Integrity Life Australia Limited, in the matter of Integrity Life Australia Limited [2025] FCA 92

ORDERS

INTEGRITY LIFE AUSTRALIA LIMITED ABN 83 089 981 073 First Applicant AIA AUSTRALIA LIMITED ABN 79 004 837 861 Second Applicant | |||

DATE OF ORDER: | |||

THE COURT ORDERS THAT:

1. Pursuant to section 194 of the Life Insurance Act 1995 (Cth), the scheme for the transfer of a part of the life insurance business of Integrity Life Australia Limited, the First Applicant, to AIA Australia Limited, the Second Applicant, in the form of Annexure A to these orders (Scheme), be confirmed without modification.

2. The Scheme takes effect on and from 12:01 am (AEST) on 1 March 2025.

3. The applicants pay the costs of the proceeding of the Australian Prudential Regulation Authority as agreed or, if no agreement can be reached, as assessed.

4. There be liberty to apply.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

Scheme under Part 9 of the Life Insurance Act 1995 (Cth) for the transfer of retail life insurance business FROM Integrity Life Australia Limited ABN 83 089 981 073 to AIA Australia Limited ABN 79 004 837 861

1. Overview

(a) This is a scheme prepared pursuant to Part 9 of the Life Act and operates only on, and subject to, its confirmation by the Court (Scheme).

(b) ILAL has agreed to transfer its Retail Life Insurance Business to AIAA, subject to confirmation by the Court of this Scheme and the satisfaction of certain conditions.

(c) ILAL and AIAA are registered life companies under the Life Act. ILAL is incorporated in New South Wales and AIAA is incorporated in Victoria. The ultimate parent companies of ILAL and AIAA are IGHL and AIA Group Limited respectively.

(d) The objective of this Scheme is to transfer ILAL's Retail Life Insurance Business to AIAA.

(e) This Scheme is based on actuarial reports prepared by Mr Michael Dermody and Mr Nghiep Luu, the appointed actuaries of ILAL and AIAA respectively.

2. Interpretation

In this Scheme:

Adjustment Amount has the meaning given to it in the Transfer Deed.

AIAA means AIA Australia Limited ABN 79 004 837 861.

AIAA Policies means the life policies issued by AIAA.

AIAA Policy Owner means the owner of an AIAA Policy.

AIAA Policy Terms means the terms and conditions contained in the AIAA "Priority Protection" product disclosure statement and policy document (version 29 dated 12 May 2024) and any supplementary product disclosure statement and includes the AIAA Priority Protection Incorporated by Reference Material (Identification No. AIA07702-10/23) document.

APRA means the Australian Prudential Regulation Authority.

ASIC means the Australian Securities and Investments Commission.

Assumed Liabilities mean all the Liabilities of ILAL (whether arising or accruing before or after Completion) that relate to the Retail Life Insurance Business, including:

(a) the Life Policy Liabilities; and

(b) Liabilities under the Contracts,

but excluding the Excluded Liabilities.

Completion means completion of the transfer of the Retail Life Insurance Business from ILAL to AIAA.

Completion Payment has the meaning given to it in the Transfer Deed .

Conduct and Operational Liabilities means a Life Policy Liability that arises after the Scheme Effective Time from any act or omission of ILAL (including QBE Life (Australia) Limited (ACN 089 981 073) and CUNA Mutual Life Australia Limited (ACN 089 981 073) in contravention of a Law in relation to the sale, distribution, claims handling or administration of an ILAL Out of Force Life Policy, but does not include:

(a) a Liability to pay a claim made under an ILAL Out of Force Life Policy; or

(b) a Liability in respect of any open remediation or open complaint set made in respect of an ILAL Out of Force Life Policy as at the Scheme Effective Time.

Contracts means the Reinsurance Contracts and the Transferring Contracts.

Court means the Federal Court of Australia.

Diversa means Diversa Trustees Limited, the trustee of the Smartsave ‘Member’s Choice’ Superannuation Master Plan and ILAL’s Here For You Super Plan, an insurance-only division of OneSuper, and any successor trustee of those plans.

Ex-CUNA Policies means those policies listed in item number 2 of Schedule 1.

Ex-CUNA Policy Terms means the relevant terms and conditions of the Ex-CUNA Policies and comprising the relevant policy document, customer information brochure, policy information statement, cover document, product disclosure statement, policy schedule and application form (as applicable).

Ex-CUNA Policy Owner means an owner of an Ex-CUNA Policy.

Ex-CUNA Product Transfer Rules means the rules that govern the transfer of cover benefits under the Ex-CUNA Policy Terms to the AIAA Policy Terms that are set out in clause 4 of Schedule 2.

Duty means any stamp, transaction or registration duty or similar charge which is imposed by any Government Agency and includes any associated interest, penalty, charge or other amount which is imposed.

Excluded Assets means the following assets of the Retail Life Insurance Business at Completion:

(a) the IT systems and/or platforms that are used by ILAL in connection with the Retail Life Insurance Business;

(b) the Intellectual Property Rights used by the Retail Life Insurance Business at Completion;

(c) the Excluded Records; and

(d) the Tax Assets.

Excluded Liabilities means the following liabilities of the Retail Life Insurance Business:

(a) the liabilities arising under the Transfer Deed;

(b) the Conduct and Operational Liabilities; and

(c) the Tax Liabilities.

Excluded Records means any documents, information, data, books, customer records accounts and data (whether machine readable or in printed form) that do not relate to the ILAL Transferring Life Policies.

Existing AIAA Policies means the AIAA Policies immediately prior to the Scheme Effective Time.

Government Agency means any governmental, semi-governmental, administrative, fiscal, judicial or quasi-judicial body, department, commission, authority, tribunal, agency or entity, and includes APRA, ASIC, the Australian Financial Complaints Authority and the Australian Taxation Office.

GST has the meaning given in the GST Act.

GST Act means A New Tax System (Goods and Services Tax) Act 1999 (Cth).

IGHL means Integrity Group Holdings Limited ABN 33 159 865 666.

ILAL means Integrity Life Australia Limited ABN 83 089 981 073.

ILAL Policy means a life policy issued by ILAL.

ILAL Policy Owner means the owner of an ILAL Policy.

ILAL Out of Force Life Policy means the ILAL Transferring Life Policies issued by ILAL in respect of the product groups set out in items 2, 3 and 4 of Schedule 1 that have expired or lapsed before the Scheme Effective Time and does not include expired or lapsed Life Policies where benefits remain payable or in respect of which a person has a guaranteed renewal right as at the Scheme Effective Time.

ILAL Transferring Life Policies means all Life Policies issued by ILAL in respect of the product groups set out in Schedule 1 that are in-force or which have expired but under which benefits remain payable or may be payable, or in respect of which a person has a guaranteed renewal right as at the Scheme Effective Time, including any policy schedules, policy documents, product disclosure statements and supplementary product disclosure statements comprising such policies.

ILAL Transferring Life Policy Owner means an owner of an ILAL Transferring Life Policy.

Integrity Policies means those policies listed in item number 1 of Schedule 1.

Integrity Policy Owner means an owner of an Integrity Policy.

Integrity Policy Terms means the relevant terms and conditions of the Integrity Policies listed in item number 1 of Schedule 1 and comprising:

(a) the policy schedule or policy certificate issued in respect of each policy; and

(b) the "Integrity’s Here for You" policy document and product disclosure statement issued from time to time (including any supplementary product disclosure statements), as applicable.

Integrity Product Transfer Rules means the rules that govern the transfer of cover benefits under the Integrity Policy Terms to the AIAA Policy Terms that are set out in clause 3 of Schedule 2.

Intellectual Property Rights means all intellectual property rights throughout the world, whether registered or unregistered, including trade marks, designs, patents, circuit layouts, copyright and know how.

Investment Assets means the assets of ILAL's statutory fund that are referable to the ILAL Transferring Life Policies and comprise the Completion Payment plus the Adjustment Amount.

Law means any applicable statute, law, rule or regulation or code of practice, or any applicable guidance, directive, policy or procedure issued or adopted by a Government Agency.

Liabilities means any liability or obligation (whether actual, contingent or prospective), including any damage, loss, cost, charge and expense, and irrespective of when the acts, events or things giving rise to the liability or obligation occurred.

Life Act means the Life Insurance Act 1995 (Cth).

Life Policy has the meaning given in the Life Act.

Life Policy Liabilities means all Liabilities arising under or in respect of the ILAL Transferring Life Policies, including all accrued liabilities.

Loss means any losses, liabilities, damages, costs, charges and expenses and includes Tax and Duty.

Product Transfer Rules means the rules that govern the transfer of cover benefits under the Integrity Policy Terms and the Ex-CUNA Policy Terms to the AIAA Policy Terms that are set out in Schedule 2.

Records means all original and certified copies of the documents, information, data, books, customer records accounts and data (whether machine readable or in printed form) that are used in the Retail Life Insurance Business that relate to the ILAL Transferring Life Policies including but not limited to policy owner communications, underwriting and claims files, policy wordings and disclosure documents.

Reinsurance Contracts means the reinsurance contracts set out in Schedule 4.

Remediation Program has the meaning given to it in the Transfer Deed.

Retail Life Insurance Business means the life insurance business (within the meaning of the Life Act) conducted through ILAL Statutory Fund No.1 in respect of the ILAL Transferring Life Policies and comprising the Transferring Assets and the Assumed Liabilities but excluding all the Excluded Assets and Excluded Liabilities.

Scheme Confirmation Hearing Date means the hearing at which the Court makes orders to confirm the Scheme under section 194 of the Life Act.

Scheme Effective Time has the meaning given in clause 3.1.

Statutory Fund has the meaning given to that term in the Life Act.

Tax means any tax, levy, charge, excise, GST, impost, rates, Duty, fee, deduction, compulsory loan or withholding, which is assessed, levied, imposed or collected by any Government Agency and includes any interest, fine, penalty, charge, fee, expenses or other statutory charges or any other such amount imposed by any fiscal agency on or in respect of any of the above.

Tax Assets means all current Tax assets of ILAL referable to the Retail Life Insurance Business immediately after the Scheme Effective Time, including current Tax assets arising in connection with the Scheme.

Tax Liabilities means all current Tax liabilities of ILAL referable to the Retail Life Insurance Business immediately after the Scheme Effective Time, including current Tax liabilities arising in connection with the Scheme.

Transferring Assets means the assets of the Retail Life Insurance Business at Completion, including:

(a) the Investment Assets;

(b) the rights and benefits under the ILAL Transferring Life Policies;

(c) the rights and benefits under the Contracts;

(d) the Records,

but not including the Excluded Assets.

Transferring Contracts means each contract listed in Schedule 3.

Transfer Deed means the transfer deed between AIAA, ILAL and IGHL, dated 11 December 2024.

Headings are for convenience only, and do not affect interpretation. The following rules also apply in interpreting this document, except where the context makes it clear that a rule is not intended to apply.

(a) A reference to:

(i) a legislative provision or legislation (including subordinate legislation) is to that provision or legislation as amended, re-enacted or replaced, and includes any subordinate legislation issued under it;

(ii) a document (including this document) or agreement, or a provision of a document (including this document) or agreement, is to that document, agreement or provision as amended, supplemented, replaced or novated;

(iii) a party to this document or to any other document or agreement includes a successor in title, permitted substitute or a permitted assign of that party;

(iv) a person includes any type of entity or body of persons, whether or not it is incorporated or has a separate legal identity, and any executor, administrator or successor in law of the person; and

(v) anything (including a right, obligation or concept) includes each part of it.

(b) A singular word includes the plural, and vice versa.

(c) A word which suggests one gender includes the other genders.

(d) If a word or phrase is defined, any other grammatical form of that word or phrase has a corresponding meaning.

(e) If an example is given of anything (including a right, obligation or concept), such as by saying it includes something else, the example does not limit the scope of that thing.

(f) A reference to a matter being, at a relevant time, to the knowledge of a person means that the matter is, at that time, within the actual knowledge of the person.

(g) A matter that is not known by a person is not to the knowledge of that person even if that matter would have been discovered if that person had made the enquiries that a reasonable person in that person's position would have made.

(h) A reference to information is to information of any kind in any form or medium, whether formal or informal, written or unwritten, for example, computer software or programs, concepts, data, drawings, ideas, knowledge, procedures, source codes or object codes, technology or trade secrets.

(i) The expression this document or this Scheme includes the agreement, arrangement, understanding or transaction recorded in this document, including any schedule to this document or this Scheme.

(j) A reference to time is a reference to Sydney, New South Wales, Australia time.

3. Transfer of the Retail Life Insurance Business

(a) The Scheme Effective Time means 12.01 a.m. on the first calendar day of the month following the Scheme Confirmation Hearing Date, or such other date that the Court may specify as the commencement date of the Scheme should the Scheme be confirmed by the Court

(b) The Scheme becomes binding on all persons from the Scheme Effective Time.

3.2 Transfer of the Retail Life Insurance Business

(a) At and from the Scheme Effective Time:

(i) the Retail Life Insurance Business is transferred from ILAL to AIAA, and AIAA obtains and assumes all rights and benefits (including the Transferring Assets), and all obligations and liabilities (including the Assumed Liabilities), of the Retail Life Insurance Business on the basis set out in this Scheme, including all rights, title, interests, liabilities, obligations, benefits and powers that have arisen, or may in the future arise, under any of the above;

(ii) AIAA is liable for and must assume and pay, and indemnify ILAL against Loss arising from, the Assumed Liabilities; and

(iii) AIAA is entitled to the benefit of the Transferring Assets and assumes responsibility for the Transferring Assets.

(b) The Excluded Assets and Excluded Liabilities are not included in the Scheme.

3.3 Consequences of the transfer of the Retail Life Insurance Business

Without limiting clause 3.2, the matters set out in clauses 4 to 8 occur at the Scheme Effective Time unless otherwise stated.

4. Consequences of the transfer of the Retail Life Insurance Business

4.1 Issuer of ILAL Transferring Life Policies

AIAA becomes the issuer of the ILAL Transferring Life Policies and ILAL ceases to be the issuer of the ILAL Transferring Life Policies.

4.2 ILAL Transferring Life Policy Owners

(a) The ILAL Transferring Life Policy Owners cease to be ILAL Policy Owners and become AIAA Policy Owners.

(b) Subject to the effect of clause 4.3, the rights and liabilities of the ILAL Transferring Life Policy Owners will be the same in all respects as they would have been if:

(i) the applications on which the ILAL Transferring Life Policies were based had been made to, or accepted by, AIAA instead of ILAL; and

(ii) the ILAL Transferring Life Policies had originally been issued by AIAA instead of ILAL.

4.3 Changes to the terms and conditions of the ILAL Transferring Life Policies

(a) The terms and conditions of each ILAL Transferring Life Policy listed in item numbers 3 and 4 of Schedule 1 will not change as a result of the Scheme except for the matters set out in clause 4.12(c) and (d) below.

(b) The terms and conditions of each ILAL Transferring Life Policy listed in item numbers 1 and 2 of Schedule 1 are replaced at and from the Scheme Effective Time by:

(i) the AIAA Policy Terms; and

(ii) a replacement AIAA policy schedule issued by AIAA on or as soon as practicable after the Scheme Effective Time,

in accordance with and subject to the Product Transfer Rules set out in Schedule 2.

4.4 Assumption and release of policy liabilities

Subject to the effect of clause 4.3 and clause 4.7:

(a) AIAA assumes all liabilities and obligations of ILAL under, or in respect of, the ILAL Transferring Life Policies; and

(b) ILAL is released and discharged from all liabilities and obligations under, or in respect of, the ILAL Transferring Life Policies.

4.5 Rights and benefits

Subject to the effect of clause 4.3, AIAA is entitled to all rights and benefits of ILAL under, or in respect of, the ILAL Transferring Life Policies, including but not limited to:

(a) the right to receive any fees payable under, or in respect of, the ILAL Transferring Life Policies;

(b) the right to receive premiums payable under, or in respect of, the ILAL Transferring Life Policies;

(c) the right to enforce all rights and remedies available under the ILAL Transferring Life Policies and applicable law in respect of any non-payment of such premiums or fees;

(d) the right to enforce all rights and remedies available under the ILAL Transferring Life Policies and applicable law, including in respect of any failure by an ILAL Transferring Life Policy Owner to comply with obligations regarding disclosure and misrepresentation; and

(e) any claims by way of subrogation or contribution.

4.6 Authorities

All directions, authorities, mandates or instructions given to ILAL:

(a) to deduct premiums or fees payable in respect of the ILAL Transferring Life Policies (including by debiting a bank account, through automatic payroll deductions or through electronic bank transfer); or

(b) to disclose or obtain information in the course of carrying on the Retail Life Insurance Business,

are deemed to be given to AIAA instead of ILAL.

For all ILAL Transferring Life Policies listed in Schedule 1

(a) Subject to the effect of clause 4.3 and sub-clauses 4.7(b) to (f), any person having a claim on or obligation to ILAL under, or in respect of, an ILAL Transferring Life Policy, has the same claim on or obligation to AIAA instead of ILAL.

For ILAL Transferring Life Policies listed in item numbers 1 and 2 of Schedule 1

(b) Claims that are made and notified under Integrity Policies or Ex-CUNA Policies prior to the Scheme Effective Time will be assessed, or will continue to be assessed, and paid by reference to the Integrity Policy Terms or the Ex-CUNA Policy Terms (as applicable) for the life of the claim.

(c) Claims made under Integrity Policies or Ex-CUNA Policies after the Scheme Effective Time that arise from an insured event that occurred prior to the Scheme Effective Time will be assessed by reference to the Integrity Policy Terms or the Ex-CUNA Policy Terms (as applicable).

For ILAL Transferring Life Policies listed in item number 1 of Schedule 1

(d) An insured life that suffers a relapse for the purpose of their Income Insurance cover under the Integrity Policy Terms will have their relapsed claim assessed and paid under the Integrity Policy Terms where:

(i) the original claim was made prior to the Scheme Effective Time; and

(ii) the relapse occurs within the period specified in the Integrity Policy Terms.

(e) If the Life Cover Reset, Critical Illness Reset or Critical Illness Relapse option is held under an Integrity Policy, and:

(i) a claim is made under Integrity Policy Terms prior to the Scheme Effective Time or clause 4.7(c) applies to the claim, for which a right to restore cover could be made, and

(ii) the date the Policy Owner could elect to restore cover under the relevant option occurs after the Scheme Effective Time,

then where the Policy Owner does elect to restore the relevant cover it will be restored under AIAA equivalent terms as outlined in Schedule 2, and all future claims will be assessed under AIAA’s Policy Terms.

(f) If the 14 Day Life Cover Reset option is held under an Integrity Policy, and:

(i) a claim is made under Integrity Policy Terms prior to the Scheme Effective Time or clause 4.7(c) applies to the claim, for which a right to restore cover could be made, and

(ii) the date the Policy Owner could elect to restore cover under this option occurs after the Scheme Effective Time,

then where the Policy Owner does elect to restore cover, such cover will be restored under the Integrity Policy Terms, and all future claims will be assessed under the AIAA Policy Terms.

(g) Capitalised terms that do not have a defined meaning in clause 2 above, have the meaning given to them in the Integrity Policy Terms.

(a) Any proceedings in connection with an ILAL Transferring Life Policy that are in progress, pending, or that commence, whether by or against ILAL, in any court, tribunal or entity dealing with complaints, must be continued by or against AIAA instead of ILAL and AIAA must be substituted for ILAL as a party to those proceedings.

(b) Any judgment, order, award, determination or settlement in any proceeding described in clause 4.8(a) will have effect as if such judgment, order, award, determination or settlement had been made for or against AIAA.

4.9 Applications

(a) Any pending application for an ILAL Transferring Life Policy which has not been accepted by ILAL at the Scheme Effective Time is, for all intents and purposes, to be treated as an application to AIAA, and any policy resulting from such an application takes effect as a AIAA Policy.

(b) All proposals, applications, declarations and representations made to ILAL on which any ILAL Transferring Life Policy or other life policy (whether issued or entered into by ILAL or AIAA) is based are taken to have been made to AIAA instead of ILAL.

4.10 Commissions

AIAA:

(a) bears the obligation to pay commissions payable to any person in respect of an ILAL Transferring Life Policy from the Scheme Effective Time; and

(b) is entitled to seek repayment of commission (whether originally paid by AIAA or ILAL) in excess of the recipient's entitlement, instead of ILAL.

4.11 Transferring Contracts

(a) AIAA assumes the position of ILAL under all Transferring Contracts as if AIAA was the original party to those contracts in place of ILAL. The Transferring Contracts will continue in full force and effect on this basis.

(b) Without limiting clause 4.11(a):

(i) AIAA assumes all rights, powers, privileges, and all liabilities and obligations of ILAL under the Transferring Contracts, whenever occurring or accruing;

(ii) AIAA assumes the position of ILAL under the Transferring Contracts in respect of any proceedings that are in progress, pending by, or against, ILAL in respect of the Contracts;

(iii) all references to ILAL in a Transferring Contract will be read as a reference to AIAA; and

(iv) all references to ILAL Statutory Fund No.1 in a Transferring Contract will be read as a reference to AIAA Statutory Fund No.1.

(c) ILAL is released and discharged from all obligations and liabilities under the Transferring Contracts, whenever occurring or accruing.

(d) Each Reinsurance Contract under which ILAL is a cedant will transfer to AIAA, with the same consequences as set out above in clauses 4.11(a) to 4.11(c) with respect to the Transferring Contracts.

4.12 Consequences for ILAL Transferring Life Policies

(a) Subject to the effect of clause 4.3 and clause 4.7, AIAA assumes the position of ILAL under all ILAL Transferring Life Policies as if AIAA was the original party to those policies in place of ILAL. The ILAL Transferring Life Policies will continue in full force and effect on this basis.

(b) Without limiting clause 4.12(a) and subject to clause 3.2(b):

(i) AIAA assumes all rights, powers, privileges, and all liabilities and obligations of ILAL under the ILAL Transferring Life Policies (excluding Conduct and Operational Liabilities), whenever occurring or accruing; and

(ii) AIAA assumes the position of ILAL under the ILAL Transferring Life Policies in respect of any proceedings that are in progress, pending by, or against, ILAL in respect of the ILAL Transferring Life Policies.

(c) All references to ILAL in an ILAL Transferring Life Policy are replaced with AIAA.

(d) All references to ILAL Statutory Fund No.1 in an ILAL Transferring Life Policy will be read as a reference to AIAA Statutory Fund No.1.

(e) ILAL is released and discharged from all obligations and liabilities under the ILAL Transferring Life Policies, whenever occurring or accruing.

(f) The Transferring Life Policies will remain on foot and there will be no cancellation and reissue of the Transferring Life Policies as a result of the Scheme.

4.13 Consequences for Existing AIAA Policies

The terms and conditions of the Existing AIAA Policies will not change as a result of the Scheme.

5. Assets and Liabilities

5.1 ILAL Transferring Life Policies

Each ILAL Transferring Life Policy referable to ILAL Statutory Fund No.1 becomes a AIAA Policy referable to AIAA Statutory Fund No.1.

5.2 Assets

The Investment Assets become assets of AIAA Statutory Fund No.1.

5.3 Liabilities

The Assumed Liabilities referable to ILAL Statutory Fund No.1 become liabilities of the AIAA Statutory Fund No.1.

6. Conduct of the Retail Life Insurance Business at and from the Scheme Effective Time

(a) At and from the Scheme Effective Time, AIAA will maintain such policies and procedures as are required to enable it to conduct the Retail Life Insurance Business in a manner which is consistent with its legal and regulatory obligations and which satisfies the contractual rights and benefits, and the reasonable benefit expectations, of the ILAL Transferring Life Policy Owners.

(b) For the purposes of this clause 6, "policies and procedures" includes any policies and procedures relating to:

(i) the method of determining premium rates and charges;

(ii) underwriting and claims management;

(iii) the capital management framework;

(iv) the risk management framework; and

(v) remediation programs.

(c) AIAA must review its policies and procedures periodically to ensure that they remain appropriate.

(d) At and from the Scheme Effective Time, AIAA will conduct the remediation programs currently being conducted by ILAL as set out in Schedule 5 in accordance with the general principles specified in section 1.2 of the AIAA Remediation Standard, as set out in Schedule 6.

7. Implementation

AIAA and ILAL will do all such things and execute all such deeds, instruments, transfers or other documents as may be necessary or desirable to give full effect to the provisions of this Scheme and the transactions contemplated by them.

All costs, including any tax and stamp duty, associated with the transfer of the Retail Life Insurance Business will be paid by ILAL and AIAA and not directly by ILAL Transferring Life Policy Owners or AIAA Policy Owners.

9. Governing law

This Scheme is governed by the laws of New South Wales, Australia.

ILAL Transferring Life Policies

The ILAL Transferring Life Policies are the policies issued under the following product names:

No. | Product name |

1. | The Life Policies issued by ILAL under the product name "Integrity’s Here for You". |

2. | The Life Policies that were originally issued by CUNA Mutual Insurance Society for life, term life cover, crisis recovery and accident insurance under the product names: (a) MemberCare Life Insure Policy; (b) MemberCare Term Life Insurance Plan/Term Life Cover; and (c) MemberCare Term Life and Crisis Recovery Plan. |

The Life Policies that were originally issued by QBE Insurance (Australia) Ltd and ILAL for mortgage and loan protection cover under the product names: (a) MemberCare Loan Insure; (b) MemberCare Mortgage Insure; (c) Mortgage Protection Insurance; and (d) Loan Protection Insurance. | |

The Life Policies that were originally issued by LFI Group Pty Ltd and QBE Life (Australia) Limited for mortgage and loan protection cover under the product names “Loan Protection Insurance” and “Mortgage Protection Insurance”. |

Product Transfer Rules for ILAL Transferring Life Policies

1 The ILAL Transferring Life Policies whose terms and conditions are to be replaced

1.1 The terms and conditions of each ILAL Transferring Life Policy as listed in:

(a) item number 1 of Schedule 1, referred to as Integrity Policies; and

(b) item number 2 of Schedule 1, referred to as Ex-CUNA Policies,

are to be replaced on the basis set out in this Schedule 2.

2 The replacement terms and conditions for the ILAL Transferring Life Policies

2.1 At the Scheme Effective Time:

(a) The Integrity Policy Terms and the Ex-CUNA Policy Terms are replaced by the AIAA Policy Terms and a replacement policy schedule issued by AIAA; and

(b) the AIAA Policy Terms will apply in accordance with and subject to the Integrity Product Transfer Rules or the Ex-CUNA Product Transfer Rules as applicable.

2.2 Terms used in this Schedule 2 have the same meaning as set out in clause 2.1 of this Scheme document.

3 Integrity Product Transfer Rules

3.1 The Integrity Product Transfer Rules set out:

(a) the main policy benefits provided to Integrity Policy Owners under the Integrity Policy Terms;

(b) how these policy benefits will transfer to their equivalent replacement policy benefits under the AIAA Policy Terms; and

(c) some rules concerning premium changes and minimum premium requirements that are applicable to all ILAL Transferring Life Policies.

3.2 Tables 1 to 9 contain a list of each of the benefits and features provided under an Integrity Policy and the rules that will determine which corresponding benefit and feature under the AIAA Policy Terms will be provided to Integrity Policy owners at and from the Scheme Effective Time.

3.3 Integrity Policy Owners will only receive the benefits and features of the AIAA Policy Terms as outlined in Tables 1 to 9 below.

3.4 Further to clause 3.3, Integrity Policy Owners will receive all built-in benefits as described in the AIAA Policy Terms under the specific cover set out in the tables below, as applicable. The Rider Benefits – being optional benefits provided at an additional cost – that are referred to in the AIAA Policy terms will not apply on transfer unless they are expressly provided for in the tables below.

3.5 Integrity Policy Owners will not receive the Care Support Package Benefit in the form provided for under the Integrity Policy Terms, save for the specified benefits that are set out in the table below, or which are provided as built-in benefits under, the applicable AIAA Policy Terms.

3.6 The amounts that are shown as being cover amounts in the policy schedule or policy certificate for an Integrity Policy will become corresponding sums insured under the AIAA Policy Terms, save that:

(a) where a Superannuation Contribution Option is held under Income Insurance for Integrity Policies; and

(b) the Superannuation Contribution Option transferring sum insured exceeds the maximum allowable sum insured under AIAA’s relevant superannuation benefit,

the balance of the sum insured will be added to the relevant AIAA income protection sum insured.

3.7 Capitalised terms used in these Product Transfer Rules or the tables below have the meaning given to them in the Integrity Policy Terms or the AIAA Policy Terms, or as set out in clause 2.1 of this Scheme document, as the context requires.

3.8 As soon as practicable after the Scheme Effective Time, AIAA will issue a replacement AIAA policy schedule to each Integrity Policy Owner in accordance with the Integrity Product Transfer Rules, as applicable, and incorporating, where applicable, any specific exclusions from the cover recorded in the policy schedule or policy certificate issued in respect of the Integrity Policy.

Table 1 - Life Cover

Integrity Policy Term benefit | Integrity Policy Term | Replacement AIAA Policy Term |

Where the Integrity Policy owner is an individual or a company and is not a superannuation fund | ||

Life Cover | • Life Cover. | • Life Cover Ordinary Plan, Life Cover. |

Life Cover and Care Support Package (in respect to the benefit of Occupationally Acquired Needlestick Cover) | • Life Cover; and • Care Support Package Benefit. | • If the insured life satisfies the criteria for “M” Occupation Category under the AIAA Policy Terms, the Policyowner will receive Life Cover Ordinary Plan, Life Cover and Needlestick Injury Rider Benefit. • If the insured life does not satisfy the criteria for the ‘M’ Occupation Category under the AIAA Policy Terms, the Policyowner will receive Life Cover Ordinary Plan, Life Cover. |

Where the Integrity Policy owner is Diversa or a self-managed superannuation fund | ||

Life Cover | • Life Cover | • Life Cover Superannuation Plan, Life Cover. |

Life Cover and Care Support Package (in respect the benefit of Occupationally Acquired Needlestick Cover) | • Life Cover; and • Care Support Package Benefit. | • If the insured life satisfies the criteria for “M” Occupation Category under the AIAA Policy Terms, the Policyowner will receive Life Cover Superannuation Plan, Life Cover with Superannuation PLUS Rider Benefit and Needlestick Injury Rider Benefit. • If the insured life does not satisfy the criteria for “M” Occupation Category under the AIAA Policy Terms, the Policyowner will receive Life Cover Superannuation Plan, Life Cover. |

Table 2 - TPD Cover

Integrity Policy Term benefit | Integrity Policy Term | Replacement AIAA Policy Term |

Where the Integrity Policy owner is an individual or a company and is not a superannuation fund | ||

Combined Benefit | • TPD Combined Cover and Life Cover is held under the Integrity Policy as at the Scheme Effective Time; and • there is no 14-day Life Cover Reset option on the TPD Cover. | • Life Cover Ordinary Plan, Life Cover and TPD Optional Rider Benefit. |

• TPD Combined Cover and Life Cover is held under the Integrity Policy as at the Scheme Effective Time; and • there is 14-day Life Cover Reset option on the TPD Cover. | • Life Cover Ordinary Plan, Life Cover and TPD Stand Alone cover | |

TPD Stand Alone | • TPD Stand Alone Cover is held under the Integrity Policy as at the Scheme Effective Time. | • Life Cover Ordinary Plan, TPD Stand Alone cover. |

TPD – Life Cover Reset | • the Life Cover Reset Option under the TPD Combined Cover is held under the Integrity Policy as at the Scheme Effective Time. | • Life Cover Ordinary Plan, Life Cover and TPD Optional Rider Benefit with TPD Buy-back. |

TPD definition | • Own Occupation TPD Cover is held under the Integrity Policy as at the Scheme Effective Time; or • Any Occupation TPD Cover is held under the Integrity Policy as at the Scheme Effective Time. | • The TPD Own Occupation and TPD Any Occupation definitions under the AIAA Policy Terms will apply. |

Where the Integrity Policy owner is Diversa or a self-managed superannuation fund | ||

Combined Benefit | • TPD Combined Cover and Life Cover is held under the Integrity Policy as at the Scheme Effective Time; and

• There is no 14-day Life Cover Reset option on the TPD Cover | • Life Cover Superannuation Plan, Life Cover and TPD Optional Rider Benefit. |

• TPD Combined Cover is held under the Integrity Policy as at the Scheme Effective Time and is provided outside of a superannuation fund in a linked ordinary policy and. • Life Cover is provided within a superannuation fund; and • There is no 14-day Life Cover Reset option on the TPD Cover | • Life Cover Superannuation Plan, Life Cover with Superannuation PLUS Rider Benefit and TPD Optional Rider Benefit. | |

• TPD Combined Cover and Life Cover is held under the Integrity Policy as at the Scheme Effective Time; and • There is 14-day Life Cover Reset option on the TPD Cover. | • Life Cover Superannuation Plan, TPD Stand Alone cover. | |

• TPD Combined Cover is held under the Integrity Policy as at the Scheme Effective Time and is provided outside of a superannuation fund in a linked ordinary policy; and • Life Cover is provided within a superannuation fund; and • There is 14-day Life Cover Reset option on the TPD Cover | • Life Cover Superannuation Plan, Life Cover with Superannuation PLUS Rider Benefit and TPD Stand Alone Cover. | |

Standalone TPD Cover | • TPD Stand Alone Cover is held under the Integrity Policy as at the Scheme Effective Time. | Life Cover Superannuation Plan, TPD Stand Alone cover. |

Split TPD Cover | • If Split TPD Cover is held at the Scheme Effective Time. | If TPD Stand Alone Cover applies (as described above) then: • Life Cover Superannuation Plan, TPD Standalone and Maximiser Linked Benefit. If TPD Optional Rider Benefit applies (as described above) then: • TPD Optional Rider Benefit and Maximiser Linked Benefit. |

TPD Life Cover Reset | • the Life Cover Reset Option under the TPD Cover is held under the Integrity Policy as at the Scheme Effective Time. | • Life Cover Superannuation Plan, TPD Optional Rider Benefit with TPD Buy-back. |

TPD definition | • Own Occupation TPD Cover is held under the Integrity Policy as at the Scheme Effective Time; or • Any Occupation TPD Cover is held under the Integrity Policy as at the Scheme Effective Time. | The TPD Own Occupation and TPD Any Occupation definitions under the AIAA Policy Terms will apply. |

Table 3 - Critical Illness

Integrity Policy Term benefit | Integrity Policy Term | Replacement AIAA Policy Term |

The policy owner of the Integrity Policy is an individual or a company and is not a superannuation fund. | ||

Combined Benefit | • Critical Illness Combined Cover and Life Cover are held under the Integrity Policy as at the Scheme Effective Time. | • Life Cover Ordinary Plan, Life Cover and Crisis Recovery Optional Rider Benefit. |

• Critical Illness Combined Cover is held as at the Scheme Effective Time, and: • Life Cover is provided within a superannuation fund. | • Life Cover Superannuation Plan, Life Cover, Superannuation PLUS and Crisis Recovery Optional Rider Benefit. | |

Stand Alone | • Stand Alone Critical Illness Cover is held under the Integrity Policy as at the Scheme Effective Time. | • Crisis Recovery Stand Alone Plan, Crisis Recovery Stand Alone. |

Life Cover Reset | • Life Cover Reset Option under the Critical Illness Cover is held under the Integrity Policy as at the Scheme Effective Time; and • Life Cover is held outside superannuation. | Life Cover Ordinary Plan, Life Cover and Crisis Recovery Optional Rider Benefit with Crisis Recovery Buy-back Rider Benefit. |

• Life Cover Reset Option under the Critical Illness Cover is held under the Integrity Policy as at the Scheme Effective Time; and

• Life Cover is held inside superannuation. | • Life Cover Superannuation Plan, Superannuation PLUS, Crisis Recovery Optional Rider Benefit with Crisis Recovery Buy-back Rider Benefit. | |

Critical Illness Reset or Critical Illness Relapse | • the Critical Illness Reset or the Critical Illness Relapse Option is held under the Critical Illness cover under the Integrity Policy as at the Scheme Effective Time and • Life Cover is held outside superannuation. | • Life Cover Ordinary Plan, Life Cover, Crisis Recovery Optional Rider Benefit with Crisis Recovery Buy-back Rider Benefit and Crisis Reinstatement Rider Benefit. |

• the Critical Illness Reset or the Critical Illness Relapse Option is held under the Critical Illness cover under the Integrity Policy as at the Scheme Effective Time and ; • Life Cover is held inside superannuation. | • Life Cover Superannuation Plan, Life Cover, Superannuation PLUS and Crisis Recovery Optional Rider Benefit with Crisis Recovery Buy-back Rider Benefit and Crisis Reinstatement Rider Benefit. | |

• The Critical Illness Reset or the Critical Illness Relapse Option is held under the Stand Alone Critical Illness cover under the Integrity Policy as at the Scheme Effective Time. | • Crisis Recovery Stand Alone Cover with Crisis Reinstatement Rider Benefit. | |

Table 4 - Income Insurance (for Integrity Policies with a PDS that has a date of issue on or after 1 October 2021)

Integrity Policy Term benefit | Integrity Policy Term | Replacement AIAA Policy Term | |

The policy owner of the Integrity Policy is an individual or a company and is not a superannuation fund. | |||

Income Insurance Cover with an Income Replacement Ratio (IRR) of 50%, 60% or 70% | • an IRR of 50%, 60% or 70% of Monthly Earnings is held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time. | • Income Protection Plan, Income Protection CORE Flat 70% Option and Complimentary Income Protection CORE Extras. | |

Claim Benefit Indexation Option | • Claim Benefit Indexation Option is held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time. | • Income Protection Plan, Income Protection CORE Flat 70% Option and Complimentary Income Protection CORE Extras and Claim Escalation benefit. | |

Superannuation Contribution Option | • Superannuation Contribution Option is held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time. | • Income Protection Plan, Income Protection CORE Flat 70% Option and Complimentary Income Protection CORE Extras and Retirement Protector benefit. | |

Waiting Period | • the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 30 days, 60 days, 90 days or 2 years. | • a corresponding 30 day, 60 day, 90 day or 2 year Waiting Period under the AIAA Policy Terms will be applied. | |

• the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 180 days or 1 year. | • a Waiting Period of 90 days under the AIAA Policy Terms will apply. | ||

Benefit Period | • the Benefit Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 2 years, 5 years or to age 65. | • a corresponding 2 year, 5 year or to age 65 Benefit Period under the AIAA Policy Terms will apply. | |

Where the Integrity Policy owner is Diversa or a self-managed superannuation fund | |||

Income Insurance Cover with an Income Replacement Ratio (IRR) of 50%, 60% or 70% | • an IRR of 50%, 60% or 70% of Monthly Earnings is held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time. | • Superannuation Income Protection Plan, Income Protection CORE Flat 70% Option; and • Complimentary Income Protection CORE Extras | |

Split Income Insurance | • Split Income Insurance is held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time. | • Superannuation Income Protection Plan, Income Protection CORE Flat 70% Option; and • Complimentary Income Protection CORE Extras | |

Claim escalation | • Claim Benefit Indexation Option is held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time | • Superannuation Income Protection Plan, Income Protection CORE Flat 70% Option and Complimentary Income Protection CORE Extras and Claim Escalation Rider Benefit. | |

Waiting period | • the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 30 days, 60 days, 90 days or 2 years | • a corresponding 30 day, 60 day, 90 day or 2 year Waiting Period under the AIAA Policy Terms will apply. | |

• the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 180 days or 1 year. | • a Waiting Period of 90 days under the AIAA Policy Terms will apply. | ||

Benefit Period | • The Benefit Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 2 years, 5 years or to age 65. | • a corresponding 2 year, 5 year or to age 65 Benefit Period under the AIAA Policy Terms will apply. | |

Table 5- Income Insurance (for Integrity Policies with a PDS that has a date of issue on or before 1 April 2021)

Integrity Policy Term benefit | Integrity Policy Term | Replacement AIAA Policy Term |

The policy owner of the Integrity Policy is an individual or a company and is not a superannuation fund. | ||

Income Insurance | • Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is not held; and • neither of the Care Support Package Benefit nor the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Income Protection Plan, Advantage Optional and Claim Escalation benefit. |

• Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is not held; and • one or both of the Care Support Package Benefit and the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Income Protection Plan, PLUS Optional and Claim Escalation benefit. | |

• Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is held; and • neither of the Care Support Package Benefit nor the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Income Protection Plan, Advantage Optional, Retirement Optimiser and Claim Escalation benefit. | |

• Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is held; and • one or both of the Care Support Package Benefit and the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Income Protection Plan, PLUS Optional, Retirement Optimiser and Claim Escalation benefit. | |

Waiting period | • the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 30 days, 60 days, 90 days, 1 year or 2 years. | a corresponding 30 day, 60 day, 90 day, 1 year or 2 year Waiting Period under the AIAA Policy Terms will apply. |

• the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 180 days. | • a Waiting Period of 90 days under the AIAA Policy Terms will apply. | |

Benefit Period | • the Benefit Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 2 years, 5 years or to age 65 or age 70. | • a corresponding 2 year, 5 year or to age 65 or age 70 Benefit Period under the AIAA Policy Terms will apply, save that: o those persons who are classified under the AIAA Policy Terms as being under Occupation Category B1 (being those occupations not classified as white collar and which may involve some very light manual work), who have a Benefit Period to age 70 under the Integrity Policy Terms, will have a reduced Benefit Period under the AIAA Policy Terms to age 65. |

Where the Integrity Policy owner is Diversa or a self-managed superannuation fund | ||

Income Insurance | • Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is not held; and • neither of the Care Support Package Benefit nor the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Superannuation Income Protection Plan, Income Protection, Super Extras, Advantage Optional and Claim Escalation benefit. |

• Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is not held; and • one or both of the Care Support Package Benefit and the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Superannuation Income Protection Plan, Income Protection, Super Extras, PLUS Optional and Claim Escalation benefit. | |

• Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is held; and • neither the Care Support Package Benefit nor the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Superannuation Income Protection Plan, Income Protection, Super Extras, Advantage Optional, Claim Escalation benefit and Retirement Optimiser benefit. | |

• Income Insurance Cover is held under an Integrity Policy as at the Scheme Effective Time and where: • Superannuation Contribution Option is held; and • one or both of the Care Support Package Benefit and the Specified Injuries and Specified Medical Conditions Benefit is also held. | • Superannuation Income Protection Plan, Income Protection, Super Extras, PLUS Optional, Claim Escalation benefit and Retirement Optimiser benefit. | |

Waiting Period | • the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 30 days, 60 days, 90 days, 1 year or 2 years; | • a corresponding 30 day, 60 day, 90 day, 1 year or 2 year Waiting Period under the AIAA Policy Terms will apply. |

• the Waiting Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 180 days. | • a Waiting Period of 90 days under the AIAA Policy Terms will apply. | |

Benefit Period | • the Benefit Period held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is 2 years, 5 years or to age 65 or age 70. | • a corresponding 2 year, 5 year or to age 65 or age 70 Benefit Period under the AIAA Policy Terms will apply, save that: o those persons who are classified under the AIAA Policy Terms as being under Occupation Category B1 (being those occupations not classified as white collar and which may involve some very light manual work), who have a Benefit Period to age 70 under the Integrity Policy Terms, will have a reduced Benefit Period under the AIAA Policy Terms to age 65. |

Basis of Cover | • the Basis of Cover held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is Indemnity 12 months. | • Indemnity cover. |

• the Basis of Cover held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is Indemnity 36 months. | • Extended Indemnity cover. | |

• the Basis of Cover held under the Income Insurance Cover on the Integrity Policy as at the Scheme Effective Time is Agreed Value. | Agreed Value cover. | |

Table 6- Premium rates

Replacement AIAA Policy Premium Type | |

• All of the insurance cover held under the Integrity Policy as at the Scheme Effective Time has a Stepped Premium structure. | • a Stepped premium structure will apply. |

• All of the insurance cover held under the Integrity Policy as at the Scheme Effective Time has a Level Premium structure | • a Level premium structure will apply. Where there is an applicable policy term, AIAA will calculate the Level premium to match the Level Premium payable under the Integrity Policy term. Where the AIAA Policy term provided is in addition to the existing Integrity Policy term, AIAA will calculate the AIAA premium based on the entry age as at the Integrity Policy. |

• If the insurance cover held under the Integrity Policy as at the Scheme Effective Time has a combination of Stepped Premium and Level Premium structure. | • a Level premium structure will apply. For Stepped premium converting to Level premium, AIAA will use the insured life age at next birthday at the start of their cover with Integrity to calculate level premium rates. |

Premium changes and minimum premium requirements (applicable to all ILAL Transferring Policies) 1. AIAA will not apply any new premium rate changes introduced during 2025 to its Priority Protection policyholders as a whole to the ILAL Transferring Life Policies. 2. AIAA will waive its $300 minimum premium requirement for all ILAL Transferring Life Policies at the date of transfer and for subsequent Policy Anniversary premium calculations. This waiver will cease to apply if the cover is changed following the Scheme Effective Time. 3. The new premium rates for the ILAL Transferring Life Policies will take effect from the first date of payment following the Scheme Effective Time. | |

Table 7 – Adviser Commission Discounts impacting Premium Rates

Commission Discounts

The following table sets out the rules that will apply to transfer existing adviser commission discounts that apply to the Integrity Policies on and after the Scheme Effective Time when they become AIAA Policies.

Integrity Policy Premium Discounts for Hybrid Commission Arrangements | AIAA Policy Premium Discounts for Hybrid Commission Arrangements |

0.0% | P100 - 0.0% |

2.5% | P90 – 10% |

5.0% | |

7.5% | P85 – 15% |

10.0% | |

12.5% | P80 – 20% |

15.0% | |

17.5% | |

20.0% | |

22.5% | P70 – 30% |

25.0% | |

Integrity Policy Premium Discounts for Level Commission Arrangements | AIAA Policy Premium Discounts for Level Commission Arrangements |

0.0% | P100 - 0.0% |

2.5% | P95 – 10% |

5.0% | |

7.5% | P85 – 15% |

10.0% | P80 – 20% |

12.5% | |

15.0% | |

17.5% | P70 – 30% |

20.0% | |

22.5% | |

25.0% | |

Other Premium Discounts | |

Subject to meeting AIA’s qualification rules (as applicable), Integrity Life transferring policies may receive the following listed discounts: - Bundled discount; - Lump Sum Bundled discount; and - Preferred adviser discount provided under Integrity Life’s Here For You policy. No other discounts will apply on transfer. | |

Table 8 – Consumer Price Increase (CPI)

Integrity Policy Term | Replacement AIAA Policy Term |

Any of the insurance cover held under the Integrity Policy as at the Scheme Effective Time has a CPI Rate increase applicable to it. | CPI Increase will apply to all covers in accordance with Benefit Indexation under the AIAA Policy Terms. |

Table 9 - Occupation categories

Integrity Policy Term Occupation Class | Replacement AIAA Policy Term Occupation Category | |||||||||||||||||||||||||||||||||||||

• 1- Professional, other than medical professional occupations | • A1 | |||||||||||||||||||||||||||||||||||||

• 1- White | • A2 | |||||||||||||||||||||||||||||||||||||

• 2 - Light Blue | • B1 | |||||||||||||||||||||||||||||||||||||

• 3 - Blue | • C1 | |||||||||||||||||||||||||||||||||||||

• 4 - Heavy Blue | • D | |||||||||||||||||||||||||||||||||||||

• 5 - Red | • E | |||||||||||||||||||||||||||||||||||||

• Medical professional occupations, comprising:

| • M |

4 Ex-CUNA Product Transfer Rules

4.1 The Ex-CUNA Product Transfer Rules set out:

(a) the main policy benefits provided to Ex-CUNA Policy Owners under the Ex-CUNA Policy Terms; and

(b) how these policy benefits will transfer to their equivalent replacement policy benefits under the AIAA Policy Terms.

4.2 Tables 1 and 2 contain a list of each of the benefits and features provided under a Ex-CUNA Policy and the rules that will determine which corresponding benefit and feature under the AIAA Policy Terms will be provided to Ex-CUNA Policy Owners at and from the Scheme Effective Time.

4.3 Benefits and features of the AIAA Policy Terms are only to be provided to Ex-CUNA Policy Owners to the extent that they are expressly referred to in Tables 1 and 2.

4.4 Further to clause 4.3, Ex-CUNA Policy Owners will receive all built-in benefits as described in the AIAA Policy Terms under the specific cover set out in the Replacement AIAA Policy Term in the Tables below, as applicable. The Rider Benefits – being optional benefits at an additional cost – that are referred to in the AIAA Policy terms will not apply on transfer. Where an accidental death benefit is provided under an Ex-CUNA Policy, that benefit will not be provided under the AIAA Policy Terms.

4.5 The amounts that are shown as the sum insured for benefits (other than accidental death) in the policy schedule or policy certificate for an Ex-CUNA Policy will become corresponding Sums Insured under the AIAA Policy Terms.

4.6 Capitalised terms used in these Product Transfer Rules or the tables below have the meaning given to them in the EX-CUNA Policy Terms or the AIAA Policy Terms, or as set out in clause 2.1 of this Scheme document, as context requires.

4.7 As soon as practicable after the Scheme Effective Time AIAA will issue a replacement AIAA policy schedule to each owner of an EX-CUNA Policy in accordance with the Ex-CUNA Product Transfer Rules, as applicable, and incorporating, where applicable, any specific exclusions from cover recorded in the policy schedule or policy certificate issued in respect of the Ex-CUNA Policy.

Table 1 - Life Cover

Ex-CUNA Policy benefit | Ex-CUNA Policy Term | Replacement AIAA Policy Term |

Life Cover / Term Life | • Life cover or term life cover held under the Ex-CUNA Policy as at the Scheme Effective Time | • Life Cover Ordinary Plan, Life Cover. |

Table 2- Premium rates

Ex-CUNA Policy Premium Type | Replacement AIAA Policy Term Premium Type |

• All Ex-CUNA Policies as at the Scheme Effective Time. | • a Stepped premium structure will apply. |

Premium changes and minimum premium requirements Subject to meeting AIA’s qualification rules (as applicable), Ex-CUNA transferring policies may receive the following listed discount; - Lump Sum Bundled discount; No other discounts will apply on transfer.

| |

Transferring Contracts

No. | Contract | Parties |

1. | Promoter Agreement dated 12 April 2019 | ILAL and Diversa Trustees Limited |

2. | Insurance Service Level Agreement dated 12 April 2019 | ILAL and Diversa Trustees Limited |

3. | Outsourced Services Agreement dated 22 December 2017 as amended and restated by the Amendment and Restatement Deed dated 6 February 2025 | ILAL and QBE Management Services Pty Ltd |

Reinsurance Contracts

ILAL Remediation Programs

Refunds not yet processed incident remediation

Extract of AIAA Remediation Standard

5 General Principles

5.1 Remediation must:

(a) commence promptly and ensure conflict of interest controls are in line with the Conflicts of Interest Standard;

(b) return affected customers as closely as possible to the position they would have otherwise been in had the misconduct or other failure not occurred;

(c) give customers the benefit of the doubt and minimise the risk of under- compensation ie. ensure customers do not incur fees or charges as a result of the Remediation;

(d) use best endeavours to identify all customers impacted by the Remediation issue;

(e) use best endeavours to identify customers in hardship or vulnerable circumstances and consider if any special treatment or immediate action is appropriate for them;

(f) understand and be accountable for addressing the root cause(s) of the Remediation issue;

(g) make the Remediation process easy for customers by minimising complexity and, where possible, limiting their involvement in the process;

(h) adhere to the relevant internal dispute resolution obligations and timeframes when a customer complains about the Remediation issue;

(i) ensure customers are made aware of AIAA’s external dispute resolution scheme if they are not satisfied with the outcome provided to them, and provide details of the external dispute resolution scheme;

(j) treat all impacted customers in a consistent manner, to the extent possible;

(k) ensure that AIAA does not profit from a Remediation issue;

(l) ensure the determination of whether a customer is impacted by the Remediation issue and the extent of any impact is assessed in an objective, straightforward and consistent manner; and

(m) monitor and improve processes and methods as required to ensure that each Remediation is executed in line with the AIAA Remediation Standard.

5.2 Defined terms in this Schedule 6 have the meanings ascribed to them in the AIAA Remediation Standard.

JACKMAN J:

Introduction

1 In these proceedings the applicants, Integrity Life Australia Limited (ILAL) and AIA Australia Limited (AIAA), make an application under s 193 of the Life Insurance Act 1995 (Cth) (Life Act) for an order under s 194 of the Life Act confirming a scheme for the transfer of part of the life insurance business of ILAL to AIAA (Scheme). The terms and details of the Scheme are stipulated in the scheme document (Scheme document).

2 On 17 December 2024, I made orders pursuant to s 191(5) of the Life Act dispensing with the need for compliance with s 191(2)(c) of the Life Act insofar as it requires a summary of the Scheme approved by APRA (Scheme Summary) to be given to owners of policies issued by the applicants affected by the Scheme, provided that the applicants carry out certain steps (Dispensation Orders). As set out below, the steps required under the Dispensation Orders and the procedural requirements under the Life Act have been substantially complied with.

3 The Scheme is based on actuarial reports prepared by Mr Michael Dermody, the appointed actuary of ILAL, dated 12 December 2024 (ILAL Actuarial Report) and Mr Nghiep Luu, the appointed actuary of AIAA, dated 12 December 2024 (AIAA Actuarial Report). Mr David Goodsall, an independent actuary, has also prepared a report on the Scheme dated 12 December 2024 (Independent Actuarial Report). Each of the actuaries has updated his report by further evidence in the form of an affidavit.

Background to the Scheme and the life insurance business of the applicants

Life Insurance Business of ILAL

4 ILAL is authorised under the Life Act to conduct life insurance and conducts this business in Australia. It is a wholly owned subsidiary of Integrity Group Holdings Limited (IGHL) and operates IGHL’s life insurance business. IGHL is a registered non-operating holding company that is privately owned by a number of local and offshore investors. Leadenhall Capital Partners and Schroder Investment Management Limited are its majority shareholders.

5 ILAL was acquired by IGHL in December 2017 from QBE Insurance Group. ILAL was formerly known as:

(a) QBE Life (Australia) Limited (QBE Life) from March 2012 to January 2018; and

(b) CUNA Mutual Life Australia Limited (CUNA) before March 2012.

6 ILAL has a single statutory fund that contains ordinary and superannuation life business, referred to as Statutory Fund No 1 (ILAL SF1). ILAL also operates a shareholders’ fund which is maintained separately from ILAL SF1.

7 ILAL carries on three main categories of life insurance business as follows:

(a) individual life risk business. This comprises death, total and permanent disablement (TPD), trauma and income protection cover, as follows:

(i) life policies sold under the “Integrity’s Here for You” product disclosure statement and policy document (Integrity Policies) which were distributed through financial advisers; and

(ii) life policies sold under the “Medibank” and “ahm” brands (Medibank Policies) which were distributed directly;

(b) group risk business (Group Risk Business). This comprises group insurance schemes where cover is provided for group life insurance (death and TPD) and group salary continuance. This business was distributed through a network of brokers, superannuation trustees and commercial partnerships and comprises the following portfolios:

(i) corporate group life policies which include the Australian Retirement Trust superannuation fund’s corporate plans and Marsh Pty Limited’s Mercer Marsh Benefits (Marsh) small and midsize enterprises corporate plans;

(ii) group life policies sold under the “Coverforce” brand; and

(iii) group life policies for small business sold under the “Five+” brand; and

(c) legacy business from QBE Life and CUNA. This comprises the following products that have been closed to new business since soon after the acquisition of QBE Life:

(i) loan and mortgage protection insurance jointly issued by QBE Life and each of QBE Insurance (Australia) Limited and LFI Group Pty Limited (Ex-QBE CCI Policies); and

(ii) life, term life cover, crisis recovery and accident insurance cover issued by CUNA (Ex-CUNA Policies).

8 The life business which is proposed to be transferred under the Scheme is that referable to the Integrity Policies, the Ex-QBE CCI Policies and the Ex-CUNA Policies (Transferring Policies). This business is referred to and defined in the Scheme document as the “Retail Life Insurance Business” (Retail Life Insurance Business). The other business of ILAL, including the remaining group life insurance sold under the Marsh corporate plans and the Five+ brand, as well as the Medibank Policies are not the subject of the proposed Scheme.

Life Insurance Business of AIAA

9 AIAA is authorised to conduct life insurance under the Life Act. Since 28 February 2009, AIAA has been a wholly owned subsidiary of AIA Company Limited, a company incorporated in Hong Kong. AIAA is part of the AIA Group which comprises the largest independent publicly listed Pan-Asian life Insurance group. It has a presence in 18 markets and has total assets of US$286 billion as of 31 December 2023. The AIA Group services the holders of more than 42 million individual policies and over 18 million participating members of group insurance schemes.

10 The AIA Group has operated in Australia since 1972. AIAA provides life insurance coverage to over 2.5 million people in Australia and employs approximately 1,850 people in Australia.

11 AIAA’s life insurance business is managed within two statutory funds: Statutory Fund No 1 for non-investment linked business (AIAA SF1) and Statutory Fund No 2 for investment linked ordinary business (AIAA SF2). AIAA operates, among other life insurance business, individual lump sum (death, disablement, trauma and income protection insurance) business, with a gross annual premium in-force of $1,511 million as at 31 December 2023, and group lump sum (death, disablement, trauma and income protection insurance) business, with a gross annual premium in-force of $2,068 million as at 31 December 2023.

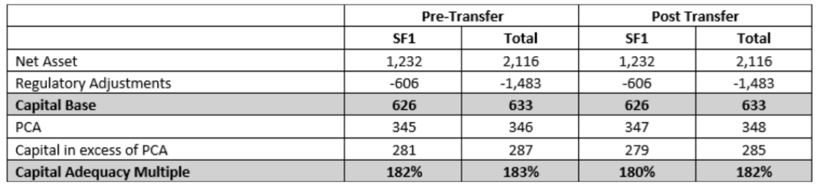

12 As at 31 December 2023, AIAA SF1 had net assets of $1,325 million and a Capital Adequacy Multiple (CAM) of 212%. As at 31 December 2023 AIAA, as a whole, had net assets of $2,226 million and a CAM of 223%. As at 31 December 2024, AIAA SF1 had net assets of $1,232 million and a CAM of 182%. As at 31 December 2024, AIAA, as a whole, had net assets of $2,116 million and a CAM of 183%.

ILAL’s entry into run-off and its current financial position

13 Following the acquisition of QBE Life from QBE Insurance Group, ILAL’s plan under new management and ownership was to cease to write the legacy business from QBE Life and CUNA, and to expand into retail advised and group insurance business channels. This expansion involved ILAL offering the Integrity Policies and the Group Risk Business referred to above.

14 Over time, ILAL was unable to achieve the targets and sales volumes in its business plans so as to grow and operate at a large enough scale to be profitable. This lack of growth stemmed from substantial reductions in both the number of financial advisers providing risk advice and the number of lives insured across all of the sales channels. Not being able to achieve sufficient scale required significant ongoing investment from ILAL’s institutional investors that could not be maintained.

15 Attempts were made during 2023 to make ILAL’s financial position more sustainable. This involved exploring options to recapitalise the business from existing and new shareholders, selling IGHL’s life insurance business and restructuring ILAL’s business (including migrating existing business through a platform operated by the administrator of the Medibank portfolio and closing the retail advised business while continuing to write the Group Risk Business). These processes were not successful.

16 On 5 September 2023, ILAL made a decision to stop writing new business because of the lack of ongoing investment. The decision resulted in a reduction to the forecast revenue position for the business. ILAL assessed that its forecasted capital position at 30 September 2023 would, as a result of the reduction in future cashflows, be below its prescribed capital requirement. This placed ILAL in a position of non-compliance with Prudential Standards LPS 110 Capital Adequacy and LPS 100 Solvency Standard, and in turn, in breach of s 230AAA of the Life Act.

17 ILAL entered into run-off for its Group Risk Business on 5 September 2023, and its retail advised business on 29 September 2023 when it ceased sales of new business. New sales of Medibank Policies ceased in April 2024. ILAL invoked its documented process for the run-off and administration of each of its portfolios (Run-Off Plan). ILAL reported its breaches of the Life Act to APRA and APRA issued directions to ILAL under s 230B(1) of the Life Act on 18 October 2023. These directions required ILAL:

(a) only to carry on life insurance business for the purpose of discharging liabilities arising under life policies issued on or before 31 October 2023 or, with APRA’s approval for existing contractual arrangements with certain business partners, life policies issued on or before 31 March 2024 (in effect, ILAL was prohibited from writing new business after these dates);

(b) to seek APRA’s written approval before making a reduction in its Capital Base or before making any payments to shareholders or related entities whether by dividend, interest or any other means; and

(c) to seek APRA’s written approval before transferring any asset of a Statutory Fund.

18 Under its Run-Off Plan, ILAL is working towards completing the run-off of its Retail Life Insurance Business by June 2025, or earlier if possible. This involves the transfer or transition of the various portfolios comprising ILAL’s Retail Life Insurance Business, the main purpose of which is to protect policy owners’ contractual benefits and to provide options for continuing their cover in light of ILAL’s deteriorating financial position. The proposed Scheme is an integral part of this run-off process.

19 The various arrangements for the run-off of the remaining business of ILAL (other than through the proposed Scheme) have been set out in detail in applicant’s evidence. They include transfer of the Medibank Policies, which have been transferred to Zurich Australia Limited under Pt 3 of the Financial Sector (Transfer and Restructure) Act 1999 (Cth) (FSTR Act), with an effective date of 20 December 2024. Further, the twenty or so group life insurance and group salary continuance plans comprising the remaining portfolio of corporate group life business have either been transitioned to TAL Life or cancelled at the policyholder’s instruction. One in-force policy remains as part of the Five+ group life business, which is to be cancelled with effect on 28 February 2025.

20 ILAL is currently in the process of negotiating commercial arrangements with a number of life insurers for them to accept certain residual open claims and incurred-but-not-reported (IBNR) claims liabilities for ILAL’s corporate group life business. These arrangements are proposed to be effected by deeds of assignment that are to be approved by APRA under s 27A of the Life Act. These liabilities include about 271 open claims as at 31 December 2024. ILAL is also arranging transfer of any remaining claims exposure for each individual policy not transferred under the Scheme that relates to an out-of-force policy. The expected claims cost for these IBNR liabilities is close to nil.

21 Commercial negotiations to finalise these transfers are continuing. Two of the three insurers involved have provided indicative commercial terms which are not considered financially viable, and ILAL is working with these insurers on solutions to reduce their costs. ILAL remains confident that the transfers of these remaining liabilities can be effected by 30 June 2025, if not earlier.

22 The run-off process is being closely monitored by APRA. This is a necessary consequence of the directions that APRA has issued and some aspects of the transfer of the remaining business contemplate the exercise of powers by it.

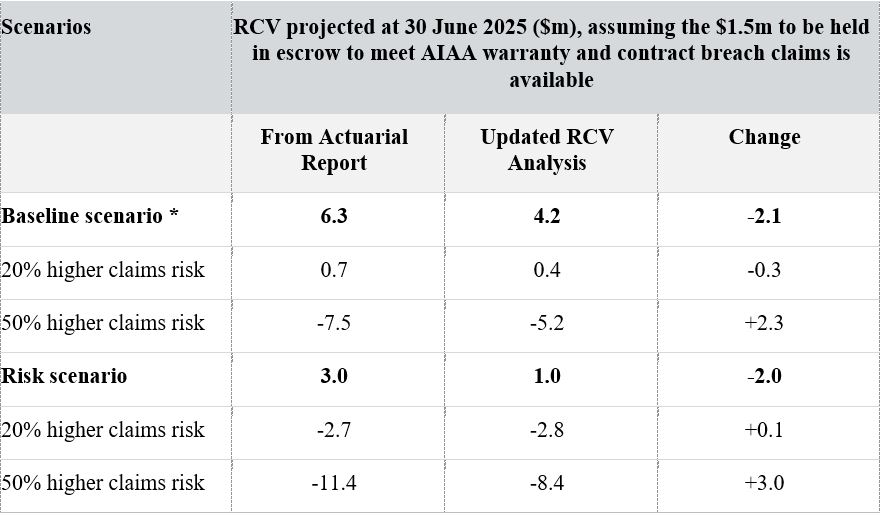

23 Notwithstanding the risks associated with the breaches that have been reported to APRA, ILAL has performed an assessment of its solvency under the course of executing the Run-Off Plan. In particular, ILAL performs financial analysis of the expected remaining assets across IGHL (including the capital available in IGHL and ILAL) once the Run-Off Plan is complete. This is referred to as the Residual Capital Value (RCV). This analysis is performed monthly and is updated for actual experience, material changes in anticipated future experience of the policies and any other material changes to the Run-Off Plan. Mr Dermody has set out in the ILAL Actuarial Report an RCV analysis based on different scenarios:

(a) first, a “Baseline Scenario”, taking into account expected internal and external expenses, including those involved in transitioning the business and costs of the proposed Pt 9 transfer and the ultimate winding-up of IGHL; and

(b) second, a “Risk Scenario”, which involves longer time frames for the transfer of cover. Under this scenario, the transferring policies and corporate group life policies are assumed not to be transferred until August 2025 and September 2025 respectively.

The results of this detailed analysis are set out in tables 2 to 4 of the ILAL Actuarial Report, and show projected available assets at 30 June 2025 of $4.8 million in the Baseline Scenario and $1.5 million in the Risk Scenario. However, further analyses involving claims 20% and 50% higher than expected show negative RCV projections at 30 June 2025, ie a shortfall of assets. Mr Dermody states:

In summary the analysis indicates that ILAL is expected to meet its obligations to policy owners on the Baseline Scenario and the Risk Scenario if claims are expected. My overall view is that ILAL is not in a strong financial position to address the potential risks that may emerge.

24 Mr Dermody updated his review of ILAL’s current financial position and in particular the RCV, with data available as at 30 November 2024. The RCV analysis shows a deterioration of the financial position compared to the forecast of approximately $1.4 million, the primary driver of which is excess claims in November 2024. Mr Dermody finds that ILAL is expected to have limited remaining assets once the run-off is complete in both the Baseline (or Best Case) and the Risk scenarios, assuming that an escrow amount of $1.5 million (to meet potential warranty and contract claims by AIAA under the transfer deed) is available to meet any remaining policy liabilities of AIAA. Importantly, the date by which ILAL’s capacity to meet policy owner benefits in full is now expected to be exhausted by November 2027, some three months earlier than the assessment at [2.10] of the ILAL Actuarial Report.

25 The board of ILAL has also developed an “in principle” plan referred to as the Retail Contingency Plan (RCP) which sets out the approach to run-off the retail advised business and Ex-QBE CCI Policies if the proposed transfer under the Scheme does not proceed and no other opportunity to transfer the business arises. The key features of the RCP include:

(a) a plan to increase premiums on the first policy anniversary following the hypothesised failure of the transfer by a range of between 20% and 60% (now more likely to be at the higher end of this range), and on the second policy anniversary, an increase in the order of 50% on the premium after the first year increase; and

(b) an expectation that expense overruns will continue to occur, notwithstanding ILAL seeking to reduce and manage expenses, as a result of the difficulties in reducing policy numbers, by financial incentive or otherwise, to a level that would substantially eliminate the costs associated with the business.

Importantly, under the RCP, it is expected that ILAL’s capacity to meet policy owner benefits in full, would be exhausted in the period between July and November 2027.The proposed Scheme and Transfer

The Scheme