Federal Court of Australia

Australian Competition and Consumer Commission v FitBit LLC [2023] FCA 1535

ORDERS

AUSTRALIAN COMPETITION AND CONSUMER COMMISSION Applicant | ||

AND: | Respondent | |

DATE OF ORDER: |

THE COURT DECLARES THAT:

1. From about 10 May 2020 to 22 February 2022, FitBit LLC, in trade or commerce, in connection with the promotion and supply of FitBit products to 18 Australian consumers:

(a) engaged in conduct that was misleading or deceptive, or likely to mislead or deceive, in contravention of s 18 of the Australian Consumer Law (ACL), being Schedule 2 to the Competition and Consumer Act 2010 (Cth); and

(b) made false or misleading representations regarding the existence, exclusion or effect of any condition, warranty, guarantee, right or remedy in contravention of s 29(1)(m) of the ACL,

by representing to those Australian consumers, via its customer service representatives, that those 18 Australian consumers did not have a right to refunds unless the FitBit products those consumers had purchased were returned within 45 days from the date of purchase, when in fact, those consumers’ right to reject products with a major failure, outside of 45 days from the date of purchase but within a reasonable time, and to seek a refund persisted, by virtue of the following:

(c) ss 54 and 55 of the ACL provide for consumer guarantees; and

(d) having regard to ss 64 and 276 of the ACL, FitBit LLC could not exclude, restrict or modify the availability of the consumer guarantees or a consumer’s entitlement to exercise the rights to a remedy for goods that do not comply with

the consumer guarantees.

2. From about 20 November 2020 to 14 February 2022, FitBit LLC, in trade or commerce, in connection with the promotion and supply of FitBit products to 40 Australian consumers:

(a) engaged in conduct that was misleading or deceptive, or likely to mislead or deceive, in contravention of s 18 of the ACL; and

(b) made false or misleading representations regarding the existence, exclusion or effect of any condition, warranty, guarantee, right or remedy in contravention of s 29(1)(m) of the ACL,

by representing to those Australian consumers, via its customer service representatives, in the course of communications with those 40 Australian consumers (of which, 39 who reported a problem with a replacement FitBit device and 1 reported a problem with an original FitBit device), that those consumers did not have a right to replacement products because the “warranty period” of two years offered on FitBit devices had expired, with the applicable “warranty period” in the case of the 39 consumers who reported a problem with a replacement FitBit device being the two year warranty period for the original device, when in fact, those consumers may have had a right to reject the FitBit device and obtain a refund or replacement regardless of whether the 2-year warranty period for their device had expired, by virtue of the following:

(c) ss 54 and 55 of the ACL provide for consumer guarantees; and

(d) having regard to ss 64 and 276 of the ACL, FitBit LLC could not exclude, restrict or modify the availability of the consumer guarantees or a consumer’s entitlement to exercise the rights to a remedy for goods that do not comply with the consumer guarantees.

AND THE COURT ORDERS THAT:

3. Within 45 days, FitBit LLC pay to the Commonwealth a pecuniary penalty of $11,000,000 in respect of its conduct declared to be contraventions of s 29(1)(m) of the ACL.

4. Pursuant to s 246(2)(b) of the ACL and s 23 of the Federal Court of Australia Act 1976 (Cth), FitBit LLC at its own expense:

(a) within 30 days of the date of this Order, appoint a suitably qualified compliance professional with expertise in consumer law who is independent of FitBit LLC and its related bodies corporate and has not previously been engaged by FitBit LLC (Reviewer) to review the efficacy of:

(i) FitBit LLC’s compliance program(s) insofar as they are designed to minimise the risk of contraventions of the ACL (Compliance Program); and

(ii) FitBit LLC’s implementation of the Compliance Program.

(b) instruct the Reviewer to prepare a written report to FitBit LLC within a period of 3 months of the date of their appointment that makes recommendations which identify:

(i) any revisions to FitBit LLC’s Compliance Program, and FitBit LLC’s implementation of that program, that are reasonably necessary to limit the risk of future contraventions of the ACL of the nature of those the subject of this proceeding; and

(ii) any material deficiencies in the Compliance Program or FitBit LLC’s implementation of that program that are reasonably necessary to be rectified, and should be rectified, to limit the risk of future contraventions of the ACL of the nature of those the subject of this proceeding.

(c) use best endeavours to provide the Reviewer with access to all sources of information in FitBit LLC’s possession, power or control that is relevant to the Reviewer’s review;

(d) within 30 business days of receiving the Reviewer’s written report, provide a copy of that report to the Applicant; and

(e) use best endeavours to implement with due diligence any recommendations made by the Reviewer.

5. FitBit LLC provide to the Applicant:

(a) written confirmation verifying that it has carried out its obligations under paragraph 4(b) above, within 10 days of FitBit LLC appointing the Reviewer; and

(b) written confirmation verifying that it has carried out its obligations under paragraph 4(e) above, within 6 months of the date of the Reviewer’s written report.

6. Within 45 days, FitBit LLC pay a contribution of $200,000 to the Applicant’s costs of, and incidental to the proceeding.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(Revised from transcript)

WIGNEY J:

1 FitBit LLC manufactures and sells wearable fitness trackers and smart watches, including to customers in Australia. The Australian Competition and Consumer Commission commenced this proceeding against FitBit alleging that it made false and misleading representations to, and engaged in conduct which was misleading or deceptive, or likely to mislead, a number of Australian consumers and thereby contravened ss 18(1) and 29(1)(m) of the Australian Consumer Law (sch 2 to the Competition and Consumer Act 2010 (Cth)). The impugned statements and conduct concerned the existence, exclusion or effect of consumer guarantee provisions of the Australian Consumer Law. The relief sought by the Commission included declaratory relief, the payment of a pecuniary penalty and orders which required FitBit to take certain steps in relation to its programs concerning compliance with the Australian Consumer Law.

2 While FitBit initially defended the proceeding, it now admits that it contravened ss 18(1) and 29(1)(m) of the Australian Consumer Law as alleged by the Commission. The Commission and FitBit have also reached an agreement concerning the declarations and orders that they submit that the Court should make. The question for the Court is essentially whether those declarations and orders can and should be made.

RELEVANT STATUTORY PROVISIONS

3 Section 18(1) of the Australian Consumer Law provides:

(1) A person must not, in trade or commerce, engage in conduct that is misleading or deceptive or is likely to mislead or deceive.

4 Section 29(1) of the Australian Consumer Law relevantly provides:

(1) A person must not, in trade or commerce, in connection with the supply or possible supply of goods or services or in connection with the promotion by any means of the supply or use of goods or services…

(m) make a false or misleading representation concerning the existence, exclusion or effect of any condition, warranty, guarantee, right or remedy (including a guarantee under Division 1 of Part 3-2)…

5 Section 224(1) of the Australian Consumer Law relevantly provides that if the Court is satisfied that a person has contravened certain provisions of the Australian Consumer Law, which relevantly includes a provision of Part 3-1 (within which s 29(1)(m) is situated), the Court may order the person to pay a pecuniary penalty in respect of each act or omission as the Court determines to be appropriate.

6 Section 224(2) provides:

(2) In determining the appropriate penalty, the Court must have regard to all relevant matters including:

(a) the nature and extent of the act or omission and of any loss or damage suffered as a result of the act or omission; and

(b) the circumstances in which the act or omission took place; and

(c) whether the person has previously been found by a court in proceedings under Chapter 4 or this Part to have engaged in any similar conduct.

7 Sections 224(3) and 224(3A) in combination provide the maximum pecuniary penalty payable by a body corporate for each contravening act or omission of a provision of Part 3-1, including s 29(1)(m). During the period when the contravening conduct occurred, s 224(3A) provided that the maximum pecuniary penalty payable in respect of a contravention of a provision of Part 3-1 was the greater of:

(a) $10,000,000;

(b) if the court can determine the value of the benefit obtained directly or indirectly and that is reasonably attributable to the act or omission, three times the value of that benefit; and

(c) if the court cannot determine the value of that benefit, 10% of the annual turnover of the body corporate during the 12-month period ending at the end of the month in which the act or omission occurred or started to occur.

AGREED FACTS RELATING TO THE CONTRAVENING CONDUCT

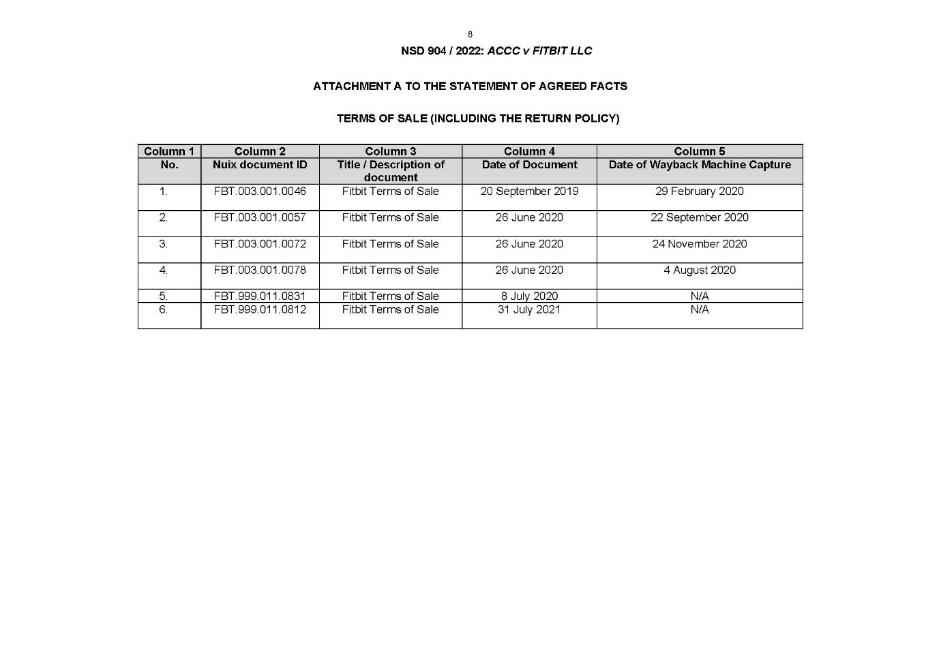

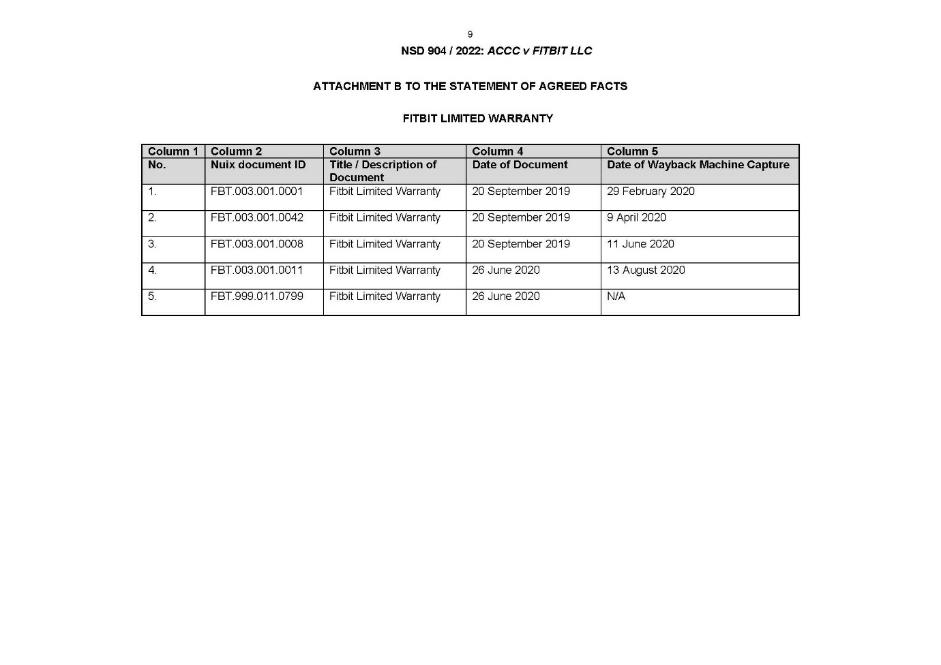

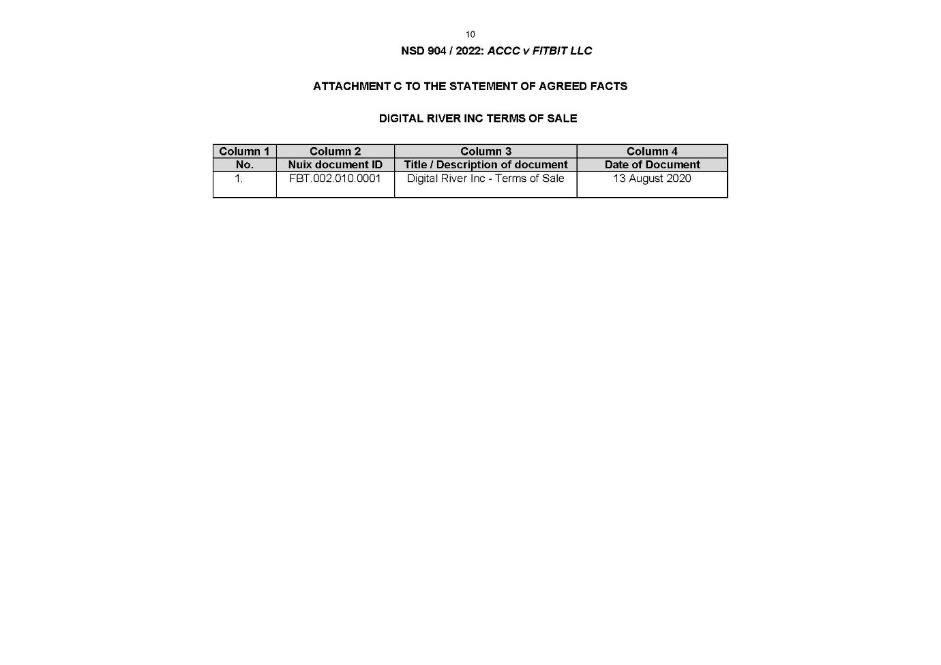

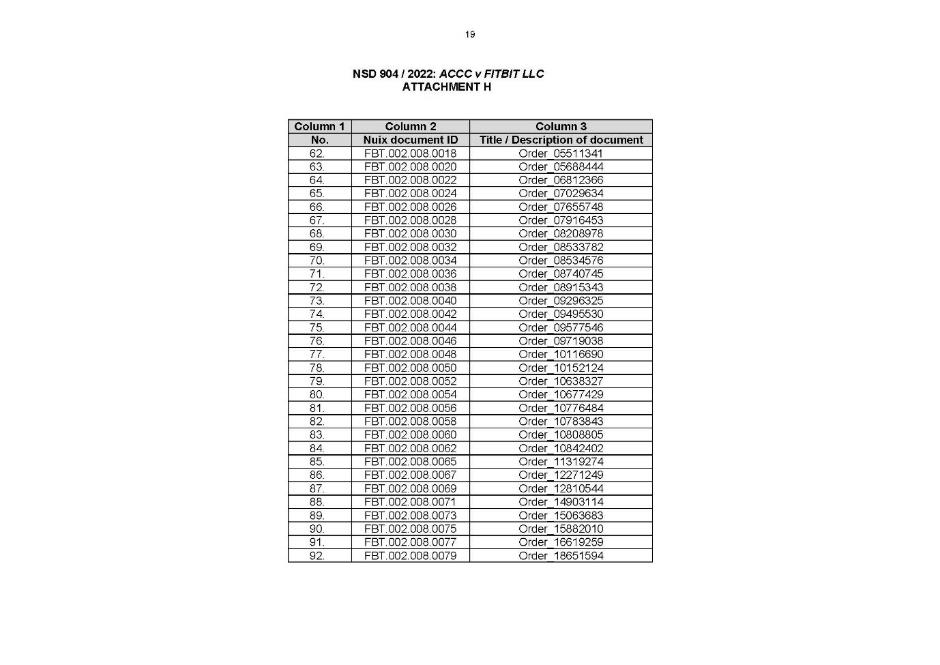

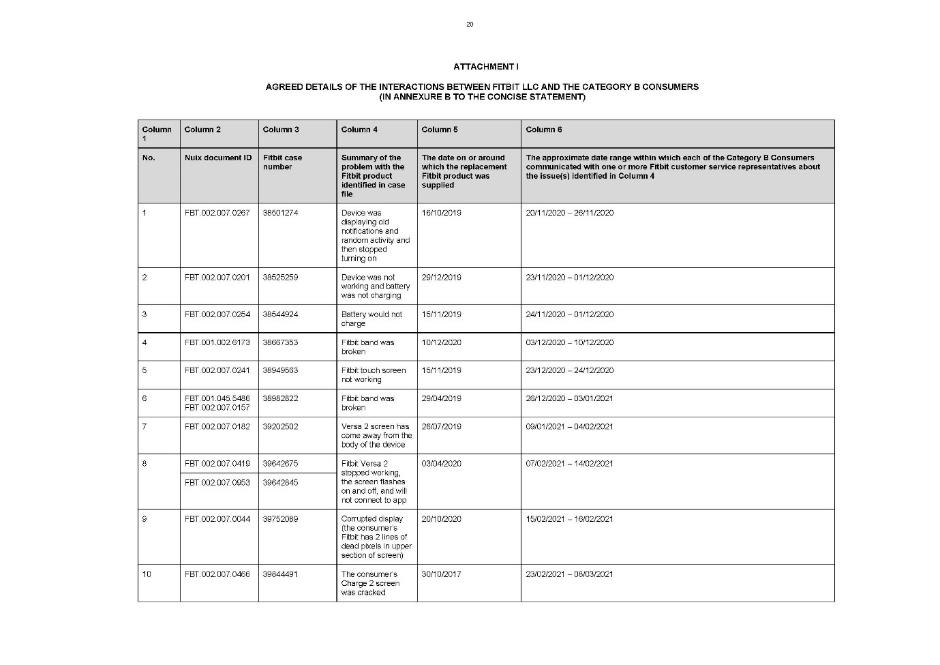

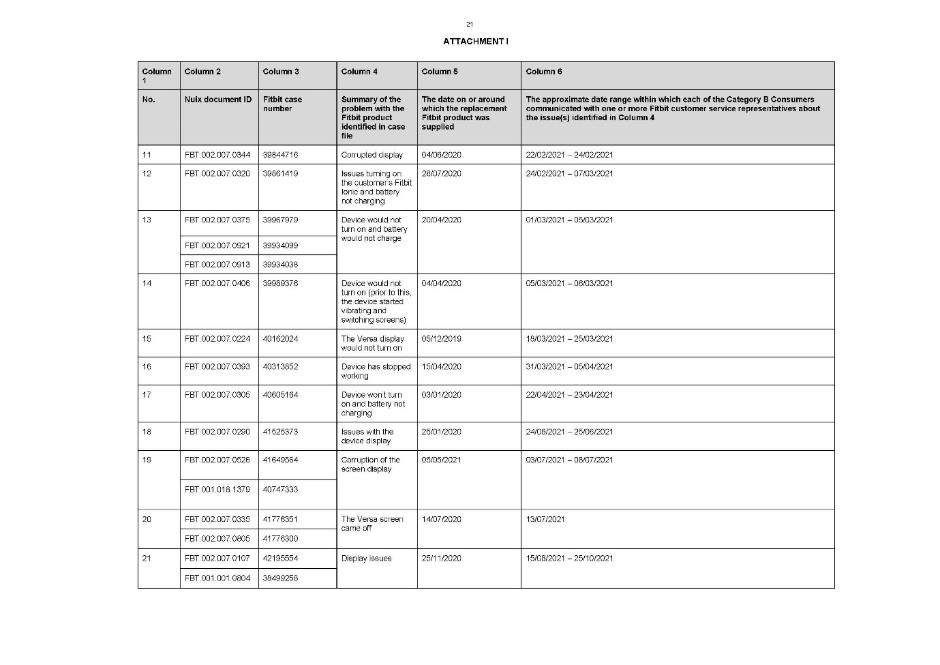

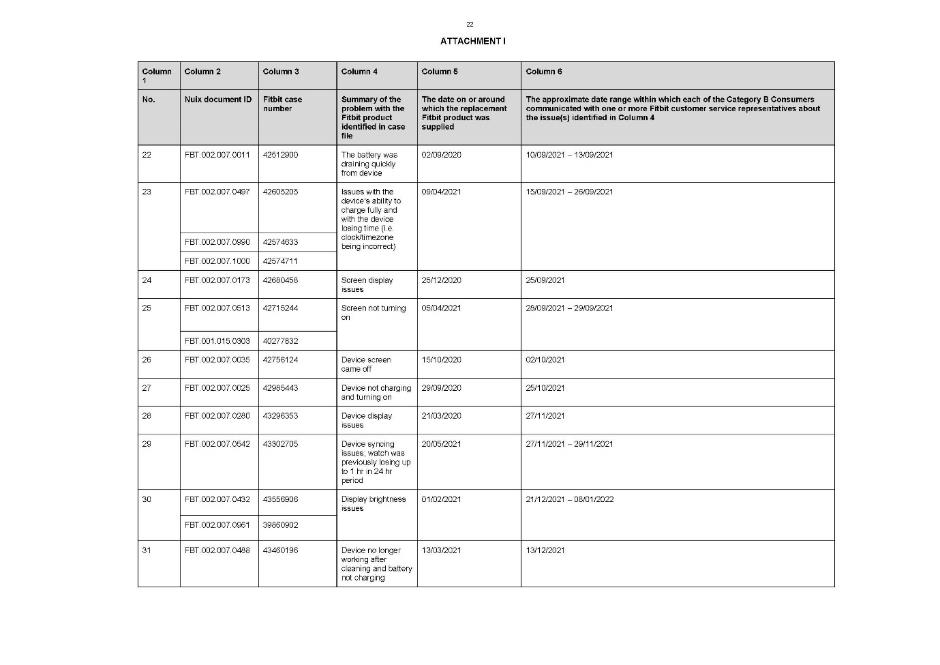

8 The parties jointly relied upon a Statement of Agreed Facts filed on 31 July 2023 and a Statement of Agreed Facts and Admissions filed on 8 December 2023. Copies of those documents are attached to this judgment at Annexure A. Following is a short summary of the relevant facts. There is no basis for the Court to believe or conclude that the agreed facts are inaccurate or incomplete in any material respect.

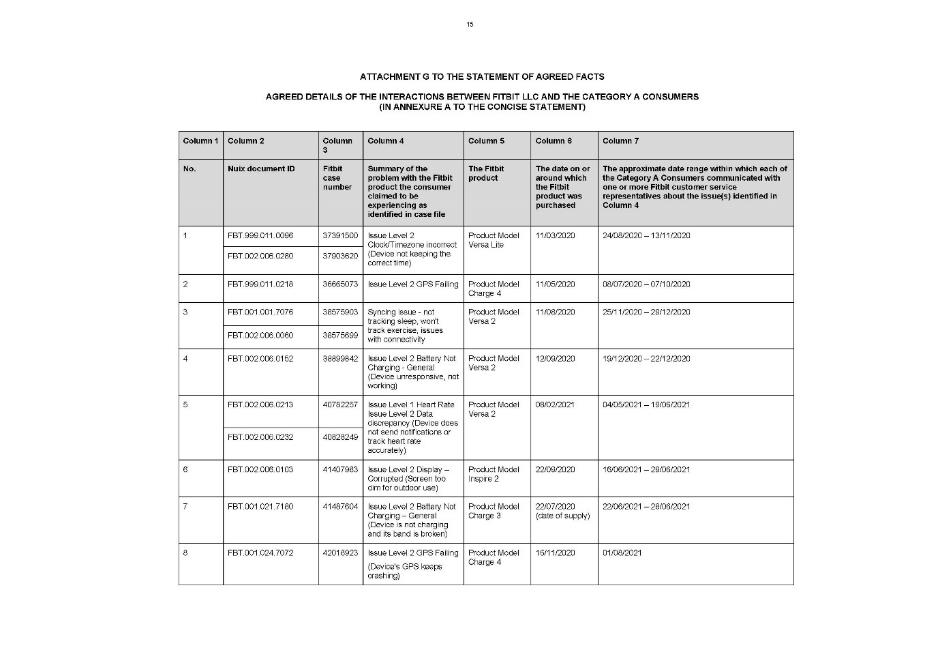

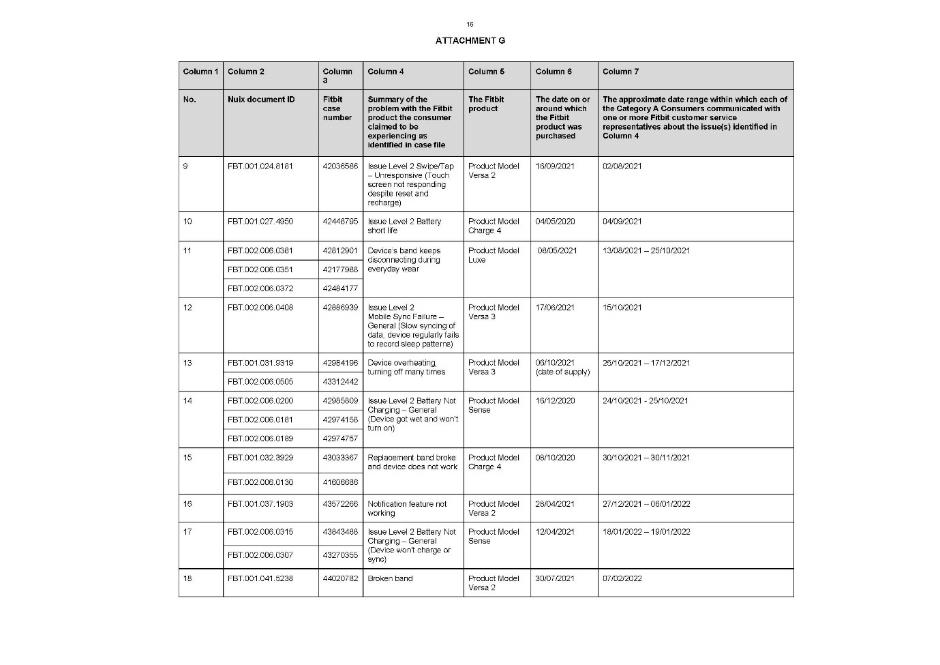

9 The first category of contraventions concerned representations made by FitBit customer service representatives to Australian consumers between about 10 May 2020 and 22 February 2022. During that period, 18 consumers contacted FitBit to complain about a problem they claimed to be experiencing with a FitBit product. A FitBit customer service representative told each of those 18 consumers that they did not have any right to a refund unless the product being complained about was returned within FitBit’s own return policy period of 45 days from the date of purchase and/or shipment.

10 The representations made to the 18 consumers were false or misleading, and constituted misleading or deceptive conduct, or conduct which was likely to mislead or deceive, because the fact that 45 days had passed since the date of purchase or shipment of the product could not, in and of itself, preclude a consumer’s right to a remedy under the consumer guarantee regime established by the Australian Consumer Law. On each occasion that FitBit’s representative made the false or misleading representation to the 18 consumers, FitBit contravened ss 18(1) and 29(1)(m) of the Australian Consumer Law.

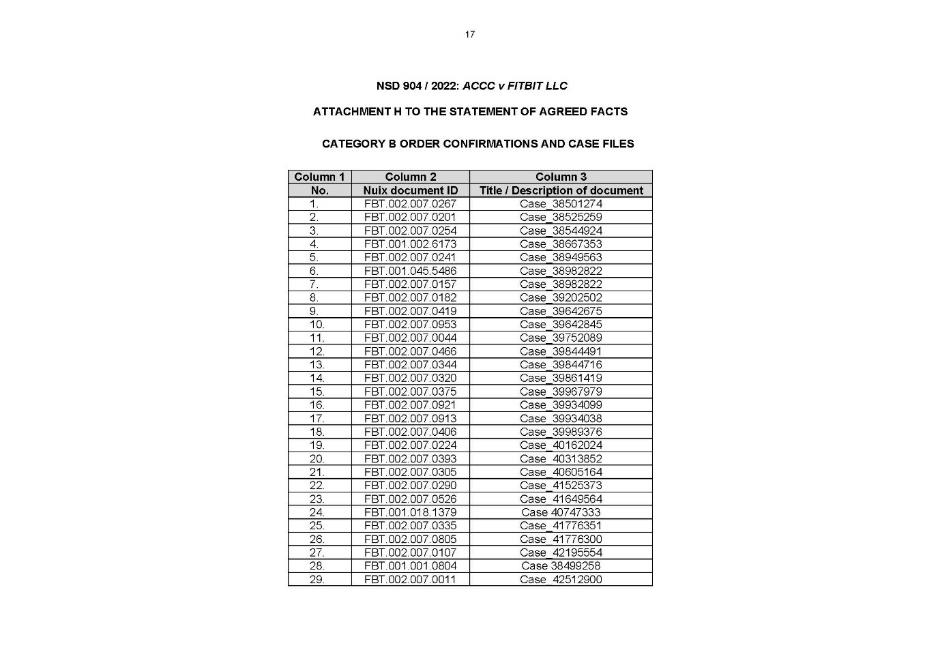

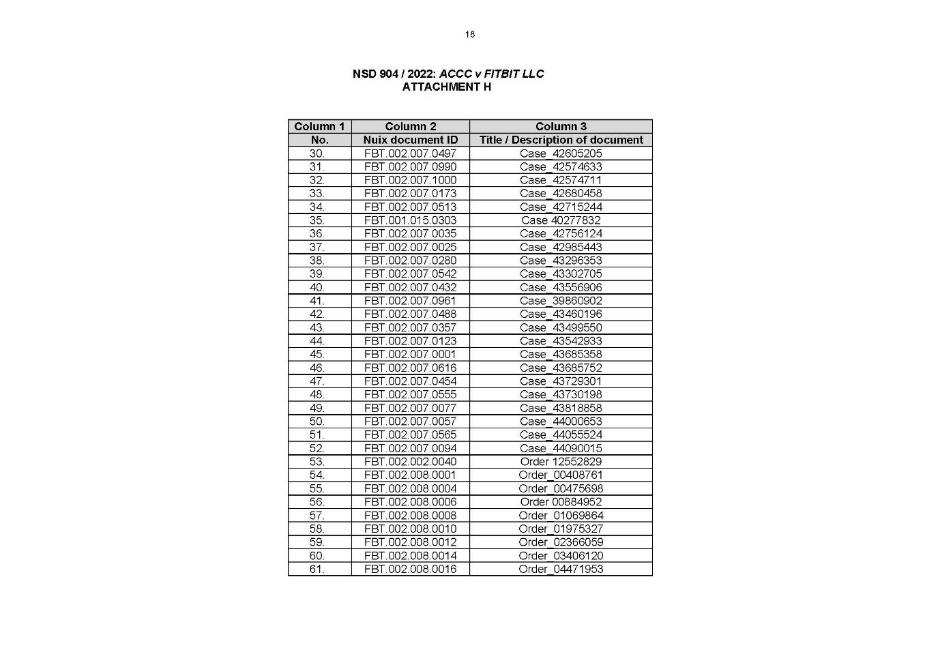

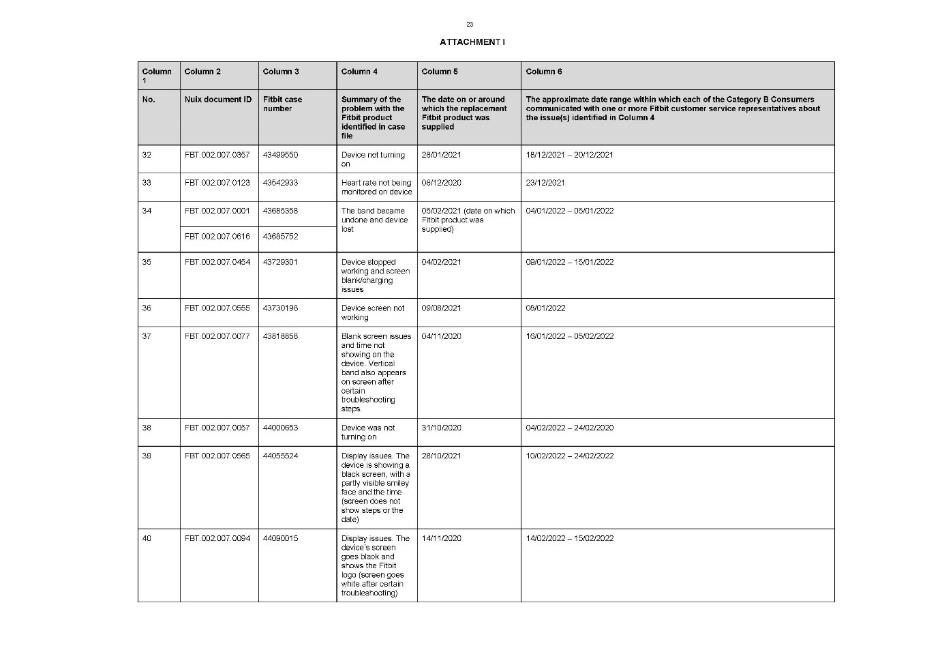

11 The second category of contraventions concerned representations made by FitBit customer service representatives to Australian consumers between about 20 November 2020 and 14 February 2022. During that period, 40 consumers contacted FitBit to complain about a problem they claimed to be experiencing with a FitBit product. A FitBit customer service representative told each of those 40 consumers that they did not have any right to a replacement product because the applicable warranty period had expired.

12 The representations made to the 40 consumers were false or misleading and constituted misleading or deceptive conduct, or conduct which was likely to mislead or deceive, because the fact that the FitBit’s own limited warranty period had expired could not, in and of itself, preclude a consumer’s right to a remedy under the consumer guarantee regime established by the Australian Consumer Law. On each occasion that FitBit’s representative made the false or misleading representations to the 40 consumers, FitBit contravened ss 18(1) and 29(1)(m) of the Australian Consumer Law.

13 Senior management of FitBit were not directly involved in the contravening conduct. The contraventions were also not deliberate, in the sense that the conventions were not the product of any deliberate disregard of the Australian Consumer Law, but were rather the product of a lack of focus or inadequate training of the customer services representatives who had engaged with the consumers in question.

AGREED FACTS RELEVANT TO PENALTY

14 The Statement of Agreed Facts and Admissions also included the following facts which were said to be relevant to the assessment of the appropriate pecuniary penalty.

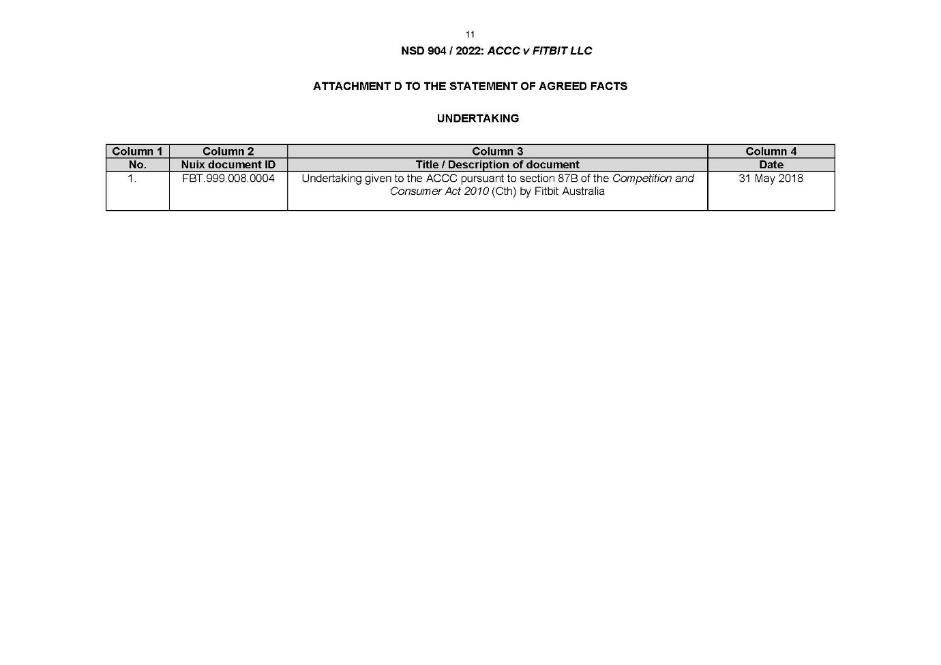

15 In May 2018, following an investigation by the Commission concerning alleged misleading representations on its website concerning consumer guarantees, FitBit (Australia) Pty Limited, a related body corporate of FitBit, gave the Commission an undertaking under s 87B of the Competition and Consumer Act. The terms of the undertaking required FitBit (Australia) to establish a compliance program which met certain requirements. FitBit was aware of the undertaking and was involved in implementing some of its requirements.

16 FitBit has not previously been found by a court to have engaged in any conduct in breach of the Australian Consumer Law.

17 FitBit is a very large multinational company based in the United States. It has access to substantial financial resources.

18 At the time of the contraventions, FitBit had in place a relevant compliance program. That program, however, obviously did not prevent the contraventions and FitBit accepts that continuing compliance measures are required.

19 FitBit co-operated with the Commission by voluntarily providing some information and documents prior to the commencement of this proceeding. It also initiated settlement discussions with the Commission and agreed to a statement of facts before any evidence was filed in the proceeding.

20 The maximum penalty for each contravention is $10,000,000. That is because both s 224(3A)(b) and (c) of the Australian Consumer Law are inapplicable. Paragraph 224(3A)(b) is inapplicable because it is agreed that the value of the benefit obtained by FitBit from each individual contravention, to the extent that it was able to be determined, did not exceed $3,330,000. Paragraph 224(3A)(c) is inapplicable because it is agreed that the figure representing 10% of FitBit’s adjusted turnover for its Australian operations for the 2019 and 2022 financial years was less than $10,000,000. The maximum penalty was therefore as provided in s 224(3A)(a).

THE PROPOSED RELIEF

21 The Commission and FitBit jointly proposed and submitted that the Court should make declarations concerning FitBit’s contraventions, order FitBit to pay a pecuniary penalty of $11,000,000 and make orders which required FitBit to appoint an independent expert to review its relevant compliance program and implement any recommendations made by that expert.

22 The Commission and FitBit filed and relied on joint written submissions concerning the proposed relief. A copy of the joint submissions is attached to this judgment at Annexure B. Those written submissions were supplemented by oral submissions made at the hearing.

SHOULD THE COURT MAKE THE AGREED PECUNIARY PENALTY order?

23 It is first necessary to have regard to the principles which must be applied when parties to a civil penalty proceeding jointly request the Court to impose an agreed penalty. It is also necessary to briefly consider the applicable principles in respect of the fixing of pecuniary penalties generally.

Applicable principles

24 The principles that the Court must apply in considering whether to impose an agreed pecuniary penalty jointly proposed by the parties are settled and well-known. They are accurately identified in the joint submissions.

25 In short summary, the Court must consider and determine whether the agreed penalty is within the range of possible penalties that the Court could reasonably impose in all the circumstances. If the agreed penalty is within that range, the public policy of promoting the predictability of outcomes in civil penalty proceedings makes it highly desirable for the Court to accept the parties’ joint proposal and impose the agreed penalty.

26 In considering and determining whether the agreed penalty falls within the range of appropriate penalties in the circumstances, it is necessary to have regard to the applicable principles concerning the fixing of pecuniary penalties. Those principles are also settled and well-known. They are accurately identified in the joint submissions.

27 In short summary, the purpose of imposing a civil penalty is to promote the public interest in compliance with the relevant Act by the deterrence of further contraventions of a like kind. In determining the size of the penalty which would serve the objective of deterrence, the Court must have regard to both the circumstances of the contravener and the circumstances of the contravention.

28 Without intending to be exhaustive, the factors concerning the circumstances of the contravener which are generally relevant when determining the size of the penalty which would serve the objective of deterrence, where the contravener is a corporation, include: the size and financial position of the corporation; whether the corporation has a corporate culture conducive to compliance with the relevant Act; whether the contravener has engaged in similar conduct in the past; and whether the contravener has demonstrated contrition and co-operated with the relevant authorities. As noted earlier, s 224(2)(c) of the Australian Consumer Law expressly requires the Court, in determining the appropriate pecuniary penalty, to have regard to whether the contravener has previously been found by a court to have engaged in similar conduct.

29 Likewise without intending to be exhaustive, the factors concerning the circumstances of the contravention which are generally relevant to determining the size of the penalty which would serve the objective of deterrence include: whether the contravening conduct was systematic, deliberate or covert; the period over which the contravening conduct occurred; whether the contravention arose out of the conduct of senior management; whether the contravener profited from the contravention and if so the extent of that profit; and whether the contravention caused any loss or injury. As noted earlier, ss 224(2)(a) and (b) of the Australian Consumer Law expressly require the Court, in determining the appropriate pecuniary penalty, to have regard to the nature and extent of the act or omission, any loss or damage suffered and the circumstances in which the act or omission took place.

30 The maximum penalty is also a relevant consideration in determining the size of the penalty, though it does not constrain the exercise of the discretion beyond requiring some reasonable relationship between the theoretical maximum and the final penalty imposed.

31 An appropriate penalty is said to be one that strikes an appropriate balance between oppressive severity and the need for deterrence in the particular case.

The parties’ submissions concerning the appropriate penalty

32 The Commission and FitBit jointly submitted that a global pecuniary penalty of $11,000,000 was an appropriate sum to achieve deterrence. They emphasised the following factors.

33 First, in relation to the nature and extent of the contraventions and any loss or damage suffered, there were 58 separate contraventions which occurred over a period of nearly two years. The gravamen of the contraventions was the provision of inaccurate information to consumers concerning their potential rights. As a result, the consumers lost the opportunity to potentially avail themselves of their rights and were potentially denied the opportunity to save themselves financial expense or personal inconvenience. The Commission did not, however, allege that the consumers were denied rights actually owing to them, or that any of the consumers were in fact actually entitled to a remedy under the consumer guarantee regime in the Australian Consumer Law. It should also be noted in this context that FitBit’s published terms of sale referred to consumer rights under the Australian Consumer Law.

34 Second, the maximum penalty for each of the 58 contraventions was $10,000,000, meaning that the maximum penalty for all the contraventions was $580,000,000.

35 Third, the contraventions involved misrepresentations by FitBit representatives to consumers concerning their potential rights under the Australian Consumer Law. The rights of Australian consumers under the Australian Consumer Law are self-evidently important and should be given adequate focus and attention by all corporations who engage with Australian consumers, including large multinational corporations.

36 Fourth, FitBit’s Australian subsidiary had previously given the Commission an undertaking, with FitBit’s knowledge, which concerned the publication of information concerning consumer redress and the failure to provide proper information about consumer rights under the Australian Consumer Law. The issues underlying that undertaking were not materially dissimilar to those underlying the contraventions by FitBit in this proceeding.

37 Fifth, FitBit is a company in respect of which consumer laws such as those in the Australian Consumer Law should be “front of mind”. The proposed penalty should encourage ongoing compliance with consumer laws and achieve the necessary deterrent effect.

38 Sixth, FitBit is a substantial corporation. The assessment of an appropriate penalty must generally take into account the size and financial resources of the contravener.

39 Seventh, the contraventions involved two courses of conduct. The first concerned representations to 18 consumers concerning the need for a consumer to comply with FitBit’s 45-day return policy. The second concerned representations to 40 consumers concerning FitBit’s warranty period. An overall penalty of $4,000,000 was said to be appropriate in respect of the first course of conduct, and an overall penalty of $7,000,000 was said to be appropriate in respect of the second course of conduct. The higher penalty for the latter was said to be appropriate because more consumers were affected by that conduct.

40 Eighth, the parties jointly submitted that the penalty was not disproportionate having regard to the theoretical maximum penalty of $580,000,000.

41 Ninth, the proposed penalty was said to be sufficient to deter FitBit and “send a strong message to other suppliers of products to Australian consumers”.

42 At the hearing, FitBit, through its senior counsel, apologised for the contravening conduct. That apology was consistent with the contrition which was manifest in FitBit’s co-operation with the Commission and the approach it took to this proceeding. There is no reason to doubt the genuineness of FitBit’s contrition.

Determination – the agreed penalty is an appropriate penalty

43 I am persuaded that the agreed penalty of $11,000,000 is an appropriate penalty in all the circumstances. I should emphasise that I do not suggest that I would necessarily have imposed that precise penalty had I not been confronted with the parties’ agreement and joint submissions. I am, however, persuaded by the parties’ joint submissions that the agreed penalty falls within the range of penalties that would be reasonable and appropriate having regard to the relevant facts and circumstances. In particular, I am persuaded that the agreed penalty is adequate and sufficient to serve the objective of deterrence, both general and specific, in the particular circumstances of this case.

44 In those circumstances, and having regard to the public policy involved in promoting the predictability of outcomes in civil penalty proceedings, it is desirable and appropriate that I impose the agreed penalty.

DECLARATORY RELIEF

45 The Court has a wide discretionary power to make declarations under s 21 of the Federal Court of Australia Act 1976 (Cth). Declarations relating to contraventions of legislative provisions are likely to be appropriate where they serve to record the Court’s disapproval of the contravening conduct, vindicate a regulator’s claim that the respondent contravened the provisions, assist a regulator to carry out its duties, and deter other persons from contravening the provisions: Australian Competition and Consumer Commission v Construction, Forestry, Mining and Energy Union (2007) ATPR 42-140; [2006] FCA 1730 at [6]. It is, in those circumstances, appropriate to make declarations concerning FitBit’s contraventions.

46 The parties have reached an agreement concerning the form of declarations that should be made by the Court. The declarations would appear to be in an appropriate form.

OTHER RELIEF

47 The parties also agree that it is appropriate that FitBit be ordered to implement various compliance measures pursuant to s 246(2)(b) of the Australian Consumer Law. I am persuaded that it is appropriate to make the orders proposed by the parties in that regard.

DISPOSITION

48 The Court will make the orders jointly proposed by the parties.

I certify that the preceding forty-eight (48) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Wigney. |

Associate:

ANNEXURE A – Statement of Agreed Facts and Statement of Agreed Facts and Admissions

ANNEXURE B – Joint Submissions