Federal Court of Australia

Australian Securities and Investments Commission v Ryan [2024] FCA 1267

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The proceeding be dismissed.

2. The plaintiff pay the defendant’s costs of the proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

O’CALLAGHAN J

Introduction

1 Dixon Advisory & Superannuation Services Pty Ltd (DASS) and E&P Operations Pty Ltd (EPO) were wholly owned subsidiaries of E&P Financial Group Ltd (EP1). EP1 and its subsidiaries formed part of a consolidated group (the Group).

2 EP1 listed on the ASX in May 2018, following what proved to be an ill-fated merger between Evans and Partners Pty Ltd (EAP), and EP1 (then named Laver Place Pty Ltd and the holding company for the group trading as “Dixon Advisory”).

3 Mr Paul Ryan, the defendant, was a director of DASS from 30 March 2021; a director of EPO from 25 March 2020 until 5 July 2023; and Chief Financial Officer and Company Secretary of EP1 from 3 February 2020 until 24 November 2022. The other director of DASS was Mr Lyle Meaney.

4 DASS operated a financial advice business focused on retail clients (most of which were self- managed superannuation funds) and held an Australian Financial Services Licence (AFSL), a condition of which was that it maintained a net positive asset position. As an AFSL holder, DASS was required to lodge annual standalone audited general purpose financial reports with the Australian Securities and Investments Commission (ASIC).

5 DASS specialised in the provision of financial and investment advice, portfolio management and superannuation services, including the administration of self-managed superannuation funds. It was a revenue generating entity, which incurred only nominal direct expenses. That was because EPO provided various services to DASS — it employed DASS advisers and support staff, leased the offices from which DASS operated and owned and operated the technology systems used by DASS and other EP1 subsidiaries.

6 EPO “swept” cash from DASS from time to time, to fund the services it provided to DASS (and other entities in the Group). The movement of funds and liabilities as between EPO and DASS was recorded in an intercompany (running) loan account.

7 Historically, EPO charged a management fee equivalent to 90% of DASS’s gross revenue for the provision of such services. It was recorded in the books of DASS as an expense, and its payment to EPO was usually recorded as a reduction in the balance of an intercompany loan account between EPO and DASS.

8 DASS’s client revenues declined not long after the listing occurred, because it and the Group began to face scrutiny and complaints in respect of advice that DASS had provided to its clients recommending they invest in financial products offered by DASS, in particular in a fund called the US Masters Residential Property Fund (the URF). The URF was an ASX listed trust investing in the United States residential property market.

9 From 2020, DASS faced a number of claims relating to the provision of financial advice to clients who were advised to invest in the URF and related products, including a proceeding issued against it by ASIC, 90 complaints made by clients to the Australian Financial Complaints Authority (AFCA), and two class actions, with a potential liability in the vicinity of $500 million.

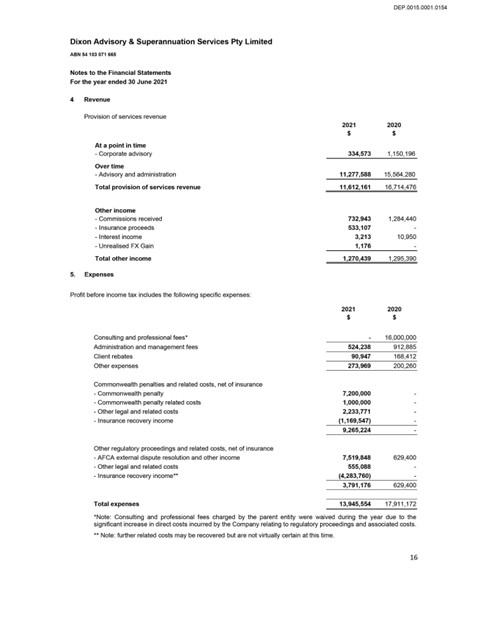

10 By the end of the 2021 financial year, DASS’s revenue was in sharp decline. For the financial year ending 30 June 2021 its revenue was about $11 million, compared to about $16 million for the previous financial year, and about $20 million in the financial year ending 30 June 2019.

11 DASS held investment management insurance which covered liability for the AFCA complaints and legal costs in the ASIC proceeding referred to above up to $20 million.

12 In order to ensure that DASS maintained a net positive asset position, and did not breach a term of its AFSL licence, in about July 2021 EPO agreed to waive the management fee ordinarily charged to DASS for the financial year ending 30 June 2021, calculated in the sum of about $11.6 million. The waiver of the management fee meant that instead of the intercompany receivable being reduced by that amount, it remained at about $19 million.

13 On 21 December 2021, MinterEllison sent Mr Ryan a draft advice and a draft Deed of Acknowledgement of Debt (which I will refer to as the deed or the DOAD) in respect of the intercompany receivable between DASS and EPO. MinterEllison advised that the directors of DASS (including Mr Ryan) were justified and acting reasonably in taking the view that the execution of the deed was appropriate and in the best interests of DASS or EP1 or both, provided that the constitution of DASS was first amended specifically to authorise the directors of DASS to act in the best interests of EPO (its parent), pursuant to s 187 of the Corporations Act 2001 (Cth) (the Act).

14 On 22 December 2021, the DASS Board of directors resolved to approve the revision to its constitution and to put it to EPO (DASS’s sole shareholder) for approval and adoption.

15 On 24 December 2021, MinterEllison issued its final advice, confirming that the directors of DASS (including Mr Ryan) were justified and acting reasonably in taking the view that the execution of the deed was appropriate and in the best interests of DASS or EP1 or both.

16 The MinterEllison advice was founded on a number of assumptions, two of which are critical to ASIC’s case, viz:

[Clause 1.10] The parties agreed that the Intercompany Debt would accrue on the basis that repayment would only be required if and to the extent the Relevant Liabilities become payable by DASS and are not recoverable from insurance.

…

[Clause 1.12] The limitation of the purposes to which the proceeds of repayment of the Intercompany Debt may be applied, being the discharge, wholly or in part, of the Relevant Liabilities, formed part of the negotiations between DASS and [EPO] when the temporary suspension of the management fee ordinarily charged to DASS by [EPO] was put in place. The proposed Deed will acknowledge this.

17 As I explain below, ASIC contended that the evidence adduced at trial should persuade me that the parties did not in fact so “agree” and did not engage in such “negotiations”; that Mr Ryan knew assumptions to that effect were critical to MinterEllison’s advice; that he knew or was wilfully blind to the fact that the parties did not so agree and did not engage in such negotiations; and that he did not discharge his duties in good faith in the best interests of DASS in breach of his statutory duties.

18 The DOAD was executed later that day. The effect of the DOAD in substance was that the balance of the intercompany loan in favour of DASS would only be repayable by EPO as and when the provisioned amounts in respect of the ASIC proceeding and AFCA claims became due and payable and only to the extent that insurance did not respond.

ASIC’s case

19 ASIC alleged that Mr Ryan contravened his statutory duties as a director of DASS under ss 180, 181(1)(a) and 182 of the Act and sought orders that he pay pecuniary penalties and be disqualified from managing corporations for (an unspecified) time. These reasons deal only with questions of liability.

20 I should say at the outset that ASIC did not allege that Mr Ryan was motivated by, or gained, any personal benefit or advantage by the conduct that ASIC sought to impugn. Nor was it alleged that DASS’s creditors suffered any loss, in the events that occurred.

21 The gist of ASIC’s case is that by voting in favour of certain resolutions between 22 and 24 December 2021, when DASS was “nearing insolvency”, Mr Ryan, in his capacity as a director of DASS contravened ss 180, 181(1)(a) and 182, because the resolutions materially prejudiced its ability to pay its creditors.

22 The resolutions gave effect to two things:

(a) a change in DASS’s constitution so as expressly to permit its directors to act in the best interests of EPO; and

(b) entry by DASS into the DOAD on 24 December 2021 between it and EPO (to the advantage of EPO and to the detriment of DASS).

23 By way of concise statement dated 3 August 2023, ASIC alleged that the resolutions materially prejudiced DASS’s ability to pay its creditors, because the purpose and effect of the DOAD was to prevent a voluntary administrator of DASS from calling on the approximately $19 million intercompany receivable that would otherwise have been available for DASS’s creditors. Instead, the DASS creditors (mainly its clients who had suffered large losses with their investments) were prevented from “avail[ing] themselves of the asset and any negotiating opportunity that [would have] presented to them”.

24 By way of concise statement in response dated 28 September 2023, Mr Ryan said in substance that:

(1) in passing the resolutions, he sought, obtained and relied upon written legal advice from MinterEllison that was provided in final form on 24 December 2021 to the effect that DASS’s constitution should be amended to expressly authorise the directors of DASS to act in the interests of DASS’s holding company and that, as a director of DASS, he was justified and acting reasonably in taking the view that the execution of the DOAD was appropriate and in the best interests of DASS or EP1 or both;

(2) he exercised the degree of care and diligence that a reasonable person in his position as a director of a company in DASS’s circumstances within the EP1 Group would have exercised;

(3) the decision to amend the DASS constitution and the decision to execute the deed were business judgments within the meaning of s 180(2) of the Act;

(4) he exercised his powers and discharged his duties in good faith and in the best interests of DASS;

(5) he did not improperly use his position to gain an advantage for EPO, nor to cause detriment to DASS;

(6) he acted in the interests of DASS as a whole, considering and appropriately weighing the interests of DASS’s creditors as part of a holistic assessment and did not act contrary to the interests of creditors;

(7) it was for the shareholder of DASS, EPO, to determine whether to amend its constitution, not for the directors of DASS.

25 Mr P Wallis KC, who appeared with Ms N Moncrieff of counsel for Mr Ryan, put the defendant’s case succinctly in his closing address in this way:

… a proper characterisation of what Mr Ryan did was seek, responsibly, advice from trusted and experienced lawyers as to how to handle the situation. And the advice, properly read from the perspective of a layperson … said in substance, it is permissible for EPO to amend the constitution of DASS to include that provision, and it’s permissible for you, then, to rely upon it in respect of executing the deed. So that’s what he did.

Now, we ask the question, how can that be a breach of any obligation under the Corporations Act as a director when he is acting entirely consistently with the legislative framework that has been laid out. We say the answer is, he can’t be.

26 Mr Ryan also submitted that s 181 was not enlivened in relation to his conduct as a director of EPO in resolving to approve the revised DASS constitution. (That said, I do not read the concise statement as making any allegation that Mr Ryan breached his duties as a director of EPO).

27 ASIC’s reply was as follows:

In reply to the defendant’s concise statement in response filed 28 September 2023 (Response), the plaintiff:

1 Joins issue.

2 Says further as follows, in response to the allegations made in paragraphs 2(g) and 2(h):

(a) The written advice from Minter Ellison there set out (ME Advice) recorded (at [1.1]) that: “Our understanding and instructions regarding the relevant background facts are set out below. Our opinion below is based on the accuracy of the background stated, which we have not independently tested or verified”;

(b) To the knowledge of Ryan:

(i) the background fact or circumstance set out in the last sentence of [1.10] was not accurate;

(ii) the background fact or circumstance set out in the first sentence of [1.12] was not accurate;

(c) in these premises:

(i) Ryan did not in fact rely on the ME Advice;

(ii) further or alternatively, any reliance by Ryan on the ME Advice (including for the purposes of s 189 of the Corporations Act):

(A) was not reasonable;

(B) was not in good faith;

(C) did not justify Ryan to hold a view that execution of the Deed (as defined in the Response) was appropriate and/or in the best interests of DASS or EP1 (each as defined in the Response) or both.

28 In its closing written submissions, ASIC contended that “[a]s a director of two corporations … Mr Ryan owed duties to each of DASS and [EPO], and to both of them, including to manage conflicts of duty and duty as between their respective interests”, but added that whether s 181 of the Act is here engaged in relation to Mr Ryan’s conduct in passing the EPO resolution “is not of particular moment”.

29 In ASIC’s written opening submission, it was made clear that the question of whether Mr Ryan had honestly and reasonably relied on the MinterEllison advice was “in all likelihood, the determinative issue”:

Centrally to the case at trial, and singularly relevant when he gives evidence, Ryan has foreshadowed that he will rely on written advice provided by MinterEllison. MinterEllison provided final written advice on 24 December 2021. That reliance, when it occurs, will then engage the factual issues of knowledge pleaded in ASIC’s Reply. Further and moreover, insofar as Ryan relies upon the final MinterEllison advice, in relation to his conduct (qua director) concerning amendments of the DASS Constitution (on 22 December 2021) he necessarily must also be relying on earlier iterations of the advice (that is, on earlier drafts of that advice).

There is no objection by Ryan to ASIC tendering all of the documents nominated in its case in chief; and in its reply (save for a reservation on transcripts of compulsory ASIC interviews). In all likelihood, the determinative issue at the trial of the matter will be the reasonableness of the reliance by Ryan, on the written advice of MinterEllison.

(Emphasis added.)

30 In his written closing submissions, Mr P H Solomon KC, who appeared with Ms V Bell of counsel for ASIC, said that its “first case” was “the case that most starkly corresponds to the facts and circumstances in play”, namely that by causing DASS to amend its constitution so as to afford the directors of DASS statutory protection when causing DASS to enter into the DOAD; and/or causing DASS to enter into the DOAD, Mr Ryan breached his duty to exercise his powers and discharge his duties in good faith in the best interests of DASS within the meaning of s 181(1)(a) of the Act.

31 Mr Solomon also submitted that Mr Ryan preferred his own interests in taking steps to entrench the constitutional amendment for his own protection in the events in immediate contemplation, but the point was not addressed in the concise statement or the reply and Mr Ryan rightly objected to a new case being made in opening. I accordingly decline to deal with it.

32 ASIC submitted that “neither the constitutional amendment, nor the entry into the DOAD itself (and, a fortiori, not the constitutional amendment for the purpose of protecting the directors in entering into the DOAD) was in the interests of DASS” and that “[n]o reasonable director in Mr Ryan’s position could have thought it was”.

33 The second and third ways ASIC put its case were that Mr Ryan failed to exercise the requisite degree of care and diligence required by s 180(1) of the Act because he failed to exercise the requisite degree of care and diligence when assessing the effect of the constitutional amendment and/or the DOAD on DASS’s creditors; and that he improperly used his position as a director of DASS to gain an advantage for EPO within the meaning of s 182 of the Act.

34 In its written opening submission, ASIC submitted that he improperly used his position to gain advantage for the Group, not just EPO. Again, that point was not addressed in the concise statement or the reply and Mr Ryan objected to a new case being made in opening. I accordingly decline to deal with it.

35 In his opening address, senior counsel for ASIC summarised the three critical issues raised by its case as follows:

Let me tell you what we expect the case will be about. It will be about three things. I’m intending now to summarise the essence of the case accurately. These are the three things that it’s about. One thing is to understand what agreement or understanding was reached between these two entities through individuals in July, August and/or September. Mr Ryan and Mr Anderson have both given their sworn evidence on that, and we will test it in cross-examination. The second central feature of the case, which is about the acts and omissions of a director, is what reliance, in fact and/or reasonably, was placed on legal advice by MinterEllison and guidance by the group’s CEO, Mr Anderson. My expectation is that will be the decisional issue. MinterEllison gave advice. What reliance, in fact and/or truth, did Mr Ryan place on it?

HIS HONOUR: Yes.

MR SOLOMON: Thirdly, it appears from Mr Ryan’s evidence that he contends that this deed was in the interests of DASS, whether or not there was an earlier agreement or understanding.

HIS HONOUR: Yes.

MR SOLOMON: So that’s the essence of the case: the agreement or understanding Mr Ryan relies upon from July, August, and or September; the reliance on legal advice and, further, Mr Anderson in advance of the resolution in December; and the circumstance as to whether, in any event, the interests of the company were served by entering – of DASS were served by entering into this deed. There’s an associated question which concerns a resolution to amend the constitution, two days earlier, which we will deal with in the evidence.

(Emphasis added.)

36 By the time of ASIC’s closing address, those three issues had turned into sixteen which, it was submitted, would determine the outcome of the proceeding. As senior counsel put it:

We think, and I expect this to be uncontroversial, that the essence of this case concerns the findings your Honour makes on various controversial factual matters. That might be true of most trials, but there’s a lot of cases that have been – that your Honour has been referred to. I’m speaking for myself. I’ve had the pleasure of reading each of them over the last four weeks. And law is interesting on aspects of 180 and 181 and 182 and 187 and 189. But as a submission, we invite your Honour, if your Honour considers them potentially relevant, to treat our 16 factual findings as the factual issues. They are not agreed. There are factual issues, and we think at the end of that, it’s likely to fall out what the legal conclusion then will be.

37 Neither party took me in any detail in oral closing addresses to the sections of the Act relied on, and closing submissions proceeded on the basis contended for by senior counsel for ASIC – that is, that resolution of the sixteen factual questions, one way or the other, would determine the outcome of the proceeding.

38 It was not, and is not, clear to me how a number of the questions were said to arise from the “pleaded” case, but counsel for Mr Ryan voiced no objection to me dealing with them seriatim, or with the proposition that the answers to the questions inherent in ASIC’s proposed factual findings would be determinative of the outcome. So I proceed accordingly.

39 For the reasons that follow, I conclude (among other things) that:

(1) Mr Ryan did in fact rely on the MinterEllison advice;

(2) clauses 1.10 and 1.12 of the MinterEllison advice were not materially inaccurate;

(3) Mr Ryan’s reliance was reasonable and in good faith and it did justify him holding the view, as he did, that the execution of the DOAD was appropriate and in the best interests of DASS;

(4) ASIC has therefore not established that Mr Ryan contravened ss 180, 181(1)(a) or 182 of the Act in his capacity as a director of DASS; and

(5) the proceeding is to be dismissed.

The evidence relied on

40 ASIC read three affidavits of Melisande Guanlao, an Investigator in ASIC’s Enforcement & Compliance team, one made 15 February and two made 15 May 2024, and (with some exceptions) tendered the bundles of documents referred to in those affidavits.

41 Mr Ryan read the affidavits of:

(a) himself made 26 April 2024;

(b) Mr Stephen Hill (who was at the relevant times Group Financial Controller and then Deputy Chief Financial Officer of EP1) made 26 April 2024;

(c) Mr Peter Anderson (who was at the relevant times the Chief Executive Officer and Managing Director of EP1) made 26 April 2024; and

(d) Mr David Evans (Chairman of the EP1 Board) made 26 April 2024.

42 ASIC correctly summarised the substance of Mr Ryan’s evidence in its written opening submission as follows:

(a) from around October 2020, the Group began to plan for various contingencies, including the possibility of DASS having to be placed into voluntary administration;

(b) the Group’s contingency planning was known as “Project Fork”, of which Mr Ryan was a member along with Mr Francis Araullo and Mr Marc Falkiner;

(c) from September 2020, restructuring and insolvency firm McGrathNicol was intimately involved in all aspects of Project Fork;

(d) from October 2020, MinterEllison provided legal advice with respect to the Project Fork contingency planning;

(e) at some point between late October 2020 and late March 2021, he had a conversation with Mr Anderson in which Mr Anderson said to him that the intercompany loans in favour of DASS was one of the Group’s biggest risks if it ever became necessary to place DASS into voluntary administration and that they needed to manage those risks by reducing the balance of the loans as much as possible by the end of FY2021;

(f) on his instruction, in late May and early June 2021, the finance team “started the process of reducing the balances of the intercompany receivables involving DASS”;

(g) in or around late July or early August 2021, he had a discussion with Mr Hill in which one of them said that the only available lever they had to ensure that DASS remained in a net positive asset position was for EPO to waive the management fee for the 2021 financial year. He instructed Mr Hill to waive the management fee and prepare the DASS financial accounts accordingly;

(h) shortly after the discussion with Mr Hill, he (Mr Ryan) had a conversation with Mr Anderson in which he told Mr Anderson that it was necessary for EPO to waive the management fee such that the balance of the intercompany receivable in favour of DASS would increase, not be reduced;

(i) during a conference call with McGrathNicol, MinterEllison and the Project Fork team on 8 November 2021, he said that DASS should not be permitted to call on the intercompany receivable unless and until a claim had actually crystallised and it was not covered by insurance;

(j) in early December 2021, the likelihood of a decision to appoint voluntary administrators to DASS was increasing;

(k) on 20 December 2021, Messrs Anderson, Falkiner and Ryan met with Mr Stephen Longley of PwC to discuss the potential appointment of a voluntary administrator to DASS;

(l) he relied on the fact that Mr Hill did not identify any errors in the Background section of the DOAD;

(m) he was mindful that DASS’s creditors were all current or former clients of DASS and that the current clients were dependent on the ongoing support of EPO and the Group if they were to continue to receive investment advice services from the Group; and

(n) he took into account that Mr Anderson had stated to him and the EP1 Board that he intended to ensure that the Group contributed an amount that was approximately the same as (and potentially more than) the balance of the intercompany receivable in favour of DASS at the time to any Deed of Company Arrangement (DOCA).

43 ASIC correctly summarised the substance of Mr Anderson’s evidence in its written opening submission as follows:

(a) he commenced as a non-executive director of EP1 in April 2019 and as the CEO of EP1 on 8 July 2019;

(b) as a result of the commencement of litigation against DASS, he decided it was prudent for the Group to obtain independent advice from McGrathNicol as to the steps that might need to be taken if the worst-case scenario came to pass;

(c) he and Mr Ryan met with Mr Rob Smith and Mr Andrew Wharton of McGrathNicol in about mid-September 2020;

(d) in March 2021, he had a conversation with Mr Ryan in which he stated that “the intercompany loans in favour of DASS were the Group’s biggest risk in a potential voluntary administration and DOCA and that we needed to manage those risks by reducing the balance of the loan so that the Group was not exposed”;

(e) in early September 2021, Mr Ryan told him that EPO had waived the management fee that it would ordinarily have charged DASS for FY2021 so as to ensure that there was a sufficiently high balance of the intercompany receivable between DASS and EPO in DASS’s favour for DASS to maintain positive net assets as required for its AFSL; and

(f) he (Mr Anderson) said that there was no scenario in which the Group would agree to put cash into DASS to cover the AFCA claims and that Mr Ryan needed to document the arrangement.

44 ASIC correctly summarised the substance of Mr Hill’s evidence in its written opening submission as follows:

(a) at some point in July 2021, he realised that, as a result of the methodology for calculating AFCA provisions, DASS would have negative net assets if EPO charged its management fee to DASS in the usual way;

(b) at around this time, the finance team realised that the only available way to keep DASS in a positive net asset position was for EPO to waive its management fee to DASS for FY2021;

(c) it was for that reason that the management fee for FY2021 was waived;

(d) by September 2021, he “understood that [EPO] and DASS had agreed (as per practices that had already been established) that [EPO] would repay the intercompany receivable as and when the mounting provisions that were recorded as liabilities on DASS’s balance sheet crystallised or actually became due and payable”.

45 Mr Ryan also relied on an expert report from Mr Sebastian Hams of KordaMentha dated 29 April 2024. His evidence was that, on the assumptions instructed to him, DASS was solvent on and at all times from FY19 to 24 December 2019.

46 Mr Evans’ evidence was not in the end relied on, at least for anything that mattered.

47 Messrs Ryan, Hill, Anderson and Hams were cross-examined.

The facts

September 2020

48 Prior to the merger of Evans and Partners and Dixon Advisory, in around June 2011 Dixon Advisory established the URF, a unit trust and registered management investment scheme. The primary strategy of the URF was investing in the New York and New Jersey residential property market. Upon its establishment, DASS was the investment manager and responsible entity of the URF. On 23 July 2012, the URF was listed on the ASX.

49 From 2020, DASS became the subject of myriad litigation relating to provision of financial advice to clients who were advised to invest in the URF and related products, including a proceeding issued by ASIC on 4 September 2020 in the Federal Court (ASIC proceeding); over 90 complaints made by its clients to AFCA; and two separate Federal Court class action proceedings.

50 After the filing of the ASIC proceeding in September 2020, the Group engaged Messrs Robert Smith and Andrew Wharton at McGrathNicol, to assist it with what was called “contingency planning”.

51 The contingency planning project came to be known as “Project Fork”.

52 The scope of the project included “consider[ing] risks and contingency options for DASS in the event of a material adverse outcome from ASIC’s actions, including a Scheme of Arrangement or insolvency process”.

53 The Project Fork team within the Group comprised Mr Ryan, Mr Araullo (then Executive Director – Risk & Compliance) and Mr Falkiner (then Executive Director, Strategy & Operations (E&P Wealth)), with oversight from Mr Anderson.

54 From the time of its engagement in September 2020, it was Mr Ryan’s role to ensure that McGrathNicol was provided with access to all financial information of the Group that they requested. Mr Ryan worked closely with McGrathNicol, as did Mr Anderson and the senior management of the Group. Mr Ryan deposed that he did not have any experience in corporate restructuring or insolvency, and that he relied on Mr Anderson and McGrathNicol to provide him with guidance as to how to proceed towards a potential voluntary administration of DASS.

55 Mr Ryan also deposed as to the following about Mr Bart Oude-Vrielink:

From around July 2019, Bart Oude-Vrielink of MinterEllison provided advice to EP1, DASS and the Group in respect of regulatory and general corporate legal issues. Mr Oude-Vrielink has been David Evans’ go-to lawyer at least as far back as the formation of EAP in 2007 and was EAP’s preferred external legal advisor until the merger in 2017. He was utilised far less while Alan Dixon was in charge of EP1 but was progressively reinstated upon Mr Anderson’s appointment as CEO in mid-2019. I knew Mr Oude-Vrielink to be one [of] Australia’s pre-eminent corporate law and capital markets lawyers. In October 2020, MinterEllison was first requested to provide advice in connection with Project Fork. From that point, MinterEllison provided legal advice with respect to the Project Fork contingency planning through to the voluntary administration of DASS. Various requests for advice were made between October 2020 and December 2021 regarding the position of DASS. MinterEllison, specifically Mr Oude-Vrielink, was familiar with issues facing the Group and DASS and a trusted advisor to the Group and I also relied on him to provide me with guidance as to how to proceed towards a potential voluntary administration of DASS.

October 2020

56 On 20 October 2020, McGrathNicol provided a draft Project Fork contingency plan report to EPO and its associated entities.

57 The report confirmed that the scope of the work was to review assets, operations and contractual rights and obligations of DASS; to review the Group structure and understand the relationships and inter-dependencies between DASS and other Group entities, to consider risks and contingency options for DASS in the event of a material adverse outcome from ASIC’s actions, including a scheme of arrangement or insolvency process; and prepare a contingency planning document for review by the Board of ED1 (as the parent company was then called) and management.

58 Among other things, the draft report noted that DASS had net related party loans of $11.7 million, comprising a $16.2 million receivable by DASS and $4.5 million payable by DASS (including $3.3 million intercompany tax loans). It recorded that “loans receivable and payable by DASS from other group entities are undocumented and non-interest bearing”.

59 Part of the report dealt with its “key objectives” as follows:

We have set out below our understanding of the Group’s prioritised objectives when navigating through the process of defending ASIC proceedings, AFCA investigations and any potential client class action (“DASS Claims”). It is paramount that any material financial or other consequences are ‘ringfenced’ to DASS to the fullest extent possible, and that the ED Group is protected from any financial, reputation and regulatory risks (in order of importance).

…

CRITICAL

Protect Evans Dixon Group from any fallout from DASS Claims

C1: Financial

• Ringfence any DASS penalties and investor remediation costs to DASS entity and prevent contagion or claims on the broader group.

60 Part 3.5 of the report was headed “3 DASS – 3.5 Clients” and read, relevantly:

All DASS client agreements are with [EPO], with T&Cs and invoice references to DASS and other FWM [Family Wealth Management] entities providing relevant services. This gives rise to two key issues, being (in order of importance) (i) potential risk of DASS Claims attaching to [EPO] (major operating and holding entity of FWM, Walsh and Fort Street businesses) or other FWM entities (DAS, DAP and Clear Law Pty Ltd), and (ii) potential complexity in the process to transfer DASS clients to another ED Group entity. Minter Ellison is preparing relevant advice for the Group which we understand will be completed after our report is issued.

61 Part 3.6 dealt with related party loans (RP loans), and contained this recommendation:

Recommendation: We recommend Management investigate all potential means as appropriate to reduce the quantum RP loans receivable by DASS in the event of a future VA [voluntary administration]. This may include tax related entries or other entries which create contra balances with the relevant group entities.

(Emphasis in the original.)

62 Part 4.3 of the report was headed “DASS contingency options – Scenarios which may lead to Tipping Point”, and said relevantly:

At this early stage, it is not possible to map out all the events which may unfold in ASIC and AFCA’s proceedings and investigations against DASS. We have outlined a number of scenarios below which may lead to a “Tipping Point” where the expected total quantum of fines, remediation costs and legal costs exceed DASS’ capacity to pay or the Group’s willingness to fund. At this juncture, we recommend Management discuss with ASIC a negotiated solution which involves a fixed sum of DASS / ED Group funds being contributed to a SoA [scheme of arrangement] in resolution of all ASIC and investor claims.

We expect that at some point during the DASS Claims processes (i) Management and the Board will have visibility regarding the expected quantum of total fines, remediation costs and legal costs, and (ii) the total amount will exceed DASS’ capacity to pay and the Group’s willingness to fund (referred to opposite as [$Xm]).

We have labelled this the “Tipping Point”, being the time when Management should approach ASIC regarding a negotiated settlement via SoA and used [sic] this as the starting point for a DASS Event [defined as a scheme of arrangement or voluntary administration] in our indicative roadmap in section 4.4.

63 Shortly after he received the first draft Project Fork report, Mr Ryan deposed that he read and discussed it with Mr Anderson.

64 Mr Ryan said that he did not recall the content of his discussion at that time with Mr Anderson, including whether they discussed McGrathNicol’s recommendation with respect to DASS’s intercompany receivables. Mr Ryan deposed, however, that at some point between late October 2020 and late March 2021, when the Group received the final version of the Project Fork report, he had a discussion with Mr Anderson in which Mr Anderson said that the intercompany receivables in favour of DASS were one of the Group’s “biggest risks” if it ever became necessary to place DASS into voluntary administration, and said that the Group needed to manage those risks by reducing the balance of the intercompany loans as much as possible by the end of FY2021.

February 2021

65 In mid-February 2021, McGrathNicol distributed to Messrs Ryan, Anderson and Hill, among others, a further version of the draft Project Fork contingency planning report dated 16 February 2021.

66 It included a new section summarising the key risks and recommendations relating to EPO in the event that the DASS claims were pursued against EPO as the key operating, employing and asset holding entity.

March 2021

67 Mr Ryan was appointed a director of DASS on 30 March 2021.

68 A day later, McGrathNicol provided a further draft of its Project Fork report to Mr Ryan and others for their review and comment.

69 It incorporated advice received from MinterEllison in February 2021 and included a “Key Takeaways” section. This section identified that the “the most significant risks to [the Group] relate to (i) client T&Cs [terms and conditions] and invoices due to [EPO] being the contracting counterparty with clients, and (ii) net related party receivables in DASS of $11.7m which represent liabilities for the rest of the Group.”

70 Around that time, Mr Ryan deposed that he instructed his finance team to look into options to reduce DASS’s intercompany balances in accordance with McGrathNicol’s recommendation.

May/June 2021

71 In late May and early June 2021, as Mr Ryan deposed, “the finance team, led by Mr Hill with assistance from Mr [Mugu] Selvaratnam [the Group Financial Controller] and Ms [Linh] Vo [Financial Accountant], started the process of reducing the balances of the intercompany receivables involving DASS”.

72 On 31 May 2021, Mr Ryan deposed that he received letters of determination advising that the relevant insurers would provide insurance coverage to the Group and DASS as follows:

(a) Defence costs for the ASIC proceeding would be covered, with a limit of liability of $20,000,000, and a deductible of $250,000 (insurance did not cover against fines or penalties).

(b) Some of the then existing AFCA claims would be covered. The covered claims were aggregated with the defence costs for the ASIC proceeding. Accordingly, there was a limit of liability of $20,000,000 and a deductible of $250,000.

73 Mr Ryan deposed that he “thereafter proceeded on the basis that DASS was insured against both defence costs and any settlements in relation to the eligible AFCA complaints, with the exception of those settlements resulting from excessive fees being charged”.

74 Mr Ryan further deposed that “[f]rom the outset, the Group … funded the legal costs incurred on behalf of DASS and sought to settle any complaints in respect of which AFCA issued a preliminary determination in favour of the claimant, with the Group also funding the compensation paid to the claimant. These amounts were paid by EPO and recorded in the intercompany receivable between DASS and EPO (as a reduction in the balance in favour of DASS)”.

75 Following the insurance determination, any reimbursement payments made by the insurer were received by EPO and recorded in the intercompany receivable between DASS and EPO.

76 To the extent that there were no reimbursements, or the amount of the reimbursement was less than the amount expended in respect of an AFCA claim, the Group bore those costs.

77 As Mr Ryan further deposed, “[t]he Group subsequently adopted a corresponding approach with respect to other proceedings issued against DASS, including with respect to all legal and associated costs of the proceedings, including the ASIC Proceeding”.

78 In relation to the ASIC proceeding, Mr Ryan deposed as follows:

… The Federal Court had set a date for a mediation of 28 June 2021. In the lead up to the mediation, I had several discussions with Mr Anderson in which we discussed the commercial terms on which DASS might consider settling the ASIC Proceeding, and the extent to which EP1 would support the payment of any agreed penalty. In our discussions, Mr Anderson said that he considered it to be in EP1’s and DASS’ interests to achieve an agreed outcome in the ASIC Proceeding and that he thought ASIC might agree to a settlement by which DASS admitted a limited number of contraventions and agreed to pay a penalty and legal costs of up to $10 million. Mr Anderson said that EP1 would need to support DASS up to this amount. Mr Anderson asked me to review the Group’s cash position and to report back to him whether the Group had sufficient cash to pay a penalty of up to $10 million.

79 Mr Ryan attended an EP1 Board meeting held on 24 June 2021. He provided the Board with an update on EP1’s financial position (including as to EP1’s cash position) if the settlement of the ASIC proceeding involved the payment of $10 million. As the minutes record, he explained that, in relation to the ASIC Proceeding:

… management had considered the Group’s ability to pay a penalty in respect of any admissions in the context of its profitability and cash position. Mr Ryan noted that based on the FY22 Budget and FY23 Forecast, if the company were to provide financial support to DASS up to the proposed Maximum Amount of $10m, the cash buffer over and above the group’s regulatory and bank guarantee facility requirements would decline to $5-10m during October/November 2021, being the seasonal working capital low point following payment of annual staff bonuses and associated tax.

80 At that meeting the Board resolved to provide DASS whatever financial support in a form to be agreed considered reasonably necessary to ensure that DASS would have the financial capacity to pay the ASIC penalty and costs and remain able to pay its debts. The Board’s resolution was in these terms:

EP1 will provide to DASS whatever financial support (in such form as the Directors and the DASS directors agree) that the DASS directors consider reasonably necessary to ensure that DASS will have the financial capacity to pay the Maximum Amount and remain, after the payment, able to pay its debts as and when they become due and payable and in compliance with the financial conditions of its Australian financial services licence.

81 On 30 June 2021, the EP1 Board “confirm[ed] the operation and efficacy” of that resolution and notified the DASS Board accordingly.

82 By 30 June 2021, the finance team had reduced the balances of all of the intercompany receivables involving DASS to zero (or close to it), other than the intercompany receivable between DASS and EPO.

July 2021

83 On 8 July 2021, ASIC and DASS signed a heads of agreement to settle the ASIC proceeding in which it was agreed, among other things, that DASS would pay a pecuniary penalty of $7.2 million to the Commonwealth and ASIC’s costs of the investigation and proceeding agreed at $1 million.

84 At around the same time, Mr Ryan spoke with Mr Anderson. Mr Anderson told him “that he had been considering the total amount of money that the Group would likely have to contribute in order to finally dispose of all claims against DASS in relation to URF, including the potential class actions” and that “he considered that the Group would need to contribute the $8.2 million in respect of the ASIC proceeding, as well as all of the balance of the available insurance and around another $10 million that would be needed to convince the DASS claimants to agree to enter into a holistic remediation scheme, or other structure such as a deed of company arrangement … that resolved all claims against DASS”.

85 Mr Ryan deposed that “[f]rom that point on, I proceeded on the basis that the Group would likely make these sums available to resolve the claims against DASS”.

86 In early July 2021, the finance team began preparing the financial accounts for the Group for FY2021. Mr Ryan deposed that:

Given the settlement of the ASIC Proceeding (which was still subject to Court approval), it was necessary to record a provision of $8.2 million as a liability in the balance sheet of DASS (and therefore also the Group). Under relevant accounting standards, the threshold for recognising a provision was: (i) an entity had a present obligation (legal or constructive) as a result of a past event, (ii) it was probable that an outflow of resources would be required to settle the obligation, and (iii) a reliable estimate could be made of the amount of the obligation. The finance team also engaged in substantial and detailed work to seek to calculate the appropriate amount to be recorded as a provision in respect of the AFCA claims against DASS. Given that by this time AFCA was calculating some (but not all) of the amounts of compensation to be paid to claimants on a “whole of portfolio” approach, the calculations were complicated but resulted in a provision of approximately $7.8 million.

The fact that insurance was responding to the claims meant that there was also an insurance receivable that could be recorded as an asset in the balance sheet of DASS (and therefore also the Group). However, under relevant accounting standards, there was a higher threshold of likelihood to be applied before an insurance receivable asset could be recognised — receipt of the insurance needed to be “virtually certain” — and this could only be met where DASS had received written confirmation from the Insurers that insurance would respond to the relevant claim.

Given that it took time for the Insurers to provide this confirmation, these requirements resulted in a mismatch in timing between recognition of the provision liabililty [sic] and the insurance receivable asset, in which the provision was much larger than the insurance receivable, even though it was likely that insurance would ultimately respond to most, if not all, of the AFCA claims.

Late July/August 2021

87 On 23 July 2021 Mr Selvaratnam emailed to Mr Hill a draft memorandum entitled “E&P Financial Group Limited Management Fees Methodology – AFSL entities”. Mr Selvaratnam stated that he had “updated the memo to reflect DASS’ loss making position due to the regulatory proceedings and related costs, as such management have decided to waive the fees in FY21 and unwind the 1H21 management fees as well”. Relevantly, the draft memorandum recorded the following:

The purpose of this memorandum is to provide guidance on the calculation of management fees to [EPO] from the five AFSL entities [which included DASS] that have been in the E&P Financial group (“E&P”) for financial year.

For ease of accounting and administration purposes, a number of expenses indirectly relating to [DASS] are booked directly to [EPO] at source. However, the revenues associated with each entity are recognised in the company where the revenue is sourced.

…

Therefore, in order to rectify this mismatch between revenue and expense in the P&L of [DASS] … it is necessary to charge [it] a management fee to more accurately portray the true position of the entity’s financial position/performance in the financial statements.

It should also be noted that the management fee is calculated and charged every six months at the end of each reporting period December and June … a management fee is only charged to an extent that would not jeopardise the ability … of [DASS] to pass [its] AFSL/ASX financial requirements as per [its] AFS license[].

88 The calculation of the management fee for DASS was detailed in the draft memorandum as follows:

1. DASS: The significant direct expenses booked at source which relate to DASS include AAM Equities/Contract note expenses, IRESS charges, investment advisory and professional fees and client rebates. In general terms, DASS is the entity within the group which provides the financial and investment advisory services to clients within the group, and the direct costs above are minimal compared to the overall costs required for the entity to operate if it were a standalone entity.

Therefore, in order to estimate the remaining, indirect and overhead costs of business in relation to DASS (which are processed and booked in [EPO]), a fee equivalent to 90% of the gross revenue booked by DASS is charged by [EPO] to DASS as a management fee. However, during the current period DASS’s direct expenses increased significantly due to regulatory proceedings and related costs (ASIC penalty $7.2M, ASIC costs $1.0M, AFCA Provision $2.5M, Legal costs $3.1M). As a result, DASS is currently in a loss position and management has decided to waive the management fee for FY21.

(Emphasis added.)

89 Consistently with the terms of the draft memorandum, Mr Ryan deposed that by late July or August 2021, “the finance team had done sufficient work to calculate that DASS would need to recognise provisions as liabilities in respect of the ASIC proceeding and AFCA claims which ultimately totalled $16 million whilst an insurance receivable asset of only approximately $5.5 million could be recognised in the FY2021 accounts. The recognition of such large liabilities in DASS’s balance sheet raised the prospect that DASS would not be able to maintain a net positive asset position if EPO charged the Management Fee for FY2021, in accordance with its usual practice”.

90 Mr Ryan continued:

At around this time, I had a discussion with Mr Hill in which one of us (I do not recall who) said that the only available lever that we had to ensure that DASS remained in a net positive asset position was for EPO to waive the Management Fee for FY2021, so that the intercompany receivable would not be reduced by the amount of the Management Fee, with the result that the balance of the intercompany receivable would remain high enough to offset the provisions and other liabilities of DASS. I could not think of any other alternative to this course so I decided that the Group would follow this course and instructed Mr Hill to waive the Management Fee and prepare the DASS accounts accordingly.

I recognised that the decision that EPO would waive the Management Fee would have the opposite effect of what Mr Anderson had asked me to do in around March 2021, namely to seek to reduce the balance of the intercompany receivable in DASS’s favour as much as possible. However, I considered that the Group had no other alternative if it wanted to keep DASS in a positive net asset position in light of the provisions that had to be recognised. The need to recognise the provisions also foreclosed for the time being any other possible available means of reducing the balance of the intercompany receivable, such as having DASS declare dividends or agree to forgive the intercompany receivable.

91 Throughout August 2021, Mr Ryan and the finance team were busy finalising the Group’s consolidated financial statements, which were authorised by the directors of EP1 for issue on 24 August 2021.

92 Mr Selvaratnam and Mr Hill worked with the Group’s auditor, Deloitte, to respond to all requests required to satisfy the Group’s audit requirements. In relation to the management fees charged by EPO to all AFSL entities in the Group, there had been a practice across previous financial years of preparing a memorandum to address the fee which would be charged to each entity. Following the decision to waive the management fee for FY2021, Deloitte requested that the memorandum be updated to reflect the reasons for that decision.

93 On 10 August 2021, Mr Selvaratnam emailed to Ms Joanna Rolland at Deloitte (copying Mr Hill) an updated memorandum (which was relevantly in the same terms as the previous draft sent internally on 23 July 2024 to Mr Hill, in so far as it related to DASS).

94 On 18 August 2021, Piper Alderman wrote to DASS and EP1 stating that it had been instructed to prepare a class action claim against those companies and their directors and/or officers relating to advice provided to clients of DASS to invest in the URF and related products.

95 On 26 August 2021, Mr Ryan received an email from Mr Selvaratnam attaching a first draft of the FY2021 DASS financial statements. In his email, Mr Selvaratnam noted that there was a “nil management fee expense in FY21 (FY20 $16M) due to the increase in expenses relating to the ASIC & AFCA provision”. The draft financial statements recorded “Consulting and professional fees” as $0, and a related party receivable of approximately $19 million. Mr Ryan provided comments on this draft statement.

96 Mr Ryan deposed that the increasing provisions arising from the settlement of the ASIC proceeding and the adoption of the “whole of portfolio” approach by AFCA to assess loss of claimants, the proportion of insurance moneys being consumed by the various claims against DASS and the renewed threat of an imminent class action prompted him and Mr Anderson to devote more time to advancing Project Fork from late August and early September 2021.

97 On 31 August 2021, Mr Anderson told Mr Ryan that he intended to call Mr Smith to engage McGrathNicol to prepare a report on the solvency of DASS and the triggers that might lead to DASS becoming insolvent.

98 Later that day, Mr Ryan was copied to an email that Mr Anderson sent to Mr Smith in which he requested Mr Smith to prepare a report on the solvency of DASS.

September 2021

99 On 1 September 2021, a Project Fork team workshop was held over Zoom. The meeting was attended by Messrs Ryan, Anderson, Falkiner, Araullo and Meaney, as well as Messrs Smith and Wharton of McGrathNicol. At the meeting, so Mr Ryan deposed, they “discussed and sought to decide on what external advice and services would be required to progress through the next stages of contingency planning”.

100 By letter dated 1 September 2021 addressed to Mr Anderson, McGrathNicol confirmed the terms of its additional or new scope of work in these terms:

Background and scope

The scope of our work will be to:

1. prepare a report for Directors (DASS and EP1) (the “Report”) that addresses:

– solvency considerations of DASS and key decision points;

– DASS potential financial exposures (contingent or actual) including quantification, crystallisation, mitigations and triggers;

– explanation of the Safe Harbour regime;

– options and other considerations for Directors; and

2. prepare, project manage and iterate a contingency implementation plan through to project completion in response to the potential exposures in DASS (the “Contingency Plan”).

Our work will require us to liaise regularly and work collaboratively with EP1 management including Peter Anderson (CEO), Paul Ryan (CFO) and EP1’s legal advisors Minter Ellison.

Reporting

At the completion of scope item 1, EP1 will receive the Report as outlined above for review by EP1 and DASS’s Board and management. A draft of the Report will be forwarded to you for review and comment prior to being finalised. In respect of scope item 2, we will prepare the Contingency Plan, which we will then project manage and iterate over implementation of the plan.

101 Mr Ryan signed this engagement letter on behalf of the Group on 2 September 2021.

102 On the same day, Mr Ryan received an email from Mr Selvaratnam attaching a further draft of the DASS financial statements, together with a proposed note for the accounts to explain the management fee waiver.

103 The proposed note, with which Mr Ryan agreed, read: “Consulting and professional fees charged by the parent entity were waived during the year due to the significant increase in direct costs incurred by the Company relating to regulatory proceedings and associated costs”.

104 Mr Ryan and Mr Meaney signed the DASS Financial Statements for the year ended 30 June 2021 on 7 September 2021. They included this:

105 The financial statements were lodged with ASIC on 30 September 2021.

106 On 14 September 2021, McGrathNicol provided a draft Project Fork project plan spreadsheet (Project Fork spreadsheet) in accordance with its 2 September 2021 engagement letter. In the Project Fork spreadsheet, McGrathNicol sought to map out all tasks required to be completed in advance of placing DASS into voluntary administration. The Project Fork spreadsheet referred, at the top of the document to “Date of VA: 12/1/2021 [sic] Estimated, update timing as required.” (In an updated version of this spreadsheet prepared on 27 September 2021, the estimated date of voluntary administration was corrected to 12/1/2022.)

107 Mr Ryan deposed that a copy of the Project Fork spreadsheet was saved to a Dropbox folder to which he, Messrs Falkiner, Hill, Selvaratnam and Mr Robert Darwell (Director – Corporate Finance & Strategy) had access, along with Messrs Smith, Wharton and Mr Jeremy Cohen from McGrathNicol, so that it could be updated from time to time as tasks were progressed. While all had editing privileges, the practice was that McGrathNicol would update the status of tasks from time to time.

Conversation between Mr Ryan and Mr Anderson

108 In July, August or early September 2021 — it was not clear exactly when — discussions occurred between Mr Ryan and Mr Anderson over the telephone in relation to a question that is central to this case.

109 What was in fact said in the course of that conversation, and in particular whether they discussed that the receivable in favour of DASS would be extinguished after the ASIC proceeding and AFCA provisions were paid, was the subject of controversy at trial.

110 I set out the evidence given by Mr Ryan and Mr Anderson about their conversation below.

111 In his affidavit, Mr Ryan deposed as follows:

… I had a conversation with Mr Anderson in which I told him that due to the large provisions to be recognised in DASS’s accounts in respect of the ASIC Proceeding and the AFCA claims and the mismatch in timing with the insurance receivable asset, it was necessary for EPO to waive the Management Fee that it would ordinarily charge to DASS for FY2021 so as to keep the intercompany receivable high enough to leave DASS net asset positive, as required for it to retain its AFSL. I told him that the result was that the balance of the intercompany receivable in favour of DASS would increase, not be reduced. Mr Anderson responded by saying that he understood and agreed that this was the appropriate course but that I needed to document the arrangement between DASS and EPO in the coming weeks because the large majority of DASS liabilities were provisions and might not ever become due and payable, DASS had insurance that was responding to the AFCA claims and the Group was not agreeing to an unconditional transfer of resources to DASS by agreeing to waive the Management Fee. I responded that I understood and would attend to documenting the arrangement between DASS and EPO with respect to the intercompany receivable.

In around late August or early September 2021, during at least one of the weekly finance team meetings, I mentioned to Mr Hill and Mr Selvaratnam that the arrangements between DASS and EPO with respect to the intercompany receivable needed to be documented to reflect the fact that the Group was not agreeing to an unconditional transfer of resources to DASS by agreeing to waive the Management Fee and that it was on my to do list.

From around early September 2021, approximately every two or three weeks, Mr Anderson asked me “How are you going documenting the intercompany loan?”, to which I responded that I had not gotten to it yet but that I would get to it.

It took me longer than I had hoped to commence the process of documenting the intercompany receivable between DASS and EPO. This was because I was busy with a wide range of tasks, including finalising the Group and then subsidiary accounts for FY2021, as well as performing my other day-to-day functions and undertaking numerous other tasks with respect to Project Fork …

(Emphasis added.)

112 During his cross-examination, Mr Ryan gave the following evidence about his conversation with Mr Anderson, as follows:

Did you understand Mr Anderson was asking you to go away and draft an agreement that dealt with anything other than the 11.6 million waiver of the management fee?---Yes.

You understood he was asking you to do more than that?---Yes.

What did you understand he was asking you to go away and do?---Document the understanding that the ASIC provisions and the AFCA claims, which were the substantial reason for the intercompany receivable being as high as it was, in effect, needed to be documented based on the understanding we had. So it was that full amount.

And did you discuss that the thing to be documented was to impose a condition on the otherwise recoverability of the receivable?---It was implicit in the discussion with Mr Anderson that the receivable balance was left that high because of those provisions. If those provisions never fell due and payable or insurance responded, the effect was that the receivable should drop away because the group would not otherwise agree to it - - -

And so - - -?--- - - - being that high.

I’m sorry. Did you understand Mr Anderson to be discussing with you that the receivable was only to be called upon to pay if necessary an ASIC penalty [and] the AFCA claims?---With the exception of the BAU transactions, yes.

Do you accept that that was a substantial condition on the recoverability of the receivable?---Yes, just as it would have been a substantial imposition on the group to leave the receivable that high.

113 In his affidavit, Mr Anderson deposed as to his recollection of the conversation with Mr Ryan, including as follows:

The approach that AFCA had adopted to the DASS client claims and the commencement of the ASIC proceeding meant that the Group had to give consideration to the amount of any provisions to include as liabilities in the Group’s accounts for FY2021. At the same time, the Group also had to determine the amount of corresponding insurance receivable assets that could be included in the Group’s accounts for FY2021 in respect of the AFCA determinations. The Group’s insurers had told it that any penalty paid in the ASIC proceeding would not be covered by insurance. Mr Ryan and his finance team were primarily responsible for these tasks and they worked closely with Deloitte to develop an appropriate methodology for the AFCA claims.

At some point in early September 2021, at around the time that the DASS financial accounts were signed-off, Mr Ryan told me that because of the difference between the provisions that DASS had to recognise as liabilities in its financial accounts for FY2021 in respect of the ASIC and AFCA claims and the (lower) corresponding insurance recoverable assets that DASS could recognise, EPO had waived the management fee that it would ordinarily have charged DASS for FY2021 so as to ensure that there was a sufficiently high balance of the intercompany receivable between DASS and EPO in DASS’s favour for DASS to maintain positive net assets, as required for its AFSL. Mr Ryan told me that it was his strong expectation that DASS’s insurance position would ultimately be much better than DASS could recognise in its accounts because it was expected that all of the URF-related AFCA claims would end up being covered by insurance, but the relevant accounting standards imposed a recognition test of virtual certainty that DASS could not meet at that time.

When Mr Ryan told me this, I said to him that he needed to go and document the arrangement by which the intercompany receivable balance was increasing so as to make it clear that this was a bridging mechanism by which the Group was providing financial support to DASS. I said that we both knew that the AFCA claims were to be paid by insurance and that there was no scenario in which the Group would agree to put cash into DASS to cover those claims just because of the timing difference in the accounting standards. I said that I did not want a transfer of wealth from the Group to DASS in circumstances where DASS was loss-making, being propped up by the Group, and at risk of voluntary administration, because this would be at the expense of the EP1 shareholders, which would not be fair on them. Mr Ryan responded that he understood and would take steps to arrange the documentation.

I cannot now recall a specific conversation on a specific date with Mr Ryan in which I explained the following further matters to him, but in the course of our day-to-day interactions, I conveyed to him that:

(a) I considered that the Group had previously been propping up DASS because the management fee that EPO could charge to DASS had been capped at 90% of DASS’s revenue, despite the fact that the costs borne by the Group in responding to the various claims against DASS had been much larger than this.

(b) The need that had just arisen to maintain the intercompany receivable at the high level of approximately $19 million, so as to cover the provisions in DASS’s accounts for both the ASIC proceeding and the AFCA claims, had greatly exacerbated this problem.

(c) As far as I was concerned, there was no scenario in which I would allow DASS’s creditors to end up with a windfall gain at the expense of EP1’s shareholders when DASS had been permitted by the Group to hold these assets only so that DASS could retain its AFSL while the Group sought to deal with the claims against DASS in the best way that it could for the benefit of the DASS clients.

(d) I was not prepared to permit EP1’s shareholders to wear such a result, particularly in circumstances where many of them had already suffered very substantial losses as a result of participating in the public listing of EP1 at a purchase price of approximately $2.50 and then seen the share price fall to well below $1, primarily due to issues related to URF.

114 Mr Anderson gave the following evidence about the conversation in the course of his cross-examination:

…Mr Anderson. I was very clear. I want you to tell his Honour what, if any, recollection you have on what you told Mr Ryan to go and document; do you have any recollection of that? --- It would not have been specific; it would have been conceptual.

Yes. Do you recall what you told him, or do you assume what you told him?---No. I definitely spoke to ASIC and – and the AFCA claims as are in here, as reflected in this paragraph.

Yes. And please only answer if you recall, but you recall telling Mr Ryan something about the ASIC claims and the AFCA claims; is that correct?---The ASIC – the ASIC penalties and – and the AFCA claims? I – yes.

…

Yes. And what did you tell Mr Ryan to go into the document, as best you can recall?---So, I wanted the nature of the support that was being provided to be documented. And how that occurred was – I left for Paul to go away and work out – my expectation was with the lawyers. But they were the two key pieces that I was focused on the whole time.

…

Yes. And when did that change occur? At what period of time?---I’m saying at the point when Mr Ryan came and told me that because of their accounting treatment in September ’21 when he came and told me that the management fee was going to be waived, which was the first I had heard of it, and wasn’t expected, I believe it changed then, and I’ve effectively said to him, “Well, you’re going to do that, and increase that loan balance because of the waiver of the management fee, then it needs to be conditional.” So that’s when I think, effectively, and admittedly I said, “You need to go away and document it, and articulate what those conditions are”, but – that’s my answer.

Yes. So your evidence to his Honour is that the conditions were imposed in and around the time that you and Mr Ryan spoke in September 2021?---When the management fee was waived, yes.

Yes?---That was the trigger for it, yes.

Yes, that was the trigger for the conditions coming into existence on your evidence. Is that correct?---Yes.

And the conditions were spoken of between you and Mr Ryan. Is that correct?---Conceptually, yes. As in, the conceptual conditions, yes, between me and Mr Ryan.

…

You accept and would agree to his Honour that the imposition of any conditions of this type was to the detriment of DASS, and the benefit of EP Ops. That’s correct, isn’t it?---I don’t agree with that. So – so DASS without the support of – so the group has had to provide the support in terms of both the 8-plus million dollars in relation to ASIC, and also in relation to the AFCA claims, and, Mr Solomon, we’ve ended up in insolvency. We were trying not to go get there, and there were a whole lot of moving parts at the time that haven’t come in today, including other parts of the group, but DASS actually had the benefit of that support from the group. That was definitely an asset for DASS. It gave it an opportunity to work through things that didn’t actually work out, but to suggest that they’re not the beneficiary is completely wrong. This was the group providing financial support – conditional financial support to DASS which was chronically loss-making, was – was experiencing all sorts of difficulties that you’re aware of, and this support was giving DASS the potential to move past that. It didn’t happen, but that’s what the support provided.

Do you accept that the imposition of new conditions in respect of the receivable was to the advantage of E&P Ops?---Well, no, because the conditions were only required because the receivable changed in nature. The receivable wasn’t – this wasn’t – we had a discussion about it. [I] was told about the receivable. I was told that the management fee was waived without any prior warning. We had – on behalf of the group, the management – the careful management of that loan was required for the purpose that it – we didn’t – it couldn’t get out of hand – the broader group couldn’t pay out a silly number in relation to the loan, and so the support that was provided was always intended to be conditional on behalf of ASIC. It was – it only arose at the last minute on behalf of the AFCA claims, which, again, were 100 per cent backed by insurance. So, that’s why it became conditional, and the nature of the support changed. The support historically was just around the operating performance of the business. The revenue and the expenses. That was all the support was historically; that was all it was reflected. It transitioned in ’21 with the need to reflect these – I’ll call them extraordinary items. They were clearly one-off, significant, unusual items that affected the business. They were way outside the ordinary course of business. People like Mr Ryan, who were trying very hard to deal with it were frankly – it was very challenging, and it’s reflected in the set of circumstances. But I don’t accept – the nature of the loan definitely changed; the waiver of the management fee changed; the conditions were always there in relation to the ASIC piece; and it’s unfortunate the way this has played out …

October 2021

115 On 14 October 2021, Maurice Blackburn filed and served proceedings against DASS in the Federal Court on behalf of their clients, who alleged that DASS breached its retainer or duties, and provisions of the Act, and sought compensation for loss and damage in the amount of $900,000.

116 On 15 October 2021, ASIC and DASS filed a statement of agreed facts, joint submissions and a proposed minute of order to give effect to the settlement in the ASIC proceeding. A penalty hearing was listed before the Federal Court for 25 November 2021. Mr Ryan deposed that if the court approved the penalty following that hearing, his intention was that EPO would make the penalty payment on behalf of DASS, which would thereby reduce the intercompany receivable in favour of DASS.

117 On 25 October 2021, Mr Cohen of McGrathNicol sent an email to Messrs Ryan, Anderson, Meaney, Araullo and Falkiner attaching a working draft of the Project Fork contingency planning document.

118 Mr Cohen’s covering email noted that the advice would continue to be updated as additional legal advice was received and the contingency plan was refined.

119 The report included various references to the ways in which managing DASS client interests as best as possible could be achieved through the planning of a voluntary administration and subsequent DOCA process.

120 Separately, on the same day, McGrathNicol issued a presentation titled “Project Fork Solvency Considerations”.

121 Among other things, it concluded that, from both a cash flow and balance sheet perspective, DASS was solvent, but that:

Given that various triggers could increase the risk of DASS becoming insolvent, Directors should plan for the appointment of a Voluntary Administrator if the financial position of DASS deteriorates. In undertaking this planning, key considerations include:

• A pre-emptive VA appointment may be advisable if DASS becomes “likely” to become insolvent as a result of various trigger events occurring;

• It may be beneficial for various events to have occurred prior to any such VA appointment, to improve certainty and reduce the extent of creditor claims, including:

- Court approval of the ASIC settlement;

- URF sale (potentially reducing quantum of claims);

- NEW/USF merger announcement (potentially reducing quantum of claims); and

- Progression (or discontinuation) of the Class Action statement of claim.

122 Also on 25 October 2021, somebody within the Project Fork team saved an updated version of the Project Fork spreadsheet. The new version of the spreadsheet now included the following tasks:

C2.1 Produce a memo and updated analysis to update the appropriateness of the calculation methodology for DASS’ management fee. Ensure that proportion of DASS revenue charged include external costs such as Adviser fees (legal and McN) and management time where appropriate. Obtain approval from DASS and E&P Directors that methodology is fair.

C2.2 Finalise loan agreement between E&PO and DASS with condition that loan can only be called where debs [sic] are due and payable. Minters to review agreement.

123 In relation to this new version of the Project Fork spreadsheet, Mr Ryan deposed as follows:

Although the version of the Project Fork Plan Spreadsheet was first saved on 25 October 2021, from my review of that version, it appears likely that further edits were made to the document after that date. This is because Task C2.2 is identified as: (i) having an ‘estimated task start date’ of 9 November 2021; and (ii) being 50% complete (notwithstanding that, as at 25 October 2021, Minter Ellison had not yet been instructed to prepare any loan agreement between EPO and DASS).

124 On 27 October 2021, Mr Ryan attended the meeting of the EP1 Board. Mr Anderson presented to the Board in relation to the status of Project Fork. The minutes of the Board meeting relevantly record:

Referring to the McGrathNicol report, it was noted that the net asset position of DASS, in conjunction with confirmed insurance cover and head company support (in relation to the ASIC liability) mean that DASS is solvent. It was further noted that, notwithstanding the existence of a number of potential additional liabilities (primarily contingent liabilities), the availability of insurance, the timing of payments and existence of cash on hand mean there is currently a significant solvency buffer.

125 As part of the Project Fork presentation, a report entitled “DASS quarantine option” was also presented to the Board. The quarantine option report reiterated the advice of McGrathNicol that DASS was currently solvent. In addressing the option to place DASS into voluntary administration, it noted that this would facilitate a client remediation scheme via a DOCA. The quarantine option report also stated that EP1 would accept the outcome of the ASIC process and EP1 would voluntarily contribute the full penalty and costs amount in the ASIC proceeding into a DOCA. More specifically, the quarantine option report addressed the objectives of a DOCA process for DASS as follows:

(i) balance of insurance proceeds (estimated $15 million), ASIC liability ($8.2 million), additional voluntary contributions (say, $10 million) all applied to DOCA

(ii) seek to ensure all claimants treated pari passu subject to insurance mechanism

(iii) Court directions possibly required to stop AFCA claim process and ensure pari passu treatment

126 Mr Ryan deposed that on the basis of the quarantine option report, he “expected that the Group would make available to DASS clients a total amount that was at least as great as the balance of the intercompany receivable in any DOCA proposed by the Group, even if DASS and EPO executed an agreement prior to the voluntary administration that placed limitations on the circumstances in which DASS could call for repayment of the intercompany receivable.”

November 2021

127 On 1 November 2021, a representative proceeding was commenced by Piper Alderman in the Federal Court against DASS, EP1 and Mr Alan Dixon on behalf of DASS clients who had invested in the URF and related products. It was served on 3 November 2021.

128 On 5 November 2021, Mr Ryan asked Mr Hill to prepare an analysis of the intercompany loan balance as part of a briefing pack that would be provided to McGrathNicol and MinterEllison for the purpose of documenting the intercompany receivable.

129 On 8 November 2021 (at 10.27am), Mr Hill sent an email to Mr Ryan attaching a spreadsheet analysing the intercompany balance between DASS and EPO, stating:

Just further to our chat on Friday and prior to our Fork call this afternoon, I have prepared an analysis of the intercompany balance as at 30 September 2021 (the October numbers will be finalised soon) in relation to the “offsetting” provision amounts against the intercompany balance.

Of the $20.3m intercompany balance, there are offsetting provision amounts totalling $19.1m as at 30 September 2021. I would assume that this provisions balance will be larger again in October 2021 given the additional AFCA determinations that have landed.

Note there is also $5.5m of insurance receivable, so I’m not sure how this would be treated in a situation where we are effectively holding an intercompany receivable balance to offset the provisions held.

130 Later on 8 November 2021, at around 1pm, Mr Ryan participated in a conference call with the Project Fork team and McGrathNicol. The invitees for the call were Messrs Falkiner, Hill, Smith and Cohen.