Federal Court of Australia

Compumod Investments Pty Limited as trustee for the Compumod Pty Limited Staff Superannuation Fund v Universal Equivalent Technology Limited (Settlement Approval No 2) [2024] FCA 917

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

Confidentiality

1. Until 4.00 pm on the date that is 10 years after the date of this order or until further order of the Court, pursuant to s 37AF of the Federal Court of Australia Act 1976 (Cth) (FCA Act) and on the grounds set out in s 37AG(1)(a) of the FCA Act the material listed in Annexure A to these Orders is confidential and not to be published or made available to any person other than:

(a) the Court;

(b) the Applicant and its legal representatives; and

(c) Therium Litigation Finance Atlas AFP IC and its legal representatives.

2. Pursuant to s 37AF of the FCA Act and on the grounds set out in s 37AG(1)(a) of the FCA Act, until 49 days after the date of these Orders, or if an appeal or application for leave to appeal has been filed in respect of these Orders by that date then until further order of the Court, the material listed in Annexure B to these Orders is confidential and not to be published or made available to any person other than:

(a) the Court;

(b) the Applicant and its legal representatives; and

(c) the Funder and its legal representatives.

Settlement approval

3. Pursuant to s 33V(1) of the FCA Act, the settlement of the representative proceeding brought by the applicant against the second respondent, including the dismissal of the claims against the second respondent, be approved upon the terms set out in the Deed of Settlement entered into between the applicant, the second respondent, Hicksons Lawyers and Therium executed on 28 June 2024 (Settlement Deed).

4. There be no order as to costs of the proceeding between the applicant and the second respondent, and any extant costs orders between those parties be vacated.

5. Other than as provided in these Orders, the proceeding is dismissed with no order as to costs.

6. The Settlement Sum provided for in the Settlement Deed be paid into the trust account of the applicant’s solicitors, Hicksons Lawyers, on the terms provided for in the Settlement Deed to be held on trust for the applicant, group members and Therium, subject to the terms of Order 7 below.

7. The Settlement Sum provided for in the Settlement Deed shall be aggregated with the Settlement Sum referred to in Order 3 made by Justice Lee on 27 May 2024 and together shall constitute the Total Settlement Sum.

8. Pursuant to s 33V(2) of the FCA Act, the Court makes the following orders with respect to the distribution of the Total Settlement Sum:

(a) reimbursement be made from the Total Settlement Sum to Therium in the following amounts:

(i) legal costs incurred to 31 May 2024 of $1,630,468.71;

(ii) book building costs of $330,000; and

(iii) adverse costs insurance upfront premium of $261,600;

(b) deductions be made from the Total Settlement Sum and paid as follows:

(i) to Hicksons Lawyers in respect of remaining professional costs and counsel fees since 1 June 2024 up to the sum of $210,000;

(ii) to the lead applicant as nominal payment in recompense for the assistance provided in the sum of $15,000;

(iii) to Premier Litigation Funding Management Pty Limited (PLFM) for management of the settlement distribution scheme in the sum of $104,500; and

(iv) to Therium in respect of its funding commission in the sum of $2,009,529.39;

(c) the remaining balance of the Total Settlement Sum be paid into a trust account held by PLFM to be administered in accordance with the proposal reproduced at pages 398 to 399 of Exhibit CM-1 to the affidavit of Christopher Edward Moore sworn on 17 July 2024.

9. Pursuant to s 33ZB(a) of the FCA Act, the persons affected by these orders are:

(a) the applicant;

(b) all group members who have not opted-out;

(c) the first respondent;

(d) the second respondent;

(e) Hicksons Lawyers;

(f) Therium; and

(g) the NSW Registry of the Federal Court of Australia.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

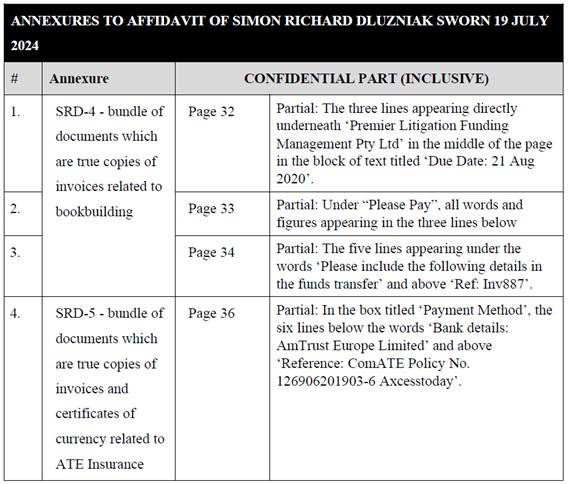

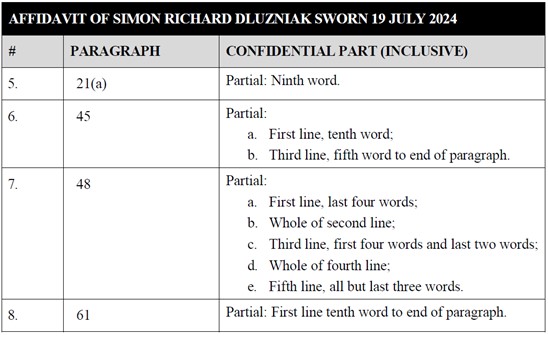

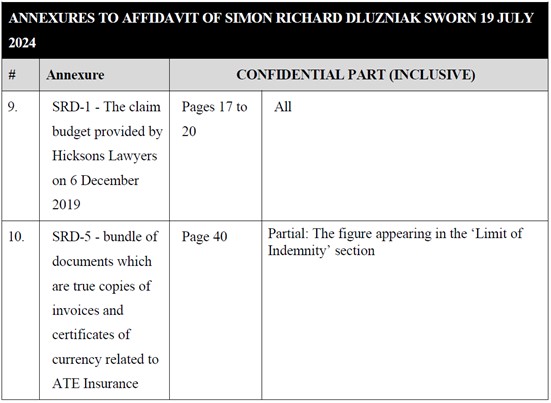

Annexure A

Annexure B

MARKOVIC J:

1 On 2 August 2024 I made orders, among others, pursuant to s 33V of the Federal Court of Australia Act 1976 (Cth) (FCA Act) approving both a settlement of this proceeding as between the applicant, Compumod Investments Pty Limited as trustee for the Compumod Pty Limited Staff Superannuation Fund, and the second respondent, PricewaterhouseCoopers Securities Limited (PwCS) and the proposed distribution of proceeds of the settlement with PwCS and an earlier settlement (first settlement) reached with the third to sixth respondents, who are the insurers of the first respondent, Axsesstoday Limited (AXL). These are my reasons for making those orders.

2 The proceeding is a closed class representative proceeding. It arises out of a corporate bond raising marketed and sold to retail investors, including Compumod and, as explained below, 291 group members based on a prospectus that allegedly misstated or failed to disclose critical information relating to the investment risk. AXL is the borrower. It failed a short period after the bond issue and the retail investors who purchased the bonds allege that they suffered losses of approximately 65 cents on the dollar on their investment with total losses assessed at approximately $36.3 million as at 25 July 2024. AXL has now been deregistered.

3 The settlement with AXL’s insurers was approved on 27 May 2024 under s 33V(1) of the FCA Act: see Compumod Investments Pty Limited as trustee for the Compumod Pty Limited Staff Superannuation Fund v Universal Equivalent Technology Limited (Settlement Approval) [2024] FCA 571 (Compumod (Settlement Approval No 1)). That was, as described by Compumod, a settlement reached on pragmatic grounds given the limit of AXL’s insurance cover. The terms of the settlement include payment of a sum of $1 million.

4 The settlement with PwCS followed two mediations and a without prejudice meeting between legal representatives one week before commencement of the seven day trial. It was at that latter meeting that Compumod (and the group members) and PwCS reached a settlement, subject to the Court’s approval, by way of payment of the sum of $8.25 million inclusive of costs.

5 By orders made on 28 June 2024 I granted leave to Therium Litigation Finance Atlas AFP IC, the funder, to appear on this application. It seeks orders approving distribution to it of certain amounts from the amounts paid or to be paid pursuant to the first settlement and the settlement reached with PwCS (settlement sum).

Group Members

6 Before proceeding further, it is necessary to say something about the group members. As defined in the third further amended statement of claim they are relevantly persons who subscribed to the corporate bonds issued by AXL under one of two relevant prospectus and who entered into a litigation funding agreement (LFA) with Therium and a retainer agreement in respect of the proceeding with Hicksons Lawyers.

7 At the time of the first settlement with AXL’s insurers and until recently, the parties understood that there were approximately 277 group members: see for example Compumod (Settlement Approval No 1) at [1]. However, the evidence before me disclosed that there are in fact 291 bond holders who have entered into an LFA and a retainer agreement. As explained by Liam Maguire, a solicitor with Hicksons, of the 14 additional bondholders to the initial group of 277:

(1) three bondholders returned signed LFAs and retainer agreements directly to Premier Litigation Funding Management Limited Pty Ltd (PLFM), the entity responsible for the bookbuild. They were identified by PLFM as forming part of the closed class, and a figure of 280 bondholders was communicated to Hicksons. However, despite providing that information to Hicksons, PLFM inadvertently failed to update its internal register of bondholders to reflect the total bondholders as 280 (which it was at that time). This had the effect that the total bondholders remained recorded as 277; and

(2) 11 bondholders returned their signed LFAs and retainer agreements to PLFM via their agent, Evans and Partners Pty Limited (E&P). E&P is a financial advisor who acted as an agent for a number of bondholders and coordinated the execution of the LFA and retainer agreements by their clients, and their return to PLFM.

8 The register of bondholders was not updated in a timely manner to reflect receipt of the 14 additional bondholders’ LFAs and retainer agreements as a result of administrative error and thus PLFM did not record those bondholders as group members and did not include 11 of those 14 bondholders in the figure provided to Hicksons for the purposes of settlement.

9 Notwithstanding that, it is clear that the 14 bondholders have been and are group members such that there are in total 291 group members. Further, the 14 bondholders have been treated as group members. They were each sent a copy of the opt-out notice dated 13 March 2024 and the notification of proposed settlement dated 25 July 2024 and none of them have opted out or objected to the proposed settlement. For completeness I note that as at 31 July 2024 none of the initial 277 group members had raised any objection to the settlement.

Legal principles

10 Section 33V(1) of the FCA Act relevantly provides that a representative proceeding cannot be settled without the approval of the Court and s 33V(2) provides that if approval is given, the Court may make such orders as are just with respect to the distribution of any money paid under a settlement.

11 The principles that apply to an application of this nature are well settled. As Compumod submits, they have been set out in numerous cases: see for example Camilleri v The Trust Company (Nominees) Ltd [2015] FCA 1468 at [5]; Fowkes v Boston Scientific Corporation [2023] FCA 230 at [31]-[45].

12 There are two stages: the settlement and the distribution, although the considerations are not necessarily distinct: Davis v Quintis Limited (Subject to Deed of Company Arrangement) [2022] FCA 806 at [4].

13 At the first stage, the central question is whether the settlement is fair and reasonable in the interests of the group members as a whole or, to like effect, whether the settlement constitutes a fair and reasonable compromise of the claims made on behalf of group members: Compumod (Settlement Approval No 1) at [6].

14 At the second stage, in Ewok Pty Ltd as trustee for the E & E Magee Superannuation Fund v Wellard Limited [2024] FCA 296 Button J considered whether deductions in favour of a funder were “just” in the context of a settlement approval in a closed class proceeding where, as is the case here, every group member had entered into contractual arrangements with the funder. Her Honour observed at [53] that what is “just” is responsive to the factual circumstances of a case.

The proposed settlement

15 For the following reasons I was satisfied that the proposed settlement with PwCS is a fair and reasonable compromise of the claims made on behalf of group members:

(1) a confidential opinion was provided to the effect that the settlement is reasonable. As Lee J observed at [15] of Compumod (Settlement Approval No 1), “[t]he job of the Court is not to second guess that judgment by persons who know far more about the matter than the judge approving settlement”. Experienced counsel, who were involved in the matter leading up to its preparation for hearing, considered the claims and the factors which affect it and concluded that the settlement is fair and reasonable;

(2) relevantly, the primary alleged wrong-doer was AXL, against which Compumod’s (and the group members’) claim was more straightforward. Unexpectedly, AXL was grossly under insured. A consequence of that was that recovery depended on the more complex claim against PwCS. As Compumod submitted, a combination of the risks associated with the claim against PwCS and the prospect of success against PwCS only on an apportionable claim basis means that the proposed settlement is reasonable;

(3) the proposed settlement also avoids the real risk of the need to prove individual reliance on the part of each group member;

(4) while counsels’ confidential opinion was prepared based on 280 group members, the increase in group members to 291 increases the total value of bonds by $601,000 which is less than 1.5% of the total value stated in that opinion and thus will have de minimis effect; and

(5) the terms of settlement as set out in the settlement deed between Compumod, PwCS, Hicksons and Therium are conventional. They address the difficulties identified in Compumod (Settlement Approval No 1) at [7]-[10].

The proposed distribution

16 Distribution of the settlement sum is to be undertaken pursuant to cl 7 of the LFA. In summary that clause provides that distribution will be made after deduction of: Therium’s costs; the administrator of the distribution scheme’s costs; unpaid legal costs; and Therium’s “Participation Percentage” which is “30% of the total amount of the Net Recoveries”. Included in Therium’s costs are “Expenses” which are, in turn, defined to include bookbuild costs and any premium paid or payable to a third party insurer for adverse costs insurance (ATE insurance).

17 There was evidence before me of the amounts to be deducted in relation to each of those items. It is not necessary to set it out here. I was satisfied that the major deductions were provided for in the LFA entered into by Compumod and each group member and that those costs were appropriate and “just” as required by s 33V(2) of the FCA Act. In particular, I was satisfied that:

(1) the legal costs were appropriate and proportionate given the level of complexity of the proceeding and that it had run to settlement over a period of four years;

(2) the payment to Compumod as lead applicant for the time of its representative is conventional and, as submitted by Compumod, appeared to be at the lower end: see for example Zantran Pty Limited v Crown Resorts Limited (No 4) [2022] FCA 500 at [51]; Money Max Int Pty Limited (Trustee) v QBE Insurance Group Limited [2018] FCA 1030; 129 ACSR 1 at [211]-[219];

(3) as a significant user of ATE insurance, Therium negotiated a “block policy” with AmTrust which enables it to automatically insure any cases in Australia funded by a Therium funding entity. In negotiating the policy, Therium in effect tested the market and determined that AmTrust’s pricing was best given a number of factors, including lowest price. The evidence before me demonstrated that the level of cover obtained for the proceeding was appropriately calculated;

(4) the commission of 30% payable to Therium on the net recoveries is in accordance with the terms of the LFA and, as deposed to by Simon Richard Dluzniak, a director and investment manager of Therium Capital Management (Australia) Pty Ltd and an investment adviser to the Therium Group which includes Therium, the funding return was within the typical range of funder’s commission that had been approved in the context of Pt IVA settlements in recent years;

(5) settlement distribution costs have been calculated having regard to the time that will be needed to undertake the two-stage process described below and are reasonable particularly when seen in light of the competing proposal obtained by Hicksons; and

(6) the total deductions amount to approximately 50% of the settlement sum.

18 The settlement distribution is to be administered by PLFM. PLFM is the manager of a number of trust funds and organises and manages the periodic distributions of income and capital to unit holders in those trust funds. The distribution process will comprise two stages:

(1) PLFM will contact group members and request their bank account details and a call-back process will be initiated to confirm all bank account details for anti-fraud purposes. PLFM will create a spreadsheet with the individual distributions calculated for each group member which Hicksons will review and approve; and

(2) PLFM will set up a trust account from which all payments will be made. Once a payment is made, PLFM will send the group member a statement which details the amount of the distribution made to the group member, the bank account details (partially redacted) to which the distribution was paid and the date of the payment.

19 The distribution amount in respect for each group member will be calculated according to the following formula:

Individual group member’s distribution = A x (B/C) where:

A = net sum available for distribution;

B = the face value of the individual group member’s bonds; and

C = the aggregate face value of all group members’ bonds.

20 As explained by Christopher Edward Moore, a solicitor and consultant with Hicksons who has had carriage of this proceeding, whilst the losses of each group member have been reduced by interest payments and distributions under the deed of company arrangement for AXL, those deductions were made in equal proportions to the value of the bonds held by each group member. Therefore using the face value of the bonds is an accurate proxy to ensure that each group member receives an equal proportionate share of the settlement proceeds.

21 The distribution process also addresses what is to occur if a group member cannot be contacted despite all reasonable attempts to do so. In those circumstances, if the undistributed amount is:

(1) greater than $20,000, PLFM will approach the Court for directions; or

(2) less than $20,000, PLFM will seek to pay that group member’s distribution to the New South Wales Government under the Unclaimed Money Act 1995 (NSW). If the funds are not accepted under that Act, PLFM will pay the Group Member’s distribution, as well as any other residual funds remaining in the trust account, to the Cancer Council NSW (Charitable Fundraising Authority No. 18521).

22 Finally, Compumod raised one particular matter about the distribution. It noted that, as identified in counsels’ confidential opinion and referred to above that, following success on the common questions, each group member would need to establish an individual reliance case but that the proposed settlement distribution scheme does not allow for differentiation based on individual reliance. I accepted that was appropriate in this case for the four reasons given by Compumod: first, the need to establish individual reliance was a risk, not a certainty, which depended on why Compumod succeeded on the common questions or on which questions it succeeded; secondly, an advantage of the settlement was to remove the risk of the need to litigate and establish individual reliance; thirdly, the cost of establishing individual reliance would be disproportionate to the benefit to any group member; and fourthly, no group member objected.

Conclusion

23 For those reasons I made the orders sought by Compumod.

I certify that the preceding twenty-three (23) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Markovic. |

Associate: