FEDERAL COURT OF AUSTRALIA

Inruse Pty Limited as trustee for the 224 Hinxman Trust v Equity Lenders Pty Ltd [2024] FCA 1434

ORDERS

INRUSE PTY LIMITED ACN 001 776 445 AS TRUSTEE FOR THE 224 HIXMAN TRUST Applicant | ||

AND: | EQUITY LENDERS PTY LIMITED ACN 630 816 330 First Respondent ROBERT KIRK Second Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The application be dismissed.

2. Pursuant to r 40.02 of the Federal Court Rules 2011, the applicant pay the respondents’ costs in a lump sum fixed at $80,137.72.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

THAWLEY J:

OVERVIEW

1 The applicant, Inruse Pty Limited as trustee for the 224 Hinxman Trust, seeks damages against the respondents, Equity Lenders Pty Limited and its sole director, Mr Robert Kirk. Equity Lenders is a mortgage originator and broker, linking private lenders with borrowers, particularly in the construction and building industries. Inruse makes investments in the Hinxman Trust for the purposes of generating wealth for Mr Swain and his family. Unless otherwise stated in these reasons, a reference to Inruse is a reference to Inruse in its capacity as trustee of the Hinxman Trust.

2 By three loan agreements between July and December 2021, Inruse lent money to Construxn Pty Ltd, a construction and property development company based in Queensland. Mr Nelson Wayne Leon was the sole director and shareholder of Construxn.

3 The three loans were as follows:

(a) The First Loan, made on 13 July 2021: a loan of $262,500, secured by a second mortgage over 69A Albert Street, Goodna, Queensland (the Goodna property) and 36-46 Bromley Street, Cornubia, Queensland (the Cornubia property). The First Loan was for 6 months at an interest rate of 24% pa ($31,500), with three months interest prepaid on drawdown ($15,750) and a “Funder Fee” of 4.4% ($11,550) payable to Inruse on drawdown. Interest became payable at 48% in certain circumstances. By 14 October 2021, the borrower was in default such that interest was payable at 48%;

(b) The Second Loan, made on 18 August 2021: a loan of $222,700, secured by a second mortgage over 40 Glenmore Crescent, Rochedale, Queensland (the Rochedale property). The first mortgagee was Certane Ct Pty Ltd, being an investment vehicle for the Australian Secure Capital Fund (ASCF). The Second Loan was for 2 months at an interest rate of 24% pa ($8,908), fully prepaid on drawdown together with a “Funder Fee” of 4.4% ($9,798.80) payable to Inruse on drawdown. Interest became payable at 48% in certain circumstances. On 18 October 2021, the borrower requested an extension until 18 November 2021. Inruse granted this extension at the default rate of interest of 48%, but Construxn defaulted on repayment; and

(c) The Third Loan, made on 13 December 2021: a loan of $579,500, secured by a third mortgage over 47 Edward Street, Brisbane. Certane was the first and second mortgagee. The Third Loan involved a refinancing (and therefore a discharge) of the First Loan. The Third Loan was for three months at a “lower rate” of 48% pa, with the whole of the interest deducted from the principal on the loan date (a total of $69,540). Interest became payable at a “higher rate” of 60% in certain circumstances. An establishment or lender’s fee of 4.4% ($25,498) was paid to Inruse at drawdown. Unless the loan was repaid before the loan repayment date and there had not been any event of default, a “deferred commitment fee” of $100,000 was payable. Before entering into the Third Loan, Construxn was in default under both the First and Second Loans. Construxn defaulted by not repaying the Third Loan on 13 March 2022.

4 In respect of each of the loans:

(a) Equity Lenders acted for Inruse as broker and mortgage originator; and

(b) Bransgroves Lawyers acted for Inruse.

5 On 12 June 2022, Construxn was placed under administration: Swain at [10]. Inruse has not been repaid the amounts owing under the Second and Third Loans which, after default, accrued interest at 48% and 60% respectively.

6 Inruse blames Equity Lenders and Mr Kirk for its predicament. By its primary case, Inruse claims that it was induced to engage Equity Lenders and make the loans by representations contained in documents accessed on or through its website, namely a “Private Lender Guide” and “FAQ’s on becoming a lender on the Equity Lenders panel of lenders” (FAQs). The Guide and FAQs, amongst other things, provided information as to what Equity Lenders would do if a lender became a lender on Equity Lenders’ panel of lenders, lending on first or second mortgages. The Guide and FAQs addressed loans in which the maximum loan to value (LVR) was 70%.

7 Mr Swain was the controlling mind of Inruse. He has 18 years’ experience in the banking industry and 39 years’ experience as a business manager assisting clients with their business and wealth management. Since 2016, he has devoted his attention solely to managing his family wealth. He had experience in private lending before the relevant events the subject of these proceedings.

8 After twice reading the Guide and FAQs carefully, Mr Swain contacted Mr Kirk at Equity Lenders and, after discussions, instructed Equity Lenders that Inruse preferred to lend on a second mortgage basis, charging interest of between 18% and 24% pa, with an LVR up to 90%.

9 In accordance with Mr Swain’s instructions, Equity Lenders put forward the First Loan at 24% interest with an LVR in respect of two properties of 85.7% and 85.736%. The Second and Third Loans had an LVR of about 75%.

10 Inruse says that it was induced to deal with Equity Lenders by the representations it says were conveyed in the Guide and FAQs, including that Equity Lenders would only put forward loans where the lenders funds would be “safe” or “secure” and where there was sufficient equity in the security property to repay the loans.

11 Inruse claims that, were it not for the representations, Inruse would have engaged a different mortgage broker, and that: (i) it would have entered into different private loans at the same or similar rates to those which it in fact entered into; and (ii) it would not have suffered the losses it did.

12 Inruse claims damages:

(a) under s 236(1) of the of the Australian Consumer Law (ACL), being Sch 2 of the Competition and Consumer Act 2010 (Cth) for a breach of s 18(1) of the ACL on the basis that Equity Lenders engaged in misleading or deceptive conduct by making certain representations about Equity Lenders’ lending policies;

(b) against Mr Kirk on the basis that he was “involved in” the contraventions within the meaning of s 2(1) and s 236(1) of the ACL;

(c) for breach of contract, the alleged terms finding analogues in the alleged misleading or deceptive representations; and

(d) for negligence at common law and under s 267(4) of the ACL on the basis that Equity Lenders failed to comply with the guarantee under s 60 of the ACL by failing to provide services with due skill and care.

13 For the reasons which follow, each of Inruse’s claims should be dismissed.

FACTUAL BACKGROUND

Mr Swain and Inruse

14 Mr Swain and his daughter, Ms Elizabeth Swain, are directors of Inruse which is used as an investment vehicle for the Hinxman Trust: Swain at [1]-[3].

15 Mr Swain is an experienced investor, having retired in 2016 to run his family office full-time. He holds a Master of Business Administration from Southern Cross University: Swain at [20]. From 1959 until 1977, Mr Swain was employed by the Australia and New Zealand Bank (ANZ) as a city branch accountant and relieving manager: Swain at [21]. In about 1977, Mr Swain left the ANZ and commenced a business management practice which he operated until 2016: Swain at [22]. Although Mr Swain was not a tax agent or a registered accountant, he maintained financial accounts for his clients before those clients submitted the financial accounts to their accountants. As part of his business management practice, Mr Swain managed the personal wealth of Australian businessman, Mr Warren Anderson.

16 When he ceased operating his business management practice in 2016, Mr Swain turned his attention solely to managing his family wealth: Swain at [23]. Mr Swain is solely responsible for making investment decisions for Inruse: Swain at [35].

17 By reason of his experience in the banking industry and as a business manager, and his previous experience in causing the Hinxman Trust to invest in private mortgages, Mr Swain was experienced in private mortgage lending and was aware that it was a “potentially risky class of investment”: Swain at [71]. Mr Swain stated that he retained a mortgage broker when undertaking private mortgage lending “as an extra layer of assessment to help mitigate the risk” to Inruse: Swain at [74].

The decision to retain Equity Lenders

18 On 10 May 2021, Mr Swain decided to explore whether Equity Lenders would be an appropriate broker to act for Inruse in relation to a $500,000 investment.

19 Mr Swain gave evidence that he visited Equity Lender’s website after dinner on 10 May 2021, first viewing the “splash page”: Swain at [88]. Mr Swain stated that he then carefully read the FAQs, namely the document entitled “FAQ’s on becoming a lender on the Equity Lenders panel of lenders”: Swain at [92]. The FAQs included the following (emphasis original):

Why does a 2nd mortgage have higher risk compared to a 1st mortgage?

…

Risks to lenders include:

• the 1st mortgagee is paid in full prior to the 2nd mortgagee receiving funds from sale proceeds

• if the lvr was high ie above 70% and the sale price low ie based on market value, the 2nd mortgagee may receive less than their original loan amount from sale proceeds

How EquityLenders mitigates the risk to you as the lender of 2nd mortgages seeking higher returns:

• you nominate the maximum lvr you are comfortable with ensuring there is sufficient remaining equity available to both the 1st mortgagee and you, each being paid out in full from the proceeds of a property sale

• EquityLenders does not exceed 70% lvr which means at least 30% of the remaining equity is available as buffer should either the 1st mortgagee or you as the 2nd mortgagee be entitled to higher amounts

• valuations ordered by EquityLenders include both market value and forced sale values to ensure that you as the lender are aware of what the property sale can achieve if proceeding with mortgagee in possession

• interest is generally prepaid for the term of the loan to reduce loan default or occurrence of arrears

• an email + formal letter + one or more phone calls are sent, issued, or made to the borrower(s) within days of becoming aware a repayment has not been received with instructions to immediately rectify

• at the time of borrower(s) accepting your loan secured by a 2nd registered mortgage, all of the borrower(s) personal property is registered on the PPSR with your name as the interested party

…

Who is/are the company borrower(s) that I will be lending to?

…

Note: You alone approve how, when, where and to whom your funds are loaned to!

…

Is lending to a Company or Corporate Trustee safe?

Before any Indicative Loan Offer is issued to a Company or Corporate Trustee borrower:

1. a lending Manager at EquityLenders discusses the loan requirements with the Company Director(s) and if the borrower can proceed, an indicative quote is prepared and issued to the property owner(s)

2. an application is provided to, and completed by, the Director(s)

3. EquityLenders undertakes personal credit reports on all Directors using Equifax and Company credit reports on the company using Creditorwatch

4. the purpose of the loan is determined, the exit strategy is determined, and the amount of available equity is determined based on Core Logic desktop valuation(s) and realestate.com.au comparable(s)

As a general rule, Directors and Companies that reveal credit issues including paid and unpaid defaults, court writs, court judgments, payment arrears and unacceptably low credit scores, any further and are not presented to any lender on the panel.

Only applicants with acceptable credit scores together with generous equity are presented to you by EquityLenders.

EquityLenders management will determine the following before presenting any submission to you:

5. the borrower is a new or established Company with an ACN

6. the Company has a satisfactory credit report with an acceptable credit score

7. the Director(s) personal credit is satisfactory with an acceptable credit score

8. the loan to value ratios (LVR’s) are not exceeded ie at or above 70%

9. the property that your funds are being loaned against is verified by a sworn valuation from a panel valuer

10. the borrower’s application form and supporting documentation is checked and verified

Note: It is not in anyone's [sic] interest to provide loans to Directors and Companies that have not first been vetted by EquityLenders experienced management, then vetted by you and finally vetted by the gatekeepers Bransgroves Lawyers.

…

What is the role of EquityLenders?

EquityLenders is an Arranger and Lender’s Broker that arranges private mortgages on behalf of private lenders.

Our role:

Typically, EquityLenders will receive loan applications from Borrower’s Brokers who represents the interests of the borrower(s). When a suitable application arrives from a property owner(s), EquityLenders will undertake preliminary due diligence and then contact Panel Lenders (You) to gauge interest.

Once EquityLenders is satisfied there is tentative, non‐binding, in principle agreement from you the lender to fund the loan, subject to valuation and due diligence, EquityLenders will then issue an Indicative Letter of Offer to the borrower(s).

The salient features of the Indicative Letter of Offer are that:

the issuer is EquityLenders (not you as the lender)

it is an offer to arrange finance (not provide finance)

the prospective lender ‘you’ is identified only as “Private Lender/s”

you will be entitled to withdraw at any time, for any reason

establishment fees are payable to EquityLenders, upon settlement. Sometimes EquityLenders and the Borrower’s Broker will have an email agreement that the Borrower’s Broker’s fees will be built into one of these fees. The Borrower’s Broker will then be paid after settlement by EquityLenders

Upon acceptance of the Indicative Letter of Offer the borrower(s) must pay:

a commitment fee if requested (so that EquityLenders gets something if the borrower(s) withdraws)

a deposit on the legal fees (so the Lender’s Solicitor gets something if the borrower withdraws)

a valuation fee (being the valuer’s fixed quoted fee)

It contains all information required to prepare security documents namely:

borrowers

guarantors

security

principal

higher and lower rates of interest

special conditions.

The borrower(s) then accept the Indicative Letter of Offer and returns to EquityLenders the offer letter together with any requested upfront fees. Upon receipt, EquityLenders then instructs the valuer(s) and obtains the valuation(s).

EquityLenders may present you with either a brief synopsis of the loan request or the loan request package by email. The email typically includes the application package, signed and accepted letter of offer if available, valuation(s) if available, Equifax (personal credit) reports if available, Creditorwatch (Company credit) reports and Core Logic (property) reports and any observations.

After completing whatever due diligence you may wish to perform (including inspecting the security) you are requested to either call 1300 859 075 or email EquityLenders loans@equitylenders.com.au and indicate you are ready to proceed and or instruct Solicitors.

EquityLenders will then email the lender’s Solicitor advising that you instruct EquityLenders to act on the advance. The email attaches the signed Indicative Letter of Offer.

The Lender’s Solicitor, being Bransgroves Lawyers will then prepare security documents on behalf of you and certify title to you the lender. When you accept the certification, you transfer the loan principal or contribution to the principal to Bransgroves Lawyers Trust Account. Bransgroves Lawyers then settle the loan on PEXA (the Australia‐wide electronic conveyancing platform).

EquityLenders role may then cease, or we may upon your instruction:

collect and distribute interest,

act as Bare Trustee,

act as Administrative Agent,

manage the loan in the capacity of Mortgage Manager (*not available on Omicron Mortgages)

or all the above.

*If the mortgage is a contributory mortgage i.e. Omicron Mortgages, or there are one or more loans which constitute a common enterprise, you and other lenders ie your SMSF etc enter into a Syndication Deed that provides for the day‐to‐day management of the loan through voting by you and the other lenders

20 Mr Swain stated that he then read the “Private Lender Guide” hosted on the Equity Lenders’ website: Swain at [94]-[96]. The Guide included:

Benefits of being a private lender

…

• You approve what you will and won’t lend on

• You approve who you will and won’t lend to

…

Our lending policy

Applications for loans secured by 1st and 2nd mortgages must clearly demonstrate a commercial financial benefit to property owners, guarantors & lenders.

…

Why are there differences in interest rates that are being offered?

For loans that are secured by a registered 1st mortgage, the risk to lenders is perceived to be low. For loans that are secured by registered 2nd mortgages, the risk to lenders is perceived to be higher resulting in a higher interest rate.

…

Is lending to a Company or Corporate Trustee safe?

Before loan offers are issued, a lending Manager at Equity Lenders first discusses the loan requirements with the Director(s), then requests an application be completed by the Director(s), undertakes personal credit reports on all Directors with Equifax and Company credit reports on the business with Creditorwatch. Loans with acceptable credit scores together with generous equity are presented

…

21 Mr Swain finished reading at around 3.30am on 11 May 2021: Swain at [97].

22 Mr Swain sent an email to Mr Kirk at 3.33am on 11 May 2021 asking about the terms and conditions on which Equity Lenders might act as broker for Inruse in respect of a $500,000 investment: Swain at [99]; CB360.

23 Mr Kirk responded by an email sent at 11.11am requesting further details about Inruse’s investment proposal, including whether Inruse had a preference for first or second mortgages and the maximum LVR that Inruse wished to lend: CB359.

24 Mr Swain responded to this email at 12.32pm, by annotating Mr Kirk’s email in red font: CB1698. Mr Kirk’s email (together with Mr Swain’s annotated responses) are as follows:

For the $500k you wish to place

I would need to know the following by return email:

1. Funds available only for 1st mortgages, only for 2nd mortgages, caveats. Or do you only want your funds lend on 2nd mortgages, caveats Will consider all, preference for 2nd mortgages

2. Interest rate you are seeking for 1st mortgages, 2nd mortgages, caveats 1st mortgages – 1st 1.5% pm; 2nd mortgages – 1.5-2.0%pm

3. Max lvr you wish to lend to ie 75% Up to 90%

4. Which cities don't you wish to lend in No preferences

5. Funds available for regionals and coastal No preferences

6. Min loan term 3-6 months

7. Max loan term 7-24 months

8. Min loan amount $200,000

9. Max loan amount $500,000

10. Do you lend on vacant land No

11. Do you lend on commercial No

12. Do you require desktop, kerbside or full valuations Full valuations

13. Do you require personal credit reports or company credit reports Yes

14. Do you have a preference for loan agreement preparation as we use Bransgroves Lawyers directly Happy to continue with Bransgroves

25 It is clear from this email that Mr Swain preferred to lend on 2nd mortgages rather than 1st mortgages; that he wanted an interest rate of between 18% and 24% pa; and that he was willing to consider loans up to a 90% LVR. The interest rate suggested by Mr Swain exceeded that indicated as the starting interest for 2nd mortgage lending (see CB352) and his suggested LVR far exceeded the 70% LVR stated in the Guide and FAQs, which Mr Swain had carefully read. Mr Swain knew, as those documents indicated, that the interest rate was a function of risk, a matter which was in any event well known to Mr Swain.

26 In light of Mr Swain’s email, and his considerable experience, I conclude that Mr Swain was willing to take a higher risk for a higher return. In particular, he was interested in departing from the parameters referred to in the Guide and FAQs and Mr Kirk’s email of 11 May 2021 by taking on loans where the LVR was up to 90%.

27 I do not accept that, at any point from this time, Mr Swain believed that Equity Lenders would only put forward for his consideration loans with a maximum LVR of 70%. If it were otherwise, Equity Lenders would be acting contrary to what Mr Swain had requested.

28 It is also relevant to note that it is clear from Mr Kirk’s email of 11 May 2021 that Equity Lenders would perform its role according to the instructions given to it by Inruse. A reasonable person reading the Guide and the FAQs would not have concluded that Equity Lenders would only conduct itself strictly in accordance with the general material provided on its website. In Mr Swain’s particular case, if he ever held that view, which I doubt, he could not have held it after providing the instructions which he gave on 11 May 2021.

29 Mr Swain says that he re-read Equity Lenders’ website and the Guide between 11 May 2021 and 17 May 2021: Swain at [100]. Mr Swain gave the following evidence regarding Equity Lenders’ website, the FAQs and the Guide (Swain at [101]):

In reading the Equity Lenders website, the FAQ and the Private Lenders Guide, I was comforted by the idea that Equity Lenders promised to undertake personal credit checks on directors and credit reports on businesses, and that I would only be offered loans with acceptable credit scores and generous equity. I felt that this was an extra layer of comfort and protection, which meant that Inruse would only be offered safe loans. Because of these promises, I elected to cause Inruse to invest with Equity Lenders rather than one of the other brokers offered on the Omicron portal.

30 I do not accept this evidence as accurate. It is inconsistent with Mr Swain’s email at 12.32pm on 11 May 2021. Specifically, Mr Swain’s evidence that, as at 17 May 2021, he considered that Inruse “would only be offered loans with … generous equity” or that “Inruse would only be offered safe loans” is implausible. Further, for reasons expanded upon later, I do not accept Mr Swain’s evidence that he retained Equity Lenders “[b]ecause of these promises”. I accept that Mr Swain contacted Equity Lenders because of what he read. I do not accept that Mr Swain believed that the Guide and FAQs made the “promises” asserted.

31 Mr Swain telephoned Mr Kirk on 17 May 2021: Swain at [102]. At 10.51am on 17 May 2021, Mr Kirk sent an email to Mr Swain with the subject line “2nd mortgages”: CB363. It included:

Good to talk with you just now.

The 2nd mortgage requests we assist owners with are usually as follows:

1. Min amount $50k

2. Max amount $1m

3. Indicative interest rates from 14.95% pa to 24% pa depending on the lender and the LVR

4. LVR up to 80% as we haven’t had any lenders offering above 80%

5. Loan terms from 1 month to 24 months

6. Locations mostly in capital cities across Australia including major regionals and major coastals

7. App fees from $0 to 2.2% of the loan amount and min $3,300

8. Prepaid interest or monthly in advance interest only

9. Settlement by caveat followed by registered mortgage or straight to 2nd mortgage if time permits

10. Often vals not required. Sometime owners provide vals, our office provides desktop vals, our office provides kerbside vals or pre selling vals etc

11. Legal docs always from Bransgroves at their scale fees

12. Only lending to company borrowers as we don’t offer regulated loans

32 Mr Swain responded at 2.32pm stating (CB365):

Thank you for general terms.

I assume borrower pays all your fees out of which you manage the facility on my behalf and the interest rate(s) are net to me.

I will lend at 1.5% pm on LVR up to 80% or 2.0% pm on 81-90% LVR.

33 It is clear from Mr Swain’s response that he understood that Inruse’s lending activities could occur on terms different to the sorts of lending indicated in the FAQs and Guide. I infer from Mr Kirk’s statement – “we haven’t had any lenders offering above 80% [LVR]” – and Mr Swain’s reply that he will lend at “2.0% pm on 81-90% LVR” that Mr Swain had a high risk appetite, that is, preferred higher returns notwithstanding higher risk.

34 It is also relevant to note that the 17 May 2021 email made it clear that valuations were often not required, including because owners sometimes provide valuations.

35 When the 17 May 2021 email (item 10) is read with the 11 May 2021 email (item 12), it is tolerably clear that Equity Lenders would provide or arrange valuations of varying thoroughness depending on the requirements of a client lender.

The First Loan

36 Between 21 May 2021 and 7 July 2021, Equity Lenders acted as broker for Inruse in respect of a potential loan to Nepean Highway Holdings Pty Ltd (Nepean Highways Loan): Swain [106]. That loan was proposed to be for $262,500, secured against a property in Malvern East in Victoria.

37 Inruse paid $262,500 to Bransgroves’ trust account for settlement of the Nepean Highways Loan: Swain [110]. One half of this was funded by a friend of Mr Swain, Harry: Swain at [109]. The loan was at 24% pa interest.

38 On 14 June 2021, Mr Kirk sent Mr Swain an email proposing a second mortgage loan for a “long-term client [Construxn] in Brisbane that purchased DA approved development land in Brisbane.”: CB396.

39 Consistently with Mr Swain’s instructions to source loans up to 90% LVR with interest at 24%, the proposed loan was at 24% pa at a 90% LVR, with a principal sum of $162,000. The loan was to be secured against the Goodna property. Mr Kirk attached to his email:

the Development Approval from Ipswich City Council;

a “Private Mortgage & Caveat Loan Application” form which had been completed by Construxn (First Loan Application): CB422;

a “Terms sheet” prepared by Equity Lenders relating to the proposed loan; and

a valuation report of the Goodna property from City Valuers Group dated 14 May 2021, prepared for the director of Construxn, Mr Leon.

40 In the First Loan Application, Construxn identified each of its properties, the value of each property, and the sum of any existing loan on the property. Construxn identified 13 properties, including the Goodna property which was listed as having an existing loan of $567,000 and an estimated property value of $810,000.

41 Mr Swain declined the Construxn loan proposal put for Inruse’s consideration in the 14 June 2021 email on the basis that he could not consider another loan (in addition to the Nepean Highways Loan) until settlement of the sale of a property: CB458.

42 Mr Kirk sent an email to Mr Swain on 7 July 2021 at 1.18am, advising Mr Swain that the Nepean Highways Loan would not proceed because the mortgagor rescinded the contract: CB460. The email included:

Hi Peter,

I’ve been advised today by the purchaser Nepean Highway Holdings Pty Ltd that the seller has pulled out of the contract and purchase is no longer proceeding.

I’d like to keep the funds in trust and replace with 2 other properties for a different borrower that can settle on Friday or Monday at your higher [lender’s] fee of 4.4%.

I have a long-term client in Brisbane that purchased DA approved development land in Brisbane. It’s for 18 townhouses.

Valuation is attached for $810k. His building company Palisade Homes is the builder. I have provided the 1st mortgage using Bransgroves and am now seeking a 2nd mortgage from you. He also settled a few months ago on a different property in the Brisbane suburb of Cornubia, its now been fully renovated and value no longer $860k but more like $1.2m according to the owner.

He is seeking the following loan:

1. Borrower is Construxn Pty Ltd with sole director Nelson Wayne Leon

2. Security properties include:

a. [6]9A Albert Street, Goodna, Qld 4300 with valuation of $810,000

b. 36-46 Bromley Street Cornubia Qld 4130 with valuation of $860k and existing loan of $602k

3. Seeking circa 85% lvr loan amount $262,500

4. Loan term 6 months

5. Minimum interest term 3 months

6. Prepaid minimum interest term 3 months

7. Interest rate 24% pa

8. Purpose is to assist with purchase and settlement of property and cashout for a different settlement.

9. Lender fee 4.4% or $11,550 to Inruse

10. Equity Lenders fee 2.2%

11. Equity Lenders mortgage management fee x 0.17% pm

12. Bransgroves fee $3k approx. + disb

13. Exit is by way of cash from sales proceeds of his Loganholme land sale after 3 months and before 6 months

The loan amount is exactly the same as per the Nepean Highway Holdings Pty Ltd.

If you are ok with the replacement deal, please confirm by return and I’ll order the new loan docs for Wednesday afternoon release and settlement Friday.

43 Mr Kirk’s email was accompanied by:

the Goodna property valuation ($810,000) as had been attached to the 14 June 2021 proposal: CB462;

a valuation report of the Cornubia property ($860,000) from Valuations QLD dated 20 January 2021, prepared for Mr Kirk: CB487; and

a “Terms sheet” prepared by Equity Lenders relating to the proposed loan: CB486.

44 The “Terms sheet” contained a summary of the central aspects of the loan. It identified the borrower and the properties to be secured by a second mortgage. It contained LVR calculations in relation to the Goodna property (85.7%) and the Cornubia property (85.736%). It set out the indicative fees and interest, the loan purpose and the loan exit strategies (“cashflow” and “other”).

45 On the same day at 11.31am, Mr Swain agreed to the proposed loan terms, with “settlement no later than Monday 12th July 2021”: CB496.

46 On 8 July 2021 at 5.59pm, Mr Kirk wrote the following email to Mr Swain (CB593):

Earlier today in preparation for settlement, the two 1st mortgagees received requests to consent and enter into a deed of priority.

Please advise by return email, including to both Christina and Meerna [Bransgroves Lawyers], if you require 2 consents and deeds of priority for your 2nd mortgages. As before, they will hold up settlement while waiting for them to be attended to.

47 On 9 July 2021 at 10.35am, Mr Swain replied (CB591):

Failure to settle without consent would place my security at risk – Yes?

If Branscgroves [sic] agree we are not at risk, then go ahead. Otherwise, wait for 1st mortgagees’ consents.

48 On 9 July 2021 at 4.42pm, Ms Jabbour of Bransgroves Lawyers sent an email to Mr Swain attaching the deed of priority in relation to the Cornubia property “which confirms the first mortgagee priority at $602,000 plus any outstanding interest/costs” and confirming that a deed of priority in relation to the Goodna property would be drafted in the same terms, except with a priority amount of $567,000: CB592. Mr Swain was asked if he was “happy to proceed with these”.

49 On 10 July 2021, Mr Swain confirmed that he was happy to proceed with the deeds of priority: CB591. On 12 July 2021, Ms Jabbour emailed Mr Swain the two deeds of priority for the First Loan, requesting that Mr Swain sign and return the last page of each deed: CB591.

50 Mr Swain stated in his affidavit that he “did not press for a deed of priority” because he thought that Equity Lenders had “assessed Construxn and the loan and found that Construxn would be able to repay the debt, and in the event of default, that there was sufficient equity to repay the loan”: Swain at [129]. I do not accept this evidence as accurate.

51 First, Mr Swain did “press for a deed of priority” and, indeed, he was sent and executed two deeds of priority. I have no doubt that Mr Swain carefully read and understood them.

52 Secondly, his evidence that he did not “press for a deed of priority” because he thought Equity Lenders had “assessed” Construxn is an inaccurate reconstruction. Mr Swain wanted deeds of priority because he knew, consistently with the terms of his email of 9 July 2021, that the obvious risks would be mitigated if he obtained deeds of priority.

53 Mr Swain’s evidence in cross-examination on the topic of the deeds of priority was unsatisfactory and not credible, including his claim that he did not “understand the difference between a deed of priority and a simple second mortgage”. His evidence included (T31):

It’s correct, isn’t it, that for the first loan, you obtained a deed of priority?---I – I understand I did.

And it’s correct, isn’t it, that at that time in July 2021, you thought it was important to obtain a deed of priority because otherwise your security would be at risk?---That was the advice that I was given.

Yes. But if I could just ask, your state of mind as best you can recall, you thought it was important because, otherwise, your security would be at risk?---I – I didn’t understand the difference between a deed of priority and a simple second mortgage.

54 Mr Swain was then taken to his email in which he stated “Failure to settle without consent would place my security at risk – Yes?” and the fact that Bransgroves did not proceed without obtaining deeds of priority and then gave the following evidence:

So you would agree, would you not, that Bransgroves did not see fit to proceed without the deed of priority?---Right.

And is it correct then that in light of that – I think you referred earlier to advice – you would agree that it was important to obtain a deed of priority, because otherwise your security would be at risk?---Yes.

55 Later, and as is recorded below, Mr Swain gave evidence that he did not obtain deeds of priority in relation the Second and Third Loans and that he was warned by Bransgroves that the risk of settling on those loans without a deed of priority was that there may not be enough equity in the secured property after the first mortgagee was paid out to cover Inruse’s advance.

56 I do not accept as truthful Mr Swain’s evidence in cross-examination that he did not understand the difference between a deed of priority and a second mortgage. That evidence cannot be correct given Mr Swain’s affidavit evidence, in particular [129] where he incorrectly explained why he did “not press for a deed of priority”.

57 Inruse did not put the deeds of priority into evidence notwithstanding that they had been attached to emails sent to Mr Swain and are likely to be available given the attachments to all other emails appear to have been available. I infer that the terms of the deeds of priority would not have assisted Inruse’s case. I consider it likely that Mr Swain read them when he received them, consistently with the care with which he read other documents. Mr Swain is an astute investor with many years’ experience, including experience in second mortgage lending.

58 On 12 July 2021 at 3.09pm, Ms Sawaqed of Bransgroves Lawyers emailed Mr Swain a “Certification as to Title with Enclosures” for the First Loan: CB500. The email requested that Mr Swain review the Certification as to Title with Enclosures carefully and confirm that he was happy to proceed to settlement: CB500. The Certification as to Title included the following (emphasis in original):

We have (or will before settlement) done the following:

…

5. Performed a company and PPSR search on the corporate borrowers (attached).

…

We regard the following as commercial aspects of this loan (rather than a legal) and so have not:

1. Made any investigation as to the level of debt owing on prior encumbrance to Trendworld Industrial Corporation Ltd (Trendworld) or AAL Properties Group Pty Ltd (AAL). We have obtained a deed of priority from each.

2. Enquired of you or given any advice on the efficacy of investigations you have made into the credit worthiness of the borrowers or exit strategy.

3. Assessed or even read any valuation you may or may not have obtained to determine its purport or whether it contains unacceptable disclaimers or whether the LVR is acceptable.

4. You have not provided us with a valuation and so we have been unable to perform certain items on the certification checklist.

5. There are no easements / restrictions / encumbrances on the properties.

We caution you that:

…

6. This loan is settling simultaneously with the incoming first mortgage in relation to the Goodna Property.

7. We have obtained a deed of priority with AAL (the incoming first mortgagee on Goodna) which confirms that their priority amount is $567,000.

8. We have obtained a deed of priority with Trendworld (the first mortgagee on Cornubia) which confirms that their priority amount is $420,000.

…

12. 36-48 Bromley St Pty Ltd is a guarantor to this loan. We note that it is controlled by the same parties and they are related entities. We have therefore not required financial advice to be obtained.

…

14. The PPSR search on the guarantor returns 37 results being ALLPAAP [all present and after-acquired property] security interests to various parties. The summary is enclosed. The borrower’s solicitor advised that these registrations will not be discharged on or before settlement. As such, your interests will rank 38th in all claims against the personal property of the guarantor.

15. The PPSR search on the borrower returns 16 results being ALLPAAP security interests to various parties. The summary is enclosed. The borrower’s solicitor advised that these registrations will not be discharged on or before settlement. As such, your interests will rank 17th in any claim against the property of the borrower [and] your interest will rank 18th in interest in relation to the motor vehicle.

16. There is 1 PPSR security interest against the corporate guarantor being an ALLPAAP in favour of Trendworld Industrial Corporation Ltd. This is not being discharged and at settlement you will have the 2nd ranking ALLPAAP against the corporate guarantor.

59 As noted above, the Certification as to Title included a company and PPSR search for Construxn.

60 One enclosure to the Certification as to Title was a National Personal Insolvency Index report, dated 8 July 2021, which disclosed that a creditor’s petition had been filed against Mr Leon on 27 August 2012, which had been dismissed: CB579.

61 The Certification as to Title also enclosed a Creditorwatch report on Construxn. The Creditorwatch report included (CB652):

Credit Rating Grade: D1

Risk Level: High

Credit Advice for D1 rating: Entity is currently highly vulnerable. COD [cash on delivery] trading highly recommended.

Entity has a 13% chance of failure within the next 12 months

62 Mr Swain’s evidence in cross-examination in relation to this report appeared evasive. Mr Swain stated (T33):

And it’s correct, isn’t it, that at this time, you were also provided with a credit report that said that Construxn had a credit rating of D1, with a high risk level?---Well, I don’t recall that. I did my own search on the borrower.

63 Mr Swain was then taken to the report and he observed that it was dated 7 July 2021 and gave the following evidence (T33):

So would you agree that you knew then, from July 2021, that Construxn was a risky entity to lend money to?---In regard to that particular loan, it was satisfactorily repaid.

If I could just press my question, Mr Swain. You knew from July 2021 that Construxn was a risky entity to lend to, didn’t you?---Well, I was provided information to that extent.

…

Mr Swain, I will just be very clear. I put it to you, that you knew from July 2021, that Construxn was a risky entity to lend to. Do you agree with that?---Yes.

64 The Certification as to Title enclosed a garnishee notice issued by the Queensland Commissioner of State Revenue relating to a debt of $1,627.50 payable on 15 April 2021: CB581. Handwritten notations on the document indicate the amount of $1,652.00 was outstanding as at 30 June 2021.

65 On 13 July 2021 at 8.47am, Ms Jabbour followed up Mr Swain to confirm that he was happy to proceed to settlement (re-attaching the Certification as to Title and Enclosures): CB685.

66 At 10.52am, Mr Swain confirmed that he was happy to proceed with settlement that day. At 11.02am, Mr Swain provided Bransgroves with the two signed deeds of priority: CB776; 778.

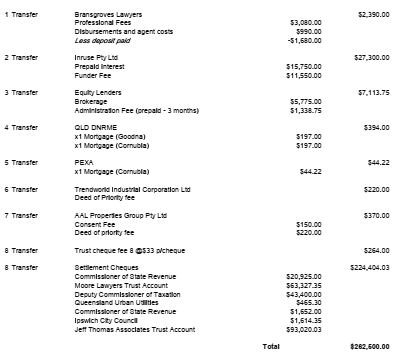

67 Settlement then occurred and Mr Swain was provided with a copy of the relevant settlement documents. The payment direction indicated that none of the funds were to be paid to Construxn, at least directly. It provided (CB798):

68 The stated purpose of the loan was “to assist with purchase and settlement of property and cashout for a different settlement”: CB460.

69 I have no doubt that Mr Swain carefully read all of the various documents he was provided by Equity Lenders and by Bransgroves.

The Second Loan

70 On 14 August 2021, Mr Kirk sent an email to Mr Swain in relation to a second loan to Construxn (CB800). The email included:

Hi Peter

I’ve been asked for a loan secured by 2nd RM [registered mortgage] on a property in Brisbane for the same borrower you assisted a month or so ago.

He needs the funds only for a month. I’ve told him you have funds but earmarked for a borrower that is late on settling. He’s asked if he can use those funds on Tuesday and have the funds returned to you within the month. I can hold off the current borrower Barber Society as they can wait for the funds to be made available. They have taken a couple of months and can wait another month.

If you are ok to provide the following loan, the borrower wishes to proceed early next week with a drawdown. Details of the loan required is as follows:

1. Borrower is Construxn Pty Ltd with sole director Nelson Wayne Leon

2. Security property is 40 Glenmore Cres, Rochedale Qld 4123 valued at $4,250,000

3. Security property currently has a 1st RM to ASCF of $3,187,500 at 75% lvr

4. Seeking loan amount $222,700 secured by 2nd RM

5. Loan term up to 2 months

6. Prepaid interest term 2 months totalling $8,908 (non-refundable)

7. Min interest term 2 months

8. Interest rate 2% per month

9. Fee to Inruse 4.4% or $9,799

10. Borrower will pay Bransgroves legal fee directly

11. Valuation is attached

12. Equity Lenders fee is 2.2% and will be payable upon discharge and not included in the loan

13. Amount in the hand net of fees and interest is $203,990

14. Exit is by way of cashflow as he has sold a property that settles in the coming 4 weeks

15. Purpose is to assist with settlement expenses and deposit shortfall on a non-security property he has under contract.

If you like the deal, please confirm and I will order the loan docs etc for an early next week settlement.

71 Mr Kirk attached to his email:

the “Private Mortgage & Caveat Loan Application” (Second Loan Application) made by Construxn;

a valuation report of the Rochedale property from City Valuers Group dated 11 June 2021, prepared for Mr Leon; and

a loan “Terms sheet” prepared by Equity Lenders.

72 Like the First Loan Application, the Second Loan Application identified 14 properties owned by Construxn and secured by various mortgages. The Second Application identified the existing loan amounts on each property: CB831.

73 Mr Swain replied the next day, stating (CB839):

Can do.

Please have Bransgroves confirm account into which I deposit funds and reference.

74 On 16 August 2021, Ms Sawaqed emailed the loan documentation (including the security documents and mortgage memorandum) to Construxn’s solicitors, Jeff Thomas & Associates, for execution: CB843. Mr Thomas returned the executed documentation later that day: CB843.

75 On 17 August 2021, Ms Sawaqed sent Mr Swain the Certification as to Title for the Second Loan. Similarly to the First Loan, the Certification as to Title included a company and PPSR search of Construxn and identified prior encumbrances on the secured property: CB885. The Certification as to Title included (emphasis original):

We regard the following as commercial aspects of this loan (rather than a legal) and so have not:

1. Made any investigation as to the level of debt owing on prior encumbrance to Certane CT [the first mortgagee].

2. Enquired of you or given any advice on the efficacy of investigations you have made into the credit worthiness of the borrowers or exit strategy.

3. Assessed or even read any valuation you may or may not have obtained to determine its purport or whether it contains unacceptable disclaimers or whether the LVR is acceptable.

4. You have not provided us with a valuation and so we have been unable to perform certain items on the certification checklist.

…

We caution you that:

…

5. The first mortgagee has declined to provide a priority amount and you have instructed us to proceed to settlement without a deed of priority (which is against our recommendation). Following settlement we will put them on notice of your interest.

6. We caution you of the risk of settling without a deed of priority with Certane CT, namely there may not be enough equity in the property after the first mortgagee is paid out to cover your advance. As we do not have a deed of priority, we do not know how much is owed, or whether the loan/property is cross-collateralised with any other debts owed by the guarantor to Certane CT.

…

76 Mr Swain agreed in cross-examination that he instructed Bransgroves to proceed to settlement without a deed of priority and accepted it should have been a worry that the first mortgagee had declined to provide a priority amount. His evidence included (T33-34):

Thank you. It’s also correct, is it not, Mr Swain, that for the second loan in August 2021, you proceeded without a deed of priority?---Yes.

And you were – on 17 August, you were warned by Bransgroves that the risk of settling on the second loan without a deed of priority was that there may not be enough equity in the property after the first mortgagee is paid out to cover your advance. That’s correct, isn’t it?---Yes.

For the second loan, you were also advised by Bransgroves that the first mortgagee had declined to provide a priority amount, and you instructed Bransgroves to proceed to settlement without a deed of priority; correct?---Correct.

It was reckless to proceed without a deed of priority, wasn’t it?---I don’t consider it was reckless. It was a decision that I made at the time.

Well, proceeding without a deed of priority was against Bransgroves’ recommendation, wasn’t it?---Yes.

And it should have been a worry to you, shouldn’t it, that the first mortgagee had declined to provide a priority amount?---Yes.

77 I do not accept Mr Swain’s evidence that he did not press for a deed of priority in relation to the Second Loan because he had “formed a view that Equity Lenders had already assessed Construxn and the loan and found that Construxn would be able to repay the loan” – see: Swain at [146]. There was no reasonable basis for such an unqualified conclusion. Further, this evidence is inconsistent with what Mr Swain in fact did in relation to the First Loan, namely press for a deed of priority because of the perceived risk associated with the lending to Construxn.

78 The Certification as to Title again included a Creditorwatch report for Construxn: CB941. The report, extracted 16 August 2021, contained the same credit warnings as the earlier report given by Bransgroves in relation to the First Loan (see [61] above).

79 The Certification as to Title again included a National Personal Insolvency Index report in relation to Mr Leon, this one extracted on 17 August 2021: CB965.

80 I have no doubt that Mr Swain carefully read the Certification as to Title, including the Creditorwatch report consistently with the care with which he read the Guide and FAQs.

81 On 18 August 2021, Ms Sawaqed followed up Mr Swain for approval of the Certification as to Title, re-attaching the documents to her email: CB977. Mr Swain replied at 10.59am stating “Please proceed to settlement”, and then transferred the principal amount to Bransgroves’ trust account: CB1071-4. The loan settled later that day.

82 On 20 August 2021, Ms Sawaqed confirmed to Mr Swain that the first mortgagee had declined to enter a deed of priority but had advised that the amount of their first mortgage advance was $3,187,500: CB1076.

Default on the First and Second Loans

83 On 14 October 2021, Construxn defaulted in payment of interest on the First Loan: Swain at [149]. Four days later, on 18 October 2021, Mr Kirk emailed Mr Swain stating that Construxn had requested an extension of the Second Loan term until 18 November 2021 and that the interest due be payable upon discharge on the same date: CB1079.

84 Later that day, Mr Swain agreed to the extension in relation to the Second Loan and enquired with Mr Kirk about what Construxn proposed in relation to payment of interest on the First Loan which, Mr Swain observed, now attracted 48% default interest (rather than 24% interest): CB1082. Mr Swain’s email stated:

We are prepared to postpone settlement of the $222,700 until 18th November, 2021 on the basis of a default interest charge of 48% being applied. This being $8,908.

What does the borrower contemplate in regard to the interest on the $262,500, now in arrears since 14th October, 2021 and attracting a default rate of 48%.

85 Between 4 November 2021 and 29 November 2021, Mr Swain and Mr Kirk exchanged emails regarding arrangements for repayment of the First and Second Loans: CB1086-1098.

86 Throughout this period, Mr Swain became increasingly “anxious” (CB1090) about repayment of the loans. Construxn attributed its default to a delay in settlement of the sale of a property from which funds would be applied to discharge the two loans.

87 On 29 November 2021, Inruse received two interest re-payments, both in the sum of $5,450.00, neither of which matched the default interest payable on either the First or Second Loan: CB1100. Mr Swain wrote to Ms Jabbour (cc’ing Mr Kirk) stating that (CB1103):

Received two deposits of $5,450.00 each. Neither matches with default interest payable on either loan.

…

We require the current shortfall of $27,916 ($21,000 + $17,816 - $10,900) by close of business on 2 December, 2021 together with substantiated evidence of forthcoming settlement of both loans Recovery action to then commence if these conditions not met.

88 In compliance with Mr Swain’s demand, the amount of $27,916.00 was deposited into Inruse’s account on 29 November 2021: CB1100. The principal on the First and Second Loans remained outstanding.

The Third Loan

89 On 5 December 2021 at 1.02pm, Mr Kirk sent an email to Mr Swain stating that Construxn wanted to: (1) rollover both the First and Second Loans to the end of January with prepaid interest and fee; and (2) borrow an additional $300,000 until the end of January: CB1106. The email stated that “[i]nterest rates and fees are not a consideration and [Construxn] will pay whatever rate and fees are required” and that Construxn “requires the $300k net on Monday the 6th December for a … purchase deposit”. The email stated:

On Friday I received confirmation from the borrower’s solicitor acting for the property sale, that a loan extension is required.

You may recall the borrower [Construxn] was seeking bridging funds from you while waiting on a property sale to materialise to an ASX listed company. The sale was continuously delayed due to an outstanding requirement by the council and was expected to settle a few months ago. Because settlement hadn’t proceeded, the Gov’t a week or so ago swept in and stopped the sale from proceeding. Instead, the Qld Dept of Health are purchasing the site. The site is approved for the brand new Hospital in Logan City Brisbane with adjoining Accor motel.

Contracts etc are presently underway and settlement is now expected by latest end of January 2022.

The borrower has requested the following to be considered by Inruse:

1. Rollover both existing loans to the end of January with prepaid interest, prepaid fees and a variation loan agreement

2. An additional loan of net $300k if your funds are available till end of January 2022 with prepaid interest and fees for the term. Funds to be secured against an additional property that he owns in the Brisbane CBD, a commercial building worth $1m in available equity

Interest rates and fees are not a consideration and will pay whatever rate and fees are required, requires the $300k net on Monday the 6th December for a separate purchase deposit. Construxn have a further 2 hospital sites under contract for some months and now require deposits and finalising. I am assisting the purchaser with their financing.

Please let me know on either of the above 2 requests as soon as you can especially request number 2 for the $300k cashout.

90 At 4.20pm that day, Mr Swain replied (CB1106):

Will discuss and decide on rollover tomorrow.

Please urgently provide details of proposed security with valuation.

Please provide copies of correspondence from Construxn’s lawyers including confirmation of the Qld Dept of Health proposed acquisition.

91 On 6 December 2021 at 12.39am, Mr Kirk stated (CB1108):

The attached val[uation] is from the settlement purchase that occurred earlier this year. Since the renovations and lease, there hasn’t been an updated val required.

The above loan was also expected to be paid out from settlement proceeds a few months ago. The owner continues to pay double interest rate until settlement.

The only email I have been copied in to [sic] is from the borrowers Lawyer John Porter. It’s attached. It confirms the final amount will be known in the coming 2 weeks and settlement no later than end of January. The contract of sale that was to be with the current buyer isn’t available to me and is no longer applicable now that the Qld Gov’t is purchasing instead. Should you wish to contact John Porter directly to get first hand information, please let me know and I will get the ok for you to call him or be called by him.

92 Mr Kirk’s email attached a valuation report for 47 Edward Street Brisbane, dated 11 December 2020, prepared by Hymans Valuers and Auctioneers.

93 At 12.17pm on 6 December 2021, Mr Swain replied (CB1242):

Are Bransgroves acting for you/us? Essential this applies.

We are prepared to assist on the following terms:

1. Interest rate to apply to new loan – 4% per month.

2. Lenders’ fee – 4%

3. In the event repayment does not occur at the end of the term, a deferred lenders’ fee of $100,000 to apply.

4. Term of loan – 3 months

5. Loan amount $300,000

6. Loan of $262,500 extended until 13 February, 2022 with an additional deferred lender’s fee of $50,000 if not settled at end of term. Penalty interest rate of 4% per month to apply.

7. Loan of $222,700 extended until 18 February, 2022 with an additional deferred lender’s fee of $50,000 if not settled at end of extended term. Penalty interest rate of 4% per month to apply

8. Loans at 6. And 7. above to attract a lender’s fee of 4%.

Please forward borrower’s acceptance of terms.

94 Mr Kirk then sent the following email to Mr Swain on 7 December 2021 (following a telephone call between the two) (CB1245):

Good to talk with you just now. Just been requested by the owner to request the following changes for your consideration:

1. I have arranged for one of your two loans to be repaid tomorrow using a different private lender and its [sic] for 6 months. This is the loan for $262,500 against Bromley [Cornubia property] and is at 70% lvr. You are welcome to replace your 2nd mortgage behind that loan as soon as it settles if you wish

2. The owner wishes to increase the loan requested from net $300k to net $450k or higher subject to your funds availability …

95 Further email correspondence was exchanged on 7 December 2021 between Mr Kirk and Mr Swain regarding the proposed terms of the Third Loan: CB1249-57. Mr Kirk advised that Construxn was seeking a loan of $579,500, with a proposed term of three months, and he provided Mr Swain with a “Terms sheet” for the Third Loan: CB1258.

96 On 8 December 2021, Ms Sawaqed provided Mr Swain with draft loan documents for his review: CB1282. The proposed loan was for $579,500 with a lower interest rate of 48% pa and higher interest rate of 60% pa: CB1290. Only the lower rate of interest needed to be paid if, on a day when interest was payable under the agreement, no interest was owing and no event of default had occurred: CB1377 (cl 277). An establishment fee of $25,498 was payable to Inruse at drawdown, representing a 4.4% lender’s fee: CB1258; 1299.

97 During cross-examination Mr Swain was asked questions about the interest rates of 48% and 60%. Mr Swain stated that he thought the rate was 24%: T35.22.

98 Mr Swain ultimately accepted that the high rates were indicative of high risk (T35-36). Mr Swain then sought to deflect answering a question about whether he allowed the high rates of interest to cloud his judgment about the associated risks by stating that he just accepted the rates offered and that he did not “set the rates”. His evidence included:

Do you see that? So do you agree that these rates of interest for the third loan provided a warning to you that it was high risk?---Well, they are high rates; that’s for sure.

But would you agree that - - -?---These are the - - The higher rates correspond with higher risk?---Agree. Yes.

Yes. And it’s correct, isn’t it, that you were attracted by the high rates of interest on offer for each of the loans?---Yes.

Do you accept that you allowed the high rates of interest to cloud your judgment about the associated risks?---Well, I accepted the – the rates that were offered. I didn’t set the rates.

No. But would you accept that you allowed the attractiveness of those high rates of interest to cloud your judgment about the associated risks?---No. I just accepted the rates that were offered; they didn’t cloud my judgment one way or the other. I mean, I was in a risky lending pattern with all of these particular loans.

And when you say “risky lending pattern”, at the time of the third loan, Construxn was already in default, wasn’t it?---In respect to the third loan? You – you mean they were in – in – in default from – under the first mortgage, or the first or second mortgage?

Either way, Mr Swain, they had not met their obligations to you, had they?---No.

And it’s correct, though, that you were willing to run the risk so as to receive the high amounts of interest; correct?---Are – are you saying that the loans were in default before I started the loan, or are – the loans were in default after I made the loan?

My question, Mr Swain, was that you were willing to run the risk of having no deed of priority so as to receive the high amounts of interest?---Well, a deed of priority wasn’t available, was it?

Well, perhaps if I come at it this way Mr Swain. It was your decision whether or not to proceed with each of the three loans; correct?---Yes.

And so in the case of the second and the third loans, where there was no deed of priority, you were willing to run the risk of not having a deed of priority to receive the high amounts of interest; correct?---Correct.

99 Mr Swain was later taken to his email of 6 December 2021 in which he proposed an interest rate at 48% (4% per month) in response to being told by Mr Kirk that “[i]nterest rates and fees are not a consideration and [Construxn] will pay whatever rate and fees are required”. Mr Swain was asked if he was involved in setting the rate and gave the following answer:

And do you accept that you were involved in setting the interest rate, contrary to an answer that you gave earlier about the interest rate being offered?---Well, I would have to look at the previous offer rate.

100 During a pause between cross-examination and re-examination, Mr Swain stated that he wished to correct some evidence he had given and he was then asked what he wished to correct in re-examination.

101 Mr Swain said that the interest rate of 48% was set by Equity Lenders in their “Terms sheet” rather than by him. His evidence included (T40):

… On this particular loan of 579,500, this term sheet mentioned that the loan amounts – well, the proposal was for a second mortgage at 48 per cent with a – just ..... what I’m saying is that I didn’t set the 48 per cent. It was – the 48 per cent was proposed by Equity Lenders, and naturally I accepted that 48 per cent. That’s all I wish just to clarify the fact that I didn’t initially set the interest rate. I followed the advice of the broker - - -

102 The “Terms sheet” was sent by Equity Lenders on 7 December 2021 in response to Mr Swain’s instructions to Equity Lenders on 6 December 2021 that he was prepared to indulge Construxn with a $300,000 loan at 48%. The rate of 48% was put by Mr Swain in response to Mr Kirk’s email which stated that “[i]nterest rates and fees are not a consideration and [Construxn] will pay whatever rate and fees are required”. I do not accept that the rate of 48% was proposed by Equity Lenders or that Mr Swain followed the advice of Mr Kirk.

103 On 9 December 2021, Ms Jabbour provided Mr Kirk with a draft Deed of Variation in relation to the Second Loan ($222,700) and stated that she would prepare an equivalent deed for the First Loan ($262,500) if Mr Swain was happy with the deed: CB1309; 1311. The draft Deed of Variation varied the terms of the Second Loan and included an acknowledgement that the higher rate of interest applied (48% pa) and that the loan repayment dates were extended. A “deferred commitment fee” of $50,000 was payable on discharge, although it would be waived if the loans were repaid before the “varied loan repayment date”. It was proposed that the Second Loan would be cross-collateralised against the First and Third Loans.

104 On 9 December 2021, Ms Sawaqed emailed Mr Swain a “Certification Letter” for variation of the Second Loan: CB1532. This confirmed that the borrower (Construxn) and guarantors (40 Glenmore Pty Ltd and Mr Leon) had executed the variation documents. The Certification Letter drew to Mr Swain’s attention the fact that the cross-collateralisation clause had not been accepted and noted that Bransgroves had not carried out due diligence (apart from the searches listed) and provided no assurance that the borrower or guarantors could repay the Third Loan (CB1533):

4. We note that we sought to include a clause to cross-collateralise this loan with the new loan in relation to the property at 47 Edward Street, Brisbane City QLD 4000. This would have meant that if this property was sold, you could seek to recover the money owed to you under the loan for 47 Edward Street. The Borrower has struck this clause out. We note however, that you are able to recover this debt from the 47 Edward Street property as we have included that same clause in that loan agreement which remains.

…

8. Other than in relation to the searches listed above we have not carried out due diligence on the Borrower or Guarantors and provide no assurances as to their capacity to repay the Loan in accordance with the varied terms.

105 The Certification Letter included a Creditorwatch report of Construxn, extracted 8 December 2021, and National Personal Insolvency Index report, extracted 8 December 2021 in relation to Mr Leon: CB1556; 1575. The Creditorwatch report included the same credit risk warnings which Mr Swain had been provided twice before: CB1558:

106 On 9 December 2021, Mr Swain caused Inruse to pay the sum of $317,000 to Bransgroves, representing the difference between the amount of the proposed Third Loan (being $579,500) and the repayment of the principal of the first loan (being $262,500): Swain at [189].

107 On 10 December 2021, Ms Sawaqed emailed the Certification as to Title for the Third Loan to Mr Swain: CB1576. Similarly to the First and Second Loans, the Certification as to Title included a company and PPSR search of Construxn and identified prior encumbrances on the secured property.

108 The Certification as to Title included the following (emphasis original):

We regard the following as commercial aspects of this loan (rather than a legal) and so have not:

1. Made any investigation as to the level of debt owing on prior encumbrance to Certane CT.

2. Enquired of you or given any advice on the efficacy of investigations you have made into the credit worthiness of the borrowers or exit strategy.

3. Assessed or even read any valuation you may or may not have obtained to determine its purport or whether it contains unacceptable disclaimers or whether the LVR is acceptable.

…

We caution you that:

…

7. We have not obtained a priority amount from Certane CT (who hold the first and second registered mortgages). You have instructed us to settle notwithstanding that a deed of priority has not been provided. We caution you of the risk of settling without a deed of priority with Certane CT, namely that there may not be enough equity in the Property after the first/second mortgages are paid out to cover your advance. As we do not have a deed of priority, we do not know how much is owed, or whether the loan/property is cross-collateralised with any other debts owed by the guarantor to Certane CT.

…

109 Mr Swain’s evidence in cross-examination included (T33-34):

And on 10 December 2021, you were expressly warned by Bransgroves that the risk of settling on the third loan without a deed of priority was that there may not be enough equity in the property after the first, second mortgages are paid out to cover your advance. That’s correct, isn’t it?---Yes.

And despite that advice from Bransgroves, you proceeded with the third loan without obtaining a deed of priority; correct?---Correct.

Would you accept that it was reckless in the case of the third loan to proceed without a deed of priority?---I don’t think the word “reckless” is appropriate. I may not have understood the ramifications, but I was being guided by the advice that the borrower was substantial and would be able to meet his commitments.

Well - - -?---And the borrower was recommended by the broker.

When you mention, Mr Swain, being guided by advice, the advice you had received from Bransgroves was to receive – to obtain a deed of priority, was it not?---Yes.

110 I do not accept Mr Swain’s evidence that he “was being guided by the advice that the borrower was substantial and would be able to meet his commitments”. The evidence did not establish that Equity Lenders represented to Mr Swain that Construxn “would be able to meet [its] commitments” under the Third Loan. I do not accept that Mr Swain thought that Equity Lenders had given any such advice. Mr Swain knew there was a realistic possibility that Construxn would default under the Second Loan as varied and under the Third Loan. That was a reason why he proposed, by his email of 6 December 2021, “deferred commitment fees” of $50,000 and $100,000 in the relevant agreements which he later obtained.

111 Mr Swain replied to Bransgroves’ email of 10 December 2021 the same day, stating: “All reviewed and approved”: CB1658. The First Loan was repaid on 10 December 2021 and the Third Loan settled on 13 December 2021: CB1659-60.

Recovery proceedings

112 On approximately 30 May 2022, Inruse and the other lenders entered into a Bare Trust Deed with Bransgroves (Syndication Deed), and instructed Bransgroves to commence enforcement proceedings against Construxn. The Syndication Deed appointed Omicron Mortgages Pty Ltd as bare trustee of charges over each of the secured properties.

113 On 12 June 2022, Construxn was placed under administration: Swain at [10].

114 On 26 August 2022, Omicron lodged caveats against each of the Construxn properties. On 29 August 2022, Omicron commenced proceedings seeking the declaration of a caveatable interest in the Construxn properties. There was no evidence as to the current status of these proceedings.

MISLEADING AND DECEPTIVE CONDUCT

Overview of Inruse’s case

115 Inruse’s misleading and deceptive conduct case as pleaded comprised the following essential elements.

116 First, Equity Lenders published the Guide and the FAQs: SOC at [6] and [7]. Assessed in context, those two documents were said to convey the following representations (SOC at [8]):

a. that Equity Lenders was a long-established business, with highly experienced staff;

b. that Equity Lenders would undertake preliminary due diligence of any borrowers, including speaking with borrowers, assessing their credit worthiness, assessing the value of real estate security and the level of equity, and repayment exit strategy;

c. that Equity Lenders would only present loans to be made to reputable borrowers;

d. that Equity Lenders would only present loans to be made where the lenders funds would be secure;

e. that any funds advanced by a lender would be safe and secured;

f. that Equity Lenders would only advance lending proposals where there was sufficient equity in any security property(ies) to repay any amounts lent and interest, fees and charges incurred on that loan;

g. that in assessing the equity position of the borrower and the proffered security, Equity Lenders would consider the indebtedness of the borrower and would advise the lender of the equity position of the security, including any prior ranking securities and their amount, including where those securities cross-collateralised other debts; and

h. that in packaging any loan application, Equity Lenders would assess the application, undertake necessary investigations in to [sic] the value of the asset, the credit history of the borrower, the loan to value ratio and the equity position of the borrower and would advise a panel lender of any relevant information, including whether the borrower was currently in default, and would not propose loans where there was a risk of the lenders funds not being repaid,

(together, “the Lending Policy Representations”).

117 Secondly, Mr Swain carefully read the Guide and the FAQs twice before entering into the First Loan, once on 10 and 11 May 2021 and a second time between 11 and 17 May 2021. Inruse understood the Lending Policy Representations as being “promises” by Equity Lenders that if Inruse agreed to appoint Equity Lenders as Inruse’s lending broker and mortgage originator (SOC at [10]):

a. that Equity Lenders would undertake preliminary due diligence of any borrowers, including speaking with borrowers, assessing their credit worthiness, assessing the value of real estate security and the level of equity, and repayment exit-strategy;

b. that Equity Lenders would only present loans to be made to reputable borrowers;

c. that Equity Lenders would only present loans to be made where the Lenders funds would be secure;

d. that any funds advanced by a lender through Equity Lenders would be safe and secured;

e. that Equity Lenders would only advance proposals where there was sufficient equity in any security property(ies) to repay any amounts lent and interest, fees and charges incurred on that loan;

f. that in assessing the equity position of the borrower and the proffered security, Equity Lenders would consider the indebtedness of the borrower and would advise the lender of the equity position of the security, including any prior ranking securities and their amount, including where those securities cross-collateralised other debts; and

g. that in packaging the loan application, Equity Lenders would assess the application, undertake necessary investigations in to [sic] the value of the asset, the credit history of the borrower, the loan to value ratio and the equity position of the borrower and would advise a panel lender of any relevant information, including whether the borrower was currently in default, and would not propose loans where there was a risk of the lenders funds not being repaid.

118 Thirdly, the Lending Policy Representations were misleading or deceptive or likely to mislead or deceive “given the failure to advise or identify the existence or potential existence of further debts secured against the security properties proffered by Construxn, or their magnitude, or that those debts could or would be so great as to result in the mortgage securities held by Inruse not being able to satisfy [sic – be satisfied]”: SOC at [44(c)].

119 Fourthly, after it was engaged, Equity Lenders proposed three loans: SOC at [12], [13] (the First Loan); [20], [21] (the Second Loan); [28] and [29] (the Third Loan). Equity Lenders did not correct or qualify any of the Lending Policy Representations before Inruse entered into any of the three loans: SOC at [14] (the First Loan); [22] (the Second Loan) and [31] (the Third Loan).

120 Fifthly, Mr Swain thought that Equity Lenders was only putting forward loans which had met an assessment against Equity Lenders’ criteria and due diligence: Swain at [117] to [119] (First Loan); [132] to [134] (Second Loan); [179] and [180] (Third Loan). Because of this Mr Swain considered that, if Construxn defaulted, there would be sufficient security to meet and repay the loans: Swain at [117] to [119] (First Loan); [134] to [136] (Second Loan).

121 Finally, Inruse suffered loss because of the misleading or deceptive conduct: SOC at [46]. The losses were occasioned by Construxn’s default on the Second and Third Loans.

122 As to quantification of loss, Inruse’s pleaded claim was for: (a) the principal amount lent to Construxn; (b) the interest which Inruse would have been entitled to receive; (c) the interest that Inruse would have been entitled to receive if it had lent to other parties through another broker; and (d) prejudgment interest – see: [43], [48] and [51] of the SOC. Claims (c) and (d) were not alternative claims, creating significant double or triple counting.

123 By its oral opening submissions, Inruse redefined the quantification of its losses to claim (MFI-1):

(a) the principal sums on the Second ($222,700) and Third Loans ($579,500);

(b) the default fees on those loans of $50,000 and $100,000 respectively;

(c) loss of earnings by reference to what Inruse says it would have earned on second mortgage loans at 24% interest through a different mortgage broker from the time the Second and Third Loans were repayable (18 October 2021 and 13 March 2022) until dates proximate to the hearing, calculated to be $260,700 (Second Loan) and $645,500 (Third Loan), together with “loan application fees” of $125,690.40;

(d) refinancing costs totaling $81,008;

(e) “internal loan management fees”, representing Mr Swain’s time spent in relation to these proceedings, being 220 hours of Mr Swain’s time at $330 an hour, totalling $72,600; and

(f) its costs of these proceedings said to be $199,087.65 as at 3 December 2024.

124 The total claim was therefore roughly $2.34 million.

Was there a breach of s 18(1)?

Establishing a breach of s 18(1) of the ACL

125 Section 18(1) of the ACL provides:

18 Misleading or deceptive conduct

(1) A person must not, in trade or commerce, engage in conduct that is misleading or deceptive or is likely to mislead or deceive.

126 In Self Care IP Holdings Pty Ltd v Allergan Australia Pty Ltd [2023] HCA 8; 97 ALJR 388 at [80] and [81], Kiefel CJ, Gageler, Gordon, Edelman and Gleeson JJ set out the four steps involved in determining whether a person has breached s 18 of the ACL. The steps are:

(a) First, identifying with precision the “conduct” said to contravene s 18(1). The first step requires asking: “what is the alleged conduct?” and “does the evidence establish that the person engaged in the conduct?”

(b) Second, considering whether the conduct was conduct “in trade or commerce”.

(c) Third, considering what meaning the conduct conveyed to its intended audience. Where the pleaded conduct is said to amount to a representation, it is necessary to determine whether the alleged representation is established by the evidence.

(d) Fourth, determining whether the conduct, in light of the meaning the conduct conveyed, meets the statutory description of “misleading or deceptive or ... likely to mislead or deceive”, that is, whether it has the tendency to lead into error.

127 In relation to the third and fourth steps the High Court stated at [82] (footnotes omitted):

The third and fourth steps require the court to characterise, as an objective matter, the conduct viewed as a whole and its notional effects, judged by reference to its context, on the state of mind of the relevant person or class of persons. That context includes the immediate context – relevantly, all the words in the document or other communication and the manner in which those words are conveyed, not just a word or phrase in isolation – and the broader context of the relevant surrounding facts and circumstances …