FEDERAL COURT OF AUSTRALIA

Gill v Ethicon Sàrl (No 13) [2023] FCA 1131

ORDERS

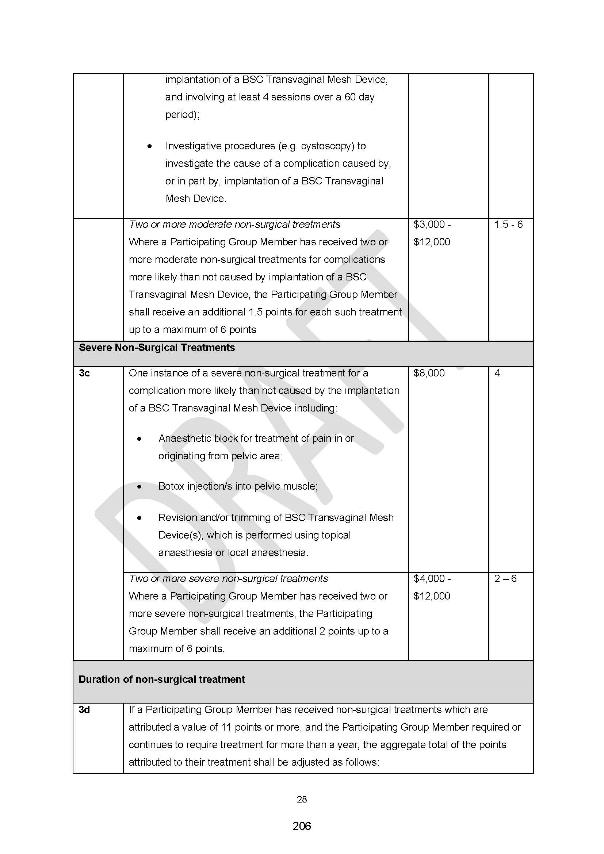

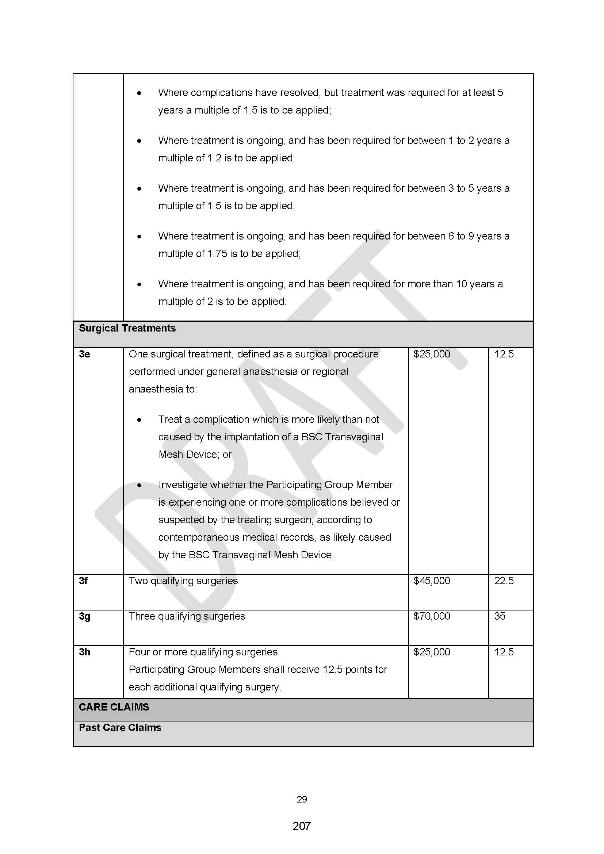

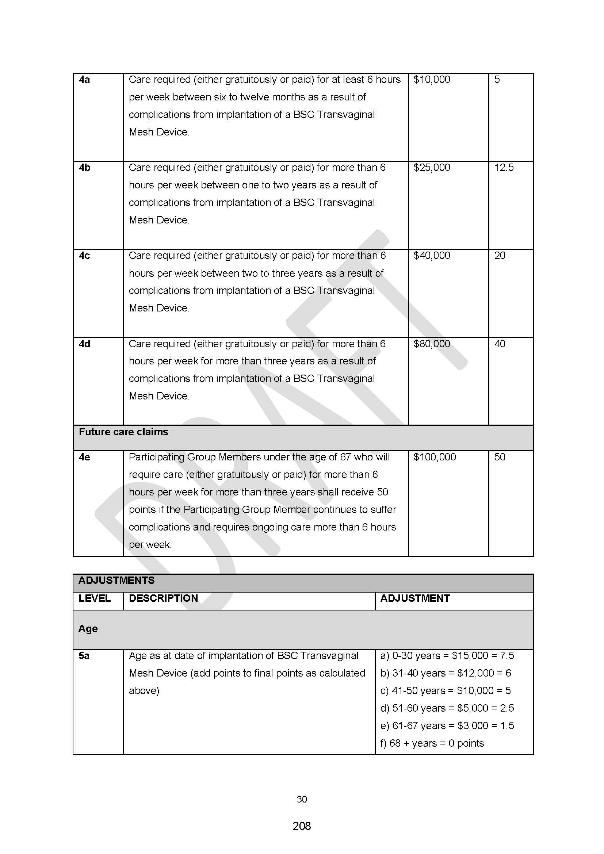

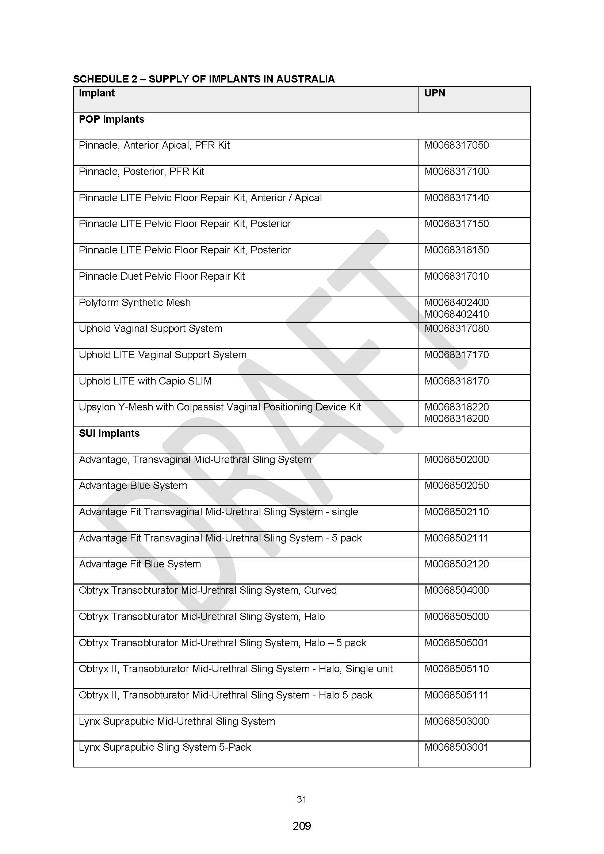

NSD 1590 of 2012 | ||

| ||

BETWEEN: | KATHRYN GILL First Applicant DIANE DAWSON Second Applicant ANN SANDERS Third Applicant | |

