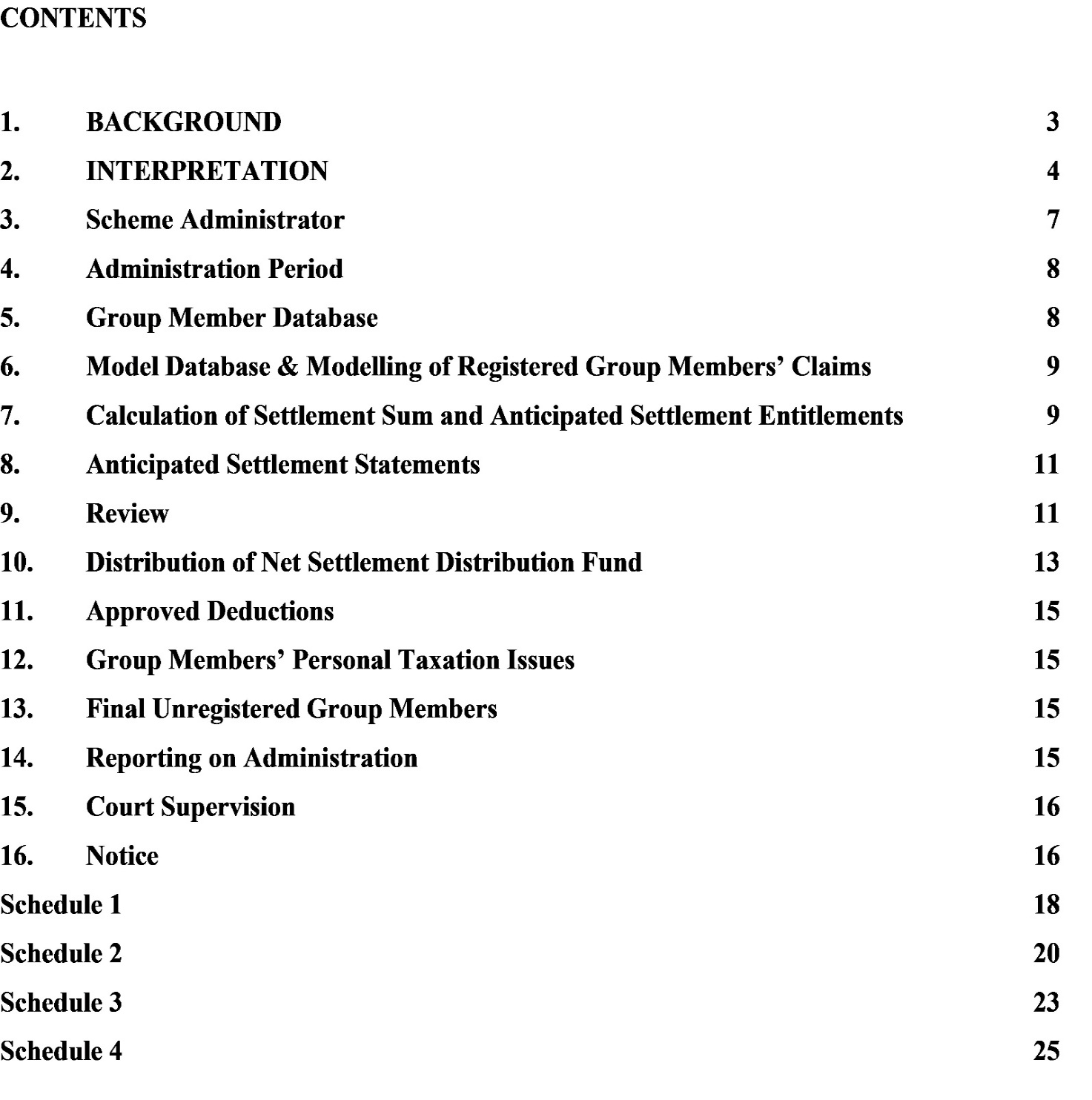

Federal Court of Australia

Boulos v M.R.V.L. Investments Pty Ltd (Settlement Approval) [2024] FCA 1377

ORDERS

Applicant | ||

AND: | M.R.V.L. INVESTMENTS PTY LTD (ACN 000 620 888) Respondent | |

THAWLEY J | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

Settlement Approval

1. Pursuant to ss 33V(1) and (2) of the Federal Court of Australia Act 1976 (Cth) (FCA Act), the Court approves the settlement of this proceeding on the terms recorded in the Settlement Deed dated 21 December 2023 as varied by the Deed of Variation dated 3 October 2024 and the Settlement Distribution Scheme (SDS) contained in Annexure 1.

2. The Court declares pursuant to s 33ZB of the FCA Act that the group members affected by the settlement are those persons defined as group members in the Further Amended Originating Application filed on 25 November 2021 who have not opted out of the proceeding.

3. Rory Michael Markham of Adero Pty Ltd is appointed as administrator of the SDS.

4. Pursuant to s 33V(2) of the FCA Act and for the purposes of the SDS, the following deductions from the settlement sum be approved:

4.1. the “Approved Adero Costs” (as defined in the SDS), in the amount $832,060.39;

4.2. the “Approved Funder Costs” (as defined in the SDS), in the amounts of;

4.2.1. $$3,721,115.37 to be paid to ICP Funding Pty Ltd (ICP Funding) by way of funding commission and management fee;

4.2.2. $2,563,384.03 to be paid to ICP Funding by way of reimbursement for project costs paid by ICP Funding in relation to the proceeding;

4.3. the “Administration Costs” (as defined in the SDS, in the amount $723,805.

5. Pursuant to ss 33Y of the FCA Act, the content of the notice contained in Annexure 2 (the Notice) is approved.

6. On or before 29 November 2024, the administrator shall send a copy of the Notice to the Registered Group Members via their email addresses previously provided to Adero Law.

7. The administrator shall notify the Court by email to the Associate to Justice Thawley when the distribution of funds under the SDS is complete.

8. Upon the notification in Order 7:

8.1 these proceedings be dismissed;

8.2 all previous costs orders be vacated; and

8.3 there be no orders as to costs.

9. The administrator has liberty to apply in relation to the SDS.

Confidentiality – Confidential Counsel Opinion

10. Pursuant to s 37AF(1) of the FCA Act, and on the ground in s 37AG(1)(a) of that Act, Annexure RMM 6-16 to the Affidavit of Rory Michael Markham sworn on 30 October 2024, is not to be published or otherwise disclosed to any person or entity except the Court and Court Staff.

11. Unless the Court otherwise orders, Order 10 continue until the notification in Order 7.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

Annexure 1

SETTLEMENT DISTRIBUTION SCHEME

FEDERAL COURT OF AUSTRALIA

RAYMOND BOULOS

v

M.R.V.L. INVESTMENTS PTY LTD CAN 000 620 888

(NSD2168/2019)

(Merivale Class Action)

Merivale Class Action Scheme

Adero Law

3 Hobart Place,

City, ACT 2601

Ph: (02) 6189 1022

Ref: RM:CB:1096

Email: merivale@aderolaw.com.au

1.1. The Applicant, on behalf of himself and Group Members, and the Respondent (Merivale) have agreed to resolve the Merivale Class Action in full and final settlement of the Claims of all Group Members arising out of, or in connection with, the Merivale Class Action without the admission of any liability.

1.2. The terms of the settlement are set out in the Settlement and Release Deed dated 21 December 2023 (Deed) and the Deed of Variation dated 3 October 2024 (Variation Deed). This Scheme sets out the terms on which the Settlement is to be administered. The Settlement and this Scheme are subject to the approval of the Court pursuant to s 33V(1) and (2) of the Federal Court of Australia Act 1976 (the Act). This Scheme does not become operative until the Effective Date.

1.3. The purposes of this Scheme are to establish a procedure for:

1.3.1. the fair and just calculation of the Settlement Entitlements of the Registered Group Members;

1.3.2. the distribution of:

(a) the Approved Funder Costs to ICP Funding Pty Ltd (ICP);

(b) the Approved Adero Costs to Adero Pty Ltd (Adero);

(c) the Administration Costs to the Administrator; and

(d) the Settlement Entitlements to the Registered Group Members,

in the event that the Settlement receives Court approval.

1.4. The Settlement Entitlements will be calculated using the same principles and calculation formulas as set out in this Scheme.

1.5. The Merivale Class Action was settled for $19,250,000 (nineteen million and two hundred and fifty thousand dollars) (Settlement Sum), subject to the Court approving the settlement.

1.6. This Scheme contemplates the following key steps:

1.6.1. Rory Markham of Adero will be appointed as the Administrator of this Scheme and Merivale shall pay the Settlement Sum into Adero’s trust account;

1.6.2. To the extent that Rory Markham is not appointed as the Administrator, Merivale will consent to the provision of the Employment Data to the Administrator, by Adero, on a confidential basis for the purposes of this Scheme only. Merivale will also consent to the use by the Administrator, whether Mr Markham or otherwise, of the Employment Data for the purposes of the Scheme. Merivale will otherwise owe no obligation under this Scheme;

1.6.3. The Administrator will pay, out of the Settlement Sum and prior to the distribution of the Settlement Entitlements to Registered Group Members, the Approved Funder Costs to ICP, the Approved Adero Costs to Adero, and the Administration Costs to the Administrator;

1.6.4. The Administrator will, for the purposes of this Scheme, model according to the Calculation Principles prepared by Adero, and calculate the Settlement Entitlements;

1.6.5. For the avoidance of doubt, Merivale is not responsible for the preparation of the Calculation Principles, the Model, or otherwise the development of the methodology and assumptions that will be applied by the Administrator to calculate Settlement Entitlements.

1.6.6. The Administrator will inform each Registered Group Member entitled to a Settlement Entitlement of the amount of that Group Member’s Anticipated Settlement Entitlement;

1.6.7. Registered Group Members may initiate a review of their Anticipated Settlement Entitlement;

1.6.8. Following the outcome of any review process, the Administrator will distribute the Settlement Entitlements to Registered Group Members according to a verification process and electronic funds transfer implemented by the Administrator; and

1.6.9. The Administrator shall make all payments to Registered Group Members of the Settlement Entitlements in accordance with this Scheme.

2.1. The meaning of defined words used in the Scheme are the same as in the Deed and the Variation Deed. Any additional words are defined below.

2.1.1. Administrator means the entity appointed under clause 3 of this Scheme.

2.1.2. Administration Costs means costs associated with the administration and implementation of this Scheme as assessed and approved by the Court.

2.1.3. Aggregate Claims means the sum of the Weighted Loss Claim Amounts of all Registered Group Members.

2.1.4. Anticipated Settlement Entitlement means an amount, calculated by the Model, and as otherwise in accordance with the Calculation Principles, which a Registered Group Member is apparently entitled to receive as part of the Settlement prior to any review process being engaged by any Group Member.

2.1.5. Approved Adero Costs means the amount of $832,060.39 to be paid to Adero being the amount of the Applicant’s legal costs as assessed and approved by the Court not paid by ICP to Adero.

2.1.6. Approved Funder Costs means the amount of $6,340,249.40 to be paid to ICP, being to the total of:

(a) $2,248,672.35 to be paid to ICP by way of reimbursement for the Applicant’s legal costs and disbursements paid by ICP by the time of the Settlement Approval in relation to the Proceeding;

(b) $314,711.68 to be paid to ICP by way of reimbursement for expenses (other than the Applicants’ legal costs and disbursements) paid by ICP in relation to the Proceeding;

(c) $3,776,865.37 to be paid to ICP by way of funding commission and management fee.

2.1.7. Calculation Principles means the principles contained in Schedule 1 of the Scheme and approved by the Court.

2.1.8. Effective Date means the date of entry of orders by the Court approving the Scheme.

2.1.9. Employee Entitlements means the entitlements, as determined by the Administrator, in accordance with the Hospitality Industry General Award 2010 (as varied from time to time) (Award).

2.1.10. Employment Data means the data contained in the documents which were provided by Merivale to Adero, pursuant to Order 21 of the Orders dated 21 December 2022, on 12 April 2023, 19 April 2023, 28 April 2023 and 10 May 2023 (which data was also produced by Merivale by way of discovery to the Applicant pursuant to Orders 4 to 6 dated 25 October 2023) and Order 6 of the Orders dated 5 March 2024.

2.1.11. Final Unregistered Group Members has the meaning given in Order 16 of the Orders dated 23 September 2024.

2.1.12. Group Member Database means the database prepared and maintained by the Administrator in accordance with clause 5 of this Scheme.

2.1.13. Group Member Information means:

(a) the full name, residential address, email address and phone number of the Group Member;

(b) a Bank State Branch (BSB), Account Number and Account name for a bank account, into which their Settlement Entitlement shall be paid; and

(c) proof of identity of the Group Member, including passport number or drivers licence number.

2.1.14. Loss Claim Amount means an amount, calculated by the Model, representing the Group Member’s claim.

2.1.15. Model means the quantification loss model developed by Adero in aid of calculating the underpayment payable under the Award to the Applicant and Registered Group Members, and to distribute the Settlement Sum in a fair and equitable method.

2.1.16. Net Settlement Distribution Fund means the settlement amount to be distributed to Group Members following the deduction from the Settlement Sum of the Approved Adero Costs, Approved Funder Costs, and Administration Costs.

2.1.17. Registered Group Members has the meaning given in Order 15 of the Orders dated 23 September 2024.

2.1.18. RGM Percentage means the Registered Group Member’s modelled claim as a percentage of the Aggregate Claims.

2.1.19. Settlement Entitlement means an amount, calculated by the Model, and as otherwise in accordance with the Calculation Principles, and after determination of any review, which a Registered Group Member is entitled to receive as part of the Settlement.

2.1.20. Scheme means this Settlement Distribution Scheme.

2.1.21. Weighted Loss Claim Amount means the Loss Claim Amount with the relative weightings applied in accordance with clause 7.2 to 7.5 of this Scheme.

2.2. In this Scheme:

2.2.1. headings are for convenience only and do not affect interpretation; and

2.2.2. the following rules apply unless the context requires otherwise:

(a) the singular includes the plural, and the converse also applies;

(b) a gender includes all genders;

(c) if a word or phrase is defined, its other grammatical forms have a corresponding meaning;

(d) a reference to a person includes a corporation, trust, partnership, unincorporated body or other entity, whether or not it comprises a separate legal entity;

(e) a reference to dollars of $ is to Australian currency; and

(f) a reference to anything done by any person includes a reference to the thing as done by a director, officer, servant, agent, personal representative or legal representative if permitted to be so done by law or by any provision of the Settlement and Release Deed and the Variation Deed or this Scheme.

3. SCHEME ADMINISTRATOR

3.1. Rory Markham of Adero will be the Administrator for the purposes of the Scheme. The Administrator, at his discretion, may utilise the services of any persons engaged by him in administering the Scheme. The Administrator accepts full responsibility for anything done by such a service provider.

3.2. If the Court does not appoint Rory Markham as Administrator, Adero will take all steps reasonably necessary to enable the Administrator to perform its functions under this document, the Deed and the Variation Deed, including providing the Administrator with a copy of the Employment Data and a full digital copy of the Model which is capable of calculating Settlement Entitlements in accordance with the Calculation Principles.

3.3. The Administrator will, subject to and in accordance with this Scheme, administer this Scheme in accordance with its terms, and in particular, will:

3.3.1. prepare and maintain a Group Member Database;

3.3.2. pay the Approved Adero Costs to Adero;

3.3.3. pay the Approved Funder Costs to ICP;

3.3.4. pay the Administration Costs to the Administrator;

3.3.5. issue Anticipated Settlement Statements and Final Settlement Statements to Registered Group Members;

3.3.6. confirm and otherwise obtain bank details of Registered Group Members;

3.3.7. distribute the Settlement Entitlements payable to Registered Group Members; and

3.3.8. notify the Court and Merivale of the conclusion of the administration of the settlement in accordance with clause 14 of this Scheme.

3.4. The Administrator, in discharging any function or exercising any power conferred by this Scheme, shall do so as required by the Court to administer this Scheme fairly and reasonably in accordance with its terms, as a duty owed to the Court.

3.5. If any conflict arises between the Administrator’s duties as trustee and Adero’s duties as the solicitor for the Applicant and Group Members, the Administrator shall apply to the Court for directions in that regard.

3.6. The Administrator, and the Administrator’s staff, in discharging any function or exercising any power or discretion conferred by this Scheme, shall not be liable for any loss to Group Members arising by reason of any mistake, act or omission, provided such mistake or omission is made in good faith or of any other matter or thing except wilful neglect or individual fraud or deliberate wrongdoing on the part of the Administrator or the Administrator’s staff who are sought to be made liable.

3.7. Notwithstanding anything elsewhere in this Scheme, the Administrator may at any time correct any error, slip, or omission occurring during the course of the administration of this Scheme.

4.1. The administration and settlement distribution steps set out in this Scheme are required to be completed in accordance with the timeframes set out in this Scheme, subject to any further Court order which may vary the Scheme.

