FEDERAL COURT OF AUSTRALIA

CEO of AUSTRAC v SkyCity Adelaide Pty Ltd [2024] FCA 664

ORDERS

CHIEF EXECUTIVE OFFICER OF THE AUSTRALIAN TRANSACTION REPORTS AND ANALYSIS CENTRE Applicant | ||

AND: | Respondent | |

DATE OF ORDER: |

THE COURT DECLARES THAT:

The Standard AML/CTF Programme contraventions

1. The respondent (SCA) contravened s 81(1) of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (the Act) on each occasion it commenced to provide a designated service to a customer from 7 December 2016 to 14 December 2022 in circumstances where:

(a) Part A of its Standard Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Programme did not:

(i) have the primary purpose of identifying, mitigating and managing the risk that SCA may reasonably face that the provision of designated services at or through a permanent establishment in Australia might (whether inadvertently or otherwise) involve or facilitate money laundering or terrorism financing (ML/TF), as required by ss 84(2)(a) and (c) of the Act and the Anti-Money Laundering and Counter-Terrorism Financing Rules 2007 (Cth) (the Rules); and

(ii) comply with s 84(2)(c) of the Act, which required that Part A of its Standard AML/CTF Programme comply with Chapters 8 and 15 of the Rules;

(b) Part B of its Standard AML/CTF Programme did not comply with s 84(3)(b) of the Act, which required that Part B of its Standard AML/CTF Programme comply with Chapter 4 of the Rules.

The ongoing customer due diligence contraventions

2. SCA contravened s 36(1) of the Act on 121 occasions between 7 December 2016 and 14 December 2022 by failing to monitor 121 customers in relation to the provision of designated services:

(a) with a view to identifying, mitigating and managing the money laundering risks that SCA reasonably faced; and

(b) in accordance with Chapter 15 of the Rules.

THE COURT ORDERS THAT:

3. SCA pay to the Commonwealth of Australia a pecuniary penalty in the amount of $67 million pursuant to s 175(1) of the Act within 30 days of the date of this order.

4. SCA pay the applicant’s costs fixed in the amount of $3 million.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(Delivered ex tempore, revised from the transcript)

LEE J:

A INTRODUCTION

1 In Chief Executive Officer of the Australian Transaction Reports and Analysis Centre v Crown Melbourne Limited [2023] FCA 782, I dealt at some length with a proceeding commenced by the applicant in this case, the Chief Executive Officer of the Australian Transaction Reports and Analysis Centre (AUSTRAC), against two entities, being Crown Melbourne and Crown Perth.

2 In that case, like this one, AUSTRAC sought declarations that a corporation operating a casino contravened provisions of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (the Act) and an order that a pecuniary penalty be payable to the Commonwealth.

B PRINCIPLES

3 I do not propose to set out in this judgment the statutory scheme or principles pursuant to which the Court deals with an agreement between a regulator and a contravening corporation as to a proposed remedial response to admitted contravening conduct. It is sufficient to incorporate by reference into this judgment, those parts of the judgment in Crown which deal with these matters: Crown (at [87]–[125]).

4 Additionally, I have received the benefit of comprehensive joint submissions between the parties prepared by experienced counsel, which I have read. They set out in comprehensive detail the background to the proceedings, the objects and structure of the Act in a manner not inconsistent with the way in which I explained it in Crown, the status of the respondent, SkyCity Adelaide Pty Limited (SCA) as a reporting entity, and foundational principles as to the approach to orders sought by agreement in a pecuniary penalty case and related principles. It would be surplusage to reproduce them (although I record that they ought to be accepted).

C APPLICATION

5 More significantly, the application of the uncontroversial principles to the agreed facts of this proceeding commences at section D2 of the joint submissions.

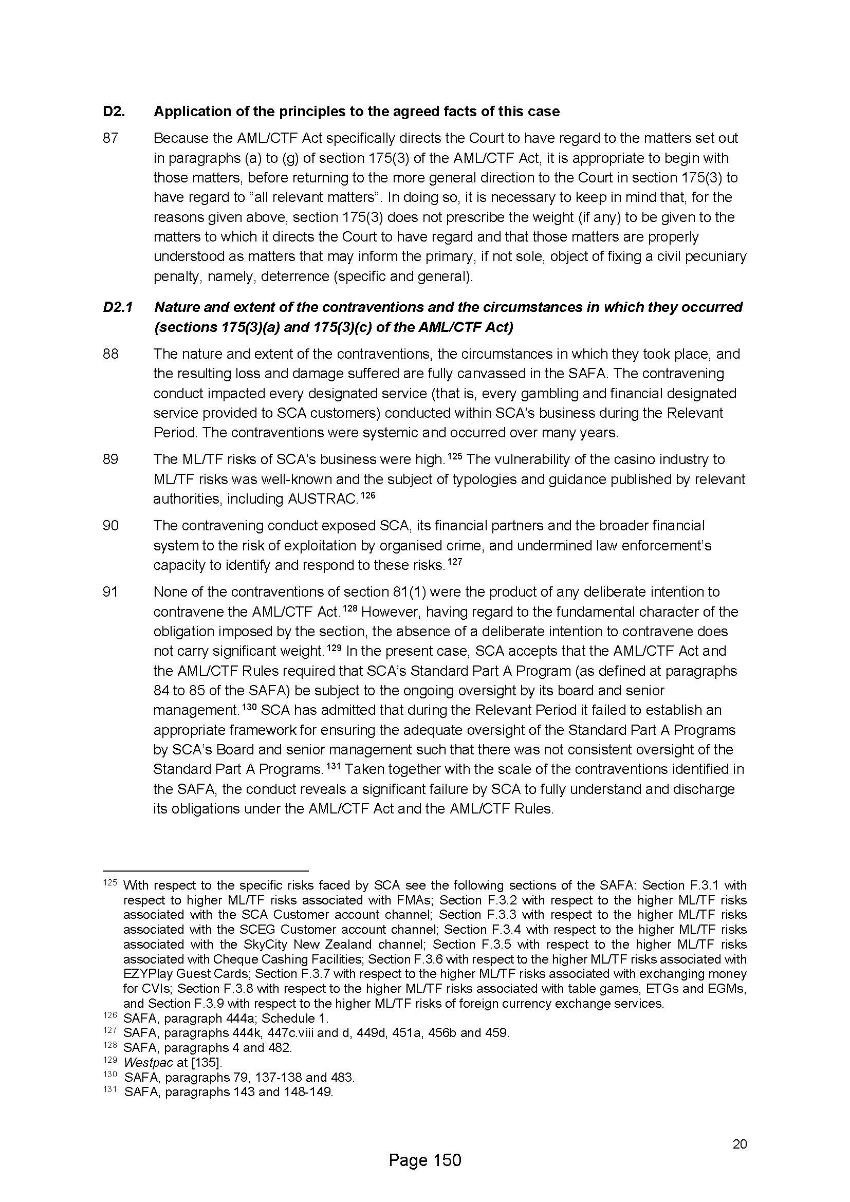

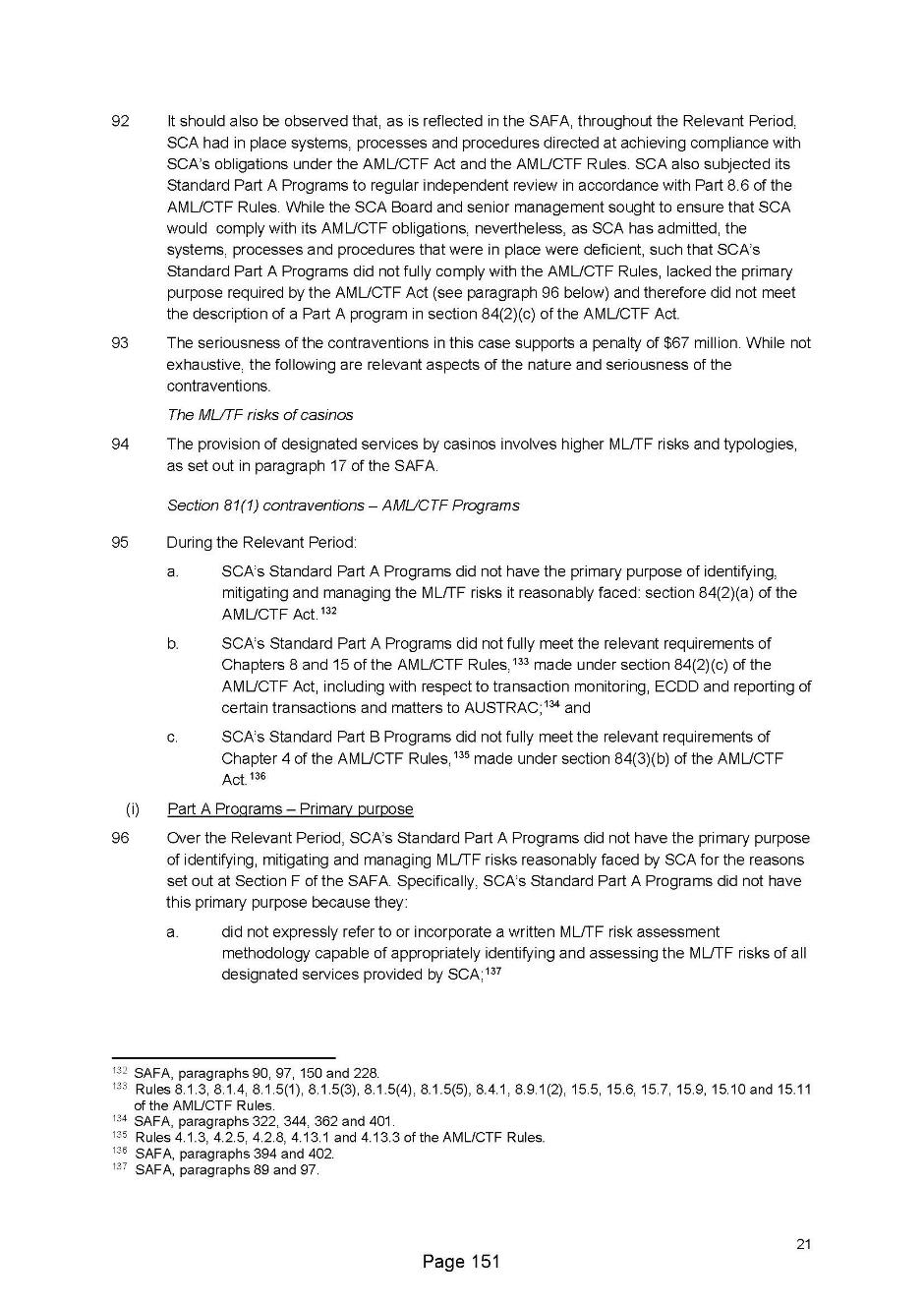

6 As Annexure A to this judgment, I will set out [87]–[178] of the joint submissions.

7 As will be seen, the reproduced part of the joint submissions deals with both the nature and extent of the contraventions, the circumstances in which they occurred, the loss and damage suffered and the benefit derived, the fact that there are no previous findings that have been made against SCA, and other relevant matters going to specific deterrence.

8 Subject to one matter to which I will come, those submissions also ought to be accepted and, with respect, put the case appropriately.

9 The only two matters that I would raise are as follows.

10 The first relates to the point made at [121] of the joint submissions that the profit and benefit SCA in fact derived from the contravening conduct is not able to be calculated meaningfully.

11 That is true as a statement of literal fact, but it is far from evident to me that, in a case where it may be significant, it would be beyond the ability of a party to a proceeding such as this to lead opinion evidence from somebody experienced in the operation of casinos, or, if it thought appropriate, for the Court to refer out and inquire into the question of an estimate of the amount of financial benefit likely to have been derived from the alleged contravening conduct.

12 Notwithstanding this general observation, more particularly, I do not think the question of the amount of financial benefit derived from the conduct is anything like determinative to the nature of the relief sought in this case and, consistently with the dictates of Pt VAA of the Federal Court of Australia Act 1976 (Cth), AUSTRAC has not thought it appropriate to adduce such evidence in these proceedings (for understandable reasons).

13 But one can readily conceive of a case where it will be necessary for the purpose of specific deterrence to reach a view, even within a relatively broad range, of the likely financial benefit obtained by contravening conduct. It is not unduly cynical to remark that the reason why corporations engage in unlawful conduct is usually by reason of the desire to focus on the maximisation of profit.

14 If, as the High Court reminds us, the whole nature of pecuniary penalties is to ensure that the demands of deterrence are properly fulfilled (see Australian Building and Construction Commissioner v Pattinson [2022] HCA 13; (2022) 274 CLR 450 (at 457 [9] per Kiefel CJ, Gageler, Keane, Gordon, Steward and Gleeson JJ)) it cannot be right (subject to maximum amounts) that a contravening corporation can end up retaining some proportion of the rewards from engaging in unlawful conduct just because identifying the extent of those rewards may lack precision and cause forensic challenges.

15 The second point is the comparison between this case and Crown.

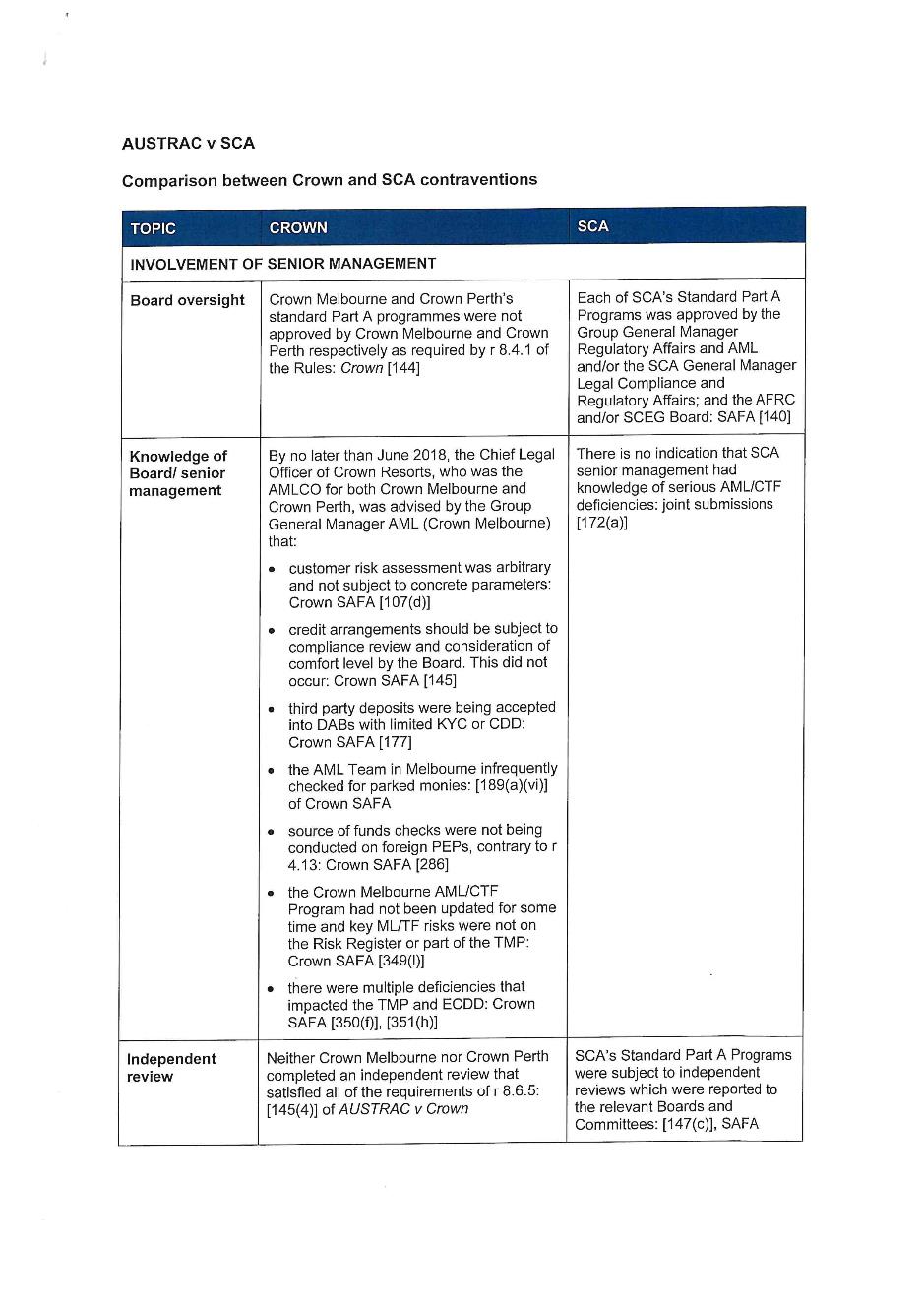

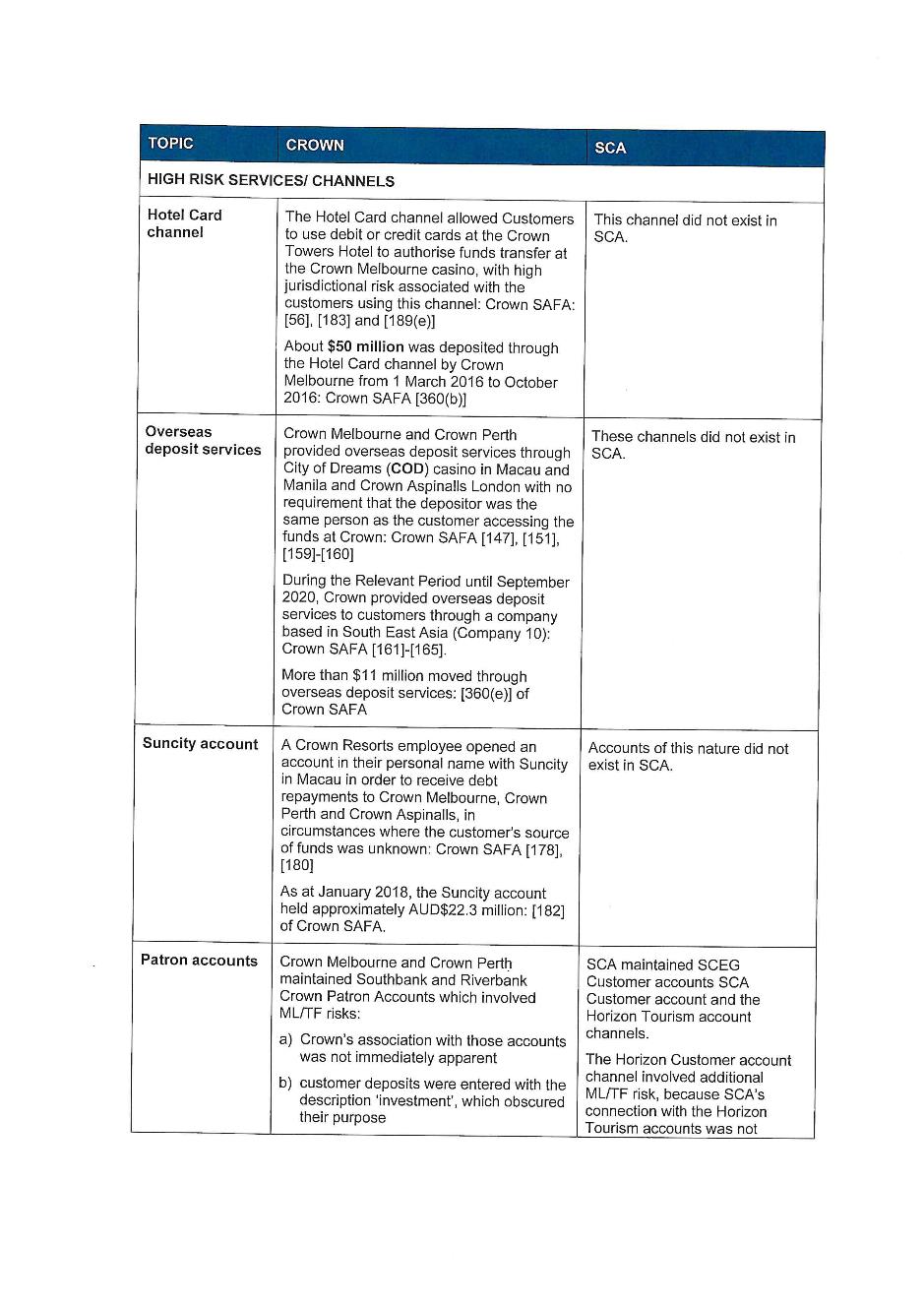

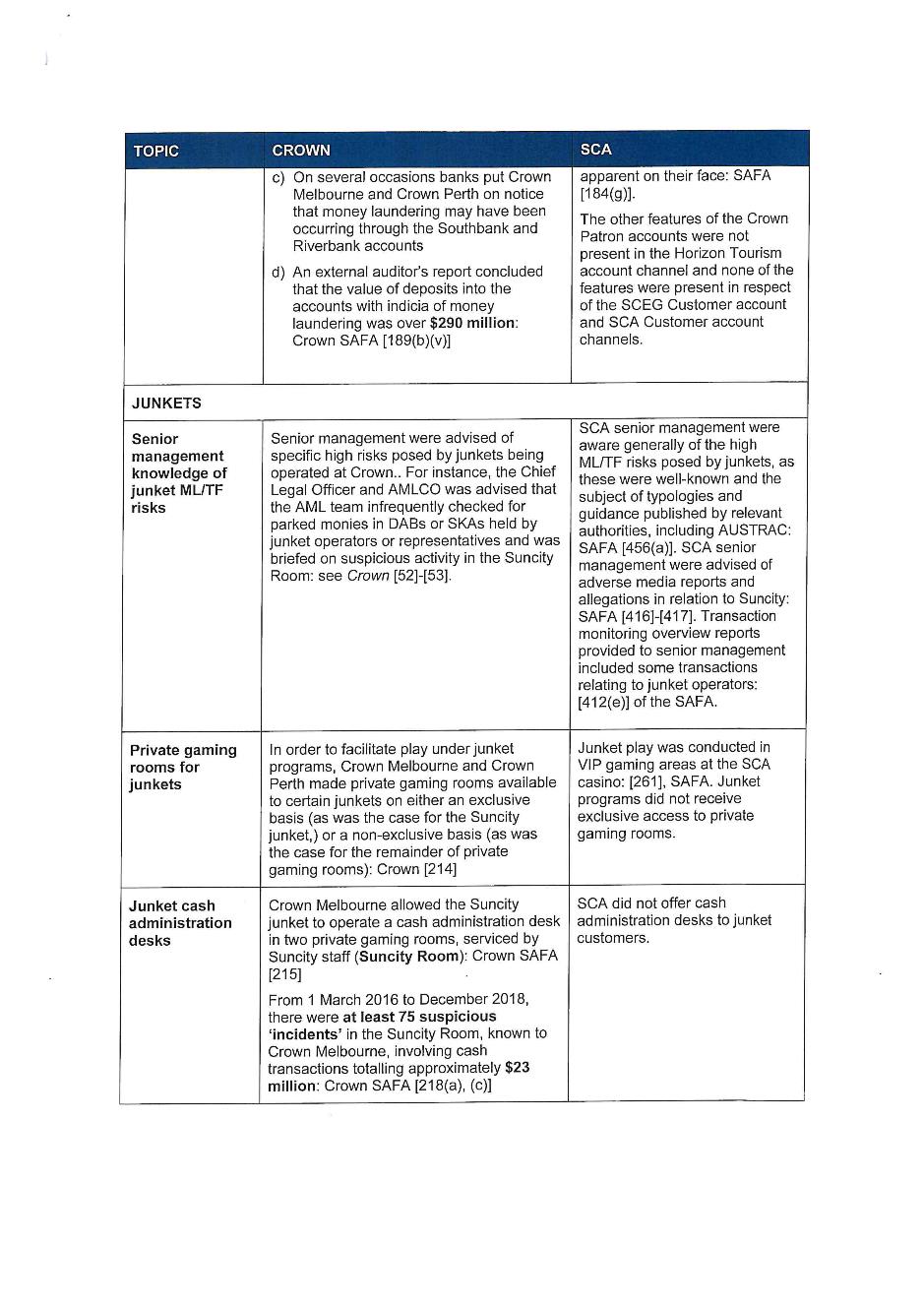

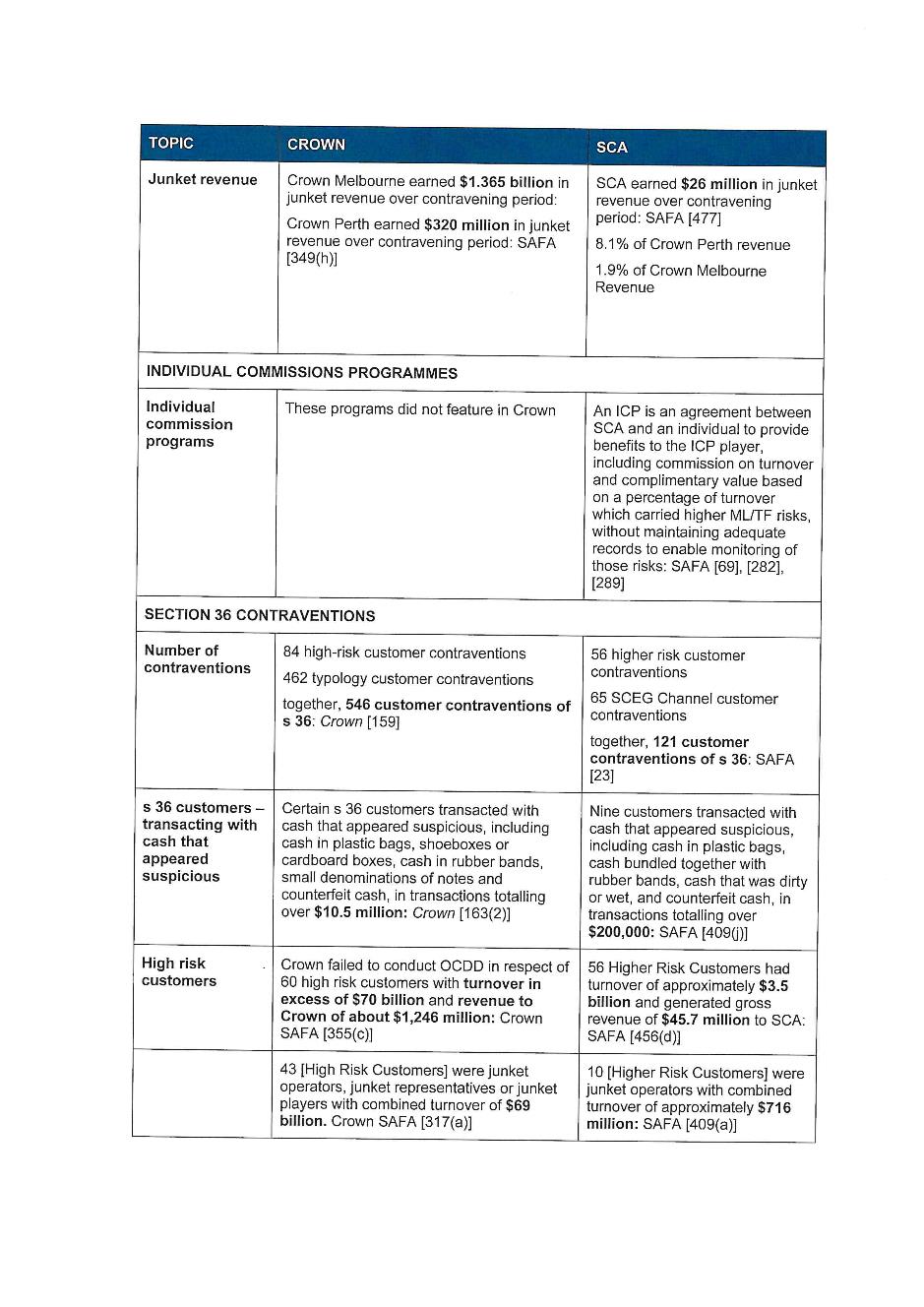

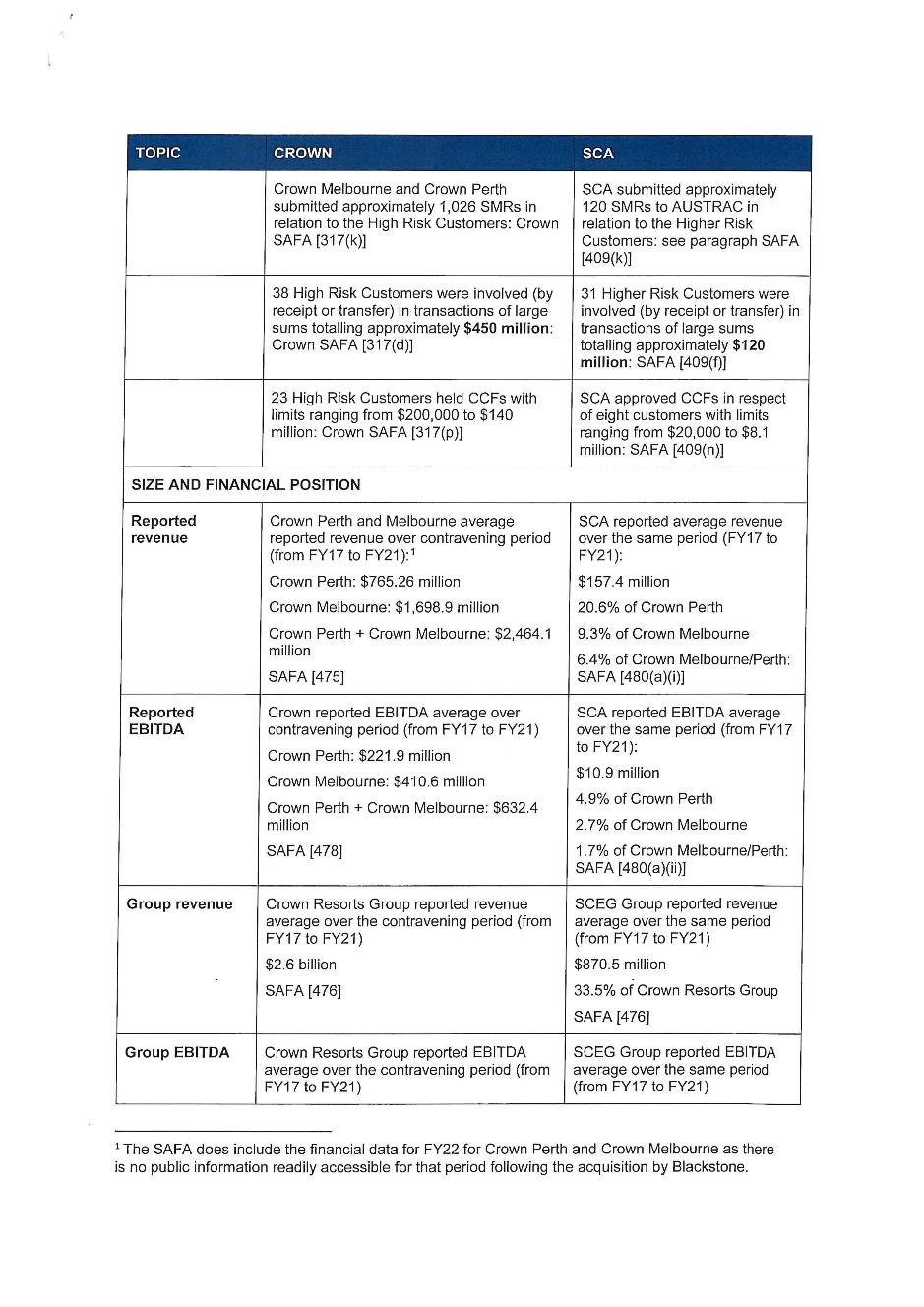

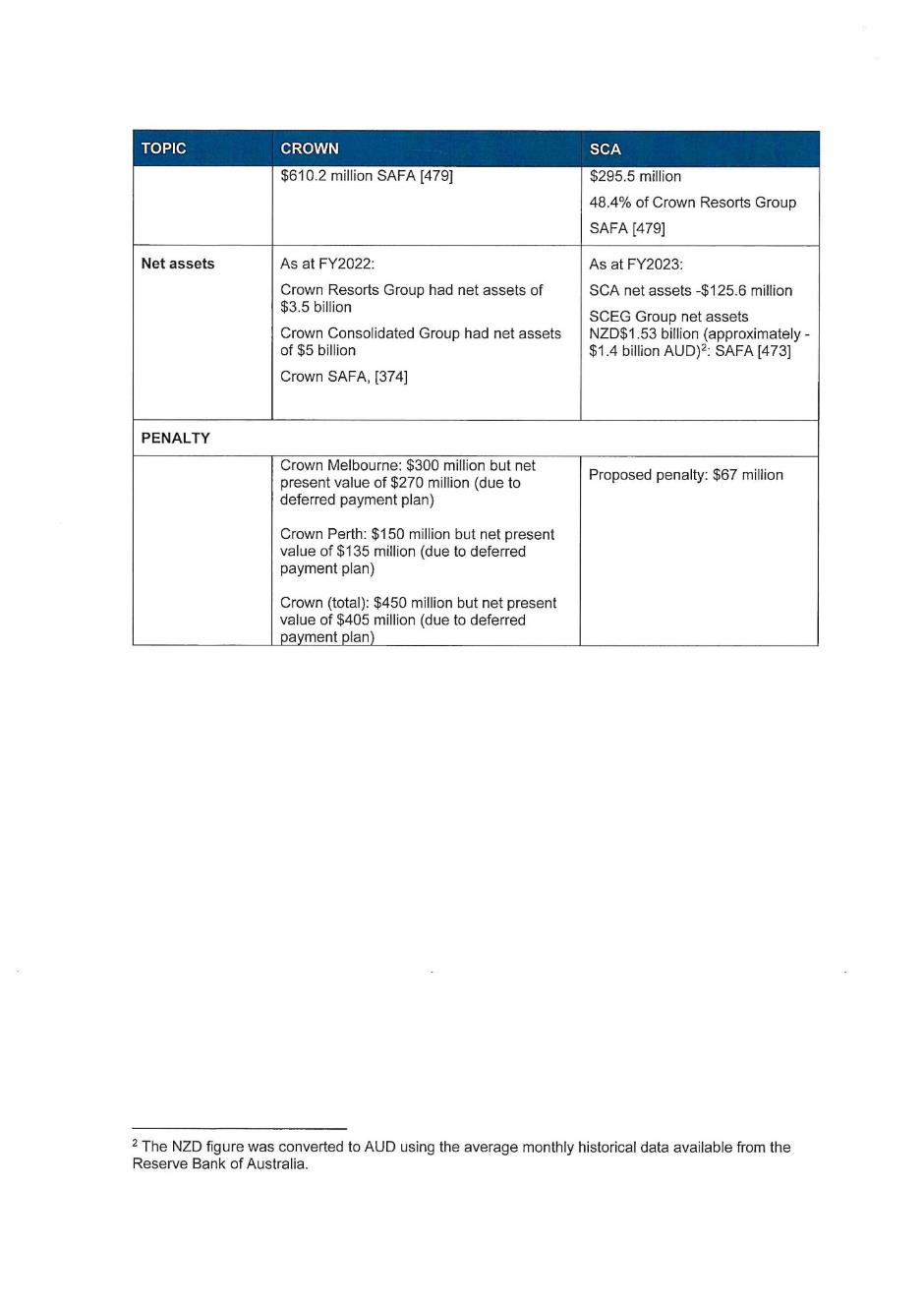

16 Annexure A to this judgment (at [165]–[174]) explains, in general terms, the similarities and differences between this case and Crown in a manner which is accurate. Further, reproduced as Annexure B to this judgment is a helpful comparative table provided to me during oral argument which illustrates, in my view, consistency in the application of principles relating to pecuniary penalties when one has regard to both the Crown proceedings and the other proceedings referred to in [163] of Annexure A.

D CONCLUSION AND ORDERS

17 In the circumstances, and for these reasons, this is a clear case where it is not only licit but appropriate to make the orders jointly proposed in accordance with the paction reached between the parties.

18 I am informed that the amount of costs that have been agreed to be paid by SCA to AUSTRAC within 14 days are $3 million and, accordingly, the order for costs should specify this amount.

19 Subject to this amendment, I make orders in the terms of the proposed orders which comprise Sch 1 to the joint submissions.

I certify that the preceding nineteen (19) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Lee. |

Associate:

Dated: 20 June 2024

ANNEXURE A

ANNEXURE B