FEDERAL COURT OF AUSTRALIA

Security Matters Limited, in the Matter of Security Matters Limited (No 3) [2023] FCA 140

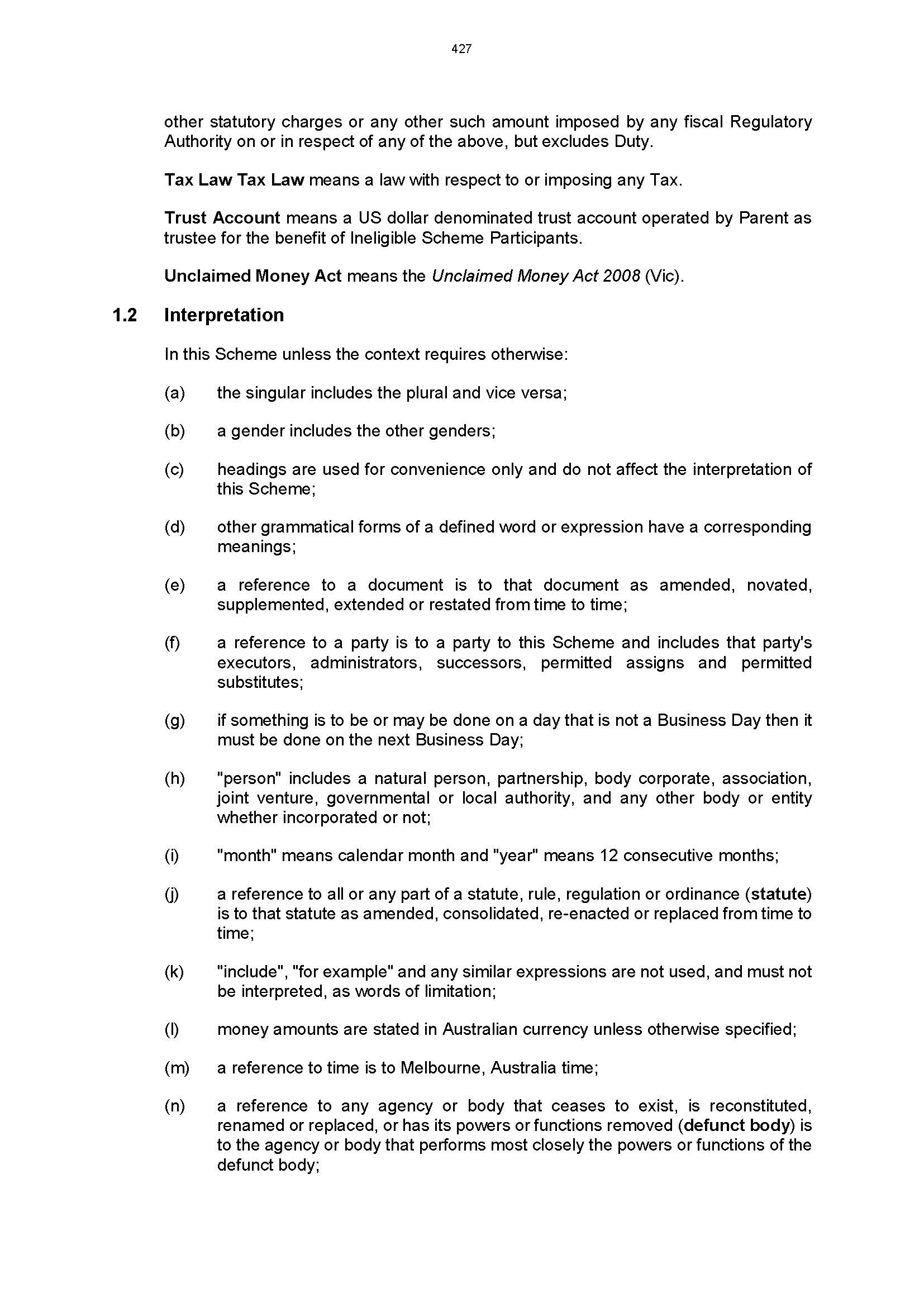

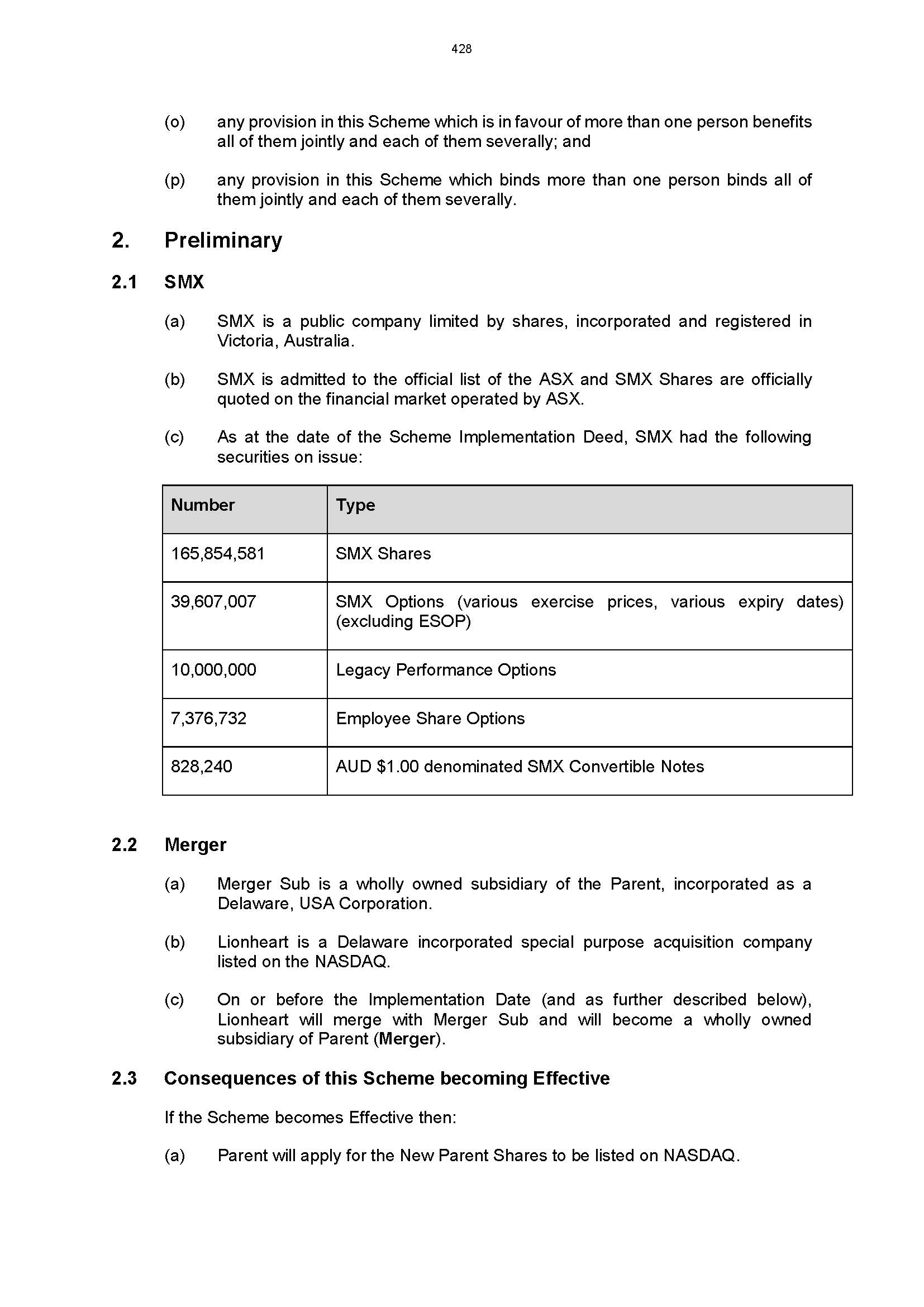

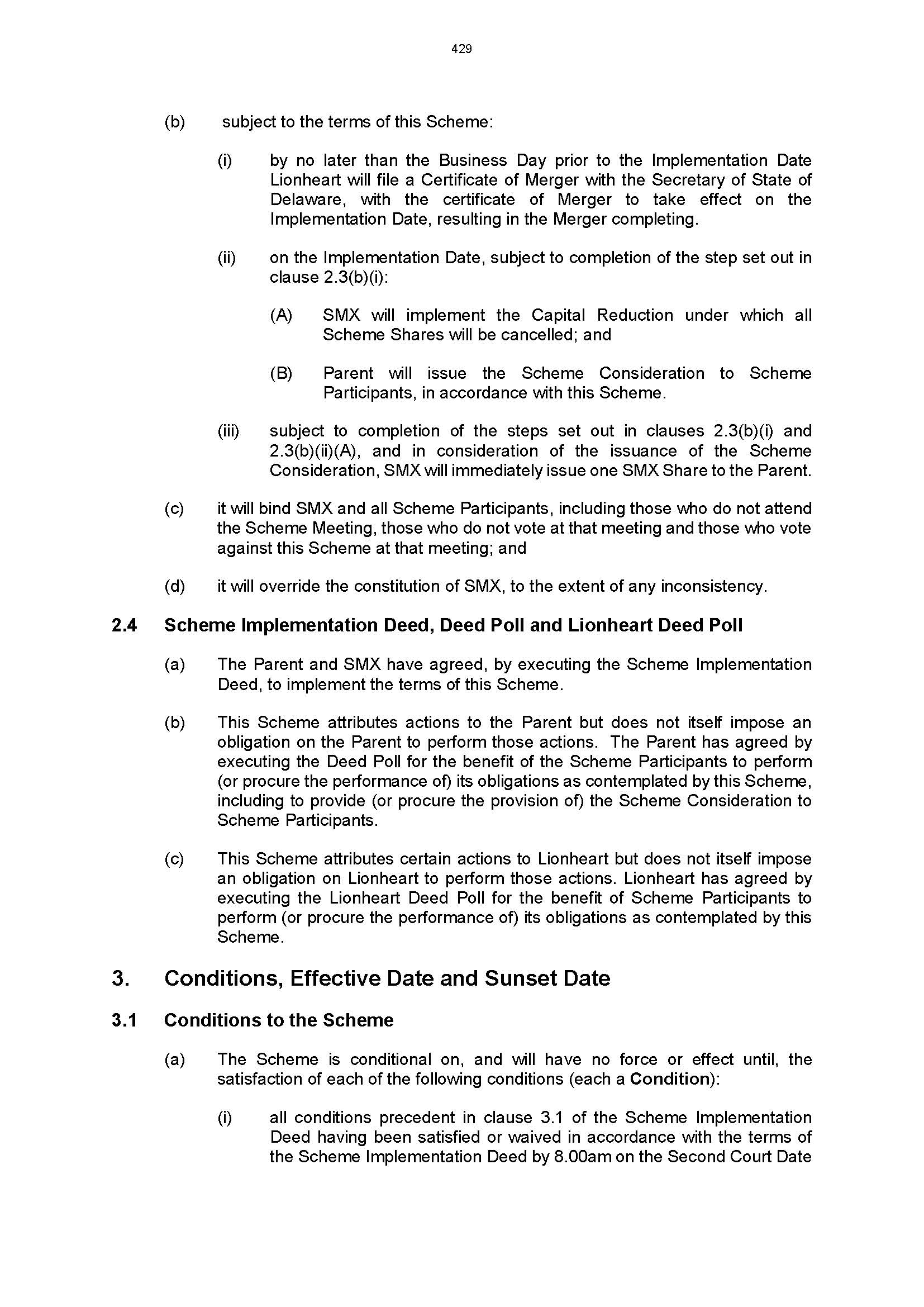

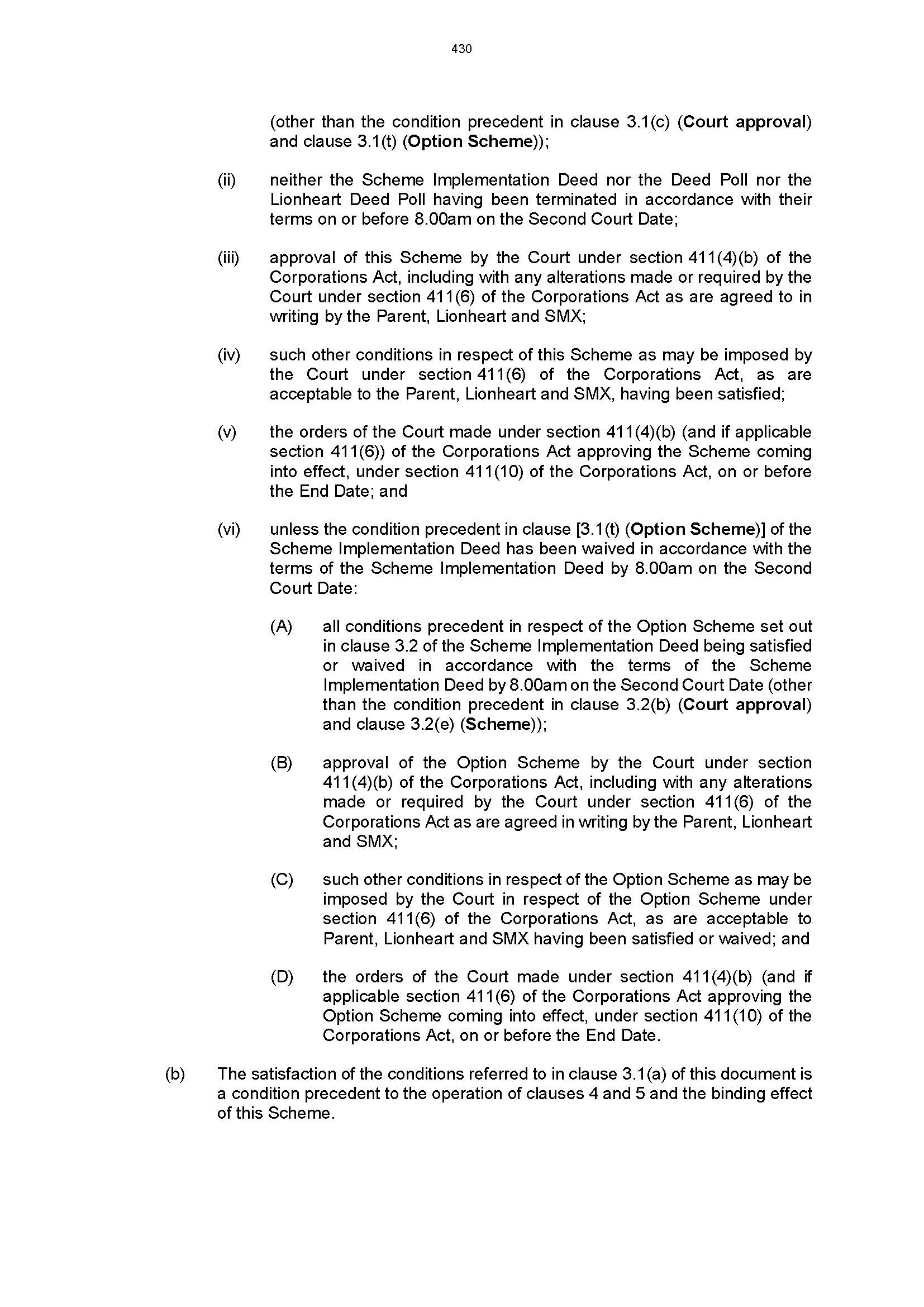

ORDERS

SECURITY MATTERS LIMITED (ACN 626 192 998) Plaintiff | ||

AND: | ||

Interested Party VARIOUS SHAREHOLDERS AND OPTION HOLDERS Interested Party AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION Interested Party | ||

DATE OF ORDER: |

OTHER MATTERS:

A. The proceeding concerns:

(a) a scheme of arrangement between the plaintiff and the holders of ordinary shares in the plaintiff, the terms of which are set out at pages 419 to 442 of exhibit “NP-17” to the affidavit of Nadav Prawer made on 23 February 2023 - a copy of which pages is Annexure A to this order (the share scheme); and

(b) a scheme of arrangement between the plaintiff and the holders of certain options in the plaintiff, the terms of which are set out at pages 444 to 467 of exhibit “NP-17” to the affidavit of Nadav Prawer made on 23 February 2023 - a copy of which pages is Annexure B to this order (the option scheme).

B. The Court is satisfied that neither the share scheme nor the option scheme has been proposed for the purpose of enabling any person to avoid the operation of any of the provisions of Chapter 6 of the Corporations Act 2001 (Cth) (the Act).

THE COURT ORDERS THAT:

1. Pursuant to s 411(4)(b) of the Act, the share scheme is approved.

2. Pursuant to s 411(4)(b) of the Act, the option scheme is approved.

3. Pursuant to s 411(12) of the Act, the plaintiff is exempted from compliance with s 411(11) of the Act in relation to the share scheme and the option scheme.

4. These orders are to be entered forthwith.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

ANNEXURE A

ANNEXURE B

O’CALLAGHAN J:

INTRODUCTION

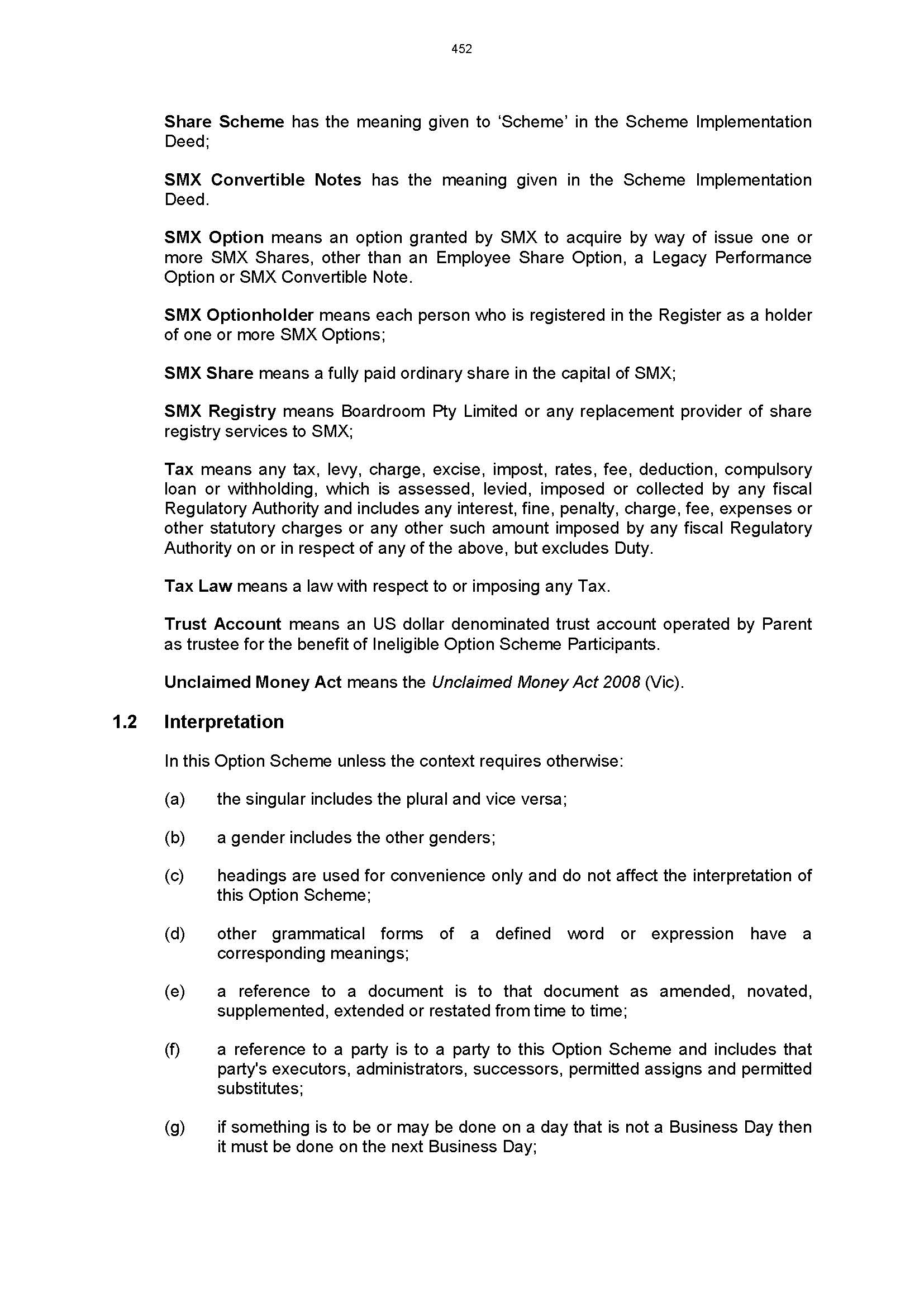

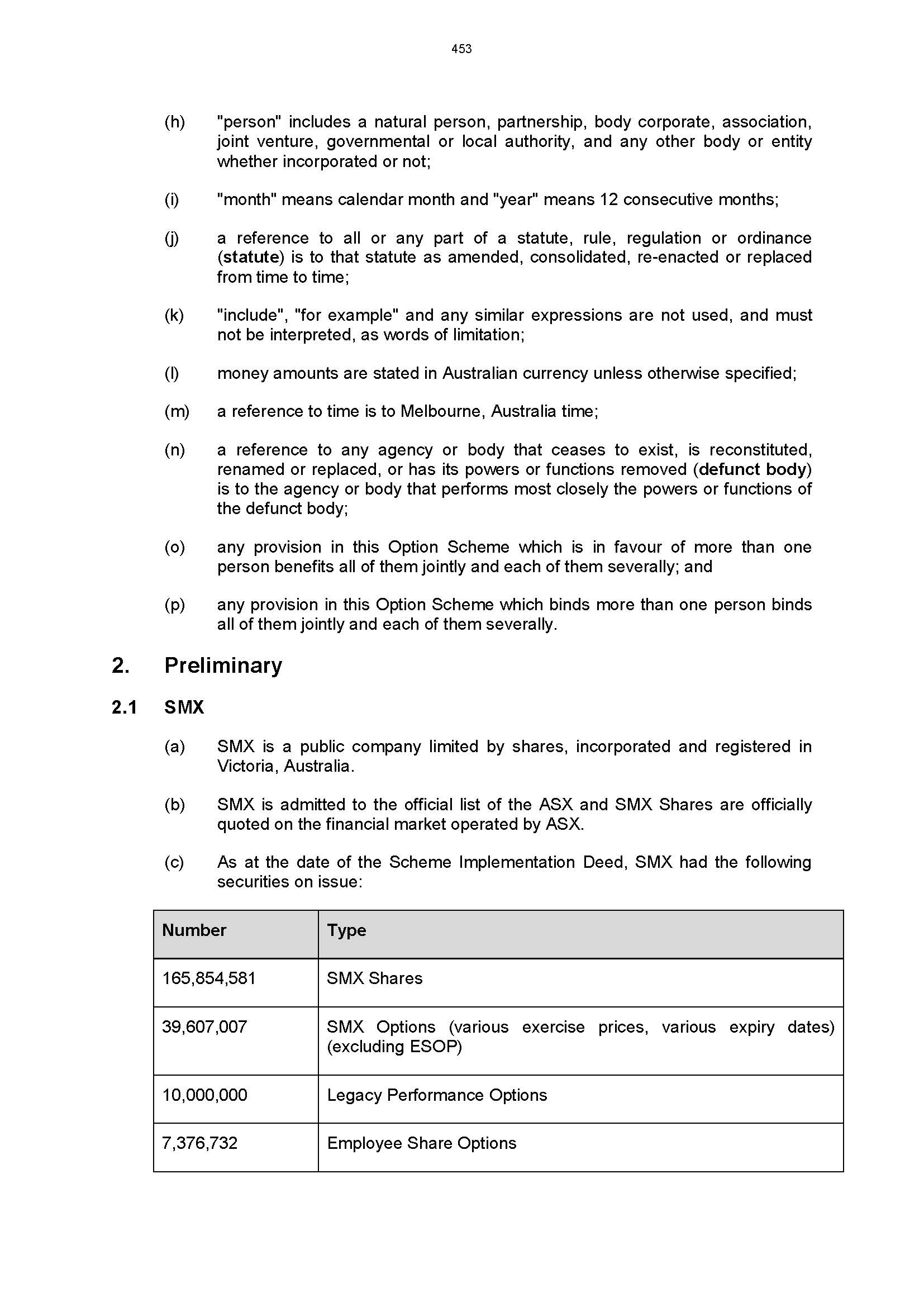

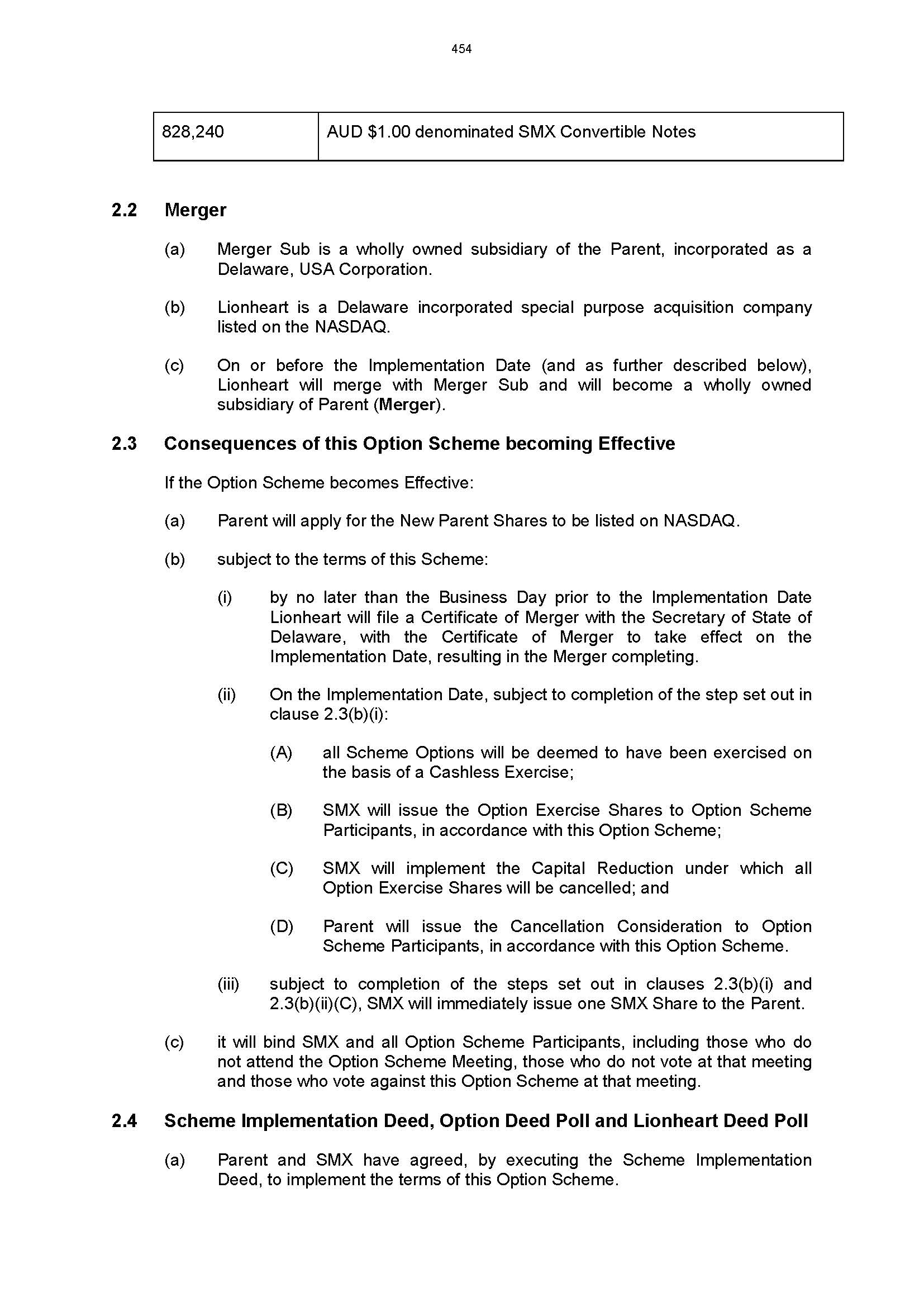

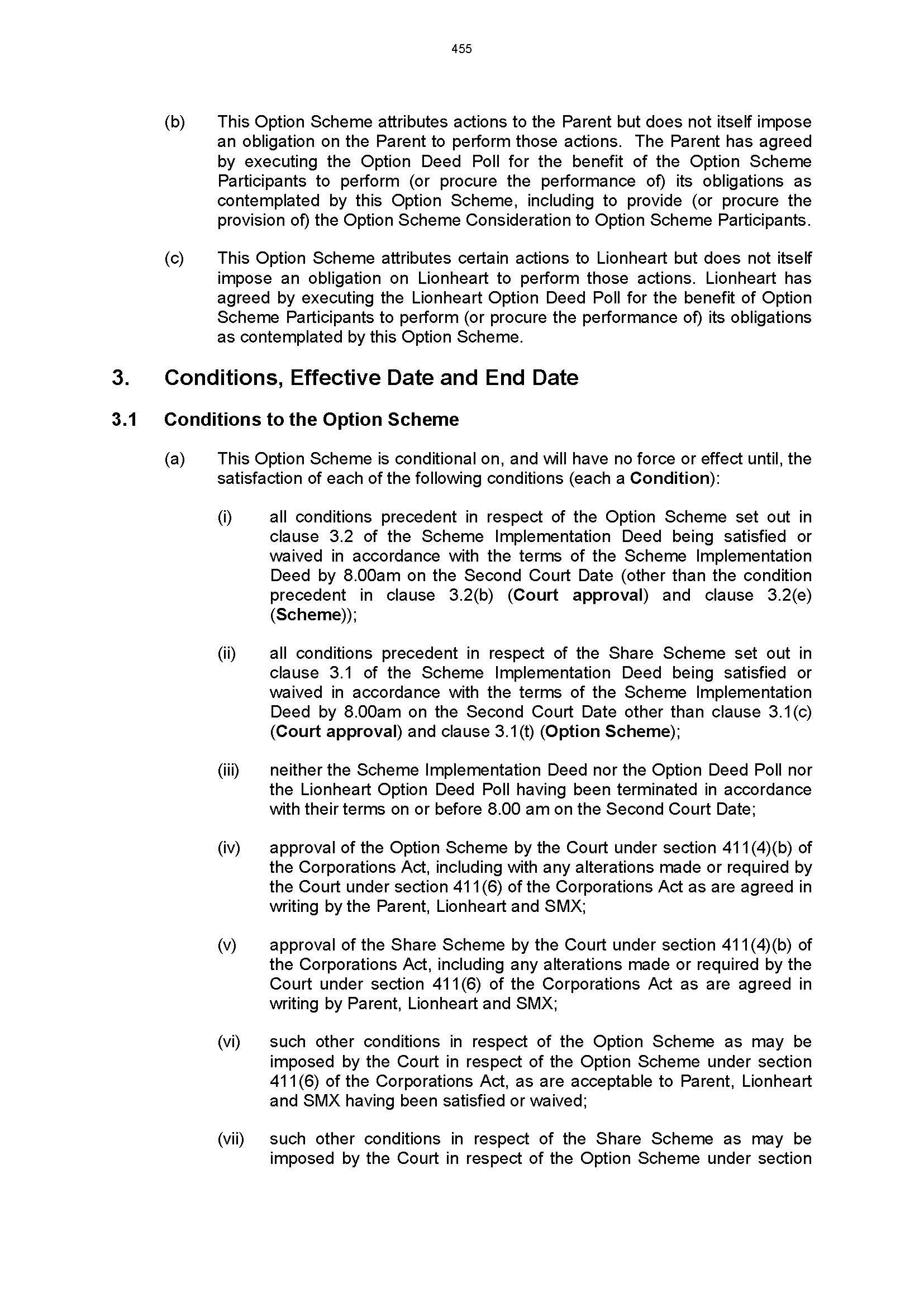

1 This is the second hearing concerning two schemes of arrangement proposed by the plaintiff (SMX), one with its shareholders (the share scheme), the other with certain of its option holders (the option scheme). The share scheme and option scheme are referred to collectively as “schemes” and shareholders and option holders are referred to collectively as “security holders”.

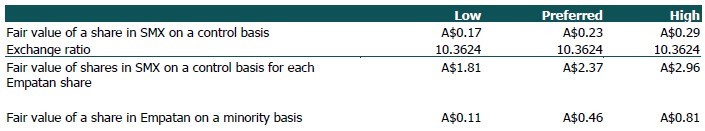

2 The schemes are part of a transaction by which it is proposed that SMX will merge with a NASDAQ-listed Delaware incorporated “special purpose acquisitions company” (or “SPAC”) called Lionheart III Corporation (Lionheart), and thereby obtain a listing on NASDAQ.

3 The proposed transaction between SMX and Lionheart involves the following steps:

(1) under the option scheme, the options in SMX will be issued on a cashless basis and option holders issued shares in SMX (based on the value of the options, as determined by a Black-Scholes calculation);

(2) all the shares in SMX (including those issued under the options scheme) will be cancelled under a reduction of capital, which was approved by the general meeting of SMX’s shareholders held on 20 February 2023;

(3) under the option scheme and the share scheme, an Irish company, Empatan plc (Empatan), will issue shares in itself to SMX’s shareholders (including those persons who had been option holders before the option scheme), on the basis that one share in Empatan will be issued for every 10.3624 SMX shares;

(4) SMX will issue a share in itself to Empatan, thereby becoming a wholly-owned subsidiary of Empatan; and

(5) Empatan and Lionheart will merge, and the merged entity will be listed on NASDAQ.

(6) Thus, subject to court approval, SMX and its business will be owned by a NASDAQ-listed company, in which SMX's current shareholders and relevant option holders will be shareholders.

4 A SPAC is, generically speaking, a company formed to raise capital by an initial public offering to finance a subsequent merger, acquisition, reorganisation or similar business combination with an existing business, with the goal of that business then being publicly traded on a stock exchange. The time in which a SPAC can consummate the transaction is limited and, once the SPAC has identified a transaction, its shareholders have rights to redeem their shares on a pro-rated basis, rather than proceed with the transaction.

5 The extent to which the SPAC’s investors redeem their shares (known as the redemption rate) is relevant to whether the SPAC will have sufficient funds to complete the business combination and continue to trade. Therefore, it is common in SPAC transactions for the funds from the non-redeemed shares to be supplemented by other forms of equity, including “private investment in public equity” or “PIPE” funding.

PROCEDURAL BACKGROUND AND SUPPLEMENTARY DISCLOSURE

6 On 9 January 2023, Anderson J ordered that meetings of the security holders be convened on 1 February 2023 and that SMX send the scheme booklet to the security holders. See Security Matters Limited, in the matter of Security Matters Limited [2023] FCA 19.

7 The scheme booklet included a report prepared in October 2022 by an independent expert, Mr Goldman.

8 An independent expert report was required here because SMX and Empatan have common directors. Regulation 8303 of the Corporations Regulations 2001 (Cth) provides:

If:

(a) …

(b) a director of any corporation that is the other party to the proposed reconstruction or amalgamation is a director of a company the subject of the Scheme;

the statement must be accompanied by a copy of a report made by an expert who is not associated with the corporation that is the other party, stating whether or not, in his or her opinion, the proposed Scheme is in the best interest of the members of the company the subject of the Scheme and setting out his or her reasons for that opinion.

9 Mr Goldman initially opined that each scheme was fair and reasonable, and in the best interests of the security holders. That conclusion was expressed, including on the basis that the Lionheart redemption rate might be 100%. He expressed the opinion, at that point, that “[t]he fair value of a share in Empatan after the implementation of the Share Scheme would reduce to A$2.16 if 100% of Lionheart’s Class A shares are redeemed”.

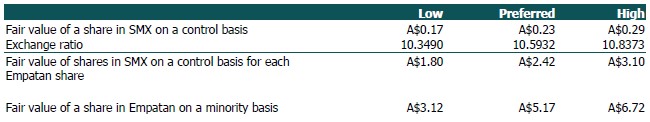

10 As to whether the share scheme was fair to shareholders, Mr Goldman compared the fair value of a share on a control basis before the implementation of the scheme, with the fair value of a share in Empatan on a minority basis following the implementation of the scheme. He summarised his view about the fair value of the relevant shares as follows:

11 He concluded that:

The fair value of shares on a minority basis that SMX shareholders will hold in Empatan after the implementation of the Share Scheme is greater than the fair value of a share held in SMX on a control basis applying the exchange ratio. Therefore, we have concluded that the Share Scheme is fair.

(Emphasis in original)

12 Mr Goldman also expressed his opinion that the share scheme had a number of advantages, on the one hand, and a number of disadvantages, on the other. The advantages included, in summary:

(a) access to capital to continue to develop SMX’s technology through to commercialisation;

(b) listing on NASDAQ providing a deeper capital pool for further fundraising; and

(c) potential for future liquidity in shares as a result of being listed on a larger exchange.

13 The disadvantages included, in summary:

(a) the level of redemptions was unknown and therefore the level of capital available to the ongoing operations may be insufficient;

(b) dilution of ownership through the issue of shares to Lionheart shareholders; and

(c) SMX Shareholders will hold a security in a foreign entity and on a foreign exchange following implementation of the Share Scheme.

14 Mr Goldman concluded that “[a]s the Share Scheme is fair, and taking into consideration the [advantages and disadvantages], we have concluded that the Share Scheme is reasonable”. (Emphasis in original).

15 Mr Goldman therefore concluded that the share scheme was “fair and reasonable and in the best interests of the SMX shareholders”, adding:

The ultimate decision on whether to approve the Share Scheme should be based on shareholders’ own assessment of their circumstances. We strongly recommend that shareholders consult their own professional advisers, carefully read all relevant documentation provided, including the Scheme Booklet, and consider their own specific circumstances before voting in favour of or against the Share Scheme.

16 Mr Goldman reached similar conclusions on similar bases with respect to the option scheme. He concluded that the option scheme was “fair and reasonable and in the best interests of the SMX optionholders”.

17 Because Mr Goldman’s report had been made in October 2022, ASIC suggested, and SMX agreed, that SMX would provide an updated independent expert report. Accordingly, Anderson J’s 9 January 2023 orders provided for SMX to apply to the court for approval to make supplementary disclosure, including an updated expert’s report.

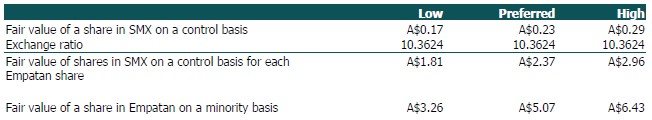

18 Mr Goldman duly published a supplementary report. The supplementary report again concluded that the schemes were fair and reasonable and in the best interests of SMX security holders. Relevantly, the assessment of the fair value of shares was as follows:

19 Mr Goldman’s supplementary report did not repeat his previous opinion that the fair value of a share in Empatan would be $2.16 given a 100% redemption rate. Instead, he said this:

A significant assumption in our assessment the Share Scheme is that redemptions are a maximum of 85%. The level of redemptions will not be known until just prior to the shareholder meeting to approve the Share Scheme. Should redemptions be higher than 85% then our approach to the assessment of the fairness and reasonableness of the Share Scheme may change and this may affect our opinion on the fairness and reasonableness of the Share Scheme and whether or not it is in the shareholders’ best interests. In the event that redemptions are more than 85% we will be issuing a second supplementary report, which will supersede our opinion in this Supplementary Report.

…

A significant assumption in our assessment the Option Scheme is that redemptions are a maximum of 85%. The level of redemptions will not be known until just prior to the optionholder meeting to approve the Option Scheme. Should redemptions be higher than 85% then our approach to the assessment of the fairness and reasonableness of the Option Scheme may change and this may affect our opinion on the fairness and reasonableness of the Option Scheme and whether or not it is in the optionholders’ best interest. In the event that redemptions are more than 85% we will be issuing a second supplementary report, which will supersede our opinion in this Supplementary Report.

20 On 23 and 27 January 2023, O’Bryan J heard SMX’s application for approval of supplementary disclosure. See Security Matters Limited, in the matter of Security Matters Limited (No 2) [2023] FCA 40.

21 On 27 January 2023, O’Bryan J ordered that the scheme meetings be postponed until 7 February 2023 and that SMX dispatch a supplementary disclosure document, including a copy of Mr Goldman’s supplementary report. His Honour’s orders also provided for SMX to apply to the court for approval of dispatch of any further report from Mr Goldman. His Honour required that the supplementary disclosure document give “prominent disclosure” to the prospect of a further supplementary expert’s report, and that it would be available to security holders online (rather than sent to them by mail).

22 On about 1 February 2023, Lionheart announced its redemption rate was in fact 99.5%.

23 Mr Goldman then issued (in draft) a further supplementary independent expert report, in which he concluded that each of the schemes was not fair and not reasonable, and not in the interests of SMX security holders. Relevantly, he concluded as follows:

24 Copies of Mr Goldman’s draft further supplementary report were then provided to ASIC.

25 On 6 February 2023, I made orders further postponing the scheme meetings to 20 February 2023, so that Mr Goldman’s further supplementary report and the further disclosure document could be finalised, and that SMX could apply for approval to dispatch that material.

26 On 9 February 2023, ASIC sent a letter to SMX, setting out what it referred to as its “concerns” about the contents of SMX’s proposed further disclosure document.

27 On 13 February 2023, Mr Goldman published the final version of his further supplementary report.

28 On 14 February 2023, I heard SMX’s application concerning the dispatch of further supplementary material. Just before the hearing, ASIC sent another letter to SMX, setting out its concerns about the contents of SMX’s proposed further disclosure document.

29 I then ordered that SMX publish the “further supplementary disclosure to scheme booklet” document, including Mr Goldman’s further supplementary report, on its website and its ASX announcements platform.

30 Section 7 of the “further supplementary disclosure to scheme booklet” was titled “SMX directors’ consideration of the further supplementary expert report”, in which an explanation was provided as to why the Directors did not (and do not) accept the conclusion reached by Mr Goldman that the schemes are not fair and not reasonable and not in the best interests of the security holders. (This section of the document is referred to by ASIC as the “Directors’ critique”).

31 The Directors’ explanation is of significance, and was relevantly in these terms:

The directors of SMX disagree with the further supplementary expert report. They do not accept the conclusions reached or the approach taken by Nexia Australia [Mr Goldman] in relation to several matters, including those described below.

In reaching those views, SMX directors have relied on advice, including from experts in the United States and Israel, about the schemes and the methodology used by Nexia Australia. That advice is considered (amongst other things):

• the many benefits of a listing on NASDAQ (as compared with a listing on ASX), including higher trading volumes, greater liquidity, greater access to capital (including by more varied investment tools than may be available in Australia), the technology orientation of the NASDAQ and its reputation as a market with that orientation

• the advantages of those benefits to a larger entity with new capital (i.e. entity created by the merger of Lionheart, Empatan and SMX) and the timeframe to obtain them (which will be faster under the Lion heart transaction than if SMX sought to obtain a NASDAQ listing in the ordinary course)

• the method used by Nexia Australia to value a NASDAQ listing

• the relevance of shareholder dilution in determining fairness and reasonableness

• the assumptions and calculations used by Nexia Australia in calculating, and drawing conclusions about, the value of shares in the merged entity.

…

(b) Understatement of value of listing

Nexia Australia has determined the value of the NASDAQ listing “on a replacement cost basis” … SMX’s directors consider that Nexia Australia has materially understated both the replacement costs and the value of a NASDAQ listing.

…

(c) Lack of attribution of value to access to capital or availability of PIPE financing

…

Although the further supplementary expert report identifies “Access to capital to continue to develop SMX's technology through to commercialisation” and “Listing on the NASDAQ exchange providing a deeper capital pool for further fundraising” as advantages of the Schemes, it does not provide any assessment of the value of those advantages nor a comparison of the costs that SMX will incur in raising capital, if the Schemes do not proceed.

That leads, in the opinion of SMX’s directors, to a material understatement of the value to SMX Shareholders and SMX Optionholders of the Schemes.

…

(e) Failure to adequately consider the value of advantages

SMX’s directors consider that Nexia Australia’s approach to valuing the transaction is overly mechanical.

While the further supplementary expert report identifies several essential advantages to SMX and, ultimately, to SMX Shareholders and SMX Optionholders from the Schemes, Nexia Australia has not assessed the value of those advantages in its consideration of fairness as, under ASIC Regulatory Guide 111, “Content of expert reports”, fairness and reasonableness are considered separately.

In the view of SMX’s directors, that approach disregards the significance of the advantages, and the opportunities, available from a listing on the NASDAQ.

(Emphases and errors in original; citations omitted)

THE SECOND HEARING

32 I heard the second meeting application on 24 February 2023. Mr CT Möller SC appeared with Mr OK Wolahan and Ms ME Hardinge of counsel for SMX. Mr S Hibble of counsel appeared for ASIC. Mr BK Holmes of counsel appeared for Lionheart. And Mr DB Bongiorno of counsel appeared for a number of security holders, to support SMX’s application.

33 It is necessary to give judgment in the matter as a matter of urgency, because the proposed transaction cannot be completed for commercial reasons unless approval orders are made today. For the reasons that follow, the orders sought by SMX will be made.

34 ASIC opposed the making of orders approving the schemes, on grounds which its counsel described in the course of his oral address as “concerns of process”. In essence, ASIC submitted that the court should not exercise its discretion to approve the schemes because ASIC is of opinion that:

(1) the security holders have not been given a reasonable time to consider the schemes;

(2) the security holders have not been given enough information to enable them to assess the merits of the proposal;

(3) alternatively, the information provided to the security holders properly discloses that the schemes are not fair, not reasonable and not in the best interests of members and therefore, in the absence of previous authority, the court should not approve the schemes;

(4) what it dubbed “the Directors’ critique” section of the further supplementary disclosure to scheme booklet dated 14 February 2023 (being the explanation discussed above at paragraphs [30]–[31]) did not comply with the Corporations Act 2001 (Cth), the relevant ASIC Regulatory Guides or the Federal Court’s Expert Evidence Practice Notes (including the Federal Court’s Harmonised Expert Witness Code of Conduct); and

(5) the Directors’ critique may have been misleading or deceptive.

35 ASIC’s concerns also included that “this is the first SPAC scheme in Australia [and it could not] point to any authority where the court has approved a scheme at a second hearing where the independent expert has said that the scheme is not fair, not reasonable and not in the best interests of members”.

36 SMX relied on eleven affidavits, viz:

(a) an affidavit made on 22 February 2023 by Doron Afik, the managing partner of Afik & Co Law (the Israeli legal advisors to SMX) and SMX’s general counsel – explaining what occurred at the share scheme meeting, the option scheme meeting, and SMX’s general meeting;

(b) an affidavit made on 22 February 2023 by Everardus Hofland, an executive director and the chairman of SMX – explaining what occurred at the share scheme meeting, the option scheme meeting, and SMX’s general meeting, all of which he chaired;

(c) an affidavit made on 23 February 2023 by SMX’s CEO, Haggai Alon – dealing with compliance with the court’s orders for further supplementary disclosure, the receipt of an opinion from Dr Tiran Rothman and the engagement of Dr Rothman to provide a further report, the location of the 20 largest shareholders in SMX, and addressing the requirements of s 411(17)(a);

(d) an affidavit made on 23 February 2023 by SMX’s solicitor, Dr Nadav Prawer – dealing with SMX’s compliance with the court’s orders convening the meetings and for further supplementary disclosure, correspondence between ASIC and Mr Goldman, and appearances for the approval hearing;

(e) an affidavit made on 23 February 2023 by SMX’s solicitor, Ari Jenshel – dealing with compliance with the court’s orders for further supplementary disclosure;

(f) an affidavit made on 22 February 2023 by Pauline Mastroianni, SMX’s solicitor’s office manager – dealing with compliance with the court’s orders convening the meetings, its orders for further disclosure, and its orders for further supplementary disclosure by SMX;

(g) an affidavit made on 23 February 2023 by Steve Hodkin, an employee of Boardroom (which maintains SMX’s share registry) – dealing with compliance with the convening orders and the orders for further disclosure and further supplementary disclosure, the receipt of proxies for the scheme meetings, and the polls conducted at the scheme meetings and SMX’s general meeting;

(h) an affidavit made on 22 February 2023 by William H Purcell, a US-based investment banker – exhibiting an expert report responding to Mr Goldman’s further supplementary report; and

(i) an affidavit made on 22 February 2023 by Dr Tiran Rothman, an economist and consultant based in Israel – exhibiting an expert report about obtaining a NASDAQ listing;

(j) an affidavit made on 24 February 2023 by Mr Alon – exhibiting with SMX’s ASX announcements regarding Lionheart’s approval of the transaction and the further postponement of the scheme and general meetings; and

(k) an affidavit made on 24 February 2023 by Ms Mastroianni – exhibiting a complete version of the letter of instruction to Mr Purcell (one page of which was otherwise inadvertently missing from the record).

37 SMX relied upon the affidavits of Mr Purcell and Dr Rothman as providing a sound basis for the statements made by the Directors to the effect that the schemes are fair and reasonable, contrary to the ultimate view expressed by Mr Goldman. SMX said that in doing so it was doing what is required under cl 8301(a) of Schedule 8 of the Corporations Regulations, which requires that an explanatory statement must set out in a case such as this “in relation to each director of the company... whether the director recommends the acceptance of the Scheme or recommends against acceptance and, in either case, his or her reasons for so recommending”.

38 SMX also relied on a minute of the meeting of the Board of Directors held on 12 February 2023, which relevantly recorded the following:

[Mr] Haggai reported on the recent developments, including the Court hearings and resolution, status of opinion of IER (Goldman) who sees the transaction as unfair and unreasonable. Haggai also reported as to the efforts to raise PIPE funds and the current market status, as well as to agreements for postponement of payments by suppliers and creditors.

Shareholder continue to have time to consider the transaction and change their proxy vote, or sell shares in the market.

…

An overview of the Yorkville transaction was provided and it was noted that other funding possibilities were available with a number of investment banks and credit facilities being offered to the combined entity in the vicinity of a few tens of million, although some of these were mutually exclusive. The advantages of moving to NASDAQ in respect of funding abilities in NASDAQ was noted.

The Board discussed the opinion of Mr. Goldman.

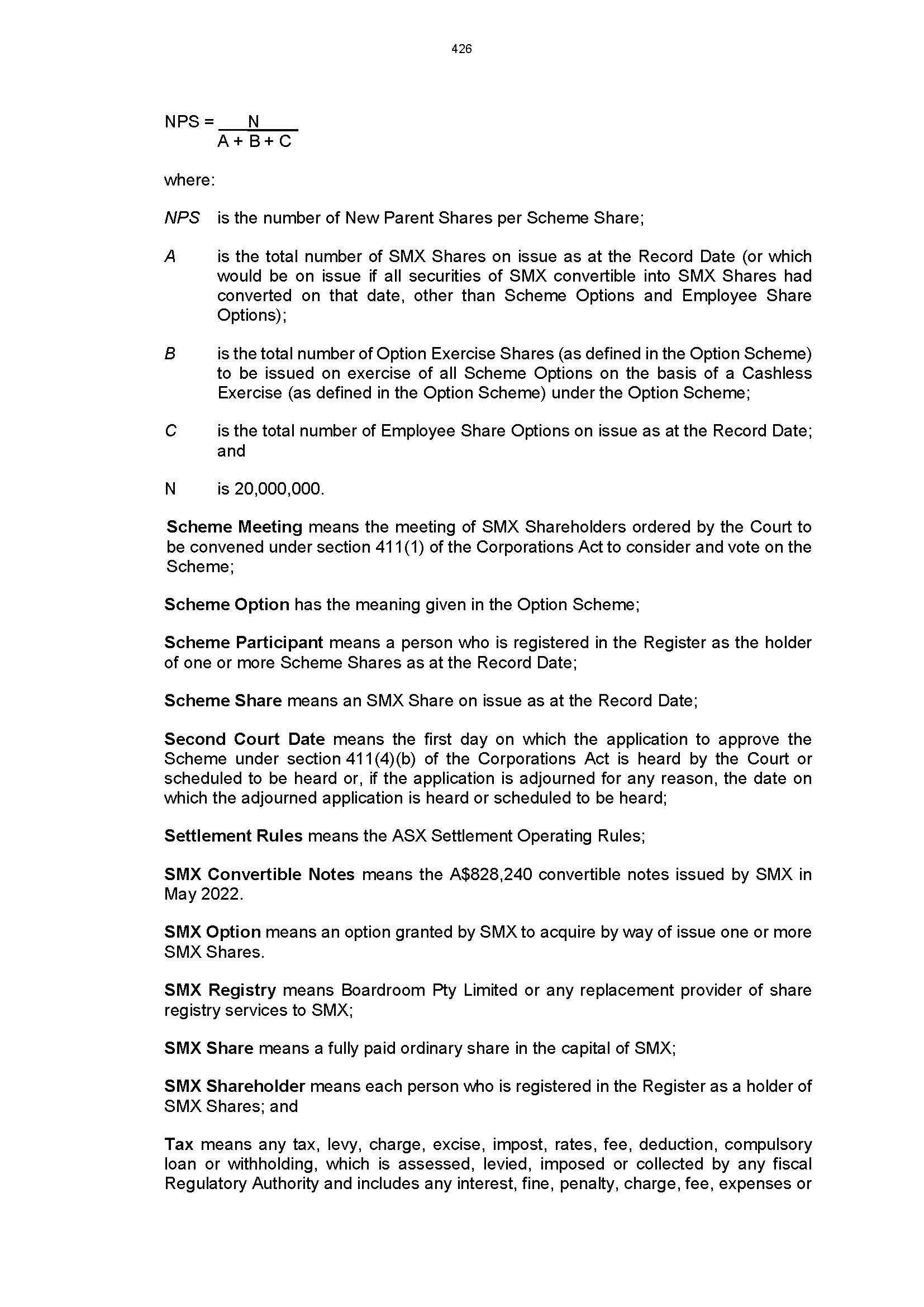

…

It was noted that signing of the term sheet with Yorkville had specifically not been signed ahead of seeking shareholder approval[ ]that the Board also discussed the possibility that the Court may reject the Company’s application for the transaction to proceed given the Independent Expert’s Opinion, as well its plans to adduce additional expert evidence to mitigate this risk.

…

After discussion the Board has decided unanimously as follows:

1. Despite the high redemption rates and with consideration of the fact that the transaction was approved by Lionheart's board of directors and by Lionheart's shareholders, the Board does not change its prior resolutions and is still supportive of the transaction given the greater access to capital markets and a larger pool of investors, increased visibility of the company and higher credibility (given a NASDAQ listing) …

39 Mr Purcell’s “Second Expert Rebuttal Report” dated 21 February 2023 set out why he “strongly disagree[s] with the opinions rendered by Mr Goldman, as well as the methodology and assumptions Mr Goldman used in rendering those opinions”.

40 Mr Purcell expressed the following opinions (among others):

(a) Mr Goldman became “extremely nervous and anxious” upon learning of the high redemption rate, and therefore concluded or assumed that SMX would no longer have sufficient capital to proceed with its operations, without giving any credit or substance to the PIPE funding;

(b) Mr Goldman’s opinion is based on a flawed foundation that the schemes are a “control” and “minority interest” transaction involving the “fair value of shares on a minority basis”. Mr Purcell describes this foundation as “totally incorrect from an investment banking and financial point of view” because in any scenario, relevant security holders will own well over 50% of the shares of the new entity trading on NASDAQ;

(c) A NASDAQ listing would involve many benefits and is supported by a USD200 million valuation by a US investment bank. A significant benefit is that NASDAQ has a heavy emphasis on technology companies, compared with the ASX which is oriented towards natural resource companies; and

(d) If the transaction is not approved, not only will security holders forego benefits, SMX (and as a result, its security holders) will incur negative consequences including significant transaction costs, continued trading on the ASX, and potential liability to pay a break fee.

41 Dr Rothman’s report dated 21 February 2023 presented his economic opinion on the delisting of SMX from the ASX and its impact on valuation. Dr Rothman opined that such a delisting is common for early-stage firms seeking higher liquidity and visibility in capital markets, both of which are more likely on NASDAQ than the ASX. He also noted that if the transaction does not proceed, replacement costs for an IPO are likely between USD3 million and USD7 million.

The share scheme meeting

42 The affidavits of Messrs Afik, Hofland and Hodkin proved that the scheme meetings were duly held on 20 February 2023 in accordance with the court’s orders.

43 Each meeting was held virtually by means of a facility, hosted by Boardroom, called “LUMI”.

44 Mr Hofland chaired the scheme and general meetings.

45 The share scheme had a quorum of at least 2 members in person, by proxy or by representative.

46 Before the meeting, SMX had received 135 valid proxies in respect of 130,835,021 shares, which between them represented 77.94% of the total SMX shares on issue.

47 The resolution to approve the share scheme was conducted by a poll. Mr Hodkin of Boardroom was appointed the returning officer. The result of the poll was as follows:

No. of votes | % of votes | No. of % shareholders | of shareholders who voted | |

For | 130,635,610 | 99.85% | 130 | 96.30% |

Against | 199,411 | 0.15% | 5 | 3.70% |

TOTAL | 130,835,021 | 100% | 135 | 100% |

Abstain | 2,800 | 0% | 1 | 0% |

The option scheme meeting

48 The option scheme meeting had a quorum of at least two option holders in person, by proxy or by representative.

49 Before the meeting, SMX received 44 valid proxies in respect of 28,428,181 options, who between them represented 88.25% of the total options eligible to vote on the scheme.

50 The resolution to approve the option scheme was conducted by a poll, with Mr Hodkin appointed the returning officer. The result of the poll was as follows:

No. of votes | % of votes | No. of option holders | % of option holders who voted | |

For | 28,482,181 | 100% | 44 | 100% |

Against | 0 | 0% | 0 | 0% |

TOTAL | 28,482,181 | 100% | 0 | 0 |

Abstain | 0 | 0% | 0 | 0% |

The general meeting

51 SMX’s general meeting, to consider the capital reduction resolution, was held after the option scheme meeting.

52 Before the general meeting, SMX received 136 valid proxies in respect of 133,321,462 shares, which between them represented 79.42% of the total SMX shares on issue.

53 At the meeting, a motion to amend the proposed resolution to clarify the precise time the capital reduction would take effect, was passed.

54 The resolution to approve the capital reduction was conducted by a poll. Mr Hodkin was appointed the returning officer. The result of the poll was as follows:

No. of votes | % of votes | No. of shareholders | % of shareholders who voted | |

For | 133,295,605 | 99.98% | 133 | 97.8% |

Against | 25,857 | 0.02% | 3 | 0.02% |

TOTAL | 133,321,462 | 100% | 136 | 100% |

Abstain | 1,380 | 0% | 1 | 0.007% |

STATUTORY AND PROCEDURAL REQUIREMENTS

55 In Re Wesfamers Ltd (No 2) [2018] WASC 357 at [15], Vaughan J (as his Honour then was) said the court will usually approach its task on the basis that members are better judges of their own commercial interests than the court, and that “[t]he function of the court does not extend to usurping the views of the shareholders”. The court is “not a mere rubber stamp” and it will look at the arrangement to ensure that it is a reasonable one”. The court’s primary concern is with “whether the proposal is ‘fair and reasonable’” and “[i]n…that respect [it] does not determine that the scheme is intrinsically in the members' interest or otherwise” and “[t]he court ought only require satisfaction that the arrangement is one which is capable of being accepted”.

56 The court’s task is twofold:

(1) to ensure that all statutory and procedural requirements under s 411 of the Act have been observed; and

(2) to determine in the exercise of its discretion whether to approve the scheme.

57 Section 411(4) of the Act relevantly provides:

A compromise or arrangement is binding on the creditors, or on a class of creditors, or on the members, or on a class of members, as the case may be, of the body and on the body or, if the body is in the course of being wound up, on the liquidator and contributories of the body, if, and only if:

(a) at a meeting convened in accordance with an order of the Court under subsection (1) or (1A):

(i) in the case of a compromise or arrangement between a body and its creditors or a class of creditors – the compromise or arrangement is agreed to by a majority in number of the creditors, or of the creditors included in that class of creditors, present and voting, either in person or by proxy, being a majority whose debts or claims against the company amount in the aggregate to at least 75% of the total amount of the debts and claims of the creditors present and voting in person or by proxy, or of the creditors included in that class present and voting in person or by proxy, as the case may be; and

(ii) in the case of a compromise or arrangement between a body and its members or a class of members – a resolution in favour of the compromise or arrangement is:

(A) unless the Court orders otherwise – passed by a majority in number of the members, or members in that class, present and voting (either in person or by proxy); and

(B) if the body has a share capital – passed by 75% of the votes cast on the resolution; and

(b) it is approved by order of the Court.

58 The principal statutory and procedural requirements for approval under s 411 are that:

(1) there has been compliance with the orders convening the scheme meeting and the rules of court (here the Federal Court (Corporations) Rules 2000 (Cth));

(2) there has been compliance with the disclosure obligation under s 412(1);

(3) the resolution approving the scheme have been passed by the majorities required by s 411(4)(a)(ii); and

(4) the condition under s 411(17) has been satisfied.

59 Taking each of those matters in turn:

Compliance with the Rules and the court’s orders

60 Rule 3.5(b) of the Federal Court (Corporations) Rules 2000 (Cth) requires that a copy of the convening orders be lodged with ASIC as soon as practicable after the order is made.

61 That requirement was fulfilled on 9 January 2023.

Dispatch of Scheme Booklet

62 Justice Anderson’s convening orders required that the scheme meetings be convened by sending on or before 10 January 2023:

(1) in the case of shareholders and option holders who had elected to receive communications electronically, an email in an approved form which included a link to an online portal or website from which the scheme booklet could be downloaded and attached a scheme proxy form that included a link to an online portal or website that enabled the scheme participant to lodge their proxy for the scheme meeting;

(2) in the case of shareholders and option holders who had elected to receive hard copy communications, a copy of the scheme booklet, scheme proxy form and a reply-paid envelope by pre-paid post; and

(3) in the case of shareholders and option holders who had not elected either way, a letter in an approved form which included a link to the scheme booklet and a copy of the scheme proxy form that included a link to an online portal or website that enabled the scheme participant to lodge their proxy for the scheme meeting.

63 The dispatch of the scheme booklet and the other material required under the convening orders is the subject of the first affidavit of Ms Mastroianni, the affidavit of Mr Hodkin and the affidavit of Dr Prawer. The evidence in Ms Mastroianni’s first affidavit and Mr Hodkin’s affidavit about the dispatch establishes that the materials were sent to each scheme participant on 10 January 2023 by the methods that the convening orders required.

64 Ms Mastroianni’s first affidavit establishes that where email “bounce-back” messages were received from security holders who had elected to receive communications electronically, hardcopy documents were sent by post to the relevant security holders.

Dispatch of first supplementary disclosure document

65 Justice O’Bryan’s 27 January 2023 orders required the dispatch of the supplementary disclosure document on or before 5pm on 30 January 2023 in essentially the same manner as the dispatch for the scheme booklet.

66 The evidence (found in the first Mastroianni affidavit, the Hodkin affidavit and the Prawer affidavit) establishes that the supplementary disclosure document was sent to security holders on 30 January 2023 by the methods that the orders required.

Publication of notice of postponement

67 My 6 February 2023 orders required the publication of a notice in the approved form of the postponement of the scheme meetings on SMX’s ASX announcements platform and on SMX’s website.

68 The notice of the postponement was published on 6 February 2023 by the method that the orders required.

Publication of further supplementary disclosure document

69 My orders of 14 February 2023 required the publication of the further supplementary disclosure document on SMX’s ASX announcements platform and on SMX's website.

70 The affidavits of Messrs Jenshel and Alon establish that the further supplementary disclosure document was published on 14 February 2023 by the methods the orders required.

Orders about scheme meetings

71 As I have explained above, the scheme meetings were held in compliance with the orders.

Orders about return of proxy forms

72 Mr Hodkin’s affidavit explains how proxies were received and processed. It demonstrates that all the proxies were valid and effective.

Orders about advertising second hearing

73 Ms Mastroianni’s first affidavit demonstrates that each of the relevant orders in respect of the placement of advertisements was complied with.

Compliance with disclosure obligations under s 412(1)

74 Section 412(1)(a) of the Act requires, for each scheme of arrangement, the sending of an explanatory statement that explains the effect of the arrangement and sets out prescribed information and any other information that is material to the making of a decision by members whether to agree to the arrangement.

75 In this case, the explanatory statement required by s 412(1) (for both schemes) was contained in the scheme booklet as supplemented by the supplementary disclosure document and the further supplementary disclosure document.

Passing of the approval resolutions

Results of the polls

76 The results of the polls are set out above. The resolution for the share scheme was passed by 130 of 135 (96.30%) members present and voting (in person or by proxy) and 96.30% of votes cast. It follows, therefore, that the share scheme resolution passed with the majorities required by s 411(4)(a)(ii) of the Act, namely:

(1) a majority in number of members present and voting (either in person or by proxy) at the scheme meeting; and

(2) 75% of the votes cast on the resolution.

77 The resolution for the option scheme was passed by 44 of 44 (100%) of option holders present and voting (in person or by proxy) and 100% of votes cast. It further follows that the option scheme resolution passed with the majority required by s 411(4)(a)(i) of the Act, namely a majority of the option holders whose claims against SMX in the aggregate amount to at least 75% of the total amount of the claims of eligible option holders.

Voter turnout

78 As to voter turnout for the share scheme, the affidavits of Messrs Hodkin and Hofland establish:

(1) 135 shareholders (out of 827 voted on the resolution (and one abstained), that is, 16.32% of SMX's shareholders;

(2) 130,835,021 shares (out of 167,854,581 on issue) voted, that is, 77.9% of SMX's total issued shares; and

(3) five members (holding 199,411 shares) voted against the resolution, representing 3.7% of the number of shareholders who voted and 0.15% of the votes cast by shareholders at the meeting and 0.12% of SMX's entire share capital).

79 As to voter turnout for the option scheme, those affidavits establish:

(1) 44 option holders (out of 72) voted on the resolution (and none abstained), that is, 61.11% of relevant SMX option holders;

(2) 28,482,181 options (out of 32,211,716 on issue) voted, that is, 88.42% of the options eligible to vote on the option scheme; and

(3) no option holders voted against the resolution.

80 There is, as SMX submitted, “nothing out of the ordinary in the response rates for the scheme meetings”. Compare, by way of example only, Re Tatts Group Limited (No 2) [2017] VSC 770 at [67] (Sifris J) (58% of shares and 16% of shareholders), Re Skilled (No 2) [2015] VSC 805 at [18] (Robson J) (62% of shares and 14% of shareholders), and Re Think Childcare Ltd (No 2) [2021] FCA 1228 at [17]-[22] (69% of shares and 26% of shareholders). Further, as Beach J said in Re Amcor Limited (No 2) [2019] FCA 842 at [18]–[20]:

Now I would note that shareholder turnout was relatively low, although the number of shares voted as a percentage of Amcor’s total issued share capital was high. In particular:

(a) 6.70% of Amcor’s shareholders voted on the resolution; and

(b) 72.20% of shares were voted on the resolution.

But the low voter turnout at the Scheme meeting does not give rise to any concern that shareholders were deterred or did not have notice of the Scheme meeting. In this respect:

(a) except for minor procedural irregularities, there is nothing to suggest that there was any irregularity in the manner of dispatch of material to the shareholders;

(b) shareholders were provided with notice of the Scheme meeting;

(c) there is no evidence of any issue that would have deterred shareholders from voting at or from attending the Scheme meeting; and

(d) those shareholders who did vote voted overwhelmingly in favour of the Scheme.

Moreover, the comments of Santow J in Re Matine Ltd (1998) 28 ACSR 268 at 295 that “[t]he apathetic shareholder who chooses not to vote upon a scheme should not be presumed to be antagonistic to the scheme or to warrant paternalistic protection” are entirely apposite to the present context.

Conditions precedent

81 Clause 3.2 of each of the share scheme of arrangement and the option scheme of arrangement is a certification provision.

82 SMX submitted, and I agree, that none of the conditions to either scheme is such as to require proof by primary evidence of its satisfaction. Further, none of the conditions is such that its failure may adversely affect the interests of scheme participants, such that primary evidence of satisfaction is required rather than a certificate.

83 The appropriate certificates were provided to the court at the hearing last Friday, and were subsequently filed on 27 February 2023.

Section 411(17)

84 Section 411(17) of the Act provides that the court must not approve a compromise or arrangement unless it is satisfied that the compromise or arrangement has not been proposed for the purpose of enabling any person to avoid the operation of any of the provisions of Chapter 6. The provision is concerned to ensure that members are not being adversely affected by what is in substance a takeover proceeding by way of a scheme of arrangement. On the other hand, if there is produced to the court a statement in writing by ASIC to the effect that ASIC has no objection to the compromise or arrangement, the statutory obligation for the court to consider s 411(17)(a) does not arise.

85 In this case, ASIC did not produce such a statement. On the contrary, it opposed approval of the schemes.

86 However, as SMX submitted, the proposed transaction in this case could not have been achieved under the takeover provisions in Chapter 6 because it involves all of SMX’s share capital and a restructure that involves the cashless exercise of eligible options, followed by the cancellation of SMX’s share capital in exchange for shares in Empatan, which will merge with the NASDAQ-listed Lionheart. Further, in his affidavit, Mr Alon deposed as follows:

15. I am informed by Dr Prawer and believe that paragraph 411(17)(a) of the Corporations Act requires that the Court be satisfied that the Schemes have not been proposed for the purpose of enabling any person to avoid the operation of any of the provisions of Chapter 6 of the Act, which is concerned with takeovers.

16. I am SMX’s CEO. I have been involved in the proposed transaction between SMX and Lionheart since before it was first announced in July 2022. I was involved in the negotiations between SMX and Lionheart concerning the scheme implementation deed. At no stage has anyone – whether from SMX or its professional advisers, Lionheart or its professional advisers, or anyone else – suggested to me that the proposed transaction should or could proceed by way of a takeover, or that it should proceed by way of schemes of arrangement to avoid any of the takeovers provisions.

17. Further, given that Lionheart is a SPAC and any business combination it entered required the approval of its shareholders, I doubt that the proposed transaction could have proceeded by way of a takeover. To my understanding, a SPAC could not engage in a takeover, but only a business combination.

87 I am therefore satisfied, as SMX submitted, that there is nothing that suggests that either scheme has been proposed for the purpose referred to in s 411(17)(a). Accordingly, I am satisfied that the schemes have not been proposed for the purpose of enabling any person to avoid the operation of any of the provisions of Chapter 6.

ASIC’S OBJECTIONS TO THE SCHEMES

88 ASIC plays an important role in the scheme approval process, and the courts are often assisted by the role that ASIC performs in considering the scheme material. See, eg, Re SMS Management & Technology Ltd [2017] VSC 257 (Robson J). Of course, its regulatory and supervisory role does not supplant the court’s role.

89 ASIC’s interpretation of its role and approach to schemes such as those relevant here is set out in its Regulatory Guide 60: Schemes of Arrangement dated September 2020 (RG60).

90 Paragraph 60.4(d) of RG60 provides that ASIC’s role is to assist the court by helping to ensure that all matters that are relevant to the court's decision are properly brought to the court's attention before it confirms a scheme.

91 Paragraph 60.15 of RG60 also provides that ASIC will appear at the second hearing if it considers that further matters have arisen which should be raised with the court.

92 Paragraph 60.106 also provides that ASIC may appear at the second hearing if it opposes an application before the court on grounds arising out of s 411(17) where it has concerns relating to the disclosure provided or the principles set out in s 602 or we have some other reason to oppose the scheme (e.g. public policy grounds).

93 In his oral address, Mr Hibble expressed ASIC’s concerns in this way:

At the outset, your Honour, I just wanted to make it plain the focus that ASIC has in this case …

So a scheme of arrangement is a process and there are various stages with each stage having its own requirements as part of that process. And ASIC, as the regulator, has a role in monitoring and enforcing compliance with that process. So ASIC[’]s concern in this case is with the process. And, in particular, we say that the process hasn’t been properly complied with in two broad ways; firstly, that the information provided to scheme members did not comply with the relevant ASIC regulatory guides and, secondly, that the scheme members did not have adequate time to consider that relevant information …

And [SMX’s] position appears to be that the disagreements or conflicts that they have with that report can be cured by the provision of expert reports to the court. Now, ASIC doesn’t accept that that’s a legitimate resolution of the process problem. So we’re here to assist your Honour by raising our concerns about the process. And the nature of our concerns has meant that we’re here today to submit that the court should not approve the schemes.

…

But, in addition to the specific concerns I’ve already raised with you, ASIC is also concerned because this is the first SPAC scheme in Australia. And ASIC … can’t point to any authority where the court has approved a scheme at a second hearing where the independent expert has said that the scheme is not fair, not reasonable and not in the best interests of members.

94 The substance of Mr Hibble’s written submissions was as follows:

21. ASIC submits that the Court should place no weight on the [various reports of Mr Purcell and Dr Rothman] (or oral evidence adduced by their authors) because:

(a) they do not comply with the Act, the relevant ASIC Regulatory Guides or the Federal Court’s Expert Evidence Practice Notes (including the Federal Court’s Harmonised Expert Witness Code of Conduct) – ASIC submits that the net effect of this non-compliance is that the scheme members did not have enough information to enable them to assess the merits of the proposal or that some of that information may have been misleading or deceptive. Schedule A sets out the specific grounds which ASIC wishes to draw the Court’s attention as to where the Other Expert Reports are non-compliant;

(b) the scheme members did not have reasonable time to consider the proposal because the Second Supplementary Goldman Report was only made available on ASX’s Markets Announcement Platform on 14 February 2023 given that the Scheme meetings were held on 20 February 2023 that only gave Scheme members 6 days to consider the material (and 5 days to lodge proxy forms, or to amend previously lodged proxy forms), whereas paragraph 96 of RG60 provides that ASIC considers that it is generally appropriate for shareholders to be provided at least 10 days to consider any supplementary documentation distributed before being required to vote on a scheme – this is acutely relevant here where the additional material goes to the heart of the viability of the Schemes for members.

22. The Other Expert Reports were neither commissioned nor prepared on the same basis as the Goldman Reports, in particular:

(a) the First Purcell Report states that it is “…to rebut the Report submitted by Brent Goldman (“Goldman”) of Nexia Sydney Financial Solutions Pty Ltd (“Nexia Sydney”)”;

(b) the Second Purcell Report states that it is “…responding to and disagreeing with Mr Goldman’s Second Supplemental Expert Report submitted on 13 February 2023”;

(c) the First Rothman Report and the Second Rothman Report were both prepared on the basis of providing an “…economic opinion on the delisting of SMX company from ASX and its impact on the company’s valuation”

23. Given this ASIC submits that the:

(a) the net effect of the Scheme proponents approach is that the Goldman Reports and the Other Expert Reports have passed like ships in the night – the Scheme members have not been given, for example, competing expert reports prepared on the same basis which came to different conclusions;

(b) the only proper independent expert reports provided to the Scheme members and to the Court are the Goldman Reports. The Second Supplementary Goldman Report clearly opines that the Schemes are neither fair nor reasonable, and not in the best interests of Scheme members. As far as ASIC is aware, no Australian court has approved a scheme of arrangement where the independent expert has concluded the scheme is not fair and not reasonable and not in the best interests of Scheme members; and

(c) ASIC is also not aware of any previous schemes considered by an Australian Court where a scheme proponent has challenged an independent expert report obtained by it and disclosed to shareholders through the use of competing selective opinions from other experts. In this regard ASIC notes that, as far as it is aware, no concerns were raised by the Scheme proponents about the approach of the First Goldman Report or the First Supplementary Goldman Report prior to the receipt of the Second Supplementary Goldman Report.

Second Supplementary statement

24. ASIC holds concerns in relation to the content of the Second Supplementary Statement dated 14 February 2023, particularly the Directors’ [c]ritique, including that it:

(a) is not itself an expert report and does not comply with the Act, the relevant ASIC Regulatory Guides or the Federal Court’s Expert Evidence Practice Notes (including the Federal Court’s Harmonised Expert Witness Code of Conduct);

(b) did not provide reasonable grounds for various statements critiquing aspects of the Second Supplementary Goldman Report;

(c) suggests alternative conclusions as to aspects of valuation that are contrary to an expert’s assessment of ‘fairness’ and ‘reasonableness’ as set out in ASIC Regulatory Guide 111 Expert reports and as is accepted market practice in control transactions in Australia; and

(d) discloses aspects of advice received by the Company from ‘experts’ who are not appropriately licensed to provide financial product advice to shareholders in Australia, as set out in ASIC’s letter dated 9 February 2023.

25. Further, ASIC does not understand the Schemes proponents to deny that the Second Supplementary Goldman Report was required in the circumstances. That being so, the effect of the Directors’ [c]ritique is extraordinary: Scheme Members are invited to vote for the Schemes in circumstances where the relevant independent expert report (the Second Supplementary Goldman Report) is entirely disavowed by the Directors and sought to be replaced by assertions which do not comply with the Act, the relevant ASIC Regulatory Guides or the Federal Court’s Expert Evidence Practice Notes (including the Federal Court’s Harmonised Expert Witness Code of Conduct).

26. Because of this non-compliance there is a very real risk that the Directors’ [c]ritique is misleading and deceptive.

95 Although the written submission commenced with the proposition that its submissions were made for the purposes of s 411(17)(b), it was not explained to me why. Ultimately, ASIC’s submission that I should not approve the schemes was grounded in considerations of process and public policy.

THE CASE PUT BY SMX, LIONHEART AND VARIOUS SECURITY HOLDERS

96 SMX submitted that none of matters raised by ASIC is sufficient to merit the court refusing to approve the schemes.

97 Taking each in turn:

Insufficient time to consider the schemes

98 SMX submitted that ASIC’s contention that its security holders have not been given a reasonable time to consider the schemes cannot be sustained.

99 It relied on the following facts.

100 The schemes were first announced by an ASX announcement in July 2022.

101 In January 2023, security holders received the scheme booklet, which contained a comprehensive and detailed explanation of the proposed transaction, including its advantages and disadvantages, and its benefits and risks. These included the prominent disclosure of the prospect, and risks, of a high redemption rate by Lionheart stockholders.

102 The scheme booklet also disclosed that Nexia (Mr Goldman) would prepare supplementary independent expert reports, including about the effect of the redemption rate, in these terms:

The Independent Expert's Report was provided and is dated 8 October 2022. SMX has engaged the Independent Expert to further consider both any developments in relation to Lionheart and also SMX’s current finances and significant deals, and provide an updated report well prior to the Scheme Meeting, the Option Scheme Meeting and the General Meeting, all called for 1 February 2023. In addition, should there be developments in relation to redemption rates by Lionheart shareholders, which SMX anticipates would be known a number of days before the meetings, the Independent Expert will be asked to venture their opinion on this as well. Updates to the Expert's position and other information will be contained in supplementary scheme booklets once approved by the court. These will also be placed on the websites for the meetings, as detailed in the Notices sent to all Shareholders and Optionholders.

103 At the end of January 2023, SMX’s security holders duly received the supplementary disclosure document, which annexed Mr Goldman’s supplementary expert report. It referred to the 85% assumption and also stated that if a higher redemption rate occurred, a second supplementary report would be issued, as follows:

A significant assumption in our assessment of fairness is that redemptions are a maximum of 85%. The level of redemptions will not be known until just prior to the shareholder meeting to approve the Share Scheme. Should redemptions be higher than 85%, then our approach to the assessment of the fairness of the Share Scheme may change, and this may affect our opinion on the fairness of the Share Scheme. In the event that redemptions are more than 85%, we will be issuing a second supplementary report, which will supersede our opinion in this Supplementary Report.

104 Further, the supplementary disclosure document itself included, in accordance with the order of O’Bryan J, “prominent disclosure” of the prospect of a further supplementary expert report. It stated (emphasis in original):

Further, if Nexia Australia does issue a further supplementary report, SMX expects to publish the report - at the same time and on the same websites - as the information about Lionheart's final rate of redemption.

If the final redemption rate is below 85%, or if Nexia Australia decides that a further supplementary report is not required, then only information about the final rate of redemption will be provided.

Important notice

The information about Lionheart’s final rate of redemption and any further supplementary expert report by Nexia Australia WILL NOT be sent to you. Rather, you will need to obtain the information from SMX’s website (https://smx.tech/home, under the “Investor” tab) or from the ASX announcement page for SMX (https://www2.asx.com.au/markets/company/smx).

105 On 1 February 2023, SMX published an ASX announcement, containing information about the redemptions by Lionheart shareholders.

106 On 14 February 2023, SMX published the further supplementary disclosure document, which annexed the second supplementary expert report, in accordance with the orders of the court.

107 It was submitted that those facts demonstrate that the release of the second supplementary expert report “had been foreshadowed for a long time, and SMX’s securityholders had not only been informed of a possible further but also that it would be published in the manner it was. Accordingly, there can be no sensible contention that the securityholders had insufficient time to consider the schemes, in particular the possibility of a 100% Lionheart redemption rate”.

Insufficient information to assess the merits of the proposal

108 SMX next responded to ASIC’s submission that the scheme members did not have enough information to enable them to assess the merits of the proposal or that some of that information may have been misleading or deceptive because the reports prepared by Mr Purcell and Dr Rothman did not comply “with the Act, the relevant ASIC Regulatory Guides or the Federal Court’s Expert Evidence Practice Notes (including the Federal Court’s Harmonised Expert Witness Code of Conduct)”.

109 SMX submitted that the first difficulty with those contentions is that they assume that the reports prepared by Mr Purcell and Dr Rothman were provided to security holders. They were not. In those circumstances, SMX submitted, “[i]t is difficult to see why a report commissioned by a company’s board or an opinion obtained for use as expert evidence in a legal proceeding must comply with the Act or ASIC regulatory guides. Most of the provisions that ASIC cites about the content and qualifications of expert reports relate only to expert reports required to be given as part of an explanatory statement dispatched to securityholders”.

110 SMX submitted that the second difficulty with those contentions is that SMX’s security holders received a comprehensive scheme booklet containing the first independent expert report, a supplementary disclosure document annexing the supplementary independent expert report, and a further supplementary disclosure document annexing the second supplementary expert report, and that, contrary to ASIC’s contentions, SMX’s security holders received ample information with which to assess the merits of the schemes.

In the absence of previous authority, the court should not approve the schemes

111 SMX next dealt with ASIC’s submission that, because the second supplementary expert report “properly discloses” that the schemes are not fair, not reasonable and not in the best interests of members, therefore, in the absence of previous authority, the court should not approve the schemes.

112 Counsel’s written submissions included the following:

As ASIC would have it, the conclusions of the second supplementary [expert report] mean that, ipso facto, the Court should not approve the schemes. That contention cannot be sustained. It seeks to attach to an independent expert report a weight and purpose beyond that for which the Act or authority provides, ignores the views of securityholders expressed at a scheme meeting, and would suborn the role of the Court to the opinion of the independent expert. Further, it is not supported by the statute.

Clause 8303 of Schedule 8 to the Corporations Regulations 2001 (Cth) explains when an independent expert report will be required. That schedule (which applies perforce Corporations Regulation 5.1.01) prescribes the contents of the explanatory statement required by s 412(1)(a) of the Act. Clause 8303 provides:

If:

the other party to the proposed reconstruction or amalgamation of the company the subject of the Scheme has a prescribed shareholding in the company; or

a director of any corporation that is the other party to the proposed reconstruction or amalgamation is a director of a company the subject of the Scheme;

the statement must be accompanied by a copy of a report made by an expert who is not associated with the corporation that is the other party, stating whether or not, in his or her opinion, the proposed Scheme is in the best interest of the members of the company the subject of the Scheme and setting out his or her reasons for that opinion.

However, there is nothing in the Act, the Corporations Regulations or Schedule 8 that gives an independent expert report the dispositive effect for which ASIC appears to contend.

As to “previous authority”, SMX, like ASIC, has not identified a case where the Court has approved a scheme in circumstances where an independent expert has opined it (the scheme) is not fair and not reasonable. Further, there is authority that a court asked to approve a scheme will adopt a cautious approach if the independent expert has concluded that the scheme is “not fair” [citing Zenyth Therapeutics v Smith (2006) 60 ACSR 548 at 568 [114] (Dodds-Streeton J); Re PrimeQ Limited [2018] FCA 1705 at [22] (White J)].

But there is no reason in principle why the scheme cannot be approved, despite the opinion of the independent expert. There are numerous cases, for instance, where the Court has approved a scheme that the expert has said is not fair but reasonable [citation omitted]. Further, the circumstances of a particular transaction may mean that, despite a report determining that the scheme is not fair and not reasonable, scheme participants nonetheless can rationally conclude that the scheme is in their interest and vote in favour of it. In Re PrimeQ Ltd, for instance, an independent expert concluded that a share scheme was fair and reasonable, but an interrelated scheme concerning performance shares was not fair and not reasonable [citing Re PrimeQ Ltd [2018] FCA 1705 at [21]-[30] (White J)]. Justice White concluded that there were circumstances of the transaction that indicated that performance shareholders could rationally conclude that it was in their interest to vote in favour of both schemes.

Re PrimeQ Ltd involved an application to convene scheme meetings. In this case, the position is stronger because SMX's securityholders have voted to approve the schemes. Further, who is ASIC to say that the expert's opinion should gainsay the securityholders’ decision?

The Court is not bound to approve a scheme merely because it has made orders convening meetings and the statutory majorities have been achieved. But, as has been said on many occasions, the court will usually approach the task of whether to approve a scheme upon the basis that the members are better judges of what is in their commercial interests than the court [citing Re Seven Network Limited (No 3) [2010] FCA 400 at [32] (Jacobson J)] As O’Bryan J has explained, “It is not the Court's role to usurp the shareholders' decision whether to agree to a scheme. The question whether or not to accept particular consideration for shares is quintessentially a commercial matter for the members to assess…” [citing Re Australia and New Zealand Banking Group Limited [2022] FCA 1378 at [37] (O’Bryan J)]. Or as White J said in Re Pheon Pty Ltd [(1987) 47 SASR 427 at 435] “After all, it is their money which is at stake.”

Thus, a court will have regard to members' assessment of their interests as manifested in the voting at the scheme meeting, will recognise that shareholders are generally "the best judges of whether an arrangement is to their commercial advantage", and will "be reluctant to make decisions contrary to the views of security holders expressed at meetings" [citing See e.g. Re ResApp Health Ltd [2022] NSWSC 1353 at [23] and the cases there cited (Black J)].

…

Here, SMX’s securityholders voted overwhelmingly to approve the schemes. The size of the majority approving a scheme is relevant to whether the court should approve it [citing Re Cytopia Ltd (No 2) [2010] VSC 4 at [15] (Croft J); Re Westgold Resources Ltd (No 2) [2012] WASC 395 at [41]-[42] (Hall J)].

ASIC does not appear to contemplate that Mr Goldman's conclusion might not be correct, or that SMX's securityholders might take a different view of the commercial benefits to SMX and themselves of a NASDAQ listing. Here, Mr Goldman's reports contain sections identifying, and bringing to the attention of securityholders, a range of advantages and disadvantages of the schemes. But he has not quantified or valued some of those advantages -such as exposure to foreign shares, the opportunity to be listed on the NASDAQ and access to PIPE funding. The specific interests of different securityholders may be different, and they may reasonably and sensibly consider that the advantages identified are worthwhile.

Further, there can be no suggestion that the schemes were not "at least so fair and reasonable, as that an intelligent and honest man, who is a member of that class… might approve [them]". The evidence of Mr Purcell and Dr Rothman, who have more experience than Mr Goldman of NASDAQ and SPAC transactions, demonstrates the advantages and increased value of a NASDAQ listing, including a "liquidity premium" and from access to increased capital raising.

Ultimately, who is to say that Mr Goldman knows better than the securityholders? After all, it is their money which is at stake.

Non-compliance of the “Directors’ critique” with the Act, ASIC Regulatory Guides or the Harmonised Expert Witness Code of Conduct

113 SMX next dealt with ASIC’s concerns about the content of what called the “Directors’ critique”, those concerns being:

(1) it is not itself an expert report and does not comply with the Act, the relevant ASIC Regulatory Guides or the Federal Court’s Expert Evidence Practice Notes (including the Harmonised Expert Witness Code of Conduct);

(2) it did not provide reasonable grounds for various statements critiquing aspects of Mr Goldman’s further supplementary report;

(3) it suggests alternative conclusions as to aspects of valuation that are contrary to an expert’s assessment of fairness and reasonableness as set out in ASIC Regulatory Guide 111 and as is accepted market practice in control transactions in Australia; and

(4) it discloses aspects of advice received by SMX from experts who are not appropriately licensed to provide financial product advice to shareholders in Australia.

114 SMX submitted that none of those concerns had merit, as follows:

115 As to point (1), SMX submitted that section 7 of the further supplementary disclosure document (what ASIC called the Director’s critique) is not, and does not purport to be, an expert report prepared in accordance with any particular regime of rules. Accordingly, there is no requirement that it comply with the Act or the relevant ASIC Regulatory Guides. The reference to the Harmonised Expert Witness Code of Conduct was said to be “baffling” because the Code applies to witnesses giving evidence in court.

116 As to point (2), SMX submitted that ASIC’s submissions do not identify the “various statements” that are said to lack reasonable grounds, and that it overlooks the contents of the opinions from Mr Purcell and Dr Rothman.

117 As to point (3), it was likewise submitted that ASIC submissions do not identify the “alternative conclusions” or the “aspects” of valuation.

118 As to point (4) (that SMX’s Directors informed themselves by reference to US experts who do not hold Australian financial service licences) SMX submitted that it is irrelevant that neither Mr Purcell and Dr Rothman holds an AFSL because the reports were not provided to SMX's security holders, nor were their names or particulars. (SMX agreed that “[t]he position may be otherwise if either of their reports had been provided to SMX’s securityholders, because the reports might amount to provision of financial advice”). The submission continued:

More important is their experience and expertise. Mr Purcell (an American) has almost 60 years’ experience as an investment banker in the United States, including in corporate financing, mergers and acquisitions, and corporate valuations. Dr Rothman is an economist who has published a book about company valuations, which explains the mathematical and economic techniques used in corporate valuations, especially those used for ventures at developmental and early-growth stages. Both men are superbly qualified to opine about a proposed transaction involving a NASDAQ listing via a SPAC.

As well as more experience, both experts have access to more specific data than cited by Mr Goldman in his assessment of, for instance, the costs of an initial public offering on the NASDAQ. Mr Goldman, unfamiliar with SPACs and the NASDAQ, has used data from initial public offerings in attempting to determine the 'replacement cost' of listing on the NASDAQ.

The “Directors’ critique” may have been misleading or deceptive

119 SMX submits that ASIC does not identify how the so-called Directors’ critique is misleading or deceptive. Rather, it was submitted, “its complaint builds on the contentions … that the relevant part of the further supplementary disclosure document is non-compliant with the Act, ASIC regulatory guides, and the expert witness code. For the reasons already given, it was not required to”. The submission continued:

Further, given that SMX prepared and published a further supplementary disclosure document, which drew attention to the second supplementary [expert report], is difficult to see how SMX's directors have "entirely disavowed" that report, as ASIC contends.

It is true that, in section 7 of the further supplementary disclosure document, SMX's directors set out their reasons for disagreeing with parts of the second supplementary [expert report]. It is also true that, in doing so, they referred to advice they received, including from Mr Purcell and Dr Rothman. The section commenced as follows:

The directors of SMX disagree with the further supplementary expert report. They do not accept the conclusions reached, or the approach taken by, Nexia Australia in relation to several matters, including those described below.

In reaching those views, SMX directors have relied on advice, including from experts in the United States and Israel about the Schemes and the methodology used by Nexia Australia.

In doing so, the directors were doing what is required under clause 8301(a) of Schedule 8, which requires that an explanatory statement must set out (unless the company the subject of the scheme is being wound up or is under official management) "in relation to each director of the company... whether the director recommends the acceptance of the Scheme or recommends against acceptance and, in either case, his or her reasons for so recommending".

120 The submission concluded:

ASIC's position appears that directors must accept an independent expert report as holy writ - beyond comment, critique, or criticism. That position, if adopted, would not only make directors akin to Moses atop Mount Sinai, receiving commandments from above, but also (in a case like the present) denude clause 8301(a)(i) of operation and place directors in potential breach of their statutory and fiduciary duties. Can it seriously be contended that a director who disagrees with an independent expert report cannot - indeed, is not obliged to - say so, and why?

Lionheart

121 Mr Holmes made the following oral submission on behalf of Lionheart:

…

In my respectful submission, the legal and commercial relevance of an independent expert report in the scheme has been overstated in this case. The undisputed facts, your Honour, are that the shareholders were sent a Scheme Booklet as well, which hasn’t attracted terribly much attention. A lengthy Scheme Booklet that explained to them what might happen with redemptions in mid-January. On 31 January, they were sent another disclosure telling them, well, via the ASX, what the legal redemptions were – 98 per cent.

They had that information 20 days later when they turned up to a scheme meeting and voted overwhelmingly to approve the scheme. In fact, almost 78 per cent of all shares in the company were voted in favour of the scheme. That matter, in my submission, is of far more significance than debates about the reasoning process or details of the third expert report. Recalling, of course, that in the first expert report sent with the Scheme Booklet, the expert had said that if there is 100 per cent redemptions, the scheme is still fair. Not only reasonable, his conclusion was that the scheme consideration being offered fell within the value range of an SMX share, even if there were 100 per cent redemptions. So a shareholder might reasonably be thinking at the scheme meeting, well, the expert has said the opposite things himself.

…

MR HOLMES: My only point being, your Honour, that it’s very difficult, and the court should not put itself – try and put itself in the shoes of a shareholder, trying to second-guess what they might have been thinking. The relevant facts the court ought to take into account, in my submission, is that the shareholders were given disclosure about these matters.

HIS HONOUR: So you say I shouldn’t ignore the fact that the expert arrived at that other valuation of $2.16, but you say I won’t – that doesn’t – the fact that a path of reasoning hasn’t been disclosed as to how he reached at 11 cents instead is really neither here nor there. It just – it certainly doesn’t lead to the conclusion that Mr Hibble contends for. You say, well, it was open to a shareholder to say, “That’s very odd. He’s changed his mind. Well, I will place less weight on the third report” or – but as you say, I don’t mean to get inside a shareholder’s head, but ---

MR HOLMES: No.

HIS HONOUR: --- you say it’s not irrational for a shareholder to vote the way most of them did.

MR HOLMES: It’s not, and certainly if one bears in mind the test being whether an intelligent and honest person might reasonably agree to the scheme. In my submission, that doesn’t require the court … to convince itself that the expert report is defensible and … in my submission, it has been elevated beyond its role in relation to this scheme at the expense of other matters such as the overwhelming support of shareholders who knew about the redemption rate for 20 days voting in favour of the scheme. Why they might have done so, again, in my submission, is not something the court ought to try and second-guess. And the authorities are clear in this respect, and it appears that ASIC accepts that that’s the case. And the authorities support the fact that, beyond the court considering whether the scheme is such that an investor might reasonably agree, the fairness test does not permit the court to substitute the commercial judgment of the members with its own.

The authorities are all one way and very clear on that point, your Honour. And ASIC[’]s focus on the process which, in ASIC[’]s submission, is its sole focus not on the substance but on the process, has, in my submission, shifted the balance too far in terms of ASIC regulatory guides and the role they might have. And they are not law, it’s trite to say. They are guides. Whether or not they’re complied with does not determine the outcome of the court’s exercise of its discretion. And, in this instance, ASIC submitted that what shareholders weren’t given and perhaps ought to have been given were two compliant expert reports presenting opposite sides of the argument. That was the submission put. But, your Honour, here they were only given one, which was recommending against the scheme and they voted in favour of it. So what difference could it have made?

A second report telling them to vote in favour of the scheme could only have elevated the … 99 per cent closer to 100, in my submission. The final submission I want to make, your Honour, is that there has been no issue raised by ASIC or anyone else with the notice given to shareholders about today’s hearing, the purpose of that notice being for any shareholder to come along and object to approval of the scheme, be it because they have some concern about the process or they were confused about expert opinions and now they’re not sure they want to necessarily have the court approve the scheme. Of course, the only shareholders who have appeared today appear in support of the scheme. Those are the only matters I wanted to raise, your Honour.

Security holders

122 Mr Bongiorno made the following submissions on behalf of the security holders for whom and for which he appeared:

….

[Having referred to clause 8303 of the Corporations Regulations] … for present purposes, it’s absolutely critical in rejecting ASIC[’]s arguments that when in compliance with clause 8303 a company has an independent expert report placed in front of a scheme meeting, that they’re not propounding it as truth in the same way that I might seek to do so in a commercial trial in front of your Honour. It’s a requirement that is intended to inform the meeting and ventilate appropriately the issue of the transaction’s fairness.

What isn’t in clause 8303 is a requirement that the contents of the report endorse as fair and reasonable the transaction under consideration, and there is a tendency in ASIC[’]s submissions, whether stated or unstated, to elevate the status of the independent expert report to – or a favourably independent expert report as essentially a precondition to the approval of the scheme. In that connection, there is a tendency or – Mr Hibble on at least a couple of occasions, and this is throughout the written submissions, refers to the disavowal of Mr Goldman’s opinion. Mr Goldman’s opinion as contained in his third report was never avowed and it’s a mischaracterisation to frame things that way---

HIS HONOUR: Never avowed by the company?

MR BONGIORNO: No. Now---

HIS HONOUR: It was produced because there was a regulatory requirement to produce it?