Westpac Trust Account are assets of the Trust.

54 There are other unsatisfactory aspects of Andrew Chen’s evidence. In his affidavit of 13 December 2024, he stated that he inquired of Michael Schwartz, in his capacity as a director of DBNZ, and in consequence verily believed certain facts concerning the payments by creditors of DBNZ to DBA. In particular, that the funds in the Westpac Trust Account are property of the Trust and DBNZ “does not seek repayment of the funds and makes no claim upon them”. Despite that evidence being pure hearsay, it was not objected to. However, in cross-examination it emerged that these statements are false. Andrew Chen admitted that the documents that were cross-referenced to this evidence as attachments to the affidavit were not provided to him by Michael Schwartz. Rather, he received them from Lee Du Bray. Andrew Chen attempted to down-play that evidence, characterising it as “basically, inadequacy in my affidavit”. The cross-examination continued, exposing that he made further false statements in his affidavit. Andrew Chen did not make any inquiry of Michael Schwartz before he made his affidavit. He made inquiries of Lee Du Bray, and simply repeated what he had been told to say by Lee Du Bray in his evidence. It was directly put to him that he had engaged in a course of deliberate obfuscation to conceal the true state of affairs, which Andrew Chen unconvincingly denied. In his mind it did not “really matter” whether the source of the information that he deposed to was Lee Du Bray or Michael Schwartz. In other words, making misleading statements in affidavit evidence should not have adverse consequences for him.

55 Andrew Chen then became argumentative in his evidence. He denied, again unconvincingly, that his affidavit was constructed so as to give a misleading impression of the true facts.

56 Regrettably, that does not conclude the necessary credit findings as to the evidence given by Andrew Chen. He was taken to the Vincent Young letter of 1 September 2022. He first stated that “we” instructed the solicitor to send the letter for the purpose of causing the Liquidators to release the funds in the Westpac Trust Account. Andrew Chen was not a director of Bad Wolf on 1 September 2022. Surprisingly, Andrew Chen could not answer whether Vincent Young was a law firm in Sydney or Melbourne. He next accepted that “we” was “obviously” a reference to Lee Du Bray and then conceded that he did not “directly” give the instructions. Rather, he was aware that Lee Du Bray was attending to that task, albeit as an undischarged bankrupt. Some nine days later, Lee Du Bray managed to cause Andrew Chen to be appointed as the director of Bad Wolf, despite that an undischarged bankrupt is prohibited from being concerned with the management of a corporation: s 206B(3) Corporations Act. Some six days later, Andrew Chen sent his email of 15 September 2022 to the Liquidators. Surprisingly, the cross-examination did not then with laser like focus interrogate Andrew Chen as to whether any of the facts contained in his email were true to his knowledge.

57 I cannot accept the truthfulness of Andrew Chen’s evidence as to facts that are central to the claims of Bad Wolf: that customers of DBNZ were directed to pay invoices into the Wise Payments Account, which direction was then altered to require payments to the NZ Currency Account and that, having done so, there was some arrangement between DBNZ and DBA whereby the funds deposited therein were directed by DBNZ to be held on the terms of the Trust. I find that he deliberately gave misleading evidence and I cannot accept him as a witness of the truth. That finding does not undermine the documents which evidence the money trail, but it raises considerable doubt about the contentions set out in the Vincent Young correspondence which is a primary component of the evidence relied on by Bad Wolf.

58 In any event, Andrew Chen gave other evidence that leads to the irresistible conclusion that he is the instrument through which Lee Du Bray conducts this proceeding; ultimately characterised as his “puppet” in the closing submission of Mr Kirby. It was Lee Du Bray who caused Lucinda Morgan to be appointed as a director of Bad Wolf on 1 April 2022. It was Lee Du Bray who caused Andrew Chen to be appointed as a director of Bad Wolf concurrently with the removal of Lucinda Morgan. Prior to the appointment of the Liquidators, it was Lee Du Bray who had the authority to approve creditor payments of DBA. Andrew Chen was never involved in the “nitty-gritty” of the banking transactions. When it was directly put to Andrew Chen that he was “conducting this proceeding, in effect, at the request or direction, of Lee Du Bray” he answered: “yes, potentially”. He accepted that he agreed to be appointed as the director of Bad Wolf “in order to basically assist Lee Du Bray, the shareholder”, he understood his role in this proceeding as “assisting” Lee Du Bray who had directed him to commence this proceeding in the name of Bad Wolf and that Lee Du Bray is funding this proceeding through a related entity. Thus, I accept the puppet submission.

Consideration

59 I am not satisfied that it has been established that the funds in the Westpac Trust Account are an asset of the Trust.

60 The starting point is the bank statements which are evidence that the funds are held by DBA in its capacity as the Trustee of the Trust. However, that is not determinative. Clause 1 of the Deed defines “Trust Fund” as:

The Settled Sum and all other monies, investments and property paid or transferred to and accepted by the Trustee as additions to the Trust fund.

61 The settled sum was $10. Clause 6 of the Deed (titled “What power is there to put more assets into the Trust?) provides:

All assets given to the Trustee for the Trust are treated as if the asset was given to the Trustee at the time of the signing of this deed.

62 Clause 9 of the Deed provides for various powers of the Trustee (“In addition to the powers given to the Trustee by this Deed”), including investing the Trust fund in any investments, to carry on any trade or business venture, to open and operate any bank or similar accounts and to exercise such additional powers as “can be performed by a human being”. Clause 19 is concerned with how the Trustee makes decisions, and provides in part:

Any exercise by [DBA], or the Trustee from time to time, of any power is made:

a. in writing signed by all the Trustees; or

b. by resolution duly passed by all present at a meeting of the Trustee or in the case of a sole corporate trustee by all the directors.

63 No evidence has been adduced that DBA agreed to accept each transfer of funds from the Wise Payments Account or the NZ Currency Account to be held upon the terms of the Trust. Several steps were required. A determination by DBNZ that certain amounts due to it (that is its chose in action against each debtor) be paid to the Wise Payments Account and then to the NZ Currency Account. What was this arrangement? Was there an agreement to assign each right to recover the debtor payments from DBNZ to DBA? If so, was the assignment written or oral? Did DBA give consideration for any assignment, or was it an equitable assignment in favour of a volunteer? Or was there an agreement that DBA would act as the agent of DBNZ? Or was the arrangement that DBA would act as an express trustee to hold the funds only for the benefit of DBNZ? If so, what were the terms of the agency or the express trust; in particular when and in what circumstance would DBA use the deposited funds to permit DBNZ to “operate its business” as contended in the Vincent Young letter of 13 September 2022? Or was no consideration given to these matters, in which event is this a case of resulting trust, for that step? That is a resulting trust of the type that may arise where there is no presumption of gift: Fowkes v Pascoe (1875) 10 Ch App 343 at 345, Jessel MR, at 348, James LJ.

64 The second step arises after the funds were received into the NZ Currency Account. When and in what terms did DBNZ decide that some portion of the funds so deposited would be paid over, transferred or gifted to DBA to be held upon the terms of the Trust? What was agreed between DBA and DBNZ? These steps required corresponding determinations by DBA: to accept the funds and with each transfer the obligations of the Trustee to hold all the deposited funds upon the terms of the Trust. How Lee Du Bray could have participated in these decisions and steps consistently with the prohibition that a bankrupt must not manage a corporation was not explained in the correspondence or addressed by Bad Wolf in this proceeding.

65 There is no contemporaneous document which evidences any of those decisions or determinations. No exercise of any of the powers of DBA to implement these steps as required in writing by clause 19 of the Deed has been produced. It was not open to DBA to unilaterally determine that funds directed to be paid by DBNZ into the NZ Currency Account would thereafter be held on the terms of the Trust. This is not pedantic trust law that may be overlooked. A trustee is bound by strict obligations to hold trust property upon the terms of a trust, to preserve the trust property and to act only in the interests of the beneficiaries. A trustee must “obey the terms of the trust” “in all things great and small, important, and seemingly unimportant”: Youyang Pty Ltd v Minter Ellison Morris Fletcher [2003] HCA 15; (2003) 212 CLR 484 at [32] and [33]. In acting, a trustee gives “substantial and valuable consideration” for amounts paid over to be held upon the terms of a trust: Cook v Benson [2003] HCA 36; (2003) 214 CLR 370 at [32]. If DBA and DBNZ agreed to the arrangement as contended in the Vincent Young correspondence of 1 and 13 September 2022, one would expect there to be some contemporaneous documentation consistent with it, apart from entries in bank statements.

66 There are numerous other difficulties with acceptance of the Bad Wolf contention, quite apart from the unsatisfactory evidence of Andrew Chen.

67 What must be examined is the entirety of the circumstances as they were in June and July 2022, to objectively determine whether the funds deposited to the NZ Currency Account and thereafter transferred in part to the Westpac Trust Account were intended by DBNZ and DBA to be held on the terms of the Trust. As explained in Byrnes v Kendle [2011] HCA 26; (2011) 243 CLR 253, it is essential to the creation of a trust obligation that the parties intend so to do. Although the case was concerned with the creation of a trust, there is in my view no difference in principle to the approach that must be taken when, as here, the question is whether the trust fund was intended to be augmented by the transfers from the NZ Currency Account. As explained by Gummow and Hayne JJ by reference to the objective theory of contract at [59]:

Likewise, the "objective theory" of contract formation, which, as Mason ACJ, Murphy and Deane JJ put it in Taylor v Johnson, stands "in command of the field", is concerned not with "the real intentions of the parties, but with the outward manifestations of those intentions". While the origins and nature of contract and trust are quite different, there is, as Mason and Deane JJ observed in Gosper v Sawyer, no dichotomy between the two. For example, a common form of express trust is that created by covenant between settlor and trustee. Hence the significance of consistency between trust and contract with respect to matters of intention in contract formation and trust declaration.

[Footnotes omitted]

See also Heydon and Crennan JJ to the same effect at [105], [107], [110] and [113]. Separately at [16], French CJ referred to the “principle that a trust cannot be created unless the person creating it intends to do so” and then noted the earlier decision in Kauter v Hilton [1953] HCA 95; (1953) 90 CLR 86, a case concerned with the opening of bank accounts by an elderly man in his name as trustee for his niece who was at the time the housekeeper for he and his wife. Following his death, a dispute arose as between the executors of his estate and the niece as to whether the money in each account was correctly the subject of a declaration of trust in her favour. It was held that despite him reserving the right to revoke the trusts, that was not inconsistent with an immediate trust in her favour. Two passages from the judgment are presently relevant. At 97, Dixon CJ, Williams and Fullagar JJ referred to the:

[E]stablished rule that in order to constitute a trust, the intention to do so must be clear and that it must also be clear what property is subject to the trust, and reasonably certain who are the beneficiaries.

68 At 100, in rejecting the submission of the executors, they observed:

The effect of Jolliffe's Case [1920] HCA 45; (1920) 28 CLR 178 is that the mere opening of an account under the section by one person in trust for another is not necessarily sufficient to make that person a trustee for the other person. All the relevant circumstances must be examined in order to determine whether the depositor really intended to create a trust. Even where it is held that a trust is intended it is still material to ascertain its terms.

69 In Byrnes the Court disapproved of the majority subjective reasoning in Jolliffe in favour of the minority objective reasoning of Isaacs J, but did not disapprove of the reasoning in Kauter.

70 It should also be noted that after the event evidence as to what was intended at the time is inadmissible, save to the extent that it is an admission contrary to interest: Charles Marshall Pty Ltd v Grimsley [1956] HCA 28; (1956) 95 CLR 353 at 365. The email of Andrew Chen of 15 September 2022, is partly of that character but was not objected to and for that reason it is a question of weight. I afford it little weight for two reasons. One, the paragraph commencing “the only exception” is entirely speculative and is not a reliable basis to make factual findings. The other, he was and is acting as the puppet of Lee Du Bray with no personal knowledge of the facts in issue which undermines his credibility.

71 To put it mildly, the explanation for the transfers and deposits set out in the Vincent Young letters “does not add up”. The explanation is that in order to circumvent the effect of the freezing orders that had bitten upon the bank accounts of DBNZ, Lee Du Bray opened the Wise Payments Account and the NZ Currency Account and directed certain debtors to make payments to those accounts (which and in what order is not revealed). The solicitor’s contention proceeds that thereafter the funds were transferred to the Westpac Trust Account. The numbers need to be examined to test the credibility of those contentions.

72 The total of the amounts deposited to the NZ Currency Account in June 2022, by Fonterra and Goodman Fielder was $616,597.99 ($275,508.36 + $222,260.04 + $118,829.59). The amounts withdrawn from that account and transferred to the Westpac Trust Account on 22 and 27 June 2022 were $220,799.29 and $220,118.86; a total of $440,918.15. If the true intention of DBNZ and DBA was that the diverted debtor payments were to be held upon the terms of the Trust, then there is no explanation as to why the difference of $175,679.84 was not transferred to the Westpac Trust Account for that purpose. Bad Wolf has not identified or adduced evidence that there was some split intention that some portion of the debtor payments would be held by DBA in the NZ Currency Account (perhaps as noted above pursuant to some undisclosed express Trust or if not a resulting trust) and the balance would be held by DBA upon the terms of the Trust. Bad Wolf does not claim that the $175,679.84 is held on the terms of the Trust. As much was conceded by Mr McAloon in his oral opening submissions (T 11, L 20-45- T12 L1-5, T 17, L35-40).

73 Bad Wolf makes no attempt to grapple with this point in submissions beyond pointing to the contention in the Vincent Young letter of 13 September 2022 that: “DBNZ then further directed that the money” in the NZ Currency Account be transferred to the Westpac Trust Account. The difficulty is that “the money” was not so transferred; only part of the funds were. No evidence has been adduced about the contended direction: who gave it, on what terms, when was it given, to whom was it given and why was it limited to the amount of $440,918.15? And as I have noted there is no evidence as to why the LinkExport funds were deposited directly to the Westpac Trust Account.

74 Relatedly, the evidence of Bad Wolf does not address why DBNZ directed some portion of the funds in the NZ Currency Account to be held by DBA on the terms of the Trust for the purpose of permitting, according to the Vincent Young letter of 1 September 2022, DBNZ to “continue to trade and receive payments”. I am prepared to assume, favourably to Bad Wolf, that DBNZ is within the class of General Beneficiaries defined in the Deed as including an Eligible Corporation, which in turn means “any corporation at least one share in which is beneficially owned or held by a Beneficiary”. The Relationship Orders identify the relationship property as at 15 January 2009 as including Lee Du Bray’s shares in DBNZ. According to the New Zealand Companies Office search dated 24 January 2024, the only shareholder is Sofia. It does not record when Sofia became the shareholder. My assumption extends to accepting that on a proper construction of the Deed, an Eligible Corporation does not cease to be within the class of General Beneficiaries if a Beneficiary ceases to be a shareholder. There is no doubt that Lee Du Bray is and was a Beneficiary.

75 My assumption leads to a further difficulty in determining objectively whether DBNZ intended that the funds in issue be held by DBA on the terms of the Trust. There is no evidence that the Trustee, acting pursuant to the hybrid provisions of the Deed, resolved to create Distinct Income Units in favour of DBNZ, whereby it became entitled to Distinct Income (and where the rights attached to the units “are decided by the Trustee”): see, in particular, clauses 25 and 26 of the Deed. The accounts of the Trust as at 30 June 2013 record 840,000 subscribed units, which number remained static up to 30 June 2023. There is no register of unit holders and otherwise no disclosure of who held or holds the units. The solicitor’s correspondence does not assert that DBNZ was entitled to an income distribution as a unit holder.

76 Thus, if the intention was to transfer the funds in issue to DBA to be held on the terms of the Trust, the discretionary provisions of the Deed would have applied. A beneficiary within the class of beneficiaries of a discretionary trust has limited rights. In particular, a beneficiary has no right to direct that payments be made for his or her benefit and no interest in the trust fund. The right of a beneficiary is to have the trust properly administered and with an expectation that the beneficiary may be considered as a potential recipient of income or capital: see the comprehensive analysis of French J in Australian Securities and Investments Commission v Carey (No 6) [2006] FCA 814; (2006) 153 FCR 509.

77 DBNZ could only have a fixed and compellable interest in the income or capital of the Trust if DBA determined to provide for it by exercising the power to pay or apply a sum for its benefit, usually evidenced by exercise of the power at clause 24 of the Deed to make “a book-entry” for the payment of income or capital to it: Fischer v Nemeske Pty Ltd [2016] HCA 11; (2016) 257 CLR 615.

78 It follows that the purported directions variously given to the Liquidators to pay over the balance of the Westpac Trust Account to DBNZ (the Vincent Young letter of 13 September 2022), with the threat of legal proceedings in the event of non-compliance, is completely inconsistent with the contention by the solicitors that the funds were held subject to the terms of the Trust.

79 This is not simply a conclusion about a misconceived demand without legal effect. It goes to the heart of the claims now made by Bad Wolf. It is Vincent Young when acting for DBNZ who contended that the funds in the Westpac Trust Account are held for the benefit of DBNZ either pursuant to the Trust or some other unspecified trust. If the true intent of the parties to the asserted determination was that a portion of the funds in the NZ Currency Account would be held by DBA on the terms of the Trust, that position is irreconcilable with DBNZ nonetheless and despite the Trust terms demanding that the balance of Trust funds be released to it. And at the time, Vincent Young were being instructed to make the contentions in their correspondence by Lee Du Bray, the individual who has and could have given evidence as to what was said and done at the time in order to objectively establish that the funds in the Westpac Trust Account were intended to be held on the terms of the Trust.

80 Michael Schwartz could also have given evidence as to the how DBNZ manifested its intent that the funds in issue would be held on the terms of the Trust. No reason has been given for the failure of Lee Du Bray or Michael Schwartz to give evidence. Indeed, Andrew Chen’s evidence (which I am prepared to accept) is that he knows of no reason why either could not have given evidence and he discussed the case with Lee Du Bray on the weekend before giving his evidence on 10 June 2025. I draw the usual and well-understood inference. Their absence as witnesses is unexplained where each could have given evidence relevant to the facts in issue, where their evidence as the persons involved in the transactions would reasonably be expected and where it could reasonably be expected that Bad Wolf would have called them. I infer that any evidence from either would not have assisted the case of Bad Wolf: Jones v Dunkel [1959] HCA 8; (1959) 101 CLR 298.

81 Bad Wolf’s case that the balance funds in the Westpac Trust Account is Trust property rests on the slender hearsay (and internally inconsistent) evidence of the Vincent Young correspondence of 1 and 13 September 2022, the misleading and unsatisfactory evidence of Andrew Chen, the unreliable accounts of the Trust to 30 June 2023 and the fact that the Westpac Trust Account as at 12 August 2022, recorded a credit balance of $462,658.33. A central component of that case is that DBNZ gave two directions (unparticularised as to form, date or the individuals concerned) that funds due to it would be paid into Wise Payments Account and or the NZ Currency Account and later that a portion of the funds so deposited be transferred to the Westpac Trust Account. Each direction is critical to the contention that it is “irrefutable” that the balance funds in the Westpac Trust Account “belong to either” the Trust or DBNZ (employing the language of the Vincent Young letter of 13 September 2022). The hearsay evidence is simply insufficient to satisfy me as to those matters.

Result of the Bad Wolf claim

82 Accordingly, when all the surrounding circumstances as they existed at the time are objectively analysed, I am unsatisfied that Bad Wolf has established that the balance of funds in the Westpac Trust Account is property of and is held on the terms of the Trust. The fact that funds are held in the Westpac Trust Account is not of itself sufficient. One probability that looms large is that the DBNZ is the beneficiary of an undocumented express trust for it alone, or perhaps a resulting trust, on each occasion that funds were deposited by its debtors to the NZ Currency Account and its fixed interests were not then displaced when someone, somehow, made a decision to transfer funds from the NZ Currency Account and into the Westpac Trust Account. The same doubt attaches to the making of an undisclosed decision that a credit due to DBNZ from LinkExport would be paid into the Westpac Trust Account.

83 Returning to Bad Wolf’s originating process, it is appropriate to grant leave to proceed pursuant to s 471B of the Corporations Act against DBA. I refuse the other relief that it seeks, and it will be ordered that the balance of the originating application be dismissed.

The Liquidators’ application

84 By the time of closing submissions, Dr Greinke refined the orders and advice the Liquidators seek pursuant to s 90-15 of the Insolvency Practice Schedule to:

1. Pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations), Schedule 2 to the Corporations Act 2001 (Cth), the second defendants (Liquidators) be appointed joint and several receivers of the assets of the Du Bray Property Trust.

2. It be declared that the Liquidators, as the Liquidators of Du Bray and Associates Pty Ltd (ACN 095 326 935) (in liquidation) and the receivers of the Du Bray Property Trust are entitled to collect and realise the property of Du Bray and

3. Associates Pty Ltd and the Du Bray Property Trust, notwithstanding the freezing orders made by the High Court of New Zealand.

4. Without limiting Order 2, the Liquidators are entitled to the monies in bank accounts in the name of Du Bray and Associates referred to in the affidavit of Richard Stone affirmed on 5 September 2024 and 5 June 2025.

5. Direct the third defendant to release to the Liquidators all monies in bank accounts in the name of Du Bray and Associates, including the following accounts (redactions applied):

a. XXXXXXXXX976 (as trustee for the Du Bray Property Trust);

b. XXXXXXXXX438;

c. XXXXXXXXX446;

d. XXXXXXXXX039;

e. XXXXXXXXX618.

1. Pursuant to section 90-15 of the Insolvency Practice Schedule:

a. the Liquidators may call for proofs of debt in the winding up of Du Bray and Associates together with the receivership of the Du Bray Property Trust, to be lodged by a particular date, after which any claims not so lodged, including claims by creditors of the Du Bray Property Trust, shall be deemed to be abandoned;

b. Du Bray and Associates is entitled to be exonerated from the assets of the Du Bray Property Trust in respect of such liabilities incurred as trustee as are proved in the winding up;

c. the Liquidators are entitled to be exonerated from and hold a lien over assets of the Du Bray Property Trust for their remuneration, disbursements and costs, including legal costs, incurred respect of investigating the affairs of the Du Bray Property Trust and as receivers of the Du Bray Property Trust, the amount of which to be determined by the Court, in respect of which the plaintiff, the fourth defendant and the Liquidators be granted liberty to apply.

1. The Liquidators shall give notice of these orders by circular sent by email and by ordinary prepaid post within seven days of the making of these orders to each of the persons known to be potential creditors of Du Bray and Associates Pty Ltd and the Du Bray Property Trust and persons known to be beneficiaries of the Du Bray Property Trust.

2. There be liberty to apply to any person not a party to these proceedings claiming to be prejudiced by the making of these orders to apply to vacate or vary the orders within one month of the making of these orders.

85 QRS seeks orders for the balance of the Westpac Trust Account to be paid into a controlled money account, into court or by some mechanism paid to the High Court of New Zealand. The basis for those orders was not satisfactorily explained. Mr McAloon in his closing submission, as an alternative to Bad Wolf’s primary claims for relief, submitted that if I was “sufficiently troubled” whether the funds in the Westpac Trust Account is property of the Trust, then I should order the funds be paid to a controlled money account or into Court with an opportunity for DBNZ to make any claim that it is advised to make (together with any other potential creditor or claimant).

86 What is plain from the proceeding is that a final determination must be made as to the status of the funds in the Westpac Trust Account. The Liquidators have spent considerable funds and energy thus far in investigating the facts; though thus far inconclusively. The Liquidators are independent. Presently, it is uncertain whether external creditors have claims against DBA in its own right and/or in its capacity as trustee of the Trust. Questions of whether DBA is entitled to be indemnified for incurred liabilities, by recoupment or exoneration, remain to be determined. There is no dispute that substantial funds in other Westpac accounts and in the Wise Payments Accounts are not assets of the Trust. The obviously efficient course is to make orders that place the Liquidators as receivers and managers of all the assets of DBA as owned by it and those which it holds as trustee of the Trust, or perhaps some other trust.

87 The appointment of Liquidators as receivers and managers of trust property is commonplace where, as here, DBA acts as a bare trustee in consequence of its removal as the Trustee of the Trust. The usual justification is to permit an orderly realisation of the assets, a simplification of the liquidation, the identification of creditor claims against the Trustee and satisfaction of the Trustee’s right of exoneration: Cremin, in the Matter of Brimson Pty Ltd (in liq) [2019] FCA 1023 at [48]-[51], Moshinsky J; Krejic (Liquidator) v Panella, in the matter of Richmond Lifts Pty Ltd (in liq) (No 2) [2025] FCA 248 at [12]-[13], Moore J and Pirina, in the matter of Ceylan Irmak Pty Ltd (in liq) [2024] FCA 1280 at [12]-[14], Jackman J.

88 The appointment of the Liquidators as receivers and managers of the Trust property as proposed in their first order is plainly appropriate, with some modifications. It is usual for such appointments to be made pursuant to s 57(1) of the Federal Court of Australia Act 1976 (Cth), without security and without the need for a guarantee under r 14.21 and r 14.22 of the Federal Court Rules 2011.

89 The balance of the orders are largely routine, self-explanatory and should also be made. One, however, requires particular attention. The second order is in the form of a declaration that the Liquidators may realise the property despite the freezing orders. As I have noted, the freezing orders have not been registered in this Court and are not therefore enforceable as such in this jurisdiction: s 65 Proceedings Act and LFDB v SM. There is however, utility in making the declaration as Westpac has made it plain in correspondence that because it has notice of the freezing orders, it requires a court order to release the funds.

90 I should add that in submissions and in response to concerns that I raised, Dr Greinke withdrew proposed orders fixing the remuneration of the Liquidators at this stage. There are live issues as to what are the assets of the Trust and what costs have been incurred by the Liquidators in getting in and preserving Trust assets (which is properly within the scope of a Re Universal Distributing lien), what claims are within the scope of the right of indemnity of DBA as the former trustee of the Trust and what costs have been incurred and remuneration earned in the general administration of the non-trust business of DBA. These matters require close attention on a future application by the Liquidators for approval of their remuneration.

91 For these reasons, I make orders accordingly.

I certify that the preceding ninety-one (91) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice McElwaine. |

Associate:

Dated: 18 July 2025

SCHEDULE OF PARTIES

VID 1066 of 2023 | |

Defendants | |

Fourth Defendant: | QRS |