Federal Court of Australia

Australian Energy Regulator v Origin Energy Electricity Ltd [2022] FCA 802

ORDERS

DATE OF ORDER: |

THE COURT NOTES THAT:

For the purposes of the declarations and orders that follow, the relevant State/Territory energy laws are referred to as follows:

(a) NERL means Schedule 1 to the National Energy Retail Law (South Australia) Act 2011 (SA) (SA Act), which contains the uniform energy law known as the National Energy Retail Law;

(b) Retail Laws means the Retail Law ACT, Retail Law NSW, Retail Law QLD and Retail Law SA as defined below;

(c) Retail Rules means the National Energy Retail Rules made pursuant to s 238 of the Retail Law SA and adopted in the relevant State/Territory energy laws referred to below;

(d) Retail Law ACT means the National Energy Retail Law (ACT), which, by virtue of s 6 of the National Energy Retail Law Act 2012 (ACT) (ACT Act), applies the NERL in the Australian Capital Territory with the modifications set out in the ACT Act. Sections 6, 7 and 9 of the Retail Law ACT apply the Retail Rules in the Australian Capital Territory;

(e) Retail Law SA means the National Energy Retail Law (South Australia), which, by virtue of s 4 of the SA Act, applies the NERL in the State of South Australia as implemented by the SA Act. Sections 2, 3 and 15 of the Retail Law SA apply the Retail Rules in the State of South Australia;

(f) Retail Law NSW means the National Energy Retail Law (NSW), which, by virtue of s 4 of the National Energy Retail Law (Adoption) Act 2012 (NSW) (NSW Act), applies the NERL in the State of New South Wales with the modifications set out in Sch 1 of the NSW Act. Sections 2, 3 and 15 of the Retail Law NSW apply the Retail Rules in the State of New South Wales; and

(g) Retail Law QLD means the National Energy Retail Law (Queensland), which, by virtue of s 4 of the National Energy Retail Law (Queensland) Act 2014 (QLD Act), applies the NERL in the State of Queensland with the modifications set out in the schedule to the QLD Act or as prescribed by regulation under s 12 of the QLD Act. Sections 2, 3 and 15 of the Retail Law QLD apply the Retail Rules in the State of Queensland.

For the purposes of the declarations and orders that follow, the respondents are referred to as follows:

(a) the first respondent, Origin Energy Electricity Ltd (ACN 071 052 287), is referred to as Origin Energy;

(b) the second respondent, Origin Energy Retail Ltd (ACN 078 868 425), is referred to as Origin Retail;

(c) the third respondent, Origin Energy LPG Ltd (ACN 000 508 369), is referred to as Origin LPG;

(d) the fourth respondent, Sun Retail Pty Ltd (ACN 078 848 549), is referred to as Sun Retail; and

(e) the fifth respondent, OC Energy Pty Ltd (ACN 144 655 514), is referred to as OC Energy,

(referred to together as Origin).

THE COURT DECLARES THAT:

1. In the period from March 2019 to 6 October 2021 in the case of the respondents excluding OC Energy and in the period from September 2019 to 6 October 2021 in the case of OC Energy, Origin automated aspects of its ‘Power On Program’ (Automated System) and, by use of the Automated System:

(a) proposed to increase the amount of payment plan instalments of certain hardship customers within certain thresholds set by Origin’s system (the Threshold Amount);

(b) sent an SMS to those customers advising of the change and stating they should call Origin if the revised amount was not affordable; and

(c) automatically cancelled those customers’ existing payment plans and established new plans with increased instalment amounts, if they had not called Origin three days after the SMS was sent,

and thereby breached:

(d) section 43(2)(c) of the Retail Laws because, in respect of those customers, Origin failed to maintain and implement, as relevant, paragraphs 2.2 and 3.1 of Origin’s Hardship Policy in effect from 12 September 2019 (Third HP) and paragraphs 2.2 and 3.1 of OC Energy’s Hardship Policy in effect from 12 September 2019 (OC Energy HP) (in respect of 3,228 customers in total); and

(e) section 50(2) of the Retail Laws and rule 72(1) of the Retail Rules because each new automatically established payment plan was established without having regard to the relevant customer’s capacity to pay (in respect of 4,183 customers in total).

2. In the period from January 2018 to October 2021 in the case of the respondents excluding OC Energy, and in the period from September 2019 to October 2021 in the case of OC Energy, Origin, by use of the Automated System:

(a) automatically cancelled the payment plans of hardship customers who did not pay at least 90% of an instalment within four business days after the due date for that instalment; and

(b) if the cancelled payment plan was the hardship customer’s first plan cancelled for non-payment in the preceding 12 months, automatically and unilaterally established a new payment plan on the same terms as the cancelled payment plan,

and thereby breached:

(c) section 43(2)(c) of the Retail Laws because, in respect of those customers, Origin failed to maintain and implement, as relevant, paragraphs 4.6 and 5.1 of Origin’s Hardship Plan in effect from October 2014 to 26 November 2018 (First HP), Origin’s Hardship Plan in effect from 26 November 2018 to 12 September 2019 (Second HP) and paragraphs 2.2 and 3.1 of the Third HP and the OC Energy HP; and

(d) section 50(2) of the Retail Laws and rule 72(1) of the Retail Rules, because each new automatically established payment plan was established without having regard to the relevant customer’s capacity to pay.

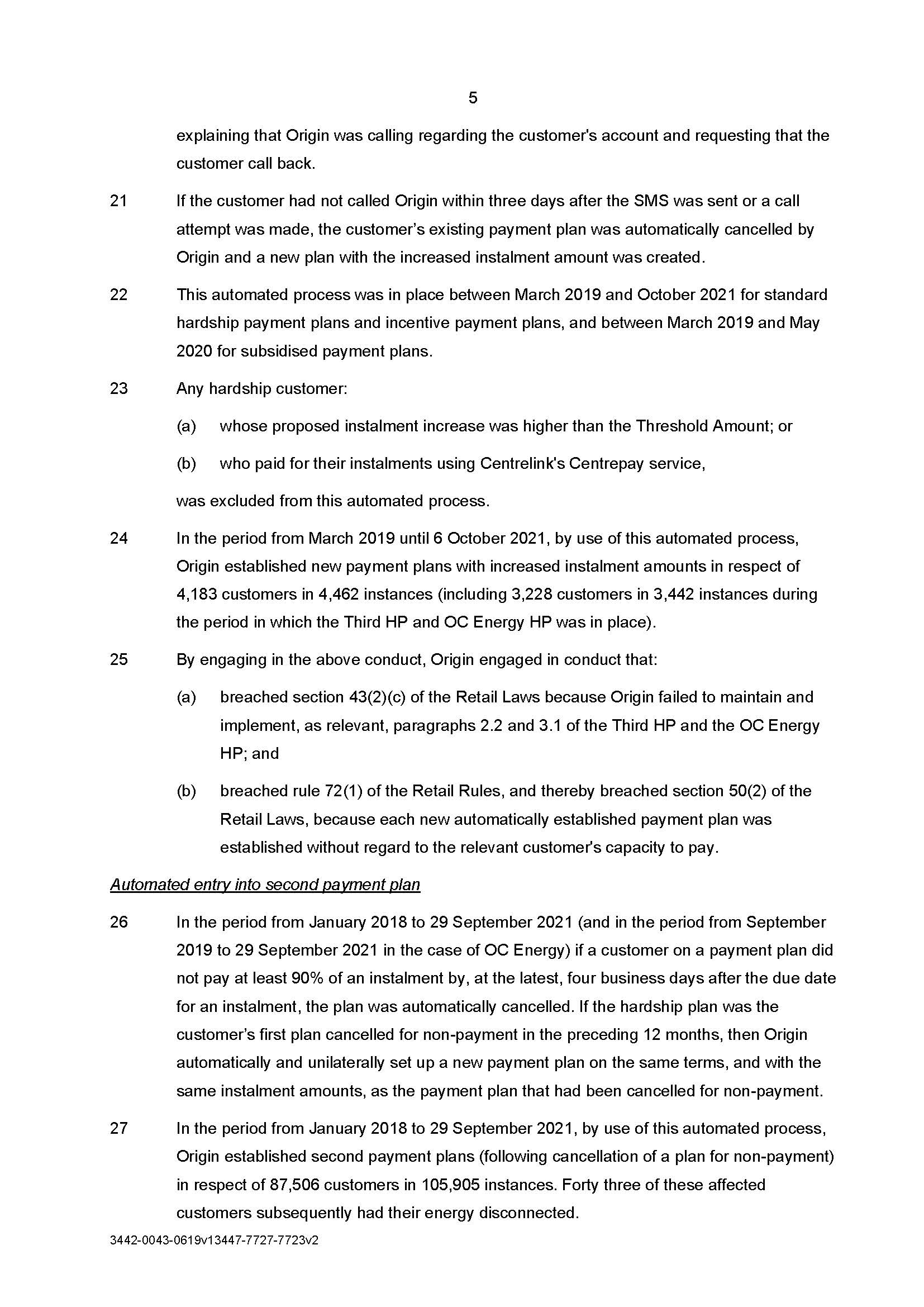

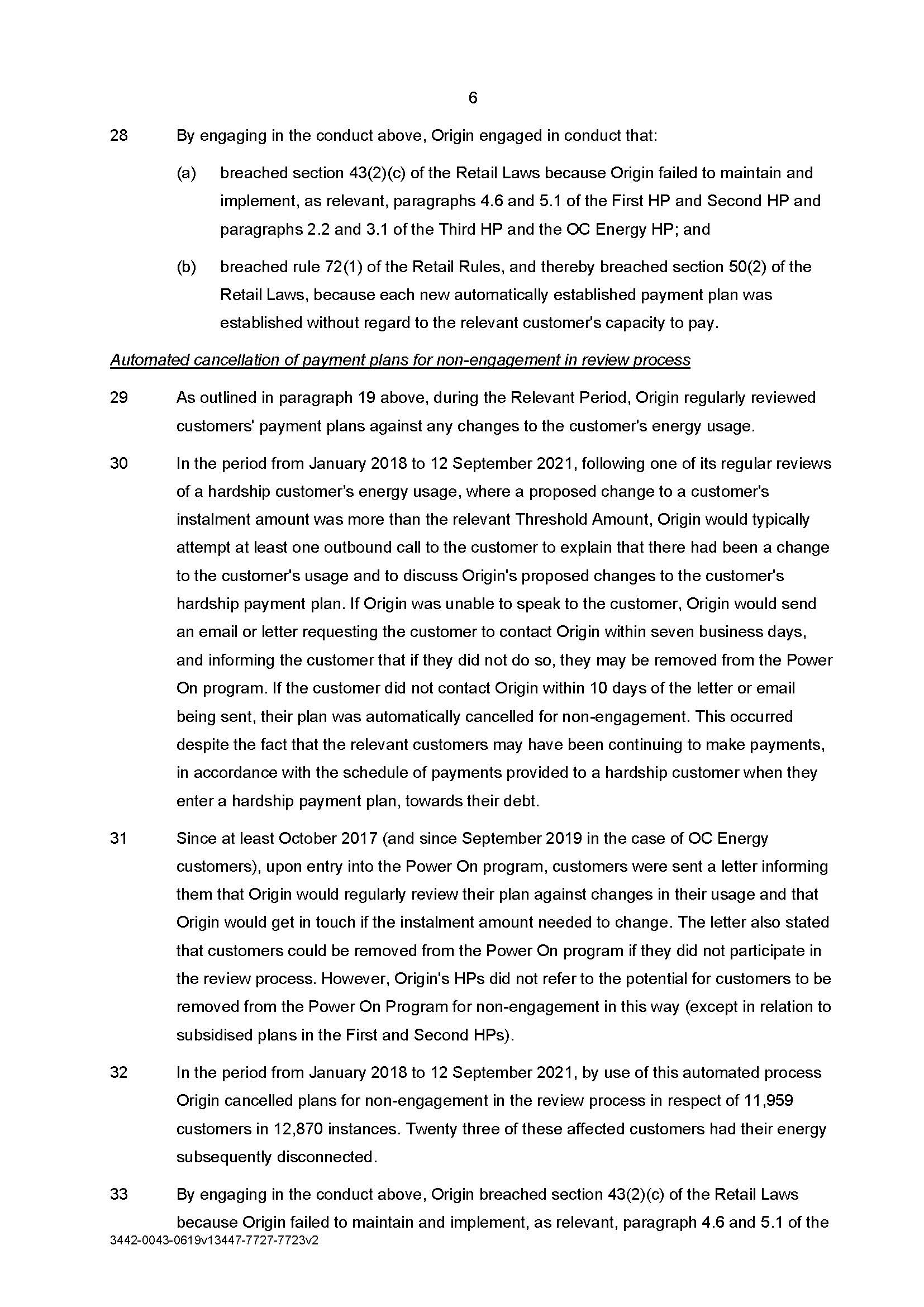

3. In the period from January 2018 to 12 September 2021, Origin (with the exception of OC Energy), by use of the Automated System:

(a) proposed to increase the amount of payment plan instalments of certain hardship customers by more than the relevant Threshold Amount;

(b) attempted an outbound call to those customers and, if Origin was not able to speak to a customer, sent an email or letter advising the customer to contact Origin within 7 business days and informing the customer that if they did not do so, they may be removed from the Power On Program; and

(c) if the customer did not contact Origin within 10 days of the letter or email being sent, automatically cancelled the customer’s payment plan for non-engagement, notwithstanding the fact the customer may have been continuing to make payments towards their debt,

and thereby breached:

(d) section 43(2)(c) of the Retail Laws because, in respect of those customers, Origin failed to maintain and implement, as relevant, paragraphs 4.6 and 5.1 of the First HP and Second HP (save where a customer was on a subsidised plan) and paragraph 2.5 of the Third HP.

4. In relation to each of the 18 customers referred to in Confidential Schedule 1 to the Amended Concise Statement, Origin Energy, Origin Retail or Origin LPG, as relevant, breached one or more of the following sections of the Retail Laws (depending on the location of the customer) and/or the Retail Rules:

(a) section 43(2)(c) of the Retail Laws by failing to maintain and implement its hardship policy by engaging in the conduct described at paragraphs 1 to 3 above;

(b) section 46 of the Retail Laws and rule 71(1) of the Retail Rules by failing to inform the hardship customer of Origin’s hardship policies;

(c) sections 50(1) and 50(2) of the Retail Laws, by failing to offer and apply a payment plan to the hardships customer;

(d) rule 72(1) of the Retail Rules, by failing to have regard to the customer’s capacity to pay in establishing a payment plan for the customer;

(e) rules 107(2), 111(2) and/or 116(1)(d) of the Retail Rules by wrongfully arranging for the de-energisation of the customer’s premises or residential customers experiencing payment difficulties who had not been offered two payment plans in the 12 months prior to Origin arranging the de-energisation, or were adhering to a payment plan; and/or

(f) section 47 of the Retail Laws, by failing to give effect to the general principle that de-energisation of premises of a hardship customer due to inability to pay energy bills should be a last resort option.

THE COURT ORDERS THAT:

5. Origin must:

(a) within 120 days of these orders, establish a compliance and training program that is specifically designed to:

(i) ensure an understanding and awareness of its responsibilities and obligations in relation to dealing with hardship customers and customers experiencing financial difficulties, with particular emphasis on the requirements of sections 43(2)(c), 46, 47, 50(1) and 50(2) of the Retail Laws, and rules 71(1), 72(1), 107(2), 111(2) and 116(1)(d) of the Retail Rules; and

(ii) ensure that the relevant internal operations of its business comply with sections 43(2)(c), 46, 47, 50(1) and 50(2) of the Retail Laws, and rules 71(1), 72(1), 107(2), 111(2) and 116(1)(d) of the Retail Rules;

(b) at its own expense, maintain and administer the compliance and training program referred to in sub-paragraph (a) above, for a period of three years;

(c) at its own expense, appoint a suitably qualified compliance professional with expertise in the national energy laws, who is independent and whose appointment has been approved by the AER, to conduct a review of the implementation and effectiveness of the compliance and training program referred to in sub-paragraph (a) above annually for three years, commencing 12 months after the date of these orders and to prepare a written report to be provided to Origin within 60 days of the commencement of each review (the Reviewer).

The appointed Reviewer may be replaced by Origin if necessary, with the prior approval of the AER;

(d) use its best endeavours to provide the Reviewer with access to all sources of information within the possession, power or control of Origin and its related bodies corporate that are relevant to the review;

(e) within 30 days after receiving the Reviewer’s written report provide a copy of that report to the AER; and

(f) implement promptly and with due diligence any recommendations made by the Reviewer (unless the AER consents to a request by Origin not to do so, acting reasonably), and advise the AER in writing of the implementation.

6. For the purposes of paragraph 5(c), Origin must ensure that the Reviewer is independent, by reason that, he or she:

(a) did not design or implement the compliance and training program referred to in paragraph 5(a);

(b) is not a current employee, contractor or director of Origin or any related body corporate, and has not been an employee, contractor or director of Origin or any related body corporate in the five years preceding the date of these orders; and

(c) has no significant shareholding or other interests in Origin or its related bodies corporate.

7. Origin must, for three years from the date of these orders or within the period specified, take the following actions and adopt the following practices designed to prevent the recurrence of the breaches of the Retail Laws and Retail Rules which are the subject of declarations in this proceeding:

(a) within 90 days of the date of these orders, appoint a suitably qualified person as a compliance officer to be responsible for compliance of the de-energisation process implemented by Origin in relation to hardship customers or residential customers who have informed Origin that they are experiencing payment difficulties, with the requirements of these orders;

(b) ensure that, after the appointment of the compliance officer, that role remains filled by a suitably qualified person for at least three years from the date of these orders;

(c) design, implement and maintain in operation a process to be completed by Origin staff prior to any de-energisation of the premises of a customer described in sub-paragraph (a) above, which process is to be directed at ensuring that, before the premises of any such customer are de-energised:

(i) the customer has been informed of Origin’s hardship policy and, if the customer has requested a copy of the policy, the customer has been provided with a copy of the policy;

(ii) Origin has complied with its hardship policy with respect to the customer in the preceding 12 months;

(iii) the customer has been offered two payment plans in the preceding 12 months and, if so, the customer:

A. has agreed to neither of them; or

B. has agreed to one but not the other, but the plan to which the customer has agreed has been cancelled due to non-payment by the customer; or

C. has agreed to both but the plans have been cancelled due to non-payment by the customer;

(iv) the customer is not adhering to a payment plan; and

(v) thereafter the customer’s premises are being de-energised as a last resort.

For the purposes of these orders, “payment plan” means a payment plan under rule 33 or rule 72 of the Retail Rules.

(d) ensure that the compliance officer:

(i) provides details of the process described at sub-paragraph (c) to the AER within 90 days of the date of these orders and subsequently on request; and

(ii) reports annually to the board of directors of Origin on compliance with the matters set out in sub-paragraphs (a) and (c) and, within 30 days of that report being made to the board, provides a copy of that report to the AER;

(e) ensure that the compliance officer provides all requested assistance to the Reviewer appointed to conduct a review in accordance with paragraph 5; and

(f) ensure that the compliance officer promptly receives a copy of the Reviewer’s report each year and is responsible for overseeing the implementation of all recommendations in the report by Origin.

8. Pursuant to section 44AAG(2)(a) of the Competition and Consumer Act 2010 (Cth) (the CCA), Origin Energy pay to the Commonwealth of Australia a pecuniary penalty in the sum of $14,115,000 in respect of the contraventions referred to in the declarations in paragraphs 1 to 4 of these orders within 30 days of the date of these orders.

9. Pursuant to section 44AAG(2)(a) of the CCA, Origin Retail pay to the Commonwealth of Australia a pecuniary penalty in the sum of $1,476,000 in respect of the contraventions referred to in the declarations in paragraphs 1 to 4 of these orders within 30 days of the date of these orders.

10. Pursuant to section 44AAG(2)(a) of the CCA, Origin LPG pay to the Commonwealth of Australia a pecuniary penalty in the sum of $1,313,000 in respect of the contraventions referred to in the declarations in paragraphs 1 to 4 of these orders within 30 days of the date of these orders.

11. Pursuant to section 44AAG(2)(a) of the CCA, Sun Retail pay to the Commonwealth of Australia a pecuniary penalty in the sum of $92,500 in respect of the contraventions referred to in the declarations in paragraphs 1 to 3 of these orders within 30 days of the date of these orders.

12. Pursuant to section 44AAG(2)(a) of the CCA, OC Energy pay to the Commonwealth of Australia a pecuniary penalty in the sum of $3,500 in respect of the contraventions referred to in the declarations in paragraphs 1 to 2 of these orders within 30 days of the date of these orders.

13. Origin Energy pay a contribution towards the applicant’s costs of and incidental to this proceeding, fixed in the sum of $200,000, within 30 days of the date of these orders.

14. The proceeding otherwise be dismissed.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

MOSHINSKY J:

Introduction

1 The respondents, Origin Energy Electricity Ltd (Origin Energy), Origin Energy Retail Ltd (Origin Retail), Origin Energy LPG Ltd (Origin LPG), Sun Retail Pty Ltd (Sun Retail) and OC Energy Pty Ltd (OC Energy) (collectively referred to as Origin), carry on businesses of providing electricity and gas services to homes.

2 In accordance with s 43(2)(a) of the National Energy Retail Law as applicable in each of South Australia, ACT, NSW and Queensland (together, the Retail Laws), Origin developed a customer hardship policy in respect of residential customers of Origin Energy, Origin Retail, Origin LPG and Sun Retail.

3 During the period from 1 January 2018 to 6 October 2021 (the Relevant Period), the hardship policy was updated on several occasions. The policy that had been in effect from October 2014 (the First HP) was amended and updated on 26 November 2018 (the Second HP) and again on 12 September 2019 (the Third HP). OC Energy’s hardship policy, which was in effect from 12 September 2019, was identical to the Third HP (OC Energy HP). The First HP, the Second HP, the Third HP and the OC Energy HP are referred to as the Hardship Policies in these reasons.

4 The Hardship Policies were approved by the applicant, the Australian Energy Regulator (the AER), in accordance with s 45 of the Retail Laws.

5 The Hardship Policies outlined Origin’s commitments and obligations in respect of hardship customers.

6 Pursuant to s 43(2)(c) of the Retail Laws, Origin was required to maintain and implement the Hardship Policies.

7 The Hardship Policies set out the terms of what Origin referred to as its “Power On Program”. This included:

(a) the manner in which Origin identified residential customers experiencing payment difficulties due to hardship;

(b) how these customers were entered into Origin’s hardship program; and

(c) how Origin established and implemented payment plans in respect of these customers.

8 The AER is established by s 44AE of the Competition and Consumer Act 2010 (Cth). Its functions and powers are set out in s 204 of the Retail Laws and include investigating breaches of the Retail Laws and the National Energy Retail Rules (the Retail Rules) and instituting and conducting proceedings in relation to those breaches: s 204(1)(c) and (d) of the Retail Laws. The AER has the power to institute civil proceedings in respect of a breach of the Retail Laws and the Retail Rules: s 289(2) of the Retail Laws.

9 The AER commenced this proceeding by originating application. It subsequently filed an amended originating application dated 8 October 2021. The AER sought declarations that Origin had contravened the Retail Laws and the Retail Rules by:

(a) certain systemic conduct; and

(d) certain conduct relating to 18 individual customers.

10 The AER also sought: orders that Origin pay a civil penalty; injunction orders; orders for a compliance program to prevent a recurrence of breaches; and an order that Origin pay the AER’s costs.

11 The AER’s allegations were set out in detail in its amended concise statement filed on 8 October 2021. It was alleged that since at least January 2018 Origin had automated aspects of the administration of its “Power on Program” (Automated System). The Automated System applied to customers of OC Energy from at least September 2019. It was alleged that, as a result of this automation, Origin had engaged in three types of conduct that contravened the Retail Laws and the Retail Rules. These types of conduct were summarised under the following headings:

(a) automated entry into a new payment plan with an increased instalment amount;

(b) automated entry into a second payment plan without regard to capacity to pay; and

(c) automated cancellation of payment plans for non-engagement.

12 The AER and Origin have reached an agreement regarding resolution of this proceeding. In summary, Origin has admitted that it engaged in systemic conduct, and conduct in relation to the 18 individual customers, in contravention of the Retail Laws and the Retail Rules. The parties jointly propose that the Court make declarations of contravention and impose civil penalties totalling $17 million. The parties jointly propose that certain additional orders be made regarding a compliance program and in relation to costs.

13 The parties have prepared a statement of agreed facts (the SOAF), a copy of which (excluding the Hardship Policies) appears as a schedule to these reasons. The SOAF includes facts relating to each of the 18 individual customers, who are referred to by initials to protect their privacy. The SOAF includes admissions by Origin that it breached provisions of the Retail Laws and the Retail Rules.

14 The parties have provided an agreed minute of proposed orders. The proposed declarations (together with applicable definitions) are as follows:

THE COURT NOTES THAT:

For the purposes of the declarations and orders that follow, the relevant State/Territory energy laws are referred to as follows:

(a) NERL means Schedule 1 to the National Energy Retail Law (South Australia) Act 2011 (SA) (SA Act), which contains the uniform energy law known as the National Energy Retail Law;

(b) Retail Laws means the Retail Law ACT, Retail Law NSW, Retail Law QLD and Retail Law SA as defined below;

(c) Retail Rules means the National Energy Retail Rules made pursuant to s 238 of the Retail Law SA and adopted in the relevant State/Territory energy laws referred to below;

(d) Retail Law ACT means the National Energy Retail Law (ACT), which, by virtue of s 6 of the National Energy Retail Law Act 2012 (ACT) (ACT Act), applies the NERL in the Australian Capital Territory with the modifications set out in the ACT Act. Sections 6, 7 and 9 of the Retail Law ACT apply the Retail Rules in the Australian Capital Territory;

(e) Retail Law SA means the National Energy Retail Law (South Australia), which, by virtue of s 4 of the SA Act, applies the NERL in the State of South Australia as implemented by the SA Act. Sections 2, 3 and 15 of the Retail Law SA apply the Retail Rules in the State of South Australia;

(f) Retail Law NSW means the National Energy Retail Law (NSW), which, by virtue of s 4 of the National Energy Retail Law (Adoption) Act 2012 (NSW) (NSW Act), applies the NERL in the State of New South Wales with the modifications set out in Sch 1 of the NSW Act. Sections 2, 3 and 15 of the Retail Law NSW apply the Retail Rules in the State of New South Wales; and

(g) Retail Law QLD means the National Energy Retail Law (Queensland), which, by virtue of s 4 of the National Energy Retail Law (Queensland) Act 2014 (QLD Act), applies the NERL in the State of Queensland with the modifications set out in the schedule to the QLD Act or as prescribed by regulation under s 12 of the QLD Act. Sections 2, 3 and 15 of the Retail Law QLD apply the Retail Rules in the State of Queensland.

For the purposes of the declarations and orders that follow, the respondents are referred to as follows:

(a) the first respondent, Origin Energy Electricity Ltd (ACN 071 052 287), is referred to as Origin Energy;

(b) the second respondent, Origin Energy Retail Ltd (ACN 078 868 425), is referred to as Origin Retail;

(c) the third respondent, Origin Energy LPG Ltd (ACN 000 508 369), is referred to as Origin LPG;

(d) the fourth respondent, Sun Retail Pty Ltd (ACN 078 848 549), is referred to as Sun Retail; and

(e) the fifth respondent, OC Energy Pty Ltd (ACN 144 655 514), is referred to as OC Energy,

(referred to together as Origin).

THE COURT DECLARES THAT:

1. In the period from March 2019 to 6 October 2021 in the case of the respondents excluding OC Energy and in the period from September 2019 to 6 October 2021 in the case of OC Energy, Origin automated aspects of its ‘Power On Program’ (Automated System) and, by use of the Automated System:

a. proposed to increase the amount of payment plan instalments of certain hardship customers within certain thresholds set by Origin’s system (the Threshold Amount);

b. sent an SMS to those customers advising of the change and stating they should call Origin if the revised amount was not affordable; and

c. automatically cancelled those customers’ existing payment plans and established new plans with increased instalment amounts, if they had not called Origin three days after the SMS was sent,

and thereby breached:

d. section 43(2)(c) of the Retail Laws because, in respect of those customers, Origin failed to maintain and implement, as relevant, paragraphs 2.2 and 3.1 of Origin’s Hardship Policy in effect from 12 September 2019 (Third HP) and paragraphs 2.2 and 3.1 of OC Energy’s Hardship Policy in effect from 12 September 2019 (OC Energy HP) (in respect of 3,228 customers in total); and

e. section 50(2) of the Retail Laws and rule 72(1) of the Retail Rules because each new automatically established payment plan was established without having regard to the relevant customer’s capacity to pay (in respect of 4,183 customers in total).

2. In the period from January 2018 to October 2021 in the case of the respondents excluding OC Energy, and in the period from September 2019 to October 2021 in the case of OC Energy, Origin, by use of the Automated System:

a. automatically cancelled the payment plans of hardship customers who did not pay at least 90% of an instalment within four business days after the due date for that instalment; and

b. if the cancelled payment plan was the hardship customer’s first plan cancelled for non-payment in the preceding 12 months, automatically and unilaterally established a new payment plan on the same terms as the cancelled payment plan,

and thereby breached:

c. section 43(2)(c) of the Retail Laws because, in respect of those customers, Origin failed to maintain and implement, as relevant, paragraphs 4.6 and 5.1 of Origin’s Hardship Plan in effect from October 2014 to 26 November 2018 (First HP), Origin’s Hardship Plan in effect from 26 November 2018 to 12 September 2019 (Second HP) and paragraphs 2.2 and 3.1 of the Third HP and the OC Energy HP; and

d. section 50(2) of the Retail Laws and rule 72(1) of the Retail Rules, because each new automatically established payment plan was established without having regard to the relevant customer’s capacity to pay.

3. In the period from January 2018 to 12 September 2021, Origin (with the exception of OC Energy), by use of the Automated System:

a. proposed to increase the amount of payment plan instalments of certain hardship customers by more than the relevant Threshold Amount;

b. attempted an outbound call to those customers and, if Origin was not able to speak to a customer, sent an email or letter advising the customer to contact Origin within 7 business days and informing the customer that if they did not do so, they may be removed from the Power On Program; and

c. if the customer did not contact Origin within 10 days of the letter or email being sent, automatically cancelled the customer’s payment plan for non-engagement, notwithstanding the fact the customer may have been continuing to make payments towards their debt,

and thereby breached:

d. section 43(2)(c) of the Retail Laws because, in respect of those customers, Origin failed to maintain and implement, as relevant, paragraphs 4.6 and 5.1 of the First HP and Second HP (save where a customer was on a subsidised plan) and paragraph 2.5 of the Third HP.

4. In relation to each of the 18 customers referred to in Confidential Schedule 1 to the Amended Concise Statement, Origin Energy, Origin Retail or Origin LPG, as relevant, breached one or more of the following sections of the Retail Laws (depending on the location of the customer) and/or the Retail Rules:

a. section 43(2)(c) of the Retail Laws by failing to maintain and implement its hardship policy by engaging in the conduct described at paragraphs 1 to 3 above;

b. section 46 of the Retail Laws and rule 71(1) of the Retail Rules by failing to inform the hardship customer of Origin’s hardship policies;

c. sections 50(1) and 50(2) of the Retail Laws, by failing to offer and apply a payment plan to the hardships customer;

d. rule 72(1) of the Retail Rules, by failing to have regard to the customer’s capacity to pay in establishing a payment plan for the customer;

e. rules 107(2), 111(2) and/or 116(1)(d) of the Retail Rules by wrongfully arranging for the de-energisation of the customer’s premises or residential customers experiencing payment difficulties who had not been offered two payment plans in the 12 months prior to Origin arranging the de-energisation, or were adhering to a payment plan; and/or

f. section 47 of the Retail Laws, by failing to give effect to the general principle that de-energisation of premises of a hardship customer due to inability to pay energy bills should be a last resort option.

15 The proposed orders are as follows:

5. Origin must:

a. within 120 days of these orders, establish a compliance and training program that is specifically designed to:

i. ensure an understanding and awareness of its responsibilities and obligations in relation to dealing with hardship customers and customers experiencing financial difficulties, with particular emphasis on the requirements of sections 43(2)(c), 46, 47, 50(1) and 50(2) of the Retail Laws, and rules 71(1), 72(1), 107(2), 111(2) and 116(1)(d) of the Retail Rules; and

ii. ensure that the relevant internal operations of its business comply with sections 43(2)(c), 46, 47, 50(1) and 50(2) of the Retail Laws, and rules 71(1), 72(1), 107(2), 111(2) and 116(1)(d) of the Retail Rules;

b. at its own expense, maintain and administer the compliance and training program referred to in sub-paragraph (a) above, for a period of three years;

c. at its own expense, appoint a suitably qualified compliance professional with expertise in the national energy laws, who is independent and whose appointment has been approved by the AER, to conduct a review of the implementation and effectiveness of the compliance and training program referred to in sub-paragraph (a) above annually for three years, commencing 12 months after the date of these orders and to prepare a written report to be provided to Origin within 60 days of the commencement of each review (the Reviewer).

The appointed Reviewer may be replaced by Origin if necessary, with the prior approval of the AER;

d. use its best endeavours to provide the Reviewer with access to all sources of information within the possession, power or control of Origin and its related bodies corporate that are relevant to the review;

e. within 30 days after receiving the Reviewer’s written report provide a copy of that report to the AER; and

f. implement promptly and with due diligence any recommendations made by the Reviewer (unless the AER consents to a request by Origin not to do so, acting reasonably), and advise the AER in writing of the implementation.

6. For the purposes of paragraph 5(c), Origin must ensure that the Reviewer is independent, by reason that, he or she:

a. did not design or implement the compliance and training program referred to in paragraph 5(a);

b. is not a current employee, contractor or director of Origin or any related body corporate, and has not been an employee, contractor or director of Origin or any related body corporate in the five years preceding the date of these orders; and

c. has no significant shareholding or other interests in Origin or its related bodies corporate.

7. Origin must, for three years from the date of these orders or within the period specified, take the following actions and adopt the following practices designed to prevent the recurrence of the breaches of the Retail Laws and Retail Rules which are the subject of declarations in this proceeding:

a. within 90 days of the date of these orders, appoint a suitably qualified person as a compliance officer to be responsible for compliance of the de-energisation process implemented by Origin in relation to hardship customers or residential customers who have informed Origin that they are experiencing payment difficulties, with the requirements of these orders;

b. ensure that, after the appointment of the compliance officer, that role remains filled by a suitably qualified person for at least three years from the date of these orders;

c. design, implement and maintain in operation a process to be completed by Origin staff prior to any de-energisation of the premises of a customer described in sub-paragraph (a) above, which process is to be directed at ensuring that, before the premises of any such customer are de-energised:

i. the customer has been informed of Origin’s hardship policy and, if the customer has requested a copy of the policy, the customer has been provided with a copy of the policy;

ii. Origin has complied with its hardship policy with respect to the customer in the preceding 12 months;

iii. the customer has been offered two payment plans in the preceding 12 months and, if so, the customer:

(A) has agreed to neither of them; or

(B) has agreed to one but not the other, but the plan to which the customer has agreed has been cancelled due to non-payment by the customer; or

(C) has agreed to both but the plans have been cancelled due to non-payment by the customer;

iv. the customer is not adhering to a payment plan; and

v. thereafter the customer’s premises are being de-energised as a last resort.

For the purposes of these orders, “payment plan” means a payment plan under rule 33 or rule 72 of the Retail Rules.

d. ensure that the compliance officer:

i. provides details of the process described at sub-paragraph (c) to the AER within 90 days of the date of these orders and subsequently on request; and

ii. reports annually to the board of directors of Origin on compliance with the matters set out in sub-paragraphs (a) and (c) and, within 30 days of that report being made to the board, provides a copy of that report to the AER;

e. ensure that the compliance officer provides all requested assistance to the Reviewer appointed to conduct a review in accordance with paragraph 5; and

f. ensure that the compliance officer promptly receives a copy of the Reviewer’s report each year and is responsible for overseeing the implementation of all recommendations in the report by Origin.

8. Pursuant to section 44AAG(2)(a) of the Competition and Consumer Act 2010 (Cth) (the CCA), Origin Energy pay to the Commonwealth of Australia a pecuniary penalty in the sum of $14,115,000 in respect of the contraventions referred to in the declarations in paragraphs 1 to 4 of these orders within 30 days of the date of these orders.

9. Pursuant to section 44AAG(2)(a) of the CCA, Origin Retail pay to the Commonwealth of Australia a pecuniary penalty in the sum of $1,476,000 in respect of the contraventions referred to in the declarations in paragraphs 1 to 4 of these orders within 30 days of the date of these orders.

10. Pursuant to section 44AAG(2)(a) of the CCA, Origin LPG pay to the Commonwealth of Australia a pecuniary penalty in the sum of $1,313,000 in respect of the contraventions referred to in the declarations in paragraphs 1 to 4 of these orders within 30 days of the date of these orders.

11. Pursuant to section 44AAG(2)(a) of the CCA, Sun Retail pay to the Commonwealth of Australia a pecuniary penalty in the sum of $92,500 in respect of the contraventions referred to in the declarations in paragraphs 1 to 3 of these orders within 30 days of the date of these orders.

12. Pursuant to section 44AAG(2)(a) of the CCA, OC Energy pay to the Commonwealth of Australia a pecuniary penalty in the sum of $3,500 in respect of the contraventions referred to in the declarations in paragraphs 1 to 2 of these orders within 30 days of the date of these orders.

13. Origin Energy pay a contribution towards the applicant’s costs of and incidental to this proceeding, fixed in the sum of $200,000, within 30 days of the date of these orders.

14. The proceeding otherwise be dismissed.

16 The parties provided a detailed joint submission in advance of the hearing (the Joint Submission). Origin also filed an affidavit of Jonathan Briskin, the Executive General Manager, Retail of Origin, dated 6 June 2022. At the hearing on 14 June 2022, I was concerned that the SOAF did not address certain matters that I considered important for my consideration of whether the proposed penalty was within the appropriate range. I requested that the parties provided further material dealing with these matters, either in the form of a supplementary statement of agreed facts or an affidavit.

17 Subsequently, Origin filed a second affidavit of Mr Briskin, dated 27 June 2022, and the AER indicated that it did not seek to cross-examine Mr Briskin. In light of that affidavit, I indicated to the parties that I did not require them to provide any further written or oral submissions.

18 For the reasons that follow, I consider there to be a proper basis for making the proposed declarations. I also consider the proposed civil penalties to be appropriate and will make orders for the payment of those penalties. In my view, the penalties reflect the circumstances of the contraventions and should operate as a deterrent against such conduct being engaged in by Origin or by other energy retailers in the future.

19 I also consider it appropriate to make the other orders proposed by the parties.

Applicable principles and provisions

The Retail Laws

20 The National Energy Retail Law is contained in the Schedule to the National Energy Retail Law (South Australia) Act 2011 (SA) (SA Act) and applies relevantly:

(a) in South Australia, pursuant to s 4(3) of the SA Act;

(b) in the Australian Capital Territory, pursuant to s 6 of the National Energy Retail Law Act 2012 (ACT);

(c) in New South Wales, pursuant to s 4 of the National Energy Retail Law (Adoption) Act 2012 (NSW); and

(d) in Queensland, pursuant to s 4 of the National Energy Retail Law (Queensland) Act 2014 (Qld),

(collectively referred to in these reasons as the “Retail Laws”).

21 The Retail Rules, as referred to in the Retail Laws, are made pursuant to Pt 10 of the Retail Laws.

22 Origin has admitted breaches of the following provisions of the Retail Laws and the Retail Rules:

(a) section 43(2)(c) of the Retail Laws, which requires Origin to maintain and implement its hardship policy;

(b) section 46 of the Retail Laws and r 71(1) of the Retail Rules, which impose obligations on Origin to inform residential customers about its hardship policy where it appears to the retailer that non-payment of an energy bill is due to the customer experiencing payment difficulties due to hardship, and to inform hardship customers of the existence of the retailer’s hardship policy as soon as practicable after the customer is identified as a hardship customer, respectively;

(c) section 50(1) and (2) of the Retail Laws and r 72(1) of the Retail Rules, which require Origin to offer and apply payment plans to hardship customers, and to other residential customers who have informed Origin in writing or by telephone that they are experiencing payment difficulties or who Origin otherwise believes are experiencing repeated difficulties in paying their bills or require payment assistance, which payment plans must comply with the Retail Rules (including that payment plans are established having regard to the customer’s capacity to pay, any arrears owed by the customer and the customer’s expected energy consumption needs over the following 12-month period);

(d) rules 107(2) and 111(2) of the Retail Rules, which prohibit retailers from arranging de-energisation of the premises of hardship customers or residential customers who have informed the retailer in writing or by telephone that the customer is experiencing payment difficulties, unless in accordance with the Retail Rules (including that retailers must not arrange for the de-energisation of the premises of a relevant customer unless the retailer has offered the customer two payment plans in the previous 12 months);

(e) rules 107(2) and 116(1)(d) of the Retail Rules, which prohibit retailers from arranging for the de-energisation of a customer’s premises where the customer is a hardship customer or a residential customer and is adhering to a payment plan; and

(f) section 47 of the Retail Laws, which requires Origin to give effect to the general principle that de-energisation of premises of hardship customers due to inability to pay bills should be a last resort option.

23 Of the above provisions, the following are civil penalty provisions: ss 43(2)(c) and 50(1) of the Retail Laws and rules 71(1), 72(1) and 107(2) of the Retail Rules.

24 The Retail Laws regulate the supply of energy by energy retailers to residential customers, including the relationship between energy retailers such as Origin and their customers.

25 The Retail Laws and Retail Rules also require retailers such as Origin to develop, maintain and implement a customer hardship policy. As stated in the Second Reading Speech, “[t]he purpose of a customer hardship policy is to identify residential customers experiencing payment difficulties due to hardship and to assist those customers to better manage their energy bills on an ongoing basis”: see Minister John Hill, Second Reading Speech, National Energy Retail Law (South Australia) Bill 2010 (SA), 27 October 2010. These policies must outline how a retailer should deal with customers suffering financial hardship and provide appropriate protections. These protections include that de-energisation of hardship customers because they are unable to pay their bills should always be a last resort option, and that energy retailers must have regard to the capacity to pay of hardship customers in establishing payment plans for hardship customers.

Declaratory relief

26 This Court has the power to make declarations under s 21 of the Federal Court of Australia Act 1976 (Cth). The Court also has the power under s 44AAG(1)(b) of the Competition and Consumer Act to make an order, on application by the AER, declaring that a person is in breach of a State/Territory energy law (as defined in s 4(1) of the Competition and Consumer Act), which includes the Retail Laws. The discretion to exercise the power is wide.

27 In Australian Building and Construction Commissioner v Construction, Forestry, Mining and Energy Union (2017) 254 FCR 68, the Full Court stated (at [90]):

The fact that the parties have agreed that a declaration of contravention should be made does not relieve the Court of the obligation to satisfy itself that the making of the declaration is appropriate. … It is not the role of the Court to merely rubber stamp orders that are agreed as between a regulator and a person who has admitted contravening a public statute.

(Citations omitted.)

The Full Court continued (at [93]):

Declarations relating to contraventions of legislative provisions are likely to be appropriate where they serve to record the Court’s disapproval of the contravening conduct, vindicate the regulator’s claim that the respondent contravened the provisions, assist the regulator to carry out its duties, and deter other persons from contravening the provisions.

(Citations omitted.)

28 In Forster v Jododex Australia Pty Ltd (1972) 127 CLR 421, Gibbs J stated (at 437-438) that before making declarations three requirements should be satisfied:

(a) the question must be a real and not a hypothetical or theoretical one;

(b) the applicant must have a real interest in raising it; and

(c) there must be a proper contradictor.

Civil penalties

29 The Court has the power to order Origin to pay a pecuniary penalty under s 44AAG(2)(a) of the Competition and Consumer Act if it has made an order declaring that Origin is in breach of a State/Territory energy law under s 44AAG(1).

30 Section 294 of the Retail Laws sets out the matters to be taken into account in determining a civil penalty. Specifically, civil penalties must be determined having regard to all relevant matters, including:

(a) the nature and extent of the breach;

(b) the nature and extent of any loss or damage suffered as a result of the breach;

(c) the circumstances in which the breach took place;

(d) whether the person has engaged in any similar conduct and been found to be in breach of a provision of the Retail Laws, the National Energy Retail Regulations or the Retail Rules in respect of that conduct; and

(e) in the case of a regulated entity (such as Origin) – whether the person has established, and has complied with, policies, systems and procedures under s 273.

31 Section 296 of the Retail Laws provides that “if the breach consists of a failure to do something that is required to be done, the breach is to be regarded as continuing until the act is done despite the fact that any period within which, or time before which, the act is required to be done has expired or passed”.

32 Section 297(2) of the Retail Laws provides that a person is not liable for more than one civil penalty in respect of the same conduct.

33 Until 28 January 2021, the term “civil penalty” was defined in s 2 of the Retail Laws as:

(a) an amount not exceeding $100,000; and

(b) an amount not exceeding $10,000 for every day during which the breach continues.

34 On 29 January 2021, civil penalties under the national energy laws were increased and a penalty tier structure was introduced. Sections 43(2) and 50(1) of the Retail Laws and rules 71, 72 and 107(2) of the Retail Rules are tier 1 civil penalty provisions.

35 Section 4A(1)(c)(ii) of the Retail Laws sets out the relevant penalty for tier 1 breaches. In relation to breaches by a body corporate from 29 January 2021, the maximum penalty is the greater of the following:

(a) $10,000,000;

(b) if the Court can determine the value of any benefit reasonably attributable to the breach of the civil penalty provision that the body corporate, and any body corporate related to the body corporate, has obtained, directly or indirectly – 3 times the value of that benefit; or

(c) if the Court cannot determine the value of the benefit – 10% of the annual turnover of the body corporate during the 12-month period ending at the end of the month in which the body corporate breached, or began breaching, the civil penalty provision.

36 The principles applicable to the discretion to impose pecuniary penalties have been discussed in many cases. I refer to and adopt the summary of the principles in my judgment in Australian Competition and Consumer Commission v Optus Internet Pty Ltd [2018] FCA 777 at [18]-[28]. In Australian Competition and Consumer Commission v EnergyAustralia Pty Ltd [2015] ATPR ¶42-491; [2015] FCA 274 at [109], Gordon J accepted that the principles relevant to determination of penalties under s 76 of the Trade Practices Act 1974 (Cth) and s 224 of the Australian Consumer Law (being Sch 2 to the Competition and Consumer Act) were also relevant to the assessment of civil penalties under the Retail Laws as applied in South Australia and the Australian Capital Territory. The principles have also been considered recently by the High Court in Australian Building and Construction Commissioner v Pattinson (2022) 399 ALR 599.

Application of principles to the present case

Declarations

37 I am satisfied that the contraventions of the Retail Laws and the Retail Rules that are the subject of the proposed declarations (set out above) are established by the facts and admissions set out in the SOAF. The relevant facts are set out in the SOAF and it is unnecessary to repeat them in these reasons.

38 I consider it appropriate to make declarations substantially in the terms proposed by the parties. The preconditions for the making of declarations, set out above, are satisfied. In particular, I am satisfied that: there is a real and not a hypothetical question; the applicant has a real interest in raising the question; and there is a proper contradictor.

Civil penalties

39 The parties propose civil penalties totalling $17 million, comprising a total of $14.6 million referable to the systemic conduct and a total of $2.4 million for the conduct relating to the 18 customers. I consider the proposed civil penalties to be appropriate. My reasons are as follows.

Maximum penalty

40 As noted above, the maximum penalty changed during the Relevant Period. For the period up to 28 January 2021, the maximum penalty was $100,000, plus an amount not exceeding $10,000 for every day during which the breach continued. The maximum penalty increased on 29 January 2021. From that date, the maximum is the greater of three alternatives. It is common ground that the third of these alternatives is the relevant alternative in the present case, namely 10% of the annual turnover of the body corporate during the 12-month period ending at the end of the month in which the body corporate breached, or began breaching, the civil penalty provision.

41 The material originally filed by the parties did not enable that amount to be calculated. I therefore requested the parties to provide further agreed facts or evidence enabling the amount to be calculated (at least in approximate terms). The second affidavit of Mr Briskin includes the statement that the total annual turnover for the Origin group, in respect of its businesses as a whole, was $14,473,275,110 in the period between 1 February 2020 to 31 January 2021. On the basis of this figure, and approaching the matter on the basis of the corporate group, the maximum penalty per contravention for the period from 29 January 2021 is approximately $1.4 billion, being 10% of the annual turnover.

42 It is established that, where a very large number of contraventions is involved, as is the case in this proceeding, the maximum penalty may rise to a number such that there is no meaningful maximum penalty: Australian Competition and Consumer Commission v Reckitt Benckiser (Australia) Pty Ltd (2016) 340 ALR 25 at [157]. In such cases, the focus should be on the conduct and on determining a penalty to match the conduct.

Nature and circumstances of the contravening conduct

43 I next address the nature and circumstances of the contravening conduct. This is set out in detail in the SOAF. I highlight the following facts and matters, which are drawn substantially from the Joint Submission.

44 In the period from January 2018 to 6 October 2021, Origin automated aspects of the administration of its hardship program, which was known as the “Power On Program”. This led to the three categories of systemic conduct that are the subject of this proceeding:

(a) Automated entry into a new payment plan with an increased instalment amount: Where a customer’s energy usage increased within certain thresholds set by Origin’s system (Threshold Amount), Origin entered the customer into a new payment plan with an increased instalment amount to cover the customer’s higher usage without Origin having had regard to the customer’s current capacity to pay.

(b) Automated entry into a second payment plan without regard to capacity to pay: Where a customer did not pay an instalment due under their payment plan by the due date (or paid less than the amount due), Origin unilaterally cancelled the customer’s existing payment plan and established a new payment plan on the same terms as the previous plan without Origin having had regard to the customer’s current capacity to pay.

(c) Automated cancellation of payment plans for non-engagement: Where a customer’s energy usage increased above certain thresholds set by Origin’s system, Origin attempted to contact the customer to discuss Origin’s proposed changes to the customer’s payment plan. If Origin was unable to speak with the customer, and the customer did not get back in touch with Origin within 10 days, Origin cancelled the customer’s payment plan for non-engagement.

45 I accept the parties’ submission that these should be treated as three courses of conduct.

46 In relation to the conduct constituted by automated entry into a new payment plan with an increased instalment amount, I note the following facts and matters:

(a) During the Relevant Period, Origin regularly reviewed customers’ payment plans against any changes to the customer’s energy usage.

(b) In the period from March 2019 to 6 October 2021 (and in the period from September 2019 to 6 October 2021 in the case of OC Energy), by use of the Automated System, following a regular review of a customer’s payment plan, if:

(i) the review indicated that the customer’s existing instalments were too low relative to their increased energy usage; and

(ii) Origin proposed to increase the customer’s instalments by less than, or equal to, the Threshold Amount,

Origin sent an SMS to the customer advising the customer of the change, and advising the customer to call Origin if the revised amount was not affordable. If the SMS message was not successfully delivered (or if Origin only had a landline telephone number on file for the customer), Origin called the customer. If the customer did not answer, Origin left a message explaining that Origin was calling regarding the customer’s account and requesting that the customer call back.

(c) If the customer had not called Origin within three days after the SMS was sent or a call attempt was made, the customer’s existing payment plan was automatically cancelled by Origin and a new plan with the increased instalment amount was created.

(d) This automated process was in place between March 2019 and October 2021 for standard hardship payment plans and incentive payment plans, and between March 2019 and May 2020 for subsidised payment plans.

(e) Any hardship customer:

(i) whose proposed instalment increase was higher than the Threshold Amount; or

(ii) who paid for their instalments using Centrelink’s Centrepay service,

was excluded from this automated process.

(f) Origin has admitted that, by engaging in the conduct described above, it:

(i) breached s 43(2)(c) of the Retail Laws, because Origin failed to maintain and implement paragraphs 2.2 and 3.1 of the Third HP and the OC Energy HP; and

(ii) breached s 50(2) of the Retail Laws and r 72(1) of the Retail Rules, because the plans were established without regard to the customer’s capacity to pay.

(g) This conduct was ongoing at the time that this proceeding was instituted. The conduct occurred in the period from March 2019 to on or about 6 October 2021, being the date that Origin undertook to the Court to cease the conduct. The conduct affected 4,183 customers in 4,462 instances (this included 3,228 customers in 3,442 instances during the period in which the Third HP and the OC Energy HP were in place).

47 In relation to the conduct constituted by automated entry into a second payment plan without regard to capacity to pay, I note the following:

(a) In the period from January 2018 to 29 September 2021 (and in the period from September 2019 to 29 September 2021 in the case of OC Energy), by use of the Automated System, if a customer on a hardship plan did not pay at least 90% of an instalment by, at the latest, four business days after the due date for an instalment, the plan was automatically cancelled. If the hardship plan was the customer’s first plan cancelled for non-payment in the preceding 12 months, Origin automatically and unilaterally set up a new plan on the same terms, and with the same instalment amounts, as the payment plan that had been cancelled for non-payment. Origin has admitted that the new plans were established without regard to each customer’s current capacity to pay.

(b) Origin has admitted that, by engaging in the conduct described above, it:

(i) breached s 43(2)(c) of the Retail Laws, because Origin failed to maintain and implement paragraphs 4.6 and 5.1 of the First and Second HPs and paragraphs 2.2 and 3.1 of the Third HP and the OC Energy HP; and

(ii) breached s 50(2) of the Retail Laws and r 72(1) of the Retail Rules, because the new plans were established without regard to the customer’s capacity to pay.

(c) This conduct was ongoing at the time that this proceeding was instituted. The conduct occurred in the period from January 2018 to on or about 29 September 2021, being the date that Origin ceased the conduct in the context of this proceeding. The conduct affected 87,506 customers in 105,905 instances. Forty-three of the affected customers had their energy subsequently disconnected.

48 In relation to the conduct constituted by automated cancellation of payment plans for non-engagement, I note the following:

(a) In the period from January 2018 to 12 September 2021, following one of its regular reviews of a hardship customer’s energy usage, where a proposed change to a customer’s instalment amount was more than the relevant Threshold Amount, Origin would typically attempt an outbound call to the customer to explain that there had been a change to the customer’s usage and to discuss Origin’s proposed change to the customer’s hardship payment plan. If Origin was unable to speak to the customer, an email or letter was sent advising the customer to contact Origin within seven business days, and informing the customer that if they did not do so, they may be removed from the Power On Program. If the customer did not contact Origin within 10 days of the letter or email being sent, by use of the Automated System, their payment plan was automatically cancelled for non-engagement. This occurred despite the fact the customer may have been continuing to make payments towards their debt.

(b) Since at least October 2017 (and since September 2019 in the case of OC Energy customers), upon entry into the Power On Program, customers were sent a letter informing them that Origin would regularly review their plan against changes in their usage and that Origin would get in touch if the instalment amount needed to change. The letter also stated that customers could be removed from the Power On Program if they did not participate in the review process. However, Origin’s Hardship Policies did not refer to the potential for customers to be removed from the Power On Program for non-engagement in this way (except in relation to subsidised plans in the First and Second HPs).

(c) Origin has admitted that, by engaging in the conduct described above, it breached s 43(2)(c) of the Retail Laws, because Origin failed to maintain and implement paragraphs 4.6 and 5.1 of the First and Second HPs (save where a customer was on a subsidised plan) and paragraph 2.5 of the Third HP.

(d) This conduct was ongoing at the time that this proceeding was instituted. The conduct occurred in the period January 2018 to on or about 6 October 2021, being the date that Origin undertook to the Court to cease the conduct. The conduct affected 11,959 customers in 12,870 instances. Twenty-three of the affected customers had their energy subsequently disconnected.

49 The effect of Origin’s systemic conduct, as described above, was significant. I note the following matters:

(a) The Hardship Policies should have provided adequate protections for Origin’s customers who were experiencing financial hardship. However, Origin’s Automated System resulted in failures to implement its Hardship Policies in a number of different circumstances. Origin’s systemic conduct meant that affected hardship customers failed to receive certain protections that should have been afforded to them under the Retail Laws and Retail Rules, and under Origin’s Hardship Policies. In particular, those customers were denied the protections of having their financial circumstances taken into account in every case that a payment plan was established. The systemic conduct affected a large number of customers as outlined above. Origin’s systemic conduct affected a vulnerable group of customers who Origin had identified as hardship customers. As a result of Origin’s systemic conduct, these customers were automatically moved onto new payment plans with increased instalments or second payment plans, without taking into account their capacity to pay and personal circumstances, or had their payment plans cancelled for non-engagement in the review process.

(b) Origin’s systemic conduct had the effect that some hardship customers were required to make instalment payments and, in some cases, to make higher payments, when they may not have been in a position to do so, either at all or without compromising their ability to purchase other essential goods and services.

(c) At least 66 customers affected by Origin’s systemic conduct were subsequently disconnected and left without an essential service. This was likely to have caused significant distress to the customers and their families. In this context, it should be noted that Origin’s systemic conduct also meant that hardship customers who were moved onto a second plan (on the same terms as the first plan without regard to their capacity to pay) were brought a step closer to being removed from Origin’s Power On Program and potentially being disconnected and this had the capacity to cause significant distress.

50 The systemic conduct referred to above arose from the automation of many of Origin’s systems in relation to its Power On Program, being a program specifically designed to address the needs and circumstances of hardship customers. It is surprising and troubling that the automated system resulted in Origin breaching its own Hardship Policies and provisions of the Retail Laws and the Retail Rules. The material originally filed by the parties did not explain to my satisfaction how this came about. This is relevant in considering the appropriateness of the proposed penalty, as it goes to the nature and circumstances of the contravening conduct and to whether Origin has demonstrated insight into its contravening conduct. The second affidavit of Mr Briskin provides a more detailed explanation of how the systemic conduct that is the subject of this proceeding came about. In that affidavit, Mr Briskin explains the process by which Origin automated aspects of its Power On Program and who was involved in that process. He explains how the errors in the automation system occurred in relation to the automated second payment plans (at paragraphs 12-13) and in relation to automation associated with hardship payment plan reviews (at paragraphs 14-18). Mr Briskin states that, during the Relevant Period, he believed that Origin’s automated systems complied with the Retail Laws and the Retail Rules (for the reasons set out at paragraphs 20-24). He states at paragraph 25:

Despite my belief that the Automated System was compliant with the [Retail Laws] and [the Retail Rules] for the reasons outlined in paragraphs [20] to [24] above, it is now my view that Origin did not have sufficient regard to its obligations under the [Retail Laws] and the [Retail Rules] and to certain terms of its Hardship Policies. As detailed in my First Affidavit, under my direction, Origin has carefully reflected on these matters and has taken, and is taking, steps to improve our hardship processes and address matters which it has identified as potential contributors to these breaches occurring. This includes:

(a) providing additional training to the whole of Origin’s retail business to enhance awareness and understanding of customer protections enshrined in the [Retail Laws] and [the Retail Rules] and reduce the likelihood of business processes being implemented or changed in a manner which does not comply with these requirements;

(b) committing additional resources to Origin’s compliance team to ensure that compliance matters are interrogated appropriately; and

(c) improving Origin’s governance and assurance processes more generally, to ensure that regulatory breaches are promptly detected, reported and addressed.

51 In my view, this case presents an important reminder of the need to ensure that automated processes are compliant with the relevant regulatory requirements and relevant corporate policies.

52 In relation to the 18 individual customers, I note the following matters. Origin also admits that it breached the Retail Laws and Retail Rules in relation to these customers. Specifically, Origin admits that the relevant Origin entity:

(a) failed to maintain and implement its hardship policy in breach of s 43(2)(c) of the Retail Laws in relation to 14 customers on 24 occasions by use of the Automated System described above;

(b) failed to inform customers of the existence of its hardship policy in breach of s 46 of the Retail Laws and r 71(1) of the Retail Rules in relation to six customers on 17 occasions;

(c) failed to offer payment plans to customers in hardship in breach of s 50(1) of the Retail Laws in relation to four customers on five occasions;

(d) failed to offer and apply payment plans to customers in hardship having regard to their capacity to pay in breach of s 50(2) of the Retail Laws and r 72(1) of the Retail Rules in relation to 15 customers on 27 occasions;

(e) wrongfully arranged disconnection of hardship customers in breach of rules 107(2) and 111(2) of the Retail Rules in relation to seven customers on 11 occasions;

(f) wrongfully arranged disconnection of hardship customers whilst the customer was adhering to a payment plan in breach of rules 107(2) and 116(1)(d) of the Retail Rules in relation to one customer on one occasion; and

(g) failed to ensure that the arrangement of disconnection was a last resort option in breach of s 47 of the Retail Laws in relation to 10 customers on 14 occasions.

Other relevant considerations

53 The Joint Submission contains a detailed treatment of the other relevant considerations (including the mandatory considerations) at paragraphs 92-132. I accept the submissions in those paragraphs.

54 Mr Briskin’s second affidavit addresses the steps Origin has taken to cease the contravening conduct in response to the AER’s investigation and the commencement of this proceeding.

55 Mr Briskin also addresses the matters of rectification and remediation. He states at paragraphs 32-34 of his second affidavit:

32. As discussed above at paragraph [31], Origin has not relied on payment plans established or affected by the automated processes the subject of this proceeding for the purposes of disconnections since April 2020. Origin also ceased the automated processes the subject of this proceeding, pursuant to its voluntary undertaking to the Court in October 2021. I wish to say as follows about our processes going forward:

(a) Origin processes have been redesigned. Even after Origin’s undertakings come to an end, Origin will not recommence these automated processes in their current form. As detailed in my First Affidavit in this proceeding, Origin has taken or is taking a range of actions to improve its compliance processes and training related to hardship. This has included extensive work by a project team to redesign Origin’s processes so that:

(i) Payment plans for customers in Origin’s Power On Program are only ever established (including following a review) after a detailed discussion with the customer about their circumstances and their capacity to pay. The only exception to this is if eligible customers use Origin’s self-service hardship portal to select their own instalment amount and confirm that it is affordable;

(ii) Customers will not be removed from Origin’s Power On Program for non-engagement without this step being made transparent to customers in Origin’s hardship policy. A draft hardship policy which reflects these and other changes designed to improve Origin’s hardship program has been developed and is expected to be submitted to the AER for approval in the near future.

(b) No reliance on defective payment plans. As detailed in my First Affidavit, I deeply regret that these automated processes impacted hardship customers during the Relevant Period (Affected Customers). When assessing any customers for disconnection for non-payment, Origin will continue not to rely on payment plans affected by the automated systems the subject of the proceeding. This means that, to the extent Origin may seek to take steps to disconnect any of the Affected Customers going forward for non-payment, it will only do so in the event that the customer has received additional payment plans, or payment plan offers, in accordance with the Affected Customer’s statutory entitlements and Origin’s redesigned processes.

33. Origin is also taking steps to contact the following customers to arrange a compensation payment of $800:

(a) any Affected Customer who had their energy subsequently disconnected following the use of the automated processes the subject of the proceeding; and

(b) any of the 18 Individual Customers for each wrongful disconnection.

34. Origin is also taking steps to waive any outstanding energy debt for these customers.

56 I note also that, in paragraph 5 of his first affidavit, Mr Briskin, on behalf of Origin, states that:

(a) Origin deeply regrets that the breaches occurred and acknowledges that the breaches were serious and meant that many of our customers did not receive a number of the important protections to which they were entitled under the Retail Laws and Retail Rules.

(b) Origin fully accepts that it fell short of its regulatory obligations and of the values it seeks to uphold, including the support of vulnerable customers experiencing hardship.

(c) Origin is committed to ensuring that it meets its compliance obligations in future and, to that end, Origin has taken significant steps to improve its compliance processes and training relating to hardship and has also consented to the compliance orders proposed in this proceeding.

Conclusion in relation to penalty

57 The contraventions are serious and occurred over a lengthy period of time. Having regard to the nature and circumstances of the contravening conduct, and the other relevant considerations, I consider the penalties proposed by the parties, which total $17 million, to be appropriate. In particular, I consider the penalties to have sufficient deterrent value, both as regards specific and general deterrence.

Compliance program

58 The parties jointly seek orders relating to a compliance program and to prevent a recurrence of breaches, as set out above. I am satisfied that it is appropriate to make these orders.

Conclusion

59 For these reasons, I will make declarations and orders substantially in the form proposed by the parties.

I certify that the preceding fifty-nine (59) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Moshinsky. |

Associate:

a

VID 479 of 2021 | |

SUN RETAIL PTY LTD (ACN 078 848 549) | |

Fifth Respondent: | OC ENERGY PTY LTD (ACN 144 655 514) |