Federal Court of Australia

Coleman v Gannaway [2023] FCA 224

ORDERS

DAVID COLEMAN Applicant | ||

AND: | Respondent | |

DATE OF ORDER: | 16 March 2023 |

THE COURT ORDERS THAT:

1. Pursuant to s 30(1) of the Bankruptcy Act 1966 (Cth), the Bankruptcy Notice BN 257781 issued on 24 October 2022 at the request of the respondent be set aside.

2. The respondent pay the applicant’s costs.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

JACKMAN J:

1 The applicant in these proceedings seeks an order setting aside the Bankruptcy Notice BN 257781 issued on 24 October 2022 at the request of the respondent (the Bankruptcy Notice), pursuant to s 30(1) of the Bankruptcy Act 1966 (Cth) (the Act).

2 On 15 October 2021, the High Court of the Republic of Singapore entered judgment against the applicant in favour of the respondent ordering the applicant to pay:

(1) The sums of SGD825,000 and USD55,000;

(2) Interest of 5.33% per annum on the sum of SGD750,000 from 15 September 2021 till the date of this judgment;

(3) Interest of 10% per month on the sum of USD50,000 from 13 January 2020 till the date of this judgment; and

(4) Costs on an indemnity basis, fixed at SGD9,000 (all in), inclusive of the costs of HC/SUM 3747/2021 and the proceedings in HC/S 1085/2020.

3 I will refer to that judgment as the Singaporean Judgment.

4 On 18 February 2022, the Supreme Court of New South Wales registered the Singaporean Judgment. I will refer to that judgment as the NSW Judgment. The terms of the NSW Judgment are relevantly as follows:

David James Henry Coleman, first defendant is to pay Paul Roland Gannaway, first plaintiff the sum of

Claim amount: $825,000.00

Interest claimed: $3390.57

Filing fees: $1169.00

Other costs: $900.00

TOTAL: $838,559.57

The NSW Judgment referred to the above Judgment being in respect of the judgment entered in Singaporean Dollars.

David James Henry Coleman, first defendant is to pay Paul Roland Gannaway, first plaintiff the sum of

Claim amount: $55,000.00

Interest claimed: $8,794.52

TOTAL: $63,794.52

The NSW Judgment referred to that as being in respect of the judgment being entered in United States Dollars.

5 On 24 October 2022, the Official Receiver issued the bankruptcy notice at the request of the respondent. The bankruptcy notice annexed both the Singaporean Judgment and the NSW Judgment.

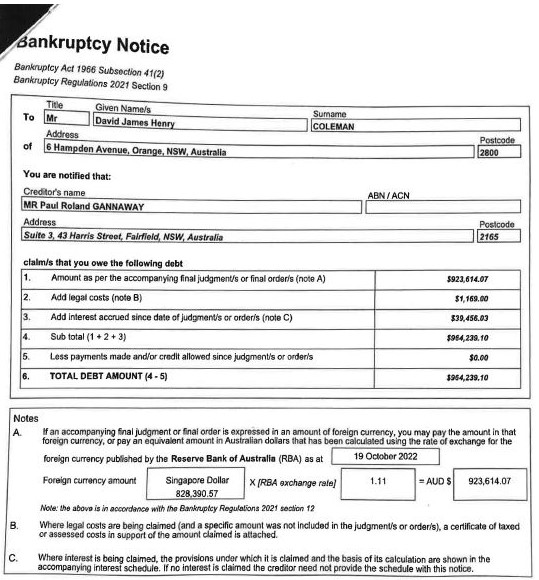

6 The first page of the bankruptcy notice was as follows:

7 It will be observed, in relation to the calculation in Note A, that $828,390.57 x 1.11 does not equal $923,614.07. Rather, it equals $919,513.53.

8 It is also relevant to note, because it features prominently in the applicant’s argument, that the amount of SGD828,390.57 was not the amount of the total judgment in Singaporean Dollars expressed in either of the accompanying final judgments.

9 On 11 November 2022, the applicant commenced these proceedings by which he applied to set aside the Bankruptcy Notice.

10 The only amounts claimed in the Bankruptcy Notice were the sums of SGD825,000.00, being the principal amount of the Singaporean Judgment, and the interest amount in the NSW Judgment of SGD3,390.57, being a total of SGD828,390.57. The Bankruptcy Notice does not claim the USD component of the NSW Judgment, nor does it claim the costs component of the Singaporean Judgment.

11 The respondent read the affidavit of Mr David, the solicitor acting on behalf of the respondent, dealing with the process of generating the Bankruptcy Notice. He explains that the creditor logs into the website of the Australian Financial Security Authority (AFSA) and then commences the “submit a bankruptcy notice” process. In the section titled General Details, the details of the judgment or order are entered, including the judgment or order case number, court, state, order, date and amount. In the section titled Interest Schedule, the details of the interest claimed are entered. In the section titled Claim Details, the details of the claim are entered, and as the judgment is a foreign currency judgment, details of the foreign judgment are entered in this section. Mr David then entered the amounts claimed of SGD825,000.00 and the interest of SGD3,390.57, being a total of SGD828,390.57. Mr David then entered the exchange rate of 1.11495 (explained below), and the amount was then automatically converted into the AUD amount of $923,614.07. Legal costs of $1,169.00 (being the filing fee for the NSW Judgment) were then added. Interest amounts of $39,456.03 were added. The total debt of $964,239.10 was automatically generated. Mr David then filled in the debtor details, creditor details and contact details in the appropriate section. The above information was then submitted, and the Bankruptcy Notice was then issued.

12 The Reserve Bank of Australia (RBA) published an exchange rate for AUD:SGD on 19 October 2022 to four decimal places, being 0.8969. It is common ground between the parties that the RBA did not publish an exchange rate of SGD:AUD. Mr David calculated the exchange rate for SGD:AUD by applying the inverse of 1AUD:0.8969SGD, which yields a figure of 1.11495, rounded down from 1.114951499609767 which is the quotient of 1 divided by 0.8969. Mr David’s evidence is that five decimal places was the maximum number of decimal places that the AFSA website allowed to be entered.

13 As indicated above, Mr David entered on the AFSA website the exchange rate of 1.11495, and the website then automatically converted the SGD828,390.57 into the AUD amount of $923,614.07. That arithmetic was correct. However, despite the multiplier actually used being 1.11495, when the Bankruptcy Notice was issued, the multiplier appeared as 1.11. That would appear to be the result of a flaw in the AFSA website, in that the website allowed Mr David to enter five decimal places, but the output of the entries made on the website only referred to the first two of those decimal places.

14 In his affidavit, Mr David did not say whether there was any other means of requesting the Official Receiver to issue a Bankruptcy Notice, other than through the AFSA website. In the absence of evidence going to that matter, I am not prepared to draw an inference that the AFSA website is the only means of undertaking that task. I can well imagine that it is the preferred means for the Official Receiver to handle such requests, and would appear to be administratively the most convenient method for creditors, but it may not be the only available method.

The Salient Legislative Provisions

15 Section 41(1) of the Act provides that an Official Receiver may issue a bankruptcy notice on the application of a creditor who has obtained against a debtor one or more final judgments or orders that meet the description given in the section. Sub-section (2) provides that: “The notice must be in accordance with the form prescribed by the regulations.”

16 Regulation 9 of the Bankruptcy Regulations 2021 (Cth) (the Regulations) provides as follows:

(1) For the purposes of subsection 41(2) of the Act, the form of bankruptcy notice set out in Schedule 1 is prescribed.

(2) A bankruptcy notice must follow that form in respect of its format (for example, bold or italic typeface, underlining and notes).

(3) Subsection 2 does not limit section 25C of the Acts Interpretation Act 1901.

17 Regulation 12 of the Regulations provides as follows:

(1) This section applies in relation to a bankruptcy notice issued by the Official Receiver in relation to a debtor if the notice includes a final judgment, or final order, that is expressed in an amount of foreign currency (whether or not the judgment or order is also expressed in an amount of Australian currency).

(2) The bankruptcy notice must also include the following:

(a) a statement to the effect that the debtor must pay:

(i) the amount of foreign currency; or

(ii) the equivalent amount of Australian currency;

(b) The conversion calculation for the equivalent amount of Australian currency;

(c) A statement to the effect that the conversion of the amount of foreign currency into the equivalent amount of Australian currency has been made in accordance with this section.

(3) For the purposes of subparagraph (2)(a)(ii), the equivalent amount of Australian currency is the amount worked out using the rate of exchange for the foreign currency published by the Reserve Bank of Australia in relation to the date that is 2 business days before the day on which the application for the notice is made.

18 Regulation 8 of the Regulations provides relevantly as follows:

(1) This section sets out the requirements for an application to the Official Receiver for a bankruptcy notice by a person who has obtained against a debtor one, or 2 or more, final judgments or final orders of a kind described in paragraph 40(1)(g) of the Act.

(2) The application must be in the approved form.

The Applicant’s Submissions

19 The applicant submitted that the error in calculation on the face of the Bankruptcy Notice of multiplying SGD828,390.57 by 1.11 and producing AUD923,614.07, instead of the correct product of AUD919,513.53, was sufficient to establish non-compliance with reg 12(2)(b), which requires that the bankruptcy notice include “the conversion calculation for the equivalent amount of Australian currency”.

20 Further, the applicant submitted that the Bankruptcy Notice breached reg 12(2)(a) because the notice did not include “the amount of foreign currency” within the meaning of that regulation. The applicant submitted that the use of definite article “the” meant that there can only be one amount of foreign currency that satisfies the regulation, that being the amount of foreign currency expressed in the final judgment included in the notice. The applicant submitted that the chosen amount of foreign currency in the notice, namely SGD828,390.57 was not what was expressed in either the Singaporean Judgment or the NSW Judgment which accompanied the notice. The amount of the Singaporean Judgment was said to be SGD837,614.18 plus USD60,369.86 and the amount of the NSW Judgment was SGD838,559.57 plus USD63,794.52 and AUD1,169.00.

21 The applicant then submitted that, by reason of being issued in breach of reg 12, the Bankruptcy Notice was defective. The applicant relied on what was said in Kleinwort Benson Australia Ltd v Crowl (1988) 165 CLR 71 at 79-81 to the effect that a defect in a bankruptcy notice is not formal, and therefore cannot be cured by s 306(1) of the Act, if it fails to meet a requirement made essential by the Act, or if it could reasonably mislead a debtor as to what is necessary to comply with a notice. The applicant submitted that the Bankruptcy Notice in this case falls into both of those categories. As to the essentiality of the requirements of reg 12, the applicant relied on Sackville J’s judgment in Parianos v Lymlind Pty Ltd (1999) 93 FCR 191.

22 Separately from the argument based on reg 12, the applicant submitted that the Bankruptcy Notice did not comply with s 41(2) of the Act and reg 9(2) of the Regulations by reason of the fact that it annexed two judgments, both the Singaporean Judgment and the NSW Judgment which were in different amounts, neither of which actually appeared in the Bankruptcy Notice, thus (so it was submitted) rendering it impossible for the debtor to ascertain to which judgment the amount claimed in the Bankruptcy Notice was said to be referable. Accordingly, it was submitted, the Bankruptcy Notice did not correctly identify the source of the liability to make the payment demanded by the notice, referring to the Full Court’s decision in Mastronardo v Commonwealth Bank of Australia Ltd [2019] FCAFC 127; (2019) 269 FCR 529 at [8] and [15]. The applicant then submitted that this constituted both a breach of an essential requirement under the Act, and that the attachment of two judgments could reasonably mislead the applicant as to what is necessary to comply with the notice.

The Respondent’s Submissions

23 The respondent accepted that on the face of the Bankruptcy Notice, the calculation of Singaporean Dollars times the nominated exchange rate of 1.11 was not correct, and the product of those figures was as the applicant had submitted. However the respondent submitted that the important figure was the amount of AUD923,614.07, which was the correct product of the amount of SGD828,390.57 multiplied by the rate which was prescribed by reg 12(3). The respondent submitted that the correct exchange rate had to be used, and was in fact used, even though what appeared in the Bankruptcy Notice was an exchange rate expressed to only two decimal places, and the calculation was wrong as a matter of arithmetic based on the 1.11 multiplier.

24 The respondent submitted that the creditor was justified in using as many decimal places as possible to get the highest degree of accuracy which was possible in the circumstances, and the technological constraint in entering decimal places on the AFSA website meant that there was a limit of five decimal places which could be inserted.

25 The respondent contended that the process by which the respondent had applied for the Bankruptcy Notice did not provide an opportunity to express the exchange rate with a greater degree of accuracy, and also submitted that there was not currently a process which permitted any greater degree of accuracy. The respondent relied on reg 8(2), which provides that the application for a Bankruptcy Notice to the Official Receiver must be in “the approved form”. The respondent submitted that the computer system on the AFSA website was the approved form, and no other method of obtaining a Bankruptcy Notice from the Official Receiver was available. The respondent conceded that there was no evidence as to whether it was possible to request the Official Receiver to issue a Bankruptcy Notice by taking Schedule 1 and inserting by hand the information required, and then submitting that handwritten form to the Official Receiver.

26 The respondent submitted that if the approved form can only accommodate the exchange rate being expressed to two decimal places, there is a conflict in the regulations between reg 12(3) and reg 9, in that the form mandated by reg 9 does not permit more than two decimal places to be used, whereas reg 12(3) refers to rates published by the RBA which are to four decimal places. The respondent submitted that the paramount provision is reg 12(3), because compliance with that provision is material to the correctness of the arithmetic process by which the amount in reg 12(2)(a)(ii) is calculated, and it is the more specific provision.

27 As to the consequences of non-compliance with reg 12, the respondent submitted that compliance with reg 12(2)(b) was not essential, and sought to distinguish Parianos v Lymlind Pty Ltd, above, on the basis that the language of the regulation then was different to the current regulation. The respondent further submitted that Parianos dealt with the counterpart to reg 12(3), rather than the counterpart to reg 12(2)(b). The respondent further submitted, in the alternative, that the non-compliance with reg 12(2)(b) was a formal defect which could be cured by s 306(1) of the Act.

28 As to the applicant’s argument that reg 12(2)(a) required that the Bankruptcy Notice must stipulate the single aggregate amount of the foreign currency judgment, the respondent drew attention to the use of the indefinite article “an” before the words “amount of foreign currency” in reg 12(1), and submitted that the use of the definite article “the” in reg 12(2)(a) referred simply to the amount in the Bankruptcy Notice which the debtor was required to pay. The respondent relied also on the judgment of Rares J in Dua v Dawn Jade Ltd [2015] FCA 505.

29 As to the submission that the Bankruptcy Notice was defective because both the Singaporean Judgment and the NSW Judgment accompanied it, the respondent submitted that the figure of SGD828,390.57 was clearly referable to the principal amount of SGD825,00.00 and the interest claimed of SGD3,390.57 in the NSW Judgment. The respondent submitted that it was clear that the costs order of SGD9,000.00 was not being claimed in the Bankruptcy Notice. The respondent submitted that the Bankruptcy Notice made clear that payment of the total amount specified of AUD964,239.10 would constitute compliance with the notice, and that the judgment creditor was not requiring the judgment debtor to do anything other than to pay that amount.

Consideration

30 In my opinion, the error in Note A in the Bankruptcy Notice constitutes a non-compliance with reg 12(2)(b), which requires that the bankruptcy notice “must” include “the conversion calculation for the equivalent amount of Australian currency”. The bankruptcy notice referred to the multiplier as being 1.11, rather than the calculation which was actually performed using 1.11495. Accordingly, the stated product AUD923,614.07 was wrong as a matter of arithmetic, based on the figures that were adopted in Note A, even though it was in fact the product which was produced by the calculation that was in fact performed. Accordingly, Note A did not set out the conversion calculation which was actually performed, and nor did it set out, as a result of the calculation expressed in Note A, the “equivalent” amount of Australian currency.

31 The question then arises as to the consequences of that non-compliance, having regard to s 306(1) of the Act and the issue whether the non-compliance was a formal defect or irregularity. In Kleinwort Benson Australia Ltd v Crowl (1988) 165 CLR 71 at 79-80, Mason CJ, Wilson, Brennan and Gaudron JJ said:

The authorities show that a Bankruptcy Notice is a nullity if it fails to meet a requirement made essential by the Act, or if it could reasonably mislead a debtor as to what is necessary to comply with the notice… In such cases the notice is a nullity whether or not the debtor in fact is misled…

That statement was cited with approval in Adams v Lambert (2006) 228 CLR 409 at [25].

32 As Sackville J pointed out in Parianos v Lymlind Pty Ltd, above, at [13], that passage makes clear that a Bankruptcy Notice is a nullity if it fails to meet a requirement made essential by the Act, whether or not the notice could reasonably mislead a debtor. His Honour also said at [15] that there was no basis for drawing a distinction between a requirement made essential to the validity of a Bankruptcy Notice by the Act, and one rendered essential by a valid regulation made pursuant to the Act. Sackville J also held at [16] that the language of the then regulation strongly suggested that it was intended to create requirements essential to the validity of a Bankruptcy Notice, pointing out the emphatic language in which the regulation is expressed, including the repeated use of the word “must”.

33 I do not think that Parianos can be distinguished on the basis of the way in which the applicable regulation is now expressed. While the regulation which was the subject of Parianos provided that a Bankruptcy Notice must set out the applicable rate of exchange, whereas the current regulation leaves that as a matter to be dealt with in filling out Schedule 1 as prescribed by reg 9, which is itself expressly subject to s 25C of the Acts Interpretations Act 1901 (Cth), reg 12 as currently drafted maintains the use of the imperative and mandatory word “must”. It does so not merely in the context of prescribing a form, being the context which arose in Adams v Lambert, above, at [14] and [29]. On an ordinary and natural reading of reg 12(2)(b), the Bankruptcy Notice must include the conversion calculation for the equivalent amount of Australian currency, and in my view that imposes an essential requirement of the regulation.

34 I do not think that reg 8 provides any support for the respondent’s position. Reg 8(2) stipulates that the application to the Official Receiver for a bankruptcy notice must be in “the approved form”. It is not clear from the evidence whether the use of the AFSA website is the only such approved form. Whether or not it is the only approved form, the problem which has emerged in the present case does not concern the requirement that the application must be in the approved form. When Mr David inserted the multiplier of 1.11495 in the AFSA website, that entry was accepted by the website. There was no shortcoming in Mr David’s use of that approved form. The problem was that the output of that approved form did not reflect what had actually been entered, because it shortened the multiplier to 1.11. Accordingly, there is no conflict to be resolved between reg 8(2) and reg 12(2)(b). The problem is not a textual inconsistency between two regulations, but a factual issue arising from a defect in the AFSA website, which (on the evidence adduced) may not be the only approved form. If there were a conflict between the prescription of a form under reg 8(2) and the substantive requirements of reg 12(2)(b), then the latter would prevail, consistently with the reasoning in Adams v Lambert, above, at [14] and [29].

35 Having reached that conclusion, it is not strictly necessary to deal with whether the conversion calculation expressed in Note A of the Bankruptcy Notice could reasonably mislead a debtor as to what was necessary to comply with the notice. In my view that would also be satisfied in the present case. A person who receives a Bankruptcy Notice containing an arithmetical error in one of the critical calculations going towards the figure which is stated to be required to be paid, could reasonably be in two minds as to what is required. One possibility is that the aggregate figure demanded is to be paid, irrespective of the arithmetical error inherent in its calculation. Another possibility is that the creditor would accept payment on the basis that clear arithmetical errors in the bankruptcy notice should be treated as having been corrected, and the correct figure would be accepted as meeting the demand. That is routinely the case in everyday commerce where invoices contain an arithmetical error.

36 In the present case, the applicant could reasonably have been left in that position of doubt, even if the applicant had taken the trouble to look at the exchange rates published by the RBA at the relevant date, and then made his own calculation of the inverse of the AUD:SGD rate published by the RBA, and then worked out that the respondent had used 1.11495 as the multiplier in Note A. The applicant still would not have known why Note A had used the different multiplier of 1.11. Only someone experienced in the frustrations of using the AFSA website in its current configuration could have ascertained that the respondent had in fact inserted a figure of 1.11495, only to be met with the output of the AFSA system which showed 1.11. Even someone with that level of acute insight could still reasonably have been misled as to whether the respondent really was demanding the total figure expressed in the Bankruptcy Notice, or would readily have accepted a lower figure once the arithmetical error on the face of the Bankruptcy Notice had been drawn to his attention.

37 Accordingly, in my opinion, the Bankruptcy Notice should be set aside.

38 One cannot help but feel a great deal of sympathy for the respondent in these circumstances. Mr David’s affidavit demonstrates that he acted with due care and diligence in inserting the inverse of the exchange rate published by the RBA, with the maximum number of decimal places which the AFSA website would allow. The figure of $923,614.07 was automatically generated by the website once he had entered that multiplier. The fact that the Bankruptcy Notice as issued by the Official Receiver showed only a multiplier of 1.11 was a defect which appears to have been inherent in the system which AFSA makes available to the public. As I have said, the evidence of Mr David does not go so far as to indicate whether there is some alternative means available for requesting the Official Receiver to issue a bankruptcy notice in relation to a foreign currency judgment, but it would appear that AFSA encourages use of its website as the most convenient, if not the only, means of undertaking that exercise. It is to be hoped that that is a feature of the website which might be readily cured. It is certainly regrettable that the shortcomings of that website have adversely impacted on the position of the respondent, whose solicitor has diligently sought to comply with the statutory requirements, using the means placed by AFSA at his disposal.

39 It has not been necessary for me to deal with the question of how many decimal places should be used when adopting a foreign currency exchange rate which is not in fact published expressly by the RBA, but which is the inverse of the rates published by the RBA. Regulation 12(3) does not stipulate in those circumstances how many decimal places should be used. Given that the RBA publishes rates to four decimal places, in my view a sensible reading of reg 12(3) is that, when calculating the inverse of those published rates, one should use at least four decimal places. In the present case, the respondent used five decimal places, and cannot be criticised for adopting more accuracy than the RBA itself did in its published rates. I do not see that there is any inconsistency between the form prescribed by reg 9(2) and reg 12(3) in this regard, contrary to the respondent’s argument. However, as discussed above, any such inconsistency would be resolved in favour of reg 12(3), consistently with Adams v Lambert, above, at [14] and [29].

40 While it is not necessary for me to deal with the remaining arguments put by the applicant, those matters have been fully argued and I set out briefly below my reasoning on them.

41 As to the argument by the applicant that there was a non-compliance with reg 12(2)(a)(i) because the Bankruptcy Notice did not use the total figure of the foreign judgment but rather adopted two of the integers of that total, in my view there is no such requirement of the legislation. Provided that the Bankruptcy Notice has adopted one or more of the amounts which are the subject of the foreign currency judgment, it does not matter that the Bankruptcy Notice may have omitted other items which were also the subject of the foreign currency judgment. The use of the definite article in “the amount of foreign currency” in reg 12(2)(a) does not dictate a different conclusion.

42 That conclusion is supported by the reasoning of Rares J in Dua v Dawn Jade Ltd, above, in which the item of legal costs in the amount of HKD10,000 had been omitted from the bankruptcy notice, without causing any non-compliance with the statutory requirements. In that case, the Supreme Court of New South Wales made orders registering a judgment obtained from the High Court of the Hong Kong Special Administrative Region that, relevantly, the defendant was to pay the first plaintiff the sum of USD400,000 or the HKD equivalent at the time of payment, and the defendant was to pay the costs of the proceedings which were fixed at HKD10,000. In addition, the Hong Kong Judgment made orders for the payment of interest on those amounts. The Hong Kong Judgment also ordered the defendant to pay the second plaintiff USD600,000 or the Hong Kong Dollar equivalent at the time of payment, together with interest on that amount at the stipulated rate. The bankruptcy notice by the first plaintiff in that case adopted as the foreign currency amount USD417,972.60, which was the sum of the principal judgment debt of USD400,000 and the stipulated interest on that amount. The costs order in the fixed sum of HKD10,000 was not included in the foreign currency amount in the bankruptcy notice. The other bankruptcy notice took the same approach to the second plaintiff’s judgment debt of USD600,000 plus interest, omitting the costs component. The debtor’s argument was essentially that it was impossible to know whether the USD sums referred to in Note A of each notice were comprised of the Hong Kong Judgment debt together with some amount in respect of the costs obligation or simply interest and the USD judgment debt or some unexpressed amount of the HKD10,000 costs order, some interest and the amount of the Hong Kong Judgment debt, or various permutations of those possibilities: [16]. Rares J rejected that argument at [17]-[23] relying on what was said in Kleinwort Benson, above, at 79-80 to the effect that if the amount specified in a bankruptcy notice is in fact due and payment is claimed in accordance with the judgment, the essential requirements of s 41(2)(a)(i) of the then legislation are met, and no uncertainty arises if it is clear that payment of the amount specified in the notice will constitute compliance with the notice; and that any understatement of the amount due is substantive rather than formal only if the understatement is capable of misleading the debtor as to what is necessary for compliance with the notice. In that case, the question was whether the debtor could reasonably have been misled as to what was necessary to comply with the Bankruptcy Notices, but no uncertainty arose in circumstances where it was clear to any person in the position of the debtor that only payment of the amount specified in the notice would constitute compliance with it: [21]-[22].

43 Apart from the issue of whether any such requirement is essential, I do not see how the judgment debtor could reasonably have been misled by the adoption in the Bankruptcy Notice of the figure of SGD828,390.57. That figure is obviously the sum of the principal judgment debt of SGD825,000, together with interest as calculated and ordered in the NSW judgment of SGD3,390.57. The amount of SGD828,390.57 is then an integer in the calculations which yield the total debt amount stated at Item 6 in the Bankruptcy Notice of AUD964,239.10. That is the amount which was demanded in the Bankruptcy Notice. Note A included the required provision that if an accompanying final judgment or order is expressed in an amount of foreign currency, then the debtor may pay the amount in that foreign currency, or pay an equivalent amount in Australian dollars that has been calculated in the required manner.

44 As to the argument by the applicant that there was non-compliance with reg 9(2) of the Regulations by reason of the Bankruptcy Notice annexing two judgments rather than one judgment, in my view there is no merit in that argument. Item 1 in Schedule 1 to the Regulations refers to “Amount as per the attached final judgment/s or final order/s (Note A)”, which expressly contemplates that there may be more than one judgment or order which refers to the amount in question. Section 41(1) of the Act itself contemplates multiple judgments. The source of the liability to make the payment demanded by the Bankruptcy Notice was not obscured by the fact that both the Singaporean Judgment and the NSW Judgment were annexed. The NSW Judgment registered the Singaporean Judgment, including the principal amount of SGD825,000. The NSW Judgment quantified the amount of interest. The Bankruptcy Notice is clear as to the elements of those judgments which are adopted in the calculation of the total debt amount. Even if there was a non-compliance with reg 9(2), I would have concluded that any non-compliance was not in relation to an essential requirement of the legislation, nor was it a matter which could reasonably have misled the debtor.

Costs

45 The applicant seeks an order for the costs in the event that I am of the view that the Bankruptcy Notice should be set aside. The respondent submits that there should be no order as to costs because of the costs wasted in Mr David having attended court during the hearing pursuant to a request that he be available for cross-examination, which in the event was not pursued. I was informed by Counsel for the applicant that the proposed cross-examination of Mr David would have been in relation to a portion of his affidavit which dealt with earlier bankruptcy notices by the respondent to the applicant, which were successfully objected to on the ground of relevance.

46 In my opinion, that does not amount to conduct which would disentitle the applicant to a costs order and does not evince any unreasonableness on the part of the applicant. A deponent to an affidavit at a final hearing may be asked to attend for cross-examination as a matter of course, and it is often the case that rulings on admissibility made at the hearing itself produce an outcome whereby that witness is no longer required for cross-examination. There can be no criticism of the party taking objections to the affidavit, without at that time knowing the outcome of those objections, also requiring the deponent to be present for cross-examination in the event that the objections fail.

47 Accordingly, I make the following orders:

(1) Pursuant to s 30(1) of the Bankruptcy Act 1966 (Cth), the Bankruptcy Notice BN 257781 issued on 24 October 2022 at the request of the respondent be set aside.

(2) The respondent pay the applicant’s costs.

I certify that the preceding forty-seven (47) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Jackman. |

Associate: