FEDERAL COURT OF AUSTRALIA

Kelehear v Stellar Personnel Brisbane Pty Ltd [2025] FCA 295

File number(s): | VID 1162 of 2018 |

Judgment of: | MURPHY J |

Date of judgment: | 4 March 2025 |

Date of publication of reasons: | 31 March 2025 |

Catchwords: | REPRESENTATIVE PROCEEDING – settlement approval application under s 33V of the Federal Court of Australia Act 1976 (Cth) – claim by black coal mine workers engaged as casual employees in respect of annual leave entitlements – whether proposed settlement is fair and reasonable in the interests of group members and as between group members – settlement approved |

Legislation: | Fair Work Act 2009 (Cth) ss 45, 545 Fair Work Amendment (Supporting Australia’s Jobs and Economic Recovery) Act 2021 (Cth) Federal Court of Australia Act 1976 (Cth) ss 33V, 33ZF |

Cases cited: | Dyczynski v Gibson [2020] FCAFC 120; 280 FCR 583 at [250]-[251] Kelly v Willmott Forests Ltd (in liquidation) (No 4) [2016] FCA 323; 335 ALR 439 Matthews v SPI Electricity Pty Ltd (Ruling No 13) [2013] VSC 17; 39 VR 255 Parkin v Boral Ltd (Class Closure) [2022] FCAFC 47; 291 FCR 116 Ridge v Hays Specialist Recruitment (Australia) Pty Limited (No 2) [2024] FCA 328 Webb v GetSwift Limited (No 7) [2023] FCA 90; 414 ALR 500 Williams v FAI Home Security Pty Ltd (No 4) [2000] FCA 1925; (2000) 180 ALR 459 WorkPac Pty Ltd v Rossato [2020] FCAFC 84; 278 FCR 179 WorkPac Pty Ltd v Rossato [2021] HCA 23; 271 CLR 456 WorkPac Pty Ltd v Skene [2018] FCAFC 131; 264 FCR 536 |

Division: | Fair Work Division |

Registry: | Victoria |

National Practice Area: | Employment and Industrial Relations |

Number of paragraphs: | 90 |

Date of hearing: | 4 March 2025 |

Solicitor for the Applicant | Mr R Markham of Adero Law |

Counsel for the Respondents | Mr A Hochroth |

Solicitor for the Respondents | Ashurst Australia |

ORDERS

VID 1162 of 2018 | ||

BETWEEN: | TANIA KELEHEAR Applicant | |

AND: | STELLAR PERSONNEL BRISBANE PTY LTD (ACN 158 542 191) First Respondent STELLAR RECRUITMENT PTY LTD (ACN 157 737 150) Second Respondent | |

order made by: | MURPHY J |

DATE OF ORDER: | 4 MARCH 2025 |

THE COURT ORDERS THAT:

Settlement Approval

1. Pursuant to ss 33V and 33ZF of the Federal Court of Australia Act 1976 (Cth) (FCA Act), the settlement of these proceedings be approved on the terms set out in the:

(a) Deed of Settlement dated 25 September 2024 (the Deed) marked as Annexure RMM2-2 of the affidavit of Rory Michael Markham dated 10 February 2025;

(b) Deed of Variation dated 7 February 2025 (Variation Deed) marked as Annexure RMM2-3 of the affidavit of Rory Michael Markham dated 10 February 2025; and

(c) Settlement Distribution Scheme prepared by the Applicant’s solicitors (the SDS) in the form annexed hereto and marked “A”,

(together, the Settlement).

2. Pursuant to ss 33V and 33ZF of the FCA Act, the Court authorises the Applicant, nunc pro tunc, to enter into and give effect to the Deed and Variation Deed for and on behalf of all class members who did not file an opt out notice in accordance with s 33J of the FCA Act (the Bound Class Members).

3. Pursuant to s 33ZB of the FCA Act, the persons affected and bound by the Settlement are the Applicant, the Respondents and the Bound Class Members.

4. Pursuant to s 33V(2) of the FCA Act, Adero Law Pty Ltd (Adero) be appointed Administrator of the SDS to act in accordance with the SDS and be given the powers and immunities contained in the SDS.

5. Adero as Administrator under the SDS have liberty to apply in relation to any matter arising under the SDS.

Costs of the proceedings

6. Pursuant to ss 33V(2) and 33ZF of the FCA Act and for the purposes of the SDS, the following deductions from the settlement sum be approved:

(a) the “Adero Costs” (referred to in clause 14(a) of the Deed), in the amount of $150,000 is payable to Adero for the costs incurred by the firm in acting for the applicant on a conditional fee basis;

(b) the “Funder Costs” (as defined in the SDS), in the amount of $50,000 is payable to the Funder in full reimbursement of any amounts due under litigation funding agreements it entered into with the applicant and some group members; and

(c) the “Administration Costs” (as defined in the SDS), in the amount of $33,805 is payable to Adero for settlement administration costs to be incurred by the firm.

Consequential Matters

7. Pursuant to ss 22, 23 or 33ZF of the FCA Act, rule 1.32 of the Federal Court Rules 2011 (Cth) and/or the Court’s implied jurisdiction and upon the date of Final Settlement Approval (as the term is defined in the Deed):

(a) all remaining claims of the Applicant and all Bound Class Members in these proceedings be dismissed (without the need for any further order); and

(b) these proceedings be dismissed (without the need for any further order) on the basis that the dismissal is a defence and absolute bar to any claim (either directly or indirectly) or proceeding by the Applicant or any class member in respect of, or relating to, the subject matter of the proceedings, without prejudice to:

(i) any right of any party to the Deed to make an application to enforce the Deed in a new proceeding; or

(ii) the right of the Administrator of the SDS to refer any issues relating to the SDS to the Court for direction or determination in accordance with the terms of the SDS; and

(c) there be no order as to the costs between the Applicant and the Respondents.

Confidentiality

8. Pursuant to ss 37AF(1)(b)(iv) and 37AG(1)(a) of the FCA Act, on the ground that it is necessary to prevent prejudice to the proper administration of justice, the following documentary material (suppressed material) is to remain confidential and its publication is prohibited:

(a) the confidential opinion of Patrick McCabe dated 7 February 2025, forming annexure RMM2-4 of the affidavit of Rory Markham dated 10 February 2025;

(b) part of paragraph 96 of the affidavit of Rory Markham dated 10 February 2025, being the entirety of the second and third sentence of the paragraph; and

(c) paragraphs 97 to 128, 130 to 147 and 162 to 163 of the affidavit of Rory Markham dated 10 February 2025.

9. Pursuant to ss 37AF(1)(b)(iv) and 37AG(1)(a) of the FCA Act, on the ground that it is necessary to prevent prejudice to the proper administration of justice, the following documentary material (suppressed material) is to remain confidential and its publication is prohibited until the date of the Final Settlement Approval:

(a) Annexure RMM3-1 and RMM3-2 to the affidavit of Rory Michael Markham dated 25 February 2025; and

(b) Annexure JC1-1 to the affidavit of Jerry Chou dated 21 February 2025.

10. On or before 26 February 2025, the applicant is to upload to the Court file the materials referred to in order 9, with suppressed material redacted in accordance with the order.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

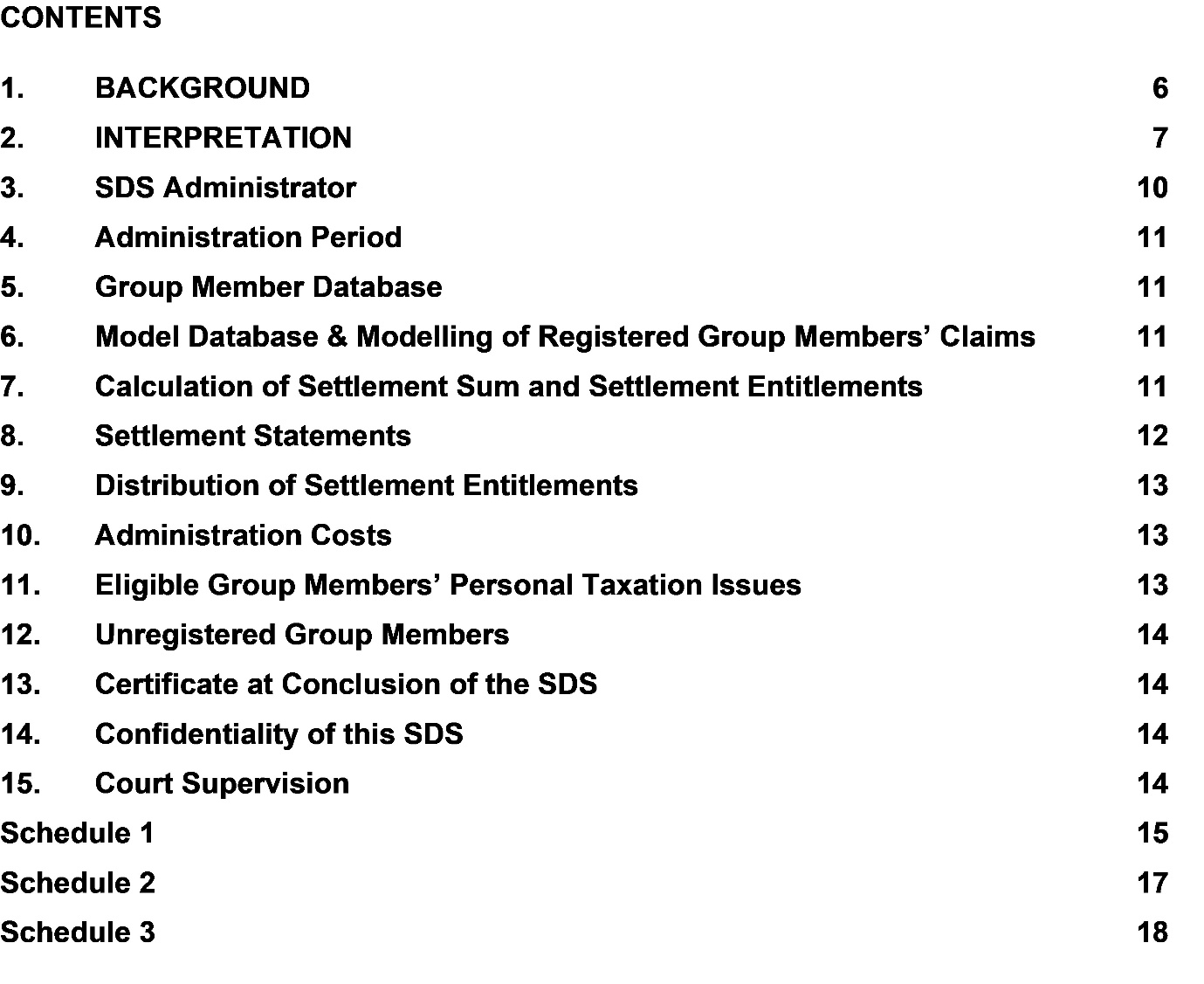

ANNEXURE A

SETTLEMENT DISTRIBUTION SCHEME (SDS)

TANIA KELEHEAR V STELLAR PERSONNEL BRISBANE PTY LIMITED & ANOR

VID1662/2018

(Stellar Class Action)

1. BACKGROUND

1.1. Tania Kelehear (Applicant), on behalf of herself and Group Members, and Stellar Personnel Brisbane Pty Limited and Stellar Recruitment Pty Limited (Stellar) have agreed to resolve the Stellar Class Action in full and final settlement of the Claims of all Group Members arising out of or in connection with the Dispute without the admission of any liability.

1.2. The terms of the settlement are set out in the Settlement and Release Deed executed on 25 September 2024 (Deed), the Deed of Variation executed on 7 February 2025 (Variation Deed) and this SDS, and is subject to the approval of the Court pursuant to s 33V of the Federal Court of Australia Act 1976 (the FCA Act). This SDS does not become operative until the Effective Date.

1.3. The purpose of this SDS is to establish a procedure for the fair and just calculation of the Settlement Entitlement in the event that the Settlement receives Court Approval.

1.4. The Settlement Entitlements will be calculated using the same principles and calculation formulas as set out in this SDS.

1.5. The Settlement Sum is $545,000 in total.

1.6. This SDS contemplates the following key steps:

1.6.1. Adero Law (Adero) will be appointed as the Administrator of the SDS and Stellar shall pay the Settlement Sum into Adero’s trust account;

1.6.2. Stellar will provide the Administrator with Employment Data, which Adero, in its capacity as Administrator, will model according to agreed Calculation Principles, and calculate the Settlement Entitlements;

1.6.3. Adero will distribute the Settlement Entitlements to Registered Group Members according to a verification process and electronic funds transfer implemented by the Administrator with the amount for Adero Costs, Administration Costs and Funder Costs to be deducted from the Settlement Sum prior to the distribution of the Settlement Entitlements to Registered Group Members; and

1.6.4. Adero shall, within 120 days of Stellar providing the data under clause 1.6.2 above or of the date the order of appointment of an Administrator is made (whichever is the latter), make all payments to group members of the Settlement Entitlements in accordance with this SDS.

2. INTERPRETATION

2.1. The meaning of defined words used in the SDS are the same as in the Deed and the Variation Deed. Any Additional Words are defined below.

2.1.1. Adero Costs means the amount of legal costs approved by the Court.

2.1.2. Administration Period means the period in 1.6.4 above.

2.1.3. Administrator means the entity appointed under clause 3 of this SDS.

2.1.4. Administration Costs means costs associated with the administration and implementation of this SDS and as approved by the Court.

2.1.5. Calculation Principles means the principles contained in Schedule 1 of the SDS and approved by the Court.

2.1.6. Certificate means the certificate to be prepared and filed by the Administrator with the Court in accordance with clause 13.1 of this SDS.

2.1.7. Effective Date means the date of entry of orders in the form of, or substantially in the form of, the Approval Orders by the Court.

2.1.8. Employee Entitlements means the entitlements as determined by the Administrator in accordance with annual leave accruals pursuant to the Black Coal Mining Industry Award 2010 (as varied from time to time).

2.1.9. Employment Data means the following data maintained by Stellar in respect of Group Members during the Relevant Period a spreadsheet confirming the start and end date of the employment of each Registered Group Member in the form produced by Stellar prior to the mediation of the Stellar Class Action, or in a form as otherwise agreed between the parties.

2.1.10. Funder Costs means the amount of costs approved by the Court to be paid to the third-party funder, Augusta 005 Limited (formerly Augusta Ventures Limited) (Litigation Funder).

2.1.11. Group Member Database means the database prepared and maintained by the Administrator in accordance with clause 5 of this SDS.

2.1.12. Group Member Information means:

(a) the full name, residential address, email address and phone number of the Group Member;

(b) a Bank State Branch (BSB), Account Number and Account name for an Australian bank account, into which their Settlement Entitlement shall be paid; and

(c) proof of identity of the Group Member, including passport number or drivers licence number.

2.1.13. Registered Group Member means a Group Member who:

(a) registered in accordance with the Court’s orders of 5 December 2023; or

(b) registered in accordance with the Court’s orders of 10 December 2024; and

(c) did not opt out of the Proceedings pursuant to the Court’s orders of 5 December 2023.

2.1.14. Settlement Entitlement means an amount, calculated by the Model, and as otherwise in accordance with the Calculation Principles, to which a Registered Group Member is entitled to receive as part of the Settlement.

2.1.15. SDS means this Settlement Distribution Scheme.

2.1.16. Unregistered Group Members means a Group Member who:

(a) did not register in accordance with the Court’s orders of 5 December 2023; or

(b) did not register in accordance with the Court’s orders of 10 December 2024; and

(c) did not opt out of the Proceedings pursuant to the Court’s orders of 5 December 2023.

2.2. In this SDS:

2.2.1. headings are for convenience only and do not affect interpretation; and

2.2.2. the following rules apply unless the context requires otherwise:

(a) the singular includes the plural, and the converse also applies;

(b) a gender includes all genders;

(c) if a word or phrase is defined, its other grammatical forms have a corresponding meaning;

(d) a reference to a person includes a corporation, trust, partnership, unincorporated body or other entity, whether or not it comprises a separate legal entity;

(e) a reference to dollars of $ is to Australian currency; and

(f) a reference to anything done by any person includes a reference to the thing as done by a director, officer, servant, agent, personal representative or legal representative if permitted to be so done by law or by any provision of the Deed, Variation Deed or this SDS.

3. SDS Administrator

3.1. Adero will be the Administrator for the purposes of the SDS.

3.2. If the Court does not appoint Adero as Administrator:

3.2.1. The Administrator so appointed by the Court will, by accepting an appointment as Administrator, agree to be bound by the Deed and Variation Deed as if it were a party to the Deed and Variation Deed to the extent necessary to perform its obligations under this document; and

3.2.2. Adero will take all steps reasonably necessary to enable the Administrator to perform its functions under this document and the Deed and Variation Deed, including providing the Administrator with a full and unrestricted digital copy of the Model which is capable of calculating Settlement Entitlements in accordance with the Calculation Principles.

3.3. The Administrator will, subject to and in accordance with this SDS, administer this SDS in accordance with its terms, and in particular, will:

3.3.1. prepare and maintain a Group Member Database;

3.3.2. remove Adero Costs, Administration Costs and Funder Costs from the Settlement Sum and calculate Settlement Entitlements of Registered Group Members based on Calculation Principles;

3.3.3. pay the:

(a) Adero Costs to Adero;

(b) Funder Costs to the Litigation Funder; and

(c) Administration Costs to the Administrator;

3.3.4. issue Settlement Statements to Registered Group Members;

3.3.5. distribute the Settlement Entitlements payable to Registered Group Members; and

3.3.6. issue the Certificate in accordance with clause 13 of this SDS.

3.4. The Administrator, in discharging any function or exercising any power conferred by this SDS, shall do so as required by the Court to administer this SDS fairly and reasonably in accordance with its terms, as a duty owed to the Court.

3.5. The Administrator, in discharging any function or exercising any power conferred by this SDS, shall not be liable for any loss to Group Members arising by reason of any mistake, act or omission made in good faith or of any other matter or thing done by the Administrator in the discharge of its function of administrator of this SDS.

4. Administration Period

4.1. The administration and settlement distribution steps set out in this SDS are required to be completed in accordance with the timeframes set out in this SDS and prior to the expiration of the Administration Period.

5. Group Member Database

5.1. The Administrator will create and maintain a database of Registered Group Members.

5.2. The Group Member Database maintained by the Administrator shall include the:

5.2.1. Group Member Information in respect of Registered Group Members as maintained by Adero in its capacity as solicitor for the Applicant; and

5.2.2. Group Member Information as submitted by Registered Group Members to the Administrator pursuant to this SDS.

6. Model Database & Modelling of Registered Group Members’ Claims

6.1. A database will be created by the Administrator which will be used for the purposes of determining the value of Settlement Entitlements payable to Registered Group Members (Model Database).

6.2. Stellar will, provide the Employment Data within seven (7) days of the date of the order to appoint an Administrator.

6.3. The Model Database maintained by the Administrator shall include the following information in respect of Registered Group Members:

6.3.1. Group Member Database as provided by the Administrator; and

6.3.2. Employment Data as provided by Stellar.

7. Calculation of Settlement Sum and Settlement Entitlements

7.1. Within thirty-five (35) days after the Effective Date, the Administrator will, by applying the Model, calculate the Settlement Entitlements of Registered Group Members in accordance with the Calculation Principles.

7.2. Within [thirty-five (35) days after the Effective Date / 7 days of the Court’s determination of the Adero Costs and Settlement Administration Costs (whichever is the later)], the Administrator will calculate the Settlement Entitlement of each Registered Group Member as follows.

7.2.1. First, the Administrator will calculate the Employee Entitlements using the Model (per principles 1 to 3 of the Calculation Principles);

7.2.2. Second, the Administrator will calculate the aggregate of all Registered Group Members’ Modelled Claims (Aggregate Claims);

7.2.3. Third, the Administrator will calculate each Registered Group Member’s modelled claim as a percentage of the Aggregate Claims (RGM Percentage) (per principle 4 of the Calculation Principles);

7.2.4. Fourth, the Administrator will deduct the Adero Costs, Administration Costs and Funder Costs from the Settlement Sum with the balance payable as Settlement Payments to Registered Group Members (Net Settlement Sum); and

7.2.5. Fifth, the Administrator will multiply the RGM Percentage by the Net Settlement Sum to calculate each Registered Group Member’s proportionate share of the Net Settlement Sum, which amount shall be their Settlement Entitlement (per principle 5 of the Calculation Principles).

8. Settlement Statements

8.1. By no later than fifty-five (55) days after the Effective Date, the Administrator will issue, or cause to be issued to each Registered Group Member, a Settlement Statement (in the form referred to in clauses 8.3 and 8.4 below);

8.2. Settlement Statements will be issued via email to the email address set out in the Group Member Information, and if there is no email address, to the postal address set out in the Group Member Information.

8.3. The Settlement Statement will be in the form of Schedule 2 to this SDS and will set out the Settlement Entitlement calculated in accordance with this SDS.

8.4. If the Registered Group Member has no Settlement Entitlement, the Settlement Statement will be in the form of Schedule 3 to this SDS and will set out the reasons why the individual has no Employee Entitlement.

8.5. As and when the Administrator issues a Settlement Statement recording that:

8.5.1. a Registered Group Member will be paid the value of the Settlement Entitlement recorded in the Settlement Statement, the issued Settlement Statement will be deemed to be a final and accurate statement as to the amount that the Registered Group Member is entitled to receive from the Settlement Sum; or

8.5.2. a Registered Group Member is not entitled to receive any amount from the Settlement Sum, the issued Settlement Statement will be deemed to be a final and accurate determination and statement that a Registered Group Member is not entitled to receive any payment from the Settlement Sum.

9. Distribution of Settlement Entitlements

9.1. Within seven (7) days of receipt of the Settlement Sum, the Administrator must pay:

9.1.1. the Adero Costs to Adero in its nominated bank account;

9.1.2. the Funder Costs to the Litigation Funder in its nominated bank account; and

9.1.3. the Administration Costs to the Administrator in its nominated bank account.

9.2. Within sixty (60) days after the Effective Date, the Administrator will pay the Settlement Entitlements to Registered Group Members in accordance with the Settlement Statements issued by the Administrator under clause 8 of this SDS.

9.3. Distributions of the Settlement Entitlements to the Registered Group Members will be made by electronic funds transfer to the nominated bank account set out in the Group Member Database.

10. Administration Costs

10.1. The Administrator shall receive a fixed amount by way of the payment of Administration Costs, in an amount to be approved by the Court, for performing its obligations under this document, irrespective of the number of such Registered Group Members.

10.2. The Administrator recognises that there may be some Administration Costs that will be unrecoverable but will nonetheless abide by its fixed fee as approved by the Court.

10.3. The Adero Costs, Administration Costs and Funder Costs are to be paid out of the Settlement Sum in priority to the Settlement Payments.

11. Eligible Group Members’ Personal Taxation Issues

11.1. Each Registered Group Member is responsible for obtaining his or her own taxation advice in respect of the distribution of the Settlement Entitlement that he or she receives.

12. Unregistered Group Members

12.1. Unregistered Group Members remain Group Members for all purposes and agree to be bound by the Settlement on the terms of the Deed, Variation Deed and in accordance with the orders made by the Court. Unregistered Group Members (who did not register before closure of the group by the Court) are not entitled to, and will not receive, a distribution from the Settlement Sum or any other amount.

13. Certificate at Conclusion of the SDS

13.1. Within five (5) business days of the Administrator distributing the Settlement Entitlements, the Administrator is to prepare and file a certificate with the Court, which certificate is required to set out and certify:

13.1.1. that Adero has paid:

(a) the Settlement Entitlements to Registered Group Members;

(b) the Adero Costs to Adero;

(c) the Administration Costs to the Administrator;

(d) the Funder Costs to the Litigation Funder;

13.1.2. whether any time periods in the SDS were not complied with by a party;

13.1.3. that subject to clause 13.1.2 above, the parties have complied with their respective obligations under the SDS; and

13.1.4. the SDS has been administered in its entirety,

(collectively, the Certificate).

13.2. The Administrator is required to serve a copy of the Certificate on Stellar, within five (5) business days of receiving a sealed copy of the Certificate.

14. Confidentiality of this SDS

14.1. The provisions in relation to confidentiality of the Deed and the Variation Deed apply to this SDS.

15. Court Supervision

15.1. Consistent with Part IVA of the Act, the implementation of this SDS is subject to the Court’s supervision.

Schedule 1

Calculation Principles

1. The intention of this Schedule 1 is to explain the principles upon which the Model has been established and which will continue to govern the calculation of Settlement Entitlements for the purposes of the SDS.

2. When using the Model to calculate Settlement Entitlements for Registered Group Members, the following information, data, details and principles will be utilised and adopted:

2.1. the Employment Data; and

2.2. the following agreed principles set out in the table below will be adopted:

Principle | |

1 | ACCRUED HOURS OF ANNUAL LEAVE FOR EACH GROUP MEMBER TO BE CALCULATED ACCORDING TO THE NUMBER OF COMPLETED WEEKS OF EMPLOYMENT SERVICE Each Group Member’s accrued annual leave shall be calculated at a rate of 4.0385 hours per week of employment with Stellar. |

2 | EACH GROUP MEMBER’S ANNUAL LEAVE AMOUNT (IN $) TO BE CALCULATED BY REFERENCE TO THE AWARD RATE AT THE DATE OF TERMINATION MULTIPLIED BY ANNUAL LEAVE HOURS ACCRUED Each Group Member's annual leave amount will be calculated according to the accrued amount in hours multiplied by the Award rate at the date of the termination of their employment. |

3 | APPLICATION OF AVERAGE ANNUAL LEAVE ENTITLEMENT Should the Respondents be unable to locate and provide the Employment Information required for any Registered Group Members, the average annual leave entitlement of the individuals for whom data has been provided is to be calculated and applied in respect of that individual. |

4 | EACH GROUP MEMBER’S ANNUAL LEAVE AMOUNT (IN $) TO BE CALCULATED AS A PROPORTION OF TOTAL LEAVE AMOUNT OF THE GROUP OVERALL Each Group Member’s accrued annual leave shall be calculated as a percentage proportion of the total sum of annual leave accrued by all Group Members. |

5 | THE SETTLEMENT SUM (MINUS LEGAL AND ADMINISTRATIVE COSTS AND FUNDER COSTS) SHALL BE SHARED AMONGST GROUP MEMBERS ACCORDING TO THE PERCENTAGE PROPORTION DETERMINED IN PRINCIPLE 4 Each Group Member’s Settlement Entitlement shall be calculated as a proportion of the Settlement Sum minus legal and administrative costs and funder costs based on the hours of accrued annual leave for the individual Group Member as a percentage proportion of hours accrued by all Group Members. |

3. Settlement Sum and Settlement Entitlements Cap

3.1. In keeping with the Deed and Variation Deed, Settlement Entitlements must be calculated on the basis that the Settlement Entitlements for Registered Group Members are capped at the sum of $545,000 less the Adero Costs, Administration Costs and Funder Costs as approved by the Court (Settlement Entitlements Cap).

4. Balancing Discount

4.1. To achieve the Settlement Entitlements Cap, the Model applies a balancing discount to the underpayment of Registered Group Members. This means the Registered Group Members receive an equal portion of their calculated claim once costs are removed.

Schedule 2

Settlement Statement

Dear Group Member

Tania Kelehear v Stellar Personnel Brisbane Pty Limited & Anor, VID1662/2018

You are receiving this Settlement Statement because you registered to participate in the settlement of the Stellar Class Action.

In accordance with the settlement distribution scheme approved by the Court for calculating and paying employee entitlements to registered group members (SDS), there has been a determination that you are entitled to receive a payment pursuant to the settlement approved by the Court.

Having regard to information about your employment (including the duration of your employment) and the calculation principles approved by the Court (Model), you are entitled to receive the sum of $[*insert*].

Legal costs required to be paid to Adero for the advancement of the Stellar Class Action, costs required to be paid to the litigation funder, Augusta 005 Limited (formerly Augusta Ventures Limited), for assistance in funding the class action and costs to the settlement administrator for distributing the settlement have already been factored in the above amount. We can confirm that no further deductions will be made for any costs in relation to the Stellar Class Action.

Pursuant to the SDS, the amount referred to above is deemed to be a final and accurate amount that you are entitled to receive in keeping with the settlement arrangements approved by the Court.

Adero will pay the amount referred to above (by way of electronic funds transfer to the bank account you nominate during this settlement administration process). The amount referred to above will be paid as soon as practicable.

Sincerely,

Adero Law

Schedule 3

Settlement Statement

Dear Group Member

Tania Kelehear v Stellar Personnel Brisbane Pty Limited & Anor, VID1662/2018

You are receiving this Settlement Statement because you registered to participate in the settlement of the Stellar Class Action.

In accordance with the settlement distribution scheme approved by the Court for calculating and paying employee entitlements to registered group members (SDS), there has been a determination that you are NOT eligible to receive a payment because your employment records indicate that you have been properly remunerated in accordance with the Black Coal Mining Industry Award 2010.

This determination is deemed to be a final and accurate determination that you are NOT entitled to receive any payment pursuant to the settlement arrangements which have now been approved by the Court.

Sincerely,

Adero Law

REASONS FOR JUDGMENT

MURPHY J

1 These reasons concern an interlocutory application brought by the applicant, Ms Tania Kelehear, seeking orders for Court approval of a proposed settlement of this class action under s 33V of the Federal Court of Australia Act 1976 (Cth) (the Act). The parties have reached an in-principle settlement pursuant to which the respondents, Stellar Recruitment Pty Ltd and Stellar Personnel Brisbane Pty Ltd (collectively, Stellar), have agreed to pay the applicant and group members $545,000 inclusive of legal costs, expenses, disbursements, GST and liability for income tax (Settlement Sum) in full and final settlement of the claim without admission of liability (proposed settlement).

2 For the reasons I explain, I am satisfied that the proposed settlement is fair and reasonable as between the applicant and the group members on the one hand and the respondents on the other, and that it is fair and reasonable as between the group members. I made orders to approve the settlement on 4 March 2025, and I now provide reasons for doing so.

THE EVIDENCE

3 The applicant filed an interlocutory application seeking approval of the proposed settlement dated 10 February 2025 (Approval Application). The applicant relied upon the following:

(a) an affidavit of Mr Rory Markham, the Managing Principal of Adero Law (Adero), which has acted as the solicitors for the applicant throughout the proceeding, affirmed 10 February 2025. The annexures to the affidavit include copies of the following documents:

(i) a notice to the applicant dated 22 February 2022 from the litigation funder of the proceeding, Augusta 005 Limited (the Funder), terminating the litigation funding agreement between the Funder and the applicant (LFA);

(ii) the Settlement Deed (Deed) between the applicant on her own behalf and on behalf of the group members, the respondents and Adero dated 25 September 2024;

(iii) the Deed of Variation (Variation Deed) between the applicant, the respondents and Adero dated 7 February 2025;

(iv) the confidential Counsel’s Opinion of Patrick McCabe of counsel dated 7 February 2025;

(v) the retainer and costs agreements between the applicant and Adero dated 18 October 2018, 7 March 2022 and 25 May 2023; and

(vi) the LFA between the Funder and the applicant dated 23 October 2018.

(b) an affidavit of Mr Jerry Chou, a solicitor in the employ of Adero, sworn 21 February 2025;

(c) an affidavit of Mr Markham sworn 25 February 2025; and

(d) the proposed Settlement Distribution Scheme (SDS).

4 By an email to my chambers dated 20 February 2025 the solicitors for the Funder informed the Court that it gave an undertaking that, upon the making of the proposed orders, the Funder will not seek to enforce any contractual or other entitlement to any assignment or payment from the applicants and group members in the proceeding.

OVERVIEW OF THE PROCEEDING

5 The applicant commenced the class action on 21 December 2018, by way of an Originating Application and Statement of Claim. She brought the proceeding on her own behalf and on behalf of all casual employees who were engaged in roles falling within the “Production and Engineering Employees” classifications of the Black Coal Award 2010 (Award) working at black coal mines in Australia and employed on one or more occasions by the respondents in the period between 25 December 2012 to 24 December 2018 (Relevant Period).

6 At that time, the class action made the following claims:

(a) the Loaded Rates Claims: insofar as the Award required shift work, weekend, holiday rates and overtime, to be paid at "double time" (or similar), it was alleged that Stellar had underpaid the group members because it treated the sum to be doubled (or similar) at the Award rate, rather than the agreed or actual rate of pay;

(b) the Annual Leave and Termination Pay Claims: it was alleged that group members were entitled to be paid annual leave, notice of termination and severance pay under what was then clause 24 of the Award; and

(c) the Accessory Claims: in the event that the first respondent was found to be the true employer, it was alleged that the second respondent was knowingly concerned in the Loaded Rates Claims and Annual Leave and Termination Pay Claims and accordingly was liable as an accessory.

7 The proceeding was funded by the Funder pursuant to LFAs between it and the applicant and approximately 32 other group members.

8 The applicant filed the proceeding approximately four months after the judgment of the Full Court in WorkPac Pty Ltd v Skene [2018] FCAFC 131; 264 FCR 536 in which the Full Court upheld a decision that the respondent, who was employed as a casual employee by a labour hire company to perform work at a black coal mine was, by law for the purposes of the Fair Work Act 2009 (Cth) (FW Act) and the relevant enterprise agreement, a full-time employee and therefore entitled to the terms and conditions for full time employees under the relevant enterprise agreement. Another Full Court in WorkPac Pty Ltd v Rossato [2020] FCAFC 84; 278 FCR 179 later reached the same decision. While Rossato was on foot the class action was held in abeyance by agreement between the parties.

9 Workpac appealed Rossato to the High Court. While that appeal was on foot the class action remained in abeyance. On 4 August 2021, in WorkPac Pty Ltd v Rossato [2021] HCA 23; 271 CLR 456, the High Court allowed WorkPac’s appeal and rejected the reasoning in Rossato and Skene. The High Court held that Mr Rossato was a casual employee, rather than a full-time employee, for the purposes of the FW Act and the relevant enterprise agreement; and that he was not entitled to the terms and conditions relating to full-time employees under the FW Act nor the relevant enterprise agreement.

10 In the meantime, through the Fair Work Amendment (Supporting Australia’s Jobs and Economic Recovery) Act 2021 (Cth) (the FW Amendment Act), Federal Parliament introduced amendments, with retrospective effect, including: (a) a definition of “casual employee” which relied solely on the terms of the employment offered and accepted, and expressly did not take into account inferences that might be drawn from other interactions between the employer and the employee through the course of employment; (b) that a regular pattern of hours did not, of itself, indicate a firm advance commitment to continuing and indefinite work according to an agreed pattern of work; and (c) a mechanism for “off-setting” the amount payable to an employee for any unpaid entitlements due under an Award or enterprise agreement who is found not to have been a casual employee, against any amount previously paid to that employee by way of a casual loading.

Termination of litigation funding

11 On 23 February 2022 the Funder wrote to the solicitors for the applicant to terminate the LFAs between the Funder and the applicant and approximately 32 group members. The Funder gave reasons for that termination which were expressly linked to the adverse developments outlined above.

12 Following the termination of litigation funding Adero entered into a conditional or “No Win-No Fee” retainer and costs agreement with the applicant and has conducted the proceeding on that basis since then.

The amendments to the proceeding

13 The applicant then sought leave to significantly reduce the scope of the claims in the proceeding by:

(a) discontinuing the Loaded Rates Claims, Accessory Claims and Termination Pay Claims; and

(b) reformulating the Annual Leave Claim so that it alleged that, in two contraventions of the Award, the respondents:

(i) engaged the applicant and group members as casual employees; and

(ii) did not pay out their accrued annual leave entitlements on termination of their employment.

On 2 October 2023 the Court granted leave to the applicant to file an Amended Originating Application and an Amended Statement of Claim (ASOC) to reflect those amendments.

14 On 7 November 2023, the respondents filed their Defence in which they denied the liability alleged in the ASOC and alleged that:

(a) the Award does not prohibit the employment of Production and Engineering employees on a casual basis;

(b) annual leave entitlements only applied to employees other than casual employees so that the applicant and group members had no annual leave entitlement; and

(c) if the applicant or group members suffered any loss the Court should compare all of the financial benefits received by the individual, including any financial benefits they would have received if not engaged by the respondents at all, or alternatively, the minimum terms and conditions to which they would have been entitled had they been engaged other than as a casual.

The claims

15 The ASOC alleges that the applicant was employed by one or other of the Stellar entities from 1 July 2014 until 28 September 2014 at a black coal mine in Queensland called Curragh North, principally to operate a rear dump truck.

16 The following matters are admitted:

(a) Stellar Personnel purported to engage Ms Kelehear as a casual employee;

(b) the Award covered and applied to the applicant’s employment with Stellar Personnel and

(c) the Award sets out classifications of employment in two schedules, Schedule A, entitled “Production and Engineering Employees”, and Schedule B, entitled “Staff Employees”, and the applicant fell within a classification in Schedule A.

The First Alleged Contravention

17 Clause 10.1 of the Award provided as follows:

An employer may employ an employee in any classification included in this award in any of the following types of employment:

(a) full-time;

(b) part-time; or

(c) in the case of classifications in Schedule B - Staff Employees, casual.

18 The ASOC alleges that Stellar contravened this clause by employing the applicant and group members as casual employees in circumstances where they are employed in a classification under Schedule A of the Award. The respondents deny this alleged contravention.

The Second Alleged Contravention

19 Clauses 25.1, 25.2 and 25.3 of the Award provided as follows:

25.1 Annual leave entitlements are provided for in the [National Employment Standards (NES)]. This clause supplements those entitlements and provides industry specific detail.

25.2 Entitlement to annual leave

(a) An employee is entitled to annual leave, in addition to the amount provided for in the NES, such that the employee's total entitlement to annual leave pursuant to the NES and this award for each year of employment is a cumulative total of 175 ordinary hours (five weeks).

(b) An employee who:

(i) is a seven day roster employee; or

(ii) works a roster which requires ordinary shifts on public holidays and not less than 272 ordinary hours per year on Sundays,

is entitled annually to an additional 35 ordinary hours (one week) of annual leave.

25.3 Accrual of annual leave

Employees, other than casual employees, accrue annual leave at the following rate:

For employees who would be entitled to annual leave of | Hours of annual leave for each completed week of employment: |

175 hours (5 weeks) | 3.3654 |

210 hours (6 weeks) | 4.0385 |

20 Clause 13.5(a) of the Award provided:

In the case of termination of employment, and in addition to any other amounts payable pursuant to this award to an employee on termination, the employee must be paid in accordance with this clause.

(a) Accrued annual leave

The employee must be paid for all annual leave entitlements, and annual leave accrued in accordance with clause 25.3, at the employee's base rate of pay.

21 The ASOC alleges that:

(a) because the applicant and group members were required to work on a roster having a pattern where shifts might be worked on any of the 7 days of the week, they fall within the terms of clause 25.2(b)(i) of the Award, and as a consequence they accrued 4.0385 hours' annual leave for each completed week of employment, and thus 6 weeks annual leave per annum; and

(b) the applicant was not paid annual leave on termination,

which constitutes a breach of the Award.

22 The respondents admit that applicant’s employment terminated on 28 September 2014, and that the applicant was not paid any annual leave entitlements upon termination, but deny that is a breach of the Award as the applicant was not entitled to annual leave, as she was employed as a casual employee. They appear to admit that the applicant worked a roster having a pattern where shifts might be worked on any of the 7 days of the week, but they deny that the applicant accrued annual leave as she was employed as a casual employee.

Penalty provisions

23 Both the First and Second Alleged Contraventions, if established, would be contraventions of section 45 of the FW Act, which prohibits the contravention of an award. Section 45 of the FW Act is a "civil remedy provision" under the FW Act.

Loss and damage

24 The applicant seeks an order under ss 545(1) and 545(2)(b) for compensation for loss suffered because of both alleged contraventions.

25 In respect of the First Alleged Contravention, the loss alleged to have been suffered is the loss of the financial and non-financial benefits of being a permanent employee (in contradistinction to being a casual employee).

26 The respondents, however, alleged that if one or other of the respondents engaged in the First Alleged Contravention, then the applicant has suffered no loss, and in particular:

(a) the appropriate counterfactual is that the applicant had not been engaged at all, rather than that the applicant had been engaged as a full-time employee; and

(b) alternatively, if full-time employment is the appropriate counterfactual, the Court should compare all of the financial benefits received by a group member, including any financial benefits they would have received if not engaged by the respondents at all or alternatively, the minimum terms and conditions to which they would have been entitled to had they been engaged other than as a casual.

The Opt Out and group member registration process

27 Mr Markham estimated that there are approximately 500 group members overall.

28 On 5 December 2023, the Court made orders by consent requiring that group members be given a Court-approved notice regarding their right to opt out of the proceeding, and that they may register their interest in making a claim in the proceeding in advance of a planned mediation.

29 The orders approved the form and content of an Opt Out and Registration Notice (Notice) to inform group members that:

(a) if they wished to opt out they were required to complete and return an opt out notice by 29 February 2024; and

(b) if they wished to register their interest in making a claim in the proceeding they should complete and return a registration form by 29 February 2024 (February 2024 Registration Deadline).

The orders did not include a class closure mechanism, but the Notice informed group members that if a settlement was reached in a mediation or at any point before the trial commenced, the applicant intended to apply for an order that any group member who did not register prior to the Registration Deadline would remain a group member and be bound by any settlement of the proceeding, but would not be entitled to any share of any monetary compensation that was gained from the settlement.

30 The orders included a protocol for providing the Notice to group members which required:

(a) the respondents, by no later than 12 December 2023, to provide to a third-party mailing service provider the last recorded email address and postal address of any person who according to the respondents’ records was employed as a casual employee and assigned to work at a black coal mine in a role covered by Schedule A to the Award in the period from 25 December 2012 to 24 December 2018 (List of Group Members) and

(b) the third-party mailing service provider, by no later than 19 December 2023, to send the Notice to all persons on the List of Group Members by email to each person on the list for whom an email address is held, and by ordinary post to the last recorded postal address of that person in the event the respondents do not hold an email address. Where any email was not delivered or “bounced back” the mailing service provider was to send the Opt Out and Registration Notice by ordinary post to the last recorded postal address of that person.

31 The orders also required Adero, by no later than 7 March 2024, to provide to the solicitors for the respondents, on a confidential and without prejudice basis for the purposes of mediation, the employment information derived from those group members who had registered (RGMs), including their dates and periods of their employment, the positions they held, and the hours that they allege that they worked.

32 Mr Markham deposed that following the registration process 149 persons had registered their interest in participating in the proceeding, and the applicant provided their claim details to the respondents as required by the orders.

33 On 21 March 2024, the respondents notified the applicant that they considered that only 48 of the 149 names on the list of RGMs provided by Adero fell within the group member definition in the ASOC. On 21 March 2024, the respondents provided the solicitors for the applicant with the employee records in respect of the 48 RGMs who they considered to be group members, in order to enable the applicant to calculate the quantum of their claims. This included providing start and end dates of their employment, hours worked, and the respondents' calculations of their annual leave hours accrued and their entitlement (if any) to unpaid annual leave on termination.

34 According to the respondents, 101 persons on the list of RGMs provided by Adero were not group members, because:

(a) 80 individuals were not employed by either of the respondents but were employed by SRSW Pty Ltd and subject to the SRSW Enterprise Agreement 2015 or the SRSW Enterprise Agreement 2019;

(b) 10 individuals were recorded in the respondents' systems, but did not in fact start an assignment or perform any work;

(c) two individuals did not work at a black coal site;

(d) the respondents had no record of five of the individual’s names; and

(e) four individuals are excluded because they were not paid.

35 Mr Markham deposed that for some months after 21 March 2024 Adero made endeavours to confirm whether the individuals identified by the respondents as falling outside the group member definition were in fact group members. He said that he had caused employees of Adero to try to contact all 101 people identified by the respondents as not being eligible to be group members to notify them that the respondents had disputed their eligibility, and to request that they confirm and provide evidence of their employment with the respondents at a black coal site during the Relevant Period, otherwise they will not be considered a group member and will not be entitled to any compensation. He deposed to repeated attempts to contact these possible group members, and that a great many of them did not respond at all, that some responded but did not provide any evidence, and that some responded and provided evidence which showed that they were not in fact group members. In the finish Mr Markham concluded that only two of the 101 people identified by the respondents as not being eligible to be group members were in fact eligible.

36 Thus, following the first registration process, there were 50 RGMs in total.

The first settlement agreement

37 On 28 March 2024 the parties attended a Court-ordered mediation conducted by Judicial Registrar Edwards. On 6 August 2024, following the applicant’s attempts to contact the 101 persons who the respondents said were not eligible to be group members, the parties reached an in-principle settlement. On 25 September 2024 the parties exchanged counterparts of the Deed.

38 Pursuant to the Deed the respondents agreed to pay the sum of $500,000 inclusive of legal costs, expenses, disbursements, GST, interest and any income tax liability to settle the claims of the applicant and all group members who had not opted out of the proceeding.

Notice of the proposed settlement

39 On 10 December 2024, the Court made orders to set a timetable for the Approval Application, and requiring that group members be given a Court-approved Notice of Proposed Settlement, and another opportunity to register to participate in the settlement. The orders provide that:

(a) any group member who had not opted out and who had registered by the 29 February 2024 Registration Deadline is an RGM; and

(b) any group member who had not opted out, but who registered by 6 January 2025 (Final Registration Deadline) by completing and returning the Group Member Registration Form annexed to the Notice of Proposed Settlement is also an RGM.

40 The orders included a class closure mechanism, such that any group member who had not opted out, and who had not registered by the Final Registration Deadline would remain a group member for all purposes and would be bound by the settlement upon its approval by the Court, and (unless the Court granted leave) would not be entitled to receive any payment under the settlement.

41 The second group member registration process utilised the same notification regime as the first registration process. By the Final Registration Deadline a further 40 group members had registered to participate in the proposed settlement. Thus, the RGMs at that point totalled 90 persons.

The second settlement agreement

42 The extent of the further group member registrations in the second group member registration process apparently came as a surprise to Adero. Between January and February 2025 the applicant sought to renegotiate the settlement agreement due to the high number of persons who had registered.

43 On 7 February 2025 the parties entered into the Variation Deed, pursuant to which the respondents agreed to increase the amount paid under the settlement to $545,000 inclusive of legal costs, expenses, disbursements, GST, interest and any income tax liability to settle the claims of the applicant and all group members who had not opted out of the proceeding. It is that in-principle settlement which the applicant seeks be approved.

THE PROPOSED SETTLEMENT

44 The salient terms of the proposed settlement, as contained in the Deed and the Variation Deed, are as follows:

(a) the respondents agree to pay $545,000 inclusive of legal costs, expenses, disbursements, GST, interest and any income tax liability to settle the claims of the applicants and all group members who have not opted out of the proceeding;

(b) upon Final Settlement Approval (as defined), the applicant on her own behalf and on behalf of each group member (to the extent of her statutory authority to do so) releases the respondents from the Claims (as defined), and all claims that are in respect of, or arise out of, directly or indirectly, the same, similar or related circumstances to the Claims made in the proceeding (whether known or unknown), including any claim for compensation, damages, interest, or other losses, pecuniary penalties or costs;

(c) Adero covenants that, other than to enforce the Deed it will not cause, encourage any person to commence and will not fund or financially support or otherwise aid, abet or counsel or procure the bringing of any Claim or proceeding against the respondents or any of their related parties (or act in any such proceeding) based on any Claims arising from or related to any allegations, facts or matters which are, or ever have been, the subject of the proceedings, or the circumstances or allegations giving rise to or referred to, or which have been referred to in the proceedings.

(d) “Claims” is broadly defined to mean:

… all claims of any kind, including allegations of liability or entitlement to sums of money or compensation, and assertions of legal or equitable rights, that are, could have been, or have been advanced in the Proceeding, including but not limited to those set out in the Amended Originating Application filed in the Proceeding on 3 October 2023 and the Amended Statement of Claim filed in the Proceeding on 10 October 2023.

45 The SDS provides that the proposed $545,000 settlement is to be disbursed as follows:

(a) $33,805 be set aside to settlement administration costs;

(b) $150,000 be set aside for legal costs;

(c) $50,000 be set aside for the Funder’s charges; and

(d) the remaining $311,195 be divided pro rata between the group members. The method for calculating each group member’s annual leave entitlement is to be based on the information provided regarding the length of their period of employment, and then to distribute the settlement sum on a pro rata basis based on that calculation.

46 For Adero’s work after litigation funding ceased and for settlement administration, the proposed settlement caps Adero’s legal costs at $183,805 (incl. GST). Mr Markham’s second affidavit shows that the firm incurred $228,541 in fees and disbursements in the post-litigation funding period, and it expects to incur a total of approximately $272,346 (being a further $10,000 in costs associated with the settlement approval hearing and $33,805 in settlement administration costs). Thus, it will receive around $88,541 less than it incurs in costs.

RELEVANT PRINCIPLES FOR SETTLEMENT APPROVAL

47 The fundamental issue for determination on an application for settlement approval under s 33V of the Act is whether the proposed settlement is fair and reasonable in the interests of the group members who will be bound by it, including as between the group members. As I said in Webb v GetSwift Limited (No 7) [2023] FCA 90; 414 ALR 500 at [15]-[16]:

The applicable principles in relation to settlement approval under s 33V of the FCA Act are now well-established. The Court’s fundamental task is to determine whether the settlement is fair and reasonable and in the interests of the group members who will be bound by it, including as between the group members inter se: see for example, Australian Securities and Investments Commission v Richards [2013] FCAFC 89 at [7]-[8]; Kelly v Willmott Forests Ltd (in liq) (No 4) (2016) 335 ALR 439; 112 ACSR 584; [2016] FCA 323 at [68]-[77]; Camilleri v Trust Company (Nominees) Ltd [2015] FCA 1468 at [5]; Blairgowrie Trading Ltd v Allco Finance Group Ltd (recs and mgrs. apptd) (in liq) (No 3) (2017) 343 ALR 476; 118 ACSR 614; [2017] FCA 330 at [81]; Caason Investments Pty Ltd v Cao (No 2) [2018] FCA 527 at [12]; McKenzie v Cash Converters International Ltd (No 3) [2019] FCA 10 at [23]-[24]; Smith v Commonwealth (No 2) [2020] FCA 837 at [6]-[12]; and Prygodicz v Commonwealth (No 2) (2021) 173 ALD 277; [2021] FCA 634 at [85]-[88].

In undertaking that task, the Court:

(a) assumes an onerous and protective role in relation to group members’ interests, in some ways similar to Court approval of settlements on behalf of persons with a legal disability;

(b) must be astute to recognise that the interests of the parties before it, and those of the group as a whole (or as between some members of the group and other members), may not wholly coincide;

(c) relatedly to the second point, should be alive to the possibility that a settlement may reflect conflicts of interest or conflicts of duty and interest between participants in the common enterprise which has conducted the representative proceeding;

(d) should understand that at the point of settlement approval, the interests of the parties will ordinarily have merged in the settlement. It is likely that they both will have become ‘friends of the deal’. As a result, both sides may not critique the settlement from the perspectives of any group members who may suffer a detriment or obtain lesser benefits through the settlement; and

(e) must decide whether the proposed settlement is within the range of reasonable outcomes, rather than whether it is the best outcome which might have been won by better bargaining.

48 The factors stated in Williams v FAI Home Security Pty Ltd (No 4) [2000] FCA 1925; (2000) 180 ALR 459 at [19] (Goldberg J), now reflected in the Class Actions Practice Note (GPN-CA) at 15.5, are a useful guide to the considerations relevant in deciding whether a proposed settlement is fair and reasonable. They include:

(a) the complexity and likely duration of the litigation;

(b) the reaction of the class to the settlement;

(c) the stage of the proceedings;

(d) the risks of establishing liability;

(e) the risks of establishing loss or damage;

(f) the risks of maintaining a class action;

(g) the ability of the respondent to withstand a greater judgment;

(h) the range of reasonableness of the settlement in light of the best recovery;

(i) the range of reasonableness of the settlement in light of all the attendant risks of litigation; and

(j) the terms of any advice received from counsel and/or from any independent expert in relation to the issues which arise in the proceeding.

The factors are to be approached as a guide rather than an exhaustive checklist.

WHETHER THE PROPOSED SETTLEMENT IS FAIR AND REASONABLE

The Confidential Opinion

49 I have had the benefit of considering the confidential opinion of Mr Patrick McCabe of counsel dated 7 February 2025 (Counsel’s Opinion). Counsel’s Opinion is provided on the basis that counsel will candidly and frankly disclose the factors material to the decision to recommend the settlement for approval by the Court. Because of its confidentiality I cannot go to the detail of that opinion and it must suffice to note that it is thorough and it addresses the risks the applicant faced in establishing the liability and the risks and variables in relation to quantum. Counsel opined that the proposed settlement is fair and reasonable, and that the SDS achieves a fair and equitable distribution of the settlement sum between RGMs. Counsel was not asked to provide an opinion as to the reasonableness of the sum set aside for legal costs or the sum to be paid to the Funder. The authorities provide that it is appropriate to give significant weight to Counsel’s Opinion and I have done so.

The scope of the proposed releases

50 The Deed includes a broad release of the group member’s claims, but it expressly provides that the release provided by the applicant on behalf of each group member is “to the extent of [the applicant’s] statutory authority” to provide such a release. With that carve out I consider the releases of group members claims to be within the applicant’s authority, and therefore not an obstacle to settlement approval: see Dyczynski v Gibson [2020] FCAFC 120; 280 FCR 583 at [250]-[251] (Murphy and Colvin JJ) and [395]-[396] (Lee J).

The preclusion of unregistered group members from participating in the settlement

51 The proceeding commenced as an ‘open’ class action, such that all persons who fall within the group definition in the ASOC are group members unless they opt out. Upon approval of the proposed settlement any group member who has not opted out will be bound by it, including by the release of their claim. But by operation of the class closure order earlier referred to, only those group members who registered by the Final Registration Deadline on 6 January 2025 will be entitled to share in the proceeds of the settlement.

52 In this context I note that a further group member registered to participate in the settlement shortly after the deadline of 6 January 2025. It is appropriate that that person have leave to be an RGM and to participate in the settlement.

53 Class closure orders are within the power of the Court: Parkin v Boral Ltd (Class Closure) [2022] FCAFC 47; 291 FCR 116 (Murphy, Beach and Lee JJ). In large part the legitimacy of such orders depends on the adequacy of the notice given to group members: Matthews v SPI Electricity Pty Ltd (Ruling No 13) [2013] VSC 17; 39 VR 255 at [79(c)] (Forrest J); Kelly v Willmott Forests Ltd (in liquidation) (No 4) [2016] FCA 323; 335 ALR 439 at [153]-[160] (Murphy J).

54 Here, the notification regime meant that group members were given notice by direct email or by post if they wished to share in the proceeds of settlement they must register, and they were advised of that requirement twice. The second notification regime notified group members of the terms of the proposed settlement; informed them that if they wished to participate in the proceeds of the settlement they were required to register; and that if they did not register they would be bound by the settlement and lose their rights to sue but not be entitled to share in the proceeds. Adeo also repeatedly endeavoured to contact the 101 persons who had registered but who the respondents said were not eligible to be group members.

55 In the circumstances, the requirement for group members to register to be eligible to share in the proceeds of the settlement, but nevertheless be bound by its terms, does not stand in the way of settlement approval.

The complexity and duration of the litigation

56 The proceeding is not complex and it involves relatively straight-forward questions of award interpretation. The litigation has been on foot since 2018 but for much of the time the proceeding was in abeyance awaiting the result in Rossato before the Full Court and then the High Court. Following the adverse result for the respondent employee in the High Court the proceeding was reformulated and brought on a much more confined basis.

57 The proceeding is still a long way from a hearing date. Pleadings are closed but discovery has not taken place and no evidence has been filed. Court approval of the proposed settlement will mean that group members will receive compensation at a much earlier stage than if the proceeding is successful at trial. That points in favour of settlement approval.

The reaction of the class

58 No group member objected to the proposed settlement. That points in favour of settlement approval, but it remains the Court’s task to decide whether the proposed settlement is fair and reasonable.

The stage of the proceedings

59 The parties reached the proposed settlement after the close of pleadings but before any evidence of been filed. Although no evidence had been filed, for the mediation the parties had the employment records in respect of the first 50 RGMs which meant that the parties had sufficient information for the parties to reach an informed view as to the aggregate value of group members’ claims before discounts for risk and other matters. That points in favour of settlement approval.

The risks of establishing liability

60 The case involves straight-forward questions of award interpretation. In my view the applicant has:

(a) good prospects of establishing the First Alleged Contravention. Without having had the benefit of argument, it appears to me that Clause 10.1 sets out the types of employment that an employee may be employed in under the Award, which includes “Schedule B - Staff Employees, casual”. The Award does not, in terms, provide for a Schedule A employee working as a “Production and Engineering Employee” to be employed as a casual employee. It is difficult to see a purpose for the inclusion of the words “in the case of classifications in Schedule B - Staff Employees, casuals” except to provide that employees in that category can be employed on a casual basis, which implicitly indicates that any employee in a classification in Schedule A may not be engaged as a casual; and

(b) poor prospects of establishing the Second Alleged Contravention. The applicant was a casual employee and, without having had the benefit of argument, it appears to me that Clause 25.3 of the Award (which provides for accrual of annual leave) does not apply to casual employees. It is true that clause 25.2(b) does not expressly disentitle casual employees from accruing annual leave, but in my view that clause is likely to be read together with clause 25.3.

The risks in relation to quantum

First Alleged Contravention

61 If the applicant can establish liability for the First Alleged Contravention (for which I consider she has good prospects) there is a real issue as to whether the applicant and group members have suffered any significant loss or damage.

62 First, the ASOC alleges that compensation is payable on the basis of the financial and non-financial benefits of being a casual employee as compared to being a permanent employee. Against that the respondents allege that that may not be the appropriate counterfactual, and if it is, they allege various offsets are appropriate.

63 Second, there is nothing to indicate that the applicant had time off for personal reasons during her work at the black coal mine, such that she suffered loss because she was not available to work. That is, it does not appear that being employed as a casual meant that they she lost money by reason of being sick or off-work for personal reasons for which she would have been paid if employed as a permanent employee under the Award;

64 Third, at least for the applicant, it seems doubtful that the further financial benefits associated with permanent employment would have exceeded the 25% casual loading paid for each hour of work.

65 There are, however, some real non-financial benefits to being a full-time permanent employee compared to being a casual employee, as listed in the ASOC. If the applicant and RGMs succeed on liability, they will be entitled to compensation for the loss of those non-financial benefits, but the extent of those benefits will vary as between employees and seem unlikely to be substantial in most cases.

Second Alleged Contravention

66 If the applicant can establish liability for the Second Alleged Contravention (for which I consider she has poor prospects), then the applicant and RGMs will be entitled to accrued annual leave, representing at least five weeks annual leave per year, or six weeks leave per year under clause 25.2(b) for a person who may be rostered to work shifts on seven days of the week. The applicant alleges that she was a seven-day roster employee. There is a dispute as to the “base rate of pay” to apply in relation to the calculation of annual leave.

67 In the ASOC the applicant alleges that her annual leave entitlement would have been $2,660. Mr Markham deposed that the average group member claim for annual leave entitlements is approximately $4,098 per person without interest and $6,100 per person including interest.

68 If the applicant and RGMs are successful in relation to this alleged contravention, and they each received that average entitlement, they would be entitled to compensation of approximately $555,100, but as I have said the applicant’s prospects of success in relation to this alleged contravention are poor.

Penalties

69 It is also relevant to the quantum of the applicant and RGMs claims that the ASOC seeks the imposition of a civil penalty, and the applicant seeks that the penalty be paid to the applicant and RGMs.

70 If the applicant can establish liability for the First Alleged Contravention then the authorities provide that it will be appropriate to impose a penalty to achieve the dual purposes of general deterrence and specific deterrence. The maximum penalty per contravention in 2014 was $51,000, and the maximum penalty at the end of the Relevant Period in February 2018 was $63,000. Although the alleged contravention occurred many times in relation to different group members, and therefore the theoretical maximum penalty for the conduct is very large, setting the appropriate penalty is a fact-specific exercise. Total penalty would be set primarily by reference to what is necessary to achieve deterrence in this factual context, which takes into account principles such as the course of conduct principle, which may recognise related contraventions as a single course of conduct for the purpose of penalty calculation which is likely here, and the totality principle, which holds that the total penalty for related contraventions should not exceed what is proper for the entire contravening conduct involved. These principles are merely examples of the diverse considerations which, in my view, would likely operate to reduce the penalty significantly from the total penalty theoretically available if one merely counts independent contraventions and multiplies by the maximum penalty per contravention. I do not have enough information to reliably assess the range of reasonable penalty outcomes but, in broad terms, it is likely to be less than $250,000.

71 The same is true of the Second Alleged Contravention, but the applicant has poor prospects of establishing this alleged contravention.

The impact of legal costs

72 The other substantial risk in relation to the quantum of the applicant’s and RGM’s claims is that their claims will be substantially consumed by legal costs. Pursuant to s 570 of the FW Act, absent an unreasonable act or omission by a party each party must bear its own costs.

73 If the proceeding continues to a trial the matters in dispute between the parties in the proceeding include:

(a) whether clause 10.1 of the Award permitted the employment of Production and Engineering employees on a casual basis, such that they were not entitled to annual leave;

(b) whether clause 25 of the Award operated so that casual employees were entitled to annual leave; and

(c) whether if casual employees were entitled to annual leave, the Court should compare all of the financial benefits received by the individuals, including any financial benefits they would have received if not engaged by the respondents at all or alternatively, the minimum terms and conditions to which they would have been entitled to had they been engaged other than as a casual.

Those contests are likely to require the involvement of either an experienced junior counsel, or senior and junior counsel, to assist in advancing the applicant's claims in the lead up to and during the trial. Although the claims are not complex, it seems likely that the applicant’s legal costs from now to the conclusion of a trial will be in the order of $200-300,000. In that regard I note that in the application to the Funder for litigation funding in December 2018, Adero estimated legal fees and disbursements for the proceeding at $1.15 million, and its later estimates are even higher.

74 If the proposed settlement is not approved, and the case proceeds to trial, there is a possibility that there might be an improved settlement offer, but it cannot be known whether any increased offer will offset the further legal costs incurred. Given how expensive class action litigation is, and the relatively modest aggregate claim value, the more likely outcome is that the further work which the applicant’s lawyers will be required to undertake will consume a substantial part of any increase in aggregate claim value.

75 Further, if the matter proceeds to trial and the applicant is successful there is a risk that the respondents will appeal. In that event, the applicant will be forced to incur further significant costs.

76 The risks in relation to quantum point strongly in favour of settlement approval.

Delay

77 No trial date for the initial trial has been sought, and if a trial date was now sought it would be at least 12 months away. That points in favour of settlement approval.

Recovery risk

78 Mr Markham deposed that the respondents are relatively small labour hire entities that do not have publicly audited financial accounts. The capacity of the respondents to meet a larger judgment is unknown.

The reasonableness of the proposed settlement in light of the attendant costs and risks

79 In my view the applicant and RGMs:

(a) face a low risk in relation to liability in respect to the First Alleged Contravention, but the aggregate value of those claims after costs is likely to be modest;

(b) face a high risk in relation to liability in respect to the Second Alleged Contravention, but if they succeed the quantum value of those claims (before legal costs) is approximately $600,000; and

(c) broadly assessed, the penalty for the First Alleged Contravention seems likely to be less than $250,000.

80 If the proposed settlement is approved the 91 RGMs will:

(a) be entitled to receive on average $5,989 per person before legal costs; and

(b) be entitled to receive on average $3,419 per person after legal costs.

Group members will, of course, have different entitlements but treating that as a guide it is a good result having regard to the attendant costs and risks. Given the costs and risks the applicant and RGMs face, and given the further costs that must be incurred if the matter is to proceed to trial, I consider the proposed settlement falls within the range of reasonableness which is appropriate for approval by the Court.

The reasonableness of the applicant’s legal costs

81 The SDS provides that, prior to distribution to RGMs, the Administrator shall deduct from the settlement sum the Court-approved legal costs, Funder’s charges, and settlement administration costs. Those costs are capped at $233,805 (incl. GST).

82 Mr Markham’s second affidavit shows that the firm has incurred $228,541 in fees and disbursements in the period after the Funder ceased to provide funding, and it expects to incur a further $10,000 in costs associated with the settlement approval hearing and $33,805 in settlement administration costs.

83 Given the modest size of the case, the modest size of the legal costs in the context of class action litigation more generally, and the fact that Adero voluntarily agreed to cap its costs at a level less than its full costs, I did not consider it appropriate to appoint a Costs Referee to inquire and report in relation to the reasonableness of the applicant’s legal costs. Based on Mr Markham’s first and second affidavits I am sufficiently satisfied that the firm’s legal costs are reasonable.

The reasonableness of the payment to the Funder

84 The SDS provides that, prior to distribution to RGMs, the Administrator shall deduct from the settlement sum the amount of $50,000 for payment to the Funder.

85 The Funder entered into LFAs with 32 of the RGMs, and it is a term of the LFAs that the Funder’s entitlement to payment of a funded group member’s share of the Project Costs (as defined) incurred up to the date of termination of the LFA by the Funder under cl 12.2 survives termination. Thus, if there is a successful “Resolution” (as defined) after termination of the LFAs, the Funder continues to be entitled to recover the Project Costs it incurred, although it is not entitled to a percentage funding commission.

86 Mr Markham deposed that the Funder paid Adero a total of $193,777.92 in legal costs, being Project Costs, up to the point that it terminated the LFAs.

87 In my view Adero and the Funder were sensible in agreeing that the Funder be paid $50,000 from the proposed settlement, and it results in a fair and reasonable outcome for group members. There were imperatives for both sides in reaching such a compromise: see the discussion in Ridge v Hays Specialist Recruitment (Australia) Pty Limited (No 2) [2024] FCA 328 at [55]-[80]. Here, $50,000 is around 25% of the costs the Funder paid, but notwithstanding the terms of the LFAs it is unlikely that I would have approved full reimbursement to the Funder when: (a) full reimbursement of the Project Costs by the 32 funded RGMs would have taken up their entire share of the proposed settlement, and would not be proportionate; (b) having some group members receive nothing and others achieve a substantial recovery is unlikely to be fair and reasonable as between group members; (c) the proposed settlement relates to a case which is substantially more confined than the case funded by the Funder; (d) the settlement was only achieved by Adero being prepared to push on when funding was discontinued and by incurring further legal costs of $228,541 which the Funder was not obligated to pay; and (e) if all of the legal costs incurred by Adero both pre and post funding are deducted from the settlement, legal costs will be disproportionate to the settlement and unlikely to be approved. On the other hand, it would be unfair if the Funder did not receive any reimbursement in circumstances where: (a) the settlement relates, at least in part, to the case which it funded and (b) the LFAs provide that the Funder’s entitlement to Project Costs survives termination.

The reasonableness of the proposed SDS

88 The SDS is attached to the settlement approval orders. It is not complex and I will not summarise its details. I note the following matters:

(a) it is appropriate to appoint Adero as Administrator of the SDS. The firm has dealt with the group members over an extended period and understands the rostering system and the calculation of annual leave entitlements;

(b) Adero’s fees for the settlement administration costs are included in the overall cap on legal costs such that, in reality, the settlement administration work will be at no cost to the RGMs;