Federal Court of Australia

AIA Australia Limited, in the matter of AIA Australia Limited (No 2) [2023] FCA 1305

ORDERS

AIA AUSTRALIA LIMITED ABN 79 004 837 861 First Applicant RESOLUTION LIFE AUSTRALASIA LIMITED ABN 84 079 300 379 Second Applicant | ||

DATE OF ORDER: | 28 June 2023 |

THE COURT ORDERS THAT:

1. Pursuant to s 194 of the Life Insurance Act 1995 (Cth), the scheme for the transfer of the superannuation and investments life insurance business of AIA Australia Limited, the First Applicant, to Resolution Life Australasia Limited, the Second Applicant (Scheme), in the form of Annexure A to these orders, be confirmed without modification.

2. The Scheme takes effect on and from 12:01 am (AEST) on 1 July 2023.

3. The applicants pay the costs of the proceeding of the Australian Prudential Regulation Authority as agreed or, if no agreement can be reached, as assessed.

4. There be liberty to apply.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

DERRINGTON J:

Introduction

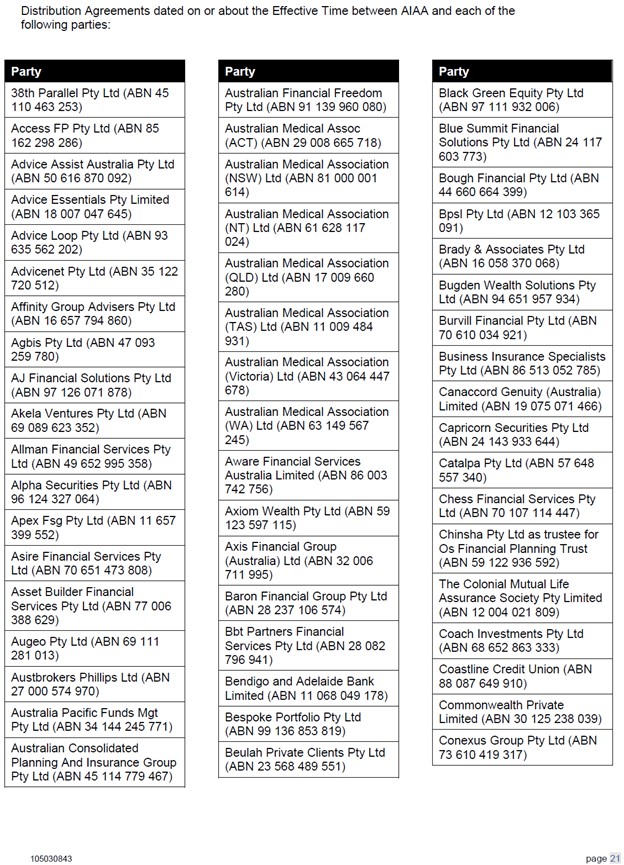

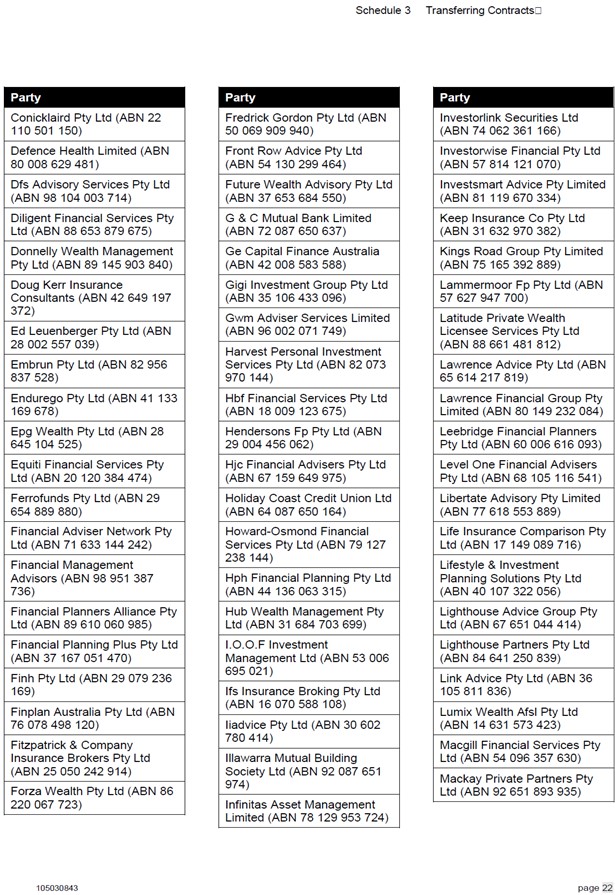

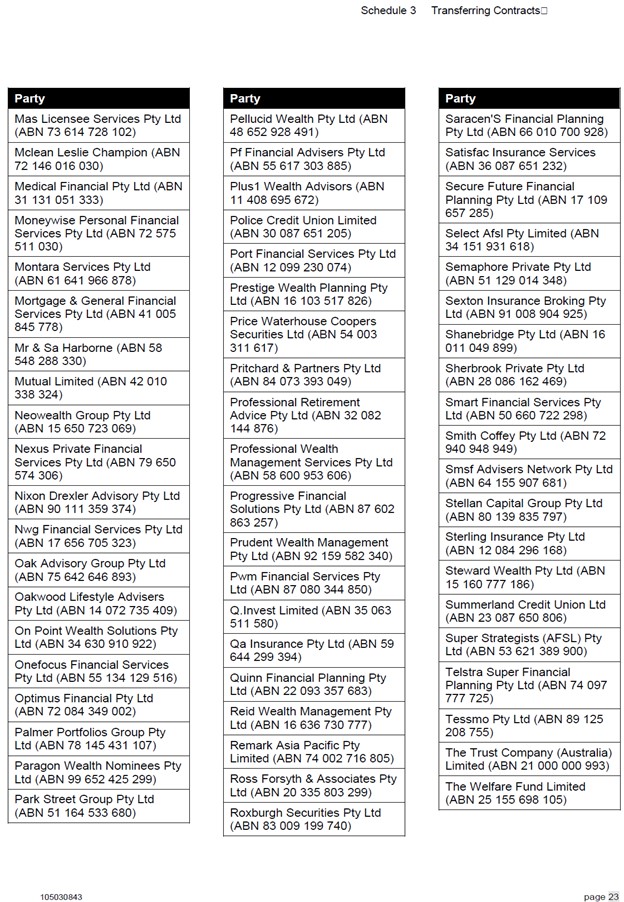

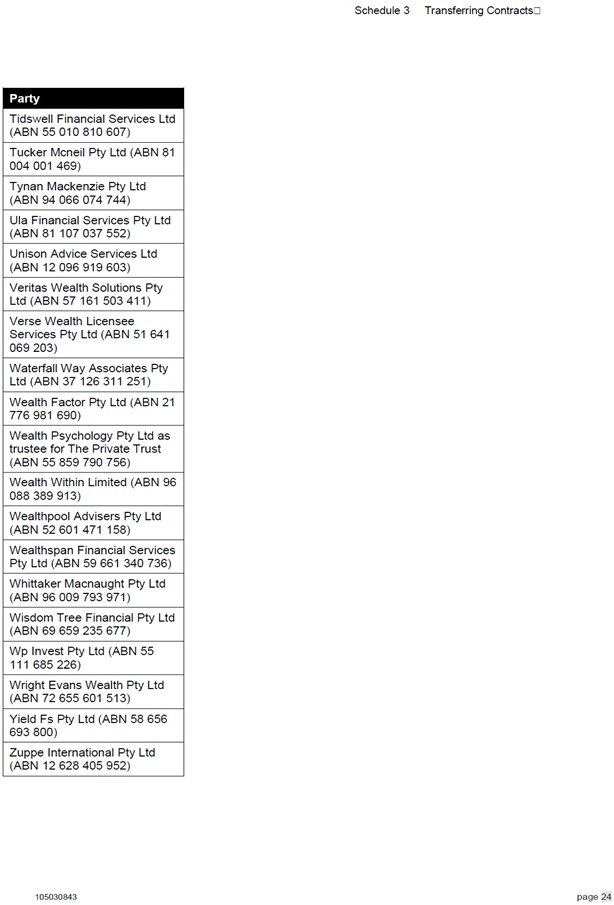

1 AIA Australia Limited (AIAA) and Resolution Life Australasia Limited (RLA), as the first and second applicants, respectively, sought confirmation of a scheme under Part 9 of the Life Insurance Act 1995 (Cth) (Life Act). Pursuant to that scheme, it was proposed that AIAA would transfer the substantial part of its superannuation and investments life insurance business (the S&I life insurance business) to RLA, excluding certain specific liabilities and assets. The transfer is referred to hereinafter as the “Scheme”.

2 The underlying transaction between AIAA and RLA was contained in a written agreement dated 23 February 2022, described as the “Business Transfer Agreement”. On 22 February 2023, orders were made pursuant to s 191(5) of the Life Act (the Dispensation Orders) dispensing, on certain terms, with the need for the applicants to give an approved summary of the Scheme to every affected policy owner: AIA Australia Limited, in the matter of AIA Australia Limited [2023] FCA 167 (the Dispensation Decision). The general background to the intended transfer of the S&I life insurance business is outlined in the Dispensation Decision, and there is no need to repeat those details here.

3 Pursuant to s 190(1) of the Life Act, no part of the life insurance business of a life company may be transferred to another life company except under a scheme confirmed by the Court. That confirmation was sought in the present case at a hearing on 28 June 2023, so as to permit the effectuation of the Business Transfer Agreement.

4 At that hearing, I was satisfied that the Scheme should be confirmed without modification, pursuant to s 194(1)(a) of the Life Act. Having regard to the exigencies of the Business Transfer Agreement, it was appropriate for orders giving the necessary confirmation to be made on the day of the hearing. These are the reasons for the making of those orders.

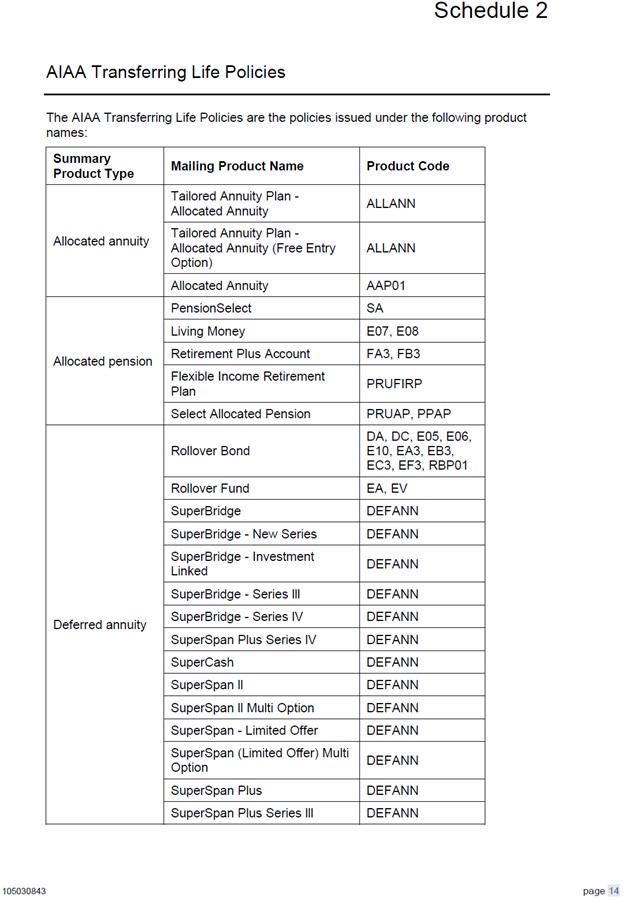

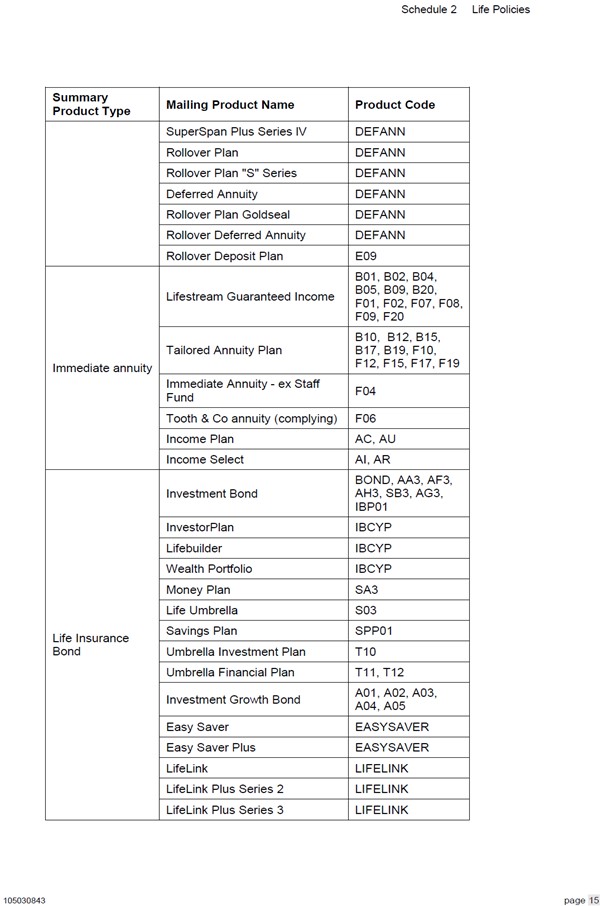

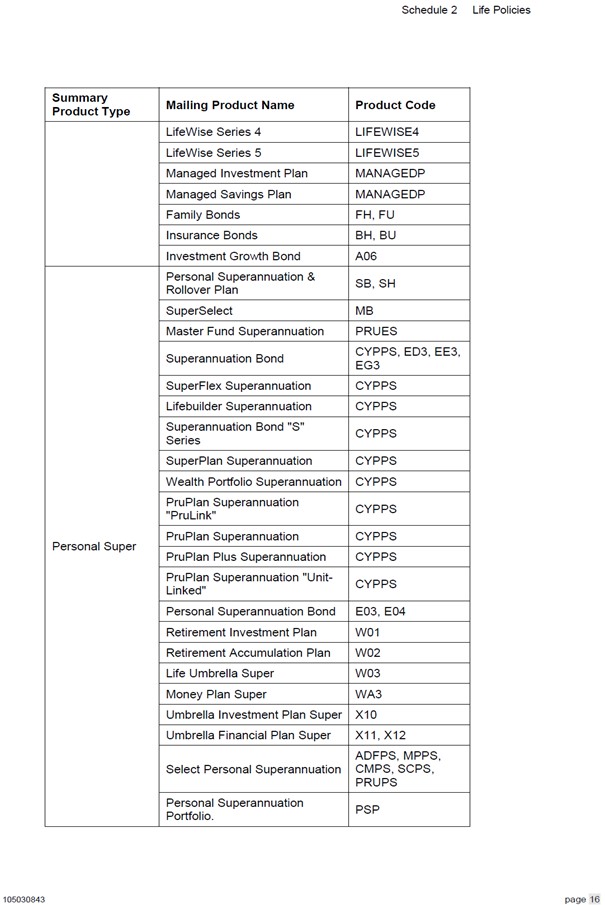

Background

5 The Scheme contemplates the transfer of AIAA’s S&I life insurance business to RLA, subject to this Court’s confirmation. To a substantial degree, that S&I life insurance business is the same life insurance business that was previously acquired by AIAA from Colonial Mutual Life Assurance Limited (CMLA) in 2021. After a review of its portfolio in Australia, AIAA has concluded that its S&I life insurance business does not have the scale necessary to support the level of ongoing investment that it requires. It now seeks to exit that area of the market by selling that part of its business to RLA.

6 By the Dispensation Orders made on 22 February 2023, this Court dispensed with the need for compliance with the requirement in s 191(2)(c) of the Life Act that, in order for an application for confirmation of a scheme to be made, a summary of the Scheme, which had been approved by the Australian Prudential Regulation Authority (APRA), had to be given to every “affected policy owner” — that is, every owner of a policy that was referrable to a statutory fund that was affected by the Scheme. That dispensation was given on the condition that the applicants carry out certain steps involving the publication and distribution of information about the Scheme. In the Dispensation Decision, the steps required to be carried out by the applicants were described collectively as the “Publicity Strategy”. It is convenient to use that nomenclature again in these reasons.

7 Amongst other things, the Publicity Strategy required the applicants to publish a notice of their intention to make the present application to the Court for confirmation of the Scheme in the Commonwealth Government Notices Gazette, and in certain newspapers approved by APRA. It also required the applicants to establish a range of systems through which persons interested in the Scheme could obtain copies of the key documents pertaining to it, and to set up a call centre and other lines of communication by which interested persons could submit enquiries.

The Scheme in overview

8 It is appropriate to set out some brief background to the Scheme, along with some of its more important details.

9 The Scheme has been considered and assessed comprehensively in certain reports prepared by actuaries appointed by each of the applicants, as well as an independent actuary. RLA’s appointed actuary was Mr Martin, whose report was dated 1 February 2023. AIAA’s appointed actuary was Mr van Koert, whose report was dated 6 February 2023. The independent actuary was Mr Goodsall, whose report was dated 7 February 2023. Mr Goodsall is an experienced actuary and a director of Synge & Noble, a consulting actuarial firm. The content of the three actuarial reports was discussed in the Dispensation Decision, and is further addressed later in these reasons.

10 For the purposes of the confirmation hearing, each of the actuaries also provided a further supplementary opinion as to the actuarial aspects of the Scheme in light of more recent financial information and events. Those opinions are dealt with subsequently in these reasons.

11 Both AIAA and RLA are authorised under the Life Act to conduct life insurance business. They do so via their statutory funds, in accordance with the Life Act.

12 AIAA holds a significant share of the Australian life risk insurance market. It also has within its portfolio a range of other business lines that are no longer core to its strategic focus. Many of those lines have been closed to new business for some years.

13 In 2017, the AIAA Group agreed to acquire the life insurance business of CMLA, which was then owned by the Commonwealth Bank of Australia. The transfer of that business to AIAA pursuant to Part 9 of the Life Act occurred in 2021.

14 The business acquired from CMLA included a large portfolio of life risk insurance business, which continues now to reflect AIAA’s strategic focus. However, it also included other business, being the S&I life insurance business, which is no longer a part of AIAA’s core strategic focus and which continues to be administered by AIAA on legacy systems previously managed by CMLA. The maintenance of AIAA’s non-core business lines on those separate legacy systems to applicable contemporary standards has diverted attention from the company’s core business strategy.

15 Following a review of its overall portfolio in Australia, AIAA concluded that the S&I life insurance business did not have the scale necessary to warrant the required level of ongoing investment in it.

16 The focus of RLA’s business, meanwhile, is the acquisition and management of closed portfolios of business, such as the ex-CMLA S&I life insurance business that is now proposed to be transferred under the Scheme. RLA is able to provide such business in a well-capitalised and stable environment in order to deliver on long-term customer promises. It has accumulated a large portfolio of superannuation and investment products, including the largest participating fund in Australia.

17 It was not in doubt that the proposed transfer of the S&I life insurance business from AIAA to RLA would be consistent with the parameters of the latter’s business model, and would allow it to add incremental scale to its existing business. That would be to the benefit of both the transferring and the existing policy owners.

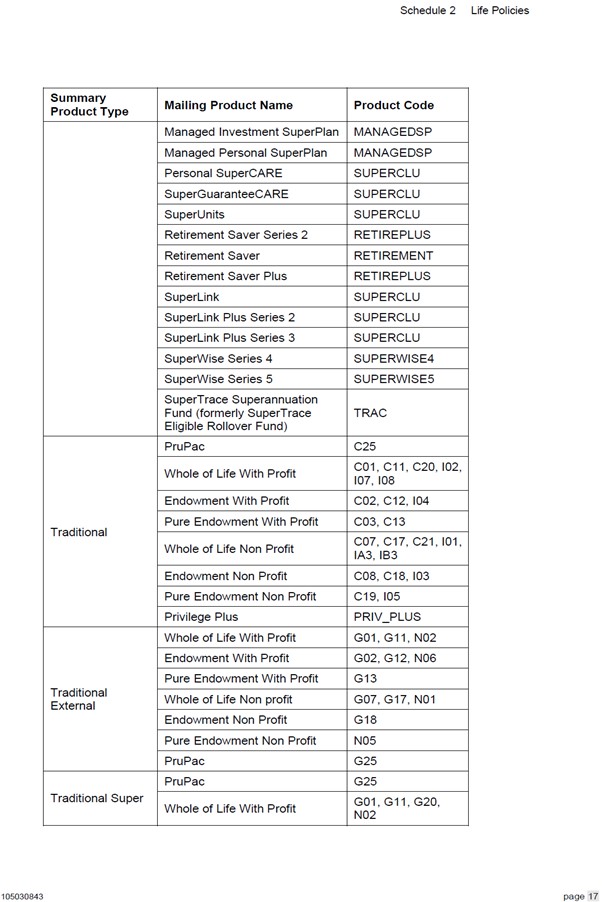

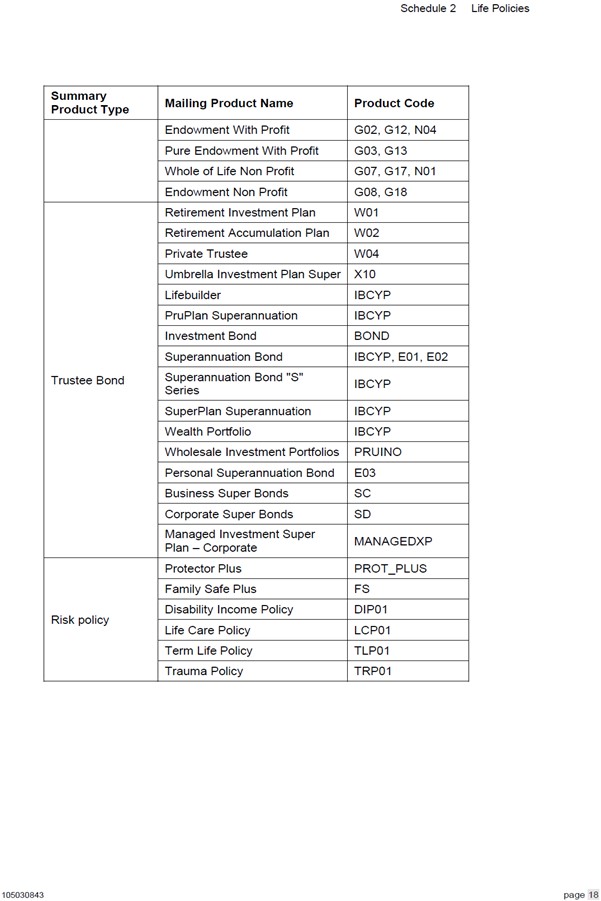

18 In a manner consistent with the foregoing commercial objectives of AIAA and RLA, the two have agreed to the transfer of the S&I life insurance business. That transfer involves approximately 125,000 policies, carrying $6.2 billion of policy liabilities (net of re-insurance) as at 30 June 2022. As described in the actuarial reports, the business to be transferred encompasses:

(a) the ex-CMLA non-participating traditional and investment account business;

(b) the ex-CMLA annuity business;

(c) the investment-linked business referable to certain of AIAA’s Statutory Funds, identified as “SF1L”, “SF2L” and “SF4” (all ex-CMLA business); and

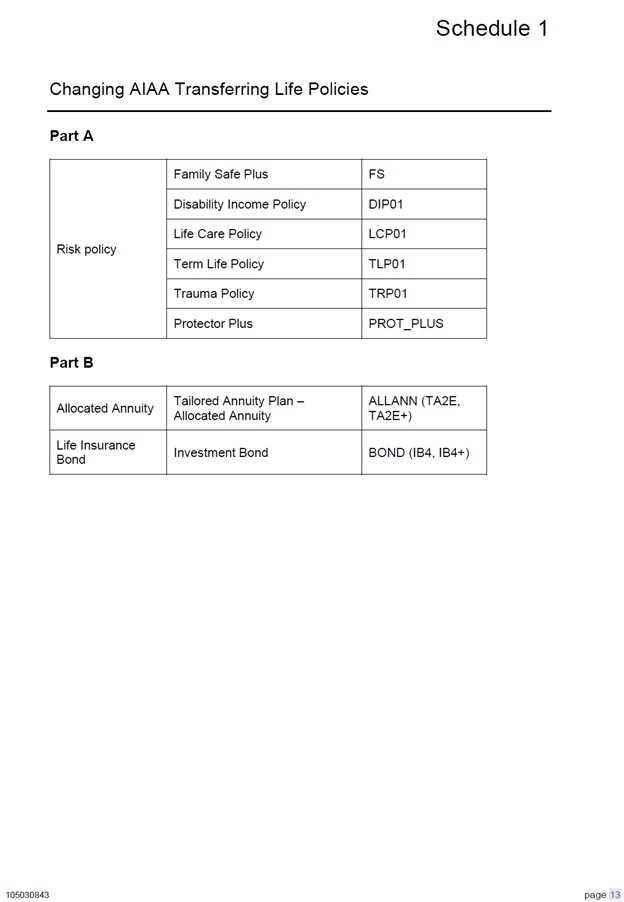

(d) certain life risk insurance policies related to the above and/or administered on the computer administration systems that support the business referred to above.

19 The transfer also involves AIAA providing to RLA the underlying legacy computer systems, and administration of business management staff supporting the relevant portfolios.

20 There is no need to set out in these reasons any detailed background to RLA’s business. It suffices to observe that it is an established life insurance company whose immediate parent, Resolution Life NOHC Pty Ltd, is registered as a Non-Operating Holding Company under the Life Act and is regulated by APRA. RLA is part of the global Resolution Life Group, which is in the business of acquiring portfolios of in-force policies from life insurers and assuming responsibility to the relevant policy owners to ensure that the commitments made to them by those life insurers are honoured in the long term. It is not in the business of selling new policies directly to customers.

21 On the facts before the Court, it was apparent that, as at 30 June 2022, RLA had approximately 910,000 policies with approximately $22.3 billion of policy liabilities, supported by approximately $26.1 billion of assets.

22 None of the actuaries who provided evidence in this proceeding suggested that any detriment would be suffered by policy owners on account of the proposed transfer to RLA.

23 As was noted in the Dispensation Decision, the transfer of the AIAA policies involves the allocation by RLA of those policies to comparable and appropriate statutory funds that it maintains.

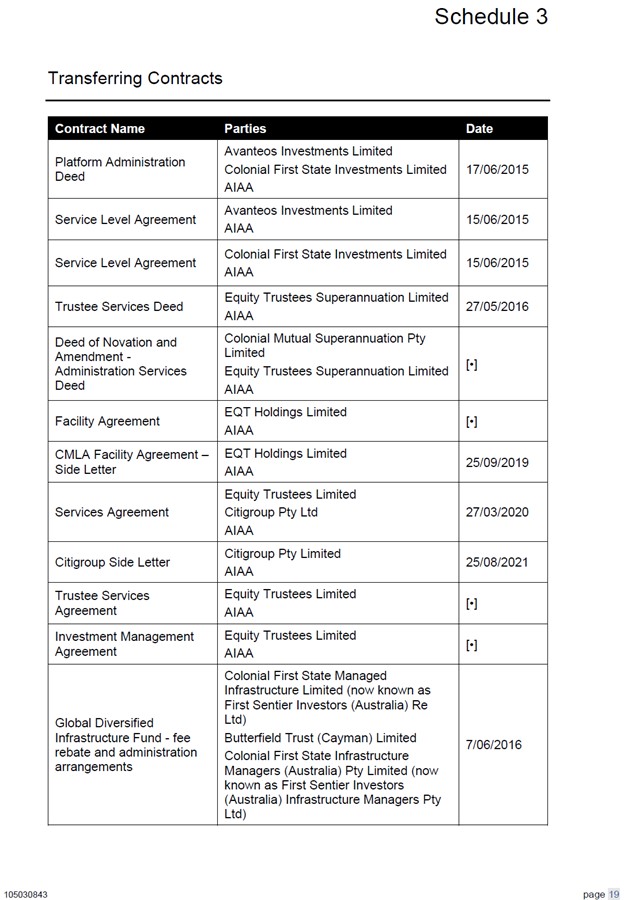

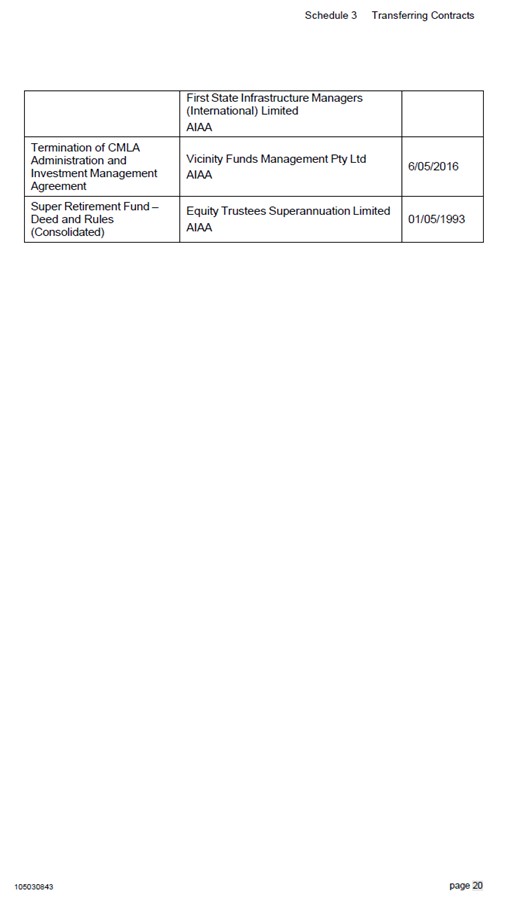

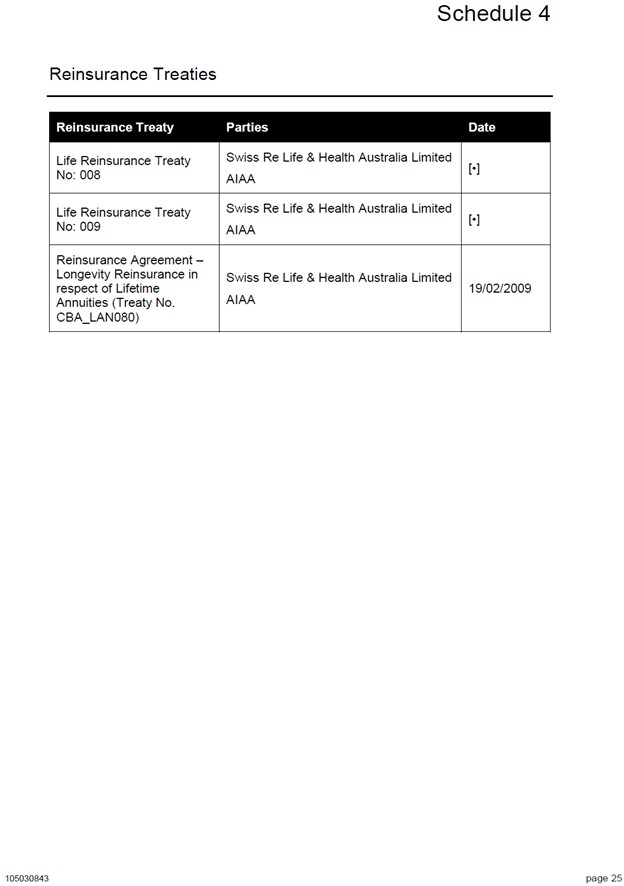

24 In addition, by the terms of the Scheme, the policy owners whose policies are transferred (hereinafter the Transferring AIAA Life Policy Owners) will not suffer detriment by reason of the transfer, given that RLA will be deemed to be the issuer of those transferring policies (the Transferring AIAA Life Policies) and will assume all of AIAA’s liabilities and obligations as the original issuer of the policies. Simultaneously, it will assume the rights and benefits to which AIAA is presently entitled in respect of the Transferring AIAA Life Policies, including the right to receive fees and premiums, and the right to enforce their terms and the remedies available under them. Subject to some minor changes to a small proportion of the Transferring AIAA Life Policies, the rights and liabilities of the Transferring AIAA Life Policy Owners will be the same in all respects as they would have been if the initial application for the policies had been accepted by RLA instead of AIAA and the policies had thereafter been issued by RLA. For these reasons, any claims or proceedings presently on foot in connection with any of the Transferring AIAA Life Policies will be maintained or continued by or against RLA. Further, other business contracts associated with the policies, and each re-insurance treaty under which AIAA is a cedant (save for one), will be transferred to RLA.

Proposed changes to terms and conditions

25 There is no intention to make changes to the terms and conditions of any existing RLA policies, or any AIAA policies not being transferred (hereinafter the Remaining AIAA Life Policies), as a consequence of the Scheme.

26 As discussed in the Dispensation Decision, some minor changes are proposed to a small number of the Transferring AIAA Life Policies. These changes are considered in more detail below. For the present purposes, it suffices to note that they involve the altering of the policies in two respects. First, to allow RLA, as the incoming insurer, to modernise the terms of certain policies without the need to obtain individual policy owner consent. Most of the policies being transferred under the Scheme have clauses that permit this to occur. Only 449 policies do not. It is proposed to insert a term in these policies allowing RLA to make improvements to the policies in future without the need for individual policy owners to “opt in”. Secondly, a very small number of life investment policies to be transferred have benefits based on “investment units” holdings multiplied by a “unit price” that is set on a “last price” or “historic price” basis. It is proposed to update those policies so that the unit prices will be set on a “next price” or “forward price” basis, which is consistent with modern industry best practice and regulatory guidance. The actuaries have assessed these changes, generally, to be an overall improvement to the terms of the affected Transferring AIAA Life Policies.

Conditions precedent in the Business Transfer Agreement

27 The completion of the transfer contemplated by the Scheme is, pursuant to the terms of the Business Transfer Agreement, contingent on a number of matters. All of the contractual conditions for completion have now been satisfied, save for the final confirmation of this Court. The satisfaction of these conditions has involved, amongst other things, the receipt of written advice from the Commonwealth Treasurer to the effect that the Scheme is approved under the Insurance Acquisitions and Takeovers Act 1991 (Cth), the receipt of written notice of an absence of objections from the Commonwealth Government under the Foreign Acquisitions and Takeovers Act 1975 (Cth), and the receipt of written advice from the Australian Competition and Consumer Commission that it has no objection to, or does not propose to take any action in respect of, the proposed acquisition of assets and business under s 50 of the Competition and Consumer Act 2010 (Cth). Accordingly, as at the date of this confirmation hearing, the transfer pursuant to the Business Transfer Agreement remained subject only to this Court’s approval.

Applicable statutory provisions and principles

28 The Court’s power to confirm a life insurance scheme is contained in Part 9 of the Life Act —specifically, in s 194.

29 In Macquarie Life Limited, in the matter of Macquarie Life Limited [2022] FCA 1602 (Macquarie Life), Allsop CJ set out and explained the statutory provisions relevant to the confirmation of a scheme as follows:

53 The objects of the Act are set out in s 3 and are as follows:

(1) The main objects of this Act are:

(a) to protect the interests of the owners and prospective owners of life insurance policies in a manner consistent with the continued development of a viable, competitive and innovative life insurance industry; and

(b) to promote financial system stability in Australia.

(1A) An additional object of this Act is to protect the interests of persons entitled to other kinds of benefits provided in the course of carrying on life insurance business (including business that is declared to be life insurance business).

(2) The principal means adopted for the achievement of these objects are the following:

…

(f) providing for the supervision of transfers and amalgamations of life insurance business by the Court.

54 The provisions applicable to curial supervision of schemes of transfer are contained in Part 9 of the Act.

55 Section 190 of the Act is expressed in the following terms:

(1) No part of the life insurance business of a life company may be:

(a) transferred to another life company; or

(b) amalgamated with the business of another life company;

except under a scheme confirmed by the Court.

…

(3) A scheme must set out:

(a) the terms of the agreement or deed under which the proposed transfer or amalgamation is to be carried out; and

(b) particulars of any other arrangements necessary to give effect to the scheme.

56 Section 193 relates to applications to the Court for confirmation and provides as follows:

(1) Any of the companies affected by a scheme may apply to the Court for confirmation of the scheme.

(2) An application for confirmation must be made in accordance with the regulations.

(3) APRA is entitled to be heard on an application.

57 Section 194 sets out what the Court must have regard to in considering whether to exercise its discretion to approve a proposed scheme:

(1) The Court may:

(a) confirm a scheme without modification; or

(b) confirm the scheme subject to such modifications as it thinks appropriate; or

(c) refuse to confirm the scheme.

(2) In deciding whether to confirm a scheme (with or without modifications), the Court must have regard to:

(a) the interests of the policy owners of a company affected by the scheme; and;

(b) if a report relevant to all or part of the scheme has been filed with the Court under section 175 –– that report; and

(c) any other matter the Court considers relevant.

58 By s 195 of the Act, when a scheme is confirmed it becomes binding on all persons and has effect notwithstanding anything in the constitution of the company affected by the scheme. The company on whose application the scheme was confirmed must cause a copy of the scheme to be lodged at an office of ASIC in every State and Territory in which a company affected by the scheme carried on business.

30 It is sufficiently clear from its text that s 194 of the Life Act confers on the Court a discretion as to whether or not a scheme is to be confirmed and, if it is, with what modifications (if any). Undoubtedly, confirmation is not to be given as a matter of course, nor is it a mere formality: Macquarie Life [59]; OnePath Life Limited, in the matter of OnePath Life Limited (No 2) [2022] FCA 811 [17] (OnePath Life (No 2)); Re Asteron Life & Superannuation Ltd (No 3) (2021) 394 ALR 89, 116 [126] (Asteron Life (No 3)); Colonial Mutual Life Assurance Society Limited, in the matter of the Colonial Mutual Life Assurance Society Limited [2021] FCA 394 [27] (Colonial Mutual Life); MLC Lifetime Company Limited and MLC Limited (No 2) [2006] FCA 1367 [5] (MLC Lifetime (No 2)). The Court’s scrutiny of the proposed scheme will be assisted by its reference to the evidence advanced in support of it, including, in particular, the considered opinions of independent actuaries.

31 Necessarily, the Court’s discretion, whilst broad, must be exercised in a principled way. The exercise of the discretion ought to advance the objects of the Life Act, including the protection of the interests of the owners and prospective owners of life insurance policies in a manner consistent with the continued development of a viable, competitive and innovative life insurance industry: see Life Act s 3; In the application of Commonwealth Insurance Holdings Ltd and The Colonial Mutual Life Assurance Society Ltd [2007] FCA 1012 [12] (Commonwealth Insurance Holdings), citing Colonial Portfolio Services Ltd v Australian Prudential Regulation Authority (2000) 11 ANZ Insurance Cases 90-103, 86,132 [4], 86,136 [29] (Colonial Portfolio Services);

32 In Asteron Life (No 3), Allsop CJ identified (at 116 – 117 [127] – [129]) that there are two main dimensions to the protection of the interests of policy owners. The first is the procedural dimension, by which the Court ensures that the processes undertaken in connection with the scheme have properly been executed in accordance with the requirements of the Life Act and the Life Insurance Regulations 1995 (Cth) (Life Regulations), as well as any orders made by the Court pursuant to s 191(5) of the Life Act. The second is the substantive dimension, where the Court is concerned to ensure that the scheme is not prejudicial to the interests of policy owners. One of the Court’s objectives in connection with the latter dimension is to avoid the occurrence of any material detriment to policy owners affected by the scheme: see Commonwealth Insurance Holdings [13]; St George Life Limited, in the matter of St George Life Limited (No 2) [2018] FCA 1396 [42]; National Mutual Life Association of Australasia Limited, the application of National Mutual Life Association of Australasia Limited and AMP Life Limited (No 2) [2016] FCA 1591 [30], [32] (NMLA (No 2)); National Mutual Life Association of Australasia Limited v Challenger Life No 2 Limited [2009] FCA 1 [15]; NULIFE Insurance Ltd v Norwich Union Life Australia Limited [2005] FCA 1635 [24].

33 The question as to whether policy owners will be adversely affected by a scheme’s implementation is to be answered predominantly by reference to the actuarial evidence. It involves a comparison between, on the one hand, their contractual and other rights, the security of their benefits, and their reasonable benefit expectations prior to the implementation of the scheme, and, on the other hand, their position if the scheme is implemented: Commonwealth Insurance Holdings [14]; NMLA (No 2) [31]; Asteron Life (No 3) at 117 [129]; Macquarie Life [60].

The procedural dimension

Compliance with Dispensation Orders

34 The Dispensation Orders required the applicants to take a number of steps that, together, were intended to ensure that policy owners and others received sufficient notice of the Scheme and of the present application for its confirmation. Several of the steps in the Publicity Strategy reflected requirements already contained in the Life Act and the Life Regulations, whilst others involved more contemporary methods of giving notification. The key objective of the Publicity Strategy was to ensure that a sufficiently large number of affected policy owners was made aware of the Scheme and the present application, such that any viable objection to the confirmation of the Scheme could be identified and brought to the Court’s attention: Dispensation Decision [57] – [58], [84].

35 Central to the process of notifying affected policy owners was the Scheme Summary and the Notice of Intention. These were approved by APRA, which also approved the manner and method of their publication.

36 Ultimately, the evidence before the Court demonstrates that the obligations set out in the Dispensation Orders, including the procedural requirements of the Life Act and the Life Regulations reflected in the Publicity Strategy, have been complied with, except in two relatively minor respects.

37 As to the first, it became apparent following the hearing at which the Dispensation Orders were made that one of AIAA’s products intended to be transferred under the Scheme had inadvertently been omitted from the Scheme document and the Scheme Summary. This product was known as the “SuperBridge – Series IV” (the SuperBridge Product), which was held by 37 policy owners. As it was, the Scheme document and the Scheme Summary were revised to include references to the SuperBridge Product, and the updated versions of those documents were used to comply with certain of the remaining steps required to be taken by AIAA and RLA under the Publicity Strategy. AIAA also arranged for the updated Scheme Summary to be provided to 19 of the 37 policy owners of the SuperBridge Product, for whom it had current mailing addresses. The updated Scheme document and Scheme Summary were uploaded to the webpage maintained by AIAA in respect of the Scheme on 20 March 2023.

38 Accordingly, whilst the original Scheme document and Scheme Summary were deficient, in that they each contained a list of products to be transferred that was incomplete, revised versions of the Scheme document and Scheme Summary were swiftly published and distributed specifically to the persons most directly affected. In these circumstances, the deficiency could have no material impact on any RLA policy owners, the owners of the Remaining AIAA Life Policies (the Remaining AIAA Life Policy Owners), or the vast majority of the Transferring AIAA Life Policy Owners. The omission of the reference to the SuperBridge Product in the current circumstances is not an error of a kind that could adversely affect the policy owners as a whole or amount to so serious an instance of non-compliance with the relevant requirements as to impact the Court’s exercise of its discretion in relation to the confirmation of the Scheme: see Colonial Mutual Life [36]; Asteron Life (No 3) at 114 [115]; Re Royal & Sun Alliance Life Assurance Ltd (2000) 104 FCR 37, 39 – 40 [15] – [18] (Royal & Sun); OnePath Life (No 2) [21].

39 Otherwise, the following points can relevantly be made:

(a) A copy of the approved and updated Notice of Intention was published in the Commonwealth Government Notices Gazette.

(b) The Notice of Intention was published in newspapers circulating in the States, the Territories and nationally, as required by the Publicity Strategy.

(c) The applicants arranged for appropriate websites and webpages to be established in accordance with the Publicity Strategy, upon which the Scheme documents (as amended) were made available for viewing and downloading. The websites also provided an avenue through which enquiries about the Scheme could be submitted. The evidence shows that there was a substantial amount of traffic on the websites, and that the Scheme documents were viewed and downloaded on multiple occasions.

(d) The applicants established dedicated email addresses to receive enquiries about the Scheme and those addresses were disclosed in the Notice of Intention and Scheme Summary, as well as on the Scheme websites. Again, the evidence reveals that the email addresses were sufficient to enable enquiries to be made, and for responses to be given, in relation to the Scheme. The evidence shows that no email correspondence was received that contained any objection to the Scheme.

(e) The applicants arranged for call centres to be established to receive and handle calls about the Scheme via a general toll-free number in Australia. Some 19 calls were received by RLA through its customer contact centre, along with one “click and chat enquiry”, and a further six enquiries via phone or email from superannuation trustees. AIAA received 516 calls to its call centre. Again, none of those communications conveyed an objection to the Scheme.

(f) The applicants also provided copies of the Scheme documents free of charge to persons who requested them. AIAA received four such requests, while RLA received two.

(g) The applicants arranged for a link to the Scheme documents to be sent by email to certain independent financial advisors on specialised distribution lists that they maintained as at 8 March 2023. Approximately 9,400 emails were sent by RLA as part of this process.

(h) RLA identified its affected policy owners who were corporate policy owners of group life policies and provided to them, by email, information about the Scheme and a link to the Scheme documents. Approximately 180 emails were sent by RLA as part of this process.

(i) RLA published a short notification about the Scheme, including details of how affected policy owners could access information, through its LinkedIn account on 22 March 2023.

40 In the circumstances, the omission of the reference to the SuperBridge Product in the relevant Scheme documents did not result in any disadvantage to any policy owner. The omission should be excused, and the Dispensation Orders should be regarded as having substantially been performed in this respect.

41 The second minor instance of non-compliance occurred in relation to the order that the Scheme documents be made available at each of the locations set out in Annexure B to the Dispensation Orders between the dates of 23 March 2023 and 14 April 2023 inclusive. That order reflected the requirement in reg 9.02(4) of the Life Regulations that a copy of the Scheme be open for public inspection every day (except weekends and public holidays) for a period of at least 15 days at an office of the applicant or another location approved by APRA. In the present case, an additional public holiday occurred in Tasmania during the nominated inspection period, such that the applicants’ chosen location in that State was open only for a total of 14 days. This did not come to the attention of those arranging the public inspection of the documents until after the inspection period had concluded.

42 However, during the time that the documents were available for inspection in Tasmania, only one person attended to inspect them. The documents at all relevant times remained available to interested persons via the online and other avenues described above. There is no evidence that any person complained either that the documents were unavailable for public inspection on the public holiday in Tasmania, being 11 April 2023, or that the documents were made available in that location for less than the prescribed 15 days.

43 In these circumstances, it can be accepted that the relevant order of this Court was substantially complied with in accordance with its terms. As a consequence of the additional public holiday in Tasmania during the inspection period, the documents could not have been made available for inspection for the 15-day period required by reg 9.02(4).

44 The non-compliance with reg 9.02(4) is not fatal to the application for confirmation: see Colonial Mutual Life [36], [44]; Royal & Sun at 40 [18], 42 [33]; MLC Lifetime (No 2) [11] – [12]. Here, having regard to the extensive requirements set out in the Dispensation Orders and the applicants’ near-perfect satisfaction of them, it could not be said that the failure to comply strictly with reg 9.02(4) could adversely have affected policy owners in any material way. It follows that the non-compliance should not impede the Court’s exercise of its discretion to confirm the Scheme.

Other procedural requirements under the Life Act and Life Regulations

45 In compliance with s 191(2)(a) of the Life Act, a copy of the Scheme and the actuarial reports accompanying it were provided to APRA. These documents, and earlier drafts of them, were given to APRA prior to the publication of the Notice of Intention as required by reg 9.01 of the Life Regulations. As an aside, it should be recognised that, to its credit, APRA has appropriately participated in and made contributions to the overall confirmation process, and has provided the applicants with comments on several iterations of the Scheme and the associated documents.

46 The present application for confirmation of the Scheme has also been made in accordance with reg 9.03 of the Life Regulations, given that the period for public inspection of the Scheme documents concluded on 14 April 2023.

Conclusion on procedural requirements

47 It follows that the procedural requirements imposed by the Life Act, the Life Regulations and the Dispensation Orders have substantially been complied with for the purposes of the present confirmation hearing. The two instances of technical non-compliance have not adversely affected the interests of any particular policy owner, or the policy owners as a whole. The Court should proceed on the basis that sufficient notification of the Scheme has been provided, such that the objections and concerns that have been raised can properly be taken to constitute the totality of those that exist.

The substantive dimension

Assessment of the Scheme

48 In the exercise of its discretion under s 194(1) of the Life Act, the Court relies heavily upon the actuarial evidence advanced in support of a scheme in order to determine whether or not it has the potential to adversely affect policy owners. Since the making of the Dispensation Orders in this case, the three actuaries, Mr Martin, Mr van Koert and Mr Goodsall, have provided updated observations in relation to the Scheme, having regard to the latest financial information available. All three of the actuaries support the Scheme.

49 In his original report dated 1 February 2023, Mr Martin, the actuary appointed by RLA, concluded (amongst other things) that:

(a) the modernisation clause proposed to be inserted into the affected policies will not adversely impact the policy owners’ interests and, overall, will be advantageous for them;

(b) the change to allow the use of a “next price” basis for unit pricing instead of a “last price” basis will permit improved management of unit pricing for the affected policies, which is advantageous to the policy owners as a whole, and will not cause any material negative impact to individual policy owners;

(c) for the non-participating policy owners, all policy terms will remain unchanged (other than as has been indicated);

(d) for those policies with benefits linked to underlying asset investment performance, the Scheme has the potential, by increasing the scale of RLA’s business, to provide enhanced opportunities for investment risk, return and investment management cost outcomes;

(e) for the participating policy owners, all policy terms will remain unchanged, including their surrender value bases;

(f) all of the participating policy assets, policy liabilities, retained policy owner profits and related shareholder retained profits (participating) will transfer “as is” into the RLA participating sub-fund, and will continue to be managed as appropriate through relevant allocated asset pools that perpetuate existing investment strategies, as well as existing approaches to bonus rates and crediting rates;

(g) participating policy owners are likely to benefit from RLA’s increased scale of operations and larger investment portfolios;

(h) the overall reasonable benefit expectations of the Transferring AIAA Life Policy Owners will continue to be met after the proposed transfer;

(i) similarly, the policy owners’ benefit security will remain adequate after the proposed transfer, given RLA’s sound financial position;

(j) there will be no change to the contractual benefits and rights of RLA’s existing policy owners as a result of the proposed transfer;

(k) there will be no impact to the reasonable benefit expectations for the policies that have benefits linked to underlying investment performance, as the increase in the scale of RLA’s overall investment portfolio will provide enhanced opportunities for investment risk-return and investment management cost outcomes;

(l) the benefit security of RLA’s existing policy owners will remain appropriate after the proposed transfer as RLA’s overall financial position will remain sound; and

(m) there are no material disadvantages for the existing policy owners of RLA as a result of the proposed transfer.

50 Mr Martin also addressed the financial impact of the Scheme in relation to both the Transferring AIAA Life Policy Owners and the existing RLA policy owners. At paragraph 5.6.2 of his report, he observed:

• As set out in Section 5.6.2, Resolution Life will continue to soundly and adequately meet the regulatory capital amounts (PCA), as well as any higher (non-disclosable) prudential capital requirement (PCR) after the Proposed Transfer.

• The capital in excess of the regulatory requirements satisfied Resolution Life internal capital reserving benchmarks, under its ICAAP, before the proposed transfer, and will continue to do so after the proposed transfer, with appropriate PCA coverage ratios before and after transfer.

• The overall financial risk profile of Resolution Life, as indicated by it continuing to meet its regulatory capital requirements and expectations, and its existing and continuing internal capital benchmarks under its ICAAP, means that the risk profile of Resolution Life for its existing policyholders will not prima facie materially change as a result of the transfer at the Transfer Date, and the position immediately after the transfer is regarded as sound and appropriate for the AIAA policyholders transferring to Resolution Life.

• The effect of the Proposed Transfer is that it is expected that the future profit and net capital generation of Resolution Life will be higher than without the transfer occurring. The increased flows will continue to provide a valuable source of financial resources to support Resolution Life deal with future risk events and outworking after the Proposed Transfer.

Each of the statutory funds of Resolution Life, and Resolution Life as a whole, will continue to meet its regulatory capital requirements.

Resolution Life as a whole, and each of its statutory fund, will remain in a sound financial position.

The benefit security of the Resolution Life Existing Policyholders and Transferring AIAA Policyholders will be sound and appropriate after the Proposed Transfer.

51 Mr Martin has provided further evidence in this proceeding by way of a supplementary affidavit, addressing updated financial information as at 31 December 2022. Having regard to that updated information, he confirms his earlier views.

52 Overall, Mr Martin’s opinion is that the minor potential detriments that might flow from the implementation of the Scheme are outweighed by the benefits that are likely to be derived by all policy owners concerned.

53 In his independent report dated 7 February 2023, Mr Goodsall concluded that, after the proposed transfer, RLA will continue to maintain assets in excess of its prescribed capital amount and capital adequacy multiples for each of its funds and sub-funds, and is expected to generate capital to sustain its business plans and meet or exceed its regulatory capital requirements and target surplus. He has identified that the essential import of the Scheme is that AIAA is transferring to RLA policies that are now considered to be outside of its strategic focus on the basis that RLA’s business model is centred on its purchasing and managing precisely those types of policies. RLA has a considerable deal of experience with the type of policies being transferred, and has the scale and capacity necessary to invest in improved systems and customer service processes targeted at them. Further, the additional scale that the proposed transfer will add to RLA’s business will benefit its existing policy owners by spreading fixed costs over a larger base.

54 At paragraph [13] of his affidavit dated 17 February 2023, Mr Goodsall expressed his actuarial conclusions as follows:

Based on my review of the Scheme, as set out in my report, in my opinion:

(a) the changes to policy terms and conditions contained in the Scheme will not materially adversely affect the contractual rights or benefits of AIAA’s policyholders or Resolution Life’s existing policyholders;

(b) there will not be any material adverse impact on reasonable benefit expectations of AIAA’s policyholders or Resolution Life’s existing policyholders;

(c) the security of policyholder benefits for both AIAA’s policyholders and Resolution Life’s existing policyholders is maintained; and

(d) the Scheme will not materially prejudice the interests of AIAA’s policyholders or Resolution Life’s existing policyholders.

55 Those views have remained unchanged as at the date of the confirmation hearing.

56 In his report dated 6 February 2023, Mr van Koert, the actuary appointed by AIAA, reached similar conclusions. He opined that:

(a) the Scheme will not adversely impact the contractual benefits and rights of the Transferring AIAA Life Policy Owners or the Remaining AIAA Life Policy Owners;

(b) the Scheme will not adversely impact the reasonable benefit expectations of the Transferring AIAA Policy Owners or the Remaining AIAA Life Policy Owners;

(c) the security of the Transferring AIAA Life Policy Owners’ and the Remaining AIAA Life Policy Owners’ benefits will continue to be appropriate post-transfer, in the sense that it will be maintained because the assets being transferred are appropriate to support those benefits and the other liabilities that are transferred; and

(d) each of AIAA’s statutory funds is expected to have capital in excess of the relevant regulatory capital requirements following the proposed transfer.

57 Mr van Koert has since opined that the updated financial accounts as at 31 December 2022 support the conclusion that AIAA will continue to satisfy regulatory capital requirements after the proposed transfer, as will RLA. Whilst the capital adequacy multiples of RLA’s Statutory Funds No. 1, No. 2 and No. 3, as well as that of AIAA’s Statutory Fund No. 1, are expected to reduce slightly from their current levels following the transfer, they remain well within appropriate limits.

58 It is to be noted that the existing re-insurance arrangements for the transferring S&I life insurance business will be maintained after the Scheme has been implemented, other than the Hannover Re treaty (which affected only a small part of the business, over which RLA has elected not to continue cover).

Updated profit figures for RLA

59 In his supplementary affidavit, Mr Martin has made reference to RLA’s latest profit figures. The company reported a profit of $224 million for 2022, and declared total dividends and capital returns of $400 million. Mr Martin has noted that RLA’s business plans indicate ongoing generation of material expected cash flows and net asset generation, as well as an ability to support material future dividends.

The Blackstone transaction

60 Subsequent to the making of the Dispensation Orders, an issue arose in relation to what was referred to as the “Blackstone transaction”, which caused there to be some doubt as to whether the consequences of the Scheme would be as benign as had initially been anticipated. There is no need to recount the details of that transaction for the purposes of these reasons. It suffices to say that, after considering the nature of the issue and its resolution as between the applicants, Mr Martin concluded that his original position was materially unchanged. Mr Goodsall reached a similar conclusion. Mr van Koert also reflected upon the impact of the Blackstone transaction and concluded that it did not change the opinions that he had previously expressed.

RLA unallocated asset pool

61 The business of RLA’s Statutory Fund No. 1 is comprised of a number of sub-funds containing non-participating and participating business. The participating sub-fund is further divided into “PRE Pools” and an “Unallocated Asset Pool”. The PRE Pools comprise allocated assets pools that support each underlying portfolio of business in the participating sub-fund. The amount of each PRE Pool is intended to support fully and reflect the reasonable expectations of policy owners in the PRE Pool.

62 The Unallocated Asset Pool is an additional pool of assets in excess of the PRE Pools. It was described by Mr Martin in his report as follows:

The UA Pool supports the financial position of the overall Par Sub-Fund, acting as a buffer against and financial support for, abnormal experience or unforeseen events and supports the working capital needs of the Par Sub-Fund as a whole. The UA Pool is allocated 80% to Policy owners’ Retained Profits” (PRP) and 20% [to] Shareholders Retained Profits Participating (SRPP) under the Life Act.

63 The AIAA participating sub-fund in the AIAA’s Statutory Fund No. 1 is similarly divided into a series of underlying “Bonus Pools”, which are the equivalent to RLA’s PRE Pools. However, AIAA does not maintain a separate Unallocated Asset Pool within its participating sub-fund. Under the Scheme, the AIAA participating policies will transfer into the RLA participating sub-fund within their existing Bonus Pools. No RLA policies or assets will be added to or comingled with the existing AIAA pools, which will become additional PRE Pools (to use RLA’s terminology).

64 Clause 6 of the Scheme provides that the Unallocated Asset Pool will continue to be managed by RLA as a resource to support overall policy owner outcomes and the practical management of the participating sub-fund as a whole. It will operate as a discrete asset pool, separate from the PRE Pools in the participating sub-fund. It is anticipated that RLA will continue to manage and apply the Unallocated Asset Pool in accordance with its existing practices for the benefit of the participating sub-fund as a whole. The Unallocated Asset Pool will continue to support the overall participating sub-fund by:

(a) supporting its financial and capital position, and its investment flexibility and strategy; and

(b) funding one-off costs imposed by external drivers or irregular costs that enhance the participating sub-fund’s outcomes.

65 Mr Martin has reported that the current intention of RLA is to distribute progressively the Unallocated Asset Pool among the participating policy owners of the participating sub-fund as the business of that fund gradually runs off, so that the Unallocated Asset Pool does not become a “tontine windfall” for a small group of policy owners in the future. The tontine principle is, in essence, that surviving group members benefit financially from the deaths of other members. There is, however, no current intention to divert any of the current progressive distribution of the Unallocated Asset Pool from the existing RLA policy owners to the Transferring AIAA Life Policy Owners. The longer-term distribution of the Unallocated Asset Pool will be subject to ongoing considerations of the emerging position and needs of the participating sub-fund, as well as future policy owner equity and fairness assessments.

66 Importantly, the actuarial evidence supports the conclusion that this approach does not involve any adverse impact on the reasonable benefit expectations of the existing RLA participating policy owners. It also establishes that there will be no adverse impact on the reasonable benefit expectations of the Transferring AIAA Life Policy Owners since, prior to the implementation of the Scheme, they could not have anticipated that they would receive any progressive distribution from the Unallocated Asset Pool. Nevertheless, their reasonable benefit expectations are improved by transferring into the larger RLA participating sub-fund with greater investment scale and diversification, with the support of the Unallocated Asset Pool for the participating sub-fund as a whole.

Re-insurance issues

67 RLA has an existing program of re-insurance in place for its substantial portfolio of life risk insurance business, and relevant re-insurance for its large conventional participating portfolio. It does not propose to change to any aspect of its re-insurance arrangements in connection with the Scheme.

68 With one exception, the existing re-insurance arrangements relating to the S&I life insurance business will transfer to RLA. Accordingly, by and large, the existing risk mitigation that these arrangements provide to AIAA will continue for RLA after the Scheme is implemented. In general terms, the evidence reveals that the applicants have each put in place arrangements with the relevant reinsurers to ensure that an appropriate degree of cover is maintained.

69 The one exception to the foregoing is that part of the transferring AIAA business includes a small portfolio of risk insurance rider covers (comprising approximately $2 million of in-force annual premium), the re-insurance arrangements on which are co-mingled with a much larger part of AIAA’s business, which will not be transferred. As a result, the re-insurance arrangements in respect of this portfolio will not transfer to RLA under the Scheme. Nevertheless, Mr Martin has indicated that, given the small size of the portfolio and the limited exposure within it, the loss of the reinsurance support is immaterial to RLA’s overall financial position and risk exposure.

70 Mr Martin’s analysis of the altered circumstances is appropriate. As a matter of practical business reality, it cannot be expected that there will be perfect symmetry between the re-insurance position prior to the implementation of the Scheme and the position that arises subsequently. For that to occur, it would be necessary to secure the agreement of all third-party re-insurers, which may not be forthcoming. The best that can be hoped for is that, as a matter of substance, the protection for policy owners remains approximately the same. In this case, Mr Martin’s observations indicate that to be the position.

Material litigation and remediation programs

71 The actuaries have raised in their reports certain issues arising in relation to the potential loss of a portion of RLA’s non-participating business, and a claim made against RLA and other entities in the AMP Group in the Supreme Court of New South Wales. Some background to these matters was set out in RLA’s written submissions in respect of the present confirmation hearing. It is appropriate to repeat that background here.

72 Approximately 30% (by in-force premium) of RLA’s Term Life and Disability insurance issued out of its non-participating sub-fund comprises death and disability insurance provided to members of the AMP Super Directions Fund, of which NM Superannuation Pty Ltd (NM Super) is now the trustee. This portfolio is referred to as the “AMP Master Trust Portfolio”, and comprises “group life” insurance cover and “retail” insurance cover.

73 Munich Reinsurance Company of Australia Ltd (Munich Re) has substantially re-insured the retail component of the AMP Master Trust Portfolio since 2006. It has made significant up-front commission payments in respect of advice received by individual superannuation fund members.

74 In August 2022, NM Super issued a “Request for Proposal”, seeking tender responses from life insurers who might wish to replace RLA as insurer of the AMP Master Trust Portfolio. In September 2022, RLA commenced proceedings in the Supreme Court of New South Wales against NM Super, seeking injunctive and declaratory relief with respect to the Request for Proposal. It contended that NM Super was unable unilaterally to terminate certain of the underlying AMP Master Trust Portfolio policies.

75 Ultimately, RLA was unsuccessful both at first instance and on appeal — the Court of Appeal delivering its judgment on 22 June 2023 in Resolution Life Australasia Ltd v NM Superannuation Pty Ltd [2023] NSWCA 138.

76 In April 2023, Munich Re commenced proceedings in the Supreme Court of New South Wales against a number of entities in the AMP Group and RLA. The claim relates to the conduct of AMP Life, as it then was, prior to its acquisition by RLA. It raises allegations of misleading or deceptive conduct, arising out of certain representations and admissions said to have been made at the time of entry into the original re-insurance treaty between Munich Re and AMP Life in 2016, and at the time of an amendment to the treaty in 2017. It also raises allegations of breaches of the warranties in the treaty given by AMP Life.

77 There is no need in these reasons to descend into any further detail in explaining these proceedings. They have already been considered carefully by the actuaries, whose conclusions are straightforward.

78 Mr Martin has identified that, whilst the loss of the AMP Master Trust Portfolio may result in a material financial detriment to shareholders, RLA’s future profit results and expected capital releases will remain strong. The capital adequacy position of RLA will not be materially impacted. There will also be no effect on the “ring-fenced” participating sub-fund, any policy owner entitlements, or the reasonable benefit expectations of any policy owner.

79 In relation to the claim by Munich Re, he has had regard to inter-party correspondence concerning the estimated loss or damage that might be recovered in the action. He has observed that RLA has the capacity to absorb the estimated loss without breaching its regulatory capital requirements. It may also be able to rely on financial support from its parent company, and the Resolution Life Group more broadly. Notably, APRA is comfortable with RLA’s ability to manage and absorb the impact of even an extreme scenario in which a loss must be funded entirely from its own resources and available parent company support.

80 On the whole, Mr Martin considers that the loss of part or all of the AMP Master Trust Portfolio and an unfavourable outcome in the Munich Re proceedings would not adversely impact policy owners’ entitlements, or their reasonable benefit expectations — including in the case of the Transferring AIAA Life Policy Owners. The capital adequacy position of RLA will remain sound.

81 Mr Goodsall and Mr van Koert have also given thorough consideration to these issues, and to the reasoning and opinions expressed by Mr Martin. They concur with his conclusions.

82 Whilst an applicant’s involvement in substantial litigation must always give the Court some pause for thought on an application of this kind, there is little reason in the present case to see the aforementioned matters as having any material effect on the Court’s exercise of its discretion in relation to the confirmation of the Scheme. The potential consequences that may follow for RLA have been assessed comprehensively by the actuaries. They have concluded, on the basis of their analysis, that there will be no material detriment to policy owners. That conclusion should be accepted.

Other proceedings

83 In the material before the Court, reference was made to other proceedings in which RLA is involved. None of those are anticipated to have a material financial impact on RLA, and no provisions have been established in respect of them. It is accordingly unnecessary, for the present purposes, to have further regard to these matters.

Remediation programs

84 The material also identifies that RLA is conducting remediation programs in relation to some of its products. It has controls and resources in place to manage these programs to their conclusion. Mr Martin has considered the programs and found that they have appropriately been provisioned in RLA’s financial statements and capital reserving.

85 RLA will also take over the management and implementation of certain remediation programs that have been conducted by AIAA but not completed by the Effective Date of the Scheme. Again, RLA has controls and resources in place to manage the programs.

86 On the whole, policy owners are unlikely to suffer any detriment in connection with the remediation programs.

Changes to terms of the Transferring AIAA Life Policies

87 Some changes were proposed to the terms of the Transferring AIAA Life Policies. These have been referred to above, and have been addressed in the Dispensation Decision. As identified already, the product modernisation changes are to the overall benefit of the policy owners. The unit pricing change has no negative impact on the policy owners; again, it is anticipated that they may be advantaged by this change. It is appropriate to point out that these changes affect only a very small minority of the transferring policies.

88 The material presently before the Court reveals that RLA proposes to deal with the affected policies in a suitable way. Its position may be summarised as follows.

89 First, it is proposed that the product modernisation provision to be inserted into certain policies will be designed only to allow changes that do not have an adverse impact on the affected policy owners. With this objective in mind, RLA intends to attach a number of safeguards (which already exist in other parts of its business) to the operation of the provision. These safeguards will entail:

(a) making all proposed policy changes subject to RLA’s “Product Life Cycle Management Process”, under which it assesses whether particular changes will adversely impact policy owners or insured persons and then implements only those changes that will not;

(b) notifying all policy owners of proposed changes; and

(c) where there is an unexpected or inadvertent adverse impact on a policy owner or insured person because of a policy change, assessing claims under both the policy terms that existed immediately before the change and the new policy terms, and then settling the claim on the most favourable basis.

90 RLA has noted, in its written submissions, that the product modernisation provision will operate subject to a qualification that changes to terms will not apply to any claim affected by a condition or symptom that existed prior to the change. It points out that this qualification is consistent with common industry practice. So much can be accepted.

91 On the whole, the actuarial evidence is to the effect that the introduction of the proposed product modernisation clause will not cause any loss or disadvantage to the impacted Transferring AIAA Life Policy Owners.

92 Secondly, setting unit prices on a “next price” or “forward price” basis will accord with modern industry best practice and regulatory guidance. Importantly, it does not involve any effective change to the methodology for calculating unit prices. Continuing to use a “last price” or “historic price” basis, by contrast, would allow the affected policy owners an opportunity to arbitrage against other policy owners by selling at the previous day’s high price after asset values fall, or purchasing more units at the previous day’s low price if asset values rise. This can result in a large profit to the individual policy owners at the expense of all other policy owners invested in that particular fund, as it causes the unit prices for those other policy owners to decrease.

93 The impact of the proposed change in pricing is the subject of detailed commentary in the actuarial reports. It is concluded that the change will be advantageous, as it removes the opportunity to arbitrage and allows all policy owners to be treated fairly and equitably. The change for individual policy owners will be small, and is not possible to predict. While it might be thought that policy owners aware of the existing arbitrage opportunity will be adversely affected, the reality is that both AIAA and RLA already have processes in place to adjust unit prices to negate attempted arbitrage. The impact to those policy owners will accordingly be slight.

94 Overall, the actuarial evidence is again to the effect that this proposed change will improve policy terms. Policy owners will be advantaged by the change, which will allow RLA to manage and maintain the policies more efficiently in future. The potential for policy owners to be impacted negatively is insignificant.

Feedback and enquiries from policy owners and others

95 Despite information and documentation about the Scheme having been distributed widely through the applicants’ implementation of the Publicity Strategy, and numerous enquiries having been received in the course of that process, no person has come forward to oppose the confirmation of the Scheme. Many of the enquiries received by the applicants instead related to matters of a general nature, and were fielded appropriately by teams and processes established in accordance with the Dispensation Orders.

96 Notably, however, some correspondence was exchanged between the applicants and one particular Transferring AIAA Life Policy Owner, Mr John Winter. Mr Winter also filed three brief sets of written submissions in this proceeding for the purposes of the confirmation hearing.

97 In his initial correspondence, Mr Winter raised concerns of a technical nature, arising from the actuarial reports. His enquiries were referred to Mr Martin and Mr van Koert, each of whom assisted in preparing responses. It appears that those responses adequately resolved Mr Winter’s concerns, and he quite properly acknowledged as much in his second written submission, filed on 30 May 2023.

98 However, Mr Winter has raised a number of additional issues in his written submissions that are, strictly speaking, unrelated to the Scheme. These issues concern the historical performance of his own “whole of life” policy, and the payment of service or trailing commissions and other fees. Further correspondence has taken place between Mr Winter and AIAA in relation to these matters, which have also been addressed in the actuarial evidence. It should be acknowledged that Mr Winter has made his submissions thoughtfully and appropriately, in a respectful and professional manner. His claims have been neither exaggerated nor pursued irrationally, and he has listened carefully to the responses given to him.

99 Dealing first with Mr Winter’s complaint about the performance of his policy and certain expense payments, it is important to point out that the investment performance of the separate bonus pool to which his policy is referable has exceeded its benchmark over the past five years by 0.9%. The actuaries have given evidence that it is not possible to compare the actual return of the separate bonus pool against the bonus pools of other whole of life policies. Mr van Koert, in particular, also gave evidence that he was not aware of any historical issue that would warrant an increase to bonus pools. However, in any event, the matter has now been referred to AIAA’s Customer Resolutions Team. Mr van Koert is confident that, in the event that any historical issue warrants an increase to bonus pools, both AIAA and RLA have processes in place to ensure that the outcomes to Transferring AIAA Life Policy Owners’ contractual benefits, rights and reasonable benefit expectations will remain materially independent of the Scheme. Ultimately, the issue raised by Mr Winter can adequately be dealt with by RLA. If he is entitled to any recovery, then his attempts to obtain it will not be hindered by the transfer of his policy to RLA under the Scheme.

100 A major part of the balance of Mr Winter’s written submissions expressed his concerns as to the payment of trailing commissions to agents in respect of life policies. He alleged that these trailing commissions ought not to have been paid as they were over many years. However, during the course of the hearing, he was satisfied that any claim that he might have in respect of the administration of the AIAA fund of which he was a member, including in relation to these commissions, would carry over and be enforceable against RLA following the implementation of the Scheme. As noted in the Dispensation Decision, the Scheme provides for all claims against AIAA in respect of the transferring funds to be actionable against RLA as if the latter was the original insurer under the policy. Moreover, to the extent that recovery might need to be made against assets other than the funds themselves, some comfort might be taken from the fact that RLA is a sizeable business with significant resources on which to draw. Ultimately, Mr Winter appeared to be satisfied that, in these circumstances, his concerns in relation to the trailing commissions would properly be dealt with outside the immediate context of the Scheme.

101 It follows that, although Mr Winter sought to raise with the Court a number of genuine concerns, none of the issues to which he drew attention provided any basis upon which to interfere with the confirmation of the Scheme.

Other enquiries

102 The evidence before the Court went into some detail about the quantity and the nature of the enquiries received as a result of the implementation of the Publicity Strategy. It is apparent that all requests for information were responded to in a proper and timely fashion. Where necessary, documentation was provided. There is no basis for any concern about the level of information and documentation provided in relation to the Scheme. Nor is there any reason to suspect that policy owners who wished to voice objections were prevented from doing so.

The position of APRA

103 On any view, the Scheme is important to the continued vitality of the life insurance industry in Australia. To its great credit, APRA has involved itself appropriately in the Scheme by playing an active role in its finalisation and in the conduct of this proceeding. It was consulted by the applicants as to the form of the Dispensation Orders, as initially sought, and it appeared at the initial hearing at which those orders were made, as well as at a subsequent case management hearing on 9 June 2023. Moreover, it continued its assiduous conduct in the monitoring of the life insurance industry by assessing the Scheme documents and the actuarial reports adduced in connection with this application. It did not require a report from a further independent actuary under s 192 of the Life Act.

104 Since the initial hearing, the applicants have continued to consult closely with APRA. The parties have engaged in further meetings and correspondence, through which APRA has had an opportunity to convey its views in relation to the evidence to be presented by the applicants. For instance, the impact of the Munich Re claim has been discussed with APRA and it has been provided with RLA’s actuarial modelling in relation to that issue.

105 As is apparent from the Life Act and Life Regulations, APRA is necessarily a significant participant in the process by which schemes are confirmed by the Court: see Royal & Sun at 40 – 41 [24]. Critically, it is entitled to be heard on any application: Life Act s 193(3). It is charged with ensuring that the interests of policy owners are protected, and it operates “as something of a watchdog in relation to transfers under Part 9 of the Act”: Colonial Portfolio Services at 86,136 [28].

106 At the confirmation hearing, APRA was represented by Ms Lyons of Counsel. She indicated that APRA, having reviewed the evidence and submissions, did not object to the orders sought by the applicants for the confirmation of the Scheme. APRA had satisfied itself that the proposed transfer would not result in any overall detriment to policy owners. It concluded that the reasonable benefit expectations and benefit security of the affected policy owners were likely to be maintained under the Scheme, and that AIAA and RLA would each remain in a sound financial position following the proposed transfer, such that each can continue to meet the regulatory capital requirements. It had also satisfied itself that the two changes to the policy terms and conditions, as explained above, were adequately addressed in the actuarial reports. It was further satisfied that the costs of the Scheme will be borne by AIAA and RLA and not by the affected policy owners. Finally, in relation to substantive matters, APRA was satisfied that the potential impacts of the proposed Blackstone transaction and the various pieces of litigation involving RLA had adequately been addressed in the material.

107 In relation to procedural matters, Ms Lyons indicated that APRA was satisfied that there had been substantial compliance with the Dispensation Orders. It was aware of the two minor instances of non-compliance, but agreed that they were not sufficiently material as to preclude the Court from confirming the Scheme. It was also satisfied that the Publicity Strategy had been sufficient to bring to the Court’s attention, and to its own attention, any objections to the Scheme (had they existed). Finally, it had considered Mr Winter’s concerns and ultimately taken the view that they did not impact upon the appropriateness of the Scheme.

108 The Court is very grateful for the careful attention that APRA has given to the Scheme. It is obvious that it has thoroughly vetted and considered all issues that could bear upon the exercise of the Court’s discretion.

Confirmation of the Scheme

109 As previously mentioned, it was appropriate to make the orders sought by the applicants for the confirmation of the Scheme at the conclusion of the hearing on 28 June 2023, even though it was not possible at that time to provide detailed reasons. It ought to be said that the thorough written submissions advanced before the Court by Counsel for the applicants, which included targeted references to the relevant material and generally enjoyed the imprimatur of APRA, provided ample justification for the making of the orders at that time.

I certify that the preceding one hundred and nine (109) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Derrington. |

Associate: