Federal Court of Australia

General Manager of the Fair Work Commission v Australian Workers’ Union [2023] FCA 1642

ORDERS

GENERAL MANAGER OF THE FAIR WORK COMMISSION Applicant | ||

AND: | Respondent | |

DATE OF ORDER: | 21 december 2023 |

THE COURT DECLARES THAT:

1. The respondent contravened section 172 of the Fair Work (Registered Organisations) Act 2009 on 13,950 occasions by failing to remove from its register of members in respect of its Queensland branch the name and postal address of members who had not paid dues for more than 24 months within 12 months of the end of the 24 month period.

2. The respondent contravened section 230(1)(a) of the Act on 6,814 occasions by failing to record in its register of members in respect of its Queensland, South Australian and Greater NSW branches the name and postal address of each member.

3. The respondent contravened section 230(2)(b) of the Act on 6,362 occasions by failing to remove from its register of members in respect of its Queensland branch the name and postal address of ceasing members within 28 days after they ceased to be a member.

4. The respondent contravened section 231(1) of the Act on nine occasions by failing to keep for seven years a copy of its register of members as it stood on 31 December in 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016 and 2017.

5. The respondent contravened section 254 of the Act on five occasions by failing to accurately report the number of members of the AWU as at 30 June in the operating reports lodged by the National Office of the respondent in 2010, 2011, 2012, 2013 and 2014.

THE COURT ORDERS THAT:

1. Pursuant to section 306 of the Act, the respondent pay penalties totalling $290,000 to the Commonwealth within 42 days of the date of this order in respect of the contraventions referred to in paragraphs 1 to 5 above.

the court notes the agreement of the parties that:

1. As part of the resolution of these proceedings, the respondent has agreed to issue a joint media release to be published on its website and Facebook page acknowledging the contraventions and penalties referred to in the Declarations and Order above, the importance of the respondent’s compliance obligations, and the steps taken by the respondent to remedy its non-compliance.

2. There be no order as to costs.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

GOODMAN J

1 At all material times the respondent (AWU) was an “organisation” registered under the Fair Work (Registered Organisations) Act 2009 (Cth). The AWU operated pursuant to Rules made in accordance with Part 2 of Chapter 5 of the Act. Under the Rules, the AWU comprised a National Office and various branch offices including: (1) Port Kembla, South Coast & Southern Highlands (until 1 September 2016); (2) Newcastle, Central Coast & Northern Region (until 1 September 2016); (3) Greater New South Wales (until 1 September 2016); (4) New South Wales (from 1 September 2016); (5) South Australia; (6) Western Australia; (7) Queensland; (8) Tasmania; and (9) the Tobacco Workers Branch, until it ceased to exist under the Rules on 1 July 2013.

2 The Act imposed a series of obligations upon the AWU’s National Office and its branches with respect to their record-keeping and reporting. The AWU and its branches used a database known as MembershipToday for the purpose of record-keeping.

3 Those obligations were not met in various ways. The applicant applies for pecuniary penalties and declarations of contraventions under the Act.

4 The parties are agreed as to the contraventions and their consequences. The central allegations in the Statement of Claim have been admitted and a Statement of Agreed Facts was admitted into evidence (a copy of which is Annexure A to these reasons for judgment). The parties have filed a joint submission concerning relief (a copy of which is Annexure B to these reasons for judgment).

5 For the reasons set out below, I am satisfied that the orders sought by the parties should be made.

B. Statutory framework

6 The following civil penalty provisions were operative at all material times.

7 First, s 172 of the Act, which provided:

172 Non-financial members to be removed from the register

(1) If:

(a) the rules of an organisation require a member to pay dues in relation to the person’s membership of the organisation; and

(b) the member has not paid the amount; and

(c) a continuous period of 24 months has elapsed since the amount became payable; and

(d) the member’s name has not been removed from the register kept by the organisation under paragraph 230(1)(a);

the organisation must remove the name and postal address of the member from the register within 12 months after the end of the 24 month period.

Civil penalty: 60 penalty units.

(2) In calculating a period for the purposes of paragraph (1)(c), any period in relation to which the member was not required by the rules of the organisation to pay the dues is to be disregarded.

(3) A person whose name is removed from the register under this section ceases to be a member of the organisation on the day his or her name is removed. This subsection has effect in spite of anything in the rules of the organisation.

8 Secondly, s 230(1)(a) of the Act, which provided:

230 Records to be kept and lodged by organisations

(1) An organisation must keep the following records:

(a) a register of its members, showing the name and postal address of each member and showing whether the member became a member under an agreement entered into under rules made under subsection 151(1);

…

Civil penalty: 60 penalty units

9 Thirdly, s 230(2)(b) of the Act, which provided:

230 Records to be kept and lodged by organisations

…

(2) An organisation must:

…

(b) remove from that register the name and postal address of each person who ceases to be a member under section 171A, or under the rules of the organisation, within 28 days after the person ceases to be a member; and

…

Civil penalty: 60 penalty units

10 Fourthly, s 231(1) of the Act, which provided:

231 Certain records to be held for 7 years

(1) An organisation must keep a copy of its register of members as it stood on 31 December in each year. The organisation must keep the copy for the period of 7 years after the 31 December concerned.

Civil penalty: 60 penalty units.

…

11 Finally, s 254 of the Act, which provided in so far as is presently relevant:

254 Reporting unit to prepare operating report

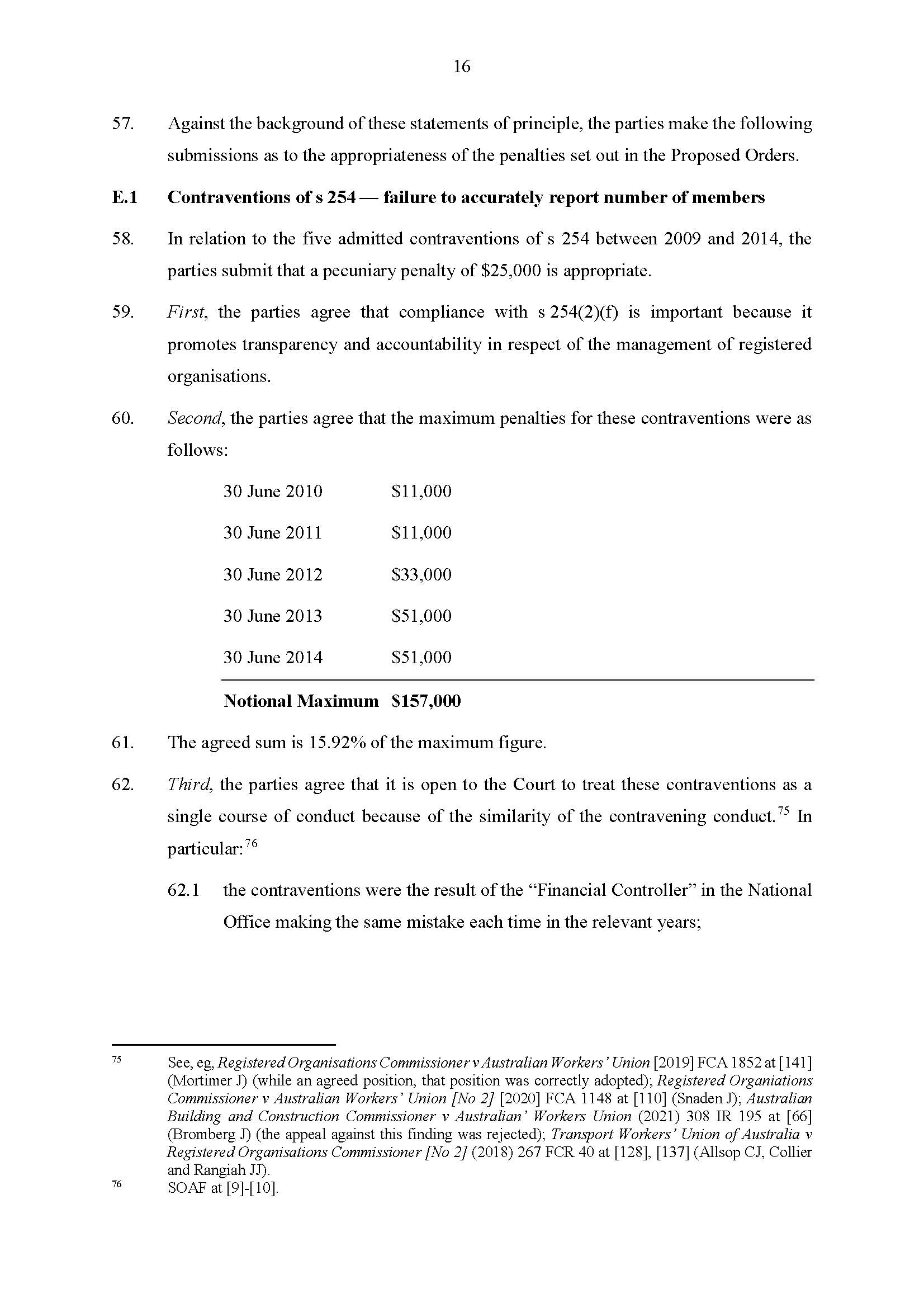

(1) As soon as practicable after the end of each financial year, the committee of management of a reporting unit must cause an operating report to be prepared in relation to the financial year.

(2) The operating report must:

…

(f) contain any prescribed information.

....

(4) A reporting unit must not contravene this section.

Civil penalty: 100 penalty units.

12 Set out below is a summary of the salient facts concerning the admitted contraventions, taken from the pleadings and Statement of Agreed Facts.

C.1 Section 172 – failure to remove unfinancial members

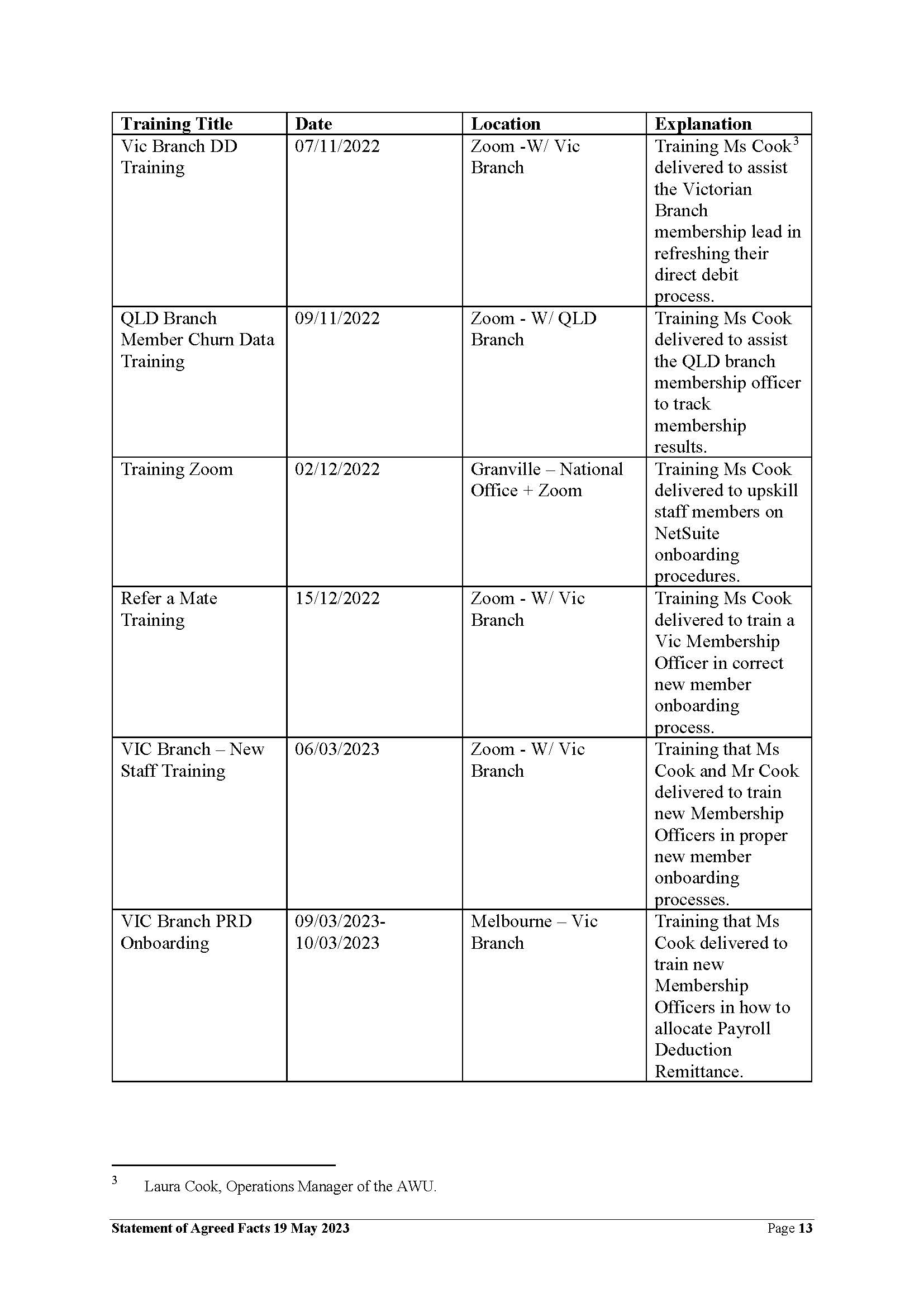

13 Between 31 December 2012 and 31 December 2016:

(1) the AWU had no uniform practice or process in relation to the removal of unfinancial members to ensure that such members were removed within 12 months of becoming unfinancial for more than 24 months;

(2) as a result, each AWU branch adopted its own practice in relation to the removal of unfinancial members, which practice operated without any oversight from the National Office;

(3) in the case of the Queensland branch:

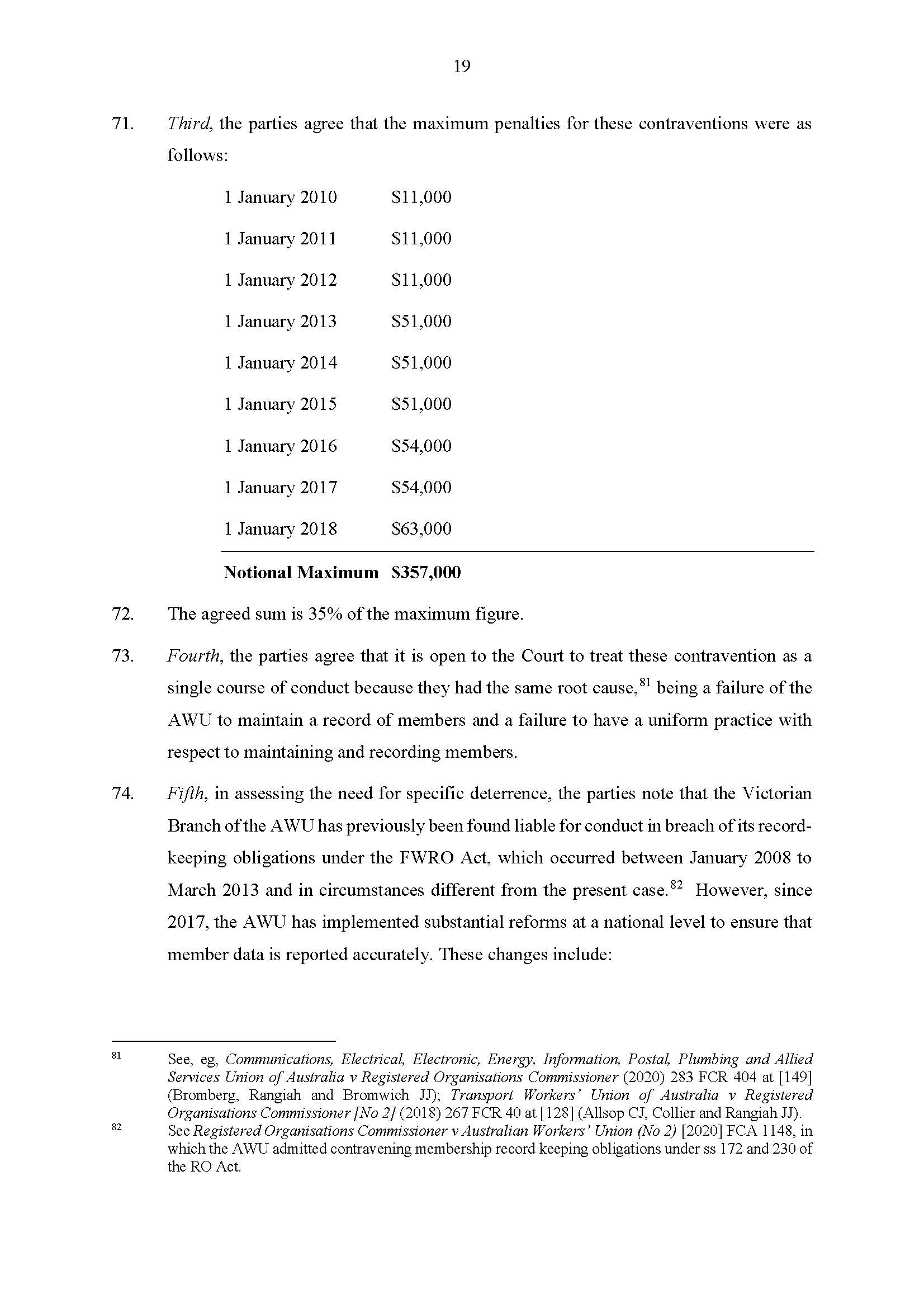

(a) its practice was to “purge” unfinancial members in bulk about once per year. This was a manual process involving the member record being moved to “archived” status in the member database;

(b) the purging or archiving process generally occurred after members had been unfinancial for more than three years rather than occurring within the period prescribed by s 172 of the Act; and

(c) between 2012 and 2016, the membership database maintained by the Queensland branch included 13,950 entries for members who were required to, but had not, paid their membership dues for more than three years.

14 For each of these 13,950 members, the AWU failed to remove their name and postal address from the AWU’s register of members within 12 months after the end of the 24 month period prescribed by s 172. As a result, the AWU contravened s 172 of the Act on at least 13,950 occasions between 2012 and 2016 with respect to the Queensland branch.

C.2 Section 230(1)(a) – failure to record name and address of each member

15 Between 2012 and 2016, the AWU failed to keep a register of its members showing the name and postal address of each member. Instead, between 31 December 2012 and 31 December 2016 the AWU:

(1) treated the aggregated membership data maintained by each of its branches as the register of members it was required to keep under s 230(1) of the Act;

(2) had no uniform set of systems or procedures in relation to member management or the validation of member entries;

(3) and its branches had no uniform practice in relation to the verification of entries or the removal of duplicate entries from their membership databases; and

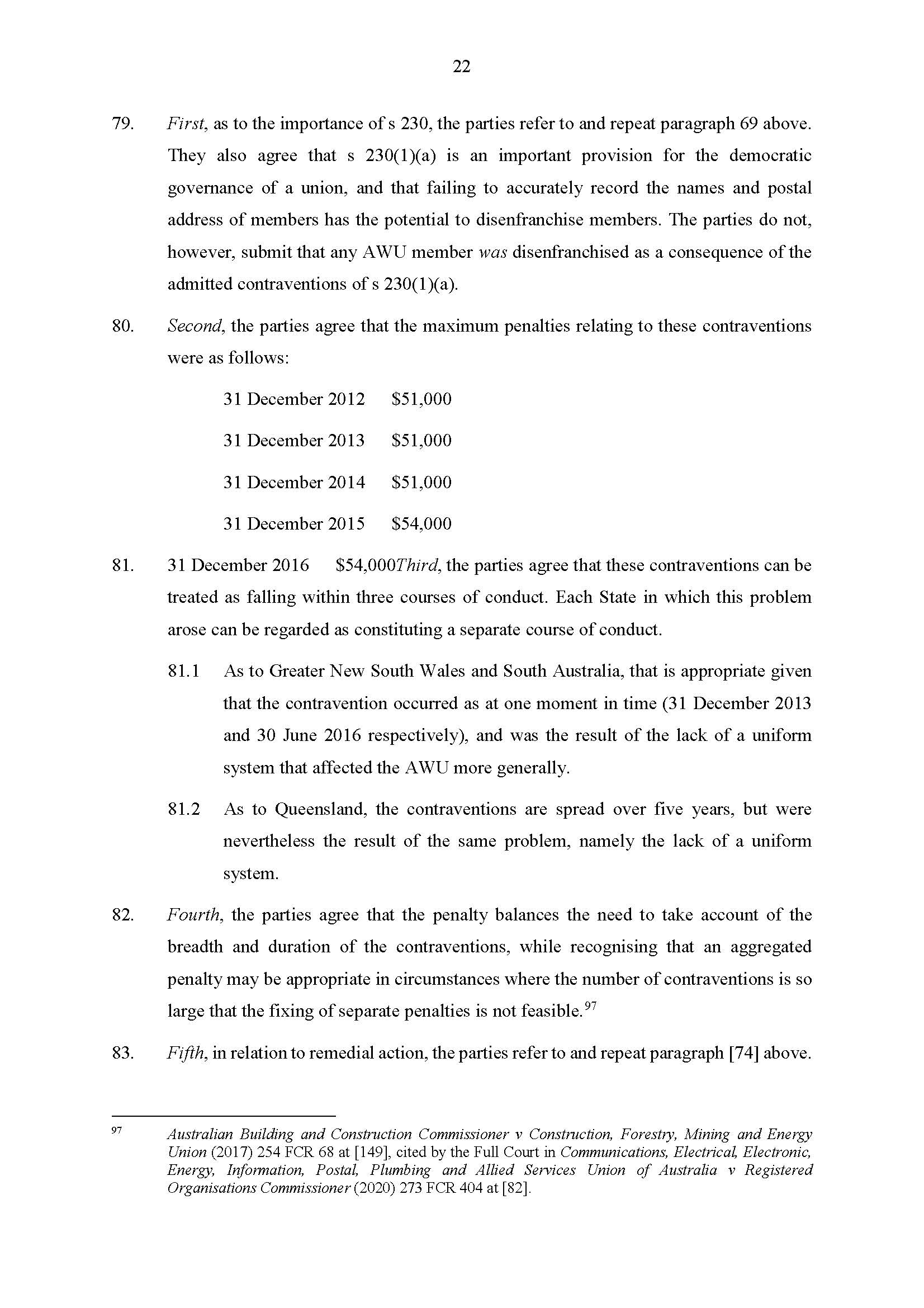

(4) contravened s 230(1)(a) of the Act on at least 4,847 occasions between 2012 and 2016 with respect to the Queensland branch;1,368 occasions in 2013 with respect to the Greater New South Wales branch; and 599 occasions in 2016 with respect to the South Australian branch (a total of at least 6,814 contraventions).

C.3 Section 230(2)(b) – failure to remove resigned members within 28 days

16 Between 31 December 2012 and 31 December 2016:

(1) rule 14 of the Rules allowed a member to resign by written notice, with such notice taking effect on the day on which it was received, on the day specified in the notice, or two weeks after the notice was received depending upon the particular circumstances;

(2) the practice of the Queensland branch upon receipt of such a notice was to assign to the member who had provided the notice an account status type of “Pending Resignation” in MembershipToday, but not to remove that member from the register immediately. Instead, such members were treated as “unfinancial” members and removed in accordance with that branch’s practice for the removal of such members; and

(3) at no time did anyone from the Queensland branch or the AWU’s National Office question whether this practice was in accordance with the AWU’s obligations under s 230(2)(b) of the Act.

17 Between 2012 and 2016, the membership database maintained by the Queensland branch included 6,362 entries for members classified as “Pending Resignation” in one year that remained on the register the following year. For each of those 6,362 persons, the AWU failed to remove their name and postal address from its register of members within 28 days after those persons ceased to be a member.

18 Thus, the AWU contravened s 230(2)(b) of the Act on at least 6,362 occasions between 2012 and 2016 with respect to the AWU’s Queensland branch.

C.4 Section 231(1) – failure to keep a copy of the register of members

19 At all material times:

(1) each AWU branch used MembershipToday, save that at the end of 2017, the New South Wales branch shifted from using MembershipToday to using a different software application database called Oracle Netsuite;

(2) the AWU’s National Office did not maintain an independent record of the AWU’s membership and instead relied on the membership data maintained by individual branches to comply with its obligations under the Act;

(3) for the purposes of the preparation of the AWU’s annual returns, the secretary of each branch provided the AWU’s National Office with membership numbers extracted from MembershipToday as at 31 December in the previous year; and some of the branches also provided the AWU’s National Office with an extract containing the membership data stored on their system as at that date; and

(4) the AWU’s National Office took no steps to: (a) collate this data for the purpose of keeping a register of members; (b) ensure that a copy of the register of members across all of the AWU’s branches was kept for seven years (either by the relevant branch or by the National Office).

20 The AWU has been unable to produce or identify an accurate or comprehensive record of the state of its register of members as at 31 December for each year from 2009 to 2017.

21 By failing to keep a copy of its register of members as it stood on 31 December for each of the years 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016 and 2017, the AWU contravened s 231(1) on nine occasions during the period from 2009 to 2017.

22 The AWU’s failure to keep a copy of its register of members during the relevant period had the consequence that it has not been possible to ascertain whether the membership data maintained by the AWU complied with ss 230(1)(a), 230(2)(b) and 172 of the Act, except for the specific contraventions of those provisions admitted by the AWU and described above.

C.5 Section 254 – failure to provide accurate operating reports

23 The membership numbers reported by AWU’s National Office in its operating report for each of the financial years 2010, 2011, 2012, 2013 and 2014 did not accurately reflect the numbers recorded in the AWU’s register of members as at 30 June in each of those years. Instead, the membership numbers used were those as at 31 December in the previous years and were replicated from the previous year’s annual report. As a result, the AWU’s National Office contravened s 254(2)(f) of the Act on five occasions between 2009 and 2014.

24 Set out below is a summary of the salient events since the contraventions.

25 The AWU has established new systems, procedures and practices regarding the management of its membership data and reporting, directed at ensuring compliance by the AWU with those obligations. Those changes included the launch of a membership project; the commissioning of an independent review of its membership data maintenance practices, reporting systems and processes; the approval of a new membership policy which incorporated changes recommended by the independent reviewer; a transition from the MembershipToday database to the Oracle Netsuite database for all branches save for the South Australian branch; the commencement of regular meetings of the membership officers engaged in each of the branches who administer the AWU membership system.

26 Further, the AWU has introduced a compliance policy that outlines all of the AWU’s compliance obligations under the Act, and has appointed a compliance officer. Since July 2021, compliance has been a standing agenda item at each quarterly National Executive. Each of the branches is required to undergo a yearly external audit of its membership register so as to ensure the membership register is compliant with the membership policy.

27 The South Australian branch (which, as noted above, has not shifted to Oracle Netsuite) has implemented various procedural changes to ensure that it complies with the membership policy. Those changes are explained in an uncontradicted affidavit of Mr Peter Lamps, the Secretary of that branch.

28 Further, as to the contravention of s 254(2)(f) of the Act, the employee who had been responsible for the non-compliant practice for the period between 2010 to 2013 ceased employment with the AWU in 2013. His replacement as Financial Controller (who is also no longer employed by the AWU) continued the same practice until the AWU ceased it in 2015. After the non-compliant practice was identified in 2015, the AWU’s National Office ceased that practice. The AWU commenced reporting information received from its branches as at 30 June in any given year. In addition, the membership policy, required that each branch provide to the National Office by 30 September each year, that branch’s membership numbers as at 30 June for the purpose of the AWU’s reporting of its membership numbers in its Operating Report.

29 Mr Daniel Walton, the National Secretary of the AWU provided unchallenged evidence that:

(1) the AWU has taken significant steps to remedy its compliance issues. It has taken ownership of its past contraventions and has implemented permanent policy and structural changes within the AWU to facilitate ongoing compliance with the Act both at a national level and individual branch level;

(2) this process has taken some time because it was necessary to first diagnose the problems, including with external professional assistance; develop clear rules and procedures to be followed nationally; develop technical solutions including through external membership database service providers, educate and train AWU staff that operate the membership system; and finally respond to any further issues that have been identified by staff. This last element is an ongoing process and recognises the fact that compliance is a live and important issue to be addressed regularly;

(3) at no stage was the AWU taking deliberate steps to contravene the Act. There was no bad faith or ill-intent behind its non-compliance issues, and its non-compliance was attributable, as the report of the independent reviewer noted, to the absence of national policies concerning the AWU’s compliance obligations; and

(4) the AWU regretted and was remorseful for the admitted contraventions; acknowledged the importance of the AWU’s membership obligations; and acknowledged that its non-compliance was unacceptable.

30 Further, Mr Lamps provided unchallenged evidence that:

(1) in his capacity as Secretary of the South Australian branch, he deeply regrets that branch’s contraventions of ss 172, 230(1)(a), 230(1)(b), 231(1) and 254(2)(f) of the Act;

(2) he also regrets that these contraventions occurred during the time he was Branch Secretary;

(3) he had assumed that the processes he had inherited were correct, however, he acknowledges that he should have satisfied himself that those processes were sufficiently robust to ensure compliance with the Act;

(4) if he knew then what he now knows, he would have taken steps to assure himself that those processes were correct;

(5) to the best of his knowledge, there was no intention to obtain a benefit or cause a loss by the contraventions of the Act, nor was past non-compliant conduct attended by any malicious or wilful intention;

(6) he is not aware of any benefit having been obtained or loss caused by that conduct;

(7) as discussed above, the South Australian branch has taken prompt and significant remedial action to introduce new policies and practices, and also improve functionality of the MembershipToday database, to ensure it complies with its obligations under the Act, and in line with the membership policy. Further, the South Australian branch’s policies and practices are regularly reviewed to ensure compliance with the AWU’s policy documents and rules;

(8) he takes very seriously the legal obligations owed by his branch and, as described above, he has taken steps to ensure that the contraventions of the Act are not repeated;

(9) the remedial action undertaken by that branch has been effective. Mr Lamps takes the errors that are found during the audits seriously and is committed to ensuring that (to the extent possible) they do not happen and that they are found and remedied promptly if they do. As part of his regular meetings with membership and administrative staff, Mr Lamps impresses upon them the seriousness of ensuring full names and addresses are entered into the database, and he conveyed this to such staff after the independent review report was delivered to him. He also directed his branch’s Finance/Administration Officer to run refresher training in a meeting with membership and administration staff and he witnessed that refresher training take place.

31 The AWU has agreed to issue a joint media release to be published on the AWU website for three months from the date of this judgment, stating:

On [INSERT DATE] the Federal Court of Australia imposed a civil penalty totalling [$290,000] on The Australian Workers’ Union (AWU) for 27,140 contraventions of the Fair Work (Registered Organisations) Act 2009.

The contraventions covered a nine-year period between 2009 and 2017, during which the AWU admitted that it did not meet its statutory obligations to keep accurate copies of its membership register.

The AWU and the FWC General Manager reached an agreed position on the penalty to be imposed by the Court. The AWU understands the importance of its compliance obligations, including those relating to keeping and providing accurate information for its members.

The AWU admitted the contraventions alleged by the General Manager in this proceeding at the first available opportunity after the proceeding was commenced. There was no intent to contravene its statutory obligations.

Since 2017 the AWU has taken significant steps to remedy its non-compliance and reporting obligations. It has implemented permanent policy and structural changes to facilitate ongoing compliance with its statutory obligations both at a national level and Branch level.

These policies and structural changes are subject to continued review by the National Executive to ensure the AWU is consistently achieving its compliance obligations. To achieve these reforms, the National Executive has worked closely with the relevant Branches so as to ensure a seamless and effective transition by each Branch to the AWU’s approach to membership data management.

The AWU and the FWC General Manager have agreed to make this joint statement.

Further details in relation to the matter can be located in the Federal Court of Australia’s online file, which is available here: NSD992/2022.

32 The AWU has also agreed to publish the joint media release on its Facebook page.

33 The parties jointly seek an order requiring the AWU to pay penalties totalling $290,000.

34 They have set out in their joint submission an accurate summary of the principles applicable to the consideration of agreed penalties and to the imposition of penalties more generally. The considerations in favour of giving effect to agreements as to penalties are well established: see, e.g. Commonwealth v Director, Fair Work Building Industry Inspectorate [2015] HCA 46; (2015) 258 CLR 482 at 496 [28] and 503 to 504 [46] (French CJ, Kiefel, Bell, Nettle and Gordon JJ).

35 I am satisfied that each of the penalties sought for the contraventions of each section are within a range that I consider to be appropriate (and thus that the total penalty is also within an appropriate range). In arriving at that view I have taken into account the principles summarised in the joint submission.

36 In particular I have had regard to: deterrence being the pre-dominant, if not sole, purpose of such penalties; the maximum penalties available; the gravity of the obligations imposed by the Act and of the contraventions (see Communications, Electrical, Electronic, Energy, Information, Postal, Plumbing and Allied Services Union of Australia v Registered Organisations Commissioner [2020] FCAFC 232; (2020) 283 FCR 404 at 438 [147] (Bromberg, Rangiah and Bromwich JJ)); and the fact that much of the conduct described above was part of a single course or courses of conduct.

37 I have also considered the features specific to the AWU and which are relevant to the question of specific deterrence, including: the evidence that the contraventions were not deliberate; the co-operation and the contrition that the AWU has displayed; the steps taken to minimise further contraventions; and the AWU’s financial position. Finally, I have had regard to the principal of totality.

38 I am also satisfied that the declarations sought should be made, for the reasons set out in the joint submission. In particular, the declarations record the Court’s disapproval of the contravening conduct and assist in deterring other organisations from contravening the Act.

39 Consistent with s 329 of the Act, no order for costs has been sought.

40 The orders sought by the parties should be made. I will make orders accordingly.

I certify that the preceding forty (40) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Goodman. |

Associate:

Dated: 21 December 2023

ANNEXURE A – STATEMENT OF AGREED FACTS