Federal Court of Australia

Australian Securities and Investments Commission v Australia and New Zealand Banking Group Limited (No 2) [2023] FCA 1217

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED (ACN 005 357 522) Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The matter be listed for a hearing on penalty on a date to be fixed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

TABLE OF CONTENTS

MOSHINSKY J:

1 The key events giving rise to this proceeding, which concerns whether the Australia and New Zealand Banking Group Limited (ANZ) breached its continuous disclosure obligation under s 674(2) of the Corporations Act 2001 (Cth), are as follows.

2 On Thursday, 6 August 2015, at 8.38 am, a trading halt of ANZ’s shares was announced, at the request of the company, pending the release of an announcement by the company. At 8.44 am that day, ANZ issued a media release that announced a fully underwritten institutional share placement to raise $2.5 billion (the Placement) and an offer to ANZ’s eligible shareholders to participate in a share purchase plan (SPP) to raise around $500 million. (The focus of this proceeding is the Placement and not the SPP.) The media release stated that the final issue price for the Placement would be determined through an accelerated book-build to be completed that day in a price range up from $30.95, being the underwritten floor price. It was also stated that the Placement had been fully underwritten by Citigroup Global Markets Australia Pty Ltd (Citi), Deutsche Bank AG (Deutsche) and JP Morgan Australia Ltd (JPM) (together, the Underwriters or the Joint Lead Managers). Pursuant to an Underwriting Agreement entered into by the Underwriters and ANZ on that day, their respective proportions were: 40% for Citi; 30% for Deutsche; and 30% for JPM.

3 During the course of 6 August 2015, the Underwriters carried out a book-build process. They updated ANZ from time to time on the progress of the book-build.

4 At 8.35 pm on 6 August 2015, the Underwriters sent an email to ANZ attaching a draft allocation list for the Placement (the Draft Allocation List) that showed the book fully covered (at 103%), but approximately $754 million of shares “left to allocate” (that is, proposed to be taken up by the Underwriters). There is a factual issue between the parties as to whether: (a) as ANZ contends, institutional investors had made applications for more than $2.5 billion of shares (i.e. the book was fully covered) and the Underwriters recommended not allocating approximately $754 million of the shares; or (b) as the Australian Securities and Investments Commission (ASIC) contends, the book was actually not fully covered, as certain investors had amended their applications or because the real demand of certain investors was less than their application. In any event, during a conference call between the Underwriters and ANZ shortly after 8.35 pm on 6 August, the Underwriters recommended that approximately $1.745 billion of shares be allocated to investors and approximately $754 million of shares (approximately 30% of the Placement) be taken up by the Underwriters. ANZ gave approval to the Underwriters to proceed to allocate in accordance with that recommendation.

5 At 2.26 am on Friday, 7 August 2015, the Underwriters sent an email to ANZ attaching a copy of a revised allocation list for the Placement (the Final Allocation List) that showed approximately $1.709 billion of shares to be allocated to investors and approximately $790 million of shares (approximately 31% of the Placement) “left to allocate” (and therefore to be taken up by the Underwriters).

6 At 7.30 am on 7 August 2015, ANZ published a media release, which was released to the market by the Australian Securities Exchange (ASX), that stated:

ANZ completes $2.5 billion Institutional Equity Placement

ANZ today announced it had raised $2.5 billion in new equity capital through the placement of approximately 80.8 million ANZ ordinary shares at the price of $30.95 per share.

Settlement is scheduled to take place on 12 August 2015 with issue of the Placement shares to occur on 13 August 2015. The Placement shares are scheduled to commence trading on ASX on 13 August 2015. The new shares will rank equally with existing ANZ ordinary shares.

Yesterday’s trading halt in ANZ ordinary shares and other securities is expected to be lifted at market open today.

7 Importantly for present purposes, ANZ’s media release did not refer to the fact that approximately $790 million of the shares had not been allocated to institutional investors and therefore would be taken up by the Underwriters. Further, ANZ did not disclose this information at any other time before the market opened on 7 August 2015.

8 In this proceeding, ASIC alleges that ANZ contravened its continuous disclosure obligation under s 674(2) of the Corporations Act (set out later in these reasons) (operating in conjunction with ASX Listing Rule 3.1) by failing to notify the ASX (either on the night of 6 August 2015 or, alternatively, prior to the recommencement of trading in ANZ shares on 7 August 2015):

(a) that, of the $2.5 billion of ANZ shares offered in the Placement, shares with a value between approximately $754 million and $790 million were to be acquired by the Underwriters (the Underwriter Acquisition Information); or alternatively

(b) that a significant proportion of the shares the subject of the Placement were to be acquired by the Underwriters (the Significant Proportion Information).

9 The continuous disclosure obligation in s 674(2) has a number of elements. Among other things, for the obligation to apply, it is necessary that the information:

(a) is not generally available; and

(b) is information that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of the relevant securities.

10 Section 677 provides in part that, for the purposes of s 674, a reasonable person would be taken to expect information to have a material effect on the price or value of securities if the information would, or would be likely to, influence persons who commonly invest in securities in deciding whether to acquire or dispose of the securities.

11 Having regard to those provisions, ASIC alleges that each of the Underwriter Acquisition Information and the Significant Proportion Information:

(a) was not generally available to the market;

(b) if disclosed, was information that a reasonable person would expect to have a material effect upon the price of ANZ shares; and

(c) was likely to influence investors in deciding whether to acquire, and in deciding whether to dispose of, ANZ shares.

12 In its defence, ANZ contends that:

(a) applications at the price of $30.95 per share were received from institutional investors for more than the full amount of the Placement Shares; this was communicated to ANZ;

(b) the Underwriters recommended to ANZ that, notwithstanding that applications had been received from institutional investors for more than the full amount of the Placement Shares, having regard to the composition of the applications, the Underwriters should take up a portion of the Placement Shares by scaling-back the allocations to certain investors; a substantial reason for this recommendation was that investors such as hedge funds, if not scaled-back, might deal with their shares in such a way as to create a disorderly, or volatile, after-market for ANZ shares; this was communicated to ANZ;

(c) ANZ accepted that recommendation (during the conference call shortly after 8.35 pm on 6 August 2015); and

(d) prior to the commencement of trading in ANZ shares on 7 August 2015, the Underwriters had each indicated to ANZ their intention to promote an orderly after-market in ANZ shares and not to promptly dispose of any allocation of Placement Shares to them.

13 ANZ admits that it did not make a disclosure at any material time in the terms alleged or of the specific information alleged, but says that disclosure of the information alleged without the contextual matters set out in [12] above would have made any disclosure misleading or incomplete.

14 ANZ admits that the Underwriting Acquisition Information was not generally available. However, it contends that the Significant Proportion Information was generally available because it consisted of deductions, conclusions or inferences made or drawn from: readily observable matter; and/or information made known in a manner that would, or would be likely to, bring it to the attention of persons who commonly invest in securities of a kind whose price or value might be affected by the information, and where since that information was made known a reasonable period for it to be disseminated had elapsed (see s 676 of the Corporations Act, set out below).

15 ANZ denies that the information, if disclosed, was information that a reasonable person would expect to have a material effect upon the price of ANZ shares and/or was likely to influence investors in deciding whether to acquire, and in deciding whether to dispose of, ANZ shares. ANZ contends that any assessment of whether the information was of that character would need to have regard to the totality of relevant information or context, which includes some or all of the matters set out in [12] above.

16 Further, ANZ denies that the Underwriter Acquisition Information and the Significant Proportion Information were information “concerning it” within the meaning of ASX Listing Rule 3.1 (set out below).

17 My conclusions, in summary, are as follows:

(a) Both the Underwriter Acquisition Information and the Significant Proportion Information were information “concerning it”, that is, concerning ANZ, for the purposes of Listing Rule 3.1.

(b) Both the Underwriter Acquisition Information and the Significant Proportion Information were not generally available at the relevant times (being the night of 6 August 2015 and prior to the recommencement of trading in ANZ shares on 7 August 2015).

(c) Both the Underwriter Acquisition Information and the Significant Proportion Information were material for the purposes of the relevant provisions.

18 It follows from the above that I have concluded that ANZ breached its continuous disclosure obligation in s 674(2) of the Corporations Act by failing to notify the ASX (either on the night of 6 August 2015 or prior to the recommencement of trading in ANZ shares on 7 August 2015) of the Underwriter Acquisition Information or the Significant Proportion Information.

19 This proceeding was commenced in September 2018. Subsequently, ANZ applied for a stay of the proceeding pending the outcome of related criminal proceedings. On 21 June 2019, I made an order that the proceeding be stayed until the hearing and determination of the criminal proceedings: Australian Securities and Investments Commission v Australia and New Zealand Banking Group Limited [2019] FCA 964. As noted in that judgment at [7], the criminal proceedings were based on allegations that during discussions on 7 and 8 August 2015 the Underwriters made arrangements or arrived at understandings in relation to the sale of ANZ shares by the Underwriters, and that they subsequently implemented those arrangements and understandings, in contravention of cartel offence provisions in the Competition and Consumer Act 2010 (Cth). ANZ was alleged to have been knowingly concerned in the making of, and giving effect to, those arrangements and understandings.

20 The criminal proceedings did not proceed to trial. The charges were withdrawn. Accordingly, in early 2022 this proceeding was listed for a case management hearing and timetabling orders were made to take the matter to a hearing.

21 The hearing of this matter commenced on 24 April 2023 and took place over seven hearing days. The hearing dealt with all questions in the proceeding other than the amount of any pecuniary penalty.

22 ASIC relied on the following lay evidence:

(a) an affidavit of Kamilla Soos, an Information and Research Analyst at ASIC, dated 20 December 2022;

(b) an affidavit of Giovanna Morel, a Research Librarian at ASIC, dated 20 December 2022;

(c) affidavits of Michelle Burton, a lawyer employed by ASIC, dated 19 September 2022, 28 October 2022, 20 December 2022, 17 March 2023 and 22 April 2023; and

(d) an affidavit of Madison Lardner, a solicitor employed by Johnson Winter Slattery, the solicitors acting for ASIC, dated 23 April 2023.

23 Broadly, these affidavits related to documents relied on by ASIC. None of these witnesses was required to attend for cross-examination.

24 In addition, ASIC tendered a number of documents.

25 ANZ called the following lay witnesses:

(a) John Needham, the Head of Capital & Structured Funding of ANZ (a role he held both at the time of trial and at the time of the Placement); and

(b) Robert Jahrling, the Head of Equity Capital Markets Syndication at Citi, and a Director of Citi, at the time of the Placement.

26 Mr Needham prepared an affidavit dated 28 November 2022 and was cross-examined. He gave evidence in a very clear and straightforward way. His evidence was evidently intended to assist the Court. He made sensible concessions. I generally accept his evidence.

27 Mr Jahrling did not prepare an affidavit, but he had been examined by ASIC pursuant to s 19 of the Australian Securities and Investments Commission Act 2001 (Cth) (the ASIC Act) (Section 19 Examination) and a transcript of that examination was in evidence (subject to a “limited use” ruling, as discussed below). Mr Jahrling was cross-examined. He gave evidence in a clear and straightforward manner. He demonstrated a good grasp of the facts and the evidentiary material. I generally accept his evidence.

28 ANZ also tendered a number of documents.

29 The documents in evidence were contained in a Court Book (CB), Supplementary Court Book (SCB) and Further Supplementary Court Book (FSCB), all of which were in electronic form.

30 There are two bodies of transcripts in evidence that it is useful to identify at this stage. These are:

(a) transcripts of examinations of persons involved in the Placement pursuant to s 19 of the ASIC Act (Section 19 Transcripts); and

(b) transcripts of telephone conversations (or conference calls) between two or more participants in the Placement (Telephone Transcripts).

31 During the course of the hearing, the parties agreed on a number of corrections to these transcripts and revised versions were provided to the Court and went into evidence (contained in the FSCB). In all but one instance, the parties were agreed on the text of the transcripts. The one exception related to the transcript of a telephone conversation that took place at 9.23 pm on 6 August 2015 (FSCB tab 19). The parties could not agree on the word or words at p 7, line 7 of the transcript, and I was invited to listen to the audio recording (which was also in evidence) and form my own view. I refer to this further below.

32 The parties agreed a process whereby, for all of the Section 19 Transcripts and for four of the Telephone Transcripts (FSCB tabs 20, 22, 23 and 24), the parties identified the particular passages upon which they relied – green highlighting was used for the passages relied on by ASIC and a blue box was used for the passages relied on by ANZ. The balance of each such transcript was the subject of a “limited use” ruling to the effect that its use was limited to providing comprehension and context for the passages relied on by the parties. In relation to three of these Telephone Transcripts (FSCB tabs 22, 23 and 24), there were “limited use” rulings in relation to the passages relied on by ASIC. In relation to the balance the Telephone Transcripts (FSCB tabs 16, 17, 18, 19 and 21), no particular passages were identified by the parties, and the whole of the transcript went into evidence without a “limited use” ruling.

33 An important document in evidence is a copy of the notebook kept by Mr Needham in which he made notes of several of the key telephone conversations (or conference calls) (CB tab 355).

34 During the hearing, the parties provided the Court with a document headed “Aide Memoire – Date and Time of Communications” (FSCB tab 27) that set out (with one exception) the parties’ agreed position on the date and time (in Australian Eastern Standard Time) that particular documents (such as emails) were sent.

35 Each party called one expert witness:

(a) ASIC called Mr Grahame Pratt; and

(b) ANZ called Mr John Holzwarth.

36 Mr Pratt held senior roles at ABN Amro / RBS Australia from 2001 to 2011. From 1996 to 2000, he held a senior position at AMP Investments. From 1992 to 1995, he held a senior position at SBC Warburg. Mr Pratt has worked in the stockbroking and funds management industries for 25 years. His roles and responsibilities have included advising private clients, sophisticated investors, institutional portfolio managers, research analysts and dealers, finance directors and company treasurers.

37 Mr Holzwarth is a partner of OSKR, LLC, a consulting firm specialising in economic and financial analysis in litigation proceedings. He has a BA in Economics cum laude from the University of Pennsylvania and an MBA from the Haas School of Business at the University of California at Berkeley. He is also a CFA® charterholder. During his career, he has developed expertise in financial and damages analysis. He has acted as an expert in several shareholder class actions in Australia.

38 The experts prepared a number of reports. They also prepared a joint report dated 7 March 2023 (the Joint Expert Report). They gave evidence concurrently during the hearing. I discuss their evidence later in these reasons.

39 The issues to be determined are identified in the parties’ pleadings. The following is a summary of the pleadings.

40 ASIC’s latest pleading is its further amended statement of claim dated 4 June 2019 (FASOC). Paragraphs 3 and 4 relate to the Underwriting Agreement, which was entered into on the morning of 6 August 2015 (referred to as the “Placement Date” in the pleading). Paragraph 5 refers to ANZ securities being placed in a trading halt at about 8.38 am on 6 August 2015. Paragraph 6 states that, immediately prior to the trading halt, ANZ securities traded on the ASX at $32.58. Paragraph 7 refers to the media release issued by ANZ at about 8.44 am on 6 August 2015. Paragraph 8 pleads aspects of that media release. Paragraph 9 pleads that, at or about that time, the Underwriters commenced the process of seeking and accepting applications in the book-build. These paragraphs are largely admitted.

41 In paragraph 10 of the FASOC, ASIC alleges that the Placement did not attract the level of interest from institutional investors that was anticipated by ANZ and/or the Underwriters. The particulars to this paragraph refer to a number of telephone conversations between participants in the Placement.

42 By paragraph 11, ASIC alleges that, during the course of 6 August 2015, there were communications between senior officers and employees of ANZ and representatives of the Underwriters to the effect that, because the level of demand from institutional investors was less than had been expected, there was a prospect of the Underwriters acquiring a significant portion of the shares that were the subject of the Placement (referred to as the “Placement Shares” in the pleading). The particulars to this paragraph refer to a number of telephone conversations between the participants in the Placement.

43 Paragraph 12 of the FASOC alleges that, shortly after 8.30 pm on 6 August 2015, ANZ accepted the Underwriters’ proposed allocations of Placement Shares in the course of a teleconference. This paragraph is admitted.

44 Paragraph 12A of the FASOC alleges that the document “ANZ Book Allocations v6.xslx” (which is the document referred to in these reasons as the Draft Allocation List) recorded the value of allocated shares to be $1,745,030,819, and recorded that shares worth $754,969,181 were not allocated. This paragraph is admitted.

45 Paragraph 12B alleges that, by email sent at 2.26 am on 7 August 2015, Mr Rick Moscati and Mr John Needham of ANZ were provided with a copy of a revised allocation list, which showed that the value of the unallocated shares had increased to $790,871,681. (This document is referred to in these reasons as the Final Allocation List.) This paragraph is admitted.

46 By paragraph 14, ASIC alleges that the Underwriters allocated to themselves and, on about 13 August 2015, acquired approximately 31% of the Placement Shares, or a total of 24,653,710 ANZ shares with a value of $763,032,324.50.

47 Paragraph 16 of the FASOC alleges that, prior to issuing the media release at 7.30 am on 7 August 2015, ANZ held information that:

(a) shares with a value between approximately $754 million and $790 million were to be acquired by the Underwriters (referred to in the pleading as the “Underwriter Acquisition”); and/or

(b) a significant proportion of the shares the subject of the Placement were to be acquired by the Underwriters.

48 Paragraph 17 alleges that the Underwriter Acquisition shares: amounted in number to about the equivalent volume of 3.77 to 3.95 days trading in ANZ shares on the ASX when compared with the Average Daily Trading Volume of ANZ over the preceding month; and amounted in value to about 0.85% to 0.89% of the issued share capital of ANZ.

49 Paragraphs 19-21 refer to the media release issued at about 7.30 am on 7 August 2015 (referred to in the pleading as the “Completion Announcement”) and state that it did not disclose the Underwriter Acquisition or the fact that the Underwriters were to acquire a significant proportion of the Placement Shares. Paragraph 22 alleges that ANZ did not disclose the Underwriter Acquisition, or that the Underwriters were to acquire a significant proportion of the Placement Shares, to the ASX by other means at any stage.

50 Paragraph 23 of the FASOC is an important paragraph. It states:

23. The information described in paragraph 21 above:

a. was not generally available to the market at the time (including to participants in the market for ANZ shares);

b. if disclosed, was information that a reasonable person would expect to have a material effect upon the price of ANZ shares (and, therefore, was information falling within rule 3.1 of the Market Listing Rules for the purposes of s 674(2)(b) of the Act);

c. was likely to influence investors in deciding whether to acquire and in deciding whether to dispose of ANZ shares for reasons including:

(i) the size of the Underwriter Acquisition (whether it was described in quantum, percentage terms or generally as “significant”); and

(ii) the expectation of both sophisticated and unsophisticated investors that the Underwriters would promptly dispose of the acquired Placement Shares and place downward pressure upon the ANZ share price;

with the result inter alia that:

(iii) potential purchasers of ANZ shares would likely refrain from purchasing shares in anticipation that the disposal of the Underwriter Shares would present an opportunity to purchase at a lower price; and/or

(iv) sophisticated traders of ANZ shares would likely engage in trading activities such as shorting the shares in anticipation of being able to purchase them at a lower price.

51 In the course of opening submissions, an issue emerged between the parties as to the way in which the above paragraph was to be read. In summary, ASIC indicated that it relied on sub-paragraphs (i) and (ii) of paragraph 23(c) in the alternative (as well as cumulatively). ANZ submitted that it was not open to ASIC to rely on sub-paragraphs (i) and (ii) in the alternative, having regard to the text of the pleading and correspondence exchanged between the parties before the hearing. I considered it appropriate to rule on this issue so that the parties had clarity as to the issues in dispute. I ruled that it was open to ASIC to rely on sub-paragraphs (i) and (ii) in the alternative (as well as cumulatively), for reasons given during the hearing.

52 Paragraphs 24 to 26 of the FASOC relate to the resumption of trading in ANZ shares. It is alleged that: the halt upon trading in ANZ shares was lifted prior to the commencement of trading on 7 August 2015; on 7 August 2015, ANZ shares opened at $29.99 before hitting an intraday low of $29.80 and closing at $30.14; and more than $1.1 billion of ANZ shares were traded on 7 August 2015.

53 By paragraphs 27 and 28, ASIC alleges:

27. In the identified facts and circumstances, ANZ was required to notify the ASX of the Underwriter Acquisition and/or that the Underwriters were to acquire a significant proportion of the Placement Shares on the night of 6 August 2015 or, alternatively, prior to the recommencement of trading in ANZ shares on 7 August 2015.

28. ANZ failed to comply with its continuous disclosure obligations under s.674(2) of the Act by:

(a) failing to notify the ASX that, of the $2.5 billion of ANZ shares offered in the Placement, shares with a value between approximately $754 million and $790 million were to be acquired by its underwriters rather than placed with investors;

(b) alternatively, by failing to notify the ASX that a significant proportion of the shares the subject of the Placement were to be acquired by the Underwriters.

I note that the information referred to in paragraph 28(a) above is referred to in these reasons as the Underwriter Acquisition Information, and the information in paragraph 28(b) is referred to in these reasons as the Significant Proportion Information.

54 By paragraph 29, ASIC pleads that the contravention arising from ANZ’s failure as alleged in paragraph 28 above: materially prejudiced the interests of purchasers or disposers of ANZ shares, including those persons who participated in the retail shareholder share purchase plan announced by ANZ on 6 August 2015; was serious and attended by aggravating circumstances as alleged in paragraph 29. It is not necessary to detail these for present purposes.

55 By paragraph 9A of its defence dated 27 June 2022 (the defence), ANZ alleges that, in relation to the Placement:

(a) applications at the price of $30.95 per share were received from institutional investors, being eligible investors under cl 1(e) of the Underwriting Agreement, for more than the full amount of the Placement Shares;

(b) ANZ was informed by the Underwriters of the matters set out in (a) above;

(c) the Underwriters recommended to ANZ that notwithstanding that applications were received from institutional investors for more than the full amount of the Placement Shares, having regard to the composition of the applications, the Underwriters should take up a portion of the Placement Shares by scaling-back the allocations to certain eligible investors below their applications;

(d) ANZ accepted the recommendation referred to in (c) above (the particulars refer to the conference call shortly after 8.30 pm on 6 August 2015);

(e) a substantial reason for the Underwriters recommending scaling-back the applications of certain investors was that investors such as hedge funds, if not scaled-back, might deal with their shares in such a way as to create a disorderly, or volatile, after-market for ANZ shares;

(f) ANZ was informed by the Underwriters of the matters set out in (e) above;

(g) prior to the commencement of trading in ANZ shares on 7 August 2015, the Underwriters had each indicated to ANZ their intention to promote an orderly after-market in ANZ shares and not to promptly dispose of any allocation of Placement Shares to them;

(h) each of the Underwriters was obliged by s 798H of the Corporations Act to comply with the ASIC Market Integrity Rules (ASX Market) 2010 (ASIC Market Integrity Rules); and

(i) the total shares ultimately allocated to the Underwriters represented:

(i) only approximately 3.4 days trading in ANZ shares based on the average daily trading volume of shares traded in the previous three months;

(ii) only approximately 0.9% of the issued share capital in ANZ, and around 0.27% of the issued share capital for JPM and Deutsche and around 0.37% for Citi; and

(iii) for each Underwriter only about one day of trading volume.

56 In the balance of the defence, ANZ refers back to paragraph 9A in its response to several of ASIC’s allegations.

57 In response to both paragraphs 21 and 22 of FASOC, ANZ admits that no disclosure was made at any material time in the terms alleged or of the specific information alleged, but says that disclosure of the information alleged without some or all of the context of the matters set out in paragraph 9A would have made any disclosure misleading or incomplete.

58 In response to paragraph 23 of the FASOC, ANZ pleads:

23. As to paragraph 23, it:

(a) admits the allegation in sub-paragraph (a) that the information described in paragraph 21(a) of the FASOC was not generally available;

(b) otherwise denies the allegations in sub-paragraph (a) and says further that the information described in paragraph 21(b) of the FASOC was generally available because it consists of deductions, conclusions or inferences made or drawn from:

(i) readily observable matter; and/or

(ii) information made known in a manner that would, or would be likely to, bring it to the attention of persons who commonly invest in securities of a kind whose price or value might be affected by the information, and where since that information was made known a reasonable period for it to be disseminated had elapsed;

(c) denies the allegations in sub-paragraphs (b) and (c), and says further or alternatively that any assessment of whether the information in paragraph 21 of the FASOC:

(i) was information that a reasonable person would expect to have a material effect on the price of ANZ shares; or

(ii) was likely to influence investors in deciding whether to acquire and in deciding whether to dispose of ANZ shares,

would need to have regard to the totality of relevant information or context, which includes some or all of the matters alleged in paragraph 9A above;

(d) denies that the “information” in paragraphs 16 and 21 of the FASOC was “information concerning it” within the meaning of ASX Listing Rule 3.1;

(e) otherwise denies the allegations in paragraph 23.

59 ANZ denies the allegations in paragraphs 27 and 28 of the FASOC (that is, the alleged breach of s 674(2) of the Corporations Act).

60 In relation to paragraph 29 of the FASOC, ANZ partially admits the factual allegations and otherwise denies the allegations.

61 By its reply dated 20 February 2023 (the reply), ASIC responds to aspects of paragraph 9A of the defence.

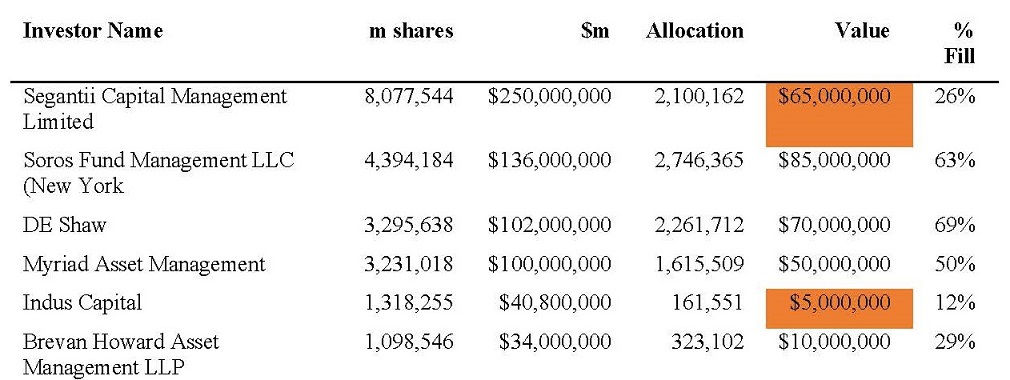

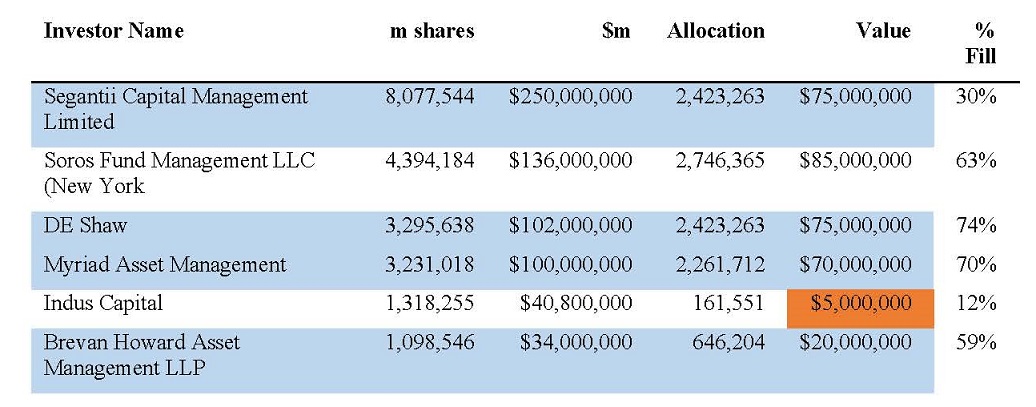

62 In response to paragraph 9A(a) of the defence, ASIC says that if, at some time in the course of the book-build, applications at a price of $30.95 per share were received from institutional investors for more than the full amount of the Placement Shares (which is not admitted), then some applications were amended by institutional investors at or prior to close of the book-build and in an amount sufficient (cumulatively) so that, at the close of the book-build, the applications then remaining were for less than the full amount of the Placement Shares. The particulars under this paragraph refer to amendments of applications by six specific investors. Those investors were:

(a) Segantii Capital Management Limited (Segantii);

(b) Soros Funds Management LLC (Soros);

(c) DE Shaw;

(d) Myriad Asset Management (Myriad);

(e) Indus Capital (Indus); and

(f) Brevan Howard Asset Management LLP (Brevan Howard).

63 The case was conducted on the basis that ASIC’s case in this regard was confined to these investors.

64 In response to paragraph 9A(e), ASIC says that, if the Underwriters recommended the allocation of Placement Shares to investors such as certain hedge funds at a level lower than the demand for Placement Shares recorded in respect of those investors in the documents entitled “ANZ Placement” or “ANZ Book Allocations VF” circulating between Underwriters and ANZ on 6 August 2015, they did so for the following substantial reasons:

(a) those hedge fund investors had either (i) amended their bids for Placement Shares with one or more of the Underwriters to that lower figure or amount; or (ii) indicated to one or more of the Underwriters that they did not want an allocation of Placement Shares higher than that lower figure or amount;

(b) having regard to (a), the Underwriters considered that those hedge fund investors’ real demand was for Placement Shares at or around the lower figure or amount proposed by Underwriters to be allocated to them;

(c) having regard to (a), there was a risk that those hedge fund investors would not sign and return confirmation letters in respect of allocations higher than the lower figure or amount.

65 In these reasons: all references to dates and times are to Australian Eastern Standard Time unless otherwise indicated; all references to “$” are to Australian dollars unless otherwise indicated; I use the expressions “Underwriters” and “Joint Lead Managers” interchangeably, generally adopting the expression used in the relevant document or other evidence; and I use the expressions “conference call” and “telephone conversation” interchangeably, generally adopting “telephone conversation” where there is a typed transcript, consistently with the label on the transcripts. To assist the parties’ consideration of these reasons, I have included some source references to documents.

66 It may be helpful to identify the key individuals relevant to the events described below. They are (including their positions at the time of these events):

(a) ANZ:

• Jill Craig, Group General Manager, Investor Relations

• Shayne Elliott, Chief Financial Officer

• Richard Moscati, Group Treasurer

• John Needham, Head of Capital and Secured Funding

• Mike Smith, Chief Executive Officer

(b) Citi:

• Jarrod Bakker, Head of Hedge Funds Sales

• Anthony Hanna, Associate, Capital Markets Origination

• Robert Jahrling, Head of Equity Capital Markets Syndication and Director

• Adam Lavis, Co-Head of Australian Equities

• John McLean, Head Of Capital Markets Origination

• Angus Richardson, Co-Head of Australian Equities

• Stephen Roberts, Chief Country Officer, Managing Director

• Itay Tuchman, Head of Markets

(c) Deutsche:

• Michael Ormaechea, Head of the Institutional Bank of CB&S

• Michael Richardson, Head of Equity Capital Markets

• Geoffrey Tarrant, Managing Director, Head of Financial Institutions Group

(d) JPM:

• Mark Dewar, Head of Equities Trading

• Harry Florin, Analyst, Equity Capital Markets

• Richard Galvin, Head of Equity Capital Markets

• Jeffrey Herbert-Smith, Managing Director, Head of Markets, Australia and New Zealand

• Richard Newton, Head of Australia New Zealand Syndicate

• Malcolm Price, Head of Sales

• Robert Priestley, Chief Executive Officer, JP Morgan, Australia and New Zealand ASEAN Region

67 On Tuesday, 4 August 2015, a meeting of the Board of Directors of ANZ took place. A copy of the minutes is in evidence. The topic, “Capital Raising Options” was discussed. The discussion included:

• APRA has set a 1 July 2016 [deadline] for implementation of the increased capital requirements for Australian residential mortgages; …

• Management believes a placement coupled with a share purchase plan (SPP) is likely to be a more cost effective capital raising method than a series of consecutive [underwritten] DRPs;

• a placement and SPP will require the release of a cleansing notice to the ASX and this option also carries with it an ongoing continuous disclosure obligation during the course of the SPP (ie. the usual carve-outs to the continuous disclosure obligation cannot be relied upon);

• it is believed the market conditions for a placement and SPP have improved recently and are favourable; …

68 It was resolved that:

A authority be delegated to the Chief Executive Officer and Chief Financial Officer (together, the Delegates) to take any action required under or in connection with the issuance of up to AUD3B of fully paid ordinary shares in the Company by way of an equity placement to institutional investors and a share purchase plan to eligible shareholders, including, without limitation, the determination of the timing of the offer and issue, the discount and price of the ordinary shares to be issued, any scaling of investors and any media releases and ASX announcements (the Placement and SPP).

B any two of the Chief Executive Officer, Chief Financial Officer, Group Treasurer, Chief Risk Officer and Group General Counsel under the Power of Attorney (General) dated 18 November 2002 are authorised to do all things necessary or desirable, in the opinion of the attorneys, under or in connection with the Placement and the SPP, including, without limitation:

(i) agreeing the terms of and executing the underwriting agreement and each other document (including media releases, announcements, notices, agreements and deeds) under or in connection with the Placement and the SPP on behalf of the Company;

(ii) approving any alteration, amendment or modification to any of the documents (including media releases, announcements, notices, agreements and deeds) prepared or entered into by the Company;

(iii) applying to ASX and NZX for a trading halt in respect of the ordinary shares in the Company (and securities of the Company and its subsidiaries that convert into ordinary shares) of up to 2 days with respect to the Placement and doing all things reasonably necessary to make application to ASX or NZX for the quotation of the new ordinary shares; and

(iv) approving the terms of the SPP and the form of the offer booklet to be sent to shareholders under the SPP,

and to do any other act or thing that they consider in their absolute discretion may be necessary or desirable in connection with the Placement and the SPP.

The Board expressly confirmed that the authority conferred on Management by the above resolutions would not be exercised unless Management is of the view at the relevant time that the decision to proceed with the placement and SPP is commercially preferable in the interests of ANZ having regard to cost, certainty of outcome, risk and the other factors discussed at the meeting.

69 On Wednesday, 5 August 2015, the closing price for ANZ shares was $32.58.

70 On the morning of Thursday, 6 August 2015, the Underwriters and ANZ entered into the Underwriting Agreement, which took the form of a letter from the Underwriters to ANZ, signed by each of the Underwriters, and accepted and agreed to by ANZ.

71 The Underwriting Agreement comprises 23 clauses and annexures A and B.

72 Clause 1(a) provided that the Underwriters would use their best endeavours to place the Placement Shares (defined as new fully paid ordinary shares in the capital of ANZ) with investors between 8.30 am and 6.00 pm on 6 August 2015 (referred to as the “Bookbuild Date”), with settlement of the Placement Shares expected to occur on 12 August 2015 (defined as the “Settlement Date”).

73 Clause 1(b) provided that the issue price of the Placement Shares would be determined by the Underwriters, and agreed with ANZ (referred to as the “Issuer”) via a book-build process and would be no less than $30.95 per Placement Share (referred to as the “Underwritten Floor”). I note that the underwritten floor of $30.95 price represents a discount of 5% to the closing price on 5 August 2015 ($32.58).

74 Clauses 1(c) and (d) stated:

(c) The Underwriters will conduct a bookbuild during the period commencing at the Bookbuild Opening Time (as defined in the Timetable) and ending at the Bookbuild Closing Time (as defined in the Timetable), to determine demand for Placement Shares from Applicants (as defined below) at various prices above the Underwritten Floor (the “Bookbuild”). For the avoidance of doubt, the Underwriters and their respective Affiliates may bid into the Bookbuild. In this Underwriting Agreement, “Affiliate” of any person means any other person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such person; “control” (including the terms “controlled by” and “under common control with”) means the possession, direct or indirect, of the power to direct or cause the direction of the management, policies or activities of a person, whether through the ownership of securities by contract or agency or otherwise and the term “person” is deemed to include a partnership.

(d) The number of Placement Shares to be allocated to each Applicant who lodges a bid in the Bookbuild will be determined by agreement between the Issuer and the Underwriters (each acting reasonably), after conclusion of the Bookbuild and advised to investors prior to the Settlement Date in accordance with the Timetable.

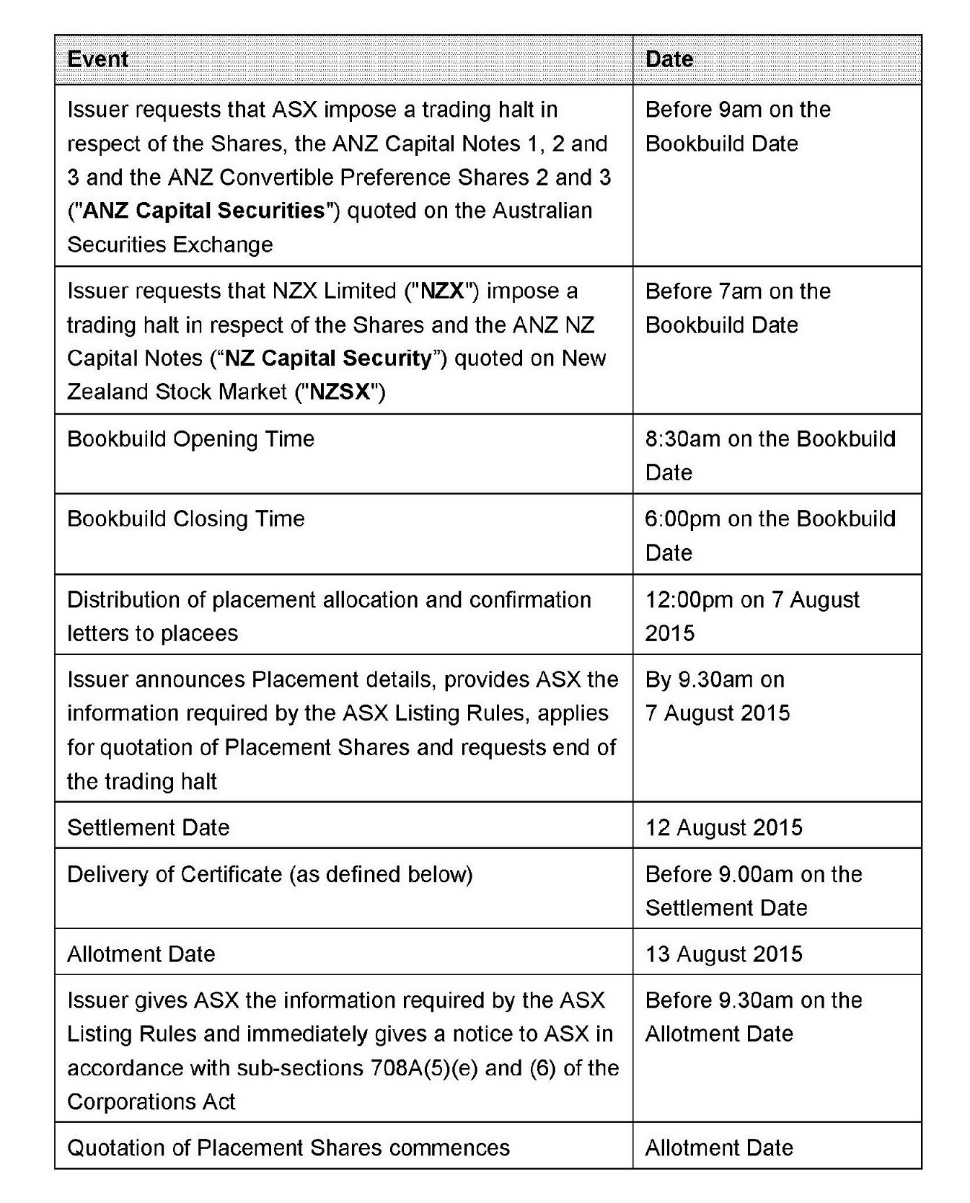

75 The timetable was set out in clause 1(h), which was as follows:

(h) The Issuer must conduct the Placement in accordance with the timetable set out below (the “Timetable”), the constitution of the Issuer (“Constitution”), the Corporations Act, the Listing Rules of ASX Limited (“ASX[”]) (“ASX Listing Rules”), other laws and regulations, and any other legally binding requirement of any governmental, semi-governmental or judicial entity or authority, including a stock exchange or a self-regulatory organisation established under statute (“Governmental Authority”).

The Timetable may be amended by agreement between the Issuer and the Underwriters (each acting reasonably) and to the extent required (if any) if ASX and NZSX provide their prior written consent.

76 Clause 2 set out conditions precedent.

77 Clause 3 dealt with settlement of Placement Shares and payment. Clause 3(c) referred to the situation where the aggregate number of Accepted Placement Shares (a defined expression) was less than the total number of Placement Shares offered. In such a case, the number of Placement Shares equal to the difference in those numbers was referred to as the “Shortfall Securities”. Clause 3(c) provided that the Underwriters would notify ANZ of the number of Shortfall Securities by 4.30 pm on the business day before the Settlement Date.

78 Clause 3(e) provided:

(e) No later than 3.00pm on the Settlement Date, each Underwriter must:

(i) subscribe, or procure subscriptions for, its Relevant Proportion (as defined below) of the Shortfall Securities; and

(ii) pay to the Issuer in cleared funds an amount equal to its Relevant Proportion of the Issue Price multiplied by the number of Placement Shares,

unless that Underwriter has terminated this Underwriting Agreement in accordance with its terms in which case the Allocation Interests shall be cancelled (unless one or more of the other Underwriters has assumed the obligations of the terminating Underwriter in accordance with clause 9.3). In this Underwriting Agreement, the “Relevant Proportion” of each Underwriter is:

(i) 40%% for Citi;

(ii) 30%% for JPM; and

(iii) 30%% for Deutsche.

79 Clause 7 dealt with announcements and provided as follows:

The Issuer and the Underwriters agree that neither they nor any of their related bodies corporate will make any release, statement or announcement or engage in publicity in relation to the Placement or take any action in relation to the Placement which would result in disclosure being required under any law or the ASX Listing Rules without the prior approval of the other party, which approval must not be unreasonably withheld, unless such release or announcement repeats or is an extract from a public statement or announcement which has previously been approved by the other parties, is required by law or the ASX Listing Rules and provided that in any case where such a release or announcement is required by law or the ASX Listing Rules:

(a) the party will use its reasonable endeavours to consult with the other party prior to making any such release or announcement; and

(b) the release or announcement, as the case may be, will comply with all applicable laws and the representations, warranties and undertakings of such party in this Underwriting Agreement.

Notwithstanding the foregoing, the Issuer will comply with its warranties in clauses 5.1(r) and 5.1(s) and each Underwriter will comply with its warranties in clauses 5.2(g) and 5.2(h) in respect of any public statement or announcement in relation to the Placement.

80 Clause 13 dealt with the relationship of the Underwriters. Clauses 13(a) and (b) provided:

(a) Unless otherwise expressly provided for in this Underwriting Agreement, all obligations and liabilities of the Underwriters under this Underwriting Agreement are several and not joint or joint and several.

(b) Each Underwriter holds and may exercise its rights, powers and benefits under this Underwriting Agreement individually. Where the consent or approval of the Underwriters is required under this Underwriting Agreement, that consent or approval must be obtained from each of the Underwriters.

81 Annexure B to the Underwriting Agreement comprised a form of Confirmation Letter, which was to be sent to investors who had been allocated shares in the Placement. The Confirmation Letter confirmed the investor’s agreement to acquire its allocation upon the terms of the letter and the Master ECM Terms dated 5 March 2015 (a copy of which is in evidence in this proceeding). The form of Confirmation Letter had a place for the price of the ANZ shares to be inserted, and a place for the following details of the investor’s allocation to be inserted: the price per share; the number of securities; and the total amount. Appendix 1 to the Confirmation Letter was a timetable. Appendix 2 to the Confirmation Letter was a form of confirmation of allocation. This form was to be signed by the investor and returned to the Underwriters to confirm the investor’s agreement to acquire the shares and pay the price for the allocation on the terms of the Confirmation Letter and the Master ECM Terms. Appendix 3 to the Confirmation Letter was a Confirmation of Allocation and Registration Details (or CARD) form, also to be completed by the investor and returned to the Underwriters.

The trading halt and announcement of the Placement

82 At 8.38 am on 6 August 2015, at the request of ANZ, the ASX announced a trading halt of ANZ’s shares and certain other securities. The evidence includes a letter from ANZ’s Company Secretary to the ASX dated 6 August 2015 requesting an immediate trading halt with respect to its ordinary shares, certain ANZ capital notes and certain ANZ convertible preference shares. The letter referred to ASX Listing Rule 17.1 and advised that:

• ANZ is seeking the trading halt pending the making of an announcement by ANZ to the market in relation to an ordinary share placement process involving institutional and sophisticated investors. The placement will commence today and is being conducted for the purpose of raising capital for general corporate purposes;

• ANZ wishes the trading halt to last until such time as it makes an announcement to the market concerning the outcome of the placement but, in any event, the trading halt will not last beyond the commencement of trading on Monday, 10 August 2015; and

• ANZ is not aware of any reason why the trading halt should not be granted.

83 At 8.44 am on 6 August 2015, ANZ issued a media release in relation to the Placement. This stated:

ANZ announces Institutional Placement (fully underwritten) and Share Purchase Plan to raise a total of $3 billion

ANZ today announced a fully underwritten institutional share placement to raise $2.5 billion. The Placement will be followed by an offer to ANZ’s eligible Australian and New Zealand shareholders who will have the opportunity to participate in a Share Purchase Plan (SPP) to raise around $500 million. The SPP is not underwritten.

The Institutional Placement and SPP will allow ANZ to more quickly and efficiently accommodate additional capital requirements recently announced by the Australian Prudential Regulation Authority (APRA), in particular the increase in average credit risk weights for major bank Australian mortgage portfolios to 25% taking effect from 1 July 2016.

Details of the Institutional Placement include:

• The Placement size is fixed at $2.5 billion and will not be increased.

• The final issue price will be determined through an accelerated book-build to be completed today in a price range up from $30.95 (underwritten floor price).

• The Placement has been fully underwritten by Citigroup Global Markets Australia Pty Limited, Deutsche Bank AG, Sydney Branch and J.P. Morgan Australia Limited.

ANZ’s shares have been placed in a trading halt with trading expected to resume at 10.00am on 7 August 2015.

ANZ Chief Financial Officer Shayne Elliott said “ANZ is currently well capitalised with a range of options available to increase capital in response to future regulatory changes.

“Recent announcements by APRA have provided greater certainty around the timing and quantum of capital changes, particularly in relation to Australian mortgages. Given current market conditions, APRA’s compressed implementation timetable for the mortgage risk weight changes and the amount of capital to be raised, we believe a Placement on these terms provides more certainty for shareholders than other methods available such as consecutive underwritten Dividend Reinvestment Plans.

“This capital raising will supplement our organic capital generation since June 2015 and allow ANZ to achieve a Common Equity Tier One (CET1) Capital Ratio above 9% following the introduction of APRA’s revised risk weightings next year. We expect that this will position our CET1 Capital Ratio in the top quartile of international banks on an internationally harmonised basis,” Mr Elliott said.

On a 30 June 2015 pro-forma basis, the placement would add approximately 65 basis points (bps) to ANZ’s CET1 Capital Ratio increasing it to 9.2%. If $500 million is raised under the SPP, on the same pro-forma basis this would add a further 13 bps increasing the CET1 Capital Ratio to 9.3%.

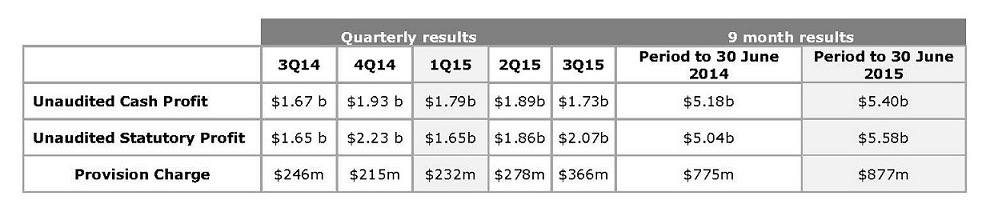

FINANCIAL PERFORMANCE FOR PERIOD NINE MONTHS TO 30 JUNE FY15

ANZ will release a scheduled Trading Update on 18 August. Ahead of that and to accompany today’s capital raising announcement ANZ advises the following financial results on an unaudited basis:

• For the nine month period to 30 June 2015, Cash Profit was $5.4 billion, an increase of 4.3% on the same period in 2014 ($5.18 billion). Profit before Provisions over the same period grew 5.1% (+3.4% on a constant Foreign Exchange (FX) basis).

• On a constant FX basis for the nine month period to 30 June 2015, revenue expense jaws were broadly neutral. Revenue for the three months to 30 June 2015 grew at a slightly faster rate than in the first half, while expense growth for the three month period slowed.

• The total provision charge for the nine month period to 30 June 2015 was 13% higher at $877 million. While the Individual Provision charge reduced 12.5%, the Collective Provision charge increased due to balance sheet growth coupled with some risk grade migration related to the resources and agriculture sectors. For the Full Year 2015, while loss rates are expected to remain well under the long term average, ANZ estimates that the total loss rate will be around 21 bps equating to a total provision charge of circa $1.2 billion given increased collective provisioning.

• Customer Deposits for the nine month period to 30 June 2015 grew 9.5% (+5% FX adjusted) with net loans and advances increasing 7.7% (+5.4% FX adjusted).

• During the third quarter (period 1 April to 30 June 2015) the Group Net Interest margin remained broadly stable assisted somewhat by slower growth in lower margin liquid asset holdings.

• The CET1 Capital Ratio was 8.6% at 30 June 2015.

SHARE PURCHASE PLAN

The SPP will provide eligible holders of ANZ ordinary shares at 7.00pm (AEST) on 5th August 2015 with the opportunity to subscribe for up to $15,000 worth of ANZ ordinary shares without incurring brokerage or other transaction costs. An SPP Offer Booklet containing further details of the SPP offer will be sent to all eligible shareholders.

It is expected that the offer price per share under the SPP will be the lesser of:

• the offer price under the Placement; and

• the volume weighted average price of fully paid ordinary ANZ shares traded on the ASX over the five trading days up to, and including, the last day of the SPP offer less a 2% discount.

ANZ reserves the right to accept oversubscriptions and may also scale back applications under the SPP. The SPP is not underwritten.

(Footnotes omitted.)

The book-build (Thursday, 6 August 2015)

84 The book-build commenced soon after ANZ’s media release of 8.44 am on 6 August 2015. The evidence includes an example of an email sent by one of the Joint Lead Managers (Citi) to an institutional investor (at 9.02 am on 6 August 2015) (CB tab 162). The subject line stated “NEW CITI DEAL – ANZ – A$2,500 million Primary Placement – BOOKS OPEN”. The email commenced with a detailed paragraph regarding the scope of distribution of the communication. It then stated:

By accepting this document, each recipient agrees to be bound by the terms of the Acknowledgements, Important Notice and Disclaimer at the end of this communication.

Australia and New Zealand Banking Group Limited (“ANZ”)

PLACEMENT OF NEW FULLY PAID ORDINARY SECURITIES

Joint Lead Managers, Bookrunners and Underwriters: Citigroup Global Markets Australia Pty Limited (“Citi”) Deutsche Bank AG, Sydney Branch (“Deutsche Bank”) J.P. Morgan Australia Limited (“J.P. Morgan”)

Issuer: Australia and New Zealand Banking Group Limited (“ANZ”)

Ticker: ANZ.AU (listed on ASX and NZX)

Securities Offered: New fully paid ordinary securities (“New Securities”)

Offering Structure: Fully underwritten institutional placement of New Securities (“Institutional Placement”).

In addition, ANZ will undertake a Security Purchase Plan (“SPP”) to provide eligible securityholders in Australia and New Zealand with the opportunity to participate in subscribing for up to a maximum of $15,000 of additional New Securities (subject to compliance with applicable regulatory requirements). The SPP will not be underwritten.

Ranking: New Securities will rank equally with existing securities on issue

Offering Size ($): A$2,500 million Institutional Placement. The Offering Size is fixed and will not be increased

Offering Size (Securities): 80.8 million New Securities for the Institutional Placement (2.9% of issued capital) at the underwritten floor price of A$30.95

Bids Accepted: In 10c increments from the underwritten floor price of A$30.95 up to market

Discount (at the underwritten floor): 5.0% discount to last close of A$32.58 (5-Aug-2015) 5.1% discount to 5-day VWAP of A$32.63 (5-Aug-2015)

Institutional Offering: * The New Securities to be offered and sold in the Institutional Placement may only be offered and sold as follows:

* Australia: The Securities may be offered to “sophisticated” and “professional” investors as those terms are defined in section 708 of the Corporations Act 2001(Cth)

* Rest of World: The Securities may be offered outside the United States to whom an offer can be lawfully made and in “offshore transactions” in compliance with Regulation S under the Securities Act

* United States: solely to (i) QIBs, pursuant to Rule 144A under the Securities Act, or (ii) Eligible U.S. Fund Managers, in reliance on Regulation S under the Securities Act.

Use of Proceeds: Proceeds will be used to supplement organic capital generation since June 2015 and allow ANZ to achieve a Common Equity Tier One (CET1) capital ratio above 9% following the introduction of APRA’s revised risk weightings next year

Issuer’s Information Materials: An ASX announcement regarding the Institutional Placement and SPP dated 6-Aug-2015 has been filed by the Issuer with the ASX. A cleansing notice which will be issued on or about the Allotment Date.

Timetable*:

Launch: Before market open, Thursday, 6-Aug-2015

Book Opens: On launch

Book Closes (Australia, NZ) 3.00pm, Thursday, 6-Aug-2015

Book Closes (International): 6.00pm, Thursday, 6-Aug-2015

Allocations Advised: Before market open, Friday, 7-Aug-2015

Trade Date (T): Friday, 7-Aug-2015

ANZ recommences trading on ASX: Friday, 7-Aug-2015

Settlement of New Securities (T+3): Wednesday, 12-Aug-2015

ASX quotation of New Securities (T+4): Thursday, 13-Aug-2015

*This timetable is indicative only and is subject to change without notice. All references to time are to Sydney, Australia time.

85 The email contained a section headed “Acknowledgements, Important notice and disclaimer” that included:

By bidding into the bookbuild, you confirm, and will be deemed to have represented, warranted, acknowledged and agreed upon submitting your bid (whether in writing or verbally) and, upon acquiring any New Securities, for the benefit of the Joint Lead Managers that:

…

(d) you are aware that your bid into the bookbuild is a binding and irrevocable offer to acquire the number of New Securities nominated by you (subject to final allocations in the discretion of the Joint Lead Managers) and is otherwise subject to the terms of the confirmation letter (“Confirmation”) that will be provided to you by the Joint Lead Managers;

…

(g) you are aware that the Master ECM Terms dated 5 March 2015 (available from the AFMA website) and which may be applied by, incorporated by reference into or amended or supplemented in the Confirmation which will be provided to you separately by the Joint Lead Managers govern your bid and your agreement to acquire the New Securities;

86 During his Section 19 Examination (in a passage relied on by ANZ), Mr Jahrling gave evidence about the book-build process. He said that in the vast majority of cases the processing would occur via the sales trader; once the sales trader receives a bid, they would enter it into a system referred to as TicketManager or Dealogic (being the same system, with different names); the information that would get logged was the name of the client, the name of the sales trader who entered the bid, the order size (in terms of dollar amount), any particular price sensitivity as it relates to the share price, and a contact for the investor. Mr Jahrling said that other people had access to the system, but in most instances the sales traders have responsibility for entering bids. He said it was possible that the sales traders may not have personally received the client bid, but they would act on instructions from someone else to enter the bid. I accept this evidence.

87 In oral evidence-in-chief, Mr Jahrling gave evidence about a reconciliation process took place between the Joint Lead Managers. He gave evidence that Dealogic is the system by which orders are entered into the book by each bank (that is, each of the Joint Lead Managers); those systems are not linked, but they are ultimately linked in that each bank sends their book to the other two “bookrunners”; in this way, all orders are captured, and all the banks have exactly the same information to enable the reconciliation process to take place. During cross-examination, Mr Jahrling gave evidence that if there was a discrepancy as to what an investor had bid, he would expect this to be recognised and addressed as part of the reconciliation process. I accept this evidence.

88 At 12.03 pm on 6 August 2015, Anthony Hanna (Citi) sent an email to Richard Moscati (ANZ) and John Needham (ANZ) attaching the “first bookbuild update” (CB tabs 151, 152). The email was copied to John McLean (Citi), Robert Jahrling (Citi), Michael Richardson (Deutsche), Richard Galvin (JPM) and Richard Newton (JPM). The spreadsheet attached to the email showed the level of demand at various prices (for ANZ shares), ranging from $30.95 per share (in the first column) to $32.25 per share (in the last column). In relation to the $30.95 price, the coverage was 46%. In relation to higher prices, the percentage coverage was lower.

89 Shortly after that email was sent, a conference call took place between the Underwriters and ANZ. It may be inferred from the calendar invitation for the call that Mr Moscati and Mr Needham of ANZ participated in the call. Mr Needham gave evidence in his affidavit (which I accept) that his general recollection is that during a call around this time the first book-build update was discussed, and that the discussion centred around which investors had already bid into the book, as well as which investors ANZ expected to bid into the book throughout the course of the day.

90 At 12.23 pm on 6 August 2015, Richard Moscati (ANZ) sent an email to Shayne Elliott (ANZ) and Jill Craig (ANZ) attaching the 12.03 pm spreadsheet. Mr Moscati’s email stated: “slow start, real money yet to show their hand”.

91 At 2.34 pm on 6 August 2015, Anthony Hanna (Citi) sent an email to Richard Moscati (ANZ) and John Needham (ANZ) attaching a “second bookbuild update” (CB tabs 182, 183). This email was copied to John McLean (Citi), Robert Jahrling (Citi), Michael Richardson (Deutsche), Richard Galvin (JPM), Richard Newton (JPM), Harry Florin (JPM) and Jessica Lin (Deutsche). The spreadsheet attached to this email was in the same format as the spreadsheet attached to the 12.03 pm email. For the price $30.95, this spreadsheet showed coverage of 81%.

92 Shortly after 2.34 pm, a conference call took place between the Underwriters and ANZ. It may be inferred from the calendar invitation that Mr Moscati and Mr Needham of ANZ participated in this call. Mr Needham gave evidence in his affidavit that it is possible that the notes on the page ending .0008 of his notebook relate to a call around this time. In any event, they relate to a call on the afternoon of 6 August 2015. The notes are as follows:

– Long only funds not there

– Demand

– Rewards for

– Retail

– ANZ Private

– Affiliates of JLMs

– Morgans

– BT Private

– Shaws

– Trading result – be down ~2%

– US

– Couple of big a/cs Hedge

–

– Wellington … Asian

93 In relation to the notes in his notebook generally, Mr Needham gave evidence in his affidavit (which I accept) that he took these notes during various calls and discussions; the notes generally record his impressions or general messages from those discussions rather than necessarily recording verbatim quotes of what was said. Mr Needham gave evidence during cross-examination (which I accept) that: he made the notes at the time of the calls; where he placed a person’s name or initials next to a particular text, he was attributing the content of the information to that person and the note reflected the substance of what they said; where he did not record a particular name or initials, the note reflects that someone said something to that effect. Mr Needham accepted that his contemporaneous notes were the best source of information he could provide as to what was said during the calls.

94 In relation to the notes set out at [92] above and specifically the reference to “Long only funds not there”, Mr Needham accepted during cross-examination that this reflected something that one of the Underwriters said during the call. Mr Needham also accepted that what he meant by “long only funds” in his note was investors who buy shares on the expectation of the share performing, and typically hold the shares for an extended period of time. Mr Needham gave evidence during cross-examination (which I accept) that the spreadsheet did contain some long-only funds, but the statement that long-only funds were not there was a general statement meaning a large number of them were not there. He accepted that there were far fewer than he had anticipated or expected. He accepted that, at this point in time, this was negative news.

95 Later during the afternoon of 6 August 2015, before the book-build closed at 6.00 pm, a further call took place between the Underwriters and ANZ. The ANZ representatives on the call were Shayne Elliott, Richard Moscati and John Needham. Mr Needham took notes of the call in his notebook (being the notes on the page ending .0009). His notes are as follows:

– Fix at bottom of floor

– Indicate price at lower end?

– Not going

– Revised down 3 – 3.5%

– Perp + UniSuper. BT. Not in.

→ 5% too far

1. $29.75 — $30

2. Banks own it.

– Books close to 100%

– Allocate $1.5 - $1.8 bn

– 92% Coverage

– Provisions spooked 3-4%

96 In relation to the note “Not going”, Mr Needham accepted during cross-examination that this was an incomplete note of a negative statement made by one of the Underwriter representatives. He accepted that it had the character of either “not going well” or “not really going” in the sense of not moving.

97 In relation to the reference to “Perp”, UniSuper and BT in the notes set out above, Mr Needham gave evidence during cross-examination (which I accept) that this referred to Perpetual, UniSuper and BT, which were very significant shareholders in ANZ. Mr Needham accepted that these were shareholders who, at the start of the day, he had hoped would participate, and hopefully strongly, in the Placement.

98 In relation to the lines beginning with “1” and “2” in the notes set out above, Mr Needham accepted during cross-examination that they were noted in this way because they were two options or two alternatives. He accepted that they were discussed with the Underwriter representatives on the call. He accepted that the first option referred to the prospect of repricing the Placement. In response to questions during cross-examination, Mr Needham said that he did not recall discussing how, practically, they would do this. He accepted that repricing the Placement would be very significant and that it would be negative news. In relation to the second option (“Banks own it”), Mr Needham accepted during cross-examination that the notion of what they would own related to the text a couple of lines further down, where he had written “Allocate $1.5 - $1.8bn”; the notion was that the banks (i.e. the Underwriters) would own the balance. Mr Needham accepted that, during this call, the second option presented to ANZ was for the banks to take between $700 million and $1 billion of shares.

99 Mr Needham gave evidence in his affidavit, which I accept, that: his recollection is that around this time (and potentially on this call) the Joint Lead Managers informed ANZ that the book was close to being fully covered; he also generally recalls that it was around this time that the Joint Lead Managers were recommending that, notwithstanding that the book was close to being fully covered, they would recommend only allocating shares to the value of $1.5 to $1.8 billion to those who had bid into the book.

100 Mr Needham also gave evidence in his affidavit that the Joint Lead Managers said that they made this recommendation because of the number and size of the hedge fund bids in the book, and because there was a risk that over-allocating to hedge funds could cause an unorderly after-market in ANZ shares following the Placement because of the risk of many of those hedge funds being short-term holders of the shares. I discuss later in these reasons whether I am satisfied that the Joint Lead Managers made statements to this effect.

101 Mr Needham gave evidence in his affidavit, which I accept, that: his understanding was that it was preferable for them to hold stock rather than over-allocating to hedge funds; this was because the Joint Lead Managers were large, well-capitalised financial institutions who were paid to take on risk under the Underwriting Agreement, and who had the ability to manage that risk such that they did not need to promptly dispose of any stock allocated to them or to dispose of it in a way that could affect the share price.

102 Subsequently during the afternoon of 6 August 2015, before the book-build closed at 6.00 pm, there was another call between the Underwriters and ANZ. Mr Needham participated and took notes in his notebook (being the notes at the top quarter of the page ending .0010). His notes are as follows:

95% – 99%

• Fid not in. Still here

• Blackrock may come small

103 During cross-examination, Mr Needham accepted that the reference to “Fid” was to the shareholder Fidelity Worldwide Investment, which was a very significant shareholder in ANZ. In relation to the note “Blackrock may come small”, Mr Needham accepted during cross-examination that this was a reference, compendiously, to the various Blackrock entities who were the most significant shareholder in ANZ in August 2015. Mr Needham accepted during cross-examination that these notes reflected news from the Underwriters that, for both of those names, there had been no bid yet, but there was a prospect that there may still be.

104 At 4.47 pm on 6 August 2015, Jill Craig sent an email to Richard Moscati and others at ANZ (copied to John Needham and others at ANZ) relating to a draft announcement to be made after completion of the Placement. Ms Craig’s email stated:

Given the current progress on the placement I’ve amended this and we can discuss. I think the more it is purely housekeeping the better

Can discuss further after your next call with the Under Writers

105 The draft announcement attached to the email was marked up to show changes to a previous draft that had been circulated. The attached draft (including the marked-up changes) was as follows:

ANZ successfully completes $[#] $[3] billion institutional equity placement

ANZ today announced it had successfully raised $[#] $[3] billion in new equity capital through the placement of [#] million ANZ ordinary shares at the price of $[#] per share. The placement was significantly oversubscribed, attracting support from a-wide range of institutional investors and consequently a scale back of bids was required.

Settlement is scheduled to take place on [#] 2015, with issue of the placement shares to occur on [#] 2015. The placement shares are scheduled to commence trading on ASX on [#] 2015. The new shares will rank equally with existing shares.

The trading halt that was implemented this morning is expected to be lifted at market open tomorrow morning.

As previously announced, ANZ also intends to offer retail shareholders the opportunity to purchase ordinary shares via a share purchase plan (SPP). The SPP will provide eligible ordinary shareholders with the opportunity, without incurring brokerage or other transaction costs, to subscribe for up to $15,000 worth of ANZ ordinary shares (subject to obtaining necessary relief from ASX). However, ANZ reserves the right to scale back applications under the SPP if total demand exceeds $[#] million. The SPP is open to eligible ordinary shareholders who were registered as holders of fully paid ordinary ANZ shares at 7.00pm (Melbourne time) on [#] 2015. Further details of the SPP will be provided to eligible shareholders in due course.

106 At 5.17 pm on 6 August 2016, a telephone conversation took place between Itay Tuchman (Citi) and Robert Jahrling (Citi). Mr Jahrling was in the United States at the time. A transcript of the conversation is in evidence (FSCB tab 16) (and not subject to any limited use ruling). Apart from some brief remarks at the beginning and end of the conversation, the conversation was as follows:

MR JAHRLING: Hey, um, look, I’m going to have to jump on a flight to Boston, right, at 6 o’clock here, um, 6am. And, um, and so I’m not going to be in this allocation room, right?

MR TUCHMAN: Okay.

MR JAHRLING: And I know obviously we’re going to struggle to get this deal over the line, right? I mean, not over the line, but by the time you have to scale and all the rest of it, it’s going to be a bit borderline, right? And we’re probably going to own some, right, the way it looks at the moment. Can I ask that we please don’t blow up all the hedge funds? Like, um, you know, we don’t show them any cornerstones and any of our deals. Um, you know, I just don’t want to land in Boston and 10 years of work has just been blown to pieces, right? I’m really worried about this, to be honest. So, you know, of course, I’m mindful of our own risk management, but, you know, these guys, they cannot take the numbers that are in that book, right? They’re not even going to be close to be able to take those numbers. And I’m really worried that if we just shove it down their throat, the implication it’s going to have for us, right?

MR TUCHMAN: Well, I mean, this is what I will say, Rob, because you’re in a rock and hard place, because if we take a multi-hundred dollar position and we lose 15 or $20 million on this endeavour, right, you’re going to blow up exactly what you’re going to blow up but worse. So –

MR JAHRLING: I don’t know, I don’t know.

MR TUCHMAN: Right. So we’re not making a choice between not blowing up some clients and – and – and you know, rainbows and – and – and sunshine, right? So the reason – you know, this is, this is my view, right? You guys put it in the book, right? I’m sensitive to what you have to say. Some of these guys are partners; some of these guys are not partners.

MR JAHRLING: Yeah.

MR TUCHMAN: But we’ve got to be smart and balance everything, but --

MR JAHRLING: Yeah.

MR TUCHMAN: -- you know, that’s why they put big numbers, because they – because they think they’re going to get scaled and they want their 50 million, right? And sometimes they get their 50 million; sometimes they get 80 or 90 million, right? Like, that’s, that’s the bit that we have to balance, right? We have to get the right number. And we’re trying hard, I think, to get a few more people on to the book at the last second to try to minimise any of that, right?

MR JAHRLING: Yeah, no, mate. Don’t worry, I’ve still got six guys to follow up, right? So I’m hustling away more than anyone, right. I get that, right? I’m, I’m not sitting here twiddling my thumbs, right, at 3 in the morning, so.

MR TUCHMAN: Yeah. Plus, plus we got these Deutsche and JP guys who, whatever we got, they got, and they’re going to try to jam it as, as hard as they can, too, right.

MR JAHRLING: Yeah, no, look, I understand. Right? It’s just, you know, like, tomorrow morning we wake up and we, you know, Syndicate (indistinct) and who does it go to? The same people who have shown us the back end of their backside today, right? And the guys that are taking it for us on every deal are the guys that, you know, then the swing factor the other way, right?

MR TUCHMAN: Absolutely.

MR JAHRLING: Up to the absolute hilt, right. So --

MR TUCHMAN: Absolutely.

MR JAHRLING: -- you know, that’s – that’s just not a great partnership, right? I mean, look, I get it, right. That’s the game, but, you know, it’s just got to be – I don’t know. Let’s just be however balanced we can be, right, because it’s always like, “Oh, well, they’re hedge funds, let’s fuck ‘em,” right. It just, just sits very – it’s just a very delicate balance, right.

MR TUCHMAN: I – I - listen, I agree, Rob. I’m not trying to say it isn’t. But, but, you know, these are not inexperienced market players, right? They, they, they understand the game they play, and hopefully the ones that are partners are going – I don’t think – listen, it’s a liquid stock, right. So the thing’s not going to drop (indistinct) tomorrow.

(Emphasis added.)

107 During his Section 19 Examination (in a passage relied on by ANZ), Mr Jahrling was asked what he meant by his question “Can I ask that we please don’t blow up all the hedge funds?” in the above transcript. He said that he drew a distinction between the allocable amount (i.e. the legally binding offer) and what you could allocate (being the amount that hedge funds and other were accustomed to receiving). He gave the following evidence, with reference to the above transcript:

So, therefore, in my opinion, what I reference here is that if the book were to close in half an hour, as was originally contemplated, and the state of the book, in order for Citigroup and the other JLMs to not ultimately own any shares and without seeing the state of the book but, as I referenced earlier, must have been somewhere near covered or just covered, would have required an allocation percentage – and again I draw the distinction between dollars and percentage – and would have required or would have most likely required an allocation percentage much greater than what they’re accustomed to.

So what I refer to here is that I think by allocating a far greater percentage of the demand to those funds, in my mind, ran the risk or would have run the risk that those funds … would have potentially received this as – that the deal may be struggling or that, you know, they’d been over-allocated to what they had potentially anticipated and therefore could have led to heightened volatility in the aftermarket.

I accept that the evidence set out in this paragraph (including the above passage) reflects Mr Jahrling’s views.

108 At 5.33 pm on 6 August 2015, a telephone conversation took place between Malcolm Price (JPM), Harry Florin (JPM) and Dave (his surname is not identified). A transcript is in evidence (FSCB tab 17) (and not subject to any limited use ruling). The conversation included:

MR PRICE: Hi, buddy. Can you just tell me where we are on coverage on this thing now, with a few of the London orders (indistinct).

MR FLORIN: Oh, I’m just putting Dave on. One sec.