Federal Court of Australia

Aircraft Structural Contractors Pty Ltd v Nauru Air Corporation [2023] FCA 993

ORDERS

AIRCRAFT STRUCTURAL CONTRACTORS PTY LTD Applicant | ||

AND: | Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The Applicant’s interlocutory application filed on 21 July 2023 is dismissed.

2. The Applicant pay the Respondent’s costs of the Applicant’s interlocutory application filed on 21 July 2023.

3. The Respondent’s costs as ordered by order 2 of the Order made on 17 March 2023 are taxable and payable immediately.

4. The Applicant pay the Respondent’s costs of the Respondent’s interlocutory application filed on 21 July 2023.

5. The Respondent’s costs as ordered by order 4 above are taxable and payable immediately.

6. The matter is listed for a case management hearing at 9.30 am on 3 November 2023.

7. The costs of the case management hearing are reserved.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(Revised from Transcript)

DOWNES J:

1 There are two interlocutory applications before me today.

2 The first is an application by the Applicant for an order that, pursuant to r 30.01 of the Federal Court Rules 2011 (Cth), the following questions as to liability (the Liability Questions) be heard separately from and before any other questions or issues for determination in the proceeding (by reference to defined terms in the Second Further Amended Statement of Claim):

(a) whether the Respondent has infringed the copyright of ASC, in the ASC Exposition, by reproducing the Reproduced Parts in the NAC Maintenance Application;

(b) if subparagraph (a) is answered in the affirmative, whether the Respondent has also breached clause 31(2) of the Maintenance Agreement;

(c) whether the ASC Exposition is Confidential Information for the purpose of clause 32(3) of the Maintenance Agreement; and

(d) if subparagraph (c) is answered in the affirmative, whether the Respondent has used, appropriated, copied, memorised or reproduced that Confidential Information and thereby breached clause 32(3) of the Maintenance Agreement.

3 As there would be common lay witnesses at both of the proposed trials, with the prospect of credit findings being made at the first trial, the Applicant sought the above order upon its undertaking that:

[It] will not object to the judge, who hears and determines the questions of liability referred to in this order, determining any other issues in the proceeding that may remain for decision thereafter on the ground that that judge may already have, in the course of determining the questions of liability, reached conclusions or expressed opinions on the credit of any witness ( or witnesses) who may be called to give evidence in respect of any issue that remains to be determined.

4 No similar undertaking was offered by the Respondent.

5 As indicated to counsel during the hearing of that application, I will dismiss the application for the separate determination of the Liability Questions. My reasons for doing so will be apparent from the transcript, as I indicated during the hearing. No further reasons for dismissing that application were sought by either side.

6 The second is an application by the Respondent for an order that:

Pursuant to rules 1.34 or 1.35 of the Federal Court Rules 2011 (Cth), the Respondent’s costs thrown away by reason of the Amended Originating Application and Second Further Amended Statement of Claim ordered on 17 March 2023 be taxable and payable immediately.

7 That application is brought by reason of an order made by Judicial Registrar Schmidt on 17 March 2023 that the Applicant have leave to file its Amended Originating Application and Second Further Amended Statement of Claim, and that it pay the Respondent’s costs thrown away as a result of the amendments.

8 The orders reserved the question of the basis on which those costs were payable and whether they were to be taxable and payable forthwith. The Respondent therefore applies for an order that its costs thrown away as a result of these amendments, in effect, be taxable and payable immediately but does not seek an order that those costs be payable other than on a party and party basis.

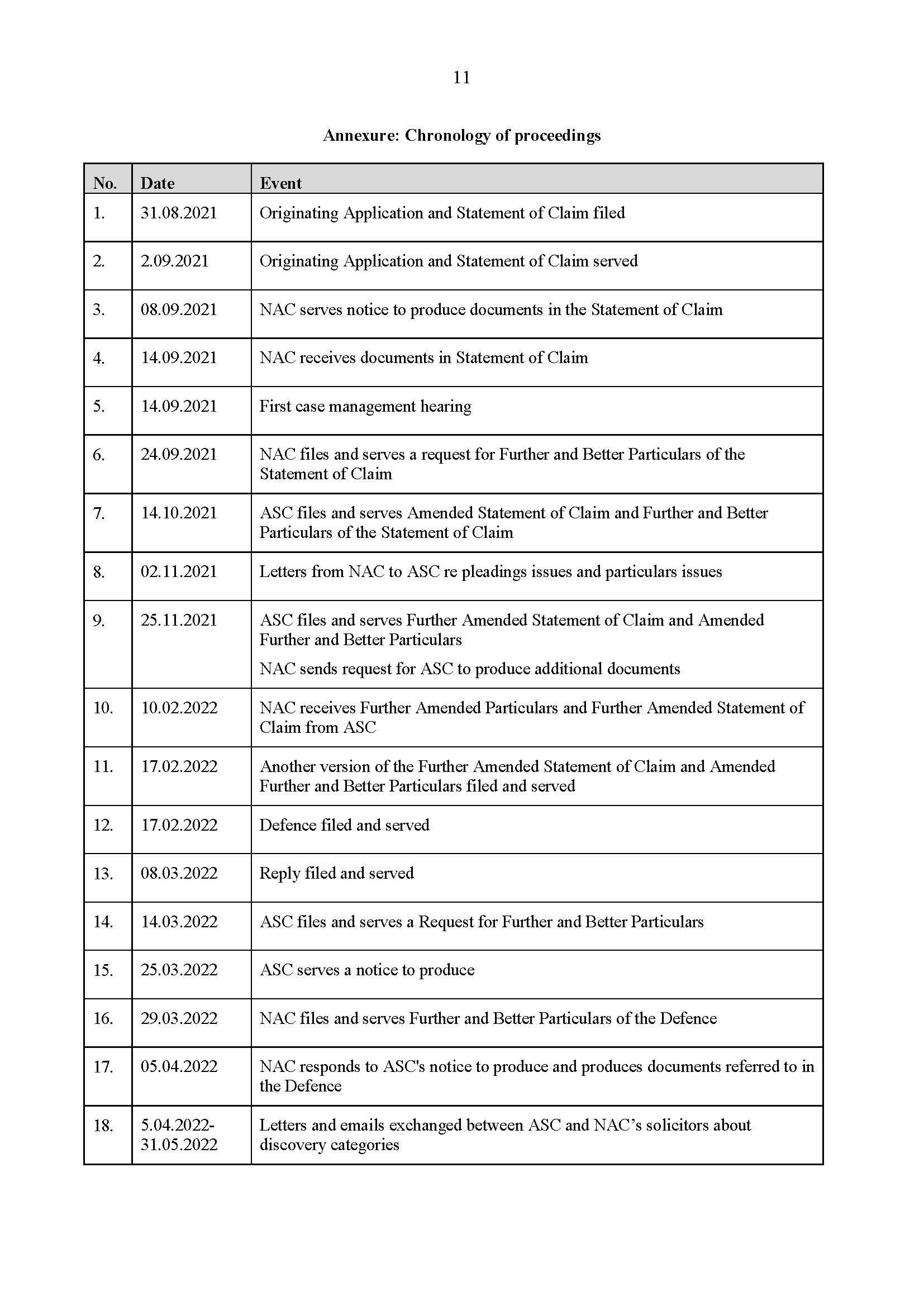

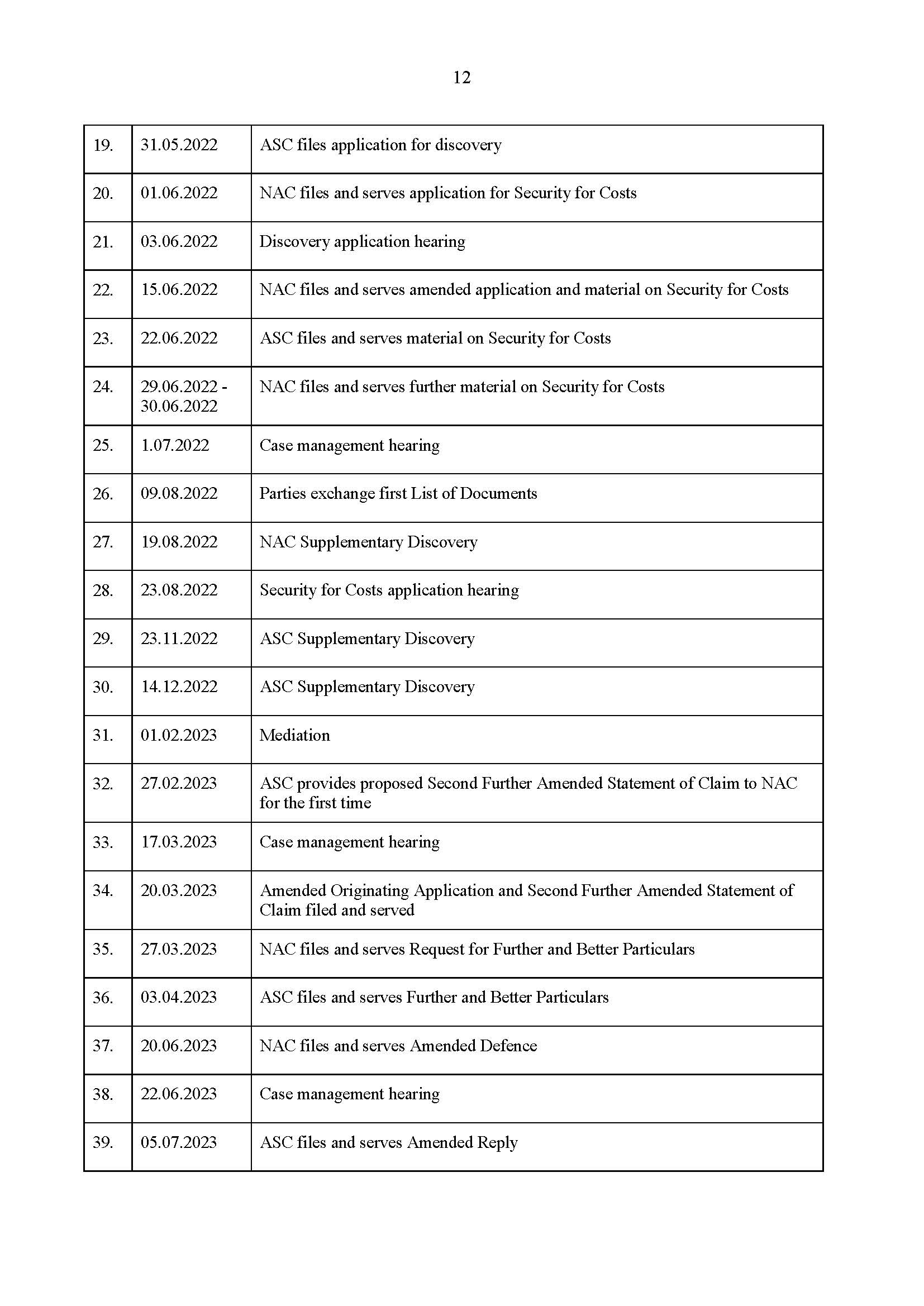

9 It is relevant to consider the procedural history of this matter. This proceeding was commenced on 31 August 2021, which is nearly two years ago. Since then, there have been four versions of a statement of claim filed by the Applicant as well as various particulars. Other steps have been taken in the proceedings, including numerous case management hearings. I attach to these reasons a chronology of the steps in the proceeding, being a chronology attached to the Respondent’s submissions.

10 By now, the proceeding should have reached the stage of being ready for trial, but, instead, as a result of the most recent amendments, the case is still at the pleading stage, and a trial will not occur until about this time next year.

11 Until leave was granted to file the Amended Originating Application and the latest version of the statement of claim, the Applicant advanced three claims:

(1) Breach of fiduciary duties which were alleged to have resulted from a claimed joint venture to sublease and operate an aircraft hangar at Brisbane Airport for the parties’ mutual benefit (which claim has now been abandoned);

(2) Misleading or deceptive conduct based on an alleged representation that the parties’ relationship would subsist for at least 14 years (which claim has now been abandoned);

(3) Breach of copyright arising from the reproduction of parts of an Exposition prepared by the Applicant in an Exposition prepared by the Respondent.

12 The claims for breach of fiduciary duties and misleading or deceptive conduct were advanced in circumstances where the parties had entered into written agreements. Both the claims for breach of fiduciary duties and misleading or deceptive conduct required an examination of dealings that led to the written agreements and of how the parties conducted themselves over several years between 2015 and 2018. They were the only claims alleged to give rise to an entitlement to substantial damages in the order of $20 million initially which was then revised down to $10 million in the form of alleged “Tooling Losses” and the loss of opportunity to provide maintenance services to third-party airlines.

13 In respect of the breach of copyright claim, the Applicant claimed that its Exposition was an original literary work within the meaning of s 32 of the Copyright Act 1968 (Cth) and thus entitled to copyright protection; that the Respondent had reproduced parts of its Exposition without its consent or other authorisation; the Applicant claimed an account of profits under s 115(2) of the Copyright Act, or unidentified additional damages under s 115(4) of that Act; and did not allege any case to the effect that the alleged breaches of copyright caused it to lose maintenance services to the Respondent or third-party airlines.

14 Until late February 2023, that was the case to which the Respondent responded.

15 The proceeding was commenced more than three and a half years after the events about which complaint was made in the earlier versions of the statement of claim. The Respondent’s response to the Applicant’s case prior to February 2023 included factual investigations involving witnesses, document-gathering and review, the preparation of a Defence, further document-gathering and review in connection with the discovery process, a contested application for security for costs and a mediation. It also involved the Respondent’s solicitors obtaining instructions and providing advice.

16 On 27 February 2023, following the mediation and without any prior notice that the Applicant was considering abandoning claims, the Respondent’s solicitors received the Second Further Amended Statement of Claim for the first time. That pleading abandoned the claims for breach of fiduciary duties and misleading or deceptive conduct, recast the copyright claim, altered the claim for lost opportunity to one by which the Applicant now said it had lost the opportunity to earn two years’ revenue for maintenance services from the Respondent and third-party airlines, and added a new claim for breach of confidence, albeit cast as a breach of contract claim.

17 I turn then to the substance of the application. The ordinary rule is, as set out in r 40.13, as follows:

If an order for costs is made on an interlocutory application, the party in whose favour the order is made must not tax those costs until the proceeding in which the order is made is finished.

18 There was no dispute on this application that the Court has power to order that the costs of an interlocutory application be taxable and payable forthwith.

19 The relevant principles relating to the exercise of such a power were identified by Perram J in Watson v Kriticos (Costs Payable Forthwith) [2022] FCA 4 at [6]–[7]:

The principles governing the exercise of the discretion are similarly well-established. As a general proposition, the discretion should be exercised in favour of a party who establishes that the demands of justice require a departure from the ordinary rule embodied in r 40.13: FKP v Spirits at [7]; Thunderdome Racetiming and Scoring Pty Ltd v Dorian Industries Pty Ltd (1992) 36 FCR 297 at 312 per Olney J. Always to be borne in mind, however, are the twin policy considerations underpinning r 40.13: first, that it is generally undesirable that the parties should be exposed to multiple taxation processes during the life of one proceeding; and second and relatedly, that during the balance of the litigation, costs orders may be made in the opposite direction which will normally be capable of being set-off against earlier costs orders.

The exercise of the discretion may be justified in a number of circumstances, including where (FKP v Spirits at [9]):

(a) the final determination of the proceeding is far away: Allstate Life Insurance Co v Australia and New Zealand Banking Group Ltd (No 13) [1995] FCA 1459 at [5];

(b) a party has been required to incur significant costs over and above those which it would have incurred had the opposing party acted in handling the proceeding with competence and diligence: Life Airbag Company of Australia Pty Ltd v Life Airbag Company (New Zealand) Ltd [1998] FCA 545;

(c) following a successful amendment application, a case is essentially a new proceeding: McKellar v Container Terminal Management Services Ltd [1999] FCA 1639 at [19] and [40];

(d) a discrete issue has been resolved: Australian Flight Test Services v Minister for Industry, Science and Technology [1996] FCA 1425 at [7]; or

(e) there is some reason to think that interlocutory disputation is draining the ability of one side to conduct the litigation: Clipsal Australia Pty Ltd v Clipso Electrical Pty Ltd [2016] FCA 37 at [12].

20 In this case, the following matters justify the order sought by the Respondent:

(1) The abandonment by the Applicant of its distinct claims for breach of fiduciary duties and misleading or deceptive conduct, which were, when they were run, the Applicant’s most substantial claims in the case.

(2) These claims were abandoned approximately 18 months after the commencement of the proceedings and after much work had been done by the Respondent to meet them, as referred to above. Had those claims not been abandoned and new or changed ones added, it is likely that this matter would either have reached the stage of trial by now or certainly by early next year. Instead, the case is still at the pleading stage with the possibility, as indicated by the Respondent, of a need for further discovery arising out of the new breach of confidence case.

(3) The costs thrown away by the abandonment of the two distinct claims are not likely to be insignificant.

(4) It does not satisfy the demands of justice to delay the Respondent’s access to the costs order, which has been made in its favour for significant and discrete costs thrown away through no fault of its own, because the Applicant has decided that it no longer wishes to pursue these substantial claims.

21 One of the arguments advanced by the Applicant against the proposed order is the inefficiencies in having what will be, in effect, two taxations of costs. It is also said that it will be difficult to separate out the costs associated with the abandoned claims from the claims that are still being pursued. While I accept that those are factors against the order being made, they are outweighed by the other factors identified above. The other observation to make is that, regardless of when it occurs, there will likely be disputes about whether or not particular costs fall within the scope of costs thrown away. And whether that dispute happens now or at the end of the case does not matter very much.

22 The Applicant also submits that there has been no unreasonable conduct by it which would justify the departure from the general position. However, I am very concerned by the slow progress of this proceeding and the number of times that the statement of claim has been amended by the Applicant. It is unreasonable for an Applicant to take so long to progress a matter through this Court. There is no suggestion by the Applicant that the Respondent’s conduct has caused the matter to be delayed.

23 The Applicant also submitted that the order sought by the Respondent could stultify the proceeding, and relied upon affidavit evidence of Mr Perceval, one of its directors, relating to its financial position.

24 At the hearing of this application, Mr Perceval was cross-examined and it became apparent that he was someone who did not have a good grasp of the financial situation of the Applicant. He was unable to say, for example, which company was his employer. Despite saying that certain financial statements, which were unsigned and which had been prepared by the Applicant’s accountant, were correct to the best of his knowledge, he was then unable to explain certain entries in those financial statements. Because of the answers given by Mr Perceval under cross-examination, I do not place any weight on his evidence as to the financial position of the Applicant.

25 My concerns are heightened by the fact that, approximately a year ago, the Applicant put forward a robust defence to a security for costs application on the basis that it would be able to pay the Respondent’s costs at the conclusion of the proceeding, but now, in the face of this application, it puts forward a position that if the order sought today is made, it would have the effect of stultifying the proceeding. In my view, the two positions cannot be reconciled. And then there is the overlay of the inability of a director of the Applicant to explain the financial information which sits behind his affidavit evidence to support the submission made today.

26 This leads then to another concern that the Applicant’s explanation of why it decided to abandon the claims is not a full and frank one. Because of the different positions advanced in the security for costs application and this application, I am concerned that the Applicant tends to proffer only part of any explanation which supports whatever position it wishes to take on a particular application.

27 In the end, what has happened in this case is that the Applicant pursued a broader case which was factually intensive and, for reasons which included (but were not confined to) financial ones, it has decided to abandon two significant claims. The Respondent should not be kept out of its costs because the Applicant has decided to pursue a different case, the case effectively starts again and the trial is now about a year away.

28 For these reasons, I will make an order in terms of the draft sought by the Respondent, which is in terms of paragraphs 2 and 4 of that draft, and will hear from the parties about costs and other orders.

I certify that the preceding twenty-eight (28) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Downes. |

Associate:

ANNEXURE A