Federal Court of Australia

Deppeler, in the matter of Moulamein Grain Co-Operative Limited (in liquidation) (No 2) [2023] FCA 658

ORDERS

DATE OF ORDER: | 20 June 2023 |

THE COURT ORDERS THAT:

1. AgRisk Management Pty Ltd, Riordan Group Pty Ltd (trading as Riordan Grain Services), Melaluka Trading Pty Ltd, Robinson Grain Trading Co Pty Ltd, Chester Commodities Pty Ltd, CL Commodities Pty Ltd, and L McKenzie Trading Pty Ltd (trading as McKenzie Ag Services) (together, the interested parties) be granted leave nunc pro tunc to intervene in the proceeding pursuant to r 9.12 of the Federal Court Rules 2011 (Cth).

2. The proceeding be listed for further hearing on 3 July 2023 at 2.00pm.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

O’CALLAGHAN J:

Introduction

1 The Moulamein Grain Co-Operative Limited (the Co-operative) was established over 20 years ago for the purpose of storing grain for farmers located in the Moulamein area in New South Wales. Its’ objects were “[t]o construct a purpose built grain facility and/or lease such a facility to provide members the opportunity to store and/or market grain”. It operated from storage facilities at two sites, one at Moulamein, the other at Burraboi.

2 Those storage facilities have been used by its members and by non-members during the harvest season, which falls between October and January each year, with grain then collected from storage, as required, during the balance of the calendar year.

3 On 13 September 2022, I made an order appointing the first and second plaintiffs as joint and several receivers of “Consignment Grain” then held by the Co-operative. The 13 September 2022 order included:

1. Pursuant to s 90-15 of Schedule 2 Insolvency Practice Schedule (Corporations) to the Corporations Act 2001 (Cth), the first and second plaintiffs (the Administrators) are justified and acting reasonably in proceeding on the basis that the grain held by the third plaintiff (the Co-Operative), as identified in the ‘Summary Sheet’ worksheet of the spreadsheet appearing at Annexure “NLD-9” to the affidavit of Nathan Deppeler sworn on 7 September 2022 (Deppeler first affidavit), is, with the exception of the grain defined in the Deppeler first affidavit as the “Co-Operative Grain” and the “PPS Lease Grain”, not property of the Co-Operative (Consignment Grain).

2. Pursuant to s 57 of the Federal Court of Australia Act 1976 (Cth) the Administrators are appointed without security as joint and several receivers of the Consignment Grain (Receivers).

3. The Receivers have, in respect of the Consignment Grain, the powers that a receiver has in respect of the business or property of a company under s 420(2)(a)-(g) of the Corporations Act as if the references in those sub-sections to “property of the corporation” were references to the Consignment Grain.

4 The receivers are also the liquidators of the Co-operative.

5 On 28 September 2022, I made an order approving the receivers’ proposed process for realising the “Consignment Grain”, as follows:

1. Including pursuant to s 90-15 of Schedule 2 Insolvency Practice Schedule (Corporations) to the Corporations Act 2001 (Cth) (IPS), that the first and second plaintiffs (Administrators), including in their capacity as the Court-appointed receivers of the Consignment Grain (as defined in the orders made on 13 September 2022), are justified and acting reasonably in realising the grain stored with the third plaintiff (Co-Operative) (including the Consignment Grain) in accordance with the process identified as “Option 3” in the affidavit of Nathan Deppeler sworn on 27 September 2022.

6 I should add that a small amount of grain (approximately 503 tonnes, with a value of about $125,000) was owned by the Co-operative. It was defined in the 13 September 2022 order as “Co-Operative Grain”. See paragraph [3] above. The Co-operative did not own any of the Consignment Grain.

7 The Consignment Grain has been realised and converted into money. By interlocutory process filed on 31 March 2023, the receivers now seek orders regarding the manner in which the net proceeds of the sale of the Consignment Grain should be distributed (and orders relating to their remuneration).

8 The interlocutory process sought the following orders in relation to the Consignment Grain and so-called “Surplus Grain”:

(1) An order that the first and second plaintiffs are justified and acting reasonably in proceeding on the basis that the net sale proceeds generated from the realisation of the Consignment Grain (as defined in the orders made in this proceeding on 13 September 2022) are to be distributed to consignors of the Consignment Grain in accordance with the process identified as the “Specific Method” on page 12 of annexure NLD-28 to the affidavit of Nathan Deppeler sworn on 31 March 2023.

(2) An order that the first and second plaintiffs are justified and acting reasonably in proceeding on the basis that the net sale proceeds generated from the realisation of the grain that is described as “Surplus Grain” in the circular that is annexure NLD-28 to the affidavit of Nathan Deppeler sworn on 31 March 2023 can be retained by the third plaintiff and applied for the benefit of creditors of the Co-Operative generally as an asset available in the winding up of the third plaintiff.

9 The principal issue in dispute between the receivers and the interested parties concerns proposed order 2.

The relevant facts

10 In the period following 28 September 2022, the receivers provided updates regarding the conduct of the receivership (and this proceeding) by circulars. Among other things, the growers were told that the grain stored with the Co-operative had, by 8 February 2023, been “turned out” and realised.

11 Grain stored at the Burraboi site generated net sale proceeds (before receivership costs) totalling $633,727.

12 Grain stored at the Moulamein site generated net sale proceeds (before receivership costs) totalling $1,008,877.

13 The receivers now seek directions as to how to distribute the net proceeds to the growers, pursuant to s 57(1) of the Federal Court of Australia Act 1976 (Cth) and the court’s inherent jurisdiction. See generally Australian Securities and Investments Commission v Letten (No 7) (2010) 190 FCR 59 at 118-19 [269]-[271] (Gordon J).

14 The receivers read three affidavits of Mr Nathan Deppeler sworn 7 September 2022, 31 March 2023, and 18 May 2023, respectively.

15 Seven owners of the grain (AgRisk Management Pty Ltd, Riordan Group Pty Ltd (trading as Riordan Grain Services), Melaluka Trading Pty Ltd, Robinson Grain Trading Co Pty Ltd, Chester Commodities Pty Ltd, CL Commodities Pty Ltd, and L McKenzie Trading Pty Ltd (trading as McKenzie Ag Services)) (together, the interested parties) oppose the orders sought by the receivers.

16 The interested parties sought leave to intervene, because (i) they owned approximately 51% by mass of the Consignment Grain and (ii) they are each parties to the non-member storage and handling agreements pursuant to which the Co-operative agreed to store and handle their grain. They also said that they hold legal interests in the proceeds of the sale of the Consignment Grain, over which the receivers were appointed. The first and second of those propositions were uncontroversial. The third was controversial.

17 In any event, the hearing was conducted on the basis that an order for leave to intervene was appropriate, which it obviously was. As Mr McAloon of counsel, who appeared for the receivers, said, “we welcome the expressions of alternative views by interested parties about issues that are not without complexity”.

18 The interested parties read the affidavit of Mr Nicholas Horwood Bechely-Crundall affirmed 2 June 2023 and the affidavit of Mr Patrick O’Shannassy affirmed 1 June 2023.

19 Mr Bechely-Crundall is a grain trader and the Head of Strategy of AgRisk Management Pty Ltd (one of the interested parties).

20 Mr O’Shannassy is the CEO of Grain Trade Australia Pty Ltd, which is the peak body for the commercial grain industry in Australia. He gave evidence that the method of distribution proposed by the interested parties is consistent with the Australian Grain Industry Code of Practice, and that he endorses that method.

21 The interested parties also relied upon another affidavit of Mr Deppeler sworn 27 September 2022.

22 The grain held by the Co-operative at the time of the receivers’ appointment was distinguished by these characteristics: its storage location – whether it was stored at Moulamein or Burraboi; the type of grain – whether it was wheat or barley; and the grade of grain. Barley and wheat are identified by grades that include, relevantly, the following: for barley, “BAR1”, “BAR2”, or “SPA1”; and for wheat, “APW1”, “ASW1”, “AGP1”, AGP2”, “H1”, “H2”, or “AUH2”.

23 The records of the Co-operative identified the grain consigned by growers by reference to each of the above characteristics.

24 Unsurprisingly, the price obtained for the grain varies according to its type and grade.

Competing distribution methods

25 The receivers originally proffered two possible distribution methods – the “social method” and the “specific method”. By the time of the hearing, they did not press the former, having told the growers in March that the receivers considered the specific method to be the more fair and equitable method of distribution of the net proceeds.

26 In essence, the social method had proposed that the net proceeds from the realisation of the grain to be shared equally among all grain holders based on the volume of grain held per the records of the Co-operative and without reference to the specific grade of grain held.

27 The specific method, on the other hand, “seeks to take account of the particular grade of grain that, according to the Co-operative’s records, was delivered for storage by individual growers, by allocating to growers the corresponding portion of the proceeds generated from the sale of that particular grade”. It was submitted that “[t]his method might be regarded as closer to what would occur if it had been possible to return to growers the actual grain held … [t]hat is … the quantum of the proceeds distributed is determined by reference to the grade of grain (not just the type of grain and its location)”.

28 The specific method is more particularly described at page 12 of annexure NLD-28 to the affidavit of Mr Deppeler sworn 31 March 2023, which was the March Circular to growers, including by way of comparison with the social method, as follows:

3.5 Proposed Distribution Methodology

As Interested Parties will recall at the meeting on 20 September 2022, two distribution methods for the net sale proceeds from the realisation of the grain were discussed:

1. pari passu with net proceeds from the realisation of the grain to be shared equally amongst all grain holders based on the volume of grain held per the records of the Co-Operative and without reference to the specific grade of grain held; (Social Method); or

2. grain holders to share net recoveries on a pari passu basis with reference to the specific grade of grain held per the records of the Co-Operative compared to the actual grain out-turned for that grade (Specific Method).

We propose to use the Specific Method as it is a fair and equitable basis for each respective grain holder given it is based on what physical grain was held on the sites for each respective grain holder. We do not consider that the Social Method is an appropriate way to distribute the proceeds in this instance as the result of this method is that grain holders who would have been entitled to a higher return for their specific grain will be compensating other grain holders for their losses. We do not see a basis on which it is appropriate that grain holders should receive an equalised distribution from the proceeds associated with other grain holders’ grain in circumstances where their particular grain was no longer onsite.

29 The interested parties take issue with the specific method, for reasons I will come to in a moment.

The “surplus grain”

30 The issue that occupied most of the hearing concerns the so-called “Surplus Grain”.

31 The problem arises this way.

32 As explained in the receivers’ March circular to the growers, during the turn out of grain that occurred as part of the sale process, 1,368 tonnes of grain was identified (by grade) that did not correspond with grain recorded (by grade) in the Co-operative’s records as being held by the Co-operative: 195.16 tonnes of BAR2 barley at Burraboi; 25.77 tonnes of APW1 wheat at Burraboi; 721.60 tonnes of PLA1 barley at Moulamein; 27.80 tonnes of H2 wheat at Moulamein; and 398.20 tonnes of SFW1 wheat at Moulamein. The receivers called this the “Surplus Grain”.

33 Ms R Zambelli, of counsel, who appeared for the interested parties, described the concept of “Surplus Grain” as a “misnomer”.

34 In his reply, Mr McAloon accepted that the term was “unfortunate” and opted to describe the grain instead as “grain of a type or grade for which no grower has established a proprietary interest”.

35 “Surplus Grain” is the term used throughout the parties’ submissions and evidence to describe the 1,368 tonnes of grain identified at paragraph [32] above. It is also the term used in the orders sought by the receivers. So I will use it in these reasons, despite the unfortunate choice of the defined term.

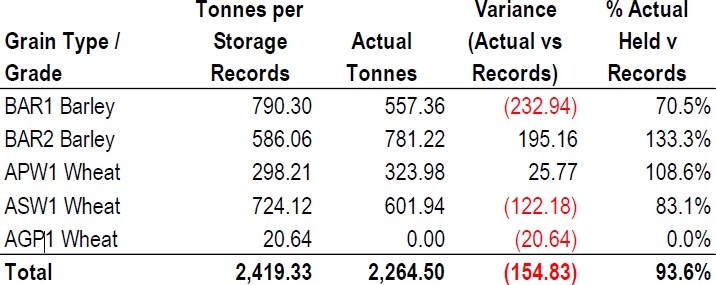

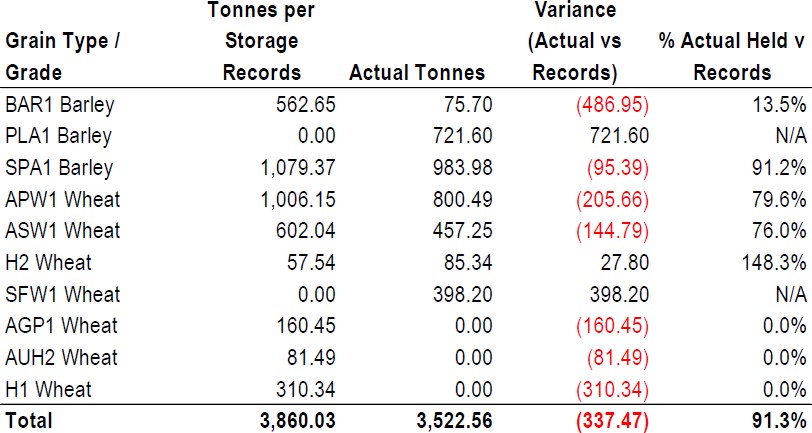

36 In tabular form, the Surplus Grain was identified in the receivers’ March Circular in respect of the Burraboi site as follows:

37 And the Surplus Grain was identified in the receivers’ March Circular in respect of the Moulamein site as follows:

38 Clause 3.3 of the March circular to growers provided:

If any Interested Party considers that they have, and can substantiate, a claim to ownership of any of the Surplus Grain, that party should contact the Receivers as soon as possible (preferably by 4 pm on 31 March 2023, to allow sufficient time in advance of the Court hearing scheduled for 6 April 2023),identifying the parts of the Surplus Grain in respect of which they claim an interest and providing all details and documents that support that claim.

39 It went on to provide:

Subject to consideration of any response to the above request and on the basis that the ownership of the Surplus Grain is not (by reference to the Co-operative’s records) capable of attribution to any specific party (or parties), it is our view that:

• there is no party with a claim to the Surplus Grain that is superior to the claim of the Co-operative; and

• the Surplus Grain (net of costs) should be retained by the Co-Operative for the benefit of creditors of the Co-Operative generally, which creditors will include any Interested Party that has suffered a shortfall as a result of the variances of the grain at the sites.

40 No grower has made a claim to the Surplus Grain, and it was implicit in the submissions made on behalf of the interested parties that they never will.

41 Mr Bechely-Crundall at [39]-[46] of his affidavit explained the methodology for which the interested parties contend, as follows:

Interested Parties’ Proposed Methodology

39 The Interested Parties’ Proposed Methodology is as follows.

40 First, a gross sale price per tonne for each grade of wheat or barley recorded by the Co-Operative is established ![]() .

.

(a) The Interested Parties’ Proposed Methodology adopts the price per tonne recorded in the March Circular, for the grades of wheat and barley that were identified when the Consignment Grain was outturned.

(b) The Interested Parties’ Proposed Methodology also accounts for those grades where a price per tonne is not listed in the March Circular, being grades of Consignment Grain which were recorded as being held by the Co-Operative, but which were not identified when the Consignment Grade was outturned. For instance H1 Wheat and AUH2 Wheat was recorded as being held by the Co-Operative at the Moulamein site, but was not recorded when the Consignment Grain was outturned. In these cases, the Interested Parties propose that a sale price per tonne can be derived from historical market price data, alternatively by engaging an independent grain broker to assess the market prices at the time of the sale.

41 Secondly, the total value of each grade of grain as recorded by the Co-Operative at each site is derived by multiplying the gross sale price per tonne ![]() by the total quantity of each grade recorded by the Co-Operative at each site

by the total quantity of each grade recorded by the Co-Operative at each site ![]() .

.

(a) The Interested Parties’ Proposed Methodology treats the total quantity of each grade of the grain stored at the Moulamein site separately from the grain stored at the Burraboi site.

42 Thirdly, the total value of the grain recorded by the Co-Operative is derived by summing the total value of each grade of grain as recorded by the Co-Operative for each site.

43 Fourthly, the total net proceeds (return) of the outturned Consignment Grain as recorded in the March Circular ![]() , for each of Co-operative’s sites, is divided by the total value of the grain owned by all of the owners, to derive a percentage of total value recovered in the outturning process in respect of each grade of grain recorded by the Co-Operative.

, for each of Co-operative’s sites, is divided by the total value of the grain owned by all of the owners, to derive a percentage of total value recovered in the outturning process in respect of each grade of grain recorded by the Co-Operative.

44 Fifthly, a price per tonne of each grade recorded is derived by multiplying the percentage of total value recovered by the market price per tonne of each grade ![]() .

.

45 Sixthly, the distribution of the net proceeds of sale in respect of each grade of grain recorded by the Co-Operative and held by each owner, is derived by multiplying this derived price per tonne by the quantity of each grade of grain recorded by the Co-Operative and owned by each owner ![]() .

.

46 The distribution received by each owner in respect of the quantity of each grade of grain recorded by the Co-Operative, under the Interested Parties’ Proposed Methodology, is, notated in mathematical terms, as follows:

The strorage and handling agreements

42 Before turning to the submissions made by the interested parties, it is necessary to set out the relevant terms of the storage and handling agreements that governed the relationships between the growers and the Co-operative.

43 The non-member storage and handling agreements relevantly provided (emphasis added):

1. PURPOSE

In consideration of:

(a) Paying to the Contractor [the Co-operative] the fees payable under this agreement;

(b) And complying with the terms and conditions of this agreement,

The Contractor agrees to provide storage and handling services to you [the grower] from 1st October 2021 under the terms and conditions outlined in this agreement.

SERVICES PROVIDED BY THE CONTRACTOR UNDER THIS AGREEMENT

2. Scope of Agreement

…

2.2 The Contractor will sample, provide quality testing services for, classify into available grades, weigh, store and load to road transport all Grain received by it under the terms of this agreement.

…

4. Storage

4.1 The Contractor acknowledges despite anything to the contrary expressed or implied in this agreement that:

(a) Grain received and stored by the Contractor must be received and stored at all times as segregated grain and clearly identified as You.

(b) This agreement shall not be construed as a lease of any storage facilities or land upon which any storage facility is located.

5. Quality Testing Services

5.1 The Contractor will provide testing of Grain in accordance with the Approved Receival Standards and Sampling Methodology for the relevant grain type and grade. The Contractor will provide physical composite samples at the completion of harvest for each segregated grade of grain at the site.

5.2 For the purpose of determining average quality of Grain the cumulative weighted average of quality data on applicable Receival Dockets will be used.

6. Pest Control

6.1 The Contractor may only treat Grain with pesticides that are approved for use by you. These may include Chorpyrifos methyl/Methoprene, Fenitrothion/Methoprene, Deltamethrin, Dichlorvos, Dryacide, or fumigants such as Phosphine, Methyl Bromide or inert gases such as nitrogen or carbon dioxide.

6.2 The Contractor will regularly inspect the Grain for the presence of insects. In the event of infestation being detected the Contractor must immediately notify you. The Grain will then be treated at the Contractor’s cost within one week of its discovery.

6.3 Where fumigants are applied to Grain, that Grain will not be accessible for a period of about four weeks from the date of fumigation, which period will be determinable at your reasonable discretion. No grain is to be out-loaded from your stock if it is within the “holding period” as specified by the pesticide manufacturer. A diarised log is to be kept of inspections dates and dates at which treatments occur.

6.4 The Contractor is required to provide you with a fumigation schedule specifying planned treatment periods within one month of in-turn in order to negate the possibility of You requesting out turn of grain during this period. This shall be the only period in which the contractor has the right to refuse outturn.

…

11. Shrinkage

11.1 The Contractor will deduct a shrinkage allowance of 0.6% from each tonne of Grain delivered into your name from direct deliveries to the site. Transfers to You from other Clients at the storage site will be transferred as “shrunk” tonnage.

…

18. Insolvency

18.1 In the event of our insolvency, the Client or any purchaser remains the owner of the Grain. The Client will be entitled to immediate discharge of its Grain, on demand, subject to any lien.

44 The member storage and handling agreements relevantly provided (emphasis added):

5. Storage

5.1 The Commodity received and stored/warehoused may be commingled with Commodity of the like type and specification in which case all commingled Commodity shall be jointly owned by all parties whose Commodity has been so commingled to the exclusion of all other persons including but not limited to the Contractor.

6. Ownership & lien

6.1 The Contractor has possession of the stored Commodity and a lien in respect of any unpaid storage charges but otherwise has no legal or equitable title to the Commodity, unless it is the owner of the Commodity.

…

16. Insolvency

16.1. In the event of the Contractor’s insolvency, You or any purchaser, remains the owner of the Commodity.

16.2. You will be entitled to immediate discharge of your Commodity, on demand, subject to any lien.

The parties’ submissions

The submissions on behalf of the interested parties

45 The interested parties submitted, in summary, as follows:

28 The Interested Parties have identified an alternative method which accords with industry standard, namely by the calculation of:

(a) a gross sale price for each grade of grain recorded by the Co-operative;

(b) the total value of each grade of wheat or barley owned by all grain owners recorded as being held by the Co-operative;

(c) the total value of all grain owned by all grain owners recorded as being held by the Co-operative;

(d) the percentage of the total value of the grain owned by all grain owners as recorded by the Co-operative which was realised on the sale of the Consignment Grain; and

(e) a derived price per tonne of each grade of grain recorded as being held by the Co-operative,

and then finally the distribution of the total proceeds of sale to the owners of the Consignment Grain by multiplying this derived price per tonne by the quantity of each grade of grain the Co-operative recorded as holding on behalf of grain owner. This is in accordance with each grain owner’s percentage holding of the total value of each grade of grain recorded by the Co-operative, and is more fully described at paragraphs [39] to [46] of the [Bechely-] Crundall Affidavit (Alternative Method).

29 The Specific Method and creation of the concept of ‘Surplus Grain’ do not accord with principles of law and equity and, in particular, are inconsistent with:

(a) the rights and interests created and/or recognised by the Member and Non-Member Agreements;

(b) principles of coherence, including the law of bailment, tort and the Receivers’ fiduciary duties; and

(c) industry practice.

46 Ms Zambelli agreed it was critical to her submission that the Alternative Method be preferred that the agreements between the growers and the Co-operative provided that property in the Consignment Grain remained at all times with the growers, and never vested in the Co-operative.

47 Ms Zambelli submitted that prior to storage, both member’s and non-member’s grain was tested by the Co-operative. There was no doubt, because the receivers conceded as much, that the testing undertaken by the Co-operative prior to their appointment was deficient. The receivers also did not dispute Mr O’Shannassy’s evidence that both the quality and grade of grain may be subject to variation in the testing undertaken between its receipt and outturn, for many reasons, including “deficient or erroneous testing at the storage facility, a lack of maintenance on the part of the storage provider, random variation between samples within a batch of grain or the commingling of grain in storage”. And it is also readily apparent, in any event, that the parties to the member and non-member agreements contemplated that issues like pests and shrinkage can affect the quality, grade, and volume of grain, because the agreements deal expressly with the consequence of such matters (see paragraph [43] above).

48 The case for the interested partied was put this way in their written submissions:

36 The mere fact that the grain has been commingled does not alter the proprietary nature of the Interested Parties’ interests in the Consignment Grain. The grain stored with the Co-operative is fungible property, in respect of grade and variety. Proprietary rights persist in fungible property and are not extinguished by the mere fact that it may not be necessary (or even possible), to return goods in specie.

37 The Grain Owners retain ownership of their grain, regardless of a difference in quality on outturn. Under both the Non-Member Agreements and the Member[] Agreements, title to the grain is never extinguished.

38 The Specific Method disregards the fact that, despite the variation in grades, substantially all of the same grain itself has been outturned. The variation in grade is not surprising in light of the evidence from the plaintiffs, the Interested Parties and the CEO of Grain Trade Australia. The reclassification of grain which has occurred by virtue of the testing at outturn does not alter the character of that grain as being owned by the Grain Owners.

39 In the absence of any express evidence as to any other competing entitlement to the Consignment Grain, the only safe inference in the present circumstances is that the Members and Non-Members own all of the grain that was outturned. Thus there is no ‘Surplus Grain’ to be addressed by the Receivers.

40 The practical effect is that, if the Receivers’ methodology is accepted by this Court:

(a) the extant proprietary rights in the Consignment Grain would be extinguished by the Receivers’ unilateral redefinition of those rights; and

(b) there would be a windfall gain to the Co-operative.

(Footnotes omitted).

49 As I understood the submissions put on behalf of the interested parties, their objection to the two orders sought by the receivers in respect of the Consignment Grain and the Surplus Grain (set out at paragraph [8] above), and the case for the Alternative Method, hinged on the nature of the growers’ rights in respect of the Surplus Grain.

50 The interested parties also submitted that the specific method “lacks coherence” with the law of bailment; the law of tort; and the receivers’ fiduciary obligations, and that such “incoherence is a conclusive reason against [it]”.

The submissions on behalf of the receivers

51 Mr McAloon agreed that by the terms the storage and handling agreements property in the Consignment Grain remained at all times with the growers, and never vested in the Co-operative.

52 That is the case. The italicised terms of the member and non-member agreements clearly so provide.

53 Mr McAloon, however, said that the submission put by the interested parties should be rejected, because no grower, despite invitation to do so, has ever sought to contend, let alone to prove, that they owned any of the Surplus Grain; that they do not have any rights in respect of grain that is not the same type and grade as that which they deposited; and that they do not have any rights in respect of grain in excess of the quantity that they deposited.

54 As Mr McAloon put it in his closing submission: “you can’t get back more than you put in, and you can’t get back [a] different grade or different grain to that which you put in”.

55 His submission continued:

And that’s important, because … based on the cooperative’s records, the [Surplus Grain] cannot, by type and grade, be allocated to any particular grower. What I mean by that is that there has either been deposits by growers, according to the records – have been matched, and the [Surplus Grain] is in excess, so it’s more than they recorded as to holding, or the other instance of the – in a single case is where there’s no record of any grower having deposited the type and grade of grain that was identified on outturn. …

Now, the cooperative’s records are not infallible, and the September affidavit of Mr Deppeler, back when he sought to be appointed as a receiver, said that the recording system of the cooperative may not be accurate. … But the important thing here is, your Honour, that growers were given an opportunity to establish that the [Surplus Grain], as identified in the March circular, was their Grain for the purpose of this storage agreement, that is, that they supplied the type and grade, even though the records say they didn’t, or that they supplied more of that type and grade – more of that type and grade than is recorded in the records. … [W]hat the March circular said – is come forward, and if you’ve got a better claim, tell us about it, contact us urgently, because, otherwise, the proposal is it will be treated as property of the co-op:

[If any Interested Party considers that they have, and can substantiate, a claim to ownership of any of the Surplus Grain, that party should contact the Receivers as soon as possible (preferably by 4 pm on 31 March 2023, to allow sufficient time in advance of the Court hearing scheduled for 6 April 2023), identifying the parts of the Surplus Grain in respect of which they claim an interest and providing all details and documents that support that claim.]

That was back when that was the contemplated return date. Now, no such claim has been made, your Honour, because, as I’ve said, we’ve had no response from – no substantive response from any party other than the Holding Redlich clients, and the Holding Redlich clients have not filed any evidence to the effect that one might expect.

Consideration

56 In Humphris, in the matter of Hazelton Air Charter Pty Limited v Mentha [2002] FCA 529, Goldberg J was asked by administrators how the sum of $150m paid by way of a settlement should be apportioned in circumstances where the settlement deed did not provide any mechanism for how that amount should be apportioned between companies in the Ansett group and companies in the Hazleton group.

57 Ultimately, his Honour ruled that the application by the administrators should be stood over for further hearing to enable the parties to present material and submissions on the issue of the extent, assessment, and valuation of the claims which were given up in exchange for an interest in the fund, because the evidence was insufficient. In the course of his reasoning, his Honour observed (at [31]):

It is not for me to reach a fair, appropriate, equitable or just conclusion as to how the fund of $150m is to be apportioned. That may be a consequence or result of my resolution of the matter. Rather, my task is to determine, by reference to appropriate principles of law and equity, what was the extent and measure of the interest in the fund of the two groups at the time at which it was agreed to create the fund, namely the time of the execution of the Memorandum [of Understanding which provided for the payment of $150m].

Fairness or appropriateness is an insufficient basis on which to determine the interest of the Hazelton group in the fund of $150m. In Muschinski v Dodds [(1985) 160 CLR 583] Brennan J said at 608:

“The flexible remedy of the constructive trust is not so formless as to place proprietary rights in the discretionary disposition of a court acting according to vague notions of what is fair.”

Deane J said at 615-616:

“The fact that the constructive trust remains predominantly remedial does not, however, mean that it represents a medium for the indulgence of idiosyncratic notions of fairness and justice. As an equitable remedy, it is available only when warranted by established equitable principles or by the legitimate processes of legal reasoning, by analogy, induction and deduction, from the starting point of a proper understanding of the conceptual foundation of such principles: ...

...

Under the law of this country – as, I venture to think, under the present law of England ... – proprietary rights fall to be governed by principles of law and not by some mix of judicial discretion ... subjective views about which party ‘ought to win’ ... and ‘the formless void of individual moral opinion’: ...”

58 And so it is here – my task is to determine by reference to appropriate principles of law and equity, what was the extent and measure of those claiming competing interests in the Surplus Grain.

59 The resolution of that question is not without difficulty.

60 On the one hand, there is undoubted appeal in the submission put on behalf of the interested parties that fairness dictates that the proceeds representing the Surplus Grain should be returned to the growers, because the Consignment Grain could only have come from them, or some of them.

61 And if, by the terms of the storage and handling agreements, ownership in the Consignment Grain, or any part of it, never vested in the Co-operative, why should the proceeds generated from the realisation of the Surplus Grain be retained by it?

62 On the other hand, the receivers’ submission that under the terms of those agreements, a member or non-member grower does not have any right in respect of grain that is not the same type and grade of that which they deposited, and they do not have a right in respect of grain in excess of the quantity that they deposited, must be accepted.

63 If the growers have no such rights, the court should not endorse a method of distribution the effect of which would be that, contrary to the true position, they do have such rights.

64 But equally, why should the court endorse a method of distribution the effect of which might be said to presuppose rights of ownership over Consignment Grain which the Co-operative never enjoyed under the terms of the storage and handling agreements?

65 The answer I think lies not so much with the rights created by the storage and handling agreements, but with whether the growers who must once have had a claim to the Surplus Grain, or some part of it, are to be taken to abandoned such claims.

66 The true position, it seems to me, is that the growers who once had, and must have had, claims to the Surplus Grain or to the proceeds of it, in light of the receivers unsuccessful efforts to solicit such claims, are to be taken as having abandoned them. And the Co-operative, having been in possession of the Surplus Grain, and now being in possession of the proceeds of sale thus has a legal right to those proceeds. As Sir Frederick Jordan said in Gatward v Alley (1940) 40 SR (NSW) 174 at 178 and 180, citing Holmes, The Common Law at 244-46, Pollock and Wright, Possession at 93, and Holdsworth, The History of English Law (vol VII) at 449-50:

A good title to property, in the sense of such ownership as the law allows, consists in having the legal right to exercise with respect to it all such rights, as against all such persons, as by law are capable of being exercised with respect to property of the class in question. A person who has possession of property but not ownership has, as a general rule, the same legal rights as the owner, save to the extent to which those rights are qualified as against the owner[.]

…

[D]e facto possession of a chose in possession is prima facie evidence of ownership, and also of itself creates a legal right to possess which is enforceable against anyone who cannot prove that he has a superior right to possess: any person who interferes with this legal right, without being able to prove a superior right, is therefore a wrongdoer.

See too In the matter of International Art Holdings Pty Ltd (admin apptd); International Art Holdings Pty Ltd (admin apptd) v Adams [2011] NSWSC 164; (2011) 85 ACSR 1 at 26 [116] (Ward J, as her Honour was).

67 I do not accept the submission put on behalf of the interested parties that the method of distribution proposed by the receivers “lacks coherence” with the law of bailment, tort, and the receivers’ fiduciary obligations. Quite apart from anything else, such asserted rights would be and are inconsistent with the true contractual position, and thus do not arise.

68 I will accordingly grant an appropriate form of declaration and make whatever directions are necessary to give effect to these reasons.

69 I think counsel on both sides assumed that the form of orders proposed by the receivers was appropriate, in the event that I found in their favour (which I have). I am not at all sure, however, that the orders proposed by the receivers at paragraph [8] above are sufficient, including because they do not address the question of treating any claim by growers as having been abandoned.

70 I will accordingly list the proceeding for further hearing to deal with the issue of the appropriate form of relief.

Costs

71 The interested parties sought an order that their costs be paid as costs of the receivership on an indemnity basis.

72 The receivers did not oppose the making of that order, but in circumstances where the proceeding will be listed for further hearing, I will deal with the issue in my additional reasons.

Receivers’ Remuneration

73 The receivers also sought the following orders:

(3) Pursuant to rule 14.24 of the Federal Court Rules 2011 (Cth), an order fixing the remuneration of the first and second plaintiffs for acting in their capacity as receivers of the Consignment Grain in the period up to and including 26 March 2023 in the sum of $302,211.11 plus GST.

(4) An order that the remuneration of the first and second plaintiffs referable to work undertaken for the application made by originating process filed on 7 September 2022, incurred while the first and second plaintiffs were administrators of the third plaintiff (but not yet appointed receivers of the Consignment Grain), be treated as remuneration of the first and second plaintiffs in their capacity as Receivers of the Consignment Grain forming part of the remuneration fixed by the order at paragraph 2 above.

74 At the hearing, the interested parties opposed proposed order 4 on the ground that it was beyond power, without sufficiently explaining why.

75 I thus directed that the parties each file written submissions on the question of whether the court has the power to fix the receivers’ remuneration for the period prior to their appointment as receivers, which they duly did.

76 Because those written submissions raised an important question of statutory construction about which, it seems, judges have expressed divergent views, the parties were told that I wished to hear oral argument about it.

77 I will hear such argument at the same time as the hearing on the appropriate form of relief on the principal issue.

disposition

78 The only order that I will make today, other than the leave order, is that the matter be listed for further hearing on 3 July 2023 at 2.00pm, which I understand is a time and date convenient to counsel.

I certify that the preceding seventy-eight (78) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice O’Callaghan. |

Dated: 20 June 2023

VID 506 of 2022 | |

RIORDAN GROUP PTY LTD (ACN 076 271 148) | |

Interested Party: | MELALUKA TRADING PTY LTD (ACN 155 534 848) |

Interested Party: | ROBINSON GRAIN TRADING CO PTY LTD (ACN 079 213 219) |

Interested Party: | CHESTER COMMODITIES PTY LTD (ACN 601 350 430) |

Interested Party: | CL COMMODITIES PTY LTD (ACN 623 903 079) |

Interested Party: | L MCKENZIE TRADING PTY LTD (ACN 634 132 433) |