FEDERAL COURT OF AUSTRALIA

Westpac Banking Corporation v Forum Finance Pty Limited (in liq) (Liability) [2024] FCA 1176

File numbers: | NSD 616 of 2021 NSD 642 of 2021 NSD 681 of 2021 |

Judgment of: | CHEESEMAN J |

Date of judgment: | 11 October 2024 |

Catchwords: | EQUITY — audacious fraud perpetrated against four financiers – collective advance by financiers of about $500 million to companies in the consolidated Forum group and to a related company incorporated in New Zealand – advances made pursuant to fictitious and fraudulent equipment leasing finance arrangements – where comprehensive uncontested tracing evidence establishes that tainted proceeds channelled through myriad of corporate entities to wide range of property (including real and personal property) and on extravagant lifestyle – where principal fraudster, Mr Bill Papas, fled the jurisdiction and did not defend the proceedings – whether respondents liable under principles in Black v Freedman – whether respondents liable under first or second limb of Barnes v Addy – whether individual respondents had knowledge (actual or constructive) of the fraudulent scheme – Held: respondents liable, separate hearing on relief |

Legislation: | Evidence Act 1995 (Cth) ss 50, 69, 140(2) Federal Court of Australia Act 1976 (Cth) s 37M Federal Court Rules 2011 (Cth) r 30.21 |

Cases cited: | Agip (Africa) Ltd v Jackson [1990] Ch 265 All Class Insurance Brokers Pty Ltd (in liq) v Chubb Insurance Australia Ltd (No 2) [2021] FCA 782; 154 ACSR 78 Anderson v Canaccord Genuity Financial Ltd [2023] NSWCA 294; 113 NSWLR 151 Arizabaleta v R [2023] NSWCCA 217 Australia Kunqian International Energy Co Pty Ltd v Flash Lighting Company Ltd [2020] VSCA 239 Australian Competition and Consumer Commission v Olex Australia Pty Ltd [2017] FCA 222; ATPR 42–540 Australian Executor Trustee (SA) Ltd v Kerr [2021] NSWCA 5; 151 ACSR 204 Australian Securities and Investments Commission v CFS Private Wealth Pty Ltd (No 2) [2019] FCA 24 Australian Securities and Investments Commission v Westpac Banking Corporation (No 2) [2018] FCA 751; 266 FCR 147 Baden v Société Générale pour Favouriser le Développement du Commerce et de l’Industrie en France SA [1993] 1 WLR 509 Bank of Credit and Commerce International (Overseas) Ltd v Akindele [2001] Ch 437 Banque Commerciale SA. En Liquidation v Akhil Holdings Ltd [1990] HCA 11; 169 CLR 279 Barnes v Addy (1874) LR 9 Ch App 244 Beach Petroleum NL v Johnson [1993] FCA 392; 43 FCR 1 Bentley Smythe Pty Ltd v Anton Fabrications (NSW) Pty Ltd [2011] NSWSC 186; 248 FLR 384 Bilta (UK) Ltd (in liq) v Nazir (No 2) [2015] UKSC 23; [2016] AC 1 Black v S Freedman & Co [1910] HCA 58; 12 CLR 105 Bradshaw v McEwans Pty Ltd (1951) 217 ALR 1 Break Fast Investments Pty Ltd v Rigby Cooke Lawyers [2022] VSCA 118 Briginshaw v Briginshaw [1938] HCA 34; 60 CLR 336 Briginshaw: Communications, Electrical, Electronic, Energy, Information, Postal, Plumbing & Allied Services Union of Australia v Australian Competition and Consumer Commission [2007] FCAFC 132; 162 FCR 466 Cathro (Liquidator) in the matter of Petsamo No 14 Pty Ltd (in liq) v Thomassian [2022] FCA 399 CCL Secure Pty Ltd v Berry [2019] FCAFC 81 Chong v CC Containers Pty Ltd [2015] VSCA 137; 49 VR 402 Consul Development Pty Ltd v DPC Estates Pty Ltd [1975] HCA 8; 132 CLR 373 Coote v Kelly [2013] NSWCA 357 Cubillo v Commonwealth (No 2) [2000] FCA 1084; 103 FCR 1 Dodd v State of Western Australia [2014] WASCA 13; 238 A Crim R 72 Eade v The King [1924] 1924 HCA 9; 34 CLR 154 Edwards v The Queen [1993] HCA 63; 178 CLR 193 ET-China.com International Holdings Ltd v Cheung [2021] NSWCA 24; 388 ALR 128 Fair Work Ombudsmen v Grouped Property Services Pty Ltd [2016] FCA 1034 Farah Constructions Pty Ltd v Say-Dee Pty Ltd [2007] HCA 22; 230 CLR 89 Fistar v Riverwood Legion and Community Club Ltd [2016] NSWCA 81; 91 NSWLR 732 Fox v Percy [2003] HCA 22; 214 CLR 118 Gautam v Health Care Complaints Commission [2021] NSWCA 85 GLJ v Trustees of the Roman Catholic Church for the Diocese of Lismore [2023] HCA 32; 97 ALJR 857 Goodrich Aerospace Pty Ltd v Arsic [2006] NSWCA 187; 66 NSWLR 186 Gore v Australian Securities and Investments Commission [2017] FCAFC 13; 249 FCR 167 Great Investments Ltd v Warner [2016] FCAFC 85; 243 FCR 516 Grimaldi v Chameleon Mining NL (No 2) [2012] FCAFC 6; 200 FCR 296, Helton v Allen [1940] HCA 20; 63 CLR 691 Heperu Pty Ltd v Belle [2009] NSWCA 252; (2009) 76 NSWLR 230 Imobilari Pty Ltd v Opes Prime Stockbroking Ltd (in liq) [2008] FCA 1920; (2008) 252 ALR 41 Jones v Dunkel [1959] HCA 8; 101 CLR 298 Kalls Enterprises Pty Ltd (in liq) v Baloglow [2007] NSWCA 191; 63 ACSR 557 Kuhl v Zurich Financial Services Australia Ltd [2011] HCA 11; 243 CLR 361 Lee v Russell [1961] WAR 103 Lennard’s Carrying Co Ltd v Asiatic Petroleum Co Ltd [1915] AC 705 Luxton v Vines [1952] HCA 19; 85 CLR 352 Maguire v Makaronis [1997] 188 CLR 449; 188 CLR 449 Martin v Norton Rose Fulbright Australia [2021] FCAFC 216; 289 FCR 369 Mayfair Wealth Partners Pty Ltd v Australian Securities and Investments Commission [2022] FCAFC 170; 295 FCR 106 McAdam v Chylos Pty Ltd [2015] FCAFC 161 Milfoil Pty Ltd v Commonwealth Bank of Australia Ltd [2020] VSCA 305 Moriah War Memorial College Association v Augustine Nosti [2020] NSWSC 942 Re Dawson [1966] 2 NSWR 211 Re Day [2017] HCA 2; 91 ALJR 262 Robb Evans v European Bank Limited [2004] NSWCA 82; (2004) 61 NSWLR 75 Sangha v Baxter [2009] NSWCA 78; 52 MVR 492 Saravinovksa v Saravinovski (No 6) [2016] NSWSC 964 Seltsam Pty Ltd v McGuiness [2000] NSWCA 29; 49 NSWLR 262 Shergill v Singh [2023] FCA 1346; 326 IR 428 Simmons v NSW Trustee and Guardian [2014] NSWCA 405; (2014) 17 BPR 33,717 Société d’Avances Commerciales (Société Anonyme Egyptienne) v Merchants’ Marine Insurance Co (The “Palitana”) (1924) 20 Ll L Rep 140 Steinberg v Federal Commissioner of Taxation (1975) 134 CLR 640 Sze Tu v Lowe [2014] NSWCA 462; 89 NSWLR 317 Tesco Supermarkets Ltd v Nattrass [1972] AC 153 Toksoz v Westpac Banking Corporation [2012] NSWCA 199; 289 ALR 577 Tripodi v The Queen (1961) 104 CLR 1 Turner v O’Bryan [2022] NSWCA 23; 107 NSWLR 171 United Group Resources Pty Ltd v Calabro (No 5) [2011] FCA 1408; 198 FCR 514 Wambo Coal Pty Ltd v Ariff [2007] NSWSC 589; 63 ACSR 429 Warner v Hung, in the matter of Bellpac Pty Limited (Receivers and Managers Appointed) (In Liquidation) (No 2) [2011] FCA 1123; 297 ALR 56 Watson v Foxman [1995] NSWCA 497; 49 NSWLR 315 Westpac Banking Corporation v Bell Group Ltd (in liq) (No 3) [2012] WASCA 157; 44 WAR 1 Westpac Banking Corporation v Forum Finance Pty Ltd [2021] FCA 1341 Whisprun Pty Ltd v Dixon [2003] HCA 48; 200 ALR 447 Youyang Pty Ltd v Minter Ellison Morris Fletcher [2003] HCA 15; 212 CLR 484 |

Division: | General Division |

Registry: | New South Wales |

National Practice Area: | Commercial and Corporations |

Sub-area: | Commercial Contracts, Banking, Finance and Insurance |

Number of paragraphs: | 1209 |

Date of last submissions: | 3 March 2023 |

Date of hearing: | 6-17, 21, 23-24 February 2023 |

Counsel for Applicants in NSD 616 of 2021: | Mr J Stoljar SC with Ms V Brigden and Ms C Hamilton-Jewell |

Solicitor for Applicants in NSD 616 of 2021: | MinterEllison |

Counsel for Applicant in NSD 642 of 2021: | Mr S Gray with Mr M Youssef |

Solicitor for Applicant in NSD 642 of 2021: | Ashurst |

Counsel for Applicant in NSD 681 of 2021: | Mr M Izzo SC with Ms E Beechey |

Solicitor for Applicant in NSD 681 of 2021: | Jones Day |

Counsel for the First, Fourth to Thirteenth, Sixteenth, Twenty-Third, Twenty-Fifth, Twenty-Eighth, Thirtieth, Thirty-First, Thirty-Sixth to Thirty-Eighth, Fortieth and Forty-First Respondents in NSD 616 of 2021; the First and Third Respondents in NSD 642 of 2021; and the First, Third to Fourteenth, Twentieth to Twenty-Eighth Respondents in NSD 681 of 2021: | Mr N Kidd SC with Mr R Jameson |

Solicitor for the First, Fourth to Thirteenth, Sixteenth, Twenty-Third, Twenty-Fifth, Twenty-Eighth, Thirtieth, Thirty-First, Thirty-Sixth to Thirty-Eighth, Fortieth and Forty-First Respondents in NSD 616 of 2021; the First and Third Respondents in NSD 642 of 2021; and the First, Third to Fourteenth, Twentieth to Twenty-Eighth Respondents in NSD 681 of 2021: | Allens |

Counsel for the Third and Forty-Fifth Respondents in NSD 616 of 2021: | Mr J Rudd |

Solicitor for the Third and Forty-Fifth Respondents in NSD 616 of 2021: | Aptum Legal |

Counsel for the Twenty-Ninth and Fiftieth Respondents in NSD 616 of 2021: | Mr I Faulkner SC and Mr D Knoll |

Solicitor for the Twenty-Ninth and Fiftieth Respondents in NSD 616 of 2021: | GA Lawyers |

Counsel for the Forty-Sixth Respondent in NSD 616 of 2021: | Mr N Kirby |

Solicitor for the Forty-Sixth Respondent in NSD 616 of 2021: | Francom Legal |

Counsel for the Second Respondent in NSD 616 of 2021; the Second Respondent in NSD 681 of 2021; and the Second Respondent in NSD 642 of 2021 | The Second Respondent did not appear |

Counsel for the Fourteenth, Fifteenth, Seventeenth, Eighteenth, Nineteenth, Twentieth, Twenty-First, Twenty-Second, Twenty-Fourth, Twenty-Sixth, Twenty-Seventh, Thirty-Second, Thirty-Third, Thirty-Fourth, Thirty-Fifth, Thirty-Ninth, Forty-Second, Forty-Third, Forty-Eighth and Forty-Ninth Respondents in NSD 616 of 2021; and the Fifteenth, Sixteenth, Seventeenth, Eighteenth and Nineteenth Respondents in NSD 681 of 2021 | The Respondents did not appear |

Counsel for the Forty-Seventh Respondent in NSD 616 of 2021 | The Respondent did not appear |

Table of Corrections | |

21 May 2025 | In paragraph 1158, “$209,450” has been replaced with “$1,558,906.64”. |

TABLE OF CONTENTS

ORDERS

NSD 616 of 2021 | ||

BETWEEN: | WESTPAC BANKING CORPORATION ABN 33 007 457 141 First Applicant WESTPAC NEW ZEALAND LIMITED (COMPANY REGISTRATION NUMBER COMPANY NUMBER 1763882) Second Applicant | |

AND: | FORUM FINANCE PTY LIMITED (IN LIQUIDATION) (RECEIVERS APPOINTED) ACN 153 301 172 First Respondent BASILE PAPADIMITRIOU Second Respondent VINCENZO FRANK TESORIERO Third Respondent | |

order made by: | CHEESEMAN J |

DATE OF ORDER: | 11 OCTOBER 2024 |

THE COURT ORDERS THAT:

1. The proceedings be listed for a case management hearing at 9.30 am on 28 October 2024.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

NSD 642 of 2021 | ||

BETWEEN: | SOCIETE GENERALE (ABN 71 092 516 286) Applicant | |

AND: | FORUM FINANCE PTY LIMITED (IN LIQUIDATION) (RECEIVERS APPOINTED) ACN 153 301 172 Respondent BASILE PAPADIMITRIOU Second Respondent FORUM GROUP FINANCIAL SERVICES PTY LTD (ACN 623 033 705) (IN LIQUIDATION) Third Respondent | |

order made by: | CHEESEMAN J |

DATE OF ORDER: | 11 OCTOBER 2024 |

THE COURT ORDERS THAT:

1. The proceedings be listed for a case management hearing at 9.30 am on 28 October 2024.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

NSD 681 of 2021 | ||

BETWEEN: | SMBC LEASING AND FINANCE, INC. ARBN 602 309 366 Applicant | |

AND: | FORUM ENVIRO (AUST) PTY LTD (IN LIQUIDATION) ACN 607 484 364 First Respondent BASILE PAPADIMITRIOU Second Respondent FORUM ENVIRO PTY LTD (IN LIQUIDATION) ACN 168 709 840 Third Respondent | |

order made by: | CHEESEMAN J |

DATE OF ORDER: | 11 OCTOBER 2024 |

THE COURT ORDERS THAT:

1. The proceedings be listed for a case management hearing at 9.30 am on 28 October 2024.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

CHEESEMAN J:

A. PREFACE

1 These reasons concern the aftermath of an audacious fraud perpetrated against four financiers who collectively advanced about half a billion dollars to companies in the Forum group in Australia and to a related company in New Zealand. The applicant financiers are Westpac Banking Corporation (WBC) and Westpac New Zealand Limited (WNZL) (together Westpac); SMBC Leasing and Finance, Inc (SMBC); and Societe Generale. There are three separate proceedings before the Court brought by the duped financiers. There is some but far from a complete overlap between the respondents to each of the three proceedings.

2 The financiers advanced funds in respect of what proved to be fictitious and falsified equipment finance contracts. The impugned contractual arrangements with each of the financiers are similar in concept.

3 To presage what follows, the underlying fraud alleged by each financier has been comprehensively established, on evidence that was in the main, not contested. All parties, including the respondents who were alleged to have the requisite knowledge of the fraud, proceeded on the basis that the fraud, and Mr Papas’ involvement in it, was established. The position taken by the respondents in this regard was realistic — it reflected the strength of the evidence establishing the fraud.

4 The principal perpetrator of the fraud was Mr Bill Papas (also known as Basile Papadimitriou). Mr Papas is a respondent in each of the three proceedings. Directly or indirectly, Mr Papas, owned and controlled many of the corporate entities through which the tainted funds cycled. For the purpose of the financiers’ claims, Mr Papas’s knowledge of the fraud is properly attributed to his related entities which, by design or result, benefitted from the fraud.

5 Mr Papas fled the country in June 2021 at about the time the first threads of the fraud were discovered by Westpac. During the currency of these proceedings, a warrant was issued for Mr Papas’ arrest on a charge of contempt. Mr Papas did not defend the proceedings.

6 Shortly after Mr Papas left Australia, his domestic partner, Ms Louisa Agostino, followed him. In her defence, Ms Agostino pleaded that she commenced a relationship with Mr Papas in or around late 2018 to early 2019 and that she resided with Mr Papas from in or around September 2020. Ms Agostino was a Forum employee for the whole of the relevant period. One of the positions that she held was that of Forum’s “Business Solutions Manager”. She was involved in the day-to-day management of the equipment lease finance part of the business, with particular responsibilities in relation to Forum’s waste management offerings. Ms Agostino worked for Forum and held shares in the group holding company. She is a respondent in the Westpac proceeding. The evidence establishes that Ms Agostino was involved in creating fraudulent documents that were deployed as part of the fraud. Neither Mr Papas nor Ms Agostino have returned to the jurisdiction. Despite filing a defence, Ms Agostino did not, in substance, defend the proceedings against her.

7 The remaining individual respondents are joined only to the Westpac proceeding. They are Mr Vincenzo Tesoriero and Mr Moussa (Tony) Bouchahine.

8 Westpac allege, amongst other things, that Mr Tesoriero acted with Mr Papas in devising the fraud or alternatively had the requisite knowledge of the fraud to render him liable to Westpac. Mr Tesoriero defended the proceeding against him. The claims made against those of Mr Tesoriero’s related companies (of which Mr Papas was not a director) depend on Mr Tesoriero’s knowledge being attributed to them. These entities hold a significant amount of the property into which the tainted funds have been traced.

9 Mr Bouchahine is the former Chief Financial Officer (CFO) of the consolidated Forum Group of companies (the Consolidated Group) and of Forum Group Financial Services Pty Ltd (in liquidation) (FGFS). The Forum Group of Companies (in liquidation) (FGOC) was the ultimate holding company in the Consolidated Group. Westpac allege, amongst other things, that Mr Bouchahine, like Mr Tesoriero, had the requisite knowledge of the fraud to render him liable to Westpac. Mr Bouchahine defended the proceeding.

10 As mentioned, neither Mr Tesoriero nor Mr Bouchahine sought to contest the fact of the overarching fraud. Their respective defences were confined to challenging the allegations made against them as to their knowledge of, and involvement in, the fraud. The proceedings have resolved against all other individual respondents.

11 There were four direct recipient companies of the tainted funds (the Primary Recipients), three of which were Forum group companies, incorporated in Australia, and the fourth of which was a company incorporated in New Zealand, owned and controlled by Mr Papas.

12 The three Forum group companies which were Primary Recipients were Forum Finance Pty Limited (in liquidation) (receivers appointed); Forum Enviro Pty Ltd (in liquidation) and Forum Enviro (Aust) Pty Ltd (in liquidation). They were each members of the Consolidated Group. Mr Papas and Mr Tesoriero were the directors of Forum Finance at all relevant times. Mr Papas was the sole director of Forum Enviro and Forum Enviro (Aust) at all relevant times. Mr Papas was a director of FGOC from 2011 until liquidators were appointed in July 2021, following discovery of the fraud. Mr Tesoriero was a director of FGOC from 27 January 2013 until 24 April 2020. Mr Papas was the owner and sole director of the fourth Primary Recipient: Iugis (NZ) Limited (in liquidation) (previously known as Orca Enviro Solutions NZ Limited), a company incorporated in New Zealand (Iugis NZ).

13 The first of the impugned advances in these proceedings was in August 2018 (by SMBC). WBC made its first advance in September 2018. Societe Generale was late to the party, making the first of its three only advances in March 2021. The last advances were made in May and June 2021. The fraud was first discovered in June 2021.

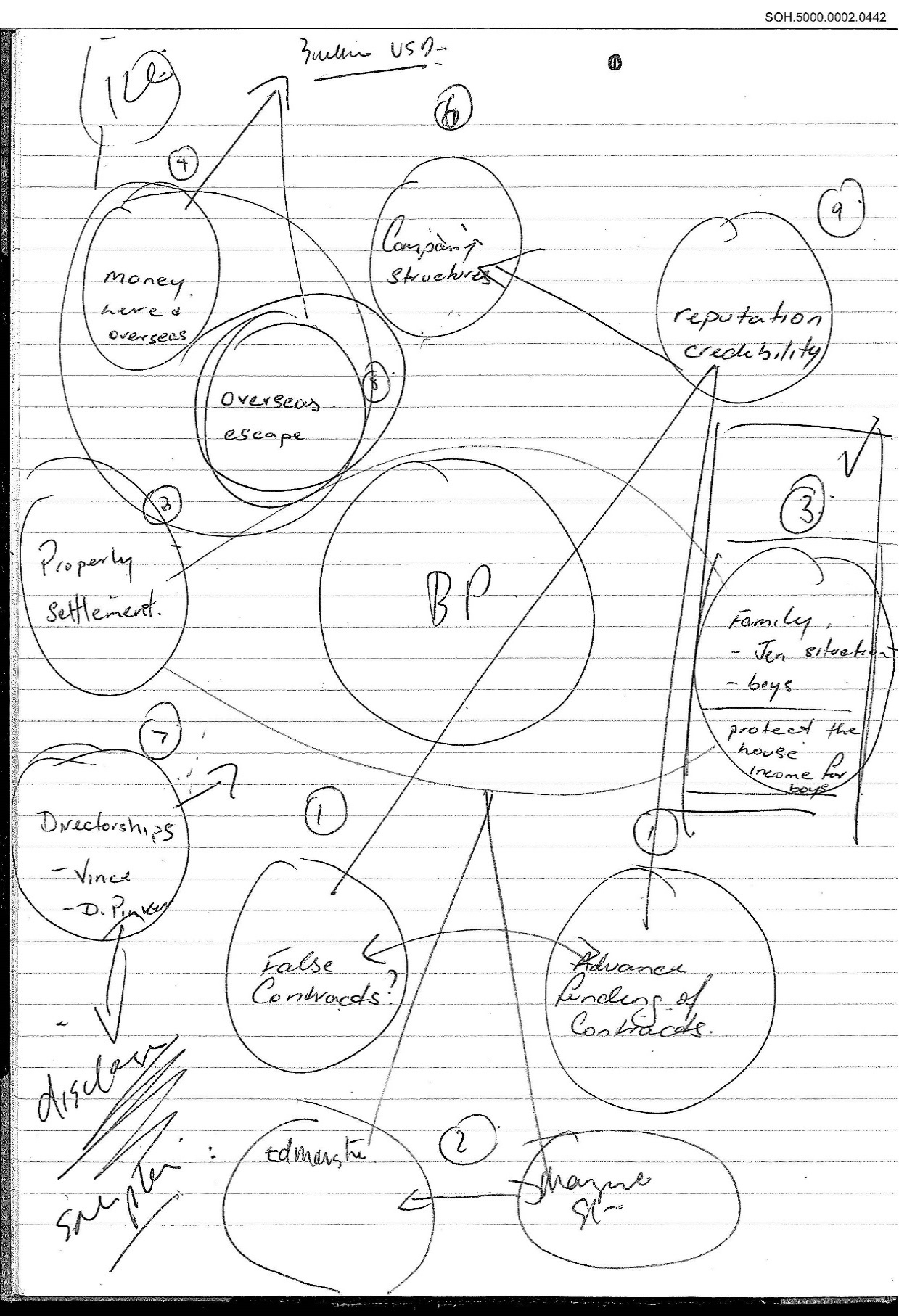

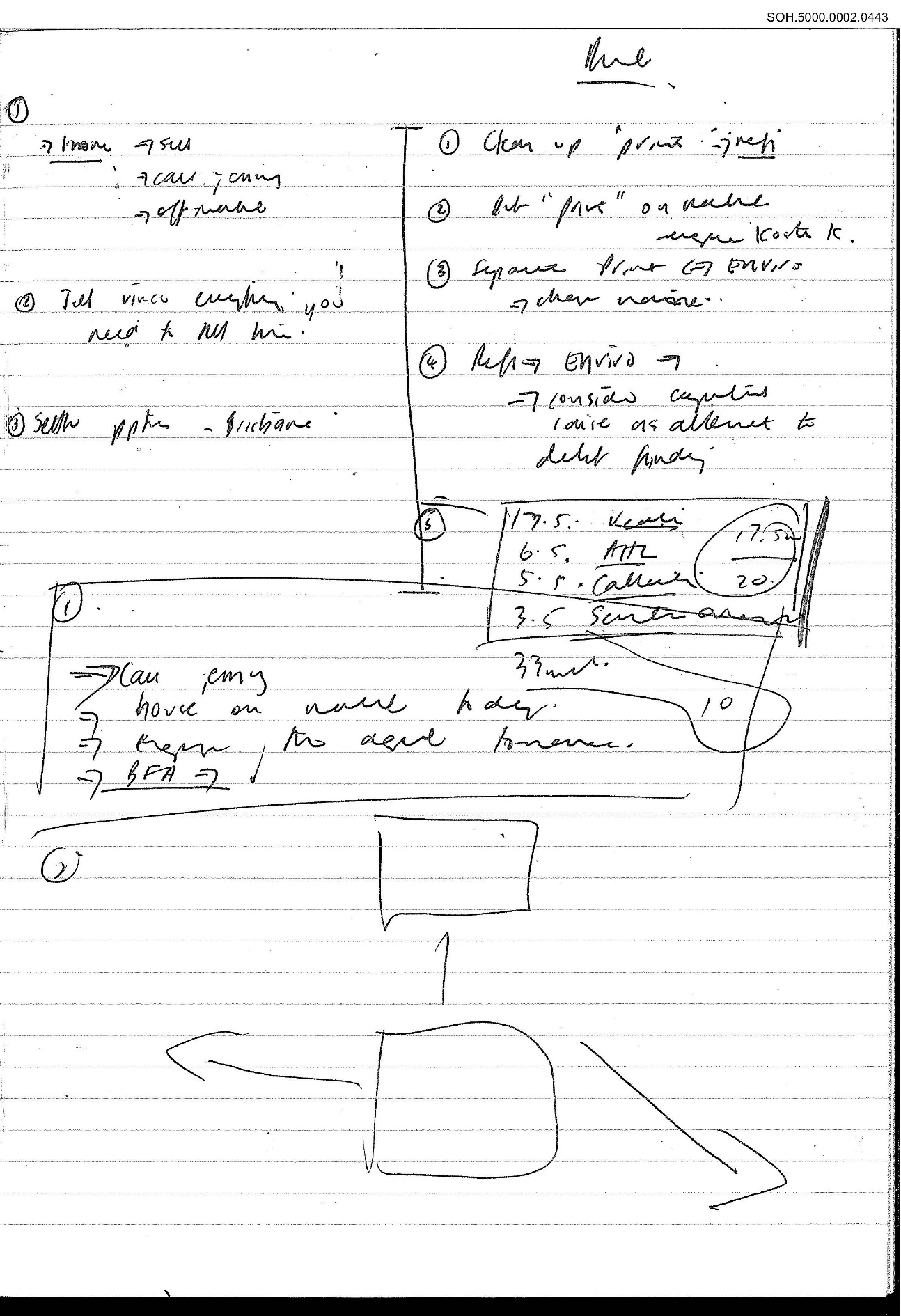

14 The Forum relationships with Westpac and SMBC were cultivated in the period that the Forum relationship with another financier, Maia Financial Pty Ltd, was in its death throes. The Maia arrangements involved similar equipment finance arrangements as those that the financiers believed were in place in these proceedings. Limited documents relating to the Maia arrangements were in evidence in these proceedings. The Maia arrangements appear to have been in place from at least September 2017. By around March 2018, Maia was raising serious concerns with Mr Papas and Mr Bouchahine about the veracity of the arrangements. In around April 2018, Mr Papas made notes in a notebook that was seized during the execution of a search warrant at Mr Papas’ Sydney office, in which he sketched a mud map of the fundamental aspects of the fraudulent scheme, and which also included reference to his “overseas escape”. Included on the second of the two critical pages in which the fraudulent scheme is detailed is a notation “tell Vince everything you need to tell him”.

15 The Maia arrangements were ultimately finalised in around October 2018 on terms which involved Maia being paid out $58,850,000, by, amongst others, Forum entities, without the involvement of the third party customers, who ostensibly had the benefit of the equipment the subject of the equipment finance contracts. Mr Tesoriero guaranteed the obligations of Mr Papas and the Forum Entities in respect of the payout. Forum Enviro took an assignment of, amongst other things, Maia’s obligations in respect of the Maia equipment finance arrangements. The early tranches of funding advanced by WBC and SMBC in respect of the fraudulent equipment finance contracts overlapped chronologically with the staged payout of Maia by Forum. The limited documentary evidence in these proceedings reveals that each of Mr Papas, Mr Tesoriero, Mr Bouchahine and Ms Agostino had, to varying degrees, involvement in the finalisation of the Maia arrangements in the period between March 2018 and October 2018. The events relating to Maia form part of the circumstances in which the knowledge of each of Mr Tesoriero (and through him, the respondent entities associated with him), Mr Bouchahine and Ms Agostino fall to be assessed. The finalisation of the Maia relationship occurred relatively shortly after Forum entities established relationships with WBC and SMBC.

16 Distribution of the tainted funds after receipt by the Primary Recipients usually involved the funds being transferred to FGFS, a private company owned and controlled by Mr Papas and Mr Tesoriero. Notwithstanding its name, FGFS was not part of the Consolidated Group. It was not accounted for as part of the Consolidated Group and its accounts were not, and were not required to be, audited.

17 Upon receipt, FGFS in the main channelled the tainted funds to companies associated with Mr Papas and/or Mr Tesoriero in Australia, New Zealand, the Hellenic Republic (Greece) and the United Kingdom (UK). FGFS also used some of the tainted funds to fund payments due from Forum companies to the financiers under the bogus equipment finance contracts. Making these payments served to cloak and thereby prolong the life of the fraud. FGFS does not appear to have carried on a legitimate business other than to facilitate the dispersal of the tainted funds to the beneficiaries of the fraud. Other than the fraudulent purpose, no commercial rationale was revealed to justify why FGFS, sitting outside the Consolidated Group and not owned by the ultimate group holding company, should receive the large sums that it did.

18 Most of the corporate respondents, both in Australia and elsewhere, are in liquidation, and leave has been granted to proceed against them. The limited number of corporate respondents who appeared at the hearing did so by their liquidators.

19 The liquidators of the key companies involved in the fraud have traced the distribution of the funds derived from the fraud and identified the property acquired and/or serviced using the tainted funds. The tracing evidence is essentially unchallenged.

20 The financiers seek a variety of proprietary and personal relief against the respondents who had requisite knowledge of the fraud whether as recipients or participants and/or who hold property into which the tainted funds have been traced. These reasons concern liability only. The financiers wish to be heard separately on the form of relief if relief is granted.

21 For the reasons which follow, I find that the financiers are entitled to relief against each of the respondents against whom they pressed their primary claims. In so far as the individual respondents to the Westpac Proceedings are concerned, namely Mr Tesoriero, Mr Bouchahine and Ms Agostino, I find that Westpac has established that they are each liable on the basis, amongst other things, that they had knowledge of the fraud. I find that Westpac has established that each of the individual respondents had knowledge at or shortly after the inception of the financing arrangements. In relation to the claims made against the corporate respondents in the Westpac and SMBC Proceedings that rely on the attribution of Mr Tesoriero’s knowledge to Mr Tesoriero’s related entities, I find those respondents liable on the basis of Mr Tesoriero’s knowledge.

22 I will make timetabling orders that afford the parties an opportunity to review the detailed reasons that follow with a view to bringing forward appropriate orders, including in relation to the arrangements for the hearing on relief. Accordingly, the only orders that I will make today, are in respect of a case management hearing on 28 October 2024.

B. INTRODUCTION

23 There are three proceedings before the Court. The applicants in each proceeding are the financiers who allege that they are the victim of a serious fraud perpetrated against them and for which the respondents are liable to them. Across the three proceedings, the fraud is alleged to have reaped in the realm of half a billion dollars collectively from the financiers.

B.1 The key parties

B.1.1 The applicant financiers

24 The applicants are WBC and WNZL (together Westpac); SMBC, a registered foreign company in Australia; and Societe Generale, a registered foreign company in Australia. I will refer to the applicants as the financiers. Where it is necessary to distinguish between the proceedings, I will refer to the individual proceedings by reference to the names of the financiers: NSD616/2021 (the Westpac Proceeding); NSD681/2021 (the SMBC Proceeding), and NSD642/2021 (the Societe Generale Proceeding). Proceedings brought by WNZL against Iugis NZ in the High Court of New Zealand have been stayed as a consequence of Iugis NZ being in liquidation.

B.1.2 The key respondents

25 Three respondents are common to all the proceedings. They are Mr Papas, Forum Finance, a member of the Consolidated Group, and FGFS, a private company of Mr Papas and Mr Tesoriero that sits outside the Consolidated Group.

B.1.2.1 Mr Papas

26 At the time of the fraud, Mr Papas was the Chief Executive Officer (CEO) of the Forum Group and a director of each of the Primary Recipients.

27 Despite initially appointing solicitors to appear on his behalf and participating in the proceedings, Mr Papas has not in any substantive way defended the allegations against him — he has not filed a defence (and has not been excused from so doing), he did not file and serve or adduce any evidence, he did not appear and was not represented at the hearing. As mentioned, orders were made on 20 October 2021 that a warrant be issued for Mr Papas’ arrest to bring him before the Court to answer a charge of contempt in the Westpac Proceeding: Westpac Banking Corporation v Forum Finance Pty Ltd [2021] FCA 1341.

28 The Court issued the warrant on that same day. Mr Papas has not been brought before the Court to answer the contempt charge.

29 Mr Papas did not appear when this matter was called on for hearing. Being satisfied that he had been served with the relevant originating applications, the pleadings and the evidence, I ordered that each of the three proceedings continue generally against Mr Papas in his absence pursuant to r 30.21(1)(b)(i) of the Federal Court Rules 2011 (Cth).

B.1.2.2 Forum Finance

30 Forum Finance is a wholly owned subsidiary of FGOC which is the ultimate holding company in the Consolidated Group. During the relevant period when the fraud was perpetrated, the directors of Forum Finance were Mr Papas and Mr Tesoriero. Westpac allege that Mr Tesoriero had knowledge of and/or devised the fraudulent scheme with Mr Papas. He is not a respondent in the SMBC or Societe Generale Proceedings. SMBC do not positively advance a claim that Mr Tesoriero had knowledge of and/or devised the fraudulent scheme but seek to rely on any such finding that may be made in the Westpac Proceeding.

31 Forum Finance is alleged to have directly received the funds advanced by WBC and Societe Generale as a result of the alleged fraud. Mr Jason Preston and Mr Jason Ireland are the liquidators of Forum Finance. Forum Finance was excused from filing a defence in each of the three proceedings. At trial, Counsel for the liquidators indicated that they intended to play only a limited role in the proceedings, being that they wished to be heard on relief.

B.1.2.3 FGFS

32 FGFS sat outside of the Consolidated Group. In the relevant period, the directors and shareholders of FGFS were Mr Papas and Mr Tesoriero. Mr Papas was a director from 23 November 2017 and continued as a director as at the date liquidators were appointed. Mr Tesoriero was a director from 13 November 2018 to 30 April 2020. FGFS is alleged to have received the tainted funds from the initial Forum recipients, including Forum Finance. As mentioned, aside from effectuating the distribution of the tainted funds to, or at the direction of, Mr Papas and/or Mr Tesoriero, FGFS did not appear to conduct a legitimate business in its own right. There did not appear to be any apparent commercial purpose for FGFS to have received the substantial sums which various Forum companies obtained from the financiers under the fictitious and falsified equipment lease contracts.

33 In broad terms, FGFS’s function was as an external treasury company of sorts, into which the tainted funds were funnelled from within the Consolidated Group and from which the tainted funds were subsequently applied in accordance with the wishes of Mr Papas and Mr Tesoriero. An issue which Mr Tesoriero contests in his defence of the Westpac Proceeding is whether the tainted funds, when moving from FGFS, were subject to approval being given by Mr Papas, even when those funds were ultimately applied to projects in which Mr Tesoriero was interested rather than Mr Papas or to projects in which both Mr Papas and Mr Tesoriero were interested.

34 Typically, the tainted funds were transferred to FGFS upon or very shortly after receipt by the initial Forum recipient. FGFS then disbursed the funds received by it in aid of personal projects being pursued by Mr Papas and/or Mr Tesoriero. The personal projects to which the tainted funds were directed included: property purchases; holiday houses; racing cars; racehorses; luxury cars; maintenance and storage of a yacht (XOXO), the purchase, maintenance and storage of a speedboat (Grady White Freedom) and a Greek football team as well as extravagant personal expenditure. FGFS also made payments back to Consolidated Group entities in order for those entities to make payments which were purportedly due to the financiers under the various contractual arrangements. The making of these cloaking payments served to delay discovery of the fraud and thereby prolong the fraud.

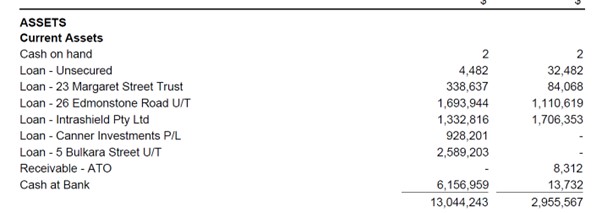

35 FGFS is alleged to have received $2,244,495 in tainted funds: $1,982,795 derived from Westpac and $261,700 derived from SMBC.

36 A result of FGFS sitting outside the Consolidated Group was that FGFS was not treated in the accounts as part of the consolidated accounts of the Consolidated Group. FGFS’s accounts were not required to be, and were not, audited. FGFS’s accounts were not prepared by the Consolidated Group’s accountant. FGFS’s accounts were prepared by Mr Lou Stefanetti of Pacific Blue Tax Services Pty Ltd, who was also accountant to Mr Tesoriero and his family. Mr Stefanetti certified in a letter dated 28 April 2017 to another financier, NWC Finance, that at that point in time, he was a practising accountant and had acted as the accountant for the Tesoriero family for the last 10 years. Mr Stefanetti continued to act as the accountant for Mr Tesoriero and his family as at, at least, 28 April 2017.

37 Mr Preston and Mr Ireland are the liquidators of FGFS, as well as being the liquidators or many other respondent companies. FGFS was excused from filing a defence in each of the three proceedings. At trial, Counsel for the liquidators indicated that they intended to play only a limited role in the proceedings, being that they wished to be heard on relief.

B.1.3 Additional respondents in the proceedings

38 Societe Generale only claims against the three respondents, common to all the proceedings, namely Mr Papas, Forum Finance and FGFS.

39 In addition to the three common respondents, there are numerous other respondents in the Westpac and SMBC Proceedings. There is a substantial, but not complete, overlap between the corporate respondents to the Westpac Proceeding and the SMBC Proceeding. By the conclusion of the hearing:

(1) the following corporate respondents were common to both the Westpac and SMBC Proceedings;

(a) Forum Group Pty Ltd (Receivers Appointed) (in liquidation) (FG);

(b) FGOC;

(c) Forum Enviro;

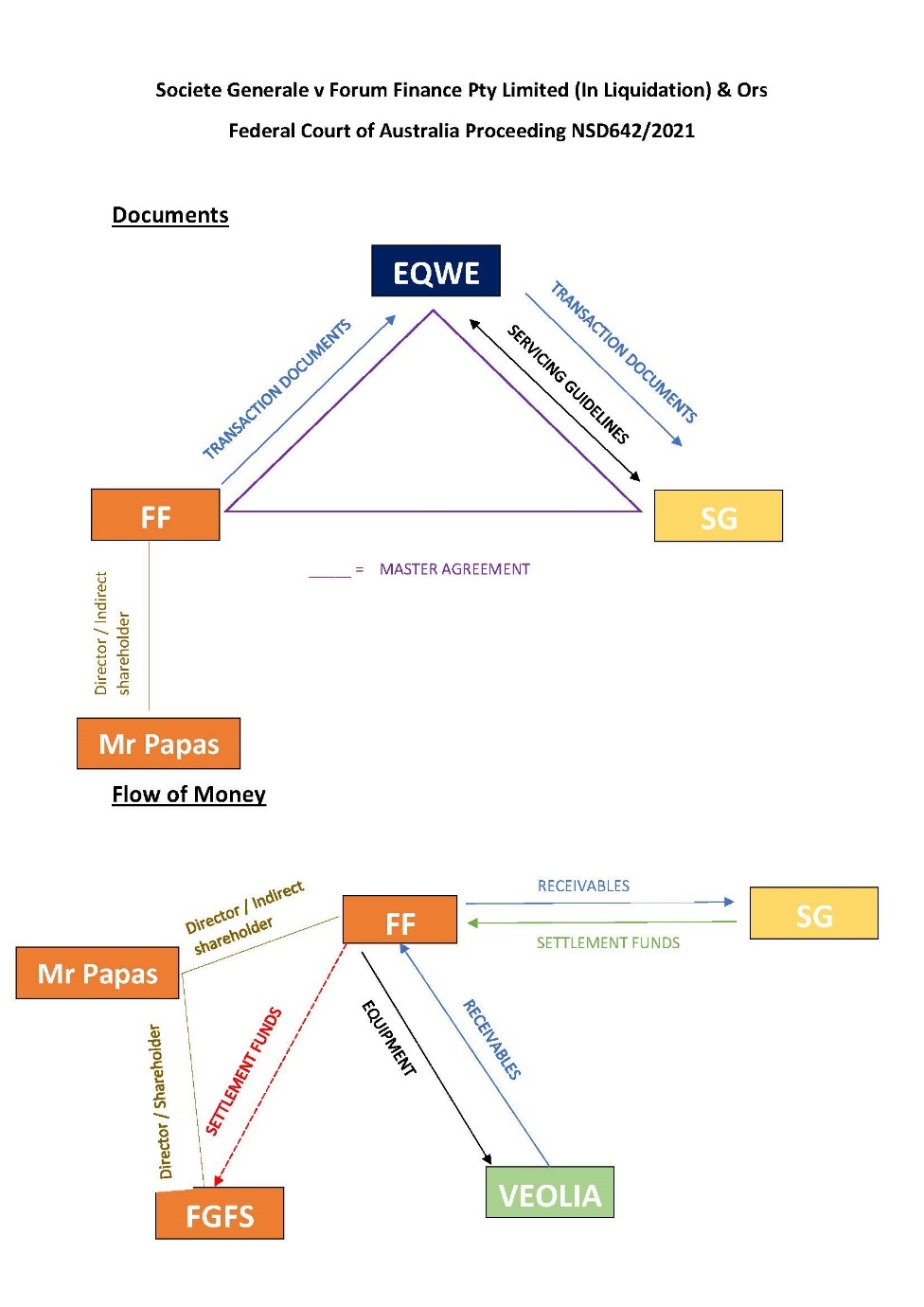

(d) Forum Enviro (Aust);

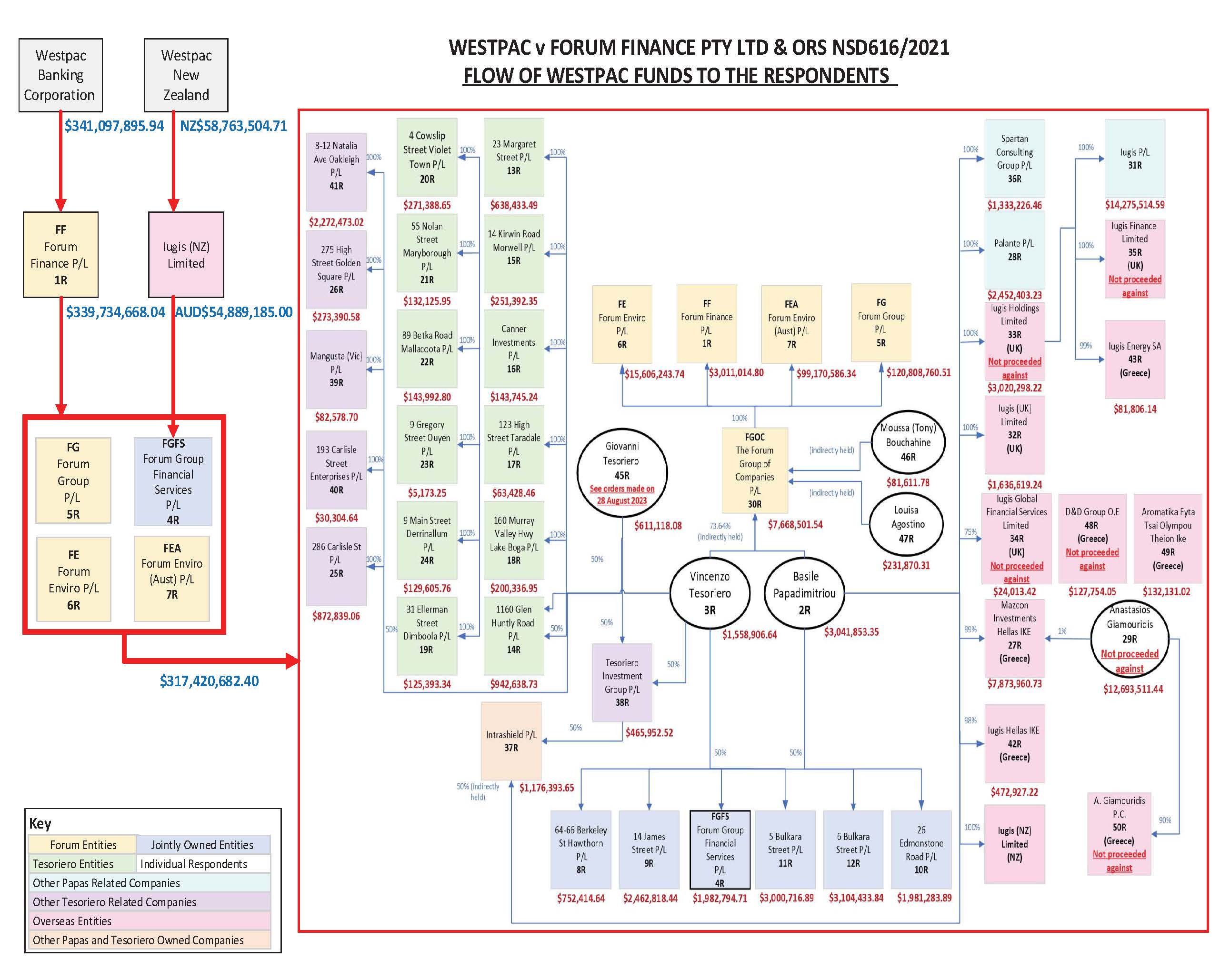

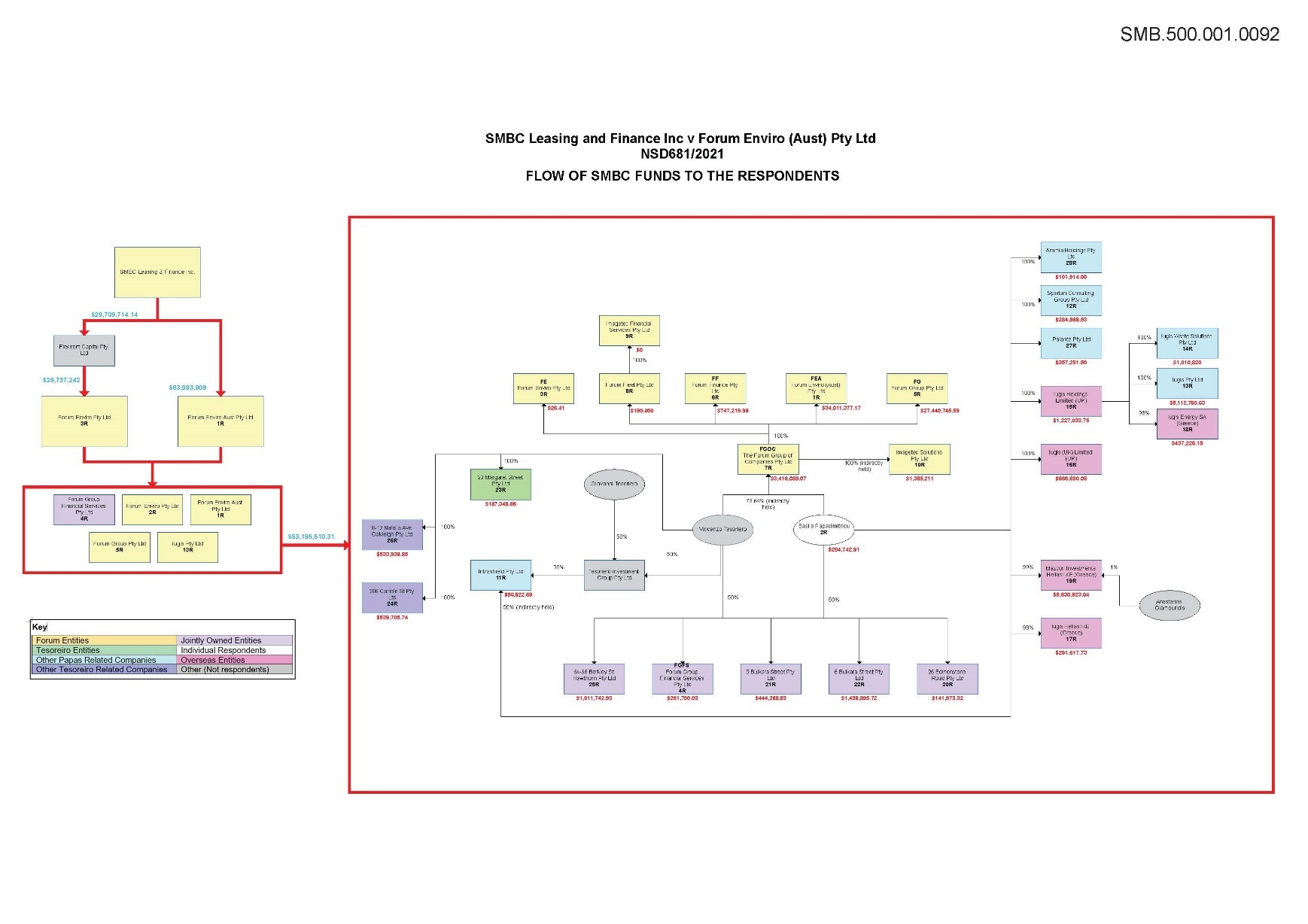

(e) Iugis Pty Ltd (in liquidation);

(f) Iugis (UK) Limited (Company No. 10745974) (in liquidation);

(g) Iugis Energy SA (registered in Greece) (Iugis Energy Greece);

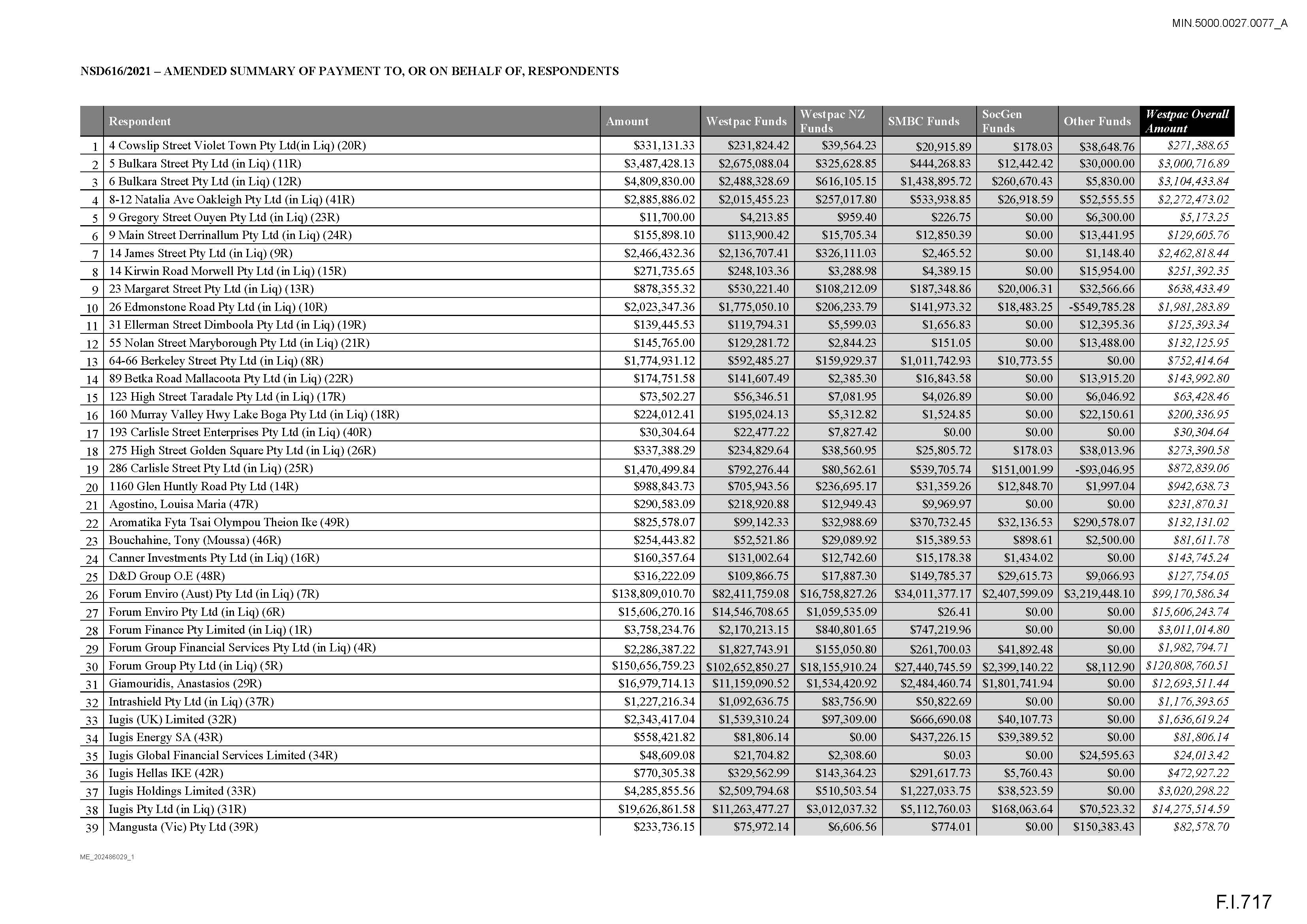

(h) Mazcon Investments Hellas Ike (registered in Greece);

(i) Palante Pty Ltd (in liquidation);

(j) 26 Edmonstone Road Pty Ltd (in liquidation);

(k) 5 Bulkara Street Pty Ltd (in liquidation);

(l) 6 Bulkara Street Pty Ltd (in liquidation);

(m) 23 Margaret Street Pty Ltd (in liquidation);

(n) 286 Carlisle Street Pty Ltd (in liquidation);

(o) 64-66 Berkeley St Hawthorn Pty Ltd (in liquidation) (64-66 Berkeley Street);

(p) Intrashield Pty Ltd (in liquidation); and

(q) Spartan Consulting Group Pty Ltd (in liquidation).

(2) there were 18 corporate respondents against which Westpac sought relief that were not sued by SMBC:

(a) 1160 Glen Huntly Road Pty Ltd;

(b) Mangusta (Vic) Pty Ltd;

(c) 14 James Street Pty Ltd (in liquidation);

(d) Canner Investments Pty Ltd (in liquidation);

(e) 9 Gregory Street Ouyen Pty Ltd (in liquidation);

(f) Tesoriero Investment Group Pty Ltd (in liquidation) (TIG);

(g) 193 Carlisle Street Enterprises Pty Ltd (in liquidation);

(h) 14 Kirwin Road Morwell Pty Ltd (in liquidation);

(i) 123 High Street Taradale Pty Ltd (in liquidation);

(j) 160 Murray Valley Hwy Lake Boga Pty Ltd (in liquidation);

(k) 31 Ellerman Street Dimboola Pty Ltd (in liquidation);

(l) 4 Cowslip Street Violet Town Pty Ltd (in liquidation);

(m) 55 Nolan Street Maryborough Pty Ltd (in liquidation) ;

(n) 89 Betka Road Mallacoota Pty Ltd (in liquidation);

(o) 9 Main Street Derrinallum Pty Ltd (in liquidation);

(p) 275 High Street Golden Square Pty Ltd (in liquidation); and

(q) Iugis Hellas Ike (Iugis Greece) (initially sued by SMBC, but SMBC did not press its claim against it in final submissions); and

(r) Aromatika Fyta Tsai Olympou Theion Ike

(3) there were five corporate respondents against whom SMBC sought relief who were not sued by Westpac:

(a) Forum Fleet Pty Ltd (in liquidation);

(b) Imagetec Financial Services Pty Ltd (in liquidation) (Imagetec FS);

(c) Imagetec Solutions Australia Pty Ltd (in liquidation);

(d) Iugis Waste Solutions Pty Ltd (in liquidation); and

(e) Aramia Holdings Pty Ltd (in liquidation).

40 Iugis Holdings Limited (Company Number 11123437) (Iugis Holdings UK) was a respondent in both the Westpac and SMBC proceedings, however, the financiers did not press their respective claims against it by the time of closing submissions.

41 As mentioned, Westpac also maintained its claims against three individual respondents who were not respondents to the SMBC Proceeding: Mr Tesoriero, Mr Bouchahine, and Ms Agostino.

42 The alleged role of each of the respondents is addressed in detail in Section D below. For introductory purposes, the following entities are significant in terms of, inter alia, the inflow of the tainted funds sourced from the financiers into the web of entities related to Mr Papas and/or Mr Tesoriero.

43 The funds from WBC flowed first to Forum Finance, which then disbursed the funds principally to FGFS, although prior to early 2019, Forum Finance dispersed the funds directly to FG and Forum Enviro. As noted, FGFS sat outside the group. Substantial funds received from WBC were also dispersed via Eqwe Pty Ltd. Eqwe acted as a third party agent of WBC in its dealings with Forum Finance. Eqwe is not a party to these proceedings. No evidence was led by Westpac from any person from Eqwe.

44 WNZL advanced funds to Iugis NZ, who then disbursed the funds received to FGFS. Iugis NZ is not a respondent to any of the proceedings. Iugis NZ was placed into liquidation on 13 August 2021. Mr Andrew Grenfell and Ms Kare Johnstone are its liquidators. Evidence was led by WNZL from Mr Grenfell in relation to the payments advanced by WNZL to Iugis NZ.

45 Forum Enviro and Forum Enviro (Aust) were the Primary Recipients of the funds advanced by SMBC. Forum Enviro and Forum Enviro (Aust) then transferred the funds in the main to FGFS. SMBC also advanced some of the funds to Flexirent Capital Pty Ltd who then paid funds to Forum Enviro, and to Forum Enviro (Aust). Flexirent acted as a third party agent of SMBC in its dealings with Forum Enviro and Forum Enviro (Aust). Flexirent is not a party to these proceedings. No evidence was led by SMBC from any person from Flexirent.

46 As with Forum Finance, Mr Preston and Mr Ireland are the liquidators of Forum Enviro and Forum Enviro (Aust) as well as FGFS. Forum Enviro and Forum Enviro (Aust) were excused from filing a defence in the Westpac and SMBC Proceedings. At trial, Counsel for the liquidators indicated that they intended to play only a limited role in the proceedings, being that they wished to be heard on relief.

47 The funds from Societe Generale were paid to Forum Finance which then dispersed the funds to FGFS.

48 FGFS dispersed funds it had derived from each of the financiers to other entities within and outside of the Consolidated Group. The entities that were outside the Consolidated Group were in the main connected in some way to either or both of Mr Papas and Mr Tesoriero.

B.2 Concurrent hearing – evidence in one, evidence in all

49 The hearing of the three proceedings was concurrent. Well in advance of the hearing, orders were made for the evidence in each of the proceedings to be evidence in each of the other proceedings. During the hearing, the tender of a small number of documents by Westpac relevant to establishing its claim against Ms Agostino was made on the basis that the documents were not tendered against Mr Bouchahine. I have not relied on these documents in relation to my findings against Mr Bouchahine.

B.3 Evidence adduced in accordance with s 50 of the Evidence Act

50 The applicant financiers made extensive use of summary documents that were prepared pursuant to s 50 of the Evidence Act 1995 (Cth) which were, save for one exception, not contested. I will refer to the s 50 summaries in context in addressing the evidence below.

51 Mr Tesoriero objected to the entirety of the s 50 summary titled “Payments to, or on behalf of, Vince Tesoriero”. This summary document lists payments made to third party entities and to 286 Carlisle Street (a Tesoriero Entity) from an account in the name of FGFS, pursuant to emails from Mr Tesoriero directing payment to these entities. For each payment, the summary document identifies the total amount of funds from each financier. The objection taken by Mr Tesoriero was that the document draws conclusion or makes inference from documents which are not tendered and are not otherwise identified. Counsel for Mr Tesoriero suggested that the summary document should be amended to identify the primary documents evidencing the direction component of the evidence relied on for the submission, that the underlying documents be tendered and that the name of the document be corrected to be “Payments Concerning Vince Tesoriero”. An updated version of the summary was tendered during the hearing with minor amendments which did not impact the nature of the objection. The parties agreed to the tender of the summary with a revised heading and the tender of ten additional documents.

C. OVERVIEW OF THE FRAUD

52 The frauds against Westpac and SMBC are alleged to have commenced at different times in 2018. The fraud against Societe Generale is alleged to have commenced in November 2020. In each case the fraud continued until detected in about June 2021. Each financier alleges that it was defrauded of the millions of dollars which it advanced pursuant to the documented arrangements it had with companies in the Consolidated Group.

53 The frauds alleged by each of the financiers are conceptually similar notwithstanding that the documented arrangements between the Forum entities and the individual financiers are bespoke to each financier.

C.1 The Documented Arrangements

54 In their evidence each financier has meticulously detailed the fraudulent transaction documents by which the fraud on them was effected. Westpac tendered a comprehensive s 50 summary of fraudulent transaction documents which is engrossed to reference the underlying primary documents which are in evidence. Engrossed versions of the customer affidavits cross-reference to the s 50 summary. SMBC also rely on a comprehensive s 50 summary of fraudulent transaction documents which is supported by a list of the underlying primary documents. Societe Generale do not have an analogous s 50 summary because of the relatively short duration of the period in which it was actively advancing funding. Instead, Societe Generale has tendered the underlying transactions documents which are supplemented by a thematic chronology which references the fraudulent transaction documents. Based on this evidence, I make the following broad findings in relation to the way in which the fraud was effected on each of the financiers. My reasons for reaching these conclusions are in Section I below.

55 In each fraud, the duped financier entered into arrangements to provide finance to enable third party customers to lease or licence equipment sourced through Forum related entities. On the surface, the Forum business model operated by presenting financiers with equipment financing packages in which a Forum entity acted as an intermediary between the financier and the customer who took delivery of the financed equipment. On the face of the relevant contractual and related documents, the detail of which is addressed in Section I.26 to I.32, each financier agreed to advance funds to a Forum company for the purpose of that company supplying equipment to customers for lease or license and in return the financier acquired from the relevant Forum company the receivable income stream comprising the usage payments due from the customer under the Forum lease or licence. The financier also took an equitable interest in the relevant equipment the subject of the lease or licence. Nothing turns on whether the arrangements took the form of leases as opposed to licences. For convenience I will describe the arrangements purportedly involving customers as leases.

56 In some cases, but not all, a third party agent of the relevant financier acted as an intermediary (or broker) in the dealings between the financier and the relevant Forum company. As mentioned, WBC’s and Societe Generale’s agent was Eqwe and SMBC’s agent was Flexirent.

57 In the main, the customers were large, well known Australian companies, usually with operations in multiple locations across Australia. They included, for example, Veolia Environmental Services (Australia) Pty Ltd, a waste management company, and Coles Supermarkets Australia Pty Ltd, a major chain of supermarkets in Australia.

58 The assets the subject of the equipment agreements included waste digesters (machines used to transform solid organic waste into liquid), surfacides (machines which use ultra-violet light to disinfect surface areas), GPS tracking devices, and multi-function office machines (machines which print, scan and transmit documents). On the face of the documented arrangements, these assets were sourced from or through entities in or related to the Consolidated Group and delivered to customers at diverse locations across Australia.

59 Pursuant to the impugned arrangements, WBC advanced about $341 million in the period from about September 2018 to June 2021; WNZL advanced about NZD $58 million in the period from about December 2018 to June 2021; SMBC advanced about $113 million in the period from about August 2018 to May 2021; and Societe Generale advanced about $8.9 million in the period from about March 2021 to May 2021.

C.2 Discovery of the fraud by the financiers

C.2.1 Westpac

60 The fraud was first discovered by Westpac in about June 2021. At that time, Ms Carly Rossbach-Smith, Treasury Operations Manager, WesTrac Pty Limited, alerted Westpac to issues concerning certain Forum Finance transactions in which it had been represented to Westpac that WesTrac had purportedly purchased equipment from Forum Finance to the tune of about $9.7 million. Ms Rossbach-Smith’s inquiries revealed that WesTrac only had one printer/photocopier arrangement in place with Forum and that was in the amount of around $1.6 million. Ms Rossbach-Smith was unable to reconcile the $9.7 million drawdown which Westpac attributed to WesTrac. In addition, she identified that documents held by Westpac which were purportedly signed by Mr Jarvas Croome, WesTrac CEO, were not in fact signed by him. Ms Rossbach-Smith reported the result of her inquiries to Westpac, and this ultimately led to the discovery of the fraud.

61 Westpac issued a demand on 15 June 2021 to Forum Finance to repurchase certain receivables relating to WesTrac. A meeting was arranged between Mr Papas and WesTrac. It was scheduled to be held on 16 June 2021. The scheduled meeting with Mr Papas did not take place. Movement records maintained by the Department of Home Affairs confirm that Mr Papas in fact left Australia on 16 June 2021. As at 30 July 2021, he had not returned. There is no evidence to suggest that he has returned since.

62 Mr Papas’ departure appears to have been in train from at least 6 May 2021 when he applied for an exemption from the COVID-19 travel restrictions on international travel to leave Australia on 20 May 2021 to go to Greece for a period of three weeks. A letter in support of Mr Papas’ application signed by Mr Craig Rollinson as Executive Director of Iugis on 6 May 2021 indicated that it was essential for Mr Papas to travel to Greece at this time to oversee and facilitate the finalisation of multiple major contracts through Iugis’ subsidiaries in Greece and the Middle East

63 In response to the demand, Westpac was paid a total of approximately $4,425,358 in two tranches on 16 and 17 June 2021 by Forum Finance. On 17 June 2021, Westpac confirmed receipt of $4,425,358 and demanded payment of the outstanding amount of approximately $5,199,433 by 18 June 2021. Viewed in context, these payments made in June 2021 to Westpac were tactical. They were directed to delaying Westpac from taking recovery action and were made contemporaneously with Mr Papas leaving the country.

C.2.2 SMBC

64 The fraud was first discovered by SMBC in about July 2021. Mr Michael Timpany, Director of SMBC Sydney Branch, sent an email to Forum Enviro personnel (including Mr Papas and Mr Bouchahine) about an unpaid Veolia-related payment which had fallen due on 30 June 2021. Following the exchange of several emails, on 2 July 2021 Mr Papas informed SMBC that “significant issues have arisen on our business” and requested that SMBC wait several days before taking action. Mr Timpany’s repeated requests for further information about the nature of the “significant” issues were left unanswered by Mr Papas or anyone from the Forum companies.

65 On 2 July 2021, Mr Timpany became aware of media reports regarding the Westpac Proceeding. Shortly after, SMBC obtained the necessary consent from Flexirent to contact Veolia directly to discuss the lease agreements ostensibly between Veolia and Forum Enviro. Ms Gurpreet Brar, CEO of Veolia India and former CFO of Veolia at the relevant times, confirmed that each of the 23 contractual documents and purported confirmation emails which ostensibly bore her signature were not signed or approved by her and appeared to be forged. Ms Brar also gave evidence that she had not seen the relevant leases before July 2021 when they were provided to her by SMBC’s solicitors. Other Veolia executives (including Mr Lorenzo Kozlovic, Mr Julian Gaillard and Mr Daniel Conlon) similarly confirmed that their purported signatures on the leases were forged and bore no resemblance to their real signatures.

C.2.3 Societe Generale

66 The fraud was first discovered by Societe Generale in about June 2021 through conversations between Mr Gregory Thong, then Head of Corporate Coverage at Societe Generale, and Mr Luke Price and Mr Mike Sheeran, directors of Eqwe. On 21 June 2021, Mr Price and Mr Sheeran called Mr Thong and referred to Forum Finance having “some issues with Westpac”. On 23 June 2021, an in-person meeting was held at Eqwe’s offices with Mr Price, Mr Sheeran and Mr Thong to discuss the Westpac transactions and Societe Generale’s exposure. From this point in time, Societe Generale received updates on the Westpac Proceeding as the Westpac investigations progressed.

67 Mr Thong also contacted Ms Brar directly, including a telephone call on 24 June 2021 asking Ms Brar to check the signatures on three Societe Generale transactions. Upon reviewing the Societe Generale transaction documents, Ms Brar confirmed that the signatures had been forged on all three documents.

68 Mr Thong and Mr Price made further enquiries of Veolia representatives between 26 June 2021 and 28 June 2021, who confirmed that the product serial numbers did not correlate with the equipment that Veolia had leased from Iugis.

69 During this time, Societe Generale’s primary contact at Forum was Mr Rollinson rather than Mr Papas. Mr Tesoriero deposes that he understood that Mr Rollinson had been acting as CEO since at least 18 June 2021 when Mr Papas “disappeared”. Mr Rollinson was not a party to any of the proceedings and did not provide an affidavit or otherwise give evidence in the proceeding.

C.3 The reality of the arrangements

70 In stark contrast to the apparent operation of the arrangements, the financiers allege that the documented arrangements were fictitious, and the relevant documents were falsified in key respects. The financiers contend that the documentation between them and the Forum entities was nothing but a veneer for an audacious fraud.

71 The financiers contend that:

(1) The assets purportedly the subject of the impugned arrangements were not possessed by the relevant Forum company and were not supplied to the purported customers. Thus, the financiers did not obtain any equitable interests in the assets, purportedly the subject of the arrangements;

(2) The agreements and related documents purportedly executed by, or emanating from, the purported customers were forged and were not executed or despatched by the customers. Instead, the financiers, or their agents, were supplied with forged documents.

(3) Accordingly, the purported customers owed no obligation to make the monthly usage payments in respect of the assets with which they were purportedly supplied. In short, the receivables income stream due from the customers under the lease agreements, which the relevant Forum company purported to assign to the financiers (whether directly or where applicable through the financier’s agent), did not exist; and

(4) In fact, the monthly payments made to financiers, that ostensibly represented receivables in accordance with the documented arrangements, were made by Forum companies, often using tainted funds traceable to advances made by one or more of the financiers, and were not monthly usage payments made by purported customers. These payments served to cloak the fraud at the heart of the arrangements by giving the appearance that receivables were being paid in accordance with the documented arrangements.

72 As to what happened to the vast sums advanced by the financiers pursuant to the impugned arrangements, the financiers contend that upon receipt, the funds were transferred by the relevant recipient in the Consolidated Group company to FGFS, the private company of Mr Papas and Mr Tesoriero, and then deployed to fund personal projects of Mr Papas and/or Mr Tesoriero including property developments, holiday houses, maintenance and storage of a yacht, luxury cars, race cars, racehorses, jewellery, and Xanthi FC, a Greek football team.

73 The amount claimed in each of the proceedings is, at least for some of the causes of action, less than the amount advanced by the financier. As mentioned, in the period before the frauds were discovered, Forum companies made some of the monthly payments due under the impugned arrangements as if the receivables had been collected from customers. These cloaking payments served to prolong the period in which the fraud went undetected but also serve to reduce the principal amount claimed by each financier in respect of some of the claims for relief. In WBC’s case, the payments made in response to the demands made in June 2021 also reduce the total amount that is being claimed in respect of some of the causes of action.

74 In broad terms, and subject to submissions in relation to relief, the cloaking payments made to each of the financiers were approximately as follows:

(1) WBC received $82,453,096, (calculated by taking the total amount paid by WBC to Forum Finance and subtracting the amount claimed as outstanding by WBC, then further subtracting certain direct debits made from Eqwe to WBC following discovery of the fraud and the payments made pursuant to the repurchase demand on 15 June 2021);

(2) WNZL received NZD $17,325,824, comprising 48 payments made under the Iugis NZ Financing Programme between 7 February 2019 and 15 July 2021;

(3) SMBC received $30,556,390, comprising 57 monthly payments made by Forum Enviro (Aust) between 30 August 2018 and 28 May 2021; and

(4) Societe Generale received $298,800, comprising three monthly payments between 31 March 2021 and 28 May 2021 in connection with one transaction totalling $252,000 and one payment for a separate transaction on 28 May 2021 totalling $46,800.

75 The internal process by which the fraud was administered was exposed in an email communication that dates from the time when the financiers were scrambling to obtain a picture of what had in fact gone on. By way of context, for example, Westpac alerted customers, including Coles and Scentre, of their concerns that scheduled payments under the Eqwe/Forum Finance programme were not being paid in accordance with the contractual arrangements and that they had commenced internal reviews to reconcile the payment schedules purportedly signed by the customers. Some customers, including Coles and Scentre, forwarded the emails that they had received from the Westpac to Mr Tas Papas who in turn forwarded the email to Mr Rollinson. The customers expressed their confusion about the communications they had received and requested an explanation from Forum in relation to, amongst other things, the payment schedules purportedly signed by the customers.

76 As the pressure was building for Forum to provide a substantive response to customers and the financiers, Mr Rollinson was forwarded a copy of an email from Mr Brandon Chin (an employee who worked as an accountant for FGFS and reported to Mr Bouchahine) in which he described the way in which the “funding processes” were reflected in FGFS and Forum’s business records. I address in greater detail Mr Chin’s role in relation to the preparation and circulation of excel workbooks under Mr Bouchahine’s supervision which are relevant to the actual mechanics of how the fraud was affected in Section I.22. Westpac rely on the excel worksheets to prove that Mr Tesoriero and Mr Bouchahine had actual knowledge of the fraud.

77 On 29 June 2021, Ms Orlandini sent an internal Forum email to Mr Rollinson in which she said: “As requested below is a detailed list of Forum and FGFS accounting processes”. By this email, Ms Orlandini forwarded an email from Mr Chin, with the subject “Funding Processes – FGFS”. In his email, under the subject line “Funding Processes – FGFS”, Mr Chin sets out “a bit of a brain dump” but one which he hopes makes “structured sense”.

78 At the time of sending his “brain dump” email, Mr Chin no longer worked for Forum. The email is sent from his Gmail account rather than a Forum email address. Mr Chin resigned on 15 June 2021, but Mr Bouchahine said that he thought that Mr Chin had resigned earlier.

79 Westpac featured this email in its oral opening submissions. SMBC closed on the actual operation of the fraud by reference to this email.

80 In his email, Mr Chin lists the steps for each of the funding processes and “money movements” for Westpac (through its agents “BHO” and “BHO NZ”) and SMBC. I infer that the word “BHO” is a reference to BHD Leasing Pty Limited trading as BHO Finance, which acted as Westpac’s agent at this time pursuant to a Principal and Agency Agreement, and, in due course, later became Eqwe.

81 In effect, the actual arrangements, as described by Mr Chin, commenced with raising a nominal invoice in the account of Forum Enviro (Aust), processing the invoice through FGFS, then FGFS handing the money back to Forum Enviro (Aust) to repay to Westpac or SMBC as a monthly return. Mr Chin says that Forum Finance kept no records of the flow of funds.

82 Under the heading “BHO Funding Process”, Mr Chin identified the following steps and his recollection of repository where the relevant documents were kept:

1. Contract paperwork provided to BHO

2. Receive email from BHO (Katrina Constable) confirming settlement date, settlement amount, paperwork and PPSR (BHO and Forum Finance)

3. We register PPSR on our side (Forum Finance and Customer) and provide back to BHO

4. Money is received into "Forum Finance Westlawn" bank account (movements below)

5. Contract set up for monthly billing in Forum Enviro (Aust) to the customer (ALH, Coles, Veolia etc) - This is in BMS (prehistoric system)

6. Invoices raised in FE (Aust) monthly to the individual customer

7. FGFS processes these invoices into its' books and pays these invoices to FE (Aust)

8. FE (Aust) repays BHO the monthly amount

Contract files and PPSRs saved in drive (this is from memory but Fiona will know where they are saved): FGFS Documents>Dropbox - BPVT>Forum Enviro (Aust)>AU Settlement

83 Under the heading “BHO Money Movements”, Mr Chin identified the following movements and record-keeping:

1. Forum Finance Westlawn - Money in and out to FGFS. No records kept in company books of Forum Finance

2. FGFS - Money received, put on balance sheet in BHO Clearing Account. FGFS pay money to FE (Aust) via invoices

3. FE (Aust) receive money from FGFS but allocate it against the invoices it raises in the system to the customer.

4. BHO repaid by FE (Aust) monthly on 1st and 15th.

The BHO repayment schedule is saved in the FG AP team's files (again from memory but Fiona or Rebecca Huang can pull up the doc): AP Team Files (they called it something silly, but I can't remember the exact name)>Accounts Folder>Balance Sheet Reconciliation>BHO>21616 BHO.. something

84 Under the heading “SMBC Funding Process”, Mr Chin sets out a corresponding framework for SMBC:

I guess this is also going to be a similar situation to the BHO stuff above - relatively new, so only a few "deals" exist.

1. Contract paperwork provided to SMBC via Alex Colbert

2. SMBC settlement amount received into FE (Aust) bank account (money movements below)

3. Email Alex Colbert for copy of all paperwork to set up contracts

4. Contract set up for billing in Forum Enviro (Aust) to the customer (ALH, Coles, Veolia etc) - again, in BMS

5. Invoices raised in FE (Aust) monthly to the individual customer

6. FGFS processes these invoices into its' books and pays these invoices to FE (Aust)

7. FE (Aust) repays SMBC the monthly amount

Documents saved in FGFS documents: (somewhere in the ballpark of). Repayment schedule (similar to the BHO stuff above) is also saved in the same location FGFS Documents>Dropbox - BPVT>Forum Enviro (Aust)>SMBC Settlement

85 I note that Mr Alex Colbert previously worked for Flexirent and from 2020, assisted Mr Papas in engaging directly with SMBC. Under the heading “SMBC Money Movements”, Mr Chin explained:

1. FE (Aust) - Money in and out to FGFS. No records kept in company books of FE (Aust)

2. FGFS - Money received, put on balance sheet in SMBC Clearing Account. FGFS pay money to FE (Aust) via invoices

3. FE (Aust) receive money from FGFS but allocate it against the invoices it raises in the system to the customer.

4. SMBC repaid by FE (Aust) at the end of every month based on a loan schedule provided by SMBC.

86 Mr Chin’s email also included the subheading “Additional Notes: (mainly for your reference, as I feel some of this Tony might not want too many parties to know)”. I infer that “Tony” is a reference to Mr Bouchahine.

87 Returning to Mr Chin’s email, under the Additional Notes subheading, Mr Chin includes the following information:

- FE (Aust) just sees money coming in for invoices it has raised, and pays this back to the funder. In a perfect world, it would be money in from invoicing equals exact money repaid, but there have been errors in the set up of contracts, which will make it hard to identify but have since been fixed, but that is the aim.

- BHO settlements have no GST, but the monthly invoices that FGFS processes into the system do, so there is a very large supposed tax refund sitting on FGFS' balance sheet (in the 10s of millions). Tony would always say he needs Lou's advice on how to treat this, as we wanted it to offset each other to net 0.

- FE (Aust) invoices to customers were manually changed using PDF editor to put FGFS' name and details on them

- Some BHO funding monthly repayments are paid directly by Forum Group (also identified in the BHO repayment schedule excel document).

- Also meaning they have contracts that are billed monthly, then processed and paid by FGFS, same way as above, with these invoices also being PDF edited.

- From memory, they are for customers: Westrac, HWL and Cerebral. 9 monthly invoices in total.

88 Critically, this contemporaneous email confirmed during the fraud, Forum and FGFS had in place an internal system (albeit, an imperfect one) whereby payments were processed through FGFS and critical transaction documents were manually altered (“PDF edited”) in order to maintain an external appearance of legitimacy. Mr Bouchahine referred in his affidavit to the process of changing the invoices in this way.

89 Mr Chin described a similar process for “NZ Settlements”, noting the following differences between the Australian and New Zealand arrangements:

BHO NZ Settlements do also exist... listed below. A bit more of a mess as:

- Bookkeeping for Iugis NZ is done by Nat and Chris (not sure how they book it in)

- Money is only transferred from NZ to FGFS when needed, rather than an in-and-out like in Forum Finance

- Money is still transferred via loans (no NZ invoices are processed into FGFS)

- BHO NZ Settlements have GST, but repayments are from AU, so no GST can be recognised on this side as it is across international borders. Another GST issue that we needed Lou to advise because we wanted it to also offset and net 0.

90 Under the heading “BHO NZ Settlements”, Mr Chin explained the following process:

1. Contract paperwork provided to BHO

2. Receive email from BHO (Katrina Constable) confirming settlement date, settlement amount, paperwork

3. Money is received into Iugis NZ Ltd bank account - NZ bank account held with ANZ NZ (movements below)

5. Contract set up in a fake Iugis NZ entity so monthly invoices can be generated with GST at NZ rate of 15%. (We tried to do in FE (Aust) but it could not do the 15% GST)

6. Invoices raised in the above entity monthly to the individual customer (Veolia)

7. FE (Aust) repays BHO NZ the monthly amount in NZD (international transaction) and puts this into the general ledger code 11670, which is the FGFS loan.

8. FGFS recognises this loan in its' books as well

Contract files saved in drive: FGFS Documents>Dropbox - BPVT>Forum Enviro (Aust)>NZ Settlement

91 Under the heading “BHO NZ Money Movements”, Mr Chin explained:

1. Money received into Iugis NZ bank account. Nat and Chris do the bookkeeping for this entity

2. FGFS - Money received, put on balance sheet in BHO NZ Clearing Account. FGFS pay money to FE (Aust) if needed via a loan

3. FE (Aust) receive money from FGFS (if applicable)

4. BHO NZ repaid by FE (Aust) monthly on 1st and 15th.

This repayment schedule is also in same file as the BHO AU repayment schedule: AP Team Files (they called it something silly, but I can't remember the exact name)>Accounts Folder>Balance Sheet Reconciliation>BHO>21616 BHO.. something

92 This articulation of the funding processes is consistent with the diagram prepared by Mr Chin described as “an overview of some of the FGFS/FE Aust processes”, sent to Mr Stefanetti and Mr Bouchahine on 3 September 2020. Mr Bouchahine was cross-examined on this diagram and confirmed that diagram accurately reflected his recollection of the relevant money flow as at the period September 2018 onward. I infer that this diagram was likely prepared for the purpose of obtaining the GST advice that is referred to in Mr Chin’s “brain dump” email.

93 Under the heading “BHO and SMBC Funding Process” is a flow chart providing for the following steps:

BHO settle funds into FF, which transfer to FGFS

• In-out FF

• FGFS BHO Clearing account

• no GST

Contract set up in FE Aust.

FE Aust raise monthly invoice to FGFS

• Inc GST Invoices

• GST Liability in FE Aust = 600k

FGFS process invoice into system

• FGFS GST Receivable = 600k

FGFS Pays FE Aust

• Clears debtors in FE Aust

FE Aust Pays BHO

• No GST Funding, therefore, no GST on repayments

94 Under the heading “FGFS Funding Process” is a similar, much simpler, flow chart providing for the following steps:

FGFS funds FG and Iugis deals - i.e. invoices raised to FGFS

• Small Deals for FG; bigger Iugis deals via loan account (no cash movement)

• GST receivable

FGFS raise monthly Invoice to Forum Group and Iugis for no billing contracts

• FGFS GST liability = ~30k

• not enough to offset 600k from FE Aust + Settlements

FG and Iugis pay FGFS

• Clear FGFS debtors

95 Under the heading “Other FGFS Processes”, other considerations are listed including “Wages”, “Fund Iugis Operations via Loans: AU, UK, Greece, Germany, UAE”, “Fund Overseas Transactions and Acquisitions” and “Fund Property and Vehicles”.

C.4 The essential features of the fraud that were critical to its success

96 The financiers contend that there were four essential features of the fraud that were critical to its success.

97 First, historically Forum had in fact supplied some equipment to customers. This enabled Forum representatives to take representatives of the financiers to particular customers’ premises to demonstrate the equipment in use.

98 Secondly, Forum made cloaking payments purportedly by way of the monthly receivables income stream which the financiers were expecting to receive, thereby perpetuating the illusion that arrangements were legitimate.

99 Thirdly, the customers which purportedly entered into the leasing arrangements with the Forum entities were wholly unaware of the arrangements and in the main did not interact directly with the financiers or their agents/brokers.

100 Fourthly and finally, the customers allegedly purchasing the equipment were well-known, established companies, imbuing the arrangement with an air of legitimacy which was another factor in forestalling the financiers’ suspicions being aroused.

101 In relation to the last feature identified, I would add that the individuals featured as representatives of each of the alleged customers were real people who were relevantly employed by the companies concerned and who, in the main, held positions within those companies as identified in the falsified documents, and who based on the their respective position titles would be expected to have authority to approve entry into the underlying purchase and lease agreements.

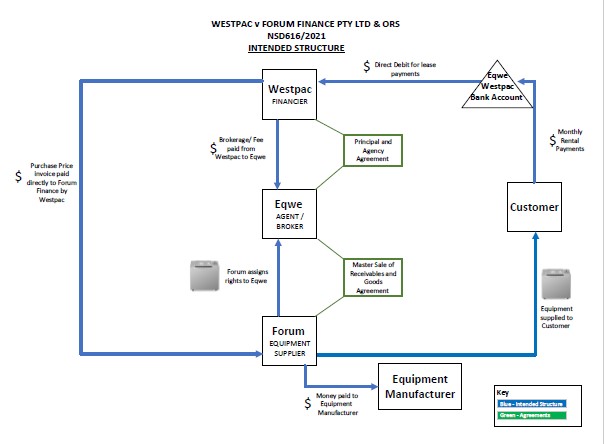

C.5 Intended and actual structure of the scheme and flow of funds

102 The financiers relied on a series of aide mémoires in their submissions. The aide mémoires were supported by the evidence before me, including comprehensive s 50 summaries and the tracing evidence given by the liquidators and relied on by the financiers.

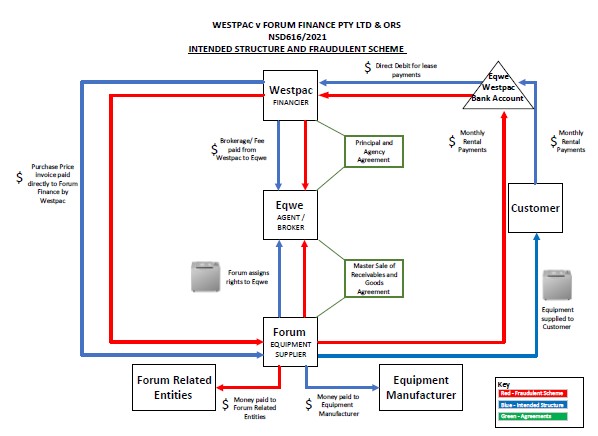

103 The first group of aide mémoires was directed to illustrating the structure of the arrangements that were in place between the Primary Recipients and the Financiers that became host to the fraudulent schemes. Although these aide mémoires were not uniform between the financiers, they are useful as a convenient snapshot of the way in which the scheme operated, the way in which the operation of the scheme departed from the documented arrangements to which the financiers had agreed, and the way in which funds were ultimately distributed to the respondents. My detailed reasons in relation to these topics are in Sections I.22 to I.31 of these reasons.

104 The second group of aide mémoires was provided by Westpac and SMBC. They each provided diagrams illustrating the ultimate flow of the funds that they had each respectively advanced to the Primary Recipients to the respondents.

105 The third aide mémoire was provided by Westpac. It is an “amended summary of payments to, or on behalf of, respondents” that traces the total amount of the funds held by each respondent which derive from the tainted funds advanced by the financiers collectively, and also within that total, the amount of funds derived from each financier individually.

106 In the balance of this section, I will introduce and annex each of the aide mémoires that may be of use in following the detailed reasons given on these topics in Section I.

C.5.1 Intended structure and actual structure

107 The tension between the documented versus the actual arrangements which I have described is summarised in a set of aide mémoires which the financiers used in their submissions.

C.5.1.1 Westpac

108 Westpac provided two separate diagrams. The first depicted the documented arrangements (Annexure B). The second compared the documented arrangements with the reality of how the scheme was in fact operated (Annexure C). I note that due to multiple references in these reasons to the contemporaneous document titled ‘Annexure A’ to the payment schedules created by Forum (discussed at Section I.3 below), the annexures to these reasons commence at Annexure B.

109 The first diagram sets out the intended structure of the scheme and illustrates the intended flow of funds, assignment of rights and equipment between the financier, the relevant Forum entity, the broker, the customer and the equipment manufacturer. In terms of fund flow the documented structure relevantly includes:

(1) Forum Finance paying an equipment manufacturer for equipment and supplying equipment to the customer;

(2) Westpac paying the purchase price invoice for the equipment directly to Forum Finance;

(3) The customer making monthly rental payments to the Eqwe Westpac Bank Account for the benefit of Westpac who received the payments by way of direct debit from the Eqwe Westpac Bank Account.

110 The second diagram is a comparison of the intended structure and the fraudulent Scheme. A series of red arrows are overlaid on the diagram of the intended structure to demonstrate the actual flow of funds between the parties. It relevantly shows that, in contrast to the intended structure, for each of the fraudulent transactions there was no authentic customer or equipment manufacturer. Instead, Forum Finance disbursed the funds that Westpac had advanced with the result that some of those funds were transferred into the Eqwe Westpac Bank Account to simulate monthly rental payments and the balance of the funds were transferred to related Forum entities.

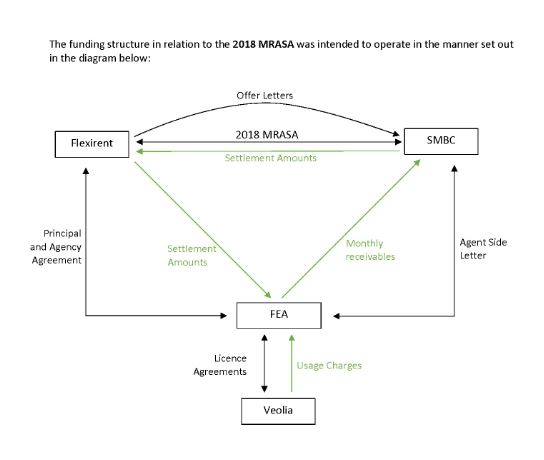

C.5.1.2 SMBC

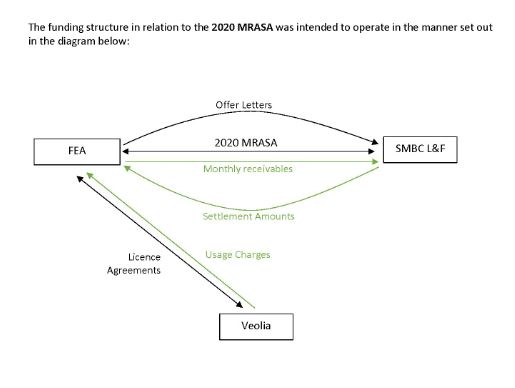

111 SMBC provided two diagrams, which set out the intended structure of the arrangements under the 2018 agreement and the 2020 agreement respectively. The only customer who was represented to have entered into equipment leases under the 2018 and 2020 agreements was Veolia.

112 The first diagram sets out the intended structure of the scheme under the Master Receivables Acquisition and Servicing Agreement between Flexirent and SMBC dated 2 August 2018 (the 2018 MRASA) (Annexure D). It illustrates the intended flow of settlement amounts, monthly receivables and usage charges as between SMBC, Forum Enviro (Aust) and Veolia.

113 Under the 2018 MRASA, it was intended that Forum Enviro (Aust) would enter into equipment leases with the customer and the customer would pay Forum Enviro (Aust) usage charges. Forum Enviro (Aust) acted as the undisclosed agent of Flexirent, providing a buffer which had the effect that Flexirent did not deal directly with the customer. Under the 2018 MRASA with SMBC, Flexirent was entitled to offer to sell SMBC receivables due from customers by submitting an offer letter that SMBC could accept by paying a settlement amount to purchase those receivables. The provision of funding was thus an offer by offer proposition.

114 The second diagram sets out the intended structure of the arrangements under the Master Receivables and Acquisition Servicing Agreement between Forum Enviro (Aust) and SMBC dated 17 July 2020 (the 2020 MRASA) (Annexure E). It too illustrates the intended flow of settlement amounts, monthly receivables and usage charges between SMBC, Forum Enviro (Aust), and Veolia, but does not include Flexirent, as there was no broker under the 2020 MRASA. It was intended that Forum Enviro (Aust) would enter into equipment leases with the customer and the customer would pay Forum Enviro (Aust) usage charges, who would pay them to SMBC.

115 SMBC did not provide a diagram to demonstrate the way in which the 2018 MRASA and 2020 MRASA operated in reality but rather opened by reference to the intended structure diagrams. In reality, under both the 2018 MRASA and the 2020 MRASA, Veolia did not in fact entered into any equipment leases with Forum Enviro (Aust) and did not pay any usage charges. In other words, there was not a lease of equipment to Veolia under either the 2018 MRASA or the 2020 MRASA and there were no monthly receivables.

C.5.1.3 Societe Generale

116 Societe Generale provided a diagram in two parts (Annexure F). The top section illustrated the relevant documentation (transaction documents, servicing guidelines and master agreement) between Societe Generale, Eqwe and Forum Finance. The lower part of the diagram represents the intended flow of receivables, settlement funds and equipment between Forum Finance, Societe Generale and Veolia and the actual flow of money between the parties, highlighting with a red line, the actual diversion of the funds from Forum Finance to FGFS pursuant to the fraudulent scheme.

C.5.2 Flow of funds

117 Westpac and SMBC each provided diagrams illustrating the flow of their funds to the respondents. The final versions of both diagrams are annexed to these reasons (Annexures G and H).

118 Both flow of funds diagrams replicate a diagram of ownership structure, but superimpose a flow of funds to represent where the financiers’ funds ultimately ended up. The dollar amounts in red beneath each entity indicate how much money is left with or is claimed against each entity. These amounts do not represent a total of all the funds which were received and then either retained or transferred from each entity. Where there is no indication of currency, the relevant currency is Australian dollars. Otherwise, “NZD” indicates that the funds are in New Zealand dollars and “USD” indicates that the funds are in United States dollars. Each of the entities in the diagrams is also colour-coded to reflect the category of respondent to which they belong (e.g. Forum Entities, Jointly Owned Entities, Tesoriero Entities).

119 The flow of funds diagrams show that Westpac’s funds initially went to Forum Finance and then to other entities, principally FGFS, and that SMBC’s funds initially went to Forum Enviro or Forum Enviro (Aust) and then to other entities. Ultimately, the funds of both Westpac and SMBC were dispersed to a variety of different individuals and entities related to Mr Papas and Mr Tesoriero.

C.5.3 Amended summary of payment to, or on behalf of, respondents

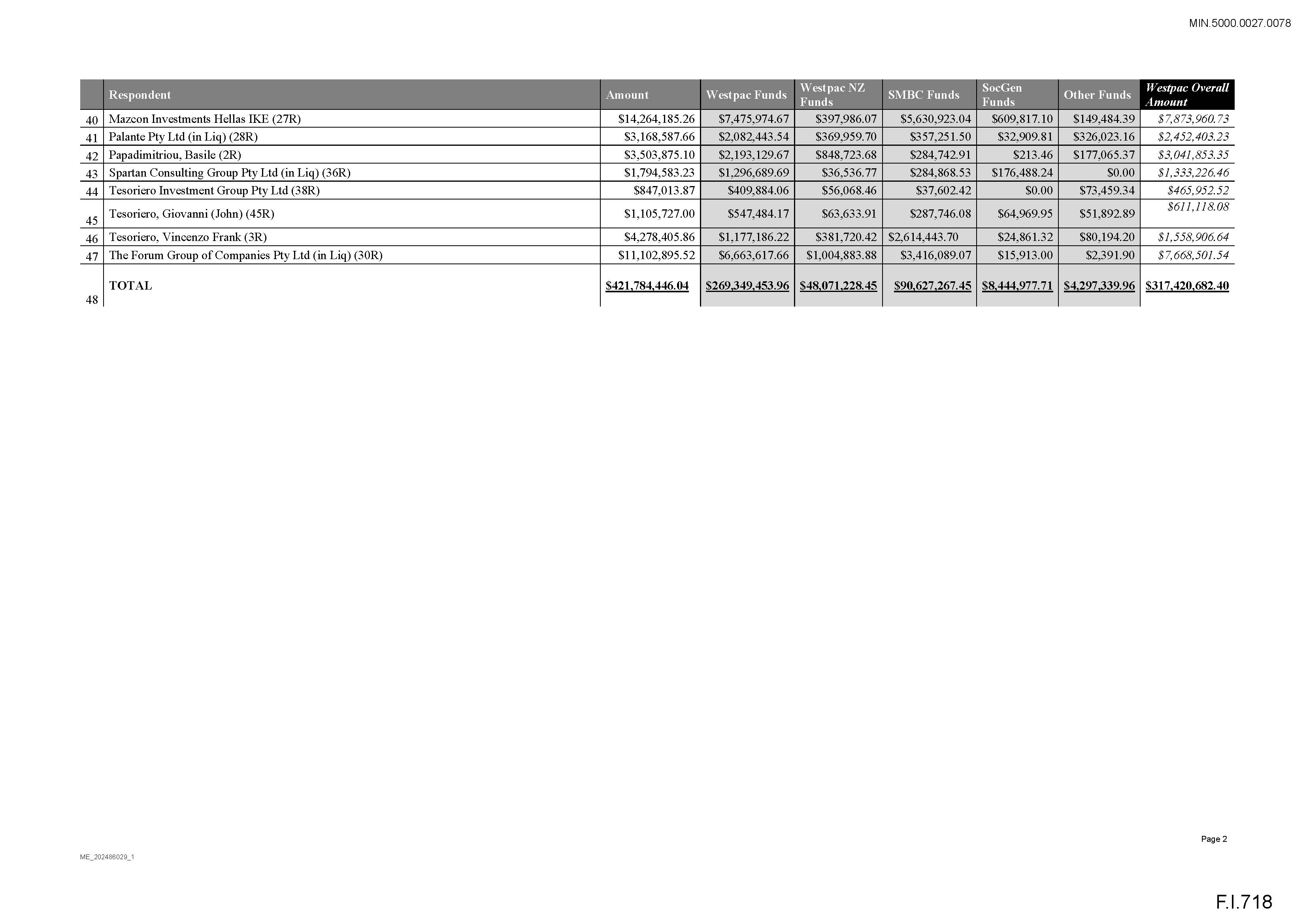

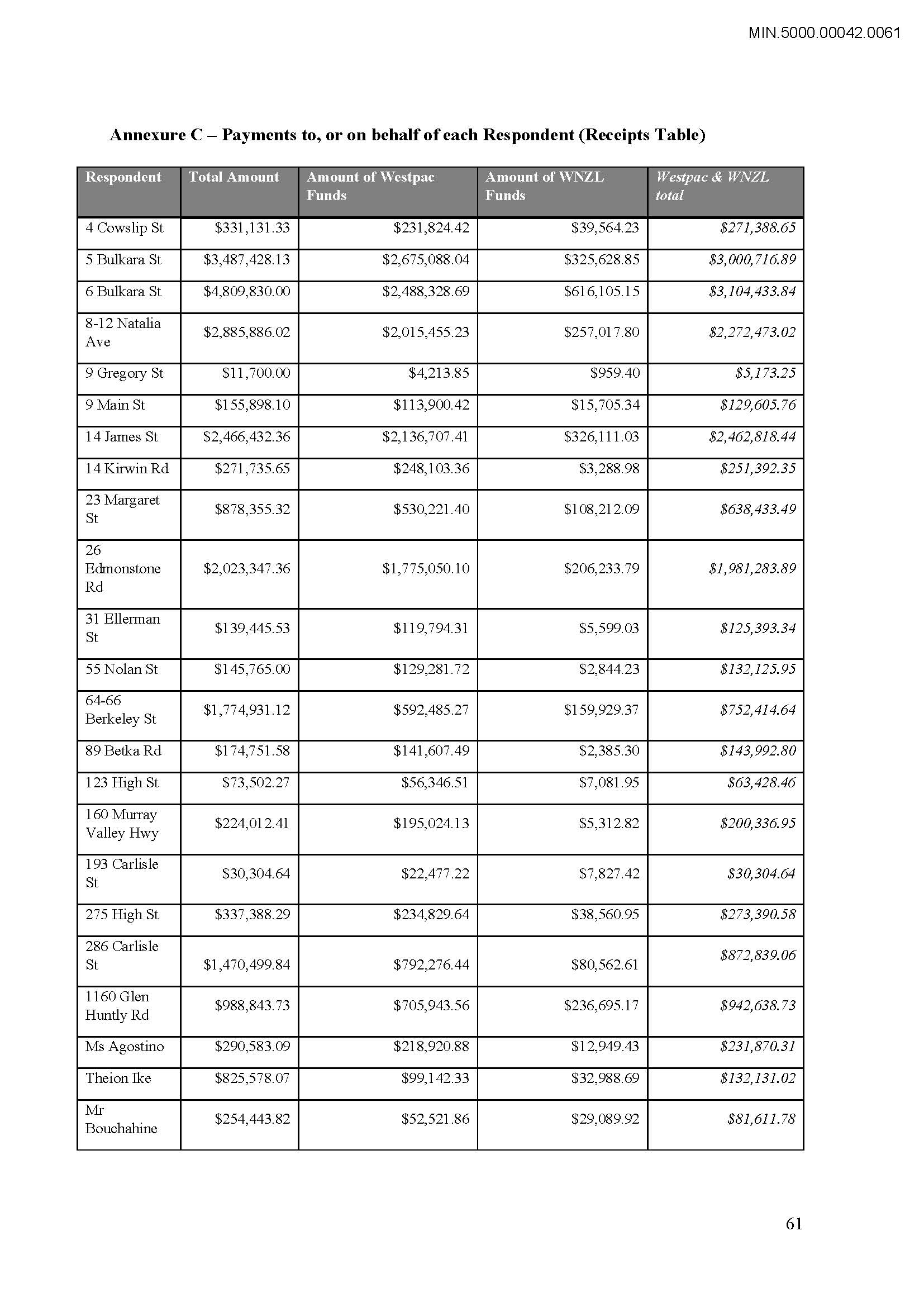

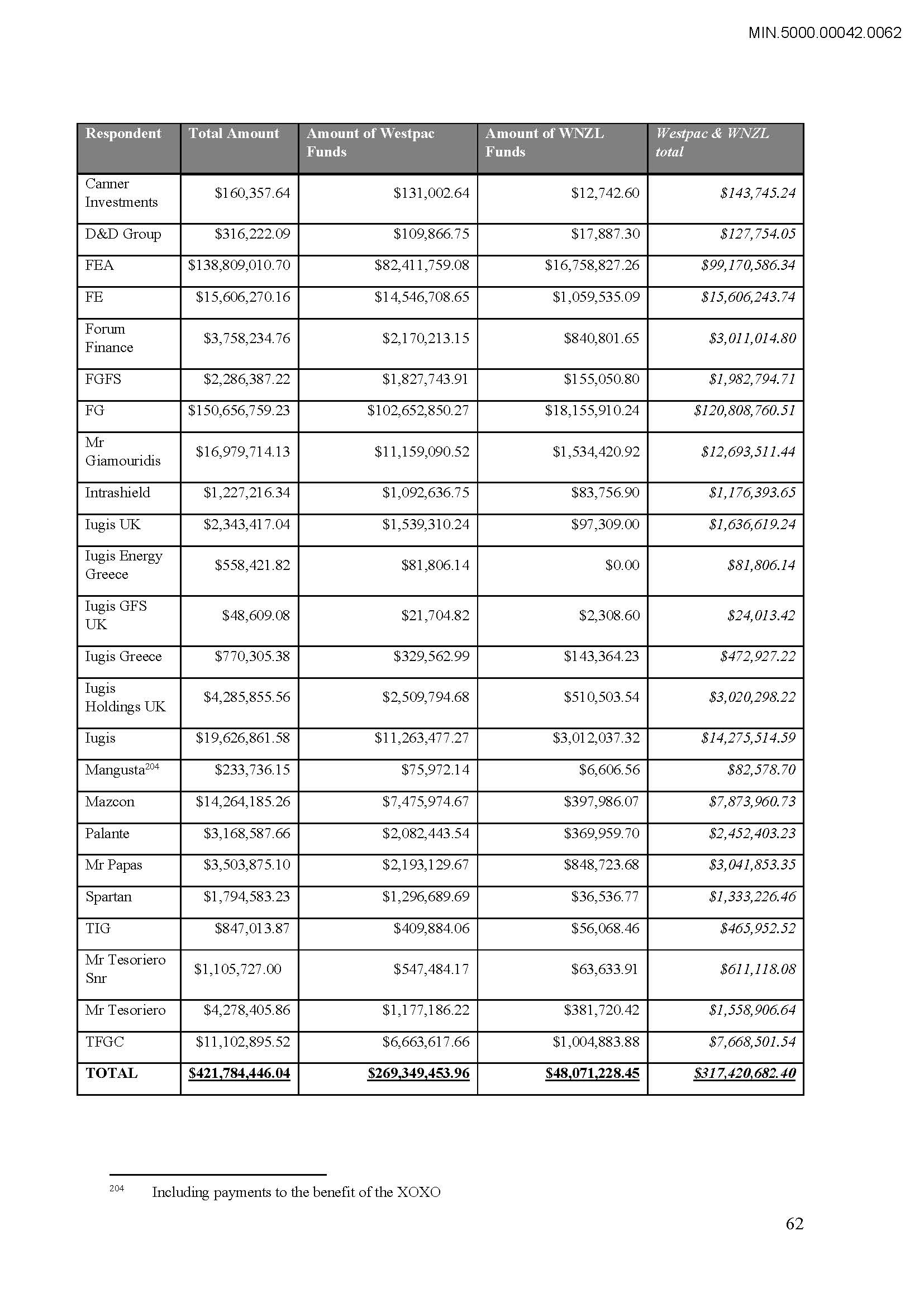

120 Westpac also provided a separate document (Annexure I) that categorises the proportion of the funds held by each respondent which derived from each financier and the total amount of tainted funds received from all the financiers. A revised version of the summary of payments to, or on behalf of, each of the respondents in respect of WBC and WNZL funds was annexed to Westpac’s closing submissions (Annexure J). This annexure also breaks down the totals given in respect of Westpac to differentiate the funds which originated from WBC from those that originated from WNZL. The amounts of the funds are the amounts received and retained by each respondent, and correspond to the amounts shown in the flow of funds annexures for Westpac and SMBC.

D. PARTIES TO THE PROCEEDINGS

121 As mentioned, the three proceedings involve many respondents. There were originally 54 respondents in net terms, and 80 respondents in total, across the three proceedings: 49 in the Westpac Proceeding; 28 in the SMBC Proceeding and three in the Societe Generale Proceeding. By the end of the hearing, the number of respondents against whom the financiers pressed their respective claims had reduced in net terms to 46 and in total had reduced to 71: 42 in the Westpac Proceeding; 26 in the SMBC Proceeding and three in the Societe Generale Proceeding. Attached as Annexure J to these reasons is a table which lists the status of the remaining respondents in each of the three proceedings.

122 A number of the respondents are in external administration. Some of the assets held by those respondents have since the appointment of external administrators been realised. As mentioned, the liquidators seek to be heard at the hearing on relief.

123 On 9 July 2021, orders were made for the winding up of Forum Finance. The liquidators were appointed as joint and several liquidators of this entity. The Court has granted Westpac, SMBC and Societe Generale leave to proceed against this company: see orders made by Lee J on 15 July 2021, 30 July 2021 and 11 November 2021.

124 On 28 July 2021, orders were made for the winding up of FGOC, 14 James Street, 26 Edmonstone Road, 5 Bulkara Street, 6 Bulkara Street, Forum Fleet, Imagetec FS, Imagetec Solutions, Iugis, Iugis Waste, Aramia, Spartan and Intrashield. The Court has granted Westpac and SMBC leave to proceed against these companies (as they relate to their proceedings): see orders made by Lee J on 22 September 2021, 12 November 2021 and orders made by Cheeseman J on 22 November 2022.