Federal Court of Australia

Anderson, in the matter of NT Port and Marine Pty Ltd (Subject to Deed of Company Arrangement) (No 3) [2024] FCA 905

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The plaintiff has leave to transfer all of the issued shares held by Ezion Offshore Logistics Hub Pte Ltd (Company Number: 201017162H) (Ezion) in NT Port and Marine Pty Ltd (Administrator Appointed) ACN 146 391 219 (Company) to Port Melville Pty Ltd ACN 106 954 134 (Port Melville) free from all encumbrances, such leave to take effect on and from the satisfaction or waiver of the conditions subsequent in clauses 3(a)(iv) and 3(a)(v) of the Deed of Company Arrangement in respect of the Company (DOCA).

2. For the purposes of paragraph 1, the transfer of shares shall be free of any security over the shares held by or on behalf of P.T. Limited ACN 004 454 666 (PT Limited) and, upon the transfer, any such security is, by this order, released and discharged.

3. PT Limited and Aus AM Pte Ltd (Company Number: 201422567M) (Aus AM) are restrained from realising or otherwise dealing with their security interests in the property of the Company while the DOCA is in force and where applicable on effectuation of the DOCA, except with the plaintiff’s written consent.

4. PT Limited and Aus AM’s security interests over the assets and undertaking of the Company be discharged upon effectuation of the DOCA, in consideration for the payment of the net proceeds of the DOCA Fund to PT Limited after satisfaction of costs and expenses as defined and prioritised in the DOCA.

5. The plaintiff is to take all reasonable steps to cause a sealed copy of these Orders to be given to Ezion, PT Limited, Aus AM, DBS Trustee Limited and creditors (including persons or entities claiming to be creditors) of the Company within three business days from today.

6. Service on Ezion at the email address “seng@deloitte.com” will be effective service for the purpose of complying with paragraph 5.

7. Service on Aus AM at the email address “tan.hw@charismaenergy.com” or by express post to “15 Hoe Chiang Road, #12-05 Tower Fifteen, Singapore 089316” will be effective service for the purpose of complying with paragraph 5.

8. The plaintiff is to inform the Court as soon as practicable in the event that the conditions subsequent in clauses 3(a)(iv) and 3(a)(v) of the DOCA are not satisfied or waived within 30 days of the date of these orders.

9. Any person who can demonstrate a sufficient interest has liberty to apply to vary or discharge any orders made pursuant to paragraphs 1 to 4 above on three business days’ written notice to the plaintiff and the Court, such liberty to be exercised within 10 business days of service of the Orders in accordance with paragraph 5.

10. The costs of and incidental to the plaintiff’s interlocutory application dated 23 July 2024 (as amended on 6 August 2024) are to be paid out of the assets of the Company and the plaintiff is entitled to be indemnified for his costs of the proceeding out of the Company’s assets as a priority expense in the administration under s 556 of the Corporations Act 2001 (Cth).

11. Liberty to apply.

12. Any requirement that the plaintiff have leave to serve a document outside of the jurisdiction is (to the extent necessary) dispensed with, nunc pro tunc.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

CHARLESWORTH J

1 The plaintiff is the sole administrator of NT Port and Marine Pty Ltd (Administrator Appointed) ACN 146 391 219 (Company). He seeks orders relating to a Deed of Company Arrangement (DOCA) executed on 31 July 2024 by him, the Company and Port Melville Pty Ltd ACN 106 954 134 (Port Melville). Subject to the fulfilment of conditions subsequent, the DOCA provides for (among other things) a Deed Fund Contribution by Port Melville and other entities of $6.8 million, in consideration for the transfer of all of the Company’s issued shares to Port Melville. The conditions subsequent relevantly include the following:

(1) Ezion Offshore Logistics Hub Pte Ltd (Company Number: 201017162H) (Ezion) consenting to the transfer of the shares for no consideration, or (absent consent) an order of this Court granting leave to the plaintiff to affect the transfer; and

(2) the Company’s two secured creditors P.T. Limited ACN 004 454 666 (PT Limited) and Aus AM Pte Ltd (Company Number: 201422567M) (Aus AM) voting in favour of the DOCA and releasing their respective security interests over the Company (or orders of this Court restraining them from realising or dealing with those interests during the life of the DOCA and discharging the interests upon its completion), or orders of this Court retraining the enforcement of the securities and discharging them.

2 The plaintiff is the administrator of the DOCA.

3 Ezion has not consented to the transfer of its shares, nor have the secured creditors voted on the DOCA or released and discharged their security interests. By his amended interlocutory application, the plaintiff seeks orders to fulfil the conditions subsequent so that the DOCA can take effect, specifically:

1. pursuant to section 444GA(1)(b) of the Corporations Act, that the Plaintiff have leave to transfer all of the issued shares held by Ezion Offshore Logistics Hub Pte Ltd (Company Number: 201017162H) (Ezion) in NT Port and Marine Pty Ltd (Administrator Appointed) ACN 146 391 219 (Company) to Port Melville Pty Ltd ACN 106 954 134 (Port Melville) free from all encumbrances, such leave to take effect on and from the satisfaction or waiver of the conditions subsequent in clauses 3(a)(iv) and 3(a)(v) of the Deed of Company Arrangement in respect of the Company (DOCA);

2. pursuant to section 444F(2) of the Corporations Act, that P.T. Limited ACN 004 454 666 (PT Limited) and Aus AM Pte Ltd (Company Number: 201422567M) (Aus AM) are not permitted to realise or otherwise deal with their security interest in the property of the Company while the DOCA is in force and where applicable on effectuation of the DOCA, except with the Plaintiff’s written consent;

3. pursuant to section 447A of the Corporations Act or alternatively section 90-15 of the IPS, the Court orders that PT Limited’s and Aus AM’s security interests over the assets and undertaking of the Company be discharged upon effectuation of the DOCA, in consideration for the payment of the net proceeds of the DOCA Fund to PT Limited after satisfaction of administration costs and expenses;

…

6. that the Plaintiff is to take all reasonable steps to cause a sealed copy of the Orders to be given to Ezion, PT Limited, Aus AM, DBS Trustee Limited and creditors (including persons or entities claiming to be creditors) of the Company within three business days of the date of the Orders;

7. that service on Ezion at the email address ‘seng@deloitte.com’ will be effective service for the purpose of complying with paragraph 6 above;

8. that service on Aus AM at the email address ‘tan.hw@charismaenergy.com’ and by express post to ‘15 Hoe Chiang Road, #12-05 Tower Fifteen, Singapore 089316’ will be effective service for the purpose of complying with paragraph 6 above;

9. that the Plaintiff is to inform the Court as soon as practicable in the event that the conditions subsequent in clauses 3(a)(iv) and 3(a)(v) of the DOCA are not satisfied or waived within 30 days of the date of these orders;

10. that any person who can demonstrate a sufficient interest has liberty to apply to vary or discharge any orders made pursuant to paragraphs 1 to 3 above on three business days’ written notice to the Plaintiff and the Court, such liberty to be exercised within 10 business days of service of the Orders pursuant to order 6 above;

11. that the costs of and incidental to this Application be paid out of the assets of the Company and that the Plaintiff be entitled to be indemnified for his costs of the proceeding out of the Company’s assets as a priority expense in the administration under section 556 of the Corporations Act;

12. that the Plaintiff have liberty to apply; and

13. as this Honourable Court deems fit.

4 In addition, the plaintiff seeks an order that the costs of the present application be paid out of the assets of the Company and that he be entitled to be indemnified for his costs of the proceeding out of the Company’s assets as a priority expense in the administration under s 556 of the Corporations Act 2001 (Cth), together with procedural orders relating to the service of documents on interested entities.

5 The orders are sought under provisions contained in Pt 5.3A of the Act. The objects of Pt 5.3A (and Sch 2 to the Act to the extent that it relates to it) is to provide for the business, property and affairs of an insolvent company to be administered in a way that maximises the chance of the company (or as much as possible of its business) to continue in existence or (if that is not possible) result in a better return for the company’s creditors and members than would result from an immediate winding up of the company: Act, s 435A.

Background to the DOCA

6 The Court has read the seventh plaintiff of the applicant sworn on 23 July 2024 and affidavits of his solicitor sworn on 31 July 2024, 6 August 2024, and 8 August 2024. The plaintiff further relies on six affidavits filed in support of earlier interlocutory applications relating to the Company, including those resulting in judgments in Anderson, in the matter of NT Port and Marine Pty Ltd (Administrators Appointed) [2023] FCA 3; and Anderson, in the matter of NT Port and Marine Pty Ltd (Administrators Appointed) (No 2) [2023] FCA 408. In those judgments, I set out some background about the Company’s business in the operation of a port situated on Melville Island and the importance of that business to (among others) the people of the Tiwi Islands. It is unnecessary to repeat those observations here.

7 The following additional background is based on the affidavit evidence (which I accept without qualification) and the documents exhibited to them.

8 The plaintiff reports (and I accept) that PT Limited is owed $50,482,489.00. Unsecured trade creditors are owed $347,412.00, excluding a further $2 million that would be provable in a liquidation (but not in the DOCA). On a forced sale of assets in the context of a liquidation, the Company’s assets are valued at $1,698,650.00.

9 Administrators were appointed to the Company on 16 December 2022. Since that time, the secured creditors have not sought to enforce their security interests and there is presently no indication that they intend to do so. The efforts of the plaintiff in keeping the business operating have protected the Company’s assets (specifically its business as a going concern) for their ultimate benefit.

10 In those efforts, the plaintiff secured funding from the National Indigenous Australians Agency (NIAA) pursuant to a Tripartite Deed, applied solely to the purpose of operating the port. That funding is now exhausted. NIAA has since provided further funding pursuant to an extension of the Tripartite Deed. Among other things, the extended funding has enabled the plaintiff to keep the port open for business and to undertake a sale process, which included negotiations for the DOCA and for a back-up Asset Sale Agreement with Port Melville.

11 Port Melville’s offer to recapitalise the Company (culminating in the DOCA) was the only binding offer the plaintiff received as a result of the sales process and is the only option available that provides for the Company and its business to remain in existence. The only other available options are the sale of assets under the back-up Asset Sale Agreement or by auction in a forced sale basis on a winding up.

12 The Deed Fund Contribution is comprised of $2,725,000.00 from Port Melville, $2,575,000 from NIAA and $1,500,000.00 from Viva Energy Pty Ltd ACN 004 610 459. The total sum of $6.8 million will be applied in the following order or priorities:

(1) payment of employee creditor claims;

(2) discharge of administration trading liabilities;

(3) payment of the plaintiff’s remuneration and expenses both as administrator of the Company and as administrator of the DOCA itself;

(4) repayment of operation funding advanced under the Tripartite Deed; and

(5) payment of dividends to secured and unsecured creditors, with $100,000.00 reserved for the pro-rata payment of the claims of key unsecured creditors.

13 The payment of $100,000.00 to unsecured creditors in priority to payment of secured creditors is to ensure that the key trade creditors continue to trade with the Company so as to ensure that the port can continue to operate.

14 The back-up Asset Sale Agreement was executed on 11 July 2024. If the Court makes orders on the present application, it will have no force or effect. If it does come into force, Port Melville will purchase all of the business, assets and undertaking of the Company for a lesser purchase price of $6,700,000.00. It is the plaintiff’s opinion that the back-up Asset Sale Agreement would require at least six weeks to settle and its implementation would come with significant additional legal and administrative costs. Under that agreement, there would be no payment to unsecured creditors of $100,000.00 as provided for in the DOCA.

15 In a report to creditors dated 5 July 2024, the plaintiff provided details of the then-proposed DOCA as well as information necessary to compare the outcome of that proposal to the other likely outcomes for the Company’s creditors should the Company be immediately wound up. That opinion is discussed below.

Meetings

16 Under the DOCA, the Company’s employees would remain employed and their entitlements will be paid in the ordinary course of the Company’s trade.

17 A meeting of eligible employee creditors was convened on 12 July 2024.

18 On the same day, a second meeting of creditors was held to determine the future of the Company in accordance with s 439A of the Act. Eight employee creditors and six other creditors attended, four of them represented by proxies. PT Limited attended by proxy but abstained from voting on all resolutions. In circumstances described later in these reasons, Aus AM did not attend.

19 Save for PT Limited’s abstention, all present creditors voted in favour of the DOCA. PT Limited also abstained from voting on a resolution for the payment of the plaintiff’s remuneration, as did another present creditor.

ORDER ENABLING THE TRANSFER OF SHARES

20 As I have mentioned, it is a term of the DOCA that Port Melville will acquire 100% of the issued share capital of the Company.

21 Section 444GA(1) of the Act provides that an administrator of a deed of company arrangement may transfer shares in a company if the administrator has obtained the written consent of the owner of the shares or otherwise with the leave of the Court. The power to grant leave may only be exercised if the Court is satisfied that the transfer would not unfairly prejudice the interests of members of the company.

22 Leave should be granted for the following reasons.

23 Ezion is a company incorporated in Singapore. It is wholly owned by Singaporean entity AusGroup Ltd. AusGroup was placed into liquidation on 18 July 2023. The plaintiff wrote to Ezion and AusGroup seeking Ezion’s consent to the transfer of its shares to Port Melville for no consideration. AusGroup has advised that Ezion does not consent to the transfer.

24 Under s 563A of the Act, shareholder claims are subordinated to unsecured creditor claims. Given the Company’s financial position, there will be no surplus for distribution to shareholders. Accordingly, Ezion would be in no worse position in the event that the DOCA took effect or in the event that the back-up Asset Sale Agreement became enforceable. I am otherwise satisfied that the shares have no residual value to Ezion because any such value depends upon the Company and its business continuing in existence. On the material before me (including the confidential material), that will not occur unless the DOCA takes effect.

25 As the Company’s sole member, Ezion is entitled to oppose the application for leave: Act, s 444GA(2)(a). I am satisfied that Ezion has been made aware of the DOCA and of the present application. Ezion’s holding company (itself under liquidation) has informed the plaintiff that it does not consent to the transfer of the shares. It was open to Ezion to seek to be joined on the application or otherwise to seek an audience for the purpose of opposing it.

26 The requirement that the Court be satisfied that the transfer of shares not “unfairly prejudice” shareholders directs attention to the impact of a compulsory sale on shareholders where there may be some residual value in the company: Re Tucker (as deed administrator of Black Oak Minerals Ltd (ACN 124 374 321) (subject to deed of company arrangement) (in liq)) (2019) 134 ACSR 472. And as White J said in Lewis, in the matter of Diverse Barrel Solutions Pty Ltd (Subject to a Deed of Company Arrangement) [2014] FCA 53 (at [19]):

… Whether or not ‘unfair prejudice’ will result from a transfer of shares is to be determined having regard to all the circumstances of the case and to the policy of the legislation. Relevant matters would seem to include whether the shares have any residual value which may be lost to the existing shareholders if the leave is granted; whether there is a prospect of the shares obtaining some value within a reasonable time; the steps or measures necessary before the prospect of the shares attaining some value may be realised; and the attitude of the existing shareholders to providing the means by which the shares may obtain some value or by which the company may continue in existence. A relevant comparison will be between the position of the shareholders if the proposal does not proceed and their position if leave to transfer the shares is granted.

27 See also Re Habibi Waverton Pty Ltd (In Liq) (admins appt) (2021) 154 ACSR 701, Rees J (at [33]).

28 In Weaver v Noble Resources Ltd (2010) 41 WAR 301 Martin CJ said (at [79]) that if shareholders were unlikely to receive any distribution in the event of a liquidation, and if liquidation is the only alternative to the transfer proposed, “then it is difficult to see how members could in those circumstances suffer any prejudice, let alone prejudice that could be described as unfair”.

29 That is the case here. Ezion is unlikely to receive any distribution in the event of a winding up. Given the Company’s financial position, it stands to receive nothing under the DOCA (which is dependent on the transfer in any event) and nothing under the back-up Asset Sales Agreement.

30 In the circumstances described, I am satisfied that an order under s 444GA of the Act granting leave to the plaintiff to transfer all of the Company’s shares to Port Melville would not unfairly prejudice Ezion’s interests. In addition, the order would best promote the objectives of Pt 5.3A of the Act because it would (among other orders) ensure the continued operation of the Company and its business.

31 The Court has been informed that the shares held by Ezion are themselves the subject of a security interest in favour of PT Limited. That security is registered on the Personal Property Security Register (PPSR) under s 150 of the Personal Property Securities Act 2009 (Cth) (PPS Act). The nature of the obligation secured by the security is not known.

32 Section 444GA of the Act contemplates that an order permitting the transfer of shares may affect the interests of persons other than a company’s shareholders. The power to affect that interest is implicitly conferred under s 444GA of the Act, and also under item 90-15(1) and (3)(a) of Sch 2 Insolvency Practice Schedule (Corporations) of the Act. Assuming that PT’s interests may be affected by the order, it is an entity having standing to oppose it: Act, s 444GA(c). However, on the material before me, I am satisfied that as the shares themselves have no value, then any security in favour of PT Limited would also have no value. The position of PT Limited in relation to securities affecting the Company’s assets is discussed below. Whilst on the material presently before me I am satisfied that PT Limited’s interests in the shares themselves would not be prejudiced, and whilst I am satisfied that PT Limited is aware of this application, it is nonetheless appropriate that it have liberty to apply to vary or revoke the order for the transfer of shares (and other orders) within a fixed timeframe. That will ensure a greater measure of certainty for the plaintiff and all other persons whose interests may be affected by the DOCA, once the time to exercise the liberty expires or once any exercise of the liberty is resolved.

33 There will be an order under s 444GA(2) of the Act granting leave to the plaintiff to transfer Ezion’s shares in the Company to Port Melville, such leave to take effect upon other conditions subsequent being fulfilled. There should be a further order to ensure that the shares can be transferred to Port Melville unencumbered of the security in PT Limited’s favour. I consider the additional order to be necessary because the relief presently sought under s 444F of the Act relates to securities affecting the Company’s assets, not its shares.

34 The plaintiff will be heard further as to the appropriate form of additional order.

ORDERS AFFECTING SECURITY INTERESTS OF PT LIMITED

35 Section 444F applies where at a meeting convened under s 439A, a company’s creditors have resolved that a company should execute a deed of company arrangement, and the company has executed such a deed. Each of those conditions is fulfilled. Subject to s 444F(3), the Court may make an order under s 444F(2) restraining a secured creditor from realising or dealing with its security interest except as permitted by the order. Section 444F provides:

(3) The Court may only make an order under subsection (2) if satisfied that:

(a) for the creditor to realise or otherwise deal with the security interest would have a material adverse effect on achieving the purposes of the deed; and

(b) having regard to:

(i) the terms of the deed; and

(ii) the terms of the order; and

(iii) any other relevant matter;

the creditor’s interests will be adequately protected.

…

(6) An order under this section may be made subject to conditions.

36 PT Limited is the trustee of the AusGroup Australian Security Trust. It is effectively the representative of approximately 300 individual noteholders who together are owed $40 million by AusGroup. Most of the noteholders are also represented by a trustee DBS Trustee Limited (DBS Trustee).

37 The Company entered into a General Security Deed with PT Limited on 28 November 2016 pursuant to which PT Limited obtained a security interest over all of the Company’s present and after acquired property. PT Limited has taken no action to enforce its security interests, whether in the “Decision Period” (as defined in the Act) or afterward. The plaintiff has kept PT Limited and individual noteholders informed about the status of the administration, including by convening a meeting with the noteholders themselves on 11 July 2024. Neither PT Limited nor the noteholders have provided any funding for the continued operation of the port during the administration, despite the plaintiff’s approaches.

38 AusGroup has published a letter on the Singapore Stock Exchange from DBS Trustee. That letter summarised the plaintiff’s report to creditors and the terms of the then-proposed DOCA. The letter informed noteholders that PT Limited had advised that it would not take any enforcement action under its securities unless it was satisfied that its liability was limited, that it was sufficiently indemnified and that it was put in funds in accordance with a security trust deed. The letter further advised that it was unlikely that noteholders would achieve a better return than it would under the back-up Asset Sale Agreement.

39 Following the second meeting of creditors, the plaintiff wrote to PT Limited seeking its consent to release and discharge all of the security interests held by it in relation to the Company’s property. PT Limited has informed the plaintiff that in order to discharge the security it must be instructed by DBS Trustee, which in turn requires instructions in accordance with its own trust deed, neither of which have been obtained. In order for instructions to be provided to DBS Trustee it would be necessary for there to be an extraordinary resolution passed at a meeting of noteholders requiring at least 21 days’ notice in writing. The plaintiff has been corresponding with PT Limited and DBS Trustee since December 2022 regarding the process and costs of calling a noteholders’ meeting, estimated at $300,000.00. The plaintiff reports that DBS Trustee is unwilling to convene a noteholders’ meeting without funding. The plaintiff has sought funding from noteholders, without success. The Company is not in a financial position to fund such a meeting.

40 In determining this application, I have had regard to the difficulties attending the process of obtaining the consent of the PT Limited. In the circumstances described I will proceed on the assumption that if a meeting of noteholders was convened, there would be no resolution directing DBS Trustee to instruct PT Limited to consent to the discharge of the securities. The absence of consent is to be afforded some weight, but it is not determinative. Section 444F(2) contemplates that the Court may make an order affecting the interests of the holder of a security notwithstanding their opposition.

41 The plaintiff must satisfy the Court that PT Limited’s interests will be “adequately protected” should an order under s 444F(2) be made. That does not require that the interests be protected “perfectly” or “completely”: In the matter of Hi-Fi Sydney Pty Ltd (Administrator Appointed) [2015] NSWSC 1312, Brereton J (at [59]); and Vincent Cold Storage Pty Ltd v Centuria Property Funds No 2 Limited (No 2) [2023] VSC 314, Osborne J (at [54]).

42 PT Limited abstained from voting on Port Melville’s DOCA proposal at the second meeting of creditors. It therefore remains at liberty to exercise its rights by enforcing its security interests: Act, s 444D(2). The orders sought by the plaintiff would first prohibit it from doing so and then discharge the interest entirely.

43 The plaintiff submits that the DOCA provides adequate protection to PT Limited, because it will receive the net proceeds of the $6.8 million contribution to the DOCA Fund after payment of the other priorities listed at [12] above. The plaintiff submits (correctly) that the rights of PT Limited as a secured creditor are subordinate to the plaintiff’s equitable lien for payment of his costs and expenses of the administration. Whilst it is true that the DOCA provides for a payment of $100,000.00 from the Deed Fund Contribution to be paid on a pro rata basis to unsecured creditors, that does not of itself mean that PT Limited will be prejudiced. If the DOCA does not proceed, PT Limited will be in a worse position under the back-up Asset Sale Agreement for two reasons. First, the consideration under the agreement is $100,000.00 less, with no provision for any payment to unsecured creditors. Hence, PT Limited will receive the net proceeds of the fund, after deduction of the plaintiff’s remuneration. I am satisfied that the plaintiff’s remuneration will be higher under that scenario because of the likely costs and expenses of performing and administering the back-up Asset Sale Agreement.

44 I have not overlooked PT Limited’s options of enforcing its own security interest, but that has not been done to date, and in that scenario, the plaintiff would remain entitled to his remuneration, including the considerable costs of the administration to date.

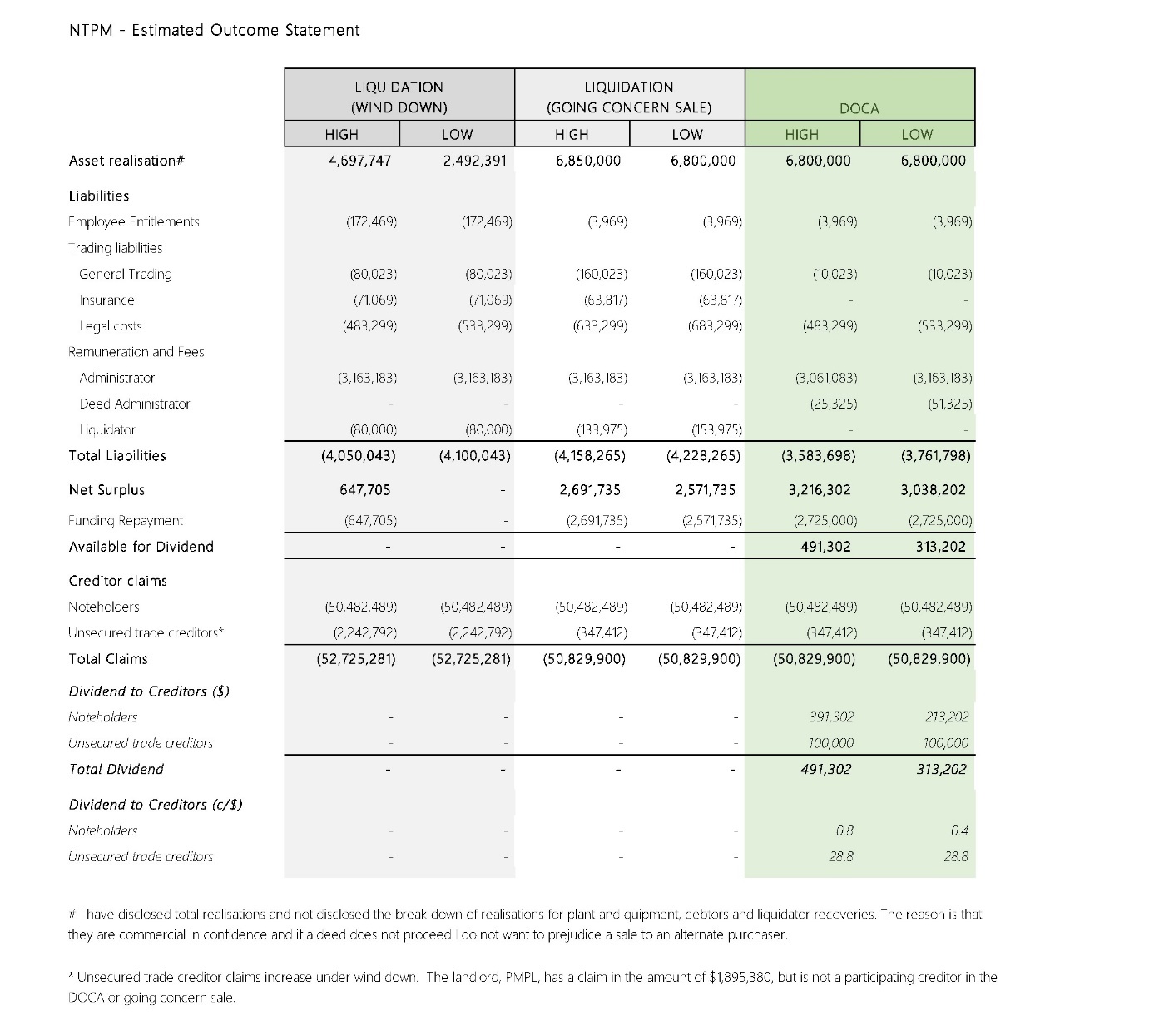

45 In a liquidation, PT Limited stands to receive nothing. So much is demonstrated by the following table prepared by the plaintiff. I accept the calculations contained in it.

ORDERS AFFECTING SECURITY INTERESTS OF AUS AM

46 At the time of the plaintiff’s appointment Aus AM was not listed as a creditor of the Company and it has not lodged a proof of debt in the administration. However, the PPSR records in 2015 that the Company granted security over all property leased, bailed, supplied or otherwise made available by Aus AM to the Company from time to time, including, but not limited to, an accommodation camp, an administration building and recreational facilities. The plaintiff has attempted to communicate with Aus AM by the addresses for service it has registered on the PPSR, including by issuing an Amendment Demand in accordance with s 178 of the PPS Act to effect the removal of the registered security. The plaintiff has received no response to any of his correspondence. Communications sent to the registered email address have been returned with a notification that they cannot be delivered.

47 An Amendment Statement has since been lodged with the Registrar under the PPS Act to seek the removal of the registration: PPS Act, s 178(1). At the time of this application the plaintiff had not been advised of the outcome.

48 I have not overlooked that Aus AM is a company based in Singapore. However, given that the only evidence of the existence of its security interest (if any) is that registered on the PPSR, I am satisfied that the plaintiff has taken all reasonable steps to communicate with it by way of the addresses for service contained on the PPSR.

49 If Aus AM has a security interest over any of the Company’s assets that is presently enforceable, it has not sought to enforce the security, nor has it corresponded with the plaintiff in relation to any debt that might be related to the security. There is some doubt as to whether there presently exists a security interest in favour of Aus AM at all. If the interest ranks second after the interest of PT Limited, then it effectively is no interest at all.

50 On the assumption that Aus AM is a secured creditor, I am satisfied that an order under s 444F of the Act would not unduly prejudice the interests of Aus AM, for the same reasons given in relation to PT Limited.

ORDER PROVIDING FOR the PLAINTIFF’S REMUNERATION

51 Were it not for the work performed in the administration to ensure the continued operation of the port, the Company would have been wound up in insolvency some time ago. In comparing the outcomes facing the Company, I have accepted the plaintiff’s evidence about the likely amounts to be paid to meet the expenses of the administration. No creditor has come forward to suggest that the figures utilised in those calculations are unreasonable or otherwise unreliable. On the basis of all of the information contained in the affidavits (including the suppressed material), it is appropriate to make an order that the plaintiff’s costs and expenses be paid in the priorities proposed by him. Those observations extend to an earlier period in which the plaintiff acted as joint administrator with another.

other ordeRS

52 The orders are to take effect on the expiry of a period in which affected parties may exercise their liberty to apply to vary or revoke them. It is appropriate to proceed in that way so that all persons affected by the future of the Company (including its employees, clients and trade creditors) may have certainty after the expiry of that period as to whether the Company is to be recapitalised in accordance with the DOCA.

53 For additional certainty there will be orders specifying the addresses for service for each of Ezion, PT Limited and Aus AM. It is sufficient that Aus AM be served by way of the same email address given in respect of the security as it appears on the PPSR: PPS Act, s 287. To date, documents have been provided to Ezion and its holding company AusGroup by its liquidators, and that remains appropriate.

54 The Court is aware of other conditions subsequent to the DOCA that are not yet fulfilled. If for any reason those additional conditions cannot be fulfilled, the Court may, of its own motion, determine whether the issues raised on the present application should be reconsidered. It is sufficient for that purpose to require the plaintiff to inform the Court if certain additional conditions subsequent are not satisfied or waived within 30 days from the orders to be made today.

I certify that the preceding fifty-four (54) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Charlesworth. |

Associate: