Federal Court of Australia

One Funds Management Limited, in the matter of One Funds Management Limited (No 2) [2025] FCA 602

File number(s): | NSD 657 of 2025 |

Judgment of: | JACKMAN J |

Date of judgment: | 6 June 2025 |

Catchwords: | CORPORATIONS – creditors’ scheme of arrangement – second court hearing for revised scheme – application for orders under s 411 of the Corporations Act 2001 (Cth) (Act) approving a scheme of arrangement – where scheme is proposed as a means of resolving claims against the company – where resolution was not passed at scheme meeting for first proposed scheme – where the scheme is conditional on releases in favour of third parties – where no provision for separate payment for legal costs, in contrast to first proposed scheme – where orders for convening of the scheme meeting substantially complied with – where suggested that insufficient disclosure of merits of scheme creditors’ claims given – it is not properly the role of the scheme company to provide legal advice to scheme creditors as to merits of claims – where single class of scheme creditors is proposed – where requisite statutory majority of votes by number and value achieved – where suggested that the court does have jurisdiction to approve schemes that extinguish scheme creditors’ claims under Part 5.1 of the Act or extinguish trust property – there is no textual basis for the claim that a scheme cannot include a provision affecting the rights of a creditor against a third party – no material to indicate that any claims are themselves trust property – the scheme should be approved |

Legislation: | Corporations Act 2001 (Cth) Federal Court (Corporations) Rules 2000 (Cth) |

Cases cited: | First Pacific Advisors LLC v Boart Longyear Ltd [2017] NSWCA 116; (2017) 121 ACSR 136 Fowler v Lindholm [2009] FCAFC 125, (2009) 178 FCR 563 In the Matter of Lehman Brothers International (Europe) (in administration) [2009] EWCA Civ 1161 Re BIS Finance Pty Ltd [2018] NSWSC 3 Re One Funds Management Ltd [2023] FCA 1212 Re One Funds Management Ltd [2025] FCA 475 Re Opes Prime Stockbroking Limited [2009] FCA 813; (2009) 179 FCR 20 Re Seven Network Ltd [2010] FCA 400; (2010) 77 ACSR 701 Trust Company (Nominees) Ltd, Re Angas Securities Ltd v Angas Securities Ltd (No 5); [2019] FCA 482; (2019) 135 ACSR 398 Young v Murphy [1996] 1 VR 279 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 46 |

Date of hearing: | 5 June 2025 |

Counsel for Plaintiff | Mr D Thomas SC with Mr H Atken |

Solicitors for Plaintiff | Allens |

Counsel for Interested Parties | Mr N Li and Mr T Hall |

ORDERS

NSD 657 of 2025 | ||

IN THE MATTER OF ONE FUNDS MANAGEMENT LIMITED | ||

ONE FUNDS MANAGEMENT LIMITED (ACN 117 797 403) | ||

Plaintiff | ||

order made by: | JACKMAN J |

DATE OF ORDER: | 6 June 2025 |

THE COURT ORDERS THAT:

1. Pursuant to section 411(4)(b) of the Corporations Act 2001 (Cth) (Act), the scheme of arrangement between the Plaintiff and the Scheme Creditors agreed to by Scheme Creditors at the meeting held on 30 May 2025, the terms of which are set out at Annexure B (Scheme of Arrangement) to the document that is Exhibit MS-3 in the proceeding, is approved.

2. The Plaintiff lodge with the Australian Securities and Investments Commission a copy of the approved scheme of arrangement at the time of lodging a copy of these Orders.

3. Pursuant to section 411(12) of the Act, the Plaintiff be exempted from compliance with section 411(11) of the Act in relation to the Scheme.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

JACKMAN J:

Introduction

1 This is an application by One Funds Management Limited (OFML) pursuant to s 411 of the Corporation Act 2001 (Cth) (Act) for orders approving a proposed scheme of arrangement between itself and a single class of its creditors, being unitholders in four managed investments funds of which OFML is trustee (Scheme Creditors).

2 On 6 May 2025, I made orders for the convening of a meeting (Scheme Meeting) of Scheme Creditors for the purpose of considering and, if thought fit, agreeing to the proposed scheme of arrangement (Scheme), the terms of which are set out at Annexure B to the explanatory statement (Explanatory Statement), and approving the despatch of the Scheme Materials to Scheme Creditors: Re One Funds Management Ltd [2025] FCA 475. In the following reasons, I adopt the definitions used in that judgement unless otherwise stated.

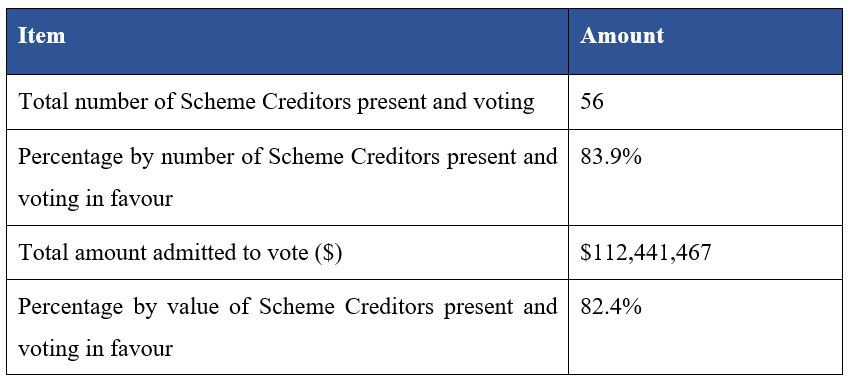

3 The Scheme Meeting was held as an online meeting on 30 May 2025 at 11.00 am (Sydney time). At the Scheme Meeting, Scheme Creditors approved the Scheme by both a majority in number present and voting by more than 75% of the votes cast (Scheme Resolution). Approximately 82.4% by value and 83.9% by number present and voting at the Scheme Meeting voted in favour of the Scheme (of those who voted for and against).

4 Excluding all tagged votes of OFML and other tagged unitholders, 76.4% by value and 80.4% by number present and voting at the Scheme Meeting voted in favour of the Scheme, satisfying the requisite statutory thresholds.

General Principles

5 The general principles which guide the Court's discretion to approve a scheme at the second Court hearing are well established. The Court has a discretion to approve a scheme, and is not bound to approve it merely because it has made orders for the convening of a meeting or because the statutory majorities have been achieved: Re Seven Network Ltd [2010] FCA 400; (2010) 77 ACSR 701 at [31]–[45] (Jacobson J) (Re Seven Network Ltd).

6 The Court will usually approach the task on the basis that creditors are better judges of what is in their own commercial interest than the Court: Re Seven Network Ltd at [32]; Re BIS Finance Pty Ltd [2018] NSWSC 3 at [10] (Black J).

7 The matters the Court must take into account in approving a scheme at the second Court hearing include:

(a) whether the orders of the Court convening the scheme meeting were complied with;

(b) whether the resolution to approve the scheme was passed by the requisite majority and whether other statutory requirements have been satisfied;

(c) whether all conditions to which the scheme is subject (other than Court approval and lodgement of the Court's orders with ASIC) have been met or waived;

(d) whether the scheme is fair and reasonable so that an intelligent and honest member of the relevant class, properly informed and acting alone, might approve it;

(e) whether the proponent has brought to the attention of the Court all matters that could be considered relevant to the exercise of the Court's discretion; and

(f) whether there was full and fair disclosure to creditors of all information material to the decision whether to vote for or against the scheme.

Compliance with the order convening the scheme meeting

8 The Scheme Meeting Materials (as defined in the Orders of 13 May 2025) were despatched on 7 May 2025. That despatch occurred in accordance with the Orders, except for the fact that the Cover Letter was sent by ordinary post rather than by registered post as required by Order 3(a)(ii). Mr Sutherland, a Director of OFML, gives evidence as to the steps he has taken to confirm that the Scheme Meeting Materials did in fact reach the Scheme Creditors.

9 Further steps were taken to ensure that the Scheme Meeting Materials reached the Scheme Creditors, which primarily involved:

(a) Lu Cheng, a consultant lawyer, fluent in Mandarin, engaged by OFML, contacting Scheme Creditors to ensure that the Scheme Meeting Materials could be accessed, and providing assistance with accessing the Scheme Website; and

(b) OFML responding to inbound inquiries regarding accessing the Scheme Website and the relevant forms.

10 Where investors identified difficulties in obtaining access to the Scheme Website, OFML provided those investors with email copies of their proof of debt and the proxy forms.

11 The sending of the Scheme Materials by ordinary post rather than registered post is properly described as a “procedural irregularity” for the purposes of s 1322 of the Act. In light of Mr Sutherland’s evidence, there is no reason to find that the irregularity has caused or may cause substantial injustice for the purposes of s 1322(2) of the Act.

12 The Scheme Meeting was held at the time and place specified in Order 1(a) and Mr Barry Kogan acted as chair of the meeting in accordance with Order 2(a). Mr Kogan’s affidavit of 3 June 2025 addresses two specific matters in relation to the conduct of the meeting:

(a) the late provision of signed proof of debt and proxy forms by one creditor after the conclusion of the meeting (which were not taken into account on the vote for that reason); and

(b) the temporary absence of a proxy from the meeting (who later rejoined the meeting).

13 The below table provides a breakdown of votes:

14 Other statutory requirements have also been satisfied:

(a) on 17 April 2025, ASIC was provided with a copy of the Explanatory Statement, as approved by the Court. ASIC has had a reasonable opportunity to examine the Explanatory Statement and make submissions to the Court in relation to it, as required by s 412(7) of the Act;

(b) no issue arises under s 411(17), given that this is a creditors’ scheme that could not be effected under the provisions of Chapter 6, but in any event, ASIC has written to say that, under s 411(17)(b) it has no objection to the Scheme;

(c) on 28 May 2025, a notice of the second Court hearing was published in The Australian newspaper in accordance with r 3.4 of the Federal Court (Corporations) Rules 2000 (Cth) (Rules); and

(d) on 6 May 2025, the Orders of the Court following the first Court hearing were sealed and lodged with ASIC, as required by r 3.5 of the Rules.

15 Clause 2.2 of the Scheme of Arrangement sets out two conditions subsequent:

(a) on the Effective Date (as defined in the Scheme Terms), the Scheme Administrator must execute the Scheme Creditor Deed Poll of Release and the Scheme Company and certain of its Related Entities must execute the One Group Deed Poll of Release; and

(b) the Scheme Company must do all things reasonably necessary to ensure that the Scheme Company Contribution (as defined in the Scheme Terms) and the Participating Insurer Contribution are paid into the Scheme Fund within 28 days after the later of the Effective Date or receipt of a payment direction.

16 In relation to the condition at clause 2.2(a), unexecuted drafts of these Deeds Polls have been tendered. Mr Kogan's affidavit confirms that, if appointed as Scheme Administrator, he will execute the Scheme Creditor Deed Poll of Release. Mr Sutherland's affidavit confirms that the One Group Deed Poll of Release will be executed.

17 In relation to the condition at clause 2.2(b):

(a) the Scheme Company has obtained contribution commitment deeds executed by the Participating Insurers, requiring them to pay the Participating Insurer Contribution into the Scheme Fund within the requisite timeframe; and

(b) OIG has executed a deed poll confirming its commitment to pay the Scheme Company Contribution into the Scheme Fund within the requisite time frame.

Disclosure to Scheme Creditors

18 The Participating Insurers have agreed to contribute an amount of $9,250,000 to the Scheme Fund in exchange for releases from each of OFML, its Related Entities and Scheme Creditors. The details of the insurer contribution were disclosed to Scheme Creditors prior to the Scheme Meeting (see sections 7.5 and 9.10 of the Explanatory Statement despatched on 7 May 2025). If the Scheme is approved by the Court, the Participating Insurers will have 28 days after the later of the Effective Date of the Scheme or receipt of a payment direction from the Scheme Administrator to pay their contributions into the Scheme Fund.

19 Following the first Court hearing, this Court made orders for OFML to provide Scheme Creditors with Mandarin translations of key sections of the Explanatory Statement and the other materials in full, due to the existence of a substantial number of foreign Scheme Creditors (Order [1(c)]). Those translated materials were made available to Scheme Creditors on the microsite for the Scheme, the link to which was despatched to Scheme Creditors on 7 May 2025.

20 OFML's entitlement to vote its scheme claim in its capacity as trustee for various managed investment Funds and how it intended to treat these votes were disclosed to Scheme Creditors prior to the Scheme Meeting. As foreshadowed, the OFML entities wrote to the beneficiaries of the relevant trusts explaining that they intended to vote their scheme claims in favour of the Scheme, and invited unitholders to provide their views, on 13 May 2025. Mr Sutherland’s affidavit explains the outcome of that consultation process and the process and reasoning behind OFML’s decision to vote in favour of the Scheme.

21 OFML’s votes were “tagged”, as were the votes of (a) unitholders who had entered into a confidential settlement agreement with OFML following Supreme Court of Victoria proceedings S ECI 2021/00105 and S ECI 2021/01578, which required them to vote in favour of the Scheme; and (b) a third-party unitholder to whom OIG Advisory transferred units, those units having been transferred to OIG Advisory in the context of settling Federal Court of Australia proceeding VID509/2020.

22 Disregarding all “tagged” votes, the statutory majorities by number and value were still achieved, with 80.4% by number and 76.4% by value of Scheme Creditors present and voting, having voted in favour of the Scheme.

23 Under the terms of the proposed Scheme, the directors and officers of OFML and its related bodies corporate will receive releases from Scheme Creditors, including in relation to ongoing Proceedings. Several of these directors and officers are named defendants in the Proceedings. These interests were disclosed to Scheme Creditors prior to the Scheme Meeting.

24 It was suggested by senior counsel appearing for three Scheme Creditors at the first Court hearing (to whom I had granted leave to appear as interested parties) (the Hua, Gong and Yang Plaintiffs) that insufficient disclosure has been given of the merits of the claims Scheme Creditors may have as against OFML's Related Entities.

25 Mr Thomas SC, who appeared for the plaintiff, submitted, and I accept, that it is not properly the role of OFML as the Scheme Company to provide legal advice to Scheme Creditors as to the merits of any claims arising as against OFML or its Related Entities. Rather, each Scheme Creditor's decision whether to vote for or against the Scheme will depend on an assessment of the Scheme Creditor's individual circumstances, and is a matter in respect of which Scheme Creditors were in a position to exercise commercial judgment, including by seeking independent professional legal and financial advice before making their decision. OFML was only in a position to give full and frank disclosure as to its own assets and financial position, which it did in the Explanatory Statement.

26 At the second Court hearing, counsel for the Hua, Gong and Yang Plaintiffs submitted that it was misleading or unreasonable for the expected return to creditors on a winding up in insolvency (set out in section 6.2 of Mr Kogan’s Expert Report) to proceed on the basis that there would be no recovery by OFML against any of its related entities. However, there is no evidence before me which establishes anything misleading or unreasonable about that assumption.

Scheme Creditors are a single class

27 At the first Court hearing, it was suggested by senior counsel appearing for the Hua, Gong and Yang Plaintiffs that the unitholders in each of the Funds are in distinct classes. It was submitted that this may require separate meetings to be run, or even separate schemes proposed, for the unitholders in each Fund.

28 The assets remaining in each of the Funds are disclosed in the Explanatory Statement, and the differences between them are primarily attributable to the value of the different investments made by the unitholders in each Fund. Those are not matters which cause the current or prospective rights of those Scheme Creditors to be so dissimilar as to make it impossible for them to consult together with a view to their common interest.

29 Unitholders' rights as beneficiaries to the trust assets available for distribution in each Fund are not disturbed by the Scheme: see cll 10.2 and 10.9 of the Scheme Terms. The fact that some unitholders may have larger claims as against the Scheme Company is addressed by the method of proportionate distribution proposed by the Scheme. The mere fact of proportionate distribution does not require the creation of separate classes.

30 It was also suggested by senior counsel appearing for the Hua, Gong and Yang Plaintiffs that separate classes may exist due to the fact that some unitholders may have stronger claims against the Scheme Company than others. The basis for that submission remains unclear, and was not maintained at the second Court hearing.

31 Funds from the Cornerstone Bond Fund and the Cornerstone New SIV Bond Fund were invested directly into loans to iProsperity Underwriting Pty Ltd. Investments into the JY Hotel Fund and Glen Waverley Fund were used for a property investment, with available funds after the property was sold being invested in the Cornerstone New SIV Bond Fund. Those are matters accounted for in the calculation of the Scheme Claims available to the Scheme Creditors, with the trustee of the JY Hotel Fund and Glen Waverley Fund only claiming in respect of the funds invested in the Cornerstone New SIV Bond Fund.

32 Even if a difference in the quality or strength of the claims could be identified, that difference would not be of a nature to be class-creating. The class test focuses on the effect of any differentiation and adopts a "practical business-like approach": Re Opes Prime Stockbroking Limited [2009] FCA 813; (2009) 179 FCR 20 at [66] (Finkelstein J); First Pacific Advisors LLC v Boart Longyear Ltd [2017] NSWCA 116; (2017) 121 ACSR 136 at [78] (Bathurst CJ, with whom Beazley P and Leeming JA agreed).

33 In circumstances where OFML was the trustee responsible for all of the impugned investments in respect of all of the Funds, the same claims would arise against it in respect of each Fund, regardless of the directness of the relevant transactions. It cannot be said that the legal rights of the Scheme Creditors are so different so as to make it impossible for the Scheme to consider them in one class.

34 There is a question as to priority to the funds remaining available for distribution in the JY Hotel Fund, by reason of an unresolved issue relating to the redemption date of some of the Class C units issued in that Fund. OFML proposes to resolve that issue by treating all Class C units as though they have the same redemption date for the purposes of the Revised Scheme, and to treat the assets in the JY Hotel Fund accordingly, with the Scheme providing a corresponding release. These issues and the proposed approach have been disclosed in section 13 of the Explanatory Statement.

35 Although the Scheme Creditors who have commenced the Proceedings will have incurred more legal costs than those who have not, the Scheme does not provide for any separate payment for legal costs. For the reasons given in my judgment following the first Court hearing (at [42]), this did not require the Scheme Creditors to be divided into separate classes.

Votes of OMFL and related entities

36 As noted above, disregarding the “tagged” votes of OFML and other parties, the requisite statutory majorities by number and value were still achieved, with 80.4% by number and 76.4% by value of Scheme Creditors present and voting, having voted in favour of the Scheme. Accordingly, it is unnecessary to consider whether those unitholders might have voted in a separate class, or their votes should be afforded lesser weight.

Fairness and no oppression

37 It was suggested by senior counsel appearing for the Hua, Gong and Yang Plaintiffs at the first Court hearing that a conflict of interest may arise because the Scheme would operate to release related entities of the Scheme Company, and that the risk of any such conflict has not been cured by judicial advice. That is not a matter which weighs against approval of the Scheme.

38 First, the Scheme is proposed by OFML in respect of claims against it personally, rather than claims against the property of any Fund. The assets which will be contributed to the Scheme Fund are not the assets of any of the Funds. They are to be contributed by the Participating Insurers and by a related entity of OFML. The proposal of the scheme by OFML does not involve any exercise of its rights or powers as trustee of a Fund. In those circumstances, the allegation of conflict of duty and interest is misconceived.

39 Second, and in any event, all the material facts which might be said to give rise to that conflict were disclosed in the Scheme Meeting Materials prior to the Scheme Meeting, at which the requisite majorities nonetheless voted in favour of the Scheme.

40 Third, if the Scheme is approved, Scheme Creditors will retain their units in the relevant Fund(s) and their entitlement according to the terms of the Fund to any distribution that is made from the assets of the Fund: see section 7.7 of the Explanatory Statement.

Jurisdiction

41 It was suggested by senior counsel appearing for the Hua, Gong and Yang Plaintiffs at the first Court hearing that the Scheme is an attempt to extinguish claims by Scheme Creditors against third parties, which may only be effected by clear and unambiguous statutory language, and that such language is not present in Part 5.1 of the Act.

42 This matter was addressed at [20]–[26] of the 2023 Judgment (that is, Re One Funds Management Ltd [2023] FCA 1212). The authorities there referred to remain applicable. As the Full Court recognised in Fowler v Lindholm [2009] FCAFC 125, (2009) 178 FCR 563 at [72]: “[t]here is simply no textual basis for the claim that a scheme cannot include a provision affecting the rights of a creditor against a third party and no basis for a gloss to that effect”. See also Trust Company (Nominees) Ltd, Re Angas Securities Ltd v Angas Securities Ltd (No 5); [2019] FCA 482; (2019) 135 ACSR 398 at [58]–[63] (Beach J).

43 A new argument was raised by the Hua, Gong and Yang Plaintiffs at the second Court hearing, namely that the rights that OFML may have as trustee of the Funds to sue its Related Entities (including directors and officers) for accessorial liability for OFML’s breach of trust is trust property, and s 411 of the Act does not confer power on the Court to extinguish trust property. Reliance was placed on Young v Murphy [1996] 1 VR 279 at 281–2 (Brooking J) and on the decision of the UK Court of Appeal in In the Matter of Lehman Brothers International (Europe) (in administration) [2009] EWCA Civ 1161 at [57]–[67] (Lehman Brothers). It was submitted that s 411 does not purport to authorise the Court to extinguish trust property.

44 The claims which have been made against OFML and its former directors and officers are described in the affidavit of Mr Sutherland of 24 April 2025, which was read at the first Court hearing. Those claims are all personal claims of wrongdoing against OFML. As I have said above, the Scheme is proposed by OFML in respect of claims against it personally, rather than claims against the property of any Fund. There is nothing in the material before me which indicates that any claims which OFML has against the directors and officers are themselves trust property. If any liability on the part of OFML must be met from its own Funds, then any success which OFML has on any corresponding claims against its directors and officers would be to its own benefit.

45 The reasoning in the UK Court of Appeal’s decision in Lehman Brothers is also readily distinguishable. That case concerned a proposed scheme of arrangement to deal with money and other assets which were held on trust by Lehman Brothers for the scheme creditors, and an element of the proposed scheme was that their proprietary rights in assets, held for their benefit by Lehman Brothers as trustee, would be released. The case did not concern personal claims against the trustee based on contract, tort or other wrongdoing. The reasoning of the Court was that the relevant legislation in the UK dealing with schemes of arrangement was not intended to allow creditors to be compelled to give up their entitlement to their own property held by the scheme company on their behalf.

46 Accordingly, the Scheme should be approved and the orders sought by the plaintiff made.

I certify that the preceding forty-six (46) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Jackman. |

Associate:

Dated: 6 June 2025