5.1. The Administrator will create and maintain a database of Registered Group Members.

5.2. The Group Member Database maintained by the Administrator shall include the:

5.2.1. Group Member Information in respect of Registered Group Members as maintained by Adero in its capacity as solicitor for the Applicant; and

5.2.2. Group Member Information as submitted by Registered Group Members to the Administrator pursuant to this Scheme.

5.3. The Administrator is to confirm the bank account details of each Registered Group Member prior to distribution of the Settlement Entitlements. Confirmation of the bank account details is to be obtained via phone (or email should this be requested by the Group Member).

5.4. In creating the Group Member Database, if the Administrator does not have some or all of the Group Member Information required in order to distribute any Settlement Entitlement, he will contact the Group Member to seek to obtain the information. Such information is to be obtained and contained via a secure portal.

5.5. If after multiple attempts at contacting the Group Member, the Administrator is unable to contact the Group Member and receive the relevant information required to distribute the Settlement Entitlement, a final communication must be sent stating that should the Group Member not reply by a certain date, the Administrator will send the Settlement Entitlement to the Public Trustee and Guardian to be held as an “unclaimed amount” pursuant to section 259 of the Legal Profession Act 2006 (ACT).

6. MODEL DATABASE & MODELLING OF REGISTERED GROUP MEMBERS’ CLAIMS

6.1. A database will be created by the Administrator which will be used for the purposes of determining the value of Settlement Entitlements payable to Registered Group Members (Model Database).

6.2. Merivale will consent to:

6.2.1. to the extent the Administrator is not Mr Markham, the provision by Adero of the Employment Data to the Administrator; and

6.2.2. the use of the Employment Data by the Administrator for the purposes of discharging its obligations under this Scheme.

For the avoidance of doubt, this Scheme is not intended to and will not impose any obligation on Merivale to provide any further employee records or information in respect of Registered Group Members.

6.3. The Model Database maintained by the Administrator shall include the following information in respect of Registered Group Members:

6.3.1. Group Member Database as provided by the Administrator; and

6.3.2. Employment Data.

7. CALCULATION OF SETTLEMENT SUM AND ANTICIPATED SETTLEMENT ENTITLEMENTS

7.1. Within fourteen (14) Days after the Effective Date or 7 days of the Court’s determination of the Approved Adero Costs, Approved Funder Costs, and Administration Costs, whichever is the later, the Administrator will calculate the Anticipated Settlement Entitlement of each Registered Group Member as follows.

7.1.1. First, the Administrator will calculate the claims of each Registered Group Member using the Model (Loss Claim Amount). The Administrator is to calculate the average Loss Claim Amount. If the Administrator determines there is insufficient data to model an individual’s claim, the average Loss Claim Amount is to be assumed as being their Loss Claim Amount;

7.1.2. Second, the Administrator will apply the relevant weighting to the Loss Claim Amount described below at clauses 7.2 to 7.5 (Weighted Loss Claim Amount);

7.1.3. Third, the Administrator will calculate the aggregate of all Registered Group Members’ weighted modelled claims (Aggregate Claims);

7.1.4. Fourth, the Administrator will calculate each Registered Group Member’s modelled claim as a percentage of the Aggregate Claims (RGM Percentage);

7.1.5. Fifth, the Administrator will subtract the amount of the Approved Adero Costs, Approved Funder Costs and Administration Costs from the Settlement Sum to calculate the balance payable as total Settlement Entitlements to Registered Group Members (Net Settlement Distribution Fund);

7.1.6. Sixth, the Administrator will multiply the RGM Percentage by the Net Settlement Distribution Fund to calculate each Registered Group Member’s proportionate share of the Net Settlement Distribution Fund, which amount shall be their share (being their Anticipated Settlement Entitlement).

7.2. Different relative weightings will be applied in the Scheme to the Loss Claim Amount (as defined above in clause 7.1.1) of all Registered Group Members, having regard to whether they were employed in any period of their employment during the Claim Period (being 25 December 2013 to 24 December 2019) in a role that is identified as being a managerial role within the Model.

7.3. These weightings are to be applied because the strength of each Registered Group Members claim is affected by whether they were engaged in a managerial position that might have precluded them from coverage under the Award.

7.4. A relative weighting of 100% will be applied to the portion of Registered Group Member’s Loss Claim Amount for work performed in a non-managerial role.

7.5. A relative weighting of 70% will be applied to the portion of the Registered Group Member’s Loss Claim Amount for work performed in a managerial role, with such figure to be the subject of determination by the Court prior to distribution.

7.6. The Anticipated Settlement Entitlement is subject to the calculation of the Net Settlement Distribution Fund and the completion of any Reviews conducted pursuant to clause 9.2.

7.7. The final Settlement Entitlement for each Registered Group Member will be determined by the Administrator once all reviews (if any) provided for in clause 9.2 have been completed and the Administrator has calculated:

7.7.1. all individual Loss Claim Amounts;

7.7.2. the Weighted Loss Claim Amounts;

7.7.3. the Aggregate Claims; and

7.7.4. the Net Settlement Distribution Fund.

7.8. Registered Group Members will be provided with an opportunity to apply to the Administrator for a Review of their Loss Claim Amount, as the case may be, in accordance with clause 9.2.

8. ANTICIPATED SETTLEMENT STATEMENTS

8.1. As soon as practicable after the Effective Date, the Administrator will issue, or cause to be issued to each Registered Group Member, an Anticipated Settlement Statement (in the form referred to in clauses 8.3 and 8.4 below).

8.2. Anticipated Settlement Statements will be issued via email to the email address set out in the Group Member Information, and if there is no email address, to the postal address set out in the Group Member Information.

8.3. The Anticipated Settlement Statement will be in the form of Schedule 2 to this Scheme and will set out the following:

8.3.1. the identity of the Registered Group Member;

8.3.2. the amount of the Registered Group Member’s Loss Claim Amount;

8.3.3. the amount of the Registered Group Member’s Weighted Loss Claim Amount;

8.3.4. the Aggregate Claims;

8.3.5. the Net Settlement Distribution Fund and a breakdown showing how that sum has been calculated; and

8.3.6. their Anticipated Settlement Entitlement.

8.4. If the Registered Group Member has no Settlement Entitlement, the Settlement Statement will be in the form of Schedule 3 to this Scheme.

9.1. A junior barrister practising in the ACT or NSW and willing to perform the work will be appointed by the Administrator to conduct any review of the Anticipated Settlement Statements that is applied for by any Registered Group Member (Reviewer).

9.2. The Anticipated Settlement Statements shall be taken to be accepted as accurate by the Registered Group Member to whom it relates, unless the Registered Group Member within twenty-one (21) days of receiving the Anticipated Settlement Statements submits to the Administrator a written request (Review Request) for a review of the Anticipated Settlement Statement (Review), together with copies of all documents on which the Registered Group Member relies for the purposes of the Review, including any statement of reasons for making the Review Request.

9.3. Should a Group Member submit a Review Request, the Administrator will review any material and reasons that the Group Member wants to raise and will at his discretion, correct any errors arising from Merivale’s data or the Administrator’s application of Model to the Respondent’s data. If the Administrator determines that the Settlement Entitlement should be amended, the Group Member will be notified of the change as soon as practicable. Following which, the Group Member has seven (7) days to notify the Administrator whether they still wish for a Review to be performed by the Reviewer, otherwise the revised determination by the Administrator will then be taken to be the Group Member’s Settlement Entitlement.

9.4. The cost of each Review by the Reviewer will be fixed at $1,500 plus GST.

9.5. If, after the Administrator has reconsidered the Anticipated Settlement Entitlement in the Anticipated Settlement Statement in accordance with clause 9.3, and the Registered Group Member confirms that he or she still presses the Review Request in accordance with clause 9.2, then subject to clause 9.6 the Administrator shall, within seven (7) days of receiving that confirmation, refer it (and any supporting documentation) to the Reviewer for consideration.

9.6. Where the Administrator forms the view that the Registered Group Member’s Final Loss Payment Amount will likely be less than $1,500, the Registered Group Member must on written request by the Administrator pay the sum of $1,500 plus GST into the Settlement Distribution Account within fourteen (14) days of being requested to do so, failing which the request for Review will lapse.

9.7. Within twenty-one (21) days of receiving the confirmed Review Request, the Reviewer will consider the Review Request and if satisfied there is an error, slip, or omission in the Anticipated Settlement Statement for that Registered Group Member, will notify the Administrator in writing of that fact (Review Determination), and the Administrator will correct the Anticipated Settlement Statement to which the request relates (Amended Anticipated Settlement Statement).

9.8. The Review is limited to a determination based on the hours-worked records, the Group Member’s employment period, their position(s) (and relevant duties), the venues, the payments made by Merivale during the relevant period, the appropriate classifications under the Award, and the application of any model or formula applied by the Administrator or as ordered by the Court. The Reviewer will have reference to Merivale’s data, any documents or material the Group Member can produce in relation to their employment and any statutory declaration the Group Member would like to make. In the case of an individual who is taken to have worked in a managerial role, consideration may need to be given as to whether that Group Member likely held an Award covered position and whether the relevant weighting was applied to their Anticipated Settlement Entitlement.

9.9. The Administrator must provide a copy of the Amended Anticipated Settlement Statement or otherwise inform the Registered Group Member of the outcome of their Review as soon as practicable after receiving the Review Determination and/or preparing the Amended Anticipated Settlement Statement.

9.10. If the Review Request does not result in the requesting Registered Group Member receiving $500 or more than they would have received but for the Review Request, then the Registered Group Member must pay the costs of the Review, which will be deducted from the Registered Group Member’s Final Settlement Entitlement, or if this amount is insufficient, from any sum paid by the Registered Group Member pursuant to clause 9.6.

10. DISTRIBUTION OF NET SETTLEMENT DISTRIBUTION FUND

10.1. As soon as practicable after:

10.1.1. all Anticipated Settlement Statements have been sent to Registered Group Members;

10.1.2. all periods of Review from all Anticipated Settlement Statements have expired and any Review Requests made by Registered Group Members have been finally determined and Amended Anticipated Settlement Statements have been sent to Registered Group Members; and

10.1.3. the Approved Adero Costs, Approved Funder Costs, and Administration Costs have been deducted from the Settlement Sum,

the Administrator will distribute the Net Settlement Distribution Fund in accordance with clauses 10.5 and 10.7.

10.2. As soon as practicable after the events referred to in clause 10.1 have occurred, the Administrator will prepare and cause to be distributed, a further statement to each Registered Group Member (Final Settlement Statement). The Final Settlement Statement will be in the form of Schedule 4 to this Scheme and will set out the following:

10.2.1. the identity of the relevant Registered Group Member;

10.2.2. their Loss Claim Amount;

10.2.3. the Weighted Loss Claim Amount;

10.2.4. the Aggregate Claims;

10.2.5. the Net Settlement Distribution Fund and a breakdown showing how that sum has been calculated; and

10.2.6. their Final Settlement Entitlement, being their distribution from the Net Settlement Distribution Fund.

10.3. Any slip or omission on the face of the Final Settlement Statements must be notified to the Administrator within fourteen (14) days of the date on which the Final Settlement Statement was sent to the relevant Registered Group Member (Final Review Date), failing which the Final Settlement Statement will be deemed correct.

10.4. If satisfied, after receipt of a notification pursuant to clause 10.3, that a Final Settlement Statement discloses an error, slip, or omission on its face, the Administrator will correct the Final Settlement Statement to which the request relates and make all necessary incidental and consequential amendments to any other Final Settlement Statement to any and all affected Registered Group Members.

10.5. Within fifty-five (55) days of the later of the expiration of the Final Review Dates of all Registered Group Members, or the correction of any Final Settlement Statements, the Administrator will distribute the Final Settlement Entitlements to each of the Registered Group Members (calculated based on the amount of the Net Distribution Fund as at the date of the distribution), by Electronic Funds Transfer to the nominated bank account set out in the Group Member Database.

10.6. If the Administrator is unable to distribute the Net Settlement Distribution Fund within the time prescribed in clause 10.5 above, he will do so as soon as practicable thereafter and in any event by the date which is eight (8) months after the Effective Date or such later date as the Court may order on the application of the Administrator (Final Distribution Date).

10.7. Any amounts which have not been paid in cleared funds to a Registered Group Member (save those referred to in clause 5.5) within three (3) months of the Final Distribution Date and any interest accrued on such amounts will:

10.7.1. if a further distribution of those funds to the relevant Registered Group Members would result in each of those Registered Group Members receiving a further distribution in excess of $100, be distributed to those Registered Group Members; or

10.7.2. if a further distribution of those funds to the Registered Group Members would result in each of those Registered Group Members receiving a further distribution of less than $100, be paid to Youth Law Australia.

10.8. Any amounts which have not been paid in cleared funds to a Registered Group Member within three (3) months of any further distribution pursuant to clause 10.7, will be paid to Youth Law Australia.

10.9. The Final Settlement Statements will be final and binding on each Group Member and the completion of distributions made pursuant to clauses 10.5, 10.7 and 10.8 will satisfy the claims of the Applicant and all Group Members.

11.1. The Administrator shall charge a fixed amount of $723,805 as Administration costs, irrespective of the number of such Registered Group Members.

11.2. The Administrator recognises that there may be some costs in implementing the Scheme that will be unrecoverable, but will nonetheless abide by the fixed Administration Costs of $723,805.

11.3. Within seven (7) Days of receiving payment from Merivale, the Approved Adero Costs are to be paid to Adero, the Approved Funder Costs are to be paid to ICP, and Administration Costs are to be paid to the Administrator out of the Settlement Sum, in priority to the Settlement Entitlements.

12. GROUP MEMBERS’ PERSONAL TAXATION ISSUES

12.1. Each Group Member is responsible for obtaining his or her own taxation advice in respect of the distribution of the Settlement Entitlement that he or she receives.

13. FINAL UNREGISTERED GROUP MEMBERS

13.1. Final Unregistered Group Members remain as such for all purposes of the proceedings and will remain a Group Member for all purposes of the proceedings, and are not entitled to, and will not receive, a distribution from the Settlement Sum or any other amount.

14. REPORTING ON ADMINISTRATION

14.1. Throughout the course of the administration of the Scheme, the Administrator must provide sixth-monthly reports to the Court, copied to Merivale’s solicitors and the Applicant’s solicitors (should Rory Markham not be appointed as the Administrator by the Court), detailing the progress of distributions to Registered Group Members, including the number of payments made, the amounts paid, the dates of payment, the Group Members to whom payment has been made and the number of any outstanding payments.

14.2. Within five (5) business days of the Administrator distributing the final payment to Group Members of the Settlement Entitlements, including in accordance with clauses 10.7 and 10.8, the Administrator is to notify the Associate to Justice Thawley (or another Justice of the Federal Court of Australia presiding over the Proceedings) of that having occurred and of the following:

14.2.1. that the Administrator has paid:

(a) the Settlement Entitlements to Registered Group Members;

(b) the Approved Adero Costs to Adero;

(c) the Approved Funder Costs to ICP;

(d) the Administration Costs to the Administrator;

14.2.2. whether any time periods in the Scheme were not complied with by a party;

14.2.3. that subject to clause 14.2.2 above, the parties have complied with their respective obligations under the Scheme; and

14.2.4. that the Scheme has been administered in its entirety.

14.3. Within seven (7) days of the step contained in clause 14.2, the Administrator is to notify Merivale of the same information contained in clause 14.2.

15.1. Consistent with Part IVA of the Act, the implementation of this Scheme is subject to the Court’s supervision.

15.2. The Administrator may refer any issues arising in relation to the Scheme or the administration of the Scheme to the Court for determination.

16.1. Any notice of document to be given or delivered pursuant to this Scheme shall be deemed to be given or delivered and received for all purposes associated with this Scheme if it is:

16.1.1. addressed to the person to whom it is to be given; and

16.1.2. either:

(a) delivered or sent by pre-paid mail to that person’s postal address, being in respect of any Group Member, the address notified in the Group Member’s Registration Form where they were considered to have become a Registered Group Member; or

(b) sent by e-mail to that person’s e-mail address being in respect of any Group Member, the e-mail address notified in the Group Member’s Registration Form where they were considered to have become a Registered Group Member.

16.2. A notice or document that complies with clause 16.1 will be deemed to have been given, or delivered and received:

16.2.1. If it was sent by mail to an addressee in Australia, two (2) clear business days after it was sent;

16.2.2. If it was sent to an addressee outside of Australia, five (5) clear business days after it was sent; and

16.2.3. If it was sent by e-mail, at the time it is sent.

Schedule 1

Calculation Principles

1. The intention of this Schedule 1 is to explain the principles upon which the Model has been established by Adero and which will continue to govern the calculation of Settlement Entitlements for the purposes of the Scheme.

2. When using the Model to calculate Settlement Entitlements for Registered Group Members, the following information, data, details and principles will be utilised and adopted by the Administrator:

2.1. the Employment Data; and

2.2. the following agreed principles set out in the table below will be adopted:

Principle | |

1 | QUANTIFIES VALUE OF ENTITLEMENTS PAYABLE UNDER THE AWARD The value of each Group Member’s entitlements claimed in the class action and that are payable under the Award to the Applicant and each group member is quantified by the Model. |

2 | EACH GROUP MEMBER’S UNDERPAYMENT (IN $) IS CALCULATED BY REFERENCE TO THEIR PAY DATA The Model deducts from the sum of the entitlements determined in principle 1, the amounts paid by the Respondent to the Group Members. |

3 | WEIGHTING OF CLAIMS A relative weighting of 100% will be applied to the underpayment modelled for periods of employment in a non-managerial role (being a role identified in the Model as non-managerial). A relative weighting of 70% will be applied to the calculation of the underpayment during the period of employment where individuals worked in a managerial role (being a role identified as being managerial in the Model). This weighting is to be applied because it is considered that there is a possibility this period may not be covered by the Award. |

4 | EACH GROUP MEMBER’S UNDERPAYMENT AMOUNT (IN $) TO BE CALCULATED AS A PROPORTION OF THE UNDERPAYMENT AMOUNT OF THE GROUP OVERALL Each Group Member’s weighted underpayment shall be calculated as a percentage proportion of the total sum of the underpayments for all Registered Group Members. |

5 | THE SETTLEMENT SUM (MINUS LEGAL, FUNDING AND ADMINISTRATIVE COSTS) SHALL BE SHARED AMONGST GROUP MEMBERS ACCORDING TO THE PERCENTAGE PROPORTION DETERMINED IN PRINCIPLE 4 Each Group Member’s Settlement Entitlement shall be calculated as a proportion of the Settlement Sum minus Approved Adero Costs, Approved Funder Costs and Administration Costs based on the loss for the individual Group Member as a percentage proportion of loss accrued by all Group Members. |

6 | APPLICATION OF AVERAGE UNDERPAYMENT WHERE THERE IS INSUFFICIENT DATA BASED ON THE AMOUNT DETERMINED IN PRINCIPLE 2 In the event that the Administrator, or any person appointed by the Administrator under this Settlement Scheme, is unable to assess or estimate a Group Member’s entitlements under this Scheme due to insufficient data produced by Merivale, then the Administrator will calculate the average underpayment of the Group Members it was able to model and apply the average underpayment to those individuals. |

3. Settlement Sum and Settlement Entitlements Cap

3.1. In keeping with the Deed and Variation Deed, Settlement Entitlements must be calculated on the basis that the Settlement Entitlements for Registered Group Members are capped at the sum of $19,250,000 less the Approved Adero Costs, Approved Funder Costs and Administration Costs as approved by the Court (Settlement Entitlements Cap).

4. Balancing Discount

4.1. To achieve the Settlement Entitlement Cap, the Model applies a balancing discount to the underpayment of Registered Group Members. This means the Registered Group Members receive an equal portion of their calculated claim once costs are removed.

Anticipated Settlement Statement

Dear [insert Registered Group Member name]

RAYMOND BOULOS v M.R.V.L. INVESTMENTS PTY LTD ACN 000 620 888, NSD2168/2019

You are receiving this Anticipated Settlement Statement because you registered to participate in the settlement of the Merivale Class Action.

In accordance with the scheme approved by the Court for calculating and paying employee entitlements to registered group members (Scheme), there has been a preliminary determination by the Scheme Administrator that you are entitled to receive a payment pursuant to the settlement approved by the Court.

Having regard to information about your employment (including your payslip data and duration of employment) and the calculation principles approved by the Court (Model), please find below the following calculations regarding the settlement:

(a) your wage underpayment was calculated as being $[*insert*] [(this amount was calculated by determining the difference between the entitlements you should have been paid under the Hospitality Industry (General) Award 2010 and the amount you were paid by Merivale) / (due to Merivale providing insufficient data for your employment, this amount is the average underpayment calculated in relation to Registered Group Members with sufficient data)] (this is NOT the amount you are to receive from the settlement) (Loss Claim Amount);

(b) your Weighted Loss Claim Amount was calculated as being $[*insert*] (your Loss Claim Amount with relative weightings applied. [No reduction was applied as you worked in a non-managerial role your entire employment with Merivale / A 30% reduction was applied to [a portion of / your entire] employment as it was identified you were employed in a managerial role]);

(c) the sum of the Weighted Loss Claim Amounts for all Registered Group Members was calculated as being $[*insert*];

(d) the Net Settlement Distribution Fund was calculated as being $[*insert*] (this is the amount available to be distributed between the Registered Group Members after deductions approved by the Court were subtracted from the Settlement Sum on $19,250,000). The Deductions from the Settlement Sum are as follows:

(i) the Approved Adero Costs are $832,060.39 (the amount approved by the Court for legal costs other than those paid by the funder); and

(ii) the Approved Funder Costs are $6,284,499.40 (the amount approved by the Court for legal costs paid by the funder of the proceeding, other costs paid by the funder in relation to the conduct of Proceeding, and the funder’s commission and management fee for funding and managing the funding of the proceeding); and

(iii) the Administration Costs are $723,805 (the amount approved by the Court for fees for the administration of the settlement).

(e) Your Settlement Entitlement was calculated as being $[*insert*] (this is the amount you were calculated as being entitled to receive from the Net Settlement Distribution Scheme).

Pursuant to the Scheme, the amount referred to above is taken to be accepted as accurate unless a written request for a review is made.

If you think the Loss Claim Amount is incorrect or you consider a reduction was mistakenly applied to your Loss Claim Amount as the Administrator had incorrectly identified that you were employed in a managerial role, you must submit a written request for a review of this Anticipated Settlement Statement (Review). A written request may be submitted by writing to the Administrator via email at merivale@aderolaw.com.au by [insert date] (being 21 days from receiving this document). Please provide copies of all documents you wish to rely on for the purposes of the Review, including any statement of the reasons for making the Review Request.

The Review is limited to a determination based on the hours worked records, your employment period, your position(s) (and relevant duties), the venues, the payments made by Merivale during the relevant period, the appropriate classification under the Award, and the application of any model or formula applied by the Administrator or as ordered by the Court. The Reviewer will have reference to Merivale’s data, any documents or material the Group Member can produce in relation to their employment, and any statutory declaration the Group Member would like to make. In the case of an individual who is deemed to have worked in a managerial role, consideration may need to be given as to whether that Group Member likely held an Award covered position and whether the relevant weighting was applied to their claim.

If the Review does not result in you receiving $500 or more than you would have received, then you will be required to pay the costs of the Review, which will be deducted from your Settlement Entitlement. If the Administrator forms the view that your final Settlement Entitlement will likely be less than $1,500, the Administrator may make a written request for you to make a payment to cover the fee of the Review prior to the Review.

The Review will be done by a junior barrister of the ACT or NSW at a fixed cost of $1,500 plus GST.

Within 28 days of receiving the request for the Review, you will be notified of the outcome by the Administrator.

We can confirm that no further deductions will be made for any legal costs in relation to the Merivale Class Action (except for any costs described above in relation to a Review).

We confirm that Your Settlement Entitlement contained in this document is not final and is subject to change depending on whether Group Members request a Review and it results in a change in their Loss Claim Amount and / or Weighted Loss Claim Amount.

Prior to any distribution of the Settlement Sum to Registered Group Members you will receive a Final Settlement Statement which will contain your Final Settlement Entitlement.

Please do not contact Merivale in respect of your settlement payment. Merivale is not involved in the assessment of the amount of your payment, and is otherwise not involved in the administration of the Scheme and has denied all liability in the Merivale Class Action.

Sincerely,

Adero Law

Schedule 3

Anticipated Settlement Statement

Dear Group Member

RAYMOND BOULOS v M.R.V.L. INVESTMENTS PTY LTD CAN 000 620 888, NSD2168/2019

You are receiving this Settlement Statement because you registered to participate in the settlement of the Merivale Class Action.

In accordance with the scheme approved by the Court for calculating and paying employee entitlements to registered group members (Scheme), there has been a determination by the Scheme Administrator that you are NOT eligible to receive a payment because your employment records indicate that you have been properly remunerated.

Pursuant to the Scheme, no compensation is taken to be accepted as accurate unless a written request for a review is made.

If you think this is incorrect, you must submit a written request for a review of this Anticipated Settlement Statement (Review). A written request may be submitted by writing to the Administrator via email at merivale@aderolaw.com.au by [insert date] (being 21 days from receiving this document).

Please provide copies of all documents you wish to rely on for the purposes of the Review, including any statement of the reasons for making the Review Request.

The Review is limited to a determination based on the hours worked records, your employment period, your position(s) (and relevant duties), the venues, the payments made by Merivale during the relevant period, the appropriate classification under the Award, and the application of any model or formula applied by the Administrator or as ordered by the Court. The Reviewer will have reference to Merivale’s data, any documents or material the Group Member can produce in relation to their employment, and any statutory declaration the Group Member would like to make. In the case of an individual who is deemed to have worked in a managerial role, consideration may need to be given as to whether that Group Member likely held an Award covered position and whether the relevant weighting was applied to their claim.

As your final Settlement Entitlement is likely less than $1,500, the Administrator will require you to pay $1,500 plus GST into the Distribution Account [insert bank details]. If the Review does not result in you receiving $500 or more, then you will be required to pay the costs of the Review, which will be deducted from your Settlement Entitlement.

The Review will be done by a junior barrister of ACT or NSW at a fixed cost of $1,500 plus GST.

Within 28 days of receiving the request for the Review, you will be notified of the outcome by the Administrator.

Please do not contact Merivale in respect of your settlement payment. Merivale is not involved in the assessment of whether you are or are not entitled to receive any payment, and is otherwise not involved in the administration of the Scheme and has denied all liability in the Merivale Class Action.

If you have any queries, please contact Adero at merivale@aderolaw.com.au.

Sincerely,

Adero Law

Schedule 4

Final Settlement Statement

Dear [insert Registered Group Member name]

RAYMOND BOULOS v M.R.V.L. INVESTMENTS PTY LTD ACN 000 620 888, NSD2168/2019

You are receiving this Settlement Statement because you registered to participate in the settlement of the Merivale Class Action.

Having regard to information about your employment (including your payslip data and duration of employment) and the calculation principles approved by the Court (Model) AND any reviews requested by Registered Group Members, please find below the following calculations regarding the settlement:

(a) your wage underpayment was calculated as being $[*insert*] (this amount was calculated by determining the difference between the entitlements you should have been paid under the Hospitality Industry (General) Award 2010 and the amount you were paid by Merivale) (this is NOT the amount you are to receive from the settlement) (Loss Claim Amount);

(b) your Weighted Loss Claim Amount was calculated as being $[*insert*] (your Loss Claim Amount with relative weightings applied. [No reduction was applied as you worked in a non-managerial role your entire employment with Merivale / A 30% reduction was applied to [a portion of / your entire] employment as it was identified you were employed in a managerial role]);

(c) the sum of the Weighted Loss Claim Amounts for all Registered Group Members was calculated as being $[*insert*];

(d) the Net Settlement Distribution Fund was calculated as being $[*insert*] (this is the amount available to be distributed between the Registered Group Members after deductions approved by the Court were subtracted from the Settlement Sum on $19,250,000). The Deductions from the Settlement Sum are as follows:

(i) the Approved Adero Costs are $832,060.39 (the amount approved by the Court for legal costs other than those paid by the funder);

(ii) the Approved Funder Costs are $6,284,499.40 (the amount approved by the Court for legal costs paid by the funder of the proceeding, other costs paid by the funder in relation to the conduct of Proceeding, and the funder’s commission and management fee for funding and managing the funding of the proceeding); and

(iii) the Administration Costs are $723,805 (the amount approved by the Court for fees for the administration of the settlement).

(e) Your Settlement Entitlement was calculated as being $[*insert*] (this is the amount you were calculated as being entitled to receive from the Net Settlement Distribution Scheme).

Pursuant to the Scheme, the amount referred to above is deemed to be a final and accurate amount that you are entitled to receive in keeping with the settlement arrangements approved by the Court.

If you think there is an error, slip, or omission contained in this document, you must notify the Administrator within 14 days of the date on which this document was sent to you by sending an email to merivale@aderolaw.com.au. If you do not notify the Administrator within 14 days then this document will be taken as being correct.

The Administrator will pay the amount referred to above (by way of electronic funds transfer to the bank account you previously nominated when registering your interest as a group member). If there has been a change in your bank account details, please urgently contact Adero via email at merivale@aderolaw.com.au. The amount referred to above will be paid as soon as practicable.

Sincerely,

Adero Law

Annexure 2

Dear Registered Group Member

The Applicant Mr Boulos, and Merivale reached a settlement agreement for $19,250,000. The Applicant has filed an application seeking the Court approve the settlement and make orders for the money to be distributed fairly and equitably to the Registered Group Members.

It is a term of the settlement agreement that Registered Group Members be informed of an obligation owed by Mr Boulos and that this communication be sent out to Registered Group Members requesting you also act consistently with the same obligation outlined below.

Mr Boulos has agreed that he personally will not make any statements or publish any statements or make any publications that do the following and that he will not encourage or assist any other person to do the same:

a. that suggest Merivale or its Related Bodies Corporate, or the directors, officers, employees or agents of Merivale admitted liability in respect of the claims in the Class Action;

b. that suggests Merivale lacks a reasonable basis for denying liability in respect of the claims in the Class Action; and

c. that makes any adverse, critical or disparaging comments regarding the conduct of Merivale or of any venues owned and operated by Merivale or its directors, officers employees or agents in relation to the employment of Mr Boulos or Group Members. This includes about the amounts paid or the method or types of payments.

Should any statements or publications be published by Mr Boulos which goes against the obligation set out above, then he must remove or seek the statements or publications be removed (to the extent that removing or seeking the removal is within his control).

For the purposes of the agreement, a “publication” includes any form of content or media on any forum, including a video published on a website or social media platform (such as any videos published on YouTube or any sponsored content posted between “stories” on Instagram).

THAWLEY J:

INTRODUCTION

1 This is an application for approval of a proposed settlement of a wages underpayment class action under s 33V of the Federal Court of Australia Act 1976 (Cth) (FCA Act). The settlement, if approved, would involve the respondent paying the applicant (Mr Boulos) and group members $19.25 million in full and final settlement of the proceeding (Settlement Sum), without admission of liability. The settlement is recorded in a Deed of Settlement dated 21 December 2023 (Deed) and a Deed of Variation dated 3 October 2024 (Variation Deed). In his affidavit dated 30 October 2024, the applicant’s solicitor, Mr Rory Markham of Adero, has put forward a Settlement Distribution Scheme (SDS) which addresses distribution of the net proceeds of the Settlement Sum. Also annexed to that affidavit is a confidential opinion from both senior and junior counsel for the applicant on the merits of the settlement reached.

2 The mechanics of the proposed settlement are broadly as follows. The settlement is contingent on the Court excluding unregistered group members from receiving compensation from the settlement. The Court would make a declaration under s 33ZB of the FCA Act that the group members affected by the settlement are all the group members as defined in the Further Amended Originating Application filed on 25 November 2021 who have not opted out of the proceeding. The applicant would release the respondent (M.R.V.L.) from the liability claims against it. M.R.V.L. is to pay $19.25 million to Mr Markham of Adero as the scheme administrator and Mr Markham of Adero (as administrator) would: (a) pay the Approved Funder Costs to ICP Funding Pty Ltd and Investor Claim Partner Pty Ltd (ICP), (together, the Funders); (b) pay the Approved Adero Costs to Adero; and (c) pay (or retain) the approved Administration Costs. The remaining funds would be distributed to the registered group members in accordance with the methodology set out in the SDS.

3 The various proposed deductions from the Settlement Sum referred to above may be summarised as follows:

(a) The Approved Funder Costs are the funding and claims management costs of the Funders, comprising:

(i) a “Funding Commission and Management Fee” in the amount of $4,393,731.10 (which is equivalent to 22.8% of the Settlement Sum);

(ii) reimbursement of the “Project Costs” paid by ICP Funding to fund the claim in the amount of $2,563,384.03, comprised of:

(A) $1,228,732.31 – legal costs paid to Adero by the Funders which would be reimbursed by Adero to the Funders;

(B) $1,019,940.04 – disbursements reimbursed to Adero in respect of disbursements incurred by Adero during the proceedings;

(C) $261,909.39 – costs of the managed investment scheme established for the purposes of the proceedings;

(D) $52,802.29 – expenses paid by ICP Funding for the benefit of group members.

(b) The Approved Adero Costs are Adero’s claimed costs and disbursements that have not been met by the Funders. The total sought is $1,503,327.44.

(c) The Administration Costs are the claimed cost of administering and implementing the SDS in the amount of $723,805, payable to Mr Markham as proposed administrator.

OVERVIEW OF THE PROCEEDING

4 It is helpful to begin with the following broad overview of certain aspects of the proceeding.

5 On 10 December 2019, Adero agreed to act for the applicant on a “no-win no-fee” basis until litigation funding was obtained, with a right to terminate in certain circumstances.

6 The proceedings commenced on 24 December 2019. The applicant contends that the respondent, who supplies labour to “Merivale” hospitality businesses, contravened the Fair Work Act 2009 (Cth) (FW Act) by underpaying him and the respondent’s hospitality workers (Group Members) employed in the period from 25 December 2013 to 24 December 2019 (Relevant Period). The applicant’s claim includes that:

(a) the Hospitality Industry (General) Award applied during the Relevant Period and that the Merivale Employee Collective Agreement 2007 did not have any lawful operation under the FW Act;

(b) even if the Agreement was lawful, the Group Members were underpaid under the Agreement.

7 The precise number of Group Members is unknown, but there are thought to be at most 14,428. The respondent produced a list of 14,428 email addresses to which opt-out notices were sent in November 2020.

8 There are now 2,895 people who have registered to participate in the settlement.

9 The respondents deny liability and raise a number of defences. The claim has been vigorously defended and is likely to continue to be vigorously defended if the proceedings continue.

10 The Funders provided $200,000 to Adero in March 2021 in order to meet counsels’ fees incurred and anticipated in respect of the hearing of a separate question. The separate question concerned certain aspects of the pleading and was, in broad terms, intended to clarify whether or not the Agreement or the Award applied. If the Award applied, the applicant’s case was significantly stronger than would have been the case if the Agreement was valid.

11 On 29 March 2021, there was a hearing in relation to the separate question and reasons for the Court’s judgment were delivered on 30 March 2021: Boulos v MRVL Investments Pty Ltd (No 2) [2021] FCA 309. The reasons favoured the applicant in concluding that the Workplace Authority Director did not have power to rescind a decision that the Agreement did not pass the “fairness test” which applied at the relevant time under the Workplace Relations Act 1996 (Cth): at [57]. It would follow that the claims of the Group Members were likely to be determined under the Award rather than the less favourable Agreement.

12 On 12 May 2021, Mr Boulos and the Funders entered into a Litigation Management and Funding Agreement (LMFA), which Mr Boulos appears to have agreed to enter in March 2021. There are 102 other Group Members who entered into an LMFA with the Funders.

13 On 6 December 2023, the applicant and M.R.V.L. engaged in a settlement conference which resulted in an agreement that, subject to court approval, M.R.V.L. would pay $18 million inclusive of costs to settle the claims of the applicant and the Group Members.

14 On 21 December 2023, the parties executed the Deed setting out the terms of the agreement to settle the proceedings for $18 million. The proceeding was listed for an approval hearing, but the applicant informed the respondent, and later the Court, that the applicant could no longer support the settlement. Ultimately, by way of the Variation Deed made on 3 October 2024, the Settlement Sum was increased to $19.25 million.

PRINCIPLES

15 The principles to be applied in considering an application for approval of a proposed settlement of a Part IVA class action are well established. The central question is whether the settlement is fair and reasonable in the interests of the group members as a whole. The principles have been set out in numerous cases, including Camilleri v The Trust Company (Nominees) Ltd [2015] FCA 1468 at [5] (Moshinsky J) and Fowkes v Boston Scientific Corporation [2023] FCA 230 at [31] – [45] (Lee J).

16 There is no single way in which a settlement should be framed: Blairgowrie Trading Ltd v Allco Finance (in liq) (No 3) [2017] FCA 330; 343 ALR 476 at [82]; Mitic v Oz Minerals Ltd (No 2) [2017] FCA 409 at [9]. The questions are: (a) whether the proposed settlement is within the range of reasonable outcomes having regard to the circumstances which are known by, or could reasonably be expected to be knowable to, the applicant and the applicant’s lawyers; and (b) whether there has been an appropriate and reasonable assessment of the relevant risks based on those circumstances: Kelly v Willmott Forests Ltd (in liq) (No 4) [2016] FCA 323; 335 ALR 439 at [74], [77]; Blairgowrie at [82], [83].

17 There are three aspects of the proposed settlement which require particular consideration in the present application:

(1) whether the settlement is fair and reasonable as between the parties to the proceeding having regard to the interests of the Group Members considered as a whole;

(2) whether the proposed arrangements for distributing the Settlement Sum among the Group Members are fair and reasonable, again taking into account the interests of the Group Members as a whole; and

(3) whether the proposed deductions from the Settlement Sum are fair and reasonable in all the circumstances.

IS THE SETTLEMENT FAIR AND REASONABLE?

18 Having regard to the confidential opinion of counsel for the applicant, and to the various risks associated with the litigation, including establishing and quantifying liability and the risk associated with recovery from a respondent with few identified assets, the Court is satisfied that the settlement is fair and reasonable even if the entirety of the deductions sought are made. That does not mean that the deductions should be allowed in full.

ARE THE DISTRIBUTION ARRANGEMENTS FAIR AND REASONABLE?

19 In Camilleri at [43]-[44], Moshinsky J said:

The cases indicate a number of factors relevant to the assessment whether a proposed distribution scheme is fair and reasonable having regard to the interests of the group as a whole. Some of these factors are as follows:

(a) whether the distribution scheme subjects all claims to the same principles and procedures for assessing compensation shares;

(b) whether the assessment methodology, to the extent that it reflects ‘judgment calls’ of the kind described above, is consistent with the case that was to be advanced at trial and supportable as a matter of legal principle;

(c) whether the assessment methodology is likely to deliver a broadly fair assessment (where the settlement is uncapped as to total payments) or relativities (where the task is allocating shares in a fixed sum);

(d) whether the costs of a more perfect assessment procedure would erode the notional benefit of a more exact distribution;

(e) to the extent that the scheme involves any special treatment of the plaintiffs or some group members, for instance via ‘reimbursement’ payments – whether the special treatment is justifiable, and whether as a matter of fairness a group member ought to be entitled to complain.

There are also procedural factors which relate to the fairness of a proposed distribution process, such as:

(a) whether appropriate individuals have been nominated to administer the scheme;

(b) whether the procedures for lodging and assessing claims are appropriate and to be conducted in a timely manner;

(c) whether the scheme incorporates appropriate ‘checks and balances’, such as procedures for ensuring consistency between assessments and meaningful opportunities for review (and objection) by group members.

20 The registered Group Members’ claims (Loss Claim Amount) are proposed to be calculated using a claims calculation model (Model). The proposed distribution will depend on an individual’s employment type, length of time employed, number of hours worked each day, any interest notionally earned (which depends on when they were employed) and the total deductions from the Settlement Sum.

21 In his affidavit sworn 30 October 2024, Mr Markham explained the operation of the Model and why various approaches were adopted rather than others. The Model will use information provided by the respondent. There are weighty costs considerations against seeking to obtain this information from each individual group member.

22 The administrator will calculate the average Loss Claim Amount under cl 7.1 of the SDS. If the administrator determines there is insufficient data to model an individual’s claim, their Loss Claim Amount will be assumed to be the average. Under cl 7. 2, the administrator will then apply a weighting to the Loss Claim Amount having regard to the timing of employment and whether the person was employed in a managerial role. Clauses 7.3 to 7.5 explain:

7.3. These weightings are to be applied because the strength of each Registered Group Members claim is affected by whether they were engaged in a managerial position that might have precluded them from coverage under the Award.

7.4. A relative weighting of 100% will be applied to the portion of Registered Group Member’s Loss Claim Amount for work performed in a non-managerial role.

7.5. A relative weighting of 70% will be applied to the portion of the Registered Group Member’s Loss Claim Amount for work performed in a managerial role, with such figure to be the subject of determination by the Court prior to distribution.

23 Under the SDS, “Anticipated Settlement Statements” will be issued, setting out a range of information including the relevant person’s “Anticipated Settlement Entitlement”: cl 8. The SDS contemplates a mechanism for review: cl 9. It contains provisions designed to discourage reviews which would result in the relevant group member receiving less than $500. After all “Anticipated Settlement Statements” have been sent and all periods of review have elapsed and any “Review Requests” have been determined, the administrator will distribute the “Net Settlement Distribution Fund”: cl 10.1.

24 The Court is satisfied that the distribution arrangements are fair and reasonable, including as between the Group Members. A more precise model, or one which allowed for speculative or unreasonable requests for review, would result in prohibitive administration costs, such that an unsatisfactory amount of the Settlement Sum would be depleted by those costs.

THE PROPOSED DEDUCTIONS

25 As mentioned earlier, there are three classes of deductions: the Funders’ costs; Adero’s unfunded costs; and administration costs. It is convenient to deal first with Adero’s costs. Some of its legal costs were paid by the Funders during the course of the proceedings, but some of its costs were incurred before funding and it was not paid for all of its costs during the funded period.

Adero’s Costs

General observations

26 Ultimately, the question in relation to Adero’s costs is whether an order for a deduction in respect of the amount claimed is “just”, within the meaning of s 33V of the FCA Act.

27 In Earglow Pty Ltd v Newcrest Mining Limited [2016] FCA 1433 at [91], Murphy J made the following observations as to what a Court should generally do when determining whether an order in relation to costs under s 33V is “just”:

… The Court should satisfy itself that the arrangements in relation to legal costs meet any relevant legal requirements, contain reasonable and proportionate terms relative to the commercial context in which they were entered, and that the costs and disbursements are in accordance with the terms of the relevant agreements and are otherwise “reasonable” …

28 In Petersen Superannuation Fund Pty Ltd v Bank of Queensland Ltd (No 3) [2018] FCA 1842; 132 ACSR 258 at [88], Murphy J made a number of observations relevant to the importance of judicial supervision of legal costs. These observations are also relevant to the importance of legal practitioners complying with their statutory and ethical obligations. A failure to comply with what is required and expected is serious. Murphy J’s observations were:

In class actions the requirement for judicial supervision of legal costs proposed to be charged is obvious because: (a) the applicant’s solicitor is in a more dominant position vis-a-vis a class member than in a solicitor-client relationship in individual litigation; (b) class members are commonly not told about the mounting costs as they are incurred and they suffer a significant information asymmetry in that regard; (c) it is not necessary for class members to retain the applicant’s solicitor and commonly they do not, yet they are usually made liable for a pro rata share of the costs; (d) even where class members retain the applicant’s solicitor they do not provide instructions as to the running of the class action and have no control over the quantum of costs, yet they are usually made liable for a pro rata share of the costs; (e) class members are unlikely to pay much attention to legal costs because they are usually only payable upon success and from the successful outcome; (f) it is usually not until after settlement is achieved that class members are told the total costs claimed, but they are not told (and it is commonly very difficult to accurately estimate) what their pro rata share of the costs will be; and (g) the Court has a protective role in relation to class members’ interests.

29 At a settlement approval hearing of the present kind, there is no true contradictor in relation to a claimant’s solicitor’s legal costs. This makes it all the more important for those solicitors to keep records which allow for proper determination and scrutiny of the claims for costs and to provide the Court with sufficient information and assistance in order that it can be satisfied that the claims are appropriate, particularly as to the amount of the claim. If there have been breaches of statutory obligations relevant to a proper determination of whether costs should be borne by group members, those should be drawn to the Court’s attention as facts material to the decision which the Court must make under s 33V. It would be improper to put forward a claim for legal costs knowing that there existed facts, not before the Court, which put in doubt, or materially adversely affected, an important aspect of a claim for costs.

Adero’s claim for costs

30 Adero relied principally on two reports prepared by a costs referee experienced in assessing legal costs: a Costs Report dated 19 June 2024 and a Supplementary Costs Report dated 23 October 2024 (together, the Costs Reports). Adero submitted that the costs referee’s opinion should be accepted.

31 It should be noted at the outset that the costs referee was provided with quite limited material. The most important document she was provided was an excel spreadsheet which was said to contain a line-by-line itemisation of professional fees and disbursements. So far as can be determined from the Costs Reports and the evidence of Mr Markham, the costs referee was not provided with any time recording protocols or other information from which to form a view about whether the spreadsheet itself could be regarded as reliable in the sense of containing sufficient information from which to ascertain whether the charges recorded in it would be allowable on a solicitor and client basis or as being otherwise accurate – compare: Watson & Co Superannuation Pty Ltd v Dixon Advisory and Superannuation Services Ltd (Settlement Approval) [2024] FCA 386.

32 The costs referee was not apparently provided all billing records and invoices for professional costs or other material to assist checking the accuracy or appropriateness of the entries in the spreadsheet. The costs referee was not provided with access to Adero’s electronic file. Given that the costs referee was required to limit the length of her report, and that there was a limit in time and costs, she did not call for the electronic file: CB310 at [4].

33 Speaking generally, if a costs referee believes that he or she cannot undertake the task requested reliably, by reason of time or cost or other constraints, that matter should be raised and addressed or at least disclosed in the report.

34 The costs referee did not state whether the descriptions in the itemisations in the spreadsheet were sufficient to enable reasonably reliable views to be formed. The referee provided “high-level comments and observations” in relation to entries and narrations of work performed: CB312 at [21]; CB336 at [18]. Although Adero’s submissions on this application for approval referred to the “assessment of the independent costs assessor as to the fair and reasonable costs of the proceeding”, the use of the word “assessment” implies a level of sophistication of analysis which was not undertaken: CB41 at [5].

35 It should also be noted at the outset that the Costs Report approached the matter on the basis that the relevant costs agreement between Adero and the applicant was valid and “generally compliant” with the relevant statutory provisions.

36 As is noted below, the costs agreement breached aspects of the relevant statutory regime and was invalid. The lack of attention to the terms of the agreement causes concern as to the reliability of the conclusions in the Costs Reports as a whole.

37 The total costs considered by the costs referee to be reasonable to deduct from the Settlement Sum was $3,718,999.79 comprised of (see Adero’s email of 25 November 2024):

$2,605,419.32 in professional fees, including: fees actually incurred ($2,376,961.38); fees which were estimated to be incurred for settlement approval ($133,457.94); and fees of $95,000 claimed in relation to work done in increasing the settlement figure from $18m to $19.25m (CB337 at [33]);

$1,113,580.46 in disbursements, including: incurred disbursements ($972,780.46 (CB315 at [48])); disbursements which were estimated to be incurred for settlement approval ($126,500 (CB315 at [48])); and the cost of the Costs Reports ($14,300 (CB315 at [48], 337 at [32])).

38 The total costs paid by the Funders to Adero were $2,248,672.35, comprised of:

$1,228,732.31 in legal fees; and

$1,019,940.04 in disbursements;

39 There was also an additional $33,000 not considered by the costs referee in respect of invoices of counsel annexed to the Mr Markham’s affidavit of 21 November 2024.

40 At the approval hearing, the amount of legal costs and disbursements claimed by Adero was stated to be $1,609,792, by reference to a summary attached to Mr Markham’s affidavit of 21 November 2024: CB691. During the hearing, a claim for an uplift of 25% on pre-funding costs of $425,859 – namely $106,464.75 – was abandoned, with the result that the claim became a claim for the amount of $1,503,327.

41 During the approval hearing, the Court asked what comprised the amount (then) of $1,609,792 and received a partial response, including that the professional costs during the no-win no-fee period were $425,859.

42 Immediately after the approval hearing, the Court inquired again (by email) as to what the amount comprised and was provided a response as to how the amount of $1,503,327 was calculated, but with little additional information as to what it comprised.

43 The costs therefore claimed by Adero total $1,503,327.44, said to be comprised of:

(a) $1,376,687.02 in professional fees incurred:

(i) in the period before funding which was stated to be $425,859 by the costs referee and Mr Markham: CB311 at [13]; T34.10-13; and

(ii) “the amount unfunded”, the composition of which has not been fully explained – see: email from Adero sent on 25 November 2024 after the hearing;

(b) $126,640.42 in disbursements unpaid by the funder, being an amount which includes the $33,000 for counsel invoices which Adero has informed the Court it will reimburse to Litigation Lending Services Ltd (LLS): T67:26-36. Apart from the $33,000 the disbursements were not identified.

The Costs Agreement

44 The applicant signed a “Retainer & Costs Agreement” with Adero on 10 December 2019.

45 Clause 15 and Sch 1 item 5 provided that the Costs Agreement was governed by the laws of New South Wales and that the parties submit to the courts of that jurisdiction. In the Costs Report, the costs referee said that the Costs Agreement “states that the law of the ACT applies” to the agreement: CB310 at [8]. The costs referee did not mention that the express terms of the Costs Agreement were directly contrary to this conclusion and did not explain which part of the Costs Agreement made the statement asserted.

46 When the issue was raised at the approval hearing, Mr Markham stated (T43.1):

I think in recollection, the reason why we had this initial difficulty in this matter, as opposed to other matters, is we had a New South Wales office and the matter was drafted in …

47 Mr Markham also stated (T43.20-23):

I had always understood it to be the LPA of the ACT, because that’s where the relevant licences of the practitioners was based. There was no licences for New South Wales solicitors with the societies.

48 That there may have been an intention that the Costs Agreement was to be governed by the laws of the ACT finds some support in the definition of “Legal Profession Act” at cl 1.1(l) (which contained a reference to the Legal Profession Act 2006 (ACT) (ACT LPA)) and the fact that the interest contemplated by cl 5.14 is calculated by reference to ACT Supreme Court rates.