FEDERAL COURT OF AUSTRALIA

Connelly (liquidator) v Papadopoulos, in the matter of TSK QLD Pty Ltd (in liq) [2024] FCA 888

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. To the extent such leave is necessary by reason of s 58(3)(b) of the Bankruptcy Act 1966 (Cth), the plaintiffs be granted leave to obtain orders 2 to 5.

2. The first defendant pay the sum of $7,293,814.09 to the plaintiffs as a debt pursuant to s 588M(2) of the Corporations Act 2001 (Cth), as damages pursuant to s 1317H of the Corporations Act 2001 (Cth) and as equitable compensation.

3. The third defendant pay the sum of $5,527,190.35 to the plaintiffs as a debt pursuant to s 588M(2) of the Corporations Act 2001 (Cth), as damages pursuant to s 1317H of the Corporations Act 2001 (Cth) and as equitable compensation.

4. The third defendant pay the second plaintiff the sum of $3,853,281.44 as a debt due and owing to the second plaintiff.

5. The first and third defendants pay the plaintiffs’ costs of the proceeding to be agreed or, failing agreement, to be taxed.

6. The tenth and eleventh defendants pay the sum of $7,293,814.09 to the plaintiffs as a debt pursuant to s 588M(2) of the Corporations Act 2001 (Cth), as damages pursuant to s 1317H of the Corporations Act 2001 (Cth) and as equitable compensation.

7. The seventh defendant pay to the plaintiffs:

(a) $930,000 pursuant to s 588FF(1)(c) of the Corporations Act 2001 (Cth), as a debt pursuant to s 588M(2) of the Corporations Act 2001 (Cth), as damages pursuant to s 1317H of the Corporations Act 2001 (Cth) and as equitable compensation; and

(b) $4,597,190.35 as a debt pursuant to s 588M(2) of the Corporations Act 2001 (Cth), as damages pursuant to s 1317H of the Corporations Act 2001 (Cth) and as equitable compensation.

8. The plaintiffs and the seventh, tenth and eleventh defendants are directed to confer for the purposes of agreeing the amount of interest which is payable on the sums referred to in orders 6 and 7, and to provide a proposed form of order to the associate to Justice Downes by 4.00pm on 15 August 2024.

9. The plaintiffs and the seventh, tenth and eleventh defendants are directed to confer for the purposes of attempting to agree upon the form of costs order and provide any agreed form of costs order to the associate to Justice Downes by 4.00pm on 15 August 2024.

10. If the parties are unable to agree upon the proposed form of order as referred to in either or both orders 8 and 9 above, then the plaintiffs (on the one hand) and the seventh, tenth and eleventh defendants (on the other hand) each provide submissions of no more than three pages to the associate to Justice Downes by 4.00pm on 16 August 2024, along with the form of order which is proposed.

11. Pursuant to r 39.32(3) of the Federal Court Rules 2011 (Cth), this Order is taken to be entered on 8 August 2024.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

DOWNES J:

SYNOPSIS

1 Until in or about October 2021, TSK QLD Pty Ltd (in liquidation) carried on business providing recruitment and labour hire services to customers in the mining, resources, energy and related industries. It had significant turnover – $90 million in the 2019 financial year and $84 million in the 2020 financial year.

2 By late February 2021, the financial position of TSK had become dire. On 14 January 2022, Mr Gavin Morton was appointed voluntary administrator of TSK. On 21 March 2022, the creditors of TSK resolved that it be wound up and that Mr Anthony Connelly and Mr William Harris be appointed liquidators.

3 This proceeding concerns an asset-stripping scheme pursuant to which, during 2021, approximately $10.3 million was withdrawn from the account of, or redirected from, and paid variously to TSK’s director (Mr Savas Papadopoulos, the first defendant), senior management (Mr Ciano Lopez, the CEO; and Mr Duncan Bremner, the CFO, both former defendants) and an external accountant adviser who held himself out as specialising in “restructuring” (Mr Benjamin Whitehouse, the tenth defendant), and their corporate entities. Those corporate entities included the second defendant, Torquejobs Pty Ltd, the third defendant, Leopho Pty Ltd, the seventh and eighth defendants, Innovant Consulting Pty Ltd and Innov Debt Co Pty Ltd, and the eleventh defendant, Rekover Pty Ltd.

4 The moneys were paid under the ruse of:

(1) a Sale Agreement: that TSK purportedly sold its business, and its accounts receivable of some $11.199 million, to Torquejobs, an entity controlled by Mr Lopez; and

(2) a Debt Collection Scheme: that TSK allegedly appointed Innovant and, later, Innov Debt pursuant to an Agency Agreement to collect TSK’s debts.

5 The architect of the scheme was Mr Whitehouse. After being approached in February 2021, he designed the scheme; drafted (or caused to be drafted) the various documents to give effect to the scheme; purportedly valued TSK’s assets at nil; and approved the payment of moneys. Further, almost $1.3 million flowed into the accounts controlled by him and his companies, and he and his companies retained about $431,000 of that amount.

6 The plaintiffs allege that TSK suffered loss and damage as a result of the scheme in the amount of $8,852,814.09, calculated as follows:

Biosar Transaction | $930,000.00 |

$7.35 million Payments | $7,358,190.35 |

$2.016 million Payments | $2,016,623.74 |

Less $250,000 paid by Torquejobs to the Company | ($250,000.00) |

Less employee entitlements assumed by Torquejobs | ($1,202,000.00) |

TOTAL LOSS AND DAMAGE | $8,852,814.09 |

7 Of that amount, the plaintiffs have, at the date of trial, recovered only $1,559,000.00 pursuant to settlements.

8 Mr Whitehouse and his companies, Innovant and Rekover (collectively, the Whitehouse defendants) were the only defendants who appeared at the trial last month. Although they did not concede liability expressly, senior counsel appearing for the Whitehouse defendants made submissions to the effect that judgment should be entered against the Whitehouse defendants immediately in the amount of $431,000, which I construed to be tantamount to acceptance that the plaintiffs had established the liability of the Whitehouse defendants. Such a position is, with respect, the correct one, especially in circumstances where the Whitehouse defendants adduced no evidence to contradict the extensive and detailed evidence adduced by the plaintiffs.

9 The only real dispute between the plaintiffs and the Whitehouse defendants concerned specific substantive issues relating to liability for the $2.016 million Payments, the quantum of any award, and a further issue concerning the form of orders. These issues are addressed below, and all are resolved in the plaintiffs’ favour.

10 Mr Papadopoulos filed a debtor’s petition after the trial commenced, and neither he nor his company Leopho appeared at the trial (although their solicitors appeared at the case management hearing on 2 July 2024, at which hearing the imminent trial was discussed). After they defaulted by failing to appear at the trial, the plaintiffs sought default judgment against Mr Papadopoulos and Leopho, and for the reasons which follow, default judgment will be entered and the orders sought by the plaintiffs will be made.

11 The plaintiffs reached a settlement with all other defendants prior to trial. This includes a deed of settlement entered into by the plaintiffs with Torquejobs and Mr Lopez (Torquejobs Settlement Deed) pursuant to which it has been agreed that payments will be made to the plaintiffs up to 2029.

WHITEHOUSE DEFENDANTS

12 It is common ground between the plaintiffs and the Whitehouse defendants that the plaintiffs’ claim for loss and damages may be awarded based on either a “payments made” assessment or a “sale agreement valuation” assessment (but not both).

13 As both methods of assessment are available, I will adopt the “payments made” method, as the calculation is based on the payments made by TSK pursuant to the scheme devised by Mr Whitehouse, and it is not dependent upon any expert opinion as to valuation. Additionally, the Whitehouse defendants did not make a cogent submission as to why the “sale agreement valuation” assessment should be preferred.

14 The only issues which therefore remain in dispute between the parties who appeared at the trial are:

(1) the liability of the Whitehouse defendants for the $2.016 million Payments;

(2) the value of employee entitlements assumed by Torquejobs; and

(3) the impact of the Torquejobs Settlement Deed upon the form of orders to be made against the Whitehouse defendants.

$2.016 million Payments

15 Between 25 October 2021 and 2 November 2021, Scottish Pacific Finance (ScotPac) made payments to TSK representing debts which it had collected on TSK’s behalf. Between 26 October 2021 and 10 November 2021, TSK made five payments to Torquejobs totalling $2,016,623.74.

16 The Whitehouse defendants deny that Mr Whitehouse had the requisite knowledge of, or involvement in, the $2.016 million Payments, to be held liable for them.

17 During a public examination of Mr Whitehouse conducted on 24 June 2022, Mr Whitehouse gave evidence that the $2.016 million Payments were made pursuant to the Sale Agreement, stating that:

At the date of sale, and at the settlement on 24 October, all cash held in the banks and consequently all cash and all debtors that were paid after that date were in the ownership under the settlement agreement of Torquejobs. They had every right to act on those bank accounts and access their funds.

18 Mr Whitehouse then went on to give evidence that the “internal accounting team” at Torquejobs “conducted” the specific transactions moving money between TSK’s and Torquejobs’ bank accounts. His evidence was that he played no part in the making of those payments.

19 The Whitehouse defendants rely upon this evidence to submit that the plaintiffs have not established that Mr Whitehouse had knowledge of the payments which were made.

20 It is plain from the scheme devised by Mr Whitehouse that all of the cash “held in the banks” of TSK as at 24 October 2021 was to be paid to Torquejobs pursuant to the Sale Agreement, and that is what occurred. On 24 October 2021, TSK had $63,785 in its account. Following the influx of funds from ScotPac, which moneys represented funds from TSK’s debtors, $2.016 million was paid to Torquejobs.

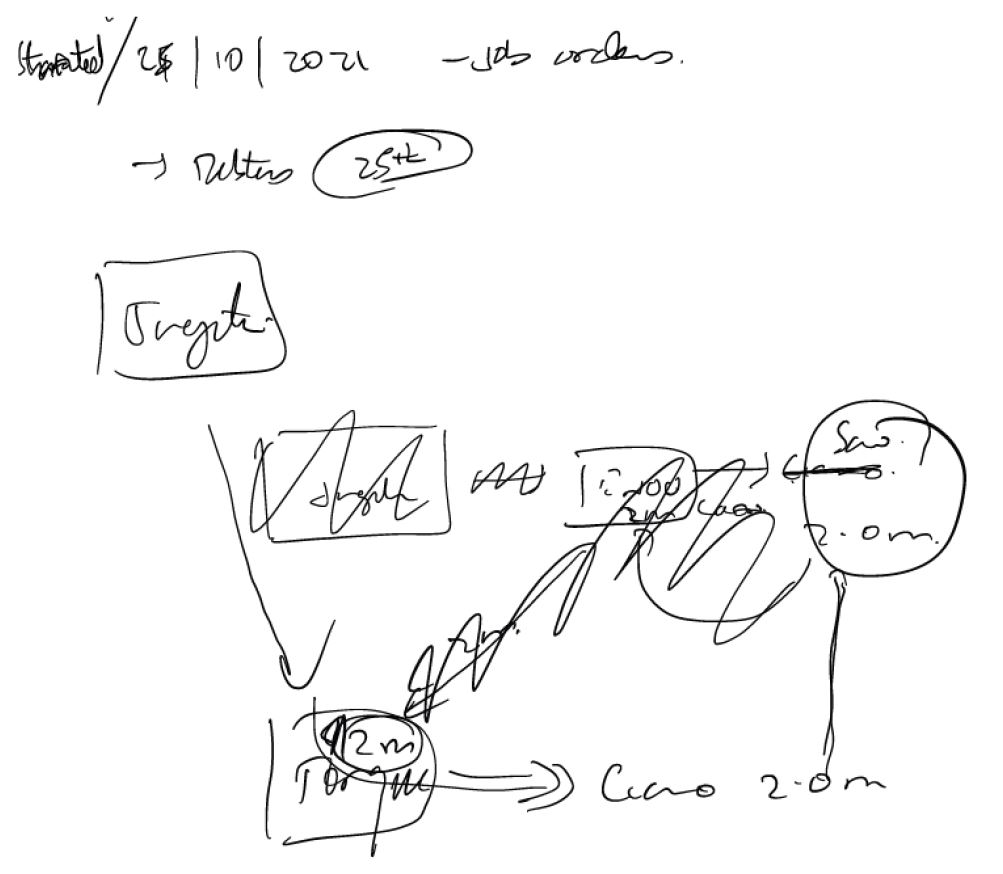

21 Indeed, Mr Whitehouse recorded in his handwritten notes that there would be a payment of $2 million by TSK to Torquejobs. A note bearing the date 25 October 2021 includes this diagram:

22 The note is headed “Debtors” with “25th” in a circle. The diagram then depicts $2 million being transferred by TSK (formerly named “Jugiter”) to “Torque” and then to “Ciano” before reaching its destination of “Sav”. An earlier note includes a diagram recording that TSK would grant a licence to “Torque” to “run business rights to all gross receipts”.

23 The Whitehouse defendants submit that $2.016 million as a figure is drawn from the pleadings and is an amalgamation of transactions defined by lawyers. They press that there is no particular significance in the $2 million figure in the diagram resembling the $2.016 million that was actually transferred.

24 Contrary to Mr Whitehouse’s submission, the fact that amounts which exceeded $2 million were transferred does not support a conclusion that the $2.016 million Payments fell outside of the scope of his scheme. This is especially as Mr Whitehouse did not give any evidence to explain the diagram shown above, and the figure of “2 m” depicted in the diagram is very close to the total of the amounts which were in fact transferred.

25 Further, that Mr Whitehouse did not know and had no direct involvement with the precise transactions which occurred in the implementation of his scheme is not to the point. He knew of all of the essential facts of his design, and it was the design that was the breach of fiduciary duty by Mr Papadopoulos: that by the Sale Agreement, following settlement, TSK would pay to Torquejobs all of the cash in its bank accounts and all proceeds of debtors thereafter received by TSK.

26 For these reasons, the quantum of any award against Mr Whitehouse and Rekover will include the $2.016 million Payments.

Employee entitlements assumed by Torquejobs

27 Both the plaintiffs and the Whitehouse defendants accept that account should be taken of the value of employee entitlements assumed by Torquejobs pursuant to the Sale Agreement, with that amount to be deducted from any amount awarded to the plaintiffs.

28 The Whitehouse defendants claim that the value of the entitlements assumed is $2,206,858.46 as derived from the affidavit evidence of Mr Connelly, consisting of:

(1) annual leave: $427,407.38;

(2) superannuation: $757,569.99;

(3) long service leave: $264,358.09;

(4) sick leave: $581,509.00; and

(5) rostered days off: $176,014.00.

29 In support of these amounts, the Whitehouse defendants rely upon documents that were prepared by Mr Whitehouse and produced during his public examination.

30 The plaintiffs claim that the correct value of the entitlements is $1,202,000.00 (as at 24 October 2021) supported by the valuation of Ms Christine Oliver set out in her expert report, which report was annexed to her affidavit affirmed on 16 August 2023.

31 The plaintiffs submit that 24 October 2021 is the correct valuation date, being the date on which the Sale Agreement completed, as that is the date the parties used to calculate the aged debts. This is so notwithstanding that the Sale Agreement provided for those debts to be valued as at 1 June 2021. For that reason, the Whitehouse defendants press for that valuation date to be used on the basis that that is what the parties agreed. However, during his public examination, Mr Whitehouse explained that the parties effectively varied the contract so as to use 24 October 2021 as the relevant date. For that reason, I accept the plaintiffs’ submission that to use 1 June 2021 as the valuation date would be artificial, and so prefer the 24 October 2021 date.

32 Leaving aside the date of the valuation, the primary difference between the amounts proposed by the parties is that Ms Oliver’s valuation records nil values for long service leave and sick leave entitlements.

33 For the following reasons, I prefer the evidence of Ms Oliver, and so find that the correct value of the employee entitlements is $1,202,000.00.

34 First, Ms Oliver, who is an independent expert, was not challenged in her valuation of the employee entitlements.

35 Second, as recorded in her expert report, the data relied upon by Ms Oliver in reaching her valuation was the balance sheet of TSK as prepared for its financial statements. That balance sheet did not record any amount for long service leave and sick leave payable.

36 Third, while it may have been that the employees of TSK had an entitlement to sick leave and long service leave, there is no evidence that those amounts were liabilities of TSK that were assumed by Torquejobs pursuant to the Sale Agreement.

Impact of Torquejobs Settlement Deed

37 The Whitehouse defendants submit that a significant portion of the loss and damage suffered by TSK will be recovered by the plaintiffs if all the payments due under the Torquejobs Settlement Deed are made. They submit that such recovery is likely because the Torquejobs Settlement Deed contemplates that a further $4.2m in instalments will be paid over time until 2029, the plaintiffs have obtained security to support those instalments and Mr Connelly has no specific reason to doubt that future instalments will be paid. They also submit that, as the creditors approved the Torquejobs Settlement Deed, it follows that the creditors, including the funding creditor (Australian Taxation Office), are amenable to receiving compensation in instalments over time.

38 The Whitehouse defendants submit that, if a significant judgment (in the millions of dollars) is made immediately enforceable against Mr Whitehouse, it may be inferred from the quantum of the claim that the burden on Mr Whitehouse of meeting the judgment would be considerable and the court may infer a risk of bankruptcy especially as Mr Whitehouse gave evidence at his public examination that he did not have any interest in real property.

39 The Whitehouse defendants submit that any recovery against the first and third defendants would need to be brought into account in calculating the total net amount payable by them to the plaintiffs. As to this, the plaintiffs accept that they cannot recover more than the judgment sum from any of the defendants; however, the avoidance of such double recovery has no role to play at this stage.

40 Based on these matters, they urge me to enter judgment in the full sum, but to exercise a discretion under r 1.32 (and potentially r 1.33) of the Federal Court Rules 2011 (Cth) to make orders which I consider appropriate in the interests of justice, in combination with the powers under rr 41.03 and 41.11, so as to order that any judgment or order, or their execution, be stayed, and thereby craft a form of discretionary remedy. The form of order which is proposed is as follows:

(1) judgment be entered against the seventh, tenth and eleventh defendants in the amount of the losses assessed, which would be the sum of $314,141.54 plus the not-yet-paid instalments owing under the Torquejobs settlement deed, namely $4,200,000, so $4,514,141.54 (which total assumes success by the defendants in relation to the $2.016 million Payments);

(2) but the enforcement of that judgment be stayed by staggering the dates for liability such that:

(a) the seventh, tenth and eleventh defendants should immediately pay the sum of $430,853,74;

(b) if (but only if) the Torquejobs parties fail to pay the remaining instalments under the Torquejobs Settlement Deed, 14 days after an instalment falls due but goes unsatisfied, the seventh, tenth and eleventh defendants must pay that missing instalment;

up to the total of the $6,073,141.54 (which accounts for the employee liabilities which Torquejobs assumed in the amount pressed by the defendants). Alternatively, the total should be $5,823,141.54 to account for the $250,000 receipt.

41 The Whitehouse defendants also submit that such an order would do justice between the parties because it would properly take into account recoveries which the plaintiffs actually receive, while giving the plaintiffs the full measure of their loss claimed, but without burdening the seventh, tenth and eleventh defendants with more than the true measure of the plaintiffs’ outstanding loss.

42 For the following reasons, I decline to make orders of the kind proposed by the Whitehouse defendants.

43 First, the fact that the plaintiffs have entered a settlement with other defendants pursuant to which payments are likely to be made by those defendants in the future does not mean that the plaintiffs should be denied the opportunity of immediate recovery from the Whitehouse defendants. If such an opportunity bears fruit, that will be to the benefit of the creditors of TSK and would lead to an earlier finalisation of the liquidation. Viewed objectively, it is unlikely that the creditors of TSK would oppose such a course.

44 Second, the submissions are premised on the Court exercising the power pursuant to rr 41.03 and 41.11 of the Rules to temporarily stay its orders, or execution of them, to avoid “irremediable harm” or “serious injury” to a party. However, there is no evidence to support a submission that enforcement of a judgment against the Whitehouse defendants will cause “irremediable harm” or “serious injury”. That Mr Whitehouse does not have real property in his own name does not mean that he does not have access to resources which would enable a judgment sum to be satisfied, and the position of the other Whitehouse defendants is not known.

Conclusion

45 The plaintiffs and Whitehouse defendants agree that the following amounts should be deducted from any award if the calculation is based on a “payments made” basis:

(1) $250,000.00, being a payment made by Torquejobs to TSK on 5 November 2021;

(2) $1,559,000.00, being amounts received under the settlements with the other defendants, including Mr Bremner, Mr Lopez and Torquejobs; and

(3) an amount representing employee entitlements assumed by Torquejobs, which I have found to be $1,202,000.00.

46 Taking into account these deductions, a total of $7,293,814.09 should be awarded against Mr Whitehouse and Rekover, and $5,527,190.35 should be awarded against Innovant, along with interest. The Whitehouse defendants have requested that they be heard on the question of costs.

THE FIRST AND THIRD DEFENDANTS

47 The plaintiffs seek the entry of default judgment against Mr Papadopoulos and his company, Leopho. Neither of them appeared at the trial despite being aware of it and are therefore in default within the meaning of r 5.22(c) of the Federal Court Rules 2011 (Cth).

48 During the trial, Mr Papadopoulos filed for bankruptcy, and his petition was accepted on 17 July 2024 by the Official Receiver. A representative of the trustee in bankruptcy appointed to Mr Papadopoulos’ estate appeared at the trial on 19 July 2024 and did not consent to, but did not oppose, the entry of default judgment against Mr Papadopoulos.

Whether leave required

49 Section 58(3)(b) of the Bankruptcy Act 1966 (Cth) provides that:

Except as provided by this Act, after a debtor has become a bankrupt, it is not competent for a creditor:

(a) to enforce any remedy against the person or the property of the bankrupt in respect of a provable debt; or

(b) except with the leave of the Court and on such terms as the Court thinks fit, to commence any legal proceeding in respect of a provable debt or take any fresh step in such a proceeding.

50 As the plaintiffs’ application for the entry of default judgment under r 5.23 of the Federal Court Rules was made orally on 15 July 2024 – that is, before Mr Papadopoulos’ petition had been accepted and endorsed such that he became a bankrupt pursuant to s 55(4A)(b) of the Bankruptcy Act – leave is not required by the plaintiffs. In any case, having regard to the factors in favour of granting leave outlined by Katzmann J in Yan v Spyrakis as trustee in bankruptcy for Liu [2022] FCA 872 at [11], I consider that leave should be granted if it is required, and I will make an order accordingly.

Entry of default judgment

51 As found above, Mr Papadopoulos and Leopho were in default within the meaning of r 5.22(c) in that they failed to appear at trial. Pursuant to r 5.23(c), which applies in this case, the plaintiffs may apply for an order giving judgment against Mr Papadopoulos and Leopho for the relief claimed in the statement of claim to which the Court is satisfied that the plaintiffs are entitled.

52 Against Mr Papadopoulos, the plaintiffs seek the payment of $7,293,814.09 as a debt pursuant to s 588M(2) of the Corporations Act, as damages pursuant to s 1317H of the Corporations Act and as equitable compensation. That amount is the same as that sought against Mr Whitehouse and Rekover, and consists of the Biosar Payment, $7.35 million Payments and $2.016 million Payments less relevant deductions as discussed above.

53 Against Leopho, the plaintiffs seek the payment of:

(1) $5,527,190.35 as a debt pursuant to s 588M(2) of the Corporations Act, as damages pursuant to s 1317H of the Corporations Act and as equitable compensation, consisting of the Biosar Payment and $7.35 million Payments less the employee entitlements assumed by Torquejobs discussed above; and

(2) $3,853,281.44 as a debt due and owing to TSK, which amount was advanced by TSK as a shareholder loan to Leopho on 30 November 2021 and which has not been repaid despite demands for payment.

54 An order for judgment in default under rr 5.22 and 5.23:

(1) does not require proof of the claim by evidence, but only requires that – on the face of the statement of claim – there is a claim for the relief sought; and

(2) the claim must fall within the jurisdiction of the Court.

See Yeo v Damos Earthmoving Pty Ltd, in the matter of Beachwood Developments Pty Ltd (in liq) [2011] FCA 1129 at [9] (Gordon J).

55 Both of these requirements are satisfied in this case. That is, it is apparent that on the face of the further amended statement of claim there is a claim for the relief sought against each of these defendants and that each claim falls within the jurisdiction of the Court.

56 In this case, I am satisfied that the plaintiffs are entitled to the relief sought by them and that it is appropriate to make the orders sought.

57 In any event, the evidence adduced by the plaintiffs at trial coupled with the admissions by Mr Papadopoulos and Leopho in their defence demonstrate that the plaintiffs have established their claims as against these defendants and that the plaintiffs are entitled to the relief sought.

CONCLUSION AND DISPOSITION

58 For these reasons, I will make orders in the terms sought by the plaintiffs, with some minor modifications.

I certify that the preceding fifty-eight (58) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Downes. |

Associate:

QUD 425 of 2022 | |

CIANO ST JOHN LOPEZ | |

Fifth Defendant: | DUNCAN ATHOL BREMNER |

Sixth Defendant: | RACHEL HELEN RUTH BREMNER (ALSO KNOWN AS RACHEL HELEN RUTH DAVIS) |

Seventh Defendant: | INNOVANT CONSULTING PTY LTD (ACN 637 244 930) |

Eighth Defendant: | INNOV DEBT CO PTY LTD (ACN 650 666 434) |

Ninth Defendant: | INNOV-D PTY LTD (ACN 650 664 083) IN ITS OWN CAPACITY AND IN ITS CAPACITY AS TRUSTEE FOR THE INNOV DEBT TRUST |

Tenth Defendant: | BENJAMIN PAUL WHITEHOUSE |

Eleventh Defendant: | REKOVER PTY LTD (ACN 641 270 019) |