FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v PayPal Australia Pty Limited [2024] FCA 762

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | Defendant | |

DATE OF ORDER: |

THE COURT NOTES THAT:

These declarations and orders adopt the following defined terms:

(i) A reference to the Fee Error Term is a reference to the term set out in Schedule 1 to these orders.

(ii) A reference to the Individual Contracts is a reference to each contract identified as such in Schedule 2 to these orders.

(iii) Relevant Period means from 21 September 2021 to 7 November 2023;

(iv) A reference to the Small Business Contracts is a reference to each contract in force during the Relevant Period:

a. between the defendant (PayPal) and any Non-Party Consumer (as defined in s 12BA of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) as in force in the Relevant Period);

b. in respect of a business account held with PayPal by that Non-Party Consumer (as defined in s 12BA of the ASIC Act as in force in the Relevant Period);

c. which meets the definition of a small business contract in s 12BF(4) of the ASIC Act; and

d. consisting of:

i. the PayPal User Agreement (User Agreement) published by PayPal on its website (including policies and applicable agreements incorporated into that User Agreement by reference);

ii. a Combined Financial Services Guide and Product Disclosure Statement (PDS) published by PayPal on its website; and

iii. an online registration form completed by that Non-Party Consumer.

BY CONSENT, THE COURT DECLARES THAT:

1. Pursuant to s 12GND of the ASIC Act, the Fee Error Term in each of the Small Business Contracts (including the Individual Contracts) is an unfair term within the meaning of s 12BG(1) of the ASIC Act.

2. Pursuant to s 21 of the Federal Court of Australia Act 1976 (Cth) and s 12GNB of the ASIC Act, the Fee Error Term in each of the Small Business Contracts (including the Individual Contracts) is void ab initio by operation of s 12BF(1) of the ASIC Act.

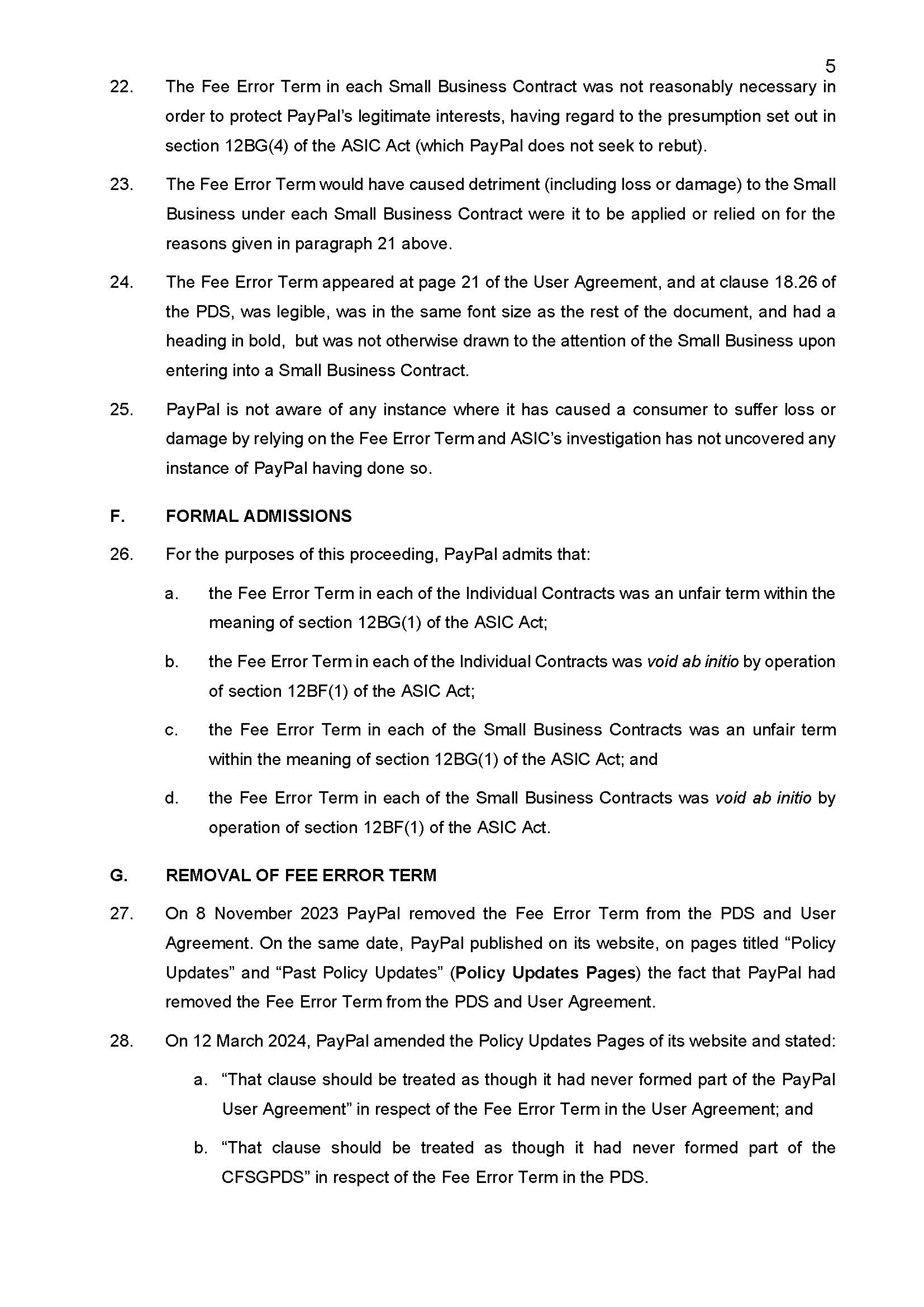

AND, BY CONSENT, THE COURT ORDERS THAT:

3. Pursuant to s 12GD of the ASIC Act, PayPal, whether by itself, its servant or agents or otherwise is restrained from applying or relying upon or enforcing the Fee Error Term in each of the Small Business Contracts (including the Individual Contracts).

Costs

4. PayPal pay the plaintiff’s costs of the proceeding in an amount to be agreed or assessed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

MOSHINSKY J:

Introduction

1 This is a proceeding brought by the Australian Securities and Investments Commission (ASIC) against PayPal Australia Pty Limited (PayPal) relating to the unfair terms provisions of the Australian Securities and Investments Commission Act 2001 (Cth) (the ASIC Act).

2 Specifically, by this proceeding, ASIC alleges that a term that was included in the contracts between PayPal and small businesses in the period 21 September 2021 to 7 November 2023 (the Relevant Period) was an unfair term and void (in standard form contracts with small businesses) under the relevant provisions of the ASIC Act. The relevant term is referred to in the materials (and will be referred to in these reasons) as the Fee Error Term. It provided as follows:

Your responsibility to notify PayPal of pricing or fee errors

Once you have access to any account statement(s) or other account activity information made available to you by PayPal with respect to your business account(s), you will have 60 days to notify PayPal in writing of any errors or discrepancies with respect to the pricing or other fees applied by PayPal. If you do not notify PayPal within such timeframe, you accept such information as accurate, and PayPal shall have no obligation to make any corrections, unless otherwise required by applicable law. For the purposes of this provision, such pricing or fee errors or discrepancies are different than unauthorised transactions and other electronic transfer errors which are each subject to different notification timeframes as set forth herein.

3 Approximately 600,000 contracts between PayPal and small businesses had this term.

4 ASIC’s allegations in this proceeding were set out in its concise statement. PayPal responded to these allegations in its concise response, which included denials of key allegations.

5 Subsequently, PayPal admitted that the Fee Error Term was an unfair term and void (in standard form contracts with small businesses) under the relevant provisions of the ASIC Act.

6 The parties prepared a Statement of Agreed Facts and Admissions. This was subsequently amended in a minor respect. I will refer to the Amended Statement of Agreed Facts and Admissions as the SOAF in these reasons. A copy of the SOAF is annexed to these reasons.

7 The parties jointly propose to the Court that it make certain declarations and orders. In essence, what is proposed is that the Court make declarations that the Fee Error Term in each of the relevant contracts was an “unfair term” within the meaning of s 12BG(1) of the ASIC Act and consequently void ab initio (in standard form contracts with small businesses) by operation of s 12BF(1) of the ASIC Act. Further, it is jointly proposed that the Court make an order restraining PayPal from applying or relying upon or enforcing the Fee Error Term in each of the relevant contracts. It is also agreed that there should be an order that PayPal pay ASIC’s costs of the proceeding.

8 For the reasons that follow, I consider there to be a proper basis to make declarations and orders largely to the effect of those proposed by the parties. In these reasons, I will draw substantially on the joint submissions prepared by the parties in support of the declarations and orders that they seek.

Background facts

9 I accept the factual matters set out in the SOAF and make findings to that effect. The following is a summary of the key facts.

10 At all material times PayPal was authorised under s 9(3) of the Banking Act 1959 (Cth) to carry on banking business in Australia confined to providing purchased payment facilities within the meaning of s 9(1) of the Payment Systems (Regulation) Act 1998 (Cth): SOAF [6]. PayPal was also licensed as an Australian Financial Services Licensee pursuant to s 913B of the Corporations Act 2001 (Cth) and was authorised to deal in non-cash payment products to retail and wholesale customers.

11 Under these authorisations PayPal provided online payment services by which consumer and commercial customers were able to send and receive payments online using linked credit cards, debit cards and bank accounts. Customers could store a balance in their PayPal account, withdraw that balance to their linked bank account, or transfer that balance to a different PayPal account within the PayPal network. For the provision of some of these services PayPal charged a fee.

12 During the Relevant Period, PayPal issued financial products described as Business Accounts. Persons who acquired Business Accounts from PayPal were called Users: SOAF [7].

13 The terms governing a User’s Business Account were set out in a contract between PayPal and the User (Business Account Contracts) consisting of, relevantly:

(a) the PayPal User Agreement (User Agreement) published by PayPal on its website (including policies and applicable agreements incorporated into that User Agreement by reference);

(b) a Combined Financial Services Guide and Product Disclosure Statement (PDS) published by PayPal on its website; and

(c) an online registration form completed by the User.

14 Each of the Business Account Contracts was a financial product by reason of s 12BAA(1)(c) of the ASIC Act: SOAF [9]. This was because they were an arrangement (and therefore a “facility”) through which a person made non-cash payments: s 12BAA(1)(c) of the ASIC Act; ss 9 and 762C of the Corporations Act 2001 (Cth) read with s 5(2) of the ASIC Act (as to the meaning of “facility”).

15 As at 30 June 2023, there were approximately 608,375 Business Account Contracts on foot between PayPal and Business Account Users: SOAF [10].

16 Some of the Business Account Contracts (Small Business Contracts) were both:

(a) standard form contracts within the meaning of s 12BF(1)(b) of the ASIC Act; and

(b) small business contracts within the meaning of s 12BF(4) of the ASIC Act: SOAF [11].

17 The Users who were party to the Small Business Contracts are referred to in these reasons as Small Businesses. As at 30 June 2023, there were approximately 606,930 Small Business Contracts on foot between PayPal and Small Businesses: SOAF [12].

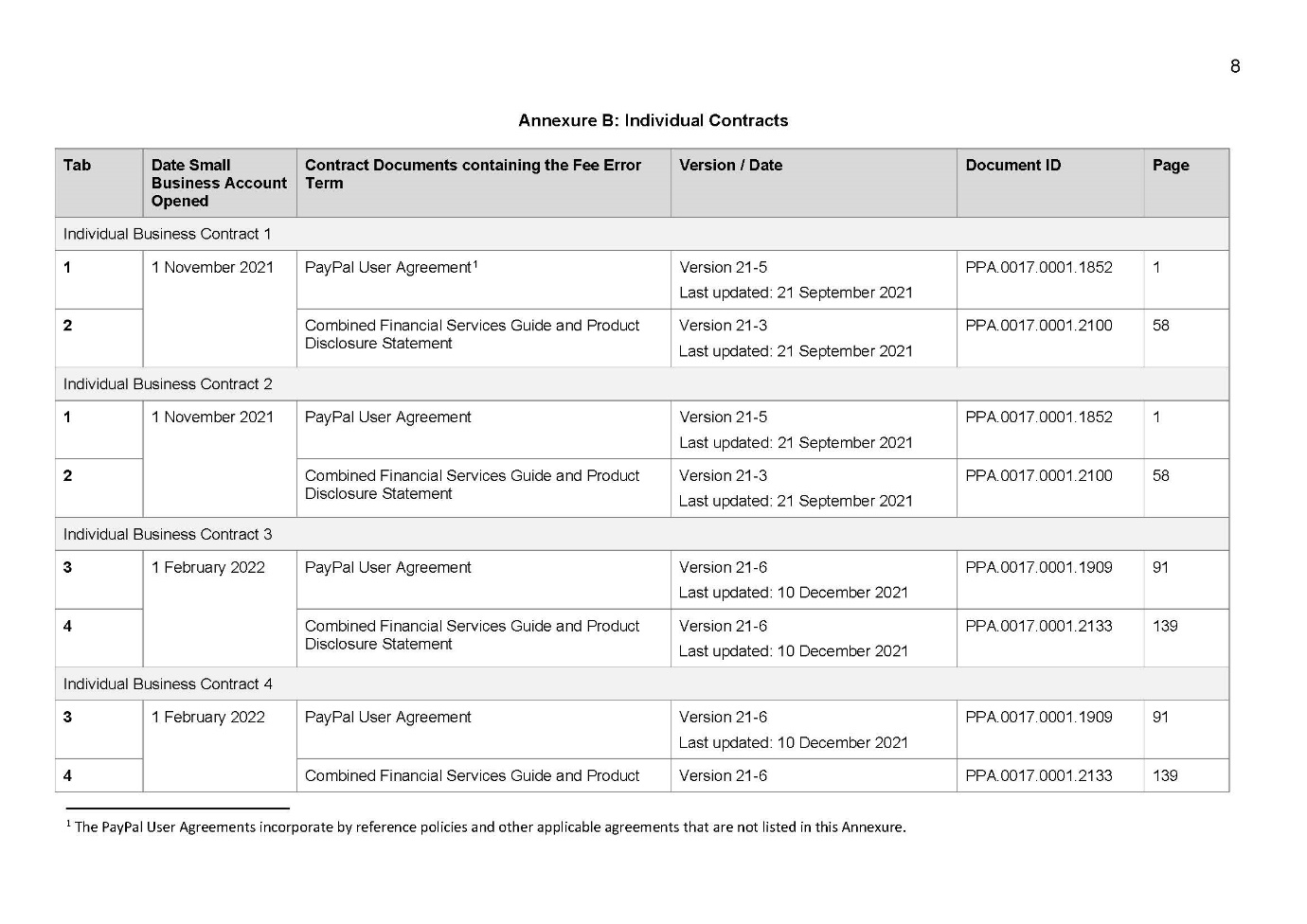

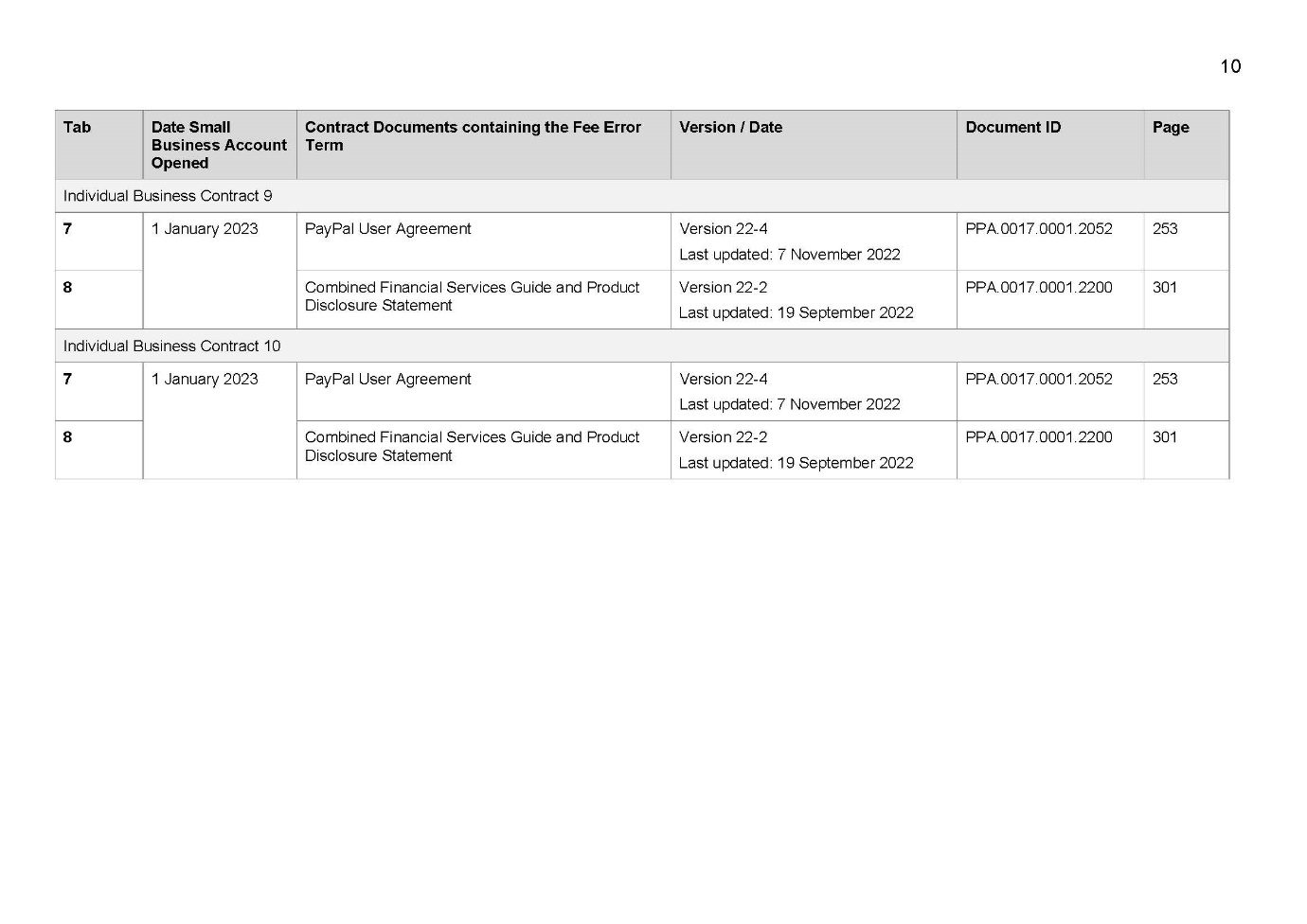

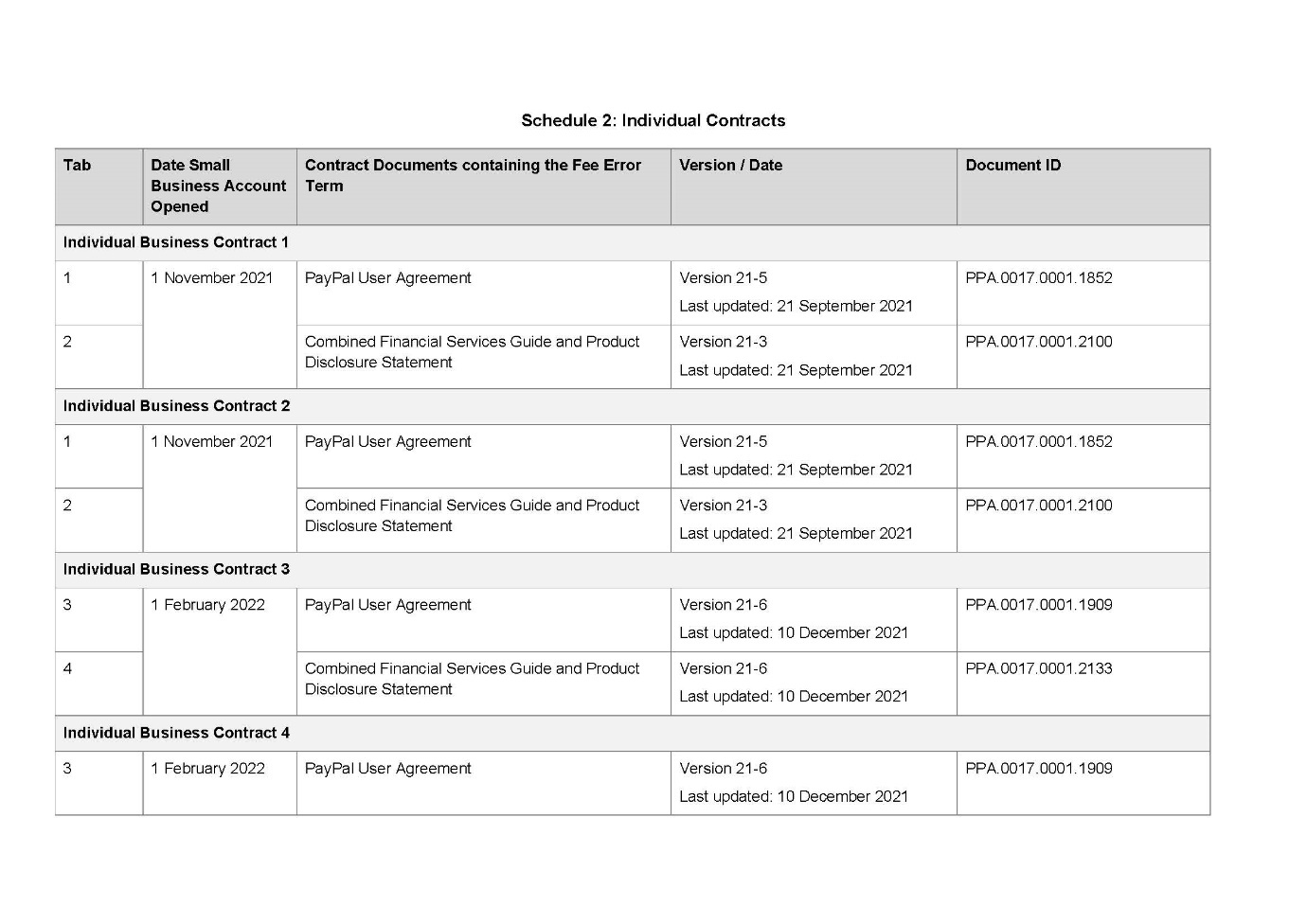

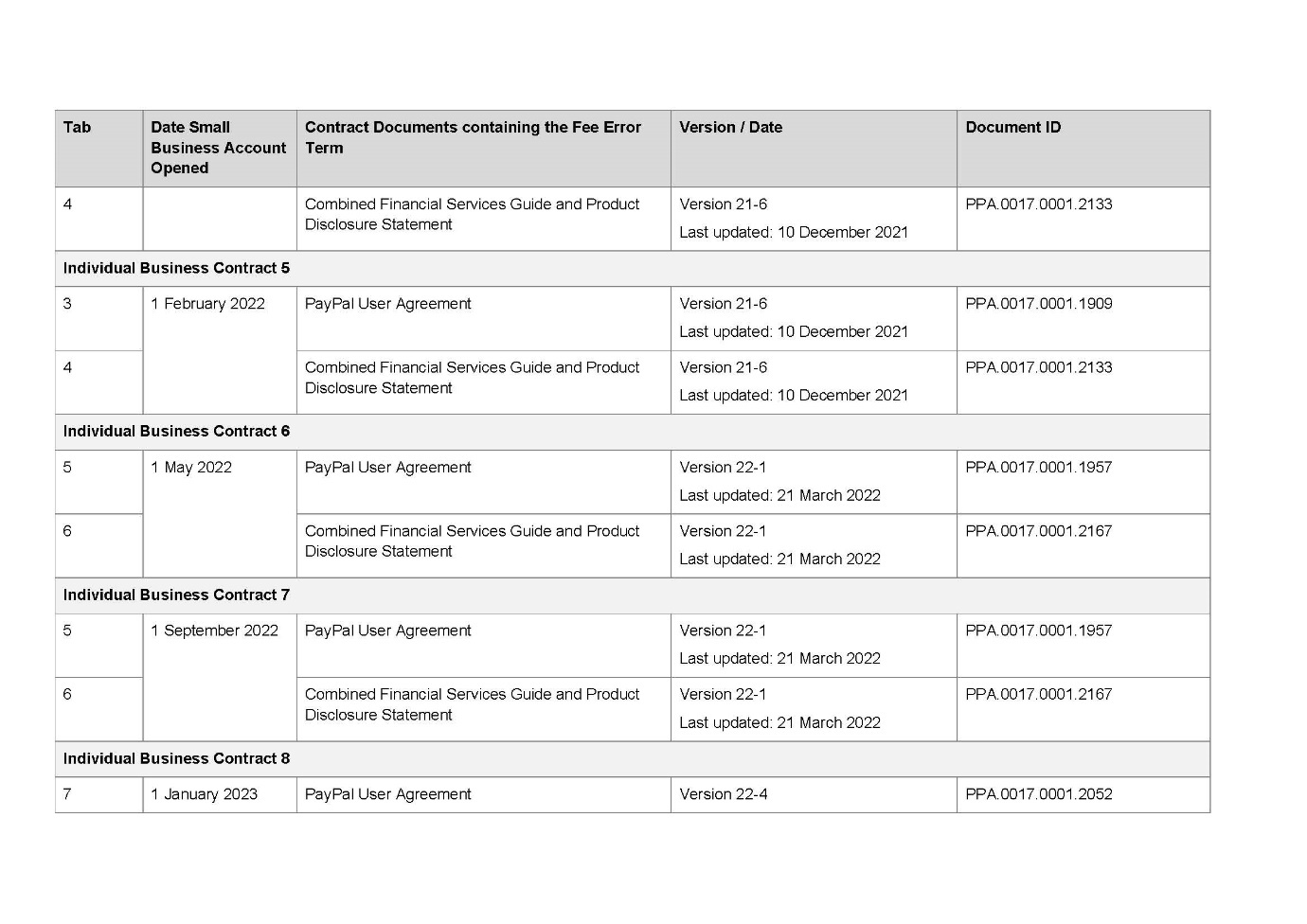

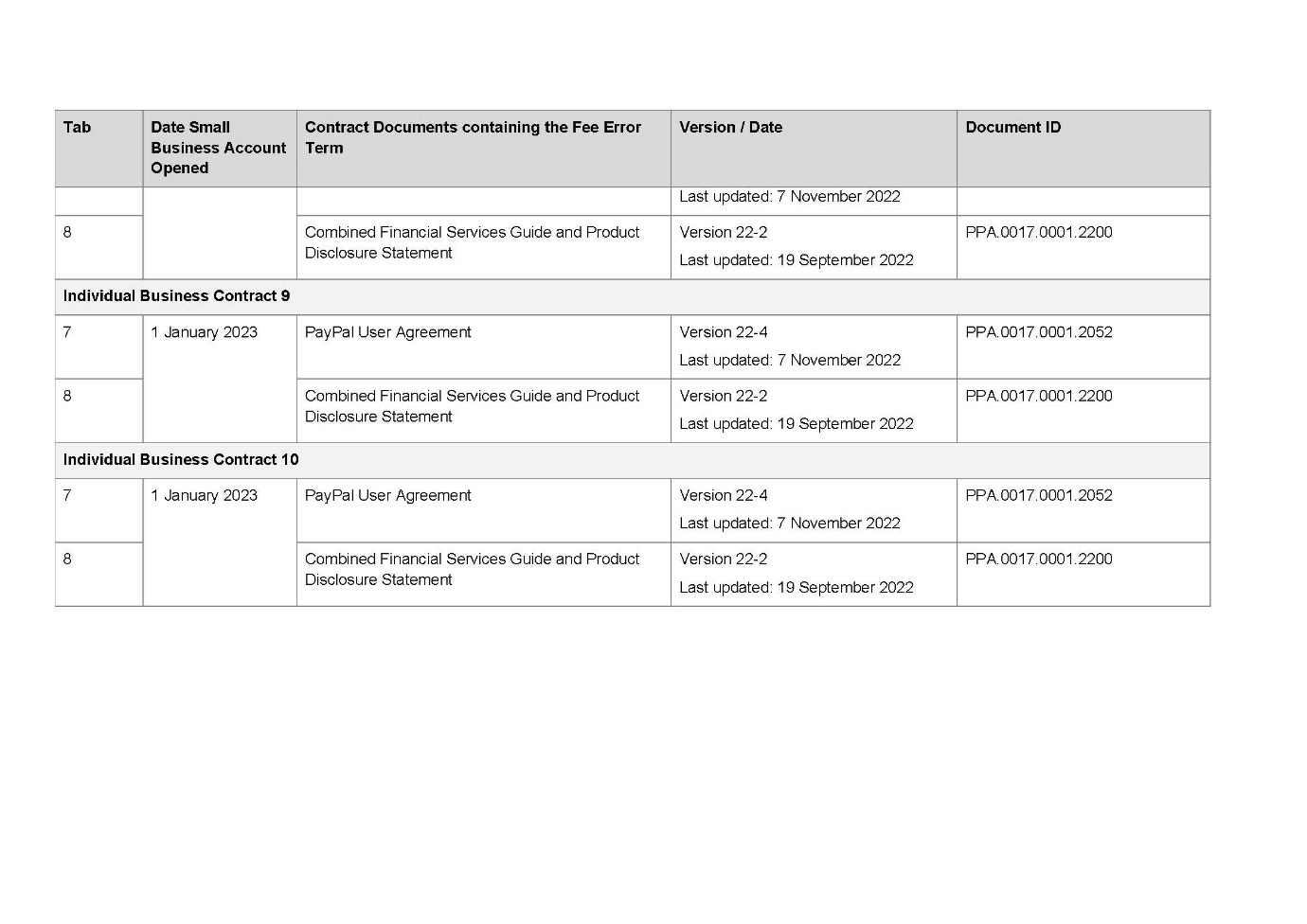

18 For the purpose of the proceedings, and in the originating process, ASIC identified 10 Small Businesses which were parties to Small Business Contracts. These are referred to in these reasons as the Individual Contracts. The Individual Contracts are listed in Annexure B to the SOAF.

19 During the Relevant Period, the Small Business Contracts (including the Individual Contracts) contained the Fee Error Term in both the User Agreement (under the heading “Your responsibility to notify PayPal of pricing or fee errors”) and the PDS (at clause 18.25 in the version of the PDS dated 21 September 2021, and clause 18.26 in subsequent versions).

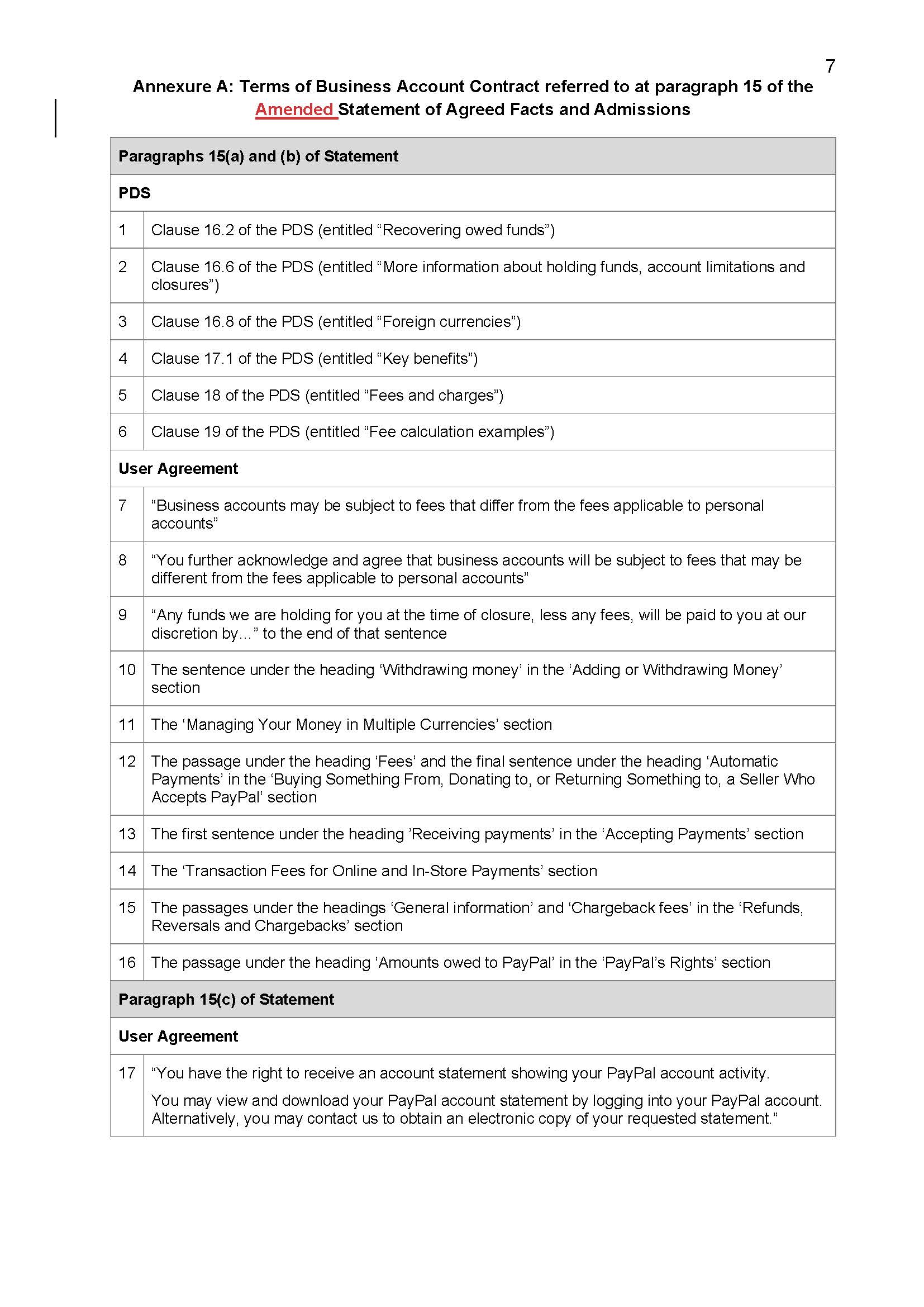

20 Under each Small Business Contract:

(a) a Small Business was obliged to pay various fees to PayPal in stipulated circumstances: see SOAF [15(a)] and clauses 16.2, 16.6, 16.8, 17.1, 18 and 19 of the PDS and the passages of the User Agreement referred to at items 7, 8, 9, 10, 11, 12, 13, 14, 15 and 16 of Annexure A to the SOAF;

(b) PayPal was entitled to deduct such fees from the Small Business’s Business Account (including from amounts credited to the Small Business’s Business Account): see SOAF [15(b)] and clauses 16.2, 16.6, 16.8, 17.1, 18 and 19 of the PDS and the passages of the User Agreement referred to at items 7, 8, 9, 10, 11, 12, 13, 14, 15 and 16 of Annexure A to the SOAF; and

(c) each Small Business had the right to receive an account statement showing the activity on their Business Account: see SOAF [15(c)] and the passage of the User Agreement at item 17 of Annexure A to the SOAF.

21 The standard pricing and fees (referred to together as “fees” in these reasons) applicable to a Small Business’s Business Account from time to time were mainly set out at clause 18 of the PDS under the heading “Fees and Charges”. Other references to fees were contained in clauses 16.2, 16.6, 19 and 22 of the PDS; and parts of the User Agreement including the passages referred to at items 7-16 of Annexure A to the SOAF: SOAF [16].

22 The applicable fees varied depending upon the circumstances of each transaction; for example, whether the transaction was a domestic transaction or cross-border transaction, the payment type, the total transaction amount, whether micropayment pricing applied, whether the transaction involved a currency conversion, or was a chargeback, was sent to multiple recipients or was a refund and whether the User was withdrawing a balance to a linked debit card or bank account: SOAF [17].

23 For various types of fees set out in clause 18 of the PDS, the account statements and other account activity information accessible by a User did not describe the fee or the manner in which it was calculated in a way that was readily reconcilable with how the fee was described in clause 18 of the PDS: SOAF [19].

24 On 8 November 2023, PayPal removed the Fee Error Term from the PDS and User Agreement. On the same date, PayPal published on its website, on pages titled “Policy Updates” and “Past Policy Updates” (Policy Updates Pages) the fact that PayPal had removed the Fee Error Term from the PDS and User Agreement.

25 On 12 March 2024, PayPal amended the Policy Updates Pages of its website and stated:

(a) “That clause should be treated as though it had never formed part of the PayPal User Agreement” in respect of the Fee Error Term in the User Agreement; and

(b) “That clause should be treated as though it had never formed part of the CFSGPDS [Combined Financial Services Guide and Product Disclosure Statement]” in respect of the Fee Error Term in the PDS: SOAF [27] to [28].

26 PayPal has co-operated with ASIC in its investigation and in resolving this proceeding: SOAF [29] to [30].

Applicable principles

Unfair contract terms

27 The parties submit, and I accept, that the purpose of the unfair contract terms provisions of the ASIC Act is to protect consumers and small businesses from the misuse of standard form contracts in the supply of financial products and services. The underlying policy of unfair contract term legislation respects true freedom of contract and seeks to prevent the abuse of standard form contracts which, by definition, will not have been individually negotiated: Australian Competition and Consumer Commission v CLA Trading Pty Ltd [2016] FCA 377; (2016) ATPR ¶42–517 (CLA Trading) at [54(a)] per Gilmour J.

28 Section 12BG(1) of the ASIC Act provides that a term of a small business contract is unfair if each of the following elements is established in relation to the term:

(a) it would cause a significant imbalance in the parties’ rights and obligations arising under the contract;

(b) it is not reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term; and

(c) it would cause detriment (whether financial or otherwise) to a party if it were to be applied or relied on.

It has been observed that the assessment of “unfairness” is to be carried out with a close attendance to the statutory provisions and is of a lower moral and ethical standard than unconscionability: Paciocco v Australia and New Zealand Banking Group Ltd [2015] FCAFC 50; 236 FCR 199 at [363]-[364] per Allsop CJ, Besanko and Middleton JJ agreeing.

29 As to the first criterion, the requirement of “significant imbalance” directs attention to the substantive unfairness of the contract. A significant imbalance arises if a term is so weighted in one party’s favour as to tilt the parties’ rights and obligations under the contract significantly in its favour, with “significant” in this context meaning “significant in magnitude”, or “sufficiently large to be important”, “being a meaning not too distant from substantial”: CLA Trading at [54(d) and (e)]; Australian Competition and Consumer Commission v Smart Corporation Pty Ltd (No 3) [2021] FCA 347; 153 ACSR 347 (Smart Corp) at [65] per Jackson J.

30 In order to assess whether an impugned term gives rise to a significant imbalance in the parties’ rights and obligations arising under the contract, it is necessary to have regard to the contract as a whole: s 12BG(2)(c). In this regard, it is useful to assess the impact of an impugned term on the parties’ rights and obligations by comparing the effect of the contract with the term and the effect it would have without it: CLA Trading at [54(c)]; Smart Corp at [65(c)].

31 Relevant matters in assessing whether there is a significant imbalance between the parties include:

(a) whether the party advantaged by the term is better placed to manage or mitigate the risk imposed by the term than the small business or customer: Australian Competition and Consumer Commission v JJ Richards & Sons Pty Ltd [2017] FCA 1224 (JJ Richards) at [56(c) and (g)]; Australian Securities and Investments Commission v Bendigo and Adelaide Bank Limited [2020] FCA 716 (Bendigo Bank) at [24(3)] per Gleeson J;

(b) whether any burden that the contract imposes on the small business or consumer is matched by a corresponding right for the benefit of the small business or consumer or a corresponding duty on the supplier: Smart Corp at [66], citing Australian Competition and Consumer Commission v Chrisco Hampers Australia Ltd [2015] FCA 1204; 239 FCR 33 (Chrisco) at [53]-[58] per Edelman J; and

(c) whether a party can “opt-out” of an unfair term: Chrisco at [52]; Bendigo Bank at [24(1)].

32 As to the second criterion, s 12BG(4) of the ASIC Act provides a presumption that a term is not reasonably necessary to protect the legitimate interests of the party who would be advantaged by it unless that party proves otherwise. That is, it is for the party advantaged by an impugned term to rebut the presumption in s 12BG(4) and prove that the impugned term was reasonably necessary to protect its legitimate interests: Bendigo Bank at [25]-[26]. In this proceeding, ASIC relies on the presumption in support of its allegation that the Fee Error Term was not reasonably necessary to protect PayPal’s legitimate interests and PayPal does not seek to displace it: SOAF [22].

33 The third criterion will be established if the application of or reliance on the impugned term “will be disadvantageous to the consumer in some way”: Smart Corp at [68]. There is no requirement that the detriment be significant: Karpik v Carnival plc [2023] HCA 39; 98 ALJR 45 (Karpik) at [31], [57]. The detriment may be monetary or non-monetary. There is no requirement that any detriment has been caused; a claimant does not need proof of actual detriment or that a term has been enforced: Karpik at [31], [57]. All that is required is that detriment would be caused if the term were to be applied or relied on. As noted in the Explanatory Memorandum to the Trade Practices Amendment (Australian Consumer Law) Bill (No. 1) 2009 (Cth) at [2.40]:

[A] term does not need to be enforced in order to be unfair, although the possibility of such enforcement may impact on the decisions made by the party that would be disadvantaged by the term’s practical effect, to that party’s detriment.

34 In determining whether a term of a contract is unfair, the Court may take into account such matters as it considers relevant, but it must take into account the extent to which the term is transparent and the contract as a whole: s 12BG(2) of the ASIC Act. A term is transparent if it is expressed in reasonably plain language; legible; presented clearly; and readily available to any party affected by the term: s 12BG(3) of the ASIC Act. Lack of transparency is not an independent element of unfairness as defined in s 12BG(1). Rather, the ASIC Act requires the Court to consider transparency when determining whether a term of a contract is an unfair term under s 12BG(1) of the ASIC Act. Further, if a term is not transparent, that does not mean it is unfair and if a term is transparent, that does not mean that it is not unfair: Chrisco at [43(5)]; Bendigo Bank at [31]. The High Court in Karpik at [32] observed the following in respect of s 23 of the Australian Consumer Law, being Sch 2 to the Competition and Consumer Act 2010 (Cth):

The requirement to consider the transparency of an impugned term is relevant to, and may affect, the analysis of the extent to which the term is unfair as assessed against each of the elements in s 24(1)(a) to (c). That is, the inquiry as to transparency is not an independent and separate inquiry from whether a term is unfair pursuant to s 24(1). The greater the imbalance or detriment inherent in the term, the greater the need for the term to be expressed and presented clearly; and conversely, where a term has been readily available to an affected party, and is clearly presented and plainly expressed, the imbalance and detriment it creates may need to be of a greater magnitude.

35 Section 12BH(1) of the ASIC Act sets out a non-exhaustive list of examples of the kinds of terms that may be unfair.

36 For unfair terms to be void under s 12BF(1) of the ASIC Act, the contract must be a standard form contract. Under s 12BK(1) of the ASIC Act, if a party alleges that a contract is a standard form contract, it is presumed to be a standard form contract unless another party to the proceeding proves otherwise. In this proceeding, the parties have agreed that the Small Business Contracts, including the Individual Contracts, are standard form contracts within the meaning of s 12BF(1)(b) of the ASIC Act and are small business contracts within the meaning of s 12BF(4) of the ASIC Act: SOAF [11].

Declarations

37 The Court has two possible sources of statutory power to make the declaration that the Fee Error Term in the Small Business Contracts and Individual Contracts was an unfair term within the meaning of s 12BG(1) of the ASIC Act.

38 First, s 12GND(2)(b), read with s 12GND(3), empowers the Court to declare that a term of a small business contract, that is a standard form contract and a financial product, is unfair on the application of ASIC. The parties submit that the requirements under s 12GND(2) have been made out: see in particular SOAF [9], [11], [13], [21]-[23] and [26].

39 Second, the Court has a wide discretionary power to make declarations under s 21 of the Federal Court of Australia Act 1976 (Cth). Although s 12GND(2) specifically provides for making declarations in respect of unfair terms in small business contracts, s 12GND(5) makes clear that s 12GND(2) does not limit any other power of the Court to make declarations: Bendigo Bank at [85].

40 In relation to the proposed declaration that the Fee Error Term is void, the Court has two possible sources of statutory power to make a declaration to that effect.

41 First, the Court has the power to make the declaration pursuant to its wide power under s 21 of the Federal Court of Australia Act.

42 Second, s 12GNB of the ASIC Act provides an alternative source of power for the Court to make the declaration that the Fee Error Term is void ab initio. In short, s 12GNB(1) empowers the Court to make such orders as it thinks appropriate if certain conditions are met, and s 12GNC provides, without limitation, the kinds of orders that may be made under s 12GNB(1). Such orders include, expressly, an order declaring any part of a contract to have been void ab initio: s 12GNC(a)(ii).

43 The parties submit, and I accept, that the criteria set out in s 12GNB are satisfied.

44 Under the general law, it is well established that before making a declaration, three requirements should be satisfied:

(a) the question must be a real and not a hypothetical or theoretical one;

(b) the applicant must have a real interest in raising it; and

(c) there must be a proper contradictor: Forster v Jododex Australia Pty Ltd [1972] HCA 61; 127 CLR 421 at 437-438; Australian Competition and Consumer Commission v Coles Supermarkets Australia Pty Ltd [2014] FCA 1405 (Coles) at [76] per Gordon J.

Orders by consent

45 The principles applicable to the making of orders by consent are well established and were summarised by Gordon J in Coles at [70]-[73] as follows:

(a) there is a well-recognised public interest in the settlement of cases under (by analogy) the ASIC Act;

(b) the orders proposed must not be contrary to the public interest and at least consistent with it;

(c) the Court must be satisfied that it has the power to make the orders and that the orders are appropriate. Parties cannot by consent confer power to make orders that the Court otherwise lacks the power to make;

(d) once the Court is satisfied it has the power to make the orders and that they are appropriate, it should exercise a degree of restraint when scrutinising the proposed settlement terms, particularly where both parties are legally represented and able to understand and evaluate the desirability of the settlement; and

(e) in deciding whether the orders conform with legal principle, the Court is entitled to treat the consent of the defendant as an admission of all facts necessary or appropriate to granting the relief sought against it.

See also Bendigo Bank at [101] and Australian Securities and Investments Commission v Bank of Queensland [2021] FCA 957; 155 ACSR 468 at [87]-[88] per Banks-Smith J.

46 The public interest in parties resolving civil penalty proceedings brought by regulators such as ASIC was reaffirmed by the High Court in Commonwealth v Director, Fair Work Building Industry Inspectorate [2015] HCA 46; 258 CLR 482 at [57] where French CJ, Kiefel, Bell, Nettle and Gordon JJ said:

... in civil proceedings there is generally very considerable scope for the parties to agree on the facts and upon consequences. There is also very considerable scope for them to agree upon the appropriate remedy and for the court to be persuaded that it is an appropriate remedy.

47 At [58], their Honours said:

Subject to the court being sufficiently persuaded of the accuracy of the parties’ agreement as to facts and consequences, and that the penalty which the parties propose is an appropriate remedy in the circumstances thus revealed, it is consistent with principle and, for the reasons identified in Allied Mills, highly desirable in practice for the court to accept the parties’ proposal and therefore impose the proposed penalty.

(Citation omitted.)

48 While their Honours were considering in that case the parties’ proposal to impose an agreed pecuniary penalty, those observations are equally apt to a case such as the present where the parties have agreed to declaratory and injunctive relief.

Application of the principles to the facts of this case

Whether the Fee Error Term is an unfair term

49 The parties submit, and I accept, that the Fee Error Term is an unfair term when contained in the Small Business Contracts, including the Individual Contracts. PayPal has made admissions that the Fee Error Term in each of the Small Business Contracts (including the Individual Contracts) was an unfair term within the meaning of s 12BG(1) of the ASIC Act and void by operation of s 12BF(1) of the ASIC Act: SOAF [26].

50 The Fee Error Term permitted PayPal to retain any fees or charges that PayPal erroneously charged unless the account holder notified PayPal in writing of any errors or discrepancies concerning the fees charged within 60 days of the fee appearing on the account holder’s account statement or account activity information: SOAF [1] and [21(a)].

51 I note that there is no allegation in this case that PayPal has in fact retained any fees or charges erroneously charged. PayPal is not aware of any instance where it has caused a consumer to suffer loss or damage by relying on the Fee Error Term and ASIC’s investigation has not uncovered any instance of PayPal having done so: SOAF [25].

Significant imbalance

52 The Fee Error Term caused a significant imbalance in the parties' rights and obligations arising under each Small Business Contract having regard to the following matters.

53 First, the effect of the Fee Error Term is that it permitted PayPal to retain fees or charges which it had erroneously deducted from the Small Business’s Business Account (that is, where that deduction was not authorised under the Small Business Contract) unless the account holder notified PayPal in writing within the prescribed period: SOAF [21(a)]. In so doing, the Fee Error Term:

(a) permitted PayPal to retain fees which it had overcharged by reason of its own error and had otherwise not bargained for; and

(b) limited the rights of Small Businesses to claim a correction of, or claim compensation for, amounts which had been overcharged to their accounts.

54 Second, the Fee Error Term imposed a de facto obligation on the Small Business to examine account statements and other account activity information to identify whether PayPal had overcharged and/or wrongly charged fees: SOAF [21(b)]. It did so in circumstances where the account holder otherwise owed no such obligation to PayPal (SOAF [20]), and it may be inferred that PayPal possessed the requisite information to confirm whether the fee or charge was correctly charged and calculated.

55 Third, PayPal, as the party to the contract advantaged by the term, was better placed and able than the Small Business to identify if fees or charges had been overcharged and/or wrongly charged, in circumstances where PayPal had charged the fees or charges: SOAF [21(c)].

56 In this regard, while:

(a) Small Businesses were able to view their account activity information and view and download their account statements by:

(i) logging onto PayPal’s business portal (via the PayPal AU website);

(ii) contacting PayPal to obtain an electronic copy of their account activity information and/or account statements; or

(iii) accessing account activity information through PayPal’s secure file transfer protocol service (SFTP), where PayPal business account holders could create a SFTP server user account that would allow the account holder to download reports from PayPal’s live environment: SOAF [18]; and

(b) the standard fees and charges were set out in the Small Business Contracts, principally in clause 18 of the PDS,

the account statements and other account activity information accessible by the Small Business did not describe various types of fees or the manner in which they were calculated in a way that was readily reconcilable with how the fee was described in clause 18 of the PDS: SOAF at [19]. Further, absent request, the Small Business Contract did not oblige PayPal to provide the Small Business with such information in the account statements and other account activity information accessible by the Small Business: [SOAF [21(e)].

57 In those circumstances, it may be inferred that the Small Businesses would have encountered difficulties in determining what fees had been charged and how they were calculated from the face of the account statements and other account activity information.

58 Unlike PayPal, Small Businesses were not placed in a position where they were able to manage the risk of incorrect charging or overcharging. Each Small Business only had 60 days to notify PayPal in writing of any erroneous deduction of fees or charges, in circumstances where (as noted above) the account statements and other account activity information accessible by the Small Business did not describe various types of fees or the manner in which they were calculated in a way that was readily reconcilable with how the fee was described in clause 18 of the PDS.

59 Fourth, the burden that the Fee Error Term imposed on the Small Business was not matched by a corresponding right for the benefit of the Small Business or a corresponding duty on PayPal. The Small Business Contracts did not contain any cognate term which prevented the Small Business from being charged fees or charges which PayPal had undercharged or neglected to charge, unless PayPal rectified the error within 60 days: [SOAF 21(d)]. That is, there was no corresponding right of the Small Business to retain the benefit of PayPal undercharging or failing to charge fees or charges, if PayPal did not detect the error and notify the customer within 60 days.

Legitimate interest

60 As referred to above, the presumption in s 12BG(4) of the ASIC Act (that the Fee Error Term is not reasonably necessary in order to protect the legitimate interests of PayPal) is engaged in the present case and PayPal does not seek to rebut the presumption: SOAF [22]. I therefore find that the Fee Error Term was not reasonably necessary to protect the legitimate interests of PayPal.

Detriment

61 The Fee Error Term would have caused detriment to Small Businesses if PayPal had relied on the Fee Error Term because, if the Small Business failed to notify PayPal in writing of any wrongly charged or overcharged fees within 60 days, the Fee Error Term permitted PayPal to retain any such fees: SOAF [21(a)] and [23]. In this scenario, the Small Business would have lost the benefit of the amount which had been wrongly (through no fault of its own) charged to its account.

62 In addition, if Small Businesses wished to ensure they were not wrongly charged or overcharged fees by PayPal then Small Businesses were obliged to examine account statements and other account activity information to identify whether PayPal had overcharged and/or wrongly charged fees, and notify PayPal of any errors within 60 days, in circumstances where it may be inferred that it was difficult for Small Businesses to determine if fees had been charged correctly because:

(a) the applicable fees varied depending on the circumstances of each transaction: SOAF [17];

(b) the Small Business Contracts did not oblige PayPal, absent request, to provide the Small Business with account statements or other account activity information which described the fee charged or the manner in which it was calculated in a way that was readily reconcilable with how the fee was described in clause 18 of the PDS: SOAF [21(e)]; and

(c) for various types of fees set out in clause 18 of the PDS, the account statements and other account activity information accessible by the Small Business did not describe the fee or the manner in which it was calculated in a way that was readily reconcilable with how the fee was described in clause 18 of the PDS: SOAF [19].

63 I note that PayPal is not aware of any instance where it has caused a consumer to suffer loss or damage by relying on the Fee Error Term. Further, ASIC’s investigation has not uncovered any instance of PayPal having done so: SOAF [25]. However, there is no requirement that there be proof of detriment actually caused – rather all that is required is that detriment would be caused if the term were to be applied or relied on.

Transparency

64 The parties are agreed that the Fee Error Term that appeared in the User Agreement and the PDS was legible, was in the same font size as the rest of the document, and had a heading in bold, but was not otherwise drawn to the attention of the Small Business upon entering into a Small Business Contract: SOAF [24].

65 The parties have not reached an agreed position on the question whether the Fee Error Term is “transparent” for the purposes of the provisions. The parties submitted it was not necessary for the Court to reach a conclusion on this issue. In the course of the hearing, I raised with the parties whether it may be incumbent on the Court to reach a position on this question, given that the terms of the legislation (s 12BG(2)) require the Court to have regard to the extent to which the term is transparent. The parties each provided references to some cases and documents in the Court Book relevant to this issue.

66 In my view, it is necessary for the Court to form a view on the extent to which the term is transparent, given the terms of s 12BG(2). A definition of transparency is provided in s 12BG(3) of the ASIC Act. Relevant authorities include JJ Richards at [60] and Australian Competition and Consumer Commission v Employsure Pty Ltd [2020] FCA 1409 at [465] (overturned on appeal, but not on this point). In the present case, having regard to the nature of the term and the length and complexity of the documents, and the fact that the term was not highlighted or otherwise drawn to the attention of the User, I consider that it was, to some extent, lacking in transparency.

Section 12BH(1) examples and the contract as a whole

67 The Fee Error Term falls within the list of examples set out in s 12BH(1) of the ASIC Act of terms that may be unfair. Specifically, if applied, the Fee Error Term would:

(a) permit PayPal (but not the Small Business) to avoid or limit its performance of the contract (specifically, its correct charging of fees) (s 12BH(1)(a));

(b) limit the right of the Small Business to sue PayPal to recover fees that were wrongly charged (s 12BH(1)(k)).

68 Finally, when regard is had to the Small Business Contracts as a whole, there is nothing otherwise within their terms which mitigates the unfairness of the Fee Error Term within the meaning of s 12BG(1) of the ASIC Act.

Conclusion

69 In light of the above, I am satisfied that the Fee Error Term of the Small Business Contracts is an unfair term within the meaning of s 12BG(1) of the ASIC Act and therefore void by reason of s 12BF(1) of the ASIC Act.

Declarations

70 The parties seek the following declarations:

NOTING THAT:

These declarations and orders adopt the following defined terms:

(i) A reference to the Fee Error Term is a reference to the term set out in Schedule 1 to these Orders.

(ii) A reference to the Individual Contracts is a reference to each contract identified as such in Schedule 2 to these Orders.

(iii) Relevant Period means from 21 September 2021 to 7 November 2023;

(iv) A reference to the Small Business Contracts is a reference to each contract in force during the Relevant Period:

a. between the defendant (PayPal) and any Non-Party Consumer (as defined in s 12BA the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) as in force in the Relevant Period);

b. in respect of a business account held with the defendant (PayPal) by that Non-Party Consumer (as defined in s 12BA of the ASIC Act as in force in the Relevant Period);

c. which meets the definition of a small business contract in s 12BF(4) of the ASIC Act; and

d. consisting of:

i. the PayPal User Agreement (User Agreement) published by PayPal on its website (including policies and applicable agreements incorporated into that User Agreement by reference);

ii. a Combined Financial Services Guide and Product Disclosure Statement (PDS) published by PayPal on its website; and

iii. an online registration form completed by that Non-Party Consumer.

BY CONSENT, THE COURT DECLARES THAT:

Individual Contracts

1. Pursuant to s 12GND of the ASIC Act, the Fee Error Term in each of the Individual Contracts (as identified in Schedule 2) is an unfair term within the meaning of s 12BG(1) of the ASIC Act.

2. Pursuant to s 21 of the Federal Court of Australia Act 1976 (Cth) (FCA Act) and s 12GNB of the ASIC Act, the Fee Error Term in each of the Individual Contracts (as identified in Schedule 2) is void ab initio by operation of s 12BF(1) of the ASIC Act and otherwise each of the Individual Contracts (as identified in Schedule 2) continues to bind the parties to it.

Small Business Contracts

3. Pursuant to s 12GND of the ASIC Act, the Fee Error Term in each of the Small Business Contracts is an unfair term within the meaning of s 12BG(1) of the ASIC Act.

4. Pursuant to s 21 of the FCA Act and s 12GNB of the ASIC Act, the Fee Error Term in each of the Small Business Contracts is void ab initio by operation of s 12BF(1) of the ASIC Act and otherwise each of the Small Business Contracts continues to bind the parties to it.

71 In my view, the general law requirements for the making of declarations (set out above) are satisfied in the present case. Further, subject to two matters, I consider it appropriate to make the declarations.

72 The first matter is that I do not consider it appropriate to make a declaration as to the balance of the contracts continuing to bind the parties to them. In my view, in circumstances where there is no real controversy about the balance of the contracts, it is not appropriate to refer to the balance of the contracts in the order. However, for the sake of completeness and clarity, I note the following matters in these reasons. Section 12BF(2) of the ASIC Act provides:

The contract continues to bind the parties if it is capable of operating without the unfair term.

There is nothing in the material to which I have been taken to suggest that the Small Business Contracts are not capable of operating without the unfair term.

73 The second matter is that, as a matter of form, I consider it preferable to combine the declarations dealing with the Individual Contracts and the Small Business Contracts, such that there would be two declarations as follows:

1. Pursuant to s 12GND of the ASIC Act, the Fee Error Term in each of the Small Business Contracts (including the Individual Contracts) is an unfair term within the meaning of s 12BG(1) of the ASIC Act.

2. Pursuant to s 21 of the Federal Court of Australia Act 1976 (Cth) and s 12GNB of the ASIC Act, the Fee Error Term in each of the Small Business Contracts (including the Individual Contracts) is void ab initio by operation of s 12BF(1) of the ASIC Act.

Injunctions

74 The parties seek injunctions as follows:

Individual Contracts

5. Pursuant to s 12GD of the ASIC Act, or alternatively s 23 of the FCA Act, PayPal, whether by itself, its servant or agents or otherwise is restrained from applying or relying upon or enforcing the Fee Error Term in each of the Individual Contracts (as identified in Schedule 2).

Small Business Contracts

6. Pursuant to s 12GD of the ASIC Act, or alternatively s 23 of the FCA Act, PayPal, whether by itself, its servant or agents or otherwise is restrained from applying or relying upon or enforcing the Fee Error Term in each of the Small Business Contracts.

75 I am satisfied that there is power to make the injunction under s 12GD. I consider it appropriate to make an injunction order substantially as sought. Again, as a matter of form, I propose to deal in one order with both the Individual Contracts and the Small Business Contracts. The form of the injunction will therefore be:

Pursuant to s 12GD of the ASIC Act, PayPal, whether by itself, its servant or agents or otherwise is restrained from applying or relying upon or enforcing the Fee Error Term in each of the Small Business Contracts (including the Individual Contracts).

Costs

76 I also consider it appropriate to make the costs order proposed by the parties.

I certify that the preceding seventy-six (76) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Moshinsky. |

Associate: