FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Westpac Banking Corporation (Penalty Hearing) [2024] FCA 52

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | WESTPAC BANKING CORPORATION ACN 007 457 141 Defendant | |

DATE OF ORDER: |

THE COURT DECLARES THAT:

Unconscionable conduct

1. On 20 October 2016, the defendant (Westpac) contravened s 12CB of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) by engaging in the pre-hedging trading as set out in the Schedule, which was conducted in trade or commerce in connexion with the supply of financial services, being the interest rate swap executed with the Consortium (Swap Deal), which was in all the circumstances unconscionable, because:

(a) The Swap Deal was the largest interest rate swap executed in one tranche in Australian financial market history with a notional value of $12 billion.

(b) The purpose of the Swap Deal was for Westpac’s counterparty, the Consortium, to minimise and control its risk of interest rate movements associated with the debt facility for funding its purchase of a 50.4% interest in Ausgrid from the NSW State Government and related ongoing funding requirements.

(c) Westpac was aware that:

(i) On execution of the agreement for the acquisition of the interest in Ausgrid with the NSW State Government and until execution of the Swap Deal, the Consortium was exposed to variable interest rate risk on the $12 billion debt facility;

(ii) The Consortium was particularly concerned about the risk of the selected counterparty to the proposed Swap Deal engaging in on-market trading ahead of execution of the Swap Deal in a manner that might increase the market rate and therefore the price of the Swap Deal to its detriment;

(iii) The Consortium had sought, and Westpac had quoted, an execution margin on the basis that Westpac would receive no notice of the Swap Deal;

(iv) As a result of paragraph (1)(c)(iii) above, Westpac would have no opportunity to conduct any on-market pre-hedging with knowledge of the precise timing of the Swap Deal;

(v) On-market pre-hedging trading would expose the Consortium to the risk that the price of the Swap Deal would increase to its detriment.

(d) Despite this awareness:

(i) Westpac had, and acted on, an internal plan to pre-hedge up to 50% of the interest rate risk that it expected to acquire upon execution of the Swap Deal (the Pre-Hedging Plan);

(ii) Westpac’s quoted execution margin for the Swap Deal was lower than the execution margins quoted by all other banks but that quoted execution margin was premised on Westpac's intention to engage in the pre-hedging.

(e) Westpac did not:

(i) clearly and fully disclose the extent of the pre-hedging it intended to engage in;

(ii) disclose the Pre-Hedging Plan to the Consortium at all; or

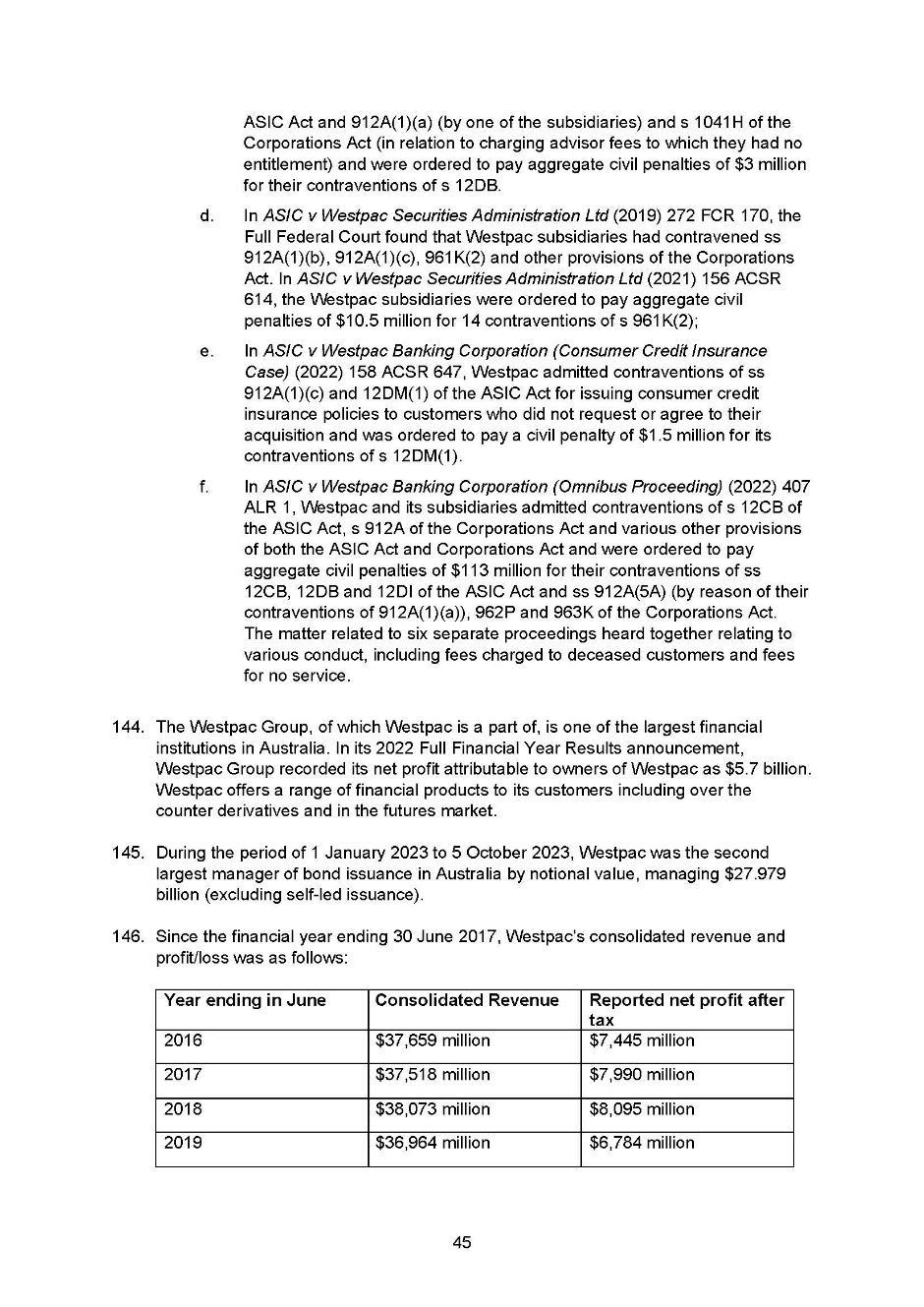

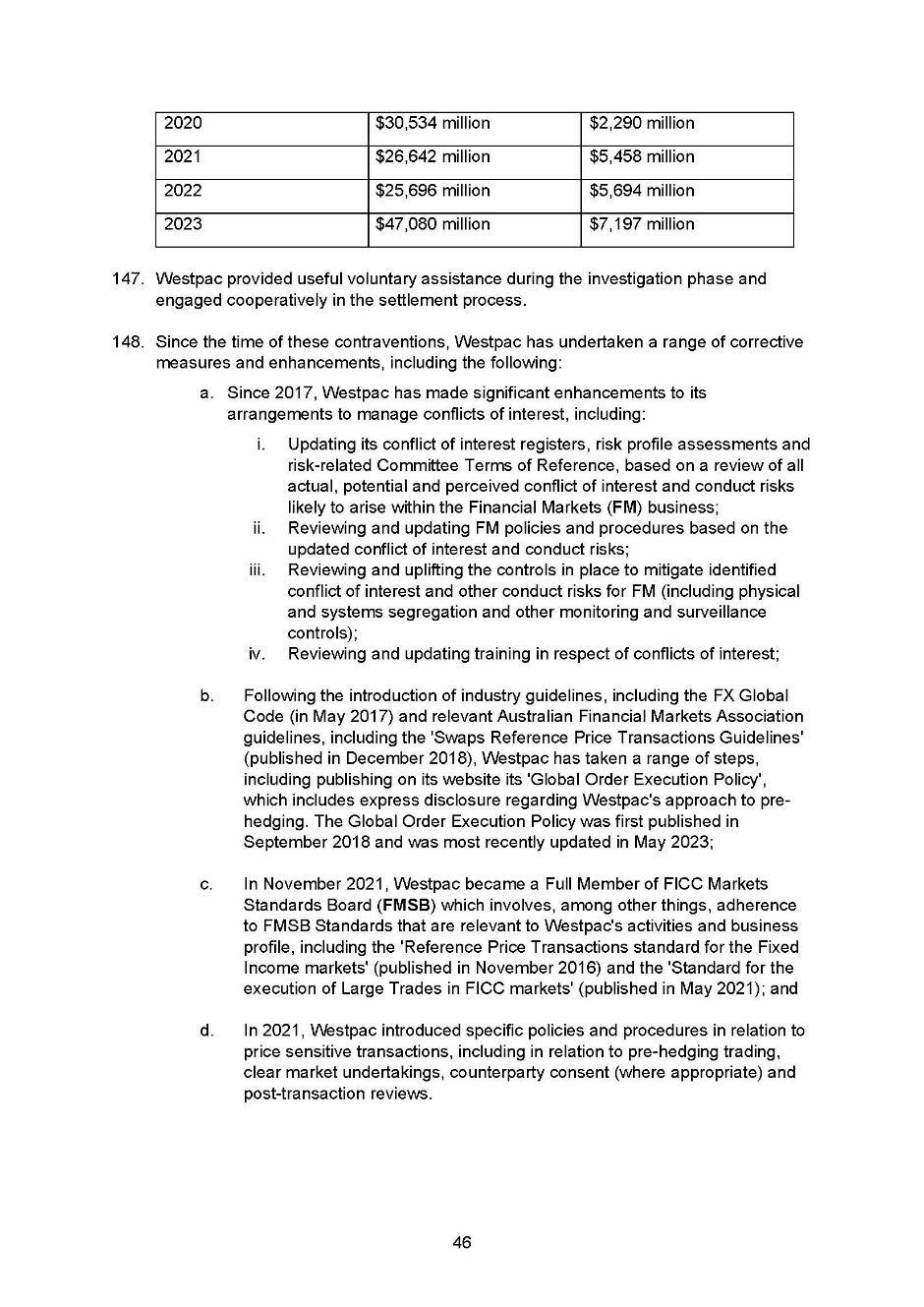

(iii) obtain the consent of the Consortium to the Pre-Hedging Plan.

(f) Westpac’s failure to disclose the matters outlined in paragraph (1)(e) above meant that the Consortium was unable to make a considered and informed decision about whether to proceed to select Westpac as the execution bank for the Swap Deal on the terms offered by Westpac.

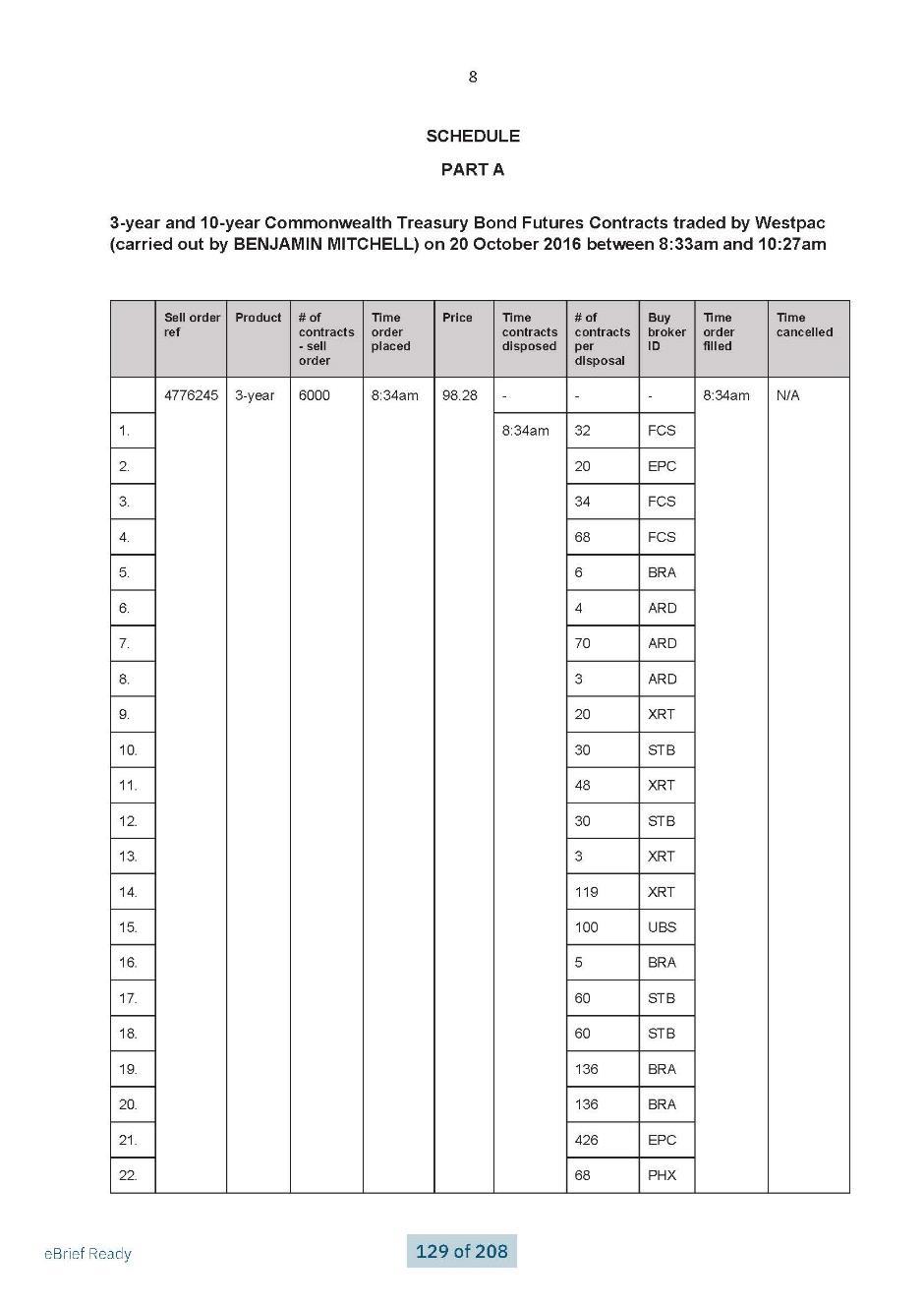

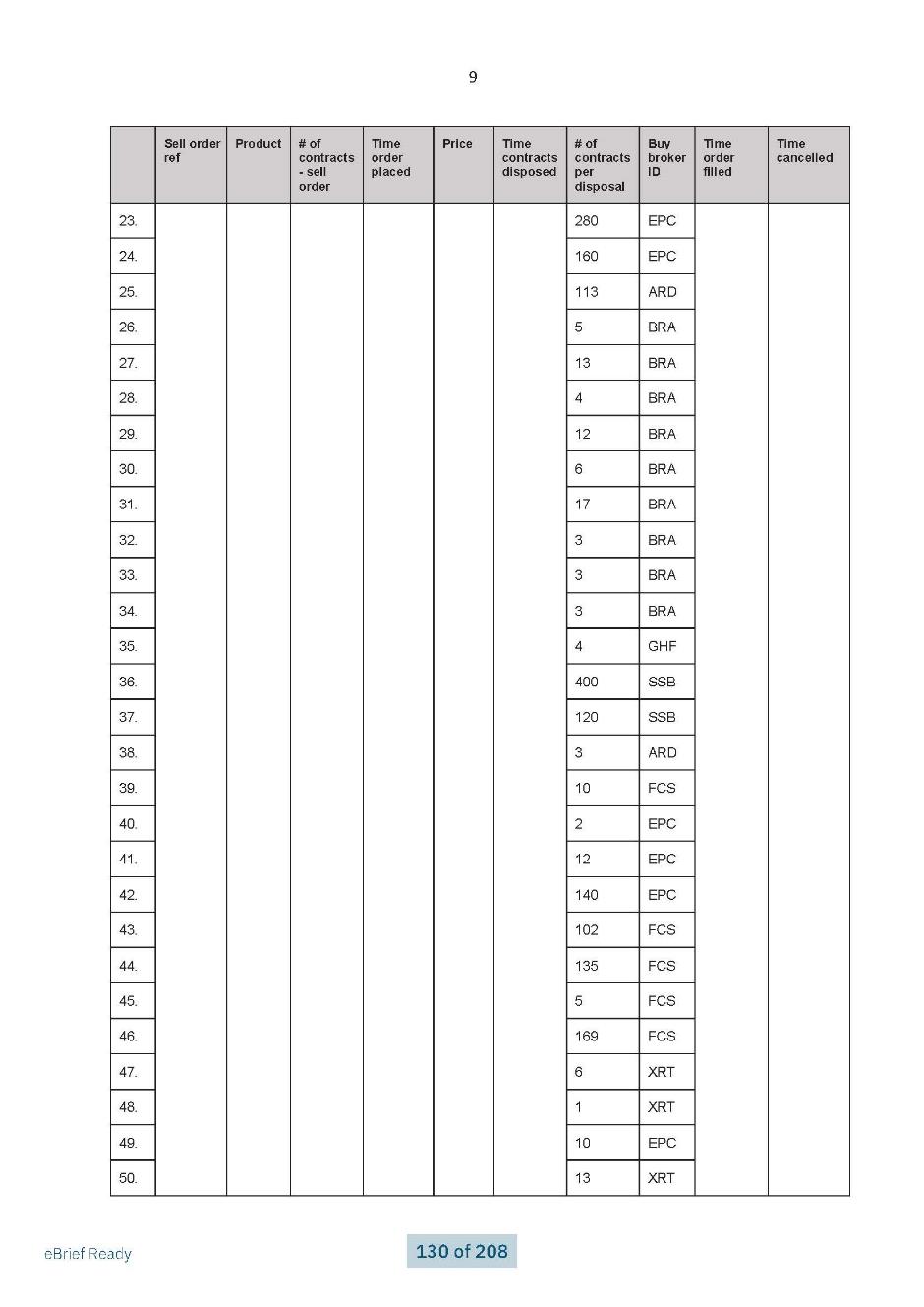

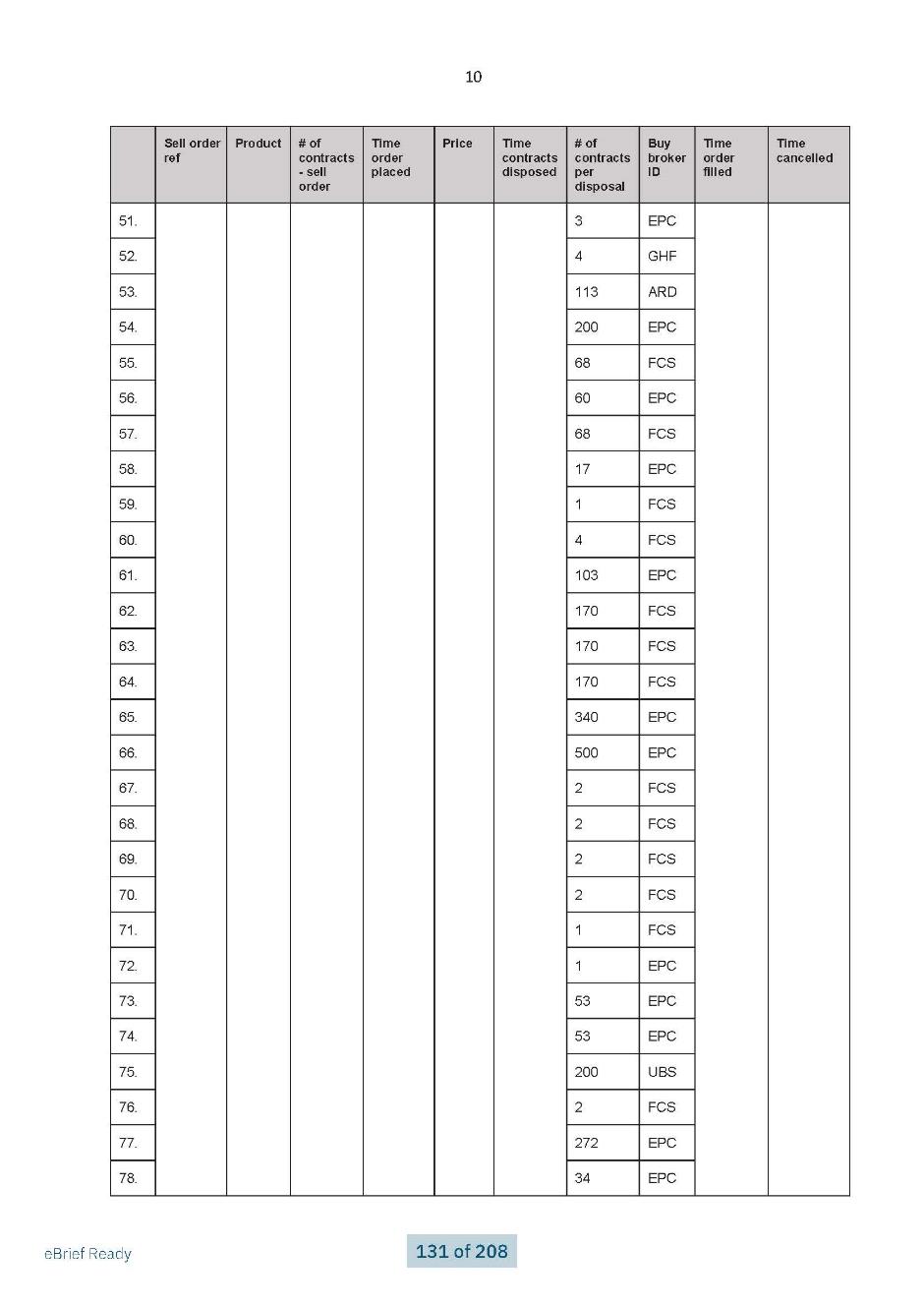

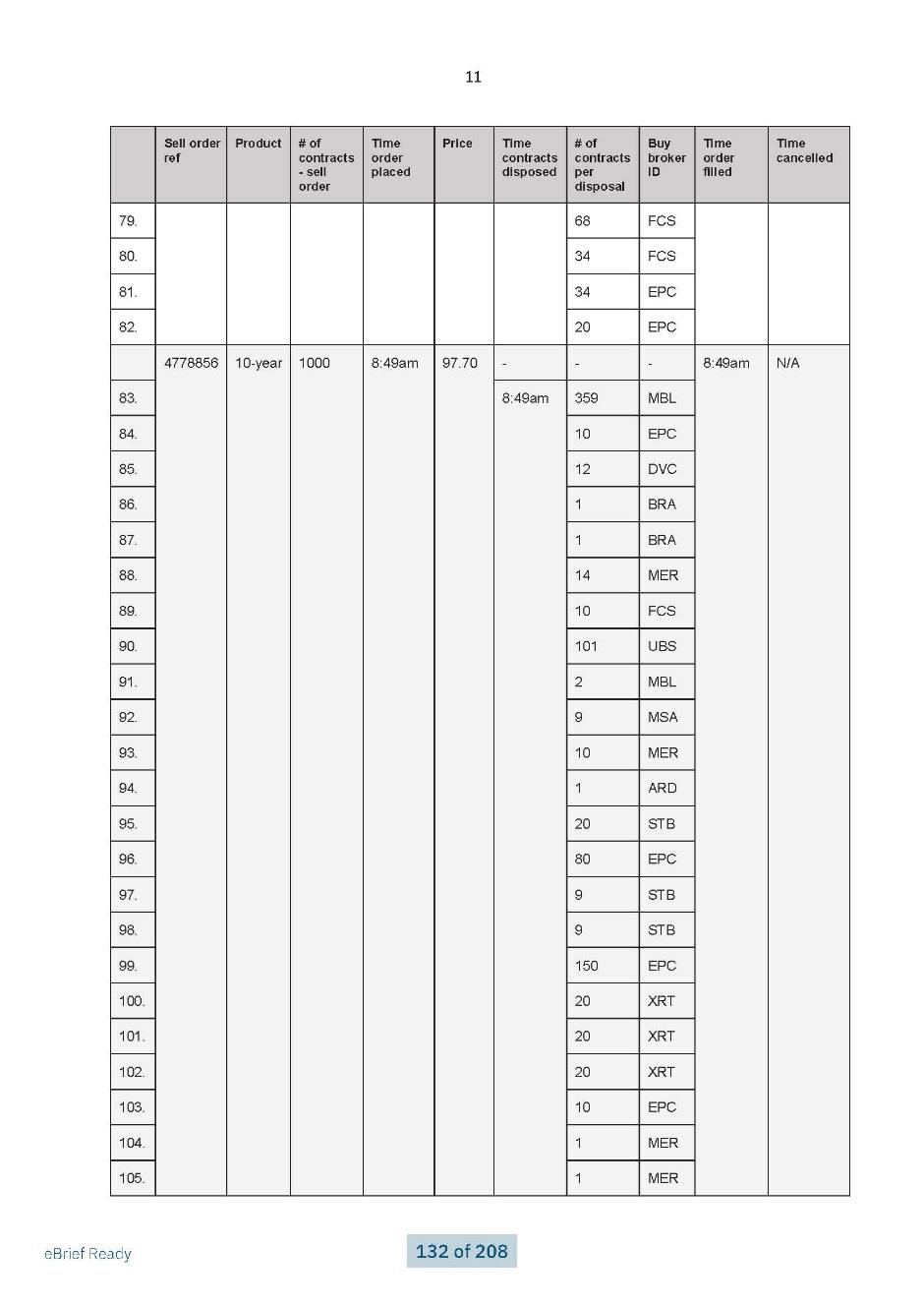

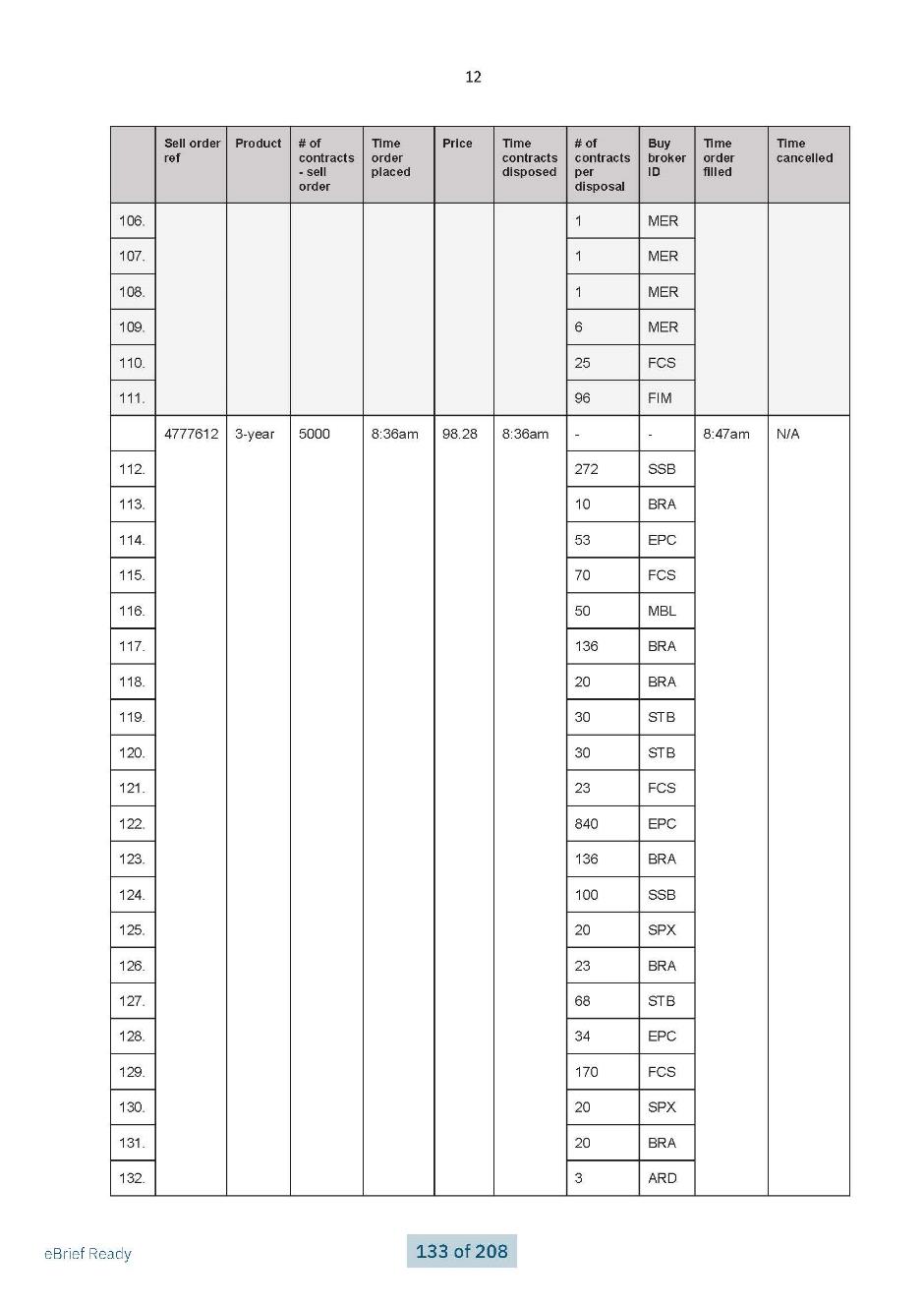

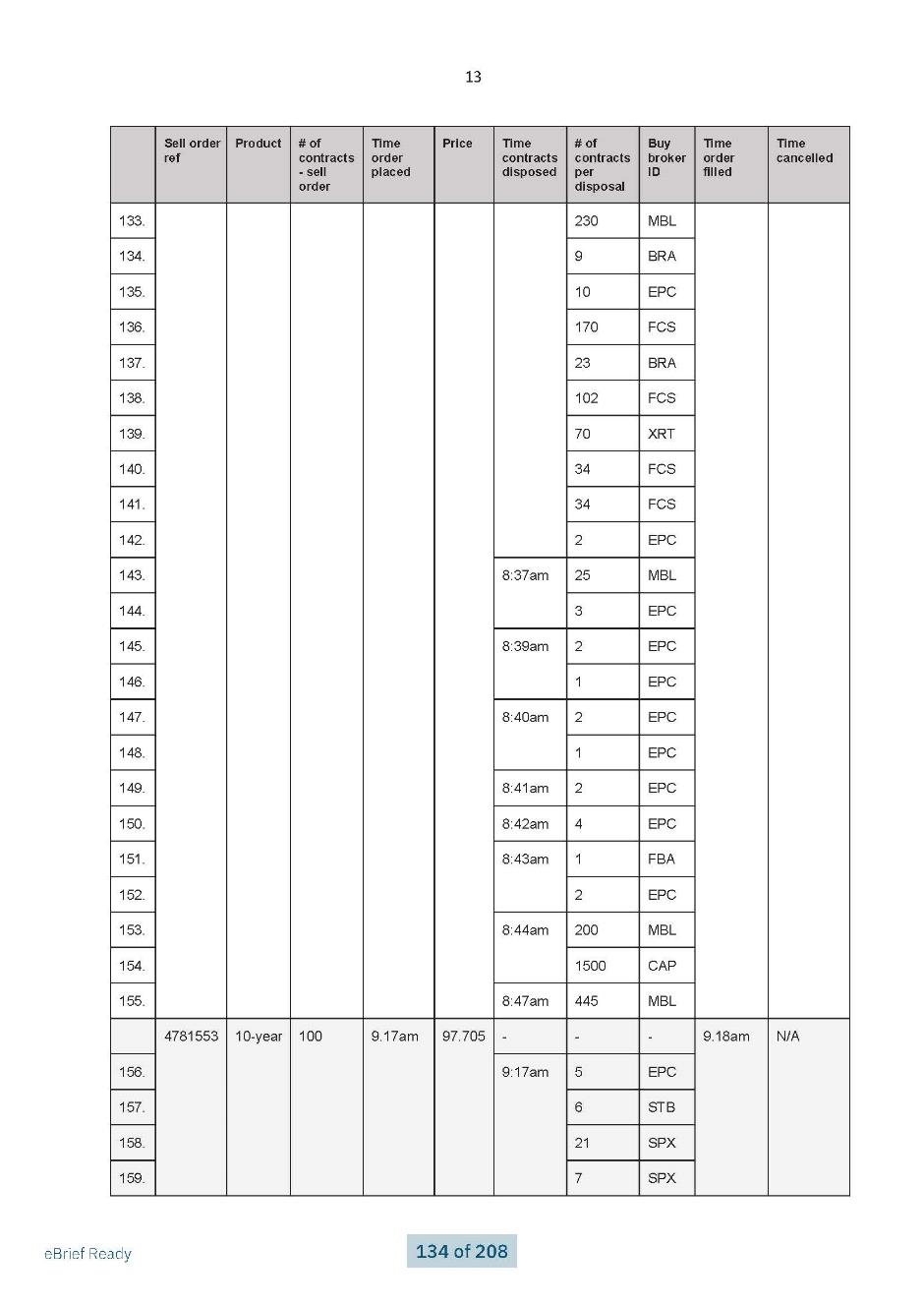

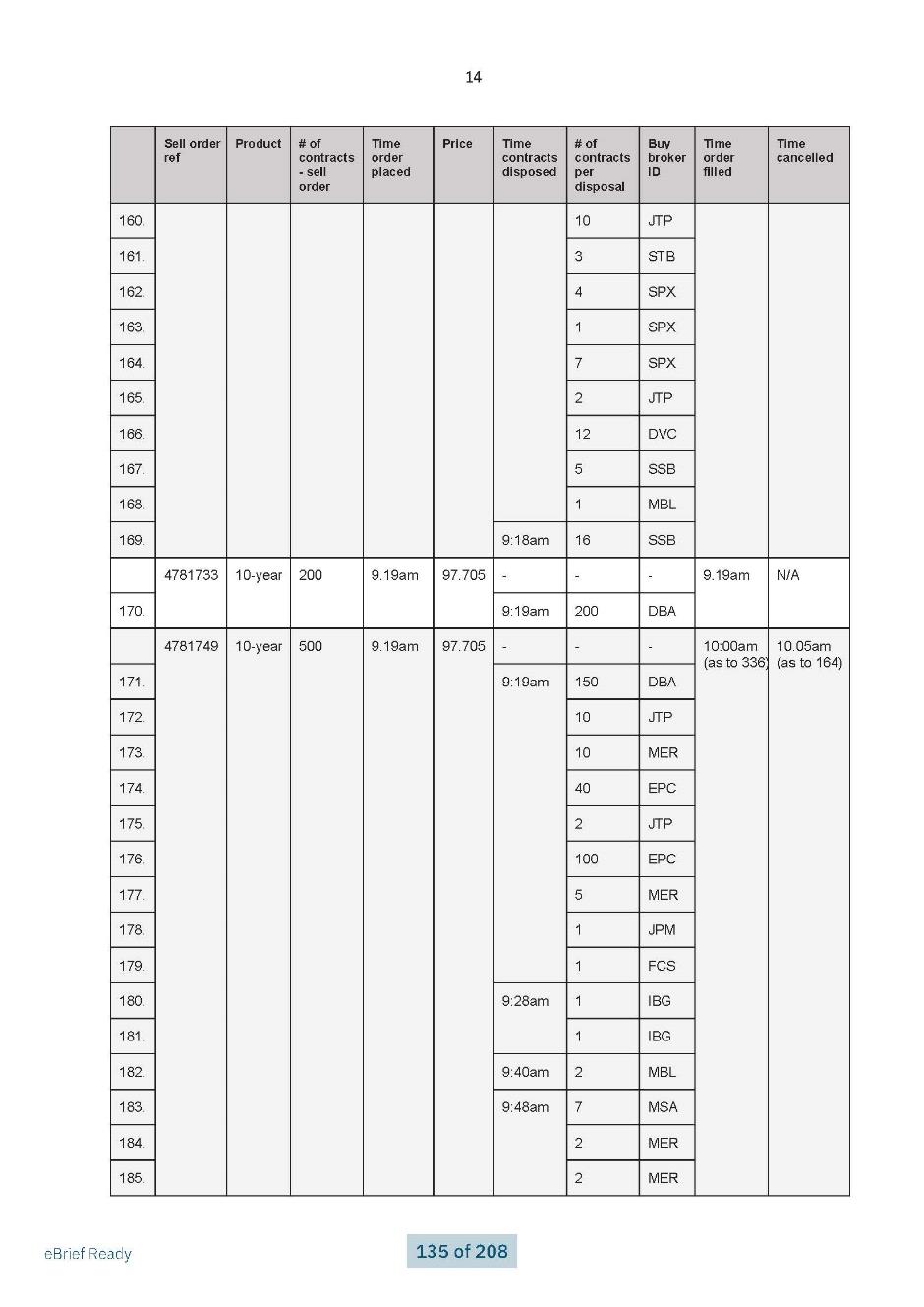

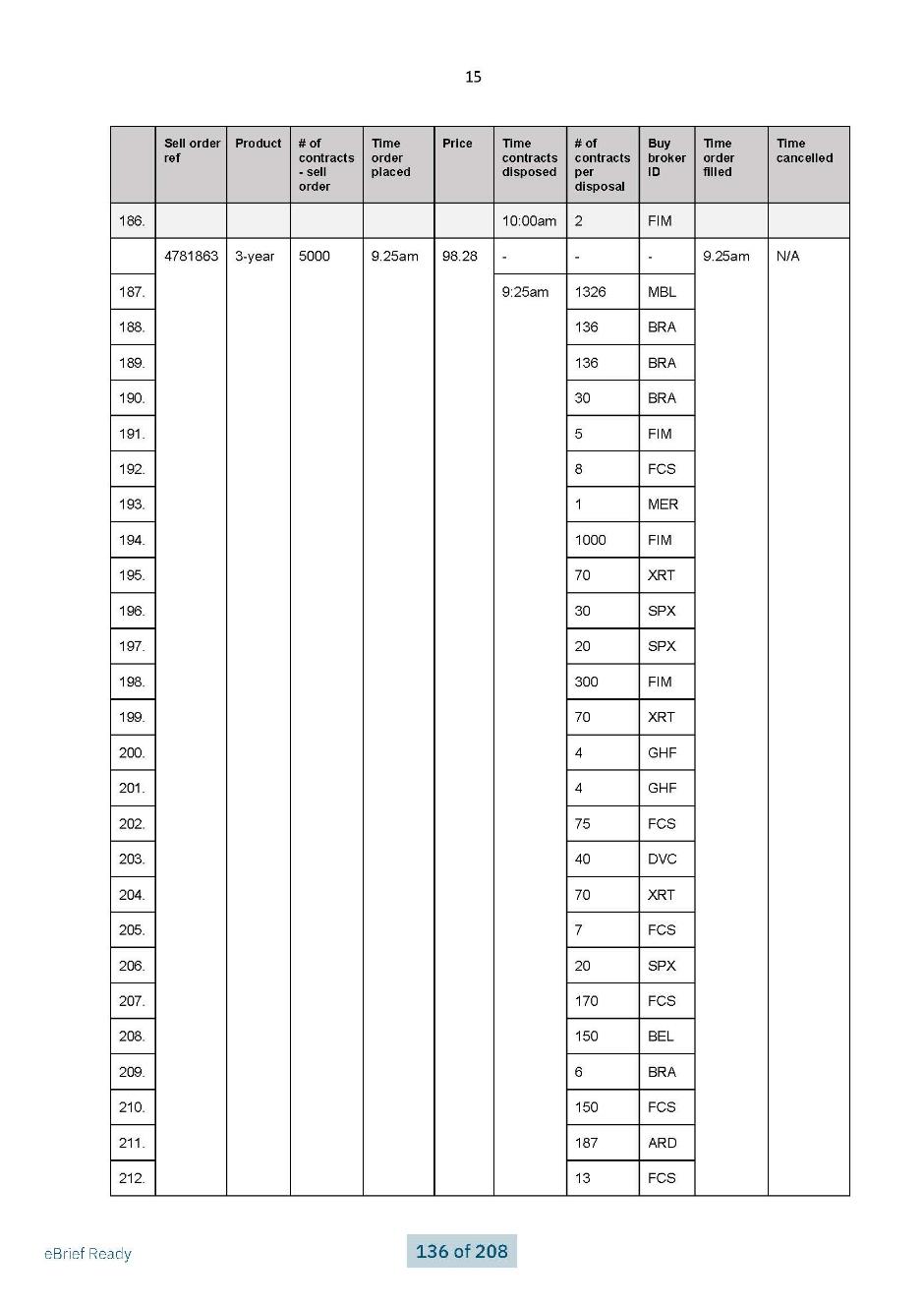

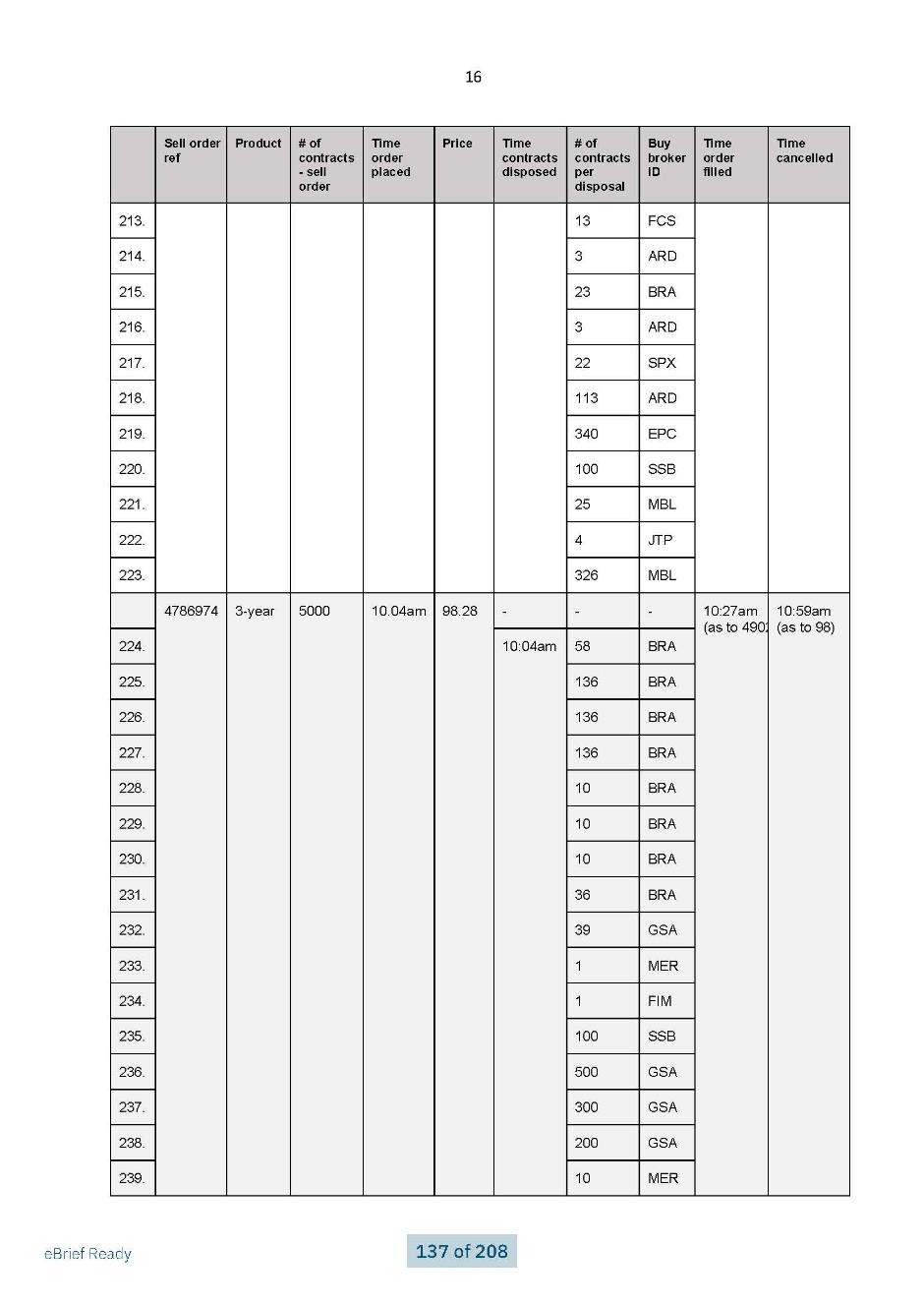

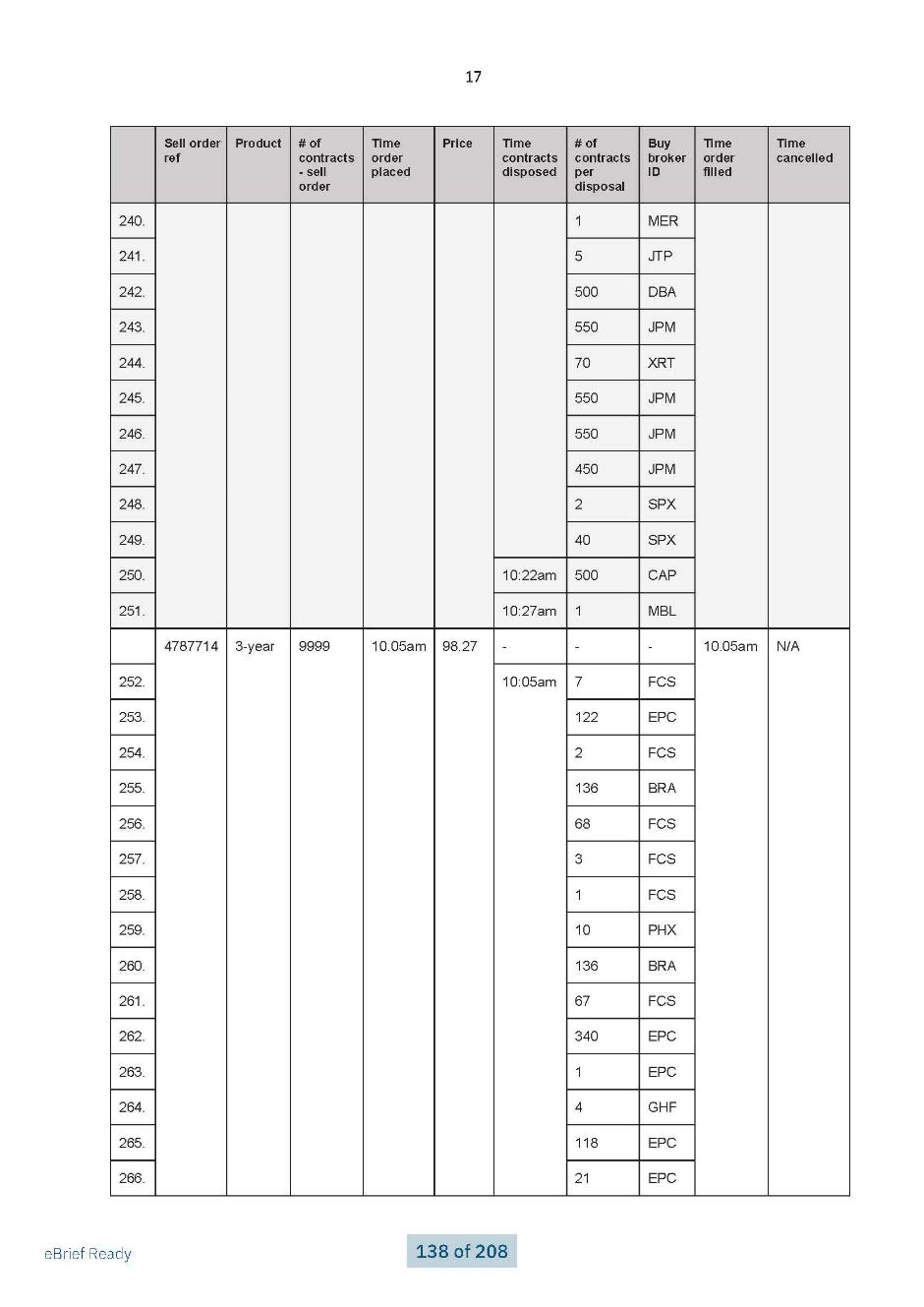

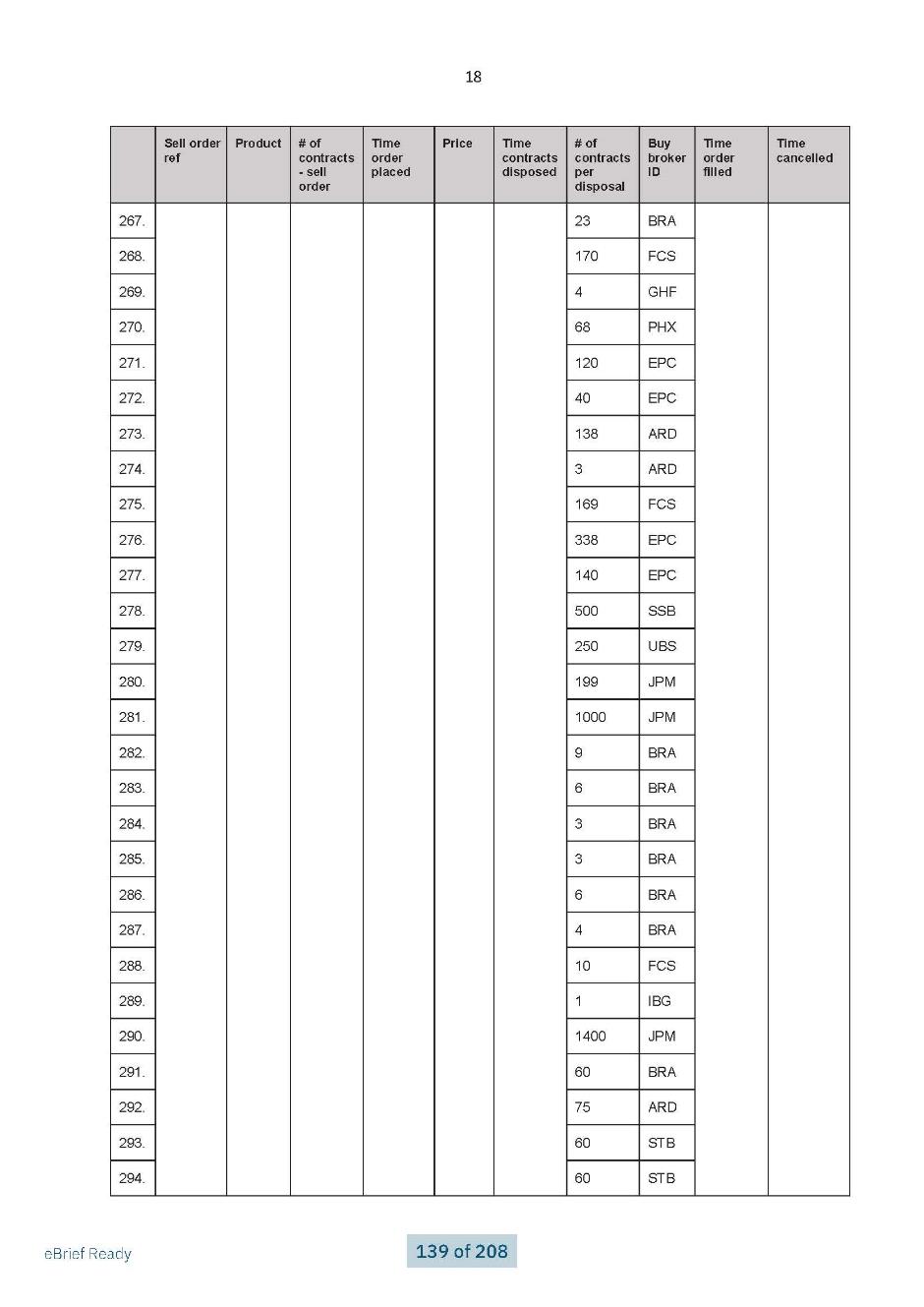

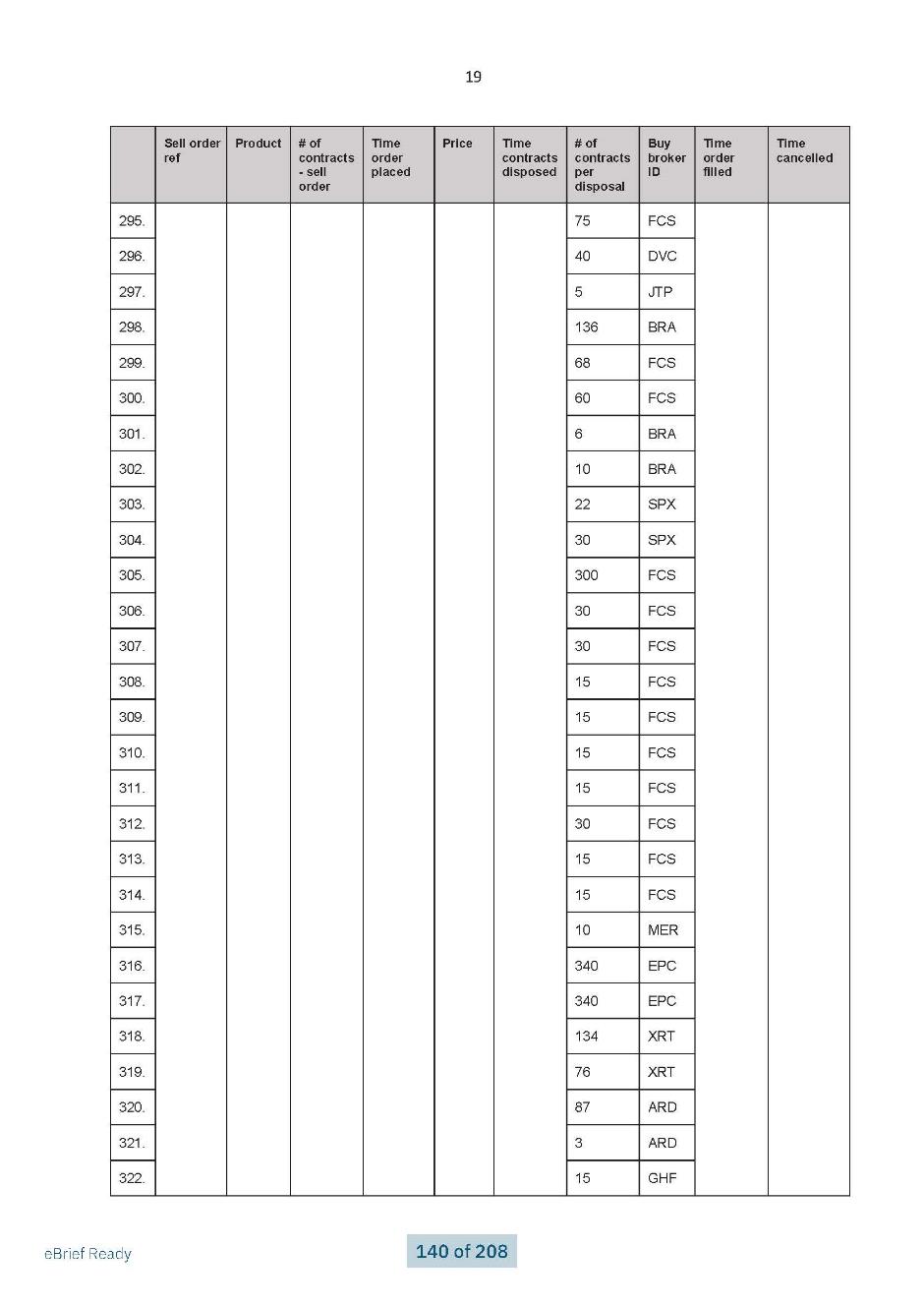

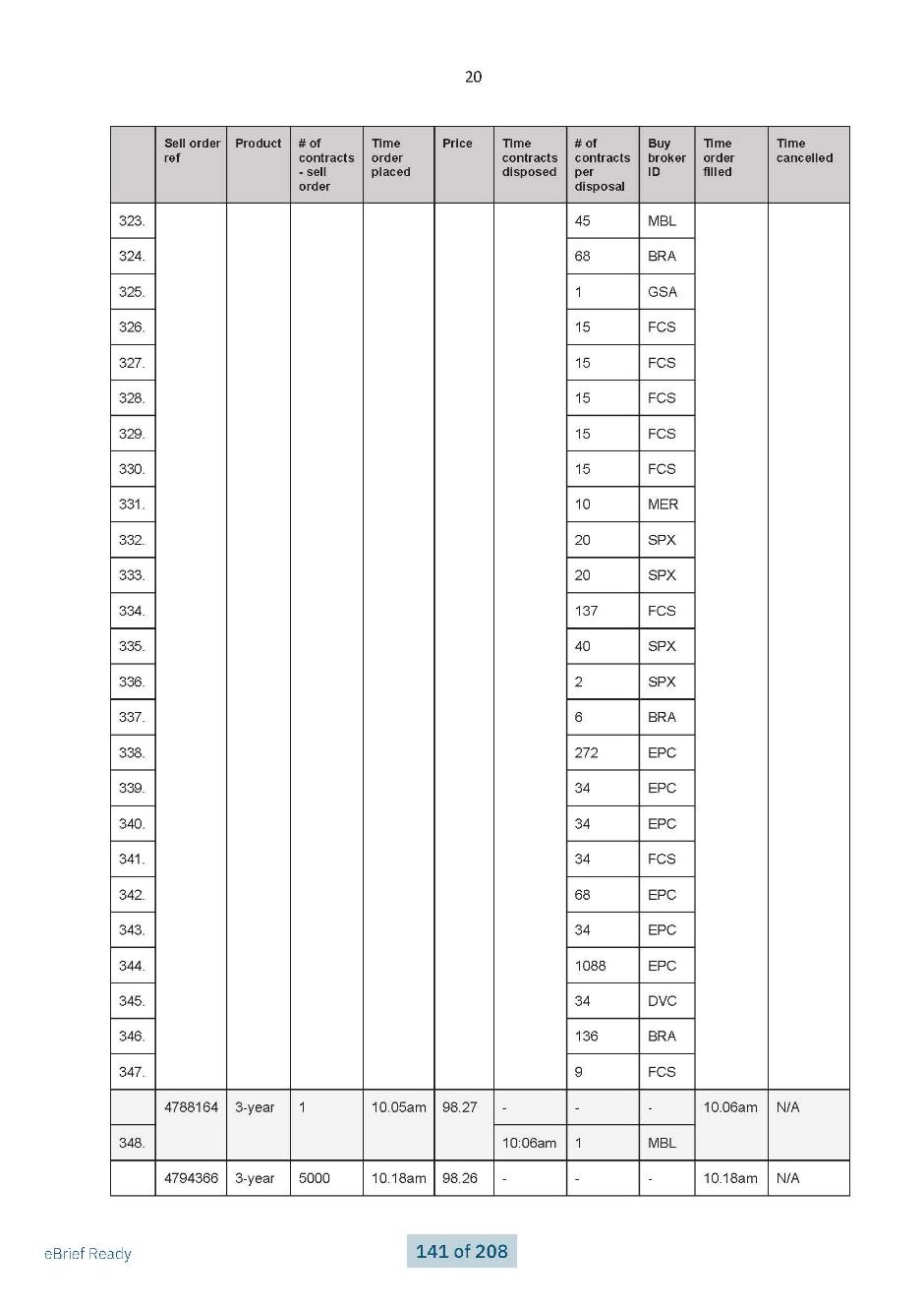

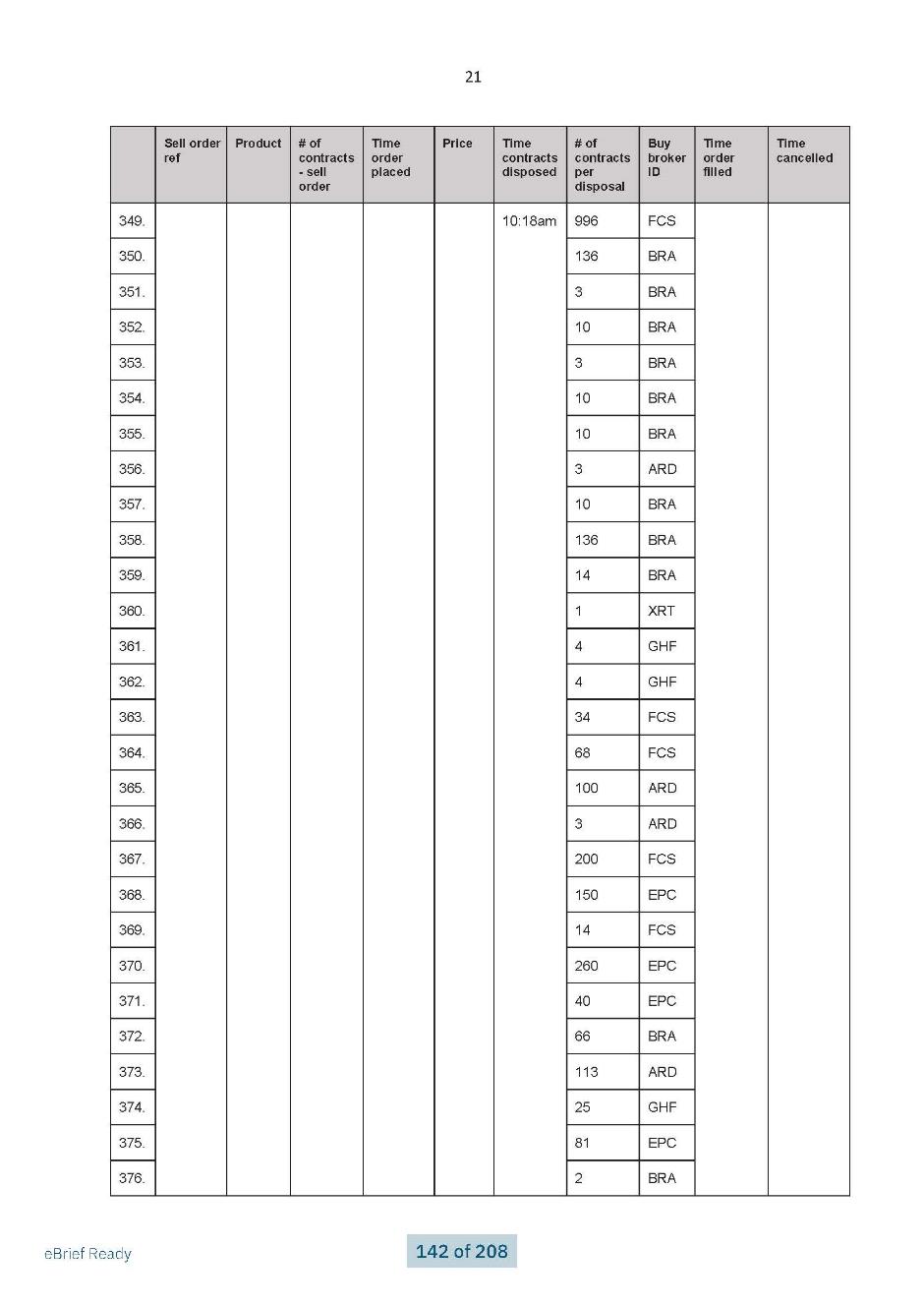

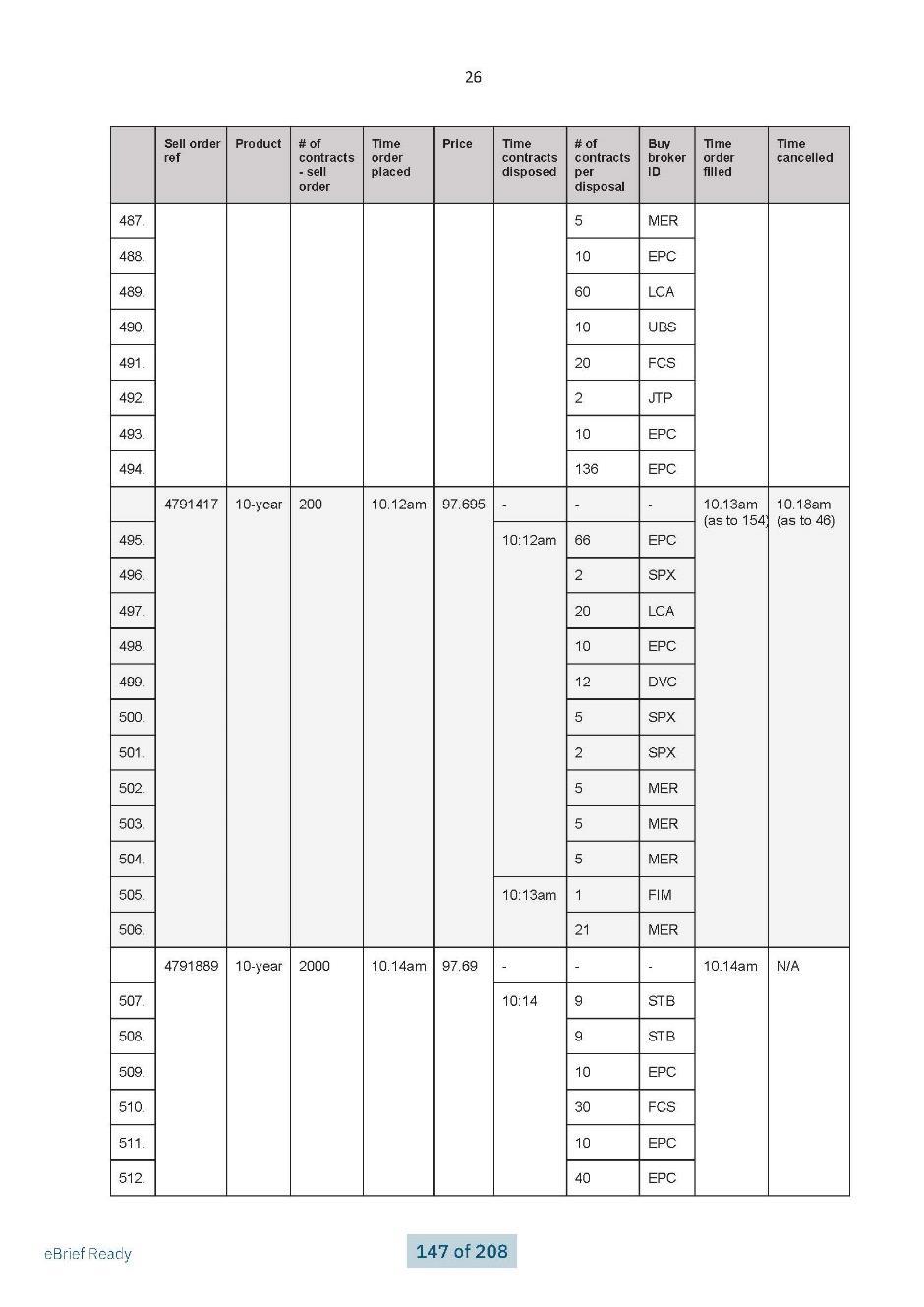

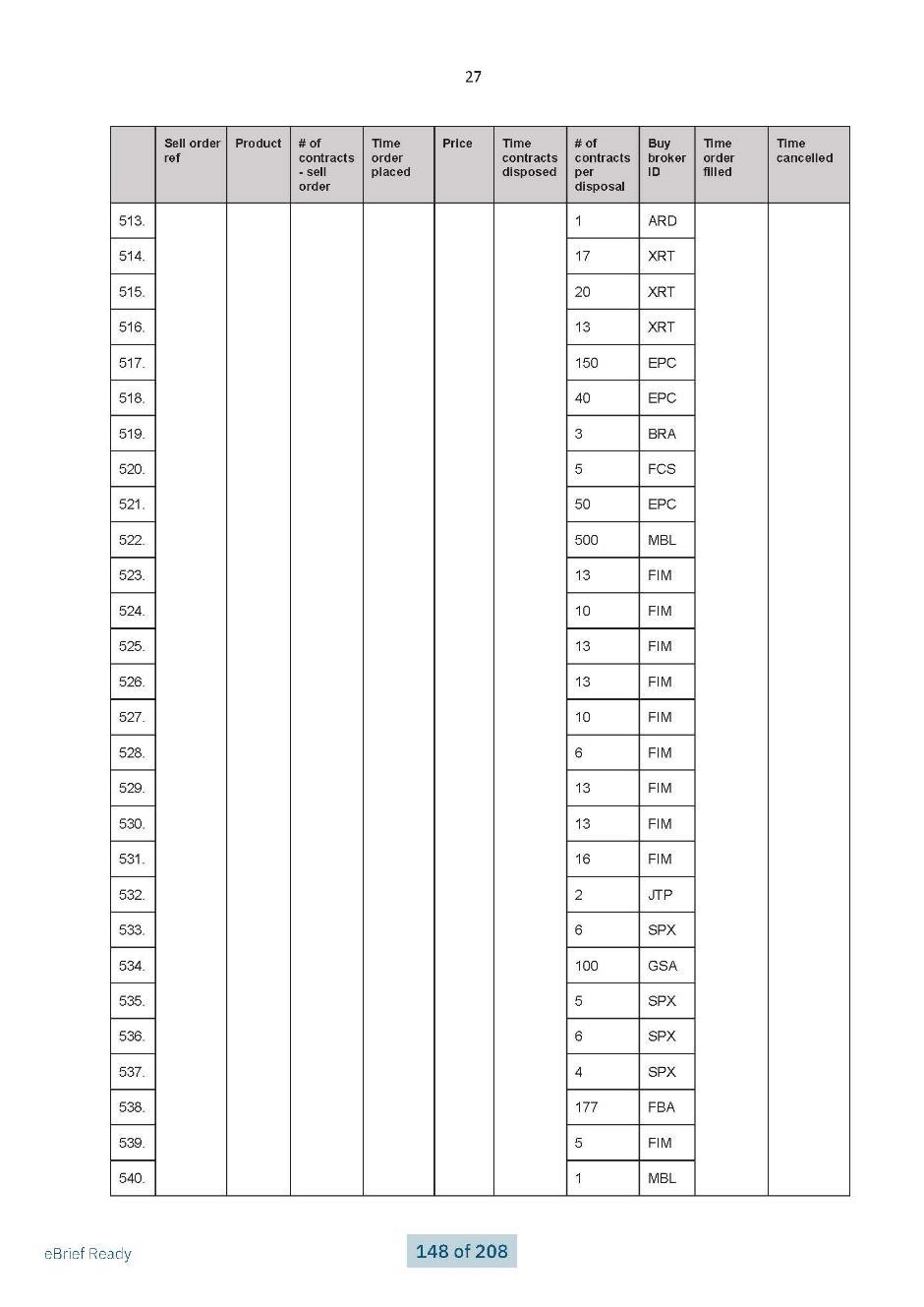

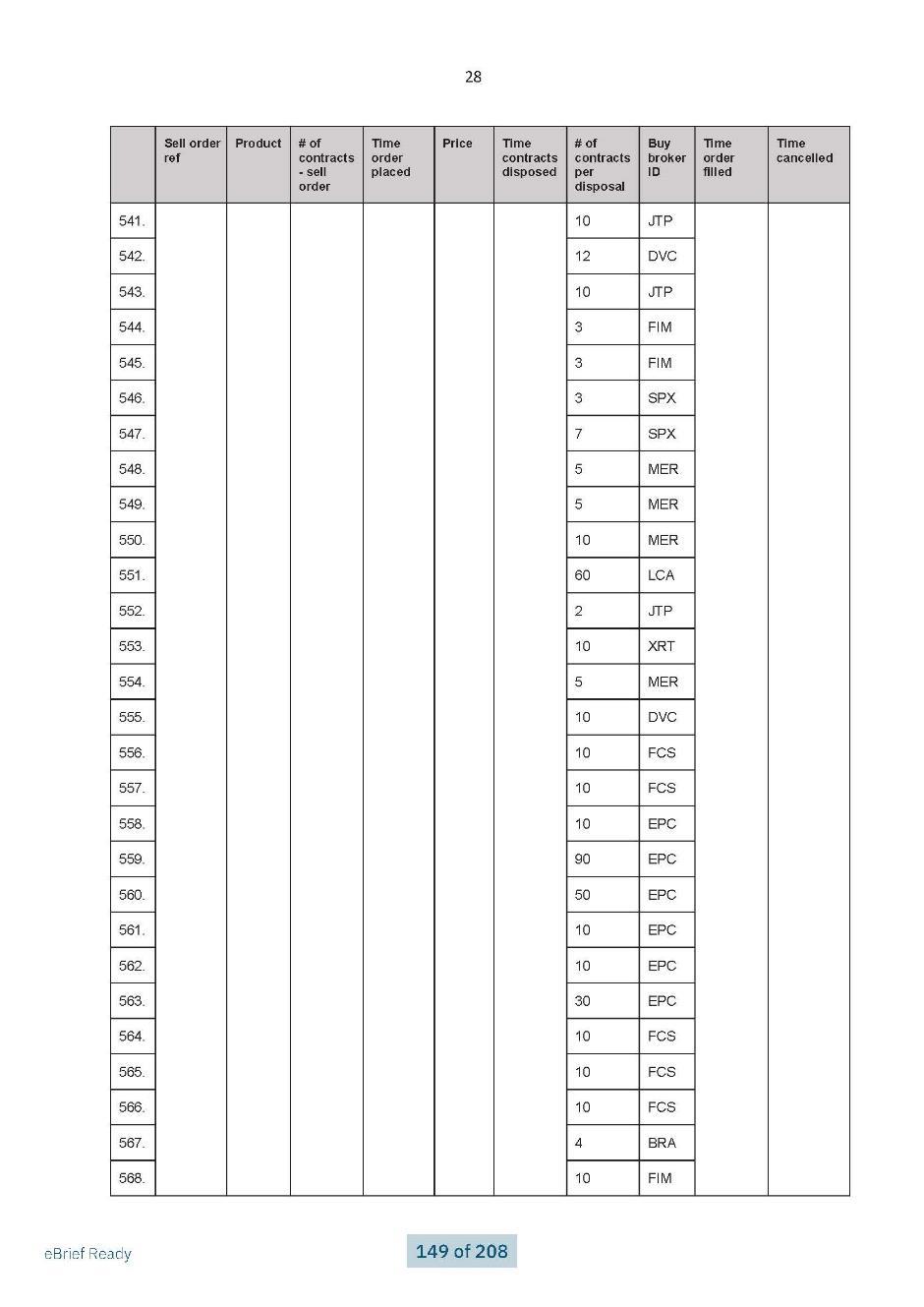

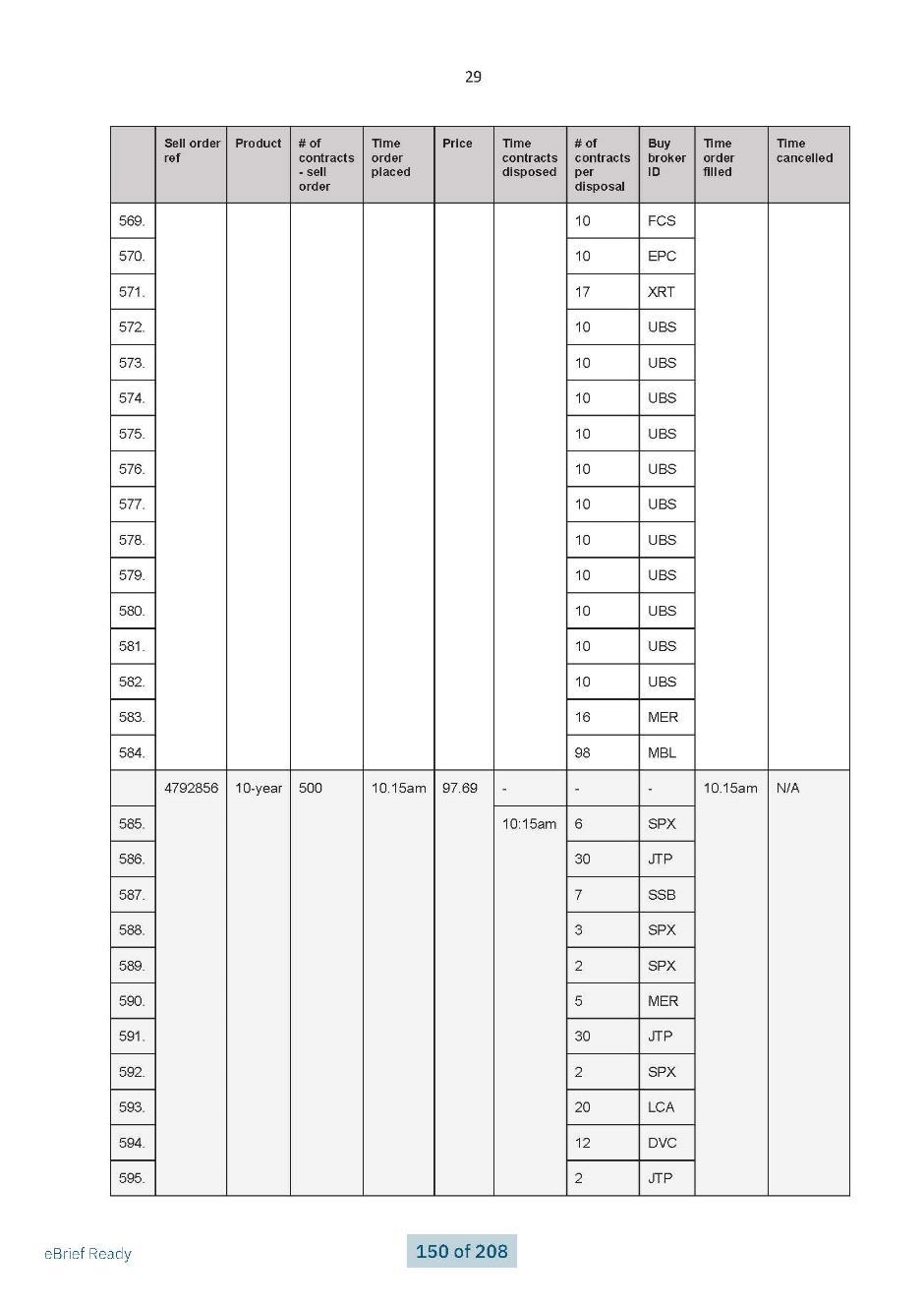

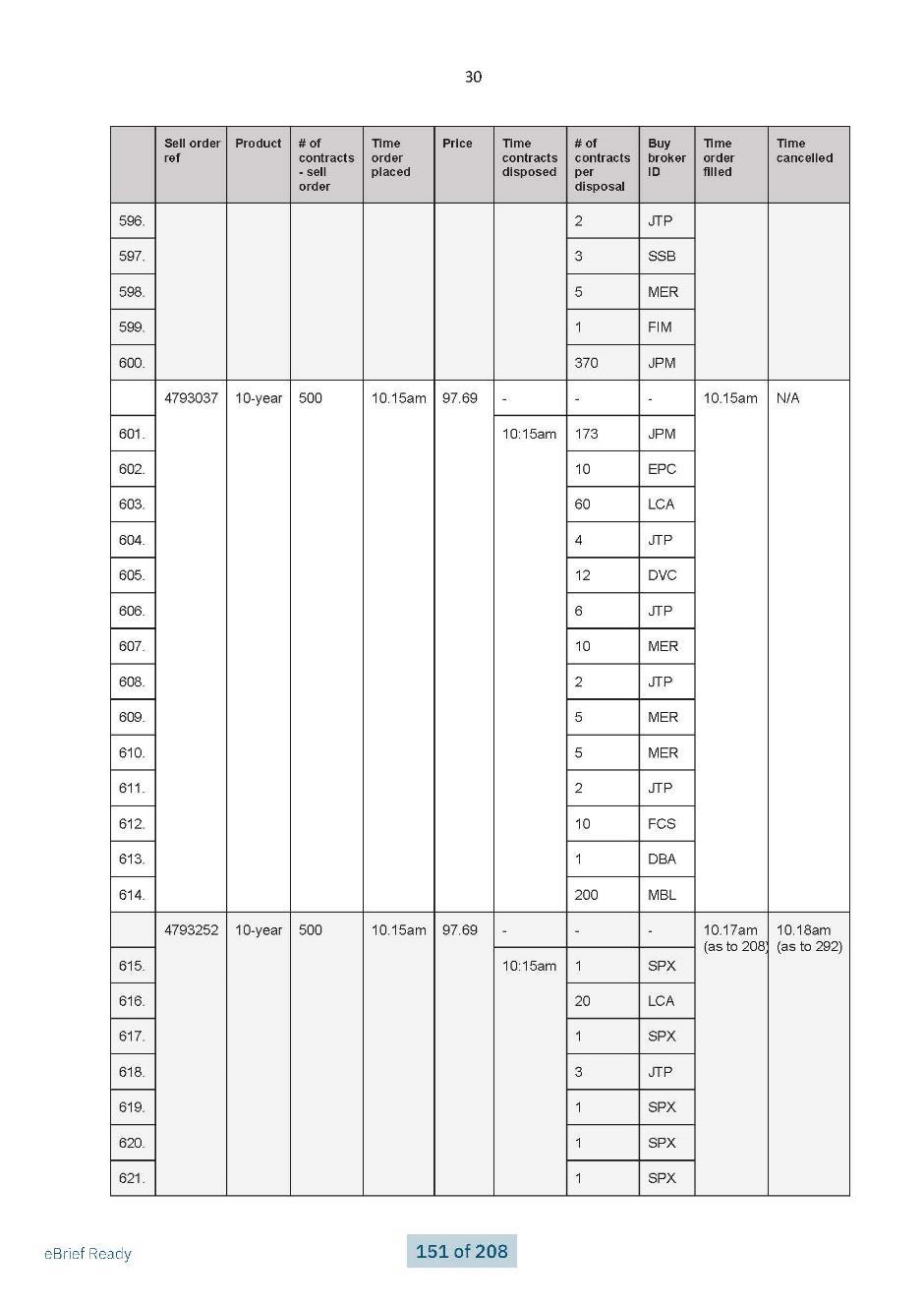

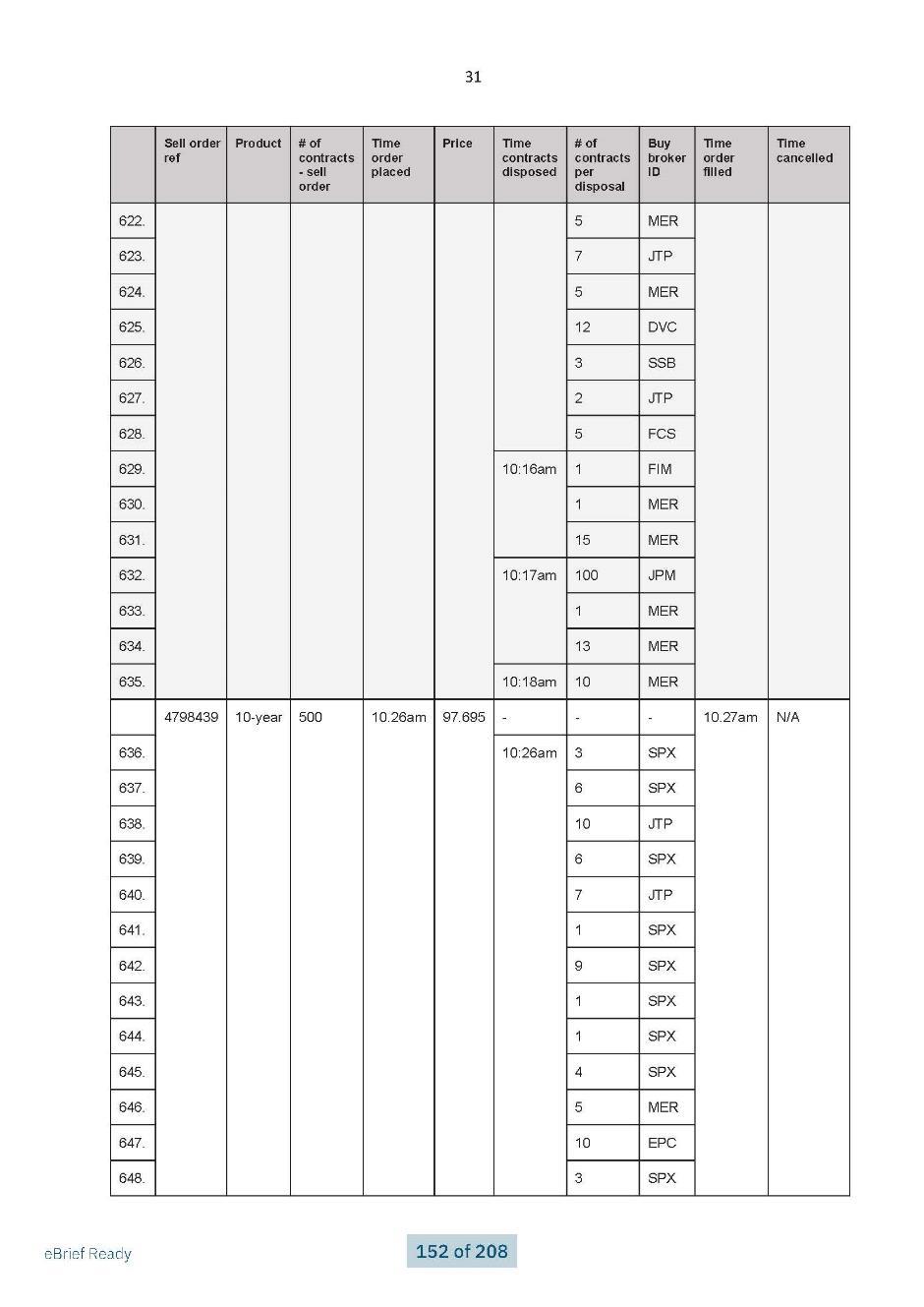

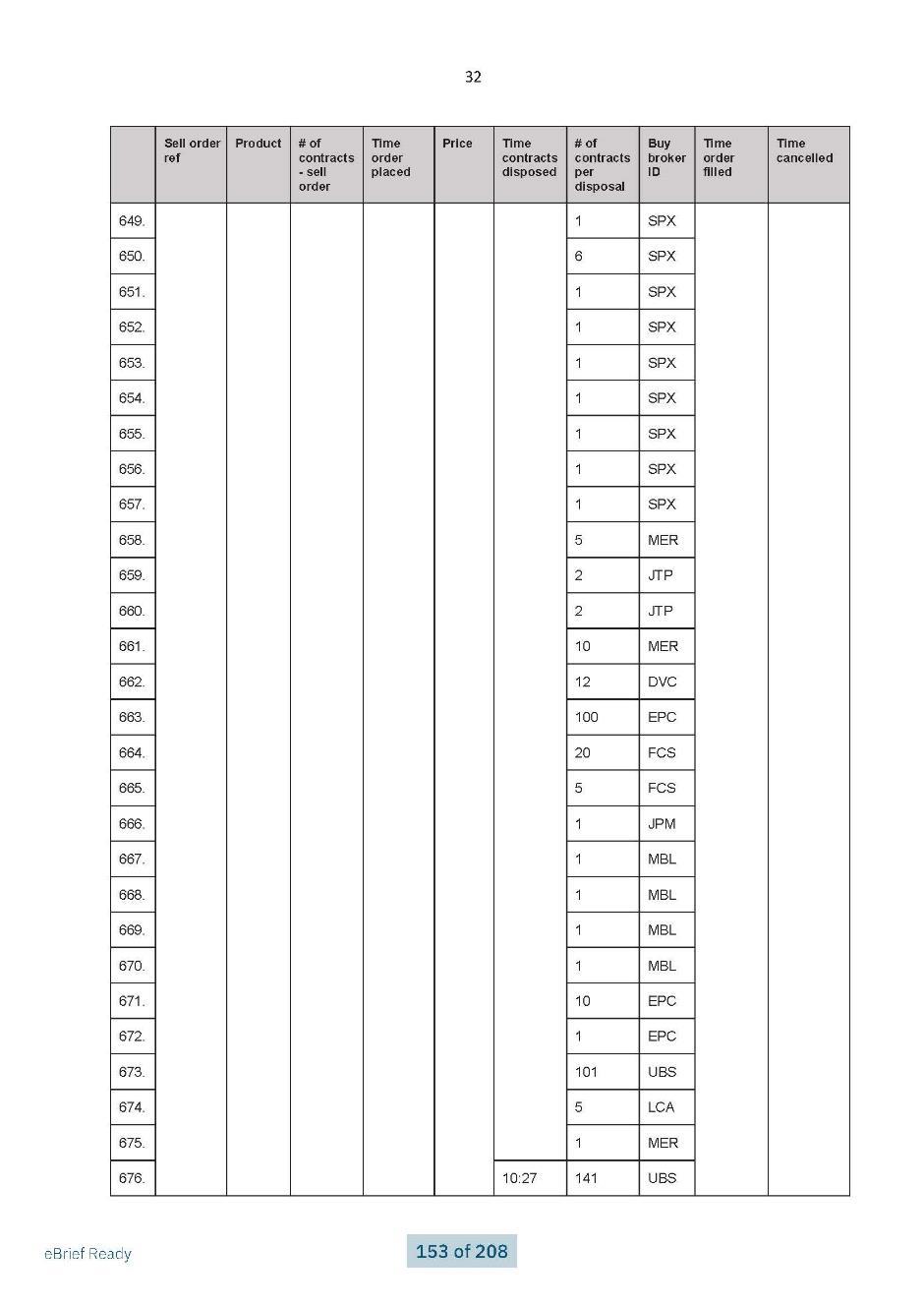

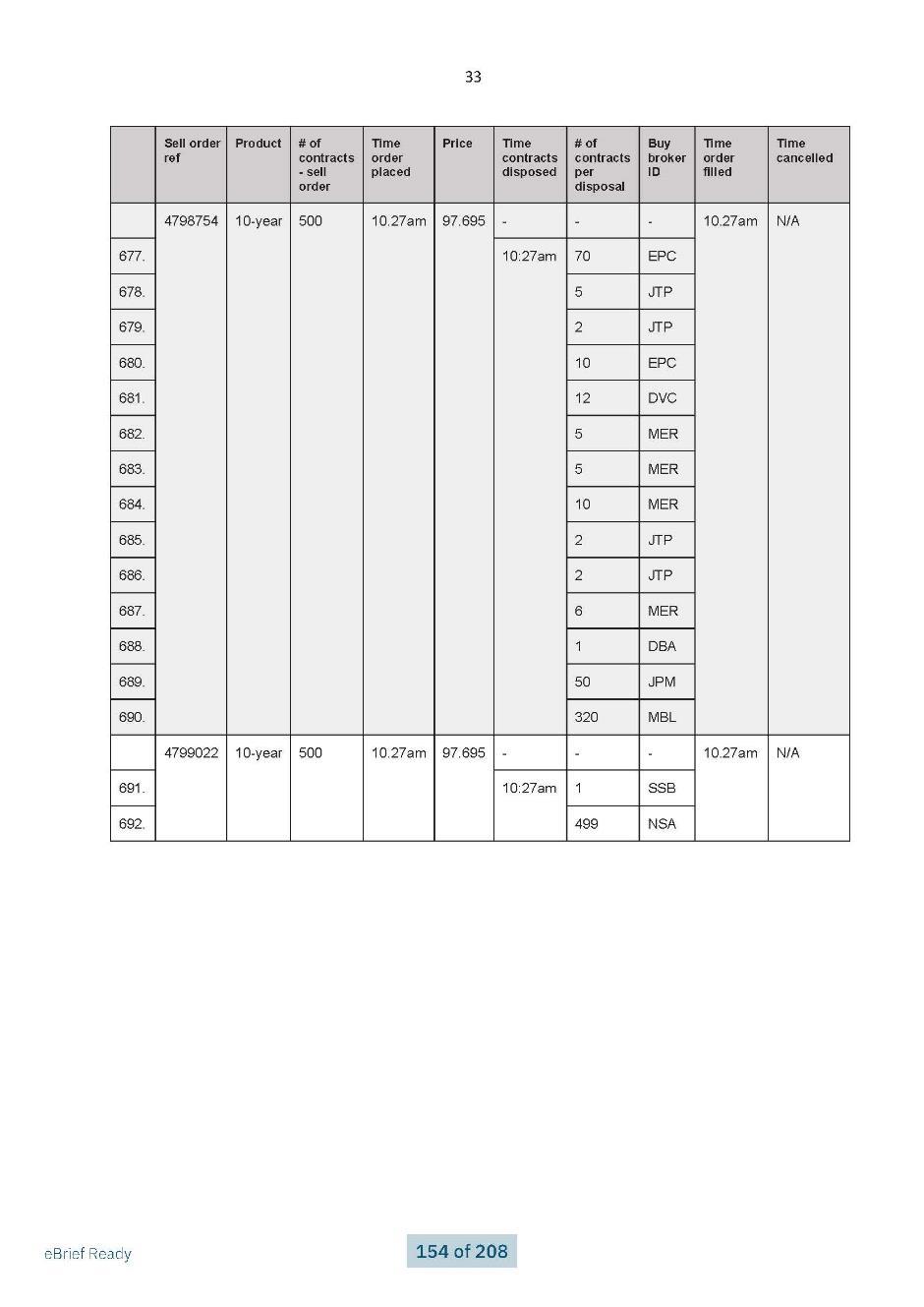

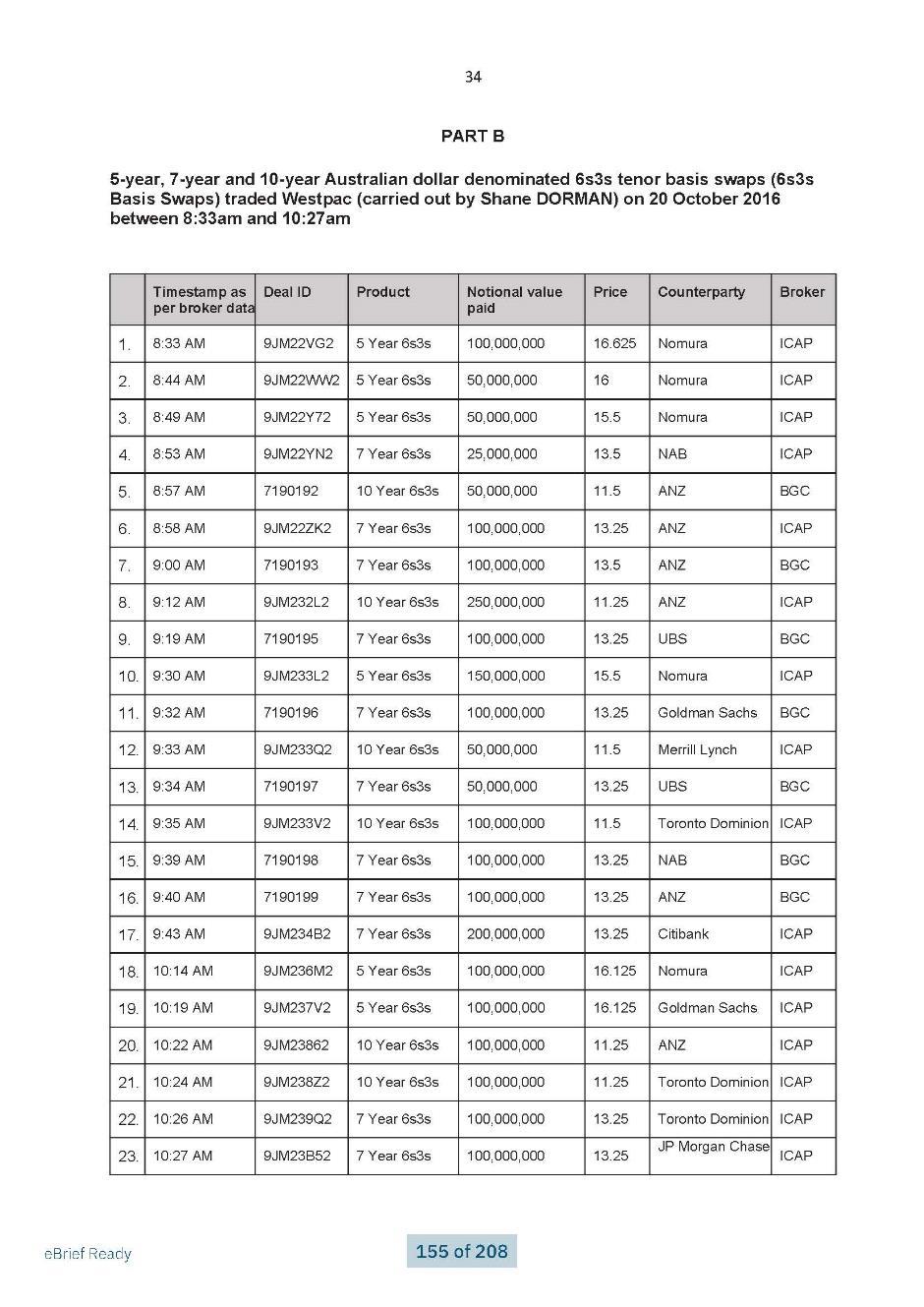

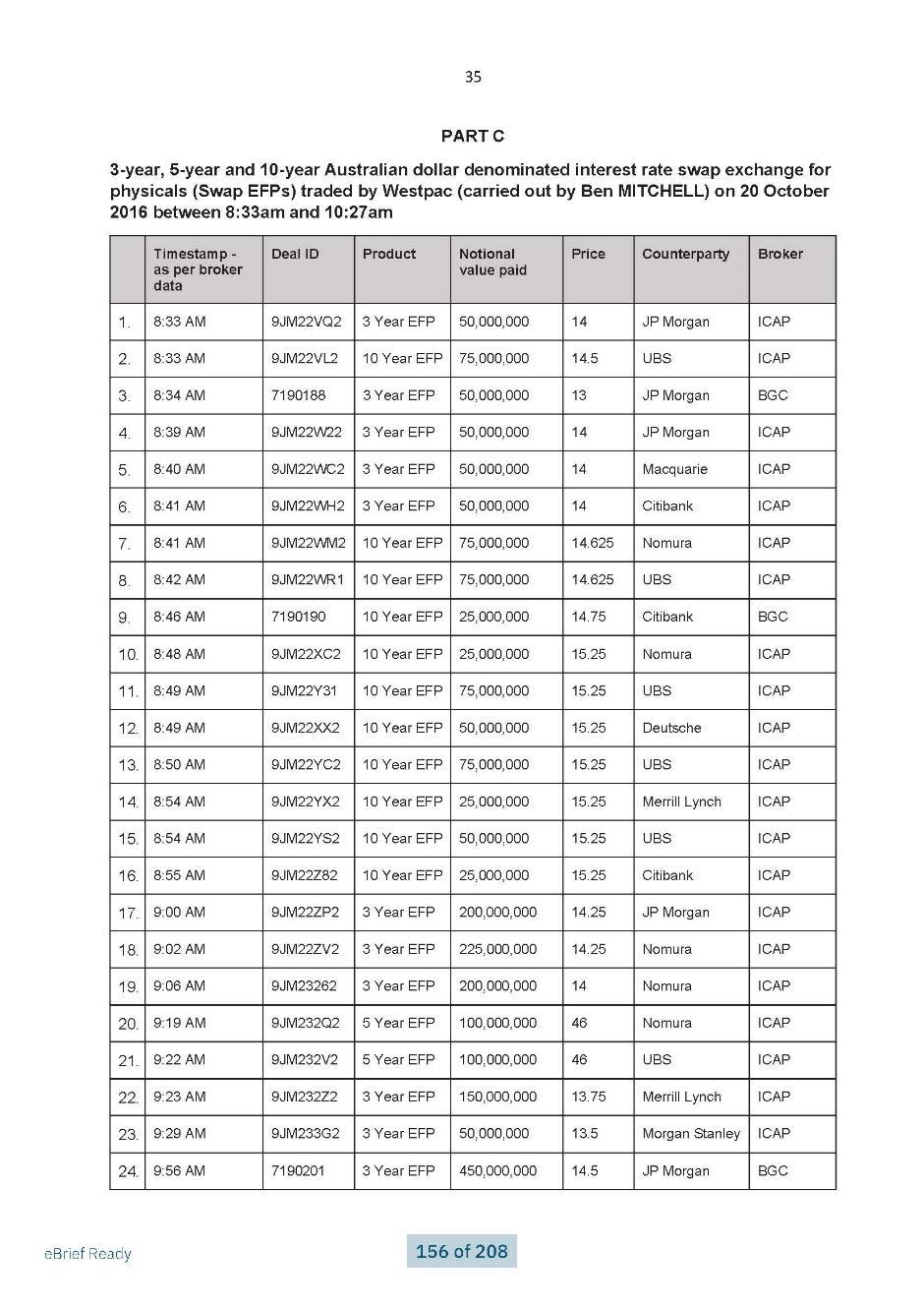

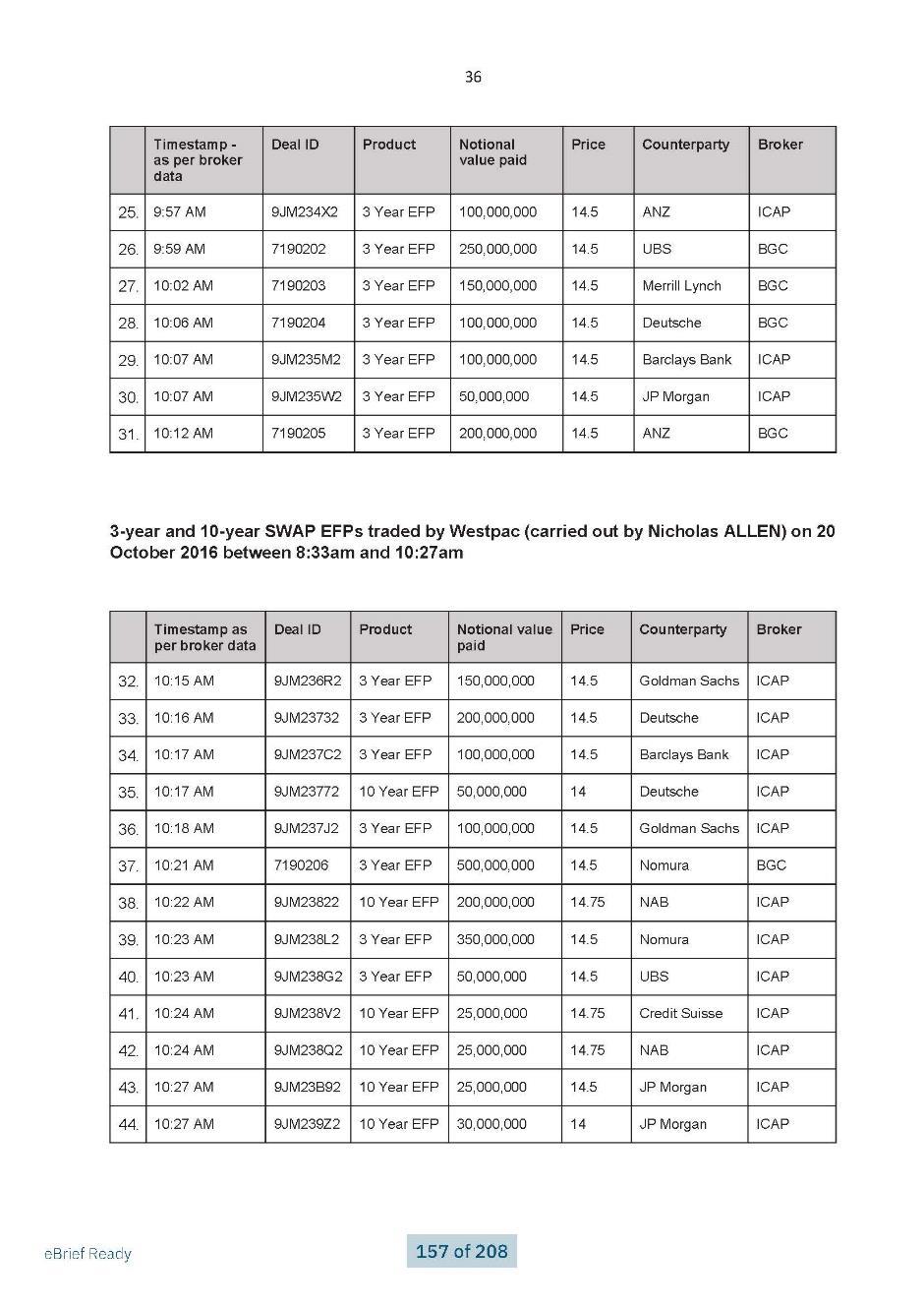

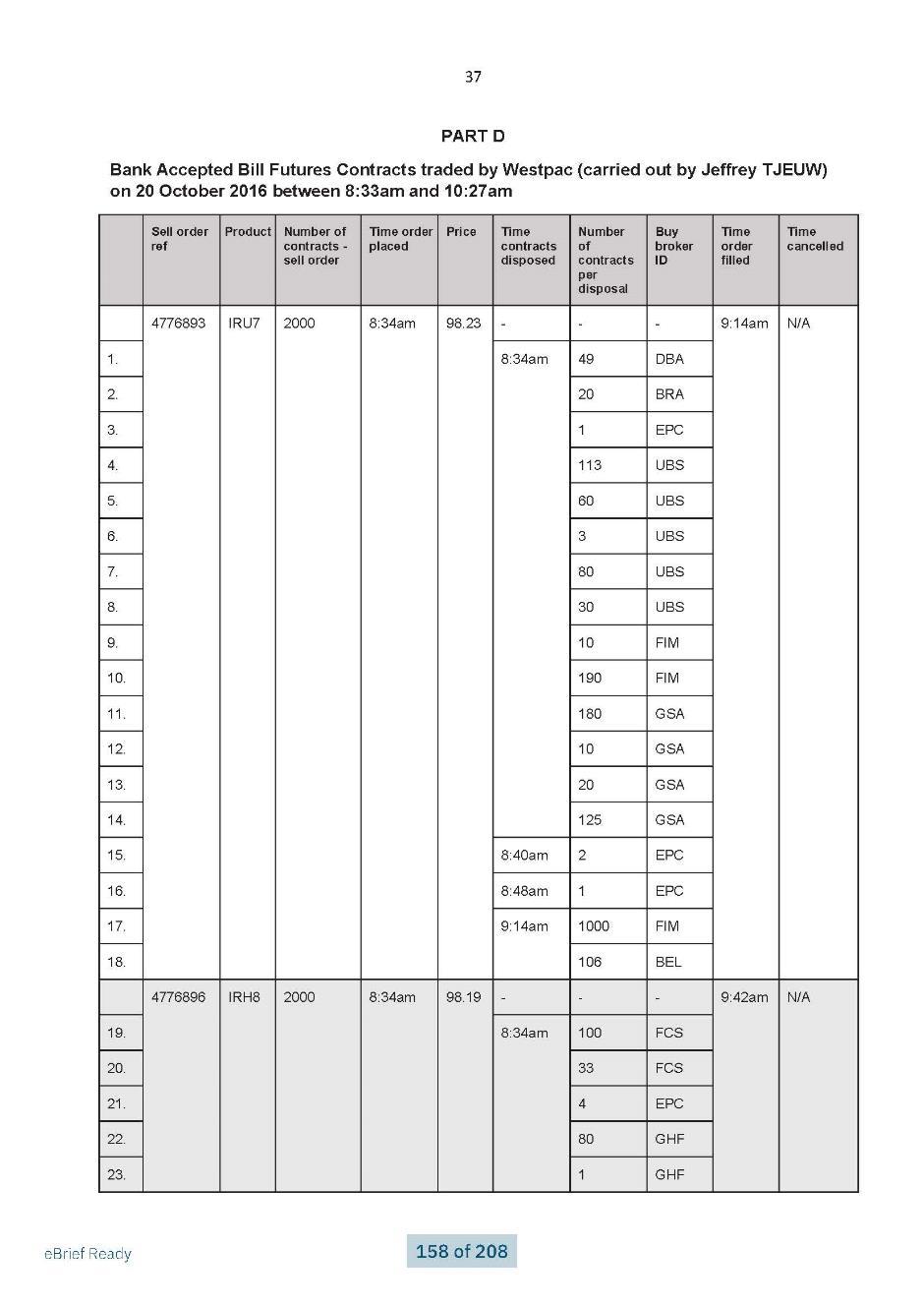

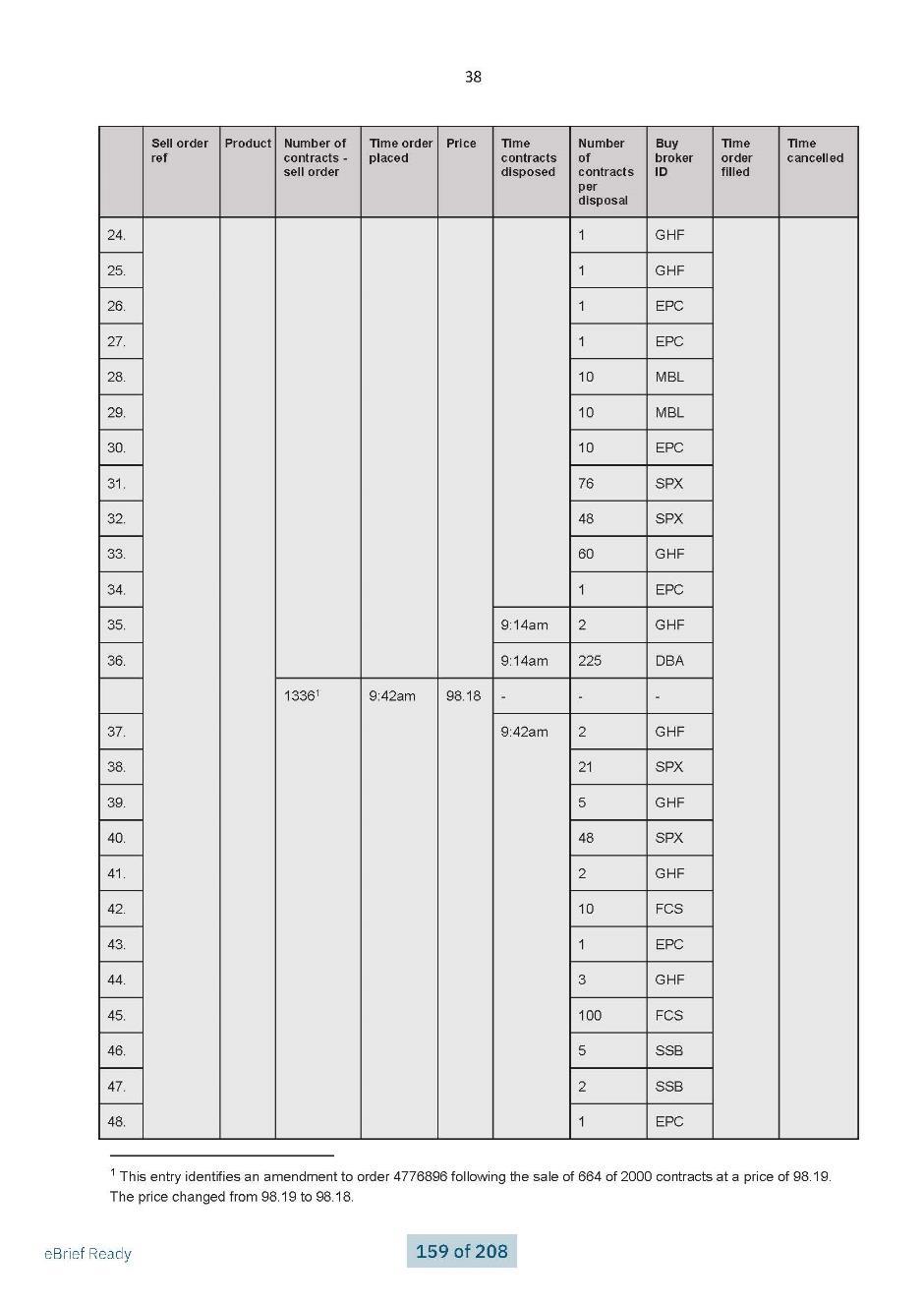

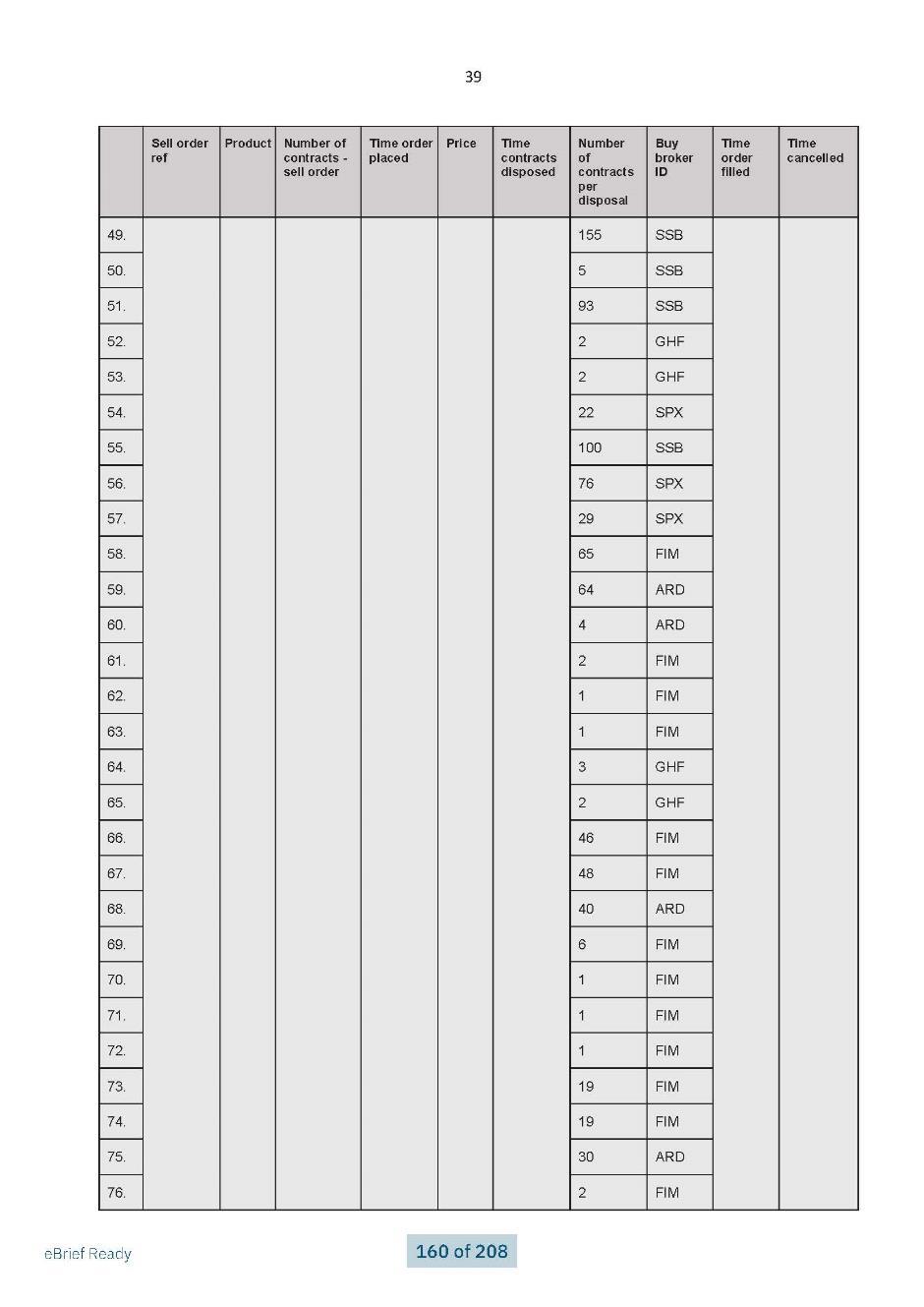

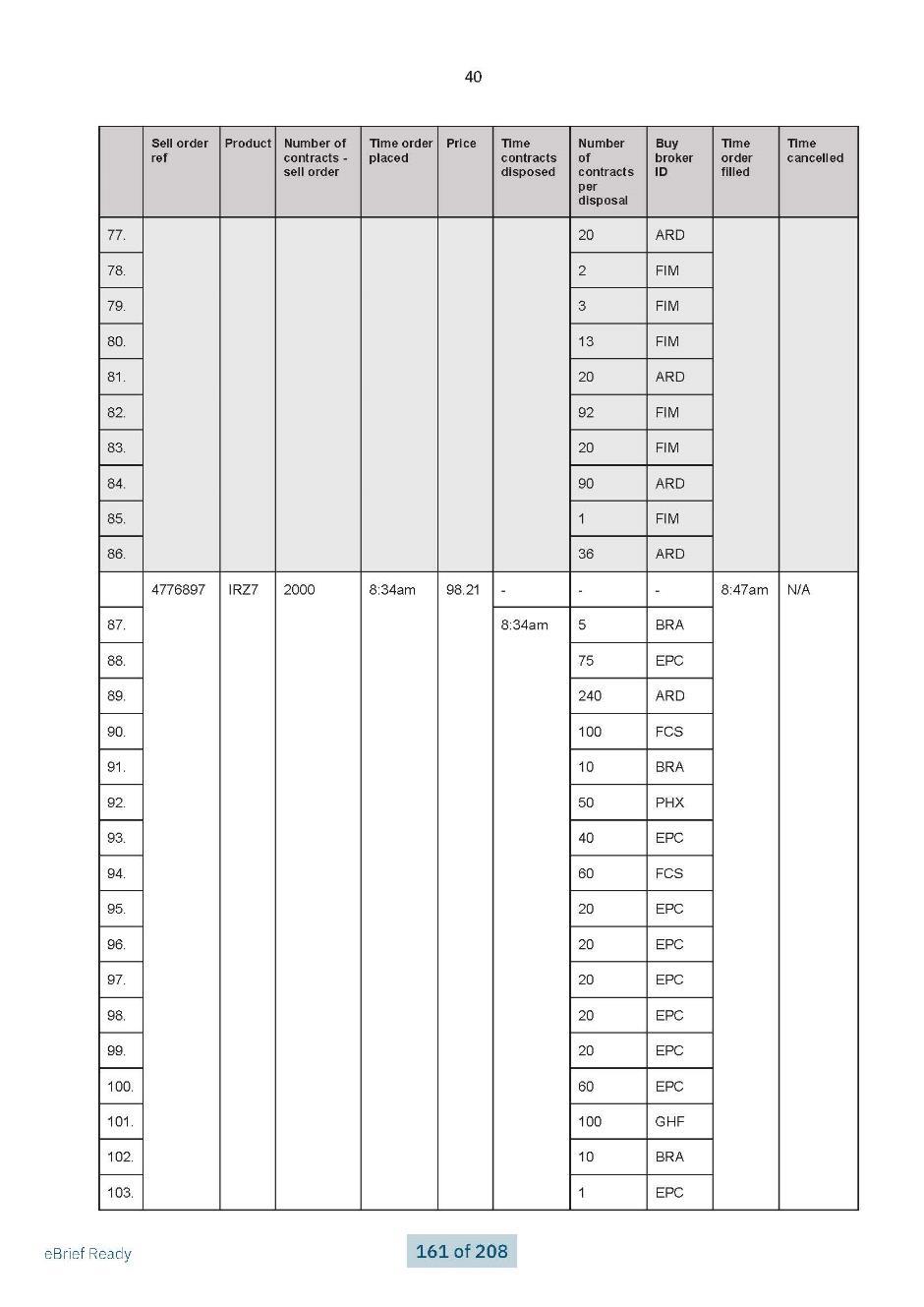

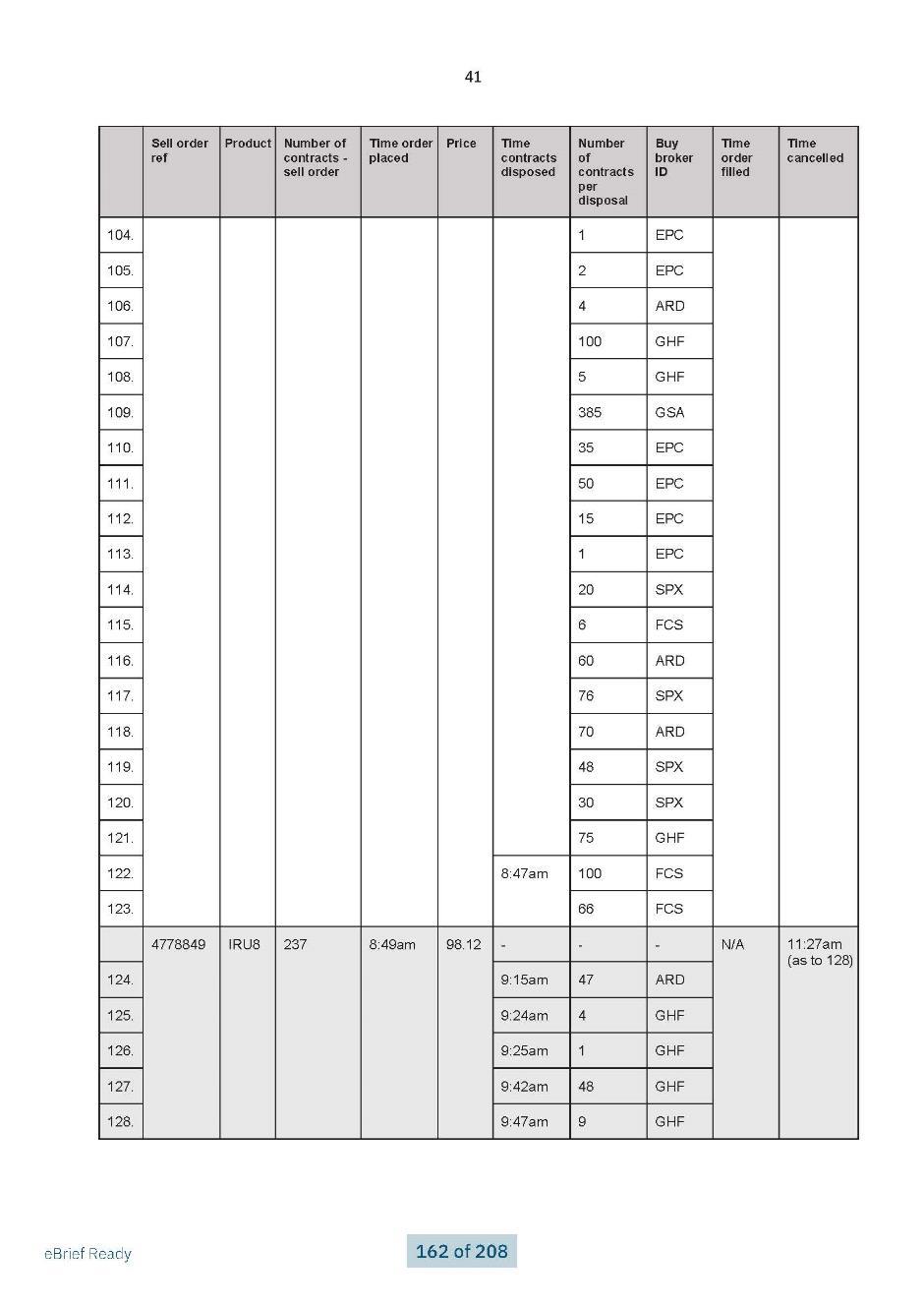

(g) Between 8:33am and 10:27am, Westpac engaged in pre-hedging trading in accordance with the Pre-Hedging Plan by trading a significantly large volume of interest rate derivatives in the futures and inter-bank swap markets in a compressed timeframe ahead of execution of the Swap Deal.

(h) Once Westpac commenced its on-market pre-hedging trading, if the Consortium had alternatively sought to proceed to execute the Swap Deal with any bank other than Westpac, it would not have been able to do so without the market rate of the Swap Deal being potentially affected by Westpac’s trading and could not protect itself against the risk that Westpac’s trading would increase the price of the Swap Deal to the Consortium.

(i) Westpac was aware that the pre-hedging trading had the potential to increase the prices of the products it traded and thereby the price of the Swap Deal to the Consortium, where every basis point increase to that price would involve a cost to the Consortium of about $4.7 million.

(j) In the context of paragraphs (1)(a) to (i) above, Westpac’s execution of the Swap Deal was in all the circumstances against commercial conscience.

Financial Service Licensee Obligations

2. Westpac contravened s 912A(1)(a) of the Corporations Act 2001 (Cth) (Corporations Act) by not doing all things necessary to ensure that the Swap Deal was provided to and executed with the Consortium efficiently, honestly and fairly, in that:

(a) Westpac engaged in the conduct specified in paragraph 1 above;

(b) Westpac had no policy specifically on pre-hedging of transactions;

(c) Westpac had inadequate training, practices or procedures as to disclosure to and, where appropriate, obtaining consent from, counterparties in relation to pre- hedging of transactions;

(d) Westpac had inadequate mechanisms in place to review the trading undertaken to pre-hedge transactions such as the Swap Deal and did not conduct any formal review after the Swap Deal was executed.

3. Westpac contravened s 912A(1)(aa) of the Corporations Act by having inadequate arrangements in place for the management of the conflict of interest that arose in the Swap Deal between Westpac’s interest in managing the anticipated risk it would acquire upon entering into the Swap Deal and the interest of the Consortium in avoiding any increase in the execution price of the Swap Deal which could result from Westpac pre-hedging its risk before execution of the Swap Deal.

AND THE COURT ORDERS THAT:

Penalty and costs

4. Pursuant to s 12GBA(1) of the ASIC Act and in respect of the contravention the subject of paragraph 1 of these Orders, Westpac pay a pecuniary penalty in the sum of $1.8 million to the Commonwealth of Australia within 28 days of these Orders.

5. Westpac pay ASIC’s costs of and incidental to these proceedings fixed in the amount of $5.4 million.

Submissions

6. On or by 23 February 2024, the parties provide further submissions as to relief.

7. The proceeding be adjourned sine die subject to further order of the Court.

AND THE COURT NOTES THAT:

8. ASIC will issue to Westpac a direction under s 91 of the ASIC Act requiring Westpac to pay ASIC’s investigation costs.

9. ASIC and Westpac have agreed that ASIC’s investigation costs referred to in paragraph 8 be fixed in the sum of $2.6 million.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(Delivered ex tempore, revised from the transcript)

LEE J:

A INTRODUCTION AND BACKGROUND

1 Before the Court is a proceeding brought by the plaintiff (ASIC) against the defendant (Westpac) in relation to Westpac’s involvement in the largest interest rate swap executed at one time in Australian financial market history (Swap Deal).

2 Today, the parties seek orders for the consensual resolution of the proceeding.

3 By way of general background, the Swap Deal consisted of 11 interest rate swaps executed by Westpac in October 2016 with a consortium of investors comprised of an IFM group of entities and AustralianSuper Pty Ltd as trustee for AustralianSuper (Consortium). The Consortium entered into the Swap Deal for the purpose of acquiring a 50.4% interest in Ausgrid, an electricity provider then owned by the State of New South Wales (Ausgrid transaction). The Swap Deal had a notional value of approximately $12 billion amortised over 10 years.

4 When this proceeding was commenced, ASIC initially alleged that by about 8:30am on 20 October 2016, Westpac knew, or believed, it would be selected by the Consortium to execute the interest rate swap transaction on that morning. ASIC alleged this was inside information and, when the market opened at 8:30am, and while in possession of the alleged inside information, Westpac’s traders acquired and disposed of interest rate derivative products in order to pre-position Westpac. ASIC alleged that Westpac’s trading occurred while it was in possession of information that was not generally available to other market participants, including those that traded with Westpac that morning. This was a particularly serious allegation because, as is well known, prohibitions against insider trading are a fundamental tenet of market integrity.

5 Following extensive discussion, ASIC has now refined its allegations. The insider trading allegations are no longer pressed, but the parties agree that by its execution of the Swap Deal, Westpac engaged in conduct contrary to various statutory norms under the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) and the Corporations Act 2001 (Cth) (Corporations Act).

6 More particularly, in accepting it engaged in conduct which was contrary to the law as being against commercial conscience, Westpac has agreed with ASIC that the Court should make:

(1) declarations pursuant to s 21 of the Federal Court of Australia Act 1976 (Cth) that Westpac engaged in contravening conduct;

(2) an order for a compliance programme pursuant to s 1101B(1) of the Corporations Act and/or s 12GLA(2)(b) of the ASIC Act;

(3) an order that Westpac pay a pecuniary penalty of $1.8 million pursuant to s 12GBA(1) of the ASIC Act; and

(4) an order that Westpac pay a contribution to ASIC’s costs.

7 There is no need for me to explain the background to the proceeding in any further detail. The parties have provided the Court with a statement of agreed facts, which was marked Exhibit A, with each fact being an “agreed fact” within the meaning of s 191 of the Evidence Act 1995 (Cth). Exhibit A is annexed to these reasons and sets out, for those interested in more granular detail, my findings as to the relevant background to the Swap Deal; the position of the Consortium; Westpac’s intention to pre-hedge; initial discussions with potential execution banks; relevant events in October 2016; the execution of the Swap Deal; Westpac’s profit; communications following the execution of the Swap Deal; Westpac’s policies, practices and procedures; and other relevant matters.

B THREE ISSUES

8 At the commencement of the hearing today, I raised three issues concerning the proposed orders with the parties.

9 First, I sought to understand why it is that ASIC submitted that the Swap Deal comprised of one transaction for the purposes of Westpac’s admitted contraventions and penalty, rather than 11 transactions. Secondly, I raised an issue as to the appropriateness or otherwise of the proposed compliance programme, and whether or not a referee should be appointed by the Court to inquire into and report on the adequacy and effectiveness of the systems, controls, policies and procedures of Westpac. Thirdly, I raised whether or not there should be a further order made under s 1101B(1) of the Corporations Act requiring Westpac to publish information to the public concerning, inter alia, the contravening conduct.

10 I will deal with each in turn.

B.1 The Relevant Transaction(s)

11 It was not immediately apparent to me why ASIC sought to characterise the Swap Deal as one transaction in the light of the fact that Westpac’s execution of each of the 11 interest rate swaps comprising the Swap Deal constituted the provision of a financial service within the meaning of s 12BAB(1) of the ASIC Act, and the supply or possible supply of a financial service by Westpac for the purposes of s 12CB of the ASIC Act (see Exhibit A (at [112])).

12 In this regard, I was referred by counsel to the amended concise statement (at [3]), set out below:

3 Throughout October 2016, and until 20 October 2016, the Consortium communicated with several banks, including Westpac, about one or more of those banks potentially entering into an interest rate swap deal with a special purpose vehicle (Consortium’s SPV) to hedge the floating interest rate risk associated with syndicated debt funding for the acquisition and ongoing funding requirements of Ausgrid (Swap Deal). The Swap Deal had a notional value of approximately $12 billion and comprised 11 interest rate swaps that amortised over 10 years.

13 I was also referred to Exhibit A (at [109]), which provides:

109. The executed confirmation for the Swap Deal confirmed:

a. the notional amount of $11,931,285,231 … amortising such that the notional principal decreases over the 10-year duration of the swap;

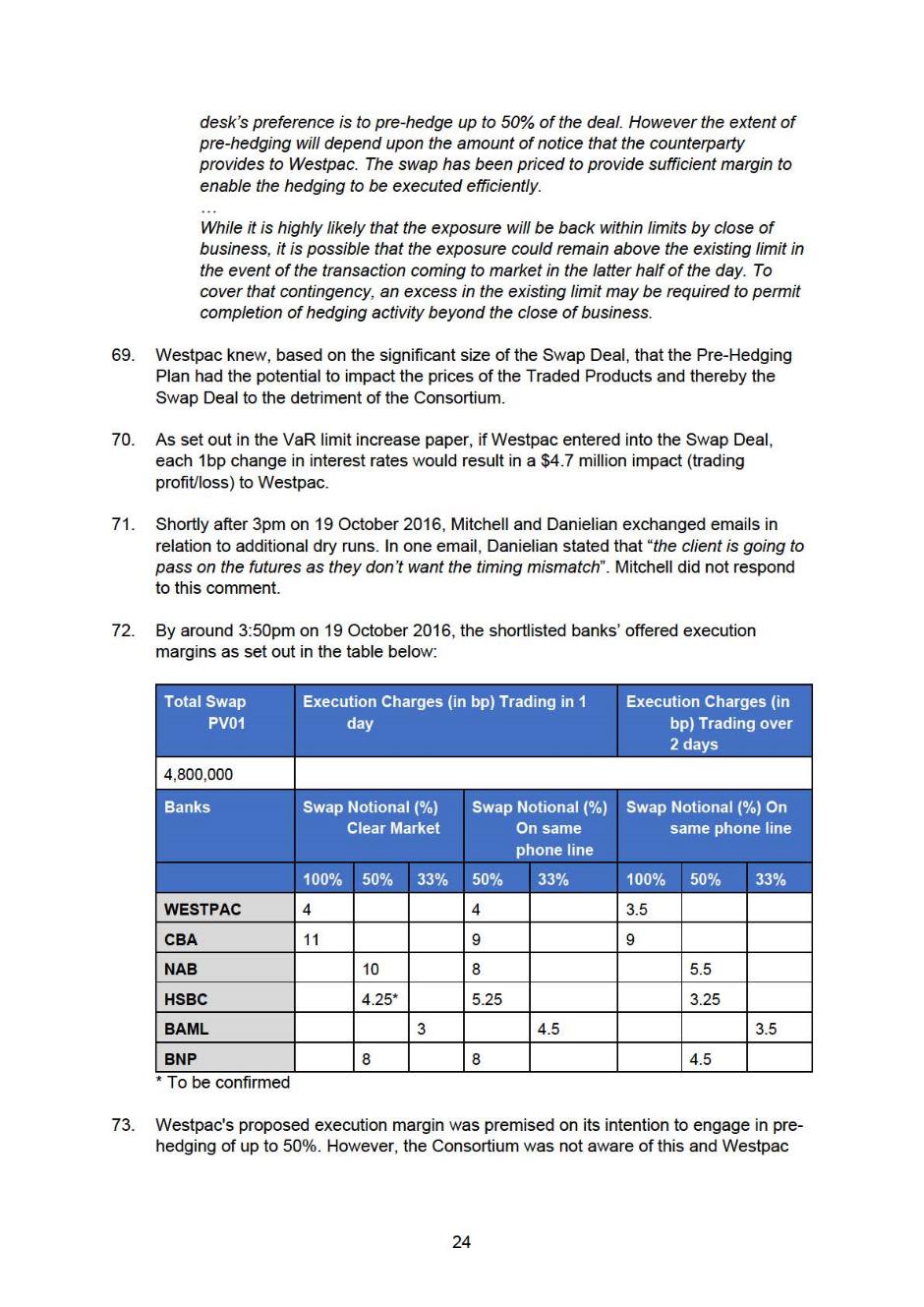

b. that Westpac would pay the floating rate (3-month BBSW) and receive a fixed rate on 1 March 2017, 1 April 2017 and every quarter thereafter until 1 April 2026. As the Swap Deal was amortising, the fixed receipts would reduce over the duration of the swap and the floating payments would likewise change as they are calculated using lower notional principals over time;

c. that the Consortium’s SPV would pay a fixed rate and receive floating (3-month BBSW) on 1 March 2017, 1 April 2017 and every quarter thereafter until 1 April 2026; and

d. that within 10 business days of execution, Westpac would be permitted to novate part of the Swap Deal to agreed financial institutions.

14 The process of characterising complex financial transactions and whether or not they constitute, in truth, one or several transactions is a notoriously difficult exercise.

15 In Australian Securities and Investments Commission v Westpac Banking Corporation (No 3) [2018] FCA 1701; (2018) 131 ACSR 585 (a related proceeding which concerned bank bill swaps) Beach J (at 597 [64]–[65]), for reasons that are unnecessary to rehearse here, rejected a submission made by ASIC that each and every trade entered into by Westpac was a separate transaction, and hence a separate contravening act. This, I am told, caused ASIC to be “once bitten, twice shy”, leading to a forensic decision in this case to characterise the 11 interest rate swaps constitute one transaction (T5.1–12).

16 It is unnecessary for me to explain in detail here why the structure of the Swap Deal could be regarded, in truth, as one transaction. Put shortly, notwithstanding that each of the 11 interest rate swaps constituted the provision of a financial service by Westpac, and the supply or possible supply of a financial service, it is at least arguable the interest rate swaps were collectively aimed at a single goal; namely to hedge Westpac’s exposure to the floating interest rate risk associated with financing the Ausgrid transaction (see above (at [12]–[13])). Hence, I understand the forensic approach to this issue adopted by ASIC.

17 Characterising what happened as one transaction does, however, have a significant consequence.

18 As can be seen from Exhibit A (at [118]), at the end of the 20 October 2016 trading day, Westpac’s derivatives trading desk had achieved a trading profit (on a mark-to-market basis) of approximately $20.7 million (of which $3.7 million was allocated to the sales team as commission).

19 As Senior Counsel for Westpac, Mr Williams SC, submitted, it would be jejune to fasten upon these figures as reflecting the financial benefit that Westpac obtained by engaging in the contravening conduct, given that other factors would likely have affected the mark-to-market calculation which are unconnected with such conduct. It is also true that the $3.7 million allocated to the sales team as commission (which, as I understand, would have been fixed by reference to a host of other factors) is also difficult to tie directly to the contravening conduct.

20 With that said, it is clear that Westpac, and those responsible for facilitating the contravening conduct on its behalf, achieved a financial outcome which involved, in a not insignificant way, the augmentation of revenue to Westpac in circumstances where but for the contravening conduct, that augmentation would not have materialised.

21 No penalty is available for Westpac’s contraventions of s 912A of the Corporations Act because, at the relevant time, it was not a civil penalty provision. Accordingly, by dint of the operation of the applicable statutory scheme, the practical consequence of Westpac engaging in conduct which was contrary to commercial conscience, and which precipitated a significant financial benefit to Westpac and those who facilitated the contravening conduct on its behalf, is a maximum pecuniary penalty of $1.8 million.

22 That figure is not a misprint.

23 This is in circumstances where since the financial year ending 30 June 2016, Westpac’s consolidated revenue and profit/loss has been as follows (see Exhibit A (at [146])):

Year ending in June | Consolidated Revenue | Reported net profit after tax |

2016 | $37,659 million | $7,445 million |

2017 | $37,518 million | $7,990 million |

2018 | $38,073 million | $8,095 million |

2019 | $36,964 million | $6,784 million |

2020 | $30,534 million | $2,290 million |

2021 | $26,642 million | $5,458 million |

2022 | $25,696 million | $5,694 million |

2023 | $47,080 million | $7,197 million |

24 Given the scope of the case now before me, there is nothing I can do about the manifest and striking disparity between the nature of the contravening conduct and the maximum pecuniary penalty.

25 While this might be thought by some to be a matter of considerable public policy concern, I note that it has, at least in part, been ameliorated by reason of law reform. But this is a legacy case.

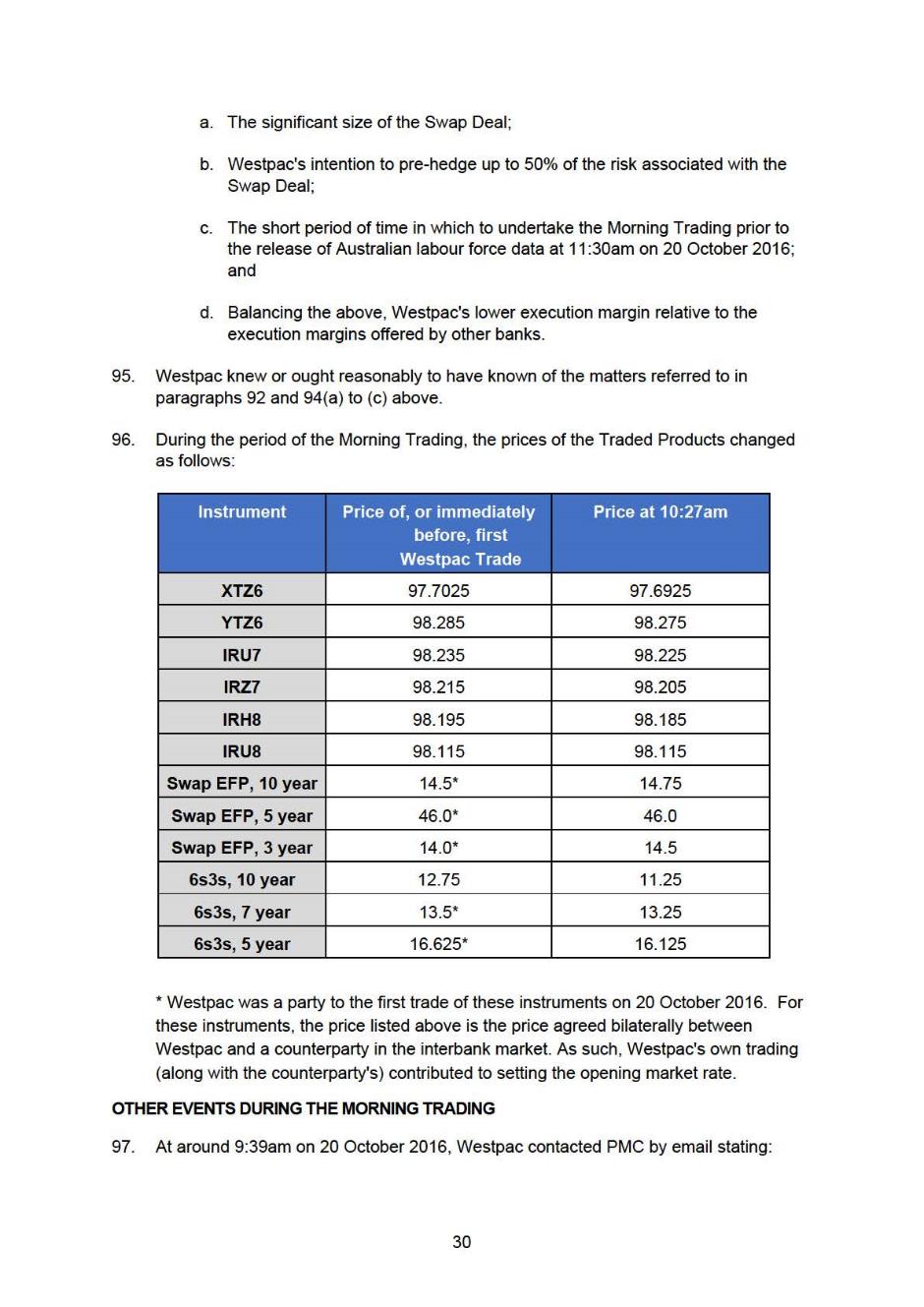

26 There is no doubt I should accede to the joint submission to impose the maximum penalty.

27 As a majority of the High Court noted in Australian Building and Construction Commissioner v Pattinson [2022] HCA 13; (2022) 96 ALJR 426 (at 431 [9] per Kiefel CJ, Gageler, Keane, Gordon, Steward and Gleeson JJ), the purpose of a civil penalty is primarily, if not solely, the promotion of the public interest in compliance with the provisions of the relevant Act by the deterrence of further contraventions of the Act.

28 Obviously enough, where the maximum penalty is so disproportionate to the nature of the conduct, it can hardly be said the interests of general and specific deterrence are significantly advanced as a consequence of the imposition of the penalty. This is even more so when Westpac has engaged in other examples of wrongful conduct, as set out below (see Exhibit A (at [143])):

a. In ASIC v Westpac Banking Corporation (No 2) (2018) 266 FCR 147, Westpac was found to have contravened s 12CC of the ASIC Act on four occasions and 912A of the Corporations Act by trading Prime Bank Bills in the Bank Bill Market with the dominant purpose of influencing yields and where BBSW set. Westpac was ordered to pay a civil penalty of $3.3 million for its contravention of s 12CC: ASIC v Westpac Banking Corporation (No 3) (2018) 131 ACSR 585.

b. In ASIC v Westpac Banking Corporation [2019] FCA 2147, Westpac admitted contraventions s 961K(2) (by being the responsible licensee for the conduct of its representative who failed to act in the best interests of his clients), and s 912A(1)(a) of the Corporations Act and was ordered to pay aggregate civil penalties of $9.15 million for its contraventions of s 961K(2).

c. In ASIC v BT Funds Management Ltd [2021] FCA 844, Westpac subsidiaries admitted contraventions of ss 12DA(1) and 12(DB)(1)(g) of the ASIC Act and 912A(1)(a) (by one of the subsidiaries) and s 1041H of the Corporations Act (in relation to charging advisor fees to which they had no entitlement) and were ordered to pay aggregate civil penalties of $3 million for their contraventions of s 12DB.

d. In ASIC v Westpac Securities Administration Ltd (2019) 272 FCR 170, the Full Federal Court found that Westpac subsidiaries had contravened ss 912A(1)(b), 912A(1)(c), 961K(2) and other provisions of the Corporations Act. In ASIC v Westpac Securities Administration Ltd (2021) 156 ACSR 614, the Westpac subsidiaries were ordered to pay aggregate civil penalties of $10.5 million for 14 contraventions of s 961K(2)[.]

e. In ASIC v Westpac Banking Corporation (Consumer Credit Insurance Case) (2022) 158 ACSR 647, Westpac admitted contraventions of ss 912A(1)(c) and 12DM(1) of the ASIC Act for issuing consumer credit insurance policies to customers who did not request or agree to their acquisition and was ordered to pay a civil penalty of $1.5 million for its contraventions of s 12DM(1).

f. In ASIC v Westpac Banking Corporation (Omnibus Proceeding) (2022) 407 ALR 1, Westpac and its subsidiaries admitted contraventions of s 12CB of the ASIC Act, s 912A of the Corporations Act and various other provisions of both the ASIC Act and Corporations Act and were ordered to pay aggregate civil penalties of $113 million for their contraventions of ss 12CB, 12DB and 12DI of the ASIC Act and ss 912A(5A) (by reason of their contraventions of 912A(1)(a)), 962P and 963K of the Corporations Act. The matter related to six separate proceedings heard together relating to various conduct, including fees charged to deceased customers and fees for no service.

29 But the maximum is the best I can do. Accordingly, in all the circumstances, subject to the two remaining matters to which I will come shortly, given the scope of ASIC’s present case, it is appropriate to make declarations and orders broadly reflecting the parties’ agreement as follows:

THE COURT DECLARES THAT:

Unconscionable conduct

1. On 20 October 2016, the defendant (Westpac) contravened s 12CB of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) by engaging in the pre-hedging trading as set out in the Schedule, which was conducted in trade or commerce in connexion with the supply of financial services, being the interest rate swap executed with the Consortium (Swap Deal), which was in all the circumstances unconscionable, because:

(a) The Swap Deal was the largest interest rate swap executed in one tranche in Australian financial market history with a notional value of $12 billion.

(b) The purpose of the Swap Deal was for Westpac’s counterparty, the Consortium, to minimise and control its risk of interest rate movements associated with the debt facility for funding its purchase of a 50.4% interest in Ausgrid from the NSW State Government and related ongoing funding requirements.

(c) Westpac was aware that:

(i) On execution of the agreement for the acquisition of the interest in Ausgrid with the NSW State Government and until execution of the Swap Deal, the Consortium was exposed to variable interest rate risk on the $12 billion debt facility;

(ii) The Consortium was particularly concerned about the risk of the selected counterparty to the proposed Swap Deal engaging in on-market trading ahead of execution of the Swap Deal in a manner that might increase the market rate and therefore the price of the Swap Deal to its detriment;

(iii) The Consortium had sought, and Westpac had quoted, an execution margin on the basis that Westpac would receive no notice of the Swap Deal;

(iv) As a result of paragraph (1)(c)(iii) above, Westpac would have no opportunity to conduct any on-market pre-hedging with knowledge of the precise timing of the Swap Deal;

(v) On-market pre-hedging trading would expose the Consortium to the risk that the price of the Swap Deal would increase to its detriment.

(d) Despite this awareness:

(i) Westpac had, and acted on, an internal plan to pre-hedge up to 50% of the interest rate risk that it expected to acquire upon execution of the Swap Deal (the Pre-Hedging Plan);

(ii) Westpac’s quoted execution margin for the Swap Deal was lower than the execution margins quoted by all other banks but that quoted execution margin was premised on Westpac's intention to engage in the pre- hedging.

(e) Westpac did not:

(i) clearly and fully disclose the extent of the pre-hedging it intended to engage in;

(ii) disclose the Pre-Hedging Plan to the Consortium at all; or

(iii) obtain the consent of the Consortium to the Pre-Hedging Plan.

(f) Westpac’s failure to disclose the matters outlined in paragraph (1)(e) above meant that the Consortium was unable to make a considered and informed decision about whether to proceed to select Westpac as the execution bank for the Swap Deal on the terms offered by Westpac.

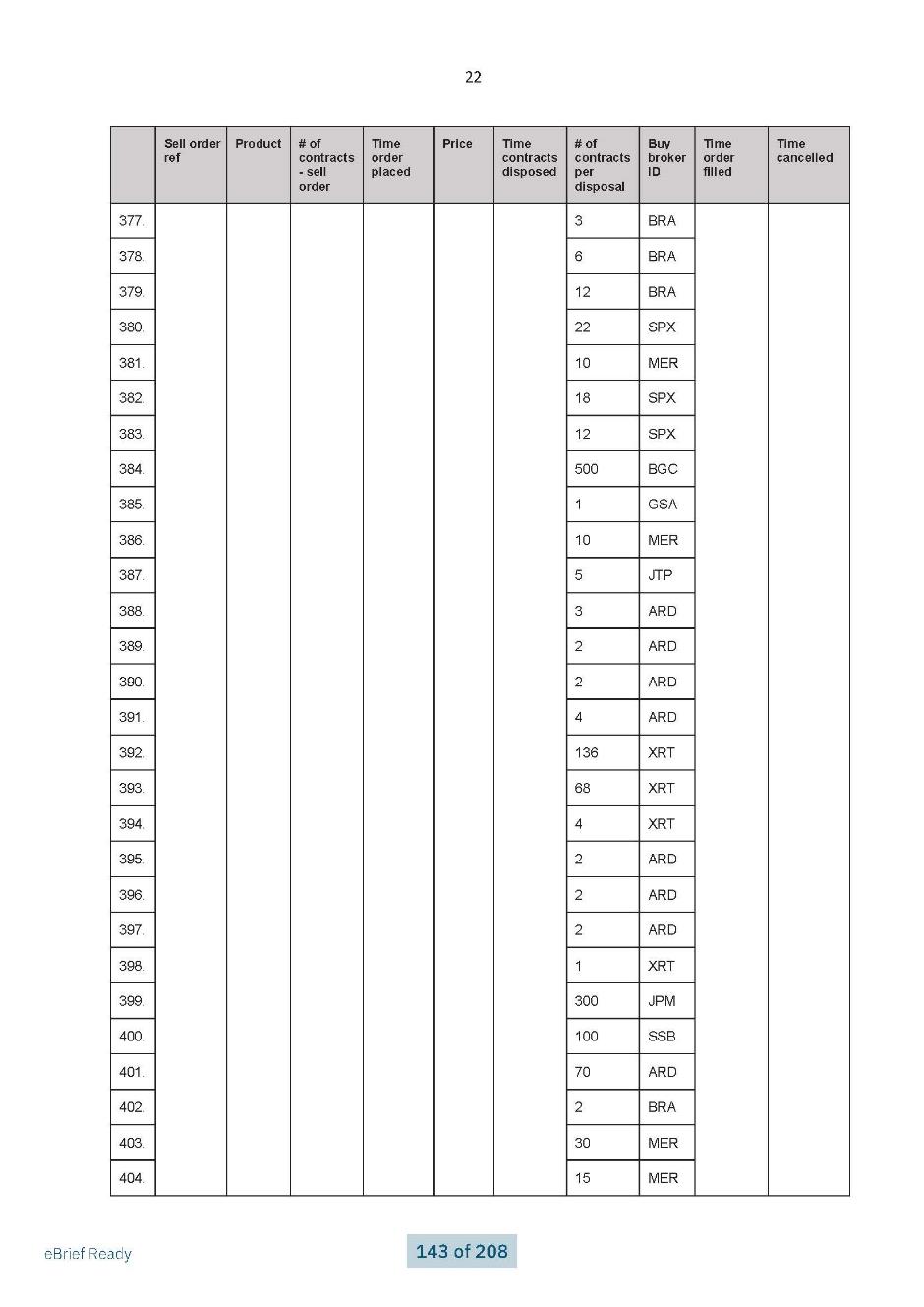

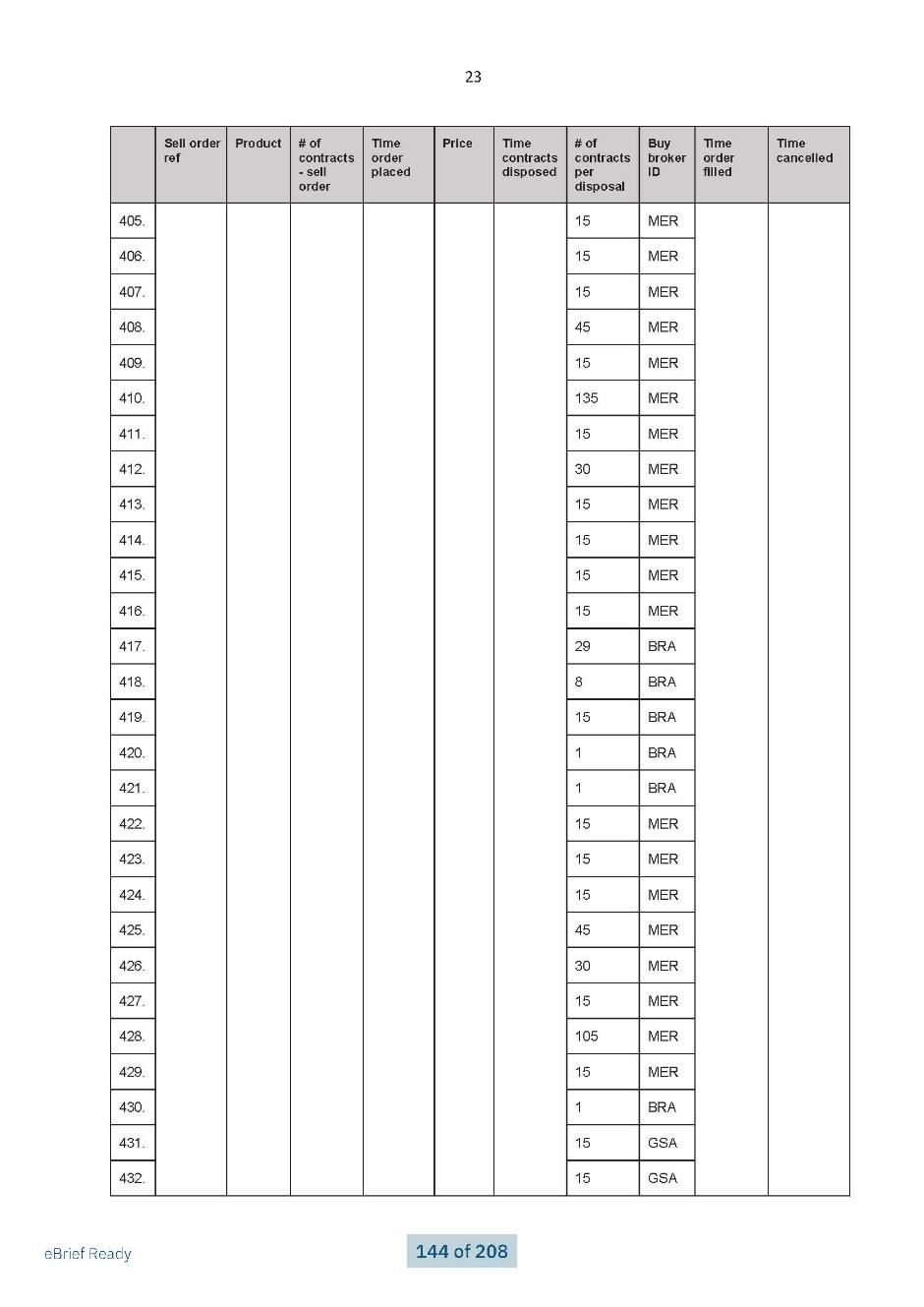

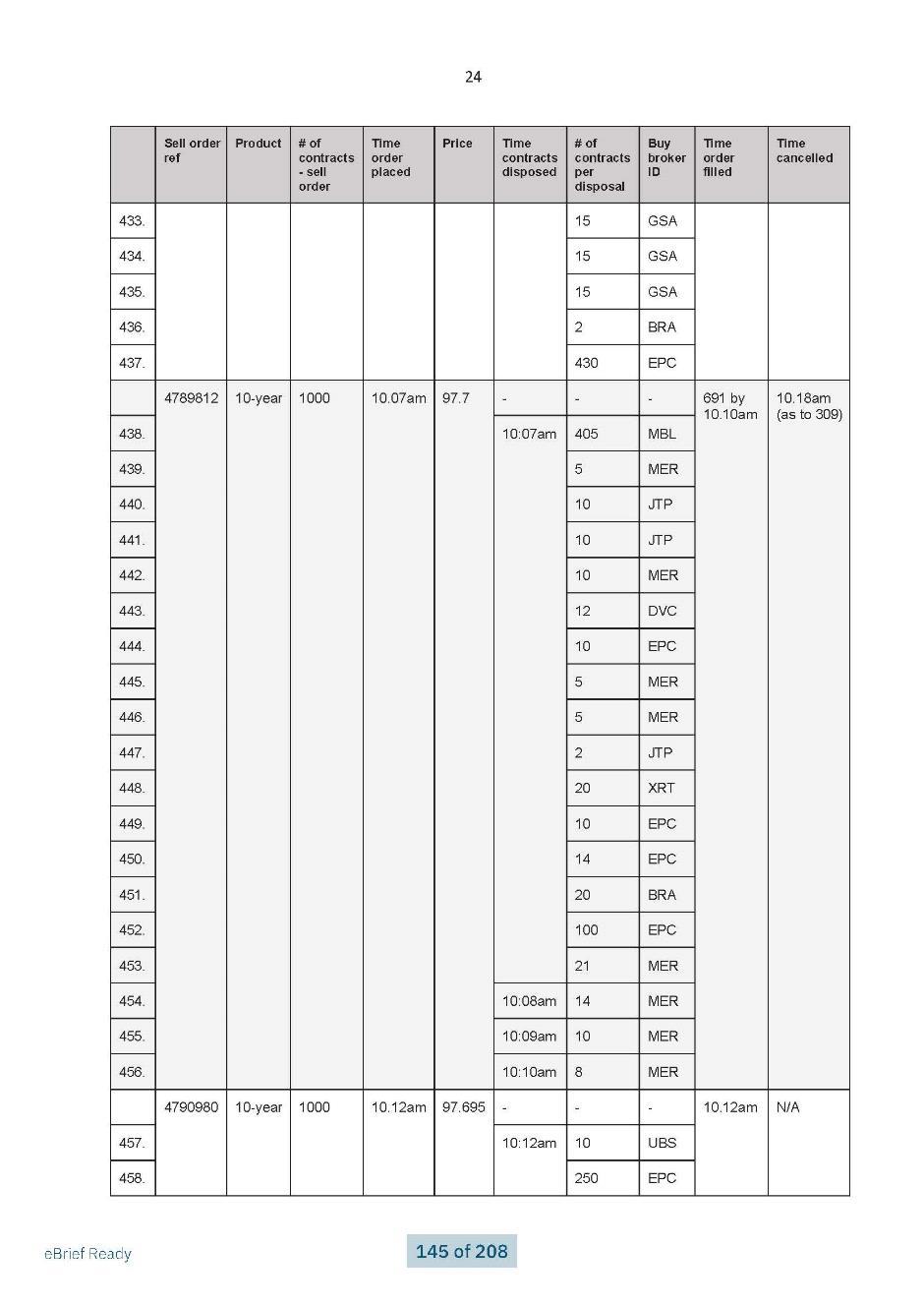

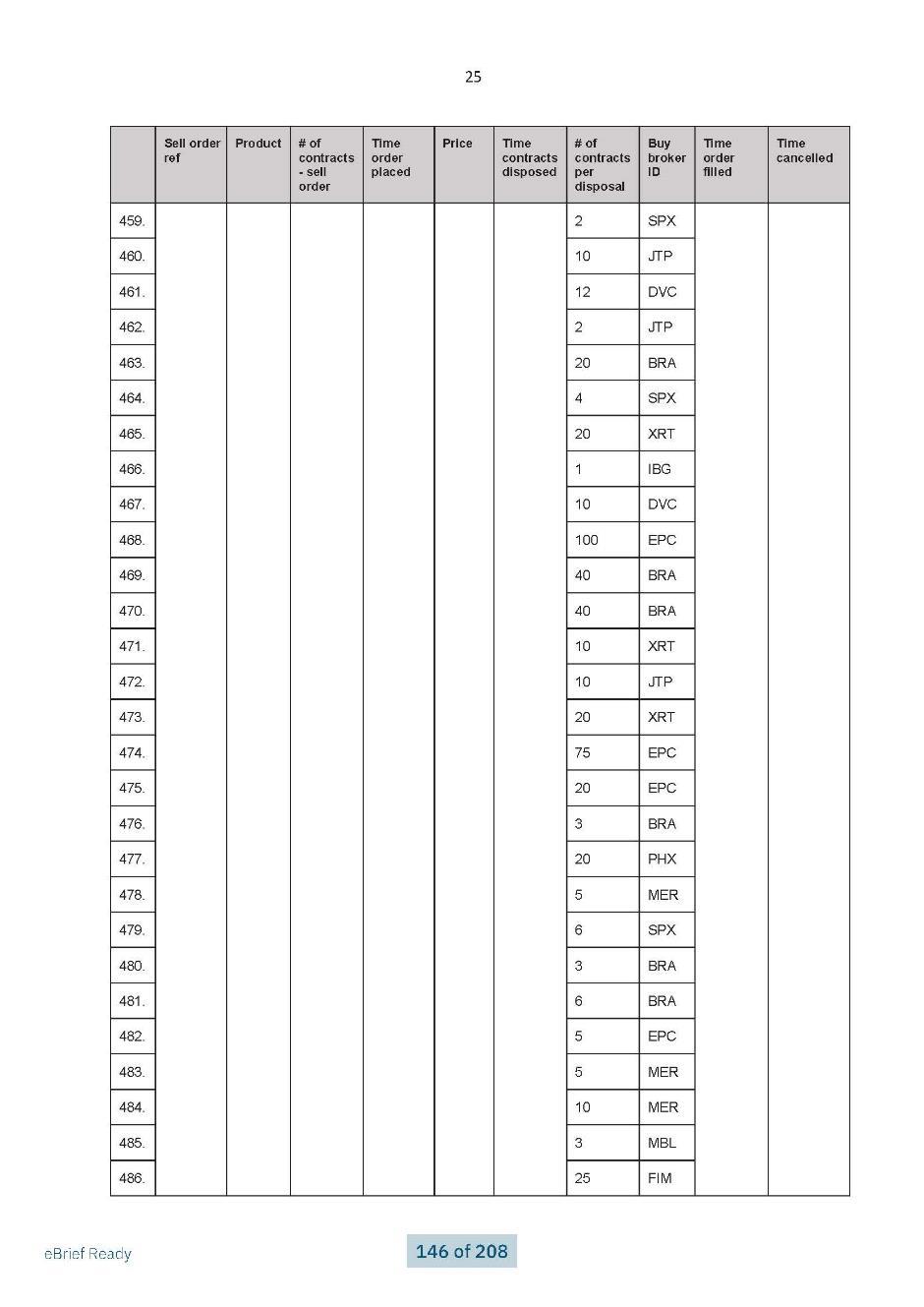

(g) Between 8:33am and 10:27am, Westpac engaged in pre-hedging trading in accordance with the Pre-Hedging Plan by trading a significantly large volume of interest rate derivatives in the futures and inter-bank swap markets in a compressed timeframe ahead of execution of the Swap Deal.

(h) Once Westpac commenced its on-market pre-hedging trading, if the Consortium had alternatively sought to proceed to execute the Swap Deal with any bank other than Westpac, it would not have been able to do so without the market rate of the Swap Deal being potentially affected by Westpac’s trading and could not protect itself against the risk that Westpac’s trading would increase the price of the Swap Deal to the Consortium.

(i) Westpac was aware that the pre-hedging trading had the potential to increase the prices of the products it traded and thereby the price of the Swap Deal to the Consortium, where every basis point increase to that price would involve a cost to the Consortium of about $4.7 million.

(j) In the context of paragraphs (1)(a) to (i) above, Westpac’s execution of the Swap Deal was in all the circumstances against commercial conscience.

Financial Service Licensee Obligations

2. Westpac contravened s 912A(1)(a) of the Corporations Act 2001 (Cth) (Corporations Act) by not doing all things necessary to ensure that the Swap Deal was provided to and executed with the Consortium efficiently, honestly and fairly, in that:

(a) Westpac engaged in the conduct specified in paragraph 1 above;

(b) Westpac had no policy specifically on pre-hedging of transactions;

(c) Westpac had inadequate training, practices or procedures as to disclosure to and, where appropriate, obtaining consent from, counterparties in relation to pre- hedging of transactions;

(d) Westpac had inadequate mechanisms in place to review the trading undertaken to pre-hedge transactions such as the Swap Deal and did not conduct any formal review after the Swap Deal was executed.

3. Westpac contravened s 912A(1)(aa) of the Corporations Act by having inadequate arrangements in place for the management of the conflict of interest that arose in the Swap Deal between Westpac’s interest in managing the anticipated risk it would acquire upon entering into the Swap Deal and the interest of the Consortium in avoiding any increase in the execution price of the Swap Deal which could result from Westpac pre-hedging its risk before execution of the Swap Deal.

Penalty and costs

…

5. Pursuant to s 12GBA(1) of the ASIC Act and in respect of the contravention the subject of paragraph 1 of these Orders, Westpac pay a pecuniary penalty in the sum of $1.8 million to the Commonwealth of Australia within 28 days of these Orders.

6. Westpac pay ASIC’s costs of and incidental to these proceedings fixed in the amount of $5.4 million.

…

AND THE COURT NOTES THAT:

9. ASIC will issue to Westpac a direction under s 91 of the ASIC Act requiring Westpac to pay ASIC’s investigation costs.

10. ASIC and Westpac have agreed that ASIC’s investigation costs referred to in paragraph 9 be fixed in the sum of $2.6 million.

B.2 The Compliance Programme

30 As noted earlier, the parties’ proposed orders contemplate the implementation of a compliance programme in the following terms:

AND THE COURT ORDERS THAT:

Compliance programme

4. Pursuant to s 1101B(1) of the Corporations Act and/or s 12GLA(2)(b) of the ASIC Act, Westpac undertake a compliance programme (Compliance Programme) at its cost which involves the following steps:

(a) Within four months of the date of these Orders or such other time as agreed in writing between ASIC and Westpac, Westpac will undertake a self-assessment and prepare a report on the adequacy and effectiveness of the systems, controls, policies and procedures in Westpac Institutional Bank to prevent, detect and respond to future breaches by Westpac of the kind identified in paragraphs 1–3 above in relation to pre-hedging of transactions (including, to the extent relevant, in relation to conflicts of interest management, client communications, and post trade monitoring) (Westpac Report).

(b) Within two months of the finalisation of the Westpac Report or such other time as agreed in writing between ASIC and Westpac, Westpac will instruct an independent expert to:

(i) having regard to the Westpac Report, independently assess the adequacy and effectiveness of those systems, controls, policies and procedures in Westpac Institutional Bank to prevent, detect and respond to future breaches by Westpac in relation to pre-hedging of transactions; and

(ii) within three months provide a report (Expert Report) to ASIC and Westpac which will identify any deficiencies and make recommendations to address those deficiencies.

(c) In relation to any deficiencies identified in the Expert Report, Westpac will action all reasonable recommendations of the independent expert within six months of receiving the Expert Report and provide a statement to ASIC explaining why a recommendation has not been adopted (if any).

(d) Westpac will provide to ASIC:

(i) within one month following implementation of the recommendations in the Expert Report, an attestation from the Chief Executive, Westpac Institutional Bank, stating that those recommendations have been implemented and describing how they have been implemented; and

(ii) 12 months following the first attestation, an attestation from the Chief Executive, Westpac Institutional Bank, stating that he or she is satisfied as to the ongoing adequacy and effectiveness of the systems, controls, policies and procedures in Westpac Institutional Bank to prevent, detect and respond to future breaches by Westpac in relation to pre-hedging of transactions.

(e) The appointment and terms of engagement of the independent expert are to be approved by ASIC in accordance with the terms set out in the Annexure to these Orders.

…

7. The parties have liberty to apply in respect to paragraph 4 of these Orders.

31 At the hearing, I raised with the parties whether or not it is appropriate that orders along these lines should be made which, in summary, put in place a process whereby Westpac would have four months to engage in a process of self-assessment; engage in a process whereby the parties agree upon an independent expert to provide a report which has the aim of identifying any recommendation to address any deficiencies; and puts in place a regime whereby those recommendations are implemented or, if not implemented, requiring an explanation from the Chief Executive of Westpac Institutional Bank why it is unnecessary that they be implemented.

32 Despite the paction between the parties, I do not presently understand why it would not be more appropriate for the Court to make an order appointing a referee independent of Westpac to inquire into and report upon the adequacy and effectiveness of the systems, controls, policies and procedures of Westpac Institutional Bank, and then provide the Court with a report setting out what (if any) deficiencies exist and what orders should be made under s 1101B(1) of the Corporations Act to remedy those deficiencies. Obviously enough, both Westpac and ASIC would then have the opportunity to be heard at any hearing as to whether or not the recommendations of the referee should be adopted by the Court, and whether those recommendations should be reflected in orders.

33 This strikes me as a more appropriate way of ensuring that no repetition of contravening conduct occurs, rather than a process which involves self-assessment, followed by a mere attestation from the Chief Executive of Westpac Institutional Bank as to whether or not that person considers it is appropriate to implement any remedial steps.

B.3 Section 1101B(1) Order

34 There is an acute public interest in securing compliance with the law by large financial institutions. The public interest is best served by transparency as to how such institutions have conducted themselves and the remedial responses allowed by the law when such institutions have acted in a matter contrary to commercial conscience.

35 In this regard, the final matter I raised with the parties concerns whether or not there should be a further order under s 1101B(1) of the Corporations Act requiring Westpac to publish information to the public, at its expense, noting, among other things:

(1) that it had contravened the law;

(2) brief details of the contraventions;

(3) information as to the financial benefit that Westpac obtained by reason of the contravening conduct; and

(4) the fact that it was required to pay a pecuniary penalty of $1.8 million and contribute to the costs of ASIC.

36 Needless to say, I have not formulated the terms of such an order, and the parties have not had time to make submissions as to whether or not such an order should be made, other than it was simply not part of the agreement struck to resolve this proceeding.

C CONCLUSION AND ORDERS

37 In all the circumstances, I am not fixed upon the idea that it would be appropriate to depart from the parties’ agreement as to the compliance programme, or make a further order under s 1101B(1). With that said, I would be assisted by further written submissions from the parties as to why it would not be appropriate for me to proceed along the lines which I have indicated above. It may be that I am satisfied that it is appropriate make orders along the lines of proposed orders 4 and 7, in which case I would make orders in Chambers.

38 If I am not then satisfied that adopting the parties’ proposed course is clearly appropriate, and require the assistance of further oral submissions, I will make the necessary arrangements through my Associate to list the matter for further hearing.

39 Accordingly, I will not dismiss the amended originating application today, but will make the orders I have indicated in these reasons.

40 I am grateful for the thoroughness of the parties’ joint submissions, the exchange today at the oral hearing, and the high degree of co-operation in agreeing upon relevant facts, which has allowed me to proceed immediately to the delivery of judgment.

I certify that the preceding forty (40) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Lee. |

Associate: