Federal Court of Australia

Australian Securities and Investments Commission v LGSS Pty Ltd (No 2) [2024] FCA 665

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | LGSS PTY LTD ACN 078 003 497 AS TRUSTEE FOR LOCAL GOVERNMENT SUPER ABN 28 901 371 321 Defendant | |

DATE OF ORDER: |

THE COURT DECLARES THAT:

1. During the Relevant Period, LGSS, in trade or commerce, made representations in connection with the supply of financial services, and the promotion of the supply of financial services, in contravention of s 12DB(1)(a) of the ASIC Act, in that:

(a) LGSS made the representation at item 1 of Annexure A from 25 May 2021 to 28 February 2023, but contrary to that representation it in fact held the investments identified in Table 1 of Annexure B, each of which were investments in companies that derived more than 10% of their revenue from gambling;

(b) LGSS made the representation at item 2 of Annexure A from 25 May 2021 to 1 March 2023, but contrary to that representation it in fact held the investments identified in Table 1 of Annexure B, each of which were investments in companies that derived more than 10% of their revenue from gambling;

(c) LGSS made the representation at item 5 of Annexure A from 28 October 2021 to 1 March 2023, but contrary to that representation it in fact held the investments identified in Table 1 of Annexure B, each of which were investments in companies that derived more than 10% of their revenue from gambling;

(d) LGSS made the representation at item 6 of Annexure A from 28 October 2021 to 1 March 2023, but contrary to that representation:

(i) it in fact held the investments identified in Table 1 of Annexure B, each of which were investments in companies that derived more than 10% of their revenue from gambling; and

(ii) it in fact held the investments identified in Table 4 of Annexure B, each of which were investments in companies that derived revenue from oil tar sands;

(e) LGSS made the representation at item 11 of Annexure A from 19 January 2022 to 8 August 2023, but contrary to that representation it in fact held the investments identified in Table 1 of Annexure B, each of which were investments in companies that derived more than 10% of their revenue from gambling; and

(f) LGSS made the representation at item 13 of Annexure A from October 2021 to May 2023, but contrary to that representation it in fact held the investments identified in Table 5 of Annexure B, each of which were investments in companies that derived one-third or more of their revenue from coal mining;

(g) LGSS made the representation at item 15 of Annexure A from 20 December 2022 to March 2023, but contrary to that representation it in fact held the investments identified in Table 3 of Annexure B, each of which were investments in companies that derived revenue from Russia;

(h) LGSS made the representation at item 16 of Annexure A from 20 December 2022 to March 2023, but contrary to that representation it in fact held the investments identified in Table 3 of Annexure B, each of which were investments in companies that derived revenue from Russia;

(i) LGSS made the representation at item 17 of Annexure A from May 2022 to April 2023, but contrary to that representation it in fact held the investments identified in Table 3 of Annexure B, each of which were investments in companies that derived revenue from Russia;

(j) LGSS made the representation at item 18 of Annexure A from 20 December 2022 to March 2023, but contrary to that representation:

(i) it in fact held the investments identified in Table 1 of Annexure B, each of which were investments in companies that derived more than 10% of their revenue from gambling; and

(ii) it in fact held the investments identified in Table 4 of Annexure B, each of which were investments in companies that derived revenue from oil tar sands.

2. During the Relevant Period, LGSS, in trade or commerce, engaged in conduct that was liable to mislead the public as to the characteristics of the investments made by LGSS on behalf of Active Super in contravention of s 12DF(1) of the ASIC Act, in that:

(a) LGSS engaged in the conduct referred to in sub-paragraphs (a) to (j) in Declaration 1 above;

(b) LGSS made the representation at item 19 of Annexure A from 1 July 2022 to 1 May 2023, but contrary to that representation:

(i) it in fact held the investments identified in Table 1 of Annexure B, each of which were investments in companies that derived more than 10% of their revenue from gambling;

(ii) it in fact held the investments identified in Table 3 of Annexure B, each of which were investments in companies that derived revenue from Russia;

(iii) it in fact held the investments identified in Table 4 of Annexure B, each of which were investments in companies that derived revenue from oil tar sands;

(c) LGSS made the representation at item 20 of Annexure A from 25 May 2021 to 30 June 2022, but contrary to that representation it in fact held the investments identified in Table 5 of Annexure B, each of which were investments in companies that derived revenue one third or more of their revenue from coal mining.

THE COURT NOTES THAT:

A. In these declarations, the following terms have the following meanings:

ASIC Act means the Australian Securities and Investments Commission Act 2001 (Cth);

Active Super means the fund known as Local Government Super (ABN 28 901 371 321);

LGSS means LGSS Pty Limited (ACN) as trustee for Local Government Super (ABN 28 901 371 321);

Relevant Period means the period from 1 February 2021 to 30 June 2023.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

Representations

Annexure B

Active Super’s investments contrary to representations

1. Gambling investments

Table 1: Gambling Investments | ||||

No. | a. Company | a. Type of holding | b. First date held | c. Disposal date/Last date held |

Skycity Entertainment Group Limited | Indirect (via the Colonial First State Wholesale Small Companies Fund) | 1 February 2021 | Held as at 31 May 2023 | |

Indirect (via SPDR S&P/ASX 200 ETF) | 30 November 2016 | 21 March 2022 | ||

PointsBet Holdings Limited | Indirect (via SPDR S&P/ASX 200 ETF) | 4 February 2021 | 19 September 2022 | |

Direct | 30 November 2016 | 23 December 2021 | ||

Jumbo Interactive Limited | Direct | 3 April 2019 | 6 June 2023 | |

Aristocrat Leisure Limited | Indirect (via SPDR S&P/ASX200 ETF) | 30 November 2016 | Held as at 23 May 2023 | |

The Lottery Corporation Limited | Indirect (via SPDR S&P/ASX200 ETF) | Added to the ASX200 24 May 2022 | Held as at 23 May 2023 | |

Tabcorp Holdings Limited | Indirect (via SPDR S&P/ASX200 ETF) | 30 Nov 2016 | Held as at 23 May 2023 | |

Crown Resorts Ltd | Indirect (via SPDR S&P/ASX200 ETF) | 30 Nov 2016 | 20 June 2022 | |

The Star Entertainment Group Ltd | Indirect (via SPDR S&P/ASX200 ETF) | 30 Nov 2016 | Held as at 23 May 2023 | |

Indirect (via the Colonial First State Wholesale Small Companies Fund) | 31 March 2023 | Held as at 31 May 2023 | ||

2. [Not used]

3. Russian investments

Table 3: Russian Investments | ||||

No. | a. Company | b. Type of holding | c. First date held | d. Disposal date/Last date held |

Rosneft Oil Co | Indirect (Macquarie Emerging Markets Fund) | 31 January 2021 | Held as at 30 June 2023 | |

Etalon Group | Indirect (Macquarie Emerging Markets Fund) | 31 January 2021 | Held as at 30 June 2023 | |

Mail.ru | Indirect (Macquarie Emerging Markets Fund) | 31 January 2021 | Held as at 30 June 2023 | |

Transneft PJSC | Indirect (Macquarie Emerging Markets Fund) | 31 January 2021 | Held as at 30 June 2023 | |

Yandex NV | Indirect (Macquarie Emerging Markets Fund) | 31 January 2021 | Held as at 30 June 2023 | |

Sberbank of Russia | Indirect (Macquarie Emerging Markets Fund) | 31 January 2021 | Held as at 30 June 2023 | |

Gazprom PJSC | Indirect (Macquarie Emerging Markets Fund) | 31 January 2021 | Held as at 30 June 2023 | |

Gazprom PJSC | Indirect (Wellington Emerging Markets Fund) | 30 June 2021 | 30 September 2022 | |

Gazprom PJSC | Indirect (Wellington Emerging Markets Fund) | 31 October 2022 | Held as at 30 June 2023 | |

4. Oil Tar Sands investments

Table 4: Oil Tar Sands Investments | ||||

No. | a. Company | b. Type of holding | c. First date held | d. Disposal date/Last date held |

ConocoPhillips | Direct | 30 Nov 2016 | 10 December 2021 | |

CK Hutchison Holdings Ltd | Direct | 4 March 2021 | Held as at 26 July 2023 | |

Shell Plc | Direct | 30 Nov 2016 | Held as at 26 July 2023 | |

TotalEnergies SE | Direct | 30 Nov 2016 | Held as at 26 July 2023 | |

PTT Exploration & Production Public Company Limited | Indirect (via Wellington Emerging Markets) | 30 Nov 2016 | Held as at 30 June 2023 | |

5. Coal mining investments

Table 5: Coal Mining Investments | ||||

No. | a. Company | b. Type of holding | c. First date held | d. Disposal date/Last date held |

Coronado Global Resources Inc. | Indirect (SPDR S&P/ASX200 ETF) | Added to the ASX200 20 June 2022 | Held as at 23 May 2023 | |

Direct | 30 June 2021 | 31 December 2021 | ||

New Hope Corporation Limited | Indirect (SPDR S&P/ASX200 ETF) | Added to the ASX200 20 June 2022 | Held as at 23 May 2023 | |

Whitehaven Coal Limited | Indirect (via SPDR S&P/ASX200 ETF) | 30 Nov 2016 | Held as at 23 May 2023 | |

O’CALLAGHAN J

1 On 5 June 2024, I found that the plaintiff, ASIC, was entitled to declarations as to contraventions by the defendant, LGSS Pty Ltd, of s 12DB(1)(a) and s 12DF(1) of the Australian Securities and Investments Commission Act 2001 (Cth) by making certain false or misleading representations, and engaging in conduct liable to mislead the public in relation to investments made by the superannuation fund, of which LGSS is the trustee, now known as Active Super, during 1 February 2021 to 30 June 2023. See Australian Securities and Investments Commission v LGSS Pty Ltd [2024] FCA 587 (Reasons).

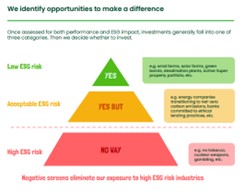

2 As explained in the Reasons, I found that LGSS had engaged in what is colloquially called “greenwashing” by making false or misleading representations to members and potential members of the fund about their “green” or “ESG” credentials.

3 I ordered that the matter be listed for further hearing, and said that I would hear the parties at that hearing on the appropriate form of declaratory relief in light of the Reasons. See Reasons at [238].

4 Following publication of my Reasons, and prior to the further hearing being listed, the parties agreed upon a form of declaratory orders and provided those proposed orders to my chambers on 19 June 2024.

5 In this case, I consider it is appropriate to make the declarations sought by the parties, as there is utility in setting out the basis of the liability found and, in turn, the basis of any penalties and consequential relief to be imposed. See Rural Press Ltd v Australian Competition and Consumer Commission (2003) 216 CLR 53 at 92 [95] (Gummow, Hayne and Heydon JJ). In addition, the declarations are appropriate because they serve the public interest in defining and publicising the type of conduct that constitutes a contravention of the ASIC Act.

6 Pursuant to my order of 5 June 2024, the proceeding will be listed for a further directions hearing, at which I will hear the parties on the appropriate timetable for the hearing and determination of ASIC’s claims for pecuniary penalties, adverse publicity orders and injunctive relief.

I certify that the preceding six (6) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice O’Callaghan. |

Associate: