Federal Court of Australia

Mehajer v Weston in his capacity as trustee of the bankrupt estate of Mehajer [2023] FCA 1230

ORDERS

Applicant | ||

AND: | PAUL GERARD WESTON IN HIS CAPACITY AS TRUSTEE OF THE BANKRUPT ESTATE OF SALIM MEHAJER Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The Amended Originating Application filed on 1 May 2020 be dismissed.

2. The applicant pay the respondent’s costs of this proceeding on a lump-sum basis, without prejudice to the right of the respondent to claim those costs as a cost of the administration of the applicant’s bankrupt estate.

3. The question of the quantum of lump-sum costs be referred to a Registrar of this Court for any further directions which may be considered necessary and for determination.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

[1] | |

[2] | |

[2] | |

[4] | |

[5] | |

[15] | |

[18] | |

(1) Did the trustee err in not objecting to the notices of income tax assessment issued by the ato? if yes, does that error warrant the replacement of the trustee? | [18] |

(2) did the trustee err in not giving consent to the bankrupt to object to the notices of income tax assessment issued by the ato? if yes, does that error warrant the replacement of the trustee? | [18] |

Background | [20] |

[38] | |

F. Ground 3: DID THE TRUSTEE ERR IN NOT ADJUDICATING THE PROOFS OF DEBT LODGED against the Bankrupt Estate? If yes, does that error warrant the replacement of the Trustee? | [47] |

Background | [48] |

[53] | |

G. Ground 4: DID THE TRUSTEE SELL A PROOF OF DEBT TO SC LOWY PRIMARY INVESTMENTS LTD? If yes, does that action warrant the replacement of the Trustee? | [60] |

Background | [61] |

[67] | |

H. Ground 5: WAS THE TRUSTEE OBLIGED TO GIVE CONSIDERATION TO THE OFFER FROM ZENAH OSMAN and Khaled Osman to purchase the “SCLOWY Hong Kong Cause of Action”? (a) If yes, did the Trustee fail to do so?; (b) If yes, does the failure warrant the replacement of the Trustee? | [71] |

Background | [72] |

[91] |

I. Ground 6: DID THE TRUSTEE ERR IN INCLUDING THE FOLLOWING PERSONS OR ENTITIES as either secured or unsecured creditors of the Bankrupt in the Reports to Creditors: (a) ACE Demolition & Excavation Pty Ltd for $6.2 million; (b) Ahmad Jaghbir for $100,000; and (c) AnpinG Yan for $25,000? If yes, does that error warrant the replacement of the Trustee? | [94] |

Background | [95] |

[97] | |

[99] | |

[100] | |

[102] | |

J. Ground 7: HAVE THE ACTIONS OF THE TRUSTEE CAUSED THE BANKRUPT “extreme hardship, mental distress, severe anxiety, pressure from family members, unjustified discomfitures”? If yes, does that warrant the replacement of the Trustee? | [104] |

K. Ground 8: IS THE TRUSTEE AFFECTED BY A CONFLICT OF INTEREST? If yes, does that warrant the replacement of the Trustee? | [107] |

Background | [108] |

[112] | |

[114] | |

Background | [115] |

[126] | |

[130] | |

Background | [131] |

[144] | |

[149] | |

Background | [150] |

[166] | |

[177] |

GOODMAN J

1 The applicant, Mr Mehajer, became bankrupt on 20 March 2018. The respondent is his trustee in bankruptcy. By his amended originating application, Mr Mehajer seeks orders to effect a replacement of the trustee. For the reasons developed below, the application should be dismissed.

2 An overview of some prior proceedings involving Mr Mehajer, the trustee and SC Lowy Primary Investments Ltd is conveniently set out in the reasons for judgment of Markovic J in Mehajer (Bankrupt) v Weston (Trustee) [2020] FCA 596 at [3] to [12]:

3. On 20 March 2018 a sequestration order was made against Mr Mehajer’s estate. The first respondent, Paul Gerard Weston, is the trustee of Mr Mehajer’s bankrupt estate (Trustee).

4. On 17 April 2018 Mr Mehajer commenced proceeding NSD617/2018 seeking an order pursuant to s 153B(1) of the Bankruptcy Act 1966 (Cth) (Bankruptcy Act) that his bankruptcy be annulled (First Annulment Proceeding). The Trustee was a respondent to the First Annulment Proceeding.

5. In the First Annulment Proceeding Mr Mehajer sought interim relief (Interim Relief Application) including an order that the sequestration order be stayed. On 26 April 2018 Mr Mehajer’s Interim Relief Application was dismissed: see Mehajer v Weston (Trustee), in the matter of Mehajer [2018] FCA 608 (Mehajer v Weston (No 1)).

6. On 21 June 2018, at the final hearing of the First Annulment Proceeding, on the application of Mr Mehajer and with the Trustee’s consent, the First Annulment Proceeding was discontinued.

7. On 12 October 2018 SC Lowy Primary Investments, Ltd (SC Lowy) filed an originating application commencing proceeding NSD1902/2018 against Mr Mehajer and the Trustee as first and second respondents respectively, seeking declarations that certain property had vested in the Trustee (Vesting Proceeding). SC Lowy subsequently filed an amended originating application in the Vesting Proceeding. On 11 December 2018, the Trustee filed a notice of cross-claim in the Vesting Proceeding seeking additional but related declarations that certain property had vested in him.

8. The Vesting Proceeding was heard on 19 December 2018 and adjourned until 25 January 2019 for closing submissions. On 25 January 2019:

(1) the primary judge gave ex tempore reasons in favour of the relief sought by SC Lowy in its amended originating application and by the Trustee in his notice of cross-claim in the Vesting Proceeding; and

(2) Mr Mehajer sought informally to commence a new proceeding seeking annulment of his bankruptcy. That informal commencement became proceeding NSD144/2019 (Second Annulment Proceeding). The Trustee and SC Lowy were the first and second respondents respectively to the Second Annulment Proceeding and are the first and second respondents to the present application.

9. The Second Annulment Proceeding was ultimately listed for hearing for three days commencing on 8 October 2019. Mr Mehajer was legally represented by a solicitor and senior counsel.

10. As noted at [2] above, on 10 October 2019 orders were made in the Second Annulment Proceeding including an order that the further amended application filed in that proceeding be dismissed. It is from those orders that Mr Mehajer now seeks an extension of time in which to appeal.

11. On 11 October 2019 Mr Mehajer filed an application for an extension of time in which to appeal the orders made in the Vesting Proceeding (Vesting Appeal Extension Application). Mr Mehajer subsequently filed an amended application for an extension of time in which to appeal. That application was listed for hearing on 4 February 2020. On 3 February 2020 Mr Mehajer sought an adjournment of the hearing. However, in the absence of consent from the respondents, the Vesting Appeal Extension Application remained listed for hearing on 4 February 2020.

12. The Vesting Appeal Extension Application came before me for hearing on 4 February 2020. Mr Mehajer did not appear. On an ex parte basis, I made orders dismissing both Mr Mehajer’s application for an adjournment of the hearing of the Vesting Appeal Extension Application and the Vesting Appeal Extension Application with costs: see Mehajer (A Bankrupt) v SC Lowy Primary Investments, Ltd (A Company Incorporated in Hong Kong) [2020] FCA 125.

3 I will adopt her Honour’s definition of the Second Annulment Proceeding.

4 As noted above, Mr Mehajer commenced the present proceeding for orders effecting the replacement of the trustee. Orders have been made, by consent, that the proceeding be set down for hearing as to whether Mr Mehajer has established any ground warranting an inquiry into the respondent’s conduct as trustee.

5 Whilst the application does not refer to any particular part of the Insolvency Practice Schedule (Bankruptcy) (IPS(B)), being Sch 2 to the Bankruptcy Act 1966 (Cth), or any other source of power to make the orders sought, the application in substance is an application under ss 90-15 and 90-20 of the IPS(B) for orders in relation to the administration of Mr Mehajer’s bankrupt estate.

6 Whilst ss 90-15 and 90-20 do not, in contrast to the former s 179 of the Act, require that the Court first consider whether an inquiry into the conduct of the trustee is warranted (see Macchia v Nilant [2001] FCA 7; (2001) 110 FCR 101 at 120 to 121 ([49] to [50]) per French J, as his Honour then was; and Borg v de Vries (Trustee), in the matter of the Bankrupt Estate of David Morton Bertram [2018] FCA 2116 at [16] to [22] (White J)), such a course is open for the reasons explained by Wigney J in Shaw v The Official Trustee in Bankruptcy of the Australian Financial Security Authority (No 3) [2021] FCA 1569 at [19] to [23].

7 The present is a case in which a two-stage approach is appropriate, particularly given the wide-ranging allegations made by Mr Mehajer. The consent orders referred to at [4] above reflect the agreement of the parties that there first be consideration of whether the Court should inquire into the conduct of the trustee.

8 In considering whether an inquiry is warranted, the duties of the trustee are relevant considerations. Section 19 of the Act sets out a non-exhaustive list of such duties, including of particular present relevance: “determining whether the estate includes property that can be realised to pay a dividend to creditors” (s 19(1)(b)); “taking appropriate steps to recover property for the benefit of the estate” (s 19(1)(f)); “administering the estate as efficiently as possible by avoiding unnecessary expense” (s 19(1)(j)); and “exercising powers and performing functions in a commercially sound way” (s 19(1)(k)).

9 Further, s 5 of the Act defines “breach of duty” to mean “malfeasance, misfeasance, negligence, wilful default or breach of trust”.

10 In Adsett v Berlouis [1992] FCA 549; (1992) 37 FCR 201 at 208 the Full Court (Northrop, Wilcox and Cooper JJ) adopted the following observations of Smithers J in Mannigel v Aitken (1983) 77 FLR 406 at 408 to 409 as a correct statement of the duties of a trustee in bankruptcy, and the proper manner of performance of such duties:

In the case of bankruptcy the Trustee is in charge of the assets of the bankrupt and those assets are to be applied for the benefit of the creditors and if there be any surplus for the benefit of the bankrupt. It is clear that the minimum standard required of the Trustee is that he shall handle the assets with a view to achieving the maximum return from the assets to satisfy the claims of the creditors and to provide the best surplus possible for the bankrupt. Obviously a great deal of discretion and judgment is required to be exercised by the Trustee. It was said by Rogerson J in Re Ladyman (1981) 55 FLR 383 at 394-396 that the standard of conduct required of the Trustee will ordinarily be the standard required of a professional man and perhaps higher. The learned judge referred to “the high standard of conduct required of trustees”.

In Re Brogden [1888] All ER 927 Lord Justice Fry said at p 935:

“A Trustee undoubtedly has a discretion as to the mode and manner, and very often as to the time in which or at which, he shall carry his duty into effect. But his discretion is never an absolute one. It is always limited by – the dominant duty – the guiding duty of recovering, securing and duly applying the trust fund; and no Trustee can claim any right of discretion which does not agree with that paramount obligation.”

Where an order is sought that the Trustee be removed and to make good the losses suffered by the estate, it must be established that the Trustee has been guilty of a breach of duty to act “diligently and prudently in regard to the business of the Trust”. See Riley J in Re Alafaci (supra) at 285.

According to Halsbury’s Laws of England (3rd ed) Vol 38, p 967, a trustee must take all reasonable and proper measures to obtain possession of the trust property and to get in all debts and funds due to the trust estate, and to preserve it, and to secure it from loss. He must take reasonable precautions to see the property is not stolen or lost by default. The Trustee is bound to execute the trust with fidelity and reasonable diligence and ought to conduct its affairs in the same manner as an ordinary prudent man of business would conduct his own affairs. But beyond this he is not bound to adopt further precautions. It was said by their Honours Dixon CJ, McTiernan and Windeyer JJ in Elder’s Trustee and Executor Co Ltd v Higgins (1963) 113 CLR 426 that:

“We are not to judge what the Trustee then did or failed to do by the light of later events…The duty of the Trustee was to exercise due diligence, care and prudence in the conduct of the business, bearing in mind the need to preserve the capital of the Testator’s estate…The argument that the Trustee having, it was said, exercised a discretion, its conduct is now unchallengeable is sufficiently answered by a passage from the judgment of Fry LJ in Re Brogden (supra)…Whether or not one calls [the trustee’s action] an exercise of discretion, the question remains was it the act of a prudent Trustee.”

It is not the role of the court to decide whether the path chosen by the Trustee led to the realisation of the greatest value for the assets of the estate. The court is in a different position from that of the Trustee. The court can examine the facts with hindsight and with the benefit of the evidence on oath of the relevant debtors and creditors and witnesses called in their support. The Trustee is required to act diligently and prudently in the exercise of his discretion in deciding matters as they arise in the course of administration of the estate. He may be constrained to act by reference to the knowledge which he has of the circumstances balancing the benefit of further inquiry against further delay and the further expense to the estate, to the creditors and possibly to the debtor if there is a surplus in the estate.

11 The Full Court in Adsett also held at 209 that a trustee in bankruptcy is governed by the general law relating to trustees, save where the position of the trustee has been modified by the Act.

12 In Ferella v Official Trustee in Bankruptcy (No 2) [2011] FCA 619, at [12] to [20], Yates J set out the following principles relevant to the consideration of whether to order an inquiry into the conduct of a trustee in bankruptcy:

12. Trustees in bankruptcy are properly to be regarded as officers of the Court and are subject to the general control of the Court: Adsett v Berlouis (1992) 37 FCR 201 at 208; Wilson v Commonwealth of Australia [1999] FCA 219 at [44]. Section 179 of the Bankruptcy Act is a specific provision that reflects that position. It is a “supervisory” provision (among other supervisory provisions such as s 178) in aid of the Court’s general supervision of trustees who are its officers and “provides what is in substance a power to review acts, omissions or decisions of the trustee”: Macchia v Nilant (2001) 110 FCR 101 at [46]; see also at [50]. Its terms are “wide and general” (Re Alafaci; Registrar in Bankruptcy v Hardwick (1976) 9 ALR 262 at 267) and involve the exercise of a “broad discretion as to whether or not there are sufficient grounds to make an inquiry appropriate”: Macchia at [49]; see also Turner v Official Trustee in Bankruptcy [1998] FCA 1558. This is reflected in the width of the relief that may be granted: the Court may remove the trustee from office or make such order “as it thinks proper”.

13. Notwithstanding this, it is recognised that the discretion to order an inquiry is tempered by a number of considerations.

14. First, the discretion “must be exercised in the interests of the orderly administration of the bankrupt’s estate”: Re Challen (a Bankrupt); Ex parte Brown v Bendeich (unreported, Federal Court of Australia, Beaumont J, 23 April 1996); Macchia at [50].

15. Secondly, the person seeking the inquiry should normally be required to establish “substantial grounds for believing that the trustee erred in the administration” or has engaged in “misconduct”: Re Gault; Gault v Law (1981) 57 FLR 165 at 173; Wilson at [44]. In this connection “(t)rustees acting honestly, with ordinary prudence and within the limits of their trust, are not liable for mere errors of judgment”: In re Chapman; Cocks v Chapman [1896] 2 Ch 763 at 776; see also at 778; Alafaci at 285.

16. Thirdly, before exercising the discretion, the Court should be mindful of the “well-established policy in bankruptcy legislation that the court should not unduly interfere with the day-to-day administration of a bankrupt’s estate by a trustee”: Re Tyndall (1977) 30 FLR 6 at 9; Turner at 3. Although Re Tyndall was a case dealing with s 178 of the Bankruptcy Act, the following observations of Deane J (when in this Court) are equally applicable to s 179. His Honour (at 10) said:

… The trustee is made responsible for the administration of the bankrupt estate under the general provisions of the Act. He must, in the course of that administration, make a variety of decisions aimed at enabling the administration to be carried out with promptness and efficiency. Some of these decisions will be business or commercial decisions in which the business or commercial experience of the trustee would itself provide a basis for arguing that, unless it were shown that the trustee’s decision was perverse or clearly wrong, it would be inappropriate and unjust for the court to interfere. Again, under the present legislation, the trustee will ordinarily be the official receiver and the court must be conscious of the fact that the official receiver will be made responsible for the administration of an extraordinarily large number of estates. In such circumstances, the administration of the Bankruptcy Act demands that the court take into account, in exercising its functions under the provisions of s 178 of the Act, the opinion of the official receiver, as trustee, as to what is expedient in the interests of the prompt and efficient administration of a particular bankrupt estate. That is, however, a completely different thing to saying that the court can only interfere with an act, omission or decision of the official receiver, as such trustee, when it is of the view that the official receiver has acted unreasonably, absurdly or in bad faith in so acting or failing to act or in reaching that decision.

17. Fourthly, the discretionary considerations to be taken into account when considering whether an inquiry should be ordered include the likely utility to be derived from an inquiry. In this connection, the ultimate question to be kept in mind is whether there is a likelihood that “the trustee should be held to account for conduct in the administration of the estate which has affected the bankrupt in some way”: Macchia at [50]. This does not mean, however, that it is necessary that there be “a financial aspect” to the complaint that is brought forward as justifying an inquiry: Maxwell-Smith v Donnelly [2006] FCAFC 150 at [63].

18. Fifthly, s 179 is not a vehicle for pressing general law claims (such as claims for damages in tort) even though conduct invoking the remedial objectives of the provision may be based upon the breach of general law rights and obligations: Macchia at [44] and [50].

19. Sixthly, the availability of general law causes of action and remedies at the suit of the person seeking the inquiry may be a sound discretionary reason why an inquiry should not be ordered under s 179: Gault at 173.

20. In Alafaci, Riley J (at 268) gave practical guidance about the procedure to be followed in relation to an inquiry pursuant to s 179:

… I do not wish to be taken as presuming to lay down any rule as to the procedure to be followed in, or the approach to be made by the court to, a case of this sort; but it seems to me that in such a case there is a preliminary question to be decided by the court – namely on the grounds and facts before it, has a case been made for inquiry into the trustee’s conduct? If the answer to that question is “yes”, the next question is – what is to be the scope of the inquiry? It may be that the material already before the court sufficiently defines the scope of the inquiry; on the other hand, the court may find it necessary to define the subjects for inquiry – eg in the form: “Did the trustee do (or fail to do) so and so?” – and to give directions before proceeding to inquire. In any event, the court will seek to inquire into specific matters, and to ensure that the trustee is given proper opportunity to prepare and present his case on those matters. If in the course of inquiry into those matters it emerges that there are other aspects of the trustee’s conduct in relation to the bankruptcy into which the court, as the authority having control over trustees, should inquire, the court will safeguard the interests of the trustee as may be necessary by such means as the granting of adjournments and the giving of directions. It will act similarly as may be necessary when the inquiry is completed and the question then arises of what order or orders, if any, should be made under s 179(1)(a) and (b).

13 His Honour’s summary, which I gratefully adopt, has been followed a number of times in this Court: see, e.g., Bell v Taylor [2015] FCA 687 at [40] (Siopis J) and Patel v Ruhe [2016] FCA 520 at [33] (Buchanan J).

14 See also Shaw at [28] to [30] and the authorities there cited concerning the need to bear in mind that during the course of an administration a trustee in bankruptcy must make various business and commercial decisions within their expertise qua trustee and that the Court is usually reluctant to interfere with such exercises of discretion by a trustee absent clear evidence of maladministration.

15 The application was argued by reference to eleven identified potential grounds for an inquiry. The evidence relevant to those grounds is set out principally in a series of affidavits made by Mr Mehajer and an affidavit of the trustee’s solicitor, Mr Calabria.

16 Mr Mehajer made a series of general submissions to the effect the trustee had neglected his bankrupt estate, had been dilatory in the performance of his functions, had done little other than incur fees, and had acted with dishonest and sinister motives. Mr Mehajer also submitted that the trustee had engaged in financial and mental abuse of Mr Mehajer and that their relationship had broken down irretrievably. To a large extent, these submissions fell outside the agreed grounds and were not supported by evidence. To the extent those submissions are reflected in the grounds and are supported by evidence they are considered below. Mr Mehajer also made a series of submissions of little to no apparent relevance to the grounds. Those submissions have been afforded little weight.

17 For the reasons developed below, I am not satisfied that any of the grounds raise matters sufficient to warrant an inquiry into the conduct of the trustee.

(1) Did the trustee err in not objecting to the notices of income tax assessment issued by the ato? if yes, does that error warrant the replacement of the trustee?

(2) did the trustee err in not giving consent to the bankrupt to object to the notices of income tax assessment issued by the ato? if yes, does that error warrant the replacement of the trustee?

18 It is convenient to consider grounds 1 and 2 together.

19 The essence of these grounds is a complaint by Mr Mehajer that objections were able to be taken to notices of assessment issued by the Australian Taxation Office (ATO) to Mr Mehajer but were not taken, or were not taken in a timely fashion, because the trustee failed to either lodge such objections himself, or to authorise Mr Mehajer to do so.

Background

20 In October 2017, the ATO issued notices of assessment for the income tax years ended 30 June 2012 to 30 June 2014 to Mr Mehajer. Those assessments were for a total amount exceeding $8,000,000. The trustee’s second report to creditors issued on 15 October 2018 and his third report to creditors issued on 31 May 2021 list a debt claimed by the ATO of $8,604,202. Mr Mehajer’s position was, and remains, that the assessments are incorrect.

21 On 20 March 2018, Mr Boutros of GBR Accounting, acting on behalf of Mr Mehajer, lodged with the ATO objections to those notices of assessment. Later that day, the sequestration order was made against Mr Mehajer’s estate.

22 On 27 March 2018, the ATO notified Mr Boutros that the objections lodged were invalid but could be validated by the lodgement of a signed declaration from the trustee. Mr Mehajer notified the trustee of this on 2 May 2018.

23 On 7 May 2018, the trustee notified Mr Mehajer that his view was that his consent would be insufficient to provide Mr Mehajer with standing and drew Mr Mehajer’s attention to paragraph 102 of Taxation Ruling TR2011/5. The trustee also indicated his view that before providing his consent he needed to form the view that he was dissatisfied with the assessment (see s 175A of the Income Tax Assessment Act 1936 (Cth)); and that he was unable to form such a view in circumstances where he had insufficient information available concerning the basis or bases for objection, and he was without funds.

24 On 18 June 2018, the ATO notified the trustee that it considered the objections to be invalid for another reason, namely that they were lodged out of time.

25 In July 2019, Mr Mehajer and the trustee exchanged the following communications:

(1) on 9 July 2019, Mr Mehajer wrote:

Also, would you be in a position to consent to the following:

- allow me to contest the ATO debt. This is critical.

…

(2) on 12 July 2019, the trustee’s office responded:

Please find attached our letter to your dated 7 May 2018 which addresses this issue.

(3) on 14 July 2019, Mr Mehajer wrote:

The debt claimed by the ATO is incorrect. I understand the onus is on me to prove otherwise. Currently, what does the Trustees [sic] intend to do with this alleged debt?

It is critical that I understand how we are going to deal with this debt before the next Case Management hearing (26/07).

(4) on 18 July 2019, the trustee’s office responded:

You have requested the trustee’s position in relation to the ATO’s claim. As the Bankrupt Estate is unfunded, the trustee does not intend to formally adjudicate on the ATO’s claim or any other creditor claims. The trustee will formally adjudicate on creditor claims in the event sufficient funds are received into the estate to enable a dividend distribution to creditors.

26 On 14 October 2019, Mr Mehajer wrote to the trustee:

As you know, on 20 March 2018 I lodged an objection against the notices of assessment and penalty for the period, years ending 30 June 2012 to 2014.

The Objection was deemed invalid because the ATO was of the view;

That bankrupt individuals do not have standings to object.

At the time of the lodgement, I was not bankrupt, but rather, became bankrupt hours later.

Despite this, my position now is;

I can still object to the ATO’s decision by obtaining a signed declaration from the trustee in bankruptcy.

One and a half years on, the trustee has done nothing about this debt and evidently favours the side of the commissioner. My legal team should have raised this also, but they didn’t. So here I am, requesting that this debt be challenged, yet again.

Since the trustee does not intend to do anything with the ATO debt and has simply accepted it as debt payable, the trustee will have nothing to lose if I am given consent?

I intend to instruct PKF forensic accountants to assist me with the objection.

I respectfully wish to challenge the Commissioners findings, and kindly ask for your most urgent consent.

Please, could I urgently request this from the trustee?

If the trustee refuses to provide such consent, I will seek my legal rights.

(emphasis in original)

27 On 30 October 2019, the trustee’s office responded:

We refer to your email dated 14 October 2019 requesting the Trustee’s consent for you to object to income tax assessments (the objections) issued by the ATO and my subsequent telephone discussions with you on 21 and 23 October 2019. We note from your email you propose to engage accounting firm, PKF, to assist you with the objections.

We have since discussed this matter with the ATO and they have advised that the objections are out of time and you would first be required to request the ATO for an extension of time to lodge the objection along with the trustee’s consent.

Prior to the trustee providing consent on this issue, would you please provide the following:

1. A copy of all documentation you rely on as the basis for the objections

2. Details of how services rendered by PKF and/or any other advisers in dealing with the objections will be funded

3. A copy of any engagement letters/costs agreements issued by PKF and/or any other advisers engaged to assist in dealing with the objections.

(emphasis in original)

(1) Mr Mehajer wrote:

Firstly, a retainer with PKF won’t be signed unless I am certain that the ATO file is in my name. A lot of professionals are assisting me in the background, however they do not want their name disclosed.

...

Thirdly, I will provide you with a formal letter (to the ATO)- requesting an extension of time.

...

(2) the trustee’s office responded:

Would you please provide us with the requested particulars you rely on to make the objections to the tax assessments as set out in my email of 30 October 2019. If you do not have these particulars, please let us know. Without you addressing this issue, the trustee is not in a position to consider whether to consent to you proceeding with the objection of the assessments.

29 On 22 November 2019, the trustee’s office wrote to Mr Mehajer:

We refer to your emails on 13, 17 and 22 November 2019 in relation to your bankrupt estate.

You have raised various aspects and issues in relation to your estate which we address below:

1. Objections to tax assessments

As advised in my email response to you on 31 October 2019 (copy attached), the trustee is not in a position to consider consenting to your request to object to your tax assessments unless you provide us with the particulars that you rely upon to make the objection in the first place. No particulars have been provided by you to date on this issue.

...

(emphasis in original)

30 The emails dated 13 and 17 November 2019 do not appear to be in evidence. An email dated 22 November 2019 is in evidence but does not address the objections to the notices of assessment.

31 On the same day (22 November 2019), Mr Mehajer responded:

I have previously advised that this document was sent directly to the ATO via registered post as shown below. I did also ask if it was necessary for me to send you a copy, which I am yet to receive a response. I will in any event provide you a copy of this document.

32 On 13 February 2020, Mr Mehajer wrote (as written):

Could you please update me on the following matters urgently:

…

• your position on the ATO’s alleged Debt. My fiancials are now complete. However, it’s my legal advice that we should be given authority to Liaise with the Australian Taxation Office to sort out the best possible deal for myself. Consent is required from your office. If consent is denied, I need to understand what your office intends to do with the alleged that, that is, to understand whether the alleged debt will be left as is, or challenged by the trustee.

33 On 19 February 2020, the trustee’s office responded:

This has been previously addressed and also explained to you at our meeting on 19 December 2019.

34 There does not appear to be any evidence before the Court as to what occurred at such a meeting.

35 As at 4 December 2020, when Mr Calabria made his affidavit: Mr Mehajer had not provided the trustee with the information requested in the email from the trustee’s office to Mr Mehajer on 30 October 2019; and the trustee’s office had not received a copy of the documents referred to by Mr Mehajer in his 22 November 2019 email. There is no suggestion that this information or the documents were subsequently provided.

36 On 31 May 2021, the trustee issued his third report. That report includes:

2. Introduction & Reasons for Report

On 20 March 2018, I was appointed Trustee of the estate.

...

Since being appointed trustee, I have undertaken the following:

1. Interviewed the bankrupt regarding his business, property, affairs and financial circumstances.

2. Conducted attendances under Section 77AA of the Act across eight (8) premises of interest in Sydney NSW with the assistance of the OF’s office and other authorities to access and secure books and records pertinent to the examinable affairs of the bankrupt (“the raids”)

3. Conducted extensive investigations including a forensic review of the documents seized and referred to in point 2. above.

4. Secured funding from the major creditor of the bankrupt estate, being the ATO, in relation to the following:

i. Defending the Bankrupt’s annulment Court application

ii. Conducting the raids

iii. Conducting a forensic review of the material seized from the raids.

iv. Prepare for and conduct Public Examinations of the Bankrupt and other parties of interest.

...

6. Creditor Funding & Priority Payments

I advise to date my investigations have been partially funded by the ATO being the major creditor of the estate. I refer to Section 5 of this report and advise that the ATO have funded the costs involved with the Section 77AA attendances; the bankrupt’s annulment proceedings; the forensic review of the materials seized from the Section 77AA raids and now to conduct the Public Examinations of the Bankrupt and related parties.

The funding provided by the ATO has been agreed in three (3) stages and summarised below:

Stage 1 (s77AA Attendances/Raids & Annulment Proceedings): to a maximum of $119,950.84 (incl. GST). attributable to the trustee’s remuneration, costs and expenses including legal fees.

Stage 2 (Forensic Review of s77AA material): to a maximum of $128,231.81 (incl. GST) attributable to the trustee’s remuneration only.

Stage 3 (Public Examinations of the Bankrupt and related parties of interest): to a maximum of $534,739 (incl. GST) attributable to the trustee’s remuneration, costs, and expenses including legal fees as well as providing an indemnity for any potential adverse costs.

(emphasis in original)

37 On 25 February 2022, the trustee wrote to Mr Mehajer in the following terms:

I refer to your request to be granted consent to file a Notice of Objection against the Australian Taxation Office (ATO) regarding your income tax assessments.

Notwithstanding that I have received inadequate documentary information to assess the nature of your objection, I hereby grant you consent to lodge and progress your Notice of Objection with the ATO.

In no way is that consent to be taken as:

a) the Trustee expressing any view as to the merits or otherwise of your proposed objections to the assessments issued by the ATO;

b) the Trustee adopting or agreeing to take any action, step or do anything in relation to, arising out of or in connection with any objections against assessments issued by the ATO;

c) the Trustee and/or the Bankrupt Estate accepting any obligation and/or liability in relation to, arising out of or in connection with any objections against assessments issued by the ATO;

d) prejudicing or waiver of any of the Trustee’s rights to make any objections against assessments issued by the ATO; or

e) authority for you to incur any costs, obligation or liability on behalf of the Trustee and/or the Bankrupt Estate, or to hold yourself out as acting on behalf of the Trustee and/or the Bankrupt Estate.

...

(emphasis in original)

38 Mr Mehajer’s submissions may be summarised as follows:

(1) he requested the trustee on many occasions to lodge objections to the notices of assessment or to consent to Mr Mehajer lodging such objections;

(2) the trustee refused to lodge objections or provide his consent to Mr Mehajer doing so;

(3) the trustee’s refusal was the product of the ATO providing funding to the trustee to investigate Mr Mehajer’s bankrupt estate; and

(4) whilst the trustee did provide consent on 25 February 2022, this was belated and raises questions as to whether such consent was provided only because of this proceeding.

39 I am not satisfied that any aspect of the first two grounds suggests that an inquiry is warranted, for the reasons set out below.

40 The trustee took the position in May 2018 that prior to providing his consent to the filing of the objections, he wished to consider whether he was dissatisfied with the notices of assessment (or, put another way, that a challenge to the notices of assessment would be an exercise advantageous to the estate). In my view, this position was well open to the trustee.

41 The trustee also took the position that in order to consider whether he was dissatisfied with the notices of assessment he required further information. Again, this position was well open to the trustee.

42 Mr Mehajer’s submissions contend that the trustee’s failure to lodge objections or to authorise Mr Mehajer to do so is of itself conduct requiring investigation. That contention does not engage with the positions taken by the trustee, which were well open to him, and must be rejected.

43 Mr Mehajer’s contention also does not engage with the fact that the trustee requested further information from him and this was not provided to the trustee: see the trustee’s 7 May 2018 letter to Mr Mehajer indicating that the trustee had insufficient information ([23] above); the requests in the trustee’s 30 and 31 October 2019 emails for a copy of all documentation relied upon by Mr Mehajer to found the objections ([27] and [28] above); the further indication in the trustee’s 22 November 2019 email that the trustee was not in a position to consider consenting to Mr Mehajer’s requests to object to the notices of assessment unless the particulars relied upon for such objections were provided ([29] above); and the evidence of Mr Calabria that the information sought had not been provided (see [35] above).

44 Mr Mehajer also relied upon the fact that subsequently, in February 2022, the trustee provided his consent (see [37] above). The trustee’s change of position is unexplained in the evidence before the Court on this application. The trustee submitted that notwithstanding the lack of information from Mr Mehajer, and in the face of continued threats of litigation by Mr Mehajer, and particularly in circumstances where the trustee remained unfunded and had collected at least four lump-sum costs orders against Mr Mehajer in relation to unsuccessful proceedings filed by him, all of which remain unpaid, the trustee gave consent to Mr Mehajer to proceed with objections against assessments issued by the ATO. However, that submission was not supported by evidence.

45 This change of position does invite questions as to why it occurred. However, it does not gainsay the proposition that the stance previously taken by the trustee was one open to him. Similarly, it was open to the trustee to change his position without such change being the product of any maladministration by him. In any event, Mr Mehajer obtained the consent that he desired.

46 As noted above, Mr Mehajer also submitted that the trustee’s initial position was the product of the fact that the ATO had provided funding to the trustee. Whilst there is evidence that the ATO provided some funding to the trustee (see [36] above), there is no evidence to support the grave allegation that the trustee did not cause an objection to be lodged because of such funding.

F. Ground 3: DID THE TRUSTEE ERR IN NOT ADJUDICATING THE PROOFS OF DEBT LODGED against the Bankrupt Estate? If yes, does that error warrant the replacement of the Trustee?

47 The essence of this ground is Mr Mehajer’s complaint that the trustee should have already adjudicated upon proofs of debt lodged with respect to Mr Mehajer’s bankrupt estate, and that as a result the administration has been more expensive than it should have been and this has caused Mr Mehajer considerable financial and personal prejudice.

Background

48 It is common ground that there has been no adjudication of proofs of debt.

49 The trustee has indicated that he does not propose to do so unless sufficient funds are received into the estate to allow a distribution to creditors. For example, on 18 July 2019, the trustee’s office wrote to Mr Mehajer:

As the Bankrupt Estate is unfunded, the trustee does not intend to formally adjudicate on the ATO’s claim or any other creditor claims. The trustee will formally adjudicate on creditor claims in the event sufficient funds are received into the estate to enable a dividend distribution to creditors.

50 On 13 April 2020, Mr Mehajer wrote to the trustee’s solicitors (as written):

To keep the ball rolling, could we agree to appoint a third party (not the trustee) to adjudicate the proof of debts current listed in the Report to Creditors schedule.

I will arrange for the funding, since this is your clients issue.

51 On 14 April 2020, the trustee’s solicitor responded:

The Trustee cannot agree to the creditors’ claims being adjudicated by a third-party. It is the Trustee’s role to adjudicate those claims, once a Notice of Intention to Declare a Dividend has been issued. Such a Notice will be issued if the Trustee realises, or expects to realise, sufficient funds to pay a dividend to creditors. We note your recognition of this timing in your written submissions recently filed in Proceedings No. NSD2185/2019.

As previously advised, the Trustee does not intend to incur the costs of adjudicating the creditors’ claims until it is necessary to do so (i.e. once a Notice of Intention to Declare a Dividend has been issued).

52 The trustee’s estimate of the net asset position of the estate was a deficiency of $23,795,195 as at the date of the second report in October 2018 and $25,547,454 as at the date of the third report in May 2021.

53 The approach taken by the trustee in not (calling for and then) adjudicating upon proofs of debt unless there is a prospect of a dividend to creditors was well open to him, and orthodox.

54 Section 140(1) of the Act requires the trustee of the estate of a bankrupt to act with all convenient speed to declare and distribute dividends amongst those creditors who have proved their debts. Before doing so, the trustee is required to give written notice of the trustee’s intention to declare the dividend to anyone the trustee knows who claims, or might claim to be, a creditor but has not lodged a proof of debt: s 140(2) of the Act. The trustee is then required to consider each proof of debt: s 102 of the Act.

55 All of these steps are premised upon the trustee having formed the view that a dividend may be payable. This is a matter for the judgment of the trustee. Until such time is reached, the trustee cannot be criticised for failing to adjudicate upon proofs of debt: see Bell at [44] to [47].

56 In the present case, the trustee has formed, as expressed in the second and third reports, the view that the payment of a dividend is “Unlikely at present”.

57 I see no basis to impugn the trustee’s formation of that view, particularly given the trustee’s estimates of the net asset position of the estate (see [52] above).

58 Mr Mehajer submitted that the trustee cannot, as a matter of logic, determine the quantum of the estate’s liabilities, its net asset position and whether a dividend is likely to be payable, without determining proofs of debt asserting such liabilities.

59 I do not accept that submission. It is open to a trustee to form a preliminary view, on the information provided to the trustee, as to the liabilities of the estate. This involves an exercise of judgment by the trustee. It may be that in a particular case, an applicant is able to prove that a trustee formed such a preliminary view improperly. However there is no evidence on this application capable of supporting such a finding or warranting an inquiry.

G. Ground 4: DID THE TRUSTEE SELL A PROOF OF DEBT TO SC LOWY PRIMARY INVESTMENTS LTD? If yes, does that action warrant the replacement of the Trustee?

60 The essence of this ground is a complaint by Mr Mehajer that the trustee “sold a proof of debt” to SC Lowy.

Background

61 There is no evidence that the trustee sold a proof of debt to SC Lowy.

62 There was however an assignment of a debt (not by the trustee) to SC Lowy. The evidence concerning that assignment is as follows.

63 On 30 June 2017, Justice Robb in the Supreme Court of New South Wales made orders in In the matter of Sydney Project Group Pty Ltd (Administrators Appointed) (Receivers and Managers Appointed) and S.E.T. Services Pty Ltd (Administrators Appointed) (Receivers and Managers Appointed) [2017] NSWSC 881, including an order that Mr Mehajer and Mr Khadijeh Mehajer (qua the third and fourth defendants) pay the costs of Mr Michael Hogan and Mr Christian Sprowles who, qua administrators of Sydney Project Group Pty Ltd (Administrators Appointed) (Receivers and Managers Appointed) and S.E.T. Services Pty Ltd (Administrators Appointed) (Receivers and Managers Appointed), were the plaintiffs in that proceeding (costs order debt).

64 On 4 September 2018, Mr Hogan and Mr Sprowles entered into a Deed of Assignment with SC Lowy. Pursuant to that Deed Mr Hogan and Mr Sprowles (now qua liquidators of Sydney Project Group and S.E.T. Services) assigned the costs order debt to SC Lowy.

65 On 11 September 2018, the solicitors for SC Lowy, wrote to Mr Mehajer providing notice of the assignment of the costs order debt to SC Lowy.

66 On 17 September 2018, the solicitors for SC Lowy wrote to the solicitors for the trustee notifying them of, inter alia, the costs order, the assignment of the costs order debt to SC Lowy, and the notification to Mr Mehajer of that assignment; and lodging a proof of debt in Mr Mehajer’s bankrupt estate in respect of the assigned costs order debt. That letter and its attachments were tendered in the Second Annulment Proceeding brought by Mr Mehajer.

67 As there is no evidence that the trustees sold a proof of debt to SC Lowy, this ground fails at the outset. Whilst there is evidence that a debt was assigned by Mr Hogan and Mr Sprowles to SC Lowy, the trustee was not a party to such an assignment. There is also no evidence that the trustee was aware, prior to 17 September 2018, that such an assignment had occurred.

68 Mr Mehajer’s submissions reveal the following complaints. First, that SC Lowy took an assignment of the costs order debt so as to become a party to the Second Annulment Proceeding and to put itself in a position to oppose Mr Mehajer’s application for an annulment of his bankruptcy in circumstances where Mr Mehajer claims that his estate has a cause of action against SC Lowy with a value in excess of $35,000,000. That may or may not be so, but it is irrelevant to the present proceeding which is concerned with whether there should be an inquiry into the trustee’s conduct.

69 Secondly, that the trustee has worked with SC Lowy since the commencement of the hearing in the Second Annulment Proceeding in circumstances where the trustee is aware that Mr Mehajer’s bankrupt estate has a claim against SC Lowy of at least $35,000,000. There is no evidence in support of this submission, much less in support of Mr Mehajer’s extravagant (and rejected) submission that both SC Lowy and the trustee were dishonest or “dodgy”.

70 Thirdly, that he was not provided with notice of the assignment. This complaint appears to be contrary to the contemporaneous correspondence described at [65] and [66] above and to the evidence that the notice of assignment was tendered during the Second Annulment Proceeding. In any event, it is of no moment to a consideration of the conduct of the trustee whether Mr Mehajer received notice of the assignment of the costs order debt.

H. Ground 5: WAS THE TRUSTEE OBLIGED TO GIVE CONSIDERATION TO THE OFFER FROM ZENAH OSMAN and Khaled Osman to purchase the “SCLOWY Hong Kong Cause of Action”? (a) If yes, did the Trustee fail to do so?; (b) If yes, does the failure warrant the replacement of the Trustee?

71 The essence of this ground is that Mr Mehajer’s bankrupt estate has a cause of action against SC Lowy with a value in excess of $35,000,000; that Ms Zenah Osman and Dr Khaled Osman (the sister and brother-in-law of Mr Mehajer), or Ms Osman alone, made an offer (or offers) to purchase that cause of action from the estate; and that the trustee failed to properly consider that offer (or offers).

Background

72 SC Lowy is a lender based in Hong Kong.

73 Mr Mehajer claims to have a cause of action against SC Lowy arising out of SC Lowy’s funding of a development known as Skypoint Towers at Lidcombe. Mr Mehajer tendered a “valuation” of that claimed cause of action which ascribed to it a value of $35,500,000. Having considered that “valuation”, I place no weight upon it given that, inter alia, the valuer has not explained his expertise and the valuation contains a number of opinions for which no reasoning has been provided. In any event, little turns on the true value of such a cause of action.

74 On or around 12 February 2020, Ms Osman and Dr Osman made an offer to purchase the purported cause of action against SC Lowy for $100,000. The trustee subsequently sought proof of their ability to pay that amount and such evidence was provided.

75 On 13 February 2020, Mr Mehajer wrote to the trustee’s office asking whether the offer had been accepted or refused, and for an urgent response.

76 On 19 February 2020, the trustee’s office responded:

The Trustee is currently considering the offer and liaising with other potential interested parties in relation to same. Please note the process in relation to a sale and assignment of a cause of action can be quite an involved process, including but not limited to liaising with our lawyers and considering any legal advice received in relation to same.

77 On 26 March 2020, the trustee’s office wrote to Mr Mehajer:

We acknowledge Zenah’s offer to purchase any potential cause of action against SC Lowy has reduced from $100,000 to $10,000. You have also asked us for details of any other interested parties.

As previously advised, I am liaising with other potential interested parties regarding purchasing the cause of action. The process in relation to a sale and assignment of a cause of action can be long and drawn out, including but not limited to seeking ongoing legal advice in relation to same. In the interests of maximising the return to the estate and confidentiality, these details cannot be provided to you.

78 On 20 April 2020, the solicitors for the trustee wrote to Mr Mehajer in relation to the Second Annulment Proceeding:

Documents challenging creditors’ claims and supporting Skypoint Claims

We refer to your Affidavit sworn 27 February 2020 and Submissions in Reply dated 14 April 2020 claiming evidence which:

(a) challenges the various creditors’ claims made against your Bankrupt Estate; and

(b) supports your allegations arising in connection with the Skypoint Towers development (Skypoint Claims).

We further note that in the course of the Hearing you stated that you have “bundles of relevant documents”, including as referred to at paragraph 44(viii) on page 6 of your Submissions in Reply.

As stated in our letter dated 3 March 2020, we are keen to receive any such documentary evidence or, in the case of witness evidence, summaries of the effect of that evidence ...

(emphasis in original)

79 The documents referred to in that letter are not in evidence on this application. As noted above, the Skypoint Claims are a reference to Mr Mehajer’s purported claims against SC Lowy.

80 On 22 April 2020, Mr Mehajer wrote to the solicitors for the trustee (as written):

Again, may I politely request an update on the SCLOWY cause of action offer add by Zenah Osman.

This has been the 9th request, collectively between yourself and the trustee (sent either by myself and or Zenah Osman).

81 On 22 April 2020, the solicitors for the trustee responded (as written):

Regarding the offers made by parties associated with you and updates provided, we note (non-exhaustively):

1. the offer made by Zenah of $100,000 has been reduced to $10,000 (in respect of cause of actions which you variously value between $30 million and $100 million);

2. on 19 February and 26 March 2020, the Trustee advised you that he was liaising with other potentially interested parties; and

3. in our phone call on 31 March 2020, we advised you that an offer superior to the offers from Zenah had been received. On that basis, Zenah’s offer would not be accepted.

As also advised on 31 March 2020, we will update you beforehand if any material steps are likely to occur regarding the Trustee dealing with those causes of action. Given this, the Trustee will not incur the costs of responding to each and every one of your repeated requests for urgent updates (at least 9 recently), which are not necessary to ensure we update you before any material steps are likely to occur.

Indeed, what would assist the Trustee to continue to assess how best to deal with the causes of action would be for you to provide the material sought in our letter dated 20 April 2020.

82 On 23 April 2020, Ms Osman sent an email to the solicitors for the trustee:

I have been advised by Salim that you have rejected my offer to purchase the Sclowy claim (Cause of action) as you need a higher offer.

Please know, that my offer was reduced to $10,000 because I was basing it off the report to creditors prepared by your client, the trustee.

Based on that report, it’s a reasonable offer I make.

You say in your email to Salim (as I’ve been told)- that Salim asserts the Sclowy Cause of Action is valued between $30-100 million.

What is your precise validation of the claim, within a reasonable range?

Let’s move forward please without delay.

...

83 On 27 April 2020, the solicitors for the trustee responded to Ms Osman (as written):

Your offer is rejected.

We are continuing to investigate the claims against SC Lowy and others. Salim has advised that he has new information and new witnesses in relation to this cause of action. We are hopeful that Salim will produce to us that Fresh Evidence that he represented to the Federal Court of Australia that he has. He has made submissions to the Federal Court that his causes of action against SC Lowy and others have greatly improved, yet over the same period your offer has been reduced from $100,000 to $10,000.

In any event, your offer is well inferior to other interest that we have in relation the causes of action. We hereby confirm to you, as we have confirmed to Salim, that we will approach you prior to the Trustee entering into any transaction dealing with those causes of action. Being persistently pursued by you and Salim and receiving from you both, by email, arguments as to why your offer of $10,000 in all of these circumstances is a good offer or a fair offer or a reasonable offer is completely unhelpful and a complete waste of time and money for both our office and the Trustee and accordingly, in turn, the creditors’ money.

Respectfully, unless there is something constructive that you or Salim have to say in relation to the negotiation for the purchase of the causes of action, in the interest of creditors, we reserve our rights not to respond to any further communication unless it is constructive, helpful or any way necessary to the sale process. The first step of theat constructive process is for Salim to provide the Fresh Evidence to us and the trustee.

Separately, please provide us with a copy of the Statement of Claim you refer to.

84 On 27 August 2020, the trustee wrote to Mr Mehajer:

4. We note the last offer submitted by Zenah Osman to purchase any potential cause of action against SC Lowy was $5,000 which was rejected by the trustee. Please advise if a new offer is now submitted by Zenah to purchase said action.

and Mr Mehajer responded:

Zenah has spoken to me yesterday and the offer is now at $50,000.

85 On 28 August 2020, the trustee wrote to Mr Mehajer:

Thank you for your email of 27 August 2020 below.

Would you please provide us with written confirmation of the offer from Zenah Osman to purchase the potential cause of action against SC Lowy and evidence of the funds being available.

86 On 3 September 2020, Mr Mehajer provided to the trustee a letter from Ms Osman addressed to Mr Mehajer dated 2 September 2020 which stated:

I confirm that I am willing to pay $50,000 to purchase the SCLOWY Cause of Action from DW Advisory.

This offer expires on Monday 7 September 2020 at 4.00PM.

I trust this letter should suffice.

87 On 7 September 2020, Mr Mehajer wrote to the solicitors for the trustee seeking an update on Ms Osman’s $50,000 offer:

88 On 22 September 2020, the trustee wrote to Mr Mehajer in connection with a number of matters that the trustee contended Mr Mehajer had failed to adequately address despite several requests that he do so, including the potential claim against SC Lowy. Relevantly, the trustee wrote:

7. Potential claim against SC Lowy

You have repeatedly been requested to provide all documents, material and/or information regarding your allegations arising in connection with the Skypoint development at 36-44 John Street, Lidcombe NSW (including, and by no means only, by letter from my lawyers to you dated 20 April 2020, copy attached).

You have not provided the following documents despite having been identified by you in previous Affidavits: ...

…

You are directed to produce the evidence referred to in relation to points 7. I. to III. above.

I reiterate that should you fail to produce the requested information/documents by 23 October 2020, such failure may lead to me lodging an objection to your automatic discharge from bankruptcy pursuant to Section 149D(1)(d) of the Act.

(emphasis in original)

89 On 13 November 2020, Mr Mehajer sent to the trustee a response to the trustee’s 22 September 2020 letter (which response was dated 18 October 2020 – see [163] below). Mr Mehajer’s letter included in answer to the first paragraph of the 22 September 2020 letter:

I have already provided the trustee with all the information I have available.

As the trustee may already know I am suing SCLowy for damages done – and it is in my best interest for my case to present all the material to the court. I have already provided the trustee with copies of all my affidavits that I have filed and rely on.

90 In response to the requests for further documents identified by Mr Mehajer in previous affidavits, Mr Mehajer provided some further information, and with respect to some of the documents indicated that he had not located such documents.

91 Mr Mehajer submitted that the trustee had failed to act upon “the offer” and had “brushe(d) Ms Osman away”. That submission is contrary to the evidence and is rejected.

92 As the evidence set out above demonstrates, the trustee:

(1) in February 2020 received an offer from Ms Osman (and Dr Osman) of $100,000, which he indicated on 19 February 2020 he was considering and may take legal advice upon. The trustee also indicated that he was liaising with other potentially interested parties;

(2) in March 2020 acknowledged that Ms Osman’s offer had been reduced to $10,000;

(3) on 31 March 2020, indicated to Mr Mehajer that an offer superior to Ms Osman’s offer had been received and as such her offer would not be accepted;

(4) on 20 April 2020, sought further details of the alleged claim against SC Lowy, by reference to an affidavit and submissions that Mr Mehajer had filed in the Second Annulment Proceeding;

(5) on 22 and 27 April 2020, confirmed the status of the negotiations to that point, stated that he awaited further evidence from Mr Mehajer and stated that Ms Osman’s offer was not the best offer that had been received and would not be accepted; and

(6) did not accept Ms Osman’s increased offer of $50,000 and reiterated his request for relevant information.

93 I discern nothing in this course of events which suggests that the trustee acted otherwise in accordance with his duties. He engaged with the various offers that were made by Ms Osman and pressed for information that was relevant to his consideration of those offers. This ground raises no issue warranting an inquiry.

I. Ground 6: DID THE TRUSTEE ERR IN INCLUDING THE FOLLOWING PERSONS OR ENTITIES as either secured or unsecured creditors of the Bankrupt in the Reports to Creditors: (a) ACE Demolition & Excavation Pty Ltd for $6.2 million; (b) Ahmad Jaghbir for $100,000; and (c) AnpinG Yan for $25,000? If yes, does that error warrant the replacement of the Trustee?

94 The essence of this ground is Mr Mehajer’s complaint that three particular parties were included in a list of creditors in the trustee’s report to creditors.

Background

95 On 15 October 2018, the trustee issued his second report. That report included a list of secured and unsecured claims identified by the trustee including three parties who had not lodged proofs of debt: ACE Demolition & Excavation Pty Ltd, Ahmad Jaghbir and Anping Yan.

96 As at 4 December 2020, the trustee had not called for formal proofs and had not adjudicated any creditors’ claims.

97 ACE was listed for an amount claimed by it of $6,200,000 based in part upon a Commercial List Summons filed in Supreme Court of New South Wales Proceedings 2018/39427, in which a claim for that amount had been made. ACE had not lodged a proof of debt as at 4 December 2020. As at that date the trustee was not aware of any documentation by which ACE accepted that the debt of $6,200,000 was not currently owing.

98 In the Second Annulment Proceeding, Mr Mehajer gave oral evidence in re-examination that, “ACE Demolition has been paid in full”. That evidence was not accepted. Lee J held (Mehajer v Weston in his capacity as Trustee of the Bankrupt Estate of Salim Mehajer [2019] FCA 1713 at [53]):

For the avoidance of any doubt, however, if I was required to make a finding as to the position relating to ACE Demolition, given no evidence was adduced by Mr Mehajer other than in re-examination which would corroborate a discharge of the debt to ACE Demolition, then I consider it is more probable than not that that amount is still owing to ACE Demolition.

99 Ahmad Jaghbir was listed as an unsecured creditor for an amount of $100,000 based on verbal advice to a member of the trustee’s staff that he was a creditor of Mr Mehajer’s bankrupt estate for that amount.

100 Anping Yan was included in the list of unsecured creditors for $25,500 based upon published media reports.

101 Mr Mehajer’s evidence is that he has lost confidence in the trustee as a result of the inclusion of these debts in the second report to creditors (among other reasons). Mr Mehajer did not seek to prove that the three impugned debts were not owing.

102 The inclusion of these persons as creditors in a report to creditors is not a matter warranting an inquiry. Whilst Mr Mehajer might assert that he owes nothing to these persons (a matter which he did not attempt to prove), his complaint is premature in circumstances where the trustee had not called for proofs of debt, much less made an adjudication upon such proofs as were submitted.

103 I note further that the proposition that Mr Mehajer is not indebted to ACE is inconsistent with the position he took with respect to garnering the support of sufficient creditors to call a meeting in order to replace the trustee, where he put forward ACE as a creditor (see ground 9 below).

J. Ground 7: HAVE THE ACTIONS OF THE TRUSTEE CAUSED THE BANKRUPT “extreme hardship, mental distress, severe anxiety, pressure from family members, unjustified discomfitures”? If yes, does that warrant the replacement of the Trustee?

104 The essence of this ground is Mr Mehajer’s complaint that the trustee has acted in such a way as to cause Mr Mehajer the consequences set out in ground 7.

105 It is apparent from the correspondence that has passed between them that there is tension in the relationship between Mr Mehajer and the trustee. However, there is no evidentiary basis from which to conclude that the trustee is the cause of such tension much less that there has been conduct of the trustee which warrants an inquiry.

106 Further, in circumstances where Mr Mehajer has not established that any of the other grounds warrant an inquiry, he has not established that the conduct complained of in those grounds warrants an inquiry into this more general complaint.

K. Ground 8: IS THE TRUSTEE AFFECTED BY A CONFLICT OF INTEREST? If yes, does that warrant the replacement of the Trustee?

107 The essence of this ground is Mr Mehajer’s complaint that the trustee has a conflict of interest arising from his move from Pitcher Partners to Dean-Willcocks Advisory (DW Advisory).

Background

108 On 1 March 2020, the trustee and a number of his staff members left Pitcher Partners for DW Advisory.

109 Mr Mehajer is concerned that a conflict of interest has arisen because a principal of DW Advisory is Mr Anthony Elkerton, with whom Mr Mehajer has had previous dealings.

110 Upon being informed that the trustee had moved to DW Advisory, Mr Mehajer made contact (via email) with the trustee and his assistant Mr Ragu Nith. He then contacted Mr Nith (by telephone) and had a lengthy discussion, in which he expressed his concerns regarding Mr Elkerton.

111 Mr Mehajer did not wish to elaborate on the specifics of what occurred because of his reservations about making certain issues known to the media.

112 Mr Mehajer submitted that he should not be put in a situation to disclose to the Court the nature of the conflict and that if the Court does not decide to replace the trustee, then the trustee will cause further problems for Mr Mehajer. However, absent such information the Court is not in a position to consider whether this ground has any substance. On the evidence provided by Mr Mehajer it is not apparent that the trustee might have a conflict of interest.

113 Thus, this ground does not warrant an inquiry into the trustee’s conduct.

L. Ground 9: Creditors meeting

114 The essence of this ground is Mr Mehajer’s complaint that the trustee failed to convene a creditors meeting at which a resolution would be put for the replacement of the trustee.

Background

115 On 31 August 2020, Mr Mehajer wrote to the trustee (as written):

I wish to advise you that my creditors and I have together decided that we should urgently call a meeting to change the trustee.

To call for the meeting to change trustee’s, could you please advise us what you would require from me.

We have a trustee that will come on board right away. Would you require this in writing also to call for a meeting.

The creditors are:

1. JFI holdings Pty Ltd and the assignee

2. Charles Gittany and the assignee

3. Ace Demolition & Excavations Pty Ltd

(emphasis in original)

116 On 1 September 2020, the trustee’s office wrote to Mr Mehajer:

We refer to your email of 31 August 2020 below.

Please note that pursuant to Section 75-15 of the Insolvency Practice Schedule (Bankruptcy), the Trustee must convene a meeting if either of the following circumstances are met:

I. The majority of creditors in number and dollar value direct the trustee to do so by resolution

II. At least 25% in dollar value of the creditors direct the trustee to do so in writing

III. If less than 25% but more than 10% in dollar value of the creditors direct the trustee to do so in writing, security for the cost of holding the meeting is given to the trustee before the meeting is convened.

In the event a request is made per points I.-III. above, pursuant to Section 75-265 of the Insolvency Practice Rules (Bankruptcy), the proposed incoming trustee must provide a signed consent to act as trustee and a declaration of independence, relevant relationships and indemnities.

117 On 4 September 2020, Mr Mehajer wrote to the trustee:

I now hold a document signed by ACE, JFI, GITTANY, *AZZAM, Fayka, and HAMDAN (new genuine creditors which have not yet lodged a POD- requesting that a meeting be called to terminate the trustee.

...

(emphasis in original)

118 On 7 September 2020, the trustee’s office responded:

We refer to your email of 4 September 2020 below.

We are unsure as to why creditor requests to replace the trustee are coming via you – particularly in circumstances where “new genuine creditors” have never contacted the trustee’s office in the past two plus years of administering your estate, let alone express any concerns as to how the administration of your estate has been run.

Accordingly, we request that these creditors independently contact our office with their requests, along with their completed proofs of debt and supporting documentation.

We otherwise reiterate the comments made in my email to you on 3 September 2020.

119 On the same day, Mr Mehajer responded:

Firstly, the creditors are asking me to communicate with you directly.

Secondly, the arising creditors, namely AZZAM, FAYKA and HAMDAN never lodged a POD as they did not want to place further pressure on me.

I believe AZZAM spoke to you last week. AZZAM is a pharmacist and I am sure he would not be jeopardizing his career if his POD is not 100% genuine.

Please, could you answer the question in relation to calling the meeting.

120 Mr Mehajer sent a further email to the trustee (as written):

Please confirm that upon each creditor signing the attached document, a meeting could be called.

The creditors have asked me to confirm with you how long would the trustee take to call this meeting.

IF it is going to be weeks or months, we will consider our options to have an urgent meeting be called. I am not sure of any requirements.

Furthermore, these creditors are also majority unit holders of units @ Skypoint Towers Lidcombe.

...

121 On 8 September 2020, the trustee’s office responded:

We have previously explained to you what is required for a meeting of creditors to be convened to consider a replacement trustee. Please refer to my most recent email of 7 September 2020, a copy of which is attached. As we have previously advised, if you are still having difficulties understanding the process we suggest you seek advice from your proposed trustee or lawyer with bankruptcy/insolvency expertise.

122 On 8 September 2020, Mr Mehajer wrote to the Associate to Rares J and the trustee’s solicitor in connection with this proceeding asserting that he had the support of at least 25 per cent of the creditors of his estate in dollar value and that they intended to call a meeting for the replacement of the trustee.

123 On 9 September 2020, this proceeding was adjourned by consent to 13 November 2020. Mr Mehajer instigated the adjournment to enable him to attract the maximum possible support from his creditors to direct the trustee to call a meeting of creditors to consider a resolution to replace the trustee.

124 On 10 September 2020, the trustee’s office sent emails to: (1) the solicitors for ACE; (2) the solicitors for JFI Holdings Pty Ltd; (3) Mr Charles Gittany; and (4) Ahmad Gharib in which the trustee’s office stated that Mr Mehajer had advised the trustee that each of them, qua creditor, wished to commence a meeting of creditors to consider replacing the trustee; and that the trustee had not received such a request.

125 Only Mr Gharib responded. Mr Gharib was asked to lodge a proof of debt but did not do so.

127 Section 75-15 of the IPS(B) required the trustee to convene a meeting of Mr Mehajer’s creditors if s 75-15(1)(a), (b) or (c) was satisfied, provided the direction was reasonable: s 75-15(1)(c) and (2).

128 The trustee advised Mr Mehajer of the steps required to be taken to convene a meeting of creditors. There is no evidence that these steps were done. In particular, there is no evidence that creditors in the requisite percentage in value wished a meeting to be convened, despite: (1) Mr Mehajer’s claim to hold a document signed by such creditors (see [117] above); and (2) the trustee, of his own initiative, contacting many of the creditors which Mr Mehajer had asserted provided such a percentage in value (see [124] above).

129 I also do not accept Mr Mehajer’s submission that the meeting did not occur because the trustee pushed him away or gave him excuses for not calling such a meeting. This submission is contrary to the contemporaneous emails set out above.

130 This ground concerns property at 14 Frances Street, Lidcombe NSW (Frances Street Property). Mr Mehajer’s complaint is that the trustee did not sell that property in accordance with Mr Mehajer’s wishes.

Background

131 A title search dated 16 November 2020 concerning the Frances Street Property records: Mr Mehajer as the registered proprietor; a mortgage registered in favour of National Australia Bank Limited (NAB); and caveats lodged by JFI Holdings, Charles Gittany, Portcullis Capital Pty Ltd, and the trustee.

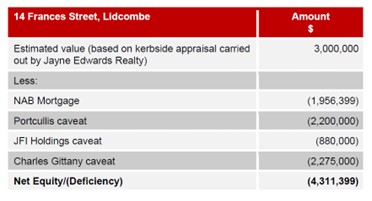

132 The second and third reports included the following summary of the equity positions in the Frances Street Property:

133 I infer from the email in the following paragraph that prior to 21 August 2020, Mr Mehajer approached the trustee concerning a sale of the Frances Street Property.

134 On 21 August 2020, the solicitors for the trustee wrote to Mr Mehajer:

Proposed sale of 14 Frances Street

Before the Trustee is prepared to enter into a Contract for Sale in respect of 14 Frances Street (Property), the Trustee requires the following:

Signed written agreement from each of you, NAB and every caveator registered on title to:

(a) the Trustee conducting the sale (without interference from any of those parties);

(b) discharge and withdraw their respective mortgages and caveats to allow completion to occur; and

(c) the sale proceeds to be applied as follows until exhausted:

(i) usual adjustments and deductions on completion;

(ii) in payment of the Trustee’s reasonable remuneration and that of his employees (at prevailing hourly rates from time to time) and costs and disbursements (including all reasonable legal costs at the solicitors’ prevailing hourly rates from time to time) in relation to, arising out of or in connection with:

(A) the sale of the Property; and/or

(B) the adjudication of the rights and claims of subsequent charges against the Property (e.g. the caveators’ claims),

(collectively, Trustee’s Costs),

(iii) in payment of the amounts agreed by NAB before discharge of its Mortgage as set out in paragraph 1 of the email from K&L Gates on 19 August 2020 at 12.54pm;

(iv) in payment of any valid subsequent charges (e.g. the caveators’ claims) in their respective priorities as determined by the Trustee; and

(v) to the extent that any funds are left over, to the Bankrupt Estate,

The Trustee is not prepared to proceed unless all of the interested parties agree to the above, not least as the Trustee is unable to complete a sale of the Property without a Discharge of Mortgage and all Withdrawals of Caveat and so is not prepared to enter into a Contract for Sale until those parties have provided their written agreement.

(emphasis in original)

135 On 26 August 2020, Mr Mehajer commenced proceeding NSD942/2020 in this Court seeking an order that the caveat lodged by Portcullis on the title of the Frances Street Property be removed.

136 On 9 September 2020, the solicitors for NAB wrote to Mr Mehajer:

Facilities provided by National Australia Bank Limited (NAB) to Salim Mehajer

We refer to your recent emails and confirm that we act for NAB.

We note your request for confirmation of NAB's position in respect of the proposed sale of the properties located at 14 Frances Street, Lidcombe and 1 Ann Street, Lidcombe (collectively, the Properties).

We are instructed that NAB has no objection to the sale of the Properties provided it receives sufficient sale proceeds at settlement to satisfy all amounts secured to NAB by its first registered mortgage over each of the Properties as at the date of settlement. NAB will provide a discharge in respect of each mortgage upon receipt of the secured amount in full.

(emphasis in original)

137 On 22 September 2020, Mr Mehajer wrote to the trustee:

... could you please advise what I need (and consent from whom) in order to auction 14 Frances Street, Lidcombe ...?

138 On 23 September 2020, the trustee’s office responded:

Our lawyers have previously advised you as to what is required in order for the trustee to consider a sale of 14 Frances Street. A copy of the email from Bridges Lawyers to you dated 21 August 2020 is attached. For the avoidance of doubt, the trustee is not adverse to a sale of 14 Frances Street taking place if these conditions are met. Please note however, that as an undischarged bankrupt you do not have the legal standing to auction any real property interests.

139 On 15 October 2020, Mr Mehajer wrote to the trustee’s solicitors concerning proceeding NSD942/2020:

The proceedings will be discontinued because I managed to resolve this matter outside of court.

The trustee should be grateful that I have resolved a $2.2M alleged debt down to $0.0 improving the estate by at least $2.2M.

The trustee had issues selling the Frances St property because of the Portcullis caveat. Now, I will have this caveat removed.

...