Federal Court of Australia

Sealanes (1985) Pty Ltd v Vessel MY "Island Escape" [2023] FCA 414

ORDERS

Plaintiff | ||

AND: | Defendant | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. Pursuant to section 31A(1) of the Federal Court of Australia Act 1976 (Cth) judgment be entered for the plaintiff against the defendant in the sum of $231,976.43 together with interest in the sum of $9,896.49 and the costs of the proceedings, including any reserved costs, to be taxed.

2. The defendant do pay the plaintiff’s costs of the application for summary judgment and default judgment to be taxed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

FEUTRILL J:

Introduction

1 These reasons concern the plaintiff’s interlocutory application for summary judgment and default judgment against the defendant ship (MY "Island Escape").

2 The plaintiffs in proceedings NSD 657 of 2022 had the ship arrested on 19 August 2022 at Roebuck Bay in Broome, Western Australia. The ship was later moved to Fremantle and sold by the Marshal under orders of the Court: see, Bank of New Zealand (Security Trustee) v The vessel MY "Island Escape" [2022] FCA 1230; Bank of New Zealand (Security Trustee) v The vessel MY "Island Escape" (No 2) [2023] FCA 101. On 23 February 2023, that sale was completed and the proceeds of the sale paid into Court.

3 The plaintiff applies for judgment on its claim pursuant to:

(a) section 31A(1) of the Federal Court of Australia Act 1976 (Cth) and r 26.01(1)(e) of the Federal Court of Australia Rules 2011 (Cth), on the ground that there is no reasonable prospect of a successful defence of the claim; alternatively

(b) rule 5.23(2)(b) of the Rules, on the ground that Island Escape Cruises (NZ) Limited, as the relevant person and demise charterer of the ship, is in default of its appearance in the proceeding.

4 In substance, the plaintiff contends that:

(a) the Court has in rem jurisdiction in respect of the plaintiff’s claim, on the ground that it is a general maritime claim;

(b) the writ and particulars set out in it, together with the evidence available, demonstrate that Island Escape Cruises is indebted to the plaintiff in the sum of $231,976.43;

(c) for the purposes of summary judgment, Island Escape Cruises has no reasonably arguable defence to the plaintiff’s claim; alternatively

(d) for the purposes of default judgment:

(i) Island Escape Cruises in default under r 5.22 of the Rules; and

(ii) it is appropriate for the Court to exercise its discretion to grant judgment in default in circumstances in which Island Escape Cruises has not evinced any intention to participate in the proceedings or defend the plaintiff’s claims, and no risk of injustice arises from 'shutting' Island Escape Cruises out of an opportunity to defend the claim as it has no reasonably arguable defence.

5 There is no difficulty in a party requesting both summary judgment and default judgment. If the requirements for one or both forms of judgment are met, it is to be expected that judgment, if ordered, will be granted on the basis considered most appropriate by the Court in the circumstances of the case: Malayan Banking Berhad v Proceeds of the Sale of The Ship “Lauren Hansen” [2021] FCA 286 at [7].

6 For the reasons set out below, judgment is to be entered in favour of the plaintiff against the ship in the sum of $231,976.43 together with interest of $9,896.49 to the date of judgment and costs, including any reserved costs, to be taxed if not agreed. I am satisfied that the defendant has no reasonable prospect of defending the plaintiff’s claim and judgment should be given under s 31A of the Federal Court Act and r 26.01(1)(e) of the Rules.

Hearing ex parte and on the papers

7 The plaintiff commenced in rem proceedings against the ship. The writ identifies Island Escape Cruises as the demise charterer of the ship and the relevant person within the meaning of s 3(1) of the Admiralty Act 1988 (Cth).

8 The writ was issued on 1 September 2022 and served on the ship on 8 September 2022. The application was filed on 13 October 2022 and served on the ship on 2 November 2022.

9 Island Escape Cruises has not entered an appearance in the proceedings in accordance with r 23 and Form 9 of the Admiralty Rules 1988 (Cth). No other potentially interested person has entered an appearance on behalf of the ship. Island Escape Cruises has also not appeared or made any submissions on the application. Nonetheless, a person who is evidently a director and a person who has evidently been appointed receiver and manager of Island Escape Cruises have been provided notice of the writ and the application and have indicated that neither intends participating in the proceedings or the application.

10 In these circumstances and considering the nature of the application, the Court will hear and determine the application in the absence of Island Escape Cruises pursuant to r 17.04 of the Rules.

11 The plaintiff also requested that the application be determined without an oral hearing. I am satisfied that an oral hearing is not necessary in accordance with s 20A of the Federal Court Act.

12 The plaintiff relied on written submissions filed on 16 December 2022. The plaintiff also relied on the following affidavits in support of the application.

(a) Affidavit of Mr Pandu Jagersberger sworn 13 October 2022.

(b) Affidavit of Ms Susan Kate Ladlow sworn 11 October 2022.

(c) Affidavit of Mr Timothy Edward Cocks sworn 15 December 2022.

(d) Affidavit of Ms Ladlow sworn 3 November 2022.

13 For the purposes of hearing and determining the application without an oral hearing, I take each of the affidavits referred to in paragraph 12 to have been read in open Court without objection.

Facts

14 On 27 May, 7 and 20 June and 3 July 2022, the plaintiff rendered invoices addressed to the ‘Master and Owners’ of the ship and Island Escape Cruises. Copies of those invoices are Exhibits to the affidavit of Mr Jagersberger. I infer from the contents of the invoices that Ms Chrissie Silveira signed the invoices and, thereby, acknowledged receipt of the goods described in the invoices. Ms Silveira’s signature appears alongside a stamp of her name and position, Chief Stewardess. I infer that Ms Silveira was the Chief Stewardess of the ship and that the goods were received onto the ship on or around the date of the invoices. All goods were supplied and received in Broome. I infer from the description of the goods in the invoices that they were supplied for the operation or maintenance of the ship.

15 Each invoice itemises the goods the subject of the invoice and the price for each item. The total of the invoices is $231,976.43. Mr Jagersberger deposed, and I accept, that the amounts of each invoice and the total amount has not been paid.

16 Mr Jagersberger deposed that the goods the subject of the invoices were supplied to Island Escape Cruises. He deposed that Island Escape Cruises was the bareboat charterer of the ship. Mr Jagersberger and Mr Cocks deposed facts, in substance, to the effect that the directors and receivers and managers of Island Escape Cruises were given notice of the proceedings and the application and indicated that neither the directors nor receivers intended to take any steps for the company to enter an appearance or defend the proceedings.

Right to proceed in admiralty

17 Notwithstanding the absence of any appearance on behalf of the ship or the relevant person identified in the writ and of any apparent challenge to the admiralty jurisdiction, the Court must be satisfied that is has such jurisdiction. In order to establish an entitlement to judgment in these proceedings, the plaintiff must establish that the Court has jurisdiction in rem. Here, the Court has jurisdiction for the following reasons.

18 The Court has jurisdiction conferred upon it under s 10 of the Admiralty Act in respect of proceedings commenced as actions in rem. A party may only proceed in rem as provided in s 14 of the Admiralty Act. Section 18 of the Admiralty Act provides, relevantly, that where, in relation to a maritime claim concerning a ship, a relevant person is, when the proceeding is commenced, a demise charterer of the ship, a proceeding on the claim may be commenced as an action in rem against the ship. A reference in the Admiralty Act to a ‘maritime claim’ is, amongst other things, a reference to ‘a general maritime claim’ which includes ‘a claim in respect of goods, material or services (including stevedoring and lighterage services) supplied or to be supplied to a ship for its operation and maintenance': ss 4(1), 4(3)(m) Admiralty Act.

19 In the context of admiralty jurisdiction invoked on a proprietary maritime claim, the Court may be satisfied as to jurisdiction if the claim as set out and particularised has the legal character required in s 4(2)(a) of the Admiralty Act: Owners of Ship Shin Kobe Maru v Empire Shipping Co Inc [1994] HCA 54; (1994) 181 CLR 404 at 426-427. The same reasoning applies, by analogy, to a claim set out and particularised with the legal character required in s 4(3)(m) of the Admiralty Act.

20 The plaintiff’s claim, as set out and particularised in the writ, relates to the supply of goods or materials to a ship for its operation and maintenance and the relevant person is a demised charterer. It follows that the Court has in rem jurisdiction over the claim under s 18 of the Admiralty Act.

21 In any event, on the basis of the facts set out earlier in these reasons, the plaintiff’s claim is manifestly a general maritime claim and, thereby, a maritime claim within the meaning of s 18 of the Admiralty Act. Further, for the reasons which follow, I am satisfied that Island Escape Cruises was, at the time the writ was issued, the demise charterer of the ship.

22 The expression ‘demise charterer’ is not defined in the Admiralty Act, but, as commonly understood in admiralty jurisprudence, a demise charter is a contract of hire of a ship, under which possession of the ship passes to the charterer, the master of the ship being the employee of the charterer and not of the owner: The I Congresso del Partido [1978] QB 500 at 539; Patrick Stevedores No 2 Pty Limited v MV "Turakina" [1998] FCA 495; (1998) 154 ALR 666 at 671. While a demise charter contemplates an agreement between the owner and demise charterer, the concept is not limited to a relationship created by contract and extends to a person (charterer) who has possession of the ship with the consent of the owner and who both manages and employs the crew on that person’s own account: CMC (Australia) Pty Ltd v Ship "Socofl Stream" [1999] FCA 1419; (1999) 95 FCR 403 at [28]; The "Guiseppi di Vittorio" [1998] 1 Lloyd’s Rep 136 at 143;.

23 There is no evidence before the Court in these proceedings as to the owner of the ship or as to the existence of an agreement between the owner and Island Escape Cruises by which the ship was hired to Island Escape Cruises. However, I infer from the invoices rendered to Island Escape Cruises and the acknowledgement of the goods received by a person evidently in the employ of that company that Island Escape Cruises was, at least, in possession of the ship with the consent of the owner. Mr Jagersberger deposed that the goods were supplied to the ship’s ‘bareboat charterers/operators’ and to his belief, based on communications between the plaintiff’s solicitors and Island Escape Cruises’ solicitors, the bareboat charter was terminated on 9 September 2022. Mr Cocks deposed that the writ was served on the directors and receivers and managers of Island Escape Cruises. None of the responses of evident representatives of Island Escape Cruises to communications from Mr Cocks in which notice of the writ of summons was given deny or assert that Island Escape Cruises was not a ‘relevant person’ as the demise charterer identified in the writ. Taken collectively, I am satisfied that Island Escape Cruises was the demise charterer of the ship at the date the writ was issued (1 September 2022) and the date it was served on the ship (8 September 2022).

Summary judgment

24 The plaintiff contends it is entitled to summary judgment under s 31A of the Federal Court Act and r 26.01(1)(e) of the Rules. I am satisfied that Island Escape Cruises has no reasonable prospect of successfully defending the proceeding.

25 Assessing the prospects of success of a defence ‘will necessarily require’ the identification and review of, on the one hand, the plaintiff’s case and the evidence supporting its claim for judgment, and on the other, Island Escape Cruises defence and supporting evidence, if any: Jefferson Ford Pty Ltd v Ford Motor Company of Australia Ltd [2008] FCA FCAFC 60; (2008) 167 FCR 372 at [126]. An assessment may be made in favour of judgment if the evidence supporting the application reasonably excludes the possibility that facts essential to the success of a defence will be able to be established: Fortron Automotive Treatments Pty Ltd v Jones (No 2) [2006] FCA 1401 at [20].

26 In the writ the plaintiff claims the sum of $231,976.43 in debt for the supply of goods and materials to the ship (that is, to the demise charterer of the ship). In the absence of any evidence to the contrary, I infer from the invoices exhibited to Mr Jagersberger’s affidavit that the plaintiff and Island Escape Cruises made contracts for the sale of the goods referred to in the invoices for the prices identified in the invoices or for a reasonable price. In the absence of any evidence to the contrary, I accept that to the extent the agreements were for a ‘reasonable price’ the prices identified in the invoices are reasonable.

27 The invoices contain a title retention clause in the following terms: ‘Title to the goods appearing on this invoice remain the property of the supplier until full payment is received.’ That term suggests that the goods the subject of the invoices were, at least in part, supplied on credit. However, the invoice does not expressly state any terms of credit. There is a note to the effect: ‘C) Credit claims will not be recognised after seven days from date of invoice’. Taking the title retention clause and the credit claim clause together, the invoice evidences a term to the effect that unless the supplier agrees to extend further credit, payment for the goods the subject of the invoice is due seven days after the date of the invoice.

28 When regard is had to the nature of the goods supplied, which are for the most part ships stores, I infer that, notwithstanding the title retention clause, the parties intended that the purchaser of the goods was entitled to consume the goods, or part of the goods, before the price became due and before title to the goods passed on payment of the purchase price. The effect of the terms was that the balance of the purchase price became due seven days from the invoice and that purchase price was the subject of an ever diminishing security as the goods were consumed.

29 There is no evidence that the plaintiff extended credit to Island Escape Cruises beyond seven days from the date of the invoice. By an email dated 12 August 2022 to a representative of Island Escape Cruises, the plaintiff claimed that the total sum of $231,976.43 was then overdue. From that I infer that credit had not been extended on any terms beyond 12 August 2022.

30 Island Escape Cruises has had ample notice of the plaintiff’s claim and its intention to apply for judgment. Despite that notice Island Escape Cruises has not entered an appearance or taken any steps to defend the proceedings against the ship or the application. Putting the non-appearance to one side, there is no evidence before the Court of any factual or evidentiary dispute that may be raised in defence of the plaintiff’s claim.

31 Having regard to the matters referred to above, I am satisfied that by no later than 12 August 2022 the total sum of $231,976.43 became due and payable under the agreements for the supply of the goods the subject of and evidenced by the invoices. I am also satisfied that there is no defence to that claim in debt. The plaintiff is entitled to judgment under s 31A of the Federal Court Act.

Default judgment

32 As an alternative to summary judgment, the plaintiff has requested an order for judgment by default under r 5.23(2)(b) of the Rules. The plaintiff requests judgement in the sum of $231,976.43 plus interest and costs on the basis that Island Escape Cruises is in default under r 5.22 of the Rules and the circumstances of the case are appropriate for the Court to exercise its discretion in the plaintiff’s favour to make an order for judgment.

33 Rule 5.22 of the Rules provides that a party is in default if the party fails to, amongst other things, do an act required to be done by the Rules, attend a hearing in the proceedings, or defend the proceeding with due diligence. The failure of the relevant person, or any other person on behalf of the defendant ship in an in rem proceeding to file an appearance, attend hearings and take any steps to defend the proceedings is in default for the purposes of r 5.22: The Sanko Steamship Co Ltd v Australia Gloria Energy Group Pty Ltd [2012] FCA 798 at [5]-[6].

34 Island Escape Cruises is in default in the following circumstances:

(a) The in rem writ was served on the ship in accordance with r 31 of the Admiralty Rules on 8 September 2022.

(b) A copy of the writ was provided to officers of Island Escape Cruises by email on 8 September 2022.

(c) Neither Island Escape Cruises nor any other person entered an appearance in the time prescribed by r 23 of the Admiralty Rules or at all.

(d) Island Escape Cruises by a director and receiver and manager has evinced an intention not to defend the proceedings.

35 The Court’s discretion to order judgement under r 5.23(2)(b) of the Rules has been enlivened by Island Escape Cruises' default: r 1.32 of the Rules; Speedo Holdings BV v Evans (No 2) [2011] FCA 1227 at [17]. That discretion is to be exercised cautiously so as not to prematurely shut a defendant out of an opportunity to defend the claim: Speedo at [21]. While trifling default may not warrant the exercise of the Court’s power, the Rules must be administered sensibly in the circumstance of the case and with an appreciation of the realities of practice and life: Speedo at [21] citing Lenijamar Pty Ltd v AGC (Advances) Limited (1990) 27 FCR 388. Where despite being notified of the claim, an owner (or other relevant person) fails to appear in an in rem proceeding within the time stipulated in the Admiralty Rules, and there is otherwise nothing to suggest that the relevant person has any defence to the claim, the plaintiff’s application is a suitable candidate for default judgment: Norddeutsche Landesbank Girozentrale v The Ship “Beluga Notification” (No 2) [2011] FCA 665 at [21]; Bank of Kuwait and the Middle East v The Ship MV “Mawahi Al Gasseem” (No 2) [2007] FCA 815; (2007) 240 ALR 120 at [8]-[9].

36 In the circumstances of this case, the relevant person (Island Escape Cruises) is in default and had not evinced any intention to participate in or defend the proceedings. There is little or no risk of injustice to Island Escape Cruises. It has had more than adequate notice of the claim against it and the application for judgment. An order for judgment in default would serve the objectives of s 37M of the Federal Court Act. To permit the proceedings to continue in the face of the default of Island Escape Cruises serves no legitimate purpose and would merely prolong the proceedings to the cost and detriment of the plaintiff. The plaintiff has demonstrated, subject to what follows, that judgment in default would be appropriate in this case.

Summary judgment appropriate

37 In this case, I consider that summary judgment is the more appropriate mechanism for judgment. The plaintiff’s claim is a routine claim in debt for the supply and acceptance of goods. There is no hint of a defence to it. That leaves the question of interest and costs.

Interest

38 The Court has a discretion to award interest and determine any applicable rate of interest under s 51(1)(a) of the Federal Court Act. The plaintiff claims interest under that section at the rate of 6.6% from 12 August 2022.

39 Pre-judgment interest is awarded to compensate a plaintiff for being kept out of the plaintiff’s money by the defendant’s refusal to pay that which the Court at trial orders to be paid. The proper rate of interest to be applied should be the rate prevailing from time to time in the market place which would represent the cost of the money to a successful plaintiff. Practice Note GPN-INT suggests that the prevailing market rate is 4% above the cash rate last published by the Reserve Bank of Australia before the periods: (1) 1 January to 30 June in any year commenced; and (2) 1 July to 31 December in any year commenced. The suggested rate in GPN-INT may be considered a ‘rough and ready guide of the prevailing interest rate at any given time’: Management 3 Group Pty Ltd (In Liq) v Lennys Commercial Kitchens Pty Ltd (No 2) [2012] FCAFC 92; (2012) 203 FCR 283 at [25]-[29].

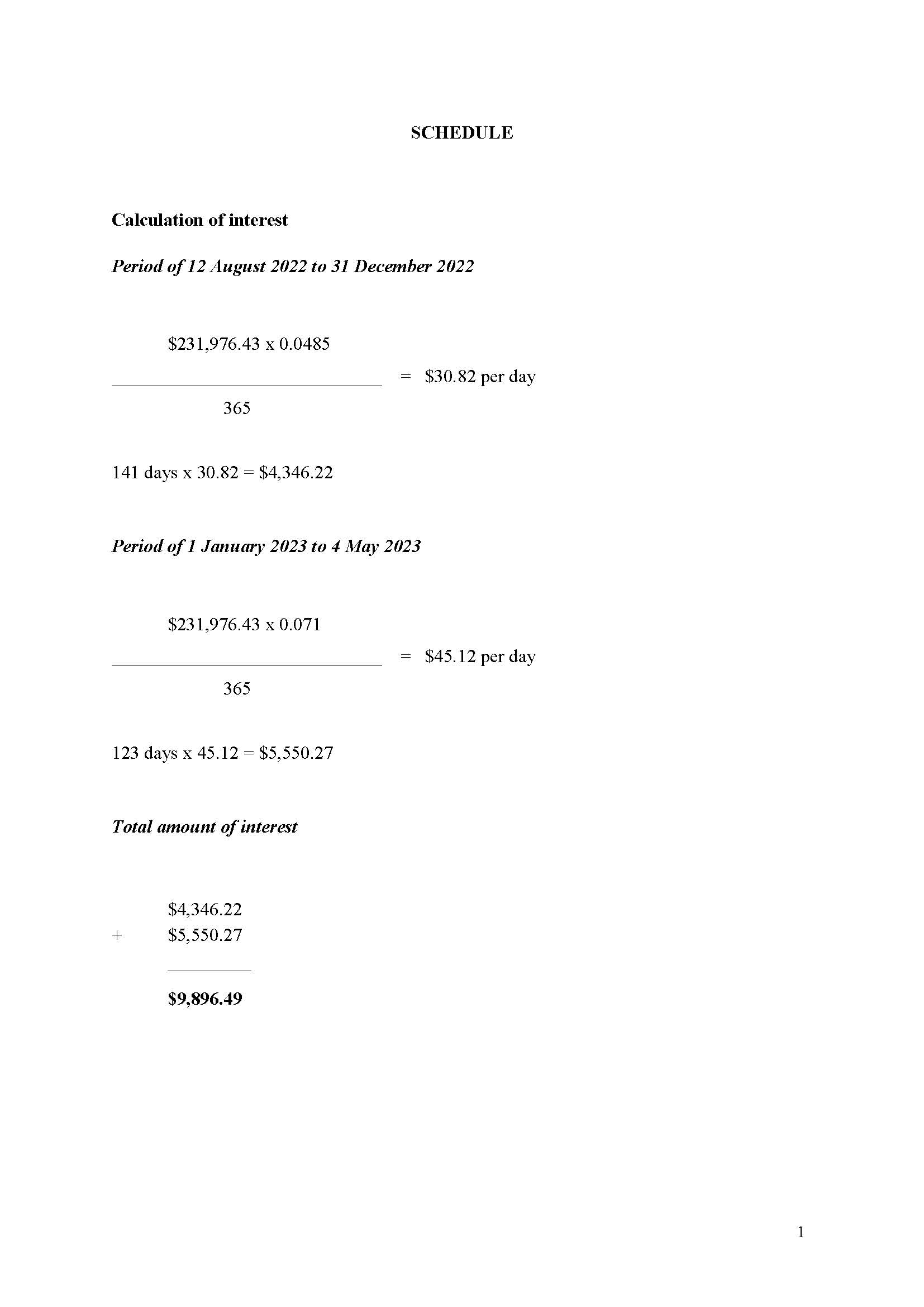

40 I take judicial notice that the applicable cash rates were 0.85% as of 8 June 2022 and 3.1% as of 7 December 2022. Interest will be awarded at the rate of 4.85% from 12 August 2022 (being the latest date upon which the total amount of the invoices was evidently due and payable) to 31 December 2022 and 7.1% from 1 January 2023 to the date of judgment.

41 The amount of interest on the judgment for the plaintiff in the sum of $231,976.43 is $9,896.49. Interest has been calculated in accordance with the schedule to these reasons.

Costs

42 In the application the plaintiff requested that an order be made for the costs to be taxed on an indemnity basis. No submissions were made in support of that proposed order. No grounds that could conceivably support an order in those terms have been identified. Costs are to be taxed in the usual way on a party and party basis.

Conclusion

I certify that the preceding forty-three (43) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Feutrill. |

43 There will be judgment for the plaintiff in the sum of $231,976.43 plus interest at the rates for the periods described earlier in these reasons and costs, including any reserved costs, to be taxed if not agreed.

Associate: