Federal Court of Australia

Spring (Liquidator), in the matter of Liquor Loot Operations Pty Ltd [2025] FCA 479

File number(s): | NSD 473 of 2025 |

Judgment of: | JACKMAN J |

Date of judgment: | 13 May 2025 |

Catchwords: | BANKRUPTCY AND INSOLVENCY – application for orders and directions to pool assets and liabilities of companies in liquidation – where creditors’ resolution approved the pooling determination – where priority and unsecured creditors stand to benefit from pooling – orders sought by the plaintiffs made |

Legislation: | Corporations Act 2001 (Cth) Insolvency Practice Rules (Corporations) 2016 (Cth) |

Cases cited: | Mentha v GE Capital Ltd (1997) 154 ALR 565 Re Dean-Willcocks; Alpha Telecom (Aust) Pty Ltd (in liq) [2004] NSWSC 738; (2004) 208 ALR 414 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 8 |

Date of hearing: | Determined on the papers |

Solicitors for the Plaintiffs: | PCL Lawyers |

ORDERS

NSD 473 of 2025 | |

IN THE MATTER OF LIQUOR LOOT OPERATIONS PTY LTD | |

ANDREW JOHN SPRING AND TRENT ANDREW DEVINE AS JOINT AND SEVERAL LIQUIDATORS OF LIQUOR LOOT PTY LTD (ACN 611 794 560), LIQUOR LOOT OPERATIONS PTY LTD (ACN 651 392 755) AND LIQUOR LOOT STAFF PTY LTD (ACN 651 393 010) (and others named in the Schedule) First Plaintiff | ||

order made by: | JACKMAN J | |

DATE OF ORDER: | 13 May 2025 | |

THE COURT ORDERS THAT:

1. Pursuant to s 447A of the Corporations Act 2001 (Cth) (Act) the Court directs that the assets and liabilities of Liquor Loot Pty Ltd (ACN 611 794 560) (In Liquidation), Liquor Loot Operations Pty Ltd (ACN 651 392 755) (In Liquidation) and Liquor Loot Staff Pty Ltd (ACN 651 393 010) (In Liquidation) (the Companies) be pooled in accordance with the creditors’ resolution on 18 April 2024 to approve the pooling determination of the Companies, as recommended by the joint and several administrators (the Pooling Determination).

2. Pursuant to s 447A of the Act, and on the facts stated in the supporting affidavit of Andrew John Spring affirmed 31 March 2025, the Court directs that the Pooling Determination for each of:

(a) the Second Plaintiff, Liquor Loot Pty Ltd (ACN 611 794 560) (In Liquidation);

(b) the Third Plaintiff, Liquor Loot Operations Pty Ltd (ACN 651 392 755) (In Liquidation); and

(c) the Fourth Plaintiff, Liquor Loot Staff Pty Ltd (ACN 651 393 010) (In Liquidation);

be ratified by the Court.

3. Pursuant to s 447A of the Act, the recommendation by the Joint and Several Liquidators upon their appointment as Joint and Several Liquidators for the Pooling Determination, be approved by the Court.

4. The Costs of this application be paid out of the assets of the Companies.

5. Liberty is reserved to apply for such further or other orders and directions as may be necessary to implement the terms of these orders.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

JACKMAN J:

1 The four plaintiffs are the joint and several liquidators of three companies, and those three companies themselves, namely Liquor Loot Pty Ltd (in liq) (Liquor Loot), Liquor Loot Operations Pty Ltd (in liq) (LL Operations) and Liquor Loot Staff Pty Ltd (in liq) (LL Staff) (together, the Companies). The plaintiffs seek orders and directions from the Court to pool the assets and liabilities of the Companies pursuant to s 447A of the Corporations Act 2001 (Cth) (the Act), following a creditors’ resolution on 18 April 2024 to approve the pooling determination of the Companies (the Pooling Determination), as recommended by the joint and several administrators. The purpose of the “pooling” arrangement is for the creditors of the Companies to have their claims “pooled” so that, in effect, they are treated as creditors of one entity.

2 The Companies have been in administration since 5 March 2024, when the joint and several administrators were appointed pursuant to s 436A of the Act. Before then, the Companies operated a business of online liquor retail. Liquor Loot acted as the ultimate holding entity and owned all the issued shares of LL Operations and LL Staff, together with the intellectual property and goodwill of the business. LL Operations was the trading entity and LL Staff was the payroll and employing entity.

3 On 11 April 2024, the joint and several administrators issued their Report to Creditors pursuant to Div 75–225 of the Insolvency Practice Rules (Corporations) 2016 (Cth). The administrators expressed the view that the Companies should be wound up and that it was in the interests of the creditors to resolve that the Pooling Determination be made for the following reasons:

(a) the Pooling Determination allows for a just and equitable resolution for the overall benefit of creditors;

(b) an overall cost saving would be provided in the liquidations as a result;

(c) there are uncertainties surrounding ownership of assets and following the sale of business, these would be eliminated, allowing the joint and several liquidators to deal with the allocation of sale proceeds simply and equitably;

(d) any distributions to employees for outstanding entitlements would be maximised;

(e) the intercompany debts would be eliminated, allowing any potential returns to unrelated unsecured creditors to be maximised;

(f) the creditor claims appear to be intermingled, arising from initial agreements having been entered into by Liquor Loot, but which were likely to have been transferred to LL Operations from 1 July 2021, and there was genuine confusion and uncertainty as to whether a number of trade creditors had claims against Liquor Loot or LL Operations;

(g) a claim had been lodged by the Australian Taxation Office which comprised a grouped GST liability; and

(h) a return to all creditors in the pooled group would likely result in a greater dividend to unsecured creditors.

The Report to Creditors explained that the purpose of seeking a pooling determination in this manner was to save the time and cost of convening additional meetings of creditors in the liquidations.

4 Concurrent meetings of the creditors of the three Companies took place on 18 April 2024, and the Pooling Determination was approved. It should be noted that a deed of company arrangement was not proposed.

5 There is ample authority for the proposition that the power of the Court under s 447A of the Act, to make such order as it thinks appropriate about how Pt 5.3A is to operate in relation to a particular company, is available to order in relation to a group of companies under administration the pooling of assets and liabilities of the group of companies: see Mentha v GE Capital Ltd (1997) 154 ALR 565 at 571 (Finkelstein J); Re Dean-Willcocks; Alpha Telecom (Aust) Pty Ltd (in liq) [2004] NSWSC 738; (2004) 208 ALR 414 at [23] (Barrett J). Those decisions pre-dated the introduction of Div 8 of Pt 5.6 concerning pooling determinations and orders, but I cannot see any reason why s 447A is not still available in appropriate circumstances to effect the pooling of assets and liabilities of several companies in a group.

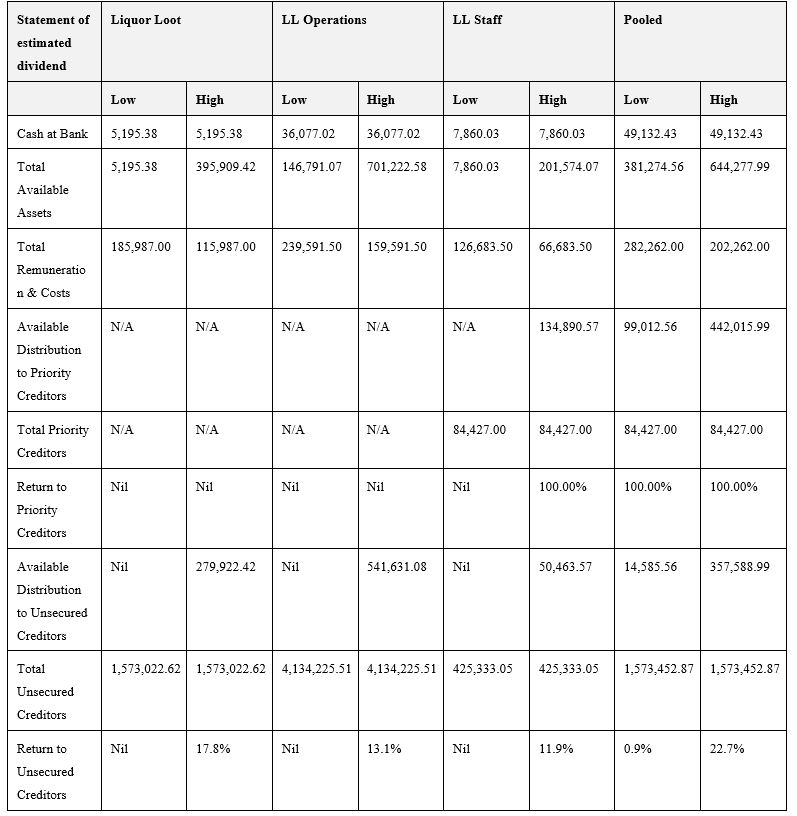

6 The likely impact of pooling on creditor returns in the present case is set out in a table in the supporting affidavit of Mr Spring at [56], which shows the following:

7 That table shows that the priority and unsecured creditors of the companies stand to benefit from pooling. As to priority creditors, in a pooled scenario, the priority creditors are expected to receive a return of approximately $84,427 on both the high and low estimate, whereas in a non-pooled scenario, LL Staff will receive a return of $84,427 on the high estimate and nil on the low estimate (and there are no known priority creditors in Liquor Loot and LL Operations). As to the position of unsecured creditors, the projected return to pooled creditors is $357,588.99 (being 22.7% of total unsecured creditors’ claims) on the high estimate, or $14,585.56 (or 0.9% of the total unsecured creditors’ claims) on the low estimate. In a non-pooled scenario, non-pooled unsecured creditors will not receive any return on the low estimate, while the returns on a high estimate would still be less than in a pooled scenario.

8 In my view, the case is plainly one where pooling is appropriate. It does not appear that any creditor opposes pooling, or that pooling will give rise to any material detriment to any creditor. Accordingly, I make the orders sought by the plaintiffs.

I certify that the preceding eight (8) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Jackman. |

Associate:

Dated: 13 May 2025

SCHEDULE OF PARTIES

NSD 473 of 2025 | |

Plaintiffs | |

Second Plaintiff: | LIQUOR LOOT PTY LTD (ACN 611 794 560) (IN LIQUIDATION) |

Third Plaintiff: | LIQUOR LOOT OPERATIONS PTY LTD (ACN 651 392 755) (IN LIQUIDATION) |

Fourth Plaintiff: | LIQUOR LOOT STAFF PTY LTD (ACN 651 393 010) (IN LIQUIDATION) |