FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v 24-U Pty Ltd [2025] FCA 321

File number: | NSD 1523 of 2024 |

Judgment of: | STEWART J |

Date of judgment: | 21 March 2025 |

Date of publication of reasons: | 4 April 2025 |

Catchwords: | CORPORATIONS – “pig butchering” – simultaneous winding up of 95 corporations – where defendant companies suspected to be involved in scam activity and financial misconduct – multiple contraventions of the Corporations Act 2001 (Cth) – where ASIC lacks confidence in the control and management of each of the companies – where defendants either have no directors, non-consenting directors, directors for whom there is no evidence that the director has ever been present in Australia, or a director who has departed Australia with no intent to live in Australia – where only two companies have non-meaningless assets – whether just and equitable to order winding up of the companies CORPORATIONS – conditional application by provisional liquidators for orders under s 90-15 of the Insolvency Practice Schedule and s 480 of the Corporations Act 2001 (Cth) – where orders sought to streamline winding up of 95 corporations to reduce costs of mandatory steps in liquidation – where liquidators have prepared preliminary and supplementary reports – where liquidators seek deregistration of 93 companies by ASIC and immediate release – where notice period under Federal Court (Corporations) Rules 2000 (Cth) r 7.5(2)(a) not expired at the time of hearing – orders to allow sufficient prescribed objection period PRACTICE AND PROCEDURE – application for non-publication, non-party access and suppression orders pursuant to s 37AF of the Federal Court of Australia Act 1976 (Cth) – financial and other sensitive personal information of individuals unknowingly associated with companies associated with scam activity and financial misconduct – ongoing ASIC investigation – where orders necessary to prevent prejudice to the proper administration of justice – where orders necessary to protect safety of any person |

Legislation: | Australian Securities and Investments Commission Act 2001 (Cth), ss 1(2), 11 Corporations Act 2001 (Cth), ss 9, 100, 117, 142, 146, 201A, 201D, 286, 461(1)(k), 462, 464, 465A, 466(2), 472(1), 474(1), 480, 481, 530A, 530B, 533, 537, 545, 588E, 601AC(1)(b), 1247B, 1308, 1322(4), Sch 2 (Insolvency Practice Schedule (Corporations)) ss 5-30(a)(iii), 60-10, 60-15, 70-5, 70-6, 70-15, 90-15, 90-20 Federal Court of Australia Act 1976 (Cth), ss 37AF(1), 37AG(1) Taxation Administration Act 1953 (Cth), Sch 1 s 260-45(2)

Federal Court (Corporations) Rules 2000 (Cth), rr 2.8, 7.5, 7.6 Insolvency Practice Rules (Corporations) 2016 (Cth), rr 70-30, 70-35, 70-40 |

Cases cited: | Australian Sawmilling Co Pty Ltd (in liq) v Environment Protection Authority [2021] VSCA 294; 64 VR 523 Australian Securities and Investments Commission v ActiveSuper Pty Ltd (No 2) [2013] FCA 234; 93 ACSR 189 Australian Securities and Investments Commission v Ferratum Australia Pty Ltd (in liq) [2023] FCA 1043; 169 ACSR 553 Australian Securities and Investments Commission v Letten (No 29) [2023] FCA 315 Australian Securities and Investments Commission v NGS Crypto Pty Ltd (No 4) [2024] FCA 986 Australian Securities and Investments Commission v Stone Assets Management Pty Ltd [2012] FCA 630; 205 FCR 120 Australian Securities Commission v AS Nominees Ltd (1995) 62 FCR 504 Bayles by his litigation representative Bayles v Nationwide News Pty Ltd (No 3) [2020] FCA 1397 Bredenkamp & Hughes (No 2) [2023] WASC 321 Cathro (liquidator), in the matter of Petsamo No 14 Pty Ltd (in liq) v Thomassian [2022] FCA 399 CIC Insurance Ltd (prov liq apptd) v Hannan & Co Pty Ltd [2001] NSWSC 437; 38 ACSR 245 Consulting Services Pty Ltd (in liq) v A.O.B Holding Pty Ltd (in liq) (No 2) [2023] FCA 1684 Deputy Commissioner of Taxation v Italian Prestige Jewellery Pty Ltd (in liq) [2018] FCA 983; 129 ACSR 115 GDK Projects Pty Ltd, in the matter of Umberto Pty Ltd (in liq) v Umberto Pty Ltd (in liq) [2018] FCA 541 Gognos Holdings Ltd v Australian Securities and Investments Commission [2018] QCA 181; 129 ACSR 363 Hedges v NSW Harness Racing Club Ltd (1991) 5 ACSR 291 Hogan v Hinch [2011] HCA 4; 243 CLR 506 In the matter of Equiticorp Australia Ltd (in liq) [2020] NSWSC 143 In the matter of JKN Hills Pty Ltd (Controllers Appointed) [2024] NSWSC 577 In the matter of Roxy’s Bootcamp Pty Ltd (in provisional liquidation) [2024] NSWSC 948 In the matter of Substance Technologies Pty Ltd [2019] NSWSC 612 Kelly, in the matter of Halifax Investment Services Pty Ltd (in liq) (No 8) [2020] FCA 533; 144 ACSR 292 Krejci (liquidator) v Panella, in the matter of Richmond Lifts Pty Ltd (in liq) [2025] FCA 151 Lee v Deputy Commissioner of Taxation [2023] FCAFC 22; 296 FCR 272 Morgan, in the matter of Traditional Values Management Ltd (in liq) [2024] FCA 74 Queensland Phosphate Pty Ltd v Korda [2019] VSCA 215; 14 ARLR 1 Re ACN 002 408 040 (in liq) [2013] NSWSC 470; 94 ACSR 485 Re Australasian Barrister Chambers Pty Ltd [2020] NSWSC 304; 146 ACSR 1 Re Better Drums Pty Ltd (in liq) [2019] NSWSC 1262 Re Cameron Lane Pty Ltd (in liq) [2024] VSC 202 Re Cardiff Coal Company [2014] NSWSC 1590; 104 ACSR 135 Re Lewis (as liquidators of Concrete Supply Pty Ltd (in liq)) [2020] FCA 841; 145 ACSR 459 Re RR Impex Ltd (in liq) [2013] NSWSC 1667 Re Whitsunday Clean Sands Pty Ltd [2017] NSWSC 1199 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Corporations and Corporate Insolvency |

Number of paragraphs: | 134 |

Date of hearing: | 20 March 2025 |

Counsel for the Plaintiff: | J Shepard and Dr N J Lennings |

Solicitor for the Plaintiff: | Australian Securities and Investments Commission |

Counsel for the Interested Persons (the External Administrators): | C A Hamilton-Jewell |

Solicitor for the Interested Persons (the External Administrators): | Hamilton Locke |

ORDERS

NSD 1523 of 2024 | ||

| ||

BETWEEN: | AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | |

AND: | 24-U PTY LTD (ACN 660 136 603) First Defendant ROOTIE TECH SOLUTIONS PTY LTD (ACN 663 868 237) Second Defendant ALEOS CAPITAL MARKETS PTY LTD (ACN 664 271 925) (and others named in the Schedule) Third Defendant | |

CATHERINE MARGARET CONNEELY Interested Person THOMAS DONALD BIRCH Interested Person | ||

order made by: | STEWART J |

DATE OF ORDER: | 21 MARCH 2025 |

THE COURT ORDERS THAT:

1. The following defined terms are used in these Orders:

(a) Confidential Kavanagh Affidavit means the Confidential Affidavit of Paul Denis Kavanagh affirmed on 14 March 2025;

(b) Corporations Act means the Corporations Act 2001 (Cth)

(c) Corporations Rules means the Federal Court (Corporations) Rules 2000 (Cth)

(d) External Administrators means the provisional liquidators and/or liquidators of the defendants, as the case may be

(e) FCA Act means the Federal Court of Australia Act 1976 (Cth)

(f) FCR means the Federal Court Rules 2011 (Cth)

(g) First Confidential Doubikin Affidavit means the First Confidential Affidavit of Brock Rhyce Doubikin affirmed on 29 October 2024;

(h) First Spencer Affidavit means the affidavit of Michael Patrick Spencer affirmed on 22 October 2024;

(i) Individual 1 means the individual identified at paragraph 172 of the Second Confidential Doubikin Affidavit;

(j) Individual 1 Details means:

(i) any reference to Individual 1 (other than as already publicly disclosed in documents produced by way of the Companies Register kept by the plaintiff and in annexure A to the redacted First Confidential Doubikin Affidavit);

(ii) the information in Sections D.6, D.7, D.8 and F.5 of the Second Confidential Doubikin Affidavit;

(iii) the information in the last sentence of paragraph 23 of the Confidential Kavanagh Affidavit; and

(iv) the information in paragraph 19 of, and item 17 of annexure A to, the First Spencer Affidavit;

(k) Insolvency Practice Rules means the Insolvency Practice Rules (Corporations) 2016 (Cth);

(l) IPS means the Insolvency Practice Schedule (Corporations) being Sch 2 to the Corporations Act 2001 (Cth);

(m) Permitted Persons means:

(i) the Court;

(ii) the plaintiff;

(iii) the plaintiff’s legal representatives; and

(iv) employees of any third party engaged to provide document management or litigation support services to the plaintiff or the Court in relation to this proceeding;

(n) Protected Personal Details means the following details or personal identifiers (genuine or otherwise) of all individuals referred to or otherwise identified in the proceeding:

(i) their date of birth;

(ii) their place of birth and nationality;

(iii) their addresses (including former addresses);

(iv) their emergency contacts and their email addresses, telephone numbers and addresses;

(v) their email addresses;

(vi) their telephone numbers (including mobile telephone numbers);

(vii) their passport details;

(viii) their driver’s license details;

(ix) their proof of age card details;

(x) their identity card details;

(xi) their criminal history; and

(xii) their signature,

excluding:

(xiii) any employee of the plaintiff;

(xiv) the provisional liquidators; and

(xv) any person who communicated with the plaintiff and/or the provisional liquidators in their capacity as a representative, purported representative, or associate of a representative or purported representative of the companies following the commencement of this proceeding, except for the individuals identified at paragraphs 15(b)(xii) and 29 of the Confidential Kavanagh Affidavit;

(o) Suppressed Individual 1 Documents means the documents referred to in sections D.6 and D.7 of the Second Confidential Doubikin Affidavit and exhibited thereto, and the documents referable to Inidividual 1 exhibited to the First Spencer Affidavit;

(p) Suppressed Investigation Documents means:

(i) the unredacted version of the First Confidential Doubikin Affidavit, including Confidential Exhibit BRD-2 thereto;

(ii) the Second Confidential Doubikin Affidavit, including Confidential Exhibit BRD-3 thereto;

(iii) the Confidential Kavanagh Affidavit, including the annexures thereto;

(iv) any unredacted version of any outlines of submissions filed by the plaintiff;

(v) the transcript of the hearing on 31 October 2024 in this proceeding; and

(vi) the court book filed by the plaintiff in this proceeding;

(q) Second Confidential Doubikin Affidavit means the Second Confidential Affidavit of Brock Rhyce Doubikin affirmed on 29 October 2024.

ON THE ORIGINATING PROCESS, THE COURT ORDERS THAT:

Amended originating process

1. The plaintiff is granted leave to file the amended originating process dated 17 March 2025 and is directed to do so forthwith.

2. [intentionally left blank]

Liquidation

3. Pursuant to s 461(1)(k) of the Corporations Act, each of the defendants be wound up.

4. Pursuant to s 472(1) of the Corporations Act, the provisional liquidators be appointed joint and several liquidators to each of the defendants (Liquidators).

5. Pursuant to s 60-10 of the IPS, the Liquidators shall be entitled to such remuneration as is determined by the Court.

6. Unless the plaintiff notifies the provisional liquidators, or Liquidators, as the case may be, in writing that the plaintiff does not wish to be reimbursed its costs, the plaintiff’s costs of and incidental to the application (taxed or as agreed) to wind up each defendant be costs in the winding up of that defendant and reimbursed in accordance with s 466(2) of the Corporations Act.

7. Orders 3 and 4 be entered forthwith.

Suppression orders

8. Orders 11, 12 and 15 of the orders made on 1 November 2024, and orders 5 and 6 of the orders made on 5 December 2024, be vacated.

9. Subject to further order, pursuant to s 37AF(1)(a) of the FCA Act, on the grounds set out in ss 37AG(1)(a) and 37AG(1)(c) of the FCA Act, the Protected Personal Details be prohibited from disclosure (by publication or otherwise), until the death of the relevant individual, to any person other than the Permitted Persons and the Provisional Liquidators, other than as already publicly disclosed in documents produced by way of the Companies Register kept by the plaintiff.

10. Subject to further order, pursuant to s 37AF(1)(b) of the FCA Act, on the grounds set out in ss 37AG(1)(a) and 37AG(1)(c) of the FCA Act, the Individual 1 Details and the Suppressed Individual 1 Documents be prohibited from disclosure (by publication or otherwise) until the death of Individual 1 to any person other than the Permitted Persons.

11. Subject to further order, pursuant to s 37AF(1)(b) of the FCA Act, on the grounds set out in ss 37AG(1)(a) and 37AG(1)(c) of the FCA Act, to the extent not already disclosed in accordance with previous orders made in this proceeding, the Suppressed Investigation Documents be prohibited from disclosure (by publication or otherwise) until midnight on 20 March 2029 to any person other than the Permitted Persons.

Non-party access orders and disclosure of partially confidential documents

12. Subject to further other, for the purposes of rr 2.32(1)(b) and 2.32(3)(a) of the FCR:

(a) the Protected Personal Details and the Individual 1 Details be treated as confidential (Confidential Information);

(b) any document, excluding the Suppressed Individual 1 Documents, in which such Confidential Information appears unredacted be treated as a confidential document, save for the period where the document is the subject of suppression orders pursuant to order 11 above (Partially Confidential Document); and

(c) for clarity, a Partially Confidential Document is any document which is not the subject of suppression orders pursuant to order 11 above (during the period of those suppression orders only) above and is not any of the following documents:

(i) the affidavit of Brock Rhyce Doubikin affirmed 29 October 2024, including Exhibit BRD-1;

(ii) the redacted First Confidential Doubikin Affidavit, without Confidential Exhibit BRD-2;

(iii) the affidavit of Brock Rhyce Doubikin affirmed on 4 December 2024, including Exhibit BRD-4;

(iv) the redacted affidavit of Paul Denis Kavanagh affirmed on 20 February 2025, without Exhibit PDK-1;

(v) the affidavit of Mitchell William Burnett affirmed on 14 January 2025;

(vi) the affidavit of Gabrielle Charlene Osorio affirmed on 29 January 2025;

(vii) the affidavit of Rhys Alyn Downie affirmed on 17 February 2025;

(viii) the affidavit of Cameron Luke Villarosa affirmed on 18 February 2025;

(ix) the affidavit of Joshua Dane Bell-Wilson affirmed on 18 February 2025;

(x) the affidavit of Michela Emmy Mueller affirmed on 19 February 2025;

(xi) the affidavit of Andrew James Fleming affirmed on 20 February 2025;

(xii) the affidavit of Daniel James Penfold sworn on 21 February 2025;

(xiii) the affidavit of Angus Patrick McKay affirmed on 19 February 2025;

(xiv) the affidavit of Pooja Gurung affirmed on 25 February 2025;

(xv) the affidavit of Cameron Patrick Henderson sworn on 25 February 2025;

(xvi) transcripts of the hearings on 5 December 2024 and 27 February 2025 in this proceeding;

(xvii) the plaintiff’s redacted outline of submissions dated 18 March 2025; and

(xviii) the Provisional Liquidators’ submissions dated 18 March 2025.

13. Pursuant to r 1.32 of the FCR, the plaintiff is to be given notice of any application for leave pursuant to r 2.32(4) of the FCR, or otherwise, by any person seeking to inspect a Partially Confidential Document and the plaintiff has leave to be heard on any such application.

14. Any application pursuant to r 2.32(4) of the FCR, or otherwise, for a person to inspect any Partially Confidential Documents be stayed for a period of 28 days from the date of the notification to the plaintiff referred to in order 13 above, to allow the plaintiff to:

(a) redact any Confidential Information in the Partially Confidential Documents; and

(b) provide a copy of redacted or amended Partially Confidential Documents to the Court for the purpose of the person’s inspection.

Non-consenting directors

15. Pursuant to s 1322(4)(b) of the Corporations Act:

(a) the documents lodged with the plaintiff in column 3 of the table in the annexure to these orders be withdrawn from the Companies Register kept by the plaintiff to the extent that the practice of the plaintiff will permit the plaintiff to remove the appointment and/or cessation of the directors in column 2 from the companies listed in column 1 by withdrawing the document; and

(b) where the plaintiff cannot withdraw the document from the Companies Register in column 3, the plaintiff is to rectify the Companies Register by amending the document in column 3 to effect the removal of the appointment and/or cessation of the directors in column 2 from the companies listed in column 1.

16. The plaintiff has liberty to apply on three days’ notice.

ON THE AMENDED ORIGINATING PROCESS, THE COURT DECLARES THAT:

17. William Reid-Drought did not consent to act as, and was not appointed as, director of the following companies:

(a) Aleos Capital Markets Pty Ltd (ACN 664 271 925) on 5 December 2022;

(b) Como Trade Pty Ltd (ACN 662 933 799) on 6 October 2022;

(c) Discovery Capital Group Pty Ltd (ACN 667 981 437) on 15 May 2023;

(d) Extreme Global Pty Ltd (ACN 670 559 672) on 16 August 2023;

(e) Goldwell Global Pty Ltd (ACN 669 654 540) on 12 July 2023;

(f) Khama Capita Pty Ltd (ACN 662 934 072) on 27 October 2022;

(g) QRS Global Pty Ltd (ACN 665 543 966) on 6 February 2023;

(h) Rayz Liquidity Pty Ltd (ACN 670 366 542) on 9 August 2023; and

(i) Topmax Global Pty Ltd (ACN 662 561 748) on 19 September 2022,

(WRD Companies).

18. The purported appointment of William Reid-Drought as director of the WRD Companies is void and of no effect.

19. Duc Thanh Nguyen did not consent to act as, and was not appointed as, director of the following companies:

(a) Aleos Capital Pty Ltd (ACN 674 120 015) on 11 January 2024;

(b) Gold Rush Global Group Pty Ltd (ACN 666 677 265) on 22 March 2023;

(c) GTS Energy Markets Group Pty Ltd (ACN 645 815 569) on 6 February 2024;

(d) Tradewill Global Pty Ltd (ACN 653 239 500) on 5 February 2024; and

(e) Tshan Markets Pty Ltd (ACN 674 120 140) on 11 January 2024,

(DTN Companies).

20. The purported appointment of Duc Thanh Nguyen as director of the DTN Companies is void and of no effect.

21. Kyoko Arima did not consent to act as, and was not appointed as, director of Juncheng Trade Pty Ltd (ACN 675 132 895) on 20 February 2024.

22. The purported appointment of Kyoko Arima as director of Juncheng Trade Pty Ltd is void and of no effect.

23. Ilaria Arduin did not consent to act as, and was not appointed as, director of the following companies:

(a) Cloud Bridge Capital Pty Ltd (ACN 661 715 966) on 5 September 2023;

(b) Extrend Cap International Pty Ltd (ACN 658 757 807) on 5 May 2022;

(c) Rich Gold Group Pty Ltd (ACN 676 210 441) on 29 March 2024; and

(d) Upone Global Financial Services Pty Ltd (ACN 675 268 774) on 23 February 2024,

(IA Companies).

24. The purported appointment of Ilaria Arduin as director of the IA Companies is void and of no effect.

25. Zhengwei Cai did not consent to act as, and was not appointed as, director of the following companies:

(a) Cloud Bridge Capital Pty Ltd (ACN 661 715 966) on 15 August 2022;

(b) Genesis Capital Resources Pty Ltd (ACN 661 621 469) on 10 August 2022;

(c) Nasd Trading Group Pty Ltd (ACN 660 933 059) on 12 July 2022;

(d) Rac Markets Pty Ltd (ACN 662 485 967) on 15 September 2022;

(e) Seventy Investech Pty Ltd (ACN 665 400 699) on 1 February 2023; and

(f) Trillion Global Capital Pty Ltd (ACN 660 834 757) on 8 July 2022,

(ZC Companies).

26. The purported appointment of Zhengwei Cai as director of the ZC Companies is void and of no effect.

27. Michaela Kym Wagner did not consent to act as, and was not appointed as, director of the following companies:

(a) Extrend Cap International Pty Ltd (ACN 658 757 807) on 13 April 2022; and

(b) Invdom Pty Ltd (ACN 675 681 268) on 11 March 2024,

(MKW Companies).

28. The purported appointment of Michaela Kym Wagner as director of the MKW Companies is void and of no effect.

29. Yuhua Wu did not consent to act as, and was not appointed as, director of the following companies:

(a) Enclave Prime Pty Ltd (ACN 662 032 402) on 13 September 2022;

(b) Gold Rush Group Pty Ltd (ACN 658 757 772) on 1 August 2023; and

(c) Tradehall Pty Ltd (ACN 641 032 402) on 24 October 2023,

(YW Companies).

30. The purported appointment of Yuhua Wu as director of the YW Companies is void and of no effect.

31. Min Yan did not consent to act as, and was not appointed as, director of Gaoman Capital Group Trading Pty Ltd (ACN 659 170 073) on 4 May 2022.

32. The purported appointment of Min Yan as director of Gaoman Capital Group Trading Pty Ltd is void and of no effect.

33. Mario Enrique Soto Ruiz did not consent to act as, and was not appointed as, director of the following companies:

(a) 24-U Pty Ltd (ACN 660 136 603) on 14 June 2022;

(b) Audrn Financial Group Pty Ltd (ACN 602 539 462) on 1 February 2023;

(c) Aus Financial Australia Pty Ltd (ACN 663 182 536) on 17 October 2022;

(d) Jinte Net Blockchain Pty Ltd (ACN 643 223 965) on 10 June 2022; and

(e) Rootie Tech Solutions Pty Ltd (ACN 663 868 237) on 16 November 2022,

(MESR Companies).

34. The purported appointment of Mario Enrique Soto Ruiz as director of the MESR Companies is void and of no effect.

35. Weiyao Zhang did not consent to act as, and was not appointed as, director of the following companies:

(a) 19 Securities Pty Ltd (ACN 667 009 743) on 17 July 2023;

(b) Ausfit Mart Pty Ltd (ACN 664 142 241) on 17 July 2023;

(c) Aximtrade Pty Ltd (ACN 655 873 377) on 17 July 2023;

(d) Caitu International Securities Pty Ltd (ACN 664 050 926) on 25 August 2023;

(e) Gongde International Pty Ltd (ACN 669 729 793) on 17 July 2023;

(f) Great Plan Service Pty Ltd (ACN 669 595 288) on 10 July 2023;

(g) Great Virtue Pty Ltd (ACN 668 832 826) on 17 July 2023;

(h) Guang Quan International Pty Ltd (ACN 668 974 383) on 20 June 2023;

(i) Guofa International Pty Ltd (ACN 671 454 265) on 14 September 2023;

(j) Guotai International Pty Ltd (ACN 670 790 655) on 24 August 2023;

(k) Jinhou International Pty Ltd (ACN 664 819 210) on 17 July 2023;

(l) Mercury Securities Group Pty Ltd (ACN 663 112 221) on 17 July 2023;

(m) Oceanus Wealth Securities Pty Ltd (ACN 667 232 644) on 17 July 2023;

(n) Ridder Trader Pty Ltd (ACN 643 571 377) on 17 July 2023;

(o) Rising Sun Capital Pty Ltd (ACN 661 452 759) on 17 July 2023;

(p) RN Prime Pty Ltd (ACN 664 101 937) on 17 July 2023;

(q) Ruifu International Pty Ltd (ACN 670 605 893) on 17 August 2023;

(r) Ruisen Securities Pty Ltd (ACN 666 827 550) on 17 July 2023;

(s) Shan Yu International Pty Ltd (ACN 668 038 944) on 17 May 2023;

(t) Yinrui International Pty Ltd (ACN 671 080 658) on 5 September 2023;

(u) Zhongke Global Pty Ltd (ACN 670 931 905) on 30 August 2023; and

(v) Zhongying Global Pty Ltd (ACN 663 466 073) on 17 July 2023,

(WZ Companies).

36. The purported appointment of Weiyao Zhang as director of the WZ Companies is void and of no effect.

37. Emily Louise Lyall did not consent to act as, and was not appointed as, director of the following companies:

(a) BHP Markets Pty Ltd (ACN 658 757 745) on 13 April 2022;

(b) CLSA Capital Group Inv Pty Ltd (ACN 676 141 512) on 27 March 2024;

(c) Katy Capital Pty Ltd (ACN 652 540 120) on 15 March 2024;

(d) Rena Markets Pty Ltd (ACN 664 271 854) on 5 December 2022; and

(e) Sophie Capital Financial Trading Pty Ltd (ACN 658 204 347) on 22 March 2022,

(ELL Companies).

38. The purported appointment of Emily Louise Lyall as director of the ELL Companies is void and of no effect.

39. Steven Joseph Stanbrook did not consent to act as, and was not appointed as, director of the following companies:

(a) Tradehall Pty Ltd (ACN 641 032 402) on 3 June 2020; and

(b) Tuotenda Capital Group Pty Ltd (ACN 654 956 153) on 1 November 2021,

(SJS Companies).

40. The purported appointment of Steven Joseph Stanbrook as director of the SJS Companies is void and of no effect.

ON THE EXTERNAL ADMINISTRATORS’ INTERLOCUTORY PROCESS, AND UPON THE MAKING OF ORDERS 3, 4 AND 7 ABOVE, THE COURT ORDERS THAT:

Notice and reporting requirements

41. Pursuant to s 90-15 of the IPS, the External Administrators are deemed to have complied with s 537 of the Corporations Act in respect of each company to which the External Administrators are appointed by lodging by post one consolidated notice in respect of the 1st to 95th defendants (Defendant Companies).

42. Pursuant to s 90-15 of the IPS, the External Administrators are deemed to have complied with s 465A(2) of the Corporations Act in respect of each company to which the External Administrators are appointed by lodging by post one consolidated notice in respect of all the Defendant Companies.

43. Pursuant to s 90-15 of the IPS, the External Administrators are deemed to have complied with s 533 of the Corporations Act in respect of each company to which the External Administrators are appointed, specifically the obligation to lodge a report with ASIC by virtue of the provisional liquidators having served ASIC with the Preliminary Report and Supplementary Report.

44. Pursuant to s 90-15 of the IPS, the External Administrators are relieved from the requirements of rr 70-30, 70-35 and 70-40 of the Insolvency Practice Rules in respect of the Defendant Companies.

45. Pursuant to s 90-15 of the IPS, the External Administrators are relieved from the obligation of lodging a return for the purposes of ss 70-5 or 70-6 of the IPS in respect of the Defendant Companies to which the External Administrators are appointed and obliged to lodge a return for the purposes of ss 70-5 or 70-6 of the IPS, except for Tradehall Pty Ltd (the 62nd defendant) and Audrn Financial Group Pty Ltd (the 69th defendant).

46. Pursuant to s 90-15 of the IPS, the External Administrators are justified for the purposes of s 260-45(2) of Sch 1 of the Taxation Administration Act 1953 (Cth), in sending by post one consolidated notice to the Commissioner of Taxation in respect of which the External Administrators are obliged to notify the Commissioner of their appointment.

Assets & investigations

47. Pursuant to s 90-15 of the IPS, in light of the steps taken by the provisional liquidators, the External Administrators are justified and act properly in taking no further steps:

(a) to obtain books and records, property and assets;

(b) to require or receive a Report on Company Activities and Property from any of the directors (or past directors) of the Defendant Companies that are wound up, as well as corresponding obligations to lodge with ASIC;

(c) to conduct further investigations into, and report to creditors about, possible recovery actions that may be available in respect of the Defendant Companies that are wound up.

Release & deregistration

48. Subject to order 49, pursuant to s 480 of the Corporations Act, the External Administrators are released (Release) in relation to the Defendant Companies and ASIC is to deregister the Defendant Companies except the 62nd and 69th defendants.

49. Order 48 is stayed until 11 April 2025, unless, by 10 April 2025, any objection is made to order 48 under r 7.6 of the Corporations Rules, in which event order 48 remains stayed until further order in relation to any defendant in respect of which any objection was made.

Service

50. Service of the interlocutory application is deemed effective at 5pm on 19 March 2025, being the business day after the External Administrators served a copy of the interlocutory application and supporting affidavit:

(a) on ASIC by email;

(b) by email on any creditors of which the External Administrators are aware; and

(c) by email on any person asserting to be a director, officer or legal representative of a Defendant Company.

Other orders

51. The External Administrators have liberty to apply on three business days’ written notice to the Court in relation to any variation of these orders or any other matter generally arising in the administration of the Defendant Companies.

52. Pursuant to s 60-10 of the IPS, the Court determines the External Administrators shall be entitled to remuneration in the amount of $591,833 and disbursements in the amount of $139,175.18, each exclusive of GST, on account of work undertaken in relation to their appointment as provisional liquidators of the Defendant Companies.

53. The External Administrators’ costs and expenses of and incidental to the application are to be treated as costs in the administration of the Defendant Companies.

54. Subject to further order, orders 52 and 53 are to operate on a several basis divided equally between the Defendant Companies insofar as the remuneration is to be claimed from the assets of the Defendant Companies.

THE COURT NOTES THAT:

A. Reasons for judgment will initially be published only to the plaintiff to afford it an opportunity to identify any information in such reasons which it contends should be suppressed or redacted.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE

No | Column 1 | Column 2 | Column 3 | Column 4 |

Company | Director name | Document Type / Document ID | Lodgement Date | |

1. | 24-U Pty Ltd (ACN 660 136 603) | Mario Enrique SOTO RUIZ | Form 201: Application for Registration as an Australian company (Doc ID 5EGG40597) | 14/06/2022 |

2. | Rootie Tech Solutions Pty Ltd (ACN 663 868 237) | Mario Enrique SOTO RUIZ | Form 201: Application for Registration as an Australian company (Doc ID 4EAB88906) | 16/11/2022 |

3. | Aleos Capital Markets Pty Ltd (ACN 664 271 925) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 3EPF06860) | 5/12/2022 |

4. | Aleos Capital Pty Ltd (ACN 674 120 015) | Duc Thanh NGUYEN | Form 201: Application for Registration as an Australian company (Doc ID 6EVC99037) | 11/01/2024 |

5. | Cloud Bridge Capital Pty Ltd (ACN 661 715 966) | Ilaria ARDUIN Zhengwei CAI | Form 484: Change to Company Details | 07/09/2023 |

6. | Zhengwei CAI | Form 201: Application for Registration as an Australian company (Doc ID 3EHC63909) | 15/08/2022 | |

7. | Como Trade Pty Ltd (ACN 662 933 799) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 3EKP59139) | 06/10/2022 |

8. | Discovery Capital Group Pty Ltd (ACN 667 981 437) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 6EBB75169) | 15/05/2023 |

9. | Enclave Prime Pty Ltd (ACN 662 396 278) | Yuhua WU | Form 201: Application for Registration as an Australian company (Doc ID 3EJB31973) | 13/09/2022 |

10. | Extreme Global Pty Ltd (ACN 670 559 672) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 6EIV90431) | 16/08/2023 |

11. | Extrend Cap International Pty Ltd (ACN 658 757 807) | Ilaria ARDUIN Michaela Kym WAGNER | Form 484: Change to Company Details | 09/05/2022 |

12. | Michaela Kym WAGNER | Form 201: Application for Registration as an Australian company (Doc ID 2EYO02549) | 13/04/2022 | |

13. | Form 484: Change to Company Details | 09/04/2022 | ||

14. | Gaoman Capital Group Trading Pty Ltd (ACN 659 170 073) | Min YAN | Form 201: Application for Registration as an Australian company (Doc ID 2EZX03094) | 03/05/2022 |

15. | Gold Rush Global Group Pty Ltd (ACN 666 677 265) | Duc Thanh NGUYEN | Form 201: Application for Registration as an Australian company (Doc ID 3EXA89902) | 22/03/2023 |

16. | Gold Rush Group Pty Ltd (ACN 658 757 772) | Yuhua WU | Form 484: Change to Company Details | 07/08/2023 |

17. | Goldwell Global Pty Ltd (ACN 669 654 540) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 7EDB51552) | 12/07/2023 |

18. | GTS Energy Markets Pty Ltd (ACN 645 815 569) | |||

19. | ||||

20. | ||||

21. | Duc Thanh NGUYEN | Form 484: Change to Company Details | 07/02/2024 | |

22. | Invdom Pty Ltd (ACN 675 681 268) | Michaela Kym WAGNER | Form 201: Application for Registration as an Australian company (Doc ID 6EZW67956) | 11/03/2024 |

23. | Khama Capita Pty Ltd (ACN 662 934 072) | William Martin REID-DROUGHT | Form 484: Change to Company Details (Doc ID 7EBX83126) | 28/10/2022 |

24. | QRS Global Pty Ltd (ACN 665 543 966) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 3ETU00093) | 06/02/2023 |

25. | Rayz Liquidity Pty Ltd (ACN 670 366 542) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 6EIC49029) | 09/08/2023 |

26. | Topmax Global Pty Ltd (ACN 662 561 748) | William Martin REID-DROUGHT | Form 201: Application for Registration as an Australian company (Doc ID 3EJN24969) | 19/09/2022 |

27. | Tradewill Global Pty Ltd (ACN 653 239 500) | Duc Thanh NGUYEN | Form 484: Change to Company Details | 07/02/2024 |

28. | ||||

29. | ||||

30. | Tshan Markets Pty Ltd (ACN 674 120 140) | Duc Thanh NGUYEN | Form 201: Application for Registration as an Australian company (Doc ID 6EVC99141) | 11/01/2024 |

31. | Upone Global Financial Services Pty Ltd (ACN 675 268 774) | Ilaria ARDUIN | Form 201: Application for Registration as an Australian company (Doc ID 6EYO04007) | 23/02/2024 |

32. | 19 Securities Pty Ltd (ACN 667 009 743) | Weiyao ZHANG | Form 484: Change to Company Details | 26/07/2023 |

33. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECO07673) | 01/02/2024 | ||

34. | Caitu International Securities Pty Ltd (ACN 664 050 926) | Weiyao ZHANG | Form 484: Change to Company Details | 25/08/2023 |

35. | Genesis Capital Resources Pty Ltd (ACN 661 621 469) | Zhengwei CAI | Form 201: Application for Registration as an Australian company (Doc ID 3EGU40846) | 10/08/2022 |

36. | Form 484: Change to Company Details | 08/09/2023 | ||

37. | Gongde International Pty Ltd (ACN 669 729 793) | Weiyao ZHANG | Form 201: Application for Registration as an Australian company (Doc ID 6EFT12453) | 14/07/2023 |

38. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECN08710) | 29/12/2023 | ||

39. | Great Virtue Pty Ltd (ACN 668 832 826) | Weiyao ZHANG | Form 484: Change to Company Details | 08/08/2023 |

40. | Form 484: Change to Company Details | 27/02/2024 | ||

41. | Guang Quan International Pty Ltd (ACN 668 974 383) | Weiyao ZHANG | Form 201: Application for Registration as an Australian company (Doc ID 6EDV43250) | 20/06/2023 |

42. | Form 484: Change to Company Details (Doc ID 7ECH99097) | 01/09/2023 | ||

43. | Guofa International Pty Ltd (ACN 671 454 265) | Weiyao ZHANG | Form 201: Application for Registration as an Australian company (Doc ID 6ELZ00915) | 14/09/2023 |

44. | Form 484: Change to Company Details | 17/10/2023 | ||

45. | Guotai International Pty Ltd (ACN 670 790 655) | Weiyao ZHANG | Form 201: Application for Registration as an Australian company (Doc ID 6EJS49251) | 24/08/2023 |

46. | Form 484: Change to Company Details | 17/10/2023 | ||

47. | Jinhou International Pty Ltd (ACN 664 819 210) | Weiyao ZHANG | Form 484: Change to Company Details | 04/08/2023 |

48. | Jinte Net Blockchain Pty Ltd (ACN 643 223 965) | Mario Enrique SOTO RUIZ | Form 484: Change to Company Details | 10/06/2022 |

49. | Form 484: Change to Company Details | 10/06/2022 | ||

50. | Form 484: Change to Company Details | 02/12/2022 | ||

51. | Juncheng Trade Pty Ltd (ACN 675 132 895) | Kyoko ARIMA | Form 201: Application for Registration as an Australian company (Doc ID 6EYG48317) | 20/02/2024 |

52. | Form 484: Change to Company Details | 07/06/2024 | ||

53. | Nasd Trading Group Pty Ltd (ACN 660 933 059) | Zhengwei CAI | Form 201: Application for Registration as an Australian company (Doc ID 3EER93488) | 12/07/2022 |

54. | Form 484: Change to Company Details | 15/09/2023 | ||

55. | Oceanus Wealth Securities Pty Ltd (ACN 667 232 644) | Weiyao ZHANG | Form 484: Change to Company Details | 04/08/2023 |

56. | Form 484: Change to Company Details | 27/02/2024 | ||

57. | Rac Markets Pty Ltd (ACN 662 485 967) | Zhengwei CAI | Form 201: Application for Registration as an Australian company (Doc ID 3EJG76524) | 15/09/2022 |

58. | Form 484: Change to Company Details | 14/09/2023 | ||

59. | Rich Gold Group Pty Ltd (ACN 676 210 441) | Ilaria ARDUIN | Form 201: Application for Registration as an Australian company (Doc ID 6EANX1202) | 29/03/2024 |

60. | Form 484: Change to Company Details (Doc ID 7ECV12343) | 08/07/2024 | ||

61. | Ridder Trader Pty Ltd (ACN 643 571 377) | Weiyao ZHANG | Form 484: Change to Company Details | 27/07/2023 |

62. | Form 484: Change to Company Details (Doc ID 7ECI00380) | 01/09/2023 | ||

63. | Form 484: Change to Company Details | 27/02/2024 | ||

64. | ||||

65. | ||||

66. | Rising Sun Capital Pty Ltd (ACN 661 452 759) | Weiyao ZHANG | Form 484: Change to Company Details (Doc ID 7ECG55503) | 31/07/2023 |

67. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECR15443) | 16/04/2024 | ||

68. | RN Prime Pty Ltd (ACN 664 101 937) | Weiyao ZHANG | Form 484: Change to Company Details | 04/08/2023 |

69. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECN08700) | 29/12/2023 | ||

70. | Seventy Investech Pty Ltd (ACN 665 400 699) | Zhengwei CAI | Form 201: Application for Registration as an Australian company (Doc ID 3ETK10481) | 01/02/2023 |

71. | Form 484: Change to Company Details | 08/09/2023 | ||

72. | Shan Yu International Pty Ltd (ACN 668 038 944) | Weiyao ZHANG | Form 201: Application for Registration as an Australian company (Doc ID 6EBF78308) | 17/05/2023 |

73. | ||||

74. | ||||

75. | ||||

76. | ||||

77. | Tradehall Pty Ltd (ACN 641 032 402) | Yuhua WU | Form 484: Change to Company Details (Doc ID 7ECK38547) | 25/10/2023 |

78. | Form 484: Change to Company Details (Doc ID 7ECM24333) | 05/12/2023 | ||

79. | Form 484: Change to Company Details (Doc ID 7ECS07774) | 07/05/2024 | ||

80. | ||||

81. | ||||

82. | ||||

83. | Steven Joseph STANBROOK | Form 484: Change to Company Details (Doc ID 9EAA33801) | 08/06/2020 | |

84. | Form 484: Change to Company Details (Doc ID 9EAA33802) | 08/06/2020 | ||

85. | Form 484: Change to Company Details (Doc ID 7EBV21125) | 08/08/2022 | ||

86. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 031024243) | 14/10/2020 | ||

87. | Trillion Global Capital Pty Ltd (ACN 660 834 757) | Zhengwei CAI | Form 201: Application for Registration as an Australian company (Doc ID 3EEK38450) | 08/07/2022 |

88. | Form 484: Change to Company Details (Doc ID 7ECI73885) | 15/09/2023 | ||

89. | ||||

90. | ||||

91. | ||||

92. | ||||

93. | Zhongke Global Pty Ltd (ACN 670 931 905) | Weiyao Zhang | Form 201: Application for Registration as an Australian company (Doc ID 6EKI00285) | 30/08/2023 |

94. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECN08708) | 29/12/2023 | ||

95. | Zhongying Global Pty Ltd (ACN 663 466 073) | Weiyao Zhang | Form 484: Change to Company Details | 31/07/2023 |

96. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECN08711) | 29/12/2023 | ||

97. | Audrn Financial Group Pty Ltd (ACN 602 539 462) | Mario Enrique SOTO RUIZ | Form 484: Change to Company Details | 01/02/2023 |

98. | Ausfit Mart Pty Ltd (ACN 664 142 241) | Weiyao ZHANG | Form 484: Change to Company Details | 04/08/2023 |

99. | Great Plan Service Pty Ltd (ACN 669 595 288) | Weiyao ZHANG | Form 201: Application for Registration as an Australian company (Doc ID 6EFK50403) | 10/07/2023 |

100. | ||||

101. | ||||

102. | Ruisen Securities Pty Ltd (ACN 666 827 550) | Weiyao ZHANG | Form 484: Change to Company Details | 26/07/2023 |

103. | Aximtrade Pty Ltd (ACN 655 873 377) | Weiyao ZHANG | Form 484: Change to Company Details | 01/08/2023 |

104. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECR15400) | 16/04/2024 | ||

105. | ||||

106. | ||||

107. | Mercury Securities Group Pty Ltd (ACN 663 112 221) | Weiyao ZHANG | Form 484: Change to Company Details | 04/08/2023 |

108. | Form 370: Notification by Officeholder of Resignation or Retirement (Doc ID 7ECO07678) | 01/02/2024 | ||

109. | Ruifu International Pty Ltd (ACN 670 605 893) | Weiyao ZHANG | Form 201: Application for Registration as an Australian company (Doc ID 6EIY85664) | 17/08/2023 |

110. | Tuotenda Capital Group Pty Ltd (ACN 654 956 153) | Steven Joseph STANBROOK | Form 201: Application for Registration as an Australian company (Doc ID 2EQA98938) | 01/11/2021 |

111. | Form 484: Change to Company Details (Doc ID 7EBN82745) | 01/12/2021 | ||

112. | Yinrui International Pty Ltd (ACN 671 080 658) | Weiyao Zhang | Form 201: Application for Registration as an Australian company (Doc ID 6EKZ32806) | 05/09/2023 |

113. | Aus Financial Australia Pty Ltd (ACN 663 182 536) | Mario Enrique SOTO RUIZ | Form 201: Application for Registration as an Australian company (Doc ID 4EAB84340) | 17/10/2022 |

114. | BHP Markets Pty Ltd (ACN 658 757 745) | Emily Louise LYALL | Form 201: Application for Registration as an Australian company (Doc ID 2EYO02546) | 13/04/2023 |

115. | CLSA Capital Group Inv Pty Ltd (ACN 676 141 512) | Emily Louise LYALL | Form 201: Application for Registration as an Australian company (Doc ID 6EALY8834) | 27/03/2024 |

116. | Katy Capital Pty Ltd (ACN 652 540 120) | Emily Louise LYALL | Form 484: Change to Company Details | 18/03/2024 |

117. | ||||

118. | ||||

119. | Rena Markets Pty Ltd (ACN 664 271 854) | Emily Louise LYALL | Form 201: Application for Registration as an Australian company (Doc ID 3EPF04849) | 05/12/2022 |

120. | Sophie Capital Financial Trading Pty Ltd (ACN 658 204 347) | Emily Louise LYALL | Form 201: Application for Registration as an Australian company (Doc ID 2EIX01596) | 22/03/2022 |

REASONS FOR JUDGMENT

STEWART J:

Introduction

1 “Pig butchering” describes a form of financial scam where contact is made with victims on social media or instant messaging apps by individuals who are unknown to them, who build a relationship (generally friendly, but often romantic) with the victims over time, slowly building their trust. Once trust is established, the perpetrators introduce the idea of investing in foreign exchange, cryptocurrency or commodities trading. The victims are referred to websites of various companies in order to create an account with an online trading platform. Victims then invest funds into the online trading platform account at the direction of the perpetrators, typically initially with a small trial investment. The perpetrators manipulate the accounts to show the appearance of substantial profits which causes the victims to invest progressively larger amounts. Ultimately, when an attempt is made to withdraw funds, the victims are unable to do so and never recover their invested funds or any profits from the purported trading. Thus, the victims are fattened like pigs for slaughter.

2 In this proceeding, the plaintiff, the Australian Securities and Investments Commission (ASIC), applied to the Court for orders to wind up the 95 defendant companies pursuant to s 461(1)(k) of the Corporations Act 2001 (Cth), ie that the Court is of opinion that it is just and equitable that the company be wound up. Having investigated the companies since October 2023, ASIC suspects that many of them are associated with a pig butchering scam, also known as the “Sha Zhu Pan” scam, conducted by transnational organised crime groups operating out of scam centres in Southeast Asia.

3 As a result of its investigation, ASIC has two primary concerns regarding the defendants which have led it to seek orders that they be wound up: first, that the affairs of the defendants are not properly managed, and so present a risk to the public that warrants protection; and second, that the defendants are not operating as legitimate businesses and that many of them have been otherwise used to conduct financial scams against members of the public in Australia and overseas.

4 On 31 October 2024, ASIC applied ex parte for the appointment of provisional liquidators to the defendant companies and other interim relief. On 1 November 2024, I appointed Ms Catherine Margaret Conneely and Mr Thomas Donald Birch of Cor Cordis as joint and several provisional liquidators to each of the defendant companies, as well as making various suppression and short service orders. The orders made on that day required the provisional liquidators to provide to the Court and to ASIC a preliminary report as to the provisional liquidation of each of the companies. The preliminary report was required to canvass numerous matters including the assets and liabilities of the companies and any likely return to any creditors on winding up.

5 On 6 December 2024, the provisional liquidators delivered their preliminary report to the Court, which detailed their investigations into the affairs of the companies. This was followed by a supplementary report delivered to the Court on 25 February 2025.

6 At the time of the hearing, nearly 1,500 claims by “investors” had been received by the provisional liquidators amounting to total claims of $35,881,288. It is not clear whether that figure represents only the principal amounts invested, or whether it includes the claimed profits. The claimants are located in India, the United Arab Emirates, the United States of America, Australia, Cameroon, Canada, Ghana, India, Ireland, Morocco, Nepal, the Philippines, Qatar and France.

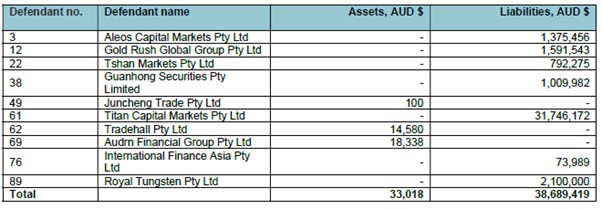

7 The provisional liquidators found that of the 95 companies, only three have assets and those together total only $33,018. Seven companies have liabilities which together total $38,689,419. The provisional liquidators recommended that all but two of the companies be wound up and immediately deregistered, with the remaining two companies being wound up in the normal course – these are the only two companies with meaningful assets. ASIC subsequently applied, at the final hearing, for various orders on the basis of this recommendation and the results of its investigation, in the form of an amended originating process. ASIC did not apply for the immediate deregistration of the 93 companies the subject of the provisional liquidators’ deregistration recommendation.

8 The provisional liquidators also made an application for orders pursuant to s 90-15 of the Insolvency Practice Schedule (Corporations) (IPS), being Sch 2 to the Corporations Act, to streamline the liquidations of the companies in order to significantly reduce the duration of the process and the costs that would otherwise have been incurred if the liquidations were not streamlined and each undertaken separately. Additionally, the provisional liquidators sought orders providing for the approval of their remuneration, and orders under s 480 of the Corporations Act that 93 of the companies be deregistered by ASIC and, thereupon, the liquidators be released in respect of those companies.

9 ASIC notified each company, at its registered address, of ASIC’s intention to seek final winding up orders and, in accordance with an extended timetable, any person notifying their interest in a company was given an opportunity to appear and be heard. ASIC also published notices and issued media releases about its application. In addition, the provisional liquidators published notices of appointment on ASIC’s portal and issued notices of appointment to each of the companies and their directors.

10 Both applications were heard on 20 March 2025, the provisional liquidators’ application immediately following the hearing of ASIC’s application. I was satisfied that proper notice of the applications had been given to all the defendant companies. There was no opposition or appearance for any defendant nor by any interested person. Only ASIC and the provisional liquidators appeared.

11 On 21 March 2025, I made final orders granting most of the relief sought by both ASIC and the provisional liquidators. My reasons for making those orders are set out below.

Applicable principles: winding up on just and equitable grounds

12 Although there is little relevant appellate level authority, the general principles that are to be applied when considering whether a company should be wound up on just and equitable grounds under s 461(1)(k) of the Corporations Act are well settled. The principles were helpfully identified from the authorities by Gordon J in Australian Securities and Investments Commission v ActiveSuper Pty Ltd (No 2) [2013] FCA 234; 93 ACSR 189 at [19]‐[24] and are regularly applied, eg Krejci (liquidator) v Panella, in the matter of Richmond Lifts Pty Ltd (in liq) [2025] FCA 151 at [54] per Cheeseman J.

13 For present purposes, the following is relevant (adding references to subsequent appellate level authority):

(1) ASIC has standing to bring an application to wind up a company on the statutory just and equitable ground: s 462(2)(f) read with s 462(2A) or s 464 of the Corporations Act, both of which are satisfied in this case.

(2) The classes of conduct which justify the winding up of a company on the just and equitable ground are not closed, and each application will depend upon the circumstances of the particular case.

(3) A company may be wound up where there is “a justifiable lack of confidence in the conduct and management of the company’s affairs” and thus a risk to the public interest that warrants protection.

(4) In relation to the consideration that there is a lack of confidence in the conduct and management of the company’s affairs, a lack of confidence may arise where, “after examining the entire conduct of the affairs of the company” the court cannot have confidence in “the propensity of the controllers to comply with obligations, including the keeping of books, records and documents, and looking after the affairs of the company”. This formulation was subsequently adopted in Queensland Phosphate Pty Ltd v Korda [2019] VSCA 215; 14 ARLR 1 at [264] per Kyrou, McLeish and Niall JJA.

(5) In relation to the consideration that there is a risk to the public that warrants attention, a risk to the public interest may take several forms. For example, a winding-up order may be necessary to ensure investor protection or where a company has not carried on its business candidly and in a straightforward manner with the public. Alternatively, it might be justified in order to prevent and condemn repeated breaches of the law. This was subsequently adopted in Queensland Phosphate at [265] and Gognos Holdings Ltd v Australian Securities and Investments Commission [2018] QCA 181; 129 ACSR 363 at [90] per McMurdo JA, Sofronoff P and Gotterson JA agreeing.

(6) There is a reluctance on the part of the courts to wind up a solvent company. A stronger case might be required where the company is prosperous, or at least solvent. Solvency, however, is not a bar to the appointment of a liquidator on the just and equitable ground, particularly where there have been serious and ongoing breaches of the Corporations Act. This principle was adopted in Queensland Phosphate at [266].

14 A further basis in support of why a company may be wound up on just and equitable grounds is where there is a lack of opposition by any of the directors of the company. It can hardly be said that the court can have any confidence in the management of the affairs of a company if neither it by a lawyer nor any director turns up to oppose its winding up. See Fourteen Consulting Services Pty Ltd (in liq) v A.O.B Holding Pty Ltd (in liq) (No 2) [2023] FCA 1684 at [42(c)] per Halley J.

15 A company may be wound up on just and equitable grounds where there are no directors and no likelihood of any directors being appointed: CIC Insurance Ltd (prov liq apptd) v Hannan & Co Pty Ltd [2001] NSWSC 437; 38 ACSR 245 at [13] per Barrett J.

16 Another factor supporting an order for the just and equitable winding up of a company is where there have been breaches of the Corporations Act: Australian Securities Commission v AS Nominees Ltd (1995) 62 FCR 504 at 532-533 per Finn J. As will be seen, the following requirements of the Corporations Act are relevant to that factor in the present case.

17 Section 201D(1) of the Corporations Act provides that “[a] company contravenes this subsection if a person does not give the company a signed consent to act as a director of the company before being appointed”. Where the consent to act as a director has not been obtained prior to the purported appointment of that director, the appointment is invalid by reason of s 201D as well as at general law: Hedges v NSW Harness Racing Club Ltd (1991) 5 ACSR 291 at 293 per McLelland J. Naturally, a fake or forged consent is not a consent under this provision and it cannot be rectified as merely a procedural irregularity: Re Whitsunday Clean Sands Pty Ltd [2017] NSWSC 1199 at [16] per Black J.

18 Section 201A(1) of the Corporations Act mandates that at least one director be ordinarily resident in Australia. A director who has always lived overseas and never entered Australia, or has previously lived in, but subsequently left, Australia for a significant period, is not ordinarily resident in Australia. See Australian Securities and Investments Commission v Stone Assets Management Pty Ltd [2012] FCA 630; 205 FCR 120 at [47] per Besanko J; In the matter of JKN Hills Pty Ltd (Controllers Appointed) [2024] NSWSC 577 at [6] per Black J.

19 Section 286(1) of the Corporations Act obliges companies to keep written financial records that “(a) correctly record and explain its transactions and financial position and performance; and (b) would enable true and fair financial statements to be prepared and audited.” The financial records must be kept for a period of 7 years: s 286(2). Section 286(4) provides that a failure to keep books and records in accordance with s 286(1) or (2) is a strict liability offence.

20 Section 588E(4) provides that “if it is proved that the company: (a) has failed to keep financial records in relation to a period as required by s 286(1); or (b) has failed to retain financial records in relation to a period for the 7 years required by s 286(2), the company is to be presumed to have been insolvent throughout the period.” The presumption of insolvency follows a finding that a company has not kept books and records. It is for the company, on evidence, to rebut that presumption: s 588E(9). See In the matter of Substance Technologies Pty Ltd [2019] NSWSC 612 at [46]-[48] per Rees J.

21 Section 1308(1) of the Corporations Act provides that it is an offence if a person lodges a document with ASIC, makes a statement or omission in the document and knows that the document is materially false or misleading because of the statement or omission. It is a strict liability offence for a person to fail to take all reasonable steps to ensure that such a document was not materially false or misleading because of the statement or omission: s 1308(3).

The work of the provisional liquidators

22 Aside from its own investigation, ASIC also relied on materials from the provisional liquidators, including their preliminary and supplementary reports. The reports set out the actions taken by the provisional liquidators in their investigation of the affairs of the companies.

23 The provisional liquidators published a notice calling for and inviting submissions of formal proof of debts or claims on ASIC’s published notices portal, as well as publishing notices of winding up orders and of their appointment. The provisional liquidators also requested information from the Australian Taxation Office (ATO) on the tax affairs of the companies and requested tax clearance pursuant to s 260-45 of Sch 1 of the Taxation Administration Act 1953 (Cth) to confirm that the companies had no outstanding tax obligations.

24 Correspondence was sent by the provisional liquidators to officers or former officers of the companies and non-consenting officers and former officers, including notification and explanation of the provisional liquidators’ appointment, a report on company activities and property, a notice to deliver books and property of the companies and a notice to attend on the provisional liquidators of the companies. A declaration form was also sent to the non-consenting directors (see [32] below) to confirm they had been registered as a director on the ASIC company register without authorisation and that they had no knowledge of their appointment nor of the company.

25 The provisional liquidators also sent notices to the Sheriff’s office, the State Revenue office and the Department of Transport office in each state and territory, as well as 41 utility providers across Australia, requesting confirmation of any monies owed by or to the companies and of whether any authority was aware of any assets or accounts held in the name of any of the companies.

26 Correspondence in the form of notices of appointment and requests for information was issued to 99 Australian financial institutions, 63 cryptocurrency exchanges and 6 share registries, while searches of public land title databases in each state and territory were also conducted as part of the investigation. The provisional liquidators also requested insolvency insurance brokers to perform searches to identify the existence of any insurance policies placed in the name of any of the companies and conducted various other searches of publicly available information.

27 On the basis of the above, I am satisfied that the provisional liquidators undertook thorough investigations to identify any assets and liabilities of the companies.

The pertinent facts

The financial scam activity

28 ASIC found that many of the companies are associated with financial misconduct complaints. Since July 2021, ASIC received 48 Records of Misconduct (ROMs) concerning 17 of the companies. There have also been complaints to the Australian Financial Complaints Authority (AFCA) of a similar nature to the ROMs. Based on a review of those ROMs, there appears to be a common pattern of scam activity in the nature of “pig butchering”.

29 Seventy‐eight of the companies are current or former corporate authorised representatives (CARs) of one or more Australian financial services (AFS) licensees currently being investigated by ASIC. Thirty of the companies (or similarly named companies) are presently referred to in or associated with active websites or mobile applications. Forty-eight of the companies have or had at least one website or mobile app associated with it. ASIC suspects that the websites and apps facilitate financial scams, including those that are the subject of the ROMs.

The management of the companies

30 ASIC submitted that there is a justifiable lack of confidence in the control and management of each of the 95 companies, all of which fall within at least one of the following five categories.

Category A:

31 Two of the companies (the first and second defendants) do not have a director.

Category B:

32 Twenty-nine of the companies have a named director who did not consent to their appointment as a director of the company (Non‐Consenting Director) and for whom there is evidence, or it is to be inferred, that false information was submitted to ASIC in respect of their appointment. Save for three, each of the 29 companies’ Non‐Consenting Directors is the company’s sole director. The three exceptions are Audrn Financial Group Pty Ltd (sixty-ninth defendant), Ausfit Mart Pty Ltd (the seventieth defendant) and Kwakol Markets Pty Ltd (the seventy-second defendant), each of which has two named directors. In each case, the second director is a No Records Director discussed in Category D below.

Category C:

33 Thirty-six of the companies formerly had a named director who was a Non‐Consenting Director and for whom there is evidence, or it is to be inferred, that false information was submitted to ASIC in respect of their appointment (Former Non-Consenting Director). The current directors are No Records Directors (Category D below) and Departed Directors (Category E below).

34 In respect of each company in Category B or Category C, at least one named director had no knowledge of, and did not consent to, being appointed as a director of the company and in respect of such appointments that are current, in all but one instance (where the position is unclear – see further at [69] below) the director does not wish to remain a named director. In some instances, Non‐Consenting Directors have no knowledge of being made a shareholder of the company where they are also recorded on the ASIC register in that capacity. Further, all but one of the Non‐Consenting Directors have deposed that documents purportedly signed by them are fake or forged, or that their details used for CAR applications made to one of the AFS licensees being investigated by ASIC are fake or forged.

35 In addition, the Non‐Consenting Directors of 24 companies deposed that they are not associated with the addresses recorded for them in ASIC’s records (save where their actual residential address has been used for seven companies, without their permission).

Category D:

36 Twenty of the companies have a director who was born overseas and for whom, despite searches undertaken including by Australian Border Force, there is no evidence that the director has ever been present in Australia (No Records Directors).

Category E:

37 Eight of the companies have a director who has departed Australia and indicated on a passenger card that they do not intend to live in Australia for the next 12 months (Departed Directors). There are three directors relevant to this category. Each is a director of at least one company (being a Category E Company) that is the subject of multiple ROMs.

38 One of the Departed Directors, being Jianghua Hu of Juncheng Trade Pty Ltd (the forty-ninth defendant), is said to usually live in Australia for approximately six months of the year and was not aware of the requirements in s 201A of the Corporations Act. The provisional liquidators found it difficult to determine whether Juncheng provided reasonable assistance to them, despite Mr Hu (though his lawyers) engaging in some correspondence with the provisional liquidators and ASIC. Ultimately, the lawyers retained for Mr Hu stated that he would prefer for the company to be deregistered and, if that is not practical, did not intend to oppose ASIC’s application to wind up Juncheng. Mr Hu is currently outside of Australia, having departed on 2 January 2025.

39 The Departed Directors have entered Australia on at least one occasion and, save for two, have been outside of Australia for at least 14 months. I conclude that in circumstances where the Departed Directors have left Australia, indicated an intention not to live in Australia for the next 12 months and have not returned since departing more than 14 months ago, the Departed Directors are not ordinarily resident in Australia.

Other matters concerning management of the companies

40 In general, ASIC’s investigation has found that most of the addresses recorded in company extracts as the registered office and principal place of business of the companies are not occupied by the relevant company. Forty-six of the companies purported to use “mailbox service providers”, however the nominated providers hold no records for those companies. Further, many of the addresses recorded in company extracts as associated with the directors of various of the companies are not associated with the relevant director, while searches of the electoral status of the No Records Directors with Australian addresses associated with them revealed that those directors are not enrolled on the Australian electoral roll. In a similar vein, 93 of the companies do not have an active Australian bank account.

41 Ninety-two of the companies did not respond to the notices issued by the provisional liquidators requiring the companies and the directors to deliver the books and records of the companies pursuant to ss 474(1), 530A and 530B of the Corporations Act. Responses were received by the provisional liquidators on behalf of Jinte Net Blockhain Pty Ltd (the forty-eighth defendant), Juncheng and Tradehall Pty Ltd (the sixty-second defendant). Even those companies or their representatives did not provide any, or any adequate, books and records on which the provisional liquidators could rely.

ASIC’s ongoing investigation

42 ASIC has an ongoing investigation into the circumstances surrounding the companies and their use in financial scam activity. In order to avoid jeopardising that investigation, I will not say any more about it, save to record that I accept the submissions at [51]-[61] of ASIC’s submissions. I have made suppression or confidentiality orders over those paragraphs.

Common features of the companies

43 As mentioned, based on their investigation, the provisional liquidators have expressed the view that all 95 of the companies should be wound up and that 93 of them should proceed to immediate deregistration. The two companies which it is recommended should proceed to conventional winding up without deregistration are Audrn Financial Group Pty Ltd (the sixty-ninth defendant) and Tradehall. They have assets of $14,580 and $18,338, respectively. None of the 93 Companies that are recommended proceed to immediate deregistration has any assets, except Juncheng which has only $91.73 in a bank account. Such a small amount does not warrant a conventional winding up.

44 The provisional liquidators’ summary of the asset and liability positions of the companies is as follows:

45 As mentioned, none of the directors, nor any interested person, has appeared before the Court or otherwise indicated their opposition to the winding up orders being sought. Where such a serious step is being taken against a company, one would assume that those with an interest in overseeing the company’s continued existence would appear. By their absence, I infer that no such person exists.

46 With the exception of three of the companies, Tradehall, Jinte and Juncheng, none of the directors of any of the companies has assisted the provisional liquidators in their investigations. As the provisional liquidators detailed in their supplementary report, the assistance rendered by the three companies was in any event limited. Accordingly, the provisional liquidators concluded that all of the companies have failed to maintain books and records and are in contravention of s 286 of the Corporations Act.

47 Further, by reason of the companies’ failure to maintain books and records, the provisional liquidators expressed their opinion that the companies may be presumed insolvent. As explained above, this arises by operation of s 588E of the Corporations Act. Accordingly, I have no confidence that any of the companies is solvent with the result that the usual reluctance of courts to wind up a solvent company does not arise.

48 With three exceptions, ASIC has found no evidence that the companies are operating from, or are otherwise associated with, the registered offices and principal places of business addresses nominated by the companies. The ASIC employee who attended the address of Titan Capital Markets Pty Ltd (the sixty-first defendant) observed that the company name was listed on the floor directory of the multi‐storey building at the address and on and inside an office on the same floor. However, the sole director of Titan Capital is a No Records Director, and a former director of Titan Capital was a Non‐Consenting Director. In addition, court documents served on Titan Capital were returned to ASIC. ASIC has not visited the addresses of Standard Holding Group Pty Ltd (the sixtieth defendant) because of its regional location and that of Bullant Capital (Aus) Pty Ltd (the eighty-third defendant).

49 The companies appear to have contravened a number of provisions of the Corporations Act, including s 286 (failing to maintain books and records) and ss 100, 117, 142, 146 and/or 1308, with the possible exception of Standard Holding Group Pty Ltd and Bullant Capital (Aus) Pty Ltd as explained in the preceding paragraph (for providing false registered office and principal place of business information to ASIC, and/or failing to update their relevant information).

Consideration of ASIC’s application

50 Helpfully, ASIC attached as an annexure to its written submissions a “Submissions Matrix” which sets out for each individual defendant the specific parts of the affidavits relied on, the findings (including as to assets and liabilities) and recommendations of the provisional liquidators, which of the Categories A to E apply to the directors of the company, whether the company is associated with a scam website, whether false address evidence was provided and its nature, and so on. The matrix has made it possible to scrutinise the case for just and equitable winding up in respect of each company individually.

51 I am satisfied that the case for winding up of each company on just and equitable grounds is overwhelming. The factual findings that I have identified above, and reference to the Submissions Matrix, make the reasons for that clear. By way of high-level summary, I identify the following.

52 First, the provisional liquidators have recommended that all the companies be wound up. They have found precious little by way of assets, with only two companies having assets worth mentioning. As explained, there is an operative and unanswered presumption that each of the companies is insolvent.

53 Secondly, there has been no opposition to the winding up of a single one of the companies.

54 Thirdly, I have no confidence in the conduct and management of the affairs of each company. That arises from the positions of the directors of the companies as captured by the Categories A to E, the ongoing and serious breaches of the Corporations Act in relation to the management of the companies, the irregularities with regard to the registered addresses and principal places of business of most of the companies and their directors and the failure to provide the books and records of the companies to the provisional liquidators, or possibly even to maintain books and records at all. It also arises from the absence of any appearance on or opposition to the winding up.

55 Fourthly, there is strong circumstantial evidence that the companies are being used for financial scam activity. There is consequently a risk to the public that warrants protection.

56 Fifthly, not one of the companies appears even to be trading.

Non-party access and suppression orders

57 ASIC also sought to vary non-publication, suppression and non-party access orders which were made at the ex parte hearing of the interim application on 31 October 2024. ASIC identified two principal bases for the orders sought at the final hearing:

(1) Non-publication orders were sought to protect that material which contains sensitive personal information about individuals not party to this proceeding, including victims of financial scam activity and persons who had assisted ASIC, where failing to do so could expose such individuals to a greater risk of scam activity and identity fraud. Further, given the resources required to redact sensitive personal information from documents, ASIC proposed that redacted versions of the documents would only be prepared and provided upon requests for access being made in respect of those documents. ASIC therefore sought non-party access orders limiting access to material containing sensitive personal information for 28 days following any request for access to enable ASIC to redact the requested material.

(2) Suppression orders were sought over certain materials referring to matters that could prejudice ASIC’s ongoing investigations, as referred to at [42] above.

58 The Court has the power to order suppression and non-publication orders under s 37AF of the Federal Court of Australia Act 1976 (Cth). The grounds for making a suppression or non-publication order are identified in s 37AG(1) with paragraphs (a) and (c) being presently relevant, ie that the order is necessary to prevent prejudice to the proper administration of justice or to protect the safety of any person.

59 The applicable principles are well settled. It suffices to note that with respect to the grounds set out in s 37AG, the order must be necessary and not simply desirable: Lee v Deputy Commissioner of Taxation [2023] FCAFC 22; 296 FCR 272 at [88] per Thawley, Stewart and Abraham JJ.

60 In Australian Securities and Investments Commission v NGS Crypto Pty Ltd (No 4) [2024] FCA 986, Collier J held at [16] that the publication of sensitive personal financial information or details which could leave individuals vulnerable to identity theft would warrant the making of a non-publication order, on the basis that publication of such information by the Court would bring the administration of justice into disrepute. See also Australian Securities and Investments Commission v Ferratum Australia Pty Ltd (in liq) [2023] FCA 1043; 169 ACSR 553 at [58] per Kennett J; Bayles by his litigation representative Bayles v Nationwide News Pty Ltd (No 3) [2020] FCA 1397 at [28], [8] per Katzmann J.

61 ASIC’s evidence establishes the basis for its concerns in relation to the sensitive personal information of individuals who are referred to in its material. ASIC also notes that if information about individuals is not protected, it may deter people from coming forward to assist ASIC with its investigations in the future, which could adversely affect ASIC’s future ability to investigate and litigate suspected contraventions of the Corporations Act.

62 Further, without referring to specifics to avoid jeopardising ASIC’s ongoing investigations, ASIC has also provided evidence indicating that if information pertaining to the active investigations were to be put into the public domain it may destroy the substance of the investigation (see Hogan v Hinch [2011] HCA 4; 243 CLR 506 at [21] per French CJ). ASIC’s concerns include identified risks to the safety of individuals involved, as well as the risk of prompting subjects of the investigation to collude, destroy evidence or avoid the jurisdiction, thereby prejudicing further steps and impairing the investigation.

63 As such, I was satisfied, on the basis of ASIC’s evidence, that the suppression orders sought by ASIC should be made, on the grounds that the orders are necessary to prevent prejudice to the proper administration of justice and to protect the safety of any person.

Non-Consenting Directors declarations

64 In its amended originating process, ASIC sought declarations that the Non-Consenting Directors did not consent to act as, and were not appointed as, directors of the relevant companies and that these purported appointments were void and of no effect.

65 ASIC also sought an order pursuant to s 1322(4)(b) of the Corporations Act directing that ASIC rectify its register by withdrawing documents or amending them, in order to give effect to the declarations sought above.

66 ASIC sought these orders on the basis that they would protect the Non-Consenting Directors who may be adversely affected by their association with some of the companies. ASIC also noted that it was in the public interest that the Companies Register be rectified so that information provided to the public is accurate and especially in light of s 1274B of the Corporations Act (which provides that documents like company extracts are proof of matters recorded therein, in the absence of evidence to the contrary).

67 ASIC further notes that there is no relevant prejudice arising from ASIC now seeking these orders by its amended originating process, with the companies sought to be wound up.

68 In Whitsunday Clean Sands, Black J held at [19] that “the balance of the case law supports the proposition that an order for rectification of the register under s 1322(4)(b) of the Corporations Act can be made to require correction of incorrect information”. His Honour also made declarations in similar terms to those sought by ASIC in the present case.

69 ASIC’s evidence established that each of the Non-Consenting Directors, except for one, did not want to remain directors of the company, and had become associated with the companies without any knowledge of their own. In the one case, the evidence was ambiguous with regard to whether the person in question desired to be removed from the register with the result that ASIC did not press for relief in respect of him. Further, ASIC’s evidence indicated concern that association with the companies may negatively affect some of the Non-Consenting Directors.

70 I accepted ASIC’s submissions and evidence on this point and I was satisfied that the declarations should be made and that there should be an order to rectify the Companies Register.

The provisional liquidators’ application: introduction