Federal Court of Australia

Impiombato v BHP Group Limited (No 3) [2023] FCA 1104

ORDERS

First Applicant KLEMWEB NOMINEES PTY LTD (AS TRUSTEE FOR THE KLEMWEB SUPERANNUATION FUND) Second Applicant | ||

AND: | BHP GROUP LIMITED (ACN 004 028 077) Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The applicants have leave to amend their interlocutory application dated 5 July 2023 to the form of the further amended interlocutory application annexed as “CM-2” to the affidavit of Cameron Myers sworn 4 September 2023.

2. The interlocutory application be treated as so amended.

3. The applicants file the further amended interlocutory application as soon as reasonably practicable.

4. The respondent (BHP Ltd) give non-standard discovery pursuant to r 20.15 of the Federal Court Rules 2011 (the Rules) of:

(a) all documents disclosed by the defendants in Municipio de Mariana & Others v BHP Group (UK) Ltd (formerly BHP Group plc) & BHP Group Limited (HT-2022-000304) (the UK Proceeding) at or about the same time as disclosure is made in the UK Proceeding;

(b) all documents in its control that fall in the categories set out in the Annexure to these orders, by making reasonable searches as described in r 20.14(1)(b) and (3) of the Rules, such discovery to be made by a date (or in tranches by dates) agreed between the parties (alternatively, by further order).

5. Discovery is to be provided electronically in accordance with the electronic discovery protocol agreed between the parties.

6. Without limiting paragraph 4, if and to the extent that BHP Ltd identifies that any of the documents responsive to category 16(a) in the Annexure are not in its control, but which BHP Ltd reasonably believes are or may be within the control of Samarco Mineração S.A Brazil (Samarco), BHP Ltd:

(a) Within 28 days, take all reasonable steps available to it to obtain such documents from Samarco, including by the exercise of any rights under the Samarco Shareholders Agreement to request or access information;

(b) Within 2 weeks following receipt of documents, provide discovery to the applicants of all such documents obtained from Samarco;

(c) Within 4 weeks following discovery in accordance with paragraph (b) above, or, if no documents are received from Samarco, within 4 weeks of receiving a response from Samarco, file and serve an affidavit by a responsible officer of BHP Ltd with knowledge of what steps BHP Ltd has taken to obtain the documents from Samarco, deposing to the steps made by BHP Ltd to obtain the documents or copies of the documents, including details of the exercise of any rights under the Samarco Shareholders Agreement to request or access information.

7. Within 4 weeks of completion of discovery in paragraph 4, BHP Ltd file and serve a list of documents verified by affidavit in accordance with the Rules, identifying in each case where a claim of privilege is made in whole or in part over a document, the nature of the privilege claimed and the basis for the claim of privilege.

8. The further amended interlocutory application otherwise be dismissed.

9. There be liberty to apply.

10. Costs be reserved.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

MOSHINSKY J:

Introduction

1 This is an application by the joint applicants for discovery. The applicants rely on their further amended interlocutory application, which is part of annexure “CM-2” to Mr Myers’s second affidavit. The further amended interlocutory application sets out the orders sought by the applicants, including an annexure setting out their proposed categories for discovery. These categories have been revised twice since the interlocutory application was originally filed on 5 July 2023, and the amendments are marked up.

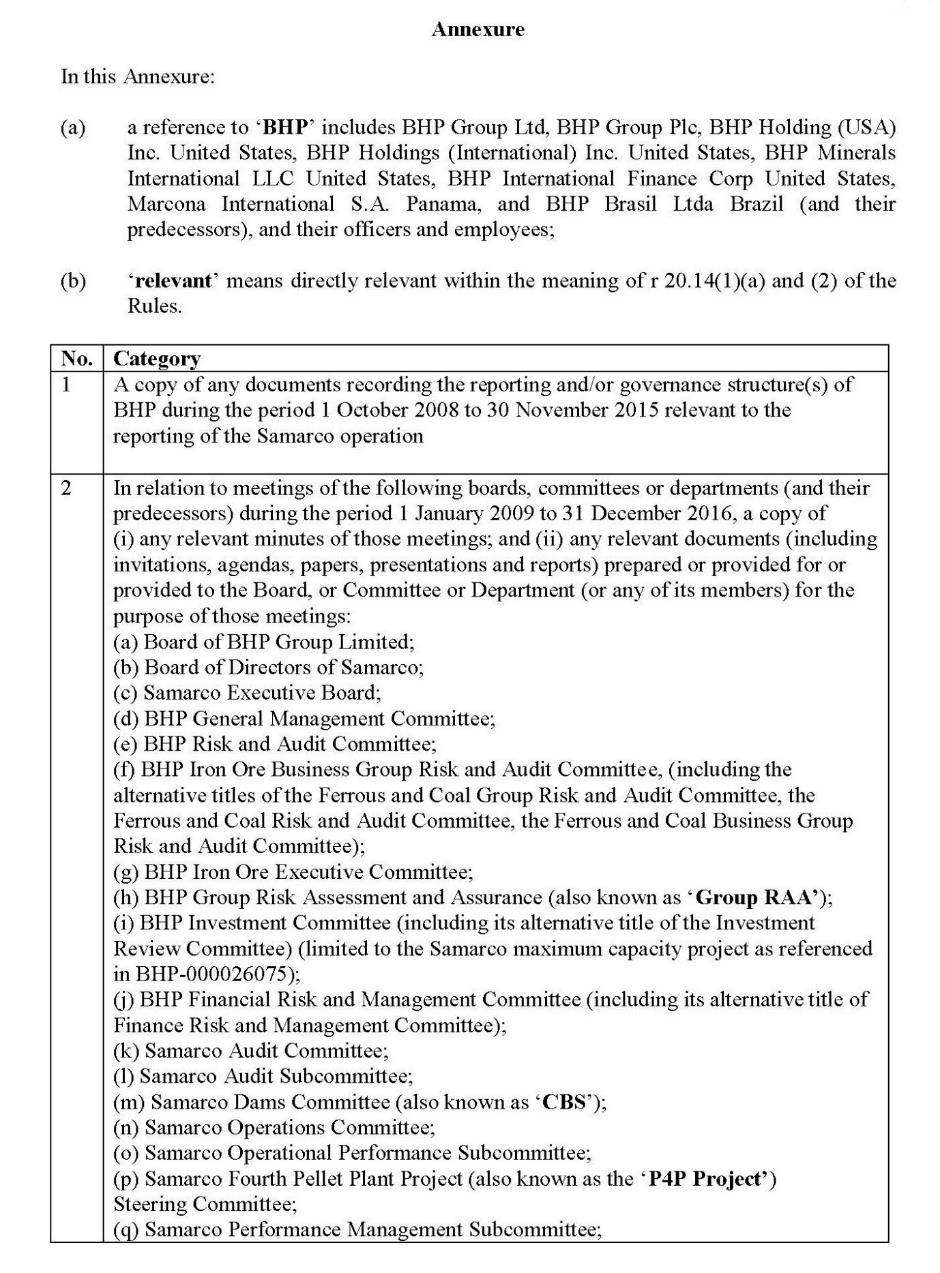

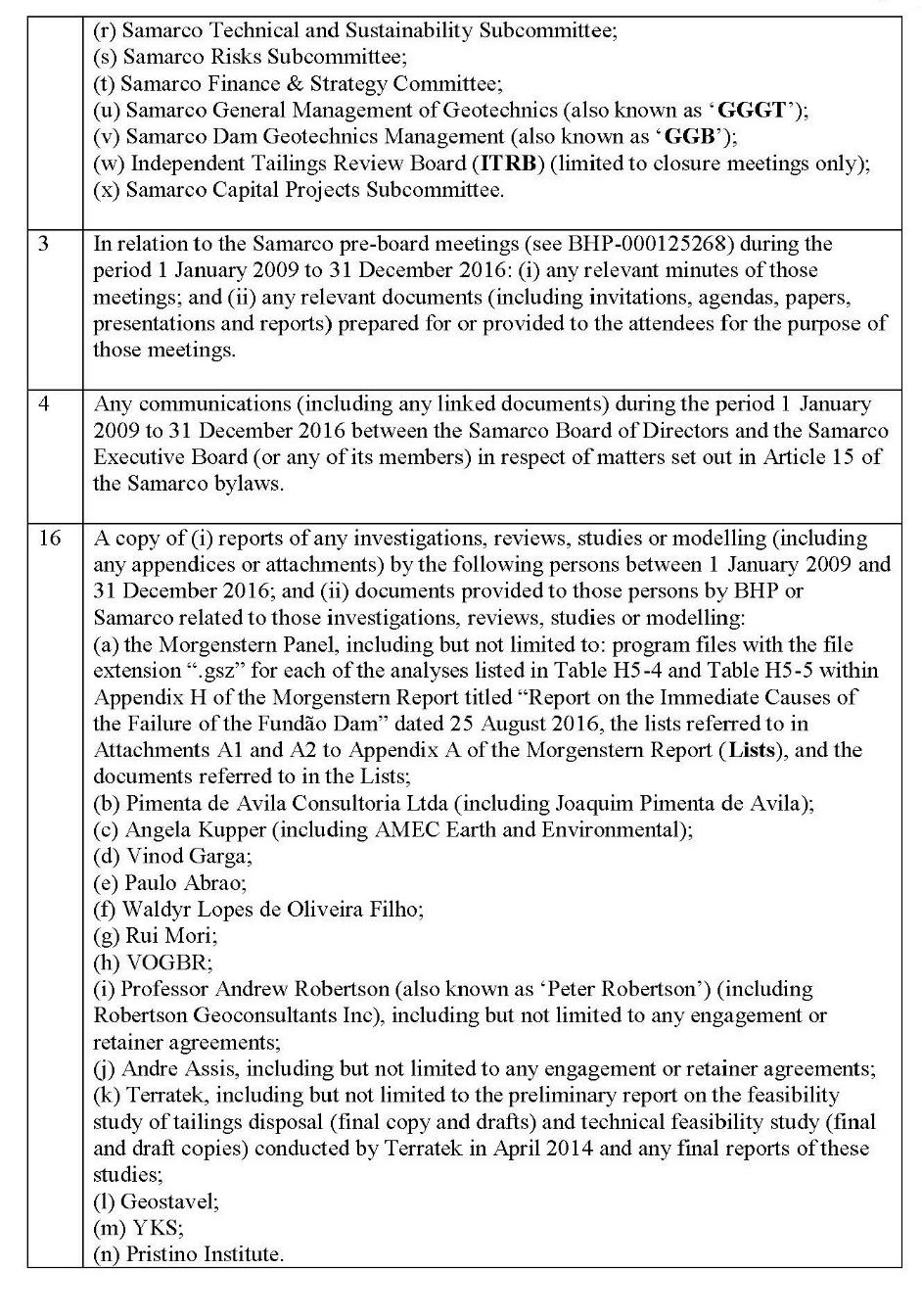

2 The applicants seek non-standard discovery, pursuant to r 20.15 of the Federal Court Rules 2011 (the Rules), of 19 categories of documents. The categories are numbered 1 to 21, but categories 17 and 18 are no longer sought. The applicants also seek a Sabre order (Sabre Corporation Pty Ltd v Russ Kalvin’s Hair Care Co (1993) 46 FCR 428) in respect of one category, namely category 16(a), such that the respondent, BHP Group Limited (BHP Ltd) would be required to seek to obtain these documents from Samarco Mineração S.A Brazil (Samarco).

3 BHP Ltd opposes the application. Accepting that there needs to be discovery in the proceeding, it proposes that discovery take place by way of standard discovery, under r 20.14, this being the “default position” under the Rules. BHP Ltd contends that the applicants have not discharged their onus of showing why there should be a departure from standard discovery. Further and in any event, BHP Ltd submits that a standard discovery process will be more cost-effective than a categories-based approach.

4 The following evidence is before the Court. The applicants rely on two affidavits of Cameron Myers, dated 31 July 2023 (First Myers Affidavit) and 4 September 2023. BHP Ltd relies on an affidavit of Christine Tran dated 22 August 2023 (Tran Affidavit).

5 The parties filed detailed outlines of submissions in advance of the hearing, which took place yesterday and occupied most of the day.

Overview of proceeding

6 The applicants’ current pleading is the amended consolidated statement of claim. The proceeding is a representative proceeding brought on behalf of shareholders of BHP Ltd and BHP Group plc. The group is defined by reference to holding shares in the period 8 August 2012 to 9 November 2015. The pleading relies on BHP Ltd’s continuous disclosure obligations under the ASX Listing Rules and s 674(2) of the Corporations Act 2001 (Cth). The pleading refers to BHP Ltd’s interest in Samarco. The pleading refers to the Fundão Dam and then to alleged information about problems with the Fundão Dam. The information is identified at various points in time from August 2012 to the period from August 2014 onwards. The pleading alleges (paragraph 46ff) that BHP Ltd was aware of the pleaded information and that it failed to make continuous disclosure of the risks in contravention of s 674(2) of the Corporations Act. The pleading also alleges that BHP Ltd made statements in its annual report that were misleading or deceptive, and that it thereby engaged in misleading and deceptive conduct in contravention of the Australian Securities and Investments Commission Act 2001 (Cth) and the Corporations Act. The pleading then alleges (at paragraph 64ff) the failure of the Fundão Dam on 5 November 2015.

Applicable rules and principles

7 Rules 20.14 and 20.15 of the Rules provide as follows:

20.14 Standard discovery

(1) If the Court orders a party to give standard discovery, the party must give discovery of documents:

(a) that are directly relevant to the issues raised by the pleadings or in the affidavits; and

(b) of which, after a reasonable search, the party is aware; and

(c) that are, or have been, in the party’s control.

(2) For paragraph (1)(a), the documents must meet at least one of the following criteria:

(a) the documents are those on which the party intends to rely;

(b) the documents adversely affect the party’s own case;

(c) the documents support another party’s case;

(d) the documents adversely affect another party’s case.

(3) For paragraph (1)(b), in making a reasonable search, a party may take into account the following:

(a) the nature and complexity of the proceeding;

(b) the number of documents involved;

(c) the ease and cost of retrieving a document;

(d) the significance of any document likely to be found;

(e) any other relevant matter.

(4) In this rule, a reference to an affidavit is a reference to:

(a) an affidavit accompanying an originating application; and

(b) an affidavit in response to the affidavit accompanying the originating application.

Note: Control is defined in the Dictionary.

20.15 Non-standard and more extensive discovery

(1) A party seeking an order for discovery (other than standard discovery) must identify the following:

(a) any criteria mentioned in rules 20.14(1) and (2) that should not apply;

(b) any other criteria that should apply;

(c) whether the party seeks the use of categories of documents in the list of documents;

(d) whether discovery should be given in an electronic format;

(e) whether discovery should be given in accordance with a discovery plan.

(2) An application by a party under subrule (1) must be accompanied by the following:

(a) if categories of documents are sought—a list of the proposed categories; and

(b) if discovery is sought by an electronic format—the proposed format; and

(c) if a discovery plan is sought to be use—a draft of the discovery plan.

(3) An application by a party seeking more extensive discovery than is required under rule 20.14 must be accompanied by an affidavit stating why the order should be made.

(4) For this Division:

category of documents includes documents, or a bundle of documents, of the same or a similar type of character.

Note: A discovery plan is a plan that has regard to the issues in dispute and the likely number, nature and significance of the documents discoverable in relation to those issues--see the Court’s Practice Note CM6, ‘Electronic Technology in Litigation’.

8 The word “control” is defined in the Dictionary to the Rules as follows:

control, if referring to a document, means possession, custody or power.

