FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Finder Wallet Pty Ltd [2024] FCA 228

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | FINDER WALLET PTY LTD (ACN 149 012 653) Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The proceeding be dismissed.

2. The plaintiff is to pay the defendant’s costs, as agreed or taxed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

MARKOVIC J:

1 The central question in this proceeding is whether a product called “Finder Earn”, marketed and issued by the respondent, Finder Wallet Pty Ltd, is a debenture for the purposes of the Corporations Act 2001 (Cth). The applicant, the Australian Securities and Investments Commission (ASIC), contends that it is and that, as a result, Finder Wallet contravened the Corporations Act by carrying on a financial services business without holding an Australian Financial Services Licence (AFSL) and by offering a debenture without a disclosure document or a target market declaration.

2 ASIC seeks declarations pursuant to ss 1101B, 1317E or 1324 of the Corporations Act or s 21 of the Federal Court of Australia Act 1976 (Cth) that Finder Wallet has contravened:

(1) s 727(1) and s 727(6) of the Corporations Act by making an offer of a debenture, in the form of its Finder Earn product, that requires disclosure to investors under Pt 6D.2 without lodging a disclosure document with ASIC;

(2) s 727(2) and s 727(6) of the Corporations Act by making an offer of a debenture, in the form of its Finder Earn product, that requires disclosure to investors under Pt 6D.2 without an accompanying disclosure document;

(3) s 994B(2) of the Corporations Act because it failed to make a target market declaration as required by s 994B(1) before it engaged in retail product distribution conduct with respect to its Finder Earn product; and

(4) subs 911A(1) and (5B) of the Corporations Act because it has carried on a financial services business without holding an AFSL covering the provision of financial services with respect to the Finder Earn product.

3 ASIC also seeks orders pursuant to s 1317G(1)(a) of the Corporations Act that Finder Wallet pay to the Commonwealth of Australia such pecuniary penalties as the Court determines to be appropriate in respect of any contraventions of the Corporations Act by Finder Wallet which are the subject of any declarations by the Court.

4 Finder Wallet contends that the Finder Earn product did not constitute a debenture as defined in s 9 of the Corporations Act and thus ASIC is not entitled to the relief sought.

5 By order made on 8 February 2023 the proceeding in respect of liability is to be heard separately from the proceeding in respect of relief. Accordingly, these reasons deal only with the former i.e. questions of liability.

THE PLEADED CASE

6 In its concise statement filed on 15 December 2022 ASIC contends that the Finder Earn product is a debenture, that Finder Wallet offered Finder Earn to consumers between about late February 2022 and 10 November 2022 (Relevant Period) and that the Finder Earn product had terms of service (Terms), the key features of which remained the same from about February 2022 despite their amendment from time to time. At [4]-[12] of its concise statement ASIC sets out the “important facts giving rise to the claim” in the following way:

4. Finder Earn was marketed as making use of a cryptocurrency called “TrueAUD” (TAUD), which was described on the website as a “stablecoin”, “pegged” against the “currency or asset which it aims to reflect, digitised in the blockchain ecosystem” (in TAUD’s case, the relevant currency is Australian dollars). The Terms described cryptocurrency as having “a high level of risk” and as being a “volatile asset”, but stablecoins were said to be “generally less volatile” than other categories of cryptocurrency.

5. For a consumer to acquire, invest in or use the Finder Earn product in the Relevant Period, he or she required an account with Finder Wallet into which he or she had deposited with (or lent to) Finder Wallet Australian dollars or another government issued currency (which the Terms describe as “fiat”, but which for present purposes are described as Australian dollars or AUD).

6. After depositing AUD, the consumer, using the website or in the “Finder App” during the Relevant Period, selected “Wallet”, then selected “Transfer”. The consumer was then provided with an opportunity to read the Terms and select “Understood”, then choose the amount of deposited AUD he or she wished to transfer, then select “Transfer and Convert”. By selecting “Transfer and Convert”, the AUD was said to be “converted” into TAUD and “allocated” to the “Cryptocurrency Earn Option”. This was done by Finder Wallet updating an internal ledger. There was no mechanism for the consumer to convert AUD to TAUD then withdraw or retain that TAUD. The conversion from AUD to TAUD and allocation of the TAUD to Finder Wallet occurred simultaneously when the customer selected “Transfer and Convert”.

7. Once an “allocation” was made, the Terms provided that ownership of the allocation passed to Finder Wallet and would be held by Finder Wallet (or a third party); that the consumer did not maintain a legal interest in it; that the allocation may be pooled with the allocation of other persons and Finder Wallet’s own property; and that the allocation could be used by Finder Wallet without limitation including to generate value for Finder Wallet.

8. The Terms also provided that Finder Wallet had no obligation to own or control an amount of cryptocurrency that was equivalent to the allocation; that Finder Wallet may use or invest the allocation at its own risk in its sole discretion; and that the consumer’s only right in relation to the allocation during the Earn Term was a contractual right to an amount of cryptocurrency equal to the allocation and any “return” at the end of the Earn Term.

9. Once an allocation was made, there was an “Earn Term”, during which the consumer earned a “return”, being 4.01% p.a. (or a promotional rate of 6.01% p.a.).

10. During the Relevant Period, the Terms provided for various ways in which the Earn Term could come to an end (which are unrelated to the performance of the TAUD). The Terms stated that, when the Earn Term came to an end, Finder Wallet would return an amount of cryptocurrency that is equivalent to the allocation plus the accrued return, then convert that cryptocurrency into AUD in the consumer’s account. That is, the consumer had the right, which is a chose in action, to repayment of the amount deposited into the account or lent to Finder Wallet, or held from time to time in the consumer’s account with Finder Wallet.

11. During the Relevant Period, there was no mechanism to exit the product by withdrawing TAUD itself. There was a required “conversion” back into AUD. That is, just as the customer started with AUD deposited into their account with Finder Wallet upon entry into the Finder Earn product, the customer also received AUD back into their account when they exited the Finder Earn product. Part of the undertaking to repay involved repaying the AUD which was deposited by the customer.

12. Finder Wallet no longer offers the Finder Earn product. When Finder Wallet ceased offering the Finder Earn product on 24 November 2022, it transferred all TAUD balances out of Finder Earn, converted the TAUD balances 1:1 into AUD and added the AUD to users’ Finder Wallet accounts.

7 In its concise statement in response Finder Wallet contends that ASIC’s application is misconceived because the Finder Earn product did not involve any undertaking by Finder Wallet to repay moneys deposited with it as a debt and therefore did not constitute a debenture within the meaning of s 9 of the Corporations Act. Finder Wallet says that the essential facts are not in dispute but that the primary flaw in ASIC’s case is that it fails “to engage with the true legal nature of the transactions underpinning the Finder Earn product” and, rather, summarises the product’s “economic effect”.

8 In summary, Finder Wallet says that the true legal effect is that the customer purchased or transferred an amount of TrueAUD to Finder Wallet and title to the cryptocurrency that was transferred then passed from the customer to Finder Wallet. It says that allocation did not create a debt owed by Finder Wallet to repay Australian dollars to the customer as a debt. Rather, the customer had a contractual right to receive, at the end of the “Earn Term” (see [32(2)] below), an amount of TrueAUD equivalent to the allocation and an additional amount of TrueAUD for the use of the allocation during the Earn Term (Return).

LEGISLATIVE FRAMEWORK

9 In order to understand why the nature of the Finder Earn product is central to ASIC’s case it is convenient to set out the applicable legislative framework.

10 Section 727 is in Pt 6D.3 of Ch 6D of the Corporations Act. It relevantly provides:

Offer of securities needs lodged disclosure document

(1) A person must not make an offer of securities, or distribute an application form for an offer of securities, that needs disclosure to investors under Part 6D.2 unless a disclosure document for the offer has been lodged with ASIC.

Offer form to be included in or accompanied by disclosure document

(2) A person must not make an offer of securities, or distribute an application form for an offer of securities, that needs disclosure to investors under Part 6D.2 unless:

(a) if a prospectus is used for the offer—the offer or form is:

(i) included in the prospectus; or

(ii) accompanied by a copy of the prospectus; or

(b) if both a prospectus and a profile statement are used for the offer—the offer or form is:

(i) included in the prospectus or profile statement; or

(ii) accompanied by a copy of the prospectus or profile statement; or

(c) if an offer information statement is used for the offer—the offer or form is:

(i) included in the statement; or

(ii) accompanied by a copy of the statement.

…

(6) A person contravenes this subsection if the person contravenes subsection (1), (2), (3) or (4).

11 Section 994B is in Ch 7 of the Corporations Act. Section 994B(1) provides:

Subject to subsection (3), a person must make a target market determination for a financial product if:

(a) under Part 6D.2, the person is required to prepare a disclosure document for the product; or

…

12 Section 994B(2) sets out the time by which a person required to make a target market determination for a financial product must do so. In particular, if s 994B(1)(a) applies, that must occur before any person engages in retail product distribution conduct in relation to the product.

13 Section 911A of the Corporations Act relevantly provides:

(1) Subject to this section, a person who carries on a financial services business in this jurisdiction must hold an Australian financial services licence covering the provision of the financial services.

…

(5B) A person contravenes this subsection if the person contravenes subsection (1).

(Notes omitted.)

14 Providing financial services in a repetitive manner to derive income is carrying on a financial services business: see for example Australian Securities and Investments Commission v Secure Investments Pty Ltd (No 2) (2020) 148 ACSR 154; [2020] FCA 1463 at [68]. Section 766A(1)(b) of the Corporations Act provides that a person provides a financial service if the person deals in a financial product. Section 766C provides for the meaning of “dealing”. Relevantly, issuing a financial product constitutes dealing in a financial product: see s 766C(1)(b). The issuer of a financial product is the person responsible for the obligations owed under the terms of the facility that is the financial product: s 761E(4).

15 At the time that the Finder Earn product was made available by Finder Wallet:

(1) s 92(4) of the Corporations Act relevantly provided that “securities” for the purposes of Ch 6D had “the meaning given by section 700 and in Chapter 7 security has the meaning given by section 761A”;

(2) s 700 of the Corporations Act provided that in Ch 6D “securities” had the same meaning as it had in Ch 7, subject to some express exclusions which are not presently relevant;

(3) s 761A of the Corporations Act was headed “definitions” and relevantly defined “security” for the purposes of Ch 7 to mean, among other things, “a debenture of a body”: see s 761A(b); and

(4) s 764A(1)(a) of the Corporations Act provided (and continues to provide) that a security is a financial product for the purposes of Ch 7. It follows, that a debenture is a financial product for the purposes of Ch 7.

16 The term “debenture” is defined in s 9 of the Corporations Act to mean:

debenture of a body means a chose in action that includes an undertaking by the body to repay as a debt money deposited with or lent to the body. The chose in action may (but need not) include a security interest over property of the body to secure repayment of the money. However, a debenture does not include:

…

BACKGROUND

17 The parties relied on a statement of agreed facts (Agreed Facts) made pursuant to s 191 of the Evidence Act 1995 (Cth) and a statement of facts disputed on the basis of relevance (Statement of Disputed Facts). Finder Wallet also relied on an affidavit affirmed on 4 August 2023 by Frederick Robert Schebesta, a director and co-founder of Finder Wallet.

18 I set out below a summary of the facts. In doing so I have had regard to the Agreed Facts and, where necessary, have resolved questions of relevance raised in the Statement of Disputed Facts.

Finder Wallet and the conception of the Finder Earn product

19 Finder Wallet is a digital currency exchange (DCE) provider registered with the Australian Transaction Reports and Analysis Centre through which customers can buy and sell cryptocurrency assets.

20 At all relevant times Finder Wallet:

(1) was a wholly owned subsidiary of Finder.com Pty Ltd;

(2) operated a DCE;

(3) offered a product to customers marketed as “Finder Earn” which was accessed via the Finder application (Finder App). For the purpose of the proceeding, it was not in dispute that Finder Wallet offered the Finder Earn product to customers during the Relevant Period; and

(4) did not hold an AFSL.

21 The Finder App is an application offered to customers on mobile device platforms. It provides various money and finance management services. The Finder App is owned by Finder Ventures Pty Ltd. Throughout the Relevant Period the Finder App allowed customers to do several things including accessing services offered by Finder Wallet and Finder Ventures, such as accessing the DCE service provided by Finder Wallet to buy and sell cryptocurrency, and accessing services not offered by Finder Wallet such as home loan comparisons or insurance policies.

22 Mr Schebesta explains that he conceived the Finder Earn product for the dual purposes of: giving Finder Wallet’s DCE customers the opportunity to sell their cryptocurrency to Finder Wallet and to earn a return; and as a novel way to promote the growth and adoption of the Finder App. Relevantly, in a letter dated 24 December 2021 from Finder Wallet to ASIC responding to queries about the Finder Earn product, Finder Wallet stated:

(1) in relation to its approach to scaling Finder Earn, among other things:

We have taken, and will continue to take, into consideration a number of factors when determining limits. This includes an on-going evaluation as to the impact the Finder Earn offer results in driving the strategic goal of growth in attaining customers and the adoption of the Finder App as a result of product satisfaction, engagement, word-of-mouth, and the crosspollination of current and future offerings made available in the App such as product comparison. The value that Finder Earn drives to the App will ultimately determine how much Finder Wallet is willing to pay customers (that is, the TAUD earned by customers based on the set rate) and what limits are appropriate. We comment later in this response on our long-term business strategy.

(2) in relation to its use of the TrueAUD borrowed from Finder Earn investors, among other things:

Finder Wallet pays the Finder Earn participants the Return based on the set rate from income streams arising from its core business, which are separate to any funds generated as a result of the Finder Earn offer.

Finder Wallet will use the TAUD allocated to it by customers participating in the Finder Earn offer, which it legally owns, in its sole discretion. This may include exchanging a portion of the TAUD into fiat or other stablecoins to diversify and manage risk, or using the TAUD to generate profit for Finder Wallet including via staking. The terms for staking will reflect the then market conditions at that time, and will be reviewed on a case-by-case basis.

All decisions and policies regarding how the TAUD is used must pass through Finder Wallet. There is an extensive due diligence process that Finder Wallet undertakes before it will approve allocation of digital assets.

(3) in relation to changing the earn rate, among other things:

Finder Earn does not offer a variable rate and does not expect to change the rate it offers as an ordinary matter of course. However, as with most standard terms and conditions, we wanted to ensure that there was some flexibility to update the terms in the future if required. To reiterate, the rate is set at the time the customer decides to participate in Finder Earn and will not change based on Finder Wallet’s use of the TAUD, or any resulting profit or loss incurred by Finder Wallet.

As outlined previously, Finder Wallet and the broader Finder group has a number of product offerings that drive revenue to the business. Finder Wallet is an innovation focused company, and heavily relies on and utilises a decision process based on data-led performance measurement.

We can comfortably fund the Finder Earn offering more than long enough for the business to evaluate its success toward the stated goals above. Should we feel this initiative does not fulfil the business objectives of the Finder group (examples being strategic ones such as App growth metrics falling below expectation, or a strategic refocus away from App and back to our website and comparison/redirect business model) the Finder Earn offering could be wound down.

…

Should we determine that Finder Earn is attracting a higher annual cost to the business that does not see a long-term value (either by way of revenue or strategy) that the business is comfortable in sustaining, but where a lower rate payable on TAUD we borrow from customers could achieve a more suitable alignment, we may choose to end the Earn Term and offer a different rate.

Similarly, if the growth-in-app is provided to be a success from the Finder Earn offering, we might end the Earn Term and offer a higher rate. For the mean-time, 4.01% is an amount we determined internally after careful consideration to be sufficient to explore this initiative.

We will be closely measuring the value-capture attained by the business against a number of metrics such as app engagement, product utilisation, referral programs, comparison revenue and overall life-time value and holistic business positioning, in guiding the future direction of the Finder Earn offer. This is a highly practised and established methodology for companies, especially where access to rich data and insights is available and appropriate investment has been made into building analytics teams to support this feedback and research (which the Finder group has).

Participation in the Finder Earn product

23 In order to participate in the Finder Earn product in the Relevant Period a customer was required first to download the Finder App and then to apply for an account with Finder Wallet to access the DCE service provided by it.

24 Upon opening an account with Finder Wallet, a customer was assigned a unique ID allowing the customer to track balances across AUD and cryptocurrency holdings. The Finder Wallet account:

(1) recorded the Australian dollars (which the Terms described as “Fiat”, but which for the purposes of these reasons I will refer to as Australian dollars or AUD) in that account; and

(2) was the way in which the customer accessed the DCE provided by Finder Wallet and, where applicable, accessed the Finder Earn product.

25 Finder Earn was marketed on the Finder.com.au website (Finder Website).

26 The Finder Website described Finder Earn as making use of a cryptocurrency called “TrueAUD”. That was the only cryptocurrency accepted by Finder Wallet into Finder Earn during the Relevant Period.

27 TrueAUD is neither created nor issued by Finder Wallet. It is a type of digital asset known as a “stablecoin” which the Finder Website described as:

pegged to the value of the Australian dollar. This means that 1 TrueAUD token can be redeemed for 1 Australian dollar, and vice versa.

The Finder Website also stated that:

TrueAUD is issued on the Ethereum Network and administered by a US-based company, TrueCoin LLC.

28 The Terms (which are more fully described below) stated that cryptocurrency has “a high level of risk” and is a “volatile asset” but that stablecoins are “generally less volatile” than other categories of cryptocurrency.

29 For the Relevant Period, the Terms provided that to access the Finder Earn product a customer had to allocate an amount of TrueAUD to the Finder Earn product, which was a transfer of that TrueAUD to Finder Wallet and that, once transferred, the TrueAUD was owned by Finder Wallet. This could be done by exchanging AUD in the customer’s Finder Wallet account to acquire TrueAUD and then transferring that TrueAUD to Finder Wallet. Each part of the process was initiated in a single action by the customer selecting a “Transfer and Convert” button in the Finder App.

The Terms

30 The Terms which applied to the Finder Earn product have been amended from time to time. The versions that applied during the Relevant Period were:

Version | Start Date | End Date |

2.1 | 29 November 2021 | 1 March 2022 |

3.0 | 1 March 2022 | 4 July 2022 |

3.1 | 4 July 2022 | 18 August 2022 |

4.0 | 18 August 2022 | 10 November 2022 |

31 In relation to those versions of the Terms:

(1) version 2.1 was in force at the start of the Relevant Period and cl 2.4(d) provided:

You will retain a beneficial interest in the Cryptocurrency at all times.

(2) on 1 March 2022 Finder Wallet published version 3.0 of the Terms which had largely identical terms to version 2.1 but also included an amended cl 2.4(d) which provided:

Subject to these Terms, including your participation in the Cryptocurrency Earn Option, you will retain a beneficial interest in the Cryptocurrency at all times.

(3) on 4 July 2022 Finder Wallet published version 3.1 of the Terms which had largely identical terms to version 3.0; and

(4) on 17 August 2022 Finder Wallet published version 4.0 of the Terms which re-formatted the Terms and incorporated them into Finder Wallet’s substantive Terms of Service but which contains largely identical key terms as contained in version 3.0.

32 The key features of the Terms insofar as they are relevant to this proceeding were stable during the Relevant Period. Relevantly, by reference to version 3.1, the Terms included:

(1) in the recitals under the heading “Introduction”:

A. These Terms of Service (“Terms”) govern your access to, and use of, our services, and constitutes a legal agreement between Finder Wallet Pty Ltd (ABN 11 149 012 653) (“Finder Wallet”), with its offices at Level 10, 99 York St, Sydney, NSW 2000, and the person agreeing to these Terms, who may be referred to as “you” or “your”. Finder Wallet may be referred to as “we”, “us” or “our” in these Terms.

…

C. By applying for a Finder Wallet account, or using our Platform, you acknowledge that you have read, understood, and agree to be bound by our Terms.

…

I. When you buy Cryptocurrency through Finder Wallet, you will hold a beneficial interest, and not the legal title, to the Cryptocurrency, therefore your rights to the Cryptocurrency are restricted.

K. When you allocate Cryptocurrency through Finder Wallet to earn a return, ownership will pass to Finder Wallet. You will only have a contractual right to an amount of Cryptocurrency equal to the Allocation and the Return at the end of the Earn Term.

L. The details we give to you for the purposes of transferring funds to your account, while unique to each account, do not represent a bank account being opened in your name, nor controllable by you. We do not issue BSBs, and we do not provide banking services.

(2) at cl 1 “Definitions and Interpretation”:

“Account” means the account you must apply for, and be approved for, prior to using the Services

…

“Allocation” means the Cryptocurrency that is allocated to Finder to participate in the Cryptocurrency Earn Option, in accordance with these Terms

…

“Cryptocurrency Earn Option” means the service offered by Finder Wallet for you to earn a Return in Cryptocurrency for allocating ownership of an amount of Cryptocurrency to Finder during the Earn Term in accordance with these Terms.

“Earn Term” means the period during which the Allocation is allocated to Finder Wallet, which period will either be:

• the fixed term selected by you when you activate the Cryptocurrency Earn Option, if we provide this option; or

• the period from the activation of the Cryptocurrency Earn Option until termination of the Cryptocurrency Earn Option or the Account (whichever occurs first).

“Fiat” means Australian dollars, or other government issued currency if expressly referred to as such.

…

“Return” means the payment from Finder Wallet to you for the use of your Allocation during the Earn Term, which payment will be calculated in accordance with the rate of return published on the Platform at the time you make your Allocation.

…

“Terms” means the terms and conditions of this agreement, which may be amended by Finder Wallet at its sole discretion.

(3) at cl 2 “Sale and purchase of Cryptocurrency”:

2.1 Terms

(a) Your use of the Platform and our Services will be governed by these Terms, and the Privacy Policy.

…

(e) You will not be purchasing the legal title to the Cryptocurrency. You will be purchasing the beneficial interest in the cryptocurrencies.

…

2.3 Transfer of funds

(a) You can instruct us to transfer the Fiat we hold for you to your nominated bank account, which must be solely under your name, and not a joint account with someone else or another entity.

…

2.4 Ownership and use of Cryptocurrency

…

(b) When you purchase Cryptocurrency we allocate the relevant amount of Cryptocurrency to your Account by updating our internal ledger. Although you have beneficial interest in the amount of Cryptocurrency displayed in your Account you do not have legal title in that Cryptocurrency.

…

(4) at cl 3 “Earning a Return on Cryptocurrency”:

3.1 How to earn a Return

(a) You can earn a Return by allocating an amount of Cryptocurrency that is held in your Account to Finder Wallet. We will pay you the Return as payment for our use of the Allocation during the Earn Term.

(b) To activate the earning process you must login into your Account, follow the prompts to select the Cryptocurrency Earn Option and issue an instruction via the App for Finder Wallet to make your Allocation to Finder Wallet.

(c) If you select the Cryptocurrency Earn Option you must allocate an amount of Cryptocurrency to Finder Wallet. You can only allocate Cryptocurrency that is held in your Account. You will be instructing Finder Wallet to:

(i) convert an amount of your Fiat currency held in your Account into Cryptocurrency, and,

(ii) subsequently, to allocate the Cryptocurrency to the Cryptocurrency Earn Option.

3.2 Ownership and use of the Allocation

(a) Ownership of the Allocation will pass from you to Finder Wallet. Your Allocation may be pooled with the Allocation(s) and Cryptocurrency of other members and with Finder Wallet’s own property. For the avoidance of doubt, Cryptocurrency allocations may be pooled in Finder Wallet’s wallet.

(b) During the Earn Term, Finder Wallet has the right to use the Allocation without limitation, including to generate value for Finder Wallet. We do not have any obligation to own or control an amount of Cryptocurrency that is equivalent to the Allocation and we may use or invest your Allocation at our risk in our sole discretion.

(c) Your only right in relation to the Allocation during the Earn Term is a contractual right to an amount of Cryptocurrency equal to the Allocation and the Return at the end of the Earn Term. We will not use the Allocation, or intend to use the Allocation, to generate a return or other benefit for you. You acknowledge and agree that the Return is in no way linked to Finder Wallet’s use of the Allocation and you do not intend for Finder Wallet to use the Allocation to generate a benefit for you.

…

3.4 End of the Earn Term

(a) The Earn Term will end:

(i) at the expiry of the fixed term selected by you when you made your Allocation, if we provide this option; or

(ii) by default, the Earn Term will be open-ended, and can be terminated at any time by signing into your Account and following the relevant prompts, or upon Finder Wallet terminating the Earn Term in its sole discretion; or

(iii) upon termination of your Account.

(b) Subject to clause 12, at the end of the Earn Term we will return an amount of Cryptocurrency in Cryptocurrency Earn Option that is equivalent to the Allocation plus the Return accrued to your Account, then convert that Cryptocurrency to an equivalent amount of Fiat currency in your Account.

…

(5) at cl 4 “Risk Warning”:

…

4.3 Insolvency risk

You do not maintain a legal interest in the Allocation or Cryptocurrency, and we do not hold Fiat currency in a trust account. Accordingly, if Finder becomes insolvent, you will be an unsecured creditor in relation to your Allocation, Cryptocurrency or Fiat currency held with us.

(6) at cl 5 “Users of the Service”:

…

5.8 Termination

We may terminate this agreement with you at any time, without prior notice. If we terminate this agreement or your Account, we will make any payment due and owing to you in accordance with the relevant clause of this agreement.

(7) at cl 7 “No provision of Banking and Financial Services”:

7.1 No AFSL

We do not have an Australian Financial Services Licence

7.2 No Financial Advice

We do not provide general or personal financial product advice. We only provide information.

7.3 No Banking Services

We do not provide banking services. We are not a bank. We do not issue BSB numbers. Any account reference we provide to you is for the purposes of tracking your funds.

The Finder App during the Relevant Period

33 In order to participate in the Finder Earn product, a customer was required to transfer to Finder Wallet an amount of TrueAUD. This could be done by the following “Transfer and Convert” mechanism which applied during the whole of the Relevant Period:

(1) subject to the Terms, to acquire TrueAUD through the DCE service using the “Transfer and Convert” mechanism, the customer was required to deposit Australian dollars into his or her Finder Wallet account;

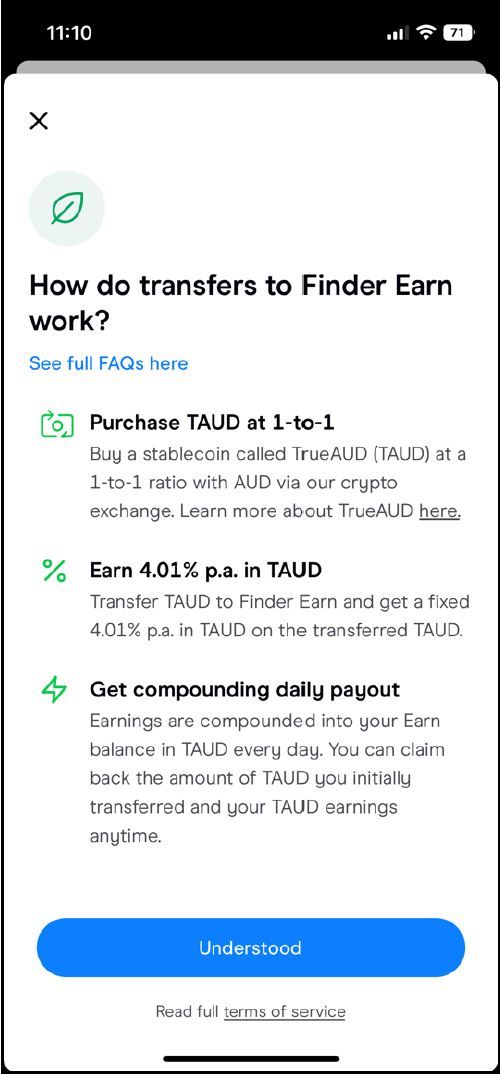

(2) after depositing Australian dollars into the Finder Wallet account, the Australian dollars could be exchanged for TrueAUD, which could be allocated to Finder Earn. Using the Finder App, the customer had to select “Wallet”, then select “Transfer”. In each instance, before the transfer was made, the customer was provided with a pop-up screen titled “How do transfers to Finder Earn work?” which reiterated the process, gave the customer an opportunity to read the Frequently Asked Questions (FAQs) and the Terms, and required the customer to select “Understood”. A screenshot of that screen as it appeared during the whole of the Relevant Period is as follows:

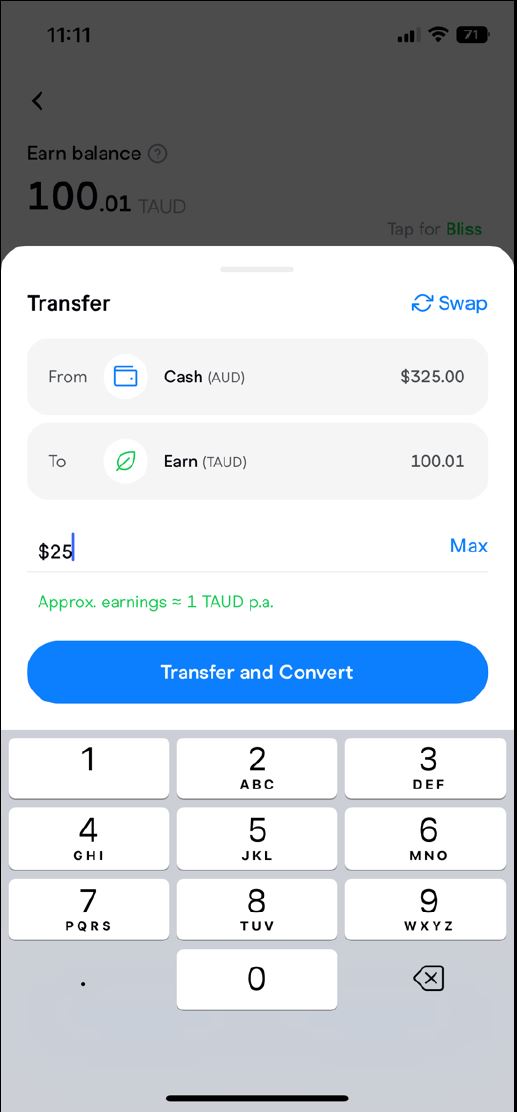

(3) if the customer clicked “Understood” the customer proceeded to the next screen. The customer could not proceed without first clicking “Understood”. At the next screen the customer could choose the amount of TrueAUD to acquire from and transfer to Finder Wallet by inputting the amount and selecting “Transfer and Convert”. Screenshots of this part of the process as they appeared during the whole of the Relevant Period are as follows:

(4) by selecting “Transfer and Convert”, the AUD were “converted” or exchanged for TrueAUD, and the TrueAUD were “allocated” to Finder Earn (referred to in the Terms as the “Cryptocurrency Earn Option”, although the only cryptocurrency which could be converted and allocated was TrueAUD). The conversion from AUD to TrueAUD and the allocation of the TrueAUD to Finder Wallet occurred when the customer selected “Transfer and Convert”. That is, subject to the Terms, TrueAUD was acquired by the customer from Finder Wallet and transferred to Finder Wallet;

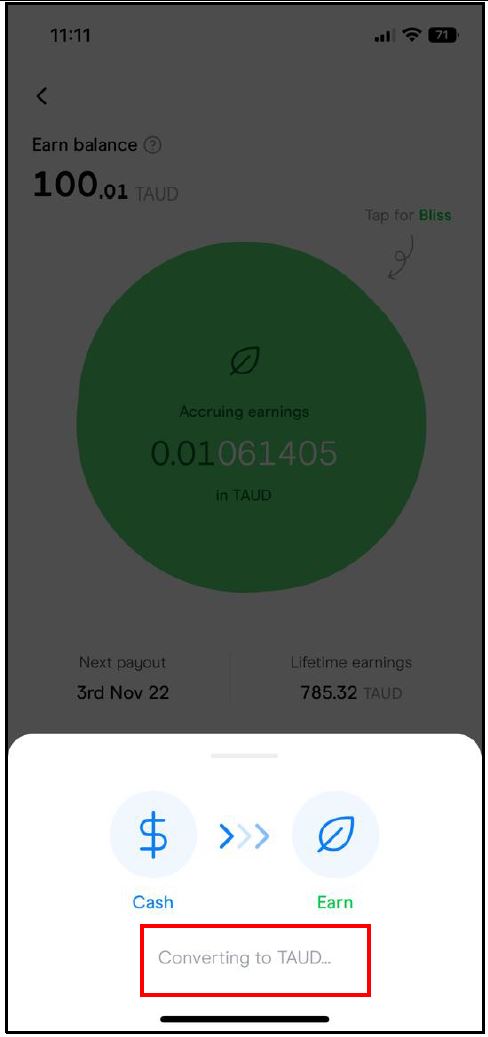

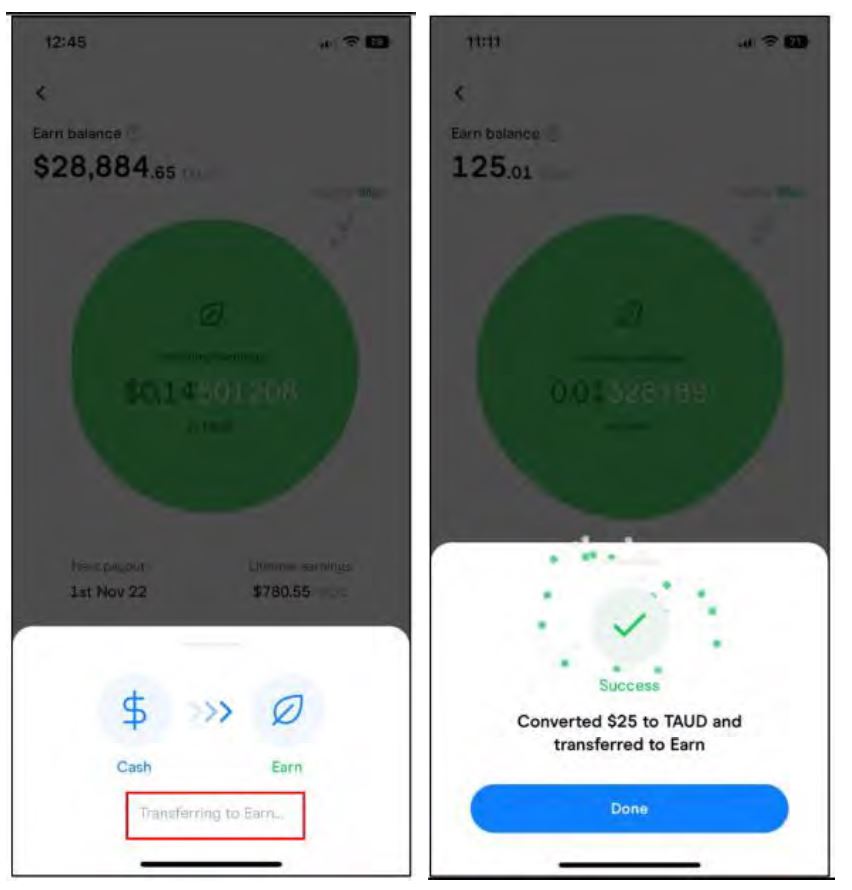

(5) Mr Schebesta explains that during the time it took to action the transfer of a customer’s TrueAUD back to Finder Wallet and to allocate it to the customer’s Earn balance, the customer was shown the text “Transferring to Earn” on his or her screen. Once both steps were completed the customer was shown the text “Converted $X to TAUD and transferred to Earn”. Examples of those screens are as follows:

(6) in accordance with the Terms, Finder Wallet bought and sold TrueAUD to customers by updating an internal ledger.

34 Once an allocation was made, the Earn Term commenced. During that period the customer earned a “return” of 4.01 % p.a. paid daily or a promotional rate of 6.01 % p.a. from about 4 May 2022 until about July 2022.

35 The Terms provided various ways in which the Earn Term could come to an end, unrelated to the performance of the TrueAUD. When the Earn Term came to an end, Finder Wallet would credit the customer with an amount of TrueAUD that was equivalent to the Allocation plus the accrued Return.

Finder Wallet ceases offering the Finder Earn product

36 On 24 November 2022, Finder Wallet ceased offering the Finder Earn product. In doing so, it:

(1) transferred all TrueAUD balances out of Finder Earn and back to the customer;

(2) exchanged the TrueAUD balances for AUD at a 1:1 ratio; and

(3) deposited that AUD into customers’ Finder Wallet accounts.

37 Prior to offering the Finder Earn product to customers (and up to the time of its “sunset” in November 2022), Finder Wallet:

(1) did not lodge a disclosure document with ASIC;

(2) did not issue an accompanying disclosure document to its customers; and

(3) did not make a target market determination.

IS THE FINDER EARN PRODUCT A DEBENTURE?

38 The first question that arises is that identified at [1] above and is the critical issue in the proceeding, namely whether the Finder Earn product is a debenture. If it is not, that is the end of the proceeding, and it should be dismissed. If, on the other hand, the Finder Earn product is a debenture, other issues will arise for consideration.

The parties’ submissions

39 ASIC submits that the legal terms on which customers participated in the Finder Earn product are found across the Terms, the Finder App, the marketing material accessible through both the Finder App and the Finder Website and the individual customer’s investment of a certain amount for a particular period of time.

40 ASIC submits that the Finder Earn product falls squarely within the definition of “debenture” in s 9 of the Corporations Act and that definition may be separated into its constituent parts by asking: (a) was there money deposited with or lent to the body; (b) is there a chose in action; and (c) if so, does the chose in action include an undertaking by the body to repay as a debt the money deposited or lent?

41 As to the first of those questions, was there money deposited with or lent to Finder Wallet, ASIC submits that:

(1) “money” is not defined in the Corporations Act but AUD, the Australian national currency, is clearly money;

(2) to use the Finder Earn product it was necessary for the customer to deposit, in the sense of paying money into a bank account in the name of Finder Wallet, AUD with Finder Wallet. By paying AUD, usually by an electronic transfer involving altering a chose in action between the customer and a bank or deposit taking institution, to the Finder Wallet account, the customer received a chose in action which was a promise by Finder Wallet to repay that money on demand;

(3) in transferring AUD to the Finder Wallet account, the customer “deposited” the AUD with Finder Wallet in accordance with the ordinary meaning of “deposit”, the payment of a sum of money into an account. That payment to Finder Wallet, which was for the purposes of using the Finder Earn product, has the same character as a deposit with a bank, creating a debtor-creditor relationship with the money payable on demand and the recipient, Finder Wallet, able to deal with the money as it saw fit;

(4) whether or not that conclusion is correct at that first point of the analysis, in then using the Finder Earn product, the customer nominated an amount of AUD and pressed the “Transfer and Convert” button, the AUD was notionally converted by Finder Wallet into TrueAUD and “allocated” (see cl 3.1(c) of the Terms) or “transferred” (as stated on the Finder App), or lent (as stated on the Finder Website and the Finder App) to Finder Wallet, with the outcome reflected in the “Earn balance” shown in the customer’s account; and

(5) in doing so, the customer lent the AUD to Finder Wallet, as the FAQs on the Finder Website and in the Finder App made clear. The other labels used in the various Finder Wallet documents are not to the point. The question is one of the juridical characterisation of the transaction. On entering into the transaction Finder Wallet received, that is obtained absolutely, the AUD the subject of the transaction and promised to repay that amount with interest. Finder Wallet was able to deal with the money as it wished. In juridical character, the amount was lent by the customer to Finder Wallet. That conclusion is reinforced by, albeit not dependent on, the notional acquisition of TrueAUD by the customer. The customer started with AUD (or a chose in action the equivalent of a credit amount in a bank account) and received in exchange a promise to repay that amount with interest. The customer did not actually acquire ownership of TrueAUD, because the “conversion” of AUD did not involve Finder Wallet transferring TrueAUD to the customer, even for a juridical moment, and did not involve the actual transfer of title to TrueAUD to Finder Wallet.

42 As to the second question, is there a chose in action, ASIC submits, having regard to the definition of “chose in action”, that a contractual right is a chose in action. ASIC relies on cl 3.4(b) of the Terms (see [32(4)] above) and submits that the customer has a contractual right to performance of the obligation set out in cl 3.4(b) of the Terms and that the original deposit necessarily carried with it a correlative right to repayment of the amount deposited.

43 As to the third question, does the chose in action include an undertaking by the body to repay as a debt the money deposited or lent, ASIC submits that cl 3.4(b) of the Terms obliged Finder Wallet not only to “return” an amount of TrueAUD equivalent to the Allocation plus the Return, but also to convert that TrueAUD to an equivalent amount of AUD in the customer’s Finder Wallet account. It contends that cl 3.4(b) taken as a whole is an undertaking by the body to repay as a debt the money deposited or lent.

44 ASIC submits that, as a matter of substance, the undertaking includes repayment as a debt of the money lent to, or deposited with, Finder Wallet by the customer and, in any event, the deposit to the account carried with it an obligation to repay on demand. ASIC contends that the obligation to repay constitutes a “debt” in the sense of being an ascertainable amount which is owed and is obliged to be paid, relying on Geeveekay Pty Ltd v Director of Consumer Affairs Victoria (2008) 19 VR 512 at [72], and that the term “debt” is not one of precise or inflexible denotation and must be applied in a practical and common sense fashion, relying on ABN Amro Bank NV v Bathurst Regional Council (2014) 224 FCR 1 at [684]. ASIC submits that it is artificial to suggest that a transaction beginning and ending with AUD that a customer chooses to invest in Finder Earn, with a notional conversion to TrueAUD in the middle and a contractual obligation to “return” the TrueAUD and reconvert it to AUD, is not a loan to, or deposit with, Finder Wallet of money which Finder Wallet undertook to repay as a debt.

45 ASIC submits that the definition of “debenture” in s 9 of the Corporations Act was intended to facilitate electronic commerce by focusing on the “right to repayment” rather than the literal document which acknowledges the debt and that it is consistent with that intention that the focus should not be on the form of the transaction, but rather the substance: the right to repayment which results in the return of AUD into the customer’s account. It contends that its interpretation of the definition of “debenture” is consistent with the legislature’s intention to regulate corporate fundraising and protect investors, referring to the Explanatory Memorandum, Corporate Law Economic Reform Program Bill 1998 (Cth) at [1.2], and that an interpretation of the definition which allows entities to avoid the financial services provisions by structuring a debt so that the obligation to repay involves an initial step of conversion to a stablecoin would be contrary to the statutory intention to improve investor protection.

46 Finder Wallet does not dispute that, in order for a customer to participate in the Finder Earn product, that customer first had to transfer Australian dollars to the customer’s Finder Wallet account. However, it submits that the arrangement to do so is no different to the large number of businesses that enable customers to fund an account for the purpose of making purchases, with a right to return of any unspent money.

47 Finder Wallet submits that whether that action comprised a “deposit” within the meaning of s 9 of the Corporations Act is irrelevant because the Australian dollars transferred into a Finder Wallet account were not automatically transferred into Finder Earn; they remained in the Finder Wallet account and could be used, or not, by a customer at the customer’s election. Finder Earn was not the only purpose for which money in a Finder Wallet account could be used.

48 Finder Wallet submits that it is artificial, and inconsistent with the well-settled principles underpinning the concept of a debenture, to conflate money transferred into a Finder Wallet account with the “deposit” of that money into a separate financial product. If it were otherwise, the corollary would be that any transfer of money into an account comprises a debenture. Finder Wallet contends that once any deposit of funds into the Finder Wallet account is distinguished from the use of that money to invest in the Finder Earn product, it is apparent that there is no deposit or loan; rather, there is a purchase by the customer of an investment which is recoverable as a contractual right to a return, not as a right to repayment of a loan as a debt.

49 Finder Wallet submits that the Court’s focus must therefore be on the Finder Earn product as distinct from the transfer of AUD into the Finder Wallet account.

50 Finder Wallet says that the fact that an investment in the Finder Earn product involved multiple steps occurring in quick succession does not mean that there is a singular transaction with a single legal character. It contends that ASIC’s references to the “substance” of the transaction, or particular features, as “administrative” or “notional” steps should be seen as an implicit admission that the legal character of the transactions does not fall within the statutory definition.

51 Finder Wallet submits that there were two transactions: first, the purchase of an interest in TrueAUD; and secondly, an investment involving the allocation (and outright disposal) of that interest in TrueAUD to Finder Wallet in exchange for the contractual right to the Return. Finder Wallet says that the fact that those two transactions happened in close succession does not mean that they can or should be conflated.

52 Finder Wallet submits that the first transaction involves the payment of Australian dollars to it in exchange for an interest in TrueAUD and that it cannot viably be said that the purchase of a currency amounts to a deposit or loan of Australian dollars to Finder Wallet. It submits that the second transaction is the making of an investment involving the allocation by the customer of TrueAUD to Finder Wallet, in exchange for the contractual right to the Return, which is not a lending or deposit relationship. Finder Wallet submits that the Terms make clear that the transaction involves the outright disposal of title to the TrueAUD by the customer, linked to a contractual right to a subsequent acquisition.

53 Finder Wallet submits that it is relevant that the product in question was quite different from that contemplated by the “usual fundraising activities traditionally associated with the issue of debentures” and that, to the extent that there is room for the “commercially sensible” or “substantive” approach taken by ASIC, then the Court would readily incline to the opposite view. That is, that the Finder Earn product was an opportunity for Finder Wallet to market its services and the Finder App and comprised a form of investment which “cannot be characterised as an undertaking to repay the loan as a debt”, referring to ABN Amro at [676].

54 Finder Wallet submits that it is by no means clear that a customer participating in the Finder Earn product had a chose in action in the relevant sense within the meaning of s 9 of the Corporations Act. It contends that plainly a customer had a contractual right as against Finder Wallet to the credit of TrueAUD equivalent to the amount of the Allocation and the Return and that right is a chose in action at common law. Finder Wallet observes that, equally, in ABN Amro, the relevant financial instrument conferred on the unitholder a contractual right to repayment of an amount that had been invested and such a right was not held to be a debenture.

55 Finder Wallet submits that it is for ASIC to make good its proposition that any form of contractual right satisfies the element of a “chose in action” within the meaning of the definition of debenture in s 9 of the Corporations Act and that in this case it has not done so.

Legal principles

56 At common law a debenture has two characteristics: it is issued by a company; and it acknowledges or creates a debt. The debt may be secured on assets of the company, but security is not an essential characteristic of a debenture: Handevel Pty Ltd v Comptroller of Stamps (Vic) (1985) 157 CLR 177 at 195-6.

57 The common law definition was modified by s 9 of the Corporations Act which includes a definition of “debenture” (see [16] above).

58 That definition focuses on the legal right to repayment of a debt. It differs from the common law definition “by treating as the debenture the rights of the debenture holder, rather than the documentary evidence of those rights”: see Principles of Corporations Law at [19.070].

59 In ABN Amro a Full Court of this Court (Jacobson, Gilmour and Gordon JJ) considered, among other things, whether particular notes, known as Rembrandt notes, were debentures and therefore securities for the purposes of the Corporations Act. That question required the Full Court, in turn, to consider the definition of “debenture” in s 9 of the Corporations Act.

60 At [621] the Full Court noted the parties’ acceptance, as found by the primary judge, that the notes were choses in action thus satisfying that part of the definition. However, the primary judge held that the notes were not debentures because: first, the chose in action did not “include an undertaking by the body to repay as a debt money deposited with or lent to the body”; and secondly, para (a)(ii) of the exception to the definition operated because the body which received the money did not receive the money as “part of a business of… providing finance”.

61 At [642]-[650] under the heading “The statutory definition of a debenture” the Full Court observed:

642 The definition of a debenture in s 9 of the Corporations Act departs in a number of respects from the common law meaning and from earlier statutory definitions. The new definition was introduced by amendments which became effective on 13 March 2000: see Ford HAJ, Austin RP and Ramsay IM, Ford’s Principles of Corporations Law (LexisNexis, subscription service) at [19.070] (service 86).

643 Under the former definition a debenture was a document issued by a corporation that created or acknowledged a debt: Explanatory Memorandum to the Corporate Law Economic Reform Program Bill 1998 (Cth) at 72. This followed the common law which grappled with difficulties in defining the precise nature of the term but accepted that the two essential characteristics of a debenture were:

“… first that it is issued by a company and, secondly, that it acknowledges or creates a debt”: Handevel Pty Ltd v Comptroller of Stamps (Vic) (1985) 157 CLR 177 at 195.

644 The amendments to the definition were intended to facilitate electronic commerce in debentures by focusing on the legal right to repayment of the debt rather than the piece of paper which evidenced it: Explanatory Memorandum at 72.

645 Thus, the amended definition departs from the earlier law in two respects. First, a debenture is defined as a chose in action rather than a document. This departure may be more of form than substance because a debenture has always been understood as constituting a chose in action: see for example, Gower LCB, Modern Company Law (2nd ed, Stevens and Sons Ltd, 1957) p 385.

646 The second departure from the earlier definition is that the chose in action must include an undertaking by the body which issues the debenture to “repay as a debt” money that has been deposited with or lent to it.

647 The definition goes on to say that the chose in action may (but need not) include a security interest over property of the body to secure repayment of the money. This corresponds with the common law nature of a debenture under which the document generally, but not necessarily, contained a charge on the undertaking of the company to support its indebtedness: Lemon v Austin Friars Investment Trust [1926] Ch 1 at 15 (Pollock MR).

648 The description of these essential characteristics of a debenture is contained in the chapeau to the definition in s 9. The chapeau is followed by a number of exclusions to which we will refer later.

649 Whilst the chapeau purports to contain an exclusive definition of a debenture, it must be borne in mind that the function of a statutory definition is to act as an aid to construction of the statute. It is to be read as part of the fabric of the statute and is not to be given a narrow, literal meaning and then used to negate the purpose or policy of the substantive enactment: Kelly v The Queen (2004) 218 CLR 216 at [84] and [103] (McHugh J).

650 It follows that the proper approach to the construction of the definition of a debenture in s 9 is to consider its meaning in light of the regulatory focus of the Corporations Act, in particular in Chs 2L and 6D. Those Chapters of the Corporations Act recognise that the nature of a debenture is, as it always has been, inextricably bound up with its function as an important aspect of corporate fundraising.

62 After referring to the relevant definition of “security” for the purpose of Ch 6D of the Corporations Act, at the time found in s 761A, and noting that it relevantly included “a debenture of a body”, the Full Court observed (at [661]) that the question that arose involved “the application of the statutory definition of a debenture, considered in its proper context, to a highly complex financial product”. There was no dispute that the financial product was a derivative; the issue that arose was whether it was a debenture.

63 The Full Court observed (at [662]) that the statutory definition is to be considered in light of the legislative history of the nature of a debenture and its function as an element of corporate fundraising. The Full Court found at [671] that the noteholders’ right to redemption and the sum payable was not linked to the conduct of the business of either ABN Amro or Perpetual but to the performance of certain credit indices against which the value of the investment and the amount that was payable upon redemption was to be measured. Their Honours observed that the contingency which determined the amount due to noteholders could arise prior to the maturity date of the notes. The Full Court concluded that the notes were a financial product within the meaning of s 763A of the Corporations Act. However, that conclusion did not answer the question of whether they were also a debenture.

64 At [673]-[674] the Full Court said:

673 The question which then arises is whether an obligation to redeem the Rembrandt notes at a time, or in an amount, contingent upon the notional returns generated by the performance of the underlying credit indices in which subscription moneys are notionally invested, is a debenture in accordance with the statutory definition in s 9. That is to say, does an instrument which provides for a return of the amount deposited, at a time and in an amount, not linked to the conduct of the business of the company which issued it but instead measured by the performance of a separate index, fall within the meaning of a debenture?

674 In our opinion it does not, at least in relation to the Rembrandt notes. There are a number of reasons for this.

65 Their Honours set out four reasons for their conclusion, the first of which they relevantly explained in the following way:

675 First, when the words of the chapeau to the definition in s 9, “to repay as a debt money deposited with or lent to” the company, are read in light of the regulatory provisions of Chs 2L and 6D, it is evident that those words import the notion of an undertaking to repay a debt comprising a loan made to the company as part of its working capital.

676 Here, the nature of the loan and the obligation to repay it are quite different from that which is contemplated by the usual fundraising activities traditionally associated with the issue of debentures. The loan made by LGFS was a particular form of investment in a financial product under which the obligation to redeem the investment by paying the Redemption Amount, both as to time and amount, was linked to the performance of the indices against which the value of the loan moneys was to be measured.

677 In our view the obligation to redeem that form of investment cannot be characterised as an undertaking to repay the loan as a debt. The obligation is different in nature from that which is ordinarily involved in the repayment of a loan, even one which is limited in recourse: cf Federal Commissioner of Taxation v Firth (2002) 120 FCR 450 at [73]-[74].

678 Whilst the statutory definition of a debenture departs from the common law, it would be surprising if a statutory definition which was intended to facilitate electronic commerce in debentures drastically altered the nature of a commercial instrument as understood for many generations.

66 At [684] the Full Court identified the second reason for reaching its conclusion that the notes were not a debenture, stating:

Second, it is true that a debt is capable of including a debt that is repayable on a contingency. But the word “debt” is not one of precise and inflexible denotation. It must be applied in a practical and common sense fashion, consistent with its context and statutory purposes: Hawkins v Bank of China (1992) 26 NSWLR 562 at 572. …

67 The third reason was, as the Full Court observed at [691], that as a general rule the term debenture was not applied at common law to an instrument unless it purported to be a debenture. Their Honours noted that the form and structure of a document gives some guidance as to the intentions and commercial objectives of the parties. Their Honours continued (at [692]) as follows:

Here, the Rembrandt notes were called “Notes”. It is true that terms of the Issue Notice describe the Notes as creating a debt and that they use the language of debt to describe the obligations of Perpetual to the noteholders. But instruments such as promissory notes would not ordinarily be described as debentures. Something more is required before the instrument can be characterised as a debenture: Re Bauer Securities Pty Ltd (1990) 4 ACSR 328 at 335; affirmed in Re Austral Mining Construction Pty Ltd [1993] 1 Qd R 358.

68 At [694] the Full Court stated its fourth reason for its finding, namely that “it is fundamental to the nature of a debenture that it be issued by the company which borrowed the funds: Levy at 264. It is that company which must acknowledge the debt and undertake to repay it”.

Consideration

69 As a preliminary matter, it is convenient to address ASIC’s contention that the terms of the Finder Earn product are not found in a single source but are found “across the [Terms], the Finder App, the marketing material accessible through both the Finder App and the [Finder Website] and the individual customer’s investment of a certain amount for a particular period of time”.

70 That said, as ASIC seems to accept, customers could only participate in the Finder Earn product in accordance with the Terms. In my view, it is the Terms, and not the marketing or explanatory material located on the Finder App or the Finder Website, that govern the relationship between Finder Wallet and the customer.

71 In Toll (FGCT) Pty Ltd v Alphapharm Pty Ltd (2004) 219 CLR 165 at [40] the High Court (Gleeson CJ, Gummow, Hayne, Callinan and Heydon JJ) observed that the rights and liabilities of parties to a contract are not determined by the subjective beliefs or understandings of the parties and that:

What matters is what each party by words and conduct would have led a reasonable person in the position of the other party to believe. References to the common intention of the parties to a contract are to be understood as referring to what a reasonable person would understand by the language in which the parties have expressed their agreement. The meaning of the terms of a contractual document is to be determined by what a reasonable person would have understood them to mean. That, normally, requires consideration not only of the text, but also of the surrounding circumstances known to the parties, and the purpose and object of the transaction.

(Footnotes omitted.)

72 The Terms were available on the Finder App. They were not signed by the customer. Rather, to participate in the Finder Earn product a customer was required to “click” a box marked “Understood” before the customer could proceed to acquire and then transfer TrueAUD to Finder Wallet. At that screen a pop-up appeared which reiterated the process and gave the customer an opportunity to read the FAQs and the Terms (see [33(2)] above).

73 Finder Wallet relies on Oceanic Sun Line Special Shipping Company Inc v Fay (1988) 165 CLR 197. In that case the respondent, Dr Fay, and his wife made a booking in New South Wales for a cruise on a vessel owned by the applicant, a Greek company. Upon payment of the fare, he received an “exchange order” which stated that it would be exchanged for a ticket when he boarded the vessel. Upon arrival in Athens Dr Fay obtained his ticket which had printed on it a condition that the Courts of Greece had exclusive jurisdiction in any action against the owner of the vessel. Dr Fay was injured on the cruise and sued the owner claiming damages for negligence in the Supreme Court of New South Wales. The owner was unsuccessful in its application for a stay of the proceeding.

74 The High Court held that the exchange order obtained by Dr Fay in New South Wales constituted a contract of carriage between the parties. Justice Brennan found (at 228) that it was too late after the original contract was made to add conditions which were not incorporated in it, referring to the clause in relation to jurisdiction printed on the ticket provided to Dr Fay subsequently in Athens. His Honour continued (at 228-9):

If a passenger signs and thereby binds himself to the terms of a contract of carriage containing a clause exempting the carrier from liability for loss arising out of the carriage, it is immaterial that the passenger did not trouble to discover the contents of the contract. But where an exemption clause is contained in a ticket or other document intended by the carrier to contain the terms of carriage, yet the other party is not in fact aware when the contract is made that an exemption clause is intended to be a term of the contract, the carrier cannot rely on that clause unless, at the time of the contract, the carrier had done all that was reasonably necessary to bring the exemption clause to the passenger’s notice: Hood v. Anchor Line (Henderson Brothers) Ltd.; McCutcheon v. David Macbrayne Ltd.; Thornton v. Shoe Lane Parking Ltd. per Lord Denning M.R., and per Megaw L.J.

75 As Finder Wallet submits, a party to a contract, in this case Finder Wallet, cannot rely on a clause, or by analogy the Terms unless, at the time of the contract, it has done all that was reasonably necessary to bring the clause (or the Terms) to the notice of the counter-party to the contract.

76 In Surfstone Pty Ltd v Morgan Consulting Engineers Pty Ltd [2016] 2 Qd R 194 Lyons J considered, among other things, whether certain terms, referred to as Guideline Terms, were incorporated by reference into a contract between the plaintiffs and the defendants. At [70], after surveying the authorities, his Honour said:

My examination of these authorities leads me to adopt the following propositions for determining whether a party (the acceptor) is bound by a term set out or incorporated in an unsigned document which the other party (the offeror) has provided to the acceptor in circumstances which show the offeror intends the document to identify terms of the contract. It is not always the case that the acceptor is not bound by an exemption clause, unless the offeror directs attention to the clause. The fundamental question is whether the offeror is reasonably entitled to conclude that the acceptor has accepted the terms in the document, including the exemption clause. That conclusion should be reached where the second party has had a reasonable opportunity to consider the terms, including the exemption clause, and has behaved in a way which manifests acceptance of the document as recording contractual terms. In other cases, where the clause is one reasonably to be expected in contracts of the kind in question, acceptance of the document makes the clause binding, even if the acceptor does not know its terms, or even that it is contained in the document. If the clause is not one reasonably to be expected, then something more is required by way of provision of information about the clause to the acceptor before the contract is formed. What information will be required will depend on the circumstances, but particularly on the terms of the clause.

77 Insofar as online agreements, like the Terms, are concerned, in Dialogue Consulting Pty Ltd v Instagram Inc (2020) 291 FCR 155 Beach J considered what was required for a party to be bound by such an agreement. In that case the applicant, Dialogue, sought an injunction and other relief in relation to, among other things, its access to “Instagram”. The proceeding was commenced in April 2019. Belatedly, the respondents sought a stay of the proceeding under s 7(2) of the International Arbitration Act 1974 (Cth) relying on an arbitration agreement between Dialogue and Instagram LLC and, with the exception of certain competition claims made by Dialogue, sought to have the proceeding referred to arbitration. Dialogue opposed the application principally because it denied the existence of any arbitration agreement and brought a cross-application which is not presently relevant.

78 One of the questions which arose for determination on the respondents’ application was “whether, applying the relevant law, an arbitration agreement was formed, and determining the parties and its scope”: at [10(c)]. Commencing at [203] Beach J addressed that question. His Honour found (at [214]-[216]) that, on the evidence, an arbitration agreement was formed under Australian law and that the law of the forum, Victorian law, applied to the question of formation of the arbitration agreement. At [217]-[219] his Honour continued:

217 Now under Australian law, what needs to be considered are questions of reasonable notice and manifestation of assent.

218 For example, in Surfstone Pty Ltd v Morgan Consulting Engineers Pty Ltd [2016] 2 Qd R 194, Lyons J accepted that the real issue was whether a contracting party had a reasonable opportunity to consider the terms and, by its conduct, indicated that it had accepted the terms, even in a situation where the contract was unsigned.

219 Further, in Gonzalez v Agoda Company Pte Ltd [2017] NSWSC 1133, Ms Gonzalez had used the website “Agoda” to reserve hotel accommodation. The payment details page contained a link to Agoda’s standard terms and conditions. Ms Gonzalez was required to click on a button marked “Book Now”. Above that button were the words “I agree with the booking conditions and general terms by booking this room …”. Ms Gonzalez clicked on that button and Agoda accepted her booking. Button J found that an exclusive jurisdiction clause in favour of Singaporean law was accordingly incorporated by signature and by reference. His Honour then said (at [123]-[125]):

In particular, I consider that the signature on the digital document provided by Ms Gonzalez clicking the “Book Now” button (by virtue of s 9(1) of the ETA), the location of the linked terms (above the signature on the digital document), and the standard nature of the terms used by Agoda are significant factors, and that on an objective analysis of the intentions of Agoda and Ms Gonzalez as contracting parties, the terms were indeed incorporated.

Explaining my view above in more detail, in terms of incorporation by signature, the terms were readily available to Ms Gonzalez, and Agoda did not seek to conceal the terms. The general rule expressed in Alphapharm at [185] applies, such that Ms Gonzalez, having provided her signature, is bound by the terms …

Moreover, the ability readily to access the terms, and their location (directly above the “Book Now” button), as features of the standard digital document used by Agoda support incorporation by reference, according to the test in Smith [170]-[171].

(His Honour’s reasons were not disturbed on appeal: see Instagram, Inc v Dialogue Consulting Pty Ltd [2022] FCAFC 7.)

79 It follows that online terms and conditions will bind a party, even if unsigned, provided the party had a reasonable opportunity to consider the terms and by his or her conduct indicated acceptance of them.

80 ASIC submits that these authorities establish that where no contract is signed the Court will determine by objective analysis the terms of the contract between the parties and one document will not necessarily contain all of the contractual terms. That may be accepted. However, it does not follow that simply because a customer had reasonable notice of what Finder Wallet said in its FAQs, they formed part of the contract between Finder Wallet and its customers. They do not.

81 That said, as the parties seemed to accept, in characterising the Finder Earn product regard can be had to what Finder Wallet told its customers about how it operated, a matter which I address further below.

82 The effect of the Terms was summarised for a customer before the customer could participate in the Finder Earn product (see screenshot at [33(2)] above) and the customer was required to click “Understood” on the relevant page before he or she could proceed further. That page also included a link to the Terms. Given their location, just under the “Understood” button, the ability to readily access them and their standard nature, I am satisfied that, while they were not signed, the Terms were incorporated by reference and were the sole source of the legal obligations between Finder Wallet and its customers in relation to the Finder Earn product. That is reinforced by the Terms themselves (see for example Recitals A and C of version 3.1 at [32(1)] above).

83 I turn then to address the question of whether the Finder Earn product is a debenture by reference to the questions identified by ASIC in its submissions, albeit in a different order.

Is there a chose in action?

84 There did not appear to be any dispute between the parties that a customer who acquired the Finder Earn product had a chose in action, at least at common law. That is because, upon acquiring or investing in the Finder Earn product, a customer had a contractual right at the end of the Earn Term as against Finder Wallet to be paid an amount of TrueAUD equivalent to the customer’s Allocation and the Return which could be enforced. I am satisfied that this right or promise also constitutes a chose in action within the meaning of s 9 of the Corporations Act.

85 However, as the Full Court cautioned in ABN Amro (at [689]) “not every chose in action which includes an undertaking to make payment of a sum of money, dependent upon any form of contingency, constitutes a debenture of the type contemplated in s 9”. The same may be said of an undertaking to make payment of a sum of TrueAUD, as is the case here.

Was there money deposited with or loaned to Finder Wallet?

86 The next question to address is whether there was any money deposited with or loaned to Finder Wallet. As set out above, in order for a customer to acquire the Finder Earn product, as a first step a customer had to open a Finder Wallet account and transfer AUD to that account from his or her bank account. It was not in dispute that once funds were transferred into a Finder Wallet account, a customer could use those funds for the purchase and sale via the DCE of different cryptocurrencies. As described by Mr Schebesta this was not limited to TrueAUD but included other cryptocurrencies such as Bitcoin and Ethereum and, from on or about 1 July 2022, Shiba Inu, Cardano, XRP, Binance Coin, Solana, Dogecoin, Chainlink, Stellar and Polkadot.

87 Customers had a right to the return of any moneys held in their account and which remained unspent. That is those funds were not simply, and without more, transferred into or made available for the Finder Earn product. While funds remained in a customer’s Finder Wallet account, they earned no return. A customer could use the funds in his or her Finder Wallet account as he or she wished either to acquire the Finder Earn product on which they would earn a Return, to acquire other cryptocurrencies or to do neither and/or to return or transfer the funds held in their Finder Wallet account back to their own bank account.

88 ASIC submits that by paying funds into a Finder Wallet account, the customer received a chose in action which was a promise by Finder Wallet to repay those funds on demand. ASIC referred to Philipp v Barclays Bank UK plc [2023] 4 All ER 847 at [28] where Lord Leggatt (with whom Lords Reed, Hodge, Sales and Hamblen agreed) described the contract between a bank and a customer who holds a currency account with the bank including that:

… under ordinary circumstances a bank is not a trustee or fiduciary of money deposited by a customer, but simply a debtor. Money deposited with a bank becomes the bank’s money, to lend or otherwise deal with (so far as the customer is concerned) as it thinks fit. The principal obligation owed by the bank is to discharge its debt to the customer when called upon to do so. …

89 ASIC suggests that the payment by a customer of funds into their Finder Wallet account for the purposes of participating in the Finder Earn product has the same character as a deposit with a bank. ASIC’s contention that that is sufficient to establish a deposit of funds for the purpose of the definition of debenture in s 9 of the Corporations Act cannot succeed.

90 First, that is not the case put by ASIC. As is apparent from its concise statement (see [6] above) ASIC contends that it is the acquisition of the Finder Earn product and its transfer to Finder Wallet by the steps it describes that constitutes the relevant deposit or loan of moneys for the purpose of the definition of debenture.

91 Secondly, banks accept deposits from customers principally as a way of raising capital. That is not the purpose of a transfer by a customer of funds into a Finder Wallet account.

92 While at that point the customer may be an unsecured creditor of Finder Wallet for the balance of his or her account, the purpose for which the moneys are paid into the Finder Wallet account is to allow the customer to use Finder Wallet’s services either by investing in a particular cryptocurrency or, during the Relevant Period, by investing in the Finder Earn product. At that stage the funds were not “deposited with or lent to” Finder Wallet in the way envisaged by s 9 of the Corporations Act.

93 In order to acquire the Finder Earn product a customer had to undertake the steps set out at [33(1)-(4)] above. Those steps were: first, the customer purchased TrueAUD using funds held by the customer in his or her Finder Wallet account; and secondly, the TrueAUD was transferred or allocated by the customer to Finder Wallet. At that stage, legal title to the TrueAUD passed to Finder Wallet and the customer had a contractual right to the Return which was paid at the end of the Earn Term.

94 It is the first step that is relevant to the question of whether there was money deposited with or loaned to Finder Wallet. The customer at that stage simply purchased TrueAUD. As Finder Wallet submits, that could not be characterised as a deposit of moneys or a loan to Finder Wallet. It is a payment by the customer of AUD held in his or her Finder Wallet account in exchange for an equivalent amount of TrueAUD. It was the TrueAUD, a cryptocurrency or, as senior counsel for Finder Wallet characterised it, a species of property, that was then transferred or loaned to Finder Wallet for it to use as it saw fit. It is not a deposit with or loan of moneys to Finder Wallet but, as specified in the Terms, the transfer or loan of the TrueAUD, an asset, the legal title to which is held by Finder Wallet for the duration of the Earn Term.

95 True it is that Finder Wallet did not debit an equivalent amount of TrueAUD from its TrueAUD account to the customer’s account for each purchase by a customer but, rather, made a book entry in the customer’s account. However, Finder Wallet’s obligation, as set out in the Terms, was to repay the TrueAUD allocated or transferred to it by the customer plus the Return in TrueAUD, to convert that amount to AUD and pay the AUD equivalent amount into the customer’s Finder Wallet account.

Was there an undertaking by Finder Wallet to repay moneys “deposited or lent” as a debt?

96 The final question to address is whether the chose in action included an undertaking by Finder Wallet to repay moneys deposited or lent as a debt.

97 At [675] of ABN Amro (see [64] above) the Full Court noted that the words in the chapeau to the definition of debenture “to repay as a debt money deposited with or lent to” the company when read in light of the regulatory provisions in Chs 2L and 6D import the “notion of an undertaking to repay a debt comprising a loan made to the company as part of its working capital”.

98 Assuming I am wrong about the characterisation of the Finder Earn product set out above and that there was in fact a deposit or loan of money, it is difficult to see how that deposit or loan was made to Finder Wallet as part of its working capital. While the Terms permitted Finder Wallet to use the TrueAUD transferred to it in any way it wished, the purpose of the Finder Earn product was, as described by Mr Schebesta and as was evidenced by Finder Wallet’s letter to ASIC (see [21] above), to promote the growth and use of the Finder App which offered a range of services as well as giving customers an opportunity to sell their cryptocurrency to Finder Wallet and earn a return. As to the former, Finder Wallet said that the value the Finder Earn product drove to the Finder App would ultimately determine the Return that Finder Wallet was willing to pay customers invested in that product.

99 Just as in my opinion there were no moneys deposited or lent, there was equally no undertaking by Finder Wallet to repay any moneys as a debt. Rather, there was a contractual promise to return to the customer the TrueAUD allocated by the customer to Finder Wallet together with the Return earned on that allocation over the Earn Term, which was also paid in TrueAUD. The customer made an investment in the Finder Earn product by allocating the customer’s TrueAUD to Finder Earn in exchange for the Return.

100 While Finder Wallet used the terminology of “loans” and “lending” in describing the Finder Earn product, for example in its FAQs and on the Finder Website, the contractual obligation to repay the TrueAUD allocated to Finder Wallet by a customer and the Return earned on that allocation (or investment) is “different from that which is contemplated by the usual fundraising activities traditionally associated with the issue of debentures” (see ABN Amro at [676]).