FEDERAL COURT OF AUSTRALIA

PointsBet Holdings Limited, in the matter of PointsBet Holdings Limited [2025] FCA 463

File number(s): | VID 463 of 2025 |

Judgment of: | BENNETT J |

Date of judgment: | 8 May 2025 |

Date of publication of reasons: | 9 May 2025 |

Catchwords: | CORPORATIONS – members’ scheme of arrangement – first court hearing – application for orders under s 411(1) of the Corporations Act 2001 (Cth) to convene a meeting of members of the plaintiff – whether statutory prerequisites satisfied – whether the Court’s discretion should be exercised to convene the meeting – held: orders made to convene a meeting of members of the plaintiff. |

Legislation: | Corporations Act 2001 (Cth) Federal Court (Corporations) Rules 2000 (Cth) Corporations Regulations 2001 (Cth) |

Cases cited: | Australian Securities Commission v Marlborough Gold Mines Ltd (1993) 177 CLR 485 Crown Resorts Ltd, in the matter of Crown Resorts Ltd [2022] FCA 367 CW Group Holdings Limited [2024] FCA 1471 FT Eastment & Sons Pty Ltd v Metal Roof Decking Supplies Pty Ltd (1977) 3 ACLR 69 Re ACM Gold Ltd (1992) 34 FCR 530 Re Amcor Ltd [2019] FCA 346 Re Citadel Group Ltd [2020] FCA 1580; 148 ACSR 598 Re DWS Limited [2020] FCA 1590; 148 ACSR 616 Re Foundation Healthcare Ltd [2002] FCA 742; 42 ACSR 252 Re Healthscope Ltd [2019] FCA 542; 139 ACSR 608 Re ISPT Pty Ltd [2024] FCA 1305 Re Japara Healthcare Limited [2021] FCA 1150; 156 ACSR 695 Re Newcrest Mining Ltd [2023] FCA 1080 Re NRMA Insurance Ltd (No 1) [2000] NSWSC 82; 156 FLR 349 Re Opes Prime Stockbroking Ltd [2009] FCA 813; 179 FCR 20 Re PM Capital Asian Opportunities Fund Limited [2021] FCA 1380 Re Rex Minerals Ltd [2024] FCA 1051 Re Security Matters Ltd [2023] FCA 19 Re Selfwealth Ltd [2025] FCA 214 Re Tatts Group Limited [2017] VSC 552 Re RXP Services Ltd [2021] FCA 38 Technology Metals Australia Ltd v Australian Vanadium Ltd [2024] WASC 26 |

Division: | General Division |

Registry: | Victoria |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 48 |

Date of last submission/s: | 7 May 2025 |

Date of hearing: | 8 May 2025 |

Counsel for the Plaintiff: | B K Holmes |

Solicitors for the Plaintiff: | Baker McKenzie |

Counsel for Mixi Australia Pty Ltd: | G Ahern |

Solicitors for Mixi Australia Pty Ltd: | Clayton Utz |

ORDERS

VID 463 of 2025 | ||

IN THE MATTER OF POINTSBET HOLDINGS LIMITED | ||

POINTSBET HOLDINGS LIMITED Plaintiff | ||

order made by: | BENNETT J |

DATE OF ORDER: | 8 May 2025 |

THE COURT NOTES THAT:

1. The Australian Securities and Investments Commission (ASIC) was provided with at least 14 days’ notice of the hearing of this application.

2. The Court is satisfied that ASIC has had a reasonable opportunity to:

(a) examine the terms of the proposed scheme of arrangement to which the application relates (Scheme) and a draft explanatory statement relating to that Scheme; and

(b) make submissions to the Court in relation to the Scheme and the draft explanatory statement.

3. The Court notes the letter from ASIC to the directors of the Plaintiff (PointsBet) dated 7 May 2025 tendered at the hearing.

THE COURT ORDERS THAT:

1. Pursuant to subs 411(1) and s 1319 of the Corporations Act 2001 (Cth) (Act), PointsBet convene and hold a meeting (Scheme Meeting) of its members holding fully paid ordinary shares (other than any “Excluded Shareholders” as defined in the Scheme) (PointsBet Shareholders):

(a) for the purpose of considering and, if thought fit, agreeing (with or without modification) to the proposed Scheme between PointsBet and PointsBet Shareholders, the terms of which are set out in Annexure A to these orders;

(b) to be held on 12 June 2025 commencing at 9.00 am (Melbourne time) at the Melbourne offices of Baker McKenzie at Level 19, 181 William Street, Melbourne, Victoria and virtually via an online platform.

2. Pursuant to subs 411(1) and s 1319 of the Act, the Scheme Meeting be convened by sending on or before 13 May 2025 to each PointsBet Shareholder:

(a) in the case of shareholders who have provided PointsBet with an email address and have elected to receive communications in relation to company meetings electronically (Email Shareholders), an email substantially in the form of the template email at pages 351 to 355 of Annexure SJS-1 to the affidavit of Samuel John Swanell affirmed on 6 May 2025 (Swanell Affidavit) which contains hyperlinks to an online portal or website from which the Email Shareholder may:

(i) access and download an electronic copy of a document substantially in the form which appears at pages 28 to 223 of Annexure SJS-1 to the Swanell Affidavit (including the annexures to that document) (Scheme Booklet);

(ii) lodge an online electronic voting form containing a proxy appointment and voting preference; and

(iii) access an online platform to listen to and participate in the Scheme Meeting;

(b) in the case of shareholders who have nominated a physical address for the purpose of receiving communications in relation to company meetings or who have otherwise elected to receive communications in relation to company meetings by post (Hard Copy Shareholders), the following documents in hard copy:

(i) the Scheme Booklet;

(ii) a personalised proxy form (Proxy Form); and

(iii) a business reply-paid envelope for the return of completed Proxy Forms;

(c) in the case of shareholders who are not Email Shareholders or Hard Copy Shareholders (No Election Shareholders), the following documents in hard copy:

(i) a letter substantially in the form which appears at page 348 to 350 of Annexure SJS-1 to the Swanell Affidavit which contains the URL address of websites from which the No Election Shareholder may:

A. access and download an electronic copy of the Scheme Booklet; and

B. lodge an online electronic voting form containing a proxy appointment and voting preference; and

C. access an online platform to listen to and participate in the Scheme Meeting;

(ii) a Proxy Form;

(iii) a business reply-paid envelope for the return of completed Proxy Forms.

3. If it comes to the attention of PointsBet that any email dispatched to Email Shareholders in accordance with order 2(a) above has returned an undeliverable or undelivered receipt for an Email Shareholder’s nominated email address, PointsBet is to dispatch to that Email Shareholder within a reasonable time thereafter the hard copy letter referred to in order 2(c) above.

4. The documents referred to in orders 2(b) and 2(c) be sent:

(a) in the case of PointsBet Shareholders whose registered address is within Australia, by prepaid ordinary post addressed to the relevant addresses recorded in PointsBet’s share register; and

(b) in the case of PointsBet Shareholders whose registered address is outside Australia, by airmail or international courier service addressed to the relevant addresses recorded in PointsBet’s share register.

5. A proxy in respect of the Scheme Meeting will be valid and effective if, and only if, a Proxy Form is completed and delivered in accordance with its terms or a proxy is lodged online in accordance with the instructions on the website referred to in orders 2(a) and (c) and received by PointsBet by 9.00 am (Melbourne time) on 10 June 2025.

6. Brett Paton or, failing him, Peter McCluskey, be chairperson of the Scheme Meeting.

7. Voting on the resolution to agree to the Scheme is to be conducted by way of a poll.

8. PointsBet Shareholders whose names are recorded in the register of members of PointsBet at 7.00 pm (Melbourne time) on 10 June 2025 will be eligible to vote at the Scheme Meeting.

9. The chairperson of the Scheme Meeting shall have the power to adjourn the Scheme Meeting to such time, date and place as he considers appropriate in accordance with its Constitution and, in that event, notwithstanding any other part of these orders:

(a) only PointsBet Shareholders whose names are recorded in the register of members of PointsBet at 7.00 pm (Melbourne time) on the date that is two calendar days before the date that the adjourned meeting resumes will be eligible to vote at the Scheme Meeting; and

(b) a reference in these orders to the Scheme Meeting is taken to include a reference to the adjourned meeting.

10. PointsBet shall have power to postpone the Scheme Meeting to such time, date and place as it considers appropriate in accordance with its Constitution and, in that event, notwithstanding any other part of these orders:

(a) only PointsBet Shareholders whose names are recorded in the register of members of PointsBet at 7.00 pm (Melbourne time) on the date that is two calendar days before the date of the postponed meeting will be eligible to vote at the Scheme Meeting;

(b) a proxy in respect of the Scheme Meeting will be valid and effective if, and only if, a Proxy Form is completed and delivered in accordance with its terms or a proxy is lodged online in accordance with the instructions on the website referred to in orders 2(a) and (c) and received by PointsBet at least 48 hours before the time scheduled for the commencement of the postponed Scheme Meeting; and

(c) a reference in these orders to the Scheme Meeting is taken to include a reference to the postponed meeting.

11. Pursuant to r 1.3 of the Federal Court (Corporations) Rules 2000 (Cth), compliance with rr 2.4(1), 2.15, 3.4 and Form 6 is dispensed with.

12. PointsBet is to publish an announcement via the ASX Market Announcements Platform substantially in the form which appears at pages 360 to 361 of Annexure SJS-1 to the Swanell Affidavit which sets out the details for the hearing of any application to approve the Scheme and the process for any person wishing to appear at that hearing to oppose the approval of the Scheme.

13. The notice referred to in order 12 must be published at least 5 days before the date of the hearing of any application to approve the Scheme.

14. The further hearing of the Originating Process is adjourned to the Honourable Justice Bennett at 10.15 am (Melbourne time) on 13 June 2025 (or as soon thereafter as the business of the Court allows) for the hearing of any application to approve the Scheme.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

Scheme

[The Order entered is available on the Commonwealth Courts Portal, which attaches the Scheme.]

REASONS FOR JUDGMENT

BENNETT J

1 This is an application made under ss 411 and 1319 of the Corporations Act 2001 (Cth) (the Act) seeking orders and directions in relation to a scheme of arrangement proposed by PointsBet Holdings Ltd (ACN 621 179 351) (PointsBet or the Plaintiff) to effect the acquisition of all of PointsBet’s shares by Mixi Australia Pty Ltd (Mixi) in return for a cash payment of $1.06 per share. At this stage PointsBet seeks orders under s 411(1) of the Act to convene a meeting of its members to consider the proposed scheme of arrangement (the Scheme).

2 The purpose of the proposed scheme meeting is for members of PointsBet to consider and, if thought appropriate, agree (with or without modification) to the Scheme. I made orders at the conclusion of the hearing on 8 May 2025. I now set out my reasons for making those orders. In doing so, I have adopted the structure of the submissions of the Plaintiff.

3 The commercial purpose of the Scheme is to effect the acquisition of all of PointsBet’s shares by Mixi. The application is supported by the following material:

(1) the affidavit of Lance Brett Sacks affirmed on 14 April 2025 (First Sacks Affidavit). Mr Sacks is a partner at Baker McKenzie, the solicitors for PointsBet. His affidavit describes the proposed Scheme in general terms, and annexes a copy of a company extract for PointsBet obtained from ASIC on 7 April 2025, a copy of PointsBet’s Constitution, and copy of the ASX announcement dated 26 February 2025 in relation to the Scheme Implementation Deed (SID) (which attaches a copy of the SID, the proposed Scheme and the proposed deed poll);

(2) the affidavit of Samuel John Swanell affirmed on 6 May 2025 (Swanell Affidavit). Mr Swanell is the Chief Executive Officer and Managing Director of PointsBet. The Swanell Affidavit gives evidence about the business and capital structure of PointsBet, and provides an overview of the main features of the Scheme and the SID. The Swanell Affidavit also sets out the interests of PointsBet directors in the Scheme, and refers to the unanimous recommendation of directors that PointsBet Shareholders vote in favour of the Scheme. The Swanell Affidavit also addresses:

(a) various matters in relation to the draft scheme booklet (Scheme Booklet) (including verification) and the proposed meeting of shareholders (Scheme Meeting) (including the prescribed matters relating to the proposed chairperson of the Scheme Meeting); and

(b) provides an overview of the proposed communications with PointsBet shareholders, and addresses the proposal to publish notice of the second Court hearing on the ASX announcements platform; and

(3) the affidavit of Sho Okuyama affirmed on 7 May 2025 (Okuyama Affidavit). Mr Okuyama is a director of Mixi, and his affidavit describes the verification of the “Mixi Information” in the Scheme Booklet, the funding of the Scheme Consideration, and annexes an executed copy of a deed poll executed by Mixi and Mixi, Inc, in favour of each person registered as a holder of fully paid ordinary shares in PointsBet in the PointsBet Share Register as at a particular date.

BACKGROUND

4 PointsBet is an Australian public company limited by shares. It is listed on the Australian Securities Exchange (ASX). It operates as an online corporate bookmaker, offering betting products and services directed to clients in Australia and Ontario, Canada. It offers four types of betting products, which have been described in the evidence as:

(1) Fixed Odds Racing;

(2) Fixed Odds Sports;

(3) PointsBetting; and

(4) iGaming (online casino).

5 PointsBet holds an Australian Sports Bookmaker Licence issued by the Northern Territory Racing Commission.

6 Mixi is an Australian proprietary company limited by shares. Mixi is a wholly-owned subsidiary of Mixi, Inc, a corporation incorporated in Japan, and listed on the prime market of the Tokyo Stock Exchange. Mixi, Inc is a consumer technology company, with its principal business activities including the development and operation of mobile games, communication services, publicly managed sports betting services and management of professional sports teams in Japan. According to the Scheme Booklet, it has a market capitalisation of approximately AUD2.48 billion (Scheme Booklet at section 6.2(a)(1)).

7 Mixi was incorporated for the purpose of acquiring the shares in PointsBet pursuant to the Scheme (Scheme Booklet at section 6.1(b)).

THE SCHEME

8 The terms of the proposed Scheme are in Schedule 3 to the Scheme Booklet. A copy of the Scheme is annexed to the Court’s orders.

9 If the Scheme is implemented, then:

(1) each person registered as a holder of a PointsBet share on the Scheme Record date (other than “Excluded Shareholders”) (the Scheme Shareholders) will receive $1.06 for each PointsBet share held by the Scheme Shareholder (Scheme Share);

(2) in exchange for receiving $1.06 for each Scheme Share (the Scheme Consideration) the Scheme Shareholders will transfer all of the Scheme Shares to Mixi;

(3) PointsBet will become a wholly-owned subsidiary of Mixi, and PointsBet will apply to the ASX for termination of the official quotation of PointsBet shares on the ASX and for PointsBet to be removed from the official list of the ASX; and

(4) the consideration for the purchase of the Scheme Shares will be paid wholly in cash and will be funded from Mixi, Inc’s cash reserves (Scheme Booklet at section 6.5; Okuyama Affidavit at [11]).

10 The Scheme defines “Excluded Shareholder” as a PointsBet shareholder who is Mixi, or a Related Body Corporate of Mixi.

11 The directors of PointsBet appointed Grant Samuel & Associates Pty Ltd as an independent expert (the Independent Expert) to prepare an independent expert report in relation the Scheme. A draft of that report has been provided (the Draft Independent Expert Report). The Draft Independent Expert Report provides in summary that:

(1) The value of a PointsBet share is between $0.96 to $1.11, assuming that 100% of the company was available to be acquired and including a premium for control.

(2) The Scheme Consideration of $1.06 per share falls within the value range of $0.96 to $1.11 per PointsBet share, so that the Scheme is fair and, as such, is also reasonable and in the best interests of PointsBet shareholders, in the absence of a superior alternative proposal emerging.

12 A copy of the draft Scheme Booklet was first lodged with ASIC on 17 April 2025. Amendments were made in response to multiple rounds of comments from ASIC. The final amended draft Scheme Booklet (including its annexures) was provided to ASIC on 6 May 2025.

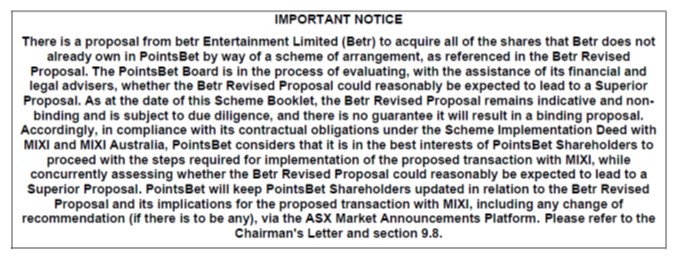

13 In this instance, there is a potential alternative proposal from Betr Entertainment Limited (Betr) to acquire all of the shares that Betr does not already own in PointsBet by way of a scheme of arrangement. The Betr proposal is referred to in the Scheme Booklet. In particular:

(1) On 18 February 2025, PointsBet received a confidential, non-binding, indicative proposal from Betr.

(2) The PointsBet Board considered the Betr proposal of 18 February 2025. It concluded that the Betr proposal could not reasonably be expected to lead to a superior proposal (as defined in the SID).

(3) On 29 April 2025, PointsBet received a further confidential, non-binding, indicative proposal from Betr, details of which were announced by Betr on 29 April 2025 (the Betr Revised Proposal). Betr also announced that it had acquired 19.9% of the shares in PointsBet and intends to vote all of its shares against the Scheme.

(4) The PointsBet board is in the process of evaluating whether the Betr Revised Proposal could reasonably be expected to lead to a superior proposal (which would trigger the matching right provisions in the SID, and require PointsBet to provide Mixi with an opportunity to provide a matching or superior proposal). PointsBet submits that it has sought clarification from Betr, but that the revised proposal remains indicative and non-binding and subject to due diligence. It submits that there is no guarantee it will result in a binding proposal.

(5) PointsBet considers that it is in the best interests of PointsBet Shareholders to proceed with the steps required for implementation of the proposed transaction with Mixi, while concurrently assessing whether the Betr Revised Proposal could reasonably be expected to lead to a superior proposal.

14 In that situation, PointsBet submits that it is appropriate to proceed with the first Court hearing under s 411 of the Act to enable PointsBet Shareholders to have the benefit of a detailed description of the Scheme, and its advantages and disadvantages as well as a detailed assessment of the Scheme by the Independent Expert.

APPLICABLE PRINCIPLES

15 The applicable principles have been set out in numerous cases (see for example Re Selfwealth Ltd [2025] FCA 214 (Selfwealth); CW Group Holdings Limited [2024] FCA 1471 (CW Group Holdings); Re ISPT Pty Ltd [2024] FCA 1305). They are conveniently summarised in the judgment of O’Bryan J in Selfwealth where his Honour said (at [20]-[26]):

Part 5.1 of the Act provides a procedure whereby an arrangement between a company and its members can be made binding on all members. Section 411 is the principal provision. The procedure involves three main steps:

(a) an application to the Court for an order to convene a scheme meeting (s 411(1));

(b) if such an order is made, the convening of such a meeting at which a resolution to agree to the scheme is considered (s 411(4)(a)); and

(c) if the resolution is passed by the necessary majorities, an application to the Court for an order approving the scheme (ss 411(4)(b) and 411(6)).

The present application concerns the first stage, being an application to the Court for an order to convene the Scheme Meeting. Section 411 of the Act confers a discretion on the Court to make an order convening the Scheme Meeting if certain statutory conditions are met, namely:

(a) an arrangement is proposed between a Pt 5.1 body and its members (or any class of them (s 411(1));

(b) an application for the order is made in a summary way by that body (s 411(1));

(c) 14 days’ notice of the hearing of the application has been given to ASIC (or such lesser period as the Court or ASIC permits) (s 411(2)(a)); and

(d) the Court is satisfied that ASIC has had a reasonable opportunity to:

(i) examine the terms of the proposed arrangement to which the application relates and a draft explanatory statement relating to the proposed arrangement; and

(ii) make submissions to the Court in relation to the proposed arrangement and the draft explanatory statement required by s 412 (ss 411(2)(b) and 411(3)).

In addition to these requirements of s 411, the procedure is regulated by s 412 of the Act and reg 5.1.01 and Sch 8 to the Corporations Regulations 2001 (Cth) (Regulations), and by the Federal Court (Corporations) Rules 2000 (Cth) (Rules). The Regulations and the Rules prescribe certain information which is required to be sent to the members about the Scheme.

The principles which apply to the exercise of the Court’s discretion at this first stage are well-known. In Re Amcor Ltd [2019] FCA 346 (Amcor), Beach J described the Court’s role at the first court hearing as follows (at [47], emphasis in original):

My function on an application to order the convening of a meeting is supervisory. At this stage I should generally confine myself to ensuring that certain procedural and substantive requirements have been met including dealing with adequate disclosure, with limited consideration of issues of fairness. But having said that, it is appropriate to consider the merits or fairness of a proposed scheme at the convening hearing if the issue is such as would unquestionably lead to a refusal to approve a proposed scheme at the approval hearing, that is, the proposed scheme appears now to be on its face “so blatantly unfair or otherwise inappropriate that it should be stopped in its tracks before going any further” (Re Foundation Healthcare Ltd (2002) 42 ACSR 252 at [44] per French J).

It is not the Court’s role to usurp the shareholders’ decision whether to agree to a scheme. The question whether or not to accept particular consideration for shares is quintessentially a commercial matter for the members to assess, and they ought not be prevented from having the opportunity to do so, provided that the Court can be satisfied that they are acting on sufficient information and with time to consider what they are voting on: Crown Resorts Ltd, in the matter of Crown Resorts Ltd [2022] FCA 367 at [27], citing Amcor at [50] and Re ACM Gold Ltd (1992) 34 FCR 530 at 534.

Therefore, if the arrangement is one that seems fit for consideration by the meeting of members, and is a commercial proposition likely to gain the Court’s approval if passed by the necessary majorities, then orders should be made to convene the meeting: Re Foundation Healthcare Ltd [2002] FCA 742; 42 ACSR 252 (Foundation Healthcare) at [36].

In summary, the Court’s task at the first court hearing is to assess first, whether the statutory prerequisites to the making of orders convening a meeting have been met and second, whether it is appropriate for the Court to exercise its discretion in favour of making those orders. Each of those matters is considered in turn.

16 I turn now to apply the criteria.

THE STATUTORY PRECONDITIONS

17 Section 411(1) requires that the plaintiff has made an application in relation to a compromise or arrangement that is proposed between a Part 5.1 body and its members. PointsBet has satisfied these requirements in the present case because:

(1) the present application was made by originating process filed on 14 April 2025;

(2) a ‘Part 5.1 body’ is defined in s 9 to include a company registered under the Act, which PointsBet is; and

(3) the proposed Scheme is an ‘arrangement’ within the meaning of s 411(1) (see Re Foundation Healthcare Ltd [2002] FCA 742; 42 ACSR 252 (Foundation Healthcare) at [39] (French J). See also Re Security Matters Ltd [2023] FCA 19 at [35(a)] (Anderson J) and Re Japara Healthcare Limited [2021] FCA 1150; 156 ACSR 695 (Japara) at [30] (Moshinsky J)).

18 Section 411(2)(a) requires that 14 days’ notice of the hearing of this application must be given to ASIC, or such lesser period of notice as the Court or ASIC permits. The Swanell Affidavit states that (at [98]-[99]):

I am informed by Ms Helen Joyce, partner of Baker McKenzie, that on 16 April 2025 ASIC was formally notified that PointsBet's application for orders that it convene the Scheme Meeting will be heard on 8 May 2025.

This notice was given by uploading the Originating Application, the First Sacks Affidavit and notification of the first Court hearing date through the ASIC online portal and ASIC acknowledged receipt of those documents by email on the next day.

19 Accordingly, this requirement has been satisfied.

20 Section 411(2)(b) requires that ASIC be given a reasonable opportunity to examine the terms of the proposed Scheme and the draft explanatory statement, and to make submissions to the Court.

21 On 7 May 2025, ASIC provided a letter to the Directors of PointsBet that was tendered to the Court. It noted that:

Section 411(2)(b) of the Corporations Act requires the court to be satisfied that ASIC has also had a reasonable opportunity to examine the terms of the scheme and the draft explanatory statement, and to make submissions to the court in relation to the Scheme and the draft explanatory statement. ASIC is of the view that it has had a reasonable opportunity.

…

ASIC does not currently propose to appear to make submissions or intervene to oppose the Scheme at the first court hearing under s 411(1) of the Corporations Act.

22 The requirement in s 411(2)(b) has therefore been satisfied.

23 The Plaintiff seeks to be relieved of the obligation in Rule 2.4(1) of the Federal Court (Corporations) Rules 2000 (Cth) (the Rules). Such dispensation is generally available where the matters required will be addressed by subsequent evidence, such that it is ordinarily sufficient for the affidavit to briefly identify the nature of the Scheme, key dates, and annex a company search (CW Group Holdings at [29], citing the Court’s Schemes of Arrangement Practice Note (GPN-SOA) (the Practice Note)). In this instance, the First Sacks Affidavit (which was filed with the Originating Process) has been prepared in accordance with the Practice Note. The First Sacks Affidavit also includes:

(1) an ASIC company extract in relation to PointsBet obtained on 7 April 2025 (being no earlier than 7 days before the originating process was filed on 14 April 2025); and

(2) the necessary evidence about the willingness of the proposed chairperson and alternate chairperson to chair the Scheme Meeting. It also includes evidence of any prior dealings of those persons with PointsBet and any conflict of interest. This satisfies rules 3.2(a) and (b) of the Rules.

24 As required by r 3.3(1) of the Rules, the orders will annex a copy of the Scheme.

25 It is necessary to consider the information to be provided to members for the purposes of their consideration of the Scheme as required by s 412 of the Act, reg 5.1.01 and Schedule 8 of the Corporations Regulations 2001 (Cth) (the Regulations). In particular, s 412(1) of the Act and Part 3 of Schedule 8 of the Regulations set out the disclosure requirements. There are three aspects to the requirements of s 412(1):

(1) first, the explanatory statement must explain the effect of the compromise or arrangement, and in particular state any material interest of the directors, and the effect on those interests of the compromise or arrangement so far as it is different from the effect on the like interests of other persons. The effect of the Scheme is addressed in various parts of the material filed in this proceeding, including in sections 4 and 9 of the Scheme Booklet;

(2) second, the explanatory statement must set out the prescribed information, being the information set out in reg 5.1.01 and Schedule 8 of the Regulations. A table setting out the information required by s 412(1) has been included in the Scheme Booklet, and this table includes the information required by reg 5.1.01 and Schedule 8 of the Regulations, and the table identifies where the required information is contained in the Scheme Booklet.

(3) third, the explanatory statement must set out any other information that is material to the making of a decision whether or not to agree to the compromise or arrangement. In this respect, it is submitted, and I accept, that the Scheme Booklet is clear and comprehensive, and along with the Independent Expert Report annexed to the Scheme Booklet, which contains a detailed evaluation of the Scheme, presented in a way that enables PointsBet shareholders to form their own view of the merits of the Scheme.

26 In addition, each of PointsBet and Mixi have adduced evidence concerning the verification, by each company, of the information contained in the Scheme Booklet.

27 It is necessary for the Scheme Booklet to be registered by ASIC before being sent to shareholders: s 412(6). Before registering the statement, ASIC must conclude that it appears to comply with the requirements of the Act, and form the opinion that the Scheme Booklet does not contain any matter that is false in a material particular, or materially misleading in the form and context where it appears.

28 Finally, the notice required by paragraph 6 of the Practice Note is included in the “Important Notices” section on the first page of the Scheme Booklet, highlighting that ordering a meeting be convened does not mean that the Court has formed any view as to the merits of the proposed Scheme, or has prepared or is responsible for the content of the explanatory statement.

29 In light of the above analysis, I am satisfied that the procedural requirements have been met. It follows that the Court’s discretion to make the convening orders is enlivened.

Discretion

30 The relevant discretionary consideration involves two main questions (see Re PM Capital Asian Opportunities Fund Limited [2021] FCA 1380 (PM Capital) at [43] (Beach J); Re Rex Minerals Ltd [2024] FCA 1051 (Rex Minerals) at [35] (O’Bryan J); CW Group Holdings at [38] (Moshinsky J); Selfwealth at [34] (O’Bryan J)):

(1) first, whether the Scheme is fit for consideration by the members (in this regard see for example FT Eastment & Sons Pty Ltd v Metal Roof Decking Supplies Pty Ltd (1977) 3 ACLR 69 at 72 (Street CJ); Australian Securities Commission v Marlborough Gold Mines Ltd (1993) 177 CLR 485 at 504 (Mason CJ, Brennan, Dawson, Toohey and Gaudron JJ)); and

(2) second, whether the members are to be properly informed as to the nature of the Scheme (see Re NRMA Insurance Ltd (No 1) [2000] NSWSC 82; 156 FLR 349 at [30] (Santow J); Foundation Healthcare at [38] (French J)).

Is the Scheme fit for consideration by members?

31 PointsBet argues that the Scheme is fit for consideration by shareholders because:

(1) the Scheme is of such a nature and cast in such terms that, if agreed to at the Scheme Meeting, the Court would be likely to approve the Scheme at the second court hearing;

(2) there is no issue arising from the Scheme which would unquestionably lead to a refusal by the Court to approve the Scheme at the second court hearing; and

(3) it cannot be said that the Scheme is on its face “so blatantly unfair or otherwise inappropriate that it should be stopped in its tracks before going any further” (Foundation Healthcare at [44] (French J)).

32 I have reviewed the terms of the scheme to satisfy myself that it is of such a nature and cast in such terms that the Court would be likely to approve it, if it were agreed to by the requisite majority. In doing so, I have considered the terms of the Agreement between the company and the acquirer to implement the scheme (Rex Minerals at [37]).

33 Overall I am satisfied based on that review that the scheme is fit for consideration by members. In reaching that conclusion, I have had regard to a range of factors, including:

(1) Performance Risk: I note that while the Scheme requires Mixi to provide the Scheme Consideration, Mixi is not a party to the Scheme, and so is not directly bound to it. Courts have often addressed this concept of “performance risk” (see Selfwealth at [39]; Rex Minerals at [42]). In responding to this recognised performance risk a number of safeguards have been adopted, including:

(a) the Scheme provides that the transfer of Scheme Shares takes place after the Scheme Consideration has been provided (the Scheme, cl 5). The avoids any risk that shareholders will be required to transfer shares without consideration;

(b) Mixi was required to enter into a deed poll in favour of Scheme Shareholders, which binds Mixi to perform the actions attributed to it under the Scheme.

Taken together, I am content that these steps obviate any performance risk.

(2) Break Fee and Exclusivity: the SID includes customary break fee and exclusivity provisions on terms which accord with the principles set out in the authorities (Japara at [50] and the authorities set out therein). The break free represents 1% of the equity value of PointsBet, and is not framed to coerce shareholders into agreeing to the Scheme. It is not payable by reason of PointsBet shareholders failing to approve the Scheme. The exclusivity period of 12 months is reasonable in the circumstances, noting the possibility of regulatory delays (see for example Re Tatts Group Limited [2017] VSC 552, where an exclusivity period of 14 months was held to be reasonable, including because of potential delays with respect to obtaining the regulatory approvals required for implementation of the Scheme: see [36]-[39] (Sifris J)).

(3) Options and Performance Share Rights: PointsBet had 933,334 options on issue. It is proposed that if PointsBet Shareholders agree to the Scheme at the Scheme Meeting, those options would be cancelled for nil consideration in accordance with the PointsBet Employee Share Option Plan. Similarly, there are a large number of performance share rights on issue, which were issued to executives and employees under the Key Employee Equity Plan. No such shares have yet vested. If the Scheme is approved, these performance shares will be extinguished, in exchange for a payment of $1.06 (less any applicable tax and superannuation). The legal rights of these shareholders are not so dissimilar from the rights of other shareholders as to make it impossible for them to consult together with a view to their common interest. They will each participate in the scheme on the same basis as other shareholders (see Re Newcrest Mining Ltd [2023] FCA 1080 at [60] (Beach J); Re Healthscope Ltd [2019] FCA 542; 139 ACSR 608 at [166]-[167] (Beach J); Re Amcor Ltd [2019] FCA 346 at [86] (Beach J); Re Citadel Group Ltd [2020] FCA 1580; 148 ACSR 598 at [63] (Beach J); Re DWS Limited [2020] FCA 1590; 148 ACSR 616 (DWS) at [40] (Beach J); Re RXP Services Ltd [2021] FCA 38 at [37]-[45] (Beach J); Japara at [69] (Moshinsky J)).

Director interests and benefits

34 The evidence discloses that each of the PointsBet directors holds shares in PointsBet, amounting to, in aggregate, 8.19% of the total issued share capital of PointsBet. No PointsBet director has a relevant interest in any shares in Mixi or Mixi, Inc. The evidence also makes clear that there is no payment or other benefit proposed to be given to any director of PointsBet as compensation for the loss, or consideration for or in connection with their office in PointsBet, in connection with the Scheme. The Managing Director of PointsBet, Mr Swanell, holds 1,647,411 performance share rights, which will be purchased in the Scheme, resulting in a payment of over $1.7 million to Mr Swanell (less any applicable withholding tax and superannuation). This benefit has been disclosed in the Scheme Booklet at [9.1] as follows:

When considering the recommendation of the PointsBet Directors, you should note that Mr Sam Swanell (PointsBet Group CEO and Managing Director) will be receiving benefits if the Scheme proceeds. This comprises the early vesting of 1,647,411 Performance Share Rights pertaining to Sam Swanell (representing an aggregate amount of $1,746,255.66, less any applicable withholding tax and superannuation, on cash settlement of the vested Performance Share Rights) in accordance with the KEEP rules and pursuant to the Scheme Implementation Deed, which is outlined in further detail in section 9.5 below.

35 Mr Swanell has made a recommendation to shareholders to vote in favour of the scheme. I consider that the overall purpose of the regulatory regime is to enable shareholders to be given adequate information about the Scheme and anything that may influence those involved with it, and that purpose is consistent with the preferable approach being for a director who is to receive a financial benefit to make a recommendation, but to disclose the benefit in the scheme booklet (DWS at [42]-[49] (Beach J); Japara at [71]-[72] (Moshinsky J)). In the present case, it could not be said that there is a material collateral benefit from the bidder if the Scheme proceeds and there is no basis to suggest that Mr Swanell is being treated favourably. Moreover, the financial benefit has been disclosed in the Scheme Booklet. I am therefore content with the approach that has been adopted.

Betr Revised Proposal

36 PointsBet submits that it is appropriate to proceed with the first court hearing in relation to the Scheme, notwithstanding the existence of the Betr Revised Proposal. It asserts that PointsBet will keep PointsBet Shareholders updated in relation to the Betr Revised Proposal and its implications for the Scheme via the ASX Market Announcements Platform.

37 A core focus of the present regime is on shareholders being informed so that they can exercise their rights with full knowledge of any relevant matters. In that respect, it is relevant that the Scheme Booklet contains some discussion of the Betr Revised Proposal, including by a prominent notice on the face of the Scheme Booklet as follows:

38 As noted above, in addition to pursuing the Betr Revised Proposal, Betr announced on 29 April 2025 that it had acquired 19.9% of the shares in PointsBet, and intends to vote all of its shares against the Scheme. The Court in Technology Metals Australia Ltd v Australian Vanadium Ltd [2024] WASC 26 considered the relevance of a voting intention opposing a scheme of arrangement. Justice Lundberg said (at [69]-[72]):

First, statements made by shareholders prior to the convening of the scheme meeting and the dispatch of the scheme booklet should not be allowed to frustrate the intention of s 411 that all shareholders should be entitled to fully consider the proposed scheme upon receiving the statutory contemplated and court-approved disclosure under s 412. A small or select group of shareholders should not be permitted to prevent fair and equal consideration of the Scheme by all of the shareholders.

Second, it would be premature to refuse to order that a scheme meeting be convened (with the effect of thereby refusing the scheme itself), on the assumption that such voting intention statements will be acted upon and that the shareholders will not change their mind when they receive the court-approved scheme booklet.

Third, the statutory process contemplates that the scheme proponent will examine the relevant considerations and formulate appropriate disclosures in the scheme booklet, which will be examined by the regulator and approved by the court for dispatch to scheme shareholders.

Fourth, any alleged unfairness said to arise, properly characterised, from all shareholders, fully informed by the scheme booklet, considering and voting upon the proposed Scheme as contemplated by s 411, can be raised by any of these shareholders as objectors at the final court hearing.

39 I agree with the observations of his Honour. I am of the view that the voting intention of Betr does not preclude the orders sought by PointsBet, particularly because:

(1) shareholders are informed of the Betr Revised Proposal, including in the prominent manner set out at [37] above;

(2) on the material before me, Betr does not appear to be bound to continue its opposition to the Scheme and it could reverse its opposition; and

(3) it was open to Betr or ASIC to attend the hearing of this matter and oppose the orders sought, and neither did so.

40 As observed by Beach J in PM Capital at [89], the key consideration in the context of an alternative proposal is “whether [the target company’s] shareholders are properly informed as to the comparative advantages and disadvantages of the scheme and the [alternative] offer so that they can make an informed decision on the scheme”. The existence of an alternative proposal at the time of the first court hearing is not necessarily a barrier to convening the scheme meeting (see, eg, PM Capital at [89]-[92]; Selfwealth at [9]-[12]).

41 At a broad level, I consider that shareholders are armed with appropriate information to ensure that they are informed of the issue, and are able to obtain any further information or updates in a timely manner.

42 PointsBet have sought orders that include a degree of flexibility to enable it to adjourn or postpone the Scheme Meeting. This raises a concern that if there is substantial delay, a question could arise about whether the information provided to shareholders in respect of the Scheme remains current at the time of the meeting. However, this issue was addressed in Crown Resorts Ltd, in the matter of Crown Resorts Ltd [2022] FCA 367 by ensuring that this issue was addressed at the second meeting (at [95] (O’Bryan J)). I am content to proceed in the same way.

Members are to be properly informed

43 The second principal aspect relevant to the exercise of the Court’s discretion is the adequacy of the information to be provided to shareholders. Where the Court is satisfied that the statutory disclosure requirements are met, it will ordinarily be satisfied that the information to be provided to shareholders is adequate for the purposes of the exercise of the Court’s discretion to convene a meeting (Rex Minerals at [55] citing Re Opes Prime Stockbroking Ltd [2009] FCA 813; 179 FCR 20 at [94]-[99] and [102] (Finkelstein J)).

44 As discussed above, I am satisfied that the statutory disclosure requirements are met. For this reason, and because shareholders will have the benefit of the opinion of the Independent Expert, I am satisfied that members of PointsBet are to be properly informed.

THE EXPLANATORY STATEMENT

45 PointsBet has filed evidence as to the manner in which the Scheme Booklet is proposed to be sent to PointsBet Shareholders. The proposal is to adopt a mixture of electronic and hard copy communications as follows:

(1) shareholders who have provided PointsBet with an email address and have elected to receive communications in relation to company meetings electronically (Email Shareholders) will be sent an email which contains a hyperlink to an online portal or website from which the Email Shareholder may: (i) view and download an electronic copy of the Scheme Booklet (which will include a Notice of Scheme Meeting and proxy form); (ii) lodge an online electronic voting form containing a proxy appointment and voting preference; and (iii) access an online platform to listen to and participate in the Scheme Meeting;

(2) shareholders who have nominated a physical address for the purpose of receiving communications in relation to company meetings or who have otherwise elected to receive communications in relation to company meetings by post (Hard Copy Shareholders) will be sent a hard copy of: (i) the Scheme Booklet; (ii) a personalised proxy form; and (iii) a business reply-paid envelope for the return of the proxy form;

(3) shareholders who are not Email Shareholders or Hard Copy Shareholders (No Election Shareholders) will be sent the following documents in hard copy: (i) a letter which contains the URL address of websites from which the shareholder may: (A) access and download an electronic copy of the Scheme Booklet; (B) lodge an online electronic voting form containing a proxy appointment and voting preference; and (C) access an online platform to listen to and participate in the Scheme Meeting; (ii) a personalised proxy form; and (iii) a business reply-paid envelope for the return of the proxy form.

46 The original orders did not provide a method for dealing with undelivered emails. With respect, I agree with the observations of O’Bryan J in Rex Minerals at [79] and Selfwealth at [58] that such an order is desirable, and will therefore be made. I am otherwise content that the methods of dispatch comply with the requirements of Division 2 of Pt 1.2AA of the Act. The proposed communications have been disclosed in the Swanell Affidavit.

CONCLUSION

47 Generally, Rule 3.4 requires the Plaintiff to publish notice of a hearing for approval at least 5 days before the date of the hearing, in accordance with Form 6. However, the Practice Note provides that the Court will be prepared to dispense with the publication of such a notice if notice can be given by an announcement on the ASX. PointsBet proposes to publish notice of the approval on the ASX announcement platform, and on the basis of that approach, it is appropriate that I make an order dispensing with compliance with rule 3.4 of the Rules.

48 Subject to some small amendments I will therefore make the orders sought by the Plaintiff.

I certify that the preceding forty-eight (48) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Bennett. |

Associate:

Dated: 9 May 2025