Federal Court of Australia

Yammine v Lantrak Holdings Pty Ltd (No 2) [2023] FCA 162

ORDERS

First Applicant NJA PTY LTD ACN 616 524 611 Second Applicant | ||

AND: | LANTRAK HOLDINGS PTY LTD ACN 615 969 483 First Respondent GARY ROBERT LIEMANT Second Respondent | |

DATE OF ORDER: |

THE COURT ORDERS THAT:

1. The respondents pay the applicants $8,730,000 (being $7,250,000 together with prejudgment interest to today).

2. Subject to order 3, the respondents pay the applicants’ costs.

3. If any party files and serves written submissions limited to two pages together with evidence in support on or before 10 March 2023:

(a) order 2 be stayed until further order;

(b) the opposing party file and serve written submissions limited to two pages and any evidence on or before 17 March 2023; and

(c) costs be reserved and, unless the Court otherwise orders, determined on the papers.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

RARES J:

Introduction

1 Samuel Goldwyn, the Hollywood movie mogul, is credited with saying that “a verbal contract isn’t worth the paper it’s written on”. This case seeks to test that aphorism. A common experience of negotiations is that an individual on one side believes that he or she has agreed to a deal with the other side that is not reflected in any documentation of the transaction. How that mistaken perception occurs may give rise to a legal, equitable or statutory remedy for the apparently mistaken side. The position becomes more complicated when those involved in the negotiations are in a non-fiduciary, but nonetheless pre-existing, close or trusting business relationship, as in this proceeding.

2 The two individual principals are the first applicant, Norman Yammine, with the second applicant, his company, NJA Pty Ltd (collectively the Yammine parties), and the second respondent, Gary Liemant (to whom I will refer in these reasons as Mr Liemant to distinguish him from his brother, Mark Liemant, who is not a party to this proceeding) and the first respondent, Lantrak Holdings Pty Ltd (collectively the Liemant parties). Mr Yammine negotiated about three actual or perceived deals personally with Gary Liemant on behalf of his brother and their associated entities.

3 It is common ground that the first deal occurred without a written contract. Mr Yammine agreed with Gary and Mark Liemant that he and they would become 50% shareholders (through NJA, as trustee of the NJA family trust, and Lantrak Holdings) in a new company, Lantrak NSW Pty Ltd, that was incorporated on 20 December 2016, and that it would acquire and operate Mr Yammine’s transport logistics business that he conducted through Recycling and Transport Solutions Pty Ltd (RTS) in consideration of a payment to Mr Yammine (or an associate) of $5 million.

4 I will oversimplify the details of the second deal in the summary below. It is the principal focus of this proceeding. It occurred in late 2018 and was, on the Liemant parties’ case, wholly in writing or, on the Yammine parties’ case, partly in writing. Previously, on 13 September 2018, after detailed negotiations with the assistance of professional advisors on both sides, the Yammine parties, the Liemant parties and other associated entities had entered into a written non-binding heads of agreement. The heads of agreement contemplated the sale by the Yammine parties and their associated entities of their 50% interest in the transport solutions business then operated through Lantrak NSW (to which the parties had given the value of $35 million in the negotiations for the heads of agreement) together with other assets, for a total consideration of $47.5 million. However, the second deal did not reflect the heads of agreement. Instead, it involved the Yammine parties transferring their 50% of the shares in Lantrak NSW and certain other assets for a total consideration of $13 million, as provided in the written sale and purchase agreement that the parties and their other associated entities executed on 12 November 2018.

5 The Liemant parties say that the sale agreement contained all the terms of the second deal and that they performed all their obligations under it and, accordingly, have no further liability to the Yammine parties.

6 On the other hand, the Yammine parties contend that, in a telephone call on about 9 October 2018 (the 9 October conversation), Mr Liemant informed Mr Yammine that the Liemant parties would not be able to pay $35 million for his 50% interest in the transport solutions business as previously contemplated. The Yammine parties contend that both in the 9 October conversation and after, Mr Liemant made and affirmed a collateral contract, a representation as to a future matter for the purposes of ss 4 and 18(1) of the Australian Consumer Law (ACL) in Sch 2 of the Competition and Consumer Act 2010 (Cth), that he or the Liemant parties would pay the Yammine entities the difference between $10 million clear of taxation liabilities and $35 million if they proceeded on the terms of what later became the sale agreement. In the event, that difference was $22 million.

7 The third, again disputed, deal involved Mr Yammine’s claim that, on about 11 October 2019, he and Mr Liemant agreed that Mr Yammine would not require Mr Liemant to honour his oral promises to pay the $22 million if Mr Liemant or the Liemant entities paid him $10 million, in consideration of which Mr Yammine and his entities would enter into an agreement for a term of 10 years not to compete with the business of Lantrak NSW (which the Liemant parties by then wholly owned).

8 This is the context in which the following four issues arise, namely:

(1) did the Liemant parties, or either of them, enter into an oral collateral contract to pay the Yammine parties $22 million in consideration of the Yammine parties agreeing to sell their 50% interest in the transport solutions business and Lantrak NSW (the collateral contract issue);

(2) are the Liemant parties, or either of them, estopped from denying that they, he or it promised to pay the Yammine parties $22 million in consideration of the Yammine parties executing the sale agreement (the estoppel issue);

(3) did the Liemant parties, or either of them, make a representation in trade or commerce to the Yammine parties that was misleading or deceptive or likely to mislead or deceive with respect to a future matter in contravention of ss 4 and 18(1) of the ACL (which I will compendiously refer to as misleading or a misleading representation) that if the Yammine interests entered into the sale agreement, the Liemant parties, or one of them, would pay the Yammine parties $22 million (the misrepresentation issue); and

(4) did the Liemant parties, or one of them, agree with Mr Yammine on about 11 October 2019 that neither he nor any of his entities would compete with the business of Lantrak NSW for a period of 10 years in consideration of the Liemant parties paying him $10 million (the non-compete contract issue)?

The two principal witnesses

9 Mr Yammine grew up in difficult circumstances and at the age of 8 was diagnosed as suffering from epilepsy. As a young man he was convicted of an offence for which he served a substantial jail sentence. He became a devout Christian. Once he was released from prison he began working as a labourer for his cousins in a large excavation company, Moits, in Sydney. He learnt how that business operated and perceived that there was a gap in the market for transport logistics. He noticed that Moits would hire trucks from many different people to cart excavated material away from development sites. After he married in about 2012, he and his wife, Joanne Mikhael, began a logistics business called Nojo, an acronym of their first names, Norman and Joanne. Nojo provided trucks to carry excavated material to landfill sites and its first client was Moits. Nojo attracted other customers in the excavation business and grew. In late 2015, Mr Yammine commenced trading through RTS as a new business providing road haulage of earth waste, soil and other materials.

10 Mr Liemant and his brother, Mark, conducted the Lantrak group, that operated, prior to 2016, in Victoria and Queensland. The Lantrak group’s predominant business was to dispose of volumes of material for its clients, to act as broker in the civil construction industry for dirt and clean fill materials and to undertake land reclamation projects. Mark Liemant did not give evidence because he was not relevantly involved in the dealings that Gary Liemant had, on behalf of the Lantrak group, including his brother, with Mr Yammine.

11 Gary Liemant was in his mid-50s when he met Mr Yammine (who was in his 30s). Mr Liemant was an experienced, astute and successful businessman.

12 As I will explain below, each of Mr Yammine and Mr Liemant gave evidence that, in particular instances, caused me to give close consideration to his credibility and reliability. In evaluating their evidence, and that of the other witnesses, I have acted on the principles that Dowsett, Rares and Logan JJ summarised in Julstar Pty Ltd v Hart Trading Pty Ltd [2014] FCAFC 151 at [72]–[74] as follows:

72 In order to determine whether conduct was misleading or deceptive for the purposes of s 52 of the Trade Practices Act and its analogues, the Court must engage in a close analysis of all the circumstances of the transaction: Campomar Sociedad, Limitada v Nike International Ltd (2000) 202 CLR 45 at 84 [99]-[100] per Gleeson CJ, Gaudron, McHugh, Gummow, Kirby, Hayne and Callinan JJ; Butcher v Lachlan Elder Realty Pty Ltd (2004) 218 CLR 592 at 604-605 [36]-[40] per Gleeson CJ, Hayne and Heydon JJ; Miller & Associates Insurance Broking Pty Ltd v BMW Australia Finance Ltd (2010) 241 CLR 357 at 384 [91] per Heydon, Crennan and Bell JJ. As the Court said in Campomar 202 CLR at 85 [102], in approving what Gibbs CJ had said in Parkdale Custom Built Furniture Pty Ltd v Puxu Pty Ltd (1982) 149 CLR 191 at 199:

“the legislation did not impose burdens which operated for the benefit of persons ‘who fail[ed] to take reasonable care of their own interests’. In the same case, Mason J concluded that, whilst it was unlikely that an ordinary purchaser would notice the very slight differences in the appearance of the two items of furniture in question, nevertheless such a prospective purchaser reasonably could be expected to attempt to ascertain the brand name of the particular type of furniture on offer [Puxu 149 CLR at 210-211].” (emphasis added)

73 Importantly, in this case, the witnesses gave their evidence over five years after the events and alleged representations the subject of the litigation in circumstances where Mrs Stariha had not raised any complaint until bringing the proceedings in 2011. That was a considerable period after each of the two purchases had completed. The assessment of the evidence of witnesses in such a case, ordinarily, will be approached in the manner discussed by McLelland CJ in Eq in Watson v Foxman (1995) 49 NSWLR 315 at 318-319 as follows:

“Where, in civil proceedings, a party alleges that the conduct of another was misleading or deceptive, or likely to mislead or deceive (which I will compendiously described as “misleading”) [sic] within the meaning of s 52 of the Trade Practices Act 1974 (Cth) (or s 42 of the Fair Trading Act), it is ordinarily necessary for that party to prove to the reasonable satisfaction of the court: (1) what the alleged conduct was; and (2) circumstances which rendered the conduct misleading. Where the conduct is the speaking of words in the course of a conversation, it is necessary that the words spoken be proved with a degree of precision sufficient to enable the court to be reasonably satisfied that they were in fact misleading in the proved circumstances. In many cases (but not all) the question whether spoken words were misleading may depend upon what, if examined at the time, may have been seen to be relatively subtle nuances flowing from the use of one word, phrase or grammatical construction rather than another, or the presence or absence of some qualifying word or phrase, or condition. Furthermore, human memory of what was said in a conversation is fallible for a variety of reasons, and ordinarily the degree of fallibility increases with the passage of time, particularly where disputes or litigation intervene, and the processes of memory are overlaid, often subconsciously, by perceptions or self-interest as well as conscious consideration of what should have been said or could have been said. All too often what is actually remembered is little more than an impression from which plausible details are then, again often subconsciously, constructed. All this is a matter of ordinary human experience.

Each element of the cause of action must be proved to the reasonable satisfaction of the court, which means that the court “must feel an actual persuasion of its occurrence or existence”. Such satisfaction is “not … attained or established independently of the nature and consequence of the fact or facts to be proved” including the “seriousness of an allegation made, the inherent unlikelihood of an occurrence of a given description, or the gravity of the consequences flowing from a particular finding”: Helton v Allen (1940) 63 CLR 691 at 712.

Considerations of the above kinds can pose serious difficulties of proof for a party relying upon spoken words as the foundation of a causes of action based on s 52 of the Trade Practices Act 1974 (Cth) … in the absence of some reliable contemporaneous record or other satisfactory corroboration.” (non-italic bold emphasis added)

74 That caution is also reflected in s 140 of the Evidence Act 1995 (Cth) and in what Dixon J said in Briginshaw v Briginshaw (1938) 60 CLR 336 at 361-363 about the standard of proof. Dixon J emphasised that, when the law requires proof of any fact, the Court must feel an actual persuasion of its occurrence or existence before it can be found. He said that a mere mechanical comparison of probabilities, independent of any belief in its reality, cannot justify a finding of fact: see too Communications, Electrical, Electronic, Energy, Information, Postal, Plumbing and Allied Services Union of Australia v Australian Competition and Consumer Commission (2007) 162 FCR 466 at 479-482 [29]-[38] per Weinberg, Bennett and Rares JJ. As Dixon J said (60 CLR at 362): “In such matters ‘reasonable satisfaction’ should not be produced by inexact proofs, indefinite testimony, or indirect inferences”. But, the nature of the fact to be proved necessarily affects the sufficiency of the evidence by which it can be established.

(underline emphasis added; other emphasis in original)

13 In assessing the witnesses’ oral evidence, and in particular, whether Mr Yammine and Mr Liemant entered into an oral agreement, or Mr Liemant made a representation, in trade or commerce, that was misleading or deceptive, based in part on oral evidence over three years after the negotiations that occurred, both sides referred to the approach of Tamberlin J, as a trial judge, in dealing with a case involving conversations that occurred seven or eight years before the trial with which Gleeson CJ, Gaudron, Kirby and Hayne JJ found no fault in Effem Foods Pty Ltd (t/as Uncle Ben’s of Australia) v Lake Cumbeline Pty Ltd (1999) 161 ALR 599 at 603 [16]. Their Honours summarised, as an appropriate approach, what Tamberlin J did in forming views as to the credibility of each of the relevant witnesses, namely:

In each case those views were based in part upon observations made, and impressions formed, concerning the demeanour of the witnesses, but they also turned in part upon reasoning as to the plausibility of certain parts of the evidence of the witnesses, considered in the light of what Tamberlin J had referred to as “the objective factual surrounding material and the inherent commercial probabilities, together with the documentation tendered in evidence”. This was an orthodox and sensible approach to the matter (As to the approach to be taken by an appellate court when reviewing a primary judge's findings of fact, see State Rail Authority of New South Wales v Earthline Constructions Pty Ltd (1999) 160 ALR 588; 73 ALJR 306).

(emphasis added)

Background

The formation of Lantrak NSW

14 The unaudited financial statements of RTS for the year ended 30 June 2016 showed that it had gross receipts of about $12.65 million and recorded a net profit before tax of about $770,000.

15 In 2016, Mr Yammine considered that RTS was flourishing. He became aware that Gary and Mark Liemant were seeking to expand their business into the Sydney market and in about October or November 2016 met with them in Sydney. Mr Yammine took them on a tour of places where RTS operated. He understood that the Lantrak group operated a different business model from that of RTS because RTS owned the trucks which it provided to carry out the work for its customers. Mr Yammine said (and I accept) that of the two brothers, Mark Liemant was the “more reserved at the time, but Gary’s more, ‘Look, let us get the numbers, and let’s get down there’”. They arranged that Mr Yammine, his accountant, Fred Kalil, and his associate, would meet Mark and Gary Liemant soon after at a restaurant in the Crown Casino in Melbourne.

16 At the Melbourne restaurant, the brothers asked Mr Yammine how much he wanted for RTS and he replied that he was seeking $10 million. Mr Liemant told Mr Yammine that they had the Lantrak brand but that it had no presence in Sydney and wanted to keep Mr Yammine involved in the business there. Mr Yammine thought that the combination would help the Sydney business grow. They struck a deal with the elements that, first, RTS’ business would be transferred to a Lantrak branded company (which in the event was Lantrak NSW) and, secondly, Gary and Mark Liemant would pay Mr Yammine $5 million for 50% of his business, $2 million of which was payable immediately and the balance, in his words, “by way of earnout”. However, as Mr Liemant said in evidence, “that agreement never completed. Lantrak [Holdings] actually never purchased the RTS entity”. Moreover, Mr Yammine did not receive $5 million.

17 As Mr Liemant said in his evidence, he did not want to acquire 100% of the business because Mr Yammine’s continuing involvement was important to the success of the Lantrak group’s venture into the New South Wales market. He was conscious of their previous failed attempt to enter that market at about the time of the Sydney 2000 Olympics.

18 Mr Liemant said that in fact, the initial payment of $2 million due to Mr Yammine was funded out of Lantrak NSW’s cash flow. Mr Liemant agreed that, in economic terms, that meant that, because Lantrak Holdings owned half of the new business, Mr Yammine was paid only $1 million, received no further payment and that “the first deal didn’t complete”. Mr Liemant said that the parties (in the sense of the Lantrak group and Mr Yammine’s interests) had changed from:

the original agreement, [where] it was proposed that we would buy 50 per cent [of the] shares in RTS. What ultimately transpired is we decided to create a new company … for tax purposes [so that] … Lantrak NSW had an element of both entities that combined together. So it brought RTS’ personnel, front-end revenue … and Lantrak’s back-end systems, funding, ability to provide finance.

19 Mr Liemant agreed that he and Mr Yammine had entered into that substantial transaction without formal documentation. He understood at that time that Mr Yammine had had a limited formal education and that he trusted Mr Liemant. While Mr Liemant did not accept that Mr Yammine saw him as a father figure at the initial stage of their relationship, he agreed that he later understood that was how Mr Yammine regarded him. Mr Liemant gave this evidence that I did not find frank or credible:

when you did the transaction in relation to the purchase of the first 50 per cent of Lantrak, you quickly came to understand that Mr Yammine was a man who was prepared to do business on a handshake and an oral agreement; you would agree with that? --- No, I don’t.

Well, you reached that understanding at some point, didn’t you? --- No, there was a number of attempts to try and document and formalise the agreement.

Well, I suggest to you, you must have known that Mr Yammine was a man who was prepared to do business on a handshake because you had bought into the New South Wales market and paid $5 million for that and hadn’t put it in writing; that’s right, isn’t it? --- We hadn’t put $5 million in at that point, no.

That’s right. And you did that because you knew Mr Yammine was a man who was happy to operate on the basis of oral agreements; that’s correct, isn’t it? Otherwise, you would have got it in writing? --- Not entirely. There was a number of attempts to try and document the agreement.

(emphasis added)

20 Mr Liemant subsequently said, more credibly:

Yes. But ultimately, you were prepared to proceed on the basis that the Lantrak group, in an economic sense, had 50 per cent of the New South Wales business without there being a written sale agreement? --- Yes, correct.

…

HIS HONOUR: Including a sale agreement that recorded how much money you were going to pay him? --- We agreed on a payment term, yes, at that point.

But it wasn’t in writing? --- No.

…

As you understood it, he was trusting you to honour that? --- Yes.

(emphasis added)

21 Mr Liemant said that, while Lantrak group performed accounting functions for Lantrak NSW, Mr Yammine’s personal relationships were very important to the success of the latter business and he was responsible for winning it work.

22 By the time that the parties had reached this stage of their relationship, it was apparent to Mr Liemant (and through him the Lantrak group) that Mr Yammine was very trusting of him (Mr Liemant), both generally and in their business dealings. Mr Liemant knew that Mr Yammine took him at his word because, in Mr Yammine’s phraseology, “we broke bread”. When pressed in cross-examination about the delay in finalising the transaction documents, Mr Yammine said (and I accept):

They couldn’t have been concerned, because we were already three months into it and no transaction had been done. And we already, I was already, knocking millions of numbers up every month in turnover for the group and the brand.

So were you also concerned that no agreement had been finalised? --- We had broke bread.

Well, leaving that aside, were you concerned - - -? --- No, but I’m just saying - - -

- - - that no agreement had been finalised? --- Well, like I said to you is that we had broke bread and I had left the pencil pushing to the pencil pushers, and I will get on with business and keep moving.

(emphasis added)

23 Thus, because of Mr Yammine’s trust in Mr Liemant’s integrity, Mr Yammine, in effect, had given the Liemant parties half of his business by transferring all of RTS’ operations to Lantrak NSW and then continued to run and expand that business without the Liemant side of the first “deal” actually paying for it. Commercially, from his side of things, Mr Yammine had no protection in writing as to his rights, other than owning 50% of Lantrak NSW and being one of its directors. As Mr Liemant acknowledged in cross-examination, Mr Yammine had been promised $5 million for a half share of RTS’ business and, in economic terms, only ever received $1 million in cash. Yet Mr Yammine continued in the relationship without questioning, or perhaps even understanding, why the Liemant parties had not paid him what, or in accordance with the deal that, they had agreed.

24 Mr Yammine confirmed that he made no claim in this proceeding that he had not been paid $5 million. He said that, in his understanding, Gary and Mark Liemant had paid him $2 million as the first payment for RTS’ business so that, assisted with finance from Lantrak group’s bank, Westpac Banking Corporation, he could use that money to buy a fleet of trucks from a landscape gardening business. Mr Yammine wanted to buy the trucks to use them, branded as Lantrak NSW, to supply Lantrak NSW’s services, but he knew that the Liemant brothers did not operate the Lantrak group as owners of trucks themselves. When Mr Yammine tried to explain this transaction in cross-examination, his unsophisticated and trusting approach to comprehension of his dealings with Gary and Mark Liemant became manifest. He was asked to explain how the first $2 million payment occurred. He said that “in my understanding, it was never a loan, it was the payment, but it was described as a loan because there was no contract”. He said that this payment occurred in about May 2017 after the formation of Lantrak NSW in December 2016. He said:

it was five months later. I was… they still should have been done in December ‘16. And I had already broke bread with Gary and kept moving. You know? I kept just going to work. I know, sometimes, it might sound, you know how do you do these things? And I respect that. I do respect that. But the thing was I trusted him. It could be irrelevant. And it’s my first round, you know? I’m not a groomed businessman. I was a person who believed in him.

(emphasis added)

25 Mr Yammine understood that the $2 million payment “was done by way of a loan and then they were going to fix up the paperwork … because … they didn’t buy shares in RTS”. He explained his understanding that the $3 million balance of the purchase price would be paid to him out of the profits of Lantrak NSW in priority and before the time when it would distribute profits equally between the shareholders.

26 I am not suggesting, and the Yammine parties did not claim, that Mr Liemant or the Lantrak group acted dishonestly or in bad faith in dealing with Mr Yammine in this way. Indeed, the Liemant parties’ lawyer, Andrew Freeman of KNP Solutions, had been corresponding with Mr Yammine’s accountants about drafts of contractual documents to record the first deal. In an email dated 1 March 2017, Mr Freeman wrote “I am yet to hear anything back and am concerned with [the] time this is taking”.

27 By 20 March 2017, Mr Yammine’s solicitors had become involved and wrote to Mr Freeman with substantive corrections to the draft, proposing a differently expressed transaction that, in the event, remained undocumented.

28 The evidence of the parties’ relationship and dealing to this point was demonstrative of Mr Yammine having a degree of commercial generosity and a preparedness (of which Mr Liemant, as a savvy, experienced businessman, was fully cognisant) to rely on what he believed was a “deal” that Mr Liemant (and the Lantrak group) would “honour”. In Mr Yammine’s vernacular, they “broke bread” or shook hands and, for him, because of his trust in Mr Liemant, that was all he needed. This mutual approach to the relationship between Mr Yammine and Mr Liemant is a critical component in the evaluation of what occurred subsequently.

The lead up to the heads of agreement

29 The business of Lantrak NSW grew rapidly, driven by Mr Yammine’s energetic exertions in securing more and more custom. However, from early on in 2017, Mr Liemant expressed concern to Mr Yammine about the new business’ aged trade debtors’ position.

30 Mr Liemant reiterated this concern throughout 2017. But, as Mr Yammine said, ultimately, he ensured that the trade debtors paid, even though some may have done so outside Lantrak NSW’s trading terms. As the financial statements of Lantrak NSW showed, at all relevant times to this proceeding, it had virtually no substantive bad or doubtful debts. This is not to eschew the Lantrak group’s concern over Mr Yammine’s management of Lantrak NSW’s trade debtors. Mr Yammine appears to have trusted the trade debtors to pay eventually, which they did.

31 On 17 November 2017, the Lantrak group’s chief financial officer, Georgina Sumanada, sent an email to Errol Pinto, a qualified accountant who was Mr Yammine’s personal assistant. The email attached the then trade debtors’ ledger which showed that there was then owing about $2.8 million over 90 days past due and another about $1.8 million that would become over 60 days past due on 30 November 2017.

32 Mr Pinto said on several occasions in his evidence that he did not give financial advice to Mr Yammine but that his role was limited to advising on the operation of the business and to act as his personal assistant, including helping by printing and transmitting documents. He said that Mr Yammine told him “to keep out of it because he was dealing direct with Gary”.

33 By 22 January 2018, Ms Sumanada was seeking an indication from Lantrak NSW’s in-house accountant of when it expected to receive payment for over $3.08 million outstanding for over 90 days, and $3.03 million that would become over 90 days past due by 31 January 2018.

34 On 7 May 2018, Mr Liemant met with Mr Yammine and told him that the Lantrak group needed to extend its Westpac facility for trade debtor finance of Lantrak NSW because of the delays in recovering what was due to it.

35 As a result of that meeting, Mr Yammine instructed his then solicitor, Christopher Nehme of Fortis Law Group, to write a letter dated 10 May 2018 to Lantrak Holdings. The letter referred to the meeting of 7 May 2018, the need to extend the Westpac facility and NJA’s willingness (as 50% shareholder in Lantrak NSW) to negotiate for the sale of its shares to Lantrak Holdings and Mr Yammine’s resignation as a director. It proposed that there be a term sheet giving Lantrak Holdings an exclusive right, exercisable by no later than 30 June 2018, to agree and execute transaction documents including, but not limited to, a share sale agreement. In contrast to Mr Yammine’s personal approach to negotiations, his then solicitors’ letter stated:

For the avoidance of doubt, this letter represents only the basis for the negotiation of a formal contractual agreement between NJA and Lantrak (or its nominee). It is not intended to be binding on NJA or Lantrak and acceptance or acquiescence hereafter will not create an enforceable contract.

36 Mr Yammine understood that if the share sale was to proceed, there would need to be formal documentation that, normally, lawyers and accountants would draft.

37 Mr Liemant had two principal concerns at this time: first, his expectation that the Lantrak group would struggle to fund an acquisition of Mr Yammine’s interest and secondly, as he said in chief, “I felt the business depended on Norm to get the sales, and I was very concerned about … Norm not being in the business. How are we going to get the sales?” (emphasis added). Mr Liemant told Mr Yammine that, if he sold his shares, he wanted him (Mr Yammine) to continue being involved in the business.

38 Subsequently, negotiations for a share sale commenced in which Nazih Touma, of Lionheart Legal, acted as the Yammine parties’ solicitor and Mr Pinto assisted Mr Yammine. The Yammine parties’ accepted that their failure to call Mr Touma warrants me inferring, as I do, that Mr Touma’s evidence would not have assisted the Yammine parties’ case: Kuhl v Zurich Financial Services Australia Ltd (2011) 243 CLR 361 at 385 [64] per Heydon, Crennan and Bell JJ; Jones v Dunkel (1959) 101 CLR 298.

39 Mr Liemant said that, in about mid 2018, Westpac indicated that it was no longer prepared to finance Lantrak NSW. He said this occurred in the context of Mr Yammine saying that he wanted to sell his half share. That led, in late May 2018, to Mr Liemant approaching corporate finance advisors, O’Connell Partners, who suggested that Alpha Group might wish to assist in him and Mark Liemant acquiring 100% of Lantrak NSW resulting in Mr Yammine not having any continuing ownership interest.

40 Tony Tromboli was an advisor for Alpha Group. In September 2019, Mr Pinto gave Mr Yammine the following documents which he had received (I infer shortly beforehand) from Mr Tromboli (who, however, I infer, had received them much earlier in about late May or early June 2018 to assist in the work Alpha Group was undertaking):

an unaudited summary of the Lantrak group’s results for the year ended 30 June 2016 (that, of course, excluded Lantrak NSW) showing total receipts of about $237.5 million and a net profit before tax of about $9.8 million;

a similar unaudited summary of the Lantrak group’s results for the year ended 30 June 2017 showing total receipts of about $335 million, including about $24.9 million for Lantrak NSW, with a net profit before tax of about $21.825 million, including about $1.75 million for Lantrak NSW and no provision for impairment (or bad or doubtful debts);

a comparable unaudited summary of the Lantrak group’s results for the seven months to 31 January 2018 showing total receipts of about $220 million, including about $33 million for Lantrak NSW, and a net profit before tax of about $10.4 million, including about $995,000 for Lantrak NSW; and

an internal Lantrak group balance sheet as at 31 March 2018 showing net assets of about $41.86 million.

41 For completeness, I should also note here that Lantrak NSW’s unaudited financial report for the year ended 30 June 2017 reported similar figures to those included in respect of Lantrak NSW in the Lantrak group’s above summary of that company’s results for that financial year.

The negotiations for the heads of agreement

42 On 26 July 2018, Mr Yammine, Mr Pinto, Gary and Mark Liemant met at the offices of PricewaterhouseCoopers (PwC) in Sydney with Michael Dean of PwC. This followed an introduction from one of Mr Yammine’s contacts as to who might be able to assist the Liemant brothers in advising on the buyout proposal. They had a high level discussion to explore possibilities. Mr Dean appears to have suggested that, given that they were located there, the Liemant brothers should deal with PwC’s Melbourne office. Mr Liemant took up that suggestion and, after about mid-August 2018, he and others in the Lantrak group had a preliminary meeting with PwC personnel in Melbourne of which he informed Mr Yammine.

43 On 21 August 2018, Gary and Mark Liemant, together with Sanjiv Jeraj and Greg Diamond of PwC, met at PwC’s Melbourne offices with Mr Yammine, Mr Pinto and Mr Touma. During the discussion, Mr Yammine’s side reiterated his interest in selling his share of the business and the conversation turned to how a value could be ascribed to it. Mr Jeraj led the discussion in which he, Mr Diamond and Mr Pinto agreed that a multiple of five times Lantrak NSW’s earnings before interest and tax (EBIT) was an appropriate means of arriving at a value.

44 Mr Liemant said in chief that valuation was Mr Jeraj’s area of expertise and that Mr Jeraj told the meeting that businesses of the nature of Lantrak NSW typically sold for a multiple of five times EBIT less debt. He remembered that Mr Yammine said that he did not understand what was involved in the concept of “less debt” and, after Mr Jeraj explained what he meant, Mr Yammine said that he would ensure that there was no debt at the time of sale.

45 The Lantrak group used a Pronto accounting system to produce management reports. Before the meeting, Mr Yammine had seen the Pronto profit and loss report of Lantrak NSW for the 12 months ended June 2018, that was created on 2 August 2018, which became exhibit B. That report recorded total sales of about $63.1 million, a gross profit of about $7.05 million and a net profit of about $1.727 million. He had looked at them with Mr Pinto before the meeting. Mr Pinto said that exhibit B came from the Lantrak group’s Melbourne office.

46 Mr Yammine thought that EBIT or earnings before interest, tax, depreciation and amortisation (EBITDA) meant something like net profits, but had never heard of the concepts of EBIT and EBITDA before this meeting. Mr Liemant did not recall Mr Yammine referring to the $7 million as gross profit at the meeting and asserted that “it was quite clear in that meeting that it was 7 million EBIT”. Although Mr Yammine agreed to a leading question in cross-examination that he recollected the multiplicand was EBITDA, I think he was mistaken and accept Mr Pinto’s and Mr Liemant’s evidence that they discussed EBIT as the multiplicand.

47 Mr Yammine said that, on the basis of either exhibit B or a similar Pronto report for Lantrak NSW used at the meeting, he thought that the business would easily achieve an EBIT of $7 million for the 2019 financial year. Mr Yammine explained his approach:

Did you think that they were talking, when they talked about EBITDA, about something like net profit, or something like that? --- Profits.

Just profits? --- Yes, profits. Profits of the business.

…

And it was your suggestion in that meeting that five times seven to 10 million dollars was about the right number. Wasn’t that right? --- I think the 10 got thrown in. The seven it was five times seven.

Yes. The 10 is really an outlier that was there and then disappeared, wasn’t it? --- I don’t know, I don’t say 10. I say five. So that’s just a - - -

All right. So five times seven is the real number that’s floating around in this discussion? --- That’s right.

And the seven came from you? --- The seven came yes, because it was … the gross profit of the Pronto system, which then, if you add it back from the NP to the GP, nothing was taken. So it was … a brand costing. So all that all that money that was spent was towards the brand. Why should I wear it if it’s going to go on? It was the same logo in Melbourne and Queensland, and New South Wales had the same logo, so all that cost that occurred was from having that brand.

(emphasis added)

48 The above, less than coherent explanation, revealed Mr Yammine’s obvious lack of financial literacy, including understanding of accounting concepts such as EBIT. Mr Yammine appears to have understood that EBIT and gross profit were commensurable when he referred to the figure of $7 million. I do not think that anyone at the meeting understood Mr Yammine as being capable of making a reliable prediction of Lantrak NSW’s EBIT or EBITDA (as opposed to profitability) for the purposes of the negotiation.

49 Everyone at the meeting used the same financial information. The Liemant side had experienced accountants, including Mr Jeraj from PwC (who was not called and whose evidence, I infer, would not have assisted the Liemant parties’ case) to assist them, and Mr Yammine had Mr Pinto, who was also an accountant, to assist him. The meeting discussed the potential value of Lantrak NSW as five times the EBIT derived from exhibit B, or a similar Pronto print out, being $35 million, which they all could then use as a basis for the negotiations. Mr Liemant understood at this meeting that Mr Yammine was expecting to receive a price of $35 million for his interest in Lantrak NSW based on what he and his expert advisors from PwC had calculated was an EBIT figure of $7 million. Mr Pinto also understood this, as (I infer), did Mr Touma.

50 During the meeting, Mr Liemant told Mr Yammine and the others that he (meaning the Liemant side) would need to obtain funding to enable such an acquisition and there would be a need for due diligence to be done because the Liemant side had to raise capital. Mr Jeraj said that the Liemant side would need to conduct due diligence on the business of Lantrak NSW. Mr Yammine was unhappy about this. He said that they already knew what the business’ financial position was because they did the back office work.

51 The meeting also discussed a possible value of between $12.5 million and $15 million for the trucks owned by Mr Yammine’s interests that Lantrak NSW used in its business. At that point, Mr Liemant said in chief that his side was not then interested in acquiring the trucks.

52 On 22 August 2018, Messrs Yammine, Touma, Liemant and Jeraj met again to further the discussion.

53 On 27 August 2018, Mr Touma emailed a first draft heads of agreement to Ms Mikhael, Messrs Liemant, Jeraj, Pinto and Diamond. The draft provided that the price of NJA’s shares in Lantrak NSW was $35 million, the price for the business, inventory and trucks was $15 million and $3 million was the price of the units held by Ari Investments Aust Pty Ltd as trustee for the Ari Investments family trust (named after Mr Yammine’s daughter) in the McGraths Hill property unit trust, which owned the land at McGraths Hill, where Lantrak NSW’s office was. The parties were to exchange finalised transaction documents by 6 September 2018. The total consideration in the first draft was $53 million payable in three instalments, the first of $23 million payable on 8 October 2018, the second of $10 million payable on 1 March 2019, and the third of $20 million payable on 2 December 2019. Mr Yammine was to repay $3 million in loans to Mr Liemant and Mr Yammine would be engaged to provide consultancy services at $10,000 plus GST per week until 2 December 2019. The draft provided that it was not binding and did not create any legal obligations.

54 Importantly, on 28 August 2018, Ms Sumanada emailed Mr Liemant a draft budget for Lantrak NSW for the year ended 30 June 2019. This projected total income of about $99.7 million, finance expenses of about $890,000 and a net profit before tax of about $6.2 million. If the finance expenses were added back to the net profit before tax to give an EBIT calculation, that would equate to about $7.1 million (or $7,107,099 to be precise). Thus, on Lantrak NSW’s own internal projections, the $7 million EBIT figure, which the participants had discussed at the meeting of 21 August 2018, was at that time realistic. The amount of depreciation and amortisation for the business was minimal given that it did not own any substantive assets to which such provisions could apply. After being taken to this document, which he said he did not recall, Mr Liemant gave this evidence:

If you add back those financing expenses, the EBIT, Mr Liemant, is $7,107,099? --- Correct, yes.

And you had no basis to think that forecast was wrong as at that date, did you? --- I was sceptical due to the fact that they had never actually achieved a six per cent in their profit. It was more like in the circa 1.9, 2 per cent.

(emphasis added)

55 I do not believe that evidence or that Mr Liemant recalled being, or was, sceptical of the projection. That is because throughout the negotiation of the heads of agreement neither he, nor others on the Liemant side, including their expert in valuation, Mr Jeraj, conveyed any substantive doubt about, or sought to resile from, the use of the $7 million EBIT figure or the $35 million valuation of the shares. Had he really believed at that time that a realistic EBIT was $2 million, he would have equated that with a value of $10 million, being $25 million less than they were discussing. It is difficult to understand why Mr Liemant would not have raised this scepticism at the time, rather than proceeding on what he would have had to regard as a gross overvalue and allowing everyone involved to waste time, and entertain unrealistic expectations, based on a misconception.

56 On 30 August 2018, Mr Diamond responded to the first draft of the heads of agreement with a second version in mark up. This draft deleted individual pricing for each item, but retained a total price of $53 million payable in three instalments with values for the items to be inserted.

57 The parties’ representatives exchanged several further drafts of the heads of agreement.

58 On about 10 September 2018, Lantrak Holdings engaged Simon Peeke, through his company BCQ Holdings Pty Ltd, to provide financial and strategic advice consultancy services.

59 On 12 September 2018, Tiffany Barton, a solicitor at PwC, sent a further draft which provided for adjustment of the purchase price to between $47.5 million and $53 million depending on variations to be agreed relating to debts associated with certain assets and a loan that Mr Yammine had to repay to Mr Liemant. The price continued to include a value for Lantrak NSW of $35 million based on an EBIT of $7 million. The parties exchanged further drafts on 12 September 2018 until about 9:00pm when Ms Barton emailed the final version.

The Heads of Agreement

60 The heads of agreement were exchanged on about 13 September 2018 between the purchasing parties (Lantrak Holdings, Earthtrak Pty Ltd, as trustee of the Liemant unit trust (as land purchaser), and Gary and Mark Liemant) and the selling parties (Mr Yammine, Ari, as trustee of the Ari Investments family trust (as the land vendor), NJA, as trustee of the NJA family trust (as share vendor), and Yammine Pty Ltd (as business investor and truck sales vendor)). The prices for the shares in Lantrak NSW, the business operated by Nojo (being the owner of the trucks and other transport solutions inventory used in Lantrak NSW’s operations) and the McGraths Hill land were not specified in total consideration of $47.5 million. That price was proposed in the heads of agreement to be payable in three instalments, the first of $5 million on execution of binding transaction documents on 27 September 2018, the second of $23 million payable on completion of the sale of the trucks and shares on 29 March 2019 and the last of $19.5 million payable on completion of the McGraths Hill property sale on 2 December 2019.

61 Lantrak Holdings agreed that it or its nominee would purchase NJA’s 50% shareholding in Lantrak NSW (cl 2.1) and would discharge the debt owing on the trucks of up to $5.5 million as well as paying the price for the trucks and, by 31 October 2018, would obtain a release for Mr Yammine and Ms Mikhael from the financier of that debt (cll 3.2–3.3). The Lantrak group agreed that, in addition to Lantrak Holdings paying for the McGraths Hill property, it would discharge all the debts of the McGraths Hill property unit trust on or before completion on or before 2 December 2019 (cll 4.2, 6.3(c)). In addition, Lantrak Holdings or a nominee would engage Mr Yammine or a nominee to provide consulting services in the period to 2 December 2019 at the rate of $10,000.00 plus GST per week (cl 5).

62 Importantly, cl 6.1 provided that the parties would negotiate in good faith to finalise the transaction documents to give effect to the transaction contemplated in the heads of agreement in preparation for exchange on or before 27 September 2018.

63 Mr Yammine agreed that he would resign as a director of each of 11 companies, including Lantrak NSW, prior to settlement of a debtor finance facility that Lantrak NSW had with Scottish Pacific Business Finance Pty Ltd (cl 6.2).

64 The parties agreed that the total consideration payable by Lantrak Holdings was $47.5 million and that they would negotiate in good faith with respect to its allocation between the assets being sold (cl 7.1). They agreed that Mr Yammine would repay $3 million to Mr Liemant out of the second instalment due on 29 March 2019 (cll 7.2, 7.3). The deposit payable on exchange of the transaction documents was to be non-refundable (cll 10.1, 10.2) and the Lantrak group, together with Gary and Mark Liemant, would guarantee and indemnify the sellers in respect of the purchasers’ obligations. The Liemant brothers would also give security over real property (cll 10.3–10.6).

65 Critically, cl 11.1 provided:

11.1 Non-binding

Except with respect to confidentiality under clause 12, the parties agree that there is no legal obligation on either party to enter into the transactions proposed by this heads of agreement.

(emphasis added)

What happened after the heads of agreement

66 On 14 September 2018, Ms Sumanada emailed Mr Peeke a copy of the heads of agreement, details of the Lantrak group’s finance facilities and Mr Pinto’s contact details to enable Mr Peeke to obtain information about financing for the trucks, as he had earlier discussed with Mr Liemant.

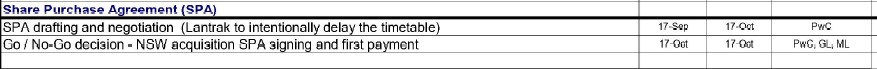

67 On 18 September 2018, Chris Taylor, a director of PwC’s mergers and acquisitions unit, emailed Ms Sumanada with a daily timetable for the forthcoming five weeks, which he told her that he planned to provide to Gary and Mark Liemant. The timetable envisaged that discussions with potential lenders would occur by 5 October 2018 and with potential investors (referred to as “Project Sahara”) by 16 October 2018. It programmed that a decision on whether or not to proceed with the transactions with Mr Yammine would occur on 17 October 2018. Under the heading ‘NSW business acquisition workstreams’, the timetable read:

68 Mr Liemant said that he did not recall seeing that timetable but accepted that he possibly had. He said that PwC’s comment, “Lantrak to intentionally delay the timetable” for the drafting and negotiation of the transaction documents, “didn’t come from me” and denied that he did delay the timetable intentionally.

69 I found that evidence problematic. Under cl 6.1 of the heads of agreement, the parties were supposed to negotiate the transaction documents so that an exchange would occur by 27 September 2018, that is, within two weeks of the exchange of those heads. Mr Liemant had engaged Mr Peeke on 10 September 2018 to assist in, among other tasks, raising the money to fund the proposed acquisition. Mr Liemant knew that raising funding for a transaction involving a binding commitment to pay a total of $47.5 million in tranches over about 15 months would take time, and almost certainly longer than two weeks in circumstances where the Liemant interests did not then have the immediate financial capacity of cash or facilities, or a willingness, to commit to such a transaction. Mr Liemant knew that PwC had labelled as “Project Sahara” the task of preparing a prospectus-type document for potential investors to support the proposed purchase and that this task had not been activated at the time of exchange of the heads of agreement.

70 Despite having negotiated the heads of agreement on the apparent basis that the Liemant side could proceed with the transaction as it contemplated with an exchange by 27 September 2018, Mr Liemant must have realised when executing the heads of agreement that the Liemant side would not be able to exchange by then as cl 6.1 contemplated. Of course, he knew that the heads of agreement were not binding. I found his evidence of not intentionally delaying the timetable for negotiating and exchanging the transaction documents implausible, given that he knew that his side still had to raise finance if it were to proceed to an exchange of contracts. PwC were the Liemant side’s highly qualified advisors in the transaction and, I infer, had communicated to Mr Liemant the need for the Liemant side to raise finance before this. At least by 18 September 2018, it must have become apparent to Mr Liemant that the Liemant parties would need to raise finance or seek investors and that, until this occurred, they could not risk exchanging contracts.

71 On 25 September 2018, Mr Peeke asked Ms Sumanada for a balance sheet and profit and loss account for Lantrak NSW and she forwarded these to him soon after on that day. Those profit and loss accounts were for the year ended 30 June 2018 and the two months ended 31 August 2018. He said that, on reviewing them, he formed the view that it was unlikely that the business would achieve an EBIT of $7 million. The total revenues for each period were, respectively, about $63.1 million and $18.75 million, and the net profits were about $1.25 million and $850,000.

72 Also on 25 September 2018, Ms Barton circulated the first draft of the sale agreement. The purchase price remained as $47.5 million but its allocation between the assets was left blank. The sellers were to enter into a restraint of trade for five, three or one years (depending on its enforceability in the usual type of cascading wording used in such restraints (cl 11)). There was an entire agreement clause (cl 14.7) and a clause in which the parties acknowledged the receipt of, or the opportunity to receive, legal advice in respect of the sale agreement (cl 14.12). While Mr Yammine did not read this or any other version of the sale agreement, he accepted that he received legal advice from Mr Touma as to its provisions (including the final version).

73 As I noted at [38] above, I infer that Mr Touma gave Mr Yammine all relevant legal advice as to the terms of each version of the sale agreement, and in particular the executed sale agreement. That advice included the effect of the entire agreement clause in precluding the ability of any party to assert that the sale agreement was incomplete or that there were other agreements, arrangements or understandings between them (or any of them) that were not contained in its terms.

74 I do not accept Mr Yammine’s denial that Mr Touma explained to him the effect of the entire agreement clause (which was at cl 11.7 in the sale agreement) before he executed the sale agreement. It is inherently unlikely that a solicitor would fail to explain the effect of such a clause to his client, particularly a person like Mr Yammine who was obviously not a commercially experienced businessman familiar with usual terms of such contracts, albeit he was no doubt very effective in orally negotiating deals. This was a multi-million dollar transaction of great significance to Mr Yammine and his family. A reasonable solicitor in Mr Touma’s position would have been aware that the terms of the proposed agreement for such a significant transaction required careful explanation to a person in Mr Yammine’s position and with his background. Whether, and to what extent, Mr Yammine may have listened to or understood a solicitor’s explanation of the terms of the sale agreement is a different question from whether he received such an explanation. Having observed him carefully in giving evidence, I formed the view that Mr Yammine focused on his personal interactive relationship with individuals with whom he dealt and had little time for paperwork or detail, despite some consciousness of their importance in defining legal rights and obligations.

Mr Yammine resigns as director

75 Importantly, on 26 September 2018, Mr Yammine resigned as a director of Lantrak NSW and the other companies as the heads of agreement had contemplated. Mr Yammine gave unchallenged evidence that Mr Liemant had asked him to resign “so then that way they can settle the deal, like, get the funds to settle the deal, because if I was a director they wouldn’t get the deal settled. So I followed the heads of agreement and signed off” (emphasis added).

76 Before the resignation, Mr Liemant had not told Mr Yammine of any difficulties that the Liemant side perceived or was having in raising finance. Mr Liemant understood that, as far as Mr Yammine was concerned, he had resigned on the basis that he expected that the Liemant side would be paying him $35 million for Lantrak NSW. Mr Liemant said in re-examination that “it was a formality to get through that [the later signing of the sale agreement] and we were moving into the consultancy agreement”. Mr Liemant said that, following his resignation, Mr Yammine’s day to day activities in the business changed because he “was no longer active in the business at that point”. This was an example of Mr Liemant, without any contractual basis, using Mr Yammine’s trust in him to move Mr Yammine to a position in negotiations that was advantageous to Mr Liemant’s interests. Mr Liemant admitted that he was not keeping Mr Yammine informed of progress on the “Project Sahara” timetable beyond “some broad discussions”.

The negotiations continue

77 On 26 September 2018, Mr Touma replied to Ms Barton’s email of 25 September 2018 reminding the Liemant side that the heads of agreement provided for the exchange of the transaction documents on the following day. He noted that it was the Liemant side’s preference that they be responsible for preparing the first draft, yet what Ms Barton had sent was not even a complete draft. He said that he was instructed to ask the Liemant side to arrange payment of the first instalment of $5 million on that or the next day by deposit into his firm’s trust account “[a]s a sign of good-faith and commitment towards this transaction”, which could be released to his client on exchange. He asked when to expect a complete first draft of the transaction documents.

78 On 26 September 2018, Mr Peeke sent Ms Sumanada his analysis of Lantrak NSW’s net profit for the year ended 30 June 2018 of about $1.25 million.

79 On 27 September 2018, Mr Touma and Mr Jeraj discussed the Liemant side’s proposal that Lantrak Victoria drawdown $5 million on the Scottish Finance facility to use as the deposit on the sale agreement. They exchanged emails about this and progressing the then-proposed transaction.

80 On 2 October 2018, Mr Peeke emailed Mr Liemant and Ms Sumanada attaching an estimate that he had made of Lantrak NSW’s results for the first quarter of the 2018-19 financial year. He said that he had had to make estimates because not all of the figures for September 2018 were yet available nor for that year as a whole. Mr Peeke estimated that it would earn about $1.08 million for the quarter and commented in his email that this “clearly ma[de] a $7M target aggressive”. Mr Peeke said that by then he probably had formed a view that the Liemant interests would not be able to “raise finance to do the deal as it was represented in the heads of agreement” and had discussed this with Mr Liemant. Both Mr Liemant and Mr Peeke agreed in evidence that Mr Peeke’s estimate was of profit, not EBIT. Mr Liemant accepted that if financing and fringe benefits tax expenses were added back to produce an EBIT figure, EBIT for the first quarter would have been $1,266,660. They agreed that using Mr Peeke’s methodology would result in an EBIT of $5,066,640 for the whole year.

81 However, Mr Liemant then sought to eschew the obvious consequence (and result of Mr Peeke’s analysis) in the third answer in the following evidence:

And the business was, at this time, still growing quickly, wasn’t it? --- Yes, it was.

And so you understood, all else being equal, that the revenue would be expected to grow throughout the year. You agree? --- Yes, I did.

So Lantrak New South Wales would be doing more business by the fourth quarter of the year than it was in the first quarter. You agree? --- I wouldn’t have exposure to that far out.

No, but that would have been your expectation at the time having regard to - - -? --- It was … it appeared to be that way, yes.

(emphasis added)

82 Mr Liemant said, despite what the figures appeared to show for the 2018-19 financial year to date and forecast, that he “had a concern with aged debtors that we weren’t collecting money so … at that stage, I only took the actual results that I had up until the end of ’18 [into account]” (emphasis added). He accepted that, with an EBIT forecast of about $5 million, the value of the business, using the multiplier of five times, was about $25 million, but retorted “I work on the actual results, not the estimates”. Mr Liemant never discussed Mr Peeke’s estimates with Mr Yammine.

83 Also on 2 October 2018, Mr Jeraj emailed Mr Touma saying that his clients were not prepared to pay any money to a trust account or pay interest on a deposit “until we have a signed contract of sale”. He wrote that his clients had started discussions with debt or capital providers who required information about the trucks and forecasts for the 2018-19 financial year profit and loss account and balance sheet for Lantrak NSW. Mr Yammine said that, at this time, Mr Liemant had told him that he needed another week to get the deal done, to which he had agreed.

84 On 4 October 2018, Mr Jeraj emailed Mr Touma informing him that the Liemant side had had preliminary discussions with their debt providers and that those financiers would need to “undertake minimum diligence” including seeking market valuations of the trucks, giving a level of comfort on the 2019 EBIT forecast for Lantrak NSW and the contracts in place for customers, waste disposal sites and the like. He explained:

Our valuation is based on the business making circa $7m this year and the run rate to August indicates a level of risk on the earnings. We therefore need results for Sept and forecast for the balance of the year.

(emphasis added)

85 Mr Jeraj asked for that information. He told Mr Touma “we will be unable to sign a Sale and Purchase Document if we have no capacity to complete on the transaction. This in fact is misleading conduct”.

86 On 5 October 2018, Mr Touma replied, reminding Mr Jeraj that “Our respective clients spent a significant amount of time (and money) in negotiating and documenting the key terms of the deal in the heads of agreement”. He stated that that document contemplated the parties exchanging transaction documents on 27 September 2018. He retorted that, unlike the position put in Mr Jeraj’s email of 4 October 2018, “Nowhere is it stated nor has your office advised us that the Sale Agreement is conditional upon securing funding”.

The events of 9 October 2018

87 At 12:39pm on 9 October 2018, Mr Peeke emailed Gary and Mark Liemant a first draft of a proposal to be put to Mr Yammine. This proposed a total purchase price of $15 million that would result in a payment to the Yammine interests of a net $12 million. That was because Mr Peeke proposed that the first $5 million payable at “settlement” would be offset by the $3 million “loan” owing by Mr Yammine to Mr Liemant to which the heads of agreement had referred. Mr Peeke proposed that payments of $2.5 million be made 12 and 24 months after settlement and a further payment of up to $2.5 million in the 2018-2019 and 2019-2020 financial years, if future pre-tax profits of Lantrak NSW exceeded $6 million. The other terms that Mr Peeke drafted made the proposal even more conditional. Mr Liemant said that Mr Peeke had prepared the draft proposal at his request. I infer that Mr Liemant had read that draft before he spoke on the phone to Mr Yammine later on 9 October 2018.

88 Later on 9 October 2018, Mr Liemant and Mr Yammine, who was at the home of his mother-in-law, had a telephone conversation (being the 9 October conversation to which I referred to in [6] above). Mr Yammine said that the 9 October conversation followed several discussions in which Mr Liemant had asked him for more time to exchange a binding sale and purchase agreement beyond the target date of 27 September 2018. He said that, before the 9 October conversation, Mr Liemant had been assuring him that he would “get this deal done”. Up to that conversation, the position was, as Mr Liemant said in his evidence:

So we’ve agreed that as at the end of September 2018, Mr Yammine had an expectation you were going to pay him 35 million for the Lantrak New South Wales business. We’ve agreed that? --- Prior to the phone call where we agreed on a final price for that, yes.

(emphasis added)

89 The context in which this conversation occurred is also relevant to assessing what was said in it. As appears above, the Liemant side was seeking funding and delaying the preparation of the contracts to give effect to the heads of agreement while contemplating a reduction in the purchase price and Mr Touma was agitating with the Liemant sides’ lawyers about the need to move things along.

90 As was his habit, in the 9 October conversation, Mr Yammine had his mobile phone on speaker so that others, including his wife, Ms Mikhael, and the husband of her sister, Mario Tartac, came to overhear what both men said. Each of Ms Mikhael and, to a lesser extent, Mr Tartac, was in a close relationship with Mr Yammine and is likely to have discussed with him matters to do with this proceeding. However, none of them was cross-examined to suggest that Ms Mikhael or Mr Tartac contrived with Mr Yammine to corroborate his account or that Ms Mikhael or Mr Tartac was being deliberately untruthful in giving their evidence as to the substance of the conversation that they overheard between Mr Liemant and Mr Yammine.

91 Mr Yammine’s evidence of the 9 October conversation was that Mr Liemant:

then pretty much said to me “look, I don’t think … we can get this done. I can’t raise funds. But I always honour what I sign. You know, we started this on breaking bread, you know, but work out something that I can give you for now, okay, and then I will be able to get the rest. I will work out something so we can get this deal, you know, this deal happening”.

What did you say to Gary? --- Then, basically, by then I was in need of money and I just said “look, Gary, you know, I believe that. If you can give me 10 million ..... $10,000 a week, and then that way at least that will give you a chance to raise the funds. But I won’t go into non-compete, that’s going to be my security for the remainder of what you signed and what you said”, your Honour. Because at that time as well, he didn’t want the trucks no more. … it was just basically the business.

…

And what did Gary say in response to you saying you would take 10 million clear, etcetera. What did he say? --- He said to me “look, write up that part of the deal and - - -

Write up what part of the deal? --- The what we, like, spoke about.

Yes? --- For the first part. He said “look, you know, I always honour what I sign. Just send me something so I can get this deal to move. But I will honour you”. Like, you know, “I will make this work”, you know. And that’s why I believed in him.

“I will honour you, I will make you sweet”, is that … what you said? --- “I will honour you”. “I will honour you”. Like, “I will make this right, I will - - -

“Make this right”? --- Yes. Sorry.

Did Gary say what he was going to make right? --- What he signed in the heads of agreement for the business. So basically if I get the 10 now, then in 12 months he will be able to raise the funds to finalise the 22.

(emphasis added)

92 In this conversation, Mr Yammine was using “10” and “22” as shorthand for those numbers as millions of dollars. He also recounted the conversation in evidence in chief as follows:

Like, he said, “I need the funding to get the deal done.” He goes, “Take something for now. I will always get this deal done that I signed. I will always honour it”. And then, that’s when I said to Gary, “All right. I will draw up this deal, but because I’m waiting for money, I’m not going to sign the non-compete in the agreement. And then when you pay me the rest of the money in 12 months’ time, that’s when I will sign off, and I will give you the non-compete.” That was my security, basically, you know. But that’s why I sent that. That’s - this part of the 35 this was the first part of the 35.

(emphasis added)

93 When, in the last answer above, Mr Yammine said “that’s why I sent that” he was referring to what he wrote down on a sheet of paper as the points that would comprise what he was prepared to accept, after the 9 October conversation, while waiting for the payment of the balance of the anticipated $35 million price for Lantrak NSW and before entering into a non-compete provision (the 9 October note). Using his phone at 9:27pm on 9 October 2018, he sent a photo of the 9 October note to Mr Liemant in a text message. The sheet of paper recorded, under the heading ‘Lantrak deal’, “10 m clear 5 m upfront Friday 5 m 29 March [2019] all taxes paid”. That is, the $10 million was to be paid in two instalments of $5 million each, one on execution and, as in the heads of agreement, a second on 29 March 2019, and the Liemant interests would pay any capital gains and other taxes for which the Yammine interests would otherwise be liable.

94 The 9 October note also provided:

“3 m Debt cleared”.

“In Good faith”.

The McGraths Hill property would be transferred to Mr Yammine’s family trust.

Lantrak NSW would enter into a contract with Mr Yammine’s trucking company, Nojo, to guarantee it the first offer to supply trucks for any work Lantrak NSW needed so that the Yammine interests could sell the trucking business with a contract that ensured it would have valuable work opportunities.

Mr Yammine would be retained as a consultant to Lantrak NSW for 12 months at $10,000 per week plus GST, a car, phone, and toll and petrol expenses.

Mr Yammine would also be paid a percentage commission on any jobs that he brought in to the overall Lantrak business in any State after the Liemant interests had finished their due diligence.

Two managers employed by Lantrak NSW, Levi Simpson and Wally (whose surname did not emerge in the evidence), would each be retained and be paid a profit share of 5% or be issued 5% of the shares in Lantrak NSW.

95 Unlike the heads of agreement, the 9 October note, first, made no provision for the sale by Mr Yammine’s interests of the trucking business and its assets or the McGraths Hill property (the outstanding interest in which, instead, Mr Yammine’s family trust would acquire) and, secondly, it provided that Mr Yammine’s $3 million debt due to Mr Liemant would be cleared “in good faith”.

96 And, of course, the 9 October note made no reference to there being a further element to the proposal, namely Mr Liemant’s “promise” to pay the balance of the $35 million if Mr Yammine proceeded in accordance with the terms in that note.

97 Mr Tartac said that he heard a conversation that Mr Yammine had with “Gary” on Mr Yammine’s phone’s loudspeaker at Mr Yammine’s mother-in-law’s home in which Mr Liemant had said that he would pay $10 million and “pay the rest later”. He testified that Mr Liemant said to Mr Yammine:

to take the deal and … he will honour the rest of the moneys that - that was owed to him … in due course. And I remember that Gary was saying that “I won’t let your family down. I won’t, I won’t. I’ll definitely pay you.”

(emphasis added)

98 Mr Tartac said that Mr Liemant told Mr Yammine to take the $10 million and that he would pay the balance of the $35 million later. Mr Tartac recalled Mr Liemant saying “accept it Norm, take the 10 million, and I will definitely fix the rest of it up in due course”. Mr Tartac said that, on other occasions, he heard other conversations on loudspeaker between Mr Yammine and Mr Liemant to similar effect. As the Liemant parties submitted, Mr Tartac was the only witness who gave evidence that Mr Liemant first proposed the figure of $10 million.

99 Ms Mikhael recalled the 9 October conversation with her husband as including Mr Liemant saying that he could not raise the funds to pay $35 million and telling Mr Yammine: “Take something for now and I will honour the rest. Just give me a number now and I will honour the rest”. She said her husband asked for “10 million clear … add up to 13, and then you can pay me the 22 within 12 months”. She recalled that Mr Yammine asked for a weekly $10,000 consulting fee as “the reassurance of the 12 months” in which Mr Liemant could raise the balance of the $35 million price.

100 Mr Liemant gave evidence in chief that he did not know that the 9 October conversation had occurred with Mr Yammine on speakerphone. He said that Mr Yammine called him and, after the two men discussed Mr Liemant’s attempts to raise funds, Mr Yammine said “It’s not going to happen, is it Gaz?” Mr Liemant said that he replied “No, it’s not. I can’t see it happening” and after a pause, Mr Yammine said “Well, would you take 10?”. Mr Liemant testified that “I was quite taken aback” (emphasis added) but responded “Well, that sounds more realistic. Let me have a look at it”. He understood that the discussion concerned the price of the 50% shareholding of the Yammine interests in Lantrak NSW. He testified that he did not remember discussing in the 9 October conversation keeping Mr Yammine involved in the business, but accepted that was possible. He denied that he said that he would pay the remainder of the $35 million at a later time. He said that at that stage he considered that the $35 million price was too high and that $10 million “would be more realistic for what we were achieving … having a multiple of five [times] of results in mind”.

101 In chief, Mr Liemant said that, if, contrary to his recollection, he had said something in the 9 October conversation to the effect that he would pay the $22 million later, “I would have had to have that documented” and that his company “would have to look at funding options. It didn’t have the capacity to fund that sort of money” (emphasis added). Mr Liemant gave this evidence in cross-examination:

Mr Yammine didn’t say why he only wanted 10 million and was prepared to move from 35, did he? --- I think it was discussed that he needed some money.

Yes. And so Mr Yammine said that he needed money? --- Yes, he, well, not directly, but it was implied that he needed money. Yes.

Well, I suggest to you that’s why Mr Yammine said he would take 10 million clear now, and you could pay the balance later? --- No, he did not say that.

So your only explanation for why the parties moved from 35 million to 10 million clear is because … your understanding was Mr Yammine needed money; is that correct? --- No, it’s not correct.

(emphasis added)

102 Accepting that one reason why Mr Liemant wanted the price to reduce was his assertion that his side did not have the capacity to pay $35 million at that time, it beggars belief that Mr Yammine would have arrived at his first offer of taking a net $10 million without any bargaining or enquiry of Mr Liemant about what he could afford to pay, especially given the background of the heads of agreement. Mr Liemant’s answers above shifted ground from, first, that they discussed Mr Yammine’s need of money, to: “he, well, not directly, but it was implied that he needed money”. I do not believe Mr Liemant’s evidence that Mr Yammine did not say directly to him that he needed money.

103 Significantly, Mr Liemant denied that he had any discussion with Mr Yammine at any time in October 2018 in which he (Mr Liemant) said that he would honour the payment of a total of $35 million or pay the balance of $22 million in 12 months at a time later than paying the $10 million clear.

104 Mr Yammine did not give discovery of the 9 October note. Initially he said in cross-examination, before the luncheon adjournment on the second day of his evidence, that he had given a copy of it to his lawyers. After lunch, Mr Yammine said that, over lunch, he had reflected on his incorrect answers and wanted to correct them. He said that “I had a memory meltdown” and was not used to the experience of giving evidence. He said that he had not sent the photograph of the 9 October note to his lawyers “And I don’t have an explanation why”. It was not suggested that anyone had raised the matter with Mr Yammine so as to prompt or cause his correction. In my assessment, Mr Yammine reacted to the pressure of the cross-examination when he gave the incorrect answers but realised, when he calmed down over lunch, that he had not been truthful and voluntarily disclosed what he had done.

105 Mr Yammine’s failure to inform his lawyers about the 9 October note or to explain why he did not do so, together with his initial incorrect assertion that he had informed them, caused me considerable concern as to his veracity. I infer that Mr Yammine did not give the 9 October note to his lawyer because it may have damaged his case. However, I am satisfied that Mr Yammine gave the incorrect answers at a time that he was very agitated because of his account being challenged in a vigorous, but entirely proper, cross-examination during which senior counsel for the Liemant parties told him, again appropriately in the circumstances, “please calm down and stop making speeches”.

106 I do not think that Mr Yammine was a dishonest witness, but this episode made me cautious to scrutinise his evidence carefully in assessing the reliability of his account. Overall, while Mr Yammine was not a person with a mastery of the detail of commercial negotiations, I found him to be generally honest and his evidence reliable, except when I have made specific findings in these reasons not to prefer or accept what he said.

107 Obviously, in its terms, the 9 October note tells strongly against any suggestion that Mr Yammine and Mr Liemant had a discussion in which Mr Liemant said anything about the $22 million or balance of the $35 million being paid later or in addition to the $10 million “clear”. At the time of the 9 October conversation, neither man knew what the difference would be between the $35 million price for the Yammine side’s 50% interest in Lantrak NSW, that was used to arrive at the price in the heads of agreement, and the amount $10 million clear of any liability that the vendors would have for capital gains tax. However, because Mr Yammine was agreeing to repay the $3 million loan to Mr Liemant out of the sale proceeds on the basis that he would receive $10 million clear of that and any tax liability, the discussion may have included mention of $22 million as a “balance”, being the difference between $35 million and $13 million, even though that did not take account of the further reduction for the tax payable.

108 As I will explain below, I am comfortably satisfied that, despite Mr Yammine’s failure to discover the 9 October note and incorrect evidence about what he had given to his lawyers, in their conversation on 9 October 2018, Mr Liemant said to Mr Yammine that he would pay the balance of the $35 million for Lantrak NSW later if Mr Yammine went ahead with a deal in which he would be paid a net $10 million and would enter into a consultancy agreement at $10,000 per week without a non-compete clause, while Mr Liemant went about raising finance for the balance.