Federal Court of Australia

Insurance Australia Limited, in the application of Insurance Australia Limited [2025] FCA 809

File number(s): | NSD 743 of 2025 |

Judgment of: | JACKMAN J |

Date of judgment: | 15 July 2025 |

Catchwords: | INSURANCE — application for confirmation of scheme pursuant to s 17F of the Insurance Act 1973 (Cth) (the Act) to transfer part of IAL’s insurance business to IMA — where IAL and IMA both subsidiaries of IAG — where Scheme part of minor variation of joint venture between IAG and RACV — where procedural requirements under the Act, Prudential Standard GPS 410 and dispensation orders substantially complied with — where no notices of objection received — where interests of transferring policyholders not adversely affected in material way — where no changes to terms and conditions of transferring policies — where transfer will not impact ability to meet policyholder obligations, APRA prudential capital requirements or internal target capital levels — where no changes to relevant reinsurance agreements — where IMA divorced from impact of Greensill litigation — where no material impact on policyholders from IAG’s acquisitions of RACQ and RAC (WA) — where APRA does not object to the Scheme — the Scheme should be confirmed |

Legislation: | Insurance Act 1973 (Cth) Financial Services and Markets Act 2000 (UK) |

Cases cited: | Aioi Nissay Dowa Insurance Company Limited, in the matter of Aioi Nissay Dowa Insurance Company Limited [2023] FCA 697 Allianz Australia General Insurance Limited, in the matter of Allianz Australia General Insurance Limited [2023] FCA 994 Insurance Australia Limited, in the application of Insurance Australia Limited (No 2) [2017] FCA 980 Integrity Life Australia Limited, in the matter of Integrity Life Australia Limited [2025] FCA 92 OnePath General Insurance Pty Limited, in the matter of OnePath General Insurance Pty Limited [2023] FCA 1424 Re London Life Association Limited (unreported, Ch D, Hoffman J, 21 February 1989); [1989] Lexis Citation 1731 Re Prudential Assurance Company Limited and Rothesay Life plc [2020] EWCA Civ 1626; [2021] Lloyd’s Law Reports 623 St Andrew’s Insurance (Australia) Pty Ltd, in the matter of St Andrew’s Insurance (Australia) Pty Ltd [2024] FCA 881 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Commercial Contracts, Banking, Finance and Insurance |

Number of paragraphs: | 56 |

Date of hearing: | 14 July 2025 |

Counsel for the Applicant: | Mr R Hollo SC |

Solicitors for the Applicant: | Sparke Helmore Lawyers |

Counsel for APRA: | Ms S Crosbie |

ORDERS

NSD 743 of 2025 | ||

IN THE APPLICATION OF INSURANCE AUSTRALIA LIMITED ACN 000 016 722 | ||

INSURANCE AUSTRALIA LIMITED (ACN 000 016 722) Applicant | ||

order made by: | JACKMAN J | |

DATE OF ORDER: | 14 JULY 2025 | |

THE COURT ORDERS THAT:

1. Pursuant to section 17F(1) of the Insurance Act 1973 (Cth) (the Act), the scheme for the transfer of part of the insurance business of Insurance Australia Limited, the Applicant, to Insurance Manufacturers of Australia Pty Limited ACN 004 208 084 (IMA) in the form of Annexure A to these orders (Scheme) be confirmed without modification.

2. The Effective Date for the purpose of the Scheme becoming effective and binding in accordance with these Orders is 12.01 am (AEST) on 31 July 2025.

3. IMA pay the costs of the proceedings of the Australian Prudential Regulation Authority as agreed or, if agreement cannot be reached, as assessed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

Annexure A – Scheme

REASONS FOR JUDGMENT

JACKMAN J:

1 The applicant seeks orders under s 17F of the Insurance Act 1973 (Cth) (the Act) for confirmation of a scheme to give effect to the transfer of part of the insurance business of the applicant, Insurance Australia Limited (IAL) to Insurance Manufacturers of Australia Pty Limited (IMA). The proposed scheme involves an intra-group transfer of contracts of insurance underwritten by IAL in Victoria within the CGU Direct, Swann Insurance and Lumley Special Vehicles short tail personal lines portfolios (Victorian STPL Portfolios), also referred to in the evidence as the Victorian CSL Business (the Scheme).

2 On 21 May 2025, I made orders dispensing with the requirement of s 17C(2)(c) of the Act to give a summary of the Scheme approved by Australian Prudential Regulation Authority (APRA) (Scheme Summary) to every affected policyholder (Dispensation Orders).

3 The applicants rely on the following evidence:

(a) an affidavit of Matthew Ernest Bennett affirmed 16 May 2025 (Bennett 1). Mr Bennett is the Executive General Manager, Distribution for the NRMA Insurance Division employed by Insurance Australia Group Limited (IAG), the parent company of IAL. He is responsible for overseeing the team tasked with the planning, delivery and the implementation pathways of the proposed Scheme (Project Team);

(b) a second affidavit of Mr Bennett affirmed 9 July 2025 (Bennett 2). Mr Bennett addresses compliance with the Dispensation Orders and the requirements of Prudential Standard GPS 410 Transfer and Amalgamation of Insurance Business for General Insurers (GPS 410) and annexes detailed correspondence with APRA in connection with those matters;

(c) two affidavits of Mr Geoff Atkins affirmed 16 May 2025 (Atkins 1) and 20 May 2025 (Atkins 2). Mr Atkins is an experienced general insurance consulting actuary and a principal of Finity Consulting Pty Limited. He has prepared an actuarial report in connection with the Scheme (Actuarial Report) which is annexed to Atkins 2; and

(d) a further affidavit of Mr Atkins affirmed 9 July 2025 (Atkins 3). In this affidavit, Mr Atkins updates his assessment of the Scheme in the Actuarial Report by reference to more recent APRA returns as at 31 March 2025.

4 Both IAL and IMA are subsidiaries of IAG, the former being 100% owned and the latter majority owned. Both IAL and IMA are authorised under s 12 of the Act to carry on business in Australia.

5 IMA is the corporate vehicle for a commercial joint venture between NRMA Personal Lines Holding Pty Limited (NRMA), a wholly owned subsidiary of IAG, and Royal Automotive Club of Victoria (RACV). IAG (through NRMA) is a majority shareholder in IMA, holding 70% of issued share capital. RACV holds the remaining 30% of the issued share capital of IMA. The parties have provided personal lines insurance in Victoria and New South Wales since 1999. In Victoria, RACV is the product distributor, and the products are branded RACV. In New South Wales, the product distributor and insurer is IAL, under the NRMA insurance brand.

6 The transfer under the proposed Scheme is to effect some agreed refinements of the joint venture between IAG and RACV. The purpose of the Scheme is to move the Victorian STPL Portfolios from IAL to IMA in order to refine and streamline the operations of both IAL and IMA by leveraging the distribution model operated through RACV for direct business in Victoria. An additional benefit of the Scheme is the transition of customers onto newer and more sophisticated IT platforms. The Victorian STPL Portfolios represent a very small proportion of the existing insurance businesses of both IAL and IMA. The Scheme is intended to give effect to a Transfer Agreement dated 16 May 2025 for the transfer and acquisition under the Scheme.

7 The Scheme is one component of a broader transaction between IAL and IMA that involves also the rebranding of certain policies under the CGU Direct, Swann Insurance and Lumley Special Vehicles lines underwritten by IAL exclusively in New South Wales and the Australian Capital Territory onto the NRMA brand. Those policies will remain underwritten by IAL, although by reason of the rebranding, they will fall into reinsurance arrangements that transfer the economic interest in that business to IMA as reinsurer. The rebranding exercise does not form part of the proposed Scheme and thus does not itself require approval from the Court.

8 IAL is one of the two largest general insurers in Australia with gross written premium of $10.6 billion in the 2024 financial year. As at 30 June 2024, IAL had total assets of $17.7 billion, liabilities of $13.8 billion and net assets of $3.9 billion. IAL has two operating divisions. The proposed transfer only relates to a small proportion of its business under its Retail Insurance Australia division.

9 IAL underwrites products under several Australian brands such as NRMA, CGU (distributed directly and via intermediaries), Swann, LSV, WFI and ROLLiN’. Under its Retail Insurance division, IAL deals predominantly in personal lines general insurance products sold directly to retail customers. These include short tail products and long tail insurance products.

10 IMA is itself a large insurer in the Australian general insurance market with gross written premium of $5.5 billion in the 2024 financial year. As at 30 June 2024, IMA had assets of $4.3 billion, liabilities of $2.8 billion and net assets of $1.5 billion.

11 IMA’s business consists of short tail personal line products, primarily motor and home insurances, as well as some more specialised products such as cover for caravans and vintage cars. These policies are sold directly to the customer and compliment the portfolios which are proposed to be transferred under the Scheme. Where IMA is the insurer, IMA outsources many operational and support services such as finance, technology and actuarial support to IAG under Service Level Agreements.

12 In terms of profitability, IMA has been consistently profitable over the last three years, achieving an insurance margin of around 10% per annum. The business plans for financial years 30 June 2025 to 30 June 2027 forecast a similar margin.

13 Mr Atkins has usefully summarised the nature of the proposed Scheme at [2.5] of the Actuarial Report as follows:

The Scheme is part of a relatively minor variation of the joint venture between IAG and RACV that has been in operation since 1999. In effect it gives RACV a 30% stake in the small amount of direct personal lines business currently written in Victoria by IAL under various brands.

While the details of the transfer appear to be complex, this is only a function of the numerous brands involved and the joint venture structure of IMA. The economic impact of the transfer is straightforward – providing RACV with a 30% stake in the business being transferred.

14 The key elements of the proposed Scheme are:

(a) IAL’s insurance business comprising the Victorian STPL Portfolios (defined in the Scheme Document as the Business), including contracts of insurance written within those portfolios (Insurance Contracts), will be transferred to IMA (cl 2);

(b) IMA will assume and take over liabilities in respect of claims and liabilities in connection with the Insurance Contracts, including those which are prospective or contingent and will become the insurer under those contracts (cl 4(a));

(c) the rights, benefits and liabilities of policyholders under Insurance Contracts, and of all persons claiming under them, will be the same for all purposes as they would have been if IMA had issued or entered into the Insurance Contracts (cl 10.1(a));

(d) any policyholder under an Insurance Contract or other person having any claim on or obligation to IAL under an Insurance Contract will have the same claim or obligation to IMA in substitution for that person’s claim on or obligation to IAL irrespective of when such claim or obligation arose (cl 10.1(c));

(e) any proceedings pending or to be brought against IAL in respect of the transferring Business will be continued or brought by or against IMA (cl 6); and

(f) IMA will receive, in addition to the Insurance Contracts, certain assets referable to the transferring Business and will pay to IAL an amount calculated under the Transfer Agreement in consideration of the transfer (cl 3).

Relevant principles for Confirmation

15 Section 17F(1A) of the Act sets out the factors to which the Court may have regard in deciding whether to confirm the Scheme. Relevantly, they are the interests of the policyholders of a body corporate affected by the scheme, and any other matter the Court considers relevant.

16 The principles applicable to confirmation of the transfer of insurance business are uncontroversial. They were summarised in Aioi Nissay Dowa Insurance Company Limited, in the matter of Aioi Nissay Dowa Insurance Company Limited [2023] FCA 697 (Aioi Nissay) at [7]:

A critical factor on an application of this kind is whether implementation of the scheme will materially detrimentally affect policyholders: Re Westport Insurance Corporation (No 2) [2009] FCA 1598; (2009) 181 FCR 530 at [32] (Lindgren J). Although an “affected policyholder” is defined in s 17C as the holder of a policy being transferred under the scheme, it is well accepted that the Court is to look to the interests of the relevant policyholders of both the transferor and transferee insurers and consider whether implementation of the scheme will detrimentally affect them in a material way: Re Australian Branch of Great Lakes Insurance SE (trading as Great Lakes Australia) (No 2) [2020] FCA 1266 at [13] (Allsop CJ). A prime consideration is the nature of the actual and potential claims to which the transferor insurer is subject and the financial viability of the transferee insurer: Great Lakes at [13]; Re Reward Insurance Ltd [2004] FCA 151 at [3] (Heerey J).

See also St Andrew’s Insurance (Australia) Pty Ltd, in the matter of St Andrew’s Insurance (Australia) Pty Ltd [2024] FCA 881 (St Andrew’s) at [6]-[7]; Allianz Australia General Insurance Limited, in the matter of Allianz Australia General Insurance Limited [2023] FCA 994 (Allianz) at [16]; OnePath General Insurance Pty Limited, in the matter of OnePath General Insurance Pty Limited [2023] FCA 1424 (OnePath General) at [6]-[7].

17 The manner in which the interests of policyholders are to be assessed as a consequence of a scheme has also been the subject of consideration in the English cases under Pt VII of the Financial Services and Markets Act 2000 (UK) (FSMA) and its predecessors. As Hoffman J (as his Lordship then was) observed (at 3) in his Lordship’s reasons in Re London Life Association Limited (unreported, Ch D, Hoffman J, 21 February 1989); [1989] Lexis Citation 1731 (London Life):

The question of whether policyholders would be adversely affected by the scheme is largely actuarial and involves a comparison of their security and reasonable expectations without the scheme with what it would be if the scheme were implemented. I do not say that these are the only considerations but they are obviously very important.

18 See also Re Prudential Assurance Company Limited and Rothesay Life plc [2020] EWCA Civ 1626; [2021] Lloyd’s Law Reports 623 at [45] and [83], and the discussion in Integrity Life Australia Limited, in the matter of Integrity Life Australia Limited [2025] FCA 92 at [62]–[63] and at [142]–[143].

Procedural matters and compliance with Dispensation Orders

19 The steps to be taken before an application for confirmation is made are set out in s 17C(2) of the Act and in GPS 410.

20 Additionally, the Dispensation Orders required the taking of steps (some of which reflect the statutory requirements) as a condition of the dispensation from compliance with s 17C(2)(c) of the Act. The applicants have approached the proof of these matters in light of the observations made in Allianz at [18] as to the Court being entitled to assume that its orders have been complied with, except to the extent that evidence is given as to any areas of non-compliance: see also OnePath General at [8].

21 The procedural requirements under the Act, and GPS 410 and the Dispensation Orders have been substantially complied with. These matters are addressed in Bennett 2. Further details of compliance with procedural matters, including the Dispensation Orders, are set out in a letter issued by IAL to APRA dated 8 July 2025 (APRA Procedural Report).

22 As required by s 17C(2)(a) of the Act, a copy of the Scheme and the Actuarial Report have been given to APRA.

23 The Notice of Intention substantially in the form approved by APRA was published on 29 May 2025 in the Commonwealth Government Notices Gazette and in the newspapers approved by APRA in accordance with [9] of GPS 410 and Order 2(a) of the Dispensation Orders. APRA had provided its approval of the Scheme Summary on 16 May 2025 prior to the publication of the Notice of Intention in compliance with [8] of GPS 410. As explained by Mr Bennett, at [12] of Bennett 2, the form of the Notice of Intention that was published included a correction of the address for the Lumley Special Vehicles website.

24 IAL provided the Scheme Summary substantially in the form approved by APRA, by a mailout completed between 2 and 4 June 2025, to 56,899 affected policyholders in accordance with Order 2(d) of the Dispensation Orders. That number is less than the estimates provided in Bennett 1 at [21], which erroneously included policies at a national level which are not to be transferred under the Scheme. The form of the Scheme Summary that was provided to policyholders and published pursuant to the Dispensation Orders also included a correction of the address for the Lumley Special Vehicles website.

25 IAL has executed the returned mail procedure required by Order 2(e) of the Dispensation Orders, resending some 280 Scheme Summaries to policyholders. Further details of the mail-out are set out in the APRA Procedural Report (see item 3 and Annexures 3 and 4).

26 The public inspection requirements, which still feature in [16] of GPS 410 and are reflected in Order 2(h) of the Dispensation Orders, have been complied with. The Scheme Documents (as defined in the Dispensation Orders) were made available for inspection from 10 June 2025 for a period of 17 weekdays at each of the approved locations. There were, however, no attendances at any of them.

27 The Scheme Documents were also made available on the dedicated webpage www.iag.com.au\licences and the following IAG branded websites:

(a) www.cgu.com.au;

(b) www.swanninsurance.com.au; and

(c) www.lumley.com.au;

as required by Orders 2(b) and (c) of the Dispensation Orders. The evidence discloses that the relevant parts of those websites received more than 580 visits and that each of the Scheme Documents was downloaded many times. Again, further details are set out in the APRA Procedural Report (in item 2 and the screenshots at Annexure 2).

28 IAL’s call centre and email contact addresses were operational in accordance with Order 2(f) of the Dispensation Orders. The Scheme Documents were made available free of charge pursuant to s 17C(4) and Order 2(g) of the Dispensation Orders. No requests were received from policyholders for the Scheme Documents to be posted or emailed to them.

29 Both the Notice of Intention and Scheme Summary advised that any person wishing to be heard at the confirmation hearing should contact Sparke Helmore Lawyers, who are the Applicant’s solicitors. Sparke Helmore Lawyers received one telephone call from a policyholder who queried the role of the Court, but, following explanation, advised that he would not be attending the confirmation hearing. The call centre also received 448 enquiries. The main themes of these calls concerned inquiries for more information about policies currently or previously held (including non-scheme related questions such as updating policy details) and inquiries for more information about the Scheme and why notification had been received.

30 The applicant has, however, received no notice from any policyholder objecting to the Scheme or seeking to be heard at the confirmation hearing. The lack of any objection to the Scheme by affected policyholders in circumstances where they have been given an adequate opportunity to do so, is a matter in favour of confirmation of the Scheme: Aioi Nissay at [15].

31 In short, the procedural requirements under the Act and the Dispensation Orders have been substantially complied with, the Scheme has been widely publicised and there has been no indication that any policyholder seeks to make any objection to the Scheme.

The Actuarial Evidence and other Commercial Considerations

32 Mr Atkins has provided his Actuarial Report in relation to the Scheme. He has updated his assessment of the Scheme by reference to quarterly APRA returns as at March 2025, which have not caused him to change the opinions and conclusions he formed in the Actuarial Report. Mr Atkins conclusion at [5.5] of the Actuarial Report is expressed in the following terms:

My opinion is that the interests of the transferring policyholders of IAL will not be adversely affected in a material way as a consequence of the Scheme.

Similarly, the Scheme will have no material adverse impact on either the existing policyholders of IMA or the remaining policyholders of IAL.

33 An important aspect of Mr Atkins’ reasoning and his analysis of the Scheme is that the Victorian CSL Business that is being transferred from IAL to IMA is a small proportion, however measured, of both IAL and IMA’s existing businesses. The gross written premium on the transferring Business is less than 1% of IMA’s pre-transfer business and less than 0.5% of IAL’s business; the total insurance liabilities of the transferring Business is 1.6% of IMA’s pre-transfer business and 0.3% of IAL’s business: see [2.3.3] and Table 2.2 at [2.5] of the Actuarial Report.

34 Further, under the Scheme, there will be no changes to the terms and conditions of the transferring policies issued by IAL as a result of the Scheme, apart from IMA being substituted as the insurer. The Scheme will also not result in any changes to the terms of other policies issued by IAL; that is, policies issued under IAL’s very substantial remaining business, or the existing policies issued by IMA.

35 No changes are expected to IMA’s Internal Capital Adequacy Assessment Process (ICAAP), capital requirements, nor its target capital ratio of 1.5 times the prescribed capital amount (PCA).

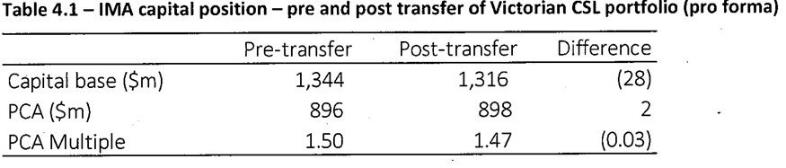

36 Mr Atkins sets out, at Table 4.1 of the Actuarial Report, his estimate of the capital adequacy of IMA on a pro forma basis at 30 June 2024, if the transfer were to have occurred on that date, reflecting the reduction in its capital base due to the purchase price to be paid by IMA ($28.4 million) and the charge due to the increase in IMA’s insurance liabilities:

37 As Mr Atkins states, the impact of the transfer on IMA’s capital position is modest, with the PCA multiple reducing from 1.50 to 1.47. The March 2025 APRA returns show that the PCA multiple for IMA (pre-transfer) has moved to 1.55. Mr Atkins also expects that the IMA business will be profitable around the time of the transfer. Based on the updated capital figures and the expected profitability of IMA, he considers that the capital position of IMA should be comfortably above 1.50 at the end of this quarter, and will return to its target rate following the usual payment of dividends. IMA has met its target capital ratio consistently in each of its last three years and its business plans forecast that it will do so over the next three years.

38 As for IAL, the March 2025 APRA returns show that its pre-transfer PCA multiple has moved from 1.62 as at 30 June 2024 to 1.55, which Mr Atkins has observed, remains a healthy capital position.

39 Mr Atkins concludes on these matters (at [5.4]) that:

The transfer will not impact the ability of IMA or IAL to continue to meet its policyholder obligations, APRA prudential capital requirements or internal target capital levels. The proposed Scheme will not impact the financial security interests of either IMA or IAL policyholders.

40 Claims from both IMA and IAL policies are handled by the retail claims team of IAL. Claims arising from the transferring Victorian STPL Portfolios will continue to be managed under the same shared staff, policies and procedures used by both IMA and IAL, and there will be no change for the existing or previous policyholders or any third-party claimants.

41 The Scheme does not change the progress or rights regarding any complaints, disputes, remediation or legal claims of any policyholder: see cll 6 and 10 of the Scheme. As with claims management, complaint handling is outsourced from IMA to IAL. Complaints arising from the transferring Victorian STPL Portfolios will therefore continue to be handled by IAL.

42 There are no material policyholder remediation programs on foot in relation to the Victorian STPL Portfolios. Any current or future policyholder remediation actions will continue unchanged with the financial responsibility moving from IAL to IMA for the transferring policies.

43 No reinsurance arrangements are proposed to be transferred or amended as part of the Scheme. IAG Reinsurance, which is a unit of IAL, purchases reinsurance from the external market on behalf of both IMA and IAL in accordance with each entity’s risk appetite and business needs. The way this is executed is that IAL issues reinsurance contracts, essentially catastrophe and per risk excess of loss reinsurance, to IMA suited to its needs. IAL then consolidates this risk into its own aggregated exposure and buys external reinsurance to protect it and other subsidiaries of IAG. No changes to these reinsurance arrangements will be needed on account of the intra-group nature of the proposed transfer under the Scheme.

44 The reinsurance agreements in place operate such that the reinsurance obligation is linked to the occurrence date of underlying claims. IMA’s reinsurance contracts with IAL will provide coverage for the claims made in respect of the transferring policies from the effective date of the Scheme. For claims with an occurrence date prior to the effective date of the Scheme and which are not fully resolved at that time, IAL will provide assets to match the estimated liabilities of the claims gross of reinsurance. This will ensure that IMA receives assets inclusive of amounts it would have received by way of reinsurance recoveries had the claim been covered under reinsurance with IAL. Mr Atkins has concluded that IMA will have no “gaps” in its reinsurance protection.

45 There will be no change to the reinsurance arrangements in place between IMA (as reinsurer through an existing 100% quota share arrangement) and IAL in respect of the NRMA branded products in New South Wales and the Australian Capital Territory.

46 IMA and IAL have reported contingent liabilities in respect of proceedings commenced by ASIC in August 2023 and subsequent class action proceedings commenced in May 2024 in the Supreme Court of Victoria concerning the pricing of, and certain disclosures about how premiums were priced for renewing customers of SGIO, SGIC and RACV home insurance products. No provisions are being held in respect of these matters. Mr Atkins has stated (at [2.2.4] of the Actuarial Report) that in his view “it is most unlikely that the financial security of either company would be threatened by an adverse judgment in any of these matters, noting the financial strength of the shareholders”.

47 IAL is also the subject of current proceedings in the Federal Court regarding the sale of historic trade credit policies (known as the Greensill litigation). IAL is defending those proceedings and IMA is not a party to them. Mr Atkins considers that the Scheme will not impact any exposure IAL might have arising from this litigation (which it disputes) or its capacity to meet such exposure if it arises. To the extent that IMA is divorced from the impact of proceedings because it is not a party to them, Mr Atkins’ view is that the transferring policyholders would be unaffected.

48 IAG has recently announced two acquisitions and strategic partnerships. The first of these was with RACQ (Queensland) in November 2024 and the second was with RAC (Western Australia) in May 2025. Each involves the acquisition by IAG of the respective insurance companies owned by the motoring clubs and long-term distribution agreements with those clubs. Both transactions remain subject to regulatory approvals.

49 On the assumption that the two transactions proceed, Mr Atkins has considered what impact, if any, there would be on policyholders. He has observed that:

(a) both transactions are independent of the Scheme in the sense that, subject to regulatory approval, they will go ahead whether or not the Scheme is confirmed;

(b) each of the transactions is a purchase by the parent IAG, rather than IAL or IMA;

(c) the acquisitions are funded (by IAG) from internal capital resources and do not involve a change of ownership of the Group or of either insurer;

(d) there will be no direct impact on the capital position of IAL and IMA, although some change can be expected over time, especially for IAL (as the Group’s captive reinsurer), if reinsurance arrangements are changed; and

(e) in the long term, IAG has indicated that it may consolidate the licences, which would likely mean transferring the relevant insurance businesses into IAL in due course.

50 Having regard to these matters, Mr Atkins has concluded (at [2.3.6] of the Actuarial Report) that:

With IMA having a separate insurance licence and its own governance arrangements, I have not identified any potential realistic scenarios that could adversely impact the transferring policyholders or those remaining with IMA or IAL.

If the transactions are successful they will, over time, improve financial security at the group level.

51 Accordingly, the implementation of the Scheme will not have a material adverse impact on the policyholders of IMA or IAL by reason of the entry by IAG into these transactions, assuming it ultimately obtains the remaining necessary regulatory approvals to complete them, and does so.

52 Costs associated with the initial negotiations of the transfer framework were borne by IAL and IMA respectively. Under cl 9 of the Scheme, all of the costs and expenses incurred in connection with the Scheme are not to be paid by or charged to policyholders, but are to be met by IMA out of its shareholder funds.

APRA’s Position

53 IAL has liaised with APRA since August 2024 on a regular basis to discuss and consult on various aspects of the proposed Scheme, including the terms of the Scheme document, drafts of the Originating Application and the Actuarial Report. APRA has provided all of the necessary approvals under the Act and GPS 410. APRA has not exercised its power, in this case, under s 17D of the Act to arrange for another actuary to make a written report on the Scheme.

54 APRA is entitled to be heard on an application for confirmation: s 17E(3) of the Act. It has been involved in the oversight of the Scheme, appeared at the Dispensation Hearing and supported the making of the Dispensation Orders. APRA has been furnished with the APRA Procedural Report. APRA has indicated that it has no objection to the proposed Scheme. As the Government Regulator charged with ensuring that insurance businesses are conducted in a way which protects the legitimate interests of policyholders, APRA’s position is a matter from which the Court can draw significant comfort: Insurance Australia Limited, in the application of Insurance Australia Limited (No 2) [2017] FCA 980 at [109]–[116]; Aioi Nissay at [14]; OnePath General at [45]–[46].

Conclusion and Orders

55 The proposed Orders do not depart from existing practice. In my view, it is appropriate that the Court confirm the Scheme without modification.

56 Order 3 of the proposed Orders provides that IMA pay APRA’s costs of the proceedings as agreed, or if agreement cannot be reached, as assessed. As set out above, under the Scheme (cl 9) all of the costs and expenses incurred in connection with the Scheme are to be met by IMA out of its shareholder funds. This reflects the express commitment that such costs are not to be borne by policyholders. Although IMA is not formally a party to the proceeding, the Court has power to make an order for the payment of costs against it. As the recipient of the insurance business to be transferred under the Scheme, IMA plainly has a sufficient connection with the proceedings to be the subject of the order proposed: see OnePath General at [48] and the cases there cited.

I certify that the preceding fifty-six (56) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Jackman. |

Associate:

Dated: 15 July 2025