Federal Court of Australia

Livingstone, in the matter of St Hilliers Contracting Pty Ltd (administrators appointed) [2025] FCA 658

File number(s): | NSD 171 of 2024 |

Judgment of: | GOODMAN J |

Date of judgment: | 20 June 2025 |

Catchwords: | CORPORATIONS – application by administrators and deed administrators for directions under s 90-15 of Schedule 2 to the Corporations Act 2001 (Cth) – whether the deed administrators are justified in returning to subcontractors of the company in administration monies retained and bank guarantees given in circumstances where the administrators will make no claim under the contracts between the company in administration and the subcontractors – application granted |

Legislation: | Corporations Act 2001 (Cth), Schedule 2, ss 9, 9AD, 90-15, 90-20 Federal Court (Corporations) Rules 2000 (Cth), r 2.8 Design and Building Practitioners Act 2020 (NSW) Home Building Act 1989 (NSW) |

Cases cited: | Banerjee, in the matter of Johnny’s Furniture Group Pty Ltd (in liq) [2024] FCA 838 Krejci, in the matter of Union Standard International Group Pty Ltd (Administrators Appointed) (No 2) [2020] FCA 1111 Morgan, in the matter of Traditional Values Management Limited (in liq) [2024] FCA 74 Woodhouse (Liquidator), in the matter of Forex Capital Trading Pty Ltd (in liq) [2022] FCA 600 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 24 |

Date of hearing: | 2 April and 27 May 2025 |

Counsel for the Plaintiffs: | Mr M L Rose |

Solicitor for the Plaintiffs: | Bridges Lawyers |

ORDERS

NSD 171 of 2024 | |

IN THE MATTER OF ST HILLIERS CONTRACTING PTY LTD (ADMINISTRATORS APPOINTED) | |

GLENN LIVINGSTONE AND ALAN WALKER IN THEIR CAPACITY AS ADMINISTRATORS OF ST HILLIERS CONTRACTING PTY LTD (ADMINISTRATORS APPOINTED) ACN 082 729 039 First Plaintiffs ST HILLIERS CONTRACTING PTY LTD (ADMINISTRATORS APPOINTED) ACN 082 729 039 Second Plaintiff | |

order made by: | GOODMAN J |

DATE OF ORDER: | 20 june 2025 |

THE COURT DIRECTS PURSUANT TO s 90-15 OF THE INSOLVENCY PRACTICE SCHEDULE (CORPORATIONS), BEING SCHEDULE 2 TO THE CORPORATONS ACT 2001 (CTH) THAT:

1. The first plaintiffs are justified in:

(a) distributing the funds held in National Australia Bank account BSB 082 057 account number 986532766 (NSW Retentions Trust Account) held in the name of the second plaintiff to each entity identified as a “subcontractor” (Subcontractor) in Schedule 1 to these orders (Amended Retentions Register) in payment of that Subcontractor’s claim against the second plaintiff for retention monies in the amount stated in the Amended Retentions Register;

(b) if there is a shortfall between an amount held in the NSW Retentions Trust Account and the amount of a claim for retention monies owing to a Subcontractor (Shortfall), paying the Shortfall to that Subcontractor out of the Deed Fund (Deed Fund) in the Deed of Company Arrangement executed in relation to the second plaintiff (DOCA) pari passu together with the ordinary unsecured creditors of the second plaintiff whose claims are admitted to proof under the DOCA; and

(c) paying the claims of subcontractors not identified in the Amended Retentions Register with claims for payment of retention monies against the second plaintiff as an ordinary unsecured creditor claim out of the Deed Fund pari passu with the ordinary unsecured creditors of the second plaintiff whose claims are admitted to proof under the DOCA.

2. The first plaintiffs are justified in returning all of the bank guarantees listed in the Schedule 2 to these orders (Bank Guarantees Register) to the respective subcontractors identified in the Bank Guarantees Register.

THE COURT ORDERS THAT:

3. The first plaintiffs give notice of these orders to the creditors, or persons claiming to be creditors, of the second plaintiff by:

(a) placing a copy of these orders on the online creditor portal maintained by the first plaintiffs; and

(b) sending a copy of these orders:

(i) by email to any creditor, or person claiming to be a creditor, of the second plaintiff for whom or which the first plaintiffs have an email address; and

(ii) by mail to all other creditors, or persons claiming to be creditors, of the second plaintiff for whom the first plaintiffs do not have an email address.

4. Liberty to apply be granted to any person who can demonstrate sufficient interest to apply to discharge or vary these orders on the giving of reasonable notice to the first plaintiffs for a period of 28 days after the making of these orders.

5. The remuneration and costs of the first plaintiffs in undertaking the distributions referred to in direction 1 be paid out of the Deed Fund as a cost of the deed administration of the DOCA.

6. The first plaintiffs’ costs and expenses of and incidental to the amended interlocutory process be costs in the deed administration of the DOCA.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

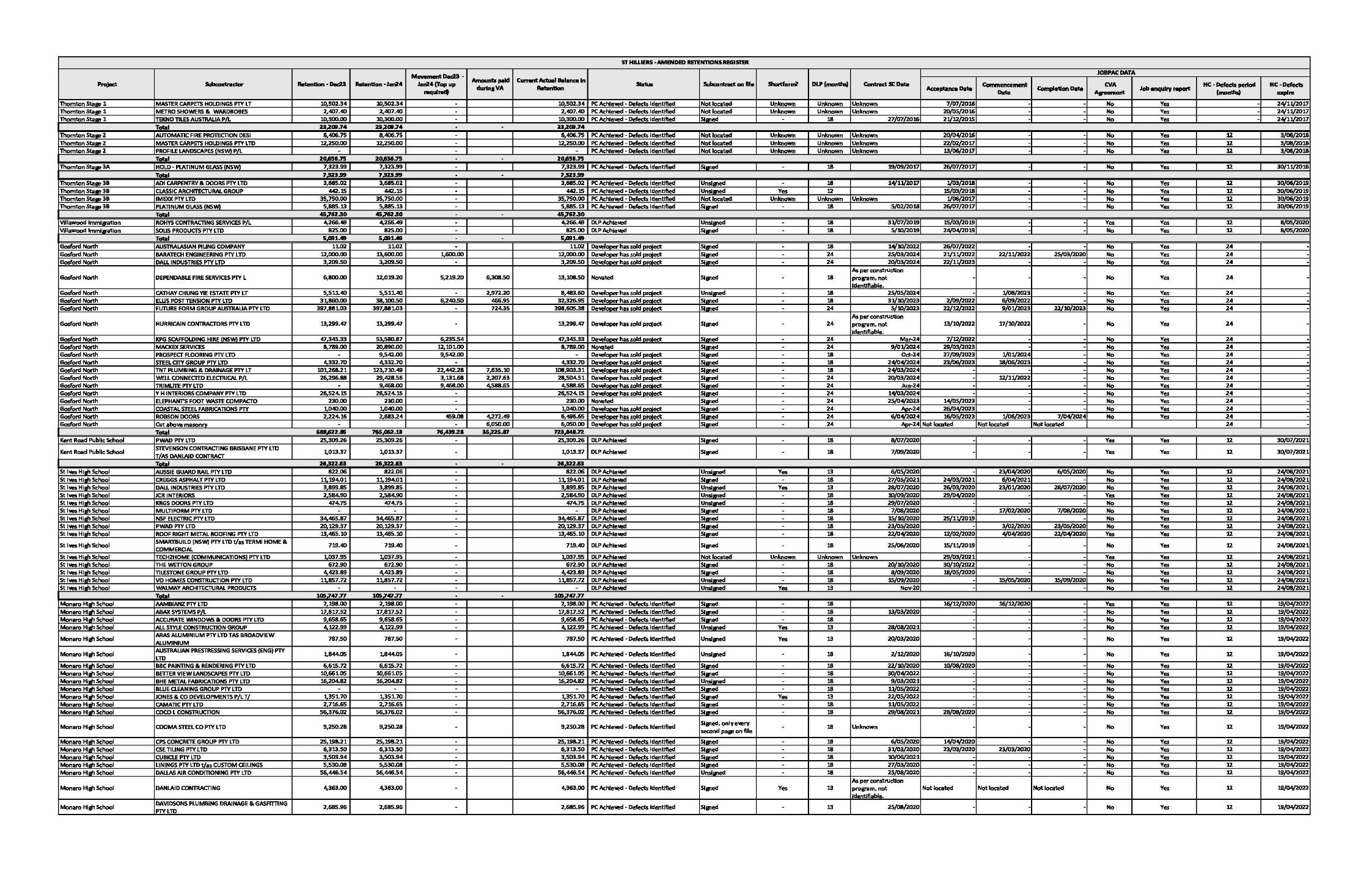

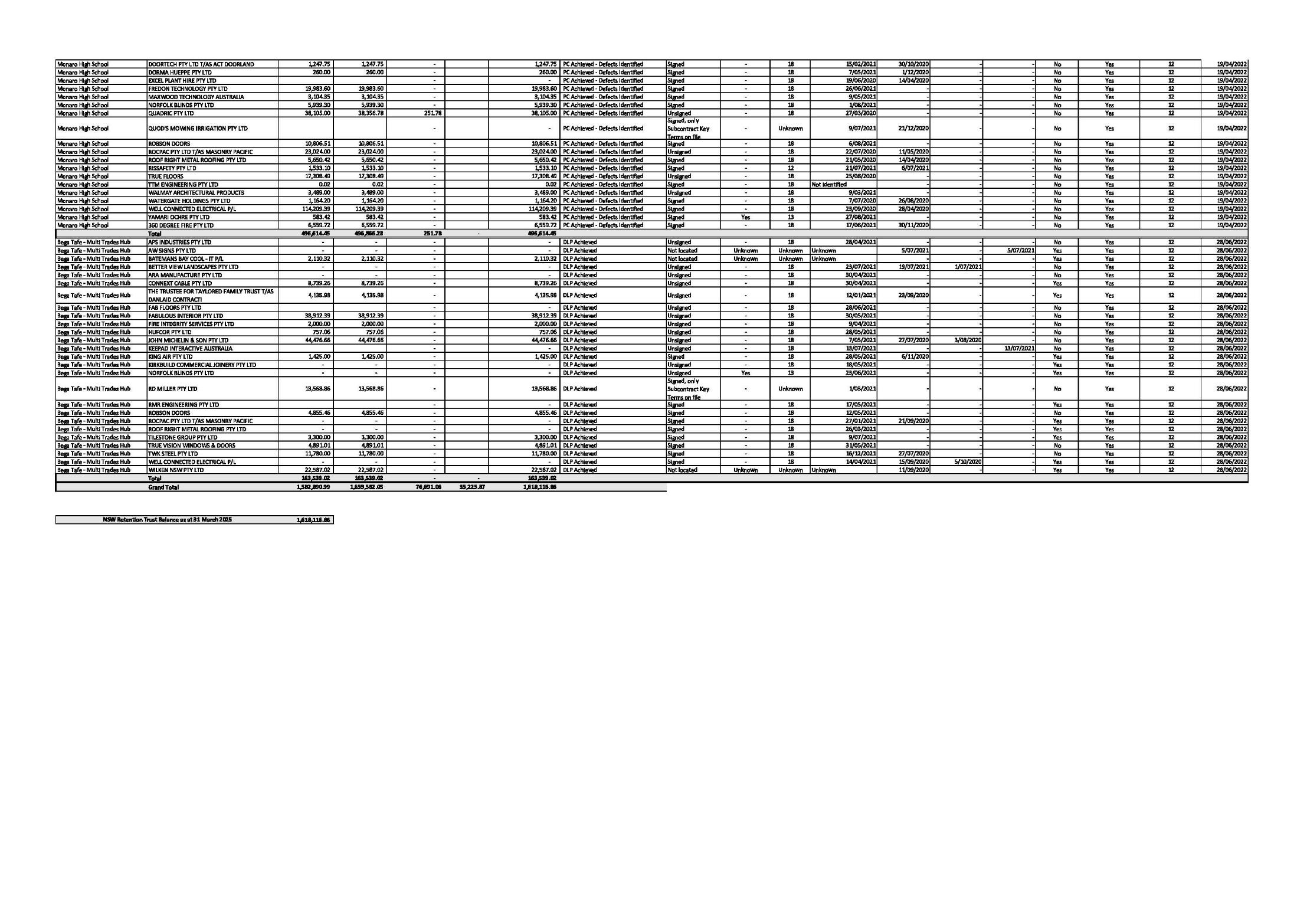

SCHEDULE 1

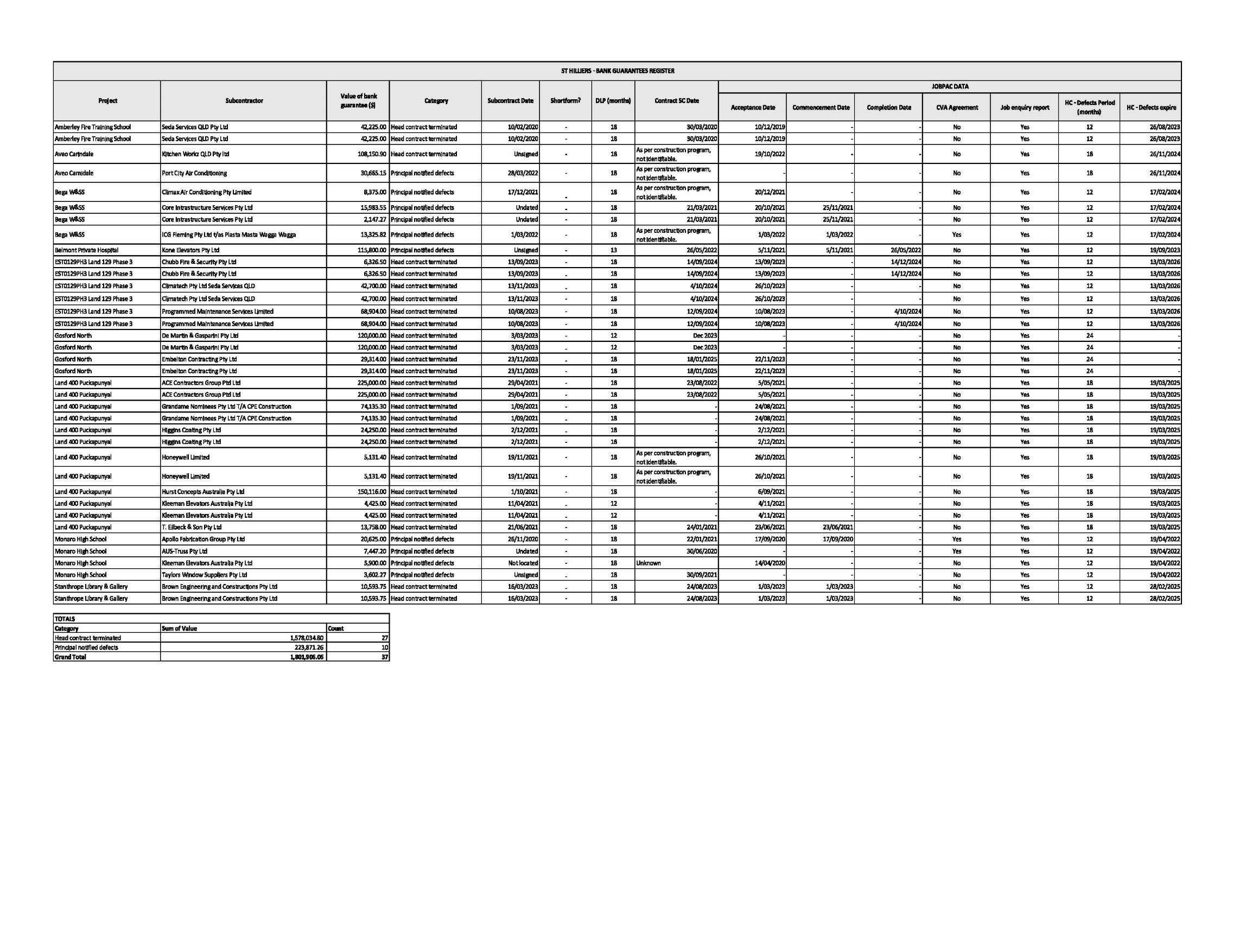

SCHEDULE 2

REASONS FOR JUDGMENT

GOODMAN J:

A. Introduction

1 The first plaintiffs – Mr Glenn Livingstone and Mr Alan Walker – are the administrators of the second plaintiff and the deed administrators of a deed of company arrangement concerning the second plaintiff (DOCA).

2 By an interlocutory process filed on 20 February 2025 and amended on 26 May 2025, the first plaintiffs in their capacity seek directions pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations) (IPS(C)), being Schedule 2 to the Corporations Act 2001 (Cth), together with various ancillary orders.

3 For the reasons which follow, the relief sought should be granted.

B. Background

4 The first plaintiffs read on this application affidavits of Mr Livingstone affirmed on 20 February 2025, 17 March 2025, 2 April 2025 and 26 May 2025. From those affidavits, and the documents exhibited thereto, the salient background facts are as follows.

5 On 4 February 2024, the first plaintiffs were appointed as administrators of the second plaintiff. As at that date, the second plaintiff – which was part of a group of companies that undertook building construction works nationally in infrastructure, commercial, retail and residential projects – was involved in a number of construction projects at various stages of completion and was in contractual relationships with various subcontractors. Under those contracts, the second plaintiff retained certain amounts provided by its subcontractors (retention monies) and the second plaintiff received bank guarantees concerning the performance of some of its subcontractors.

6 Following that appointment, construction work was suspended on all projects and subsequently the contracts between the second plaintiff and its subcontractors were terminated.

7 On 23 April 2024, Building Commission NSW suspended the second plaintiff’s contractor licence issued under the Home Building Act 1989 (NSW) (HBA licence) and registration under the Design and Building Practitioners Act 2020 (NSW) (DBP registration).

8 On 30 April 2024, the first plaintiffs returned the second plaintiff’s HBA licence to the Building Commission NSW.

9 Since about May 2024, the second plaintiff has not employed staff.

10 On 20 June 2024, the second plaintiff entered into the DOCA. As noted above, the first plaintiffs are the deed administrators. Upon entry into the DOCA, control and stewardship of the second plaintiff reverted to its director, Mr Timothy Casey, with the exception of: (1) “any Property forming part of the Deed Fund”, where (a) Property was defined as having the same meaning as in s 9 of the Act (and thus broad enough to include the second plaintiff’s interest in the retention monies and the bank guarantees); and (b) Deed Fund was defined in the DOCA as meaning the fund established under cl 6.1 of the DOCA; and (2) monies in project money accounts or retention money accounts associated with the second plaintiff to which it is not entitled (cl 9 of the DOCA). Thus, the first plaintiffs are responsible for the retention monies and the second plaintiff’s interest in the bank guarantees.

11 Mr Livingstone’s evidence of the matters of particular salience to the present application is, in summary, that:

(1) the second plaintiff holds:

(a) in an account referred to as the NSW Retentions Trust Account the amounts paid to it by various subcontractors as retention monies;

(b) a series of bank guarantees provided with respect to the performance of various subcontractors. The first plaintiffs have prepared a schedule of such guarantees (Bank Guarantees Register). Mr Livingstone’s experience is that such guarantees are usually supported by deposits of cash made by the subcontractors with the banks providing the bank guarantees;

(2) his understanding of the operation of the relevant clauses of the subcontracts is that the second plaintiff is entitled to have recourse to the retention monies or bank guarantees only after it has incurred the costs of remedying defects which the subcontractor has not rectified;

(3) the first plaintiffs are not in a position to identify particular defects or to attribute such defects to particular subcontractors due to the state of the records of the second plaintiff and the costs of overcoming deficiencies in the records of the second plaintiff, which costs would adversely impact any dividend able to be declared for unsecured creditors;

(4) in any event, the second plaintiff is currently not able to rectify any defects given that its HBA licence and DBP registration have been suspended. In order to remedy any identified defects, the first plaintiffs would need to either have the second plaintiff’s HBA licence and DBP registration reinstated or to engage a third-party builder to remedy the defects;

(5) the first plaintiffs’ opinion is that it is not in the interests of creditors for them to incur the costs of identifying particular defects or of remedying such defects. Accordingly, the first plaintiffs do not intend to make a claim to the retention monies or on the bank guarantees;

(6) if the retention monies cannot be administered by the first plaintiffs prior to effectuation of the DOCA then, under cl 9.1(d) of the DOCA, control of the retention monies held at effectuation will revert to the second plaintiff and Mr Casey will be responsible for causing the second plaintiff to comply with all of its obligations regarding the retention monies; and

(7) the first plaintiffs do not intend to defer effectuation of the DOCA.

12 The quandary faced by the first plaintiffs concerning the retention monies may be shortly stated as:

(1) the first plaintiffs have, for the reasons explained above, decided that they will not make any claim on behalf of the second plaintiff over any of the retention monies;

(2) the retention monies do not appear to belong beneficially to the second plaintiff and are thus liable to be the subject of claims for their recovery; and

(3) if the retention monies were to be treated as funds belonging to the second plaintiff, then the potential return to unsecured creditors of the second plaintiff would be higher than if the retention monies were to be returned to the relevant subcontractors and thus, on one view, it is in the interests of the unsecured creditors of the second plaintiff that the second plaintiff retain the retention monies. As Mr Livingstone explains, if the course proposed by the first plaintiffs is adopted, then the ordinary unsecured creditors may receive returns under the DOCA in an amount of between 0.09 and 0.55 cents in the dollar; on the other hand if, the retention monies were to be made available for distribution to ordinary unsecured creditors, then returns under the DOCA may be in the order of 1.97 and 2.5 cents in the dollar.

C. The proposed directions

13 The first plaintiffs propose:

(1) to distribute the funds held in the NSW Retentions Trust Account to each entity identified as a subcontractor in the Amended Retentions Register in payment of that subcontractor’s claim against the second plaintiff for retention monies in the amount stated in the Amended Retentions Register;

(2) if there is a shortfall between an amount held in the NSW Retentions Trust Account and the amount of a claim for retention monies owing to a subcontractor, to pay the shortfall to that subcontractor out of the Deed Fund pari passu together with the ordinary unsecured creditors of the second plaintiff whose claims are admitted to proof under the DOCA;

(3) to pay the claims of subcontractors not identified in the Amended Retentions Register with claims for payment of retention monies against the second plaintiff as an ordinary unsecured creditor claim out of the Deed Fund pari passu with the ordinary unsecured creditors of the second plaintiff whose claims are admitted to proof under the DOCA; and

(4) to return all of the bank guarantees identified in the Bank Guarantees Register to the respective subcontractors identified in that register.

D. Consideration

14 The first plaintiffs, as administrators of the second plaintiff, and as deed administrators of the DOCA, have standing to seek the relief sought: see s 90-20(1)(d) of the IPS(C) and the definition of “officer” in s 9AD(1)(d) and (e) of the Act.

15 As I noted in Banerjee, in the matter of Johnny’s Furniture Group Pty Ltd (in liq) [2024] FCA 838 at [26], the principles relevant to making judicial directions and orders pursuant to s 90-15(1) were summarised by Button J in Morgan, in the matter of Traditional Values Management Limited (in liq) [2024] FCA 74 at [26] to [31], in which her Honour drew from the decisions of Stewart J in Krejci, in the matter of Union Standard International Group Pty Ltd (Administrators Appointed) (No 2) [2020] FCA 1111 at [7] to [11] and Banks-Smith J in Woodhouse (Liquidator), in the matter of Forex Capital Trading Pty Ltd (in liq) [2022] FCA 600 at [51] to [54].

16 Of particular relevance to the present application are the following principles:

(1) the Court’s power to make judicial directions under s 90-15(1) is very broad;

(2) when the Court gives a judicial direction under s 90-15(1), it is not determining the rights of those concerned. Rather the function of such a direction is to confer a level of protection upon the plaintiff or plaintiffs;

(3) whether or not the direction should be given depends on whether there is a reasonable basis for the proposal advanced, sufficient to persuade the Court that it is proper to exonerate the plaintiff or plaintiffs from liability for implementing the proposal or, conversely, whether there is a good reason why the plaintiff should not proceed as proposed;

(4) the Court will not give a direction on a purely commercial decision, but may do so when there is, inter alia, a particular legal issue raised for consideration in respect of which the directions are sought;

(5) the power to make judicial directions under s 90-15(1) should be exercised where it is just and beneficial to do so; and

(6) directions may be given concerning issues arising in the determination of proofs of debt.

17 I am satisfied that the directions sought should be made, for the following reasons.

18 First, the monies provided to the second plaintiff and which form part of the NSW Retention Trust Account were provided to and retained by the second plaintiff so as to allow the second plaintiff to recover amounts owing to it by reason of defaults by subcontractors in work carried out for the second plaintiff.

19 Secondly, no claim will now be made against those funds for various reasons including the view – which appears to be reasonably open – taken by the first plaintiffs that the second plaintiff would need first to incur further costs in addressing the defects; and in circumstances where the second plaintiff lacks the requisite statutory licences and staff to do so and where the incurrence of such costs does not appear to be in the interests of creditors. In this regard, I give weight to the views of the first plaintiffs, as experienced administrators, that the incurrence of such costs would not be in the interests of creditors.

20 Thirdly, the subcontractors who provided the funds now held in the NSW Retentions Trust Account appear to have – in the absence of any claims being made by the second plaintiff – a valid claim to the return of those funds.

21 Fourthly, by reason of the quandary described at [12] above, the first plaintiffs may be exposed to criticism and open to challenge if they deal with the retention monies in the manner proposed, unless the Court makes the directions sought.

22 Fifthly, and as to the bank guarantees, in circumstances where the first plaintiffs do not propose to call on those guarantees, they would be justified in returning them in the manner proposed.

23 Finally: (1) the Australian Securities and Investments Commission (ASIC) was notified of the application, in accordance with r 2.8 of the Federal Court (Corporations) Rules 2000 (Cth); and (2) creditors of the second plaintiff have been notified of the application. Neither ASIC, nor any creditor, has sought to be heard on the application. Further, the proposed ancillary orders allow for any person who can demonstrate sufficient interest to apply to discharge or vary the proposed orders to apply to the Court.

E. Conclusion

24 For the reasons set out above, orders to the effect of those sought by the first plaintiffs should be made. I will make orders accordingly.

I certify that the preceding twenty-four (24) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Goodman. |

Associate:

Dated: 20 June 2025