FEDERAL COURT OF AUSTRALIA

Australian Securities and Investments Commission v Bettles [2023] FCA 975

ORDERS

AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Plaintiff | ||

AND: | Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The proceeding be dismissed.

2. The plaintiff pay the defendant’s costs of the proceeding.

3. If either party wishes to apply to vary Order 2 above, on or before 1 September 2023 that party should file and serve submissions, not exceeding five pages in length, setting out the orders sought and the reasons for seeking those orders.

4. If submissions are filed by a party pursuant to Order 3 above then the other party may file submissions in response, not exceeding five pages in length, such submissions to be filed on or before 15 September 2023.

5. Unless a party requests an oral hearing, any application made to vary Order 2 above will be dealt with on the papers.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

REASONS FOR JUDGMENT

MARKOVIC J:

1 Liquidators perform a unique and important public function. They act as protectors of the insolvent company, as asset recovery agents and protectors, as investigators, as inquisitors and as problem solvers: see Murray M and Harris J, Keay’s Insolvency (11th ed, Thomson Reuters, 2022) at [1.180]. When a liquidator falls short of the standards expected of them both the public’s trust in the office of liquidator and the effective administration of the body of insolvency law are eroded. In turn this affects the administration of justice: see Commissioner of Taxation v Iannuzzi (No 2) (2019) 140 ACSR 497; [2019] FCA 1818 at [204].

2 This proceeding brings into sharp focus the conduct of a liquidator. In particular, the Australian Securities and Investments Commission (ASIC) seeks orders pursuant to s 45-1 of the Insolvency Practice Schedule (Corporations) (IPS) being Sch 2 to the Corporations Act 2001 (Cth) that Jason Walter Bettles’ registration as a liquidator be cancelled and that Mr Bettles be prohibited from reapplying for registration for a period to be fixed and as considered appropriate by the Court.

3 The conduct on which ASIC relies arises out of Mr Bettles’ appointment as administrator and/or liquidator to companies in the Members Alliance Group (MA Group), a group of more than 50 companies which operated principally from the Gold Coast, Queensland as well as his conduct as a liquidator of an unrelated company, Bradford Marine Pty Ltd (in liquidation).

4 On 7 April 2022 orders were made for the question of remedies and sanction to be determined separately from the question of liability. Accordingly, these reasons address only the latter. However, given the conclusions I have reached it will not be necessary for me to consider questions of remedies and sanctions. That is because, for the reasons that follow ASIC’s claim should be dismissed.

5 The events that led to this proceeding and to ASIC seeking the relief it did are set out below.

6 ASIC relies on a further amended statement of claim filed on 10 June 2022 (FASOC). Leave to amend was granted in the course of the trial in the circumstances described below.

7 The FASOC pleads a detailed case against Mr Bettles, a high level summary of which appears below.

8 As set out above, ASIC’s case relies on Mr Bettles’ conduct as a liquidator or voluntary administrator of companies in the MA Group as well as his conduct as a liquidator of Bradford Marine. In summary ASIC contends that:

(1) Mr Bettles knew of, enabled and facilitated the diversion of income producing assets and funds from certain companies in the MA Group, referred to as the MA Trading Companies (see [39] below), to the detriment of Iridium Holdings Pty Ltd (in liquidation), the sole shareholder of the MA Trading Companies (see [35] below) and other companies in the MA Group, and of creditors of those companies;

(2) the alleged diversion of funds occurred through a strategy of which Mr Bettles was aware prior to his appointment as liquidator of Iridium Holdings and which was implemented after that appointment; and

(3) Mr Bettles breached his duty in his capacity as liquidator of Bradford Marine by accepting an offer for the purchase of a chose in action and opposing a subsequent application for his removal as liquidator.

9 More particularly ASIC puts its case in the following way.

10 In its pleaded case, ASIC alleges that:

(1) as at certain points in time leading up to his appointment Mr Bettles knew, or ought to have known, certain things about the MA Group;

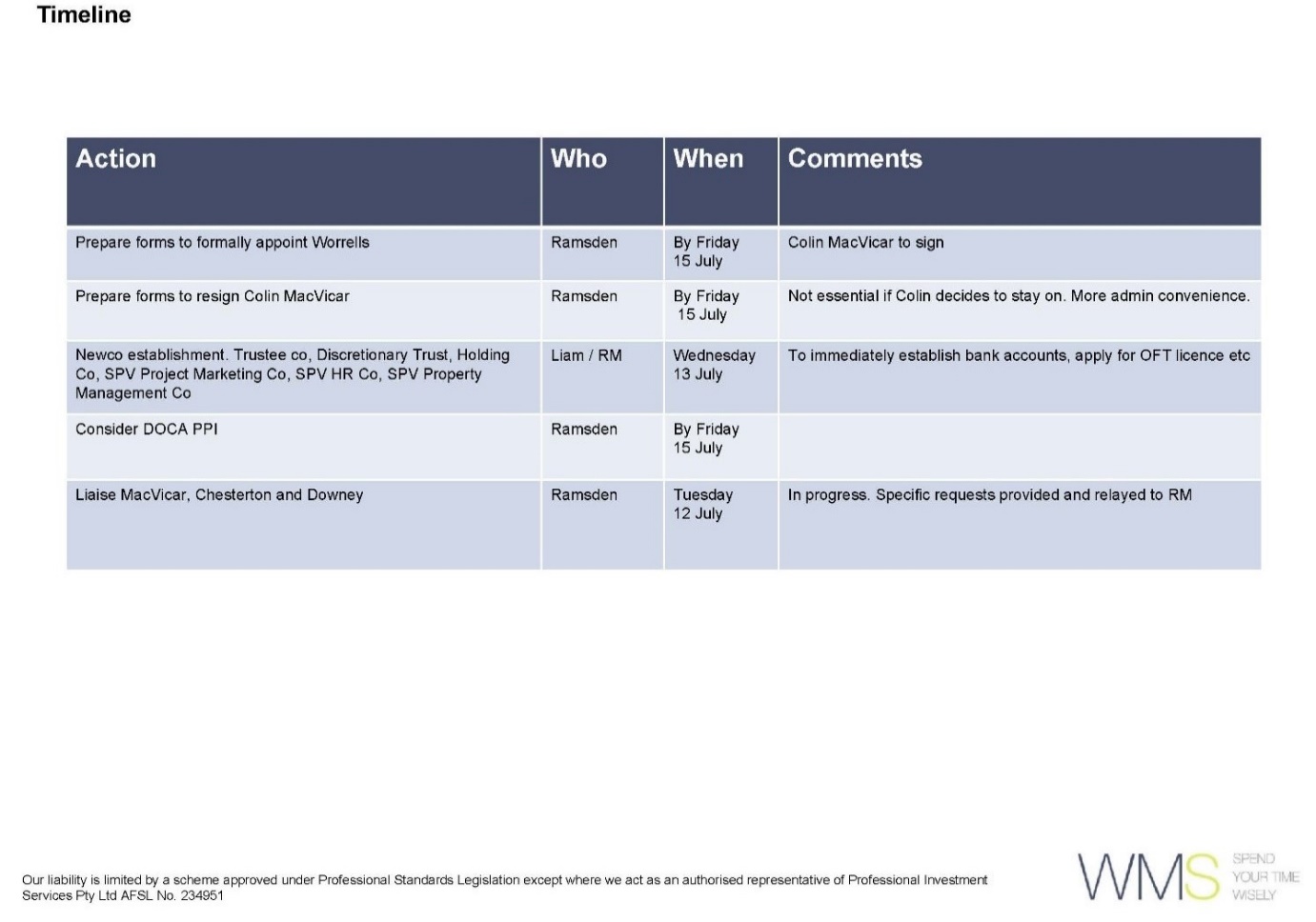

(2) more particularly as at 8 July 2016, after a meeting (see [52]-[60] below), Mr Bettles knew or ought to have known that Richard Marlborough, one of the directors of Iridium Holdings, was developing a strategy with the assistance of his professional advisors, WMS Accountants and Ramsden Lawyers, referred to as the strategy in the FASOC;

(3) the strategy was as follows:

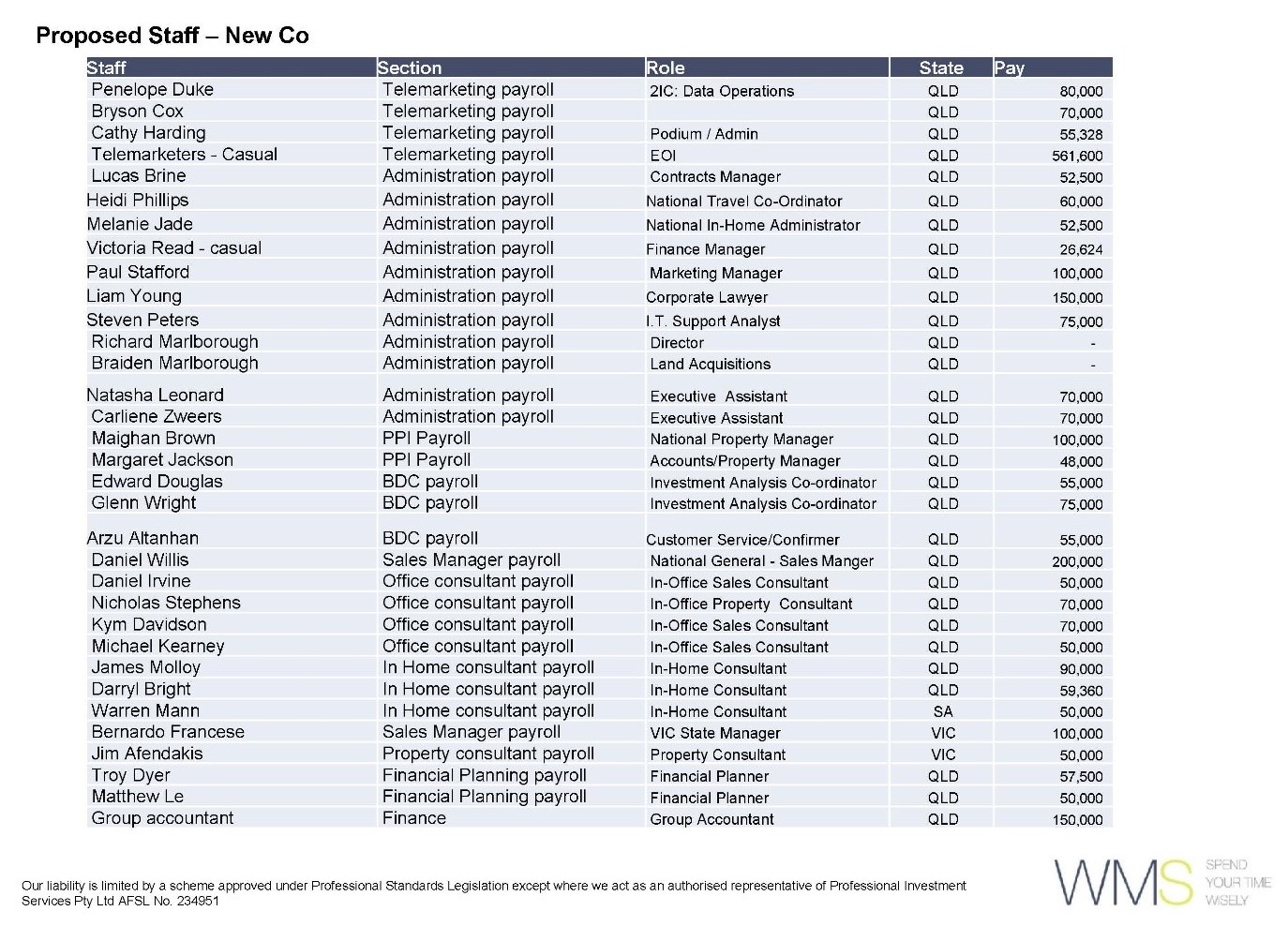

(i) Marlborough would register at least one new company which would be under his effective control (via his son, Braiden, and his employed general counsel, Young);

(ii) Marlborough would arrange for the staged winding up of the companies so as to be able to transfer the income producing assets of certain companies to such a new company;

(iii) the new company would then be able to receive the income that would otherwise have gone to the existing companies;

(iv) Marlborough required $500,000 in order to do this, and intended to obtain that from one or more of the entities that conducted the financial planning business or from the WIP of MM Prime Pty Ltd (20);

(v) the professional advisors (WMS Accountants and Ramsden Lawyers) intended to enter into arrangements which would enable them to take security for past and future fees over the assets of companies in the MA Group and with the effect that their professional fees should rank ahead of non-secured creditors; and

(vi) Marlborough wanted to limit the amounts available in MA Group companies that could be used to pay creditors, including the ATO.

(4) the strategy was implemented through a number of steps and transactions including:

(a) the incorporation of four new companies including: Benchmark Private Wealth Pty Ltd (BPW), Benchmark Wealth Property Services Pty Ltd (BWP Services) and Benchmark Private Wealth Holdings Pty Ltd (BPW Holdings) (collectively, Benchmark Group);

(b) the registration of security interests in the period 13 to 19 July 2016 against one or more of the companies in the MA Group in favour of Mr Domingo, Domingo Superannuation Fund/Mellow Brae Pty Ltd, Ramsden Law Pty Ltd, WMS Solutions Pty Ltd, Crest Accountants Pty Ltd and Members Winding Up Pty Ltd;

(c) the transfer of staff from the MA Group to BPW;

(d) appointing Mr Bettles as voluntary administrator and/or liquidator of companies in the MA Group;

(e) the entry into of the deed of settlement dated 19 July 2016 by SS Residential NSW Pty Ltd with Colin MacVicar (MacVicar Deed) pursuant to which Mr MacVicar was to receive, and did receive, $250,000 in return for his agreement to resign as a director of companies in the MA Group (MacVicar Payment);

(f) in October 2016 the entry into the following management deeds:

(i) management deed dated 11 October 2016 between BPW and MM Prime Investment Pty Ltd (MM Prime Management Deed);

(ii) management deed dated 13 October 2016 between BPW and Capricorn Securities Pty Ltd (Capricorn Securities Management Deed);

(iii) management deed dated 13 October 2016 between BPW and Iridium Financial Planning Pty Ltd (Iridium Financial Planning Management Deed); and

(iv) management deed dated 20 October 2016 between BWP Services and Airlie Beach (MA) Pty Ltd (Airlie Beach Management Deed), (collectively, Management Deeds),

in respect of each of which ASIC alleges that BPW or BWP Services did not provide any of the services which it agreed to provide as set out in each of the deeds;

(g) payments of commissions in 2016, by Elderton Holdings Pty Ltd, a member of the RILOW Group, to Members Alliance Incorporated Pty Ltd when those payments should have been made to MM Prime pursuant to an agreement dated on or about 25 February 2015 between Elderton and MM Prime (Elderton Transaction);

(h) the sale of the Client Book (see [395] below) to Crest Accountants; and

(i) the ultimate disclaimer of Provincial Property Investments (Aust) Pty Ltd’s rental roll by Mr Bettles.

11 In part, ASIC’s case against Mr Bettles arises from his role in a number of the transactions that it alleges were entered into to implement the strategy. ASIC contends:

(1) in relation to the MacVicar Deed and the MacVicar Payment that:

(a) by failing to investigate whether Mr MacVicar was entitled to the MacVicar Payment and by failing to take steps to prevent the MacVicar Payment Mr Bettles:

(i) breached s 180 of the Corporations Act as an officer of Iridium Holdings; and

(ii) breached Liquidator’s Duty No. 1 and Liquidator’s Duty No. 2 as set out in Sch C to the FASOC, which is reproduced in Annexure A to these reasons;

(b) the failure to investigate and prevent the MacVicar Payment, the breach of s 180 of the Corporations Act and the breach of Liquidator’s Duty No. 1 and Liquidator’s Duty No. 2 are matters that can be taken into account under subss 45-1(4)(a), (b), (d) and (e) of the IPS;

(c) having provided earlier advice to Mr MacVicar and his wife Jennifer MacVicar, referred to as the MacVicar Advice (see [44] below), Mr Bettles acted inconsistently with the spirit of cl 6.1 and cl 6.8 and Principle 2 of the Australian Restructuring Insolvency & Turnaround Association (ARITA) Code of Professional Practice (ARITA Code) by accepting appointments to act as liquidator of companies in the MA Group. That is also a matter which the Court can take into account under subss 45-1(4)(a) and (e) of the IPS;

(d) having accepted the appointment as liquidator of Iridium Holdings and other companies in the MA Group, the failure by Mr Bettles to investigate whether Mr MacVicar was entitled to the MacVicar Payment and to prevent the payment in circumstances where the MacVicar Advice gave rise to a relationship between Mr Bettles and Mr and Mrs MacVicar are matters that can be taken into account in considering the seriousness of the consequences of any action or failure to act by Mr Bettles, including the effect of that action or failure to act on public confidence in registered liquidators as a group under subs 45-1(4)(e) of the IPS; and

(e) Mr Bettles was “involved”, as that word is defined in s 79 of the Corporations Act, in Mr Marlborough’s breaches of duties owed to SS Residential under s 180 of the Corporations Act. To that end ASIC alleges that Mr Marlborough breached his duty owed to SS Residential by executing, and causing SS Residential’s entry into, the MacVicar Deed and by authorising the MacVicar Payment. As to the former, ASIC alleges that Mr Bettles’ involvement arises from his knowledge of each of Mr Marlborough’s relevant acts. As to the latter, ASIC alleges that Mr Bettles aided the MacVicar Payment within the meaning of s 79(a) of the Corporations Act or, alternatively, was knowingly concerned in that payment within the meaning of s 79(c) of the Corporations Act. These are also matters which may be taken into account under subss 45-1(4)(a), (b), (d) and (e) of the IPS;

(2) in relation to the Management Deeds that:

(a) because of his state of knowledge of and involvement in the preparation of the various management deeds, Mr Bettles was involved in Mr Marlborough’s contraventions of each of ss 180, 181(1) and 182(1) of the Corporations Act in relation to the entry into each of those deeds and the payment made by companies in the MA Group pursuant to those deeds;

(b) the matters pleaded in connection with the allegations at (a) above are matters which the Court may take into account under subss 45-1(4)(a), (b), (d) and (e) of the IPS;

(c) by agreeing to, and/or allowing or failing to prevent, entry into of the management deeds and/or failing to prevent payments pursuant to those deeds by using the powers he held as liquidator of Iridium Holdings, Mr Bettles breached s 180 of the Corporations Act as an officer of Iridium Holdings and was in breach of Liquidator’s Duty No. 1 and Liquidator’s Duty No. 2 as listed in Sch C to the FASOC; and

(d) the matters pleaded in connection with the allegations at (c) above are matters which the Court may take into account under subss 45-1(4)(a), (b), (d) and (e) of the IPS;

(3) in relation to the Elderton Transaction that:

(a) by failing to investigate whether MM Prime was entitled to payments pursuant to the First Tranche MM Prime Commission invoices and Second Tranche MM Prime Commission Invoices and by permitting those payments to be made to Members Alliance Incorporated rather than to MM Prime, Mr Bettles, in his capacity as an officer of Iridium Holdings, was in breach of s 180 of the Corporations Act;

(b) Mr Bettles was in breach of Liquidator’s Duty No. 1, Liquidator’s Duty No. 2 and Liquidator’s Duty No. 4 as set out in Sch C to the FASOC; and

(c) the matters pleaded in connection with the allegations set out at (a) and (b) above are matters which the Court may take into account under subss 45-1(4)(a), (d) and (e) of the IPS;

(4) in relation to the sale of the Client Book:

(a) by failing to prevent the entry into of the agreement for sale of the Client Book using the powers at his disposal Mr Bettles:

(i) in his capacity as an officer of Iridium Holdings, was in breach of s 180 of the Corporations Act; and

(ii) was in breach of Liquidator’s Duty No. 1 and Liquidator’s Duty No. 2 as set out in Sch C to the FASOC; and

(b) the matters pleaded in support of the allegations at (a) above are matters which the Court may take into account under subss 45-1(4)(a), (b), (d) and (e) of the IPS; and

(5) in relation to the disclaimer of Provincial Property’s rent roll that:

(a) Mr Bettles, in his capacity as an officer of Provincial Property and Iridium Holdings, breached s 180 of the Corporations Act in failing to investigate the value of Provincial Property’s rent roll, in failing to properly market Provincial Property’s rent roll and in disclaiming Provincial Property’s rent roll;

(b) Mr Bettles was in breach of Liquidator’s Duty No. 1, Liquidator’s Duty No. 2 and Liquidator’s Duty No. 4 as defined in Sch C to the FASOC; and

(c) the matters pleaded in support of the allegations in (a) and (b) above are matters which the Court may take into account under subss 45-1(4)(a), (b), (d) and (e) of the IPS.

12 As additional matters, ASIC contends:

(1) in relation to the members’ voluntary winding up of each of SS Residential, Iridium Financial Planning and Capricorn Securities, that Mr Bettles’ knowledge of the status of those companies at the time and of other matters which he was, or ought to have been aware, are matters which the Court may take into account under s 45-1 of IPS. ASIC further contends that by accepting the appointments of those companies, Mr Bettles breached Principle 1 and Principle 2 of the ARITA Code and Liquidator’s Duty No. 6, as set out in Sch C to the FASOC, and that these are matters which the Court may take into account under subss 45-1(4)(a) and (e) of the IPS;

(2) in relation to the declarations of independence, relevant relationships and indemnities (DIRRI) pursuant to s 506(2) of the Corporations Act signed by Mr Bettles for ten of the companies in the MA Group, Mr Bettles failed to adequately disclose the nature of his relationship with Mr MacVicar and the nature of the MacVicar Advice which was contrary to cl 6.10.3 of the ARITA Code, contrary to the spirit of cl 6.8.1 of the ARITA Code and are matters which the Court may take into account under subss 45-1(4)(a) and (e) of the IPS; and

(3) in relation to reports lodged with ASIC pursuant to s 533 of the Corporations Act, Mr Bettles, in making declarations as to the adequacy of the relevant MA Group company’s books and records, made a statement that he knew was false or misleading contrary to s 1308(2) of the Corporations Act, made declarations that were false and failed to discharge his obligations as a registered liquidator to obtain relevant books and records of the companies. Mr Bettles’ failure is a matter which the Court may take into account under subss 45-1(4)(a), (b) and (e) of the IPS.

13 The relief sought by ASIC as a result of Mr Bettles’ conduct in his role as liquidator of companies in the MA Group is set out at [294]-[301] of the FASOC.

14 At [294] ASIC defines “the conduct of the Defendant” and “the assets and income streams” respectively by reference to particular aspects of Mr Bettles’ alleged conduct and the amounts allegedly either paid out or not received by MA Group companies.

15 ASIC contends that:

(1) Mr Bettles’ conduct had the effect of avoiding or reducing scrutiny being given to elements of the strategy and its implementation and sets out why that is so;

(2) Mr Bettles consented to act as liquidator of MA Group companies, including Iridium Holdings, when he knew or ought to have known of the strategy (as defined in [58(c)] of the FASOC) and in the circumstances pleaded at [296]; and

(3) notwithstanding the circumstances pleaded at [296], Mr Bettles consented to act as liquidator of companies in the MA Group, took no steps to prevent the implementation of the strategy or to ameliorate its effects and engaged in conduct designed to avoid or reduce scrutiny of the strategy.

16 At [298]-[301] of the FASOC ASIC pleads that:

298. The Court may take into account the cumulative nature and effect of the conduct of the Defendant under div. 45-1(4) of the Act.

299. The conduct of the Defendant pleaded in paragraph 294(a) above, together with the matters pleaded in paragraphs 295, 296 and 297 above, viewed cumulatively, constituted so gross a departure from, and abrogation of, the duties of a registered liquidator, as to warrant:

(a) the cancellation of the Defendant’s registration as a Registered Liquidator;

(b) a lifetime prohibition on the Defendant from reapplying for registration as a Registered Liquidator;

(c) a lifetime prohibition on the Defendant from consenting to any appointment and acting as a liquidator; and

(d) an order that the Defendant pay ASIC’s costs.

14.2 Individual Items of the Defendant’s Conduct

300. Each individual item of the Defendant’s Conduct pleaded herein (being that conduct listed in paragraph 294(a) above) and the matters pleaded in paragraphs 295, 296 and 297 above, or any one of more item of the same taken in combination, is conduct which may be taken into account by the Court pursuant to div 45-1(4) of the Insolvency Practice Schedule.

301. The conduct of the Defendant pleaded herein, viewed as individual items of conduct or one or more item taken in combination, constituted so gross a departure from, and abrogation of, the duties of a registered liquidator, as to warrant:

(a) the cancellation of the Defendant’s registration as a Registered Liquidator;

(b) a lifetime prohibition on the Defendant from reapplying for registration as a Registered Liquidator;

(c) a lifetime prohibition on the Defendant from consenting to any appointment and acting as a liquidator; and

(d) an order that the Defendant pay ASIC’s costs.

17 ASIC also contends that Mr Bettles breached his duties in relation to the liquidation of Bradford Marine by engaging in conduct which occurred after commencement of this proceeding. The relevant events are set out in Sch D to the FASOC and are more fully described below commencing at [750].

18 As is apparent from the summary set out above, ASIC contends that by his conduct Mr Bettles breached what it refers to as “Liquidators’ Duties” as set out in Sch C to the FASOC (see Annexure A to these reasons).

19 Although there was a significant volume of documentary evidence relied on, there were only four witnesses.

20 ASIC led evidence from the following witnesses:

(1) Paul Dunn who is employed as an investigator by ASIC. Mr Dunn conducts investigations into suspected contraventions of the laws regulated by ASIC and was in ASIC’s investigation into the MA Group, Mr Dunn was cross-examined;

(2) Benjamin de Waard, who is employed as a computer forensic analyst by ASIC. Mr de Ward gave evidence about the nature of metadata and his review of the metadata of two documents. Mr de Waard was not cross-examined; and

(3) Oliver Jones. Mr Jones is a solicitor. He was admitted to practice on 2 February 2009. Mr Jones practises primarily in commercial and corporate law including advising companies from time to time about insolvency issues. He has also undertaken some immigration and employment law. From early 2009 to mid-February 2017 Mr Jones worked as a solicitor at Ramsden Lawyers on the Gold Coast, Queensland, principally under the direction of the firm’s managing partner, John Ramsden. Mr Jones was involved in advising the MA Group in relation to transactions the subject of this proceeding. He was cross-examined.

21 Mr Bettles gave evidence in support of his defence. His qualifications and background are set out below. Mr Bettles was cross-examined.

22 It is convenient at this point to make some observations about his evidence. It was apparent that Mr Bettles did his best to assist the Court. In addition to his detailed affidavits he provided frank answers in cross-examination and was prepared to make concessions where appropriate. Overall Mr Bettles struck me as someone who endeavoured to do his best both professionally and in assisting the Court.

23 As is clear from Mr Bettles’ evidence he has many years’ experience as an insolvency practitioner and registered liquidator. That said, my impression was that he had not had significant experience in large group insolvencies. A review of his evidence and the way in which he interacted with the director of, and advisors to, MA Group companies suggested a level of naivety on Mr Bettles’ part and a complete lack of scepticism. Mr Bettles was too trusting. While it is not my role to speculate, it was perhaps these qualities that ultimately caused Mr Bettles to manage the liquidations as he did. In short Mr Bettles did not strike me as someone who would act in disregard of his duties or statutory obligations. On the contrary, he struck me as someone who is earnest and attempted to “do the right thing” when it came to understanding his role as liquidator.

2.2 ASIC commences an investigation

24 On 29 September 2016 ASIC commenced an investigation under s 13 of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) in relation to potential breaches of ss 184, 911A and 1041F of the Corporations Act and s 29 and s 30 of the National Consumer Credit Protection Act 2009 (Cth) by Capricorn Securities and BPW. ASIC’s investigations subsequently expanded to include, among other matters, the conduct of the liquidators, Mr Bettles and Rajendra Khatri, appointed to companies in the MA Group.

25 Mr Bettles is a chartered accountant. He graduated in 1996 with a bachelor of accounting. He is a professional member of ARITA and is also a justice of the peace for the state of Queensland.

26 Mr Bettles has specialised in the field of insolvency since 1995 and has been a registered liquidator under the Corporations Act since 28 August 2002.

27 Since September 2004 Mr Bettles has been a partner of Worrells Solvency & Forensic Accountants, although strictly the “partner” of the firm is Bettles Holdings Pty Ltd as trustee for the Bettles Holding Trust and Mr Bettles is its nominee. Worrells is principally an insolvency practice, but also runs a small forensic accounting service. It does not provide general accounting services. Worrells has offices in Queensland, New South Wales, the Australian Capital Territory, Victoria and Western Australia. Mr Bettles is usually based at Worrells’ office situated in Robina, Queensland which is referred to as the Worrells Gold Coast office.

2.4 Worrells’ file management system

28 Worrells’ offices are paperless. All correspondence in relation to an external administration is stored electronically in files related to the relevant client. Any paper correspondence received at the offices is scanned and saved into the relevant electronic file. The originals are then destroyed in accordance with Worrells’ document protocol.

29 Worrells uses a proprietary file management system known as “Workbench” which comprises two parts:

(1) a potential system (Potential System) which includes all notes and correspondence relating to discussions prior to taking an appointment; and

(2) a general system which provides a complete record of the steps undertaken on every liquidation or administration to which members of the firm are appointed.

30 Each appointment to a particular company or entity is treated as a separate administration or liquidation. For each appointment, a separate file is opened in Worrells’ file management system and a separate client number is allocated, even where entities belong to a group of companies.

31 Worrells’ internal system has detailed notes and procedures setting out the steps required in each administration undertaken by the firm and all enquiries conducted during an administration or liquidation are recorded electronically in this system.

32 At the commencement of each appointment, a number of generic file enquiry documents, referred to as “file notes”, are set up which are specific to different elements of an external administration. Each file note sets out:

(1) a date and time of entry and the initials of the author which are automatically generated when an entry is made. The system recognises the user by his or her login details. Each author has unique initials assigned to them;

(2) a general narration of the particulars in relation to that part of the external administration;

(3) a list of the relevant legislative sections for reference;

(4) any ASIC flowchart links and required reporting;

(5) details of any actions that need to be undertaken in relation to that aspect of the external administration; and

(6) a general text area where all enquiries are recorded with the date, time and initials of the person who made or who is to make the enquiry.

33 Worrells also maintains a “webnote” system which provides periodic updates, together with relevant information, reports and statutory forms for an external administration. The “webnotes” are specific to each matter and access is password protected and available through the internet. The password is provided to all relevant stakeholders for an external administration, such as directors and creditors. Access to “webnotes” is available for a period of approximately six months following the finalisation of an external administration.

34 A new bank account is opened for each external administration to record receipts into and payments out of that administration.

35 The ultimate holding company of most of the companies in the MA Group and more particularly of those companies relevant to this proceeding was Iridium Holdings (now ACN 161 598 938 Pty Ltd (in liquidation)). The shareholders in Iridium Holdings were Astro Holdings Pty Ltd (in liquidation), a company controlled by Richard Marlborough, as to 50% and J.T. Prestige Pty Ltd (in liquidation), a company controlled by Mr MacVicar, as to 50%. Messrs Marlborough and MacVicar were also directors of Iridium Holdings.

36 The companies in the MA Group which are relevant to this proceeding include:

(1) 2585 Gracemere Pty Ltd (in liquidation);

(2) ACN 117 674 236 Pty Ltd (in liquidation), formerly Syree Enterprises Pty Ltd;

(3) ACN 129 388 969 Pty Ltd (in liquidation), formerly Silverback Constructions Pty Ltd;

(4) ACN 144 889 270 Pty Ltd (in liquidation), formerly Iridium Home Loans Pty Ltd;

(5) ACN 147 346 192 Pty Ltd (in liquidation), formerly Iridium Mortgage Fund Pty Ltd;

(6) ACN 159 641 371 Pty Ltd (in liquidation), formerly Laver Resources Pty Ltd;

(7) ACN 161 904 776 Pty Ltd (in liquidation), formerly Members Alliance Rocket Pty Ltd;

(8) MAIC Human Resources Pty Ltd (in liquidation);

(9) All My Best Wishes Pty Ltd (in liquidation);

(10) RJM Property Developments Pty Ltd (in liquidation);

(11) Silverback Investments Pty Ltd (in liquidation);

(12) HSINIF Pty Ltd (in liquidation);

(13) Provincial Property;

(14) ACN 151 259 675 Pty Ltd (in liquidation), formerly Image Building Group QLD Pty Ltd;

(15) Trats Pty Ltd (in liquidation);

(16) SS Residential;

(17) Iridium Financial Planning; and

(18) ACN 143 933 644 Pty Ltd (in liquidation), formerly Capricorn Securities;

(19) ACN 133 019 093 Pty Ltd (in liquidation), formerly MM Prime;

(20) MA Human Resources Pty Ltd (in liquidation); and

(21) Airlie Beach.

37 Iridium Holdings:

(1) was the sole shareholder of:

(a) Iridium Mortgage Fund;

(b) Iridium Home Loans;

(c) Laver Resources;

(d) Members Alliance Rocket;

(e) MAIC Human Resources;

(f) Provincial Property;

(g) Silverback Investments;

(h) SS Residential;

(i) Iridium Financial Planning;

(j) Capricorn Securities;

(k) MM Prime;

(l) Airlie Beach; and

(m) MA Human Resources;

(2) was the ultimate holding company of Silverback Constructions; and

(3) held 98% of the shares in Syree Enterprises.

38 The companies in the MA Group conducted a number of businesses, primarily in Queensland, New South Wales and Victoria including:

(1) project marketing;

(2) finance broking;

(3) financial planning and risk services;

(4) property management;

(5) construction;

(6) lease holding;

(7) staff and labour hire; and

(8) investment activities on behalf of the directors of companies in the MA Group.

39 By letter dated 28 November 2014 the Australian Taxation Office (ATO) informed Iridium Holdings that it had processed its notification to register a goods and services tax (GST) group, the group was registered from 1 July 2014 and the representative member of the group was Iridium Holdings. There were 20 other companies named as members of the group including SS Residential, Iridium Financial Planning, Capricorn Securities, MM Prime and Airlie Beach (together, the MA Trading Companies).

40 By letter dated 2 March 2015 the ATO informed Iridium Holdings that it had registered its income tax consolidated group for income tax purposes with an effective date of 1 July 2013. The letter listed 21 companies as members of the consolidated group including four of the MA Trading Companies: SS Residential, MM Prime, Airlie Beach and Capricorn Securities.

41 As set out at [10(4)(e)] above Mr MacVicar was a director of Iridium Holdings. He was also a director of a number of other companies in the MA Group.

42 Mr Bettles was first introduced to Mr MacVicar by Aaron Lavell of WMS Chartered Accountants, a firm of accountants operating on the Gold Coast, Queensland. Mr Bettles understood that WMS was one of the largest firms of accountants operating on the Gold Coast. Mr Bettles had known Mr Lavell for some time, having first met him in the mid-1990s through a mutual friend. His relationship with Mr Lavell was professional with WMS referring potential clients to him.

43 In about February 2015 Mr Lavell introduced Mr Bettles to Mr MacVicar, who was one of Mr Lavell’s clients.

44 On 11 March 2015 Mr Bettles provided the MacVicar Advice to Mr and Mrs MacVicar. The MacVicar Advice was addressed to Mr Lavell of WMS. As stated at its commencement the purpose of the MacVicar Advice was to provide advice “on the adverse financial consequences to Mr Colin and Mrs Jenny MacVicar personally should the [MA Group] cease to trade in a short timeframe because of an inability to pay outstanding debts to the Australian Taxation Office”.

45 The MacVicar Advice was detailed, spanning some eight pages and addressed the following topics:

(1) the factual background on which the advice was based including the ownership of Iridium Holdings, the holding company of the MA Group, and J.T. Prestige which as trustee for the Denominator Trust held 50% of the shares in Iridium Holdings;

(2) the “Areas of Exposure”. Here Mr Bettles noted that:

It is obviously impossible for me to advise you of every adverse financial consequence without reviewing every transaction that Mr & Mrs MacVicar and their associated entities have entered into for at least the last five years. Consequently this advice is designed to broadly identify the areas that may have a material effect on Mr & Mrs MacVicar and their associated entities, and therefore should be considered as part of a review of their affairs.

(3) he the considered the following topics;

(a) inter entity loans. Mr Bettles advised that there was a need “to carefully review the balance sheets for all entities to confirm who owes what to whom” and stated:

Some particular areas you may wish to consider are:

• MA Human Resources Pty Ltd has a significant liability to the ATO. I note that MM Prime Investments Pty Ltd acts as treasury for the [MA Group] and that MM Prime Investments Pty Ltd owes MA Human Resources Pty Ltd $4,160,087.

Should MA Human Resources Pty Ltd be wound up then the liquidator would be looking to seek recovery of the $4,160,087 owed by MM Prime Investments Pty Ltd. If this resulted in MM Prime Investments Pty Ltd being wound up then this could have a significant impact on the [MA Group] because the liquidator may seek recoveries of all of the loans owing to MM Prime Investments Pty Ltd.

• Denominator Trust owes the ATO $321,249. Should the ATO take legal action seeking recovery of this debt then it would need to take action against the trustee, as a trust is not a legal entity and therefore cannot be sued. The trustee is obviously J.T. Prestige Pty Ltd.

The winding up of J.T. Prestige Pty Ltd would give control of the Denominator Trust to the liquidator by virtue of the indemnity contained within the trust deed. The liquidator could then seek recovery of the debts owed to both J.T. Prestige Pty Ltd and Denominator Trust, which includes:

…

The winding up of J.T. Prestige Pty Ltd would also result in the liquidator controlling the 50% shareholding in [Iridium Holdings], which the liquidator would sell to any interested party.

(b) voidable transactions. Mr Bettles set out a summary of the type of transactions that can be set aside by a trustee in bankruptcy. After doing so he noted:

Some particular areas you may wish to consider are:

• [Iridium Holdings] has not paid for the purchase of Provincial Property Investments (Aust) Pty Ltd. Rather it is intended to show a loan in the accounts of J.T. Prestige Pty Ltd, which will be offset by any amounts owing by other entities to the [MA Group].

Should a liquidator be appointed to J.T. Prestige Pty Ltd the liquidator could argue that because J.T. Prestige Pty Ltd did not physically receive the purchase price then the transaction is a voidable transaction and the liquidator would seek the return of the shareholding in Provincial Property Investments (Aust) Pty Ltd or the amount of the purchase price.

• I note your advice that Mr MacVicar’s remuneration, which is directed to Denominator Trust, is derived from a fee of $4,500 for each successful property settlement achieved by the [MA Group]. I also note that you are comfortable that this fee is reasonable. Given the total quantum of monies paid in this area it is likely to be a matter thoroughly investigated by a liquidator and consequently, if you have not documented how you arrived at the figure of $4,500, I suggest you do so.

(c) director penalty regime;

(d) directors’ duties;

(e) dividends to shareholders;

(f) shareholding;

(g) beneficially held shares;

(h) director disqualification; and

(i) association membership and practising certificates.

2.7 The ATO serves statutory demands

46 Between 5 January 2016 and 21 April 2017 the ATO issued the following statutory demands to companies in the MA Group:

Date Of Demand | Debtor Company | Amount Of Demand |

5 January 2016 | Syree Enterprises | $954,098.10 |

5 January 2016 | Gracemere | $996,615.97 |

5 January 2016 | Astro Holdings | $681,501.63 |

6 January 2016 | RJM Property | $549,745.62 |

6 January 2016 | Trats | $722,837.78 |

23 June 2016 | Iridium Holdings | $2,178,490.16 |

23 June 2016 | Silverback Constructions | $636,148.38 |

23 June 2016 | Iridium Mortgage Fund | $69,039.21 |

23 June 2016 | Iridium Home Loans | $74,102.63 |

23 June 2016 | MAIC Human Resources | $599,395.64 |

24 June 2016 | HSINIF | $592,540.87 |

24 June 2016 | Members Alliance Rocket | $80,790.55 |

24 June 2016 | All My Best Wishes | $687,282.36 |

27 June 2016 | Provincial Property | $173,282.42 |

7 July 2016 | Image Building Group | $1,385,287.71 |

8 July 2016 | Laver | $6,766,842.94 |

21 April 2017 | Airlie Beach | $2,193,769.07 |

47 By letter dated 8 April 2016 WMS wrote to the ATO’s “Significant Debt Management” area on behalf of the “Iridium Holdings Group of Companies” (i.e. the MA Group) setting out “the taxpayer’s proposal to enter into a Deed of Compromise and meet ongoing compliance commitments”. By letter dated 15 June 2016 the ATO refused the proposed compromise, providing its reasons for doing so and noting at the conclusion of the letter that:

If the outstanding taxation liabilities for all entities within the Group are not paid in full immediately we will initiate action to wind up the companies by using a Creditor’s Statutory Demand for Payment.

48 Ramsden Lawyers acted for the MA Group from about June 2016. John Ramsden was the managing partner of Ramsden Lawyers and, as set out above, Mr Jones principally worked under his supervision.

49 A new matter for the MA Group was referred to Ramsden Lawyers by WMS. Mr Jones first became involved in the matter in about June 2016 at a meeting with Mr Ramsden. Mr Jones recalls that during the meeting Mr Ramsden informed him that:

(1) this would be the biggest matter of this type that the firm had ever done. It was a corporate group insolvency and restructure of more than 20 companies;

(2) the intention was to realise certain assets before the companies went into liquidation because, if the companies went into liquidation, they would lose their Australian Financial Services Licence (AFSL) and, as a result, certain assets, such as the insurance roll, would have a markedly decreased value or may even be worthless;

(3) one of the possible strategies for the restructure was to create a new corporate entity which would purchase some of the assets remaining in the MA Group;

(4) the MA Group had significant debts owing to the ATO and the Office of State Revenue for payroll tax. Mr Jones recalls that the MA Group was consolidated for tax purposes and had a tax liability of around $21 million; and

(5) Ramsden Lawyers would need to secure its fees by registration of a security interest so that they would not be considered a preference if the companies went into liquidation, the companies in the MA Group were solvent and they could therefore enter into transactions with them and register a security interest for their fees but moving forward the companies would eventually most likely become insolvent.

50 At this initial meeting Mr Ramsden instructed Mr Jones to contact Mr Lavell to get the matter started. Mr Jones did so by email sent on 1 July 2016 in which, among other things, he:

(1) sought specified “additional material” following his review of the file; and

(2) referred to a “new entity controlled by Braiden Marlborough”, Mr Marlborough’s son who, for ease and without intending any disrespect, I will refer to as Braiden. Mr Jones recalled that one of the strategies being considered at the time was for a new entity (NewCo) to be set up by Braiden to purchase certain assets of the MA Group.

51 On 5 July 2016 Mr Jones drafted a retainer letter and a security agreement to allow for registration of a security interest under the Personal Property Securities Act 2009 (Cth) (PPSA) and to ensure that both Ramsden Lawyers and WMS had documentation in place to give rise to a valid security interest under the PPSA.

52 On 8 July 2016 Mr Bettles attended a meeting with Mr Lavell of WMS and Messrs Ramsden and Jones of Ramsden Lawyers (8 July 2016 Meeting). Mr Bettles recalls that Mr Lavell invited him to the meeting to discuss the financial position and structure of the MA Group and the nature and general consequences of an insolvency appointment.

53 Mr Bettles, who did not attend the entirety of the meeting, recalls that Mr Lavell did most of the talking during the meeting addressing each of the companies in the MA Group and that Mr Ramsden was also involved in the discussions. While he cannot recall the precise words spoken, Mr Bettles recalls that the following matters were discussed:

(1) Mr Lavell identified various companies in the MA Group and their operations and, to the best of Mr Bettles’ recollection, he went through a spreadsheet or spreadsheets;

(2) there was a discussion about placing companies in the MA Group into insolvency administration; and

(3) Mr Bettles was informed that there was a need to realise the assets of the MA Trading Companies before liquidating those companies, otherwise the value in those assets would be lost.

54 Upon returning to his office, Mr Bettles made a file note which is date and time stamped 8 July 2016 at 12.38 pm. The file note records:

JB 08/07/16 12:38 PM: Meeting with Aaron Lavell from WMS Accountants, and John Ramsden and Oliver Jones from Ramsden Law to discuss the financial position of the group. It seems a number of the companies have received statutory demands from the ATO, some other companies are insolvent, and some companies are solvent but their sole shareholders are insolvent.

Aaron ran through the operations of each entity. John indicated that he was doing a review of all of the companies to provide advice to each of them on their solvency position. It seems likely that the whole group will ultimately fail and Richard (director) will end up bankrupt, but the liquidations of each company will need to be staged because in some cases assets need to be realised prior to liquidation otherwise the value in the asset will be lost.

Aaron is to email me his spreadsheets on what each company does and which companies have received statutory demands.

55 According to Mr Bettles, given the generality and high level of the discussion, at the conclusion of the meeting he had no specific knowledge of the financial affairs of the MA Group.

56 Mr Bettles was cross-examined about the 8 July 2016 Meeting. He maintained that he did not believe that there was any discussion to the effect that Messrs Lavell and Ramsden would put a proposal to him as to the order in which companies in the MA Group were to be placed into liquidation. Rather, he recalled that Mr Ramsden was still undertaking a review of the solvency of each of the companies in the MA Group at the time, although there was discussion about issues that arose in relation to some of the companies in the group.

57 However, Mr Bettles accepted that by the end of the 8 July 2016 Meeting, he was aware:

(1) there was a special purpose human resources company in the MA Group which was indebted to the ATO; and

(2) of Airlie Beach and probably aware that it held management rights for a building known as “the Summit”.

58 Mr Jones also gave evidence about the 8 July 2016 Meeting. Based on the work in progress report for the matter maintained by Ramsden Lawyers (WIP Report), the meeting went for five hours although, as Mr Jones accepted in cross-examination, that timing included travel time from Ramsden Lawyers’ offices to WMS’ offices at Robina, Queensland, where the meeting took place. Having regard to travel time Mr Jones accepted that the meeting time was closer to four hours in length and he recalled that it ended near the end of the working day. Mr Jones could not recall when Mr Bettles left the meeting. However, it is clear that by 12.38 pm, when he recorded his file note, Mr Bettles was back in his office and, given Mr Jones’ evidence as to when the meeting ended, that Mr Bettles was not present for its entirety.

59 Mr Jones did very little talking during the meeting. His role was to take notes, which he did on his iPad. Mr Jones’ notes comprise six pages. Although he cannot now recall who said what at the meeting, by reference to his notes he recalls that:

(1) as reflected on the first page of the notes, there was discussion about:

(a) the assets which remained within various companies in the MA Group, which in many cases were trail commissions being received under various agreements;

(b) checking with Liam Young, the general legal counsel of the MA Group and the sole director of BPW, BPW Holdings and Young Corporation (NSW) Pty Ltd, about whether any companies on which a statutory demand had been served were complying with payment arrangements, including checking those companies with “Image” in their names;

(c) a company called “Iridium Home Loans” and determining if the trail agreements would cease upon certain events occurring, such as liquidation;

(d) financial reports in relation to various of the MA Group companies which were reviewed during the meeting;

(e) various trail commissions being received by companies in the MA Group;

(f) Capricorn Securities, which held an AFSL, and Iridium Financial Planning, which was an authorised corporate representative under that AFSL, that a statutory demand for about $70,000 had been issued to Capricorn Securities, concern that the trailing commissions received by Capricorn Securities would cease if it went into liquidation based on that demand and whether the statutory demand should be paid in order to avoid that consequence;

(g) JP Downey of Downey and Co and MA Human Resources, which was in receivership;

(h) Iridium Home Loans paying the statutory demand, selling off its assets and putting that company into administration to effect the sale of assets or perhaps entering into a deed of company arrangement (DOCA);

(i) Airlie Beach, including that it had management rights to certain properties located at Airlie Beach which David Domingo, a director of various companies in the MA Group, wanted, that Mr Marlborough had not allowed Mr Domingo to take these management rights because he had already taken an asset worth $3 million, which concerned the Prime Securities Income Trust, and that Mr Domingo was aware that Mr Bettles would likely try to recover the $3 million asset once he was appointed liquidator;

(j) the taxation liability of the MA Group, that the MA Group was a consolidated group for tax purposes under a tax sharing arrangement which meant that there was joint and several liability for tax debts and whether the ATO would make a decision to treat the MA Group as a group for taxation purposes. In cross-examination Mr Jones accepted that the effect of the discussion was that payroll tax would likely be consolidated but that it was not known at that time whether other taxation liabilities would be consolidated by the ATO;

(k) the trail book of Capricorn Securities and Iridium Financial Planning and, if it was not sold before those companies went into liquidation, the book would not have any value if sold by liquidators because liquidation would mean loss of the AFSL and would result in the trail providers no longer paying the trail commission;

(l) the NewCo arrangement. The notes state “Richard’s son will create new entity with Liam as sole director and shareholder. Ownership of the trustee co, will also be Liam”. This was a reference to Braiden, Mr Young and the NewCo arrangement as referred to at [50(2)] above;

(m) Provincial Property and that it had rental property management rights to a large number of properties in certain regional cities; and

(n) Mellow Brae, a company associated with Mr Domingo, and a second mortgage book relating to the Prime Securities Income Trust;

(2) as reflected on the second page of the notes, there was discussion about:

(a) the transaction with Mr Domingo concerning the Prime Securities Income Trust;

(b) a $4 million asset which was the same asset as referred to at [59(1)(i)] above. During the discussion that asset was variously referred to as being worth between $3 and $4 million;

(c) MM Prime which had an asset in relation to certain work in progress from property development and that Mr Marlborough wanted to buy this business in order to collect the work in progress. I note that in his notes Mr Jones recorded that:

Richard will want to buy this business and carry on but Richard needs $500K to get them to continue business so can collect WIP. Only way to pull out is the below $400K from the planning business but that will take 90 days. Every day there is settlements that said.

(d) various options for the liquidation of the companies in the MA Group; and

(3) as reflected on the third page of the notes, there was discussion about:

(a) the current employees of the MA Group and that Mr Marlborough would employ some of them in NewCo;

(b) Mr Lavell being prepared to accept $130,000 or $140,000 in satisfaction of the outstanding amount of $165,000 owing to WMS for fees;

(c) what Mr Bettles could do once appointed as liquidator of Iridium Holdings, the sole shareholder of companies in the MA Group. Mr Ramsden noted that Mr Bettles could wind up each of the subsidiary companies;

(d) whether the liquidator could access funds held in trust. There was $450,000 available which could be used to pay WMS’ outstanding fees with the balance, of $350,000, available for use by Mr Bettles in the liquidation;

(e) a deed with the NSW government concerning a payment to SS Residential;

(f) ensuring that Capricorn Securities kept its AFSL by paying its debts and avoiding going into liquidation, the need to keep the responsible manager in order to maintain the AFSL and that he may need to be paid;

(g) tax liability, as to which Mr Bettles made a comment about the tax liability for the consolidated group;

(h) WMS’ and Ramsden Lawyers’ fees. This included a detailed discussion about how WMS’ past fees could be secured and Mr Ramsden’s suggestion, in relation to Ramsden Lawyers’ fees, that a security interest provision be inserted into its fee agreement which would make all of the MA Group companies liable for the fees and allow Ramsden Lawyers to register a security interest. The reference in Mr Jones’ notes to “Getting $450 once deed is signed” was a reference to an amount of about $450,000 which SS Residential expected to receive once the deed with the NSW government was signed; and

(i) the obligation of other MA Group members to pay Ramsden Lawyers’ fees. Mr Jones explained that his file note refers to issuing a demand to SS Residential or Airlie Beach because those companies had an asset upon which demand could be made.

60 At the end of the third page of his notes Mr Jones recorded “Telephone attendance with Richard following meetings”. Based on his review of the subsequent pages of his notes, Mr Jones believes that he and Mr Ramsden had a telephone discussion with Mr Marlborough following their meeting with Messrs Lavell and Bettles.

61 On 14 July 2016 at 11.36 am Mr Young sent an email to Messrs Ramsden and Jones, copied to Mr Marlborough and Genevieve White of Ramsden Lawyers, setting out NewCo’s requirements in relation to “its management of current business of the [MA Group] of companies for an appointed liquidator” (14 July 2016 Email). The 14 July 2016 Email referred to the “operations of NewCo” and NewCo’s requirements as follows:

1. Payment of all property management fees paid to Provincial Property Investments Pty Ltd (PPI) and Airlie Beach (MA) Pty Ltd until such time as a Deed of Company Arrangement (DOCA) has been entered into and the Airlie Beach management rights are sold;

2. NewCo will offer to pay the existing ATO debt of PPI at 100c in the dollar as part of a DOCA in order to continue the operations of the company;

3. Payment of all trail income received by Capricorn Securities Pty Ltd and Iridium Financial Planning Pty Ltd in order to manage existing WIP while a sale to market is arranged;

4. Payment of 25% of any up-front commissions received in order for NewCo to pay relevant incentives to retained staff to complete existing WIP;

5. Any costs to maintain Capricorn or Iridium Financial Planning are to be paid from the remainder of up-front commissions received. This includes (but is not limited to) payment of the existing statutory demand, any required professional indemnity insurance and financial planning software;

6. The full sale price achieved for financial planning asset will be made available to the liquidator, once such sale is finalised;

7. In relation to MM Prime Investments Pty Ltd, NewCo to split WIP on a 50/50 basis for all settled sales;

8. In order to ensure NewCo has cash flow at the front end it will require 100% of sales for the first 10 settlements;

9. NewCo will split settled WIP on a 50/50 basis for the next 20 settled deals;

10. Thereafter, NewCo will split settled WIP on a 50/50 basis with adjustments to be made in order for the liquidator to recover the 50 share of commissions retained by NewCo on the initial 10 settlements;

11. Any costs required to manage existing WIP are to be met by the portion of funds retained by the liquidator. This would include, though is not limited to, maintaining the existing CRM and cloud access to allow NewCo access to client data; and

12. Payment of Sydney rent to be met until payment of funds from Transport NSW is received, NewCo to be given access to the Sydney premises in this time.

62 Mr Bettles next met with Mr Ramsden on 14 July 2016 to discuss the operations of each of the companies in the MA Group and the nature and consequences of an insolvency appointment (14 July 2016 Meeting). Mr Bettles could not recall the detail of what was discussed at that meeting and his file note of the meeting lacks detail. He could not recall discussing the 14 July 2016 Email at the 14 July 2016 Meeting and his evidence, which I accept, is that he did not receive the 14 July 2016 Email until after the 14 July 2016 Meeting (see [102] below).

63 Mr Jones, who also attended the meeting, recalls that the purpose of the meeting was to discuss the strategy of how they would proceed with NewCo including the management of funds, the management of assets by NewCo and realisation of those assets. In his evidence in chief, Mr Jones said that he recalled that Mr Bettles approved “the strategy for the NewCo”. He understood from Mr Ramsden that he was not prepared to proceed with the strategy without Mr Bettles’ approval because he did not want the liquidator to undo, at a later stage, what had been done. Mr Jones said he recalled this because it gave him comfort to know that Mr Bettles was on board with the “strategy”.

64 However, in cross-examination Mr Jones’ recollection was undermined. He accepted two things: first, that he does not identify in his evidence the content of the “strategy”; and secondly, his understanding that the “strategy” was approved by Mr Bettles was based on information he received from Mr Ramsden and not Mr Bettles directly. In addition, Mr Jones could not recall that the 14 July 2016 Email was discussed at the 14 July 2016 Meeting.

65 On 16 July 2016 Mr Bettles attended a meeting with Mr Lavell and Justin Wowk from WMS, Messrs Marlborough and Young and Braiden (16 July 2016 Meeting). Mr Bettles does not have a specific recollection of what was discussed at that meeting but his file note of the meeting records:

Meeting with Aaron Lavell and Justin from WMS Accountants, Richard (director), Braydon (Richard’s son), Liam (former legal counsel) to go over the operations of each of the companies. The operations are set out in a powerpoint presentation that Aaron will email me. Just need to remember that:

1. there are 21 cars leased from SGI Fleet. They will arrange for the vehicles to be dropped at SGI depots around the country

2. the records are saved on a server in the cloud. Maintaining that server is necessary to complete the wip and sell the books and trails. Cost is $11,000 per month.

66 Following the 16 July 2016 Meeting Mr Bettles thought that the records “stored in the Cloud” were the books and records of the whole of the MA Group.

2.9.5 Mr Bettles’ general recollections of discussions at the pre-appointment meetings

67 Mr Bettles recalls a number of matters that were discussed at the pre-appointment meetings described above but, other than those matters raised by Mr Marlborough which must have occurred at the 16 July 2016 Meeting, he cannot recall at which particular meeting they were discussed. The matters which Mr Bettles recalls were discussed were:

(1) a conversion of assets belonging to the MA Trading Companies was to occur within a short time. Mr Bettles was told that if those companies went into administration immediately, the assets would not be realised for their proper value and therefore they should be wound up at a later date so that asset values were not lost;

(2) in the interim, the MA Trading Companies did not have any staff. Thus the assets would need to be managed by someone other than the directors of the MA Trading Companies;

(3) Mr Young, who previously worked for the MA Group, was the appropriate person to do so. He was already operating a similar but smaller business to that conducted by the MA Group. Mr Bettles does not recall whether the name “Benchmark” was used during the discussions;

(4) statutory demands had been issued by the ATO and he would be sent further information in relation to which companies had received those demands;

(5) he was asked what a liquidator would do in certain circumstances but can no longer recall the circumstances put to him;

(6) Messrs Lavell and Ramsden informed him that each of the MA Trading Companies were solvent;

(7) there would be no employees left in the MA Group companies;

(8) Mr Young’s companies would be assisting the MA Trading Companies to continue to trade or to service their clients so that the value of their assets could be preserved and then realised. Mr Bettles understood that this would mean that more funds would then flow to Iridium Holdings, as the sole shareholder of those companies;

(9) the entire MA Group started within MM Prime, which conducted a project and property marketing business, that he would not be appointed to MM Prime yet as it was one of the MA Trading Companies that was to continue to trade to recover work in progress and that MM Prime was not to be placed into liquidation so that referral fees could be collected from developers and builders. The house and land packages gave purchasers opportunities to terminate their contracts. For the property marketer to receive its referral fees, it worked as a liaison between the purchasers and developers/builders to ensure that the contract settled and that they thus received those fees. Mr Bettles recalls that he was told that all employees in the MA Group would be terminated prior to the commencement of the insolvency administration and thus it would not be possible for an insolvency practitioner to service the clients which would likely see the contracts terminated and no referral fees paid;

(10) in relation to SS Residential, that if it was placed into administration the moneys to be paid by the landlord for the surrender of the lease of a building in Sydney would not be paid and, upon the moneys being paid by the landlord for the surrender of the lease to SS Residential, that company would be placed into a members’ voluntary liquidation to enable the distribution of the funds to Iridium Holdings as its sole shareholder;

(11) in relation to Capricorn Securities and Iridium Financial Planning:

(a) that both of these companies were solvent;

(b) Capricorn Securities was the holder of an AFSL and Iridium Financial Planning was its corporate authorised representative;

(c) as the AFSL authorised representative, Iridium Financial Planning’s business included financial planning, insurance sales and investment services and it received commissions and was entitled to trailing commissions with respect to the insurance business if clients took up investments;

(d) Capricorn Securities would lose its AFSL upon the appointment of an external administrator and the business would lose value once the companies entered into administration because the agreements with the providers included clauses that entitled them not to continue to pay commissions upon the AFSL being lost or the holder of the AFSL being placed in external insolvency administration. Mr Bettles explained that, as an insolvency practitioner, he had experience in administrations of holders of AFSLs or, alternatively, authorised representatives losing the entitlement to commissions upon an administration and the providers refusing to continue to pay the commissions;

(e) Mr Young, through his company or companies, would be engaged to service the existing clients and to provide the services required to retain these clients so that the entitlement to trailing commissions was preserved; and

(f) subsequent to the realisation of the assets of Capricorn Securities and Iridium Financial Planning, those companies would be placed into a members’ voluntary liquidation and those funds would be available to be distributed to their shareholder, Iridium Holdings; and

(12) there was discussion about Airlie Beach to the following effect:

(a) that Airlie Beach provided real estate and management rights services as a caretaker and operator of a leasing business for apartments located in Airlie Beach, Queensland;

(b) there was a concern that a sale by an insolvency administrator would negatively affect the ability to realise the management and letting rights for proper value; and

(c) subsequent to the realisation of its assets, Airlie Beach would be placed into a members’ voluntary liquidation and those funds would be available to be distributed to the shareholder, Iridium Holdings.

68 In cross-examination Mr Bettles accepted that prior to his appointment to Iridium Holdings he was aware that:

(1) staffing would be an issue for the MA Trading Companies and that they would not be able to trade because they did not have any employees. Mr Bettles understood that the staff had been terminated, he assumed by Mr Marlborough or the directors of MAIC Human Resources, one of the main labour hire companies within the MA Group. He did not really consider what became of those employees;

(2) the NewCo group was going to be controlled by Mr Young, the former general counsel for the MA Group, and that Mr Marlborough was also going to be involved. Mr Bettles said that he was informed at the pre-appointment meetings that Mr Young had a business that was similar to the business carried on by the MA Group, albeit smaller; and

(3) MAIC Human Resources continued to employ staff and, on his appointment to Iridium Holdings on 22 July 2016, the remaining time of those employees with the MA Group was to be short as they were to be employed by NewCo. Mr Bettles accepted that he knew, at the very latest by 20 July 2016, that BPW was going to employ staff that worked for the MA Group.

69 Mr Jones recalls that he, Messrs Ramsden and Bettles were first shown a PowerPoint presentation by Mr Lavell (WMS PowerPoint) during the 8 July 2016 Meeting. Despite that, in cross-examination Mr Jones accepted that he did not make specific reference to the WMS PowerPoint in his notes of the 8 July 2016 Meeting. Insofar as his notes of the 8 July 2016 Meeting recorded the words “saw financials”, Mr Jones maintained that he saw the financials for the group entities at the meeting as well as the WMS PowerPoint showing all of the assets and liabilities of each member of the MA Group. Mr Jones’ evidence was that the WMS PowerPoint was a WMS document and, as far as he is aware, no one at Ramsden Lawyers made any amendment to it once it was provided to the firm.

70 Mr Bettles recalls that Mr Lavell referred to a PowerPoint presentation at the 16 July 2016 Meeting, as referred to in his file note of that meeting (see [65] above), and that the WMS PowerPoint was not referred to at the 8 July 2016 Meeting.

71 Ultimately in the evidence before me there were five versions of the WMS PowerPoint. They were:

(1) the version which ASIC contends was discussed at the 8 July 2016 Meeting (WMS PowerPoint V1);

(2) the version updated on or about 11 July 2016 (WMS PowerPoint V2);

(3) the version updated on or about 12 July 2016 (WMS PowerPoint V3);

(4) the version updated on or about 13 July 2016 (WMS PowerPoint V4); and

(5) the version updated on or about 20 July 2016 (WMS PowerPoint V5).

72 ASIC contends that WMS PowerPoint V1 was shown at the 8 July 2016 Meeting. As set out above, Mr Jones’ and Mr Bettles’ evidence are at odds as to whether there was a PowerPoint presentation at that meeting. Mr Jones’ notes, which are relied on by ASIC and which are comprehensive, do not record that a PowerPoint presentation was shown at the meeting.

73 At first Mr Jones gave evidence that WMS PowerPoint V5 was shown at the 8 July 2016 Meeting but when it was pointed out to him in cross-examination that WMS PowerPoint V5 included dates that post-dated the 8 July 2016 Meeting Mr Jones accepted that that version could not have been shown at that meeting. That revelation caused ASIC to undertake a further search in the course of the trial of the documents it held relating to its investigation and led to production of the five versions of the WMS PowerPoint set out above.

74 It also became apparent that on 7 July 2016 Loren McFarlane, executive assistant to Mr Lavell, forwarded a package of material which included WMS PowerPoint V1 to, among others, Messrs Jones and Ramsden with a message:

Please see attached documents as per Aaron’s email below. Richard will check for factual accuracy and may have further changes tomorrow.

75 Based on Ms McFarlane’s email Mr Jones gave evidence that WMS PowerPoint V1 was shown electronically at the 8 July 2016 Meeting. However, in cross-examination Mr Jones conceded that he could not be sure that it was WMS PowerPoint V1 that was shown at the 8 July 2016 Meeting and that it could have been another version of the same document.

76 The state of the evidence in relation to whether a PowerPoint presentation was shown at the 8 July 2016 Meeting and, if so, what version is unsatisfactory. The highest it goes is that it is possible that a version of the WMS PowerPoint was shown at the meeting and, taking Mr Jones’ evidence as a whole, it is likely that it was WMS PowerPoint V1 but he cannot be sure.

77 Turning to WMS PowerPoint V5, in an email dated 20 July 2016 Mr Bettles requested Mr Lavell to:

… please forward to me that powerpoint presentation we keep looking at. The one that sets out your notes on each company’s operations.

78 Later that day Mr Lavell emailed Mr Bettles the requested PowerPoint presentation, which was WMS PowerPoint V5. Mr Bettles saved a copy of Mr Lavell’s email and WMS PowerPoint V5 to Worrells’ Potential System.

79 Mr Bettles was cross-examined about this evidence and, in particular, his email dated 20 July 2016 (see [77] above). He disagreed that he had seen versions of the WMS PowerPoint at the pre-appointment meetings prior to the 16 July 2016 Meeting. He suggested that his reference to the “PowerPoint presentation we keep looking at” was infelicity of expression and that, while he had seen a PowerPoint presentation at the 16 July 2016 Meeting, he had only been shown spreadsheets at earlier meetings.

80 As Mr Bettles requested that the PowerPoint presentation that he had seen be sent to him, his usual practice would have been to review it on receipt.

81 Mr Bettles does not recall amending WMS PowerPoint V5 (Amended WMS PowerPoint) although he accepts that he did so. That must be the case given that the evidence relied on by ASIC confirms that it was Mr Bettles who made the modifications which resulted in the Amended WMS PowerPoint and it is the Amended WMS PowerPoint which is linked to each of the “100 Overview” file notes for the companies in the MA Group to which Mr Bettles was appointed as external administrator.

82 On 23 July 2016, at the time of linking the Amended WMS PowerPoint, Mr Bettles added the following entry under the heading “initial conversation with director”:

Here is a handy PowerPoint presentation prepared by WMS Chartered Accountants that sets out all the companies in the Members Alliance business and what each does.

Mr Bettles said that both WMS PowerPoint V5 and the Amended WMS PowerPoint are referred to in those file notes and were available to all partners and staff who worked on the external administrations of the companies in the MA Group to which he and Mr Khatri of Worrells’ Brisbane office were appointed.

83 Mr Bettles said that as best he can determine, the difference between WMS PowerPoint V5 and the Amended WMS PowerPoint is the deletion of slides 2 and 3 appearing in the former so that they did not appear in the latter. Slides 2 and 3 in WMS PowerPoint V5 were as follows:

Slide 2

Slide 3

84 Mr Bettles said that those slides were irrelevant to his appointment and would be irrelevant to tasks to be undertaken by him and his staff in the insolvency administrations of MA Group companies because:

(1) the timeline in slide 2 was of no relevance. Mr Bettles had not been appointed as liquidator or administrator to any company in the MA Group at either of the dates referred to in that slide. In Mr Bettles’ experience timelines are elastic and the dates shown are imprecise; and

(2) the proposed staff in slide 3 were of no relevance to Mr Bettles as they were to be employed by a company owned and operated by Mr Young, Mr Bettles was not to have any role in that company and he had been told that the companies to which he was to be appointed had no staff.

85 Mr Bettles disagreed that he removed slide 2 and 3 from WMS PowerPoint V5 to create the Amended WMS PowerPoint because those slides would have alerted other Worrells staff working on the administrations to the fact that there was a timeline for the creation of the NewCos, that there was a proposed list of staff to be transferred from the MA Group to the NewCos and that there was a plan to move staff to the NewCos and to set up a mirror image of companies and which would have caused his staff to make enquiries about exactly what was going to happen.

2.11.1 Mr Bettles’ knowledge as at 8 July 2016 including the strategy

86 It is convenient at this point to consider whether as alleged by ASIC, Mr Bettles knew or ought to have known by the conclusion of the 8 July 2016 Meeting that Mr Marlborough was developing the strategy as defined at [58(c)] of the FASOC (see [10] above).

87 Based on the evidence, at the conclusion of the 8 July 2016 Meeting Mr Bettles knew or ought to have known that:

(1) Mr Marlborough would register a new company to be controlled by Braiden and Mr Young. The evidence does not establish that Mr Bettles knew at that time that the new company was to be under Mr Marlborough’s effective control. That element of the strategy is not referred to in Mr Bettles’ or Mr Jones’ notes of the 8 July 2016 Meeting; and

(2) there would be a staged winding up of the companies in the MA Group. Mr Bettles did not know and ought not to have known that this was to enable the transfer of the income producing assets to the new company. Rather, Mr Bettles was told this was to enable the sale of assets held by certain companies prior to liquidation of those companies so that the value in those assets was not lost.

88 I am not satisfied that by the conclusion of the 8 July 2016 Meeting Mr Bettles knew or ought to have known that:

(1) the new company, once established, would be able to receive income that would otherwise have gone to existing companies in the MA Group. This element of the strategy is not referred in Mr Bettles’ or Mr Jones’ notes of the meeting;

(2) Mr Marlborough required $500,000 in order “to do this”, and intended to obtain that from one or more of the entities that conducted the financial planning business or from the work in progress of MM Prime. It is not clear what “this” is in that context, it could be the establishment of the new company and/or the ability for that company to receive the income that would otherwise have gone to existing companies. In any event Mr Bettles’ notes do not reflect that this was discussed and to the extent that Mr Jones’ notes refer to Mr Marlborough requiring $500,000, this seemed to be in connection with his intention to acquire the business of MM Prime;

(3) the professional advisors (WMS and Ramsden Lawyers) intended to enter into arrangements which would enable them to take security for past and future fees over the assets of companies in the MA Group with the effect that their professional fees should rank ahead of non-secured creditors. While Mr Bettles became aware of this, it has not been established that he knew about the intention as at 8 July 2016. Mr Bettles was not present for the whole of the 8 July 2016 Meeting and it is apparent from Mr Jones’ notes of this meeting that the topic of WMS’ and Ramsden Lawyers’ fees was discussed towards the end of the meeting; and

(4) Mr Marlborough wanted to limit the amounts available in MA Group companies that could be used to pay creditors, including the ATO. There is no evidence that this was discussed at the 8 July 2016 Meeting or that Mr Bettles could have otherwise known of this fact.

89 ASIC also contends that by the conclusion of the 8 July 2016 Meeting Mr Bettles knew or ought to have known that:

(1) the MA Group owed a significant amount to the ATO and, if he did not know the exact amount, it was at least $17 million. Mr Bettles accepts that at that time he knew that a number of companies in the MA Group had received statutory demands from the ATO but there is no evidence that he knew the total amount claimed by the ATO. Mr Jones’ notes of the 8 July 2016 Meeting do not disclose a total amount and, assuming WMS PowerPoint V1 was shown at that meeting, the total said to be owing pursuant to statutory demands is far less than $17 million; and

(2) as well as the statutory demands issued to companies individually by the ATO, Iridium Holdings and the members of the income tax and GST consolidated groups were jointly and severally liable for moneys owed to the ATO in respect of the GST consolidated group and the income tax consolidated group. It is not clear what Mr Bettles knew about the income tax and GST consolidated groups other than that there were such groups. But Mr Bettles was unsure about the effect of a tax consolidated group and as at the 8 July 2016 Meeting he did not know which companies were part of each group.

90 Based on the available evidence I am not satisfied that by the conclusion of the 8 July 2016 Meeting Mr Bettles knew or ought to have known the matters which comprised the strategy and accordingly am not satisfied that ASIC has made out this element of its case.

2.11.2 Mr Bettles’ knowledge as at 14 July 2016

91 ASIC contends that by conclusion of the 14 July 2016 Meeting Mr Bettles knew or ought to have known that:

(1) the strategy to transfer assets and income streams to one or more new companies or NewCo had developed to the point that terms were being identified as to its practical implementation, including the extent to which income would be diverted from MA Group companies to a new company or companies, and the extent to which it would be available to pay MA Group creditors;

(2) as to Provincial Property, the whole of its income stream was to be diverted to a new company until a deed of company arrangement was entered into and that the new company would pay the ATO debt owed by Provincial Property as part of a deed of company arrangement;

(3) as to Airlie Beach, the whole of its income stream was to be diverted to a new company until a deed of company arrangement was entered into and Airlie Beach’s management rights had been sold;

(4) as to the Client Book, the new company would require all trail income until the Client Book was sold and 25% of all upfront commissions, with the balance of those upfront commissions being used to pay the existing statutory demand, professional indemnity insurance and required software;

(5) as to MM Prime’s income from commissions, the new company would receive: 50% of the work in progress (i.e. commissions already due to MM Prime on settled sales); 100% of the commissions on the first ten settlements in order to fund the new company’s start-up costs; 50% of the commissions on the next 20 settlements; and 50% of commissions on subsequent settlements until “the liquidator” was able to recover 50% of the amount of the commissions diverted to the new company on the first ten settlements. In addition, the costs required to manage the work in progress, including maintaining the “existing CRM and cloud access” to allow NewCo access to client data would be met by the portion of funds retained by “the liquidator”;

(6) the new company’s rental expense in Sydney would be met by an existing MA Group company, which ASIC contends was possibly SS Residential having regard to the reference to “Transport NSW funds”; and

(7) the arrangements referred to above would be the subject of written agreements between the relevant existing company and the new company.

I pause to observe that these are all matters which are derived from the 14 July 2016 Email.

92 ASIC’s contentions are not made out.