9 While the default position under the Rules is standard discovery under r 20.14, there may be cases where it is appropriate, having regard to the particular circumstances, to depart from that default position and order non-standard discovery, for example, discovery by categories. In the course of submissions, I was taken to observations made by Lee J in Davis v Quintis Ltd (Subject to Deed of Company Arrangement) [2022] FCA 553 at [3], [6]-[8] and observations of O’Bryan J in Reilly v Australia and New Zealand Banking Group Ltd (No 3) [2020] FCA 1609 at [13] (as well as other cases). Ultimately, in a large and complex case such as this, much will depend on the particular circumstances of the case and an exercise of judgment having regard to, among other things, the overarching purpose of the civil procedure rules: see Federal Court of Australia Act 1976 (Cth), s 37M.

Consideration

10 In the present case, there are a number of contextual matters that, in my view, are relevant in considering whether discovery orders as sought by the applicants should be made.

11 First, a substantial number of documents have already been discovered by BHP Ltd in this proceeding. This initial discovery is described in the First Myers Affidavit at paragraphs 14 to 41 and in the Tran Affidavit at paragraphs 9 to 25. A large part of this initial discovery comprised documents that had been discovered in a proceeding in the United States of America (the ADR Proceeding). Approximately 106,000 documents were produced by BHP Ltd, but it appears that this includes duplicates and documents without meaningful content. Mr Myers estimates that fewer than 30,000 documents were unique documents. It is also relevant that the discovery in the ADR Proceeding was incomplete as the proceeding settled before discovery was completed.

12 Secondly, a class action proceeding is on foot in the United Kingdom, namely Municipio de Mariana & Others v BHP Group (UK) Ltd (formerly BHP Group plc) & BHP Group Limited (the UK Proceeding), arising from the same events. This proceeding is described in the Tran Affidavit at paragraphs 30 to 49. As is evident from the title to that proceeding, BHP Ltd is the second defendant to the proceeding, and the first defendant is the company formerly known as BHP Group plc. As set out in paragraph 31 of the Tran Affidavit:

(a) the UK Action comprises claims by over 700,000 individuals, businesses, foundations, churches, municipalities, utility companies and indigenous people of Brazil who have allegedly suffered loss and damage as a result of the failure of the Fundão dam;

(b) the claimants to the UK Action allege that BHP and BHP Group (UK) Ltd are liable under Brazilian law as a result of the failure of the Fundão dam in one or more of the following ways:

i. first, as “polluters” under Articles 3(IV) and 14 of the Brazilian environmental law;

ii. secondly, under standard principles of Brazilian law relating to fault-based liability; and

iii. thirdly, as controlling shareholders under specific provisions of the Brazilian corporate law which the claimants say impose duties on ultimate shareholders towards the communities in which their subsidiaries operate.

(c) the defendants broadly deny these allegations (on both factual and legal grounds) and raise additional matters including around the applicable statute of limitations, standing, and double recovery;

(d) the issues in dispute in the UK Action include (among others):

i. whether the defendants were responsible, directly or indirectly, for the activity of Samarco which resulted in the dam failure, and in particular: (A) whether the defendants exercised control over Samarco, failed to supervise the activities of Samarco, funded operations at Samarco, and/or benefitted from the activities of Samarco; and (B) whether under Brazilian law there was a sufficient causal connection between these acts and/or omissions of the defendants and the Fundão dam failure;

ii. whether it was, at relevant times, self-evident that the operations of Samarco involved a risk of catastrophic damage to the environment and community in the event the Fundao dam failed;

iii. whether the defendants were involved in the management of Samarco, including in relation to the operations and decisions which ultimately led to the dam failure, and/or whether the defendants had knowledge of those matters;

iv. whether, at specified times, the defendants disregarded advice and warnings about the health and safety risk posed by the dam and/or failed to take sufficient or satisfactory action to address those matters;

v. whether the defendants’ conduct, or one or more aspects of their conduct, caused the Fundão dam failure (under the relevant test of causation); and

vi. whether the defendants permitted the Fundão dam to be constructed as an upstream dam and repeatedly increased in height.

13 The parties to the UK Proceeding have engaged in an extensive process of negotiation of a document referred to as the Disclosure Review Document (referred to as the DRD) that sets out a detailed process for disclosure by reference to a series of issues and models. Although the process has been largely agreed, the High Court of Justice has been required to resolve some differences between the parties: see Municipio de Mariana v BHP Group (UK) Ltd (formerly BHP Group plc) and BHP Group Ltd [2023] EWHC 1134 (TCC) at [49]-[67].

14 As set out in the Tran Affidavit at paragraph 34(a), the parties to the UK Proceeding have agreed 11 issues for disclosure, namely:

1(A). What was the Defendants’ role in the selection or appointment of BHP affiliated persons on the Samarco Board and/or Samarco Committees and/or Subcommittees?

1(B). What were the actual reporting lines that were formally established between (i) appointees to the Samarco Board and the Defendants; (ii) BHP affiliated persons appointed to Samarco Committees and subcommittees and the Defendants; and/or (iii) BHP affiliated persons who attended Samarco Board meetings and the Defendants?

1(C). What were the responsibilities and functions formally assigned to BHP affiliated persons on the Samarco Board and/or Samarco Committees and/or Subcommittees?

2. Did the Defendants participate in or influence, directly or indirectly, decisions related to health and safety (“HSEC”), environment and risk management in relation to Samarco’s operations in general, and its Dams in particular? How and by whom were such decisions taken?

3. Did the Defendants participate in or influence, directly or indirectly, decisions related to the increase of Samarco’s production and/or the reduction of Samarco’s costs? How and by whom were such decisions taken?

4. Did the Defendants participate in or influence decisions, directly or indirectly, related to the building and design of the dam, the use of the Dam to store tailings deriving from the Alegria Mine, applications for its licenses, the increase in its height, design changes and/or responses to problems with drainage and/or its structural integrity? How and by whom were such decisions taken?

5(A). What was Pimenta de Avila’s role? Did the Defendants participate in or influence decisions concerning Pimenta de Avila’s role?

5(B). Were the Defendants aware of Pimenta de Avila’s advice and/or recommendations or any other advice and/or recommendations from other persons to address the dam’s structural issues.

6. Before 5 November 2015, what knowledge did the Defendants have of any changes to the Dam’s design/use and the potential consequences of such changes for the Dam’s stability?

7. In the period 2012-2015 (inclusive) did the Defendants know what was or was not notified by Samarco to the relevant authorities concerning the design or use of the Dam?

8. Were the Defendants alerted to information relevant to the stability of the dam at any time before it collapsed? How and to whom was such information communicated? To which alleged causes of the Collapse (including those identified in the Panel report) were Samarco’s Executive Board, BHP Brasil’s appointees to the Samarco Board of Directors and/or other Samarco committees alerted to before the Collapse?

9. What knowledge did the Defendants have of the potential risks or impact on communities and/or the environment in the event of the Dam’s collapse and what steps were taken as a result of any such knowledge? What standards, policies, or guidelines applicable to the Dam were in place regarding the Defendants’ identification and response to these risks?

10. Did the Defendants fund Samarco’s activities directly or indirectly, or assist in the obtaining of funding, and if so how and on what terms?

11. Did the Defendants benefit from Samarco’s activities through the payment of dividends, distributions or other forms of payment, and were the Defendants involved in and/or influenced the decisions as to the size of any dividends, distributions or other form of distribution or payment?

15 The disclosure to be made by the defendants is to be made in accordance with “Model C” and/or “Model D”. As explained in paragraph 35(a) of the Tran Affidavit, Model C requires the defendants to give disclosure, in relation to the relevant issue for disclosure, by reference to categories of documents within the defendants’ control. (I note that, for present purposes, there is no distinction between the documents in the control of BHP Ltd and those in the control of BHP Group (UK) Ltd. This was clarified by senior counsel for BHP Ltd in the course of the hearing before me). Model C is described in more detail in paragraph 36 of the Tran Affidavit.

16 Model D requires the defendants, in relation to the relevant issue for disclosure, to search for potentially probative documents within the defendants’ control by reference to: (a) the defendants’ documentary repositories for agreed human and non-human custodians; (b) date ranges; and (c) search terms. The defendants are then required to produce documents thereby identified that are relevant to the issue for disclosure. Model D is described in more detail in paragraphs 37-44 of the Tran Affidavit.

17 As set out in paragraph 34(b) of the Tran Affidavit:

(a) Model C has been agreed for issues 1(B), 1(C), 3, 10 and 11 (noting that Model D disclosure will also be given for issues 3, 10 and 11);

(b) Model D has been agreed for issues 1(A), 2, 3, 4, 5(A), 5(B), 6, 7, 8, 9, 10 and 11.

18 There is one aspect of the disclosure process in the UK Proceeding that has not yet been finalised. This relates to the specific non-human data sources to be searched for the purposes of Model D disclosure: see the Tran Affidavit, paragraphs 41, 49.

19 Disclosure in the UK Proceeding is taking place on a rolling basis on 1 September 2023, 13 October 2023 and 27 November 2023: see the Tran Affidavit, paragraph 33(b)(ii).

20 Returning to this proceeding, I note that there has been extensive correspondence between the parties in relation to discovery. The applicants submit that, at the time of filing their application, they did not have a complete picture of the process in the UK Proceeding and that they received key information about that process for the first time in the Tran Affidavit. In response to that information, the applicants amended their proposed orders and categories to seek to draw on aspects of the disclosure process in the UK Proceeding.

21 The threshold issue to be determined is whether there should be an order for non-standard discovery, rather than standard discovery. In my view, in the particular circumstances of this case, which is a large and complex commercial proceeding, there is good reason to depart from standard discovery and adopt a non-standard approach. Given the vast number of documents to be searched and considered, it is preferable to approach the exercise of discovery by reference to issues and categories, with agreed methodologies, rather than adopting a standard discovery approach. Indeed, this is exactly what BHP Ltd has agreed to in the UK Proceeding. While the civil procedure rules may well be different in the United Kingdom, the approach taken by the parties in the UK Proceeding tends to confirm that an approach based on issues and categories, and agreed methodologies, is appropriate in the circumstances of this case (which are relevantly very similar to the circumstances of the UK Proceeding).

22 To the extent that BHP Ltd submits that the applicants have not satisfied the particular requirements of r 20.15 for the making of an order for non-standard discovery, I do not accept that submission. In my view, the applicants’ material does meet these requirements.

23 The standard discovery approach proposed by BHP Ltd would involve the same reviewers who are reviewing documents for the purposes of disclosure in the UK Proceeding reviewing the documents for the purposes of making standard discovery in this proceeding. The difficulty with this proposal is that it is unnecessary (for reasons developed below) and would be productive of increased legal costs compared with simply making discovery of all the documents disclosed in the UK Proceeding (an approach discussed below).

24 While I consider that there should be non-standard discovery, I do not accept that all of the categories proposed by the applicants should be ordered. The applicants approach the exercise of discovery afresh without seeking to draw on the documents that are to be disclosed (or have been disclosed) in the UK Proceeding. This strikes me as wasteful and inefficient. Moreover, I find the issues for disclosure in the UK Proceeding (set out above) to be more clearly expressed and easier to follow than some of the applicants’ proposed categories. In circumstances where disclosure is to take place in the UK Proceeding, and having regard to the overlap between the issues in the UK Proceeding and the issues in this proceeding, it is preferable, in my view, to adopt the disclosure in the UK Proceeding as a starting point (that is, to require BHP Ltd to discover in this proceeding all documents that the defendants disclose in the UK Proceeding) and then to augment that discovery to the extent necessary by additional categories.

25 I am satisfied that all of the 11 issues for disclosure in the UK Proceeding are issues for discovery in the present proceeding. The relevance of the issues is supported by the “Overview of Overlap” that is annexure CYT-1 to the Tran Affidavit. Accordingly, I do not see any difficulty in requiring BHP Ltd to discover in this proceeding all of the documents that are disclosed by the defendants in the UK Proceeding. When I raised this possible approach with the parties in the course of the hearing, while neither party embraced it (preferring its own proposed approach), neither party submitted there was any particular difficulty in this approach.

26 I accept that, given the additional issues that arise in this proceeding (in particular, the issue of constructive awareness under the ASX Listing Rules) it is necessary to augment the discovery described above to some extent. I am satisfied that categories 1, 2, 3, 4 and 16 of the applicants’ proposed categories (albeit with some adjustments, as discussed below) are appropriate categories in that the documents they describe are relevant to the issues in the proceeding and they will likely not be covered by the discovery of the documents to be disclosed in the UK Proceeding.

27 However, I consider that some adjustments should be made to these categories, and the applicants’ proposed methodology, for the sake of clarity and ease of administration. In particular, I consider the applicants’ descriptions of the “repositories” to be searched for categories 1, 2 and 3 to be unnecessarily complicated. Similarly, I consider the “search methodologies” proposed by the applicants for categories 4 and 16 to be unnecessarily complicated. I consider it preferable, for all of these categories, to adopt the “reasonable search” mechanism in r 20.14(1)(b) and (3). In the further amended interlocutory application, the date ranges in categories 1, 2, 3, 4 and 16 have been struck through. This is because a date range has been incorporated into the applicants’ proposed preambles (to Parts B and C of the Annexure) describing what constitutes a reasonable search. I consider that it would be simpler to omit any such preamble. I have therefore reinstated the date ranges for each of these categories that appeared in the earlier iteration of the applicants’ proposed categories.

28 It is important to note that, apart from the application for the Sabre order, the discovery that is proposed to be made by BHP Ltd does not relate to documents held by Samarco. However, as is clear from the Tran Affidavit, BHP Ltd currently holds a large volume of Samarco documents. To the extent that category 2 refers to the Samarco Board, the Samarco Executive Board and Samarco committees, the discovery to be made is intended to be drawn from Samarco documents already held by BHP Ltd.

29 I have made some minor wording changes to categories 1, 2, 3, 4 and 16 for the sake of clarity. I will give the parties the opportunity to review the form of the categories and make submissions on these changes if they wish.

30 At this stage, I am not satisfied that the other categories sought by the applicants are appropriate. This is because these categories appear to be premised on a stand-alone discovery exercise for this proceeding, rather than one that involves discovery of the documents disclosed in the UK Proceeding. However, I accept that, in principle, there may be discrete categories of documents (in addition to categories 1, 2, 3, 4 and 16) that are relevant for the purposes of this proceeding, but not covered by the disclosure in the UK Proceeding, in particular having regard to the notion of constructive awareness under the ASX Listing Rules. I will leave it open to the applicants to consider whether any additional categories of discovery are necessary and, if any such categories cannot be agreed, to make a fresh application for discovery of those categories.

31 The remaining issue is the Sabre order, which the applicants seek in relation to category 16(a). Although framed more broadly in the further amended interlocutory application, in the course of the hearing the applicants accepted that, at least in the first instance, the order could be limited to documents held by Samarco. The proposed order, with this adjustment, is to the effect that, if and to the extent that BHP Ltd identifies that any documents responsive to category 16(a) are not within its control, but which BHP Ltd reasonably believes are or may be in the control of Samarco, BHP Ltd will take all reasonable steps available to it to obtain such documents from Samarco, including by the exercise of any rights under the Samarco Shareholders Agreement to request or access information.

32 Putting to one side the issue of timing, the prerequisites for the making of a Sabre order (see SPI Spirits (Cyprus) Ltd v Diageo Australia Ltd (No 2) [2006] FCA 931; 155 FCR 150 at [31]-[34]) are satisfied. The main argument put against the making of such an order is that it is premature and that an application for such an order should be considered only after discovery has been completed. While this is usually the approach taken, in the present case it is already clear that BHP Ltd does not have some of the documents in category 16(a). In particular, BHP Ltd does not have the lists referred to in Attachments A1 and A2 to Appendix A of the Morgenstern Report. These are relevant documents. In these circumstances, I consider it appropriate to make an order substantially in the terms sought, notwithstanding that discovery has not yet been completed.

33 I will hear from the parties on the precise form of the Sabre order.

I certify that the preceding thirty-three (33) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Moshinsky. |

Associate: