Federal Court of Australia

Williams & Kersten Pty Ltd v National Australia Bank Limited (No 5) [2025] FCA 155

File number: | VID 993 of 2019 |

Judgment of: | LEE J |

Date of judgment: | 26 February 2025 |

Catchwords: | REPRESENTATIVE PROCEEDINGS – settlement approval hearing of an “open-class” representative proceeding – where the parties reached agreement on the proposed settlement scheme – where the proposed settlement is well within the range of settlements that could be categorised as being fair, reasonable, and in the interests of group members – where careful consideration given to the detailed opinion prepared by counsel for the applicants – where the appropriateness of certain reductions considered – orders made approving the settlement |

Legislation: | Federal Court of Australia Act 1976 (Cth) s 33V(2) |

Cases cited: | Galactic Seven Eleven Litigation Holdings LLC v Davaria [2024] FCAFC 54; (2024) 302 FCR 493 Street v Western Australia [2024] FCA 1368 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Regulator and Consumer Protection |

Number of paragraphs: | 22 |

Date of hearing: | 26 February 2025 |

Counsel for the applicant: | Mr WAD Edwards KC with Mr M Gvozdenovic |

Solicitor for the applicant: | William Roberts Lawyers |

Counsel for the respondent: | Mr J Payten |

Solicitor for the respondent: | Allens |

Counsel for the intervener: | Mr R Craig KC with Mr D Habashy |

Solicitor for the intervener: | Johnson Winter Slattery |

ORDERS

VID 993 of 2019 | ||

| ||

BETWEEN: | WILLIAMS & KERSTEN PTY LTD Applicant | |

AND: | NATIONAL AUSTRALIA BANK LIMITED Respondent | |

order made by: | LEE J |

DATE OF ORDER: | 3 March 2025 |

THE COURT ORDERS THAT:

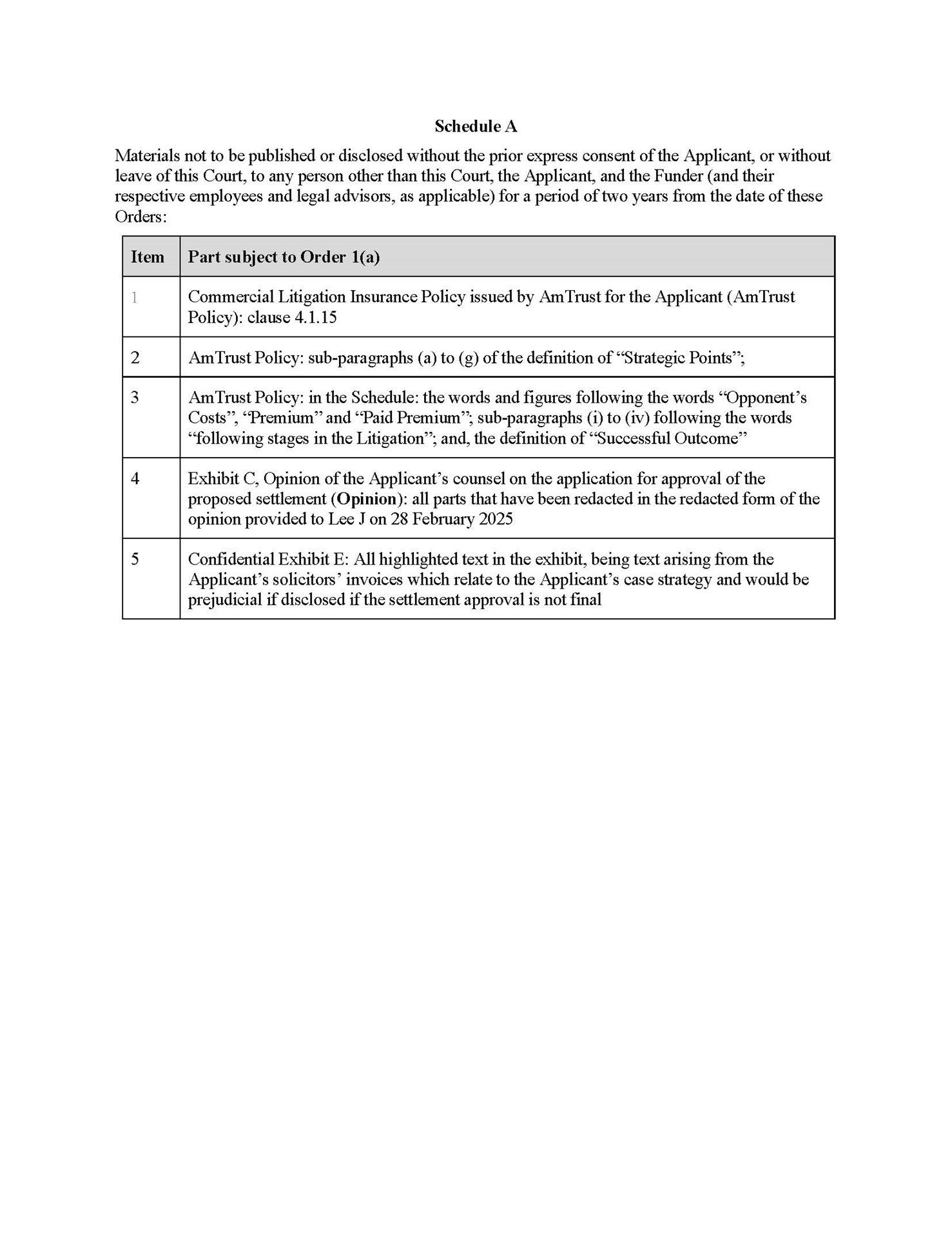

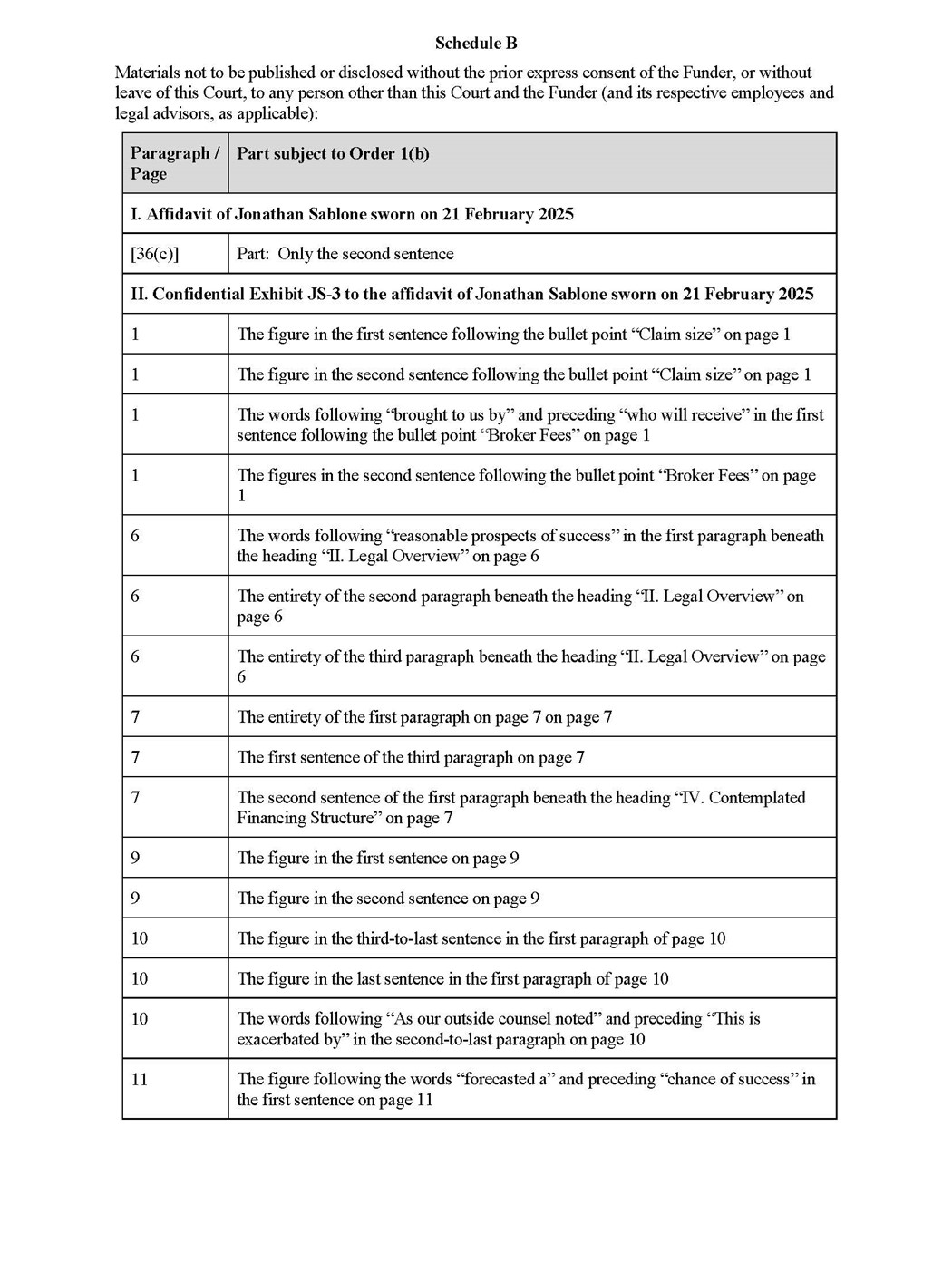

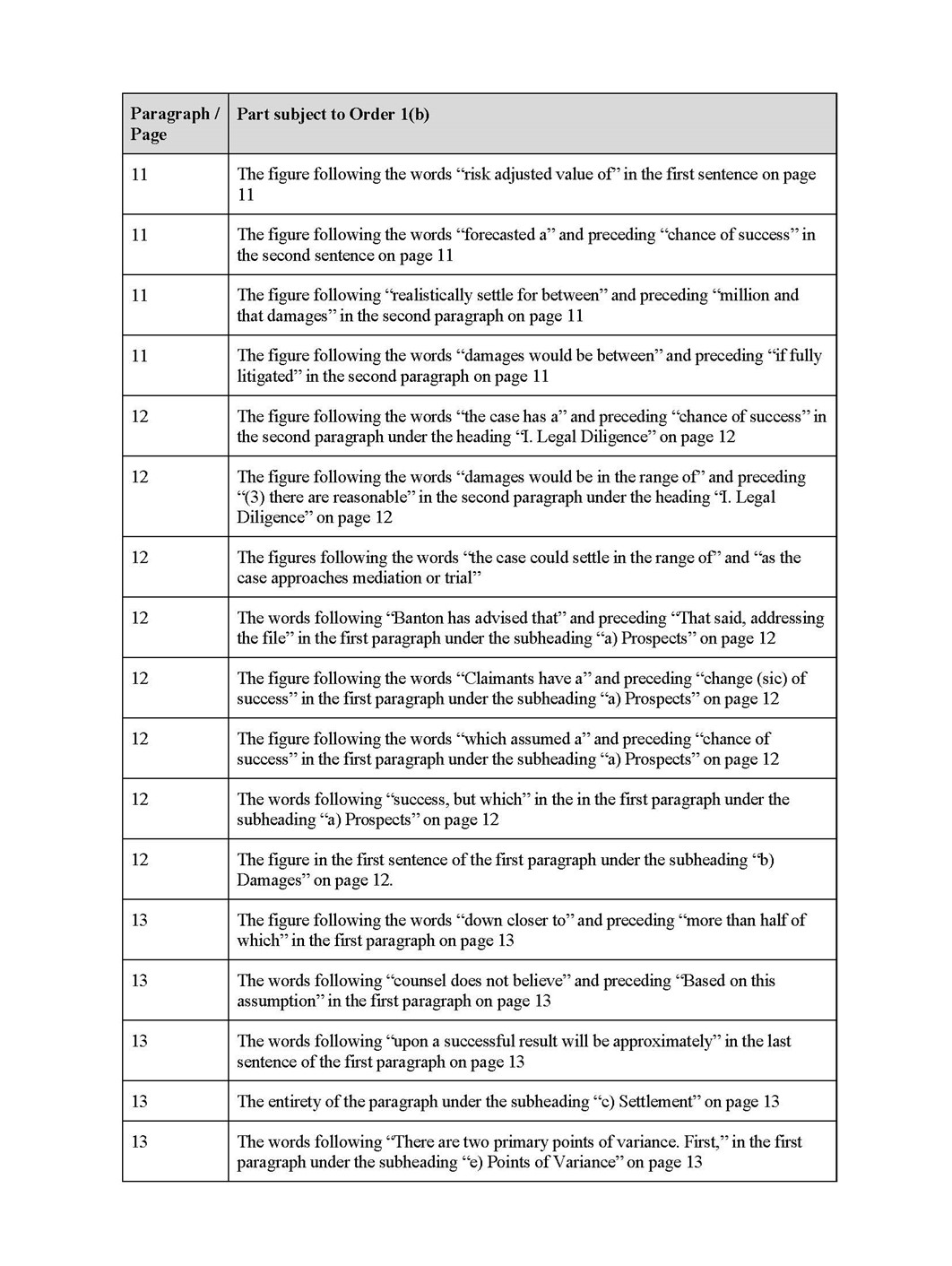

Confidentiality

1. Pursuant to sections 37AF and 37AG(1)(a) of the Federal Court of Australia Act 1976 (Cth) (Act) and subject to further order of the Court, to prevent prejudice to the proper administration of justice, the materials at:

(a) Schedule A of these Orders are not to be published or disclosed without the prior express consent of the Applicant, or without leave of this Court, to any person other than this Court, the Applicant, and 412 LF LLC (Funder) (and their respective employees and legal advisors, as applicable) for a period of two years from the date of these Orders;

(b) Schedule B of these orders are not to be published or disclosed without the prior express consent of the Funder, or without leave of this Court, to any person other than this Court and the Funder (and its employees and legal advisors, as applicable) for a period of two years from the date of these Orders.

Approval of the Settlement

2. Pursuant to s 33V of the Act, the settlement of this proceeding be approved on the terms set out in:

(a) Exhibit A, the Deed of Settlement provided to the Court in accordance with order 5(a) of the Court’s orders dated 23 December 2024 (Deed) (to the extent that the Applicant has authority to bind group members to the covenants in the Deed); and

(b) Exhibit B, the revised version of the settlement scheme provided to the Court in accordance with order 5(a) of the Court’s orders dated 23 December 2024 (Settlement Scheme).

3. Pursuant to s 33ZB of the Act, the persons affected and bound by the settlement of this proceeding are the Applicant, the Respondent and Group Members, as defined in paragraph 1 of the Second Further Amended Statement of Claim filed on 14 May 2024 (save for any person who has opted out of this proceeding) (Group Members). This includes all Group Members that do not ultimately obtain a benefit or distribution in accordance with the Settlement Scheme.

Appointment of Settlement Administrator

4. Pursuant to s 33ZF of the Act, Martin Cairns of Sapere Research Group Limited ABN 50 096 242 581 t/as Sapere Forensic Accounting & Valuation be appointed as the Settlement Administrator (as that term is defined in the Deed) who is to act in accordance with the Settlement Scheme and is to have the powers and immunities conferred upon him by the Settlement Scheme, subject to any further order of this Court.

5. The Settlement Administrator has liberty to apply without notice to the parties in relation to any matter arising under the Settlement Scheme, including for the purposes of seeking orders consequential to or in connection with the Deed or the Settlement Scheme.

6. Pursuant to sections 33ZF and 33V of the Act, the following distributions and deductions from monies paid under the settlement be approved:

Item | Distributions and deductions | Amount |

(a) | “Funder’s Commission” to be paid to the Funder (including $323,136 which the Settlement Administrator is authorised to pay directly to AmTrust Europe Limited (company number 1229676) (AmTrust)). | $8,867,537 |

(b) | “Deferred Costs” to be paid to the following persons: | $807,463 |

(b)(i) | $401,264 of “Deferred Costs” to be paid to William Roberts Lawyers | $401,264 |

(b)(ii) | $204,199 of “Deferred Costs” to be paid to Niall Coburn | $204,199 |

(b)(iii) | $50,000 of “Deferred Costs” to be paid to Douglas Campbell KC | $50,000 |

(b)(iv) | $22,000 of “Deferred Costs” to be paid to Blair Hall of counsel | $22,000 |

(b)(v) | $100,000 of “Deferred Costs” to be paid to Caroline Kenny KC | $100,000 |

