Federal Court of Australia

Copeland in his capacity as liquidator of Skyworkers Pty Limited (in Liquidation) v Murace [2023] FCA 14

ORDERS

DATE OF ORDER: | 18 JANUARY 2023 |

THE COURT ORDERS THAT:

1. The statement of claim filed on 21 July 2022 (statement of claim) be struck out pursuant to r 16.21 (1) of the Federal Court Rules 2011 (Cth).

2. The plaintiffs are to pay the costs of the defendant from the commencement of the proceedings to 18 January 2023, as agreed or if agreement is not reached by 4.30 pm on Friday, 10 February 2023 on a lump sum basis pursuant to Orders 3 to 5 of these Orders.

3. By 4.30 pm on Friday, 10 February 2023, the defendant is to file and serve an affidavit constituting a Costs Summary in accordance with paragraphs 4.10 to 4.12 of the Court’s Costs Practice Note (GPN-COSTS).

4. By 4.30 pm on Friday, 24 February 2023, the plaintiffs are to file and serve any Costs Response in accordance with paragraphs 4.13 to 4.14 of the Costs Practice Note (GPN-COSTS).

5. The determination of an appropriate fixed sum figure for the defendant’s costs of the proceedings pursuant to Order 2 above, be referred to a Registrar for determination.

6. Upon condition that Order 2 of these Orders be complied with, leave be granted to the plaintiffs to file and serve an amended statement of claim pleading the plaintiffs’ claims under s 588M of the Corporations Act 2001 (Cth) in respect of so many of the alleged debts listed in the particulars to paragraph 9 of the statement of claim as the plaintiffs may be advised to pursue.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

HALLEY J:

Introduction

1 By an amended interlocutory process dated 11 November 2022, the defendant, (Mr Murace), seeks an order for summary dismissal of the proceedings pursuant to rr 26.01(1)(a) to (d) of the Federal Court Rules 2011 (Cth) (Rules). In the alternative, Mr Murace seeks an order striking out the statement of claim, in whole or in part, pursuant to r 16.21(1) of the Rules.

2 The first plaintiff, Mr Copeland, (Liquidator) is the liquidator of the second plaintiff, Skyworkers Pty Limited (in liquidation) (Company). Mr Murace is a director of the Company.

3 In these proceedings the Liquidator advances insolvent trading claims against Mr Murace under s 588G of the Corporations Act 2001 (Cth) (Corporations Act). The Liquidator seeks to rely on a presumption of insolvency pursuant to s 588E(4) of the Corporations Act by reason of a failure to keep records and in the alternative actual insolvency pursuant to s 95A of the Corporations Act.

4 At the hearing of the amended interlocutory process on 23 November 2022, the Liquidator confirmed that he was discontinuing claims that he had advanced in the proceedings against Mr Murace for breaches of his duties as a director of the Company.

5 Mr Murace relied on his affidavit sworn 11 November 2022 and an affidavit of Mr Martin Rosenblatt, his solicitor, sworn on 26 October 2022. The Liquidator relied on his affidavits affirmed on 2 June 2022, 10 October 2022 (the first 12 paragraphs) and 3 November 2022. None of the deponents was cross-examined.

6 The summary dismissal and strike out applications raise the following issues for determination:

(a) is it necessary, pursuant to s 588G of the Corporations Act, to plead the date on which a debt relied upon is alleged to have been incurred and how the debt was created;

(b) have the plaintiffs provided proper particulars of the presumed insolvency claim;

(c) have the plaintiffs provided adequate particulars of the actual insolvency claim;

(d) in all the circumstances, should the proceedings be summarily dismissed or should the statement of claim be struck out; and

(e) what conditions, if any, should be imposed on any grant of leave to file an amended statement of claim.