AND: | ETHICON SÀRL First Respondent ETHICON, INC. Second Respondent JOHNSON & JOHNSON MEDICAL PTY LIMITED (ACN 000 160 403) Third Respondent | |

NSD 310 of 2021 | ||

| ||

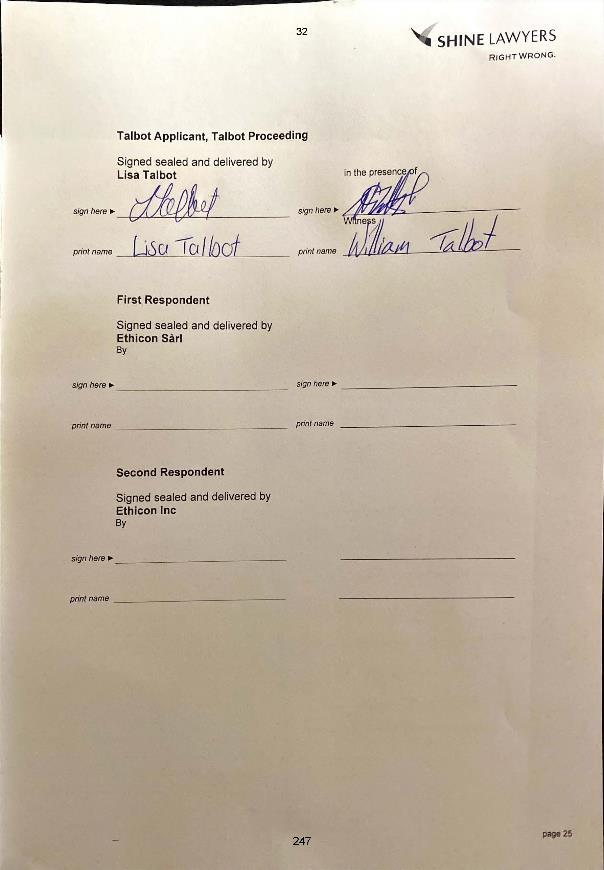

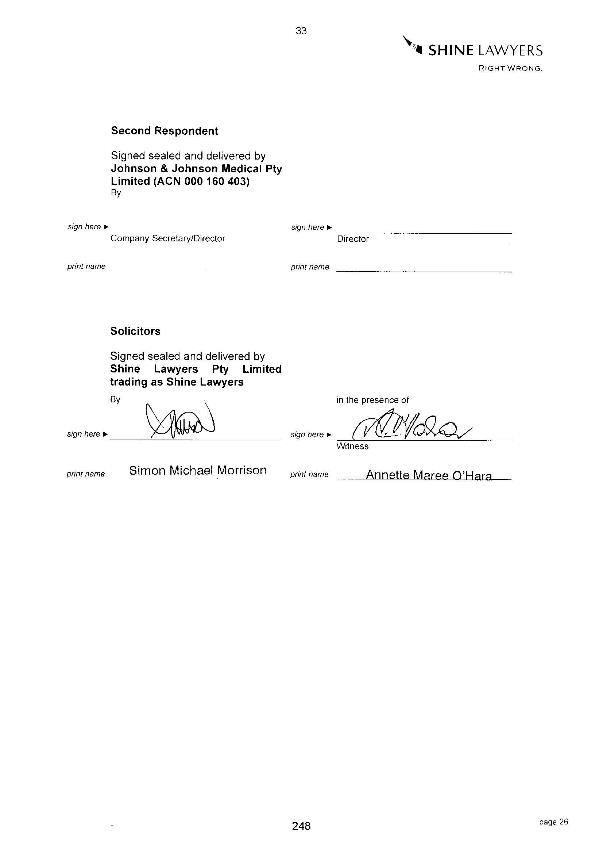

BETWEEN: | LISA TALBOT Applicant | |

AND: | ETHICON SÀRL First Respondent ETHICON, INC. Second Respondent JOHNSON & JOHNSON MEDICAL PTY LIMITED (ACN 000 160 403) Third Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

Adoption of the Referee’s Report

1. Pursuant to s 54A(3) of the Federal Court of Australia Act 1976 (Cth) (FCA Act), the Report of the Honourable J L B Allsop AC (referee), dated 8 September 2023, be adopted in full (Report).

Payment of the Referee’s and Counsel Assisting’s costs and disbursements

2. Pursuant to s 33V(2) of the FCA Act, the costs and disbursements of the referee and counsel assisting, Ms Aditi Rao, be deducted from the settlement fund.

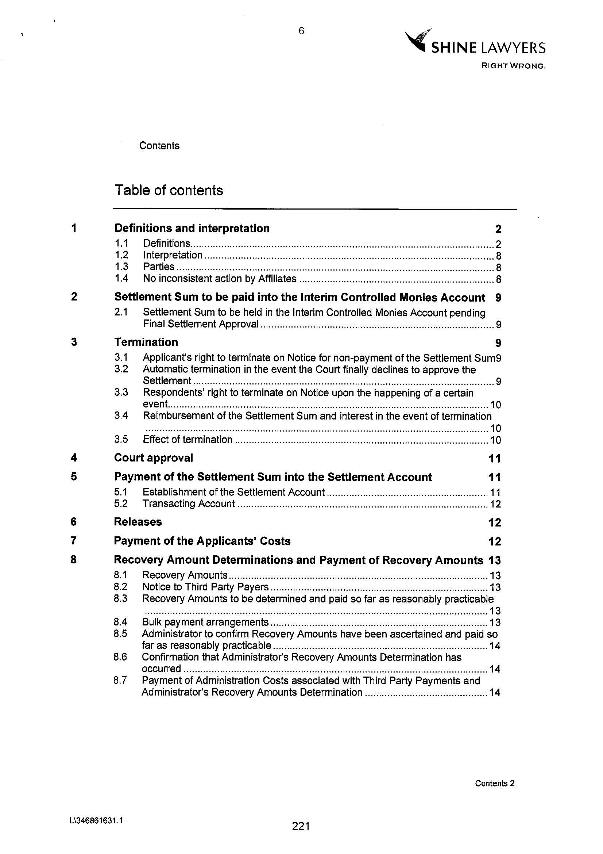

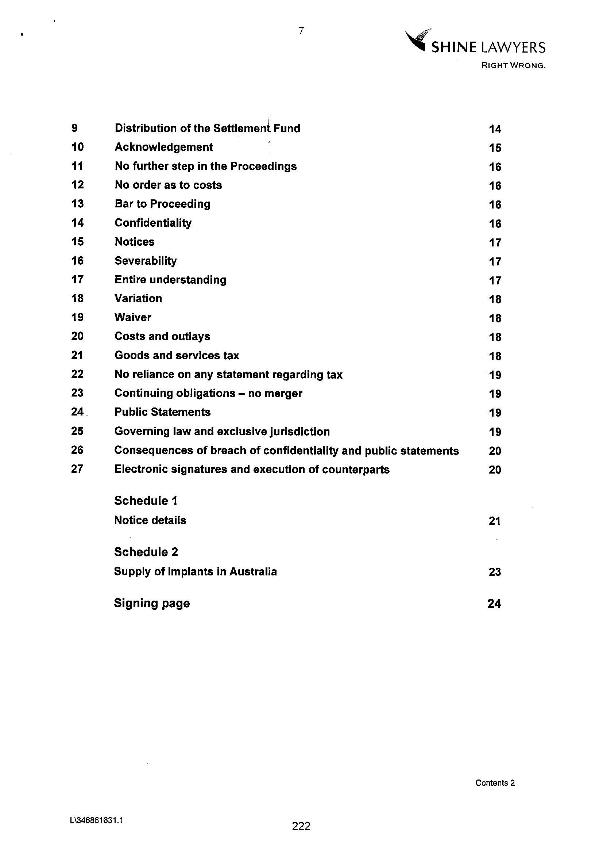

Settlement Distribution Scheme

3. Pursuant to s 33V(2) of the FCA Act, the amended settlement distribution scheme put forward by BDO, JGA Saddler and Slater and Gordon, a copy of which appears as Exhibit 3 to the Report (Settlement Distribution Scheme), be approved.

4. BDO, JGA Saddler and Slater and Gordon (Administrators) be appointed, jointly and severally, to administer the Settlement Distribution Scheme in accordance with its terms.

Data Transfer to Administrators

5. Within 14 days of the date of this Order, Shine Lawyers prepare a handover plan for the orderly handover of all hardcopy and electronic files required for the administration of the Settlement Distribution Scheme. The handover plan is to be provided to the Administrators and, if necessary, the Court.

6. Shine Lawyers deliver to the Administrators all documents required for the administration of the Settlement Distribution Scheme within a period of three months from the date of this Order. If Shine Lawyers is unable to effect a transfer of data within that time period, they immediately notify the Administrators and the Court and provide an updated time period in which the transfer can be completed.

7. Liberty be granted to Shine Lawyers to apply for a disbursement from the settlement fund in respect of the costs of and incidental to the collection, organisation and transfer of data by Shine Lawyers to the Administrators.

Costs

8. The time by which Mr Roland Matters (Costs Referee) is to provide his report to the Court in accordance with Orders 9 and 10 of the Orders dated 26 May 2023 (Costs Report) be extended to 18 September 2023.

9. Within 14 days of the Costs Referee providing the Costs Report to the Court, Shine Lawyers file and serve:

(a) an affidavit in relation to any costs and disbursements incurred after 27 May 2023 in respect of which an order pursuant to s 33V(2) of the FCA Act is sought; and

(b) written submissions, of not more than two pages, in support of approval of a disbursement from the settlement fund of any such costs.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ORDERS

Applicant | ||

AND: | First Respondent BOSTON SCIENTIFIC PTY LIMITED Second Respondent | |

order made by: | LEE J |

DATE OF ORDER: | 21 SEPTEMBER 2023 |

THE COURT ORDERS THAT:

Adoption of the Referee’s Report

1. Pursuant to s 54A(3) of the Federal Court of Australia Act 1976 (Cth) (FCA Act), the Report of the Honourable J L B Allsop AC (referee), dated 8 September 2023, be adopted in whole (Report).

Payment of the Scheme Referee’s and Counsel Assisting’s costs and disbursements

2. Pursuant to s 33V(2) of the FCA Act, the costs and disbursements of the referee and counsel assisting, Ms Aditi Rao, be deducted from the settlement fund.

Settlement Distribution Scheme

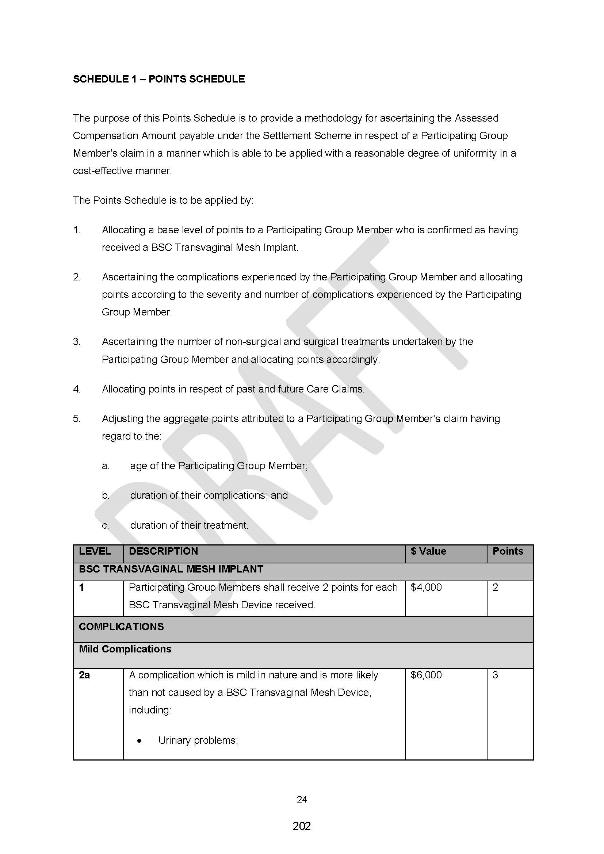

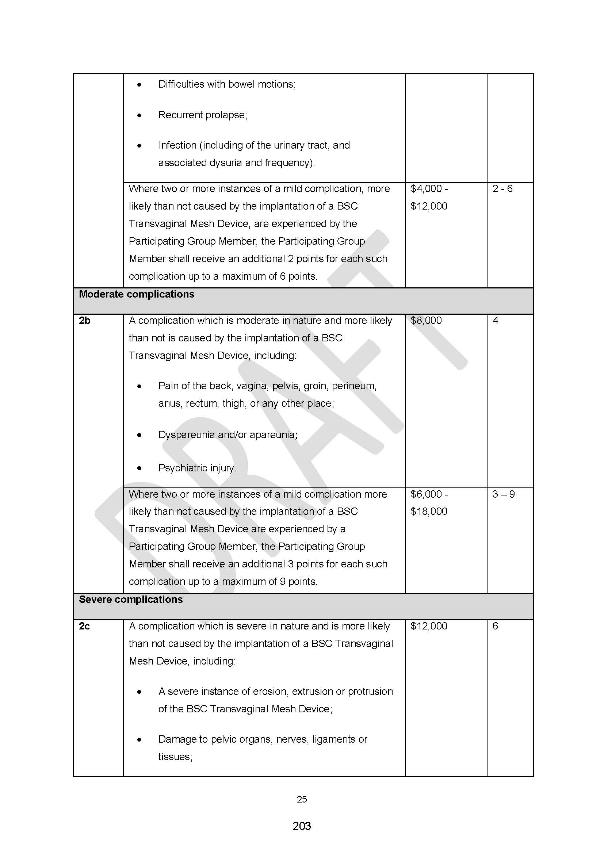

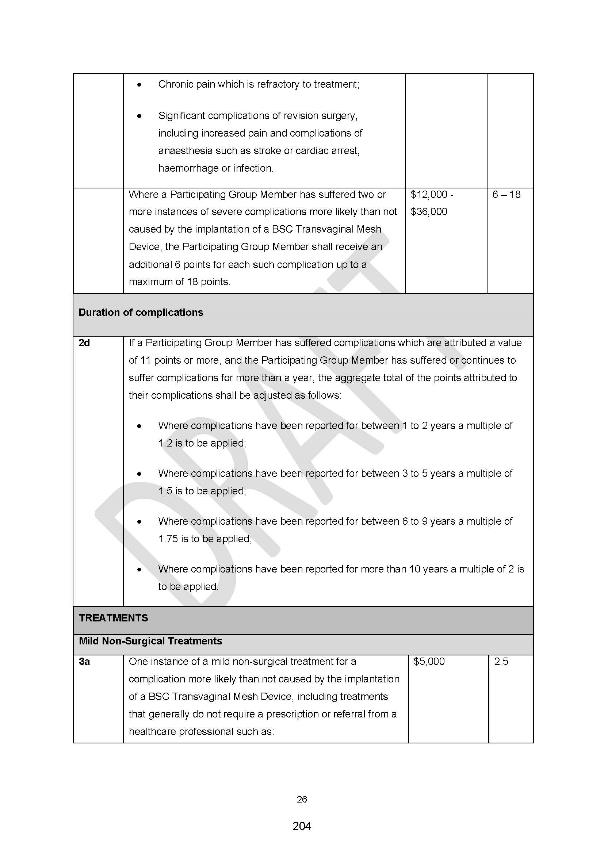

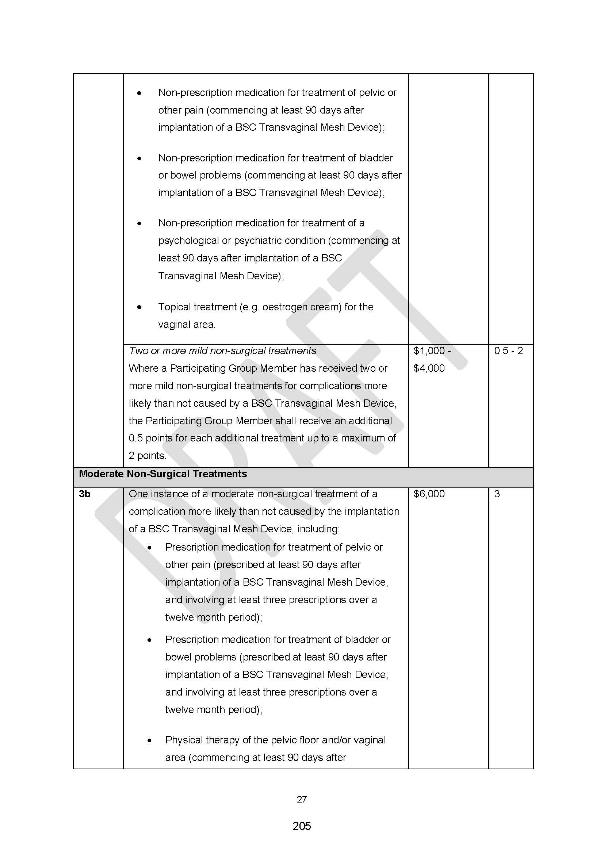

3. Pursuant to s 33V(2) of the FCA Act, the amended settlement distribution scheme put forward by BDO, JGA Saddler and Slater and Gordon, a copy of which appears as Exhibit 3 to the Report (Settlement Distribution Scheme), be approved.

4. BDO, JGA Saddler and Slater and Gordon (Administrators) be appointed, jointly and severally, to administer the Settlement Distribution Scheme in accordance with its terms.

Data Transfer to Administrators

5. Within 14 days of the date of this Order, Shine Lawyers prepare a handover plan for the orderly handover of all hardcopy and electronic files required for the administration of the Settlement Distribution Scheme. The handover plan is to be provided to the Administrators.

6. Shine Lawyers deliver to the Administrators all documents required for the administration of the Settlement Distribution Scheme within a period of three months from the date of this order. If Shine Lawyers is unable to effect a transfer of data within that time period, they immediately notify the Administrators and the Court and provide an updated time period in which the transfer can be completed.

7. Liberty be granted to Shine Lawyers to apply for a disbursement from the settlement fund in respect of the costs of and incidental to the collection, organisation, and transfer of data by Shine Lawyers to the Administrators.

Costs

8. The time by which Mr Roland Matters (Costs Referee) is to provide his report to the Court in accordance with the Orders dated 4 July 2023 (Costs Report) be extended to 2 October 2023.

9. Within 14 days of the Costs Referee providing the Costs Report to the Court, Shine Lawyers file and serve:

(a) an affidavit in relation to any costs and disbursements incurred after 27 May 2023 in respect of which an order pursuant to s 33V(2) of the FCA Act is sought; and

(b) written submissions, of not more than two pages, in support of approval of a disbursement from the settlement fund of any such costs.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(Delivered ex tempore, revised from the transcript)

LEE J:

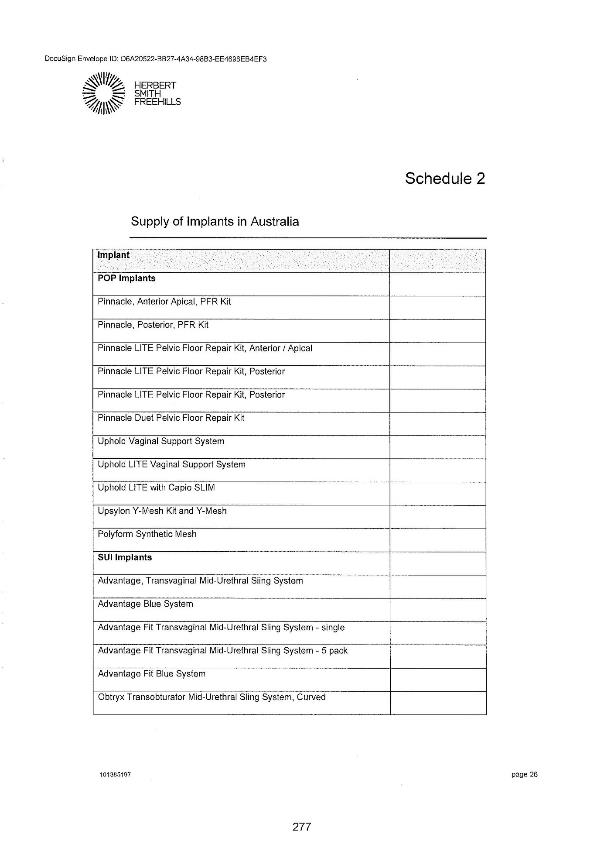

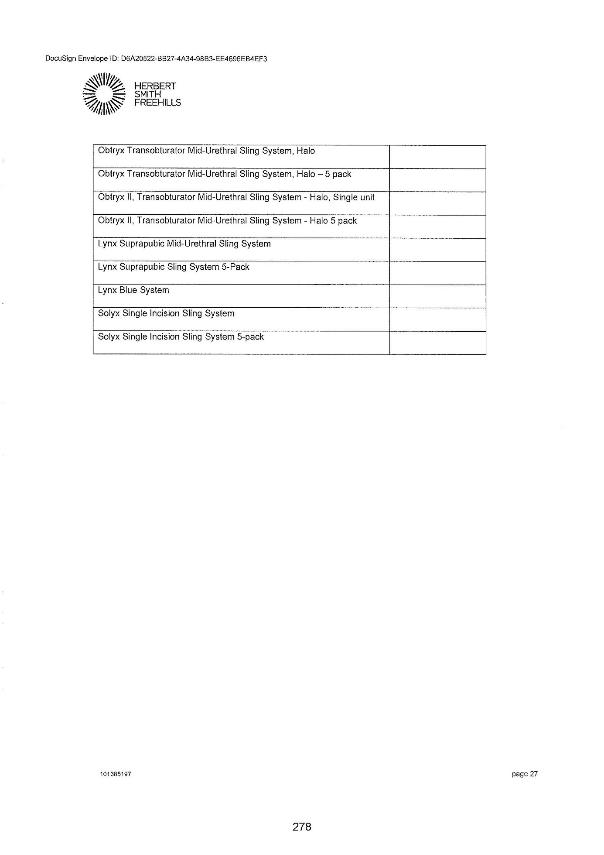

1 This judgment marks the end of a long trek towards the resolution of three open class representative proceedings, commenced against the manufacturers and suppliers of pelvic “mesh” implants.

2 I have explained the background to the proceedings and the reasons for the Court’s approval of their proposed settlement (subject to making orders as to just distributions pursuant to s 33V(2) of the Federal Court of Australia Act 1976 (Cth)) in detail in a number of earlier judgments: see, in particular, Gill v Ethicon Sàrl (No 10) [2023] FCA 228 and Fowkes v Boston Scientific Corporation [2023] FCA 230.

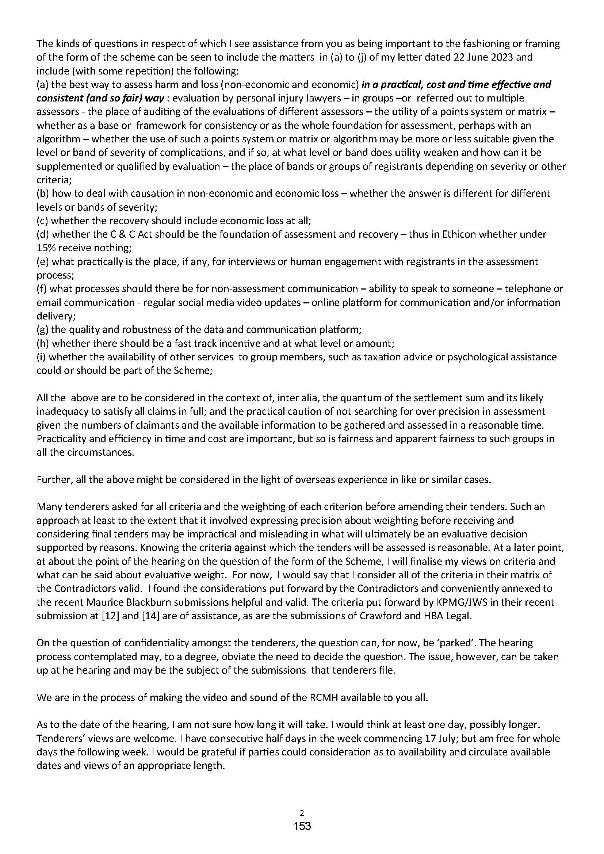

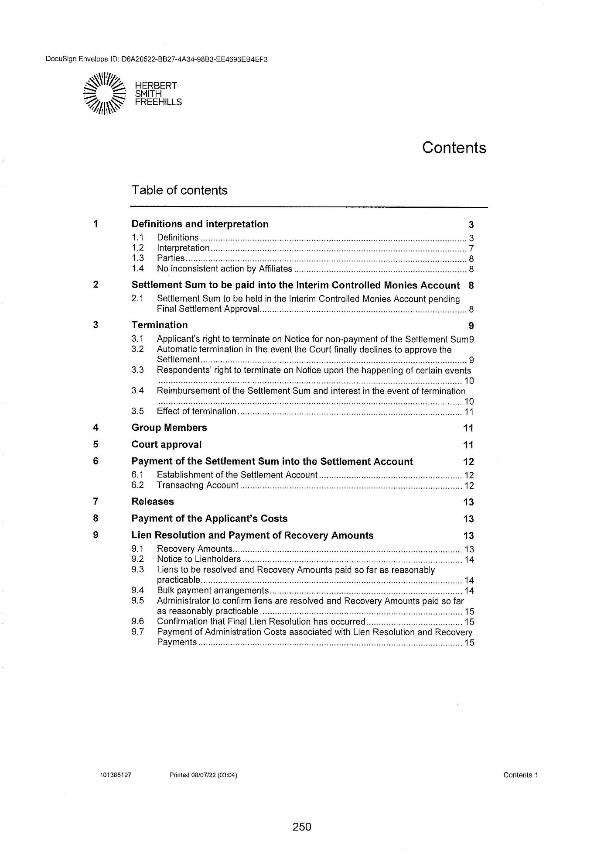

3 In May and June this year, I made orders in Gill v Ethicon Sàrl (NSD 1590 of 2012) and Talbot v Ethicon Sàrl (NSD 310 of 2021) (Ethicon Proceedings) and Fowkes v Boston Scientific Corporation (NSD 244 of 2021) (Boston Proceeding), appointing the Honourable J L B Allsop AC as a referee to consider the following questions:

(1) in relation to the Ethicon Proceedings: first “[w]hich of the settlement distribution schemes, identified in the Affidavit of Robert Ishak sworn 11 February 2023 and as updated or amended as permitted by the Scheme Referee … is most likely to result in the distribution of the Settlement Sum in a manner which is fair and reasonable and in the interests of Group Members as a whole?”; and secondly “[w]hich tenderer should be appointed to administer the Proposed Settlement Distribution Scheme identified in answer to Question 1?”; and

(2) in relation to the Boston Proceeding: first [w]hat form of settlement distribution is most likely to result in the distribution of the settlement sum in a manner which is fair and reasonable and in the interests of group members as a whole?”; and secondly “[w]ho should be appointed to administer the proposed settlement distribution scheme identified in the answer to Question 1?”

4 My rationale for appointing a referee to conduct a competitive tender process is set out in Gill v Ethicon Sàrl (No 11) [2023] FCA 229. In brief, there is no principled nor practical reason to assume, as has become common practice, that solicitors for applicants in representative proceedings should become scheme administrators by default: Lifeplan Australia Friendly Society Limited v S&P Global Inc (Formerly McGraw- Hill Financial, Inc) (A Company Incorporated in New York) [2018] FCA 379 (at [52]–[54]) per Lee J; Australian Law Reform Commission, Integrity, Fairness and Efficiency—An Inquiry into Class Action Proceedings and Third-Party Litigation Funders (Report 134, December 2018) (at [5.35]–[5.39]). The decision as to the appointment of a scheme administrator should be guided by the dictates of the overarching purpose (in requiring the discretion as to appointment to be exercised in such a way as to facilitate the just, efficient and cost-effective distribution of a settlement sum) and the protective role the Court has towards group members. It follows the principled exercise of the discretion of appointment requires more than uncritically providing a rubber stamp to a proposal made by the applicant’s solicitors.

5 The Court has now received a copy of the report prepared by the referee (Report), and the proceedings have come before me today for the making of orders relating to the Report.

6 The reference with which we are presently concerned has some unusual features. It did not involve the referee inquiring into and reporting as to a fact or facts in issue in the proceedings. Rather, consistently with the principle referred to above, it was considered the best mechanism by which the Court, in the exercise of its protective and supervisory role, could ensure the settlement distribution would be carried out in the most efficient, cost-effective, and fair way.

7 The approach of putting in place a reference has real advantages. The detailed consideration of what amount to competing commercial tenders is a difficult task for the Court to undertake in the context of a traditional hearing. Ranking such proposals is an unorthodox (albeit licit) exercise of judicial power.

8 It is not necessary for the purposes of this judgment to detail the principles that apply to the adoption of a report prepared by a referee. The discretion to adopt, vary or reject a referee’s report is to be exercised in a manner consistent with the object and purpose of the process and the wider setting in which the reference takes place: VoR Environmental Australia Proprietary Limited v Taset Inc. (No 2) [2019] FCA 1094; (2019) 385 ALR 312 (at 320–321 [29] per Lee J).

9 Where a report demonstrates a thorough and analytical approach to the assessment of the subject matter of the reference, the Court should, absent any indication to the contrary, tend towards acceptance of the report. To do otherwise would be to negate the whole purpose and facility of referring issues. There is no reason to depart from this usual approach in the present circumstances. The Report is, if I may say so with respect, a thoughtful and comprehensive document which demonstrates the care which has been taken by the referee and counsel assisting, Ms Aditi Rao. I adopt it in full.

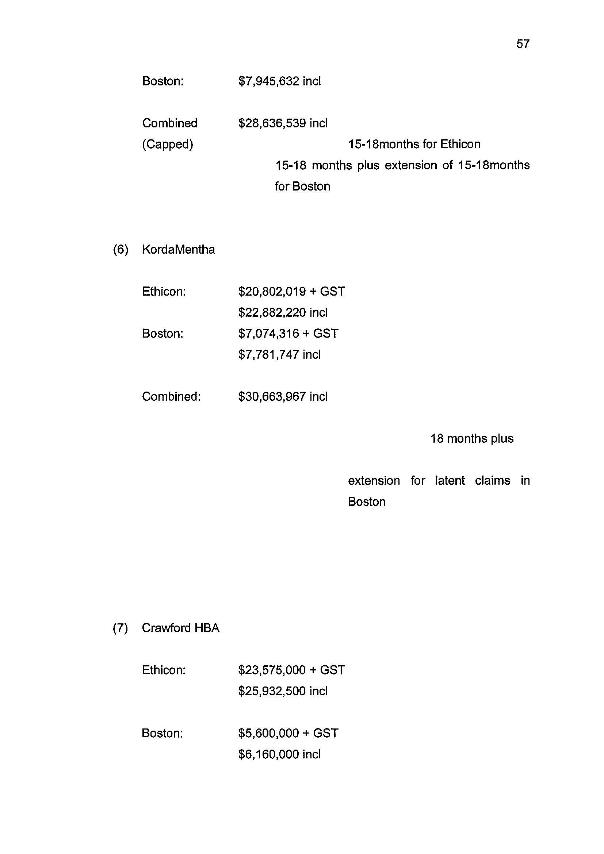

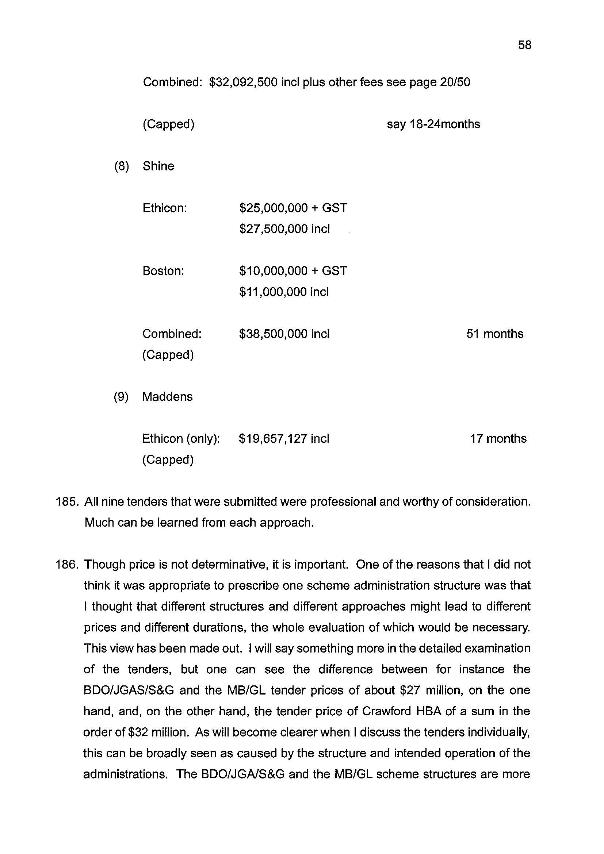

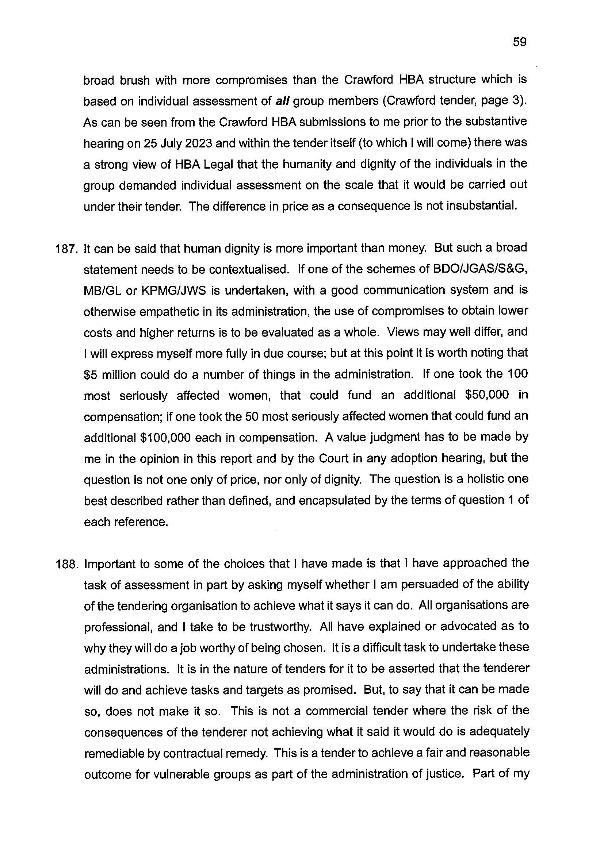

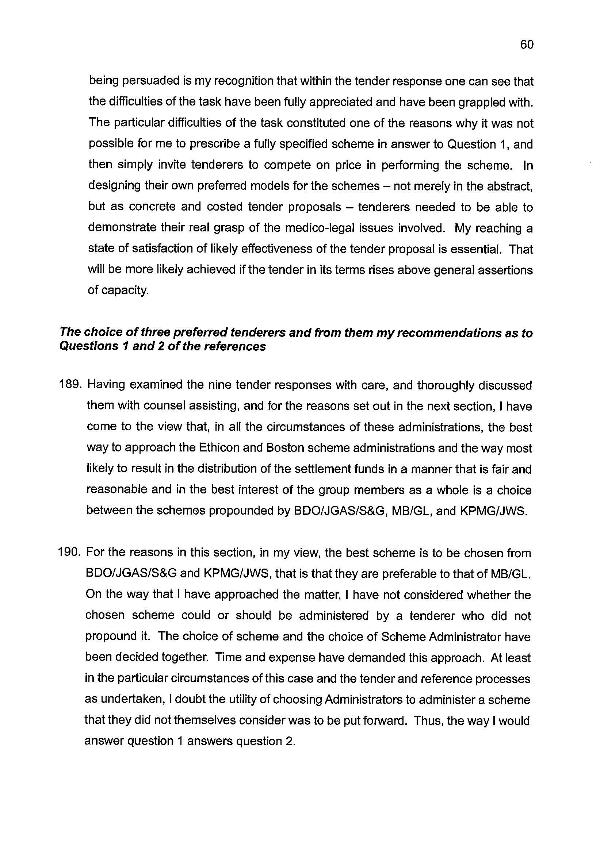

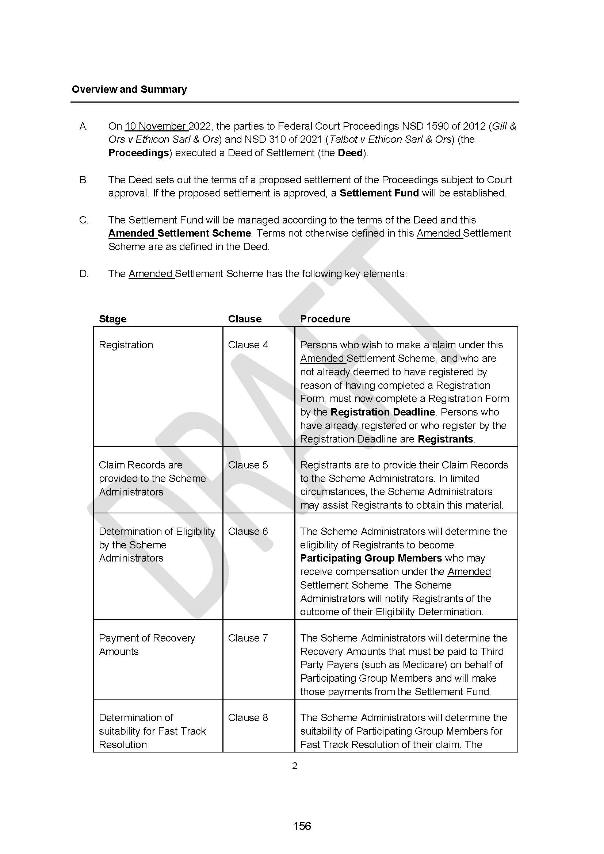

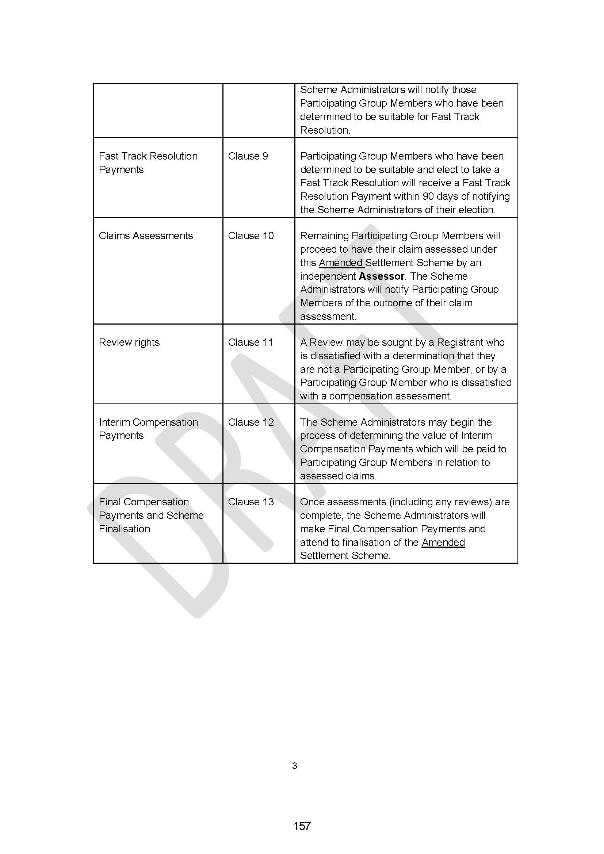

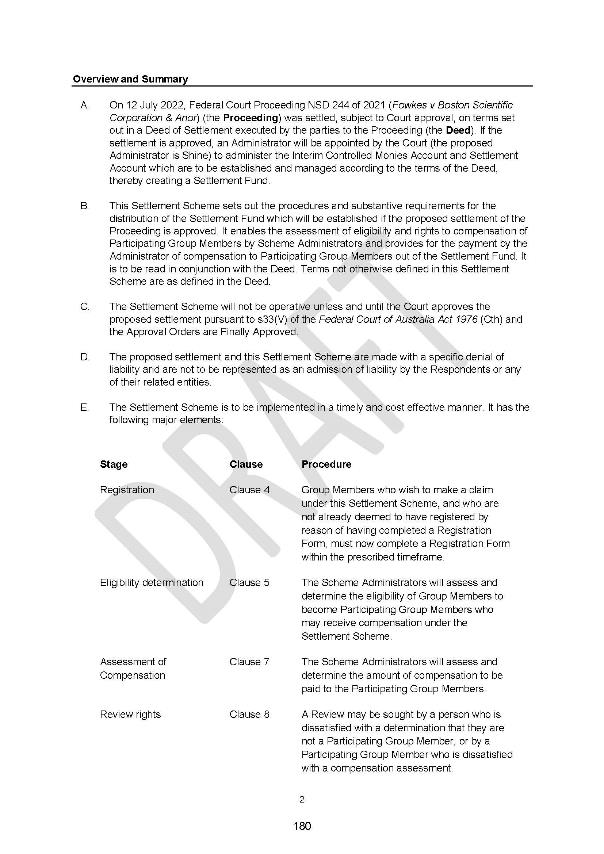

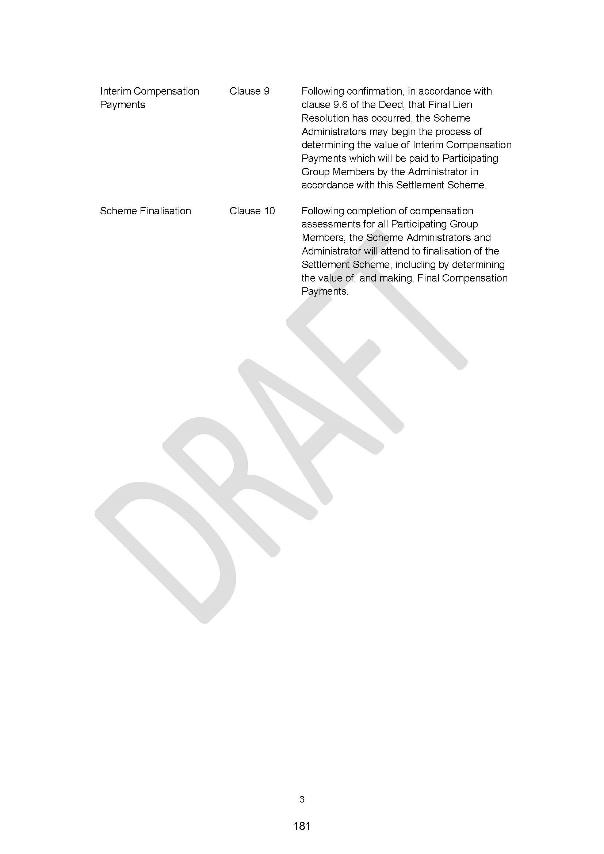

10 I propose to take the unusual course of appending as an annexure to this judgment the entirety of the Report. I do so for the benefit of group members, who will be able to read it and reflect upon the detailed evaluative process which led to the identification of three preferred tenderers and the ultimate recommendation that the settlement scheme proposed by BDO, JGA Saddler and Slater and Gordon be accepted.

11 As can be seen from the Report, this conclusion was a close-run thing. Put bluntly, the preferred tenderer won by a short half-head. Dr Cashman, who appeared today for the tenderer which could colloquially be described as the silver medallist, took me to various aspects of the Report in an effort to demonstrate it would be reasonable to form the view that his clients should have been preferred. The points made by Dr Cashman were sensible and succinctly expressed. But he frankly recognised during the course of his submissions the meticulousness of the process undertaken and the fact the conclusion reached by the referee was available on the material. I think I can say with some confidence that the referee did not misapprehend his function; nor did he clearly fall into error. As such, when one has regard to the well-established authorities, Dr Cashman did not put forward a proper legal basis upon which to reject all or part of the Report.

12 A further benefit of publishing the Report in full is that class action practitioners can absorb the important observations and incidental remarks set out in Part 3, in particular, the section entitled, “The Lessons from the Reference Process”. I am confident the approach taken in relation to these proceedings can be replicated in the future, particularly in class actions involving disparate individual circumstances and thus requiring fine judgments to be made by an administrator as to the proper proportional distribution of a large settlement fund to individual group members.

13 I will conclude by noting that both the cost and efficiency of the settlement process now put in place has great advantages over that proposed when the settlement was first struck. I am satisfied the settlement distribution will now proceed more efficiently and cost-effectively than if I had uncritically accepted the initial proposals put to me.

14 Finally, I wish to thank those who participated in the tender process. As is evident from the Report, all parties engaged with the process in a highly constructive way, and the success of the exercise in these proceedings bodes well for cases to come.

I certify that the preceding fourteen (14) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Lee. |

Associate:

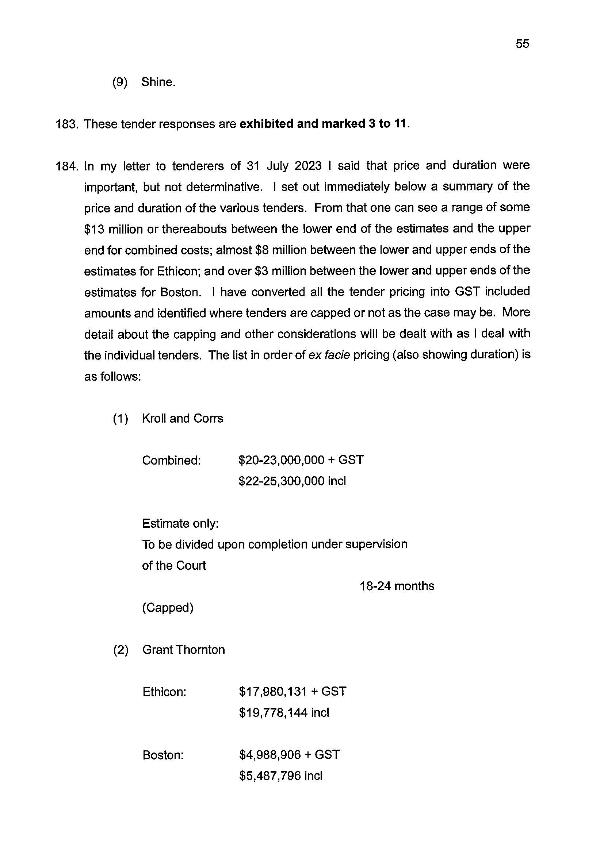

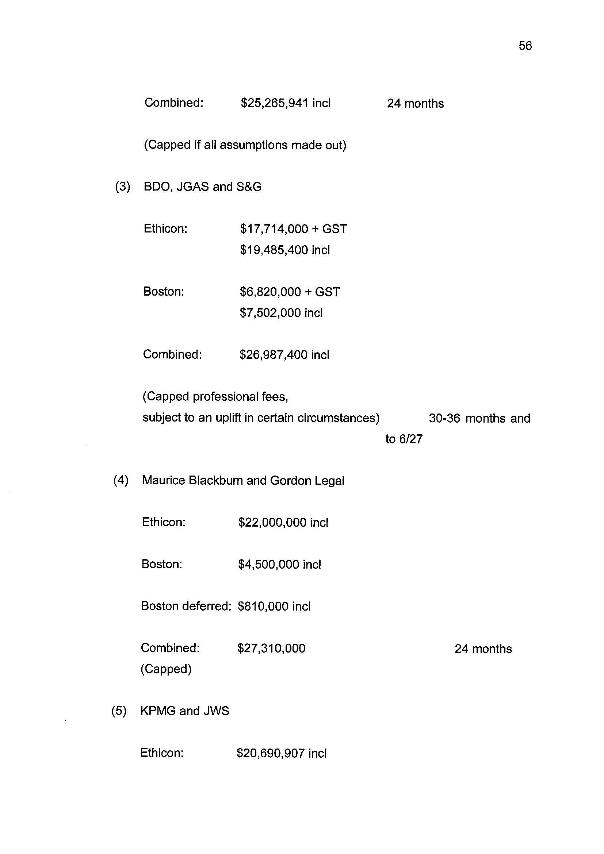

ANNEXURE