(b)(vi) | $30,000 of “Deferred Costs” to be paid to Shane Monks of counsel | $30,000 |

(c) | “Applicant’s Reimbursement Payment” to be paid to the Applicant to reimburse it for its time in acting as the representative party | $50,000 |

(d) | “Administration Costs” to the Settlement Administrator, on a monthly basis as incurred at the prescribed hourly rates up to a capped aggregate value of $275,000 (incl GST), after which no monthly payments will be made (subject to any further order of the Court) | $275,000 |

Total | $10,000,000 | |

Other Orders

7. All deeds of indemnity provided to the Respondent by AmTrust in accordance with:

(a) order 1 the orders made by this Court on 26 April 2022; and

(b) orders 1 and 2 of the orders made by this Court on 30 January 2023,

be returned to the Applicant’s solicitors or be destroyed within 14 days of the date of these orders.

8. Pursuant to r 2.43(1) of the Federal Court Rules 2011 (Cth), this Court is to return the AU$25,000 paid by the Funder on 13 May 2022 as security for the Respondent’s costs of enforcement by transferring it into William Roberts Lawyers’ trust account.

9. All costs orders made to date in the proceeding and that remain unsatisfied be vacated.

10. The proceeding be dismissed.

11. No order as to costs.

12. The parties and the Funder have liberty to apply on 2 days’ notice to relist the matter for the purpose of seeking orders consequential to or in connexion with the settlement of this proceeding.

13. Such further or other order as this Court deems appropriate.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011

REASONS FOR JUDGMENT

(Delivered ex tempore, revised from the transcript)

LEE J:

A INTRODUCTION

1 This is a settlement approval hearing of an “open-class” representative proceeding brought on behalf of the unsecured creditors of the Walton Companies, being Walton Construction (Qld) Pty Ltd (in liq) (Walton Queensland) and Walton Construction Pty Ltd (in liq) (Walton Construction).

2 The group members are persons who, between 31 March 2013 and 3 October 2013, were (a) parties to contracts with the Walton Companies; (b) subcontractors of the persons in (a); or (c) directors, officers, guarantors or otherwise liable for the debts of, persons in (a) or (b). After opt outs, there are presently 1,396 group members.

3 I am not going to rehearse in these reasons the chequered and lamentable history of this litigation. Following the engagement in late 2023 of new counsel and solicitors, both highly experienced in the conduct of Pt IVA representative proceedings, the case of the applicant, after a long period of stasis, was progressed effectively by a pleading which properly articulated the case against the National Australia Bank Limited, the respondent in this class action.

B CONSIDERATION OF THE PROPOSED SETTLEMENT

4 Following an order requiring the parties to attend a one day mediation of the proceedings, the parties have come to a sensible agreement which, in my view, is well within the range of settlements that could be categorised as being fair, reasonable, and in the interests of group members if one has regard to the gross settlement figure.

5 I have had the benefit of a very detailed opinion prepared by counsel for the applicants, Mr WAD Edwards KC, and Mr M Gvozdenovic. That opinion sets out in comprehensive detail the factual background to the proceedings, the risks in establishing contravening conduct, the risks to establishing causation, loss and damage and, building upon that analysis, considers in detail counsels’ opinion as to the fairness and reasonableness of the settlement sum. Further consideration is given to the fairness and reasonableness of the settlement distribution scheme, which would be put in place upon approval of the settlement.

6 That opinion will remain on file. It suffices for the purposes of this judgment to record that I have carefully considered it, and it seems to me to accurately assess the relevant risks. Although instinctively, I may have a slightly different view as to the relative strengths of the three aspects of the applicant’s claim, the opinion of counsel is both cogent and ably expressed.

7 Only one objection was received to the proposed settlement, which proceeded on a misapprehension as to secured creditors participating in the settlement and also with respect to the object of the settlement. The objection also proceeded without the benefit of any analysis as to the risks associated with the applicants succeeding at trial.

8 The only matter that vexed me in relation to the proposed settlement were the deductions sought pursuant to an order under s 33V(2) of the Federal Court of Australia Act 1976 (Cth). As is well known, the Court has a power to make deductions from the settlement sum, provided the Court is satisfied that the payment is from a sum of money, and that the proposed payment would, in all the circumstances, be one which is thought “just”. This led me to raise two matters with the parties.

9 The first was the deduction sought to be paid to the Funder, which reflects various amounts, including payment in relation to “After the Event” insurance (ATE insurance), “Action Costs” and “Funder’s Commission”.

10 One of the problems in this area of the law is the inability to compare apples with apples when it comes to the comparative fairness of settlements. Often, gross settlement sums are said to be subject to a deduction for “Funder’s Commission” without it being understood that additional amounts are being paid to a Funder. This is particularly the case for costs incurred by a Funder in deferring risk such as insurance premium for ATE insurance.

11 At the end of the day, the evidence on this application discloses that the amount to be paid to the Funder was not calculated on the basis of any multiplier to the Funder’s return of capital or on the basis of a percentage commission applied to the settlement sum having regard to various outcomes. Rather, the amount paid to the Funder was calculated on an alternative basis and one which, in my view, properly focuses the responsibility of both the applicant and those acting for the applicant to have regard to the interests of group members. That is, it appears that during the settlement proceedings, those acting for the applicants were only prepared to recommend a settlement which involved at least half of the settlement sum being paid to group members.

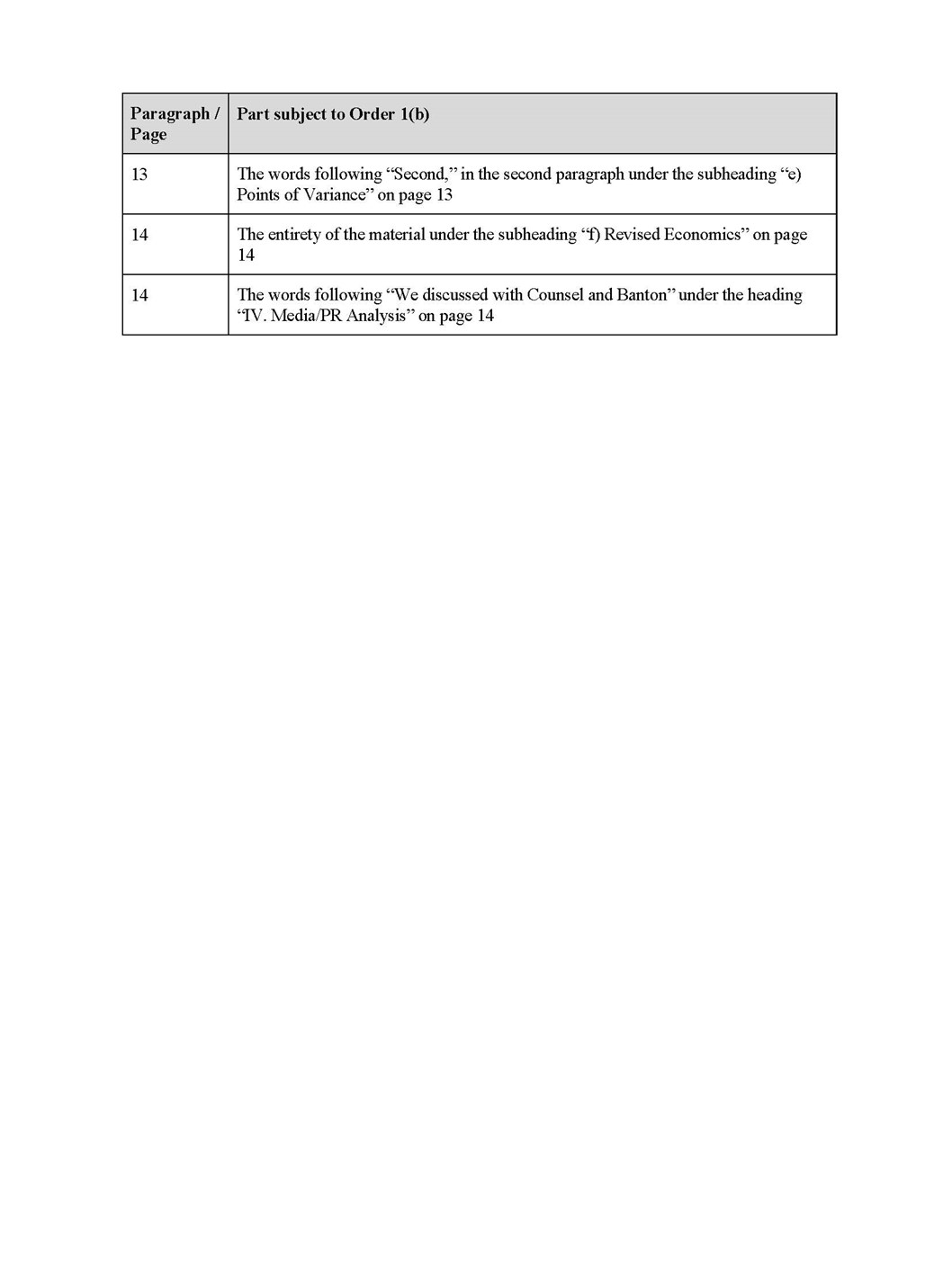

12 This is particularly important in a case such as this. The books are replete with examples of class actions where the amount in dispute is not particularly high, and the settlement sum is relatively modest, but huge costs have been expended. There is a comparative analysis contained in the submissions of the Funder, who was the intervener on this application (at [35]):

# | Case | Settlement | Commission | Legals | GMs |

1. | Blairgowrie Trading Ltd v Allco Finance Group Ltd (Recs and Mgrs apt) (2017) 343 ALR 476 at [34](j), [53](a), [124], [125], [53] and [154] | $40m | 22.1% | 26.3% $10.5m | 51% $20.6m |

2. | Clarke v Sandhurst Trustees Ltd (No 2) [2018] FCA 511 at [2], Order 1, and see also Webster v Murray Goulburn Co-Operative Co Ltd (No 4) [2020] FCA 1053 at [105](a) | $16.85m | 30% | 31% $5.22m | 39% $6.57m |

3. | Caason Investments Pty Limited v Cao (No 2) [2018] FCA 527 at [3], [165], [174], Orders 10 and 13, and see also Webster v Murray Goulburn Co-Operative Co Ltd (No 4) [2020] FCA 1053 at [105](c) | $19.25m | 30% | 39% $7.56m | 31% $5.9m |

4. | Petersen Superannuation Fund Pty Ltd v Bank of Queensland Ltd (No 3) (2018) 132 ACSR 258 at [1], [14], [15](c), [187] and see also Webster v Murray Goulburn Co- Operative Co Ltd (No 4) [2020] FCA 1053 at [105](b) | $12m | 8.3% | 39% $4.69m | 33% $4m |

5. | Santa Trade Concerns Pty Ltd v Robinson (No 2) [2018] FCA 1491 at [4], [5] and [7] | $3m | 16.67% | 50% $1.5m | 33% $1m |

6. | Hopkins v Macmahon Holdings Ltd [2018] FCA 2061 at [8] and [10] | $6.7m | 19% | 44.78% $3m | 35.9% $2.405m |

7. | Kuterba v Sirtex Medical Ltd [2019] FCA 1374 at [1], [7], [17], Order 6(b) and see also Webster v Murray Goulburn Co Operative Co Ltd (No 4) [2020] FCA 1053 at [105](d) | $40m | 25% | 23.25% $9.3m | 50% $10.2m |

8. | Rushleigh Services Pty Ltd v Forge Group Ltd [2019] FCA 2113 at [1], [11], [47]-[49], [59], Orders 7 and 8 and see also Webster v Murray Goulburn Co-Operative Co Ltd (No 4) [2020] FCA 1053 at [105](e) | $16.5m | 23.94% | 25% $4.2m | 50% $8.25m |

9. | Clime Capital Ltd v UGL Pty Ltd [2020] FCA 66 at [3], [34]-[36], [39] and Orders 8(a) and 9(a) | $18m | 22.5% | 33% $5.95m | 43.9% $7.9m |

10. | Uren v RMBL Investments Ltd (No 2) [2020] FCA 647 at [4], [47], [48], [72], [74]-[78] and Order 8 | $3m | 25% | 35.4% $1.06m | 43.3% $1.3m |

11. | Evans v Davantage Group Pty Ltd (No 3) [2021] FCA 70 at [18], [33], [37], [40], [54], [64], [65], [111] and see also Evans v Davantage Group Pty Ltd (No 4) (2021) 398 ALR 490 at [10] | $9.5m | 28.77% | 25.3% $2.44m | 37.4% $3.55m |

12. | Ghee v BT Funds Management Ltd [2023] FCA 1553 at [2], [6], [155] and Order 14 | $29.95m | 23% | 25% $7.42m | 51% $15.4m |

13. | Ingram v Ardent Leisure Ltd (Settlement Approval) [2024] FCA 836 at [2], [48], [49] and Order 5 | $26m | 30% | 19.4% $5.04m | 47% $12.3m |

14. | Compumod Investments Pty Ltd as trustee for the Compumod Pty Ltd Staff Superannuation Fund v Universal Equivalent Technology Ltd (Settlement Approval No 2) [2024] FCA 917 at [4], [17] and Order 8 | $8.25m | 30% | 22.3% $1.84m | 50% $4.125m |

Average | $17.8m | 23.9% | 31.3% $5m | 42.5% $7.39 | |

Median | $17.7m | 24.5% | 28.7% $4.9m | 43.6% $6.2m | |

13 By way of contrast, in the present proceeding, the proposed settlement is for $20 million, and the total deductions are approximately 43.3%, being a deduction of an amount to be paid to the Funder by way of a common fund order, together with reimbursement for the Funder for disbursements to date. There will be additional, relatively modest deductions for future costs associated with the approval and settlement of the scheme.

14 I agree with the assessment that the net position amounts to a relatively strong outcome for group members, and reflects the willingness of the Funder to accept a reduced commission rate relative to market parameters and stipulations in the funding agreement, so as to ensure that approximately 50% of the settlement sum goes to group members.

15 In addition to the comparators set out above, the Schedule to Street v Western Australia [2024] FCA 1368 provides a helpful summary of key parameters drawn from other settlement approvals in recent years, bearing in mind that “it is appropriate to be cautious in comparing the headline funding rates approved in other cases”: Galactic Seven Eleven Litigation Holdings LLC v Davaria [2024] FCAFC 54; (2024) 302 FCR 493 (at 516–527 [89] per Murphy J).

16 Every settlement must be looked at closely and they are all different. But to those experienced in class actions, one can get a general feel as to the relative merits of each class action in generating a return to group members.

17 The second issue was related to the first. It will come as no surprise to those that have read my previous judgments in this matter, that I have been somewhat vexed by its lack of progress and what seemed to me to be unnecessary legal costs being expended in preparing suboptimal pleadings.

18 What the evidence discloses, after having been taken carefully through it today, is the effort that the Funder has made to compromise costs that would be otherwise payable to legal practitioners, both for legal costs already charged pursuant to retainers, and also deferred costs. Those negotiating on behalf of the Funder are not gaping rustics and the Funder has been well represented. I think I can work on the assumption that it would seek to ensure, for its own commercial reasons, that it does not spend an amount for legal costs unnecessarily, and I should have some confidence in the competitive market ensuring that agreed reductions for legal costs are informed by a sensible assessment as to the worth of the legal work completed.

19 Mr Edwards has frankly indicated to me that he and his solicitors did not approach this case tabula rasa, and that the work which has been done was of assistance in getting the case to the state where it could be settled. Additionally, I am conscious that, but for the fact that solicitors and barristers were, at the start of these proceedings, prepared to undertake the risk of incurring costs without the certainty that a funder would be secured, no return would have been generated to group members. Hence, despite any misgivings I may have, I do not think it is either necessary or appropriate that I go down the path of further interrogating those costs by the appointment of a referee to inquire into whether the costs were incurred fairly or reasonably.

C CONCLUSION

20 In the end, the settlement proposed provides a return to group members which is, in my view, commensurate to the objective worth of the claims, and falls within the range of outcomes that satisfy the statutory test for approval. Accordingly, I approve the settlement.

21 I have discussed with counsel various changes that I would make to the approval orders and direct that a minute which reflects those changes be sent to my Chambers. I will then make the approval orders in Chambers.

22 There are various other deductions proposed from the settlement sum, including a payment to the applicant and costs associated with the settlement distribution administration. I am satisfied that all of these additional payments meet the statutory requirement that the deductions are just.

I certify that the preceding twenty-two (22) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Lee. |

Associate:

Dated: 4 March 2025