Federal Court of Australia

Platinum Asia Investments Limited, in the matter of Platinum Asia Investments Limited [2025] FCA 746

File number(s): | NSD 1030 of 2025 |

Judgment of: | CHEESEMAN J |

Date of judgment: | 7 July 2025 |

Date of publication of reasons: | 9 July 2025 |

Catchwords: | CORPORATIONS – members’ scheme of arrangement – first court hearing – where orders sought under s 411(1) of the Corporations Act 2001 (Cth) for convening of meeting of members of the plaintiff to consider, and if thought fit, agree to a scheme of arrangement – where ancillary orders sought as to the convening, holding and conduct of the meeting – Held: orders made. |

Legislation: | Corporations Act 2001 (Cth) ss 411, 412 Corporations Regulations 2001 (Cth) reg 5.1.01 Federal Court (Corporations) Rules 2000 (Cth) rr 2.4(2), 2.15, 3.2, 3.3 Takeovers Panel, Guidance Note 7: Deal Protection Federal Court of Australia, Schemes of Arrangement Practice Note (GPN-SOA) |

Cases cited: | Absolute Equity Performance Fund Ltd, in the matter of Absolute Equity Performance Fund Ltd [2022] FCA 933 Amcom Telecommunications Limited, in the matter of Amcom Telecommunications Ltd [2015] FCA 341 Australian Leaders Fund Ltd v Equity Trustees Ltd, in the matter of Australian Leaders Fund Ltd [2021] FCA 88 Platinum Asia Investments Limited, in the matter of Platinum Asia Investments Limited [2025] FCA 746 PM Capital Asian Opportunities Fund Limited, in the matter of PM Capital Asian Opportunities Fund Limited [2021] FCA 1380 Re Altium [2024] NSWSC 736 Re Amcor Limited [2019] FCA 346 Re Asaleo Care Limited [2021] FCA 406 Re Atlas Iron Ltd [2016] FCA 366; 112 ACSR 554 Re CSR Limited [2010] FCAFC 34; 183 FCR 358 Re DuluxGroup Limited [2019] FCA 961; 136 ACSR 546 Re Foundation Healthcare Ltd [2002] FCA 742; 42 ACSR 252 Re Healthscope Limited [2019] FCA 542; 139 ACSR 608 Re Legend Corporation Limited [2019] FCA 1249 Re Permanent Trustee Company Limited [2002] NSWSC 1177; 43 ACSR 601 Re PM Capital Asian Opportunities Fund Limited [2021] FCA 1380 Re Sienna Cancer Diagnostics Limited [2020] FCA 899 Re Sirtex Medical Ltd [2018] FCA 1315 Re Tatts Group Ltd [2017] VSC 552 Re The Trust Company (RE Services) Ltd as responsible entity of the VitalHarvest Freehold Trust [2021] NSWSC 108 Re Verdant Minerals Limited [2019] FCA 556 Re Villa World Ltd [2019] NSWSC 1207; 139 ACSR 550 Re Wellcom Group Limited [2019] FCA 1655 Rex Minerals Limited, in the matter of Rex Minerals Limited [2024] FCA 1051 Vita Group Ltd, in the matter of Vita Group Ltd [2023] FCA 400; 165 ACSR 576 WCM Global Long Short Limited, in the matter of WCM Global Long Short Limited [2022] FCA 1447 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 113 |

Date of hearing: | 7 July 2025 |

Counsel for the Plaintiff: | Mr J Lockhart SC |

Solicitors for the Plaintiff: | Mont Lawyers |

ORDERS

NSD 1030 of 2025 | ||

IN THE MATTER OF PLATINUM ASIA INVESTMENTS ACN 606 647 358 | ||

PLATINUM ASIA INVESTMENTS LIMITED ACN 606 647 358 Plaintiff | ||

order made by: | CHEESEMAN J |

DATE OF ORDER: | 7 JULY 2025 |

THE COURT ORDERS THAT:

1. Pursuant to subsection 411(1) of the Corporations Act 2001 (Cth), the Plaintiff, Platinum Asia Investments Limited (ACN 606 647 358) (PAI), convene a meeting of its shareholders (PAI Scheme Meeting) for the purpose of considering and, if thought fit, agreeing to (with or without modification) a scheme of arrangement (PAI Scheme) proposed to be made between PAI and its shareholders, on the terms contained in Annexure B to Exhibit 2 (noting that Exhibit 2 is the explanatory statement (PAI Scheme Booklet) for the PAI Scheme).

2. The following documents be approved for distribution to PAI’s shareholders:

(a) the PAI Scheme Booklet substantially in the form of Exhibit 2; and

(b) the proxy form in respect of the Scheme Meeting substantially in the form set out in Annexure MT-11 of the affidavit of Margaret Elizabeth Towers affirmed 4 July 2025 (Proxy Form).

3. The documents in order 2 are to be provided to PAI’s shareholders by sending on or before 11 July 2025:

(a) in the case of shareholders who have elected to receive notices of meetings and proxy forms electronically (Email Shareholders), an email which includes access by an embedded link to the following:

(i) an electronic copy of the PAI Scheme Booklet;

(ii) an online portal or website that is accessible by Email Shareholders and which enables Email Shareholders to lodge their proxy for the PAI Scheme Meeting and voting instructions online; and

(b) in the case of shareholders who have elected to receive hard copy notices of meetings and proxy forms, the following documents addressed to the relevant addresses recorded in PAI’s register by pre-paid post, or in the case of shareholders with registered addresses outside Australia, by pre-paid air mail:

(i) a letter in respect of the PAI Scheme Meeting which encloses a printed copy of the PAI Scheme Booklet;

(ii) a personalised single Proxy Form;

(iii) a reply paid envelope for the return of that shareholder’s Proxy Form; and

(c) in the case of shareholders who have not elected to receive electronic or hard copy notices of meetings and proxy forms and Email Shareholders with no email address recorded in PAI’s register, the following documents addressed to the relevant addresses recorded in PAI’s register by pre-paid post, or in the case of shareholders with registered addresses outside Australia, by pre-paid air mail:

(i) a letter in respect of the PAI Scheme Meeting, which contains the address of a website which enables that shareholder to access a copy of the PAI Scheme Booklet;

(ii) a personalised single Proxy Form;

(iii) a reply paid envelope for the return of that shareholder’s Proxy Form.

4. Subject to these orders, the Scheme Meeting is to be convened, held and conducted in accordance with the provisions of:

(a) Part 2G.2 of the Act (save for any applicable replaceable rule) that apply to a meeting of PAI’s members; and

(b) PAI’s constitution that apply in relation to a meeting of PAI’s members and that are not inconsistent with Part 2G.2 of the Act.

5. The PAI Scheme Meeting is to be held at 10.00am (Sydney time) on 12 August 2025.

6. Ms Towers or, failing her, Mr Ian Hunter, be Chairperson of the PAI Scheme Meeting.

7. The Chairperson of the PAI Scheme Meeting shall have the power to adjourn the PAI Scheme Meeting at their absolute discretion.

8. PAI may provide access to the PAI Scheme Meeting for such other persons as it thinks fit.

9. Rule 2.15 of the Federal Court (Corporations) Rules 2000 (Cth) shall not apply to the PAI Scheme Meeting.

10. PAI is to publish an announcement in the form set out in Annexure A to these orders via the Australian Securities Exchange no later than 8 August 2025.

11. Compliance with the following requirements of the Rules be dispensed with:

(a) Rule 2.4(1), to the extent that rule requires the affidavit filed with the Originating Process to state the facts in support of the process;

(b) Rule 3.2(b)(ii); and

(c) Rule 3.4.

12. The proceeding be stood over to 10.15am (Sydney time) on 15 August 2025 for the hearing of any application to approve the PAI Scheme.

13. Liberty to apply.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

Sydney, New South Wales: [8] August 2025

Platinum Asia Investments Limited (ACN 606 647 358) (ASX:PMC) (Company) refers to its announcement made on 7 July 2025 in relation to:

the proposed scheme of arrangement (Scheme) under which it is proposed that shares in the Company are exchanged for units in Platinum Asia Fund Complex ETF (ASX:PAXX), subject to all applicable conditions being satisfied or waived (as applicable); and

the Court orders to convene a meeting of the Company’s shareholders to consider and vote on the resolution to approve the Scheme (Scheme Meeting) and approving the distribution of a Scheme booklet containing, amongst other things, information about the Scheme and the notice of Scheme Meeting, to shareholders.

Subject to the Company’s shareholders approving the Scheme by the requisite majorities at the Scheme Meeting expected to be held at 10.00am (Sydney time) on Tuesday, 12 August 2025, the Court hearing to approve the Scheme (Second Court Hearing) is scheduled to take place at 10:15am (Sydney time) on Friday, 15 August 2025 at the Federal Court of Australia, Law Courts Building, Queens Square, Sydney NSW 2000.

Any shareholder of the Company has a right to appear and be heard at the Second Court Hearing, and may oppose the approval of the Scheme.

If you wish to oppose the approval of the Scheme, you must file with the Court and serve on the Company a notice of appearance in the prescribed form, together with any affidavit on which you wish to rely at the hearing. The notice of appearance and affidavit must be served on the Company at its address for service at least one (1) day before the Second Court Hearing. The Company’s address for service is c/- Mont Lawyers, 9 Denham Street, Darlinghurst Sydney NSW 2000.

REASONS FOR JUDGMENT

CHEESEMAN J:

INTRODUCTION

1 On 7 July 2025 I made orders pursuant to s 411(1) of the Corporations Act 2001 (Cth) convening a meeting of the members of Platinum Asia Investments Limited (PAI) for the purpose of considering and, if thought fit, approving a proposed scheme of arrangement between PAI and its members (PAI Scheme) and orders for the convening, holding and conduct of the meeting. These are my reasons for making those orders.

2 The plaintiff, PAI, seeks to restructure by proposing the PAI Scheme. To distribute the PAI Scheme Booklet to all members and to convene a meeting of members to vote on the PAI Scheme, PAI requires Court approval under Part 5.1 of the Act. The First Court Hearing on 7 July 2025 was directed to whether that approval should be given, and associated ancillary orders.

3 Capitalised terms not otherwise defined in these reasons refer to terms defined in the PAI Scheme Booklet or the PAI Scheme itself. A list of the definitions used in these reasons is included in Annexure A to these reasons.

4 PAI is a listed investment company (LIC). PAI currently has one class of security on issue, being the fully paid ordinary shares which are the subject of the PAI Scheme (PAI Shares). If the PAI Scheme is implemented, PAI Shares will be exchanged for fully paid units in the Platinum Asia Fund Complex ETF (PA Fund Units and the PA Fund, respectively). ETF designates that the PA Fund is an exchange traded fund with its units being quoted on the ASX AQUA market. The PAI Scheme is an acquisition scheme where PAI, currently a LIC, and the PA Fund, currently a managed investment scheme, are restructured with the result that if the PAI Scheme is implemented and becomes effective, PAI will become wholly-owned by the PA Fund, at which point in time PAI will be delisted.

5 The PA Fund was previously known as the Platinum Asia Fund (Quoted Managed Hedge Fund). The change in the fund’s name occurred after the PAI Scheme Implementation Deed was executed on 1 October 2024. The PA Fund is an open-ended managed fund.

6 By implementing the PAI Scheme, the PAI Board’s stated objective is to address what it identifies as a persistent trading discount between PAI Share price and the pre-tax net tangible asset (NTA) value per PAI Share by replacing PAI members’ PAI Shares with PA Fund Units. Ineligible foreign shareholders will have the PA Fund Units they receive as consideration for their PAI Shares cashed out via a nominee appointed by the responsible entity. The underlying premise that informs the design of the PAI Scheme is the PAI Board’s expectation that the PA Fund Units will trade close to their net asset value (NAV), whereas the PAI Shares have traded at a discount. In this way, the PAI Board seeks to meet its objective of closing the trading discount in the PAI Share price. If this outcome is achieved, it is expected to remove the limited ability of PAI members to effectively maximise their investments, at the point of liquefying, particularly in respect of on-market disposals. The PAI Board’s expectation is that following implementation of the PAI Scheme, PAI members will be able to sell their PA Fund Units (that they have received in place of their PAI Shares) on market at prices which are relatively close to the PA Fund’s NAV, subject to a bid-ask spread.

7 The basis for the PAI Board’s expectation in this respect is explained in the PAI Scheme Booklet. In short, it is that the PAI Board holds the view that unlike LICs, quoted managed funds typically trade close to NAV and do not exhibit discounts in the traded unit price in the same way as the share price of LICs, because of the liquidity support provided by market makers, standing in the market, buying and selling at prices which reflect the intraday NAV (or indicative NAV) plus or minus a bid-ask spread.

8 In support of the PAI Board’s stated rationale for the PAI Scheme, the PAI Scheme Booklet discloses in section 1.3 data tracking the PAI Share price relative to the PAI Units pre-tax NTA and the PA Fund unit price relative to the PA Fund NAV. The PA Fund Unit price is the daily closing price on the ASX AQUA Market, based on trading data. The PA Fund NAV is NAV per unit in the PA Fund, calculated daily in accordance with the PA Fund’s constitution and published on the PA Fund’s website

9 At that same time as the present application was made in respect of the PAI Scheme, an originating process was filed by Platinum Capital Limited (PC) which similarly seeks Court approval under Part 5.1 of the Act for a proposed members’ scheme of arrangement (the PC Scheme) (proceeding NSD1029/2025).

10 The PC Scheme is conceptually the same as the PAI Scheme and is informed by the same rationale as it applies to the trading discount in the pricing of the PC Shares. If it is implemented, PC Shares will be exchanged for fully paid units in the Platinum International Fund Complex ETF (PI Fund Units and the PI Fund, respectively). The PI Fund was previously known as the Platinum International Fund (Quoted Managed Fund). Like the PA Fund, the PI Fund is an open-ended managed fund and the PI Fund Units are quoted on the ASX AQUA market. By implementing the PC Scheme, the PC Board seeks to address what it identifies as a persistent trading discount of the PC Shares to their pre-tax NTA by replacing PC Shares with PI Fund Units, which the PC Board expects to trade close to their net asset value. In this way, the PC Board seeks to meet its objective of closing the trading discount in the PC Shares when compared to their NAV.

11 The composition of the boards of PAI and PC is identical. The two Schemes are addressed to the separate restructures of different entities. The Schemes are independent of each other. The PAI Scheme is not conditional on the PC Scheme being implemented. Nor is the PC Scheme conditional on the PAI Scheme being implemented. The relevant Scheme Booklets include a letter from the Chair in which the relationship between the two Schemes is disclosed and it is clearly stated that restructure embodied in each Scheme can still proceed even if the other Scheme does not.

12 That is of potential significance because there are concerns that the PC Scheme Resolution may not be passed at the PC Scheme Meeting. The approval of the PC Scheme by PC members is attended by known difficulties that do not appear to be mirrored in the circumstances of the PAI Scheme — PC’s largest shareholder, L1 Capital Pty Ltd and its associated entities, are expected to vote against the PC Scheme Resolution. Against that contingency, and in the event that the PC Scheme Resolution fails to pass, the PC Board intends to convene a general meeting of PC to take place after the PC Scheme Meeting on the same day to propose other capital management initiatives, including an on-market buy back. The PC Board’s intentions in this regard are disclosed in the PC Scheme Booklet. There is no similar disclosure made in relation to the PAI Scheme and senior counsel for PC and PAI confirmed that no similar substantial shareholder risk had been identified in relation to the PAI Scheme.

13 If approved and implemented so as to be Effective (including by being approved at the Second Court Hearing and lodged in accordance with s 411(10) of the Act), the two Schemes will be implemented on materially the same terms.

14 A point of intersection or commonality between the two Schemes arises from the involvement of Platinum Investment Management Limited (trading as Platinum Asset Management) (PIM) in relation to, amongst other things, both the PA Fund and the PI Fund. PIM, an unlisted public company is an Australian-based investment manager that focuses on investing in international shares. PIM is owned by Platinum Asset Management Limited (PAM), a public company listed on the ASX.

15 In its written submissions, PAI submitted that as at 31 March 2025, PIM managed approximately $10.276 billion. In the PAI Scheme Booklet it is stated that as at 31 May 2025, PIM managed approximately A$8.339 billion. This decrease in PIM’s funds under management was not addressed at the hearing.

16 In relation to the arrangements relating to PAI, PIM’s role is as the responsible entity and investment manager of the PA Fund. PAI delegates its investment management and administration functions to PIM.

17 In relation to the arrangements relating to PC, PIM’s role is the same as its role with respect to PAI. Namely, it is the responsible entity and investment manager of the PI Fund. PC delegates its investment management and administration functions to PIM.

18 The other point of similarity between the two Schemes is that both funds are feeder funds. The PA Fund primarily invests in the Platinum Asia Fund (ARSN 104 043 110) (the PA Underlying Fund). The PI Fund primarily invests in the Platinum International Fund (ARSN 089 528 307) (the PI Underlying Fund).

19 PIM is the Investment Manager for each of the Underlying Funds. PIM is also the responsible entity for each of the Underlying Funds.

20 PIM is party to each of the Scheme Implementation Deeds (including in its capacity as the responsible entity of each of the four funds presently relevant, namely the PA Fund, the PA Underlying Fund, the PI Fund and the PI Underlying Fund).

21 If the PAI Scheme is implemented, PAI will become wholly-owned by the PA Fund, the assets in its investment portfolio will be transferred to the PA Underlying Fund’s portfolio, PAI will be delisted and its independent directors will be replaced by directors nominated by PIM.

22 Likewise, if the PC Scheme is implemented, PC will become wholly-owned by the PI Fund, the assets in its investment portfolio will be transferred to the PI Underlying Fund’s portfolio, PC will be delisted and its independent directors will be replaced by directors nominated by PIM.

23 The First Court Hearings for both Schemes took place concurrently on 7 July 2025.

24 PAI and PC were represented by the same senior counsel and solicitors at the First Court Hearing in each proceeding.

25 In each application, the Court’s task was to assess first, whether the statutory prerequisites to the making of orders convening a meeting had been met and second, whether it is appropriate for the Court to exercise its discretion in favour of making the relevant orders directed to enabling the meetings to occur. In each application, I was satisfied in respect of each of those matters. Accordingly, I made orders as follows.

26 I made orders for the convening and holding of a meeting of the PAI shareholders for the purpose of considering, and if thought fit, agreeing, with or without modification, to the PAI Scheme. These are my reasons for doing so.

27 At around that same time, I made orders to similar effect in relation to the convening and holding of a meeting of the PC shareholders for the purpose of considering, and if thought fit, agreeing, with or without modification, to the PC Scheme: Platinum Capital Limited, in the matter of Platinum Capital Limited [2025] FCA 745.

28 These reasons for judgment and the reasons for judgment relating to the PC Scheme will be delivered concurrently. There may be shareholders of each of PAI and PC that have an interest in the reasons for judgment. Some of those shareholders may hold shares in both of the relevant companies, others may only hold shares in one or the other. To combine the two sets of reasons risked giving rise to confusion in conflating the bespoke circumstances of the two respective schemes. For this reason, and given that the orders concern two independent Schemes, it is appropriate that each judgment be self-contained in addressing each of the particular Schemes although this results in substantial overlap between the two sets of reasons. The approach I have taken in this regard is consistent with the approach taken by the plaintiff in each proceeding.

EVIDENCE

29 In support of the application, PAI relies on the following evidence, which was incorporated into a court book (the PAI Court Book):

(1) an affidavit of Saxon Naulls-Johnstone, PAI’s solicitor, affirmed 20 June 2025;

(2) an affidavit of Hiroshini Pater, the Financial Controller of PIM, affirmed 4 July 2025, which verifies the processes undertaken to prepare the information in the PAI Scheme Booklet; and

(3) an affidavit of Margaret Towers, non-executive director and chair of both PAI and PC, affirmed 4 July 2025.

30 In addition to the materials included in the PAI Court Book, PAI relied on the following evidence:

(1) a letter from Australian Securities and Investments Commission (ASIC) to PAI dated 7 July 2025 (marked as Exhibit 1) stating that ASIC:

(a) has examined the terms of the PAI Scheme and drafts of the PAI Scheme Booklet with the latest draft being 4 July 2025; and

(b) ASIC does not currently propose to appear to make submissions or intervene to oppose the PAI Scheme at the First Court Hearing; and

(2) a final draft of the PAI Scheme Booklet (marked as Exhibit 2).

31 To avoid confusion, I note that affidavits by the same deponents on the same dates but with different content are relied on in the PC application.

BACKGROUND

32 PAI trades on the ASX (ASX: PAI). Its stated investment objective is to “provide capital growth over the long term by investing primarily in undervalued listed securities of companies in the Asian Region ex Japan across sectors”: PAI Annual Report 2024.

33 The company search for PAI in evidence is dated 19 June 2025. It records that the company has three directors, Ian Hunter, Richard Morath and Margaret Towers, and that the company secretary is Joanna Jefferies. Ms Towers deposes that she is a non-executive director and chair of PAI and authorised to make her affidavit on behalf of the company. She deposes that PAI has two independent non-executive directors, herself and Ian Hunter, and one non-independent non-executive director, Joanna Jefferies. Ms Towers says that Ms Jefferies was appointed to the PAI Board to fill a casual vacancy on 18 June 2025. PAI submitted that the retiring director retired for family reasons. Ms Jefferies is also an officer of PIM. Given her role with respect to PIM, Ms Jefferies has abstained from recommending that PAI members vote in favour of the PAI Scheme Resolution.

34 The PAI Independent Directors, being Ms Towers and Mr Hunter, recommend that in the absence of a Superior Competing Proposal and subject to the Independent Expert continuing to conclude that the PAI Scheme is in the interest of members, that members vote in favour of the PAI Scheme. If the PAI Independent Directors determine that a Competing Proposal is a Superior Competing Proposal, PAI must, within two business days of making that determination, notify PIM. Superior Competing Proposal and Competing Proposal are defined in the PAI Scheme Booklet.

35 In its audited financial statements for the half financial year ended 31 December 2024, it provides financial information summary as at 30 June 2024 which includes that it has:

(1) A share price of $0.92 with 369,788,883 shares on issue;

(2) NTA of $1.0266 (pre-tax) and $1.0335 (post-tax);

(3) Net assets of $382.2 million; and

(4) Fully-franked dividend capacity of 0.26 cents per share.

The way in which pre-tax NTA, gross dividend yield and maximum fully franked dividend has been calculated is exposed in the footnotes which are included in the PAI Annual Report 2024.

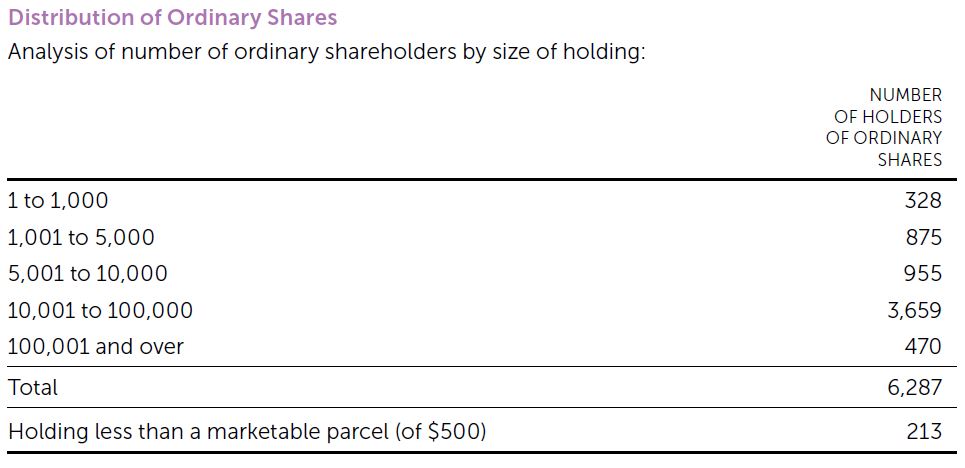

36 As at 7 August 2024, the distribution of PAI shareholders was reported to be as follows (PAI Annual Report 2024, p 18):

37 The twenty largest shareholders of PAI, as reported in the PAI Annual Report 2024, comprise a mix of institutional and private investors, including public and private companies and individuals.

38 Ms Towers’ evidence is that as at the close of business on 2 July 2025, PAI had 370,218,528 shares on issue and 5,352 shareholders. Of these shareholders:

(1) 12, representing 0.1% of the PAI Shares on issue, have elected to receive notices of meetings and proxy forms from PAI in physical format;

(2) 3,567, representing 58% of the PAI Shares on issue, have elected to receive notices of meetings and proxy forms from PAI in electronic format;

(3) 21, representing 0.3% of the PAI Shares on issue, have elected to receive notices of meetings and proxy forms from PAI in electronic format, but have no email address recorded;

(4) 1,752, representing 41.6% of the PAI Shares on issue, have made no election regarding the format of notices of meetings and proxy forms from PAI; and

(5) 85, representing 1.0% of the PAI Shares on issue, have a registered address outside of Australia.

OVERVIEW OF THE PAI SCHEME

Process to date

39 On 24 July 2024, the PAI Board announced that it had concluded a strategic review and, subject to formal legal, tax and operational due diligence, the PAI Board had agreed to pursue a scheme of arrangement under Part 5.1 of the Act.

40 On 1 October 2024, PAI and PIM (in its capacity as responsible entity of the PA Fund and as responsible entity of the PA Underlying Fund) entered into the PAI Scheme Implementation Deed subject to Court and members’ approvals. The PAI Scheme Implementation Deed was subsequently amended on 13 November 2024 to extend the end date from 30 June 2025 to 30 September 2025 and on 3 July 2025 to reflect the change in the name of the PA Fund and formally adopt the terms of the proposed PAI Scheme and the deed poll to be provided by PIM in its capacity as responsible entity of both the PA Fund and the PA Underlying Fund.

41 On 2 October 2024, PAI released an ASX announcement providing terms of the proposed PAI Scheme and attaching a copy of the PAI Scheme Implementation Deed.

42 Verification certificates as to the content of statements attributed to PIM in the PAI Scheme Booklet were signed on 3 July 2025 by each of Mr Pater (in his capacity as financial controller of PIM), Ms Jefferies (in her capacity as company secretary of PIM) and Andrew Stannard (in his capacity as finance director of PIM). On 4 July 2025, verification statements to the same effect in respect of statements attributed to PAI were signed by each of Ms Towers (in her capacity as chair and non-executive director of PAI), Mr Hunter (in his capacity as non-executive director of PAI) and Ms Jefferies (in her capacity as non-executive director of PAI).

43 On 3 July 2025, the PAI Board approved the final form of PAI Scheme Booklet, the draft email to PAI members, the draft ASX announcement and the arrangements for dissemination to PAI members (if approved by the Court at First Court Hearing). The Chair was authorised to finalise any amendments to these documents as required, provided all material amendments are notified to the PAI Board.

Summary of the PAI Scheme

44 As mentioned, the central proposition of the PAI Scheme, is that PAI Shares will be exchanged for PA Fund Units as a means of seeking to address a trading discount in the price of PAI Shares relative to the PA Fund Units pre-tax NTA. Implementation will occur by the issuing of the Scheme Consideration to Scheme Participants (and the Nominee for Ineligible Shareholders) and the transfer of all PAI Shares to PIM as responsible entity of the PA Fund pursuant to the PAI Scheme.

45 The mechanics by which that outcome is set to be achieved if the PAI Scheme Resolution becomes Effective are as follows:

(1) PIM, in its capacity as responsible entity of the PA Fund, will issue new fully paid PA Fund Units to:

(a) each PAI Scheme participant who is not an Ineligible Shareholder; and

(b) to a nominee where the relevant PAI Shares are held by an “Ineligible Shareholder”, as defined in the Scheme Booklet,

(2) The number of New PA Fund Units (being PA Fund Units issued as a result of the PAI Scheme being implemented) will be determined by reference to an Exchange Ratio mechanism. The Exchange Ratio is addressed below; and

(3) PAI will transfer all PAI Shares to PIM in its capacity as responsible entity of the PA Fund.

46 As mentioned, the result of implementation of the PAI Scheme will be that PAI will become wholly-owned by the PA Fund. If the PAI Scheme becomes Effective, it will bind PAI and all of the Scheme Participants from time to time (including those who do not attend the Scheme Meeting, do not vote at that meeting or vote against the PAI Scheme).

47 Following the implementation of the PAI Scheme, PAI submits that:

(1) the assets within PAI’s investment portfolio will be transferred to the PA Underlying Fund and managed by PIM as a part of the PA Underlying Fund’s portfolio;

(2) PAI will be delisted;

(3) the investment management agreement between PAI and PIM will terminate, without PAI incurring any termination fees; and

(4) the PAI Independent Directors will resign and new directors nominated by PIM will be appointed.

48 If the PAI Scheme becomes Effective, PAI will exit derivative and other positions that cannot be transferred in specie so that before the Valuation Date (which applies to the Scheme Consideration) and on the Implementation Date, PAI’s portfolio will be comprised of transferable positions and cash. The PAI Scheme Booklet discloses that PAI’s investment portfolio will be transferred to PIM as the responsible entity of the PA Underlying Fund or a custodian on behalf of the PA Underlying Fund (as determined by PIM as the responsible entity of the PA Underlying Fund). The PA Fund’s investment in the PA Underlying Fund will increase as a result of the implementation of the PAI Scheme because the PA Fund will be issued new units in the PA Underlying Fund in consideration for the transfer of PAI’s portfolio on the Implementation Date.

49 If the PAI Scheme is approved and becomes Effective, the number of New PA Fund Units that PAI members will receive as consideration for their PAI Shares (Scheme Consideration) is not fixed. The entitlement of Scheme Participants (including Ineligible Shareholders participating via the nominee arrangement) to New PA Fund Units will be calculated by reference to the Exchange Ratio. The Exchange Ratio is calculated as the post-tax NTA value of each PAI Share (adjusted for related costs and expenses and, if relevant, the Special Dividend), divided by the PA Fund’s NAV per PA Fund Unit. The Exchange Ratio will be calculated using market prices as at the close of trading on global markets on the business day immediately prior to the day the PAI Scheme is implemented (Valuation Date). The Valuation Date is projected to be Friday, 22 August 2025. All New PA Fund Units will rank equally in all respects with all existing PA Fund Units on issue as at the Implementation Date (expected to be Monday, 25 August 2025).

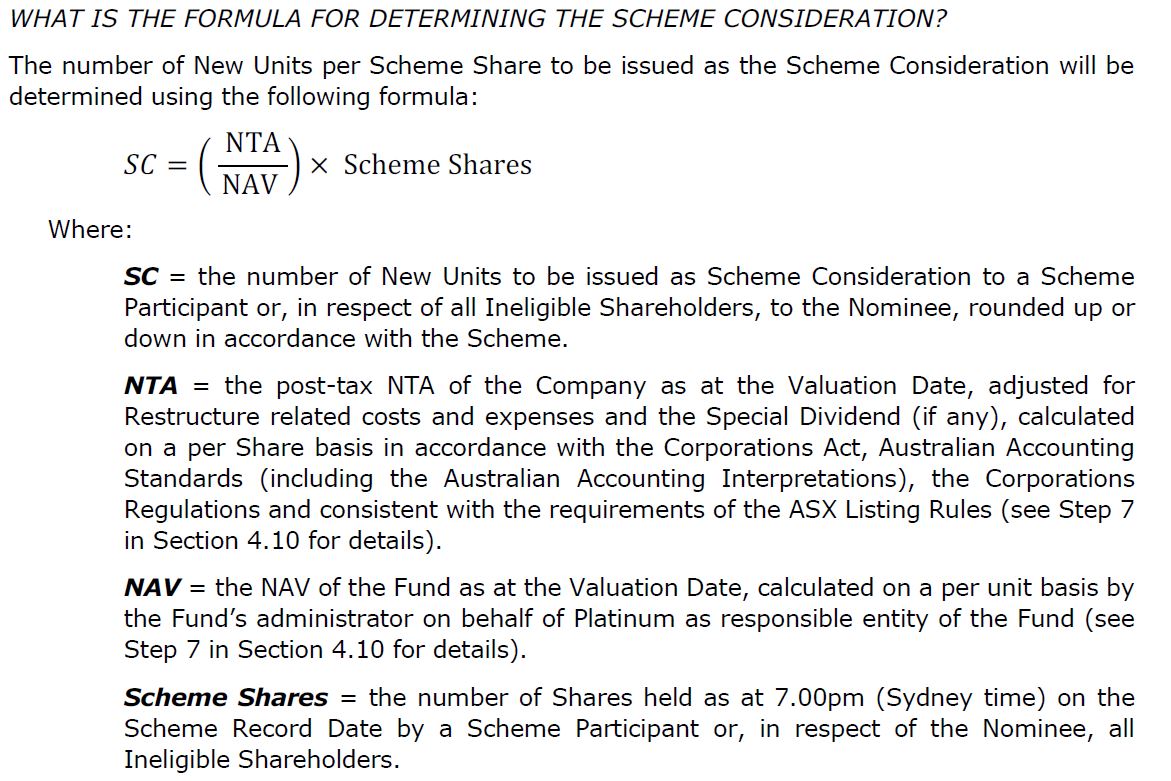

50 The formula for calculating the Scheme Consideration is explained in the PAI Scheme Booklet in section 4.5 and includes the following:

51 The Scheme Record Date is expected to be 7pm (AEST) on 20 August 2025, the second business day after the Effective Date, which is expected to be 18 August 2025. If the PAI Scheme becomes Effective, PAI Scheme Participants must not transfer, otherwise purport or agree to dispose of any PAI Share or any interest in a PAI Share after the Scheme Record Date, other than pursuant to the PAI Scheme. Any attempt to transfer or dispose of a PAI Share or interest in a PAI Share outside of the PAI Scheme after the Scheme Record Date will have no legal effect and will be disregarded by PAI.

52 PAI will maintain the PAI Share Register in its form as at the Scheme Record Date until the Scheme Consideration has been issued to the PAI Scheme Participants and PIM as responsible entity of the PA Fund (or its custodian) has been entered into the PAI Share Register as the holder of 100% of the PAI Shares. The PAI Share Register in this form will solely determine entitlements to the Scheme Consideration.

53 The Special Dividend is at the discretion of PAI’s Board and conditional on the following:

(1) the PAI Scheme being approved by PAI members and the Court and thereafter becoming Effective;

(2) PAI being able to pay the Special Dividend in cash following the Implementation Date; and

(3) compliance with relevant legislative requirements under the Act and Income Tax Assessment Act 1997 (Cth) which apply in respect of the Special Dividend.

54 The Special Dividend is an amount equal to the retained earnings that exist at the Valuation Date (after taking account of costs and expenses related to the restructure) to be paid as a special dividend if the PAI Scheme becomes effective. The Special Dividend (if paid) will be franked to the maximum extent possible, but will not be fully franked. If the PAI Board determines to pay the Special Dividend, the final amount will be calculated as at the Valuation Date and announced on the Implementation Date.

55 If a Special Dividend is declared, PAI’s post-tax NTA on the Valuation Date will be reduced by the value of the Special Dividend, which will impact the number of New PA Fund Units issued as Scheme Consideration.

56 Section 4.7 of the PAI Scheme Booklet provides worked examples demonstrating how the Scheme Consideration will be calculated as at 31 May 2025 (being the last monthly NTA published before the date of the PAI Scheme Booklet). PAI shareholders will be provided with further worked examples illustrating the application of the Scheme Consideration formula via ASX announcements prior to the PAI Scheme Meeting. A worked example of the Scheme Consideration formula based on PAI’s post-tax NTA (adjusted for restructure-related costs and expenses) and the PA Fund’s NAV as at 30 June 2025, will be provided on 16 July 2025. This coincides with the PAI Board’s announcement regarding the Special Dividend on 16 July 2025. A further worked example based on PAI’s post-tax NTA and the PA Funds’ NAV as at 31 July 2025 will be provided on 11 August 2025, being the day before the PAI Scheme Meeting, and will take into account whether the Special Dividend has been declared. If the PAI Board determines to pay the Special Dividend, this announcement will include an adjustment for the Special Dividend in each worked example of the Scheme Consideration formula.

57 As mentioned, the PAI Scheme Booklet contains the Independent Directors’ voting recommendation in favour of the PAI Scheme, in the absence of a Superior Competing Proposal and subject to the Independent Expert continuing to conclude that the PAI Scheme is in the best interests of PAI shareholders. The Independent Directors each intend to vote in favour of the PAI Scheme in respect of all PAI Shares they hold or control. The Independent Director’s interests in the PAI Scheme are disclosed in the PAI Scheme Booklet (section 11.1(a)).

58 The PAI Scheme Booklet annexes the report of the Independent Expert, BDO Corporate Finance Australia Pty Ltd, in which they opine that the PAI Scheme is fair and reasonable and in the best interests of members, in the absence of a superior proposal (section 4 of Annexure A of the PAI Scheme Booklet). The Independent Expert notes that if the PAI Scheme is implemented, there may be tax consequences for PAI shareholders. The potential tax consequences are disclosed in a detailed summary in section 14 of the Independent Expert’s Report and in section 10 of the PAI Scheme Booklet.

59 The Independent Expert has, in considering the fairness of the PAI Scheme, assessed the Fair Market Value (FMV) of the:

(1) PAI Shares pre-Scheme on a control basis; and

(2) Scheme Consideration, as the FMV of a PA Fund Unit post-Scheme on a minority basis multiplied by the Exchange Ratio.

60 PAI submitted that this approach reflects a conservative approach when comparing the two values. I accepted that submission. Based on this approach, the Independent Expert opined that as the FMV of the Scheme Consideration is greater than the FMV of a PAI Share pre-Scheme on a control basis, the PAI Scheme is fair. Having concluded that the Scheme is fair to PAI shareholders, and noting that ASIC Regulatory Guide 111 provides that an offer is “reasonable” if it is “fair”, the Independent Expert concluded that the PAI Scheme is reasonable. In the Independent Expert’s report, the Independent Expert steps through the factors that they considered in reaching their conclusions as to fairness and reasonableness. The Independent Expert’s assessment of reasonableness extended to consideration of the following factors grouped as follows:

(1) Advantages: fairness, ability to trade at close to NAV, increased liquidity and reduction in management expense ratio and aggregate underperformance to be made up before a performance fee is payable;

(2) Disadvantage: tax consequences for PAI shareholders;

(3) Other considerations: similar investment strategy, no termination fee payable to the investment manager and transaction costs.

61 The Independent Expert’s fairness assessment excludes the value of the Special Dividend because the Special Dividend will be declared prior to the Scheme Implementation Date. If the Special Dividend is declared, the worked example announcement will include a worked example of the Special Dividend calculation, and the worked example of the Scheme Consideration will include an adjustment for the Special Dividend.

62 Before addressing the substance of the present application, I will briefly summarise the principles that apply on the present application.

RELEVANT PRINCIPLES

Schemes of Arrangement Practice Note (GPN-SOA)

63 On 13 October 2023, the Court issued the Schemes of Arrangement Practice Note (GPN-SOA). In doing so, the Court recognised that “the process for approval of schemes of arrangement is intended to be as simple as possible and the Court is supportive of simplification so far as it is consistent with the Court’s statutory responsibilities and binding authority”: GPN-SOA at [3]. Scheme proponents may proceed on that basis, subject to discharging their duties given the ex parte character of the application: see Re Permanent Trustee Company Limited [2002] NSWSC 1177; 43 ACSR 601 at [7] (Barrett J, as his Honour then was).

Part 5.1 of the Corporations Act

64 Schemes of arrangement are regulated under Part 5.1 of the Act. Part 5.1 provides a procedure whereby an arrangement between a company and its members can be made binding on all members.

65 Section 411(1) of the Act is the principal provision:

Where a compromise or arrangement is proposed between a Part 5.1 body and its creditors or any class of them or between a Part 5.1 body and its members or any class of them, the Court may, on the application in a summary way of the body or of any creditor or member of the body, or, in the case of a body being wound up, of the liquidator, order a meeting or meetings of the creditors or class of creditors or of the members of the body or class of members to be convened in such manner, and to be held in such place or places (in this jurisdiction or elsewhere), as the Court directs and, where the Court makes such an order, the Court may approve the explanatory statement required by paragraph 412(1)(a) to accompany notices of the meeting or meetings.

66 The procedure involves three main steps:

(1) an application to the Court for an order to convene a scheme meeting;

(2) if such an order is made, the convening of the meeting at which a resolution to agree to the scheme is considered, and perhaps passed; and

(3) if the resolution is passed by the necessary majorities, an application to the Court for approval of the scheme.

67 This application concerns the first step.

68 The principles which apply at this first stage are well-known and have been summarised by Beach J in a number of decisions, including Re PM Capital Asian Opportunities Fund Limited [2021] FCA 1380 (at [39]-[40]):

[39] …my function on an application to order the convening of a meeting is supervisory. At this stage I should generally confine myself to ensuring that certain procedural and substantive requirements have been met including dealing with adequate disclosure, but with limited consideration of issues of fairness. But having said that, it is appropriate to consider the merits or fairness of a proposed scheme at the convening hearing if the issue is such as would unquestionably lead to a refusal to approve a proposed scheme at the approval hearing, that is, the proposed scheme appears now to be on its face “so blatantly unfair or otherwise inappropriate that it should be stopped in its tracks before going any further” (Re Foundation Healthcare Ltd (2002) 42 ACSR 252 at [44] per French J).

[40] Clearly, my role is not to usurp the shareholders’ decision whether to agree to a scheme by attempting to intrude my own commercial judgment. The question whether to accept particular consideration for shares is a commercial matter for the members to assess, and they ought not to be prevented from having the opportunity to do so provided that I am satisfied that they are acting on sufficient information and with time to consider what they are voting on. If the arrangement is one that seems fit for consideration by the meeting of members and is a commercial proposition likely to gain my approval if passed by the requisite majorities, then orders should be made to convene the meeting.

69 Therefore, if the arrangement is one that seems fit for consideration by the meeting of members, and is a commercial proposition likely to gain the Court’s approval if passed by the necessary majorities, then orders should be made to convene the meeting: Rex Minerals Limited, in the matter of Rex Minerals Limited [2024] FCA 1051 at [26] (O’Bryan J), citing Re Foundation Healthcare Ltd [2002] FCA 742; 42 ACSR 252 at [36] (French J, as his Honour then was).

70 On this application the Court’s task is to assess first, whether the statutory prerequisites to the making of orders convening a meeting have been met and second, whether it is appropriate for the Court to exercise its discretion in favour of making those orders. Each of those matters is considered in turn.

Statutory prerequisites

71 Section 411 of the Act does not state the criteria that must be satisfied before a scheme meeting is ordered, but it is clear that, if certain statutory pre-requisites are met, s 411(1) confers a discretion on the court in relation to whether the scheme meeting should be ordered: see, for example, Re Healthscope Limited [2019] FCA 542; 139 ACSR 608 at [43] (Beach J); Re Amcor Limited [2019] FCA 346 at [45] (Beach J); Re DuluxGroup Limited [2019] FCA 961; 136 ACSR 546 at [15] (O’Bryan J); Re Legend Corporation Limited [2019] FCA 1249 at [17] (O’Bryan J); Re Wellcom Group Limited [2019] FCA 1655 at [24] (O’Bryan J); Re Verdant Minerals Limited [2019] FCA 556 at [28] (Moshinsky J), citing Re CSR Limited [2010] FCAFC 34; 183 FCR 358 at [8] (Keane CJ and Jacobson J, Finkelstein J agreeing); Re Sienna Cancer Diagnostics Limited [2020] FCA 899 at [43] (Moshinsky J); and Re Atlas Iron Ltd [2016] FCA 366; 112 ACSR 554 at [30] (Gleeson J).

72 Before the Court’s discretion is enlivened, the Court must first be satisfied that:

(1) the plaintiff is a Part 5.1 body;

(2) the proposed scheme is an “arrangement” within the meaning of s 411 of the Act;

(3) the scheme is bona fide and properly proposed;

(4) ASIC has had a reasonable opportunity to examine the proposed scheme and explanatory statement and make submissions, and has had 14 days’ notice of the proposed hearing date;

(5) the procedural requirements under the Federal Court (Corporations) Rules 2000 (Cth) (Corporations Rules) have been met; and

(6) there is no apparent reason why the scheme should not, in due course, receive the Court’s approval if the necessary majority of votes is achieved.

CONSIDERATION

Statutory Prerequisites

73 On the evidence before me, I am satisfied that the relevant statutory prerequisites have been met.

74 First, as required by s 411(1), PAI, as a company registered under the Act, is a Part 5.1 body and the proposed scheme is an “arrangement” between it and its shareholders. It is well-established that a scheme to effect an acquisition of shares may be an “arrangement” within the meaning of s 411(1) of the Act: Re Foundation Healthcare at [39]. The fact that the consideration for the acquisition of the relevant shares comprises units in a managed investment scheme does not detract from that conclusion.

75 Secondly, the commercial rationale for the PAI Scheme which I have addressed above, and which is addressed in the PAI Scheme Booklet, is one which is not inappropriate and is one which sensible business people might consider to be of benefit to PAI’s members: Amcom Telecommunications Limited, in the matter of Amcom Telecommunications Ltd [2015] FCA 341 at [10] (McKerracher J). There is no reason on the evidence before me to consider that the PAI Scheme is other than one which is proper and bona fide.

76 Thirdly, as required by r 2.4(2) of the Corporations Rules, the evidence relied upon by PAI includes a search of the records maintained by ASIC dated 19 June 2025 in relation to PAI, carried out no earlier than 7 days before the originating process was filed.

77 Fourthly, PAI has complied with the requirement in s 411(2)(a) of the Act to give ASIC at least 14 days’ notice of the First Court Hearing. As required by s 411(2)(b), ASIC has had a reasonable opportunity to examine the terms of the PAI Scheme and the draft explanatory statement, and to make submissions to the Court. ASIC was provided with a draft PAI Scheme Booklet on 6 June 2025. The originating processes and supporting affidavit of Ms Naulls-Johnstone were lodged with ASIC on 25 June 2025. Following interaction between PAI and ASIC, ASIC was provided with an updated PAI Scheme Booklet and the affidavit of Ms Towers on 3 July 2025. As mentioned, PAI tendered a letter from ASIC in which ASIC confirmed that it does not propose to appear to make submissions or intervene to oppose the PAI Scheme at the First Court Hearing.

78 Fifthly, as required by r 3.2 of the Corporations Rules, the necessary evidence about the proposed chairperson and alternate chairperson of the PAI Scheme Meeting has been provided. Ms Towers deposes that she will act as chair of the PAI scheme meeting on 12 August 2025, and that Mr Hunter, the other independent director will act as alternate chairperson. Ms Towers deposes that she has no previous relationship or dealings with PAI except that she is a director and shareholder of PAI (and in that latter capacity, will be entitled to receive Scheme Consideration if the PAI Scheme is implemented, as addressed in section 11 of the PAI Scheme Booklet). Ms Towers also deposes that she does not have any previous relationship with any other person or entity interested in the PAI Scheme, and does not have any interest or obligation that may give rise to a conflict of interest or duty if she were to act as chair of the PAI Scheme meeting. Mr Hunter has informed Ms Towers of those same matters as they pertain to him and Ms Towers confirms on information and belief that he similarly has no conflict of interest or duty. That evidence is given on information and belief consistently with GPN-SOA at [3(c)].

79 Sixthly, as required by r 3.3(1) of the Corporations Rules, the proposed short minutes of order sought by PAI sufficiently identify the proposed PAI Scheme, which is Annexure B to the PAI Scheme Booklet.

80 Finally, in relation to the substantive requirement dealing with disclosure, I was satisfied to the summary standard applicable at this First Court Hearing that the PAI Scheme Booklet provides adequate disclosure and contains the prescribed information required under the Act and Corporations Regulations 2001 (Cth) for PAI members for the purpose of their consideration of the PAI Scheme.

81 The information to be provided to shareholders is regulated by s 412 and reg 5.1.01 and Schedule 8 of the Regulations. In particular, s 412(1) of the Act and Schedule 8 (Part 3) of the Regulations set out the disclosure requirements of the explanatory statement (which is included within the PAI Scheme Booklet). PAI submitted, and I accepted, that the PAI Scheme Booklet meets the requirements of s 412(1) in that the explanatory statement:

(1) explains the effect of the compromise or arrangement, and in particular states any material interest of the directors, and the effect on those interests on the compromise or arrangement so far as it is different from the effect on the like interests of other persons;

(2) sets out the prescribed information, being the information set out in reg 5.1.01 and Schedule 8 of the Regulations, and the verification of that information is demonstrated by the evidence on this application; and

(3) sets out the other information that is material to a member making a decision whether or not to agree to the PAI Scheme in that it includes a clear and comprehensive, detailed evaluation of the PAI Scheme (including by reference to the Independent Expert’s Report, which is addressed below), which is presented in a way that enables a PAI members to form their own view of the merits of the PAI Scheme.

82 In relation to the adequacy of the disclosure in the PAI Scheme Booklet, the Court’s function is not to approve the PAI Scheme Booklet and PAI does not seek an order to this effect. That approach is consistent with the approach taken by this Court in Re Duluxgroup (at [63]), Re Amcor (at [114]-[115]), Re Verdant Minerals (at [84]), Re Healthscope Limited (at [189]) and Re Sienna Cancer Diagnostics (at [98]). As noted above, iterative drafts of the PAI Scheme Booklet have been lodged with ASIC since 6 June 2025. That exchange has resulted in amendments to the PAI Scheme in response to comments made by ASIC. As mentioned, as recently as 4 July 2025, ASIC has been provided with a revised draft and on 7 July 2025 has informed PAI that it has no further comments on the PAI Scheme Booklet. The PAI Scheme Booklet must be registered by ASIC before being sent to PAI Members: s 412(6) of the Act. Before registering the PAI Scheme Booklet, ASIC must conclude that it appears to comply with the requirements of the Act, and must form the opinion that the PAI Scheme Booklet does not contain any matter that is false in a material particular or materially misleading in the form and context in which it appears: s 412(8) of the Act. If, following orders being made for the convening of the PAI Scheme Meeting, the PAI Scheme Booklet is registered by ASIC, this will provide further assurance as to the satisfaction of the relevant disclosure requirements.

83 The procedural requirements having been satisfied, I now turn to the whether it is appropriate for the Court to exercise its discretion in favour of making the orders sought by PAI.

Discretion

84 The relevant discretionary considerations involve two main questions: first, whether the PAI Scheme is fit for consideration by the members; and second, whether the members will be properly informed as to the nature of the PAI Scheme.

Whether the PAI Scheme is fit for consideration

85 I was satisfied that on the materials before me there was no issue arising from the PAI Scheme which would unquestionably lead to a refusal by the Court to approve the PAI Scheme at the Second Court Hearing. The PAI Scheme on its face is not so blatantly unfair or otherwise inappropriate that it should be stopped in its tracks before going any further: Re Amcor at [47], citing Re Foundation Healthcare at [44].

86 In reaching this conclusion, I am conscious that absent a clear indication that the PAI Scheme will not be approved at the Second Court Hearing, whether arising from the terms of the PAI Scheme itself or some other incontrovertible fact, an enquiry into the merits or fairness of the PAI Scheme is to be eschewed at this stage of the process.

87 I have addressed above the Independent Expert’s conclusion ⸺ that the PAI Scheme is fair and reasonable and in the best interests of PAI members, in the absence of a Superior Competing Proposal ⸺ and the Independent Directors’ recommendation to vote in favour of the Scheme Resolution.

88 Consistently with the duty of disclosure, and recognising that the Court will in a summary way scrutinise the terms of the PAI scheme to satisfy itself that there is no unfairness that would be likely to preclude approval of the PAI Scheme, PAI brought the following features of the PAI Scheme to the attention of the Court:

(1) The potential payment of the Special Dividend;

(2) The management of performance risk;

(3) The treatment of Ineligible Shareholders;

(4) Timing of the calculation of the Scheme Consideration;

(5) The exclusivity period; and

(6) The purpose of the PAI Scheme.

89 In raising these issues for the attention of the Court, PAI noted that it is not necessary to consider any break fee – there is none.

90 PAI submitted that none of these matters gives rise to a concern that the PAI Scheme is not fit for consideration by its members in the requisite sense. I accepted PAI’s submissions on these matters for the following reasons.

Special dividend

91 The circumstances pertaining to the potential payment of the Special Dividend are addressed above. The circumstances are disclosed in the PAI Scheme Booklet and were noted by the Independent Expert. If the PAI Board decides to pay the Special Dividend (subject to the conditions identified above) that decision will be communicated to PAI members by way of an ASX announcement prior to the PAI Scheme meeting. The contingent nature of the Special Dividend, the timing of determination of the final amount of the Special Dividend and the impact it may have on the Scheme Consideration will be disclosed to members in the manner which I have summarised above, including by way of updated worked examples of the Scheme Consideration. I was satisfied that the disclosure made in relation to the potential for the making of the Special Dividend (including as to the way in which developments in relation thereto will be communicated to PAI members ahead of the Scheme Meeting) does not weigh against the PAI Scheme being put to a meeting of PAI members for consideration.

Performance risk

92 PAI submitted, and I accepted, that the usual measures to ameliorate performance risk are employed in relation to the PAI Scheme, namely:

(1) PIM has signed and delivered a deed poll in favour of all PAI Scheme participants, binding it, in its capacity as the responsible entity of the PA Fund and the PA Underlying Fund, to comply with its obligations under the PAI Scheme and the PAI Scheme Implementation Deed (as applicable) and to do all acts and things necessary or desirable on its part to give full effect to the PAI Scheme; and

(2) the Scheme Consideration is provided simultaneously with the transfer of all shares in PAI to PIM, with both only deemed to complete when all steps have been carried out. Further, the obligation to transfer the PAI Shares is expressly subject to the provision of the Scheme Consideration.

Ineligible Shareholders

93 Unless PIM determines otherwise, an “Ineligible Shareholder” for the purpose of the PAI Scheme is a PAI Scheme participant whose address as shown in PAI’s share register as a place outside Australia (including its external territories) and New Zealand. Ineligible Shareholders will not receive New PA Fund Units as consideration under the PAI Scheme. If the PAI Scheme becomes Effective, New PA Fund Units that would have been issued to the Ineligible Shareholders will be issued to a nominee (appointed by PIM) and sold on-market. PAI will procure the payment to each Ineligible Shareholder of their pro rata proportion of the market sale proceeds (net of transaction costs) (section 4.8 of the PAI Scheme Booklet). There is nothing novel about this aspect of the PAI Scheme.

Timing of the calculation of the Scheme consideration

94 The issue as to timing arises generally in relation acquisition schemes where a listed investment company and a managed investment scheme are brought together in circumstances where the value of the scheme consideration is not quantified before the members vote to approve the scheme.

95 Each PAI Scheme participant will receive Scheme Consideration with an aggregate issue price approximately equal to the aggregate post-tax NTA value of their PAI Shares on the Valuation Date, but the precise quantification or value of the Scheme Consideration will not be known at the time of the vote. As mentioned, the Valuation Date is the last business day before the Implementation Date. The Valuation Date is currently expected to be Friday, 22 August 2025 and the Implementation Date is currently expected to be Monday, 25 August 2025. To achieve a fair result for both PAI members and PA Fund unitholders, the Valuation Date needs to be set as close as possible to the Implementation Date to minimise potential market risk. This is because adverse movements in PAI’s post-tax NTA value relative to the PA Fund’s NAV between the Valuation Date and the time of implementation could impact the value of the PAI Scheme Consideration received by PAI members. As the Valuation Date is one business day prior to the business day on which the Implementation Date falls and Implementation of the PAI Scheme will not occur until after markets close on the Implementation Date, the Scheme Consideration will be subject to this market risk for one business day.

96 I accept that this is an issue for disclosure and that relevant matters are fully disclosed in the PAI Scheme Booklet by:

(1) providing worked examples of how the PAI Scheme Consideration is calculated. An example is provided in section 4.6 of the PAI Scheme Booklet and, as mentioned, further examples are proposed to be released prior to the PAI Scheme meeting;

(2) clearly stating in the PAI Scheme Booklet that the final PAI Scheme Consideration will be announced on the ASX by 10am on the Implementation Date: see, for example, the “Important Dates” at the front of the PAI Scheme Booklet, section 4.4(b) and section 4.9 (Step 9); and

(3) disclosing the one-day market risk in section 9.5(b), and in the questions and answers in section 3 of the PAI Scheme Booklet.

97 Similar schemes which have allowed members of licensed investment companies to exit at NTA values calculated after the scheme meeting to approve a scheme have been approved in the following cases: WCM Global Long Short Limited, in the matter of WCM Global Long Short Limited [2022] FCA 1447 at [29]-[34] (Markovic J); Absolute Equity Performance Fund Ltd, in the matter of Absolute Equity Performance Fund Ltd [2022] FCA 933 at [30]-[32] and [37]-[38] (Halley J); PM Capital Asian Opportunities Fund Limited, in the matter of PM Capital Asian Opportunities Fund Limited [2021] FCA 1380 at [28]-[35] and [53] (Beach J); and Australian Leaders Fund Ltd v Equity Trustees Ltd, in the matter of Australian Leaders Fund Ltd [2021] FCA 88 at [3] (Stewart J).

Exclusivity period

98 Clause 7 of the PAI Scheme Implementation Deed imposes a number of restrictions and obligations on PAI in relation to negotiations with third parties such as “existing discussions” restrictions (cl 7.1), “no shop and no talk” (cl 7.2), “due diligence information” restrictions (cl 7.3), “non-public information” restrictions (cl 7.4), “notifications during the Exclusivity Period” obligation (cl 7.6) and a “matching right” (cl 7.7).

99 Exclusivity provisions in the form of clause 7 of the PAI Scheme Implementation Deed are now conventional in schemes of arrangement (Vita Group Ltd, in the matter of Vita Group Ltd [2023] FCA 400; 165 ACSR 576 at [25] (Jackman J)) and are not inconsistent with the Takeovers Panel’s Guidance Note 7: Deal Protection (TP Guidance 7): see Re Villa World Ltd [2019] NSWSC 1207; 139 ACSR 550 at [23] (Black J).

100 In the face of such provisions, the Court is concerned to ensure that an exclusivity provision should be:

(1) for no more than a reasonable period capable of precise ascertainment;

(2) directed at dealing with an unsolicited alternative proposal should be subject to a fiduciary carve out; and

(3) clearly disclosed in the explanatory statement sent to shareholders,

(see Re Asaleo Care Limited [2021] FCA 406 at [55] (Banks-Smith J).

101 When determining whether an exclusivity period is reasonable, courts have taken into account the following considerations:

(1) the complexities of the transaction and potential delay in obtaining regulatory approvals, particularly where there are lengthy review periods associated with obtaining such approvals;

(2) the period required to actually effect the scheme proposal;

(3) the operation of the break fee provisions with respect to the exclusivity period (if applicable); and

(4) the level of control the bidder has over the target’s actions by operation of the break fee provisions (if applicable),

(see Re Tatts Group Ltd [2017] VSC 552 at [38]-[42] (Sifris J)).

102 The exclusivity period in the PAI Scheme Implementation Deed is approximately 12 months. It is not unreasonable in the present context. Courts have previously approved schemes with exclusivity periods of 12 months or more: Re Tatts Group at [36] (14 months); Re Sirtex Medical Ltd [2018] FCA 1315 at [37] (Markovic J) (12 months); Re The Trust Company (RE Services) Ltd as responsible entity of the VitalHarvest Freehold Trust [2021] NSWSC 108 at [38] to [40] (Black J) (12 months).

103 Further, the “no talk” and due diligence restrictions are subject to the PAI Independent Directors’ fiduciary or statutory obligations (clause 7.5 of the PAI Scheme Implementation Deed). The exclusivity provisions are adequately disclosed in the PAI Scheme Booklet (section 5.13(c)).

Purpose of the PAI Scheme

104 The Court’s jurisdiction to approve a scheme is restricted by s 411(17) of the Act. This is a matter which affects the discretion ultimately to approve the PAI Scheme, rather than the discretion to make orders for the scheme meeting. At the approval stage, the Court must be satisfied there is no proscribed purpose as described in s 411(17)(a) or there must be provided to the Court a statement in writing by ASIC that it has no objection to the arrangement under s 411(17)(b). ASIC will not provide a statement under s 411(17)(b) until the Second Court Hearing. Here, as noted above, ASIC has provided a no-objection letter to PAI in which it indicated that it did not propose to appear to make submissions or intervene to oppose the PAI Scheme at the First Court Hearing.

105 I was satisfied that s 411(17) did not present a bar to a meeting being convened in circumstances where it presently seems likely that ASIC will produce the relevant statement at the Second Court Hearing and there is presently nothing to suggest that the PAI Scheme is for a proscribed purpose.

Whether PAI members are to be properly informed

106 The second principal matter relevant to the exercise of the Court’s discretion at the First Court Hearing is the adequacy of the information to be provided to members.

107 As noted above, s 412(1) of the Act and Schedule 8 (Part 3) of the Regulations set out the disclosure requirements of the explanatory statement (which is included within the PAI Scheme Booklet). Having regard to the prescription of the contents of the explanatory statement in these provisions, I am satisfied that the statutory disclosure requirements are met, and that the information to be provided to PAI members is adequate.

108 PAI members are to be presented with an appropriately detailed and clear explanation of the PAI Scheme in the PAI Scheme Booklet, as well as a careful analysis of the PAI Scheme in the Independent Expert’s Report. The PAI Scheme Booklet meets all of the statutory requirements, has been verified by PAI and PIM, and has been examined by ASIC and is required to be registered by ASIC prior to distribution to PAI members.

109 PIM will operate an inbound telephone information line to respond to queries from PAI’s shareholders in relation to the PAI Scheme. A script has been prepared for use by PIM’s representatives and is in evidence. PAI submitted, and I accepted, that it is not necessary for the Court to approve inbound calls scripts. Rather, the Court should be informed of the steps to be taken to communicate with members and any material deviation from the terms of the scripts used in respect of those communications should be brought to the attention of the Court at the Second Court Hearing. It may be that evidence of the matters discussed during such communications should be led at the Second Court Hearing. Time will tell. Consistently with Re Altium [2024] NSWSC 736 at [28] (Black J), I was satisfied that the proposed communications do not give rise to any reason not to convene the PAI Scheme Meeting.

Conclusion on the exercise of discretion

110 For these reasons, I was satisfied that it was appropriate to exercise the discretion to approve the convening of the PAI Scheme Meeting.

Ancillary orders

111 The orders sought are to convene the PAI Scheme Meeting in accordance with the provisions of Part 2G.2 of the Act and PAI’s constitution. I was satisfied it was appropriate to make orders as proposed.

112 I also made an order dispensing with compliance with rule 2.15 of the Corporations Rules. As is usual in applications of this type, that order was sought and made out of an abundance of caution to protect against a need to comply with rules directed to insolvent schemes, of which this is not one.

CONCLUSION

113 For these reasons, at the First Court Hearing, I made orders substantially in the terms sought by PAI and adjourned the proceedings until 15 August 2025, being the date of the Second Court Hearing.

I certify that the preceding one hundred and thirteen (113) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Cheeseman. |

Associate:

Dated: 9 July 2025

ANNEXURE A

DEFINITION | DESCRIPTION |

New PA Fund Units | The PA Fund Units issued as a result of the PAI Scheme being implemented |

PA Fund | Platinum Asia Fund (Quoted Managed Hedge Fund) |

PA Fund Units | Units in the PA Fund |

PA Underlying Fund | Platinum Asia Fund (ARSN 104 043 110) |

PAI | Platinum Asia Investments Limited |

PAI Scheme | Platinum Asia Investments proposed members’ scheme of arrangement |

PAI Scheme Implementation Deed | Implementation Deed for the PAI Scheme |

PAI Shares | Shares in PAI |

PAM | Platinum Asset Management Limited |

PC | Platinum Capital Limited |

PC Shares | Shares in PC |

PC Scheme | Platinum Capital Limited proposed members’ scheme of arrangement |

PI Fund | Platinum International Fund Complex ETF previously known as the Platinum International Fund (Quoted Managed Fund) |

PI Fund Units | Units in the PI Fund |

PI Underlying Fund | Platinum International Fund (ARSN 089 528 307) |

PIM | Platinum Investment Management Limited (trading as Platinum Asset Management) |