7 Mr Murace’s contentions in support of his summary judgment and strike out application were primarily advanced on the basis of the reasoning and conclusions of Parker J in Devine v Liu; Devine v Ho (2018) 338 FLR 208; [2018] NSWSC 1453 (Devine). In Devine, Parker J was relevantly concerned with an application for summary judgment and, in the alternative, a strike out application of a statement of claim. As in these proceedings, the liquidator in Devine sought to advance an insolvent trading case pursuant to s 588G of the Corporations Act based on both presumed insolvency by reason of a failure to keep financial records and actual insolvency.

Statutory Provisions

8 Subsection 286(1) of the Corporations Act provides:

286 Obligation to keep financial records

(1) A company, registered scheme or disclosing entity must keep written financial records that:

(a) correctly record and explain its transactions and financial position and performance; and

(b) would enable true and fair financial statements to be prepared and audited.

The obligation to keep financial records of transactions extends to transactions undertaken as trustee.

9 Subsection 588E(4) provides:

588E Presumptions to be made in recovery proceedings

…

(4) Subject to subsections (5) to (7), if it is proved that the company:

(a) has failed to keep financial records in relation to a period as required by subsection 286(1); or

(b) has failed to retain financial records in relation to a period for the 7 years required by subsection 286(2);

the company is to be presumed to have been insolvent throughout the period.

10 Section 588G relevantly provides:

588G Director’s duty to prevent insolvent trading by company

(1) This section applies if:

(a) a person is a director of a company at the time when the company incurs a debt; and

(b) the company is insolvent at that time, or becomes insolvent by incurring that debt, or by incurring at that time debts including that debt; and

(c) at that time, there are reasonable grounds for suspecting that the company is insolvent, or would so become insolvent, as the case may be; and

(d) that time is at or after the commencement of this Act.

…

(2) By failing to prevent the company from incurring the debt, the person contravenes this section if:

(a) the person is aware at that time that there are such grounds for so suspecting; or

(b) a reasonable person in a like position in a company in the company’s circumstances would be so aware.

(3) A person commits an offence if:

(a) a company incurs a debt at a particular time; and

(aa) at that time, a person is a director of the company; and

(b) the company is insolvent at that time, or becomes insolvent by incurring that debt, or by incurring at that time debts including that debt; and

(c) the person suspected at the time when the company incurred the debt that the company was insolvent or would become insolvent as a result of incurring that debt or other debts (as in paragraph (1)(b)); and

(d) the person’s failure to prevent the company incurring the debt was dishonest.

11 Subsections 588H(1) and (2) provide:

588H Defences about reasonable grounds, illness or reasonable steps

Application

(1) This section has effect for the purposes of:

(a) proceedings for a contravention of subsection 588G(2) relating to the incurring of a debt at a time (the key time); and

(b) proceedings for a contravention of subsection 588GAB(2) or 588GAC(2) relating to the disposition of a company’s property at a time (the key time); and

(c) proceedings under section 588M relating to the incurring of the debt or the disposition of the property.

Expectations and belief about company’s solvency

(2) It is a defence if it is proved that, at the key time, the person had reasonable grounds to expect, and did expect, that the company was solvent at that time and would remain solvent despite all its debts incurred, and dispositions of its property made, at that time.

12 The term “financial records” is defined in s 9 as follows:

financial records includes:

(a) invoices, receipts, orders for the payment of money, bills of exchange, cheques, promissory notes and vouchers; and

(b) documents of prime entry; and

(c) working papers and other documents needed to explain:

(i) the methods by which financial statements are made up; and

(ii) adjustments to be made in preparing financial statements.

13 Section 588M confers on a liquidator the right to recover from a director, as a debt due to the company, an amount equal to the loss or damage suffered by creditors by reason of a contravention by a director of s 588G(2) in relation to the incurring of a debt by a company. It relevantly provides:

588M Recovery of compensation for loss resulting from insolvent trading

(1) This section applies where:

(a) a person (in this section called the director) has contravened subsection 588G(2) or (3) in relation to the incurring of a debt by a company; and

(b) the person (in this section called the creditor) to whom the debt is owed has suffered loss or damage in relation to the debt because of the company’s insolvency; and

(c) the debt was wholly or partly unsecured when the loss or damage was suffered; and

(d) the company is being wound up;

whether or not:

(e) the director has been convicted of an offence in relation to the contravention; or

(f) a civil penalty order has been made against the director in relation to the contravention.

…

(2) The company’s liquidator may recover from the director, as a debt due to the company, an amount equal to the amount of the loss or damage.

Consideration

Pleading of when and how debts were incurred

14 In Devine, the principal ground advanced by the defendant’s application to strike out the insolvent trading claim was that the statement of claim did not plead the dates on which debts were alleged to have been incurred or how the debts were incurred. Justice Parker stated at [37]-[38]:

Furthermore, counsel for Mr Liu is plainly correct in submitting that the failure to plead when the debts were incurred is a fundamental flaw. The date on which the debt is incurred is an essential aspect of the claim. Unless that date is known, it is impossible to evaluate whether the Company was insolvent or whether the elements of contravention in s 588G are made out.

The question of when a debt is incurred may be a complex and contestable one. It is in my view essential that the Statement of Claim plead not only when it was that each debt was allegedly incurred but also how it was that the debt was incurred. The relevant contractual terms and the facts which give rise to the relevant debt should be pleaded so that they can be admitted or issue can be joined.

15 The debts the subject of the insolvent trading claim are pleaded in paragraph 9 of the statement of claim in the following terms:

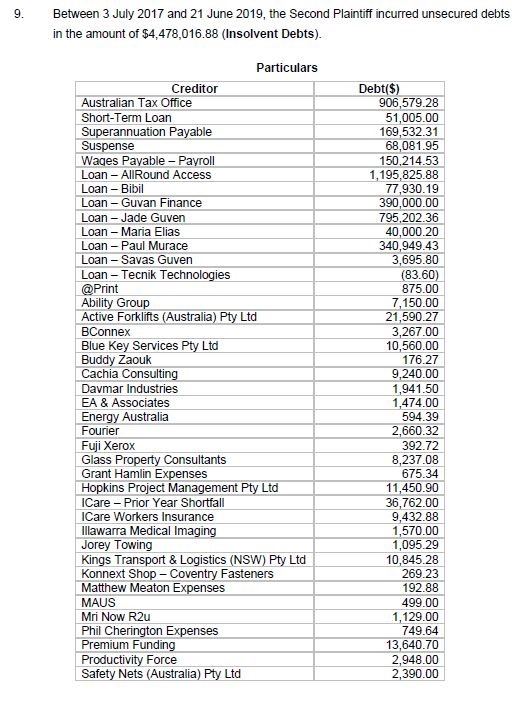

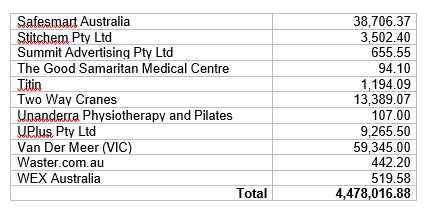

16 On 21 October 2022, the Liquidator provided an annotated copy of the table in paragraph 9 of the statement of claim to Mr Murace by way of further particulars. The annotated copy of the table included a column headed “Date of Debt Incurred” and for seven of the pleaded debts identified a range of dates in which it was alleged the debt was incurred and for four of the debts a specific date. No date nor date range was supplied for the other 40 debts in the table (not including the alleged debt recorded as “Loan - Tecnik Technologies” which is stated to have a credit balance of $83.60).

17 Mr Murace submits that he is prejudiced by the failure of the Liquidator to plead the specific dates each debt arose and the circumstances giving rise to each debt as he cannot be sure of the case he has to meet. In particular, Mr Murace submits that the absence of dates means it is not possible for him to plead and rely on the defences provided in s 588H and s 588GA of the Corporations Act as those sections require consideration to be given to specific circumstances at the time each debt arose.

18 The Liquidator submits that the decision in Devine can be distinguished on the basis that in these proceedings, evidence has not yet closed and the information in the table represents all the information that was available in the Xero accounting software used by the Company. He submits that the table in paragraph 9 of the statement of claim is the best that could be provided given that Mr Murace had not produced any other books or records of the Company.

19 I do not accept that Devine can relevantly be distinguished. Whether evidence is closed or not does not excuse the need to plead essential elements of a cause of action. Nor does any inability or failure to identify essential elements of a cause of action, irrespective of the reasons for that inability or failure, relieve a plaintiff seeking to pursue a claim from pleading sufficient material facts to establish the necessary elements of a cause of action.

20 The practical difficulties confronting liquidators in pleading and providing adequate particulars of insolvent trading cases, given the often incomplete and limited financial records of companies provided to them, are readily understandable. It is not sufficient, however, to identify only the creditor and the amount of the debts the subject of the alleged insolvent trading. As Parker J made clear in Devine at [37]-[38], if a liquidator seeks to bring proceedings for insolvent trading, it is essential for them to identify the date or dates at which the debt was incurred and how it is alleged the debt arose. In my view, the degree of specificity to satisfy the second requirement depends on the nature of the debt. A loan from a related party may well require a more fulsome explanation than a debt incurred to a supplier for the acquisition of goods or services in the usual course of trading.

21 It is no answer to these requirements to contend that the information is not available. If a Liquidator does not know when a debt was incurred and how it arose, it would seem axiomatic that the alleged debt could not be relied upon for the purpose of an insolvent trading claim.

22 As currently pleaded, the Liquidator alleges that all the debts identified in the table in paragraph 9 of the statement of claim were incurred in the period between 3 July 2017 and 21 June 2019 (Relevant Period). That period commences on the date the company was registered and concludes on the date the Deputy Commissioner of Taxation filed the originating process seeking the order for the winding up of the Company.

23 I accept that if the Liquidator is successful in establishing that the Company was insolvent at all times during the Relevant Period, then from the Liquidator’s perspective, an inability to establish the specific date on which each debt was incurred may not be material. The same cannot be said for Mr Murace. He may well be in a position to establish a defence pursuant to s 588H or s 588GA of the Corporations Act for some dates but not all dates within the Relevant Period.

24 Moreover, if the Liquidator is only successful in establishing that the Company was insolvent at certain dates within the Relevant Period, none of the alleged debts could be relied upon unless the specific date or dates on which they are alleged to have been incurred has been identified.

25 As explained above, the further particulars provided by the Liquidator only provide specific dates for which four of the alleged debts were incurred.

26 I am therefore satisfied that the pleading of the debts in paragraph 9 of the statement of claim that are alleged to give rise to the insolvent trading claim advanced is inadequate and the paragraph should be struck out.

Particulars of presumed insolvency claim

27 The presumed insolvency claim is advanced in the following terms in paragraph 7 of the statement of claim:

7. The Second Plaintiff failed to:

A. keep financial records as required by section 286(1) CA; and/or

B. retain financial records for the seven years required by section 286(2) CA,

in respect of the whole of the period from 3 July 2017 until 21 August 2019, and as a consequence, pursuant to section 588E(4) CA, the Second Plaintiff is presumed to have been insolvent throughout that period.

28 The Liquidator has not provided further particulars of the presumed insolvency claim but in his affidavit affirmed on 3 November 2022 he states:

7. In my Solvency Report, I reached the conclusion that the Company was presumed to be insolvent since the Company’s incorporation on 3 July 2017 on the basis that it failed to keep financial records for a period as required by section 286 of the Corporations Act 2001 (Cth) (Act).

8. In the Solvency Report at section 3.1.2 (at pages 29-30 of BC1), I noted further that, in my opinion, the Company should have at least maintained the following records:

(a) File server;

(b) Project contracts;

(c) Project records;

(d) Loan agreements;

(e) Sale of business agreement;

(f) Correspondence in relation to the sale of the business;

(g) Employee agreements;

(h) Employee information; and

(It) outstanding creditors information.

9. Mr Murace, as the sole director of the Company from 10 November 2017 onwards, failed to supply any books and records of the Company to me.

10. In addition to those documents, I would have expected Mr Murace to produce, amongst other documents, a balance sheet, a profit and loss statement and a profit and loss account as well as the documents supporting those figures. I also would have expected to see completed tax returns, BAS, verified financial statements and a detailed debtors and creditor’s ledger.

29 Justice Parker addressed the issue of the particulars necessary to support a presumed insolvency claim pursuant to s 588E(4) in Devine at [56]-[57] where he stated:

It must also be remembered that the section is not contravened simply because the Company failed to maintain financial records over a period of time. The failure to keep records must have had one of the consequences specified in the section. There are at least five possibilities. The Company may have failed to keep financial records which (a) correctly recorded and explained its transactions over the period; or (b) correctly recorded and explained its financial position over the period; or (c) correctly recorded and explained its financial performance over the period; or (d) would enable true and fair financial statements for the period to be prepared; or (e) would enable such statements to be audited.

In my view, proper particulars of the presumed insolvency allegation would require the identification of which of these alternatives are relied upon; and, for each alternative, the particular records whose absence is relied upon to sustain the allegation. The particulars so far provided are nothing more than a list of allegedly missing records which might or might not relate to one or other of these alternatives. Some other categories (for example, “documentation pertaining to any litigation or pending potential litigation”) are completely obscure. In other cases, it is clear that Mr Devine has some records, but what is missing is not specified. Given that Mr Devine has the “banking records”, it is not clear how other categories of records (for example, “cheque payment stubs”) makes any difference. In my view the particulars are clearly inadequate.

30 While I accept that it may well be necessary for a plaintiff to identify which of the five possibilities identified by Parker J are relied upon, in many cases each of the five possibilities are advanced. Further, I am satisfied that in many cases there is a considerable overlap in the material that would be relied upon to make good each possibility. By way of example, financial records that correctly record and explain transactions over a period would also be necessary to enable true and fair financial statements for the period to be prepared and in turn would be required to enable those statements to be audited.

31 Further, the identification in the Liquidator’s affidavit, affirmed on 3 November 2022, of the records that the Company failed to keep goes a considerable way to providing a meaningful particularisation of the presumed insolvency claim.

32 Nevertheless, the presumed insolvency claim as currently pleaded in paragraph 7 of the statement of claim fails to identify which of the five possibilities in s 588G of the Corporations Act are advanced. Nor does it identify which records are relied upon to support each possibility relied upon. Moreover, particulars of allegations in a statement of claim should be provided in the pleading itself or in discrete correspondence by way of the provision of further particulars rather than in an affidavit relied upon for an interlocutory application.

33 I am satisfied that the pleading of the implied insolvency claim advanced in paragraph 7 of the statement of claim is inadequate and should be struck out.

Particulars of actual insolvency claim

34 The actual insolvency claim is pleaded in paragraph 8 of the statement of claim in these terms:

8. Further or in the alternative to the preceding paragraph, the Second Plaintiff was insolvent within the meaning of section 95A CA from 3 July 2017 to 21 August 2019 because:

A. the Second Plaintiff was unable to pay its debts as and when they fell due and payment;

B. the Second Plaintiff had insufficient cash to meet its current liabilities;

C. the Second Plaintiff did not have assets which were sufficiently liquid or readily realisable such that the Second Plaintiff could have relied on them to meet its liabilities as and when they became due and payable;

D. the Second Plaintiff was balance sheet insolvent;

E. the Second Plaintiff had traded at a loss;

F. the Second Plaintiff had recorded continuous current liquidity ratio below 1;

g. the Second Plaintiff had overdue and unpaid Commonwealth and State Taxes;

h. the Second Plaintiff had no access to external funding or support;

i. the Second Plaintiff failed to make required statutory lodgements and meet statutory liabilities;

j. there were demands issued and default judgments granted against the Second Plaintiff; and

k. the Second Plaintiff had creditors unpaid outside trading terms.

Particulars

i. Solvency Report of Brendan Copeland dated 27 October 2020

35 The Liquidator has provided the following further particulars of the actual insolvency claim:

8 Skyworkers was insolvent in at least the following ways:

(a) from its inception for failing to maintain books and records; and/or

(b) on a cash flow basis for being unable to pay its ATO liability from at least 21 September 2017;

(c) the balance sheet showed deficits from December 2017;

(d) the profit and loss statement demonstrates it was operating as a loss from October 2017;

(e) on a working capital deficiency basis from February 2018 onwards; and

(f) on a net asset deficiency basis from 22 July 2017.

36 Unlike for a case of presumed insolvency, Parker J concluded that a claim of actual insolvency pursuant to s 95A of the Corporations Act does not normally require further particularisation. His Honour stated in Devine at [52]:

In my view, an allegation of actual insolvency under s 95A does not usually require any further particularisation. To sustain the allegation requires establishing that the company is unable to pay its debts as and when they fall due. But this would not usually require the particularisation, as at the date of alleged insolvency, of all of the Company’s debts and the dates on which those debts fell due. These would usually be matters of evidence.

37 Mr Murace submits that the particulars of the actual insolvency claim in paragraph 8 of the statement of claim is nothing more than “a boilerplate list of potential indicia of insolvency” without any particular application to the Company.

38 I respectfully agree with Parker J that an allegation of actual insolvency under s 95A of the Corporations Act does not usually require further particularisation. The question of whether a company was able to meet its debts as and when they fell due at a particular date is essentially a matter for evidence. In any event, I am satisfied that the further particulars provided by the Liquidator go well beyond any alleged boilerplate list of potential indicia of insolvency with no particular application to the Company.

39 I am satisfied that the indicia of the actual insolvency contention in paragraph 8 of the statement of claim are adequately pleaded but the contention is still otherwise dependent on an adequate pleading of the debts that are alleged to have been incurred.

Summary dismissal or striking out of statement of claim

40 Mr Murace seeks an order for summary dismissal of the proceedings pursuant to rr 26.01(1)(a) – 26.01(1)(d) of the Rules, which provides for the following:

(1) A party may apply to the Court for an order that judgment be given against another party because:

(a) the applicant has no reasonable prospect of successfully prosecuting the proceeding or part of the proceeding; or

(b) the proceeding is frivolous or vexatious; or

(c) no reasonable cause of action is disclosed; or

(d) the proceeding is an abuse of the process of the Court; or

(e) the respondent has no reasonable prospect of successfully defending the proceeding or part of the proceeding.

41 The Court also has power to dismiss proceedings under s 31A of the Federal Court of Australia Act 1976 (Cth) (Act). Section 31A relevantly provides:

31A Summary judgment

…

(2) The Court may give judgment for one party against another in relation to the whole or any part of a proceeding if:

(a) the first party is defending the proceeding or that part of the proceeding; and

(b) the Court is satisfied that the other party has no reasonable prospect of successfully prosecuting the proceeding or that part of the proceeding.

(3) For the purposes of this section, a defence or a proceeding or part of a proceeding need not be:

(a) hopeless; or

(b) bound to fail;

for it to have no reasonable prospect of success.

42 Although the grounds for summary judgment under r 26.01 of the Rules range more widely than those stated in s 31A of the Corporations Act, the authorities on s 31A are useful in considering the application of r 26.01 of the Rules: Construction Forestry Mining & Energy Union v Rio Tinto Coal Australia Pty Ltd [2014] FCA 462 at [30] (Flick J); Leica Geosystems Pty Ltd v Koudstaal [2012] FCA 1337 at [16] (Collier J).

43 It is not possible to adopt any paraphrase of the expression “no reasonable prospect of success” as a sufficient explanation of its operation or to define its content. In the context of s 31A it has been said that it is necessary to give full weight to the expression as a whole, recognising that the power to dismiss an action summarily is not to be exercised lightly but also the evident legislative purpose, as revealed by the text of the provision, would be defeated if its application was read as being confined to cases of a kind that fell within earlier, different, procedural regimes governing the summary dismissal of proceedings: Spencer v The Commonwealth of Australia (2010) 241 CLR 118; [2010] HCA 28 at [58]-[60] (Hayne, Crennan, Kiefel and Bell JJ).

44 The moving party also bears the onus of establishing that the other party has no reasonable prospect of success but once a prima facie case to that effect has been established, the opposing party must respond by pointing to specific factual or evidentiary disputes that make a hearing necessary, general or non-particularised denials are not sufficient: Jefferson Ford Pty Ltd v Ford Motor Co of Australia Limited (2008) 167 FCR 372; [2008] FCAFC 60 at [127] (Gordon J).

45 Mr Murace submits that in the 18 months since the Liquidator provided him with a table of alleged debts incurred by the Company, at the time it was insolvent, the Liquidator has made no attempt to improve his claims. Mr Murace somewhat colourfully submits that:

He merely cut and paste this table into the pleading, which in our respectful submission, he should have understood was entirely deficient. And we say that that should work against him in terms of your Honour’s discretion to summarily dismiss the claim if your Honour decides that it ultimately is deficient. [T13.9-13]

46 Mr Murace submits that the Liquidator’s failure to improve the claim, together with the concession made by the Liquidator that the information available does not enable the claim to be pleaded more specifically, is sufficient to establish that the claim should be dismissed. The submission is advanced on the basis that given this failure and concession, the insolvent trading case has no reasonable prospects, no reasonable cause of action is disclosed and it is frivolous and an abuse of process to pursue the insolvent trading case, particularly as the Liquidator has had Devine expressly brought to his attention.

47 I do not accept that an order for summary dismissal should be made at this stage of the proceedings. Such an order would be premature. The proceedings were not commenced until 3 June 2022. Mr Murace sought further particulars of the statement of claim on 12 October 2022. The specific complaints now advanced by the Liquidator were first raised with the Liquidator on 18 October 2022. Further, particulars were provided by the Liquidator on 21 October 2022 and additional particulars were in effect provided in the Liquidator’s affidavit affirmed on 3 November 2022. The particulars provided address some, but certainly not all of the specific complaints raised by Mr Murace. I am satisfied that there is a reasonable prospect, given the further particulars provided, that at least some debts could be pleaded and particularised with sufficient precision to disclose a reasonable cause of action that had reasonable prospects of success. Those conclusions preclude any finding, at this stage at least, that the proceedings are frivolous or an abuse of process.

48 In the alternative, Mr Murace seeks an order striking out the statement of claim, in whole or in part, pursuant to r 16.21 of the Rules, which provide as follows:

16.21 Application to strike out pleadings

(1) A party may apply to the Court for an order that all or part of a pleading be struck out on the ground that the pleading:

(a) contains scandalous material; or

(b) contains frivolous or vexatious material; or

(c) is evasive or ambiguous; or

(d) is likely to cause prejudice, embarrassment or delay in the proceeding; or

(e) fails to disclose a reasonable cause of action or defence or other case appropriate to the nature of the pleading; or

(f) is otherwise an abuse of the process of the Court.

49 Mr Murace does not rely on a particular subsection in r 16.21 of the Rules. I consider the most relevant subsections in r 16.21 of the Rules to be subsections (e) and (f).

50 The Court’s power to strike out pleadings that disclose no reasonable cause of action should be exercised with caution and only where clearly appropriate. The relevant principles are summarised by McKerracher J in Christou v Stantons International Pty Ltd [2010] FCA 1150 at [3]-[5].

51 The question of what amounts to an abuse of process is broadly construed and context specific: Batistatos v Roads and Traffic Authority (NSW) (2006) 226 CLR 256; [2006] HCA 27 at [9]. It is an abuse of process to maintain an action which is doomed to fail: Walton v Gardiner [1993] HCA 77; (1993) 177 CLR 378 at 393.

52 I am satisfied that an order should be made striking out the statement of claim. The only remaining cause of action sought to be pursued by the Liquidator is the insolvent trading claim against Mr Murace. That claim depends on pleading and establishing specific debts that were incurred at times when the Company was insolvent. The identification of the debts relied upon in paragraph 9 of the statement of claim is inadequate for the reasons explained above. In the absence of an adequate pleading of the debts that were alleged to have been incurred, no reasonable cause of action is disclosed.

Imposition of conditions for leave to re-plead

53 Mr Murace seeks an order that if the statement of claim is struck out that the plaintiffs should be ordered to pay forthwith all of Mr Murace’s costs from the commencement of the proceedings. In addition, he seeks an order to the effect of that foreshadowed by Parker J in Devine at [158] in these terms:

What I propose to do is to require that Mr Devine pay a sum of money on account of the costs which are the subject of the order. If the parties cannot agree on the amount, I will make a determination. This will give Mr Liu and Ms Ho a sum of money to cover costs that have been wasted so far without the complication of having to conduct an assessment. It will be a term of the leave to re‐plead that this amount be paid within a suitable period, say 28 days, as a condition of any grant for leave to re‐plead. That order will also include, in Ms Ho’s case, the costs of the transfer application and the sum to be paid by the liquidator will need to reflect that.

54 The Liquidator submits that he should be given leave to re-plead his insolvent trading case on the basis that an order should be made that he pay the costs thrown away by reason of the re-pleading. He otherwise submits that the appropriate order is that each party bear their own costs of the hearing of the amended interlocutory process because although Mr Murace had initially sought summary judgment “no submissions were realistically made about summary judgment”.

55 The Court has a broad discretionary power to award costs pursuant to s 43(2) of the Corporations Act. The discretion must be exercised judicially, not arbitrarily or capriciously, having regard to the relevant principles and the justice of the case in all the circumstances and cannot be exercised on grounds unconnected with the litigation: Summers v Repatriation Commission (No 2) [2015] FCAFC 64 (Summers) at [14] (Kenny, Murphy and Beach JJ), citing Trade Practices Commission v Nicholas Enterprises Pty Ltd and Others (No 3) (1979) 42 FLR 213, 219 (Fisher J); InterPharma Pty Ltd v Hospira, Inc (No 4) [2018] FCA 45 (InterPharma) at [8] (Kenny J).

56 Mr Murace has succeeded in his application to strike out the statement of claim but failed to obtain an order for summary dismissal of the proceedings. In his reply submissions, Mr Murace confirmed that he did press his application for the proceedings to be summarily dismissed. The strike out application, however, remained at all times the central focus of the hearing of the amended interlocutory process. That application was successful. I am satisfied that costs should therefore follow the event.

57 I consider that the appropriate costs order should be that the plaintiffs pay Mr Murace’s costs from the commencement of the proceedings given that the whole of the statement of claim is to be struck out. The only material costs that would have been incurred to date by Mr Murace would have been limited to the consideration of the statement of claim, requests for particulars of the statement of claim and the preparation and hearing of the amended interlocutory process seeking to have the statement of claim struck out or for summary judgment.

58 Further, I am satisfied that the grant of leave to the plaintiffs to file an amended statement of claim should be made conditional on the payment of Mr Murace’s costs, as agreed, or if not agreed, on a lump sum basis by a Registrar of the Court. The costs incurred to date by Mr Murace have effectively been wasted as the plaintiffs, to put it colloquially, will have to start again.

Disposition

59 The statement of claim is to be struck out.

60 The plaintiffs are to pay the costs of Mr Murace from the commencement of the proceedings to the date of the order striking out the statement of claim.

61 The plaintiffs are to be granted leave to file and serve an amended statement of claim, subject to their compliance with the costs order.

I certify that the preceding sixty-one (61) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Halley. |

Associate: