Federal Court of Australia

Boating Syndication of Australia Pty Ltd v BSA Management Qld Pty Ltd [2024] FCA 502

ORDERS

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Upon the applicants, through their counsel, giving the usual undertaking as to damages:

(a) unless otherwise ordered by the Court, the respondents (noting that the first respondent is now named YMQPC Pty Ltd) and Christian George Markgraaff and Neptune Oceanic Pty Ltd must not, in connection with the business operated by Neptune Oceanic Pty Ltd, at any time prior to 1 July 2025:

(i) canvass, solicit, approach, or accept any approach from, any person who is or was or becomes a “Unit Holder” (as that term is defined in clause 28(vv) of the Licence and Services Deed made between the applicants and the respondents in or about early August 2021) in the existing vessels, being the vessels identified in item H of the Notes to the Order made in this proceeding on 26 October 2023 (Vessels);

(ii) knowingly canvass, solicit, approach, or accept any approach from, any person who currently hold units or shares in any vessel syndicated or managed by any of the applicants; or

(iii) knowingly cause or permit any of the above things to be done by any other person on their behalf or for their benefit;

(b) the respondents (noting that the first respondent is now named YMQPC Pty Ltd) and Christian George Markgraaff and Neptune Oceanic Pty Ltd, and any servants, employees and agents of the respondents and Neptune Oceanic Pty Ltd, be restrained from using or disclosing, or attempting to use or disclose, any “Confidential Information” (as that term is defined in clause 28(l) of the Licence and Services Deed) in connection with, or otherwise contained within:

(i) the applicants;

(ii) any business/es or affairs of the applicants;

(iii) any business, organisation, company or venture in which any of the applicants hold an interest;

(iv) the terms of the Licence and Services Deed;

(v) the “Intellectual Property” (as that term is defined in clause 28(w) of the Licence and Services Deed),

except in so far as is necessary to manage the Vessels in accordance with the agreed terms recorded in the Notes to the Order made on 26 October 2023 in this proceeding.

2. Paragraph 5 of the applicants’ interlocutory application filed on 17 April 2024 is otherwise dismissed.

3. Subject to Order 4 below the applicants are to pay the respondents’ costs of paragraphs 5 and 6 of the interlocutory application.

4. If either party wishes to vary Order 3 above:

(a) that party should file and serve submissions, not exceeding four pages in length, setting out the variation sought and the basis for it within seven days of the date of these Orders;

(b) the other party may file and serve submissions in reply, not exceeding four pages in length, within 14 days of the date of these Orders; and

(c) any application for variation of Order 3 will be dealt with on the papers.

THE COURT NOTES:

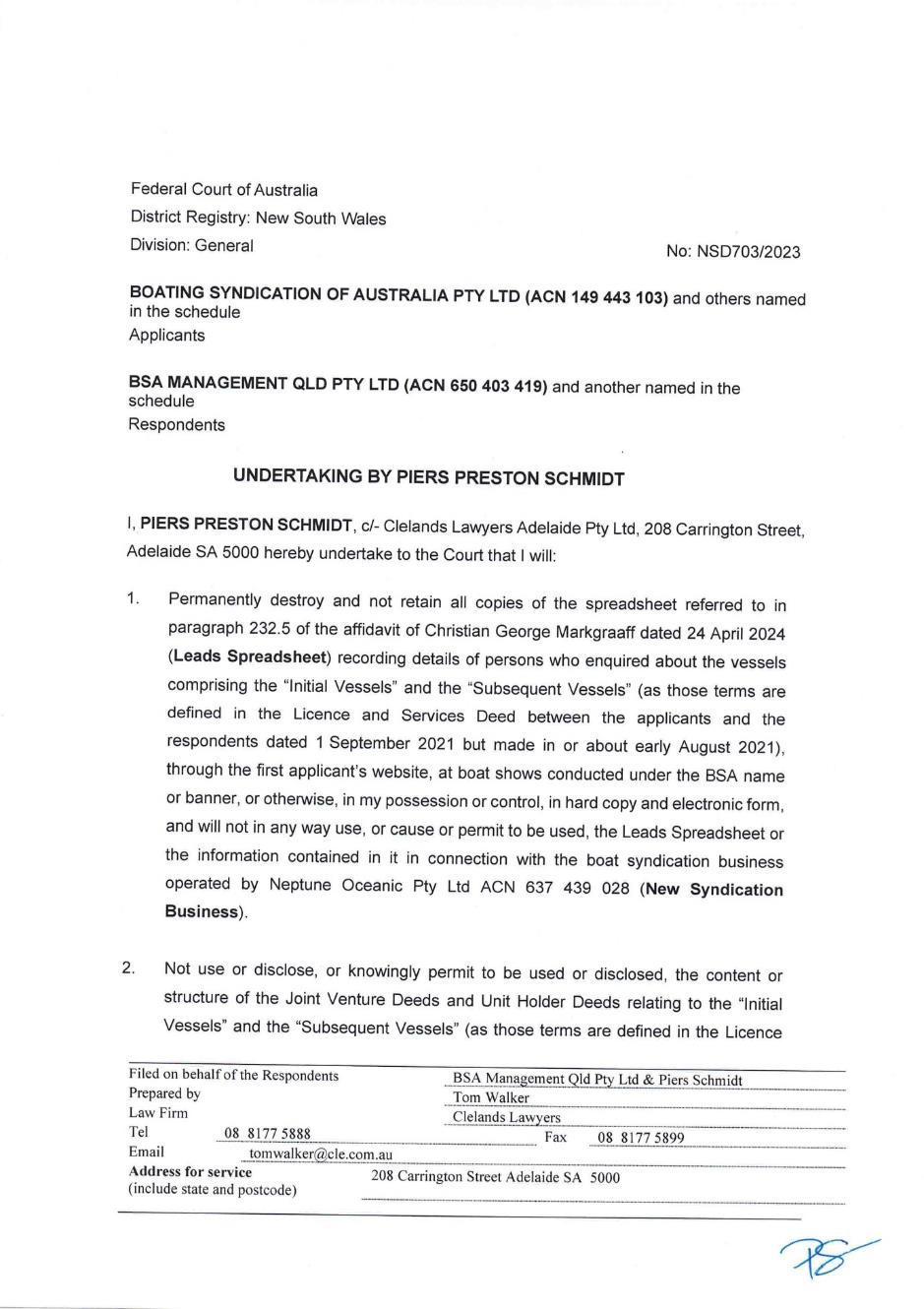

5. The undertakings dated 3 May 2024 given to the Court by each of the respondents (noting that the first respondent is now named YMQPC Pty Ltd), Christian George Markgraaff and Neptune Oceanic Pty Ltd, copies of which are annexed to these Orders.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

MARKOVIC J:

1 On 12 July 2023 the applicants, Boating Syndication of Australia Pty Ltd (BSA), A and B Management Pty Ltd (Management) and A and B Marine Custodians Pty Ltd (Custodian) commenced this proceeding against the respondents, BSA Management QLD Pty Ltd and Piers Schmidt. The proceeding arises out of a Licence and Services Deed between the applicants on the one hand and the respondents on the other.

2 Pursuant to the terms of the Licence Deed, BSA granted to BSA QLD (Licensee) a licence for the exclusive right to use and control the “Vessels”, use “BSA Intellectual Property” and conduct the “Business” exclusively in the “Territory” throughout the “Term” (all terms as defined in the Licence Deed). The Licensee was required to pay the “Licence Fee” to BSA for the licence. Mr Schmidt was named as the Guarantor in the Licence Deed. I return to the detail of the terms of the Licence Deed below.

3 The application before me for determination is a claim by the applicants for urgent interlocutory relief pursuant to para 5(e) of their interlocutory application filed on 17 April 2024 (17 April 2024 IA) by which they seek (as written):

(5) An order pursuant to clause 15(a) of the Licence and Services Deed that the Licensee and the Guarantor (together and severally the Covenantors, pursuant to clause 28(o) of the Licence and Services Deed), and any servants, employees, agents of either of them, and any director or officer of the Licensee, be restrained from:

…

e. acting in any Restricted Way (as the term is defined by clause 28(II) of the Licence and Services Deed), being participating, assisting, working or in way be directly or indirectly involved in a Competing Business:

i. in any of the capacities of executive, licensee, director, employer, consultant, adviser (formal or informal), principal, agent, manager, equity holder, partner, associate, franchisee, franchisor, unit holder, member, shareholder, beneficial owner, beneficiary, trustee, joint venturer or financier; and

ii. such that would entitle the Licensee or the Guarantor (or any of their respective associates or nominees) to receive any benefit or reward because of their associated with the Competing Business, or would confer any benefit or reward upon the Competing Business itself.

4 While the applicants originally sought the relief in paras 5(a) to (e) and 6 of the 17 April 2024 IA, they reduced their claim for two reasons. First, because the respondents have offered up undertakings (proposed undertakings) and orders (proposed orders) to the Court including, subject to minor amendments an order in the terms of para 6 of the 17 April 2024 IA, which are accepted and in relation to which orders will be made. This led to the applicants pressing for orders in the form of paras 5(c) and (e) at the hearing. Secondly, because in the course of argument the applicants abandoned their claim for an order pursuant to para 5(c) of the 17 April 2024 IA.

5 The applicants now seek an order in terms of para 5(e) of the 17 April 2024 IA for the period that ends on the day that is four weeks after the Sanctuary Cove International Boat Show (Sanctuary Cove Boat Show) to be held on 23 May 2024. I was informed that the Sanctuary Cove Boat Show is one of two boat shows held annually in Australia and has a significant audience each year, in the order of some 44,000 people. Mr Schmidt and his business partner Christian Markgraaff intend to run a stall at the upcoming Sanctuary Cove Boat Show at which they will offer two boats for syndication. The applicants say that in doing so Mr Schmidt will be in breach of cl 15 of the Licence Deed (see below) which provides for a restraint of trade on the respondents (Restraint). The question of the validity of the Restraint is at the heart of this application.

A summary of the proceeding

6 In their concise statement filed at the time of commencement of the proceeding the applicants contend that: the Licensee breached the Licence Deed in a number of respects; the Licence Deed has been terminated; and, consequent on that termination, the Licensee failed or refused to comply with the express obligations included in the Licence Deed and Mr Schmidt as Guarantor has failed to ensure punctual and correct compliance by the Licensee with the terms of the Licence Deed.

7 The applicants seek declarations against the Licensee to the effect that it breached the Licence Deed in the way in which they contend, that BSA lawfully terminated the Licence Deed and that, following termination of the Licence Deed, the Licensee has failed to comply with the requirements of that deed by ceasing to provide the “Services” and failing to return property as required. The applicants also seek declarations against Mr Schmidt and orders against the Licensee and Mr Schmidt for compliance by the Licensee with its obligations after termination of the Licence Deed; return of property; the enforcement of cl 15(a) of the Licence Deed following its termination; and seek orders as against the Licensee for damages for breach of the Licence Deed, an account of profits and equitable compensation, as against Mr Schmidt that he as Guarantor pay any debts of the Licensee and that the Licensee and Guarantor indemnify them for any amounts incurred by reason of and incidental to the claims made.

8 The respondents have filed an amended concise statement in response and a concise statement of cross-claim. In their statement in response, among other things, they contend that the Restraint is invalid or unenforceable in whole or, alternatively, in part at common law or under s 4 of the Restraint of Trade Act (NSW) (RoT Act), dispute that they have breached the Licence Deed either before or after its termination and say that the applicants breached the Licence Deed for reasons set out in their accompanying cross-claim.

9 In their cross-claim the respondents seek, among others, declarations that the Licence Deed was breached and repudiated by the applicants; it was terminated with effect from 13 June 2023 by reason of their acceptance of the applicants’ repudiation; and the Licence Deed is a franchise agreement under the Franchising Code of Conduct. The respondents seek damages in relation to the applicants’ breaches and repudiation of the Licence Deed.

10 On 25 July 2023, shortly after the proceeding was commenced, the Court made orders by consent pursuant to s 23 of the Federal Court of Australia Act 1976 (Cth) or the Court’s implied jurisdiction restraining the respondents from taking further steps vis-à-vis any “Unit Holder” and from using or disclosing the “BSA Booking System” and process other than for the purposes of providing “Services” to the “Unit Holders” (25 July 2023 Orders). The 25 July 2023 Orders were extended and on 26 October 2023 (26 October 2023 Orders) restated in the following terms:

1 Upon noting that the applicants, through their counsel, gave the usual undertaking as to damages on 7 September 2023, the Court orders pursuant to s.23 of the Federal Court of Australia Act 1976 (Cth) or the Court’s implied jurisdiction:

(a) The respondents be restrained (whether by themselves, their directors, servants, employees, agents or otherwise), until 4pm on 24 November 2023, or as otherwise ordered by the Court or with express written consent from the applicants, from:

(i) canvassing, soliciting, inducing or encouraging any Unit Holder to:

1. sell, assign or relinquish their Units in any of the Vessels; or

2. acquire any interest or participate in any Competing Business (as defined in clause 28(k) of the Deed) or in the business known as Neptune Oceanic Yacht Share or in the companies Neptune Oceanic Pty Ltd and Neptune Oceanic Custodians Pty Ltd;

(b) canvassing, soliciting, approaching, or accepting any approach from, any Unit Holder with respect to any interest or participation in: the syndication of any yacht (other than the Vessels) owned, managed, or in the custody of, the respondents or an Associate of any of the respondents; a Competing Business in which any of the respondents has an interest (as defined in clause 28(k) of the Deed); or in the business known as Neptune Oceanic Yacht Share or the companies Neptune Oceanic Pty Ltd and Neptune Oceanic Custodians Pty Ltd; and

(c) canvassing, soliciting, inducing or encouraging any Unit Holder to remove or replace the entity appointed as the custodian of a Vessel under any Joint Venture Deed or Unit Holders Deed.

2. The respondents are restrained (whether by themselves, their directors, servants, employees, agents or otherwise), until 4pm on 24 November 2023, or as otherwise ordered by the Court or with express written consent from the applicants, from using or disclosing to any third party, or attempting to use or disclose to any third party, the BSA Booking System and process other than for the purposes of providing Services to the Unit Holders.

11 At the time of making the 25 July 2023 Orders and the 26 October 2023 Orders the Court also recorded an agreement between the parties made without any admissions or concessions by any party and subject to the final determination of the rights and liabilities of the parties in the proceeding, which enables the respondents to continue to provide the services and manage the “Vessels” for the benefit of the “Unit Holders” in accordance with the terms of the “Joint Venture Deed” and the “Unit Holder Deed” (referred to as the Interim Arrangement).

Licence deed

12 Before proceeding further, it is convenient to set out the terms of the Licence Deed. The signed copy of the Licence Deed in evidence before me was undated but the evidence suggests that it was signed on or about 7 August 2021.

13 Clause 3 of the Licence Deed sets out the terms of the licence and relevantly provides:

The Parties acknowledge and agree that:

Payment of Licence Fee

(a) the Licensee must pay the Licence Fee to the Nominated Bank Account in cleared funds strictly within five (5) Business Days of the Execution Date;

Licence

(b) upon payment of the Licence Fee in accordance with clause 3(a) of this Deed, BSA grants to the Licensee the exclusive right to:

(i) use and control the Vessels;

(ii) use BSA Intellectual Property provided by BSA to the Licensee from time to time; and

(iii) conduct the Business,

exclusively in the Territory throughout the Term;

(c) the Licensee's exclusive rights pursuant to this clause 3 is a licence only and rests in contract only;

(d) the Licensee does not have exclusive possession of any Company premises;

(e) the exclusive rights pursuant to this clause 3 are personal to the Licensee;

(f) the Licensee is solely responsible for the use, supervision, management and/or control of:

(i) the Vessels;

(ii) BSA Intellectual Property provided by BSA to the Licensee from time to time; and

(iii) the Business,

exclusively in the Territory throughout the Term, and must ensure that any Vessels, BSA Intellectual Property and the Business are protected at all times from access, use or misuse, damage or destruction by any unauthorised person;

…

14 Clause 4 sets out the Licensee’s obligations and addresses the “Initial Vessels”, “Subsequent Vessel”, the “Services”, “Performance” and “No authority”.

15 In relation to the “Initial Vessels” and the “Subsequent Vessel” the Licence Deed relevantly provides:

The Parties acknowledge and agree that:

Initial Vessels

(a) on and from the date of payment of the Licence Fee in accordance with clause 3(a) of this Deed:

(i) and subject to any Joint Venture Deed or other agreement entered into between the Companies, Unit Holders, Clients and/or the Licensee from time to time, property in, and title to, only units in the Initial Vessels will pass to the Licensee;

(ii) the Custodian must at all times remain the full legal and registered owner of the Initial Vessels;

(iii) the Initial Vessels must be at the sole risk of the Licensee throughout the Term;

(iv) the Licensee must do all acts and things, including signing any documents which become necessary, to give full effect to the assignment or otherwise transfer of any applicable Joint Venture Deed or otherwise agreement or arrangement in connection with the Initial Vessels;

(v) the Licensee is responsible for the costs of all insurance policies in any way connected with the Initial Vessels including, but not limited to:

(1) comprehensive motor vehicle insurance;

(2) excess of insurance claims for their own property; and

(3) professional indemnity;

…

Subsequent Vessel

(e) the Licensee must, at its sole expense, purchase or otherwise acquire a minimum of one (1) additional (and new) Subsequent Vessel for the sole purpose of a Joint Venture by the first (1st) day of each 12 month period of the Term commencing on the first (1st) anniversary of the Execution Date;

(f) the Licensee must use its best endeavours to ensure that any Subsequent Vessel purchased or otherwise acquired by the Licensee throughout the Term becomes subject to a Joint Venture Deed and Unit Holder’s Deed, in the form approved by BSA from time to time, strictly within 60 Business Days of the date of purchase or otherwise acquisition of each Subsequent Vessel;

(g) the property in, and title to, only units in any Subsequent Vessel will be held by the Licensee in accordance with terms of any applicable Joint Venture Deed and Unit Holder’s Deed pursuant to this clause 4;

(h) the Licensee must do all acts and things, including signing any documents which become necessary, to ensure the Custodian becomes the full legal and registered owner of any Subsequent Vessel purchased or otherwise acquired in accordance with this clause 4, within 20 Business Days of each respective date of purchase or otherwise acquisition of a Subsequent Vessel;

(i) the Licensee must do all acts and things, including signing any documents which become necessary, to ensure the Custodian remains the full legal and registered owner of any Subsequent Vessel purchased or otherwise acquired in accordance with this clause 4;

…

16 Clause 7 of the Licence Deed concerns “Payment proportions” and sets out the respective proportions that were to be received by BSA and the Licensee of management fees and syndication profit. In relation to the latter cl 7 provides for a sliding scale for the sharing of syndication profit, commencing with a share of 50:50 between the Licensee and BSA for syndication profit up to $249,999 and ending with a share of 75:25 between the Licensee and BSA for syndication profit made over $1 million.

17 The Restraint is set out in cl 15 of the Licence Deed which provides:

(a) In consideration of the actions contemplated in this Deed, during the Restraint Period, each Covenantor must not, within the Restraint Area:

(i) canvass, solicit, induce or encourage any Unit Holder or Client to leave the Companies; or

(ii) canvass, solicit, approach or accept any approach from any:

(1) Unit Holder; or

(2) Client; or

(3) person who was at any time an existing or prospective client or customer of the Companies; or

(iii) canvass, solicit, approach or accept any approach from any person who refers business to the Companies on a regular or ongoing basis, with a view to obtaining custom or any business introduction from that person in any Competing Business; or

(iv) interfere in any way with the relationship between the Companies and the Unit Holder and Clients, including any of their employees, Clients, customers, licensees, suppliers or Associates; or

(v) act in any Restricted Way

(collectively the Restrained Conduct).

(b) Each Covenantor acknowledges and agrees that:

(i) each agreed restraint specified in this clause 15 is, in the circumstances, reasonable and necessary to protect the genuine business interests of the Companies;

(ii) damages are not necessarily an adequate remedy if there is a breach or threatened breach of this clause 15;

(iii) the Companies may apply for injunctive relief if there is a breach or threatened breach of this clause 15 or the Companies believe a breach of this clause 15 is likely;

(iv) the Companies may also seek specific performance, an account of profits, equitable compensation, or other relief available at law or in equity as a remedy for a breach or threatened breach of this clause 15.

(c) Each possible combination of the Restraint Period, Restraint Area, and the Restrained Conduct above are separate and independent provisions and operate simultaneously.

(d) Each Party agrees that each combination of the Restraint Period, Restraint Area, and the Restrained Conduct above is severable from the other combinations, and the other combinations of the Restraint Period, Restraint Area and the Restrained Conduct will remain operative if another combination is severed.

(e) This clause 15 survives termination of this Deed.

18 Clause 16 concerns termination and provides for the circumstances in which BSA may terminate the Licence Deed and what is to occur after termination or expiry of the “Term” including:

(b) on and after any termination of this Deed or the expiry of the Term:

(i) the Licensee must stop providing the Services;

(ii) the Licensee must transfer any title in, and otherwise possession of, the Vessels (including any units) to the Companies or their authorised representative immediately on demand and the Companies may enter upon the premises of the Licensee, or any other premises occupied or controlled by the Licensee, to obtain possession of any Vessels;

(iii) BSA will pay for units owned by the Licensee for the value calculated as the purchase price of each Vessel divided by the number of units owned in that Vessel within 20 Business Days;

…

(c) upon any termination of this Deed in accordance with clause 16(a) of this Deed or the expiry of the Term, BSA will pay to the Licensee an amount equivalent to the market value of the Licensee less any damages or other Loss accrued in connection with, or otherwise arising from, any breach of this Deed by the Licensee. For the purpose of this clause, the market value of the Licensee will be agreed in writing between the Parties and, in the absence of such agreement, will be determined by an independent valuation of the Licensee as a separate business;

…

19 Definitions for the purposes of the deed are included at cl 28 which relevantly provides:

(d) Business means any business/es of the Companies operated and situated exclusively in the Territory;

…

(k) Competing Business means any business that is the same or substantially similar to the Business/es;

…

(o) Covenantors means:

(i) the Licensee; and

(ii) any Guarantor/s,

Whether jointly or severally;

…

(y) Joint Venture Deed means a Joint Venture Deed with a Unit Holder and/or Client;

…

(gg) Prospective client or customer means a person, entity or company with whom the Companies had engaged in negotiations to do business during the:

(i) 18 months preceding the Execution Date;

(ii) 12 months preceding the Execution Date;

(iii) six (6) months preceding the Execution Date;

(iv) three (3) months preceding the Execution Date;

…

(jj) Restricted Area means:

(i) a 100 kilometre radius of any Companies’ premises;

(ii) a 50 kilometre radius of any Companies’ premises;

(iii) a 25 kilometre radius of any Companies’ premises;

(iv) a 10 kilometre radius of any Companies’ premises;

(v) a five (5) kilometre radius of any Companies’ premises;

(vi) the area in which the Companies are located and conducts their business and from which they receive the majority of their custom;

(kk) Restricted Period means the period between the Execution Date up to the expiration of:

(i) 24 months from the Term Expiration Date;

(ii) 18 months from the Term Expiration Date;

(iii) 12 months from the Term Expiration Date;

(iv) six (6) months from the Term Expiration Date;

(v) three (3) months from the Term Expiration Date;

(ll) Restricted Way means that each of the Covenantors must not act, participate, assist, work or in any way be directly or indirectly involved in a Competing Business in any of the capacities of executive, Licensee, director, employer, consultant, adviser (formal or informal), principal, agent, manager, equity holder, partner, Associate, franchisee, franchisor, unit holder, member, shareholder, beneficial owner, beneficiary, trustee, joint venturer or financier, such that would entitle them or any of their respective Associates or nominees to receive any benefit or reward because of their association with the Competing Business or would confer any benefit or reward upon the Competing Business itself;

…

(ss) Term means the period between the Execution Date and:

(i) the Term Expiration Date plus any Option Term where the Licensee exercises a right to extend the Term in accordance with clause 2 of this Deed; or

(ii) the date of termination of this Deed,

(tt) Term Expiration Date means the date set out in item 5 of Schedule 1;

(uu) Territory means the geographical area set out in item 6 of Schedule 1;

(vv) Unit Holder means any person holding or acquiring units in a Joint Venture, or otherwise with respect to the syndication of any Vessel, or any nominee of a person or persons holding or acquiring such units;

(ww) Unit Holder’s Deed means any Unit Holder’s Deed with a Unit Holder and/or Client;

20 Schedule 1 to the Licence Deed provides:

(1) in item 3 that the Licence Fee is $150,000;

(2) in item 5 that the Term Expiration Date is 1 September 2026; and

(3) in item 6 that the Territory is:

Distance of 20 kilometres east to west with the midpoint calculated from the section of the East Continental Coastline of Australia that is situated exclusively between Tweed Heads NSW 2485 and Hervey Bay QLD 4655

Background facts

21 The parties relied on a significant volume of detailed evidence. Given the time available both for the hearing of the 17 April 2024 IA and its determination it is not possible to set out that evidence in any detail.

22 For the purposes of these reasons I set out a summary of those parts of the evidence to which I was taken and which are relevant to the resolution of whether the relief sought should be granted.

The applicants

23 Andrew Young is the director of each of the applicant companies. He has been in the business of syndicating boats for about 15 years.

24 BSA is the largest boat share operation in Australia. Together the applicants offer 13 different boat sizes ranging from 26 feet to 100 feet.

25 The business started with one syndicated vessel based in Sydney and has grown into an operation with 56 syndicated vessels, including those being managed by the respondents, operating from three Sydney locations, two Gold Coast locations, one Hamilton Island location and one Airlie Beach location. The applicants formerly operated from a Brisbane location but the respondents ceased operations there following entry into the Licence Deed.

26 The applicants operate under the brand “BSA” or “Boat Syndication Australia” and own and operate the website https://www.boatingsyndicationaustralia.com. Mr Young says that the business licenced to the respondents was marketed to the public and operated under the BSA brand at the time of the Licence Deed and as far as he is aware continued to do so until June 2023.

27 In about 2016 the applicants licenced their Gold Coast operations to an enterprise run by Josh Metz. Mr Young was not happy with Mr Metz’s performance as a licensee as he failed to grow the business in accordance with agreed parameters set out in the relevant licence. Accordingly, Mr Young accepted a surrender of Mr Metz’s licence in about 2021.

28 At the time of the Licence Deed the applicants had five syndicated boats operating in the Gold Coast which equated to approximately 48-50 Unit Holders and a Gold Coast database of over 800 potential or actual customers.

The respondents and associated entities

29 Messrs Schmidt and Markgraaff are the current directors of BSA QLD.

30 Mr Markgraaff is a director of Neptune Oceanic Pty Ltd, a company which he registered on 13 November 2019. On 19 January 2023 Mr Schmidt also became a director of Neptune. Messrs Schmidt and Markgraaff each hold 50% of the shares in Neptune.

31 When Neptune was first incorporated it operated Mr Markgraaff’s former business in marine consultancy and yacht management services for the luxury yacht industry. Neptune was originally named Due North Marine Pty Ltd before Mr Markgraaff changed its name to Neptune Oceanic Pty Ltd on March 2020.

32 Messrs Schmidt and Markgraaff first met in early May 2021 at a school function for their children who are about the same age and attended the same school. They briefly discussed their respective careers and background.

33 At that time Mr Schmidt informed Mr Markgraaff that he was considering purchasing a licence to operate a BSA branded yacht syndication business in Queensland and moving from Adelaide to pursue the business. Mr Markgraaff explained his background in marine engineering and luxury yachts and his current business. Messrs Schmidt and Markgraaff met again a few weeks later to discuss Mr Schmidt’s proposed licence purchase in more detail and Mr Schmidt explained to Mr Markgraaff that the licence to operate under the BSA branding on the Gold Coast was available to purchase from BSA in Sydney. Mr Markgraaff was aware of BSA because a friend of his had worked for Mr Young’s company, Longreef Yachts Pty Ltd in Sydney. Mr Markgraaff expressed interest in assisting with maintenance and management as a contractor via his company Neptune.

34 Between 20 and 23 May 2021 Messrs Schmidt and Markgraaff went to the Sanctuary Cove Boat Show to look at a variety of boats and further discussed the proposed yacht syndication business.

35 On 8 June 2021 Mr Markgraaff started working, via his company Neptune, as a maintenance contractor for BSA. He understood from his discussions with Mr Schmidt that he, in turn, had discussed with and obtained Mr Young’s agreement to the provision of services by Neptune to BSA.

36 Mr Markgraaff understood from his conversations with Mr Schmidt that BSA had taken over its Queensland business from Mr Metz, that it had engaged Mr Schmidt to manage that business following the May 2021 Sanctuary Cove Boat Show and that Mr Schmidt was negotiating with Mr Young to purchase the licence to operate the BSA Queensland business that had previously been operated by Mr Metz through a company known as Platinum Marine Yacht Management Pty Ltd.

37 By late June 2021 Messrs Schmidt and Markgraaff were working closely together managing BSA Queensland for BSA. They realised they had complementary skills which were well suited to owning and operating a yacht syndication business together.

Management’s berth licences on the Gold Coast

38 From the time Mr Young started his business on the Gold Coast in about 2012 until the applicants licenced the Gold Coast operations, Management continuously held licences to berths at locations in the Gold Coast.

39 According to Mr Young these are the locations where the syndicated boats are berthed. That is, as I understand his evidence, they are the locations at which the syndicated boats which are subject to the Licence Deed were berthed and continue to be berthed. They are also the places where Unit Holders arrive to take control of the boats and where they hand them back. The applicants’ staff, or the respondents’ staff during the currency of their licence, also carry out cleaning, refuelling and mechanical checks at those locations.

40 The berth licences are generally annual and renewed each year, although they can be arranged for shorter periods if that is agreed with the marina manager.

Events after entry into the Licence Deed

41 As set out above the parties entered into the Licence Deed on or about 7 August 2021.

42 Subsequent to entering into the Licence Deed Neptune purchased 40% of the shares in BSA QLD for $75,000, Mr Markgraaff also became a director of BSA QLD and Neptune contributed $25,000 as working capital for BSA QLD. On 25 January 2022 Neptune acquired a further 10% of the shares in BSA QLD.

43 Since the date of the Licence Deed BSA QLD has purchased and syndicated two additional vessels, the “Antares” and the “Duchess” which are Subsequent Vessels for the purposes of the Licence Deed. In addition, BSA QLD purchased the shares/units in the Initial Vessel “Cinque Terre” from the original co-owners/unit holders, the vessel was renamed to “Wayfarer” and the shares/units were resold.

44 BSA QLD acquired the Duchess, originally named the Magician, for $1.85 million in 2022 and showed it at the 2022 Sanctuary Cove Boat Show. Syndication in the Duchess sold out at the conclusion of that show. Because of that success BSA QLD sought out and obtained the Antares which it purchased from Alexander Marine, a boat broker.

Approach by Alexander Marine

45 In about June 2022 Todd Holzapfel of Alexander Marine, who Mr Markgraaff knew well from previous dealings, put a proposal to Messrs Markgraaff and Schmidt to sell and operate a superyacht manufactured by Ocean Alexander, a Taiwanese yacht manufacturer with shipyards in Taiwan and the United States of America. The superyacht was known as an Ocean Alexander (OA 28E). Mr Holzapfel’s proposal included that any sale and operation by Messrs Markgraaff and Schmidt of the OA 28E would have to be separate from the BSA brand.

46 The OA 28E is a 28.8 metre (94.7 foot) luxury super yacht with living quarters for a skipper and three crew. While the applicants disagree, Mr Markgraaff’s view is that the OA 28E is distinct from vessels in BSA QLD’s fleet because it has to be professionally crewed and operated and cannot be self-driven by the owners of the vessels. It is suitable for extended ocean-going voyages and is able to travel, for example, to Fiji, Hawaii, New Caledonia and Vanuatu, and was promoted on this basis.

47 After discussing the proposal with Mr Schmidt, Mr Markgraaff informed Mr Holzapfel that he and Mr Schmidt were interested but that they would need to speak to Mr Young about the proposal first.

48 On 5 July 2022 Messrs Schmidt and Markgraaff met Mr Young for lunch at the Boathouse restaurant in Rose Bay, Sydney. It was at this meeting that they discussed Alexander Marine’s proposal about the OA 28E. Both Messrs Schmidt and Markgraaff gave evidence about this meeting.

49 At the luncheon Mr Schmidt informed Mr Young about the Alexander Marine proposal to purchase and syndicate the OA 28E and that Alexander Marine did not want them to do that under BSA branding. Mr Schmidt inquired of Mr Young if he was agreeable to that course and Mr Young replied saying words to the effect that it would be okay with him, but it sounded expensive and difficult. Mr Young informed them that he had tried something similar before and could not get interest at that price level so they may be wasting their time. Mr Schmidt recalls that he said to Mr Young words to the effect that while it would be difficult, they wanted to give it a go as they had the manufacturer backing them and that Mr Young responded “okay, good luck”.

50 On 7 July 2022 BSA Queensland and/or its nominee entered into a heads of agreement with Alexander Marine for the purchase of the OA 28E. Mr Markgraaff explains that the heads of agreement was signed by BSA QLD and/or its nominee for convenience because at the time he and Mr Schmidt had not decided upon the entity to be used for the potential venture. They subsequently decided to undertake the OA 28E venture via Neptune if it proceeded. It was for that reason that Mr Schmidt was appointed as a director of, and his company PPS Worldwide Pty Ltd became a 50% shareholder in, Neptune.

The July 2022 Sydney Boat Show

51 From 28 July 2022 to 1 August 2022 Messrs Markgraaff and Schmidt attended the 2022 Sydney Boat Show to promote the OA 28E. They did so under the Alexander Marine banner which was annexed on the Alexander Marine stand.

52 Mr Young was also present at the 2022 Sydney Boat Show at the BSA stand which was approximately 40 to 50 metres from the Alexander Marine stand.

53 Messrs Schmidt and Markgraaff promoted the OA 28E, with Alexander Marine as the “Yacht Partner”, under interim branding, “Luxury Yacht Ownership Australia”. They developed that brand with Alexander Marine for short term use at the 2022 Sydney Boat Show in order to give them time to consider the branding to be used for the OA 28E venture and to discuss and agree the proposed ownership structure, if it was to proceed, based on sufficient interest shown at the 2022 Sydney Boat Show.

54 On the afternoon of either 29 or 30 July 2022 Messrs Schmidt and Markgraaff invited Mr Young onboard the OA 28E and showed him the vessel. They discussed the proposed venture with Mr Young and gave him one of their promotional brochures. According to Mr Markgraaff, Mr Young did not express any concerns about their involvement with the OA 28E at the time of the tour of the vessel nor during the 2022 Sydney Boat Show.

55 On the evening of 30 July 2022 Messrs Schmidt and Markgraaff attended the BSA Gala Dinner, held annually by Mr Young for promotional purposes, which was also attended by people holding units/shares in BSA vessel syndicates. According to Mr Markgraaff they interacted with Mr Young over the course of the evening and he did not raise any issues.

56 Mr Young’s evidence about his interactions with Messrs Schmidt and Markgraaff at the 2022 Sydney Boat Show is that he deliberately maintained civility in order to get further information about the proposed syndication of the OA 28E before deciding how to act, considered that Messrs Schmidt and Markgraaff were unlikely to seriously try to compete with BSA in the Sydney market and that they would be unsuccessful if they did.

57 About four weeks after the 2022 Sydney Boat Show Messrs Young, Schmidt and Markgraaff met at a restaurant or coffee shop in the Gold Coast. Mr Young recalls that at this meeting he told Messrs Schmidt and Markgraaff that their proposal to run a yacht syndication in Sydney was a breach of the Restraint, Mr Markgraaff said that he thought it was a different business model, and Mr Young disagreed. Mr Young’s evidence is that ultimately both Messrs Schmidt and Markgraaff told him there was not enough interest, it was too hard and it was just a one-off exercise, which Mr Young says he accepted.

58 Mr Schmidt also gave evidence about this meeting. He says that Mr Young did not allege any breach of the Restraint and that he and Mr Markgraaff did not indicate that it was too hard or that it was just a one-off exercise. Mr Schmidt recalls that he said that at that point, they had not received much interest from the 2022 Sydney Boat Show because of the price of the shares but he did not state or imply that the venture would not proceed any further.

19 January 2023 meeting

59 On 19 January 2023 Mr and Mrs Young met with Messrs Schmidt and Markgraaff at a café/restaurant in the Gold Coast.

60 Mr Young says that at that meeting they discussed the proposal for Messrs Schmidt and Markgraaff to buy BSA out of its Gold Coast operations. Mr Young says he asked Messrs Schmidt and Markgraaff whether they were intending to pursue their OA 28E proposal at some stage in the future and that both men replied “definitely not”.

61 Mr Schmidt agrees that at this meeting there was discussion about the proposal for him and Mr Markgraaff to buy out BSA’s Gold Coast operations but that neither he nor Mr Markgraaff said that they were not intending to go ahead with the OA 28E venture.

The 2023 Sanctuary Cove Boat Show

62 Following the 2022 Sydney Boat Show Messrs Schmidt and Markgraaff progressed their discussions with Alexandar Marine and took further steps in relation to the OA 28E venture.

63 One of the things Messrs Schmidt and Markgraaff did was to arrange a promotional stand at the 2023 Sanctuary Cove Boat Show at which the OA 28E was displayed with “Neptune Oceanic” branding. They also had a promotional stand for BSA QLD at that boat show under BSA branding. Mr Schmidt worked at the BSA QLD stand while Mr Markgraaff worked at the OA 28E stand.

64 On the morning of 27 May 2023 there was a confrontation at the Sanctuary Cove Boat Show between Messrs Schmidt and Young on the one hand and Messrs Markgraaff and Young on the other.

65 Following those confrontations Messrs Markgraaff and Young exchanged emails.

66 On 27 May 2023 Mr Markgraaff sent an email in which he wrote (omitting formal parts):

We understand you're upset about the turn of events but we respect the licence agreement and our clients/staff and would like to offer to come to a short-term agreement while we finalise a more formal outcome.

We also understand that our business relationship is most likely not going to continue but we would like to follow a dispute resolution process with you to transition the clients and our respective businesses.

I suggest that we continue operating as normal for the next week/s while we come to a amicable resolution.

We understand that you have been in contact with Marina Mirage / Sanctuary Cove regarding the vessel’s operation. We don't believe this is in line with servicing the BSA clients in the near term and for you in the long term.

Our team will be operating as normal until we come to a resolution that is in line with the licence agreement and the law.

It would be mutually beneficial if we took some time to discuss this in a calm professional manner today or tomorrow.

Look forward to your response.

67 Mr Young responded to Mr Markgraaff’s email later that day in the following terms (omitting formal parts):

The licence agreement is in place to protect BSA ie my business and our rights which we have worked and built up over last 15 years .

You know what you have done and immediate action was taken to prevent any further damages caused by your actions .

I will leave this for mark to formally respond Monday morning but we will be taking over immediate operations from Monday morning until this matter is finalised.

68 After Mr Markgraaff received Mr Young’s email he became aware that BSA QLD’s access to the booking portal on the BSA website had been removed. Until that time BSA QLD had read-only access to the portal via a username and password on the “Owners Login” link on the BSA website.

69 On 28 May 2023 Messrs Markgraaff and Young exchanged further emails. It is not necessary to set out the terms of those emails save to note that, among other things, Mr Markgraaff referred to the events leading up to their involvement in the OA 28E venture and the stand at the 2023 Sanctuary Cove Boat Show and denied any breach of the Licence Deed but noted that, even if BSA QLD was in breach, the Licence Deed required the applicants to give notice of an alleged breach so that BSA QLD had an opportunity to “discuss the issue with you, and then fix the problem if there is one”. Finally, Mr Markgraaff referred to the removal by Mr Young of BSA QLD’s access to the BSA booking system. Mr Young responded to Mr Markgraaff’s email on the same day in the following terms (as written):

Firstly all bsa vessels are owned by a and b marine custodians pty ltd as per licence agreement and I am the sole director of this company so legally you have no right to refuse any access to these boats and happily call the police to assist me as the legal entity to prevent any trespassing from my perspective .

I did not threaten you publicly what I said was I should be irate enough to loose my control but I was quite specific in walking away and you persisted in following me bombarding me with abuse and threats .

I am happy to try mediate however I see no reason too.

The vessel you are attempting to syndicate is a direct competition and business model to my larger 90 ft vessel in survey and i never agreed to allow you or piers to get involved in any competition.

We were all taken back when we saw you onboard in Sydney and assumed we would cancel the licence agreement then, however you and piers had confirmed with me that you were not continuing with that venture post [2022 Sydney Boat Show] so I gave you both the benefit of doubt.

This was a clearly dishonest move on your part and I don’t deal with dishonest people ever. Too much negativity. I have spent 15 years building my business BSA and make no mistake the BSA boats in qld are BSA boats which you run under a quite specific liscence agreement.

The lawyers will be involved from Monday but in the interest of continuing for now we will send you screen grabs of this weeks bookings to continue the owners usage during the transition .However access to our IP will be terminated until the legals have been actioned officially

Make no mistake you and piers will no longer operate under the BSA branding from this point on nor piggy back our success. Taken a long time to build up to this point .

Excuse any typos busy at a boat show wasting my time on this.

70 Mr Markgraaff subsequently received an email from Mrs Young which included a screenshot of the “dashboard”, which was the booking and usage record, taken from the BSA website.

71 Ultimately Neptune did not proceed with the OA 28E venture as it was unable to obtain sufficient interest for the sale of the shares in it.

Events following the 2023 Sanctuary Cove Boat Show

72 On 29 May 2023 Brander Smith McKnight, who at the time were the applicants’ lawyers, sent a letter to Messrs Markgraaff and Schmidt. The letter included:

Breaches

We are instructed that on 19 January 2023 you have incorporated a company called Neptune Oceanic Pty Ltd (“Neptune”) for the purpose of operating a Competing Business, as defined in the Deed.

We are also instructed that between 25 to 28 May 2023 (inclusive) Neptune established a promotional stand at the [Sanctuary Cove Boat Show] for the purpose of promoting Neptune in direct competition to our clients. As you are aware our clients also established a promotional stand at the same boat show.

The establishment and operation of Neptune is a clear breach of clause 15a)(v) of the Deed and the establishment of the promotional stand is a clear breach of clauses 15a)ii)(3), iii) and iv).

The establishment and operation of Neptune may also constitute a breach of clause 14 of the Deed. We note that the directors of Neptune are Mr Piers Schmidt and Mr Christian Markgraaff.

…

Demand

We demand that you immediately cease the operation of Neptune, within seven (7) days provide all books and records, including Business Activity Statements, bank statements, and customer records of Neptune sufficient to enable our client to make an assessment of any profits to be recovered from Neptune and any damages suffered by our clients and provide our clients with access to all books and records and booking systems of [BSA QLD].

We demand that you reply to this letter within three (3) business days providing assurances that Neptune has ceased to operate and that you will comply with the demand for Neptune’s books and records.

In the event that we have not received a satisfactory reply within the specified time we are instructed to apply to the Court for urgent injunctive relief to prevent the further operation of Neptune, the provision of all books and records, the winding up of Neptune and a freezing order on all bank accounts in the name of Neptune.

…

73 On 2 June 2023 Brander Smith McKnight sent a further letter on behalf of the applicants to BSA QLD. That letter included:

We note that any expressions below which first appear in bold and then with an initial capital letter and not contained within any parentheses are used in the same sense as such expressions as defined in clause 28 of the Deed.

We refer to clause 4(d) of the Deed which stipulates that any Company is entitled to request that the Licensee return possession of, and title in, any Initial Vessel to the Company or its authorised representative immediately on demand and such Company may enter upon any premises of the Licensee, or any other premises occupied or controlled by the Licensee, to inspect or obtain possession of any Initial Vessel.

By this letter, and pursuant to clause 4(d) of the Deed, each of the Companies request and demand that the Licensee immediately returns possession of, and title in, all Initial Vessels (set out in item 2 of Schedule 1 to the Deed) to the Companies.

Clause 4(d) of the Deed also stipulates that each of the Companies may enter upon any premises of the Licensee, or any other premises occupied or controlled by the Licensee, to inspect or obtain possession of the Initial Vessels.

Please provide confirmation of the Licensee’s immediate compliance with this request and demand by no later than 2:00pm today (2 June 2023).

74 On 5 June 2023 Brander Smith McKnight sent a letter to BSA QLD in which they referred to the demand contained in their 2 June 2023 letter and noted that BSA QLD had not returned possession of and title in the Initial Vessels to the applicants and that BSA QLD had indicated that it would not do so unless the applicants attended to various matters requested in its solicitors’ letter. The letter continued:

2. BREACH NOTICE

2.1. By reason of the above, it is BSA’s position that the Licensee has breached clause 4(d) of the Deed.

2.2. TAKE NOTICE that unless the Licensee remedies this specified breach of clause 4 of the Deed within five (5) Business Days of the date of receiving this notice from BSA, BSA may exercise its rights under clause 16(a) of the Deed and terminate the Deed with immediate effect by giving notice to the Licensee.

2.3. This notice is given to the Licensee in accordance with clause 27 of the Deed.

75 Correspondence between the applicants’ and the respondents’ respective solicitors continued.

76 On 12 July 2023 the applicants commenced this proceeding. In their letter dated 14 July 2023, Brander Smith McKnight explained that the commencement of the proceeding was necessitated by:

1. RECENT CONDUCT

1.1. We also refer to our letter dated 29 June 2023 enclosing a termination notice and numerous requests made in accordance with clause 16(b) of the Licence and Services Deed.

1.2. We note that our clients have not received any response to that letter or any confirmation that those requests have complied with in full by your clients.

1.3. Since the date of that letter:

a. the business name, NEPTUNE OCEANIC YACHT SHARE ABN 89 650 403 419 was registered by the Licensee on 3 July 2023. We enclose a copy of an ASIC Business Name Details extract for ease of reference;

b. the enclosed email was received by at least one (1) unit holder from your client, Piers Schmidt on about 5 July 2023;

c. the enclosed email was received by at least one (1) unit holder from your client on about 11 July 2023.

1.4. We refer to those emails and note that both of them indicate that your clients are proceeding with operating and establishing a competing company and business named Neptune Oceanic Yacht Share.

1.5. We are instructed that your clients have continued to conduct themselves in a manner which is contrary to and otherwise in breach of those surviving obligations under the Licence Services Deed with respect to, among others:

a. the failure to return the Vessels and Company Property (cl.4(d), cl.6(a)(iii)),

b. the failure to ensure that the Custodian was the legal and registered owner of the Vessels (cl.4(h), cl.4(i));

c. the failure to pay or remit management fees (cl.7(a)) or syndication profit (cl.7(b);

d. Confidential Information (cl.14(a)); and

e. Restraints (cl.15(a));

1.6. We note that Mr Schmidt (as named Guarantor under the Licence and Services Deed) has failed or refused to ensure the punctual and correct compliance by the Licensee of the obligations under clause 16(b) of the Licence and Services Deed, pursuant to the obligations of the Guarantor under clause 18 of the Licence and Services Deed.

77 The emails referred to in the letter that were said to be received by Unit Holders concerned the notification by email dated 4 July 2023 by BSA QLD of its rebranding to “Neptune Oceanic Yacht Share” to manage the Gold Coast fleet following termination of the Licence Deed and an email dated 11 July 2023 announcing “some major improvements” to the management of the vessels subject to syndication.

The events leading to the filing of the 17 April 2024 IA

78 On 4 April 2024 Clelands Lawyers, solicitors for the respondents and for Neptune, wrote to Tisher Liner FC Law, the solicitors for the applicants (4 April 2024 Letter). That letter recited some of the history of the matter and included:

11. While [BSA QLD] intends to continue to abide by the terms of the Interim Arrangement in respect of the existing vessels, the business conducted by [BSA QLD] under the Interim Arrangement is not viable to sustain our clients Mr Schmidt and Mr Markgraaff, and their families, on an ongoing basis.

12. This is in circumstances where:

12.1. A yacht syndication business model requires the regular syndication of new vessels in order to be profitable.

12.2. The Interim Arrangement does not extend to the syndication of new vessels.

12.3. The 'Termination Date' in relation to the joint ventures for the vessels 'Kokomo' and 'St Tropez' arose on 31 October 2023 and 28 February 2024 respectively, and the 'Termination Date' for the vessel 'Sanctuary' will arise on 1 July 2024.

12.4. From the 'Termination Date' under the respective Joint Venture Deeds, the vessel concerned is required to be sold under clause 17 of the respective Joint Venture Deeds.

12.5. Kokomo is therefore in the process of being sold.

12.6. Your clients have not responded to our clients’ proposal in our letter of 13 February 2024 that the ‘Termination Date’ for ‘St Tropez’ and ‘Sanctuary’ be extended.

12.7. If the existing vessels are required to be progressively sold under the existing joint venture arrangements, the monthly management fees payable to [BSA Qld] by the unit holders will decrease.

12.8. In any event, management fee income in isolation, under the Interim Arrangement, generates insufficient profit for our clients to earn a reasonable living.

13. Further, in the Proceedings, your clients are denying any liability to [BSA Qld] under clauses 16(b)(iii) and 16(c) of the Licence Deed, as observed in our letter of 13 February 2024.

14. In the above circumstances, Mr Schmidt and Mr Markgraaff need to engage in other business activities, outside of the Interim Arrangement, in their chosen field of yacht syndication to generate sufficient income to support themselves and their families.

15. The main reasons why the restraints in the Licence Deed do not restrain our clients from conducting their intended new yacht syndication business are as follows (without limitation to other issues that exist in respect of the restraint clauses in clause 15 of the Licence Deed).

The 4 April 2024 Letter went on to explain why, in the view of the respondents’ solicitors, the Restraint does not prevent Mr Schmidt, or Neptune or Mr Markgraaff, from conducting or being involved in a competing business in the Gold Coast.

79 It was not in dispute that the 17 April 2024 IA was brought by the applicants as a result of Neptune signalling its intention to commence a boat syndication business operating on the Gold Coast (referred to as the New Syndication Business) in competition with the applicants. However, as is evident from the 4 April 2024 Letter, the respondents and Mr Markgraaff are of the view that the New Syndication Business is not precluded by the 26 October 2023 Orders or the Restraint.

Relevant principles

80 It is not in dispute that for the applicants to succeed on their application for interlocutory relief they have to establish that: there is a serious question to be tried; and the balance of convenience favours the grant of the interlocutory relief that they seek. Those factors are interrelated: Bullock v Federated Furnishing Trades Society of Australasia (1985) 5 FCR 464 at 472. The apparent strength of the parties’ substantive cases will often be an important consideration to be weighed in the balance, and the relative weakness of a parties’ case is a relevant and important factor: see GlaxoSmithKline Australia Pty Ltd v Reckitt Benckiser Healthcare (UK) Limited [2013] FCAFC 102 at [81]-[83].

81 In a restraint of trade case, whether there is a serious question to be tried depends upon whether it is seriously arguable that there is a valid contractual restraint, a breach or apprehended breach of it and whether, as a matter of discretion, the court would grant injunctive relief in respect of that breach: see John Fairfax Publications Pty Ltd v Birt [2006] NSWSC 995 at [5].

Restraint of trade clauses

82 As the proper law of the Licence Deed is New South Wales (see cl 20), the RoT Act applies to it and the dispute.

83 Relevantly, s 4 of the RoT Act provides:

(1) A restraint of trade is valid to the extent to which it is not against public policy, whether it is in severable terms or not.

(2) Subsection (1) does not affect the invalidity of a restraint of trade by reason of any matter other than public policy.

(3) Where, on application by a person subject to the restraint, it appears to the Supreme Court that a restraint of trade is, as regards its application to the applicant, against public policy to any extent by reason of, or partly by reason of, a manifest failure by a person who created or joined in creating the restraint to attempt to make the restraint a reasonable restraint, the Court, having regard to the circumstances in which the restraint was created, may, on such terms as the Court thinks fit, order that the restraint be, as regards its application to the applicant, altogether invalid or valid to such extent only (not exceeding the extent to which the restraint is not against public policy) as the Court thinks fit and any such order shall, notwithstanding sub-section (1), have effect on and from such date (not being a date earlier than the date on which the order was made) as is specified in the order.

(4) Where, under the rules of an association, a person who is a member of the association is subject to a restraint of trade, the association shall, for the purposes of subsection (3), be deemed to have created or joined in creating the restraint.

(5) An order under subsection (3) does not affect any right (including any right to damages) accrued before the date the order takes effect.

84 Save for one matter, the principles relating to the application of s 4 of the RoT Act did not seem to be in dispute. In OAMPS Insurance Brokers Ltd v Peter Hanna [2010] NSWSC 781 at [69]-[70] Hammerschlag J summarised them as follows:

69 The legal principles applicable to the operation of the Act and to assessing the validity and operation of the Restraint Deed can briefly be stated as follows:

a under the Act a restraint is valid to the extent to which it is not against public policy, even if not in severable terms;

b a restraint is invalid as contrary to public policy unless the restriction it imposes is reasonable in the interests of the parties;

c reasonableness is a question of law. OAMPS has the onus to prove the circumstances from which reasonableness can, as a matter of law, be inferred;

d the principal interest the Restraint Deed protects is OAMPS’ customer connections;

e the fact that the parties have, at arms length, agreed to the terms of the Restraint Deed and acknowledged its reasonableness is to be taken into account and indicates, subject to the relevant circumstances, that it is;

f an employer’s customer connection is an interest which can support a reasonable restraint of trade, but only if the employee has become, vis-a-vis the client, the human face of the business, namely the person who represents the business to the customer;

g an employer is not entitled to require protection against mere competition. Covenants that restrain competition are invalid unless they are reasonably necessary to protect legitimate business interests;

h the effect of the Act is that the Court must first determine whether the alleged or apprehended breach or breaches infringe or will infringe the terms of the restraint properly construed. Next, it must determine whether the restraint in its application to the breach or breaches offends public policy. If it does not then in its application to the alleged infringing conduct the restraint is valid unless the Court makes an order under s 4(3) of the Act. The effect of s 4(1) of the Act is that in determining the validity of the restraint, attention must be focussed on actual or apprehended breaches not on imaginary or merely potential breaches;

i the Court gives considerable weight to what parties have negotiated and embodied in their contracts, but a contractual consensus cannot be regarded as conclusive, even where there is a contractual admission as to reasonableness;

j the validity of the Restraint Deed is to be tested at the time of entering into the contract and by reference to what the Restraint Deed entitled or required the parties to do rather than what they intend to do or have actually done.

(Citations omitted.)

70 The onus is on OAMPS to establish that the Restraint Deed is reasonably necessary to protect its legitimate business interests, by adducing evidence of facts from which reasonableness can as a matter of law, be inferred.

85 The applicants submit the better view of s 4 of the RoT Act is that it departs from the common law position by which all restraints of trade were presumptively invalid and in doing so imposes an onus on the “person subject to the restraint”, i.e. the respondents, to persuade the Court that the restraint of trade clause is unreasonable, relying in particular on s 4(3) of the RoT Act. However, that was not the view expressed on OAMPS at [70] (see above) nor was it the view expressed in the earlier decision of Palmer J in Idameneo (No 123) Pty Ltd v Dr Teresa Angel-Honnibal [2002] NSWSC 1214 at [48].

86 In Idameneo Palmer J considered the question of onus of proof. In doing so his Honour observed (at [44]) that at common law, in determining whether a restraint of trade is void as a matter of public policy, a court has to consider: first, whether the restraint is reasonable as between the parties; and secondly, whether the restraint is contrary to public policy. While still considering the position at common law Palmer J said at [45]:

In Herbert Morris Ltd v Saxelby [1916] 1 AC 688, it was held by Lord Atkinson (at 700) and by Lord Parker (at 707-8) that the onus of establishing that the restraint is reasonable as between the parties lies on the person seeking to enforce the restraint, while the onus of establishing that the restraint is contrary to the public interest lies on the person seeking to invalidate the restraint. That proposition has been widely accepted although it has been observed that the reason for apportioning onus in this way is somewhat obscure: see per Lord Hodson in Esso Petroleum Co Ltd v Harper’s Garage (Stourport) Ltd [1968] AC 269, at 319E. The proposition seems to have been accepted without the necessity for comment by the High Court in Buckley v Tutty at 337.

87 His Honour then turned to the RoT Act noting (at [46]) that whether a restraint is valid now falls to be determined by the common law principles as modified by s 4(1) of that Act. At [48] Palmer J observed that, other than enabling a court to “read down” the restraint of trade covenant to the particular breach alleged, s 4(1) adds nothing to the common law rules concerning validity of a restraint of trade clause. It says nothing about who is to bear the onus of establishing reasonableness as between the parties and as to whether the restraint is in the public interest. His Honour expressed the view that he could see no reason why the apportionment of the onus of proof on these issues, as laid down in Herbert Morris Ltd v Saxelby [1916] 1 AC 688, should be regarded as altered in any way by the RoT Act.

88 The applicants rely on Orton v Melman (1981) 1 NSWLR 583 at 588-9 in submitting that the onus is on the respondents to persuade the Court that the restraint of trade clause is unreasonable. However, there McLelland J was considering the defendant’s application by way of cross-claim for an order under s 4(3) of the RoT Act. After referring to s 4(3) his Honour noted, having regard to the terms of the subsection, that it was a condition precedent of the power of the court to grant relief under s 4(3) that there be found to be “a manifest failure by a person who created or joined in creating the restraint to attempt to make the restraint a reasonable restraint” and that the onus of establishing that rested upon the applicant for relief under s 4(3), in that case the defendant/cross-claimant.

Consideration

Serious question to be tried

89 The applicants make four principal submissions in support of their overarching contention that there is a serious question to be tried:

(1) on a proper construction of the Licence Deed the respondents’ conduct infringes the Restraint;

(2) the geographic protection given by the Restraint is the Gold Coast;

(3) the present case is akin to a business sale and not simply the restraint of a former employee such that the Court will be more likely to enforce the Restraint; and

(4) the Restraint is reasonable in the present context. That is because the respondents have had the significant advantage of the applicants’ confidential information including the use of the Vessels, access to the Unit Holders and use of BSA branding and market reach in order to springboard into the Neptune business.

90 The respondents submit that on a proper construction of the Restraint, at best the applicants have a weak case that it applies to the New Syndication Business. In summary the respondents submit that:

(1) putting to one side the use of the term “Restricted Area” in cl 28(jj), instead of “Restraint Area” used in cl 15, which may render the Restraint void for uncertainty, the definition of “Restricted Area” does not extend to the New Syndication Business being operated on the Gold Coast;

(2) the restraint period of two years following the expiry of the Term on 1 September 2026 is patently excessive and unreasonable in the circumstances. That is, the Licence Deed has been terminated and yet the cascading periods in the Restraint are to operate from the “Term Expiration Date” of 1 September 2026;

(3) the nature of a business is significant in assessing reasonableness, that broad restraints are more likely to be held valid where the business is specialised or operates in a limited market but that is not the nature of BSA’s business;

(4) in assessing reasonableness a close examination of the nature of applicable intellectual property and confidential information is required. The intellectual property and confidential information accessed under the Licence Deed are of a relatively limited scope. In any event the respondents have acceded to the order sought by the applicants in para 6 of the 17 April 2024 IA in respect of confidential information and have given undertakings in relation to the “Leads Spreadsheet”; and

(5) the legitimate protectable interests of the applicants, identified as being the applicants’ relationships with Unit Holders, are sufficiently protected by the proposed orders, which will be in place until 1 July 2025.

91 The restraint in cl 15 of the Licence Deed requires that the respondents not act in a Restricted Way during the Restraint Period and within the Restraint Area. The definition of each of these terms is set out at [19] above. Importantly the meaning of the term Restricted Way is broad and requires the respondents not to act, participate, assist, work or in any way be directly or indirectly involved in a Competing Business in a number of named capacities. It was not in dispute that if the Restraint applies Mr Schmidt, as both a director and shareholder of Neptune, would be in breach by conducting the New Syndication Business which is a Competing Business.

92 In my view, having regard to the parties’ submissions, I am satisfied that, on balance, there is a serious question to be tried, namely the validity of the Restraint. However, I am also of the view that the strength of the applicants’ case for final relief in relation to the Restraint has a number of weaknesses. My reasons follow.

93 First, cl 28(jj) of the Licence Deed defines the term “Restricted Area” instead of the term “Restraint Area” which is used in the Restraint itself, i.e. cl 15. A question that arises is whether the Restraint is void for uncertainty because of that error. However, the respondents accept that the applicants have an arguable case. That is, there is an arguable case that as a matter of construction a court would read the defined term “Restraint Area” as “Restricted Area”.

94 Secondly, the respondents contend that the “Restricted Area” as defined does not extend to the New Syndication Business being operated on the Gold Coast. That is because “Restricted Area” is defined by reference to a maximum radius of 100 kilometres from “any Companies’ premises” or “the area in which the Companies are located and conducts their business and from which they receive the majority of their custom”. They say that at the time the Licence Deed was made, and at all other times, the Companies did not have any “premises” in the Gold Coast. That was not where they were “located” and received the majority of their custom.

95 The applicants rely on the fact that they were operating berths in the Gold Coast from which the BSA business in the Gold Coast was operating before it was transferred to the respondents. They submit that is enough to be an anchor for “any of the Companies’ premises” within the meaning of cl 28(jj) of the Licence Deed and that the term “Restricted Area” is intended to capture all places from which the applicants conducted the business at the time of entering into the Licence Deed which included the business on the Gold Coast that was licenced to the respondents. Put another way, they say that if there was not a business operating in the Gold Coast there was nothing to licence to the respondents under the terms of the Licence Deed.

96 There are a number of issues that arise in relation to the meaning of “Restricted Area” in the context of the Licence Deed and the Restraint. They include: whether a berth in a marina situated on the Gold Coast at which a vessel is moored can be construed as being “the Companies’ premises”. There was evidence before me that a berthing licence is a licence to moor a vessel at a berth for a particular term and a marina berth is only an area of water to park a boat; more particularly, whether a marina berth amounts to “premises”; whether the “Restricted Area” can, as seems to be suggested by the applicants, have a different application during and after the term of the Licence Deed; whether the definition of Restricted Area is unreasonably broad given it specifies distances from “any of the Companies’ premises”, I infer, anywhere in Australia; and if, as the respondents say, the term is ambiguous, how it is to be construed. The respondents submit that the contra proferentem rule would apply, relying on Tipto Pty Ltd v Yuen [2015] NSWSC 1086 at [143]-[148].

97 Notwithstanding those issues, some of which may raise considerable obstacles for the applicants, I am satisfied there is an arguable case that the marina berths operated by the applicants before their transfer to the respondents may constitute the “Companies’ premises” within the meaning of cl 28(jj) of the Licence Deed and that the Restraint operates having regard to those premises.

98 Thirdly, the applicants contend that a “Restraint Period” of, at the top end, two years and, at the lower end, three months, following the Term Expiration date is reasonable. The applicants note that the term “Restraint Period” is defined by reference to the “Restricted Period” in cl 28(kk) of the Licence Deed which in turn provides for a waterfall of periods, each operating from the “Term Expiration Date” which is 1 September 2026. The “Restricted Period” takes no account of a situation where the Licence Deed is terminated prior to the Term Expiration Date.

99 The applicants submit that the contractually agreed Restricted Period of two years following the expiration of the Term on 1 September 2026 is an appropriate and proportionate response to the risks to the BSA business and the goodwill of that business. But, putting to one side whether the termination was lawful, in circumstances where the Licence Deed came to an end more than three years before the contracted Term Expiration Date there is an air of unreality about the applicants’ submission. While I have not come to any concluded view it seems to me that the inflexibility of the definition of “Restraint Period” may, subject to findings about the nature of the BSA business and the goodwill to be protected, lead to a conclusion that, given the duration contended for by the applicants based on the cascading definition of Restricted Period, the Restraint is excessive and unreasonable.

100 Fourthly, and in part related to the question of the duration of the Restricted (or Restraint) Period, is the nature of the BSA business. The applicants contend that it is a highly specialised business, that it is the only yacht syndication business in the Gold Coast that had an established reputation on the Gold Coast at the time of entry into the Licence Deed and that Mr Young spent significant time training Mr Schmidt in the operation of the business. Those matters are disputed by the respondents. The outcome of that dispute, which is likely to have a bearing on the assessment of the reasonableness of the Restraint, is not a matter to be resolved on this application but is to be resolved at trial.

101 Fifthly, the nature of the intellectual property which the applicants seek to protect comprises the use of the Vessels which had approximately 34 Unit Holders, the BSA branding, the BSA booking system, the database of Unit Holders, contact details of potential clients enquiring about the Gold Coast through the BSA website or at boat shows conducted under the BSA banner and the suite of contractual documents that establish the business. Save for the reference to “use of the Vessels” and the “applicants’ booking system”, the parties were agreed that this was the extent of the intellectual property and confidential information accessed under the Licence Deed.

102 In relation to those matters:

(1) the respondents had “read only” access to the BSA booking system, any changes required to the booking system by BSA QLD were made by email request to BSA in Sydney and since late May 2023 the respondents have not had access to or used the BSA booking system; and

(2) by the proposed undertakings and the proposed orders the respondents have given undertakings and will accede to the order sought by the applicants in relation to the “Confidential Information” as defined in the Licence Deed. In addition, Messrs Schmidt and Markgraaff have each undertaken not to use the “Leads Spreadsheet” in connection with the New Syndcation Business. That is a spreadsheet which records the details of people who enquired about the Gold Coast fleet through BSA’s website or at boat shows conducted under the BSA banner.

103 The primary protectable interest is the goodwill of the business the subject of the Licence Deed and, in particular, the customer relationship with Unit Holders. Based on the evidence before me the applicants are concerned by the relationship between Unit Holders and the respondents. That concern and the protectable interest is sufficiently protected by the proposed orders by which, once made, the respondents and Mr Markgraaff and Neptune will be restrained from canvassing, soliciting, approaching or accepting any approach from any person who is, or was, or becomes a “Unit Holder in the existing vessels” until 1 July 2025, which is a period of about two years from the termination of the Licence Deed.

104 Finally, the applicants rely on sub-clause 15(b) by which the respondents acknowledged that the Restraint is reasonable and necessary to protect the applicants’ genuine interests and that damages are not necessarily an adequate remedy if there is a breach or threatened breach of the Restraint. As observed in OAMPS (at [69(i)]), the Court will give “considerable weight to what parties have negotiated and embodied in their contracts”. However, that cannot be regarded as conclusive, “even where there is a contractual admission as to reasonableness”. It is a factor to be weighed in the balance in assessing the reasonableness of a restraint.

105 I note that in DXC Eclipse Pty Ltd v Wildsmith [2023] NSWCA 98 Bell CJ (with whom Brereton JA and Simpson AJA agreed) found there to be considerable force in the argument made in that case that “given the cascading series of restraint periods identified in [the restraint clause], the clarity, and therefore the force, of the Acknowledgement is diminished, especially in view of [the restraint clause’s] recognition that aspects of the restraint… may be struck down” (at [156]). Relevantly, cl 15(d) of the Licence Deed provides that each combination of the Restraint Period, Restraint Area and the Restrained Conduct is severable from the other combinations.

Balance of convenience

106 I turn then to the question of balance of convenience which requires an assessment of whether the inconvenience or injury which the applicants would be likely to suffer if an injunction were refused outweighs the injury which the respondents would suffer if an injunction were granted: see Australian Broadcasting Corporation v O’Neill (2006) 227 CLR 57 at [65]. As I have already observed, the two aspects of the test for a grant of an injunction are interrelated. In this case, where there is some doubt and weakness in the serious question, there must be a more marked balance of convenience in favour of the grant of the injunction sought.