Federal Court of Australia

Park, in the matter of Queensland Nickel Pty Ltd (in liq) (No 2) [2022] FCA 705

ORDERS

DATE OF ORDER: |

THE COURT NOTES THAT:

In this Order:

Palmer Parties has the meaning given in the Order dated 11 May 2022, that is, it means QNI Metals Pty Ltd, QNI Resources Pty Ltd and Queensland Nickel Sales Pty Ltd.

THE COURT ORDERS THAT:

1. Paragraph 3 of the Amended Interlocutory Application filed 13 June 2022 is dismissed.

2. The Palmer Parties pay the costs of and incidental to the application brought against HWL Ebsworth Lawyers forthwith and on an indemnity basis.

3. Paragraphs 4 and 5 of the Amended Interlocutory Application filed 13 June 2022 is dismissed.

4. The time for compliance in Order 2 of the Order dated 11 May 2022, and varied on 16 May 2022, is extended to 31 May 2022.

5. Pursuant to r 1.39 of the Federal Court Rules 2011 (Cth), the time for service of the Interlocutory Application dated 6 June 2022 and the affidavit of Tracey Robinson sworn on 6 June 2022 is abridged.

6. The Palmer Parties shall pay the Plaintiffs and the Fifth Interested Person’s costs of and incidental to this application.

Note: Entry of orders is dealt with in Rule 39.32 of the Federal Court Rules 2011.

(REVISED FROM TRANSCRIPT)

DOWNES J:

1 This is an application for the joinder, as a proposed sixth interested person, of the law firm acting for the plaintiffs in this proceeding. A previous iteration of the application sought both discovery from the proposed sixth interested person as well as an order that they provide a concise statement in response. The application for that relief was abandoned approximately one hour ago. What is left of the application is that an order is sought that the lawyers for the plaintiffs be joined as an interested person to the proceeding pursuant to r 2.13(1) Federal Court (Corporations) Rules 2000 (Cth). It is submitted that the utility for doing this is that the law firm will be bound by the findings made in the proceeding.

2 This proceeding was commenced by originating application and, as a consequence of orders made on 16 May 2022, a statement of claim filed in another proceeding (QUD257/2021) has been filed in this proceeding as being grounds of opposition to the relief sought. That is, the grounds of opposition are being raised by the second, third and fourth interested persons, known as the Palmer Parties. In addition, the Palmer Parties are seeking certain relief in this proceeding which appears on what is now page 18 of the amended statement of claim which was accepted for filing on 8 June 2022.

3 None of the relief on page 18 of the amended statement of claim seeks any orders against the proposed sixth interested person. Indeed, the amended statement of claim contains only one sentence that appears to make reference to the proposed sixth interested person. In any event, the joinder of the law firm for the plaintiffs as an interested person in this proceeding will not have the consequence that it will be bound by the findings as between the plaintiffs and the Palmer Parties in relation to the grounds of objection contained in the amended statement of claim or in relation to the relief sought on page 18 of the amended statement of claim. As a consequence, there is no utility in the joinder.

4 Even if that was not the case, it is of real concern that an application is being brought by one party to join lawyers for another party on the premise that they will be bound by findings made in the proceedings, in circumstances where there is to be a trial of this matter in just over four weeks. It may be inferred from this that one reason for the application is to seek to disrupt the preparation by the plaintiffs for the trial, and there is no explanation in the evidence as to why this application was not brought at an earlier time.

5 For these reasons, the application, insofar as it relates to HWL Ebsworth Lawyers, is dismissed. The Palmer Parties will pay the costs of and incidental to the application brought against HWL Ebsworth Lawyers forthwith and on an indemnity basis.

6 As to the application for discovery, I indicated during the hearing that I would rule on each category. At the end, these rulings will be combined into one set of reasons.

7 By categories 9, 10 and 11 of the amended interlocutory application, the following documents were sought:

9. All documents produced, sent or received between 14 April 2016 and 13 September 2016, referring to or relating torecording the seeking of litigation funding to pursue claims on behalf of QNI including the Mineralogy Claim.

10. All documents produced, sent or received between 14 April 2016 and 13 September 2016 referring to or relating torecording the GPLs’ decision, including the reasons for the decision and any trust minutes, to enter into the Vannin Funding Agreement on 13 September 2016, including the commercial prudence of entering the agreement, and whether it was in the interests of the JVCs (as beneficiaries) to do so.

11. All documents sent or received between 14 April 2016 and 13 September 2016 between the GPLs and Vannin referring or relating torecording theGPLs’ decision to enter intonegotiations in respect of the Vannin Funding Agreement on 13 September 2016, including the commercial prudence of entering the agreement, and whether it was in the interests of the JVCs (as beneficiaries) to do so.

8 A submission was made by the Palmer Parties that these categories of documents are directly relevant to the matters raised in paragraphs 23, 38 to 39 and 42 to 45 of the amended statement of claim, taking into account what is stated in response in the plaintiffs’ concise statement in response.

9 Paragraph 23 of the amended statement of claim provides:

23. Upon expiry of the Standstill Agreement, the GPLs assert that QNI is entitled to retain the whole of the Trust Property pursuant to a right of indemnity or exoneration to pay liabilities arising in the liquidation, including:

(a) approximately $15.4 million in professional fees and disbursements incurred by the GPLs and its legal representatives; and

(b) between $35 million to $55 million payable to Vannin Capital Operations Limited (Vannin) as a funding premium (Funding Premium) pursuant to a written agreement between QNI and Vannin dated 13 September 2016 (Vannin Funding Agreement).

Particulars

Letter from HWL Ebsworth to Robinson Nielsen Legal dated 14 July 2021; letter from HWL Ebsworth to Alexander Law dated 15 September 2021 enclosing excel spreadsheet; and affidavit of K L Trenfield filed 23 July 2021 in Federal Court Proceeding QUD235/2021 at [49], [80].

10 This paragraph relates to an assertion by the GPLs, as they are called in the pleading, in relation to an entitlement to retain the whole of the trust property, pursuant to a right of indemnity or exoneration. It was submitted by counsel for the Palmer Parties that that allegation is not in dispute, and that appears to be correct.

11 Paragraphs 38 and 39 plead:

38. Despite the matters pleaded in paragraphs 35 to 37 inclusive above, QNI via the GPLs:

(a) did not avail itself of funding secured from the Commonwealth of Australia;

(b) did not cause the SPLs to issue and/or conduct the Mineralogy Claim;

(ba) further or alternatively, insofar as it was required, did not apply to extend the powers of the SPLs so as to enable the SPLs to institute and/or conduct the Mineralogy Claim;

(c) entered into the Vannin Funding Agreement;

(d) accepted funding under the Vannin Funding Agreement on terms that QNI would pay Vannin a Funding Premium, being the greater of:

(i) 35% of the total litigation proceeds obtained by the GPLs; or

(ii) a cost multiple of three time the total costs funded by Vannin;

Particulars

Clauses 3 and 4 of the Vannin Funding Agreement.

(e) separately pursued the Mineralogy Claim in overlap with the SPL Proceeding;

(f) duplicated expenditure incurred by the SPLs by retaining in the Mineralogy Claim different:

(i) liquidators;

(ii) solicitors;

(iii) counsel; and

(iv) funding arrangements.

39. In consequence of the matters pleaded in paragraph 38 above, QNI incurred the following liabilities (the Mineralogy Claim Expenses and Liabilities):

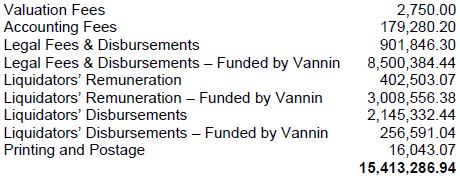

(a) $15,413,286.94 (GPL Liabilities); and

Particulars

The best particulars of the GPL Liabilities that the applicants can presently provide are the figures contained in the excel spreadsheet provided by HWL Ebsworth to Alexander Law on 15 September 2021 as follows:

(b) $35 million to $55 million in the form of the Funding Premium payable to Vannin.

Particulars

Clauses 3 and 4 of the Vannin Funding Agreement; affidavit of K L Trenfield filed 23 July 2021 in Federal Court Proceeding QUD235/2021 at [80].

12 Paragraph 38 effectively claims that QNI, via the GPLs, did not avail itself of funding secured from the Commonwealth of Australia, did not cause the SPLs to issue and/or conduct the Mineralogy Claim, did not make any application to extend the powers of the SPLs, entered into the Vannin Funding Agreement, and accepted funding under that agreement on certain terms. Again, those facts do not appear to be in dispute.

13 Paragraph 39 pleads that certain liabilities were incurred, and they are pleaded or described as the Mineralogy Claim Expenses and Liabilities. The documents in categories 9, 10 and 11 do not relate to the expenses and liabilities referred to in paragraph 39 of the amended statement of claim.

14 Paragraphs 42 through to 45 plead:

42. The Vannin Funding Agreement provided, relevantly:

(a) by clause 3, Vannin would fund QNI to pursue all legal claims and causes of action available to QNI save for those under the control of the SPLs or the subject of Proceeding BS6216 of 2016; and

(b) by clause 4, QNI would pay to Vannin the Funding Premium, being the greater of:

(i) 35% of the total litigation proceeds obtained by the GPLs; or

(ii) a cost multiple of three times the total costs funded by Vannin.

43. QNI asserts that it owes contingent liabilities under the Vannin Funding Agreement of:

(a) approximately $10.8 million in funding costs; and

(b) between $35 million to $55 million being the Funding Premium.

44. The Vannin Funding Agreement was contrary to the best interests of the beneficiaries of the Bank Account Trust and the Trust Property because:

(a) at the time of entering the Vannin Funding Agreement:

(i) the SPLs had already been appointed to QNI;

(ii) funding from the Commonwealth of Australia had already been secured for the SPLs via the SPL Appointment Order;

(b) the Vannin Funding Agreement did not make available to QNI any claims that were not already permitted to be brought by the SPL under the SPL Appointment Order;

(c) the Vannin Funding Agreement subjected QNI to an obligation to pay a Funding Premium of between $35 million to $55 million;

(d) the Funding Premium payable under the Vannin Funding Agreement:

(i) would substantially deplete the Trust Property;

(ii) is and was unreasonable by ordinary commercial standards;

(iii) is and was disproportionate to the risk assumed by Vannin in funding the Mineralogy Claim; and

(iv) is and was disproportionate to any benefit conferred on QNI, the beneficiaries and the Trust Property.

45. In the premises of paragraph 44 above, liabilities arising under the Vannin Funding Agreement:

(a) are not expenses properly or reasonably incurred by QNI; and

(b) are not permitted to be indemnified or exonerated out of Trust Property.

15 These paragraphs plead certain facts in relation to the Vannin Funding Agreement as defined. Paragraphs 42 and 43 are stated as being not in dispute in the plaintiffs’ concise statement in response. The critical allegations, as I understand it from counsel for the Palmer Parties, are contained in paragraphs 44 and 45. That is, that the Vannin Funding Agreement was contrary to the best interests of the beneficiaries of the Bank Account Trust and the Trust Property because of certain facts.

16 It is pleaded in paragraph 5 of the concise statement in response that, in the premises (which is a reference to earlier subparagraphs in paragraph 5), the entry into that agreement was in the best interests of the trust.

17 By categories 9, 10 and 11, documents are sought which include those which relate to the seeking of litigation funding and the reasons given for entering into the Funding Agreement, along with documents sent or received between the GPLs and Vannin – all in connection with the Vannin Funding Agreement.

18 In my view, none of those documents are directly relevant to the allegations which are referred to in the second-last column to the annexure to the amended application and which are contained in the paragraphs of the pleading set out above. The allegations between the parties, as exposed by the pleading and concise statement in response, effectively related to whether or not, as a matter of objective fact, the Vannin Funding Agreement was contrary to the best interests of the beneficiaries.

19 Correspondence about the agreement or seeking litigation funding from other litigation funders do not bear on the question of whether or not the Vannin Funding Agreement was objectively in the best interests of the beneficiaries.

20 An additional reason for refusing the application is that the Palmer Parties have almost completely failed to attend to the requirements of paragraph 10.6 of the Central Practice Note: National Court Framework and Case Management (CPN-1). The affidavit in support of the amended application does not depose to the necessity of discovery or even attempt to explain why it might be required, particularly having regard to the documents already in the Palmers Parties’ possession.

21 Although it is asserted that the categories are not intended to be more expansive than standard discovery, according to the affidavit of Ms Robinson, the categories are not, in fact, targeted to an issue in dispute in the proceeding. In that respect, I have regard to paragraph 10.6(d)(iii) of CPN-1 which provides:

10.6 The Court will not approve expansive or unjustified Requests and will generally only consider approving a Request in one or more of the following circumstances – where:

…

(d) the Discovery Applicant has adequately justified the need for the Request, including demonstrating:

…

(iii) the limited and targeted nature of the Request; and

…

22 A further reason to refuse the application is by reference to the evidence in the affidavit of Mr Catchpoole and the affidavit of Ms Trenfield, each of which describe the work that would be required to identify, review and separate out those documents which fall within the categories and which also, then, in turn, would likely be subject to legal professional privilege. Having regard to their evidence, the consequence of allowing the application at this late stage of the proceeding would likely have the consequence that the trial set down for next month would need to be adjourned. Before I come to that issue, though, I also take into account paragraph 10.7 of CPN-1, which provides that a discovery Request must be proportionate to the nature, size and complexity of the case. That is, the Request should not amount to an unreasonable economic or administrative burden on the Discovery Respondent.

23 A critical reason, though, for refusing this particular application is that, as stated in earlier reasons in this matter, this matter was commenced in July last year and has been set down for trial in July this year. It is an application by liquidators for judicial advice. The matter was case managed and then all parties consented to the matter being set down for trial to commence on 26 July 2022.

24 At the time of the matter being set down for trial for four days, there was no indication given by the Palmer Parties that they would be seeking discovery. Further, there is nothing in the Robinson affidavit to explain why, at this late stage, an application for discovery has been brought. It was submitted by the Palmer Parties that one of the reasons for bringing the application so late was because of a recent decision to stay the proceedings in QUD15 of 2022. However, categories 9, 10 and 11 related to allegations that appeared in the amended statement of claim prior to the decision to stay that other proceeding.

25 That there was consent to the matter being set down for trial with no indication of a discovery application and then the discovery application being brought barely a month out from trial also gives rise to a concern that this is an attempt to have the trial adjourned or to at least disrupt the preparation for trial by the plaintiffs and by Vannin Capital Operations Limited, the fifth interested person.

26 For all of these reasons, the application for categories 9, 10 and 11 of the amended application is refused.

27 The next section of the amended application relates to those documents sought in categories 1, 4, 5 and 7 of the amended application. I will deal with each one in turn.

28 Category 1 seeks:

1. All documents produced, sent or received between 14 April 2016 and 18 May 2016 referring to or relating torecording the appointment of the SPLs as additional liquidators on 18 May 2016 and QNI’s decision (through the GPLs) to consent to the appointment of the SPLs.

29 Effectively, category 1 seeks documents in connection with, referring to or recording the appointment of the SPLs as additional liquidators on 18 May 2016. However, the fact of the appointment of the SPLs and the consent by the GPLs to the appointment of the SPLs is not controversial. The plea in paragraph 32 of the amended statement of claim, and the concise statement in response, makes plain that it is not in dispute. Therefore, the documents sought, at least at this first threshold, are not directly relevant to any issue in dispute between the parties.

30 By the amendments to the application, these words were added: “and QNI’s decision (through the GPLs) to consent to the appointment of the SPLs.” However, there is no plea of any fact relating to a decision by QNI through the GPLs to consent to the appointment of the SPLs, and, therefore, no attack is made in the amended statement of claim on that decision. Having regard to what is effectively common ground between the parties in relation to the appointment of the SPLs and the consent given by the GPLs to that appointment, and having regard to paragraph 10.6(d)(ii) of CPN-1, I do not consider that the documents which are sought are relevant or important to the case, and that is one factor which I take into account to reject the application in relation to category 1.

31 Category 4 seeks:

4. All documents produced, sent or received between 14 April 2016 and 30 June 2017 between the GPLs and the SPLs referring to or relating torecording:

(a) the SPLs’ funding arrangements;

(b) the SPLs’ institution or proposed institution of proceedings; and/or

(c) the SPLs’ authority to institute and conduct proceedings concerning dealings and transactions between QNI, QNI Metals and QNI Resources, including against Mineralogy.

32 Effectively, category 4 seeks documents over a period between 14 April 2016 and 30 June 2017 sent or received between the GPLs and the SPLs which refer to or record the SPLs’ institution or proposed institution of proceedings and the SPLs’ authority to institute and conduct those proceedings.

33 These documents are sought in relation to a time period prior to the institution of the proceedings by the SPLs. Paragraphs 35 and 36 of the amended statement of claim are referred to as being the material facts to which these documents are directly relevant. Paragraph 35 is uncontroversial and sets out a series of facts in relation to the SPLs including their source of funding, that they had the benefit of an undertaking from the Commonwealth of Australia and that they commenced various proceedings. Paragraph 36 pleads a material fact in relation to the extent of authorisation of the SPLs under their appointment order, and so that allegation turns on the proper construction of the order of the court in relation to their appointment.

34 The lack of connection between the documents sought in category 4 and paragraphs 35 and 36 of the amended statement of claim is an obvious one.

35 I was then taken to subparagraphs 5(b) and 5(e) of the concise statement in response, and it was submitted that the documents in category 4 are directly relevant to the allegations made in those paragraphs. However, paragraph 5 is stated in response to a series of paragraphs in the amended statement of claim, being paragraphs 36 to 41 and 44 and 45. Subparagraph 5(b) addresses the issue of whether the GPL Liabilities and the Funding Premium were necessarily, properly and reasonably incurred in order to recover the Judgment Sum, and subparagraph 5(e) deals with the manner in which duplication and overlap as between the Mineralogy Claim and the claims advanced in the SPL Proceeding were kept to a minimum. It is evident, however, when one has regard to paragraphs 44 and 45 of the amended statement of claim, that these paragraphs in the concise statement in response are made in response to the allegations made in paragraphs 44 and 45 and are not in response to the allegations in paragraphs 35 and 36.

36 In addition to not being directly relevant to an issue in the proceedings, Ms Trenfield has provided an affidavit which identifies, in relation to categories A to E of the application, that a large number of documents would need to be extracted and reviewed for the purposes of responding to these categories.

37 Taking into account that the trial is next month, I do not regard it appropriate to impose a burden on the liquidators to extract the large volume of documents referred to in that affidavit for the purposes of trying to ferret out the documents identified in category 4.

38 For these reasons, category 4 is rejected.

39 Category 5 seeks:

All documents produced, sent or received between 14 April 2016 and 30 June 2017 referring to or relating torecording the SPLs’ authority to institute and conduct proceedings concerning dealings and transactions between QNI, QNI Metals and QNI Resources, including against Mineralogy.

40 Category 5 has the same problems as category 4, but it is worse because category 5 is sought only by reference to paragraph 36 of the amended statement of claim, which is the paragraph which deals with the proper construction of the order appointing the SPLs. And it is not confined in any way; that is, it seeks all documents produced, sent or received over a period of time of some 14 months between April 2016 and June 2017 referring to or recording the SPLs’ authority.

41 As well as suffering from the same problems as category 4, this category is excessive in that it is not limited and targeted as required by CPN-1. Category 5 is also rejected.

42 That leaves category 7. Category 7 seeks:

All documents produced, sent or received between 14 April 2016 and 30 June 2017 referring or relating toto or recording considerations by the GPLs of the power to make an application to extend the powers of the SPLs under the SPL Appointment Order.

43 Category 7 relates to, effectively, documents concerning the consideration by the GPLs of the power to make an application to extend the powers of the SPLs. Reference is made to paragraph 36A and 38 of the amended statement of claim. Paragraph 36A refers to the fact that it was open to the GPLs to make an application to extend the powers of the SPLs. Allegations are made that they ought to have done so, but it is not controversial that they did not do so.

44 There are no pleaded facts about the internal decision-making process of the GPLs to not make this application. This, again, appears to be an indirect attempt to find further reasons to attack the decisions taken by the liquidators which falls outside the scope of the pleaded facts in the amended statement of claim and the concise statement in response. As well as all of the other issues already identified in relation to categories 9 through to 11, 1, 4 and 5 in terms of the timing of this application, the oppressive nature of the application and the fact that it is not limited and targeted, category 7 seeks documents that are not directly relevant, and so it is also rejected.

45 Effectively, the documents that are sought by category 12 are all documents that have been produced, sent or received over a period between April 2016 and March 2017 recording or referring to the GPLs’ decision, including reasons for the decision and any trust minutes, to cause QNI to issue the Mineralogy Claim rather than have the SPLs do so. The paragraphs that are relied upon as giving rise to the relevance of these documents are paragraphs 37 to 41 and paragraph 50 to 51 of the amended statement of claim. None of those paragraphs make any allegation about the decision-making process by the GPLs.

46 I was directed to paragraph 38(e) of the amended statement of claim where the complaint is made that the GPLs separately pursued the Mineralogy Claim in overlap with the SPL Proceeding. However, because of the reference to the Mineralogy Claim being pursued in overlap with the SPL Proceeding, this indicates that the SPL Proceeding was on foot, and the complaint therefore seems to be that the Mineralogy Claim continued, notwithstanding the existence of the SPL Proceeding. That proceeding was not commenced until June 2017, and the documents which are sought are up to 29 March 2017, and so there does not seem to be a connection between what is pleaded in subparagraph 38(e) and the documents that are sought in category 12.

47 The submission is made that these documents are, as I understand it, directly relevant within the meaning of r 20.14 Federal Court Rules 2011 (Cth). However, as I have indicated, there is no pleading which attacks the decision-making process of the liquidators in relation to the decision to cause QNI to issue the Mineralogy Claim. So I refuse the application in relation to category 12, and in doing so, I have particular regard to paragraph 10.6(d) and 10.7 of CPN-1, and also the considerations referred to earlier in relation to oppression, as indicated by Ms Trenfield's affidavit.

48 Category 16 seeks:

All documents produced, sent or received between 3 August 2019 and 25 June 2021 referring to or relating torecording the GPLs’ decision including the reasons for the decision and any trust minutes, for QNI to continue to conduct the Mineralogy Claim after the SPLs’ entry into the Settlement Deed in August 2019, including the decision to incur the Mineralogy Claim Expenses and Liabilities, and whether it was in the interests of the JVCs (as beneficiaries) to do so.

49 For the same reasons that category 12 was dismissed, category 16 is also dismissed. In particular, paragraphs 58 to 61 of the amended statement of claim, which are relied upon by the Palmer Parties in connection with category 16, do not make any allegation about a decision by the GPLs to continue to conduct the Mineralogy Claim after the entry into the Settlement Deed, and therefore, the documents that are sought are not directly relevant to any issue in the proceeding. In addition, the Palmer Parties have failed to demonstrate compliance with CPN-1 – in particular, paragraphs 10.6(d), and 10.7.

50 For these reasons, paragraphs 4 and 5 of the amended interlocutory application will be dismissed.

I certify that the preceding fifty (50) numbered paragraphs are a true copy of the Reasons for Judgment of the Honourable Justice Downes. |