Federal Court of Australia

Braz v Host-Plus Pty Ltd [2023] FCA 1454

ORDERS

Applicant | ||

AND: | HOST-PLUS PTY LTD ACN 008 634 704 AS TRUSTEE OF HOSTPLUS SUPERANNUATION FUND First Respondent AUSTRALIAN FINANCIAL COMPLAINTS AUTHORITY Second Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The appeal be allowed.

2. The determination made by the Australian Financial Complaints Authority on 26 May 2022 be set aside.

3. Pursuant to s 1057(4) of the Corporations Act 2001 (Cth), the matter be remitted to the Australian Financial Complaints Authority for re-determination in accordance with the law.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

THOMAS J:

BACKGROUND

1 Mr Lee Braz (the applicant) joined the former trustee, the InTrust Super Fund (InTrust Super), on 1 October 2011.

2 In July 2020, the applicant intended to set up a self-managed superannuation fund (SMSF).

3 The applicant, under the impression that he was engaging a legitimate accounting firm, PS Kitt & Co, unwittingly engaged a malicious actor – described in the Australian Financial Complaints Authority (AFCA) determination as “the scammer” – to assist in setting up the SMSF.

4 Later, the applicant was told by Mr Peter Kitt, the owner of PW Kitt & Co, that:

AS indicated my own name ,business and reputation has been hijacked by these con artists and can assure you that any of my business details used to perpetuate this fraud were used without my knowledge or consent.

(errors in original)

5 For the purpose of setting up a SMSF, the applicant completed a form affixed with a logo of the company, PW Kitt & Co. The form was titled:

Self Managed Superannuation Fund

Set-up a new SMSF

6 The scammer used the name “PW Kitt & Co Pty Ltd” (this name appeared at the base of page 1), which was different from PW Kitt & Co (the name printed at the top of page 1). This was not known to the applicant at the time the form was completed.

7 The applicant completed the form, including the provision of his date of birth, tax file number and address and signed it. The applicant supplied a photocopy of his passport with the form. There was a signature in the passport. The information and signatures were genuine.

8 The applicant provided the form to the scammer on 1 July 2020. The form was dated 19 June 2020.

9 On 27 July 2020, the scammer lodged a Benefit Payment Application form with InTrust Super. This was lodged without the knowledge or approval of the applicant.

10 As to this Benefit Payment Application form:

(a) the applicant’s home address in Queensland was inserted;

(b) the form related to a transfer of the total amount in the Fund;

(c) the address for the rollover was an address at 42B Kangaroo Road, Murrumbeena, Victoria and an Australian Business Number (ABN) was supplied;

(d) under the heading “Section 6: Proving your identity” option 2 was ticked, which was described in the following way: “Provide certified copies of identification documents”. The other option was to undertake electronic verification by provision of details in the form; and

(e) the document was dated 22 July 2020 and a signature apparently of the applicant was included (the signature was determined by the AFCA to be forged).

11 At the same time, an Australian Taxation Office form (the ATO form) under the Superannuation Industry (Supervision) Act 1993 (Cth) (SIS Act) headed “Rollover initiation request to transfer whole balance of superannuation benefits to your self-managed super fund” was submitted by the scammer to InTrust Super. As to this form:

(a) the residential address in Queensland was included;

(b) a membership account number as well as an ABN was included;

(c) the receiving fund details were set out (including SMSF name, Fund phone number and ABN), together with SMSF bank details (which included Account name, BSB and Account number);

(d) under the heading “Proof of identity”, there was a tick next to “I have attached a certified copy of my primary photographic identification document”; and

(e) the document was dated 22 July 2020 and contained a signature apparently of the applicant (the signature was determined by the AFCA to be forged).

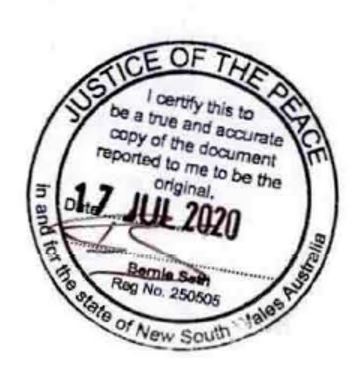

12 Attached to the ATO form was a copy of the passport (which had previously been provided unwittingly to the scammer by the applicant) with a stamp nominating the certifier as follows:

13 A later enquiry made of Mr Bernie Seth by the applicant revealed, as Mr Seth put it, that the certification was “totally fraudulent”. Mr Seth indicated he would refer the matter to the police. Neither the applicant nor InTrust Super was aware of this forgery at the time.

14 Also enclosed with the ATO form was a form headed “ANZ Internet Banking”, which contained the following information:

Account name

LEE BRAZ FAMILY SUPER PTY LTD

Product type Cheque Account

BSB

[inserted]

Account number [inserted]

Current balance

[inserted]

Available funds

[inserted]

Account opening date 03/06/2020

(bold in original)

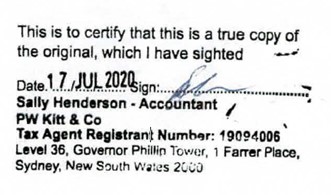

15 This document bore the following certification:

16 The certification signature was not recognisable.

17 A subsequent inquiry of Mr Kitt confirmed that the certification was not genuine and that his business had been hijacked by the scammer.

18 This fact was not known at the time by either the applicant or InTrust Super.

19 InTrust Super’s records contained the detail that, on 28 July 2020, SMSF verification was obtained. To do this, an SMSF member verification service was used, which required the provision of the ABN of the SMSF and the name and date of birth of the SMSF member. SMSF membership was confirmed for The Trustee for Lee Braz Family Super Fund.

20 InTrust Super’s records revealed that, on 28 July 2020, InTrust Super’s inquiries revealed the following:

The Trustee for Lee Braz Family Super Fund | |

ABN details Print Email | |

ABN: | [inserted] View record on ABN Lookup External site |

ABN Status: | Active from 16 Jul 2020 |

Fund type: | ATO Regulated Self-Managed Superannuation Fund |

Contact details: | |

CITYWIDE ACCOUNTING & FINANCIAL | |

42b KANGAROO RD | |

MURRUMBEENA VIC 3163 | |

AUSTRALIA | |

Status: | Complying |

ABN last updated: | 22 Jul 2020Record extracted: 28 Jul 2020 |

(errors in original)

21 On 28 July 2020, the full balance was transferred to The Trustee for Lee Braz Family Super Fund for the amount of $178,408.89. The transfer was to the bank account nominated on the fraudulent form.

SUBMISSIONS BY THE APPLICANT

Forgeries

22 In relation to the forgeries, the applicant accepted that InTrust Super may have taken the documents at face value and not been aware of the forgeries.

23 Comparison signatures were compared in one document (Part C Tab 155) and the applicant conceded that the signatures were very similar and it would have been hard to distinguish between those which were fabricated and those which were genuine.

Information before the AFCA

The forgeries regarding the Justice of the Peace and the accountant

24 The applicant submitted that the AFCA was aware, at the time of its determination, of the existence of the forgeries. The AFCA had before it the responses from the Justice of the Peace and Mr Kitt clearly identifying the forgeries.

25 The applicant submitted that the hearing before the AFCA was a de novo hearing and so the AFCA should have taken into account the fact that they were forgeries and the impact of those forgeries on the effectiveness of the documents which were lodged, particularly in the context of whether the decision taken by InTrust Super, or the conduct in relation to that decision, was fair and reasonable in all the circumstances (see s 1055 of the Corporations Act 2001 (Cth) (the Act)).

Identity of PW Kitt & Co Pty Ltd

26 The applicant pointed to the Tax Practitioners Board search which revealed that the business trading name of SMSF Advisory Services Pty Ltd was PW Kitt & Co, which is a tax agent registered at Hurstville, New South Wales.

27 The applicant submitted that there was a legitimate firm called PW Kitt & Co which traded as SMSF Advisory Services Pty Ltd. As mentioned earlier, the scammer used the name “PW Kitt & Co Pty Ltd”.

28 The applicant submitted that all of this information was before the AFCA at the time of the determination and should have been taken into account.

The bank statement

29 In relation to the banking information received by InTrust Super, the applicant submitted that what was received was “no more than a bank print screen, which has the relevant requirements – we say are very unclear, but it has … the account number, BSB”. It was “not in the usual format of either a bank statement or a e-statement … that we would normally see that you can download from the internet from your bank account”.

30 The applicant submitted that the bank printout was not a bank statement, or even an internet version of a bank statement. The applicant submitted that an internet version would have to show similar styling to a bank statement. Read in context, the applicant submitted that the document was not an internet bank statement.

31 The applicant pointed to the fact that the applicant was resident in Queensland, but the print screen was certified by a person in New South Wales.

Who can certify?

32 The applicant submitted that the bank statement was really the central issue. Had the bank statement issue been properly evaluated, the monies would not have been paid and lost.

33 As to the bank statement, regardless of the nature of the document (whether it be internet printout or bank statement), the certification was not completed in accordance with the requirements of Business rule 12.1.

34 Business rule 12.1 specified “Who can Certify Documents”.

35 Whilst the list included “a Justice of the Peace”, it did not include an accountant. The person who certified the internet bank print screen, described as an accountant, was not a person permitted by Business rule 12.1.

Payment to member

36 The applicant also referred to Business rule 12.3, which dealt with “Payment of Benefit to Member”.

37 Pursuant to Business rule 12.3:

(a) the default payment of the benefit was to be in the form of a cheque;

(b) InTrust Super offered members the option of receiving a payment by electronic funds transfer (EFT);

(c) to receive the benefit payment by EFT, the member had to supply “a copy of a bank statement (or internet statement with requirements) for the account in which the payment is to be made”;

(d) the bank statement had to meet the following requirements:

(i) dated within 12 months of the Benefit Payment Application form;

(ii) account had to be in the member’s name;

(iii) show account number;

(iv) BSB may be absent, however, “it must be stated on the [B]enefit [P]ayment [A]pplication form”;

(e) in the event that a member requested a payment by EFT on the Benefit Payment Application form, but did not supply a bank statement, the AAS Claim Officer “will phone the Member and offer them the opportunity to provide the bank statement. If this statement is not received within 10 days, the payment will be made via cheque”; and

(f) bank account details could not be taken over a recorded line.

38 The applicant submitted it was not possible to know what “internet statement” means.

39 The applicant pointed to the lack of definition as to what “internet statement with requirements” means. The applicant submitted that the AFCA was in error in incorrectly deciding that the requirements of Business rule 12.3 were satisfied.

40 The applicant submitted that, as there was a request for payment by EFT on the Benefit Payment Application form, but no bank statement was supplied (as the print sheet was not a bank statement), InTrust Super’s Claim Officer should have telephoned the member to offer the opportunity to provide the bank statement. If the statement was not received within 10 days, InTrust Super should have paid by cheque.

41 The applicant submitted that InTrust Super did not comply with its own Business Rules in relation to certification of the bank statement, nor did it comply with its Business Rules in relation to payment of the benefit by way of EFT.

Transfer of funds

42 With respect to the transfer of funds, the applicant drew attention to Business rule 12.5 (“Payment to a Self-Managed Superannuation Fund (SMSF’s)”), which was as follows:

Claim requests can be received via a [Benefit Payment Application] or the ATO transfer form “Rollover initiation request to transfer whole balance of superannuation benefits to your self-managed superannuation fund”. The claim payment will be processed via EFT once all requirements have been received.

43 The applicant drew attention to the closing words, which indicated that a claim payment will be processed via EFT “once all requirements have been received”. The submission continued that the meaning of that requirement was unclear.

44 Reference to Business rule 12.5 appeared in the AFCA determination section “Other key information” where it was stated: “Confirms that the provision of ID information met the trustee’s requirements to facilitate payment to an SMSF”.

SIS Regulations – regs 6.33, 6.33E and 6.28

45 The applicant drew attention to reg 6.33 of the Superannuation Industry (Supervision) Regulations 1994 (Cth) (SIS Regulations), which provided:

Request for rollover or transfer of withdrawal benefit

(1) A member of a regulated superannuation fund or approved deposit fund (the transferring fund) may request, in writing, that the whole or a part of the member’s withdrawal benefit in the transferring fund be rolled over or transferred to any of the following (the receiving fund):

(a) a regulated superannuation fund;

…

Note: A member may also request that his or her withdrawal benefit be rolled over or transferred to an EPSSS.

(2) The member:

(a) …

(b) if the request is to rollover or transfer an amount that is the whole of the member’s withdrawal benefit—may use the approved form to make the request.

46 In relation to the reference in the AFCA determination to InTrust Super meeting its obligations under reg 6.33E(2) of the SIS Regulations, the applicant submitted that reg 6.33E did not come into operation in relation to this transaction.

47 Regulation 6.33E provides:

Verification of self managed superannuation fund and member’s details

(1) This regulation applies to the trustee of a regulated superannuation fund or approved deposit fund (the transferring fund) if the transferring fund receives a request under regulation 6.33 to rollover or transfer the whole or a part of a member’s withdrawal benefit from the transferring fund to a self managed superannuation fund (the receiving fund).

(2) The trustee of the transferring fund must:

(a) use an electronic service provided by the Australian government to verify:

(i) the ABN and name of the receiving fund; and

(ii) that the receiving fund is a regulated superannuation fund; and

(iii) at least one unique superannuation identifier (within the meaning of Part 3B) for the receiving fund; and

(iv) for each unique superannuation identifier—one set of bank details that is sufficient to enable an electronic payment to be made; and

(v) for each unique superannuation identifier—either one internet protocol address, or one other kind of digital address approved by the Commissioner for the receipt of electronic communications; and

(b) use an electronic service provided by the Commissioner of Taxation to validate that the member is a member of the receiving fund.

…

48 The applicant pointed to the fact that reg 6.33E only applied if the transferring fund received a request under reg 6.33 to rollover or transfer the whole or a part of a member’s withdrawal benefit from the transferring fund to a SMSF.

49 In this case, the applicant submitted, there was no request made by the applicant under reg 6.33. The applicant contrasted the position with one where, for example, a member makes the necessary request to rollover or transfer the member’s withdrawal benefit to a fraudulent scammer. It was submitted that the present case was one where the scammer, not the member, applied to the superannuation fund with the result that there was no request made by a member under reg 6.33(1) and so reg 6.33E was not engaged.

50 Whilst it might appear counterintuitive for the provisions of reg 6.33E (which requires verification of information by InTrust Super) only where there is a genuine application (which would necessarily mean that the checking required under reg 6.33E was unnecessary), the applicant submitted that the requirements of reg 6.33E were a verification mechanism and were necessary because of the tracking of information with the Australian Taxation Office.

51 The applicant also drew attention to reg 6.28, as follows:

Rollover—regulated superannuation funds and approved deposit funds

(1) Except as otherwise provided by the Act, the Corporations Act 2001, the Corporations Regulations 2001 or these regulations, a member’s benefits in a regulated superannuation fund or an approved deposit fund must not be rolled over from the fund unless:

(a) the member has given to the trustee the member’s consent to the rollover; or

…

52 The applicant submitted that, in view of the provisions of reg 6.28(1)(a), the member’s benefits in a regulated fund cannot be rolled over from the fund unless the member has given the former trustee the member’s consent to the rollover. The submission continued that this obligation must be read strictly – if the member does not give consent, the rollover cannot happen.

InTrust Super’s obligations

53 A significant focus of the AFCA determination was whether InTrust Super’s conduct satisfied its transfer obligations and complied with process checks and administrative controls which were in place within the governance Rules for the Fund.

54 The AFCA referred to being satisfied that InTrust Super acted in a manner consistent with the legislative obligations under reg 6.33E of the SIS Regulations when it verified the SMSF and the applicant’s membership of the SMSF.

55 The applicant submitted that the AFCA failed to take into account InTrust Super’s obligations or all of the information which was available to the AFCA.

56 The applicant submitted that, for the purpose of s 1055 of the Act (in determining whether a decision in its operation in relation to the applicant was fair and reasonable in all the circumstances), the AFCA must take into account InTrust Super’s fiduciary duties and the broader superannuation laws. The applicant submitted that the failure to do this was a failure to take into account a proper consideration and was an error of law.

57 The applicant pointed to the following.

58 Clause 12 of the InTrust Deed of Variation (the Trust Deed) made it clear that the exercise of InTrust Super’s powers were “[s]ubject always to the Superannuation Law”. Clause 3 defined “Superannuation Law” in very wide terms.

59 Section 52 of the SIS Act deals with covenants to be included in governing rules and relevantly provides:

Covenants to be included in governing rules—registrable superannuation entities

Governing rules taken to contain covenants

(1) If the governing rules of a registrable superannuation entity do not contain covenants to the effect of the covenants set out in this section, those governing rules are taken to contain covenants to that effect.

Note: There are civil and criminal consequences for contravening a covenant: see sections 54B, 54C, 55 and 202. Civil consequences may arise from an act or omission resulting in a contravention of a covenant regardless of whether or not the act or omission was intentional. Criminal consequences under section 202 require proof of dishonesty or intention in relation to a contravention of a covenant.

General covenants

(2) The covenants referred to in subsection (1) include the following covenants by each trustee of the entity:

(a) to act honestly in all matters concerning the entity;

(b) to exercise, in relation to all matters affecting the entity, the same degree of care, skill and diligence as a prudent superannuation trustee would exercise in relation to an entity of which it is trustee and on behalf of the beneficiaries of which it makes investments;

(c) to perform the trustee’s duties and exercise the trustee’s powers in the best financial interests of the beneficiaries;

…

…

60 The applicant submitted that, in the context of considering whether a decision was fair and reasonable in its operation to the applicant, the AFCA must consider a broader context than that which had been considered in this case. The AFCA must take into account the application of the SIS Act in its entirety, including s 52, and the covenants which were taken to be included in the governing rules.

61 The applicant submitted that it was the obligation of the AFCA to consider all of the information obtained throughout its consideration and that all of this information, looked at collectively, should inform the ultimate issue in respect of the question of whether the decision was fair and reasonable in all the circumstances.

62 In terms of assessing what action should have been taken by InTrust Super, the applicant referred to Business rule 6.6.1.1 – “Unpaid over $20”, which provided that:

The Employer will be contacted by phone within 3 days of original receipt. Call or attempted call is to be lodged on tracking. An email is to be issued, (if phone is not available) to confirm the details of the short payment and request an additional payment.

…

63 The applicant submitted that this rule required InTrust Super to take an additional action in similar circumstances and should have been undertaken in the present circumstances, that is InTrust Super should have made an additional inquiry with the member.

64 The applicant also referred to Business rule 8.7, dealing with “Company Transfers Out”. Rule 8.7 provided that, upon receipt of a request from an employer wishing to transfer out of the Fund, “AAS will notify the InTrust Super Trustee Office Marketing Manager by phone or in writing within 24 hours. AAS will issue the appropriate standard letter”. A standard letter would be issued to the employer acknowledging the request and advising that InTrust Super would contact them. The applicant submitted that this was on a par with the member rolling the money out of the Fund. Whilst the identity of the employer was known, the requirement was that the former employer be contacted regarding the request. This, it was submitted, was a prudent step for a trustee to follow.

65 This was against the background of the requirement in s 6.28 of the SIS Act, which provided that funds must not be rolled out unless a member has given the member’s consent. The applicant submitted that, in this context, acting as a prudent trustee, contact should have been made with the applicant to confirm the request.

The different States

66 In section 2.4, the AFCA concluded that: “Having reviewed both the passport and withdrawal form, I am satisfied the [applicant’s] signatures are not dissimilar enough to raise suspicion by [InTrust Super] or by [the] AFCA”.

67 The applicant conceded this and did not press any point that the AFCA should have determined otherwise.

68 When discussing the different addresses provided which were not in the State in which the applicant lives, the AFCA concluded that the fact the documents showed certification in a different State did not of itself suggest fraud and observed: “Further, [InTrust Super’s] internal process does not specify the certification must be completed in the member’s home state”.

69 As to that observation, the applicant submitted that the duty of InTrust Super was to take all care and attention with respect to reviewing the documents. The fact that it was not specified that the certification must be completed in the member’s home State was irrelevant to the exercise of all care and due diligence. It does not assist with respect to the question to be considered pursuant to s 1055 of the Act.

70 The applicant submitted that InTrust Super should have been alerted to an issue because of the various addresses used covering three States, namely the home State: Queensland; the superannuation fund State: Victoria; and the accountant certification State: New South Wales.

71 The applicant submitted that InTrust Super owed a general duty, including the covenants implied pursuant to s 52.

Australian Prudential Regulation Authority Prudential Practice Guide

72 The applicant submitted that InTrust Super must have been very much aware of the issue of identity theft. The applicant drew attention to the Australian Prudential Regulation Authority Prudential Practice Guide SPG 280 – Payment Standards June 2017 (at [33]-[38]), where the topic of “Illegal early release and identity crimes” was discussed. The applicant submitted that the publication “paints the context that [InTrust Super] should be seized of the fact that there is … identity theft going on”.

The AFCA determination – misconstruing and misapplying s 1055

73 In section 2.5 of the AFCA determination, under the heading “[i]s [InTrust Super’s] decision fair and reasonable”, the following is stated:

Yes. [InTrust Super] acted to meet its transfer obligations, and comply with process checks and administrative controls that were in place at the time.

Therefore, the trustee’s decision not to provide compensation was fair and reasonable in its operation in relation to the [applicant] in all the circumstances.

…

74 The applicant referred to the decision in Pope v Lawler (unreported, Federal Court of Australia, RD Nicholson J, 7 May 1996) where RD Nicholson J concluded that:

The meaning of the words “fair and reasonable” is a question of fact. “Fair” is relevantly defined in The New Shorter Oxford English Dictionary 4th ed (1993) at 907 as “just, unbiased, equitable, impartial”. “Reasonable” is defined in the same dictionary at 2496 relevantly as “within the limits of reason; not greatly less or more than might be thought likely or appropriate.” In Associated Provincial Picture Houses Limited v Wednesbury Corporation [1948] 1 KB 223 at 230 the test of whether a court could intervene because of “unreasonableness” was said to be whether the decision was so unreasonable that no reasonable authority could come of it. … Only if the Tribunal has before it evidence which properly leads to a finding of the presence of both fairness and reasonableness in the decision of the Trustees is it entitled to act …

(emphasis in original)

75 His Honour also concluded that:

“fair” means something more than “reasonable”. To be fair there must have been evidence the decision of the Trustees in its operation in relation to the applicants in all the circumstances was just, equitable, unbiased and impartial.

76 The applicant submitted that the AFCA focused too narrowly on compliance with legislative and internal requirements when considering whether the decision was “fair and reasonable” in its application to the applicant in all the circumstances.

THE AFCA DETERMINATION

“Complaint”

77 The AFCA noted that the applicant said the trustee should reimburse his account balance because InTrust Super accepted fraudulent information when it processed the transfer.

78 The AFCA noted that InTrust Super said that the applicant compromised the security of his account by providing the scammer with his confidential information, that the information provided to InTrust Super by the scammer was not irregular or suspicious, and that it carried out its obligations under the relevant legislation correctly.

79 In sections 1.2, 2.2, 2.3, 2.4 and 2.5, the issues identified, key findings and reasons were as follows.

“Did [InTrust Super] incorrectly rollover the [applicant’s] account balance?”

80 The AFCA considered whether InTrust Super met its payment obligations under Part 6 of the SIS Regulations. It determined that InTrust Super met its obligations under Part 6.33E(2) of the SIS Regulations. The AFCA made the observation: “Further, the information provided by the scammer to [InTrust Super] did not appear suspicious and the scammer used the [applicant’s] confidential information, which he provided, to complete the rollover”.

“[InTrust Super] had transfer verification obligations”

81 The AFCA noted that superannuation trustees are bound by the SIS Regulations and that reg 6.33E sets out the trustee’s obligations to verify a SMSF and its members prior to a rollover to the SMSF. The AFCA noted that the trustee was required to verify:

• the Australian business number (ABN) and name of the receiving fund

• the receiving fund is a regulated superannuation fund; and

• the member is a member of the receiving fund.

82 The AFCA noted that the trustee was required to verify the above using electronic services provided by the Australian government and the Commissioner of Taxation.

“Did [InTrust Super] adhere to process checks and administrative controls when rolling over the [applicant’s] account balance?”

83 The AFCA answered in the affirmative, concluding that InTrust Super undertook process checks and exercised administrative controls when processing the transfer. The AFCA noted that “[InTrust Super] did not detect the forgeries, which did not appear suspicious. The forged documents were used alongside information provided by the [applicant] to complete the transfer”.

84 The AFCA noted that the InTrust Super was required to verify certain details prior to rolling over a member’s funds and that the AFCA received confirmation from InTrust Super that “the SMSF [was] a complying fund under the Australian Taxation Office (ATO) Super Fund lookup system”. The AFCA noted that the Super Fund lookup website confirmed:

• the ABN of the SMSF matches the ABN on the [applicant’s] rollover form

• the name of the SMSF matches the name of the SMSF in the [applicant’s] rollover form and bank account statement

• the SMSF is an ATO regulated super fund[.]

85 The AFCA referred to InTrust Super’s timeline of events, which reflected a search having taken place on 28 July 2020.

86 The AFCA noted that InTrust Super had also undertaken a SMSF member verification process and confirmed that the applicant was a member of the SMSF in a record extracted on 28 July 2020, prior to the rollover. The AFCA noted that, in order to use the service, InTrust Super was required to enter the ABN of the SMSF; the name and date of birth of the SMSF member; and then select SMSF membership.

87 In relation to an argument by the applicant that InTrust Super should have made contact with him to seek his confirmation, the AFCA decided: “While I appreciate the [applicant’s] argument, Regulation 6.33E of the SIS Regs did not require [InTrust Super] to call him before it completed the rollover”. The AFCA was “satisfied [InTrust Super] has acted in a manner consistent with its legislative obligations under Regulation 6.33E of the SIS Regulations when it verified the SMSF and the [applicant’s] membership of the SMSF”.

“Did [InTrust Super] adhere to process checks and administrative controls when rolling over the [applicant’s] account balance?”

88 This seems to have the same heading as section 2.3 and the first paragraph is identical.

89 Under the heading “Information provided to [InTrust Super] did not appear suspicious”, the AFCA set out the documents considered by the applicant to be forged (certification of a copy of the applicant’s passport, screenshot of the SMSF online banking account information, certification of the screenshot of the SMSF online banking account information, and signatures).

90 The AFCA recorded the trustee’s assertion that there was no breakdown in InTrust Super’s administrative controls and all process checks were carried out appropriately, including checking details against those in its system, the registration numbers of certifiers of documents, the validity of personal identification and the validity of the SMSF against the ATO’s Super Fund lookup system.

91 The AFCA was satisfied, having reviewed both the passport and withdrawal form, that the applicant’s signatures were not dissimilar enough to raise suspicion by InTrust Super or by the AFCA. The AFCA rejected an argument put by the applicant that the certifications are suspicious because they show locations in a State other than the State in which the applicant lives. The AFCA concluded: “While I appreciate the [applicant’s] position, the fact the documents show certification in a different [S]tate does not [of] itself suggest fraud. Further, InTrust Super’s internal process does not specify the certification must be completed in the member’s home [S]tate”.

92 The AFCA also rejected an argument put by the applicant that the bank statement provided to InTrust Super was “not even close” to what the actual bank account statement looked like and so should not have been accepted for this reason. The AFCA concluded that InTrust Super could not have known what the applicant’s bank statements looked like and could not have conducted a comparison. The AFCA did not consider it reasonable for InTrust Super to suspect the bank statement was fraudulent because the account statement certification was from another State or the account name was formatted in bold.

93 The AFCA appeared to have accepted a submission made by InTrust Super that, according to InTrust Super’s business rules, a bank statement would be accepted if it included the account name, account number and BSB; and that a bank statement could be an internet version if it met those requirements. The AFCA referred to Business rule 12.3 in noting that it confirmed InTrust Super’s acceptance of the bank statement meeting its requirements.

94 The AFCA determination continued: “I also acknowledge the [applicant] provided the scammer with his confidential information which the scammer used to apply for the rollover”. It is not clear what this meant or whether it was regarded as significant. It might have meant that the AFCA made that finding.

95 In conclusion, the AFCA recorded being satisfied that the information provided to InTrust Super did not appear suspicious and it correctly verified the information it received. Accepting the documents provided by the scammer were forged, the AFCA concluded InTrust Super was not required to undertake any further checking and verification than it did at the time the rollover was processed. The AFCA summarised that it was satisfied InTrust Super adhered to its obligations and internal process and had not committed an error.

96 In relation to the question “Is the trustee’s decision fair and reasonable?”, the AFCA concluded, in the affirmative, finding that InTrust Super acted to meet its transfer obligations and complied with process checks and administrative controls that were in place at the time.

97 On that basis, the AFCA concluded that the trustee’s decision not to provide compensation was fair and reasonable in its operation in relation to the applicant in all the circumstances.

98 The AFCA noted that InTrust Super had an obligation to adhere to reg 6.33E of the SIS Regulations and its internal process when verifying a SMSF before rolling its member’s funds into the SMSF.

99 The AFCA concluded: “I am satisfied [InTrust Super] complied with both its legislative and internal requirements before rolling the [applicant’s] superannuation account into the new SMSF. Therefore, I find the trustee’s decision not to provide compensation to the [applicant] is fair and reasonable”.

DISCUSSION

The AFCA determination – overview

100 In short terms, the AFCA conclusion that the trustee’s decision not to provide compensation was fair and reasonable in its operation in relation to the applicant in all the circumstances was based upon the AFCA’s conclusion that:

(a) InTrust Super acted to meet its transfer obligations; and

(b) InTrust Super complied with process checks and administrative controls that were in place at the time.

101 The AFCA determination is expressed variously to be supported by the following conclusions:

(a) InTrust Super acted to meet its transfer obligations;

(b) InTrust Super complied with process checks and administration controls that were in place at the time;

(c) InTrust Super had adhered to its obligations and internal processes and had not committed an error;

(d) InTrust Super correctly verified the information it received;

(e) whilst the documents provided by the scammer were forged, InTrust Super was not required to undertake any further checking and verification than it did at the time the rollover was processed;

(f) the information provided to InTrust Super did not appear suspicious;

(g) InTrust Super had acted in a manner consistent with its legislative obligations under reg 6.33E of the SIS Regulations when it verified the SMSF and the applicant’s membership of the SMSF; and

(h) InTrust Super was not required to contact the applicant to obtain confirmation because reg 6.33E of the SIS Regulations did not require InTrust Super to call him before it completed the rollover.

102 The AFCA referred to the actions of the applicant three times:

[T]he scammer used the [applicant’s] confidential information, which he provided. [2.2]

and:

The forged documents were used alongside information provided by the [applicant] to complete the transfer. [2.3]

and:

I also acknowledge the [applicant] provided the scammer with his confidential information which the scammer used to apply for the rollover. [2.4]

103 It is not possible to know what (if any) significance the AFCA placed on these factors. This is because the AFCA did not provide any reasons regarding whether any conclusion was reached by the AFCA which flowed from these facts. They do not seem to feature in any reasoning process as to whether the decision was fair and reasonable. No conclusions were drawn. It is not obvious that those statements, or indeed any aspect of the applicant’s conduct, formed any part of the determination. If those factors were regarded by the AFCA as of importance, the AFCA failed to provide any reasons as it was required to do. This would have amounted to a breach of the AFCA’s obligations.

The role of the AFCA

104 A complaint is made to the AFCA in accordance with s 1053(1) of the Act. The AFCA has all the powers, obligations and discretions that are conferred on the trustee who made the decision to which the complaint relates (s 1055(1)).

105 The AFCA must affirm a decision or conduct if the AFCA is satisfied that the decision, in its operation in relation to the complainant, or conduct, was fair and reasonable in all the circumstances (s 1055(2)).

106 The AFCA must not make a determination of a superannuation complaint that would be contrary to:

(a) the law; or

(b) the governing rules of a regulated superannuation fund to which the complaint relates (s 1055(7)).

107 The AFCA must give written reasons for its determination of a superannuation complaint.

108 The decision is binding on the decision-maker, but not the complainant (who retains the right to challenge the decision).

109 In summary, the AFCA’s task was to determine whether InTrust Super’s decision was fair and reasonable in all the circumstances in its operation in relation to the applicant (s 1055(3)).

110 As was said by Moshinsky, Bromwich and Derrington JJ in QSuper Board v Australian Financial Complaints Authority Ltd (2020) 276 FCR 97; [2020] FCAFC 55:

64 The powers conferred by [the Corporations Act 2001 (Cth)] s 1055 permit AFCA to set aside or vary a decision made by a trustee in relation to a fund member even where the decision was authorised by the trust deed and any regulating statute. The determining factor is not the lawfulness of the decision, but its fairness or reasonableness “in its operation in relation to the complainant”. Such a power is more aptly applied in relation to discretionary powers which, by their nature, confer wide decisional freedom on the repository such that a broad range of decisions might legitimately be made from a single set of facts. In any event, under the scheme where a complainant is aggrieved by a trustee’s decision, AFCA can consider the relevant circumstances and exercise the power or discretion of the trustee afresh so as to correct any perceived unfairness or unreasonableness arising from the original decision’s operation.

65 Despite the width of AFCA’s remedial powers, subs (7) requires that it exercise the powers of the trustee or other authorised person within legal confines. It is not entitled to make a decision which is contrary to the terms of the trust or beyond the limits of any relevant statutory regulation. For instance, AFCA could not, standing in the shoes of a trustee, exercise a power in a manner which breached the trustee duty to observe the terms of the trust.

111 The determining factor is the fairness or unreasonableness of the decision in its operation in relation to the complainant.

112 However, this does not mean that the requirements of the law are not themselves relevant to the question of whether a decision is fair and reasonable in its operation and, as is reflected in s 1055(7), the AFCA must not make a determination which would be contrary to the law or the governing rules of the regulated superannuation fund to which the complaint relates.

113 Misinterpreting the requirements of the statute is an error of law. The requirements of the law are plainly a relevant consideration. A complete failure to take the requirements of the statute into account is an error of law as per Mason J at 39-40 in Minister for Aboriginal Affairs v Peko-Wallsend Ltd (1986) 162 CLR 24.

Appeal from the AFCA

114 An appeal to this Court from the AFCA is on a question of law (s 1057(1)).

115 The Court hears and determines the appeal and makes such order as it thinks appropriate (s 1057(3)).

116 The orders that may be made by the Court on appeal include:

(a) an order confirming or setting aside the determination of the AFCA; and

(b) an order remitting the matter to be determined again by the AFCA in accordance with the directions of the Court.

117 The applicant has identified a number of questions of law. Success on any one of those questions may lead to the orders outlined above.

118 The first question of law was whether the AFCA erred in law in its interpretation and purported application of reg 6.33 and further, in doing so, incorrectly applied reg 6.33 of the SIS Regulations.

119 The focus of the argument raised by the applicant concerning this question of law rested on the application of reg 6.33 and the error was whether the AFCA failed to consider the impact of reg 6.33.

120 The applicant’s written submissions were centred, to some extent, on reg 6.33E, suggesting the AFCA should not have relied on InTrust Super satisfying its obligations under reg 6.33E, as that regulation was not enlivened as there was no request by the applicant under reg 6.33.

121 Of course, reg 6.33E operates to place obligations on the trustee of the transferring fund and these are outlined in reg 6.33E(2).

122 The applicant submitted that the AFCA should have found that InTrust Super did not satisfy its obligations under reg 6.33E(2) as that regulation was not enlivened as there was no request by the applicant under reg 6.33. If reg 6.33E did not apply, there would be no question of satisfying obligations under reg 6.33E(2).

123 I agree that the requirements of reg 6.33E did not arise as the precondition set out in reg 6.33E was not satisfied. The AFCA misconstrued the operation of reg 6.33E in the circumstances of this case.

124 Regulation 6.33E is said to apply “if the transferring fund receives a request under regulation 6.33 to rollover or transfer the whole or a part of a member’s withdrawal benefit from the transferring fund to a self managed superannuation fund”.

125 Regulation 6.33(1) provides that “[a] member of a regulated superannuation fund … may request, in writing, that the whole or a part of the member’s withdrawal benefit in the transferring fund be rolled over” to a receiving fund.

126 Unless there is a request under reg 6.33, reg 6.33E does not apply.

127 In this case, the AFCA found that the request was forged. It is not disputed that the form was lodged by a third party, not the member, and that this was done without the knowledge or authority of the member. The AFCA did not consider whether there was a request in writing to satisfy the requirements of reg 6.33(1) or whether reg 6.33E applied at all.

128 There is an additional issue.

129 It was touched upon earlier in the applicant’s submission, namely the need for the member to have given consent.

130 It goes without saying that, when dealing with a member’s funds, the trustee can only act in accordance with directions from the member.

131 This requirement is reflected in the terms of the Trust Deed as well as the Business Rules.

132 Reg 6.28, which deals with “Rollover—regulated superannuation funds and approved deposit funds”, provides:

(1) Except where it is otherwise provided by the Act, the Corporations Act 2001, the Corporations Regulations 2001 or these regulations, a member’s benefits in a regulated superannuation fund … must not be rolled over from the fund unless:

(a) the member has given to the trustee the member’s consent to the rollover; or

…

133 Business rule 12.5 specified the relevant form of request which might be used. This form of request was used by the scammer in this case.

134 The question arises whether that forged request from a third party could be regarded as a request from a member. Such a request is not signed by a member, nor is it made with the authority, consent or even knowledge of the member.

135 This issue should have been considered by the AFCA. The failure to do so is an error of law.

136 The AFCA erred in law in its interpretation of the application of reg 6.33E, particularly in the context of its conclusion in that compliance with reg 6.33E meant that the trustee’s determination not to provide confirmation was fair and reasonable. It also failed to consider the impact of the lack of consent, including the effect of reg 6.33 – failing to take into account whether the member had made a request in writing as contemplated under reg 6.33(1) that the whole of the member’s withdrawal benefit be rolled over and whether the member ever provided consent to such a rollover.

137 In view of the conclusion I have reached in the preceding paragraph, I will order that:

(a) the determination made by the Australian Financial Complaints Authority on 26 May 2022 be set aside;

(b) pursuant to s 1057(4) of the Act, the matter be remitted to the second respondent for re-determination in accordance with the law.

138 In view of my answer to Issue No 1 and the orders that I have made as a result of that answer, it is not necessary for me to consider the other issues.

CONCLUSION

139 I order that:

1. The appeal be allowed.

2. The determination made by the Australian Financial Complaints Authority on 26 May 2022 be set aside.

3. Pursuant to s 1057(4) of the Corporations Act 2001 (Cth), the matter be remitted to the Australian Financial Complaints Authority for re-determination in accordance with the law.

I certify that the preceding one hundred and thirty-nine (139) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Thomas. |

Associate: